Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

International Growth and Income Fund

|

| Entity Central Index Key |

0001439297

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| International Growth and Income Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class A

|

| Trading Symbol |

IGAAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-A |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-A

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class A | $ 98 | 0.90 % |

|

| Expenses Paid, Amount |

$ 98

|

| Expense Ratio, Percent |

0.90%

|

| Factors Affecting Performance [Text Block] |

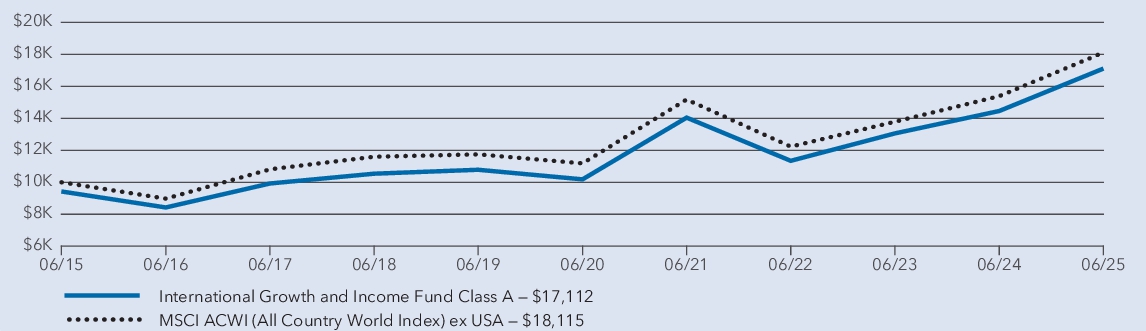

Management's discussion of fund performance The fund’s Class A shares gained 18.34% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-A . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

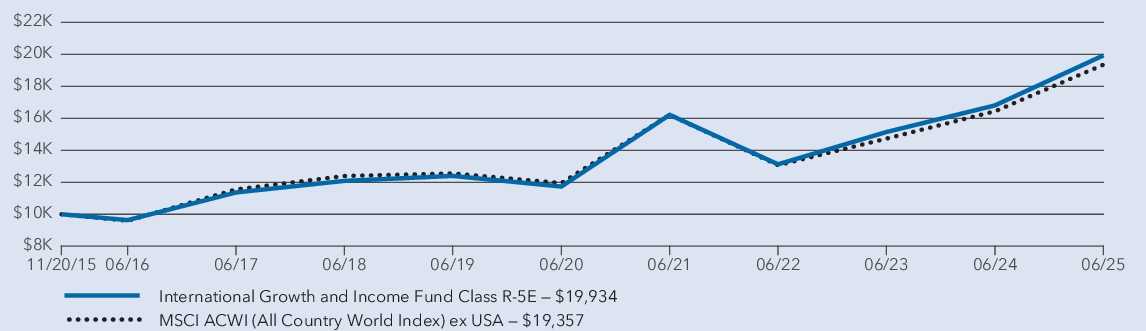

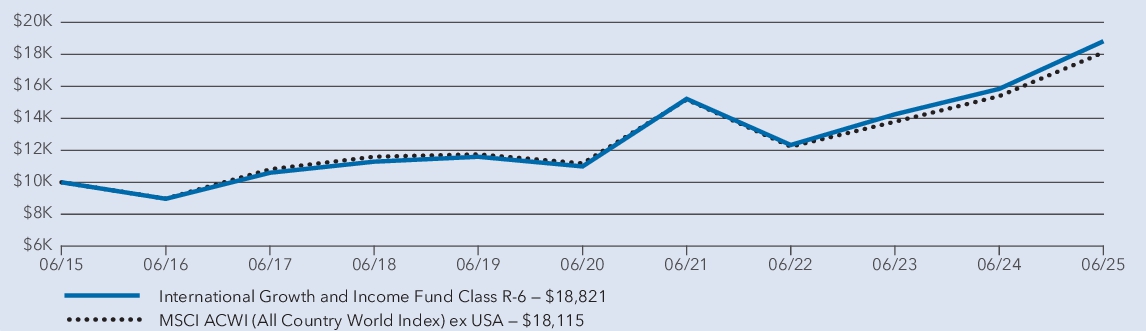

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class A (with sales charge) | 11.53 % | 9.63 % | 5.52 % | | International Growth and Income Fund — Class A (without sales charge) | 18.34 % | 10.94 % | 6.14 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

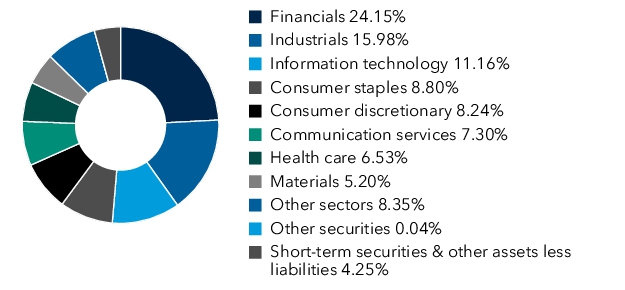

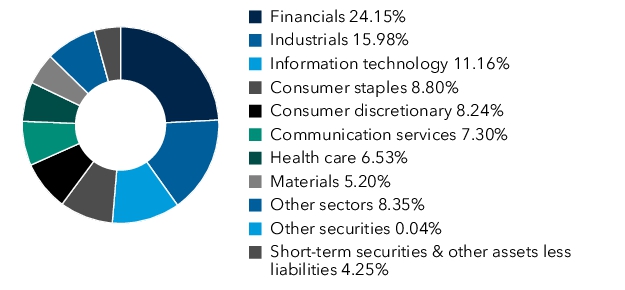

| Holdings [Text Block] |

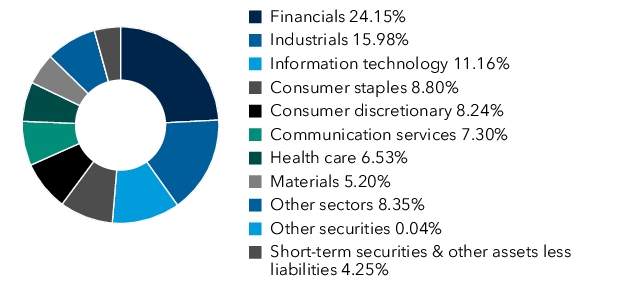

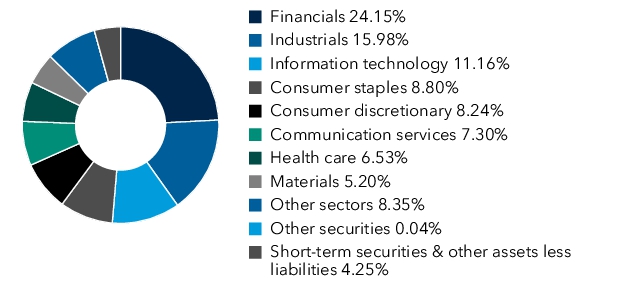

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class C

|

| Trading Symbol |

IGICX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-C |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-C

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class C | $ 179 | 1.65 % |

|

| Expenses Paid, Amount |

$ 179

|

| Expense Ratio, Percent |

1.65%

|

| Factors Affecting Performance [Text Block] |

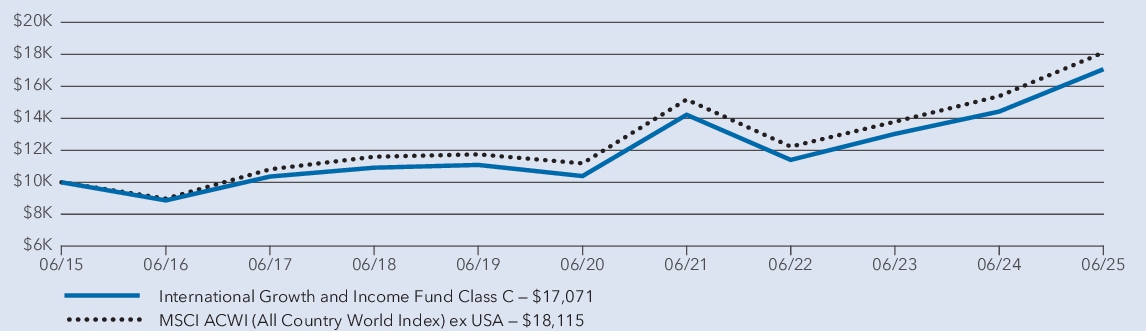

Management's discussion of fund performance The fund’s Class C shares gained 17.44% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-C . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

