Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

VanEck ETF Trust

|

|

| Entity Central Index Key |

0001137360

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000253738 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck AA-BB CLO ETF

|

|

| Class Name |

VanEck AA-BB CLO ETF

|

|

| Trading Symbol |

CLOB

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck AA-BB CLO ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck AA-BB CLO ETF | $23 | 0.45%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 23

|

|

| Expense Ratio, Percent |

0.45%

|

[1] |

| AssetsNet |

$ 106,920,247

|

|

| Holdings Count | Holding |

40

|

|

| Advisory Fees Paid, Amount |

$ 201,647

|

|

| InvestmentCompanyPortfolioTurnover |

40.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$106,920,247

- Number of Portfolio Holdings40

- Portfolio Turnover Rate40%

- Advisory Fees Paid$201,647

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

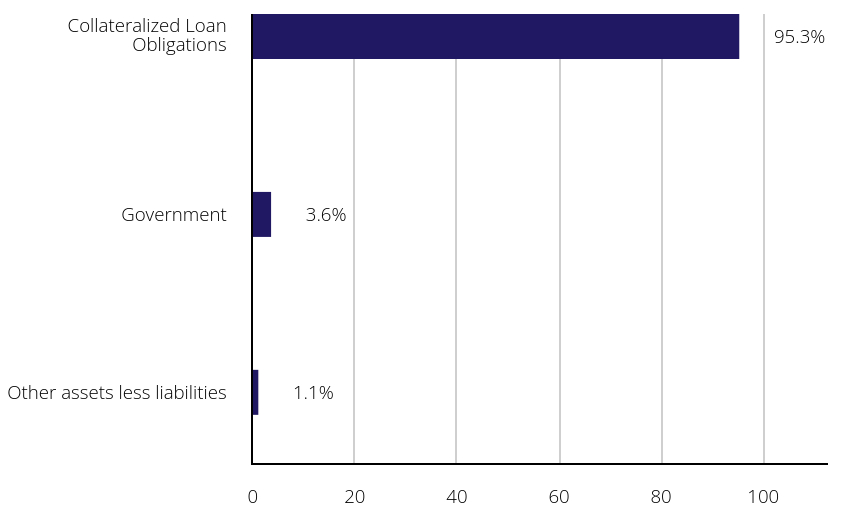

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 1.1% | Government | | 3.6% | Collateralized Loan Obligations | | 95.3% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000066393 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Africa Index ETF

|

|

| Class Name |

VanEck Africa Index ETF

|

|

| Trading Symbol |

AFK

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Africa Index ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Africa Index ETF | $44 | 0.79%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.79%

|

[2] |

| AssetsNet |

$ 51,751,734

|

|

| Holdings Count | Holding |

72

|

|

| Advisory Fees Paid, Amount |

$ 96,520

|

|

| InvestmentCompanyPortfolioTurnover |

23.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$51,751,734

- Number of Portfolio Holdings72

- Portfolio Turnover Rate23%

- Advisory Fees Paid$96,520

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

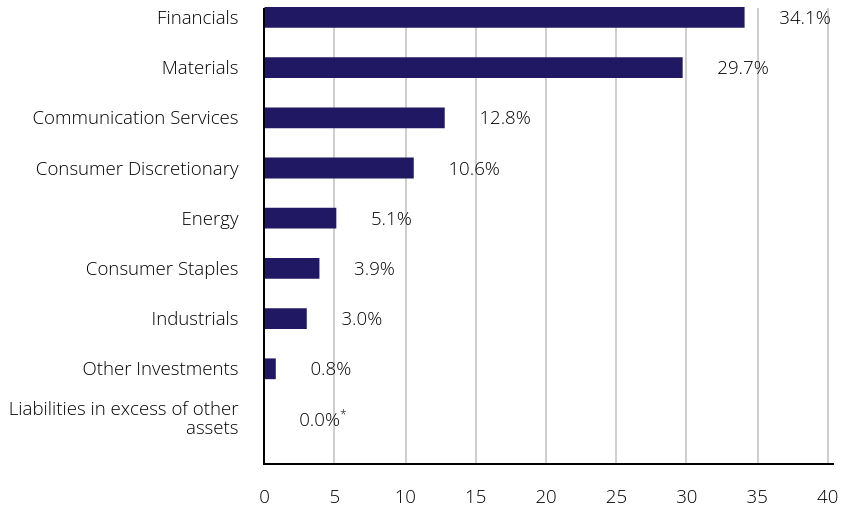

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Liabilities in excess of other assets | | 0.0%Footnote Reference* | Other Investments | | 0.8% | Industrials | | 3.0% | Consumer Staples | | 3.9% | Energy | | 5.1% | Consumer Discretionary | | 10.6% | Communication Services | | 12.8% | Materials | | 29.7% | Financials | | 34.1% |

| Footnote | Description | Footnote* | Amount is less than 0.05% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000051120 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Agribusiness ETF

|

|

| Class Name |

VanEck Agribusiness ETF

|

|

| Trading Symbol |

MOO

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Agribusiness ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Agribusiness ETF | $29 | 0.55%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 29

