Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Brighthouse Funds Trust I

|

|

| Entity Central Index Key |

0001126087

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000100075 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB Global Dynamic Allocation Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB Global Dynamic Allocation Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$47 |

0.92%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.92%

|

[1] |

| AssetsNet |

$ 1,746,789,270

|

|

| Holdings Count | Holding |

1,783

|

|

| Advisory Fees Paid, Amount |

$ 5,344,362

|

|

| InvestmentCompanyPortfolioTurnover |

8.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,746,789,270

- # of Portfolio Investments1,783

- Portfolio Turnover Rate8%

- Total Advisory Fees Paid$5,344,362

|

|

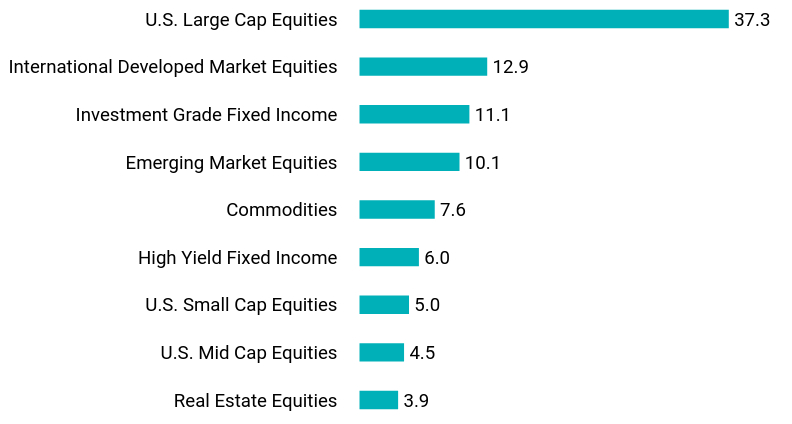

| Holdings [Text Block] |

Top 10 Fixed Income Issuers

U.S. Treasury Notes |

