Shareholder Report |

12 Months Ended |

|---|---|

|

Jun. 30, 2025

USD ($)

Holding

| |

| Shareholder Report [Line Items] | |

| Document Type | N-CSR |

| Amendment Flag | false |

| Registrant Name | WisdomTree Digital Trust |

| Entity Central Index Key | 0001859001 |

| Entity Investment Company Type | N-1A |

| Document Period End Date | Jun. 30, 2025 |

| C000240058 | |

| Shareholder Report [Line Items] | |

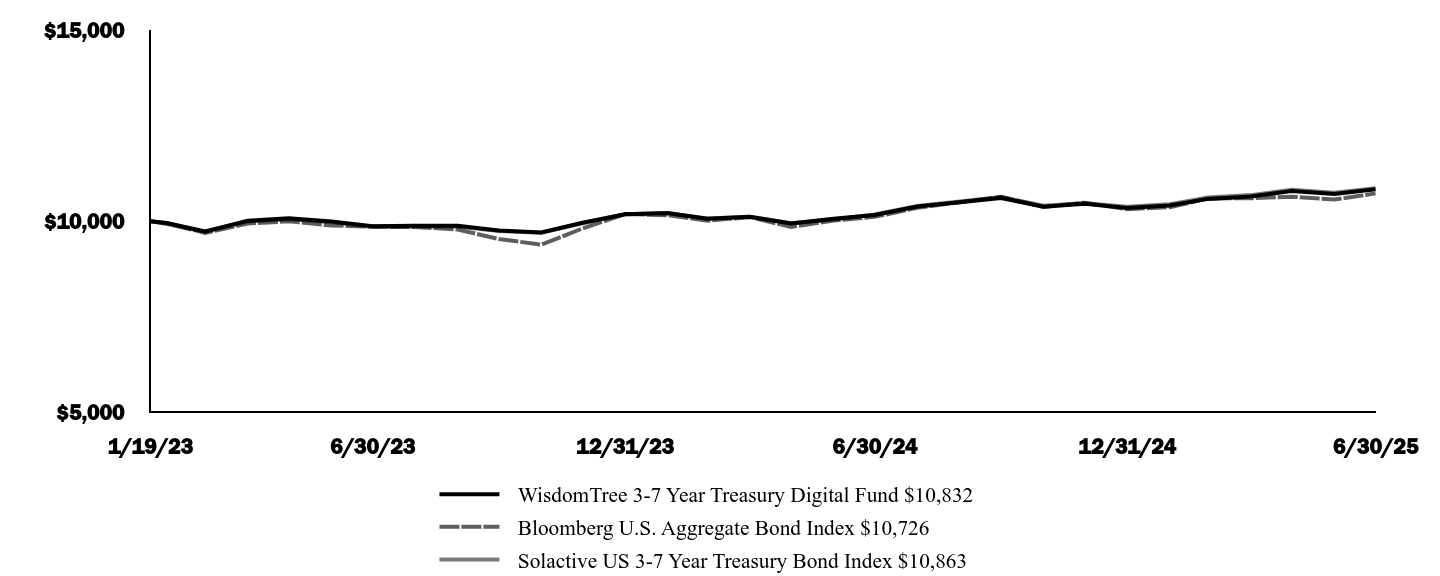

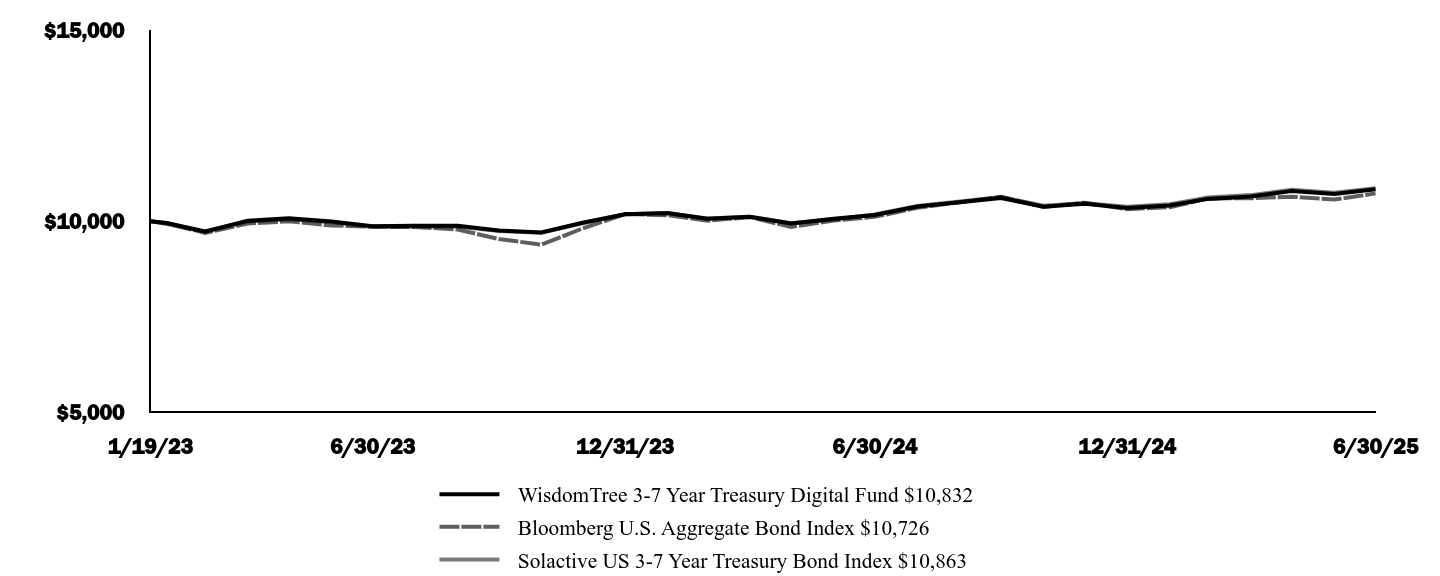

| Fund Name | WisdomTree 3-7 Year Treasury Digital Fund |

| Trading Symbol | WTTSX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree 3-7 Year Treasury Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 994,247 |

| Holdings Count | Holding | 13 |

| Advisory Fees Paid, Amount | $ 492 |

| InvestmentCompanyPortfolioTurnover | 164.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240073 | |