|

|

| Expense Ratio, Percent |

0.55%

|

[3] |

| AssetsNet |

$ 646,813,731

|

|

| Holdings Count | Holding |

51

|

|

| Advisory Fees Paid, Amount |

$ 1,442,581

|

|

| InvestmentCompanyPortfolioTurnover |

8.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$646,813,731

- Number of Portfolio Holdings51

- Portfolio Turnover Rate8%

- Advisory Fees Paid$1,442,581

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

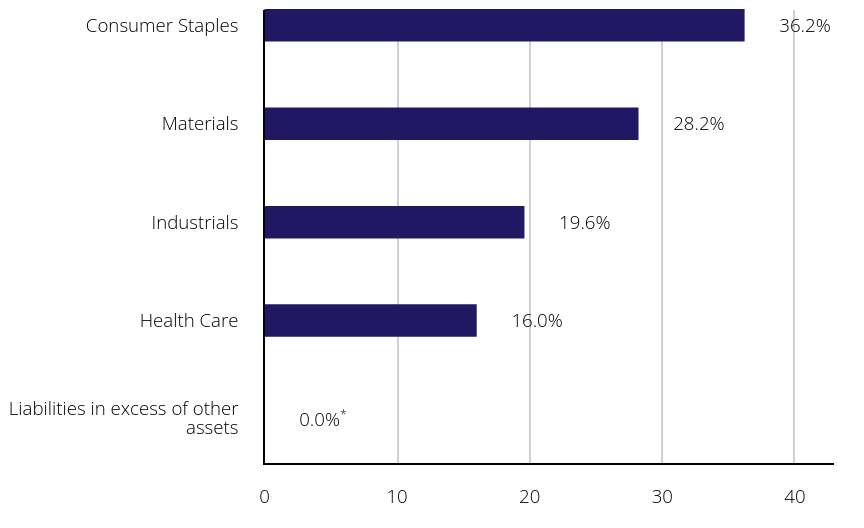

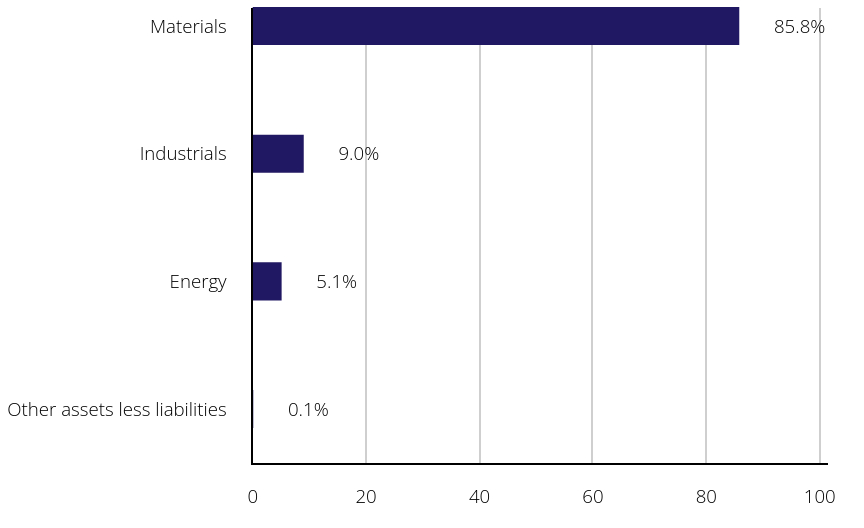

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Liabilities in excess of other assets | | 0.0%Footnote Reference* | Health Care | | 16.0% | Industrials | | 19.6% | Materials | | 28.2% | Consumer Staples | | 36.2% |

| Footnote | Description | Footnote* | Amount is less than 0.05% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000102898 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck BDC Income ETF

|

|

| Class Name |

VanEck BDC Income ETF

|

|

| Trading Symbol |

BIZD

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck BDC Income ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investmentFootnote Reference(a) |

|---|

VanEck BDC Income ETF | $21 | 0.42%Footnote Reference(b) |

|---|

| Footnote | Description | Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | Footnote(b) | Annualized |

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.42%

|

[4] |

| AssetsNet |

$ 1,602,018,111

|

|

| Holdings Count | Holding |

32

|

|

| Advisory Fees Paid, Amount |

$ 2,955,926

|

|

| InvestmentCompanyPortfolioTurnover |

16.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,602,018,111

- Number of Portfolio Holdings32

- Portfolio Turnover Rate16%

- Advisory Fees Paid$2,955,926

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

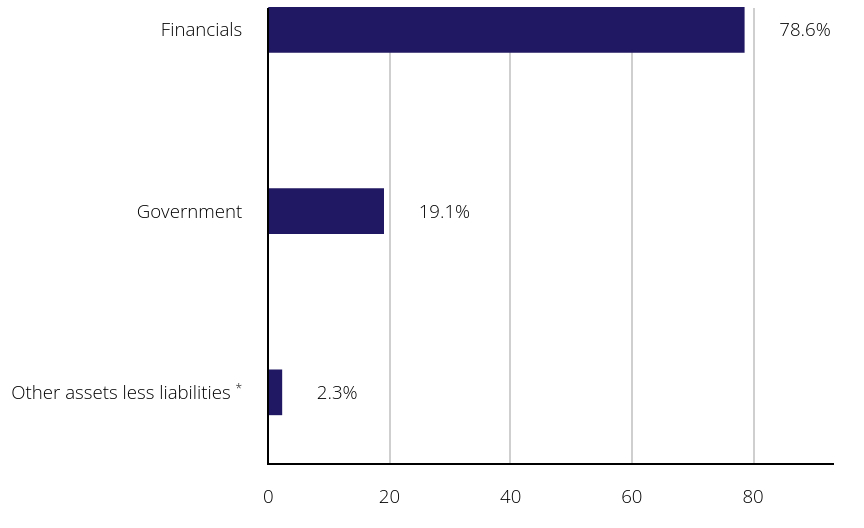

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilitiesFootnote Reference* | | 2.3% | Government | | 19.1% | Financials | | 78.6% |

| Footnote | Description | Footnote* | Includes net unrealized appreciation (depreciation) on total return swap contracts of 0.0% |

|

|

| Exposure Basis Explanation [Text Block] |

Includes net unrealized appreciation (depreciation) on total return swap contracts of 0.0%

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000076451 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Brazil Small-Cap ETF

|

|

| Class Name |

VanEck Brazil Small-Cap ETF

|

|

| Trading Symbol |

BRF

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Brazil Small-Cap ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Brazil Small-Cap ETF | $35 | 0.59%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.59%

|

[5] |

| AssetsNet |

$ 20,033,700

|

|

| Holdings Count | Holding |

95

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$20,033,700

- Number of Portfolio Holdings95

- Portfolio Turnover Rate17%

- Advisory Fees Paid$-

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

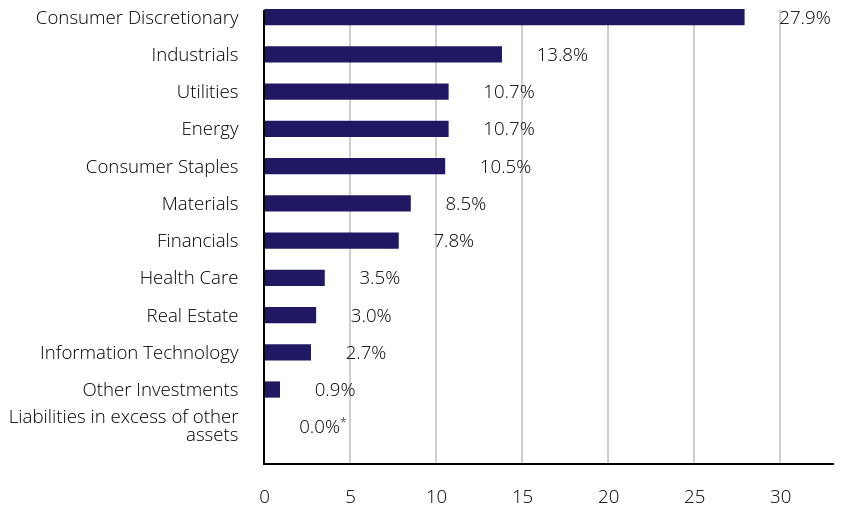

Liabilities in excess of other assets | | 0.0%Footnote Reference* | Other Investments | | 0.9% | Information Technology | | 2.7% | Real Estate | | 3.0% | Health Care | | 3.5% | Financials | | 7.8% | Materials | | 8.5% | Consumer Staples | | 10.5% | Energy | | 10.7% | Utilities | | 10.7% | Industrials | | 13.8% | Consumer Discretionary | | 27.9% |

| Footnote | Description | Footnote* | Amount is less than 0.05% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000146000 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck China Bond ETF

|

|

| Class Name |

VanEck China Bond ETF

|

|

| Trading Symbol |

CBON

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck China Bond ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck China Bond ETF | $25 | 0.50%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 25