19.3 |

U.S. Treasury Bonds |

7.7 |

French Republic Government Bonds OAT |

1.3 |

Federal National Mortgage Association |

1.2 |

Japan Government Two Year Bonds |

1.0 |

Italy Buoni Poliennali Del Tesoro |

1.0 |

U.K. Gilts |

0.7 |

Bundesrepublik Deutschland Bundesanleihe |

0.6 |

Spain Government Bonds |

0.5 |

Japan Government Twenty Year Bonds |

0.5 |

Value |

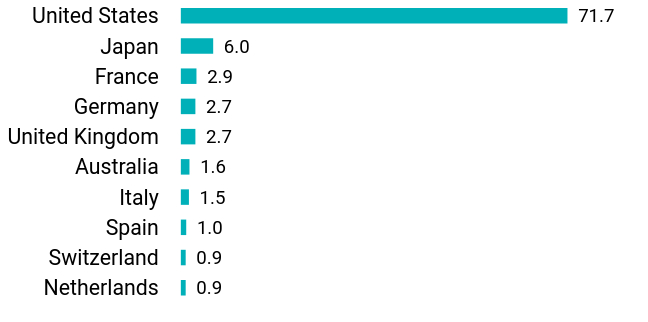

Value |

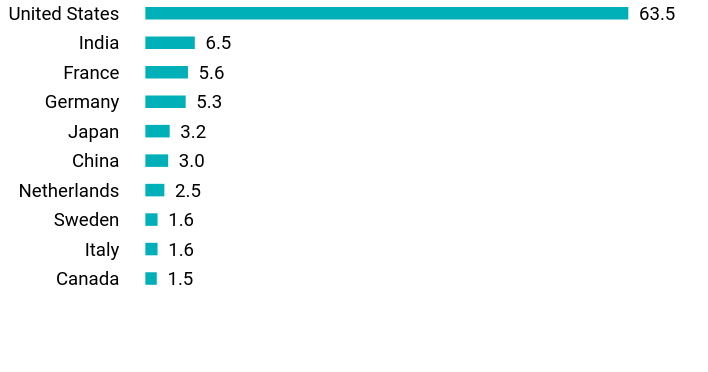

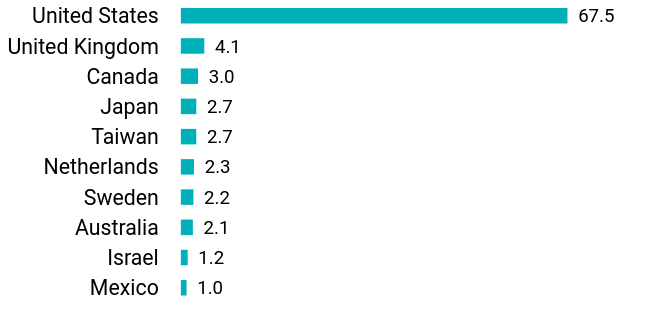

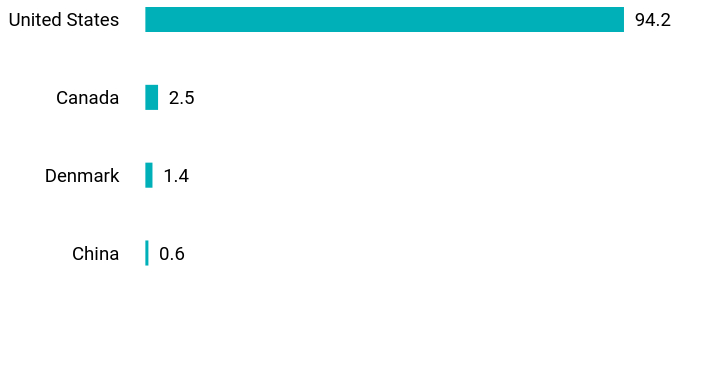

Netherlands |

0.9 |

Switzerland |

0.9 |

Spain |

1.0 |

Italy |

1.5 |

Australia |

1.6 |

United Kingdom |

2.7 |

Germany |

2.7 |

France |

2.9 |

Japan |

6.0 |

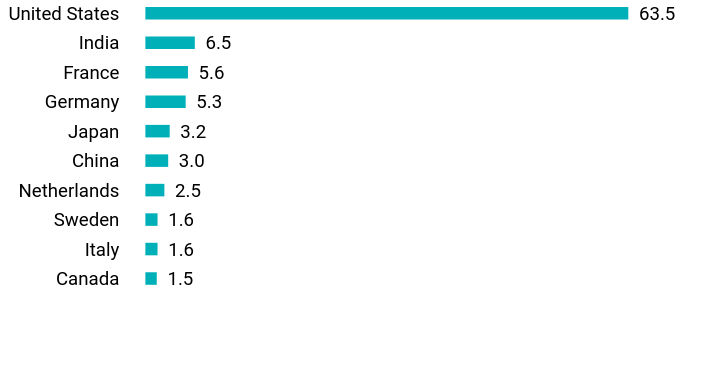

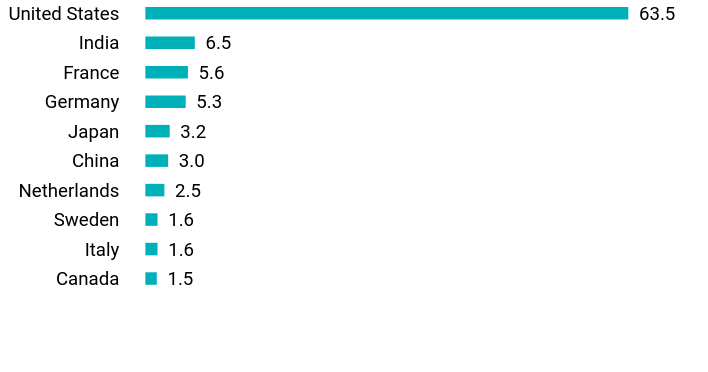

United States |

71.7 |

Value |

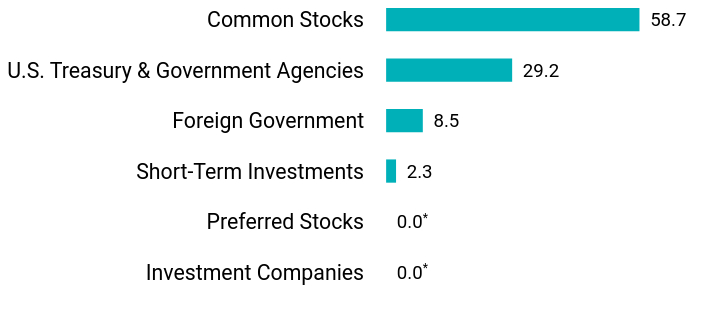

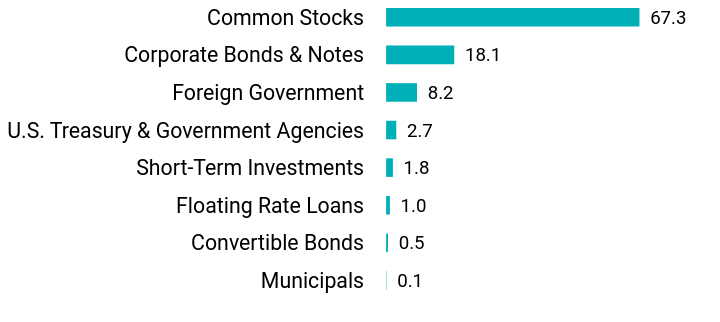

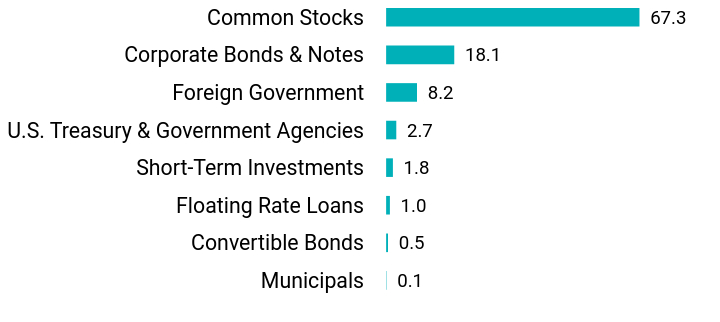

Value |

Investment Companies |

0.0Footnote Reference* |

Preferred Stocks |

0.0Footnote Reference* |

Short-Term Investments |

2.3 |

Foreign Government |

8.5 |

U.S. Treasury & Government Agencies |

29.2 |

Common Stocks |

58.7 |

| Footnote |

Description |

Footnote* |

Amount rounds to less than 0.1% | |

|

| Largest Holdings [Text Block] |

NVIDIA Corp. |

2.8 |

Microsoft Corp. |

2.7 |

Apple, Inc. |

2.2 |

Amazon.com, Inc. |

1.5 |

Alphabet, Inc. |

1.3 |

Meta Platforms, Inc. |

1.2 |

Broadcom, Inc. |

0.9 |

Berkshire Hathaway, Inc. |

0.6 |

Tesla, Inc. |

0.6 |

JPMorgan Chase & Co. |

0.6 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000210967 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB International Bond Portfolio

|

|

| Class Name |

Class A

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB International Bond Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$31 |

