Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

AMG Funds

|

| Entity Central Index Key |

0001089951

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000241081 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Municipal Enhanced SMA Shares

|

| Class Name |

AMG GW&K Municipal Enhanced SMA Shares

|

| Trading Symbol |

MESHX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Municipal Enhanced SMA Shares (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Municipal Enhanced SMA Shares

(MESHX) |

$0 |

0.00% |

|

| Expenses Paid, Amount |

$ 0

|

| Expense Ratio, Percent |

0.00%

|

| Net Assets |

$ 206,665,050

|

| Holdings Count | Holding |

140

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

21.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$206,665,050 |

| Total number of portfolio holdings |

140 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

21% |

|

| Holdings [Text Block] |

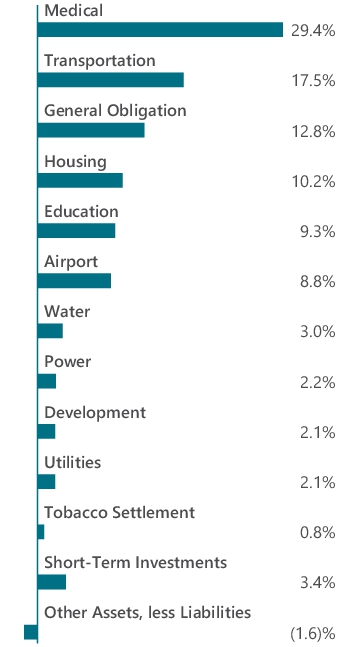

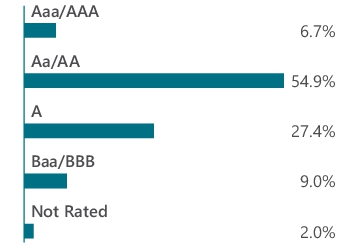

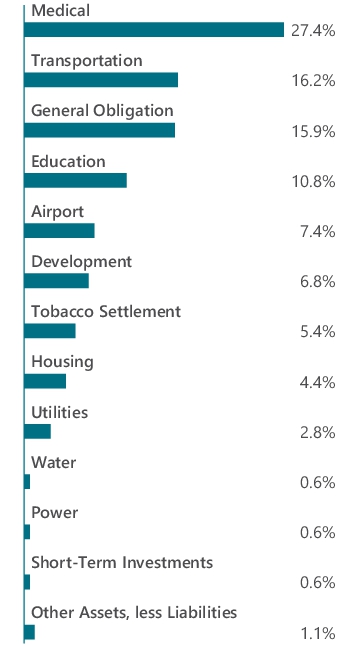

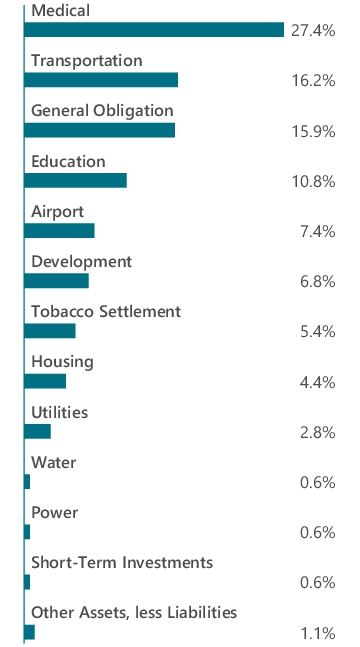

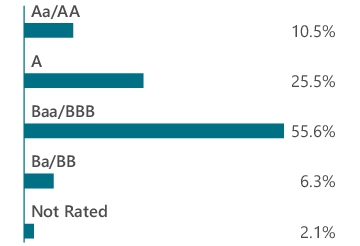

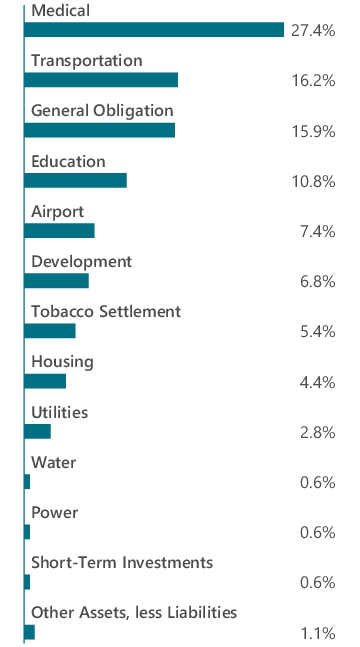

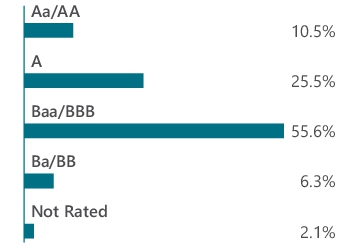

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Rhode Island Health and Educational Building Corp., 5.250%, 05/15/54 |

2.4% |

| County of Jefferson Sewer Revenue, 5.500%, 10/01/53 |

2.3% |

| Pennsylvania Higher Educational Facilities Authority, Series B2, 5.000%, 11/01/54 |

2.2% |

| Pennsylvania Economic Development Financing Authority, 5.000%, 12/31/57 |

1.9% |

| Texas Private Activity Bond Surface Transportation Corp., 5.000%, 06/30/58 |

1.9% |

| Massachusetts Development Finance Agency, 5.250%, 07/01/52 |

1.8% |

| Massachusetts Development Finance Agency, 5.250%, 07/01/55 |

1.7% |

Orange County Health Facilities Authority,

Series A, 5.250%, 10/01/56 |

1.7% |

| Metropolitan Transportation Authority, Series 1, 4.750%, 11/15/45 |

1.7% |

| Columbus Regional Airport Authority, Series A, 5.500%, 01/01/55 |

1.5% |

| Top Ten as a Group |

19.1% | Portfolio Breakdown Ratings

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Rhode Island Health and Educational Building Corp., 5.250%, 05/15/54 |

2.4% |

| County of Jefferson Sewer Revenue, 5.500%, 10/01/53 |

2.3% |

| Pennsylvania Higher Educational Facilities Authority, Series B2, 5.000%, 11/01/54 |

2.2% |

| Pennsylvania Economic Development Financing Authority, 5.000%, 12/31/57 |

1.9% |

| Texas Private Activity Bond Surface Transportation Corp., 5.000%, 06/30/58 |

1.9% |

| Massachusetts Development Finance Agency, 5.250%, 07/01/52 |

1.8% |

| Massachusetts Development Finance Agency, 5.250%, 07/01/55 |

1.7% |

Orange County Health Facilities Authority,

Series A, 5.250%, 10/01/56 |

1.7% |

| Metropolitan Transportation Authority, Series 1, 4.750%, 11/15/45 |

1.7% |

| Columbus Regional Airport Authority, Series A, 5.500%, 01/01/55 |

1.5% |

| Top Ten as a Group |

19.1% |

|

| C000261130 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Securitized Bond SMA Shares

|

| Class Name |

AMG GW&K Securitized Bond SMA Shares

|

| Trading Symbol |

GWSBX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Securitized Bond SMA Shares (the “Fund”) for the period of June 12, 2025 (commencement of operations) to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Securitized Bond SMA Shares

(GWSBX) |

$0 |

0.00% |

|

| Expenses Paid, Amount |

$ 0

|

| Expense Ratio, Percent |

0.00%

|

| Net Assets |

$ 111,086,743

|

| Holdings Count | Holding |

65

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

5.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$111,086,743 |

| Total number of portfolio holdings |

65 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

5% |

|

| Holdings [Text Block] |

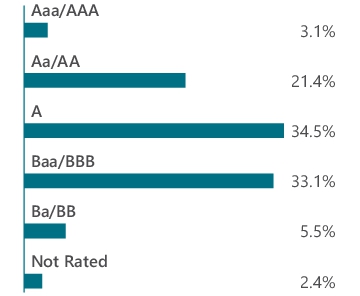

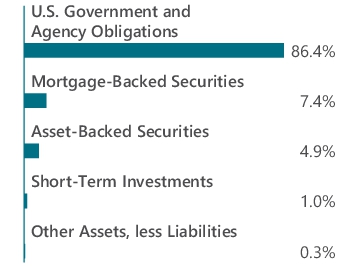

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| FHLMC, 5.500%, 02/01/54 |

4.4% |

| FNMA, 5.000%, 01/01/53 |

4.3% |

| FHLMC, 3.500%, 06/01/49 |

4.3% |

| Freddie Mac Multifamily Structured Pass Through Certificates, Class A2, 1.658%, 12/25/30 |

3.9% |

| FNMA, 2.500%, 11/01/51 |

3.7% |

| FNMA, 4.000%, 06/01/53 |

3.7% |

| FHLMC, 6.000%, 10/01/53 |

3.7% |

| FNMA, 5.500%, 07/01/53 |

3.7% |

| Freddie Mac Multifamily Structured Pass Through Certificates, Class A2, 4.500%, 07/25/33 |

3.6% |

| U.S. Treasury Notes, 4.250%, 11/15/34 |

3.5% |

| Top Ten as a Group |

38.8% | Portfolio Breakdown Ratings

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| FHLMC, 5.500%, 02/01/54 |

4.4% |

| FNMA, 5.000%, 01/01/53 |

4.3% |

| FHLMC, 3.500%, 06/01/49 |

4.3% |

| Freddie Mac Multifamily Structured Pass Through Certificates, Class A2, 1.658%, 12/25/30 |