|

|

| Expense Ratio, Percent |

0.50%

|

[6] |

| AssetsNet |

$ 18,003,661

|

|

| Holdings Count | Holding |

31

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$18,003,661

- Number of Portfolio Holdings31

- Portfolio Turnover Rate18%

- Advisory Fees Paid$-

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

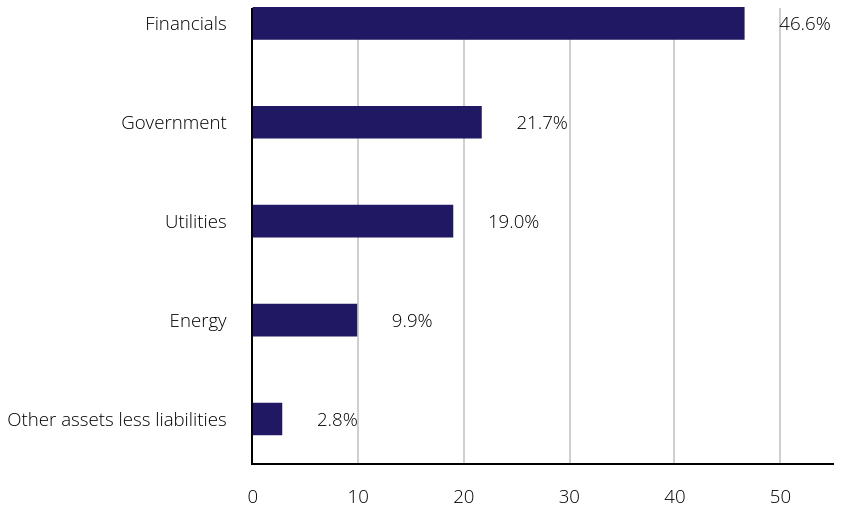

Other assets less liabilities | | 2.8% | Energy | | 9.9% | Utilities | | 19.0% | Government | | 21.7% | Financials | | 46.6% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000138289 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck ChiNext ETF

|

|

| Class Name |

VanEck ChiNext ETF

|

|

| Trading Symbol |

CNXT

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck ChiNext ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck ChiNext ETF | $33 | 0.65%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.65%

|

[7] |

| AssetsNet |

$ 27,433,078

|

|

| Holdings Count | Holding |

98

|

|

| Advisory Fees Paid, Amount |

$ 5,354

|

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$27,433,078

- Number of Portfolio Holdings98

- Portfolio Turnover Rate4%

- Advisory Fees Paid$5,354

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

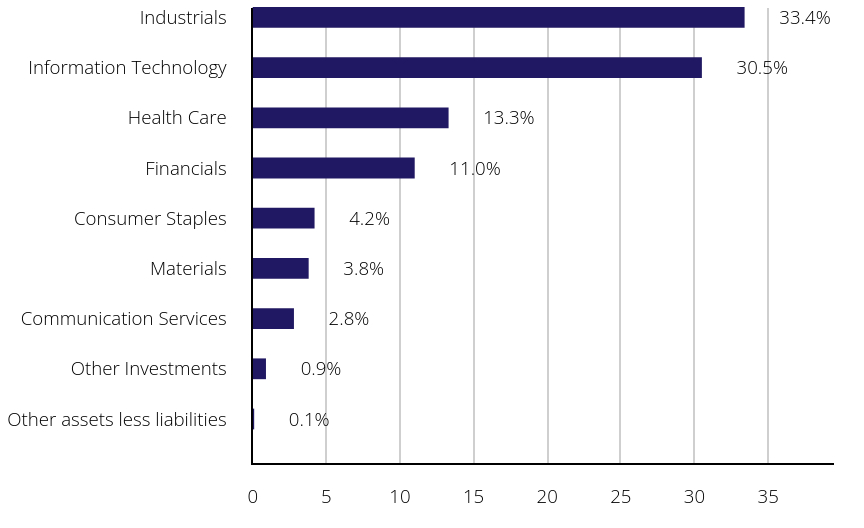

Other assets less liabilities | | 0.1% | Other Investments | | 0.9% | Communication Services | | 2.8% | Materials | | 3.8% | Consumer Staples | | 4.2% | Financials | | 11.0% | Health Care | | 13.3% | Information Technology | | 30.5% | Industrials | | 33.4% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000236336 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck CLO ETF

|

|

| Class Name |

VanEck CLO ETF

|

|

| Trading Symbol |

CLOI

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck CLO ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck CLO ETF | $20 | 0.40%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 20

|

|

| Expense Ratio, Percent |

0.40%

|

[8] |

| AssetsNet |

$ 1,054,147,029

|

|

| Holdings Count | Holding |

150

|

|

| Advisory Fees Paid, Amount |

$ 1,925,572

|

|

| InvestmentCompanyPortfolioTurnover |

20.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,054,147,029

- Number of Portfolio Holdings150

- Portfolio Turnover Rate20%

- Advisory Fees Paid$1,925,572

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

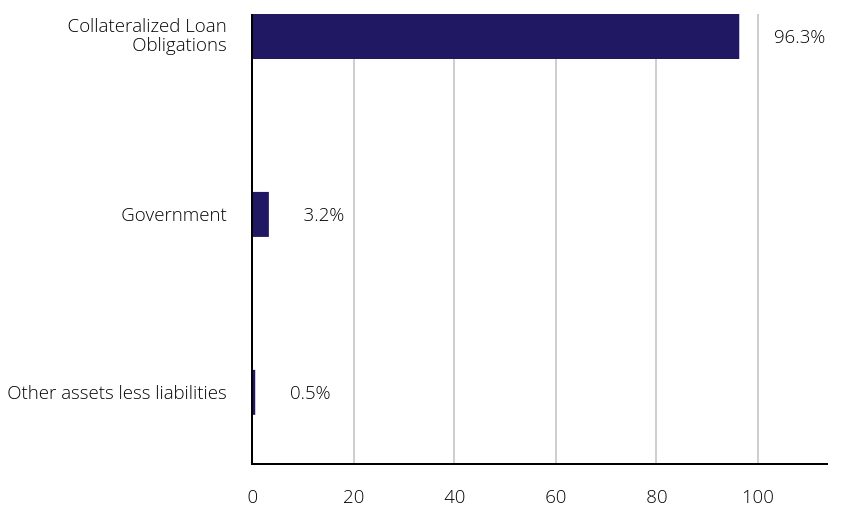

Other assets less liabilities | | 0.5% | Government | | 3.2% | Collateralized Loan Obligations | | 96.3% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000240390 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck CMCI Commodity Strategy ETF

|

|

| Class Name |

VanEck CMCI Commodity Strategy ETF

|

|

| Trading Symbol |

CMCI

|

|

| Security Exchange Name |

CboeBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck CMCI Commodity Strategy ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck CMCI Commodity Strategy ETF | $33 | 0.65%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.65%

|

[9] |

| AssetsNet |

$ 2,489,182

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,489,182

- Number of Portfolio Holdings16

- Portfolio Turnover Rate-%

- Advisory Fees Paid$-

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

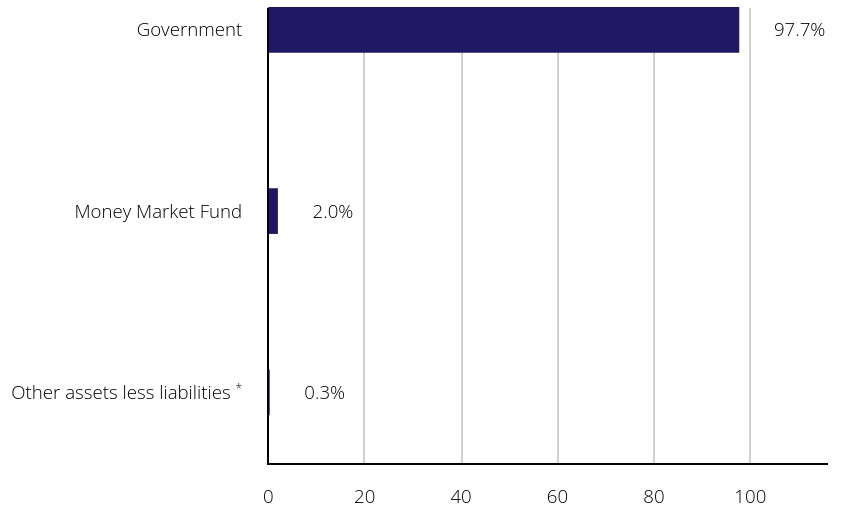

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilitiesFootnote Reference* | | 0.3% | Money Market Fund | | 2.0% | Government | | 97.7% |

| Footnote | Description | Footnote* | Includes net unrealized appreciation (depreciation) on total return swap contracts of 0.2% |

|

|

| Exposure Basis Explanation [Text Block] |

Includes net unrealized appreciation (depreciation) on total return swap contracts of 0.2%