| Shareholder Report [Line Items] | |

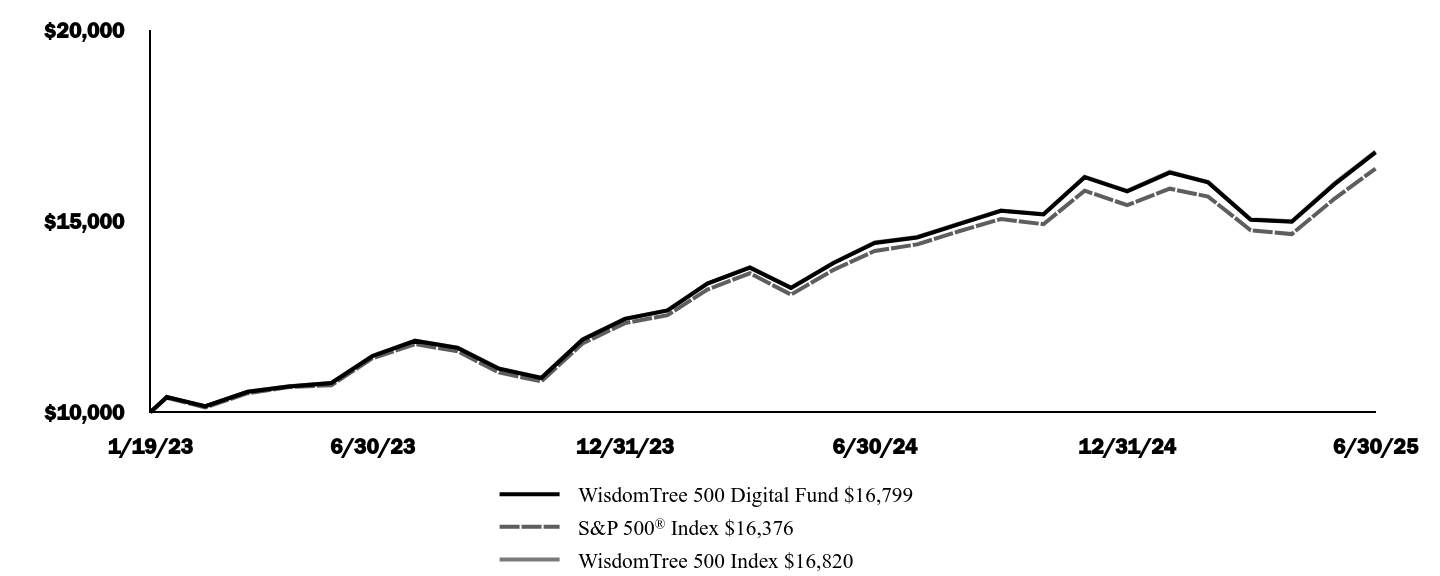

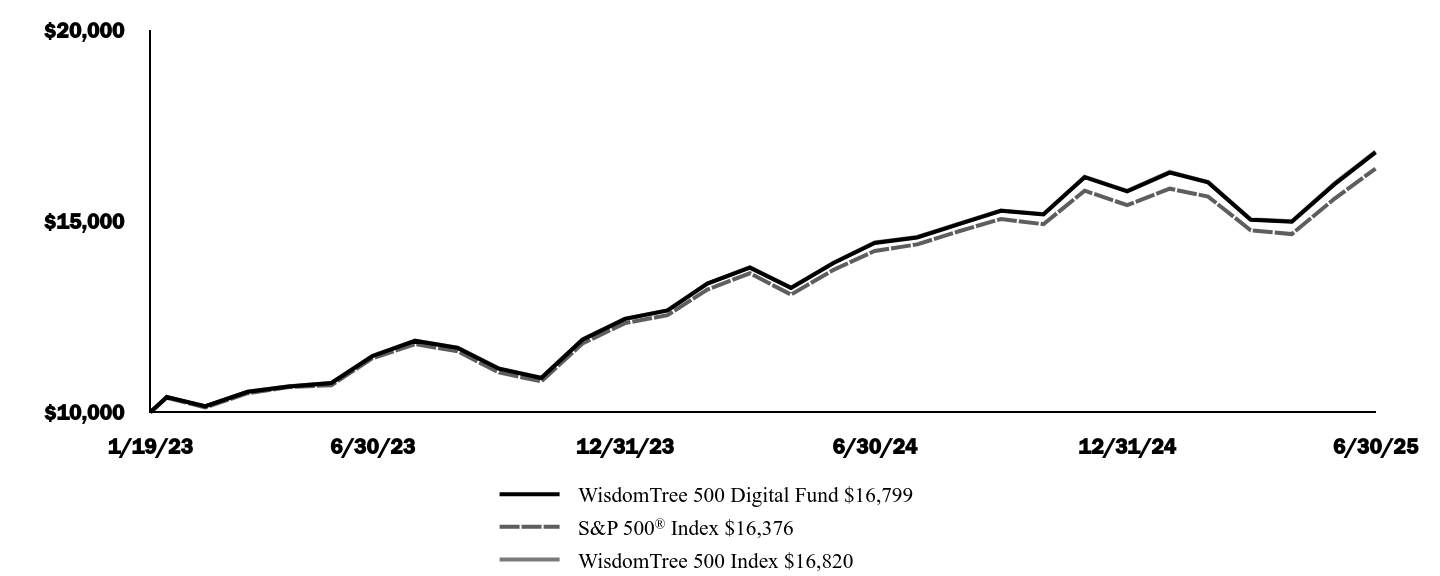

| Fund Name | WisdomTree 500 Digital Fund |

| Trading Symbol | SPXUX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree 500 Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 13,639,055 |

| Holdings Count | Holding | 500 |

| Advisory Fees Paid, Amount | $ 2,253 |

| InvestmentCompanyPortfolioTurnover | 3.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240067 | |

| Shareholder Report [Line Items] | |

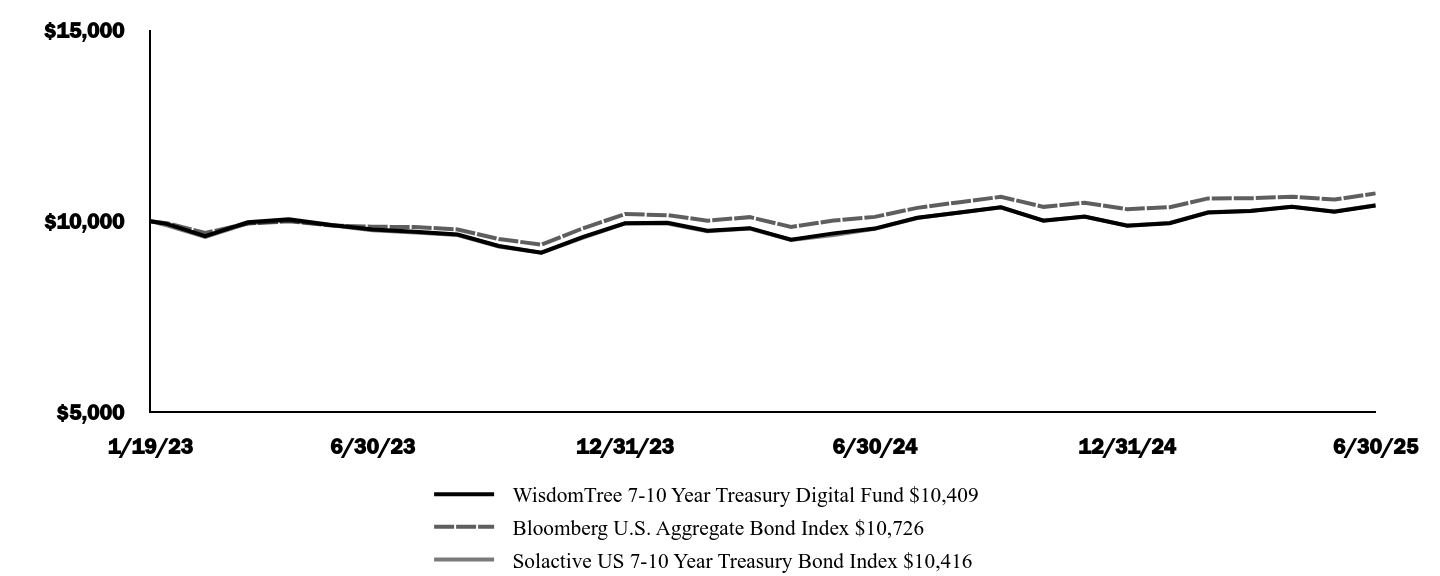

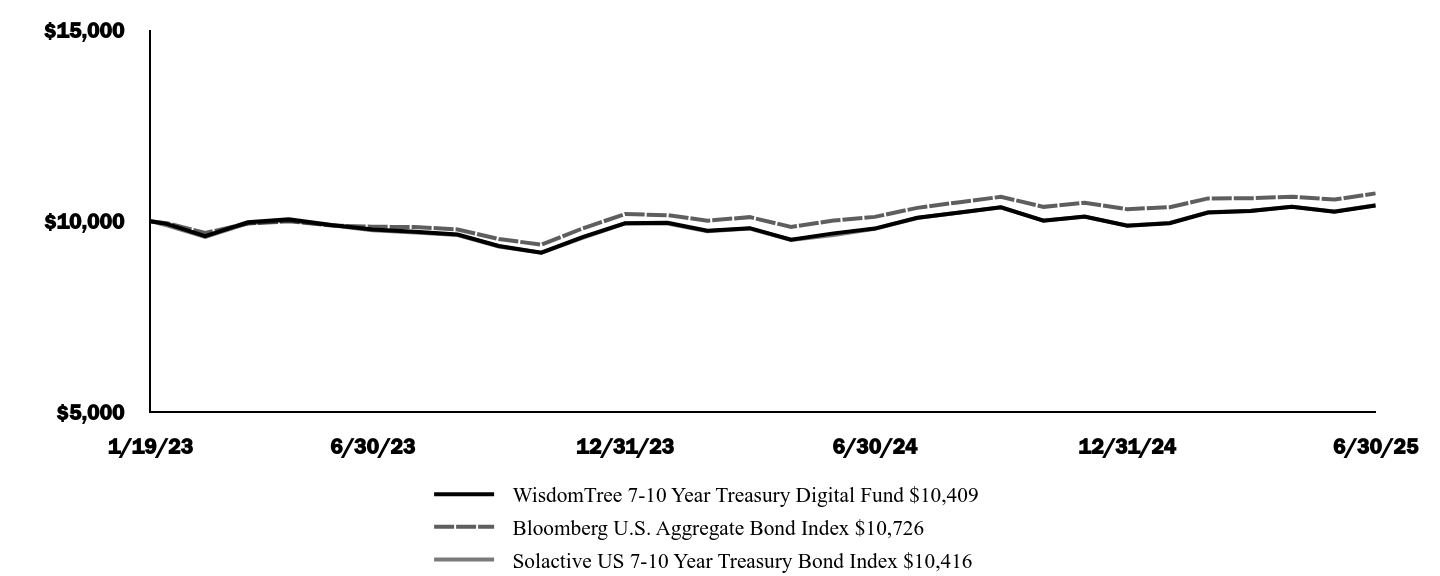

| Fund Name | WisdomTree 7-10 Year Treasury Digital Fund |

| Trading Symbol | WTSTX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree 7-10 Year Treasury Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 954,568 |

| Holdings Count | Holding | 6 |

| Advisory Fees Paid, Amount | $ 475 |

| InvestmentCompanyPortfolioTurnover | 127.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240070 | |