3.9% |

| FNMA, 2.500%, 11/01/51 |

3.7% |

| FNMA, 4.000%, 06/01/53 |

3.7% |

| FHLMC, 6.000%, 10/01/53 |

3.7% |

| FNMA, 5.500%, 07/01/53 |

3.7% |

| Freddie Mac Multifamily Structured Pass Through Certificates, Class A2, 4.500%, 07/25/33 |

3.6% |

| U.S. Treasury Notes, 4.250%, 11/15/34 |

3.5% |

| Top Ten as a Group |

38.8% |

|

| C000142968 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Special Opportunities Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

YASLX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Special Opportunities Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Special Opportunities Fund

(Class Z/YASLX) |

$47 |

0.90% |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.90%

|

| Net Assets |

$ 28,221,957

|

| Holdings Count | Holding |

46

|

| Advisory Fees Paid, Amount |

$ 47,931

|

| Investment Company Portfolio Turnover |

2.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$28,221,957 |

| Total number of portfolio holdings |

46 |

| Net advisory fees paid |

$47,931 |

| Portfolio turnover rate as of the end of the reporting period |

2% |

|

| Holdings [Text Block] |

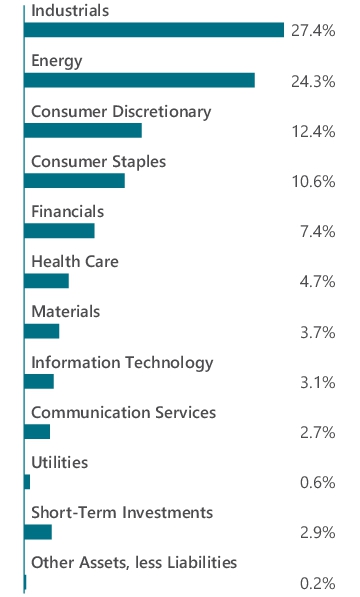

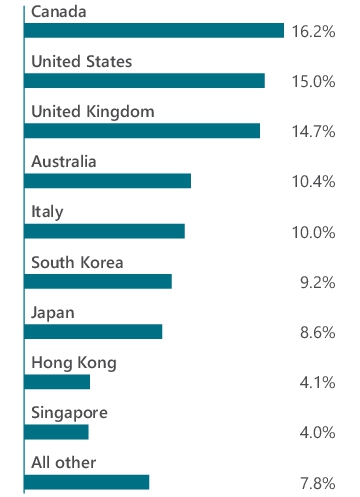

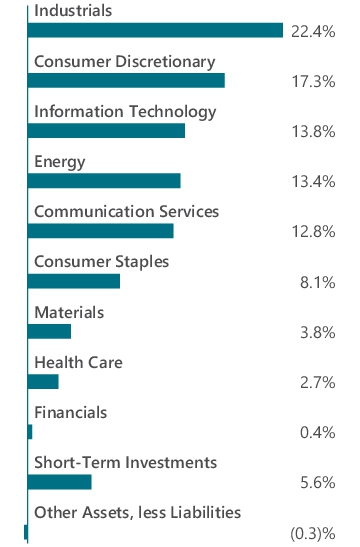

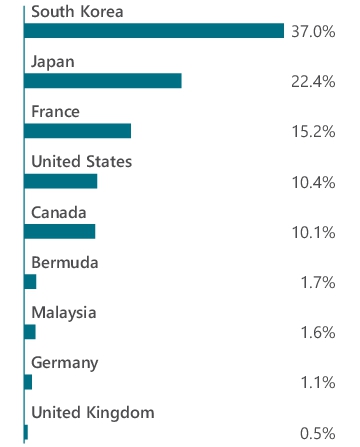

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Omni Bridgeway, Ltd. (Australia) |

7.4% |

| Arrow Exploration Corp. (Canada) |

6.4% |

| Total Energy Services, Inc. (Canada) |

5.6% |

| Italian Wine Brands S.p.A. (Italy) |

5.3% |

| Macfarlane Group PLC (United Kingdom) |

5.2% |

| Legacy Housing Corp. (United States) |

4.8% |

| Fila S.p.A. (Italy) |

4.4% |

| Brickability Group PLC (United Kingdom) |

4.3% |

| Texhong International Group, Ltd. (Hong Kong) |

4.0% |

| U-Haul Holding Co., Non-Voting Shares (United States) |

3.9% |

| Top Ten as a Group |

51.3% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Omni Bridgeway, Ltd. (Australia) |

7.4% |

| Arrow Exploration Corp. (Canada) |

6.4% |

| Total Energy Services, Inc. (Canada) |

5.6% |

| Italian Wine Brands S.p.A. (Italy) |

5.3% |

| Macfarlane Group PLC (United Kingdom) |

5.2% |

| Legacy Housing Corp. (United States) |

4.8% |

| Fila S.p.A. (Italy) |

4.4% |

| Brickability Group PLC (United Kingdom) |

4.3% |

| Texhong International Group, Ltd. (Hong Kong) |

4.0% |

| U-Haul Holding Co., Non-Voting Shares (United States) |

3.9% |

| Top Ten as a Group |

51.3% |

|

| C000142969 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Special Opportunities Fund

|

| Class Name |

Class I

|

| Trading Symbol |

YASSX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Special Opportunities Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Special Opportunities Fund

(Class I/YASSX) |

$52 |

1.00% |

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

1.00%

|

| Net Assets |

$ 28,221,957

|

| Holdings Count | Holding |

46

|

| Advisory Fees Paid, Amount |

$ 47,931

|

| Investment Company Portfolio Turnover |

2.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$28,221,957 |

| Total number of portfolio holdings |

46 |

| Net advisory fees paid |

$47,931 |

| Portfolio turnover rate as of the end of the reporting period |

2% |

|

| Holdings [Text Block] |

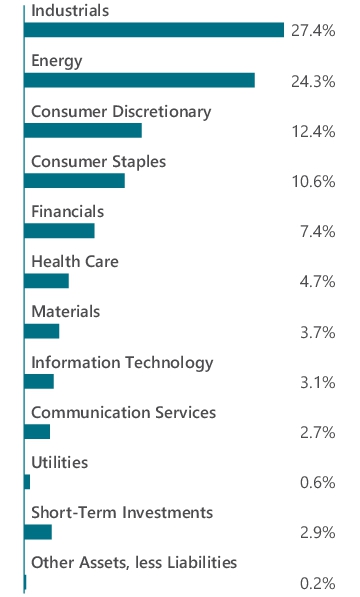

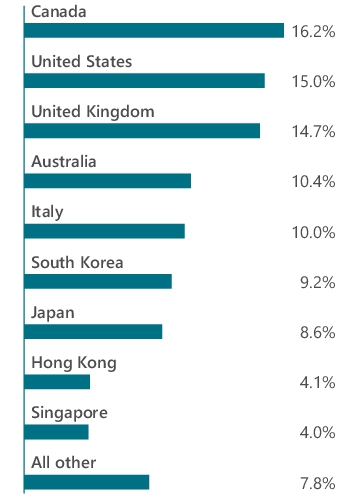

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Omni Bridgeway, Ltd. (Australia) |

7.4% |

| Arrow Exploration Corp. (Canada) |

6.4% |

| Total Energy Services, Inc. (Canada) |

5.6% |

| Italian Wine Brands S.p.A. (Italy) |

5.3% |

| Macfarlane Group PLC (United Kingdom) |

5.2% |

| Legacy Housing Corp. (United States) |

4.8% |

| Fila S.p.A. (Italy) |

4.4% |

| Brickability Group PLC (United Kingdom) |

4.3% |

| Texhong International Group, Ltd. (Hong Kong) |

4.0% |

| U-Haul Holding Co., Non-Voting Shares (United States) |

3.9% |

| Top Ten as a Group |

51.3% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Omni Bridgeway, Ltd. (Australia) |

7.4% |

| Arrow Exploration Corp. (Canada) |

6.4% |

| Total Energy Services, Inc. (Canada) |

5.6% |

| Italian Wine Brands S.p.A. (Italy) |

5.3% |

| Macfarlane Group PLC (United Kingdom) |

5.2% |

| Legacy Housing Corp. (United States) |

4.8% |

| Fila S.p.A. (Italy) |

4.4% |

| Brickability Group PLC (United Kingdom) |

4.3% |

| Texhong International Group, Ltd. (Hong Kong) |

4.0% |

| U-Haul Holding Co., Non-Voting Shares (United States) |

3.9% |

| Top Ten as a Group |

51.3% |

|

| C000122075 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG TimesSquare International Small Cap Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

TCMIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG TimesSquare International Small Cap Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG TimesSquare International Small Cap Fund