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000232971 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Digital India ETF

|

|

| Class Name |

VanEck Digital India ETF

|

|

| Trading Symbol |

DGIN

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Digital India ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Digital India ETF | $35 | 0.70%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.70%

|

[10] |

| AssetsNet |

$ 22,053,592

|

|

| Holdings Count | Holding |

49

|

|

| Advisory Fees Paid, Amount |

$ 83,366

|

|

| InvestmentCompanyPortfolioTurnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$22,053,592

- Number of Portfolio Holdings49

- Portfolio Turnover Rate13%

- Advisory Fees Paid$83,366

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

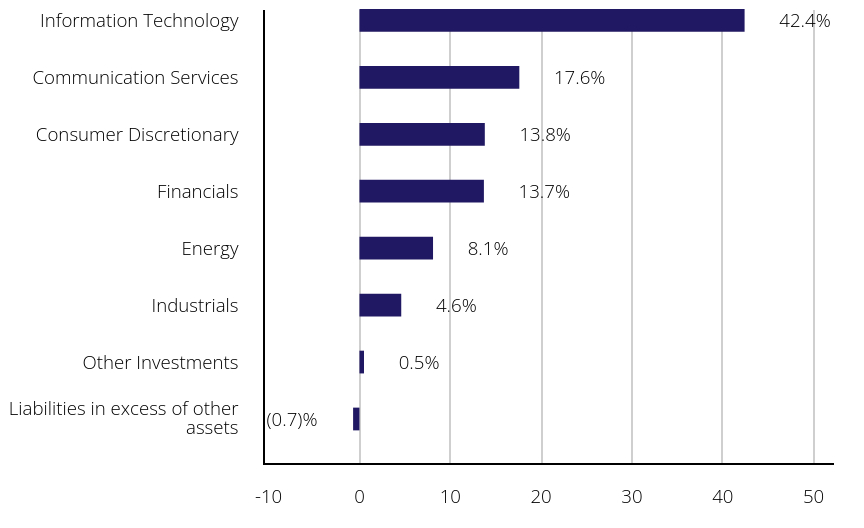

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Liabilities in excess of other assets | | (0.7)% | Other Investments | | 0.5% | Industrials | | 4.6% | Energy | | 8.1% | Financials | | 13.7% | Consumer Discretionary | | 13.8% | Communication Services | | 17.6% | Information Technology | | 42.4% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000024980 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Gold Miners ETF

|

|

| Class Name |

VanEck Gold Miners ETF

|

|

| Trading Symbol |

GDX

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Gold Miners ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Gold Miners ETF | $32 | 0.51%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.51%

|

[11] |

| AssetsNet |

$ 15,485,749,940

|

|

| Holdings Count | Holding |

64

|

|

| Advisory Fees Paid, Amount |

$ 36,226,391

|

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$15,485,749,940

- Number of Portfolio Holdings64

- Portfolio Turnover Rate5%

- Advisory Fees Paid$36,226,391

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

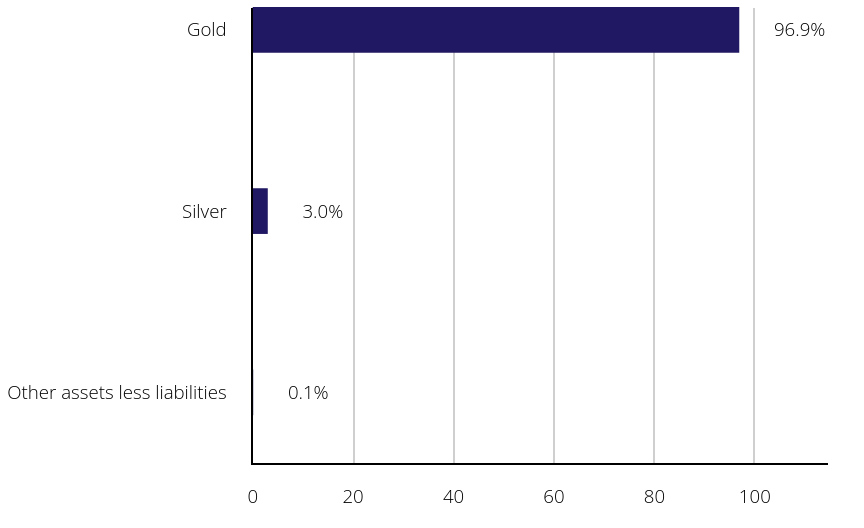

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 0.1% | Silver | | 3.0% | Gold | | 96.9% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000231316 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Green Metals ETF

|

|

| Class Name |

VanEck Green Metals ETF

|

|

| Trading Symbol |

GMET

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Green Metals ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Green Metals ETF | $34 | 0.63%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 34

|

|

| Expense Ratio, Percent |

0.63%

|

[12] |

| AssetsNet |

$ 19,072,652

|

|

| Holdings Count | Holding |

55

|

|

| Advisory Fees Paid, Amount |

$ 51,174

|

|

| InvestmentCompanyPortfolioTurnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$19,072,652