| Shareholder Report [Line Items] | |

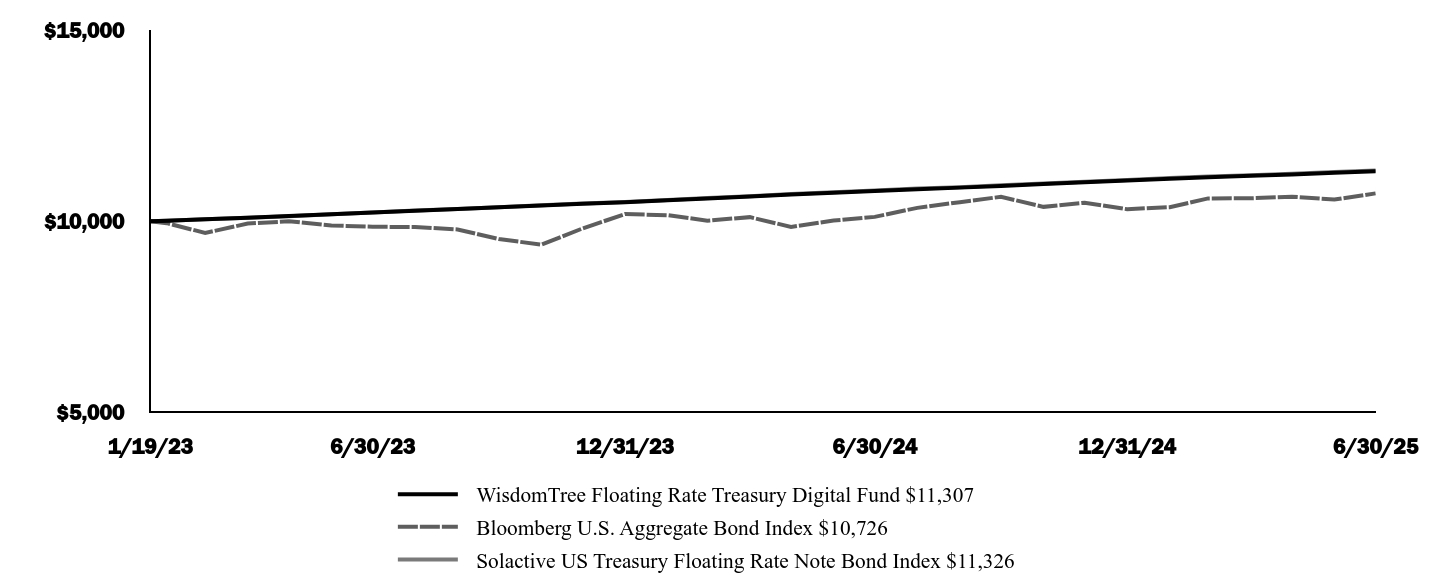

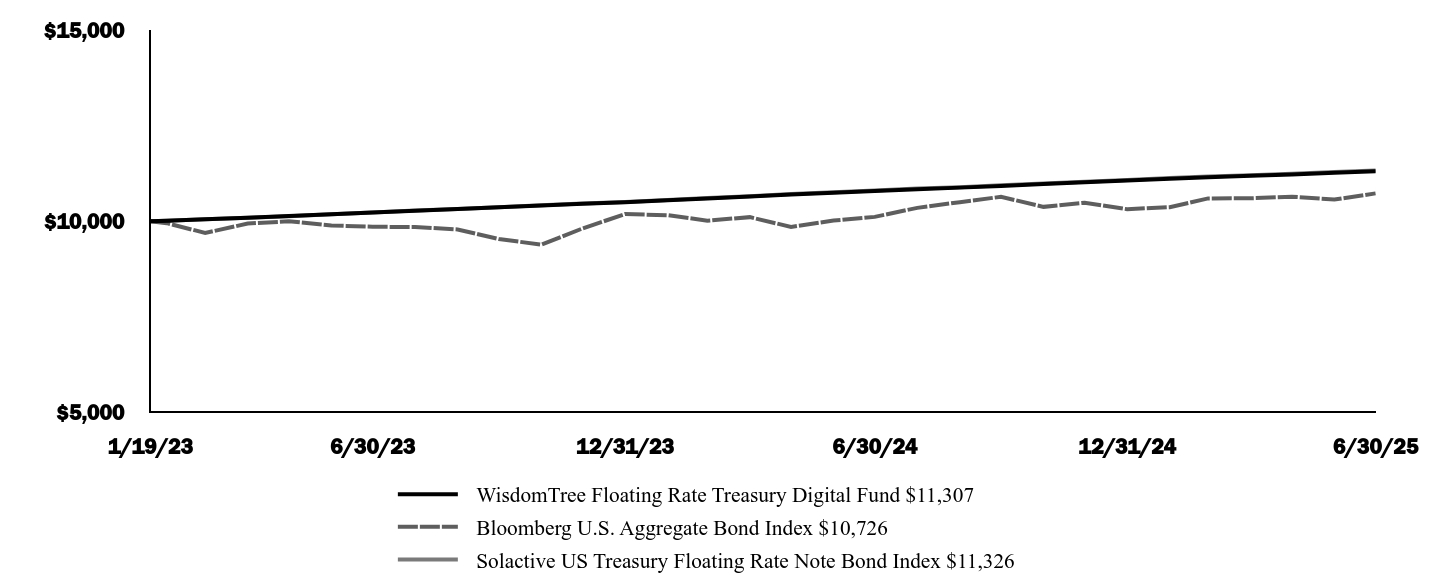

| Fund Name | WisdomTree Floating Rate Treasury Digital Fund |

| Trading Symbol | FLTTX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Floating Rate Treasury Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 1,772,365 |

| Holdings Count | Holding | 7 |

| Advisory Fees Paid, Amount | $ 845 |

| InvestmentCompanyPortfolioTurnover | 68.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000245468 | |

| Shareholder Report [Line Items] | |

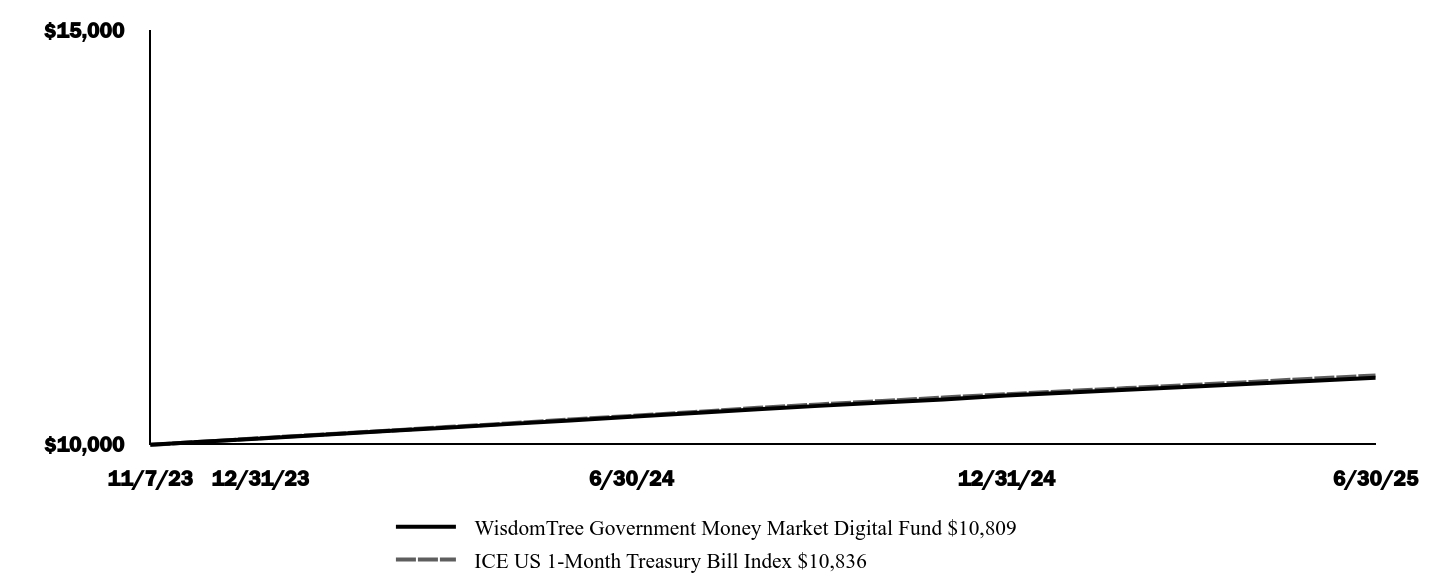

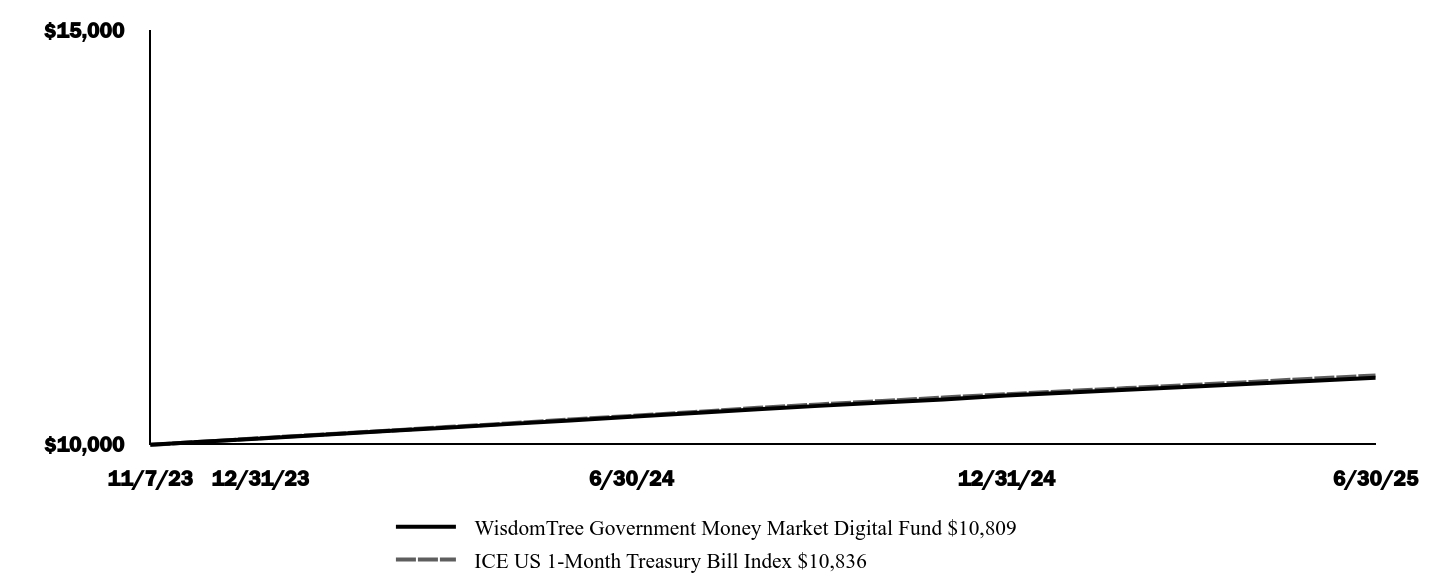

| Fund Name | WisdomTree Government Money Market Digital Fund |

| Trading Symbol | WTGXX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Government Money Market Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 26 |