0.62%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.62%

|

[2] |

| AssetsNet |

$ 408,271,086

|

|

| Holdings Count | Holding |

654

|

|

| Advisory Fees Paid, Amount |

$ 1,126,930

|

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$408,271,086

- # of Portfolio Investments654

- Portfolio Turnover Rate60%

- Total Advisory Fees Paid$1,126,930

|

|

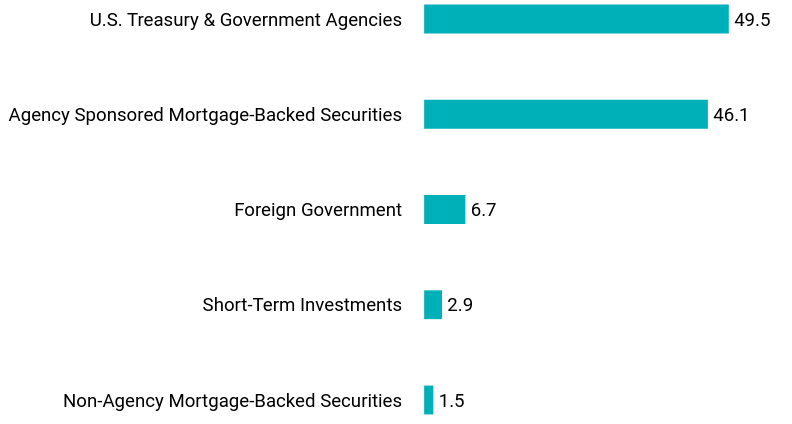

| Holdings [Text Block] |

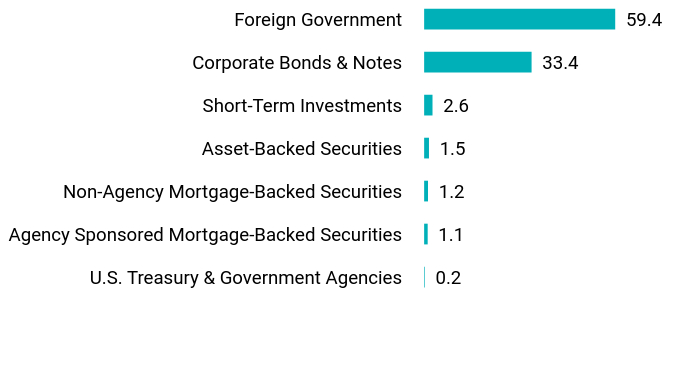

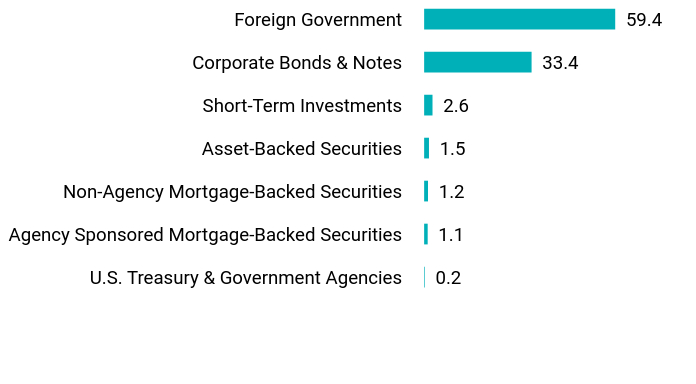

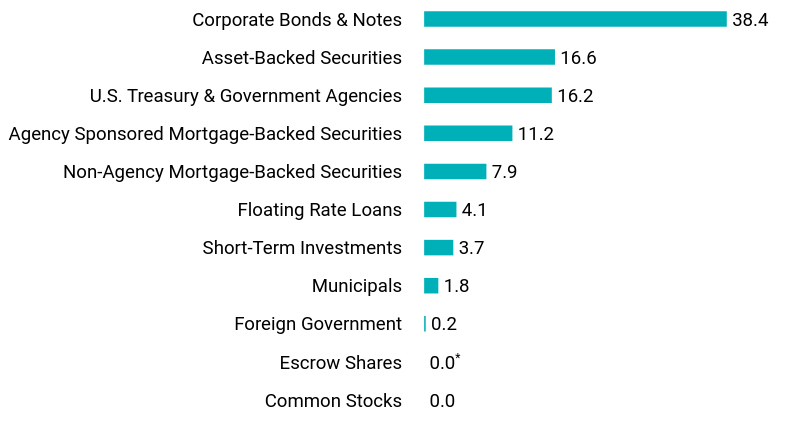

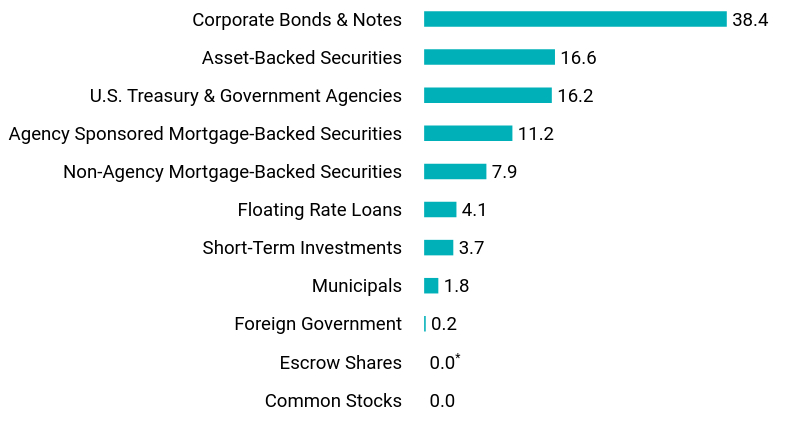