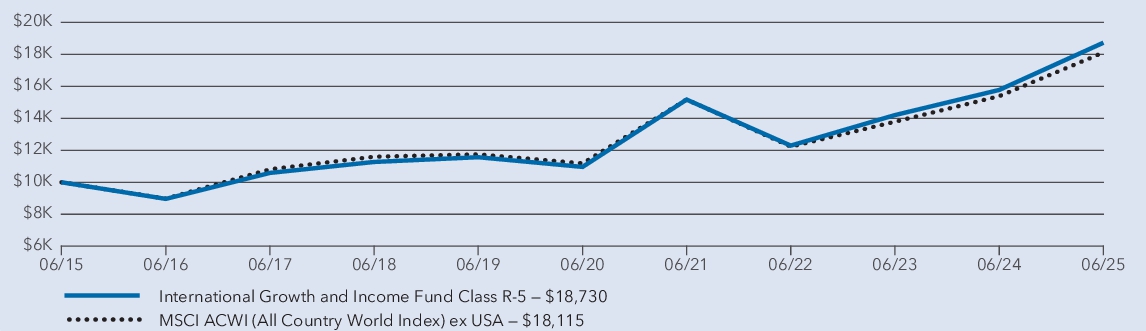

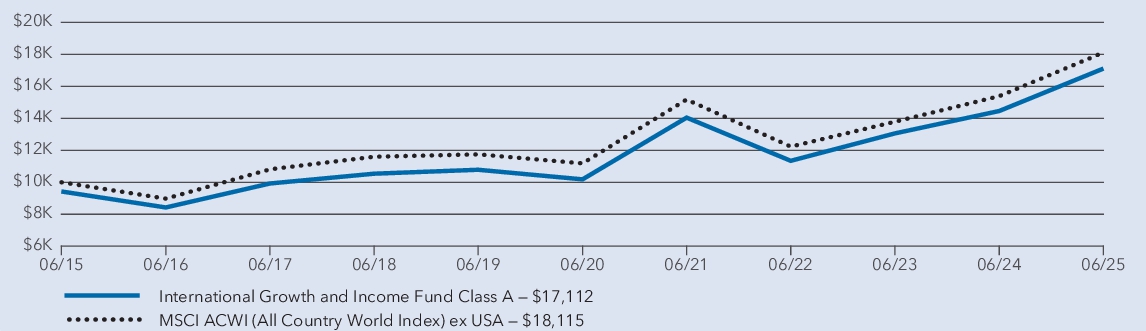

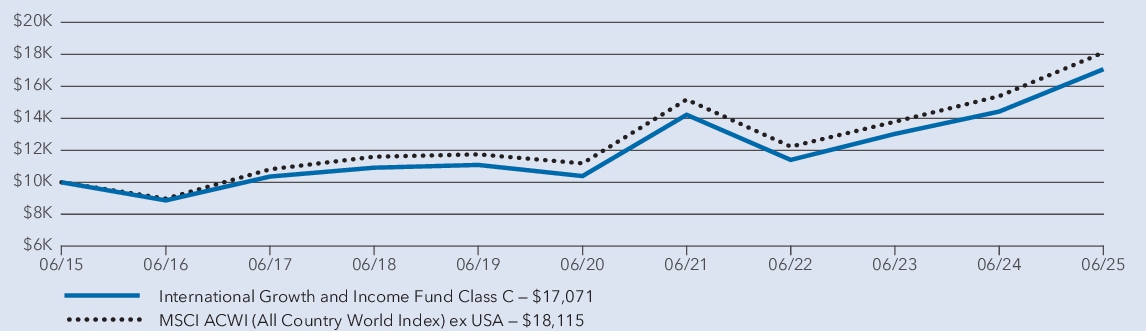

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class C (with sales charge) | 16.44 % | 10.12 % | 5.49 % | | International Growth and Income Fund — Class C (without sales charge) | 17.44 % | 10.12 % | 5.49 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged , and therefore , has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

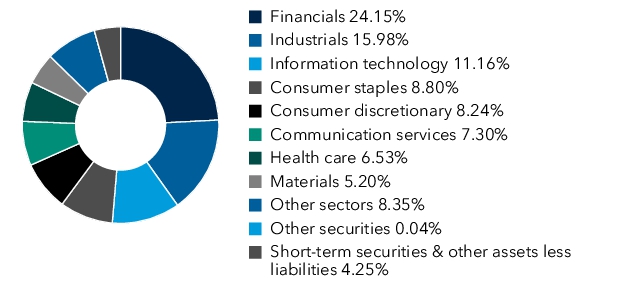

| Holdings [Text Block] |

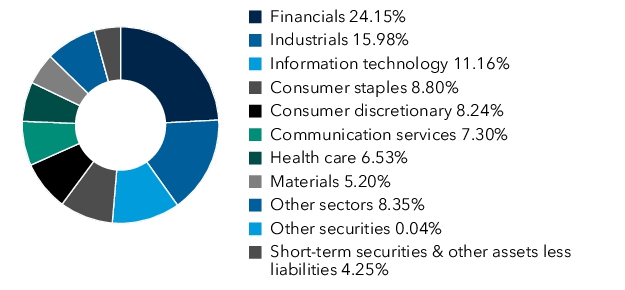

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class T |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class T

|

| Trading Symbol |

TGAIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class T | $ 71 | 0.65 % |

|

| Expenses Paid, Amount |

$ 71

|

| Expense Ratio, Percent |

0.65%

|

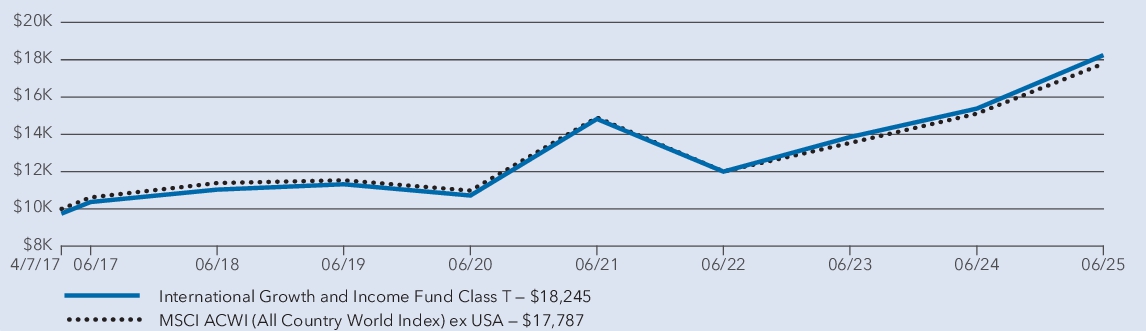

| Factors Affecting Performance [Text Block] |

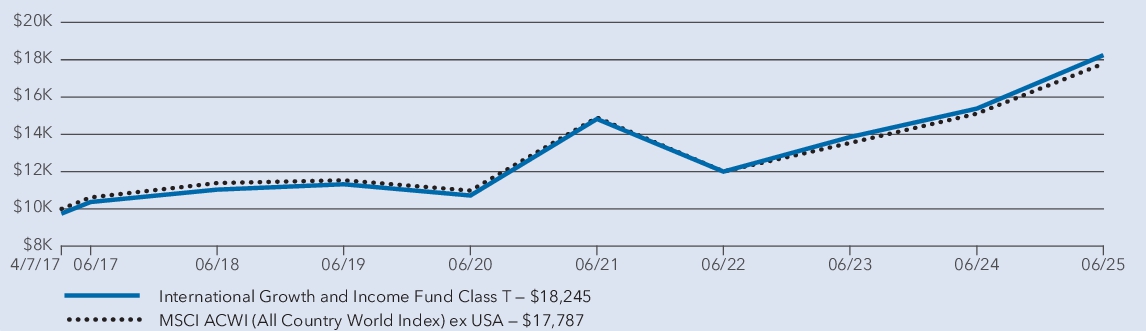

Management's discussion of fund performance The fund’s Class T shares gained 18.63% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | International Growth and Income Fund — Class T (with sales charge) | 15.64 % | 10.66 % | 7.58 % | | International Growth and Income Fund — Class T (without sales charge) | 18.63 % | 11.22 % | 7.91 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 7.25 % |

1 Class T shares were first offered on April 7, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged , and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Apr. 07, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