(Class Z/TCMIX) |

$59 |

1.05% |

|

| Expenses Paid, Amount |

$ 59

|

| Expense Ratio, Percent |

1.05%

|

| Net Assets |

$ 127,476,525

|

| Holdings Count | Holding |

84

|

| Advisory Fees Paid, Amount |

$ 383,040

|

| Investment Company Portfolio Turnover |

30.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$127,476,525 |

| Total number of portfolio holdings |

84 |

| Net advisory fees paid |

$383,040 |

| Portfolio turnover rate as of the end of the reporting period |

30% |

|

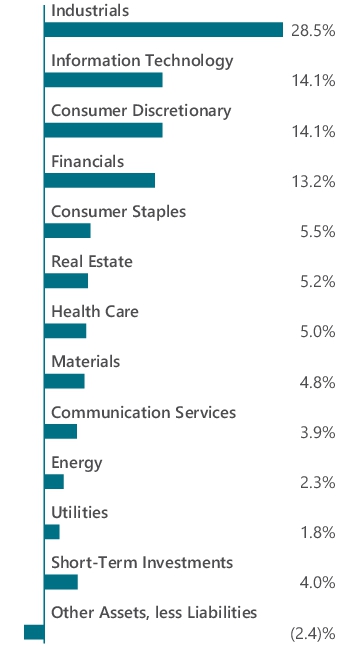

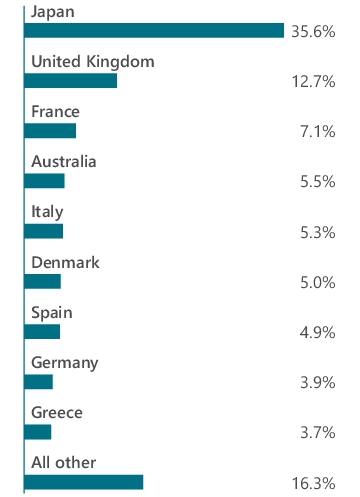

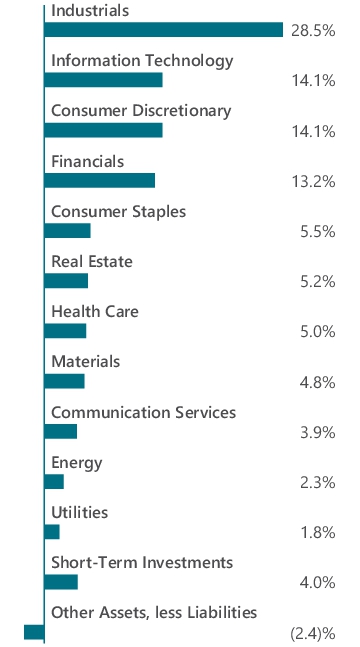

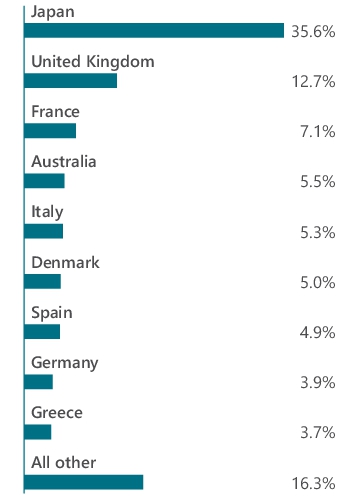

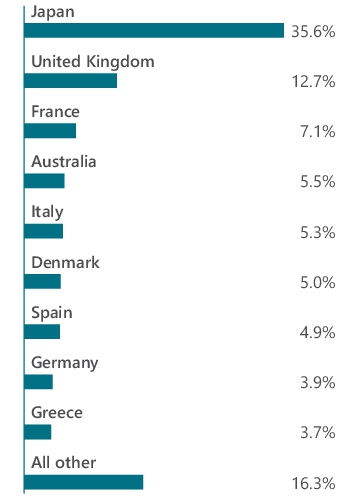

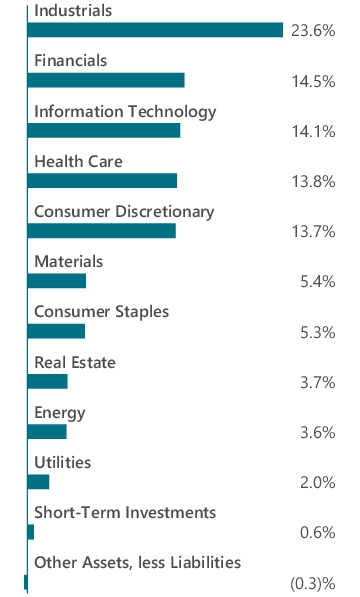

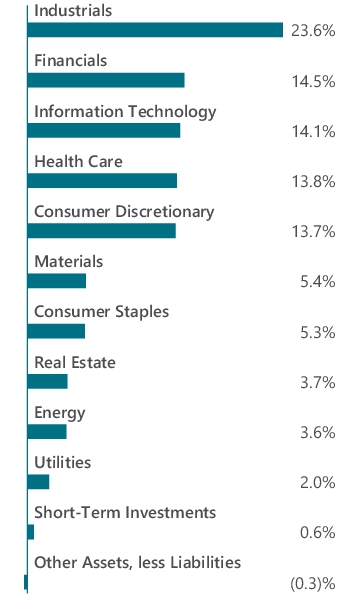

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Azbil Corp. (Japan) |

2.7% |

| Sopra Steria Group (France) |

2.6% |

| KDX Realty Investment Corp., REIT (Japan) |

2.5% |

| Daiei Kankyo Co., Ltd. (Japan) |

2.4% |

| Organo Corp. (Japan) |

2.4% |

| Alm Brand A/S (Denmark) |

2.4% |

| Greencore Group PLC (Ireland) |

2.1% |

| Siegfried Holding AG (Switzerland) |

2.1% |

| ABC-Mart, Inc. (Japan) |

2.0% |

| Piraeus Financial Holdings, S.A. (Greece) |

2.0% |

| Top Ten as a Group |

23.2% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Azbil Corp. (Japan) |

2.7% |

| Sopra Steria Group (France) |

2.6% |

| KDX Realty Investment Corp., REIT (Japan) |

2.5% |

| Daiei Kankyo Co., Ltd. (Japan) |

2.4% |

| Organo Corp. (Japan) |

2.4% |

| Alm Brand A/S (Denmark) |

2.4% |

| Greencore Group PLC (Ireland) |

2.1% |

| Siegfried Holding AG (Switzerland) |

2.1% |

| ABC-Mart, Inc. (Japan) |

2.0% |

| Piraeus Financial Holdings, S.A. (Greece) |

2.0% |

| Top Ten as a Group |

23.2% |

|

| C000122076 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG TimesSquare International Small Cap Fund

|

| Class Name |

Class N

|

| Trading Symbol |

TCMPX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG TimesSquare International Small Cap Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG TimesSquare International Small Cap Fund

(Class N/TCMPX) |

$73 |

1.30% |

|

| Expenses Paid, Amount |

$ 73

|

| Expense Ratio, Percent |

1.30%

|

| Net Assets |

$ 127,476,525

|

| Holdings Count | Holding |

84

|

| Advisory Fees Paid, Amount |

$ 383,040

|

| Investment Company Portfolio Turnover |

30.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$127,476,525 |

| Total number of portfolio holdings |

84 |

| Net advisory fees paid |

$383,040 |

| Portfolio turnover rate as of the end of the reporting period |

30% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Azbil Corp. (Japan) |

2.7% |

| Sopra Steria Group (France) |

2.6% |

| KDX Realty Investment Corp., REIT (Japan) |

2.5% |

| Daiei Kankyo Co., Ltd. (Japan) |

2.4% |

| Organo Corp. (Japan) |

2.4% |

| Alm Brand A/S (Denmark) |

2.4% |

| Greencore Group PLC (Ireland) |

2.1% |

| Siegfried Holding AG (Switzerland) |

2.1% |

| ABC-Mart, Inc. (Japan) |

2.0% |

| Piraeus Financial Holdings, S.A. (Greece) |

2.0% |

| Top Ten as a Group |

23.2% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Azbil Corp. (Japan) |

2.7% |

| Sopra Steria Group (France) |

2.6% |

| KDX Realty Investment Corp., REIT (Japan) |

2.5% |

| Daiei Kankyo Co., Ltd. (Japan) |

2.4% |

| Organo Corp. (Japan) |

2.4% |

| Alm Brand A/S (Denmark) |

2.4% |

| Greencore Group PLC (Ireland) |

2.1% |

| Siegfried Holding AG (Switzerland) |

2.1% |

| ABC-Mart, Inc. (Japan) |

2.0% |

| Piraeus Financial Holdings, S.A. (Greece) |

2.0% |

| Top Ten as a Group |

23.2% |

|

| C000180071 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG TimesSquare International Small Cap Fund

|

| Class Name |

Class I

|

| Trading Symbol |

TQTIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG TimesSquare International Small Cap Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG TimesSquare International Small Cap Fund

(Class I/TQTIX) |

$62 |

1.10% |

|

| Expenses Paid, Amount |

$ 62

|

| Expense Ratio, Percent |

1.10%

|

| Net Assets |

$ 127,476,525

|

| Holdings Count | Holding |

84

|

| Advisory Fees Paid, Amount |

$ 383,040

|

| Investment Company Portfolio Turnover |

30.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$127,476,525 |

| Total number of portfolio holdings |

84 |

| Net advisory fees paid |

$383,040 |

| Portfolio turnover rate as of the end of the reporting period |

30% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund.

| Azbil Corp. (Japan) |

2.7% |

| Sopra Steria Group (France) |

2.6% |

| KDX Realty Investment Corp., REIT (Japan) |

2.5% |

| Daiei Kankyo Co., Ltd. (Japan) |

2.4% |

| Organo Corp. (Japan) |

2.4% |

| Alm Brand A/S (Denmark) |

2.4% |

| Greencore Group PLC (Ireland) |

2.1% |

| Siegfried Holding AG (Switzerland) |

2.1% |

| ABC-Mart, Inc. (Japan) |

2.0% |

| Piraeus Financial Holdings, S.A. (Greece) |

2.0% |

| Top Ten as a Group |

23.2% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Azbil Corp. (Japan) |

2.7% |

| Sopra Steria Group (France) |

2.6% |

| KDX Realty Investment Corp., REIT (Japan) |

2.5% |

| Daiei Kankyo Co., Ltd. (Japan) |

2.4% |

| Organo Corp. (Japan) |

2.4% |

| Alm Brand A/S (Denmark) |

2.4% |

| Greencore Group PLC (Ireland) |

2.1% |

| Siegfried Holding AG (Switzerland) |

2.1% |

| ABC-Mart, Inc. (Japan) |

2.0% |

| Piraeus Financial Holdings, S.A. (Greece) |

2.0% |

| Top Ten as a Group |

23.2% |

|

| C000176472 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Global Fund

|

| Class Name |

Class I

|

| Trading Symbol |

YFSIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Global Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Global Fund