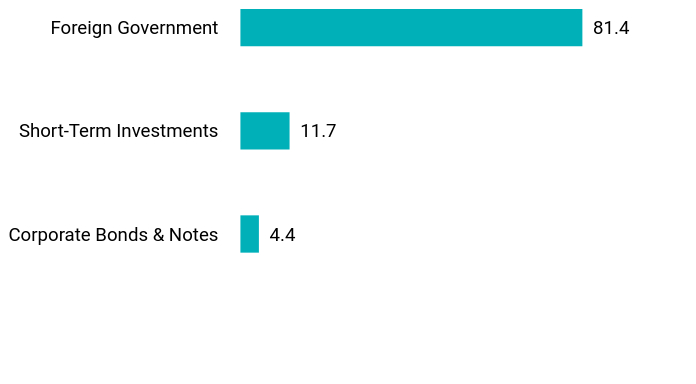

Value |

Value |

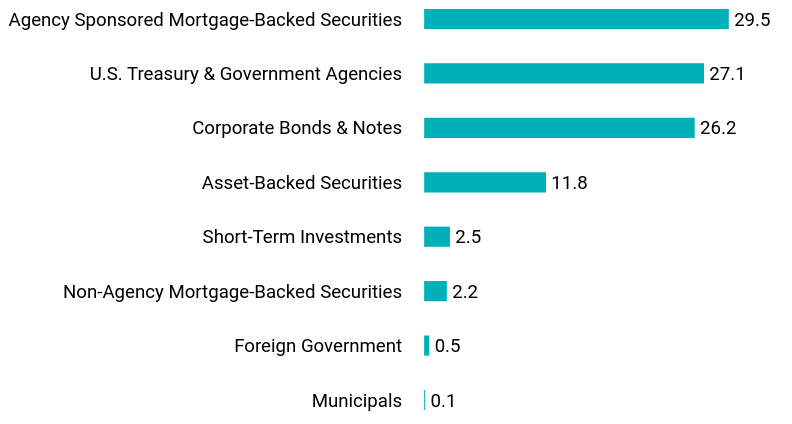

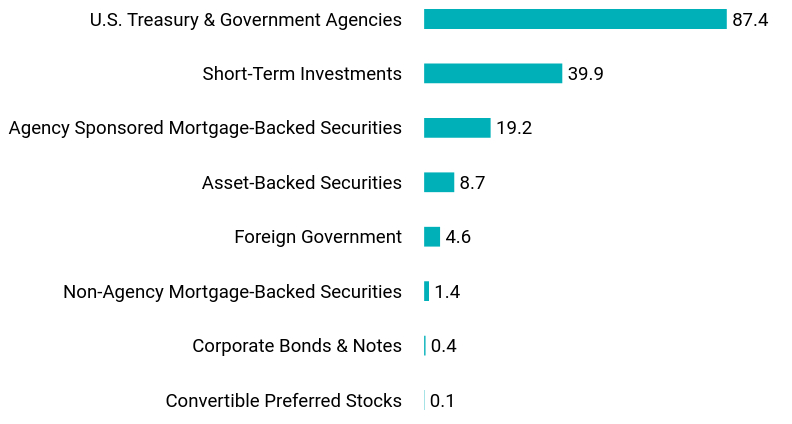

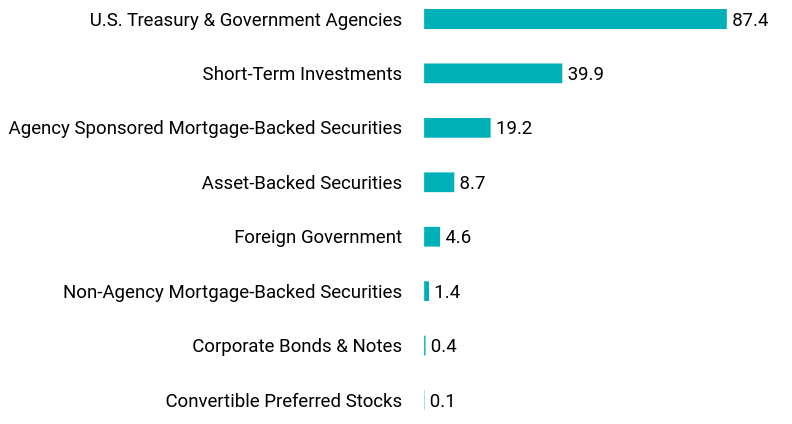

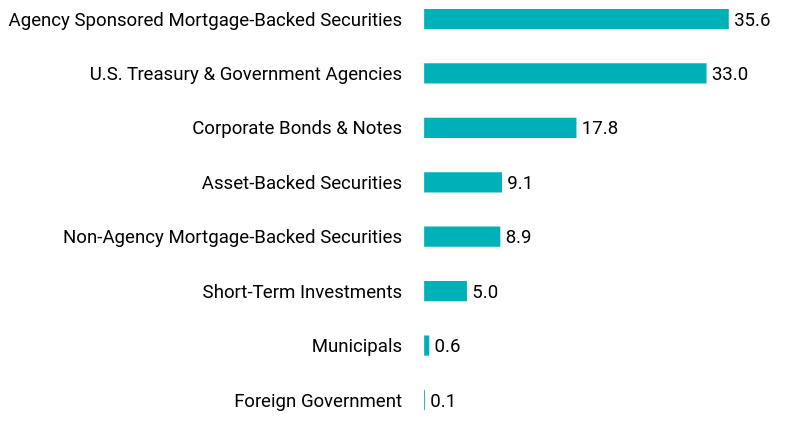

U.S. Treasury & Government Agencies |

0.2 |

Agency Sponsored Mortgage-Backed Securities |

1.1 |

Non-Agency Mortgage-Backed Securities |

1.2 |

Asset-Backed Securities |

1.5 |

Short-Term Investments |

2.6 |

Corporate Bonds & Notes |

33.4 |

Foreign Government |

59.4 |

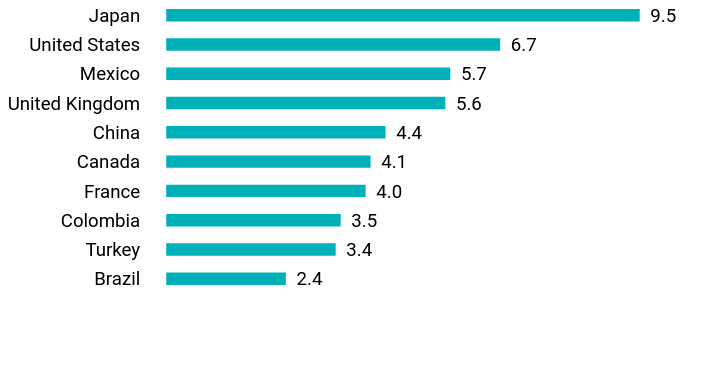

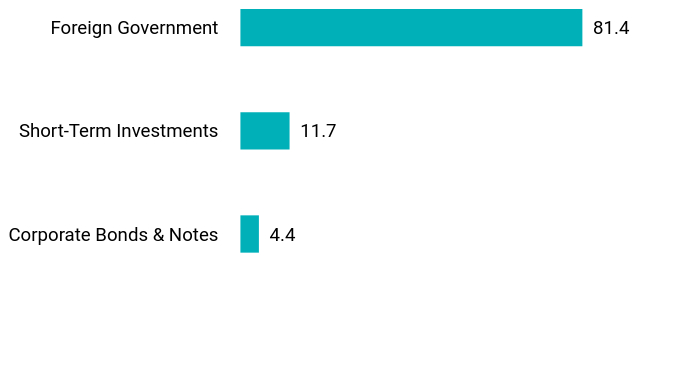