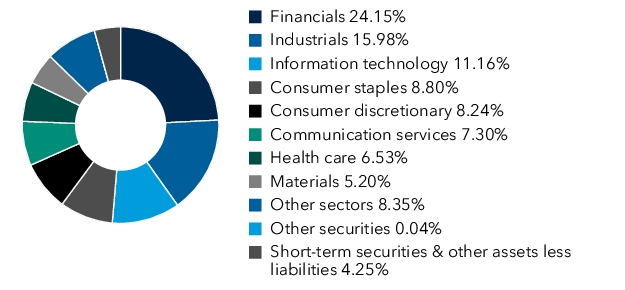

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class F-1 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class F-1

|

| Trading Symbol |

IGIFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F1 |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-1 | $ 100 | 0.92 % |

|

| Expenses Paid, Amount |

$ 100

|

| Expense Ratio, Percent |

0.92%

|

| Factors Affecting Performance [Text Block] |

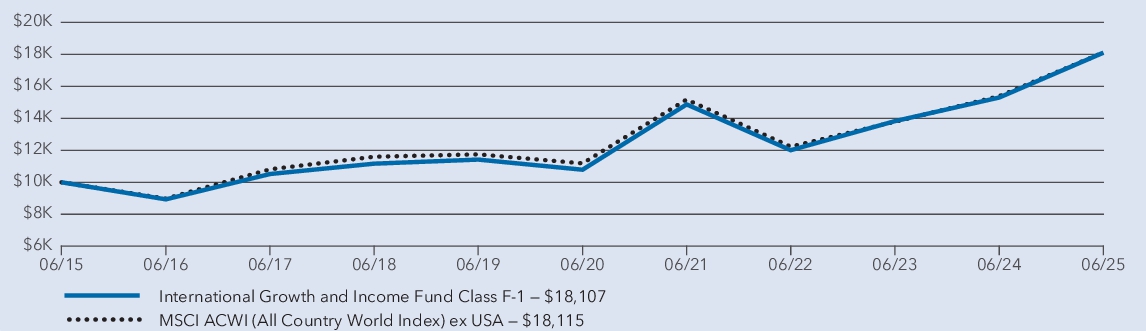

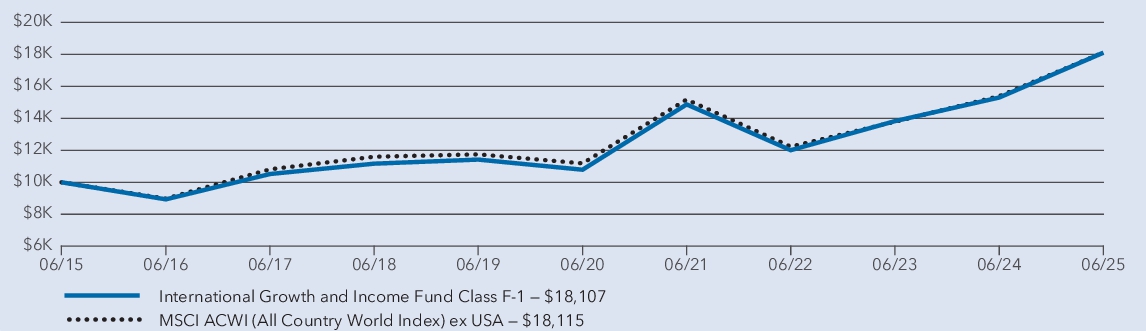

Management's discussion of fund performance The fund’s Class F-1 shares gained 18.32% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index ) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F1 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class F-1 | 18.32 % | 10.92 % | 6.12 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

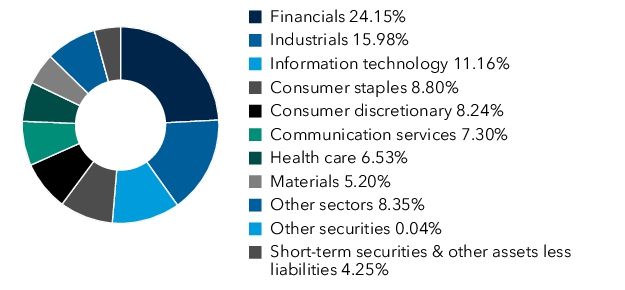

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class F-2 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class F-2

|

| Trading Symbol |

IGFFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F2 |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F2

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-2 | $ 70 | 0.64 % |

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.64%

|

| Factors Affecting Performance [Text Block] |

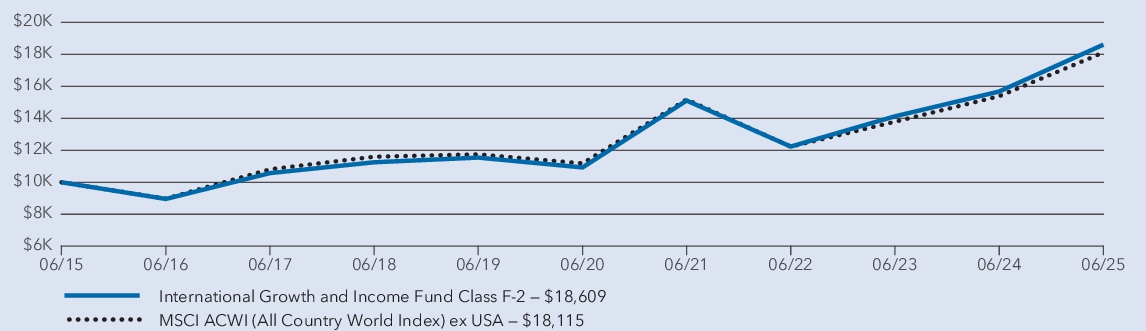

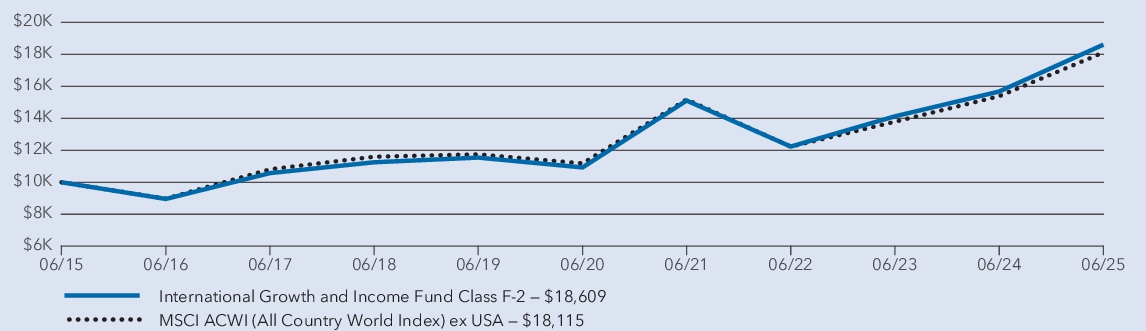

Management's discussion of fund performance The fund’s Class F-2 shares gained 18.67% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI ( All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F2 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class F-2 | 18.67 % | 11.23 % | 6.41 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

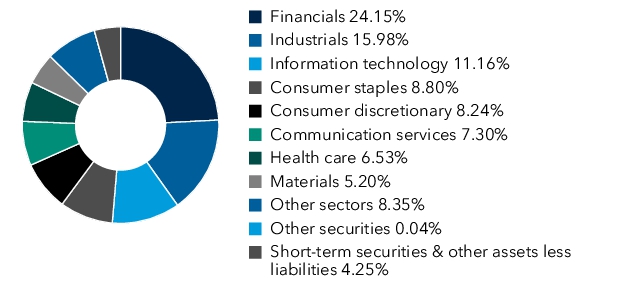

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class F-3 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class F-3

|

| Trading Symbol |

IGAIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F3 |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F3

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-3 | $ 58 | 0.53 % |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

0.53%

|

| Factors Affecting Performance [Text Block] |

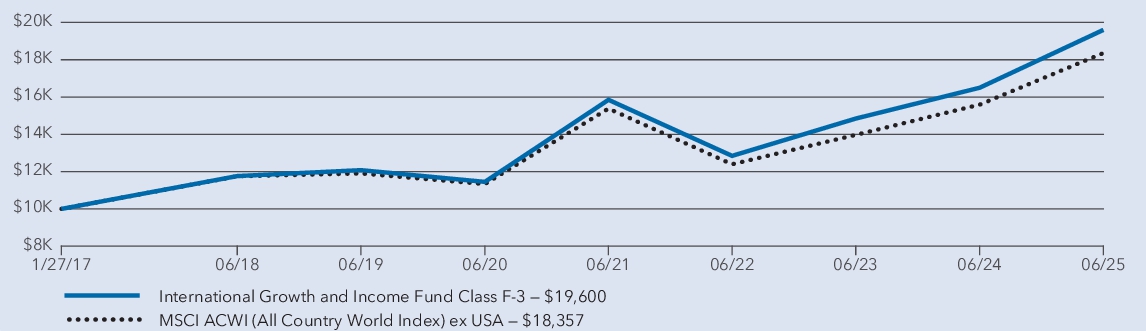

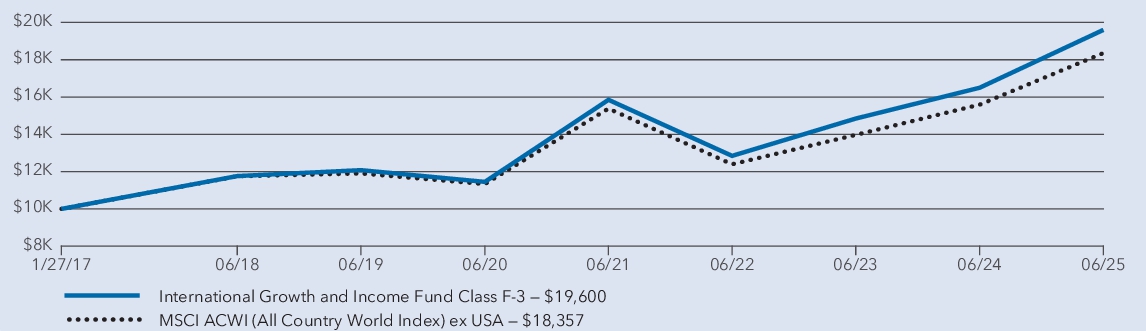

Management's discussion of fund performance The fund’s Class F-3 shares gained 18.80% for the year ended June 30, 2025. That result compares with a 17.72 % gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F3 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | International Growth and Income Fund — Class F-3 | 18.80 % | 11.35 % | 8.32 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 7.48 % |

