Shareholder Report |

6 Months Ended | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Jun. 30, 2025

USD ($)

Holding

| |||||||||||||||||||||||||||||||||||||

| Shareholder Report [Line Items] | |||||||||||||||||||||||||||||||||||||

| Document Type | N-CSRS | ||||||||||||||||||||||||||||||||||||

| Amendment Flag | false | ||||||||||||||||||||||||||||||||||||

| Registrant Name | Northern Lights Variable Trust | ||||||||||||||||||||||||||||||||||||

| Entity Central Index Key | 0001352621 | ||||||||||||||||||||||||||||||||||||

| Entity Investment Company Type | N-1A | ||||||||||||||||||||||||||||||||||||

| Document Period End Date | Jun. 30, 2025 | ||||||||||||||||||||||||||||||||||||

| C000126627 | |||||||||||||||||||||||||||||||||||||

| Shareholder Report [Line Items] | |||||||||||||||||||||||||||||||||||||

| Fund Name | TOPS Managed Risk Flex ETF Portfolio | ||||||||||||||||||||||||||||||||||||

| Class Name | Portfolio | ||||||||||||||||||||||||||||||||||||

| Trading Symbol | TMRF | ||||||||||||||||||||||||||||||||||||

| Annual or Semi-Annual Statement [Text Block] | This semi-annual shareholder report contains important information about TOPS Managed Risk Flex ETF Portfolio for the period of January 1, 2025 to June 30, 2025. | ||||||||||||||||||||||||||||||||||||

| Shareholder Report Annual or Semi-Annual | Semi-Annual Shareholder Report | ||||||||||||||||||||||||||||||||||||

| Additional Information [Text Block] | You can find additional information about the Fund at https://topsfunds.com/tops-portfolios/vit/. You can also request this information by contacting us at 1-855-572-5945. | ||||||||||||||||||||||||||||||||||||

| Additional Information Phone Number | 1-855-572-5945 | ||||||||||||||||||||||||||||||||||||

| Additional Information Website | https://topsfunds.com/tops-portfolios/vit/ | ||||||||||||||||||||||||||||||||||||

| Expenses [Text Block] | What were the Fund’s costs for the last six months?(based on a hypothetical $10,000 investment)