| Expense Ratio, Percent | 0.25% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 321,220,554 |

| Holdings Count | Holding | 22 |

| Advisory Fees Paid, Amount | $ 172,516 |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240068 | |

| Shareholder Report [Line Items] | |

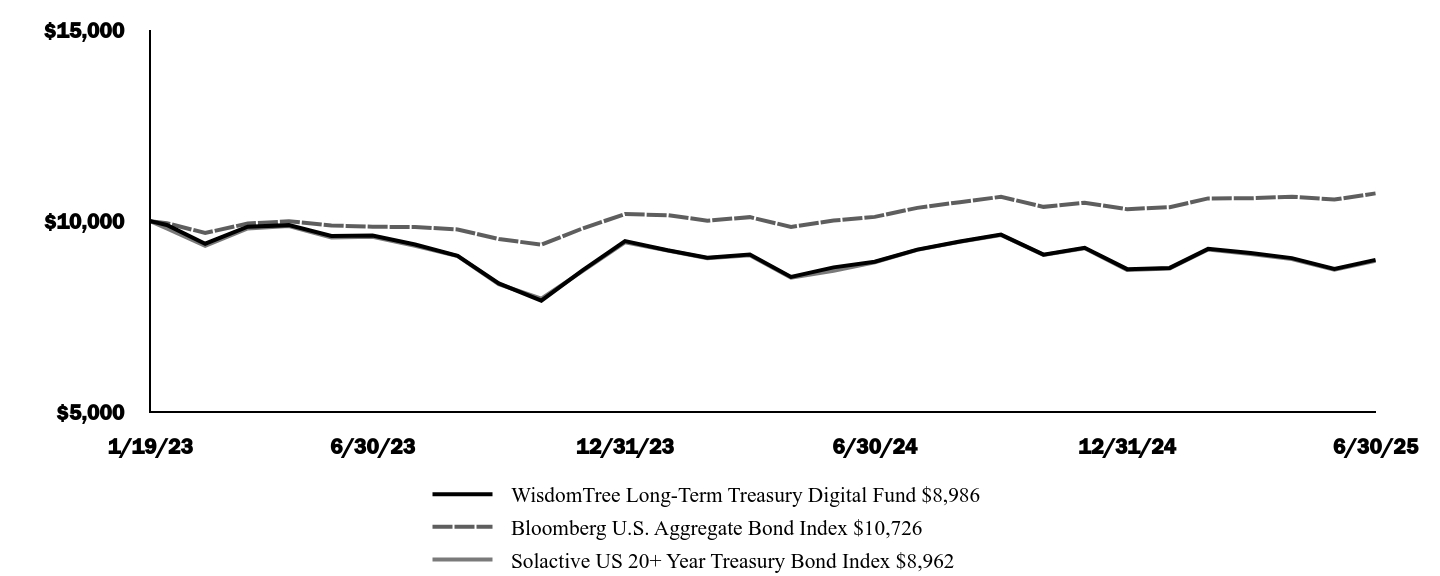

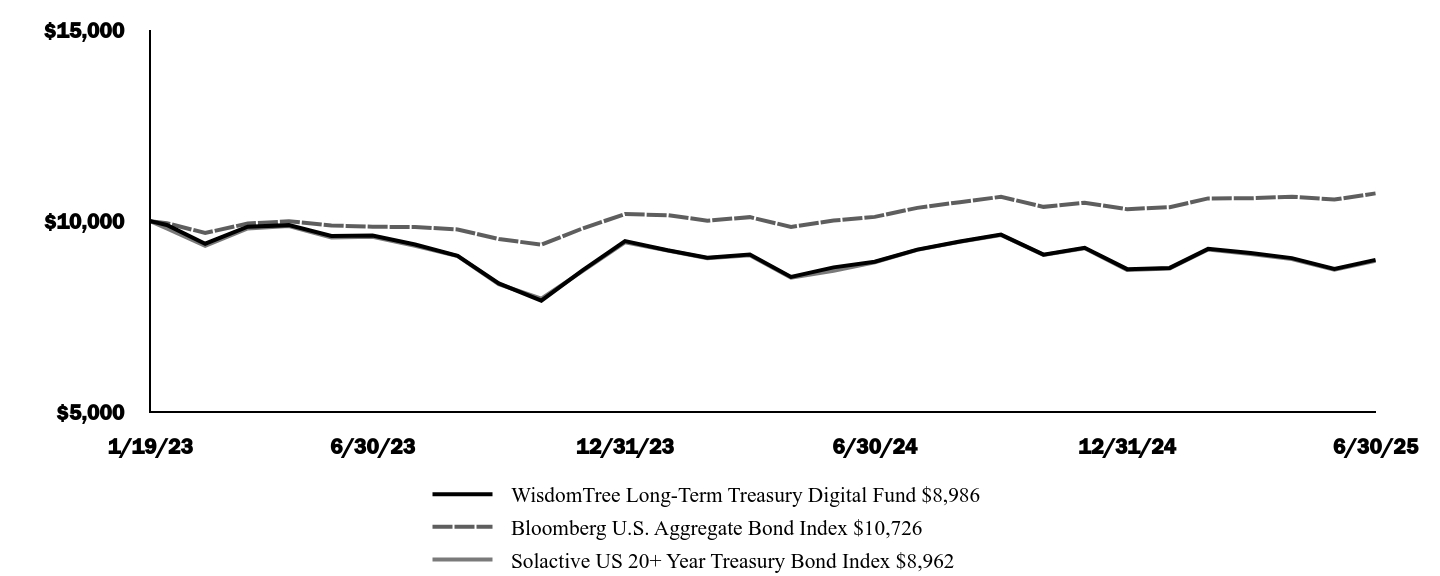

| Fund Name | WisdomTree Long-Term Treasury Digital Fund |

| Trading Symbol | WTLGX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Long-Term Treasury Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 815,027 |

| Holdings Count | Holding | 8 |

| Advisory Fees Paid, Amount | $ 422 |

| InvestmentCompanyPortfolioTurnover | 32.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240076 | |