- Number of Portfolio Holdings55

- Portfolio Turnover Rate11%

- Advisory Fees Paid$51,174

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

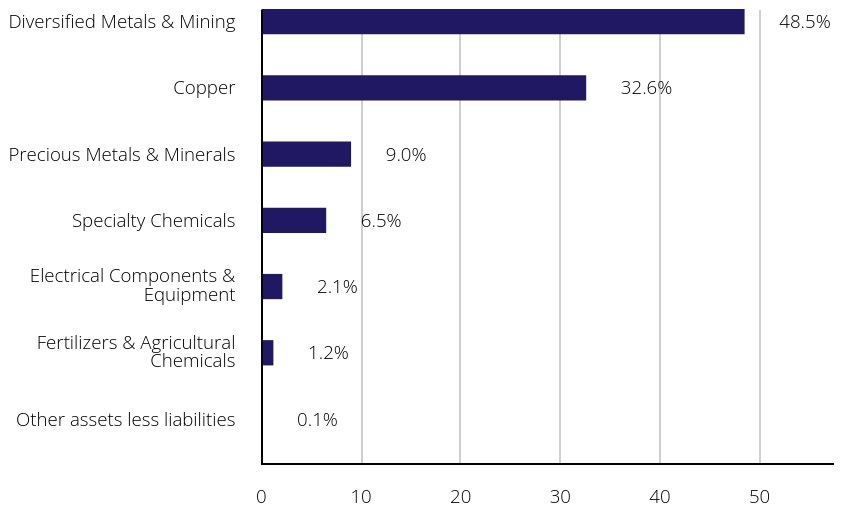

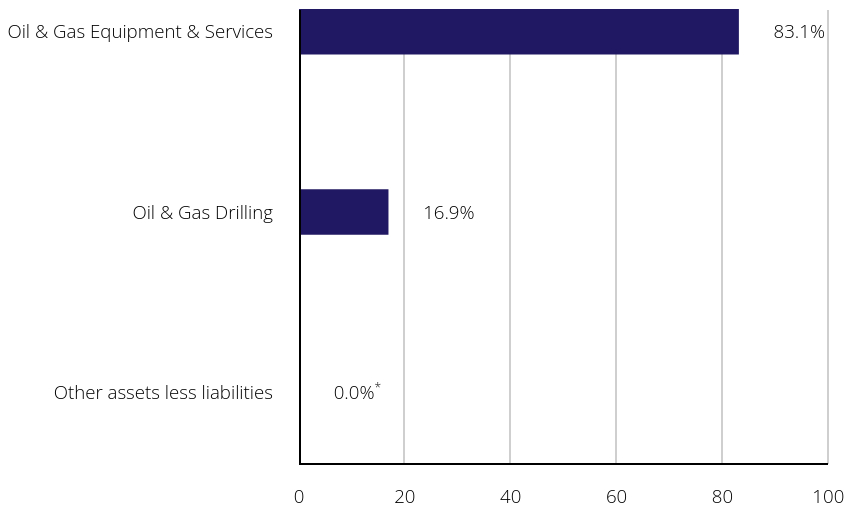

| Holdings [Text Block] |

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 0.1% | Fertilizers & Agricultural Chemicals | | 1.2% | Electrical Components & Equipment | | 2.1% | Specialty Chemicals | | 6.5% | Precious Metals & Minerals | | 9.0% | Copper | | 32.6% | Diversified Metals & Mining | | 48.5% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000082390 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck India Growth Leaders ETF

|

|

| Class Name |

VanEck India Growth Leaders ETF

|

|

| Trading Symbol |

GLIN

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck India Growth Leaders ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck India Growth Leaders ETF | $35 | 0.71%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.71%

|

[13] |

| AssetsNet |

$ 138,872,000

|

|

| Holdings Count | Holding |

80

|

|

| Advisory Fees Paid, Amount |

$ 311,763

|

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$138,872,000

- Number of Portfolio Holdings80

- Portfolio Turnover Rate41%

- Advisory Fees Paid$311,763

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

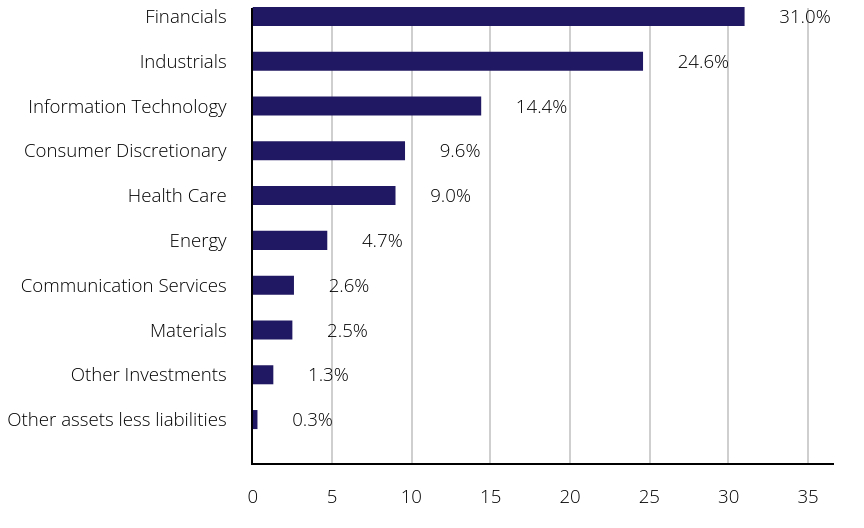

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 0.3% | Other Investments | | 1.3% | Materials | | 2.5% | Communication Services | | 2.6% | Energy | | 4.7% | Health Care | | 9.0% | Consumer Discretionary | | 9.6% | Information Technology | | 14.4% | Industrials | | 24.6% | Financials | | 31.0% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000070695 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Indonesia Index ETF

|

|

| Class Name |

VanEck Indonesia Index ETF

|

|

| Trading Symbol |

IDX

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Indonesia Index ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Indonesia Index ETF | $28 | 0.57%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 28

|

|

| Expense Ratio, Percent |

0.57%

|

[14] |

| AssetsNet |

$ 31,910,580

|

|

| Holdings Count | Holding |

59

|

|

| Advisory Fees Paid, Amount |

$ 24,558

|

|

| InvestmentCompanyPortfolioTurnover |

8.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$31,910,580

- Number of Portfolio Holdings59

- Portfolio Turnover Rate8%

- Advisory Fees Paid$24,558

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

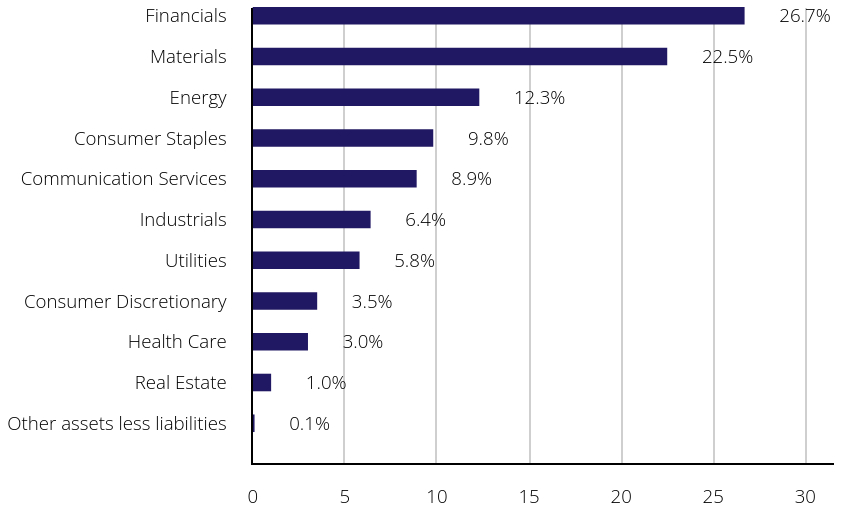

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 0.1% | Real Estate | | 1.0% | Health Care | | 3.0% | Consumer Discretionary | | 3.5% | Utilities | | 5.8% | Industrials | | 6.4% | Communication Services | | 8.9% | Consumer Staples | | 9.8% | Energy | | 12.3% | Materials | | 22.5% | Financials | | 26.7% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000102897 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck International High Yield Bond ETF

|

|

| Class Name |

VanEck International High Yield Bond ETF

|

|

| Trading Symbol |

IHY

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck International High Yield Bond ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck International High Yield Bond ETF | $21 | 0.40%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.40%