1 Class F-3 shares were first offered on January 27, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI . |

| Performance Inception Date |

Jan. 27, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

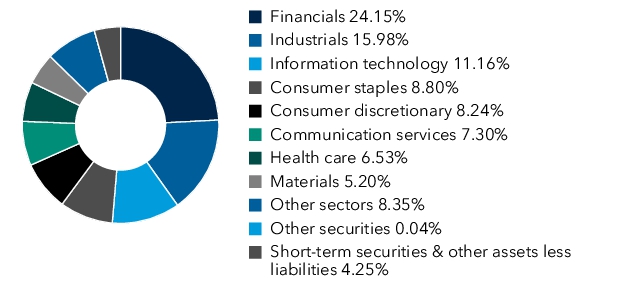

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class 529-A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-A

|

| Trading Symbol |

CGIAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529A . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529A

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-A | $ 102 | 0.93 % |

|

| Expenses Paid, Amount |

$ 102

|

| Expense Ratio, Percent |

0.93%

|

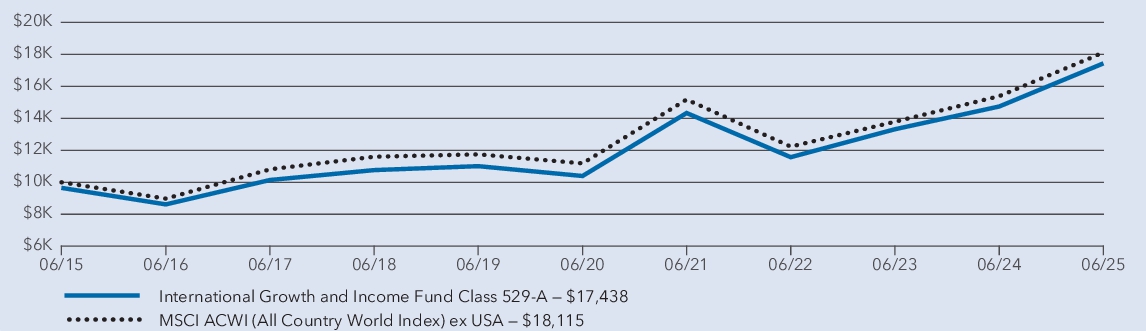

| Factors Affecting Performance [Text Block] |

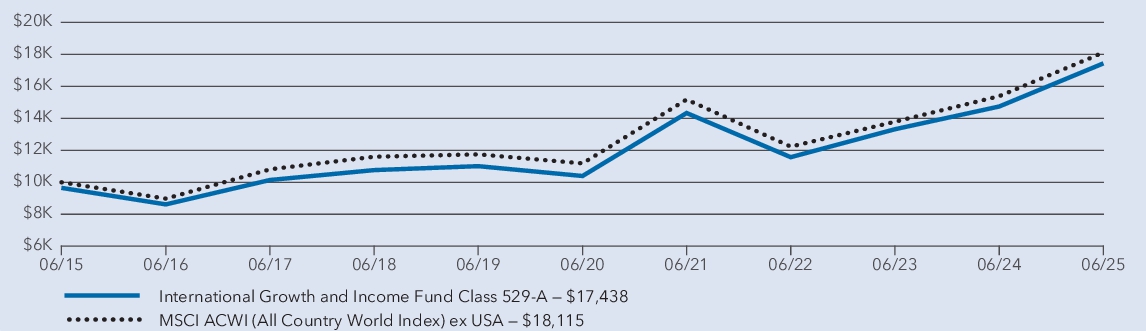

Management's discussion of fund performance The fund’s Class 529-A shares gained 18.29% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529A . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class 529-A (with sales charge) | 14.15 % | 10.12 % | 5.72 % | | International Growth and Income Fund — Class 529-A (without sales charge) | 18.29 % | 10.91 % | 6.10 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

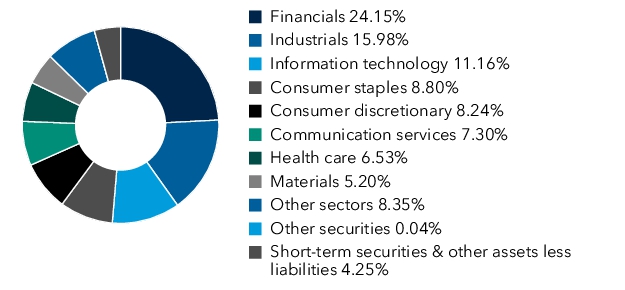

| Holdings [Text Block] |

Portfolio holdings by sector ( percent of net assets ) |

| International Growth and Income Fund - Class 529-C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-C

|

| Trading Symbol |

CIICX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529C . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529C

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-C | $ 185 | 1.70 % |

|

| Expenses Paid, Amount |

$ 185

|

| Expense Ratio, Percent |

1.70%

|

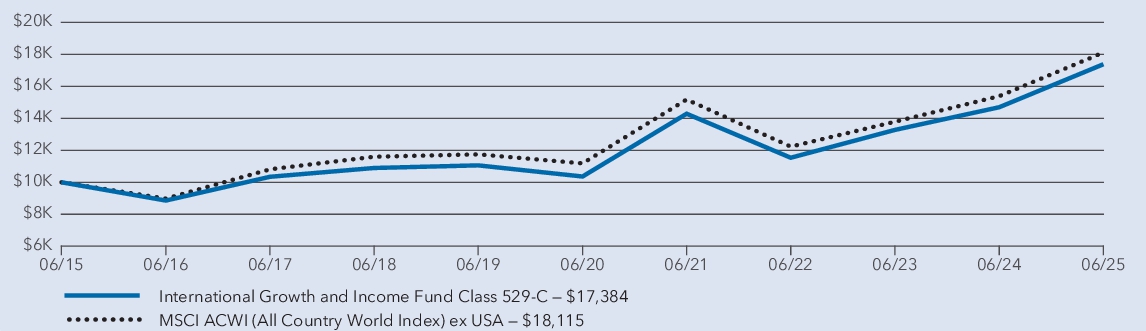

| Factors Affecting Performance [Text Block] |

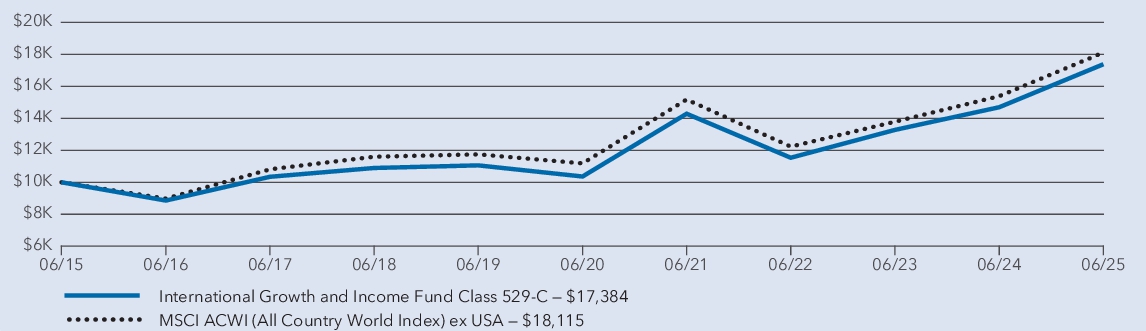

Management's discussion of fund performance The fund’s Class 529-C shares gained 17.42% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529C . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class 529-C (with sales charge) | 16.42 % | 10.07 % | 5.69 % | | International Growth and Income Fund — Class 529-C (without sales charge) | 17.42 % | 10.07 % | 5.69 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

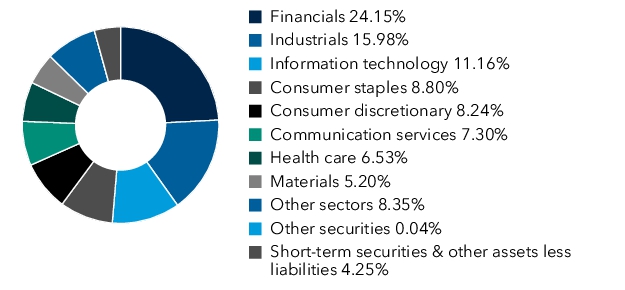

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets ) |

| International Growth and Income Fund - Class 529-E |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-E

|

| Trading Symbol |

CGIEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529E . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529E