(Class I/YFSIX) |

$50 |

0.93% |

|

| Expenses Paid, Amount |

$ 50

|

| Expense Ratio, Percent |

0.93%

|

| Net Assets |

$ 168,285,049

|

| Holdings Count | Holding |

58

|

| Advisory Fees Paid, Amount |

$ 484,729

|

| Investment Company Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$168,285,049 |

| Total number of portfolio holdings |

58 |

| Net advisory fees paid |

$484,729 |

| Portfolio turnover rate as of the end of the reporting period |

4% |

|

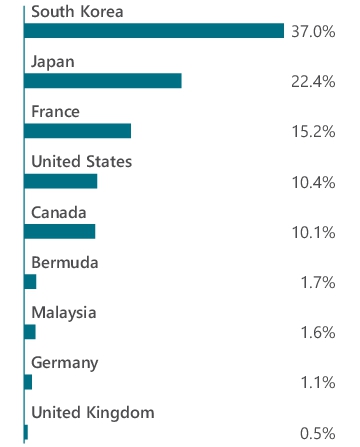

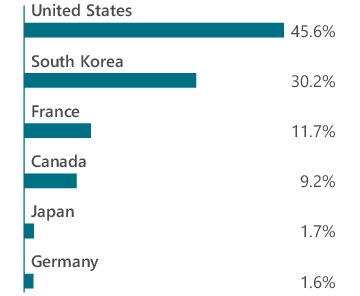

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Bolloré SE (France) |

9.7% |

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

9.6% |

| HI-LEX Corp. (Japan) |

5.7% |

| Canadian Natural Resources, Ltd. (Canada) |

5.2% |

| Cie de L'Odet SE (France) |

4.7% |

| Hyundai Mobis Co., Ltd. (South Korea) |

4.4% |

| Total Energy Services, Inc. (Canada) |

4.3% |

| LG H&H Co., Ltd., 2.720% (South Korea) |

3.8% |

| Samsung C&T Corp. (South Korea) |

3.6% |

| Hyundai Motor Co., 7.940% (South Korea) |

3.1% |

| Top Ten as a Group |

54.1% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bolloré SE (France) |

9.7% |

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

9.6% |

| HI-LEX Corp. (Japan) |

5.7% |

| Canadian Natural Resources, Ltd. (Canada) |

5.2% |

| Cie de L'Odet SE (France) |

4.7% |

| Hyundai Mobis Co., Ltd. (South Korea) |

4.4% |

| Total Energy Services, Inc. (Canada) |

4.3% |

| LG H&H Co., Ltd., 2.720% (South Korea) |

3.8% |

| Samsung C&T Corp. (South Korea) |

3.6% |

| Hyundai Motor Co., 7.940% (South Korea) |

3.1% |

| Top Ten as a Group |

54.1% |

|

| C000176471 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Global Fund

|

| Class Name |

Class N

|

| Trading Symbol |

YFSNX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Global Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Global Fund

(Class N/YFSNX) |

$61 |

1.13% |

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

1.13%

|

| Net Assets |

$ 168,285,049

|

| Holdings Count | Holding |

58

|

| Advisory Fees Paid, Amount |

$ 484,729

|

| Investment Company Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$168,285,049 |

| Total number of portfolio holdings |

58 |

| Net advisory fees paid |

$484,729 |

| Portfolio turnover rate as of the end of the reporting period |

4% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Bolloré SE (France) |

9.7% |

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

9.6% |

| HI-LEX Corp. (Japan) |

5.7% |

| Canadian Natural Resources, Ltd. (Canada) |

5.2% |

| Cie de L'Odet SE (France) |

4.7% |

| Hyundai Mobis Co., Ltd. (South Korea) |

4.4% |

| Total Energy Services, Inc. (Canada) |

4.3% |

| LG H&H Co., Ltd., 2.720% (South Korea) |

3.8% |

| Samsung C&T Corp. (South Korea) |

3.6% |

| Hyundai Motor Co., 7.940% (South Korea) |

3.1% |

| Top Ten as a Group |

54.1% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bolloré SE (France) |

9.7% |

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

9.6% |

| HI-LEX Corp. (Japan) |

5.7% |

| Canadian Natural Resources, Ltd. (Canada) |

5.2% |

| Cie de L'Odet SE (France) |

4.7% |

| Hyundai Mobis Co., Ltd. (South Korea) |

4.4% |

| Total Energy Services, Inc. (Canada) |

4.3% |

| LG H&H Co., Ltd., 2.720% (South Korea) |

3.8% |

| Samsung C&T Corp. (South Korea) |

3.6% |

| Hyundai Motor Co., 7.940% (South Korea) |

3.1% |

| Top Ten as a Group |

54.1% |

|

| C000180072 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Small/Mid Cap Core Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

GWGZX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Small/Mid Cap Core Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small/Mid Cap Core Fund