|

[15] |

| AssetsNet |

$ 41,676,539

|

|

| Holdings Count | Holding |

521

|

|

| Advisory Fees Paid, Amount |

$ 52,707

|

|

| InvestmentCompanyPortfolioTurnover |

22.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$41,676,539

- Number of Portfolio Holdings521

- Portfolio Turnover Rate22%

- Advisory Fees Paid$52,707

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

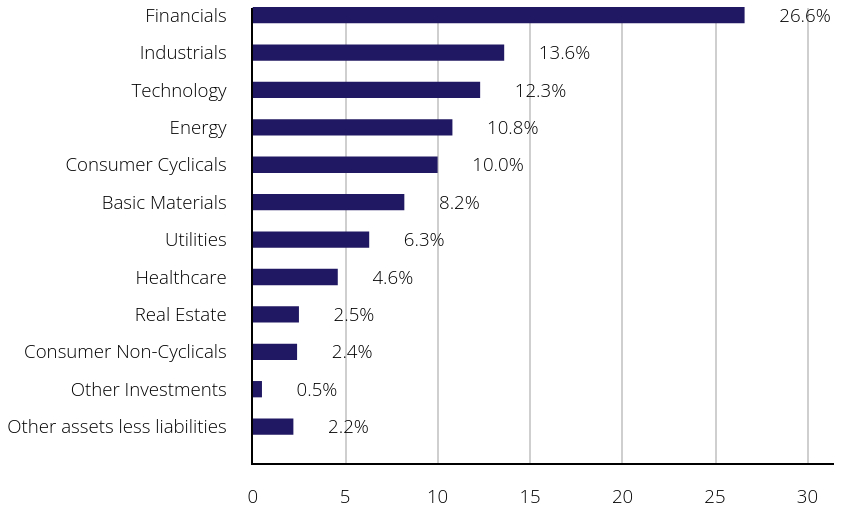

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 2.2% | Other Investments | | 0.5% | Consumer Non-Cyclicals | | 2.4% | Real Estate | | 2.5% | Healthcare | | 4.6% | Utilities | | 6.3% | Basic Materials | | 8.2% | Consumer Cyclicals | | 10.0% | Energy | | 10.8% | Technology | | 12.3% | Industrials | | 13.6% | Financials | | 26.6% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000127738 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Israel ETF

|

|

| Class Name |

VanEck Israel ETF

|

|

| Trading Symbol |

ISRA

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Israel ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Israel ETF | $32 | 0.59%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.59%

|

[16] |

| AssetsNet |

$ 111,321,152

|

|

| Holdings Count | Holding |

81

|

|

| Advisory Fees Paid, Amount |

$ 210,842

|

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$111,321,152

- Number of Portfolio Holdings81

- Portfolio Turnover Rate4%

- Advisory Fees Paid$210,842

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

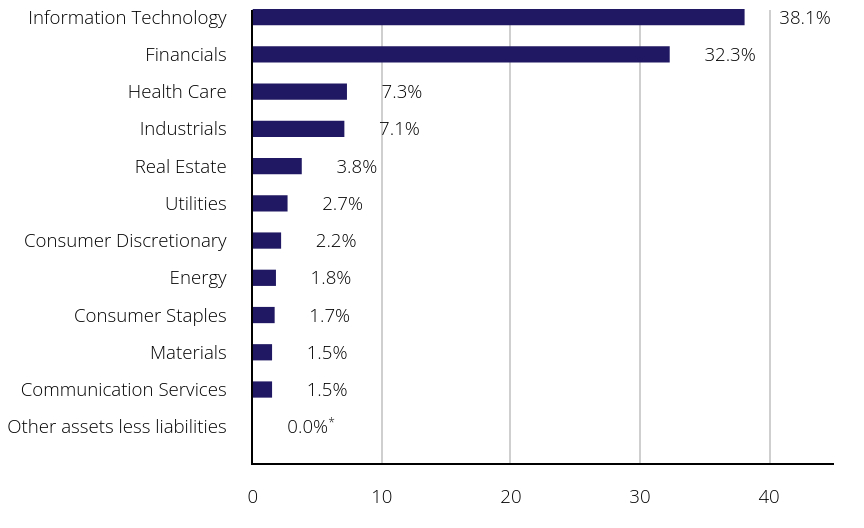

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 0.0%Footnote Reference* | Communication Services | | 1.5% | Materials | | 1.5% | Consumer Staples | | 1.7% | Energy | | 1.8% | Consumer Discretionary | | 2.2% | Utilities | | 2.7% | Real Estate | | 3.8% | Industrials | | 7.1% | Health Care | | 7.3% | Financials | | 32.3% | Information Technology | | 38.1% |

| Footnote | Description | Footnote* | Amount is less than 0.05% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000088891 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck J.P. Morgan EM Local Currency Bond ETF

|

|

| Class Name |

VanEck J.P. Morgan EM Local Currency Bond ETF

|

|

| Trading Symbol |

EMLC

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck J.P. Morgan EM Local Currency Bond ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck J.P. Morgan EM Local Currency Bond ETF | $16 | 0.30%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 16

|

|

| Expense Ratio, Percent |

0.30%

|

[17] |

| AssetsNet |

$ 3,353,863,773

|

|

| Holdings Count | Holding |

477

|

|

| Advisory Fees Paid, Amount |

$ 3,520,130

|

|

| InvestmentCompanyPortfolioTurnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$3,353,863,773

- Number of Portfolio Holdings477

- Portfolio Turnover Rate17%

- Advisory Fees Paid$3,520,130

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

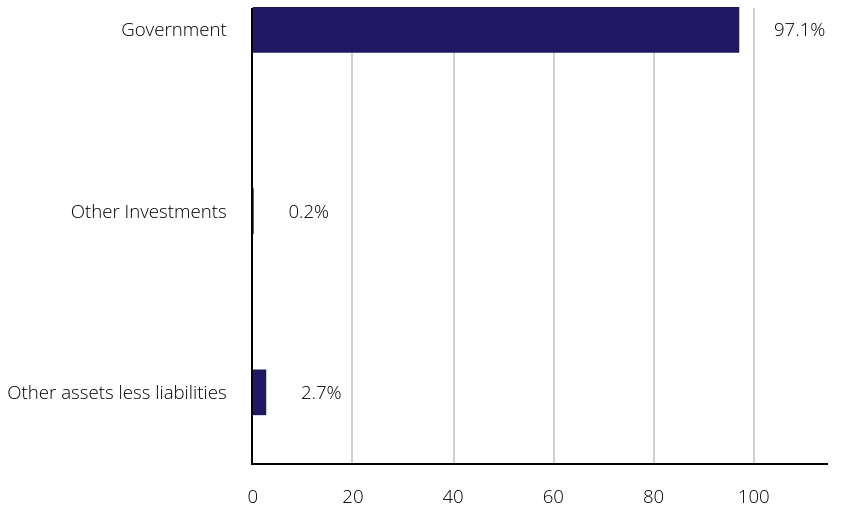

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 2.7% | Other Investments | | 0.2% | Government | | 97.1% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000081187 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Junior Gold Miners ETF

|

|

| Class Name |

VanEck Junior Gold Miners ETF

|

|

| Trading Symbol |

GDXJ

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Junior Gold Miners ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Junior Gold Miners ETF | $34 | 0.53%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 34

|

|

| Expense Ratio, Percent |

0.53%

|

[18] |

| AssetsNet |

$ 5,494,533,812

|

|

| Holdings Count | Holding |

88

|

|

| Advisory Fees Paid, Amount |

$ 12,783,173

|

|

| InvestmentCompanyPortfolioTurnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$5,494,533,812