| Shareholder Report [Line Items] | |

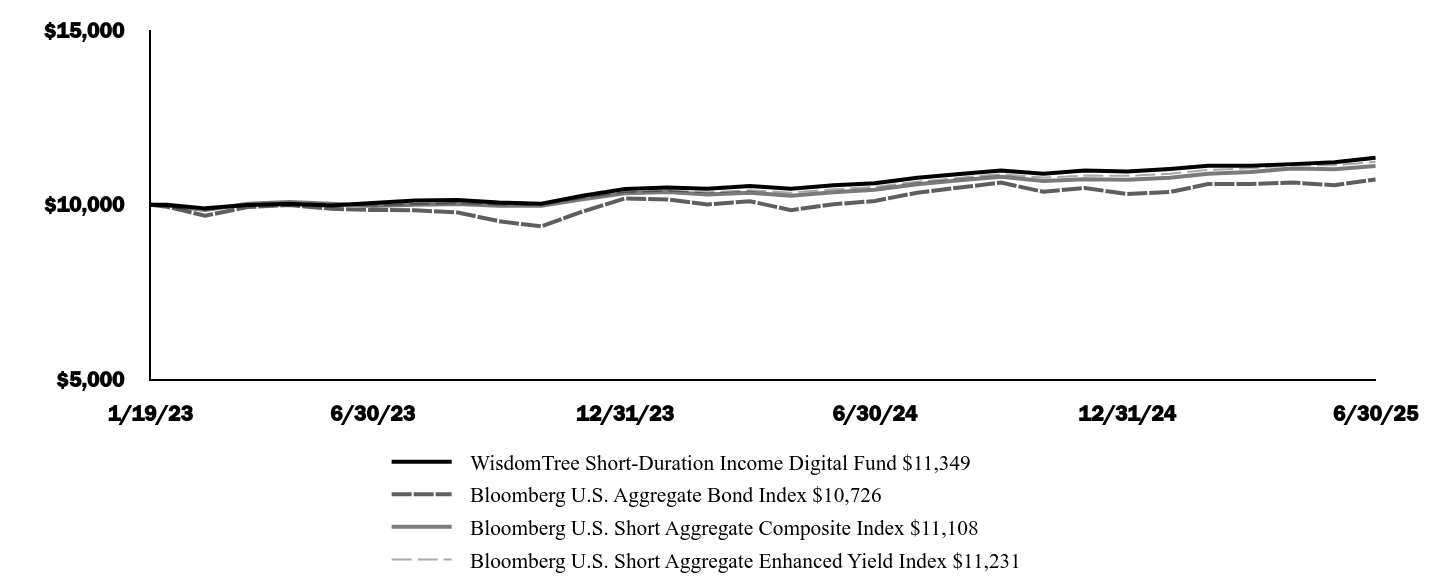

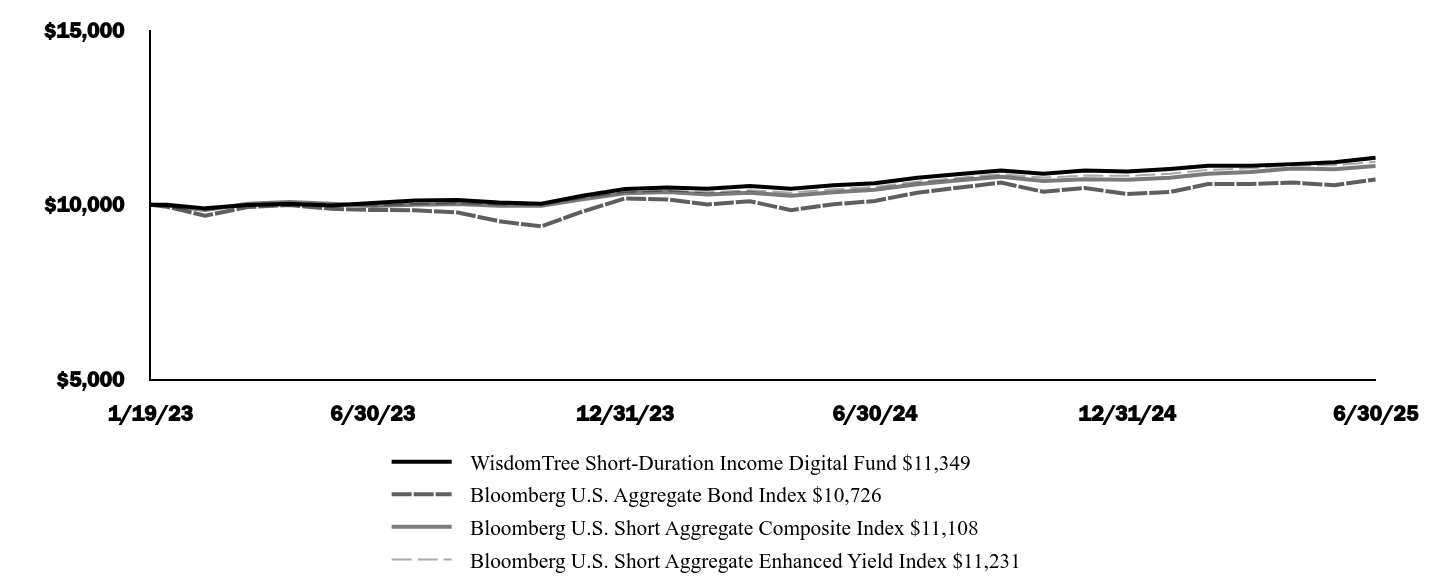

| Fund Name | WisdomTree Short-Duration Income Digital Fund |

| Trading Symbol | WTSIX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Short-Duration Income Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 16 |

| Expense Ratio, Percent | 0.15% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 1,032,166 |

| Holdings Count | Holding | 5 |

| Advisory Fees Paid, Amount | $ 1,544 |

| InvestmentCompanyPortfolioTurnover | 4.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000228751 | |

| Shareholder Report [Line Items] | |

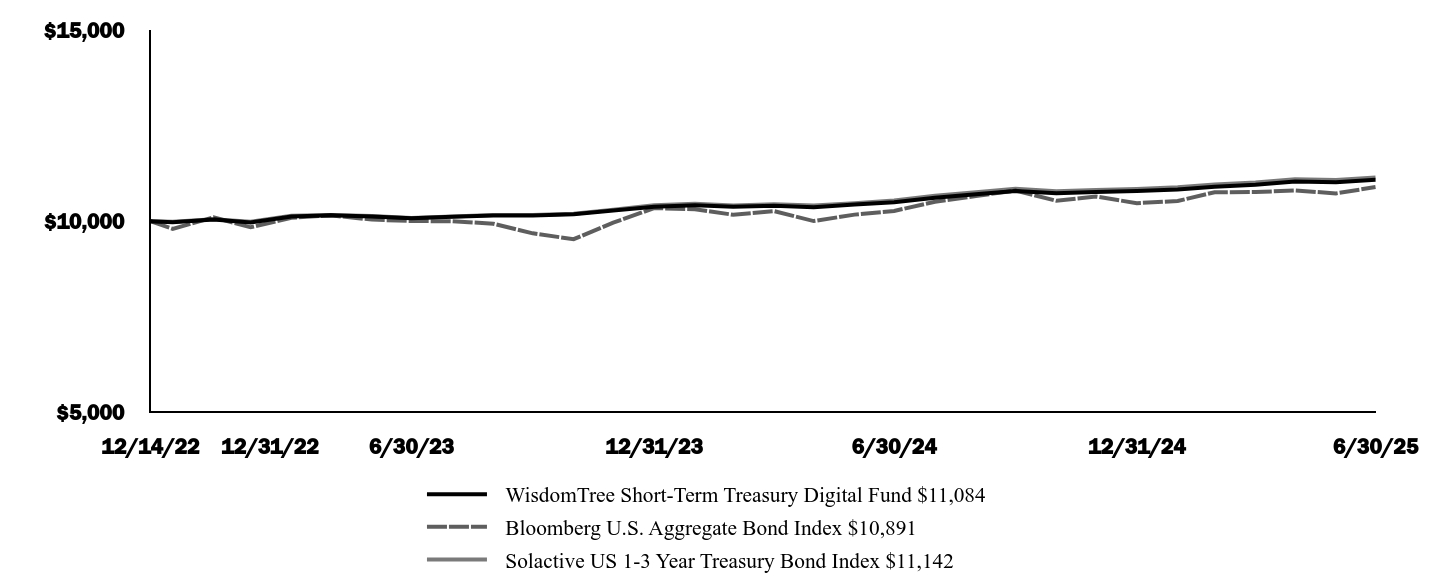

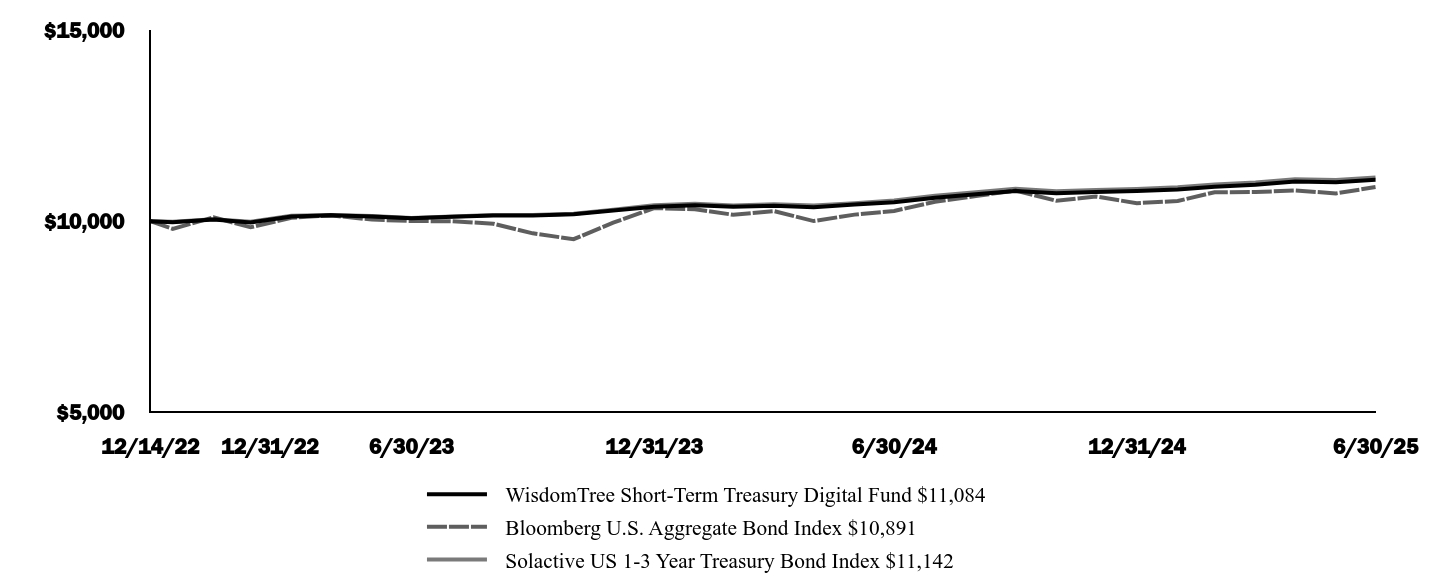

| Fund Name | WisdomTree Short-Term Treasury Digital Fund |

| Trading Symbol | WTSYX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Short-Term Treasury Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 1,024,565 |

| Holdings Count | Holding | 19 |

| Advisory Fees Paid, Amount | $ 505 |

| InvestmentCompanyPortfolioTurnover | 183.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000241818 | |