(Class Z/GWGZX) |

$40 |

0.82% |

|

| Expenses Paid, Amount |

$ 40

|

| Expense Ratio, Percent |

0.82%

|

| Net Assets |

$ 758,986,647

|

| Holdings Count | Holding |

91

|

| Advisory Fees Paid, Amount |

$ 2,341,049

|

| Investment Company Portfolio Turnover |

12.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$758,986,647 |

| Total number of portfolio holdings |

91 |

| Net advisory fees paid |

$2,341,049 |

| Portfolio turnover rate as of the end of the reporting period |

12% |

|

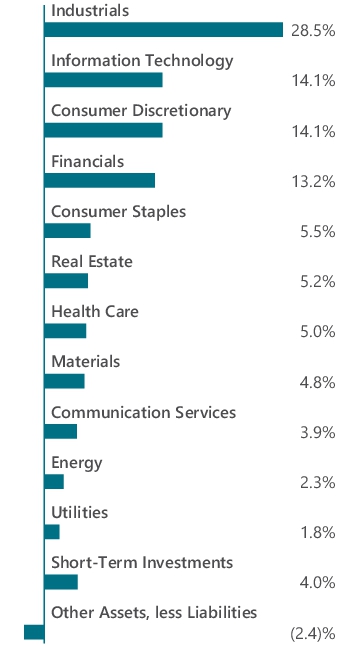

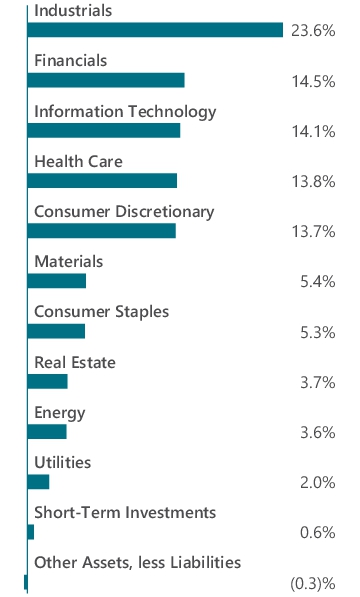

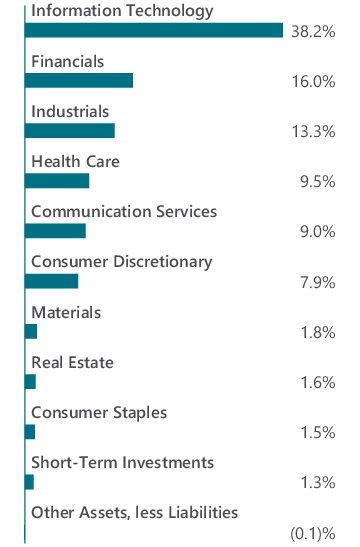

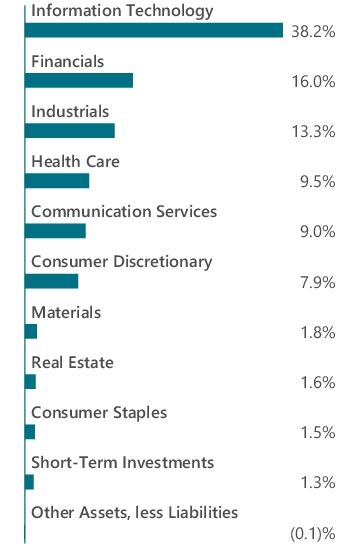

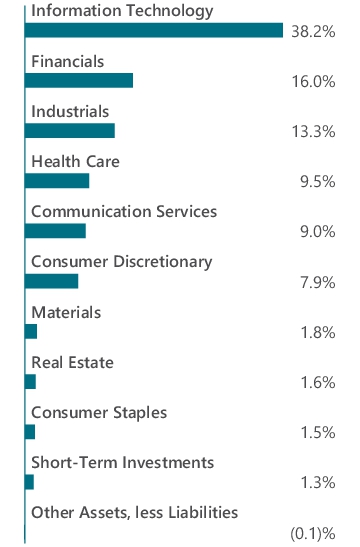

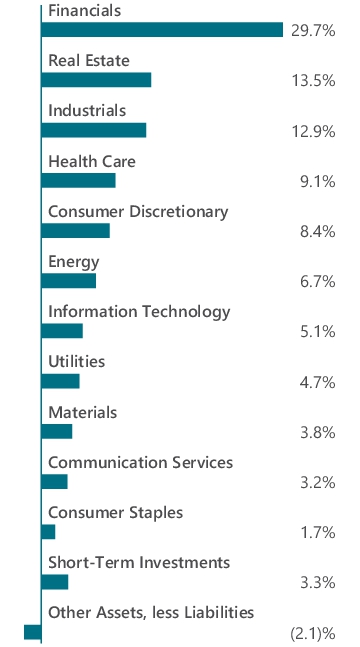

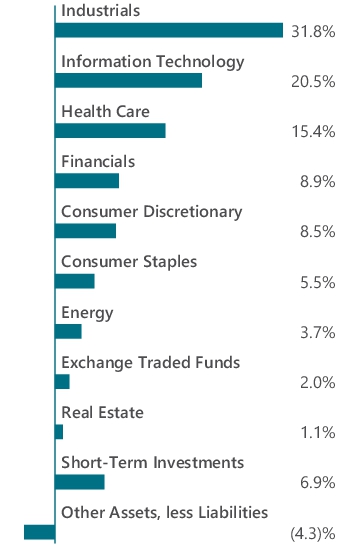

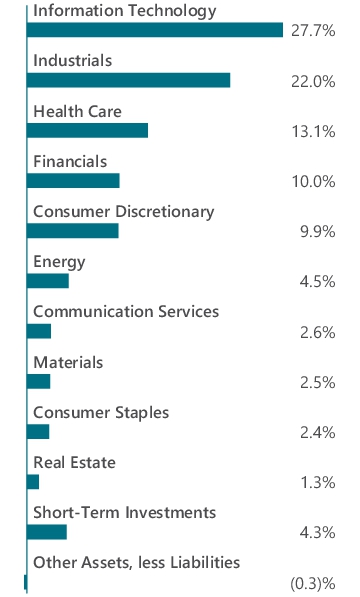

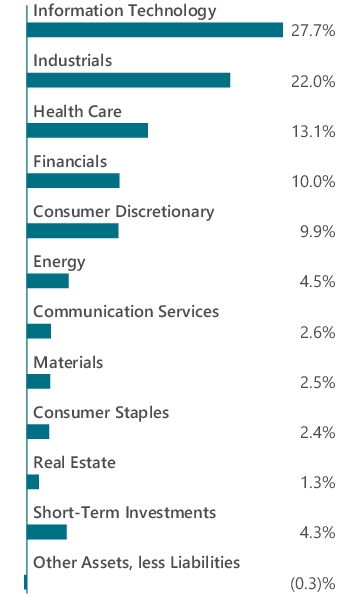

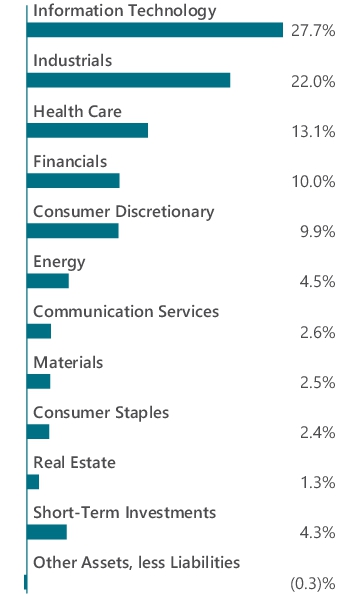

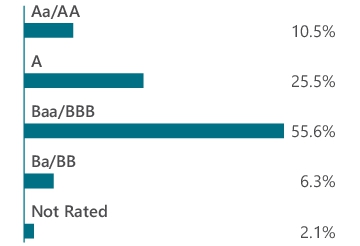

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| API Group Corp. |

2.3% |

| CyberArk Software, Ltd. (Israel) |

2.3% |

| Comfort Systems USA, Inc. |

2.1% |

| Performance Food Group Co. |

2.0% |

| Piper Sandler Cos. |

1.9% |

| Texas Roadhouse, Inc. |

1.9% |

| MACOM Technology Solutions Holdings, Inc. |

1.9% |

| RBC Bearings, Inc. |

1.9% |

| Gates Industrial Corp. PLC |

1.8% |

| Federal Signal Corp. |

1.8% |

| Top Ten as a Group |

19.9% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| API Group Corp. |

2.3% |

| CyberArk Software, Ltd. (Israel) |

2.3% |

| Comfort Systems USA, Inc. |

2.1% |

| Performance Food Group Co. |

2.0% |

| Piper Sandler Cos. |

1.9% |

| Texas Roadhouse, Inc. |

1.9% |

| MACOM Technology Solutions Holdings, Inc. |

1.9% |

| RBC Bearings, Inc. |

1.9% |

| Gates Industrial Corp. PLC |

1.8% |

| Federal Signal Corp. |

1.8% |

| Top Ten as a Group |

19.9% |

|

| C000157694 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Small/Mid Cap Core Fund

|

| Class Name |

Class I

|

| Trading Symbol |

GWGIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Small/Mid Cap Core Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small/Mid Cap Core Fund

(Class I/GWGIX) |

$42 |

0.87% |

|

| Expenses Paid, Amount |

$ 42

|

| Expense Ratio, Percent |

0.87%

|

| Net Assets |

$ 758,986,647

|

| Holdings Count | Holding |

91

|

| Advisory Fees Paid, Amount |

$ 2,341,049

|

| Investment Company Portfolio Turnover |

12.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$758,986,647 |

| Total number of portfolio holdings |

91 |

| Net advisory fees paid |

$2,341,049 |

| Portfolio turnover rate as of the end of the reporting period |

12% |

|

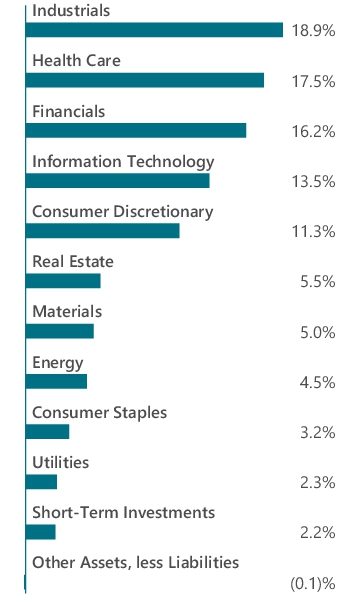

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| API Group Corp. |

2.3% |

| CyberArk Software, Ltd. (Israel) |

2.3% |

| Comfort Systems USA, Inc. |

2.1% |

| Performance Food Group Co. |

2.0% |

| Piper Sandler Cos. |

1.9% |

| Texas Roadhouse, Inc. |

1.9% |

| MACOM Technology Solutions Holdings, Inc. |

1.9% |

| RBC Bearings, Inc. |

1.9% |

| Gates Industrial Corp. PLC |

1.8% |

| Federal Signal Corp. |

1.8% |

| Top Ten as a Group |

19.9% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| API Group Corp. |

2.3% |

| CyberArk Software, Ltd. (Israel) |

2.3% |

| Comfort Systems USA, Inc. |

2.1% |

| Performance Food Group Co. |

2.0% |

| Piper Sandler Cos. |

1.9% |

| Texas Roadhouse, Inc. |

1.9% |

| MACOM Technology Solutions Holdings, Inc. |

1.9% |

| RBC Bearings, Inc. |

1.9% |

| Gates Industrial Corp. PLC |

1.8% |

| Federal Signal Corp. |

1.8% |

| Top Ten as a Group |

19.9% |

|

| C000157696 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Small/Mid Cap Core Fund

|

| Class Name |

Class N

|

| Trading Symbol |

GWGVX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Small/Mid Cap Core Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small/Mid Cap Core Fund

(Class N/GWGVX) |

$52 |

1.07% |

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

1.07%

|

| Net Assets |

$ 758,986,647

|

| Holdings Count | Holding |

91

|

| Advisory Fees Paid, Amount |

$ 2,341,049

|

| Investment Company Portfolio Turnover |

12.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$758,986,647 |

| Total number of portfolio holdings |

91 |

| Net advisory fees paid |

$2,341,049 |

| Portfolio turnover rate as of the end of the reporting period |

12% |

|

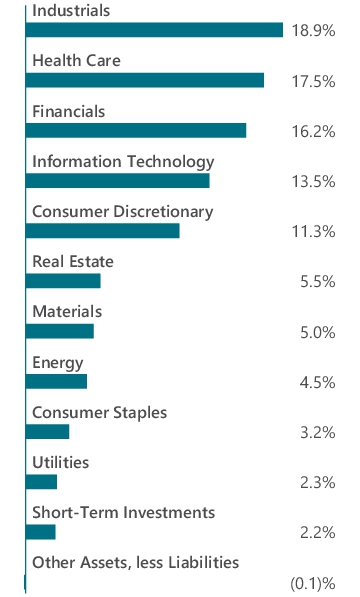

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| API Group Corp. |

2.3% |

| CyberArk Software, Ltd. (Israel) |

2.3% |

| Comfort Systems USA, Inc. |

2.1% |

| Performance Food Group Co. |

2.0% |

| Piper Sandler Cos. |

1.9% |

| Texas Roadhouse, Inc. |

1.9% |

| MACOM Technology Solutions Holdings, Inc. |

1.9% |

| RBC Bearings, Inc. |

1.9% |

| Gates Industrial Corp. PLC |

1.8% |

| Federal Signal Corp. |

1.8% |

| Top Ten as a Group |

19.9% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| API Group Corp. |

2.3% |

| CyberArk Software, Ltd. (Israel) |

2.3% |

| Comfort Systems USA, Inc. |

2.1% |

| Performance Food Group Co. |

2.0% |

| Piper Sandler Cos. |

1.9% |

| Texas Roadhouse, Inc. |

1.9% |

| MACOM Technology Solutions Holdings, Inc. |

1.9% |

| RBC Bearings, Inc. |

1.9% |

| Gates Industrial Corp. PLC |

1.8% |

| Federal Signal Corp. |

1.8% |

| Top Ten as a Group |

19.9% |

|

| C000077267 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Municipal Bond Fund

|

| Class Name |

Class I

|

| Trading Symbol |

GWMIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Municipal Bond Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Municipal Bond Fund