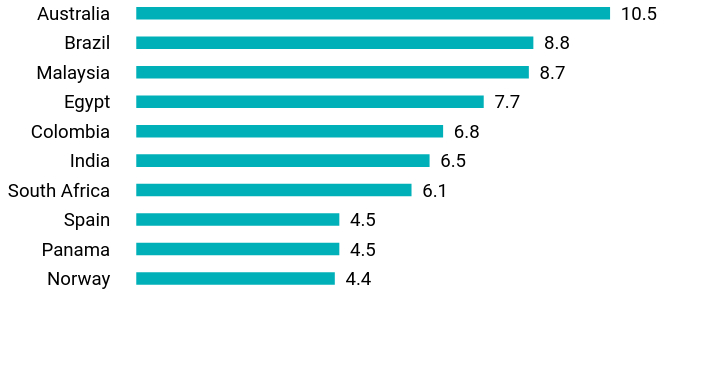

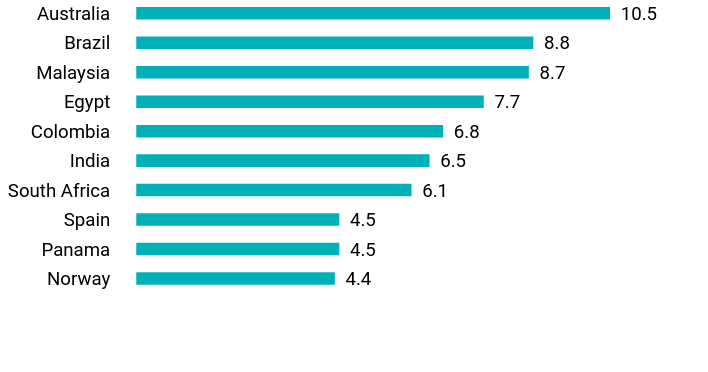

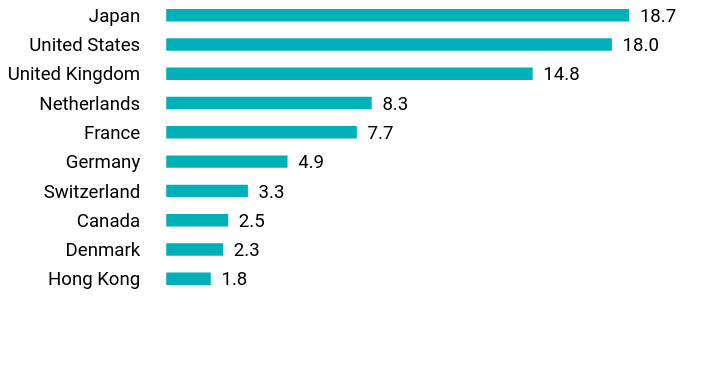

Value |

Value |

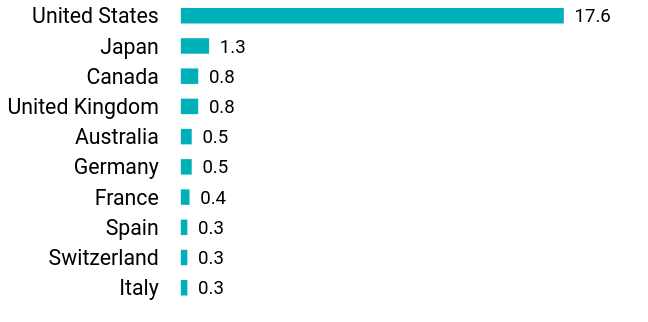

Brazil |

2.4 |

Turkey |

3.4 |

Colombia |

3.5 |

France |

4.0 |

Canada |

4.1 |

China |

4.4 |

United Kingdom |

5.6 |

Mexico |

5.7 |

United States |

6.7 |

Japan |

9.5 | |

|

| Largest Holdings [Text Block] |

Top 10 Fixed Income Issuers

Japan Government Two Year Bonds |

3.9 |

Petroleos Mexicanos |

3.6 |

China Government Bonds |

3.4 |

U.K. Gilts |

2.9 |