- Number of Portfolio Holdings88

- Portfolio Turnover Rate14%

- Advisory Fees Paid$12,783,173

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

| Holdings [Text Block] |

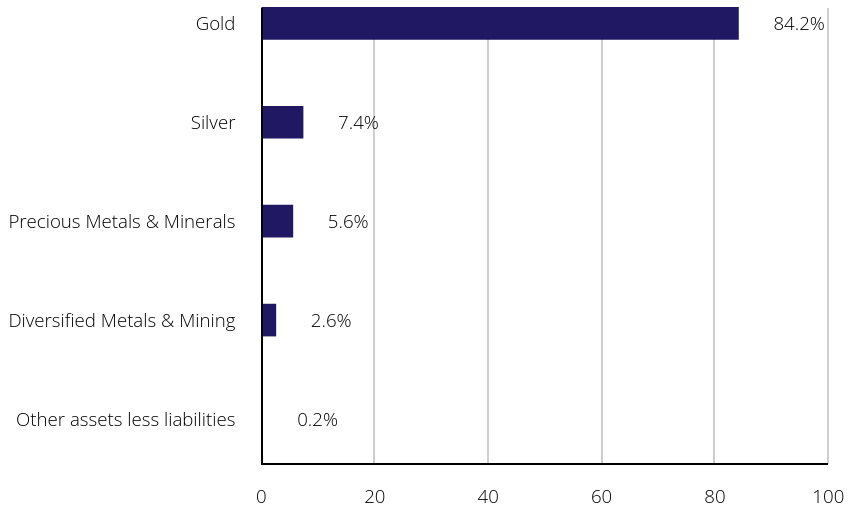

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 0.2% | Diversified Metals & Mining | | 2.6% | Precious Metals & Minerals | | 5.6% | Silver | | 7.4% | Gold | | 84.2% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000047031 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Low Carbon Energy ETF

|

|

| Class Name |

VanEck Low Carbon Energy ETF

|

|

| Trading Symbol |

SMOG

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Low Carbon Energy ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Low Carbon Energy ETF | $33 | 0.64%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.64%

|

[19] |

| AssetsNet |

$ 119,120,782

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 284,822

|

|

| InvestmentCompanyPortfolioTurnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$119,120,782

- Number of Portfolio Holdings58

- Portfolio Turnover Rate11%

- Advisory Fees Paid$284,822

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

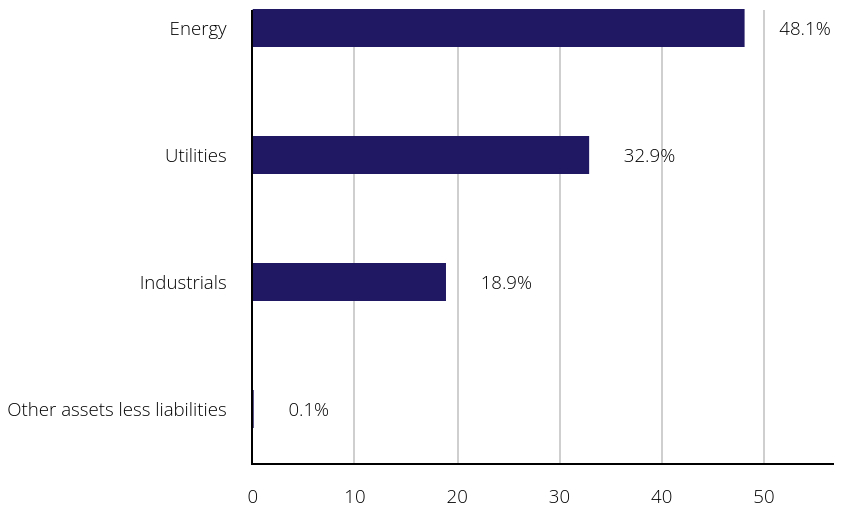

| Holdings [Text Block] |

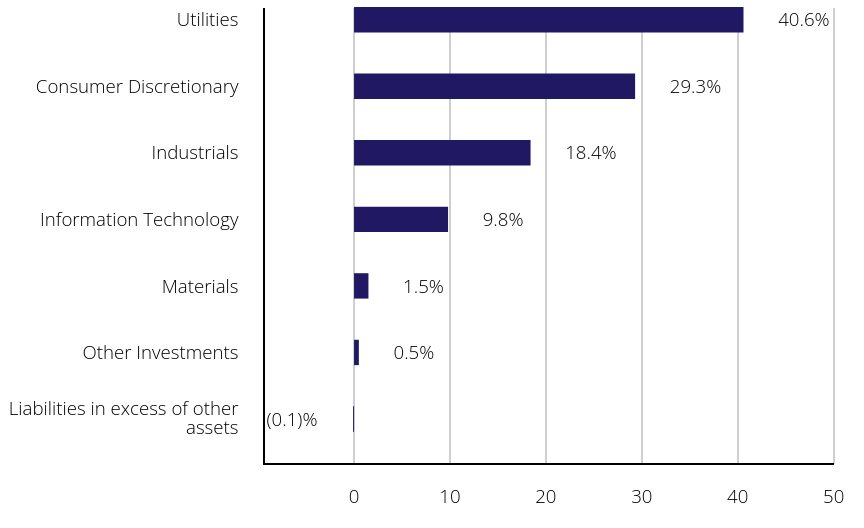

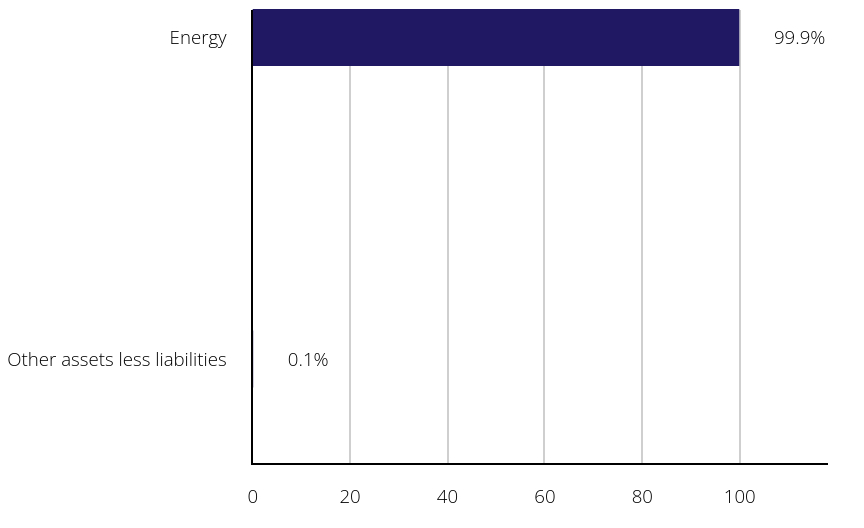

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Liabilities in excess of other assets | | (0.1)% | Other Investments | | 0.5% | Materials | | 1.5% | Information Technology | | 9.8% | Industrials | | 18.4% | Consumer Discretionary | | 29.3% | Utilities | | 40.6% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000102386 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Mortgage REIT Income ETF

|

|

| Class Name |

VanEck Mortgage REIT Income ETF

|

|

| Trading Symbol |

MORT

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Mortgage REIT Income ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Mortgage REIT Income ETF | $22 | 0.43%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 22

|

|

| Expense Ratio, Percent |

0.43%

|

[20] |

| AssetsNet |

$ 306,906,799

|

|

| Holdings Count | Holding |

26

|

|

| Advisory Fees Paid, Amount |

$ 586,663

|

|

| InvestmentCompanyPortfolioTurnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$306,906,799