(Class I/GWMIX) |

$19 |

0.39% |

|

| Expenses Paid, Amount |

$ 19

|

| Expense Ratio, Percent |

0.39%

|

| Net Assets |

$ 927,463,116

|

| Holdings Count | Holding |

216

|

| Advisory Fees Paid, Amount |

$ 674,088

|

| Investment Company Portfolio Turnover |

28.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$927,463,116 |

| Total number of portfolio holdings |

216 |

| Net advisory fees paid |

$674,088 |

| Portfolio turnover rate as of the end of the reporting period |

28% |

|

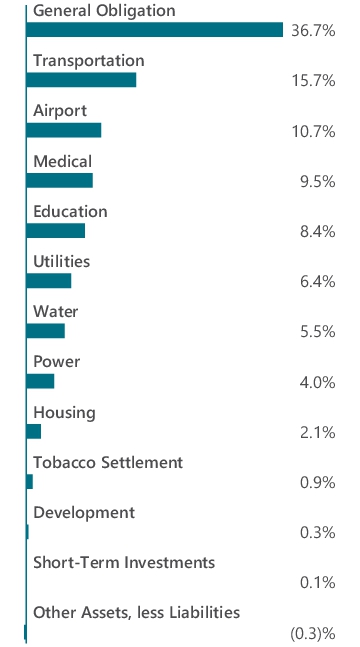

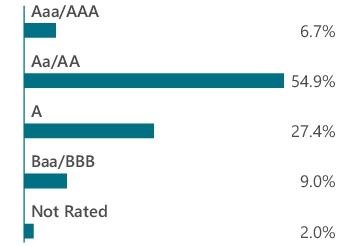

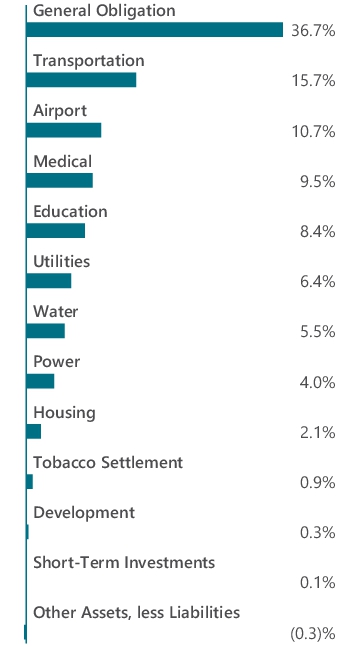

| Holdings [Text Block] |

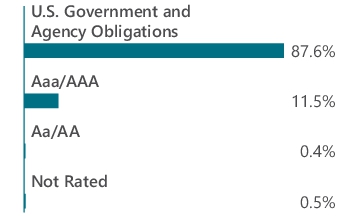

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Louisiana Stadium & Exposition District, Series A, 5.000%, 07/01/42 |

1.3% |

| Great Lakes Water Authority Sewage Disposal System Revenue, Series B, 5.000%, 07/01/34 |

1.2% |

| State of Illinois, Series B, 5.000%, 05/01/34 |

1.1% |

| Iowa Finance Authority, State Revolving Fund Green Bond, 5.000%, 08/01/30 |

1.1% |

| New York Transportation Development Corp., 5.000%, 12/01/36 |

1.1% |

| State Board of Administration Finance Corp., Series A, 5.526%, 07/01/34 |

1.1% |

| Chicago O'Hare International Airport, Senior Lien, Series A, Revenue, 5.000%, 01/01/36 |

1.1% |

| Florida Development Finance Corp., Revenue, 4.000%, 11/15/33 |

1.1% |

| New York State Dormitory Authority, Series A, 5.000%, 03/15/41 |

1.1% |

| Illinois State Toll Highway Authority, Senior Revenue, Series A, Revenue, 5.000%, 12/01/31 |

1.1% |

| Top Ten as a Group |

11.3% | Portfolio Breakdown Ratings

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Louisiana Stadium & Exposition District, Series A, 5.000%, 07/01/42 |

1.3% |

| Great Lakes Water Authority Sewage Disposal System Revenue, Series B, 5.000%, 07/01/34 |

1.2% |

| State of Illinois, Series B, 5.000%, 05/01/34 |

1.1% |

| Iowa Finance Authority, State Revolving Fund Green Bond, 5.000%, 08/01/30 |

1.1% |

| New York Transportation Development Corp., 5.000%, 12/01/36 |

1.1% |

| State Board of Administration Finance Corp., Series A, 5.526%, 07/01/34 |

1.1% |

| Chicago O'Hare International Airport, Senior Lien, Series A, Revenue, 5.000%, 01/01/36 |

1.1% |

| Florida Development Finance Corp., Revenue, 4.000%, 11/15/33 |

1.1% |

| New York State Dormitory Authority, Series A, 5.000%, 03/15/41 |

1.1% |

| Illinois State Toll Highway Authority, Senior Revenue, Series A, Revenue, 5.000%, 12/01/31 |

1.1% |

| Top Ten as a Group |

11.3% |

|

| C000077269 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Municipal Bond Fund

|

| Class Name |

Class N

|

| Trading Symbol |

GWMTX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Municipal Bond Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Municipal Bond Fund

(Class N/GWMTX) |

$36 |

0.72% |

|

| Expenses Paid, Amount |

$ 36

|

| Expense Ratio, Percent |

0.72%

|

| Net Assets |

$ 927,463,116

|

| Holdings Count | Holding |

216

|

| Advisory Fees Paid, Amount |

$ 674,088

|

| Investment Company Portfolio Turnover |

28.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$927,463,116 |

| Total number of portfolio holdings |

216 |

| Net advisory fees paid |

$674,088 |

| Portfolio turnover rate as of the end of the reporting period |

28% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Louisiana Stadium & Exposition District, Series A, 5.000%, 07/01/42 |

1.3% |

| Great Lakes Water Authority Sewage Disposal System Revenue, Series B, 5.000%, 07/01/34 |

1.2% |

| State of Illinois, Series B, 5.000%, 05/01/34 |

1.1% |

| Iowa Finance Authority, State Revolving Fund Green Bond, 5.000%, 08/01/30 |

1.1% |

| New York Transportation Development Corp., 5.000%, 12/01/36 |

1.1% |

| State Board of Administration Finance Corp., Series A, 5.526%, 07/01/34 |

1.1% |

| Chicago O'Hare International Airport, Senior Lien, Series A, Revenue, 5.000%, 01/01/36 |

1.1% |

| Florida Development Finance Corp., Revenue, 4.000%, 11/15/33 |

1.1% |

| New York State Dormitory Authority, Series A, 5.000%, 03/15/41 |

1.1% |

| Illinois State Toll Highway Authority, Senior Revenue, Series A, Revenue, 5.000%, 12/01/31 |

1.1% |

| Top Ten as a Group |

11.3% | Portfolio Breakdown Ratings

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Louisiana Stadium & Exposition District, Series A, 5.000%, 07/01/42 |

1.3% |

| Great Lakes Water Authority Sewage Disposal System Revenue, Series B, 5.000%, 07/01/34 |

1.2% |

| State of Illinois, Series B, 5.000%, 05/01/34 |

1.1% |

| Iowa Finance Authority, State Revolving Fund Green Bond, 5.000%, 08/01/30 |

1.1% |

| New York Transportation Development Corp., 5.000%, 12/01/36 |

1.1% |

| State Board of Administration Finance Corp., Series A, 5.526%, 07/01/34 |

1.1% |

| Chicago O'Hare International Airport, Senior Lien, Series A, Revenue, 5.000%, 01/01/36 |

1.1% |

| Florida Development Finance Corp., Revenue, 4.000%, 11/15/33 |

1.1% |

| New York State Dormitory Authority, Series A, 5.000%, 03/15/41 |

1.1% |

| Illinois State Toll Highway Authority, Senior Revenue, Series A, Revenue, 5.000%, 12/01/31 |

1.1% |

| Top Ten as a Group |

11.3% |

|

| C000077272 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Renaissance Large Cap Growth Fund

|

| Class Name |

Class N

|

| Trading Symbol |

MRLTX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Renaissance Large Cap Growth Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Renaissance Large Cap Growth Fund

