Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

U.S. MONTHLY INCOME FUND FOR PUERTO RICO RESIDENTS, INC.

|

| Entity Central Index Key |

0001843749

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000232117 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

U.S. Monthly Income Fund for Puerto Rico Residents, Inc.

|

| Class Name |

Class A

|

| Trading Symbol |

PRAJX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about U.S. Monthly Income Fund for Puerto Rico Residents, Inc. (the “Fund”) for the period from January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ubs.com/prfunds or by contacting us at 787‑250‑3600.

|

| Additional Information Phone Number |

787‑250‑3600

|

| Additional Information Website |

www.ubs.com/prfunds

|

| Expenses [Text Block] |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| What were the Fund costs for last six months? Annual Fund Operating Expenses (based on a hypothetical $10,000 investment) |

|

|

|

Class Name |

|

|

Cost of a $10,000

investment |

|

|

|

Cost paid as a percentage of

a $10,000 investment |

|

| |

Class A |

|

|

$181 |

|

|

|

1.78% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses Paid, Amount |

$ 181

|

| Expense Ratio, Percent |

1.78%

|

| Net Assets |

$ 63,378,535

|

| Holdings Count | Holding |

63

|

| Advisory Fees Paid, Amount |

$ 272,029

|

| Investment Company Portfolio Turnover |

3.42%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

| |

|

| Key Fund Statistics |

|

|

|

|

|

|

| Total Net Assets |

|

|

$63,378,535 |

|

|

|

| # of Portfolio Holdings |

|

|

63 |

|

|

|

| Portfolio Turnover Rate |

|

|

3.42% |

|

|

|

| Total Advisory Fees Paid |

|

|

$272,029 |

|

|

| Holdings [Text Block] |

|

|

|

|

|

| Top 5 Holdings (% of Net Assets) |

|

|

|

|

|

|

| Autopistas Metropolitanas of Puerto Rico, 6.75%, due 06/30/35 |

|

|

13.30 |

% |

|

|

| Municipal Electric Authority of Georgia, 7.06%, due 04/01/57 |

|

|

3.8% |

|

|

|

| FNMA Pool AR5162, 3.50%, due 05/01/43 |

|

|

3.3% |

|

|

|

| Metropolitan Transportation Authority, 7.34%, due 11/15/39 |

|

|

3.3% |

|

|

|

| Washington State Convention Center, 6.79%, due 07/01/40 |

|

|

2.9% |

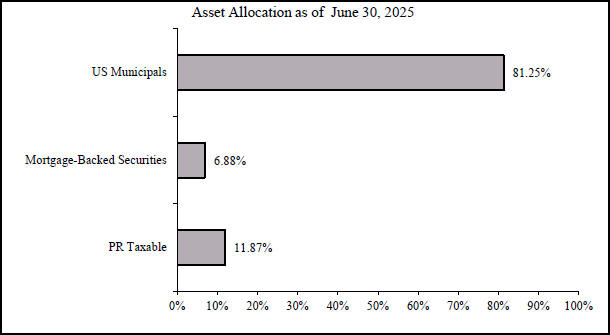

| Fund Holdings Summaries The following graph reflects the breakdown of the investment portfolio (% of Total Investments) as of June 30, 2025: The following tables show the allocation (% of Total Investments) of the Fund’s portfolio using various metrics as of the end of the period:

|

|

|

|

|

| Portfolio Composition |

|

|

|

|

| Puerto Rico Corporate |

|

|

11.87 |

% |

| Mortgage-Backed Securities |

|

|

6.88 |

% |

| U.S. Municipals - Transportation Bonds |

|

|

26.57 |

% |

| U.S. Municipals - Utilities Bonds |

|

|

14.31 |

% |

| U.S. Municipals - Dedicated Tax Bonds |

|

|

23.22 |

% |

| U.S. Municipals - Healthcare Bonds |

|

|

8.01 |

% |

| U.S. Municipals - Educational Bonds |

|

|

5.20 |

% |

| U.S. Municipals - Others |

|

|

3.94 |

% |

| Total |

|

|

100.00 |

% |

| |

|

|

|

|

|

|

|

|

|

| Geographic Allocation |

|

|

|

|

| Puerto Rico |

|

|

18.75% |

|

| U.S. |

|

|

81.25% |

|

| |

|

|

|

|

|

|

|

100.00% |

| The following table shows the ratings of the Fund’s portfolio securities (based on % of Total Investments) as of June 30, 2025. The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”). Ratings are subject to change. During the period, the United States lost its last remaining sovereign AAA rating when Moody’s downgraded it to AA1, citing as rational “the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” Both S&P and Fitch had already downgraded the rating to their equivalent rating of AA+.

|

|

|

|

|

| Rating |

|

|

Percent |

|

| AAA |

|

|

8.67 |

% |

| AA |

|

|

52.30 |

% |

| A |

|

|

30.56 |

% |

| BBB |

|

|

8.47 |

% |

| Total |

|

|

100.00 |

% |

| |

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”). Ratings are subject to change. During the period, the United States lost its last remaining sovereign AAA rating when Moody’s downgraded it to AA1, citing as rational “the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” Both S&P and Fitch had already downgraded the rating to their equivalent rating of AA+.

|

| Credit Ratings Selection [Text Block] |

The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”).