* Annualized |

||||||||||||||||||||||||||||||||||||

| Expenses Paid, Amount | $ 43 | ||||||||||||||||||||||||||||||||||||

| Expense Ratio, Percent | 0.86% | ||||||||||||||||||||||||||||||||||||

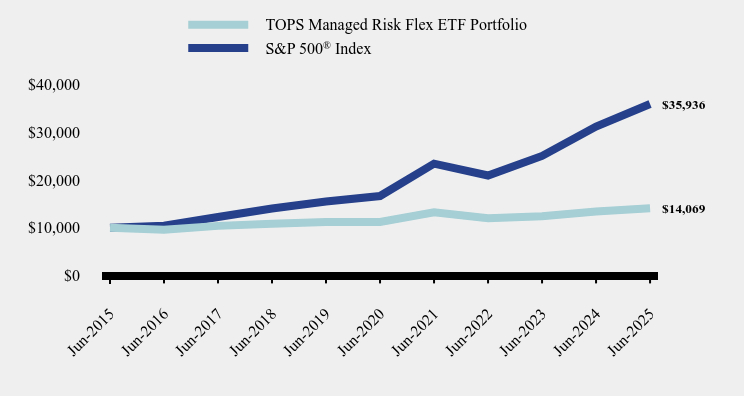

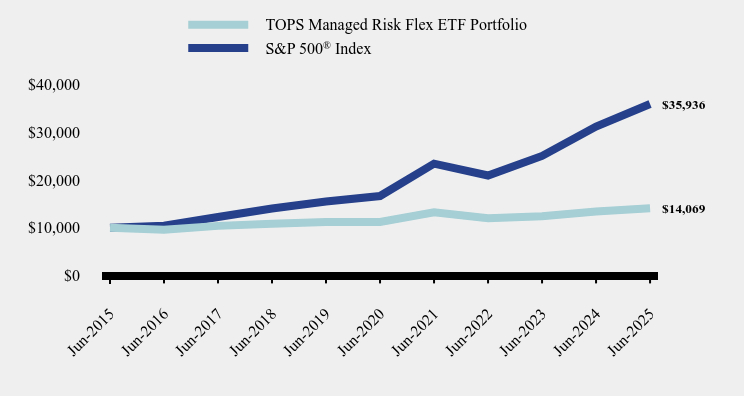

| Factors Affecting Performance [Text Block] | How did the Fund perform during the reporting period?It is remarkable to think back to all the major storylines that played out this year. The 2nd quarter was particularly eventful, starting with “Liberation Day” on April 2 and ending with the War between Israel and Iran. In the end, we saw the bear turn into a bull. Markets had a strong first half, and the TOPS portfolios were particularly boosted by a memorable rally in international stocks.

Year-to-date, large-cap growth (S&P 500 Growth Total Return Index) has risen +8.9%. Large-cap value (S&P 500 Value Total Return Index) is up +3.3%. Mid-cap equities (S&P MidCap 400 Total Return Index) are slightly positive at +0.2%, while small caps (S&P Small Cap 600 Total Return Index) continue to lag, down -4.5%. Developed international markets (FTSE Developed ex US All Cap Net Tax [US RIC] Index) are leading globally, up +20.0%. Emerging markets ex-China (MSCI Emerging Markets ex-China Net Return USD Index) are up +14.5%, and emerging markets ex-state-owned enterprises (WisdomTree Emerging Markets ex-State Owned Enterprises Index) have gained +11.4%. Broad-based emerging markets (FTSE Emerging Markets All Cap China A Inclusion Net Tax [US RIC] Index) are also up +11.2%. Emerging market local currency bonds (J.P. Morgan Government Bond Index Emerging Markets Global Core) are up +12.0%, high-yield corporate bonds (Solactive USD High Yield Corporates Index) have risen +4.8%, and intermediate-term Treasuries (Bloomberg U.S. Treasury 3-10 Year Total Return Index) are up +4.8%. Corporate bonds (ICE BofA US Corporate Index) gained +4.2%, while mortgage-backed securities (Bloomberg US MBS Float Adjusted Index) returned +4.2%. Short-term TIPS (Bloomberg US Treasury TIPS 0-5 Years Index) and short-term Treasuries (Bloomberg U.S. Treasury 1-3 Year Index) rose +4.0% and +2.8%, respectively. Global ex-US aggregate bonds (Bloomberg GLA xUSD Float Adjusted RIC Capped Index) are up +1.8%. Global natural resources (Morningstar Global Upstream Natural Resources Net Return Index) are up +11.9%. Global real estate (FTSE EPRA NAREIT Global REITs Net Tax Index) has also advanced, gaining +4.1%.

|

||||||||||||||||||||||||||||||||||||

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of how the Fund will perform in the future. | ||||||||||||||||||||||||||||||||||||

| Line Graph [Table Text Block] |

|

||||||||||||||||||||||||||||||||||||

| Average Annual Return [Table Text Block] |

|

||||||||||||||||||||||||||||||||||||

| No Deduction of Taxes [Text Block] | The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | ||||||||||||||||||||||||||||||||||||

| AssetsNet | $ 126,603,237 | ||||||||||||||||||||||||||||||||||||

| Holdings Count | Holding | 30 | ||||||||||||||||||||||||||||||||||||

| Advisory Fees Paid, Amount | $ 192,068 | ||||||||||||||||||||||||||||||||||||

| InvestmentCompanyPortfolioTurnover | 3.00% | ||||||||||||||||||||||||||||||||||||