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment ) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-E | $ 123 | 1.13 % |

|

| Expenses Paid, Amount |

$ 123

|

| Expense Ratio, Percent |

1.13%

|

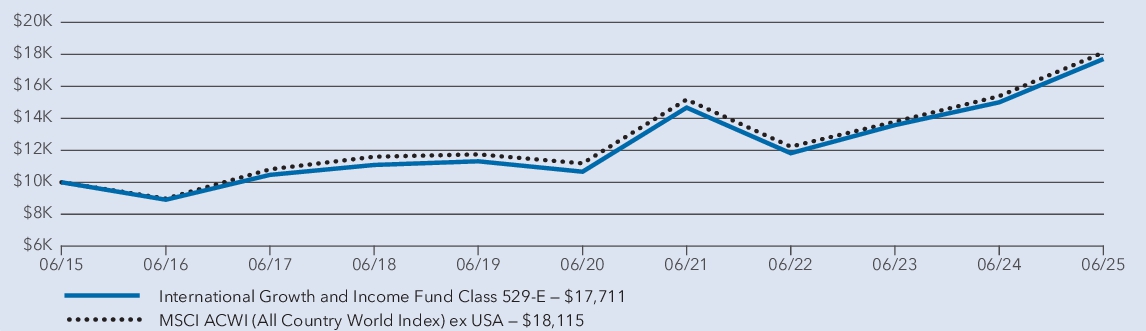

| Factors Affecting Performance [Text Block] |

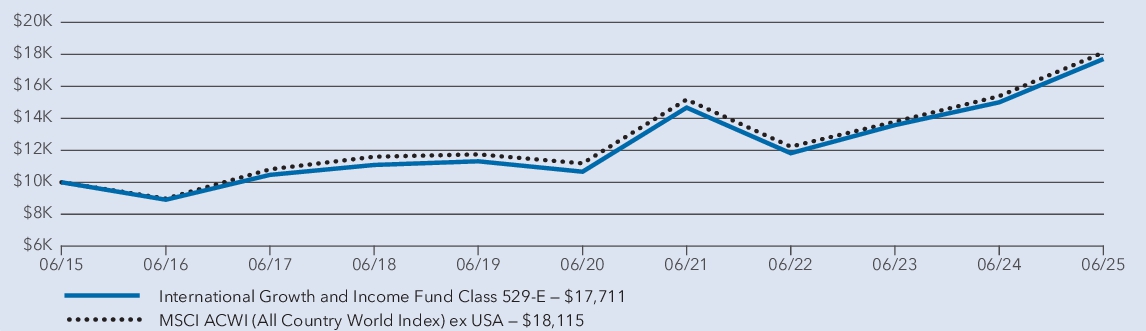

Management's discussion of fund performance The fund’s Class 529-E shares gained 18.04% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529E . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class 529-E | 18.04 % | 10.69 % | 5.88 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When a pplicable , results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

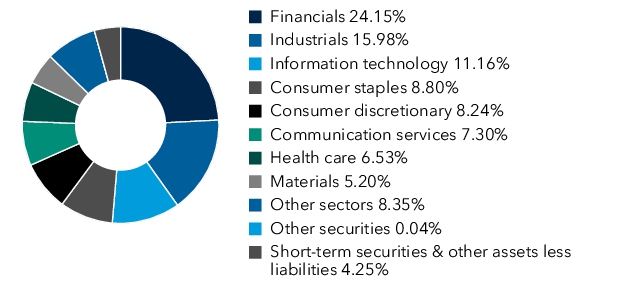

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class 529-T |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-T

|

| Trading Symbol |

TGAGX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-T | $ 75 | 0.69 % |

|

| Expenses Paid, Amount |

$ 75

|

| Expense Ratio, Percent |

0.69%

|

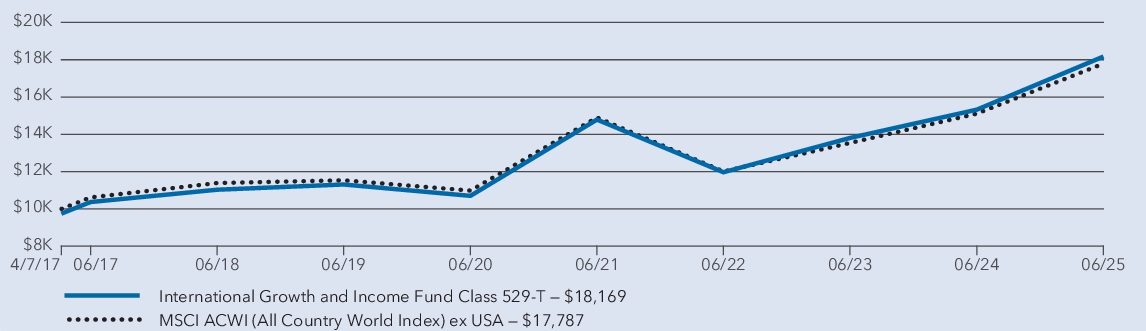

| Factors Affecting Performance [Text Block] |

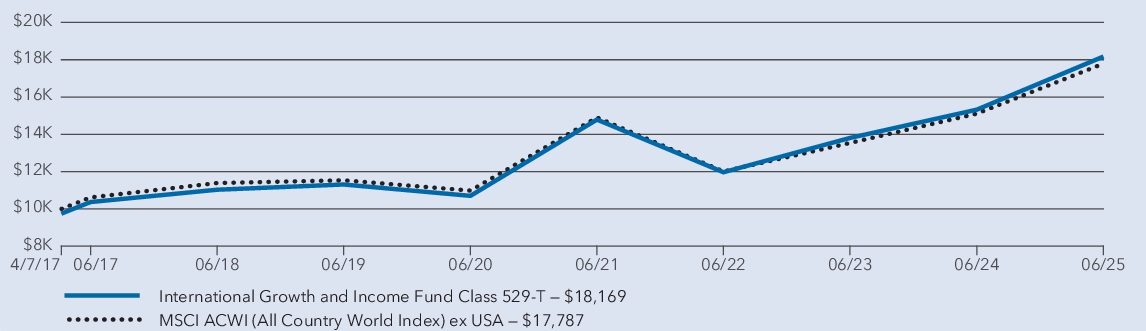

Management's discussion of fund performance The fund’s Class 529-T shares gained 18.58% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | International Growth and Income Fund — Class 529-T (with sales charge)2 | 15.60 % | 10.61 % | 7.53 % | | International Growth and Income Fund — Class 529-T (without sales charge)2 | 18.58 % | 11.17 % | 7.86 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 7.25 % |

1 Class 529-T shares were first offered on April 7, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Apr. 07, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

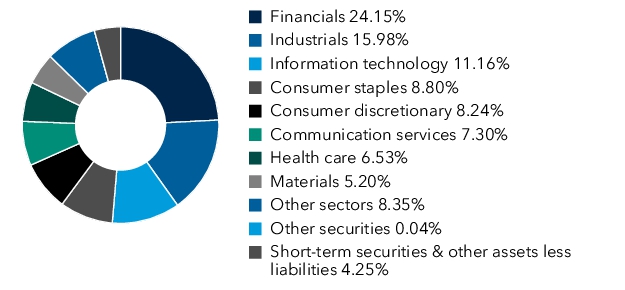

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class 529-F-1 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-F-1

|

| Trading Symbol |

CGIFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F1 |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investmen t) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-1 | $ 80 | 0.73 % |