| Shareholder Report [Line Items] | |

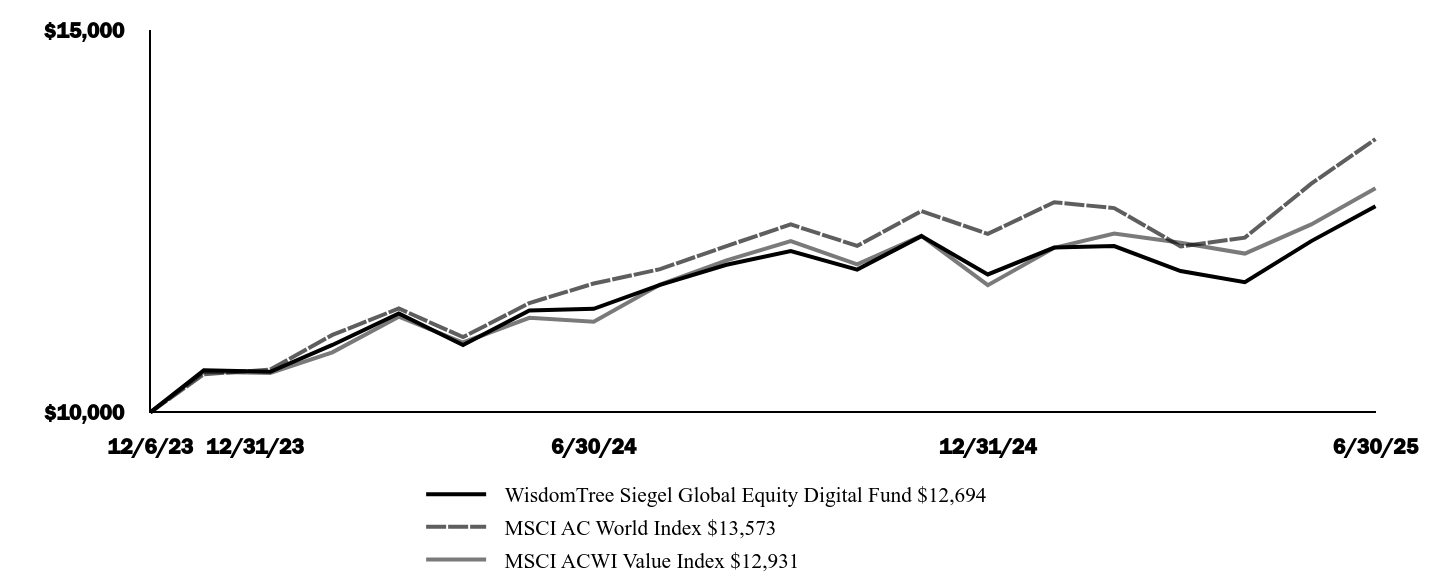

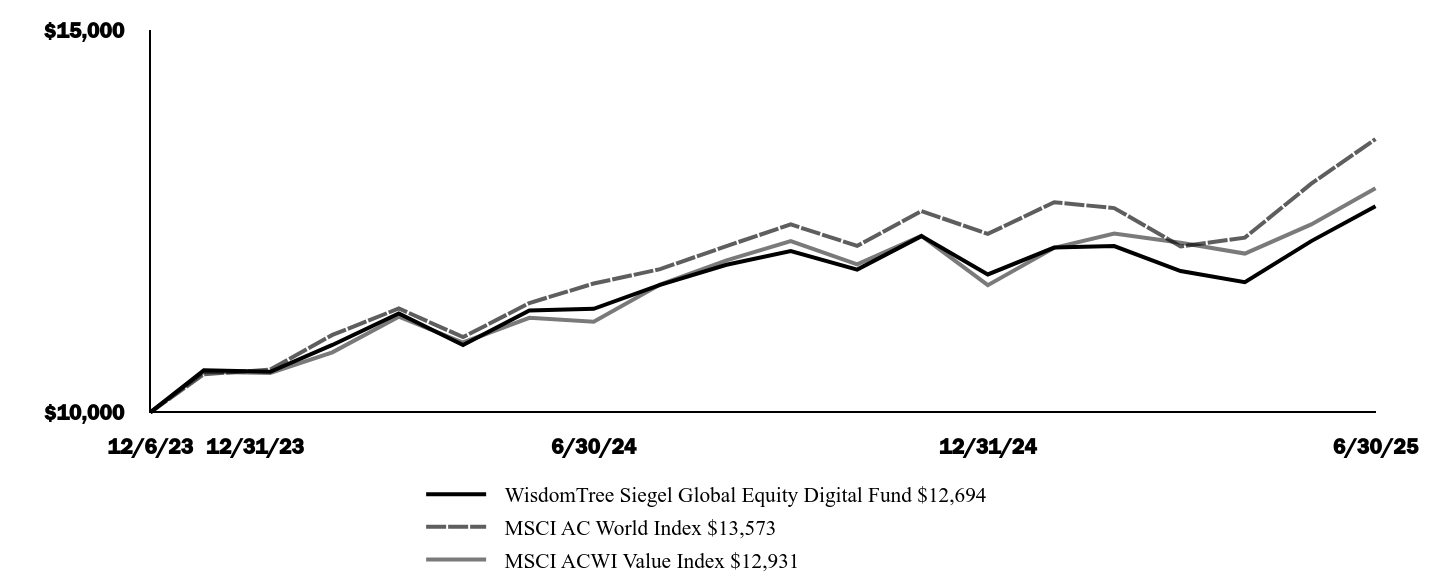

| Fund Name | WisdomTree Siegel Global Equity Digital Fund |

| Trading Symbol | EQTYX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Siegel Global Equity Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 16 |

| Expense Ratio, Percent | 0.15% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 712,208 |

| Holdings Count | Holding | 11 |

| Advisory Fees Paid, Amount | $ 710 |

| InvestmentCompanyPortfolioTurnover | 13.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000241816 | |

| Shareholder Report [Line Items] | |

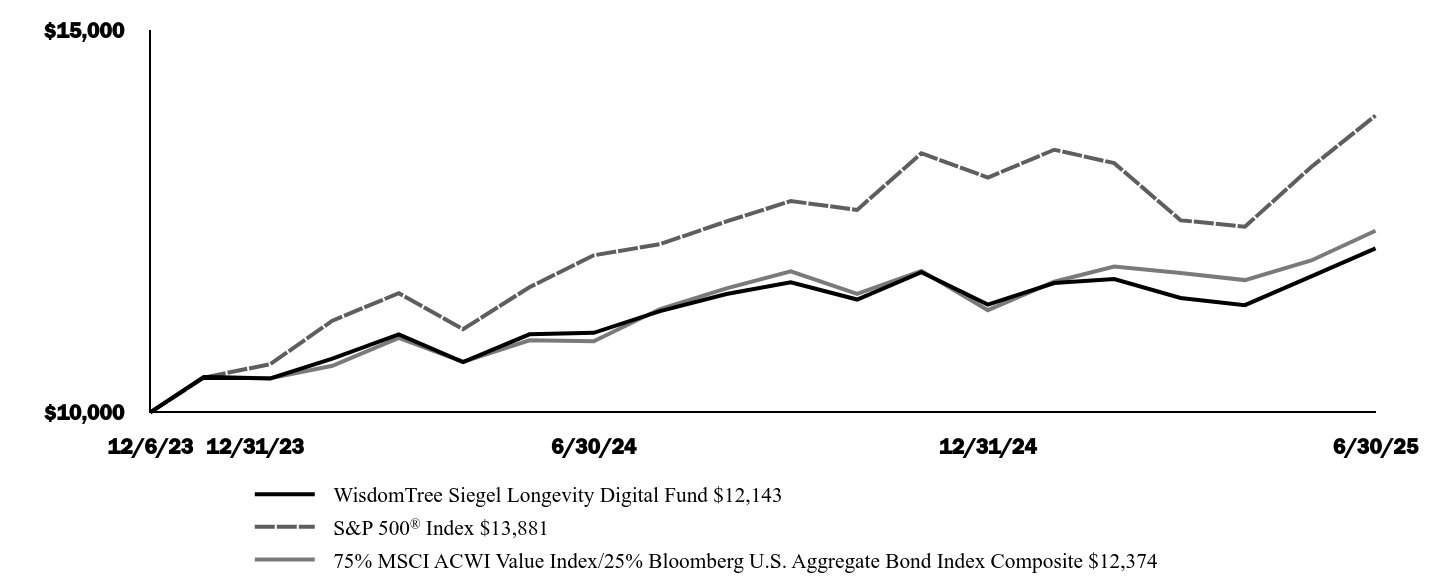

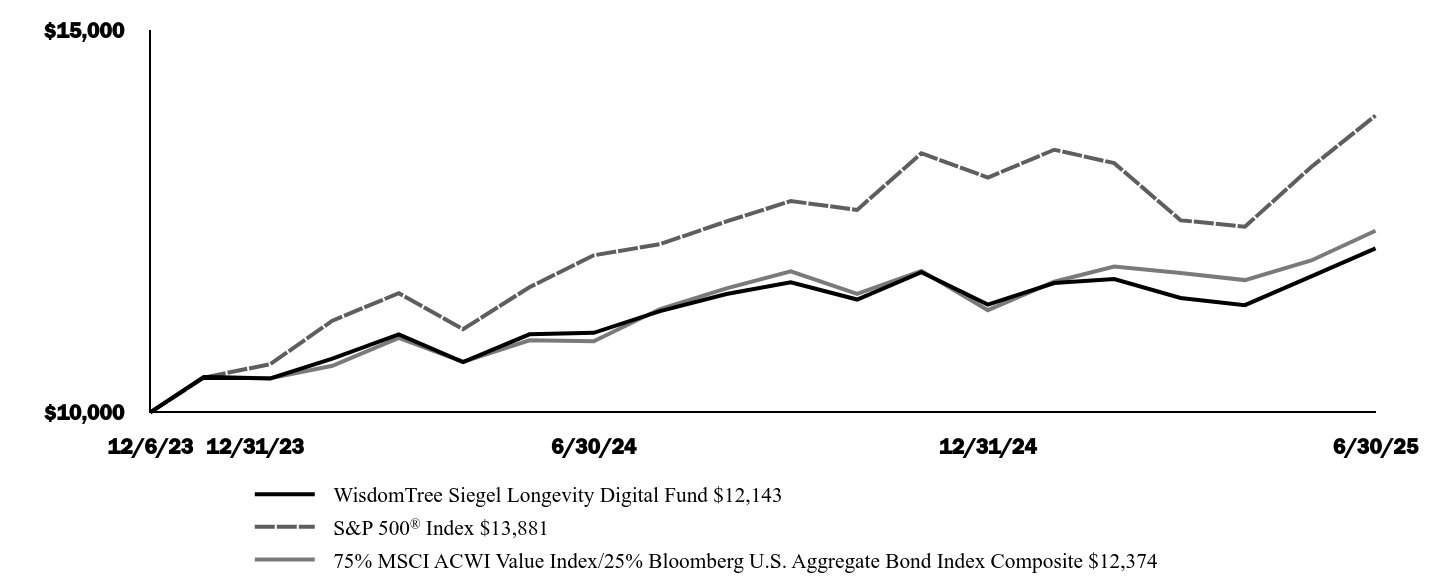

| Fund Name | WisdomTree Siegel Longevity Digital Fund |

| Trading Symbol | LNGVX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Siegel Longevity Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 16 |