(Class N/MRLTX) |

$51 |

1.00% |

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

1.00%

|

| Net Assets |

$ 138,379,377

|

| Holdings Count | Holding |

57

|

| Advisory Fees Paid, Amount |

$ 246,165

|

| Investment Company Portfolio Turnover |

23.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$138,379,377 |

| Total number of portfolio holdings |

57 |

| Net advisory fees paid |

$246,165 |

| Portfolio turnover rate as of the end of the reporting period |

23% |

|

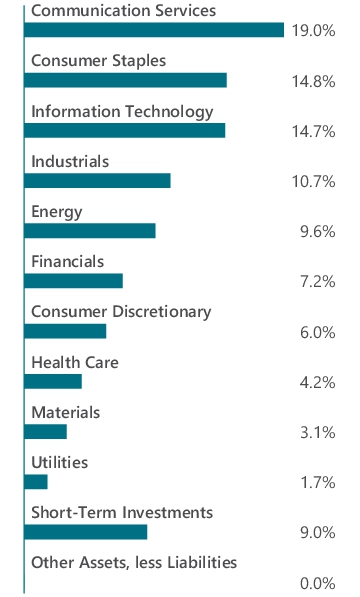

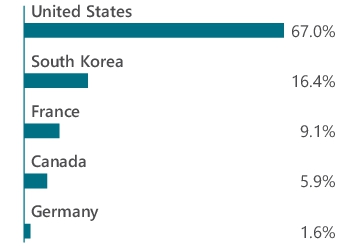

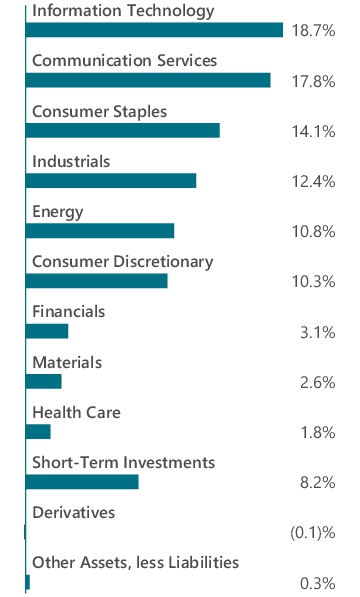

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| Microsoft Corp. |

3.2% |

| Apple, Inc. |

2.9% |

| Meta Platforms, Inc., Class A |

2.8% |

| Amazon.com, Inc. |

2.7% |

| Broadcom, Inc. |

2.5% |

| Netflix, Inc. |

2.4% |

| Amphenol Corp., Class A |

2.2% |

| Alphabet, Inc., Class A |

2.2% |

| Jabil, Inc. |

2.1% |

| Royal Caribbean Cruises, Ltd. |

2.0% |

| Top Ten as a Group |

25.0% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

3.2% |

| Apple, Inc. |

2.9% |

| Meta Platforms, Inc., Class A |

2.8% |

| Amazon.com, Inc. |

2.7% |

| Broadcom, Inc. |

2.5% |

| Netflix, Inc. |

2.4% |

| Amphenol Corp., Class A |

2.2% |

| Alphabet, Inc., Class A |

2.2% |

| Jabil, Inc. |

2.1% |

| Royal Caribbean Cruises, Ltd. |

2.0% |

| Top Ten as a Group |

25.0% |

|

| C000077271 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Renaissance Large Cap Growth Fund

|

| Class Name |

Class I

|

| Trading Symbol |

MRLSX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Renaissance Large Cap Growth Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Renaissance Large Cap Growth Fund

(Class I/MRLSX) |

$37 |

0.73% |

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.73%

|

| Net Assets |

$ 138,379,377

|

| Holdings Count | Holding |

57

|

| Advisory Fees Paid, Amount |

$ 246,165

|

| Investment Company Portfolio Turnover |

23.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$138,379,377 |

| Total number of portfolio holdings |

57 |

| Net advisory fees paid |

$246,165 |

| Portfolio turnover rate as of the end of the reporting period |

23% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| Microsoft Corp. |

3.2% |

| Apple, Inc. |

2.9% |

| Meta Platforms, Inc., Class A |

2.8% |

| Amazon.com, Inc. |

2.7% |

| Broadcom, Inc. |

2.5% |

| Netflix, Inc. |

2.4% |

| Amphenol Corp., Class A |

2.2% |

| Alphabet, Inc., Class A |

2.2% |

| Jabil, Inc. |

2.1% |

| Royal Caribbean Cruises, Ltd. |

2.0% |

| Top Ten as a Group |

25.0% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

3.2% |

| Apple, Inc. |

2.9% |

| Meta Platforms, Inc., Class A |

2.8% |

| Amazon.com, Inc. |

2.7% |

| Broadcom, Inc. |

2.5% |

| Netflix, Inc. |

2.4% |

| Amphenol Corp., Class A |

2.2% |

| Alphabet, Inc., Class A |

2.2% |

| Jabil, Inc. |

2.1% |

| Royal Caribbean Cruises, Ltd. |

2.0% |

| Top Ten as a Group |

25.0% |

|

| C000077270 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Renaissance Large Cap Growth Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

MRLIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Renaissance Large Cap Growth Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Renaissance Large Cap Growth Fund

(Class Z/MRLIX) |

$34 |

0.66% |

|

| Expenses Paid, Amount |

$ 34

|

| Expense Ratio, Percent |

0.66%

|

| Net Assets |

$ 138,379,377

|

| Holdings Count | Holding |

57

|

| Advisory Fees Paid, Amount |

$ 246,165

|

| Investment Company Portfolio Turnover |

23.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$138,379,377 |

| Total number of portfolio holdings |

57 |

| Net advisory fees paid |

$246,165 |

| Portfolio turnover rate as of the end of the reporting period |

23% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| Microsoft Corp. |

3.2% |

| Apple, Inc. |

2.9% |

| Meta Platforms, Inc., Class A |

2.8% |

| Amazon.com, Inc. |

2.7% |

| Broadcom, Inc. |

2.5% |

| Netflix, Inc. |

2.4% |

| Amphenol Corp., Class A |

2.2% |

| Alphabet, Inc., Class A |

2.2% |

| Jabil, Inc. |

2.1% |

| Royal Caribbean Cruises, Ltd. |

2.0% |

| Top Ten as a Group |

25.0% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

3.2% |

| Apple, Inc. |

2.9% |

| Meta Platforms, Inc., Class A |

2.8% |

| Amazon.com, Inc. |

2.7% |

| Broadcom, Inc. |

2.5% |

| Netflix, Inc. |

2.4% |

| Amphenol Corp., Class A |

2.2% |

| Alphabet, Inc., Class A |

2.2% |

| Jabil, Inc. |

2.1% |

| Royal Caribbean Cruises, Ltd. |

2.0% |

| Top Ten as a Group |

25.0% |

|

| C000115981 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Fund

|

| Class Name |

Class I

|

| Trading Symbol |

YACKX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Fund

(Class I/YACKX) |

$36 |

0.71% |

|

| Expenses Paid, Amount |

$ 36

|

| Expense Ratio, Percent |

0.71%

|

| Net Assets |

$ 6,719,854,242

|

| Holdings Count | Holding |

62

|

| Advisory Fees Paid, Amount |

$ 14,532,595

|

| Investment Company Portfolio Turnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$6,719,854,242 |

| Total number of portfolio holdings |

62 |

| Net advisory fees paid |

$14,532,595 |

| Portfolio turnover rate as of the end of the reporting period |

1% |

|

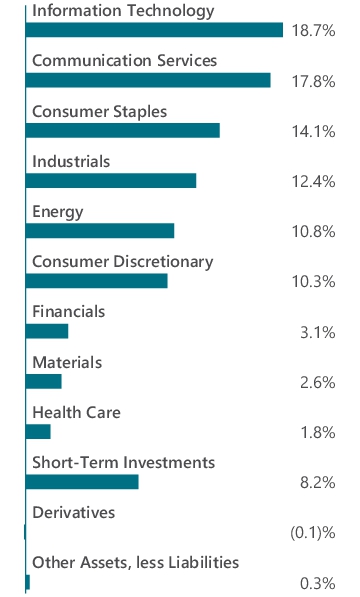

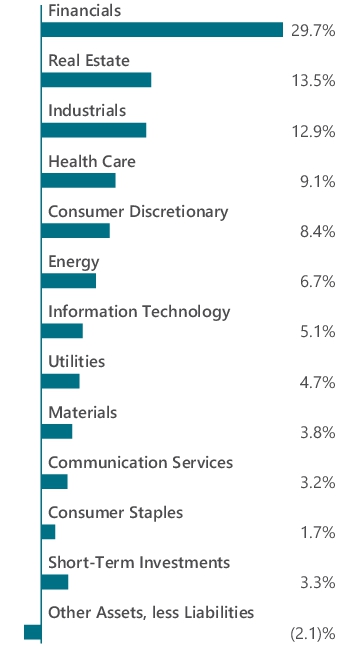

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Bolloré SE (France) |

8.3% |

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

6.4% |

| Canadian Natural Resources, Ltd. (Canada) |

5.3% |

| Microsoft Corp. |

4.8% |

| The Charles Schwab Corp. |

3.7% |

| Hyundai Mobis Co., Ltd. (South Korea) |

3.2% |

| The Procter & Gamble Co. |

2.9% |

| Cognizant Technology Solutions Corp., Class A |

2.4% |

| U-Haul Holding Co., Non-Voting Shares |

2.4% |

| Reliance, Inc. |

2.4% |

| Top Ten as a Group |

41.8% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bolloré SE (France) |

8.3% |

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

6.4% |

| Canadian Natural Resources, Ltd. (Canada) |

5.3% |

| Microsoft Corp. |

4.8% |

| The Charles Schwab Corp. |

3.7% |

| Hyundai Mobis Co., Ltd. (South Korea) |

3.2% |

| The Procter & Gamble Co. |

2.9% |

| Cognizant Technology Solutions Corp., Class A |

2.4% |

| U-Haul Holding Co., Non-Voting Shares |

2.4% |

| Reliance, Inc. |

2.4% |

| Top Ten as a Group |

41.8% |

|

| C000115979 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Focused Fund

|

| Class Name |

Class I

|

| Trading Symbol |

YAFIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Focused Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Focused Fund