| Additional Fund Statistics [Text Block] | Fund Statistics

|

||||||||||||||||||||||||||||||||||||

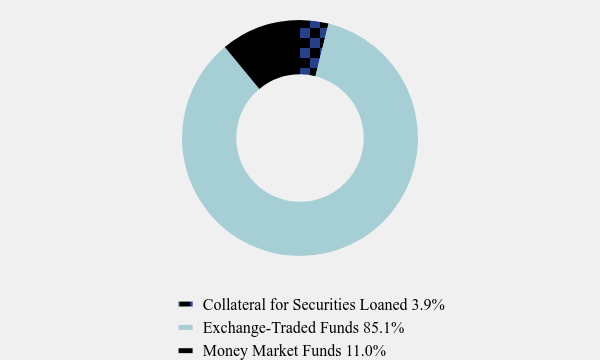

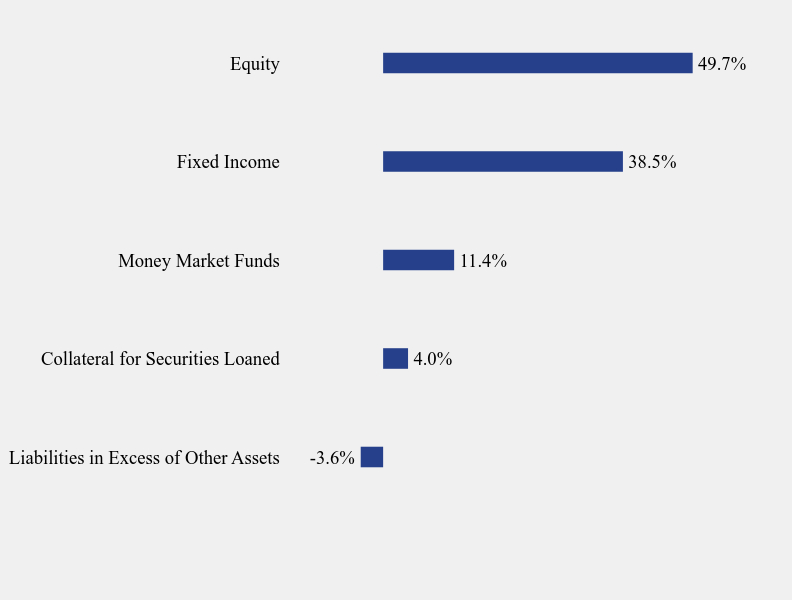

| Holdings [Text Block] | Asset Weighting (% of total investments)

Sector Weighting (% of net assets)

|

||||||||||||||||||||||||||||||||||||

| Largest Holdings [Text Block] | Top 10 Holdings (% of net assets)

|

||||||||||||||||||||||||||||||||||||

| Material Fund Change [Text Block] | Material Fund ChangesNo material changes occurred during the period ended June 30, 2025. |

| X | ||||||||||

- Definition Boolean flag that is true when the XBRL content amends previously-filed or accepted submission. No definition available.

|

| X | ||||||||||

- Definition For the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD. No definition available.

|

| X | ||||||||||

- Definition The type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'. No definition available.

|

| X | ||||||||||

- Definition A unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition One of: N-1A (Mutual Fund), N-1 (Open-End Separate Account with No Variable Annuities), N-2 (Closed-End Investment Company), N-3 (Separate Account Registered as Open-End Management Investment Company), N-4 (Variable Annuity UIT Separate Account), N-5 (Small Business Investment Company), N-6 (Variable Life UIT Separate Account), S-1 or S-3 (Face Amount Certificate Company), S-6 (UIT, Non-Insurance Product). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition The exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Trading symbol of an instrument as listed on an exchange. No definition available.

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Amount of net assets (liabilities). Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

|

| X | ||||||||||

- Definition Percentage of lesser of purchase or sale of portfolio securities to average value of portfolio securities owned. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

|

| X | ||||||||||

- Details

|