|

| Expenses Paid, Amount |

$ 80

|

| Expense Ratio, Percent |

0.73%

|

| Factors Affecting Performance [Text Block] |

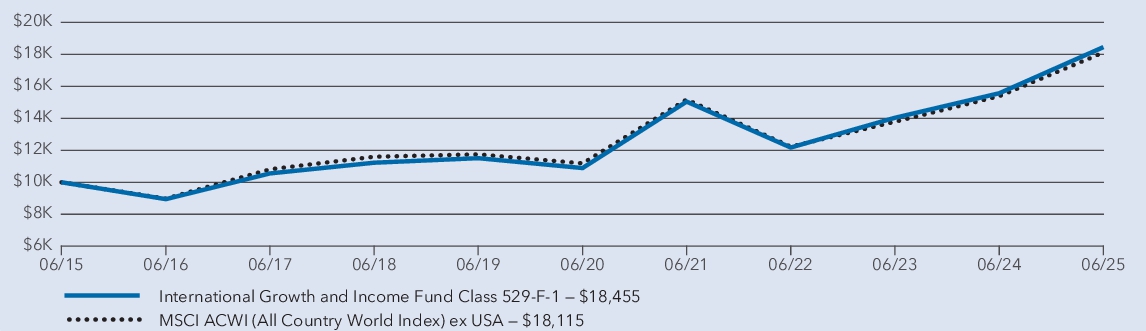

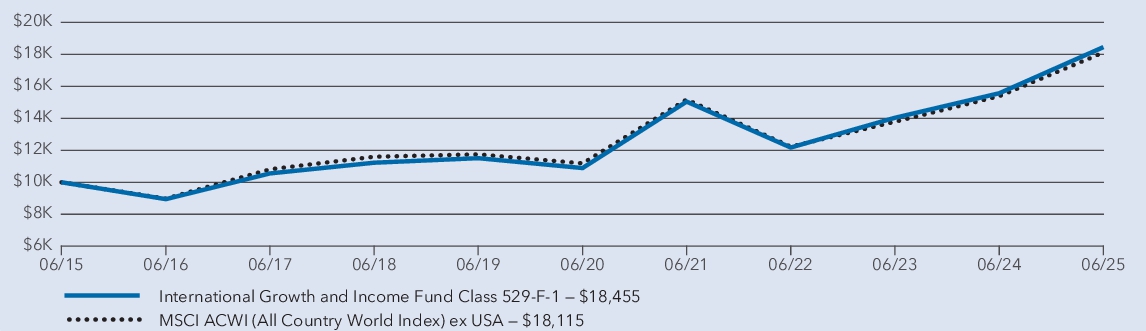

Management's discussion of fund performance The fund’s Class 529-F-1 shares gained 18.52% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529F1 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class 529-F-1* | 18.52 % | 11.13 % | 6.32 % | | MSCI ACWI (All Country World Index) ex USA† | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

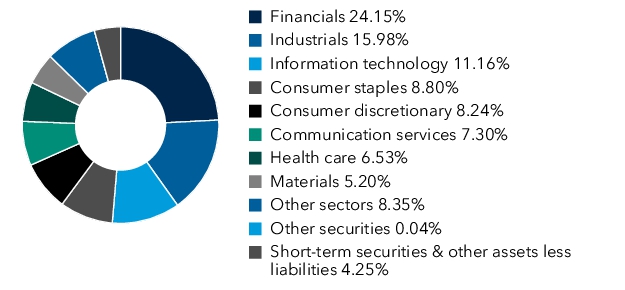

| Holdings [Text Block] |

Portfolio holdings by sector ( percent of net assets) |

| International Growth and Income Fund - Class 529-F-2 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-F-2

|

| Trading Symbol |

FGGGX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F2 . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F2

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-2 | $ 70 | 0.64 % |

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.64%

|

| Factors Affecting Performance [Text Block] |

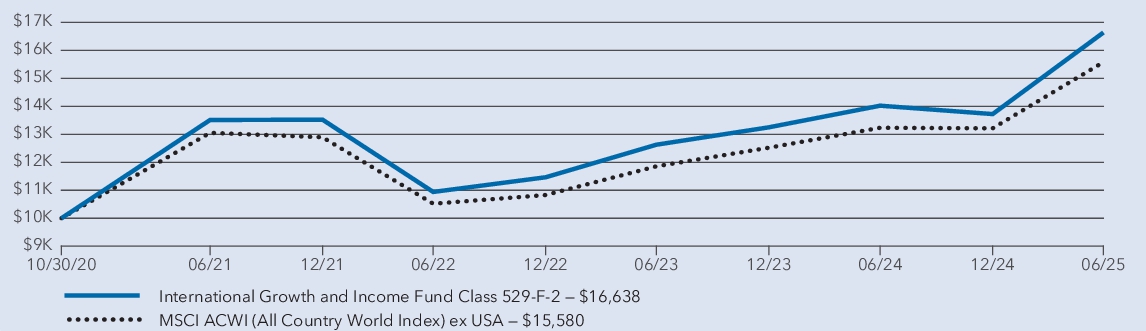

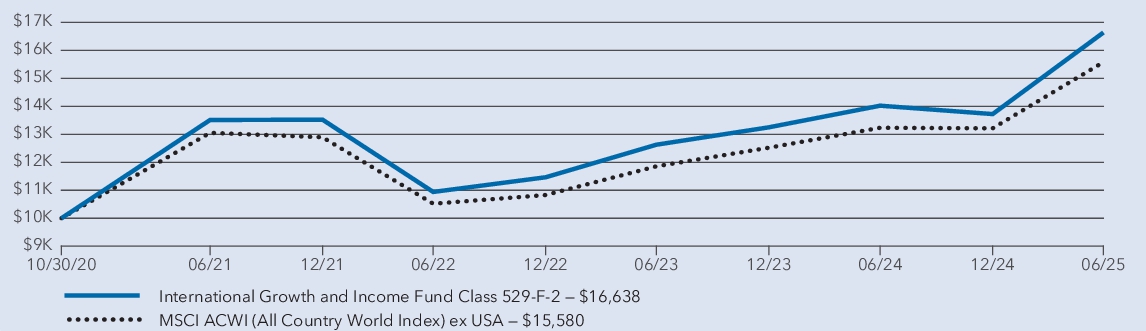

Management's discussion of fund performance The fund’s Class 529-F-2 shares gained 18.63% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529F2 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | | | International Growth and Income Fund — Class 529-F-2 | 18.63 % | 11.53 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 9.97 % |

1 Class 529-F-2 shares were first offered on October 30, 2020. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Oct. 30, 2020

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

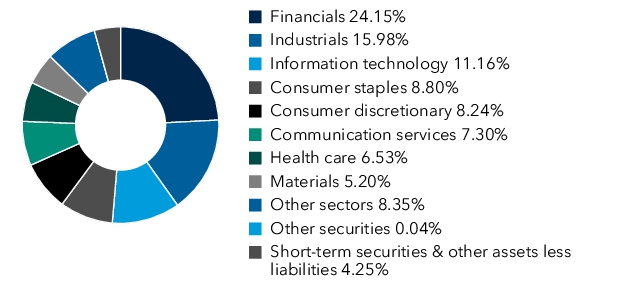

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class 529-F-3 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class 529-F-3

|

| Trading Symbol |

FGIGX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F3 . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F3

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment ) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-3 | $ 63 | 0.58 % |

|

| Expenses Paid, Amount |

$ 63

|

| Expense Ratio, Percent |

0.58%

|

| Factors Affecting Performance [Text Block] |

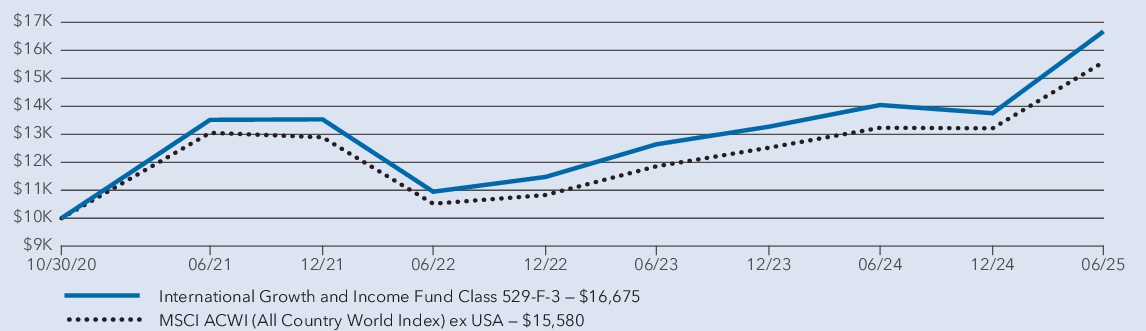

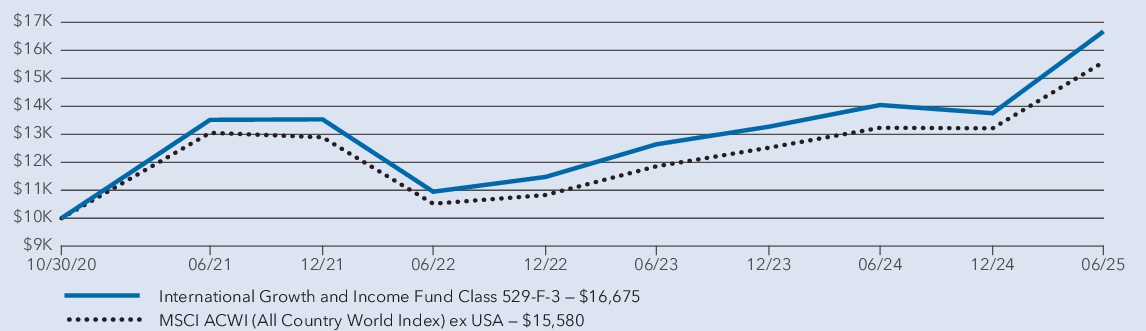

Management's discussion of fund performance The fund’s Class 529-F-3 shares gained 18.70% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-529F3 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | | | International Growth and Income Fund — Class 529-F-3 | 18.70 % | 11.58 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 9.97 % |

1 Class 529-F-3 shares were first offered on October 30, 2020. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| Performance Inception Date |