| Expense Ratio, Percent | 0.15% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 202,974 |

| Holdings Count | Holding | 15 |

| Advisory Fees Paid, Amount | $ 268 |

| InvestmentCompanyPortfolioTurnover | 33.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000241819 | |

| Shareholder Report [Line Items] | |

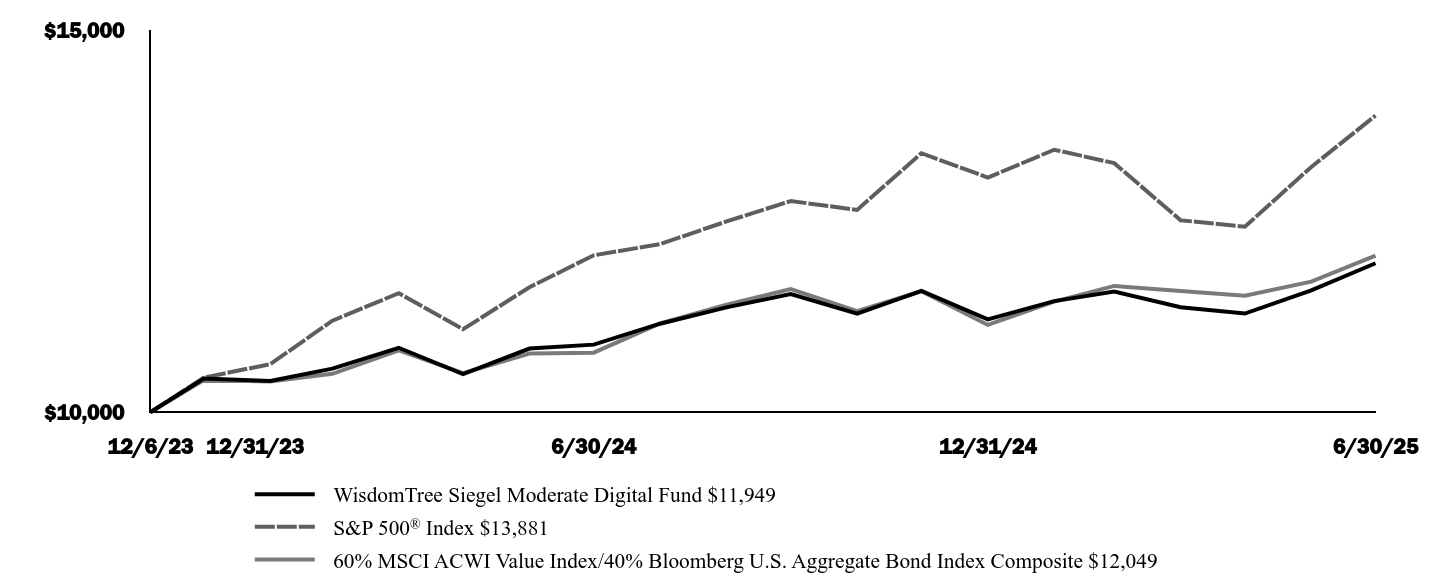

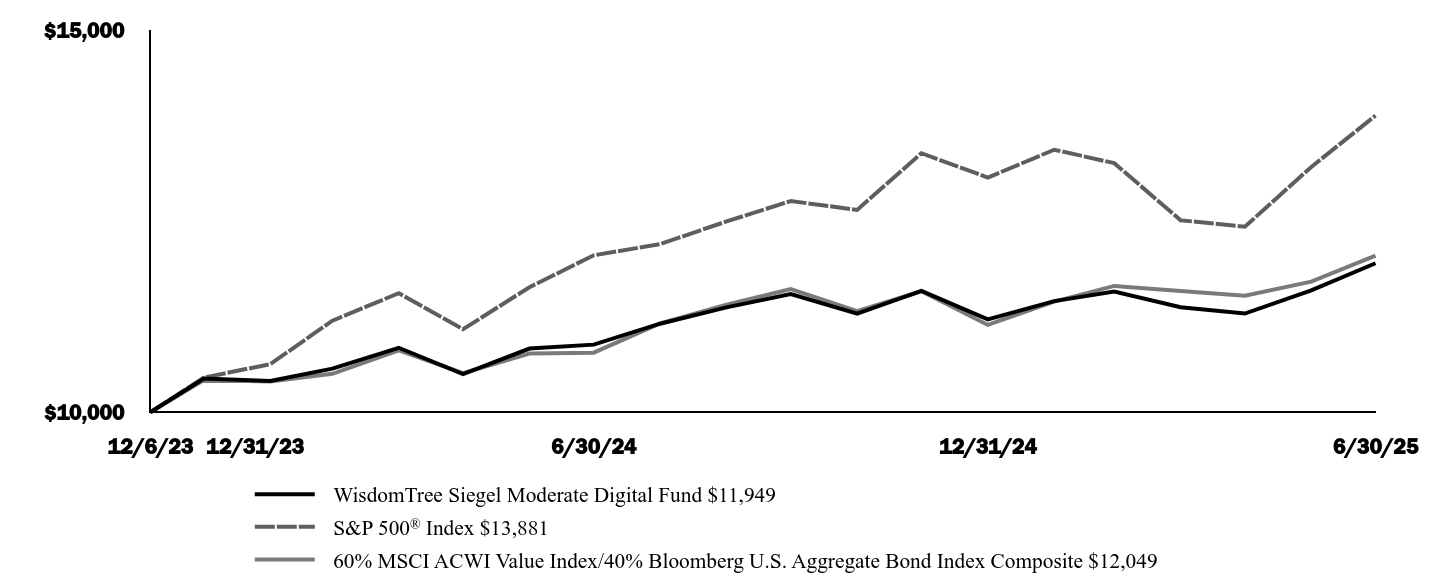

| Fund Name | WisdomTree Siegel Moderate Digital Fund |

| Trading Symbol | MODRX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Siegel Moderate Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 16 |

| Expense Ratio, Percent | 0.15% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 206,389 |

| Holdings Count | Holding | 17 |

| Advisory Fees Paid, Amount | $ 262 |

| InvestmentCompanyPortfolioTurnover | 18.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240075 | |