(Class I/YAFIX) |

$56 |

1.08% |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.08%

|

| Net Assets |

$ 2,615,782,769

|

| Holdings Count | Holding |

49

|

| Advisory Fees Paid, Amount |

$ 11,429,770

|

| Investment Company Portfolio Turnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$2,615,782,769 |

| Total number of portfolio holdings |

49 |

| Net advisory fees paid |

$11,429,770 |

| Portfolio turnover rate as of the end of the reporting period |

1% |

|

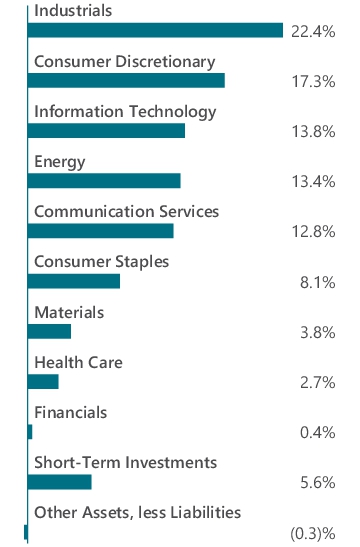

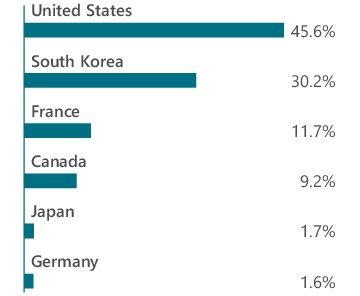

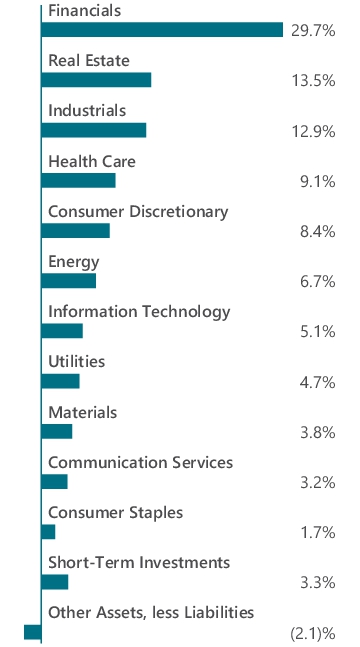

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

12.5% |

| Bolloré SE (France) |

9.9% |

| Canadian Natural Resources, Ltd. (Canada) |

8.4% |

| Microsoft Corp. |

4.4% |

| Hyundai Mobis Co., Ltd. (South Korea) |

3.6% |

| U-Haul Holding Co., Non-Voting Shares |

3.4% |

| KT&G Corp. (South Korea) |

3.2% |

| The Charles Schwab Corp. |

3.1% |

| Fox Corp., Class B |

3.1% |

| Hyundai Motor Co., 7.940% (South Korea) |

2.8% |

| Top Ten as a Group |

54.4% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

12.5% |

| Bolloré SE (France) |

9.9% |

| Canadian Natural Resources, Ltd. (Canada) |

8.4% |

| Microsoft Corp. |

4.4% |

| Hyundai Mobis Co., Ltd. (South Korea) |

3.6% |

| U-Haul Holding Co., Non-Voting Shares |

3.4% |

| KT&G Corp. (South Korea) |

3.2% |

| The Charles Schwab Corp. |

3.1% |

| Fox Corp., Class B |

3.1% |

| Hyundai Motor Co., 7.940% (South Korea) |

2.8% |

| Top Ten as a Group |

54.4% |

|

| C000115978 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Yacktman Focused Fund

|

| Class Name |

Class N

|

| Trading Symbol |

YAFFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Yacktman Focused Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Yacktman Focused Fund

(Class N/YAFFX) |

$65 |

1.26% |

|

| Expenses Paid, Amount |

$ 65

|

| Expense Ratio, Percent |

1.26%

|

| Net Assets |

$ 2,615,782,769

|

| Holdings Count | Holding |

49

|

| Advisory Fees Paid, Amount |

$ 11,429,770

|

| Investment Company Portfolio Turnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$2,615,782,769 |

| Total number of portfolio holdings |

49 |

| Net advisory fees paid |

$11,429,770 |

| Portfolio turnover rate as of the end of the reporting period |

1% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

12.5% |

| Bolloré SE (France) |

9.9% |

| Canadian Natural Resources, Ltd. (Canada) |

8.4% |

| Microsoft Corp. |

4.4% |

| Hyundai Mobis Co., Ltd. (South Korea) |

3.6% |

| U-Haul Holding Co., Non-Voting Shares |

3.4% |

| KT&G Corp. (South Korea) |

3.2% |

| The Charles Schwab Corp. |

3.1% |

| Fox Corp., Class B |

3.1% |

| Hyundai Motor Co., 7.940% (South Korea) |

2.8% |

| Top Ten as a Group |

54.4% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Samsung Electronics Co., Ltd., 2.870% (South Korea) |

12.5% |

| Bolloré SE (France) |

9.9% |

| Canadian Natural Resources, Ltd. (Canada) |

8.4% |

| Microsoft Corp. |

4.4% |

| Hyundai Mobis Co., Ltd. (South Korea) |

3.6% |

| U-Haul Holding Co., Non-Voting Shares |

3.4% |

| KT&G Corp. (South Korea) |

3.2% |

| The Charles Schwab Corp. |

3.1% |

| Fox Corp., Class B |

3.1% |

| Hyundai Motor Co., 7.940% (South Korea) |

2.8% |

| Top Ten as a Group |

54.4% |

|

| C000056573 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Small Cap Value Fund

|

| Class Name |

Class N

|

| Trading Symbol |

SKSEX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Small Cap Value Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small Cap Value Fund

(Class N/SKSEX) |

$55 |

1.14% |

|

| Expenses Paid, Amount |

$ 55

|

| Expense Ratio, Percent |

1.14%

|

| Net Assets |

$ 199,455,079

|

| Holdings Count | Holding |

88

|

| Advisory Fees Paid, Amount |

$ 665,668

|

| Investment Company Portfolio Turnover |

15.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of June 30, 2025)

| Fund net assets |

$199,455,079 |

| Total number of portfolio holdings |

88 |

| Net advisory fees paid |

$665,668 |

| Portfolio turnover rate as of the end of the reporting period |

15% |

|

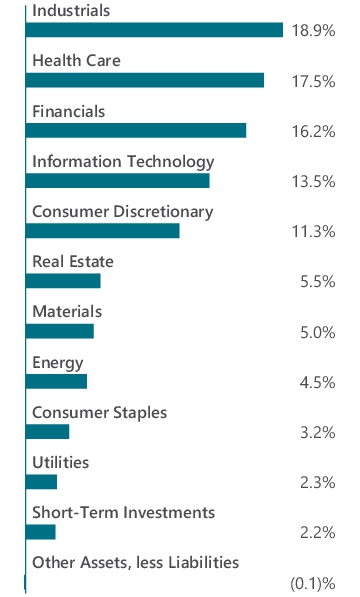

| Holdings [Text Block] |

Graphical Representation of Holdings (as of June 30, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund. Top Ten Holdings

| TTM Technologies, Inc. |

2.7% |

| Federal Agricultural Mortgage Corp., Class C |

2.3% |

| Integer Holdings Corp. |

2.2% |

| Solaris Energy Infrastructure, Inc., Class A |

2.1% |

| Ameris Bancorp |

2.0% |

| Independence Realty Trust, Inc., REIT |

2.0% |

| Selective Insurance Group, Inc. |

2.0% |

| International Bancshares Corp. |

1.9% |

| IMAX Corp. (Canada) |

1.8% |

| Group 1 Automotive, Inc. |

1.8% |

| Top Ten as a Group |

20.8% | Portfolio Breakdown

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| TTM Technologies, Inc. |

2.7% |

| Federal Agricultural Mortgage Corp., Class C |

2.3% |

| Integer Holdings Corp. |

2.2% |

| Solaris Energy Infrastructure, Inc., Class A |

2.1% |

| Ameris Bancorp |

2.0% |

| Independence Realty Trust, Inc., REIT |

2.0% |

| Selective Insurance Group, Inc. |

2.0% |

| International Bancshares Corp. |

1.9% |

| IMAX Corp. (Canada) |

1.8% |

| Group 1 Automotive, Inc. |

1.8% |

| Top Ten as a Group |

20.8% |

|

| C000180067 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG GW&K Small Cap Value Fund

|

| Class Name |

Class I

|

| Trading Symbol |

SKSIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG GW&K Small Cap Value Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small Cap Value Fund

(Class I/SKSIX) |

$45 |

0.94% |

|

| Expenses Paid, Amount |

$ 45

|

| Expense Ratio, Percent |

0.94%

|

| Net Assets |

$ 199,455,079

|

| Holdings Count | Holding |

88

|

| Advisory Fees Paid, Amount |

$ 665,668

|

| Investment Company Portfolio Turnover |

15.00%

|

| Additional Fund Statistics [Text Block] |