Oct. 30, 2020

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

| Holdings [Text Block] |

Portfolio holdings by sector ( percent of net assets) |

| International Growth and Income Fund - Class R-1 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class R-1

|

| Trading Symbol |

RIGAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R1 . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class R-1 | $ 178 | 1.64 % |

|

| Expenses Paid, Amount |

$ 178

|

| Expense Ratio, Percent |

1.64%

|

| Factors Affecting Performance [Text Block] |

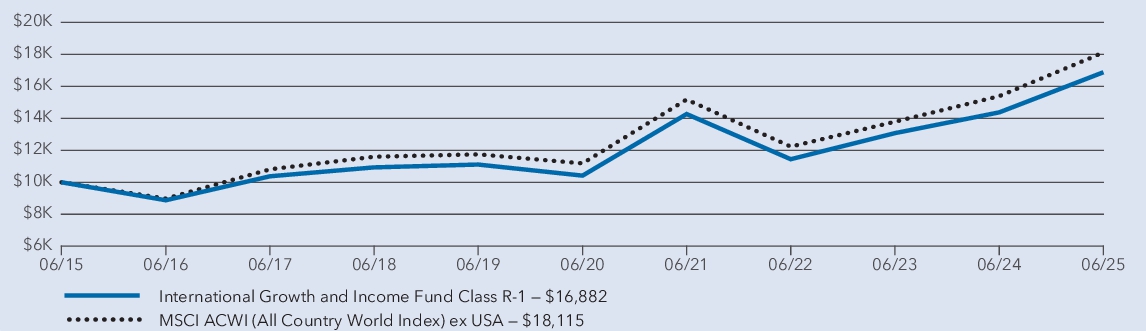

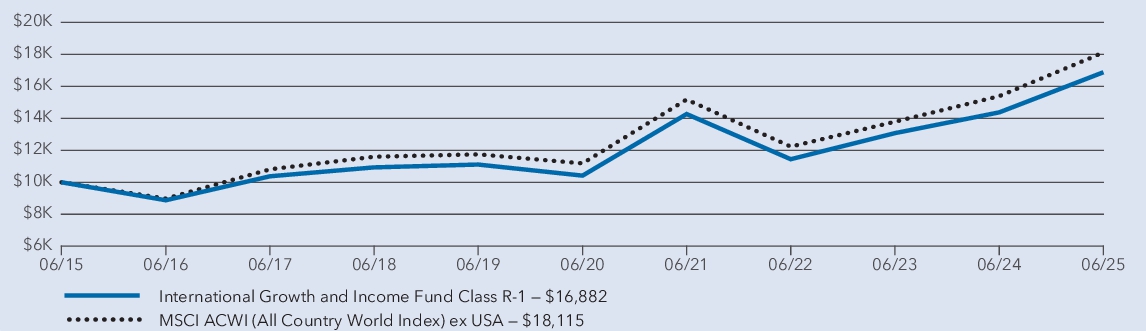

Management's discussion of fund performance The fund’s Class R-1 shares gained 17.44% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-R1 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class R-1 | 17.44 % | 10.14 % | 5.38 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

| Holdings [Text Block] |

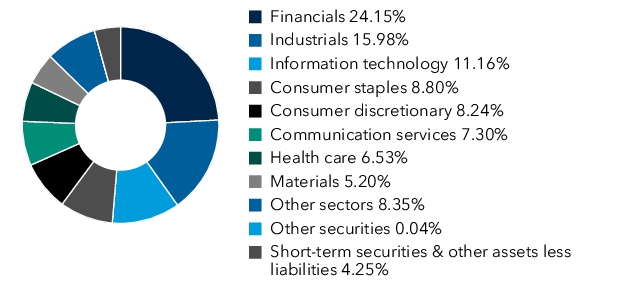

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class R-2 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class R-2

|

| Trading Symbol |

RIGBX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R2 . You can also request this information by contacting us at (800) 421-4225.

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R2

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class R-2 | $ 177 | 1.63 % |

|

| Expenses Paid, Amount |

$ 177

|

| Expense Ratio, Percent |

1.63%

|

| Factors Affecting Performance [Text Block] |

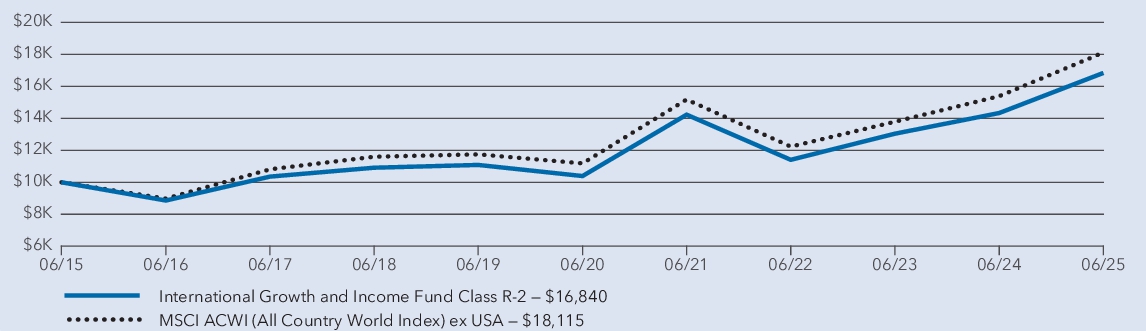

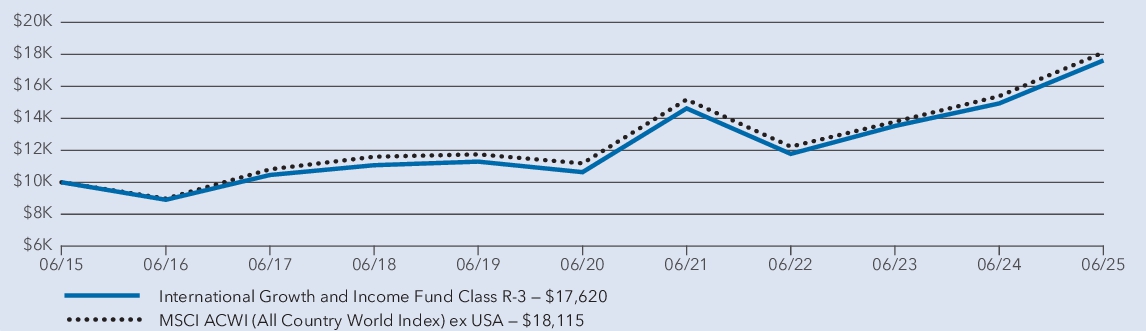

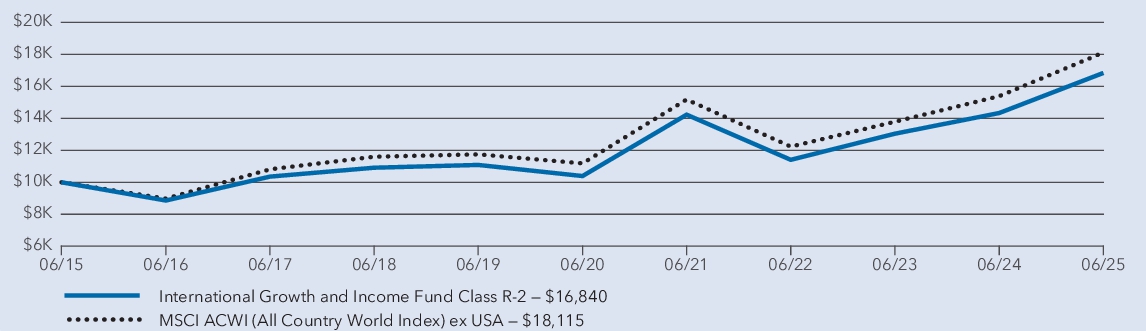

Management's discussion of fund performance The fund’s Class R-2 shares gained 17.48% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-R2 . What factors influenced results International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds. Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns. On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | International Growth and Income Fund — Class R-2 | 17.48 % | 10.14 % | 5.35 % | | MSCI ACWI (All Country World Index) ex USA | 17.72 % | 10.13 % | 6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 17,258,000,000

|

| Holdings Count | Holding |

290

|

| Advisory Fees Paid, Amount |

$ 74,000,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 17,258 | | Total number of portfolio holdings | 290 | | Total advisory fees paid (in millions) | $ 74 | | Portfolio turnover rate | 40 % |