- Number of Portfolio Holdings26

- Portfolio Turnover Rate13%

- Advisory Fees Paid$586,663

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

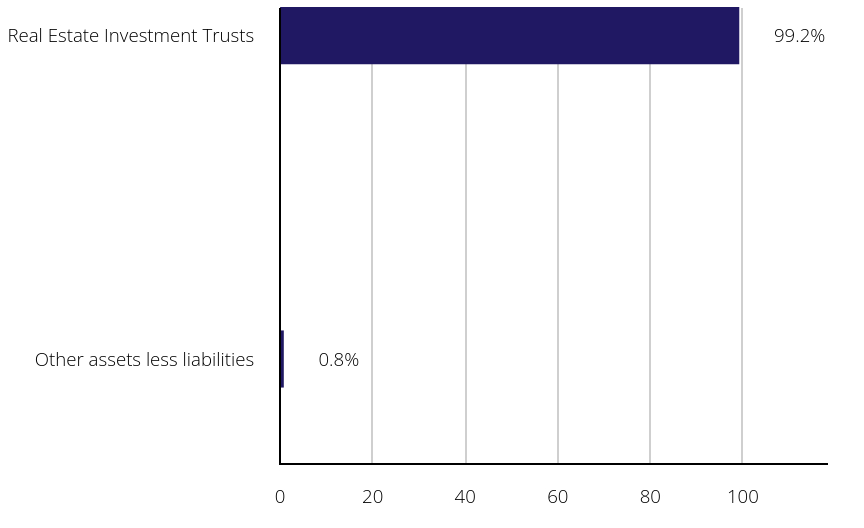

| Holdings [Text Block] |

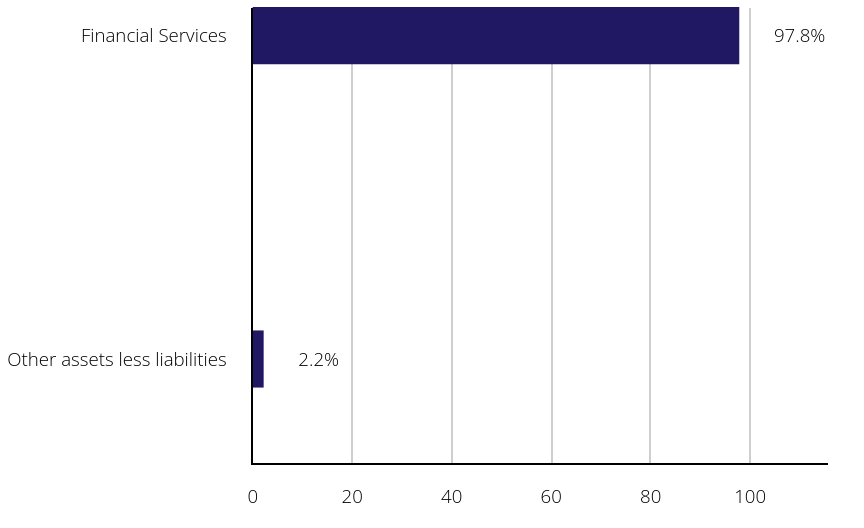

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Other assets less liabilities | | 2.2% | Financial Services | | 97.8% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| C000064328 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VanEck Natural Resources ETF

|

|

| Class Name |

VanEck Natural Resources ETF

|

|

| Trading Symbol |

HAP

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the VanEck Natural Resources ETF (the "Fund") for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

|

|

| Additional Information Phone Number |

800.826.2333

|

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">info@vaneck.com</span>

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

VanEck Natural Resources ETF | $22 | 0.42%Footnote Reference(a) |

|---|

| Footnote | Description | Footnote(a) | Annualized |

|

|

| Expenses Paid, Amount |

$ 22

|

|

| Expense Ratio, Percent |

0.42%

|

[21] |

| AssetsNet |

$ 158,315,698

|

|

| Holdings Count | Holding |

123

|

|

| Advisory Fees Paid, Amount |

$ 291,807

|

|

| InvestmentCompanyPortfolioTurnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$158,315,698

- Number of Portfolio Holdings123

- Portfolio Turnover Rate6%

- Advisory Fees Paid$291,807

|

|

| Additional Fund Statistics Significance or Limits [Text Block] |

|

|

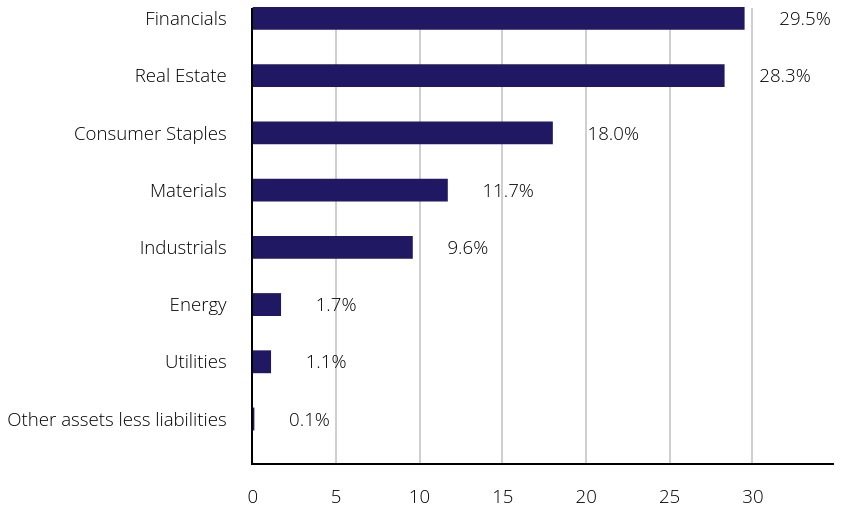

| Holdings [Text Block] |

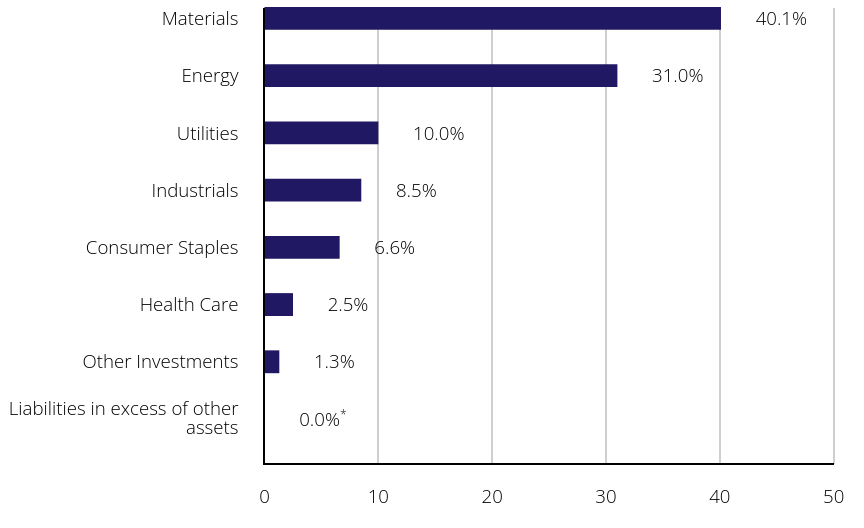

Portfolio Composition (% of Total Net Assets)Value | Value | Value |

|---|

Liabilities in excess of other assets | | 0.0%Footnote Reference* | Other Investments | | 1.3% | Health Care | | 2.5% | Consumer Staples | | 6.6% | Industrials | | 8.5% | Utilities | | 10.0% | Energy | | 31.0% | Materials | | 40.1% |

| Footnote | Description | Footnote* | Amount is less than 0.05% |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/</span>

|