| Shareholder Report [Line Items] | |

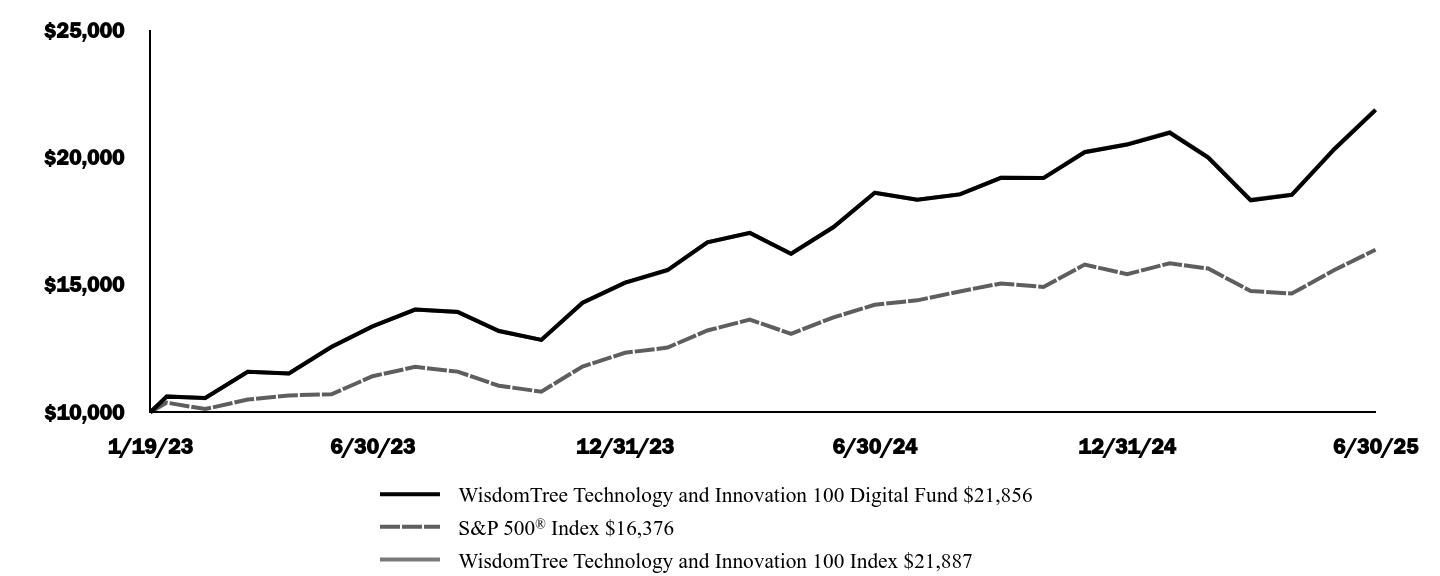

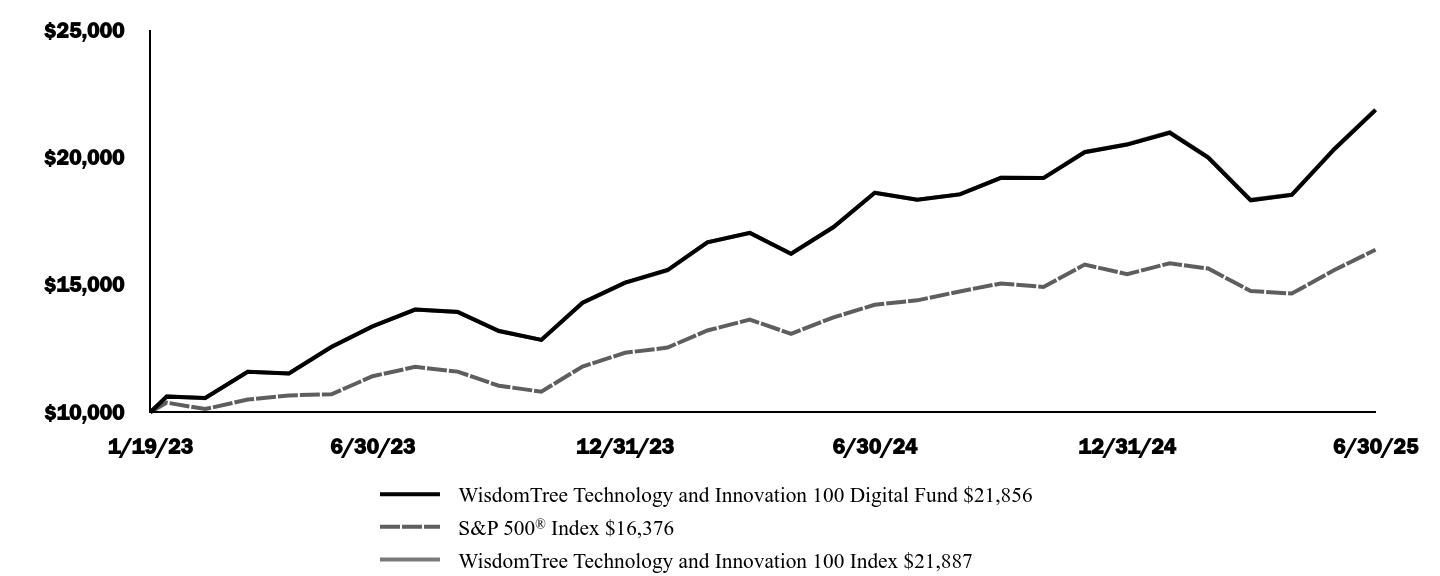

| Fund Name | WisdomTree Technology and Innovation 100 Digital Fund |

| Trading Symbol | TECHX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree Technology and Innovation 100 Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 11 |

| Expense Ratio, Percent | 0.10% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 4,506,021 |

| Holdings Count | Holding | 101 |

| Advisory Fees Paid, Amount | $ 3,952 |

| InvestmentCompanyPortfolioTurnover | 17.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| C000240071 | |

| Shareholder Report [Line Items] | |

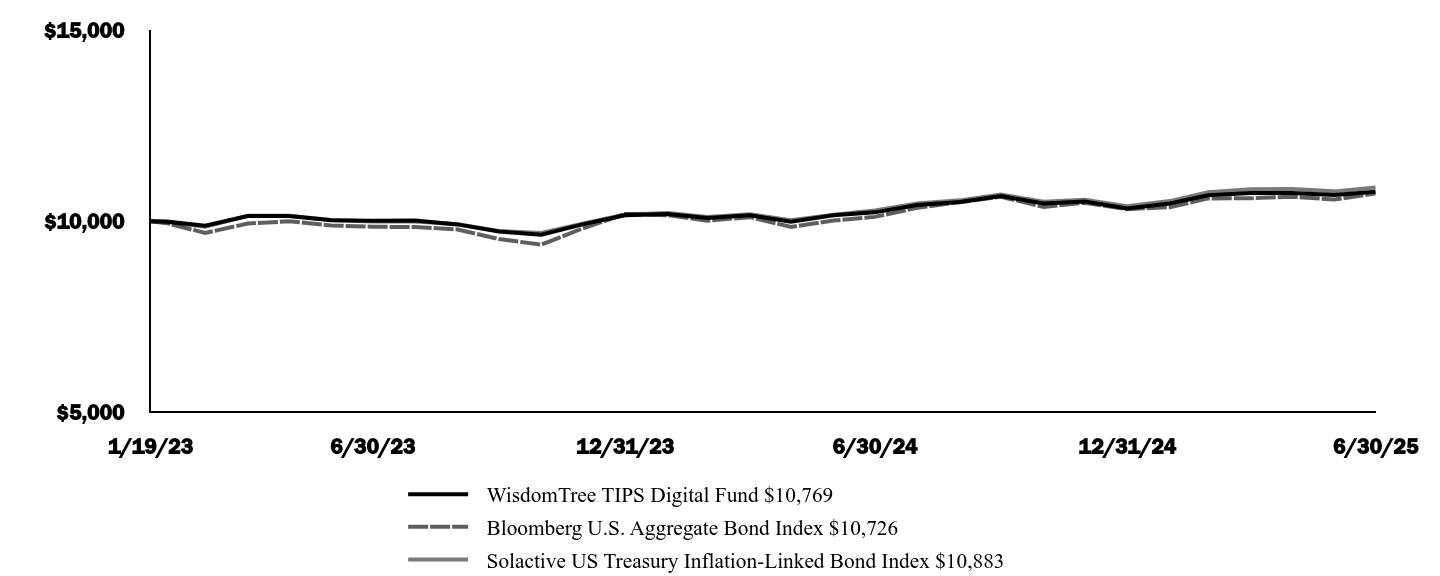

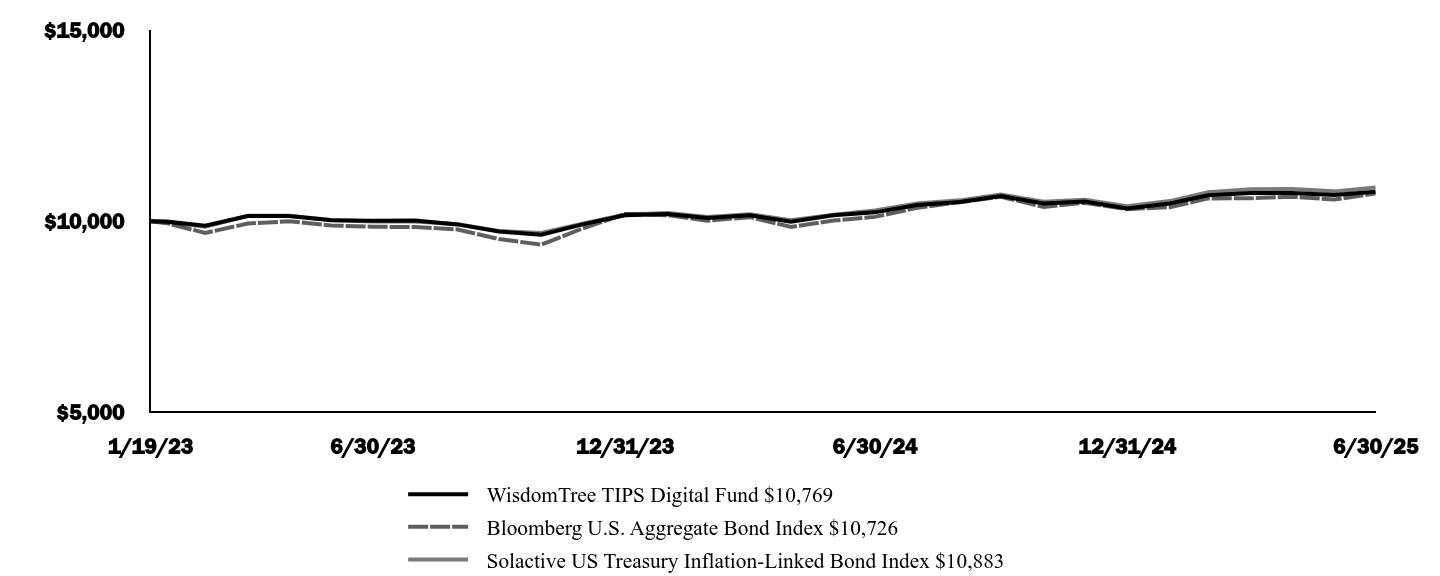

| Fund Name | WisdomTree TIPS Digital Fund |

| Trading Symbol | TIPSX |

| Annual or Semi-Annual Statement [Text Block] | This annual shareholder report contains important information about the WisdomTree TIPS Digital Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025. |

| Shareholder Report Annual or Semi-Annual | Annual Shareholder Report |

| Additional Information [Text Block] | You can find additional information about the Fund at www.wisdomtree.com/investments/regulatory. You can also request this information by contacting us at 1-866-909-WISE (9473). |

| Additional Information Phone Number | 1-866-909-WISE (9473) |

| Additional Information Website | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |

| Expenses [Text Block] | |

| Expenses Paid, Amount | $ 5 |

| Expense Ratio, Percent | 0.05% |

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance is not a good predictor of future results. The performance shown in the following graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. For the most recent performance information visit |

| Line Graph [Table Text Block] |  |

| Average Annual Return [Table Text Block] | |

| AssetsNet | $ 962,158 |

| Holdings Count | Holding | 10 |

| Advisory Fees Paid, Amount | $ 483 |

| InvestmentCompanyPortfolioTurnover | 5.00% |

| Additional Fund Statistics [Text Block] | |

| Holdings [Text Block] | |

| Largest Holdings [Text Block] | |

| Material Fund Change [Text Block] | |

| Updated Prospectus Phone Number | 1-866-909-WISE (9473) |

| Updated Prospectus Web Address | <span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 10.6667px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.wisdomtree.com/investments/regulatory</span> |