|

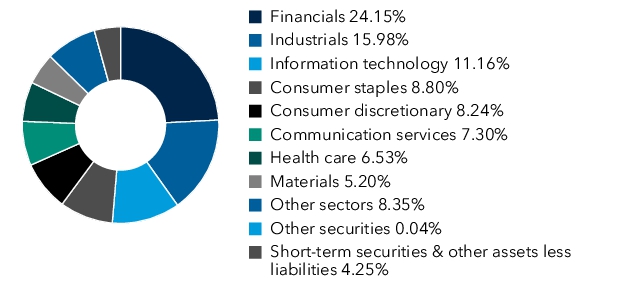

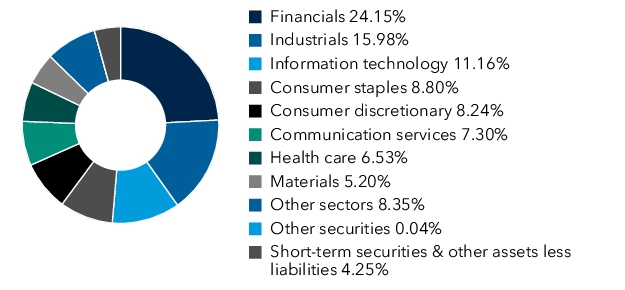

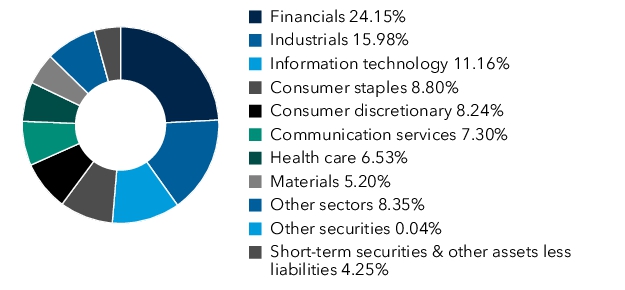

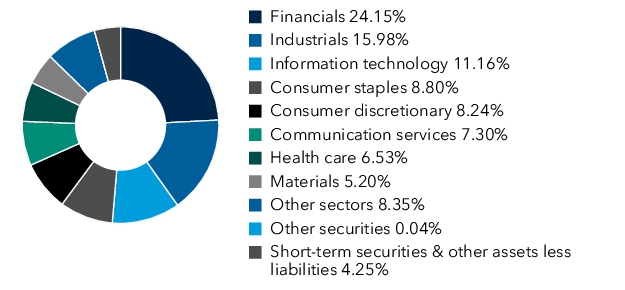

| Holdings [Text Block] |

Portfolio holdings by sector (percent of net assets) |

| International Growth and Income Fund - Class R-2E |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Growth and Income Fund

|

| Class Name |

Class R-2E

|

| Trading Symbol |

RIIEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about International Growth and Income Fund (the "fund") for the period from July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R2E |

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R2E

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-2E |

$ 145 |

1.33 % |

|

| Expenses Paid, Amount |

$ 145

|

| Expense Ratio, Percent |

1.33%

|

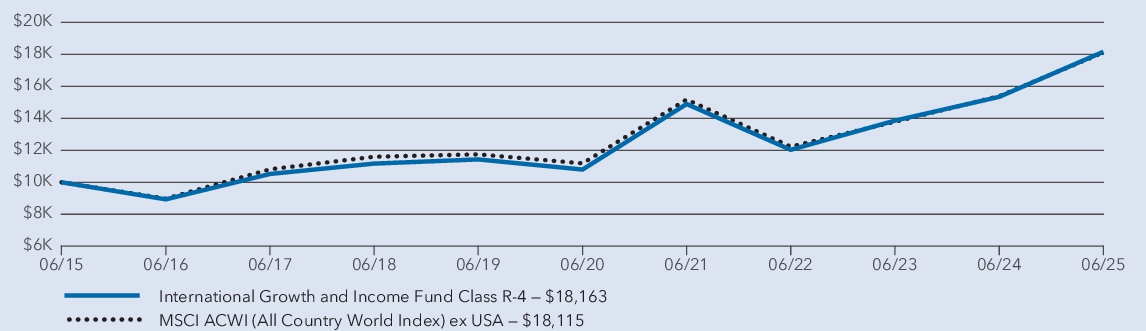

| Factors Affecting Performance [Text Block] |

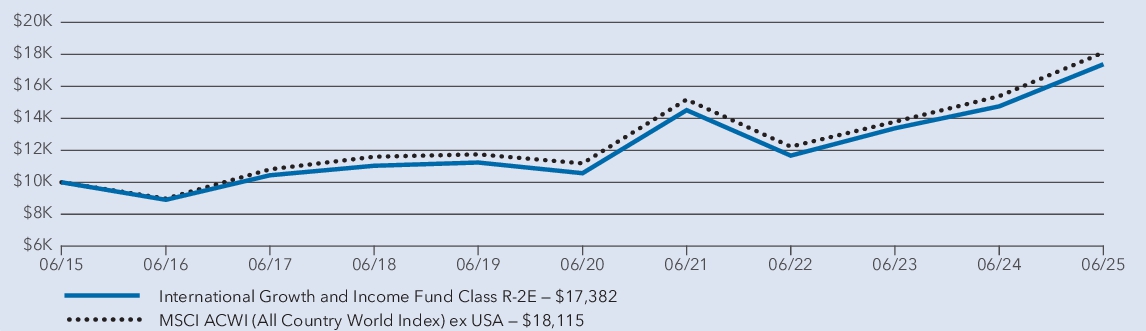

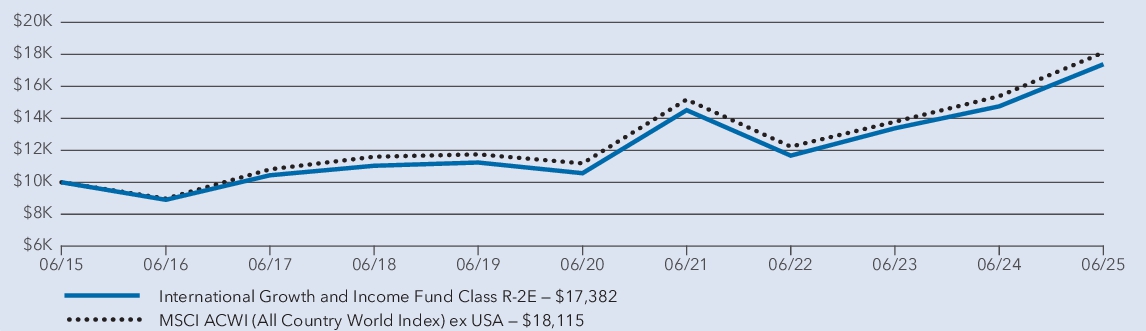

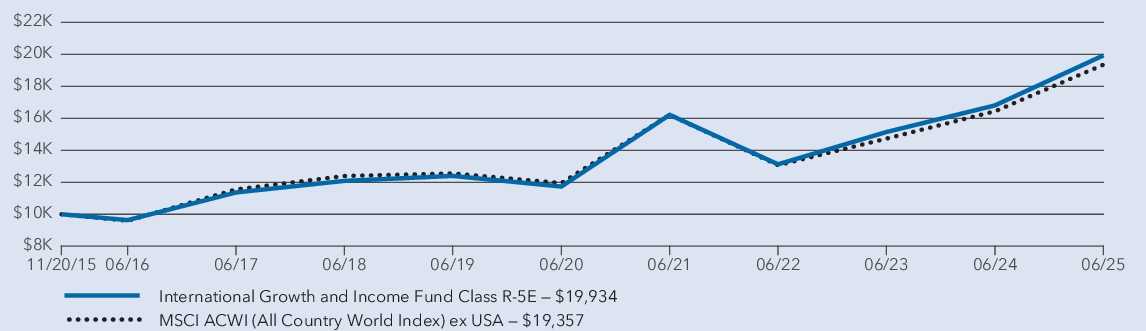

Management's discussion of fund performance

The fund’s Class R-2E shares gained 17.82% for the year ended June 30, 2025. That result compares with a 17.72% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-R2E . What factors influenced results

International stocks advanced in a period marked by erratic trade policy and signs of slowing growth. Europe saw moderate growth driven by resilient domestic demand and easing inflation despite global trade tensions. Germany announced fiscal reforms, including plans to increase spending on defense and infrastructure projects, which are expected to boost the country’s economy and potentially have broader positive implications for Europe. The U.K. showed early signs of recovery, though persistent inflation limited overall momentum. Japan’s growth slowed, hindered by weak consumer spending and declining export demand. Among emerging markets, China’s growth was supported by targeted stimulus and a rebound in exports, while India’s economy remained resilient despite slower growth amid global headwinds.

Overall, most sectors added to the fund’s positive results, with financials and utilities particularly additive. Likewise, holdings in industrials, communication services and consumer staples saw returns surpassing those of the overall portfolio. From a geographic perspective, shares of companies based in the eurozone and the United Kingdom contributed positively to absolute returns.

On the contrary, holdings in the health care sector saw negative returns during the period. Also, investments in companies based in European countries outside the eurozone were negative, and Japan holdings detracted from the broader portfolio’s return while remaining positive.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 year |

5 years |

10 years |

| International Growth and Income Fund — Class R-2E |

17.82 % |

10.46 % |

5.68 % |

| MSCI ACWI (All Country World Index) ex USA |

17.72 % |

10.13 % |

6.12 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI. |