|

| Largest Holdings [Text Block] |

|

|

|

|

|

| Top 5 Holdings (% of Net Assets) |

|

|

|

|

|

|

| Autopistas Metropolitanas of Puerto Rico, 6.75%, due 06/30/35 |

|

|

13.30 |

% |

|

|

| Municipal Electric Authority of Georgia, 7.06%, due 04/01/57 |

|

|

3.8% |

|

|

|

| FNMA Pool AR5162, 3.50%, due 05/01/43 |

|

|

3.3% |

|

|

|

| Metropolitan Transportation Authority, 7.34%, due 11/15/39 |

|

|

3.3% |

|

|

|

| Washington State Convention Center, 6.79%, due 07/01/40 |

|

|

2.9% |

|

|

| C000232116 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

U.S. Monthly Income Fund for Puerto Rico Residents, Inc.

|

| Class Name |

Class P

|

| Trading Symbol |

PRAKX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about U.S. Monthly Income Fund for Puerto Rico Residents, Inc. (the “Fund”) for the period from January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ubs.com/prfunds or by contacting us at 787‑250‑3600.

|

| Additional Information Phone Number |

787‑250‑3600

|

| Additional Information Website |

www.ubs.com/prfunds

|

| Expenses [Text Block] |

|

|

|

|

|

What were the Fund costs for last six

months? |

|

|

|

|

|

| Annual Fund Operating Expenses |

|

|

|

|

| (based on a hypothetical $10,000 investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Class

Name |

|

Cost of a $10,000

investment |

|

|

Cost paid as a percentage of

a $10,000 investment |

|

| Class P |

|

|

$181 |

|

|

|

1.78% |

|

|

|

|

|

|

|

|

|

|

|

| Expenses Paid, Amount |

$ 181

|

| Expense Ratio, Percent |

1.78%

|

| Net Assets |

$ 63,378,535

|

| Holdings Count | Holding |

63

|

| Advisory Fees Paid, Amount |

$ 272,029

|

| Investment Company Portfolio Turnover |

3.42%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

| |

|

| Key Fund Statistics |

|

|

|

|

| |

|

| Total Net Assets |

|

|

$63,378,535 |

|

| |

|

| # of Portfolio Holdings |

|

|

63 |

|

| |

|

| Portfolio Turnover Rate |

|

|

3.42% |

|

| |

|

| Total Advisory Fees Paid |

|

|

$272,029 |

|

|

| Holdings [Text Block] |

|

|

|

|

|

|

|

| Top 5 Holdings (% of Net Assets) |

|

|

|

|

|

|

| Autopistas Metropolitanas of Puerto Rico, 6.75%, due 06/30/35 |

|

|

13.30% |

|

|

|

| Municipal Electric Authority of Georgia, 7.06%, due 04/01/57 |

|

|

3.8% |

|

|

|

| FNMA Pool AR5162, 3.50%, due 05/01/43 |

|

|

3.3% |

|

|

|

| Metropolitan Transportation Authority, 7.34%, due 11/15/39 |

|

|

3.3% |

|

|

|

| Washington State Convention Center, 6.79%, due 07/01/40 |

|

|

2.9% |

| Fund Holdings Summaries The following graph reflects the breakdown of the investment portfolio (% of Total Investments) as of June 30, 2025: The following tables show the allocation (% of Total Investments) of the Fund’s portfolio using various metrics as of the end of the period:

|

|

|

|

|

| Portfolio Composition |

|

|

|

|

| Puerto Rico Corporate |

|

|

11.87 |

% |

| Mortgage-Backed Securities |

|

|

6.88 |

% |

| U.S. Municipals - Transportation Bonds |

|

|

26.57 |

% |

| U.S. Municipals - Utilities Bonds |

|

|

14.31 |

% |

| U.S. Municipals - Dedicated Tax Bonds |

|

|

23.22 |

% |

| U.S. Municipals - Healthcare Bonds |

|

|

8.01 |

% |

| U.S. Municipals - Educational Bonds |

|

|

5.20 |

% |

| U.S. Municipals - Others |

|

|

3.94 |

% |

| Total |

|

|

100.00 |

% |

|

|

|

|

|

| Geographic Allocation |

|

|

|

|

| Puerto Rico |

|

|

18.75% |

|

| U.S. |

|

|

81.25% |

|

| |

|

|

|

|

|

|

|

100.00% |

| The following table shows the ratings of the Fund’s portfolio securities (based on % of Total Investments) as of June 30, 2025. The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”). Ratings are subject to change. During the period, the United States lost its last remaining sovereign AAA rating when Moody’s downgraded it to AA1, citing as rational “the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” Both S&P and Fitch had already downgraded the rating to their equivalent rating of AA+.

|

|

|

|

|

| Rating |

|

|

Percent |

|

| AAA |

|

|

8.67 |

% |

| AA |

|

|

52.30 |

% |

| A |

|

|

30.56 |

% |

| BBB |

|

|

8.47 |

% |

| Total |

|

|

100.00 |

% |

| |

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”). Ratings are subject to change. During the period, the United States lost its last remaining sovereign AAA rating when Moody’s downgraded it to AA1, citing as rational “the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” Both S&P and Fitch had already downgraded the rating to their equivalent rating of AA+.

|

| Credit Ratings Selection [Text Block] |

The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”).

|

| Largest Holdings [Text Block] |

|

|

|

|

|

|

|

| Top 5 Holdings (% of Net Assets) |

|

|

|

|

|

|

| Autopistas Metropolitanas of Puerto Rico, 6.75%, due 06/30/35 |

|

|

13.30% |

|

|

|

| Municipal Electric Authority of Georgia, 7.06%, due 04/01/57 |

|

|

3.8% |

|

|

|

| FNMA Pool AR5162, 3.50%, due 05/01/43 |

|

|

3.3% |

|

|

|

| Metropolitan Transportation Authority, 7.34%, due 11/15/39 |

|

|

3.3% |

|

|

|

| Washington State Convention Center, 6.79%, due 07/01/40 |

|

|

2.9% |

|

|