Dominican Republic International Bonds |

2.3 |

Canada Government Bonds |

2.1 |

Japan Government Five Year Bonds |

1.9 |

Colombia Government International Bonds |

1.9 |

Italy Buoni Poliennali Del Tesoro |

1.9 |

Hungary Government International Bonds |

1.8 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000210964 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AB International Bond Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AB International Bond Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$44 |

0.87%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.87%

|

[3] |

| AssetsNet |

$ 408,271,086

|

|

| Holdings Count | Holding |

654

|

|

| Advisory Fees Paid, Amount |

$ 1,126,930

|

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$408,271,086

- # of Portfolio Investments654

- Portfolio Turnover Rate60%

- Total Advisory Fees Paid$1,126,930

|

|

| Holdings [Text Block] |

Value |

Value |

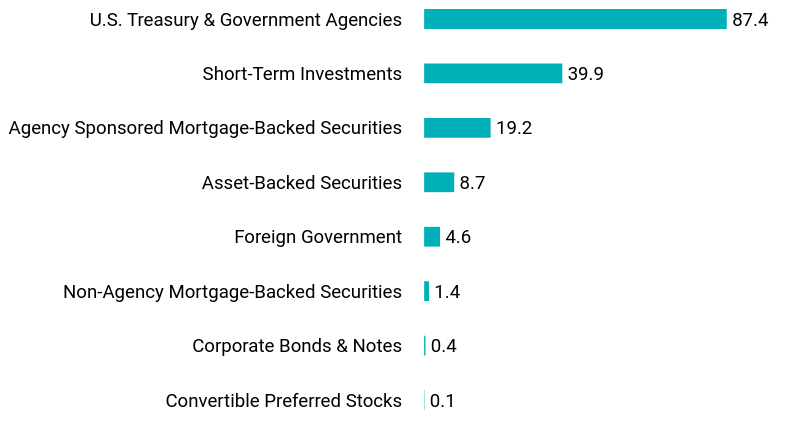

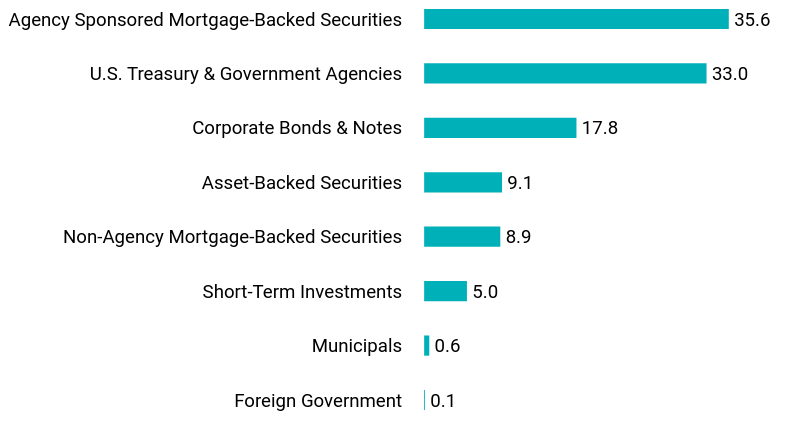

U.S. Treasury & Government Agencies |

0.2 |

Agency Sponsored Mortgage-Backed Securities |

1.1 |

Non-Agency Mortgage-Backed Securities |

1.2 |

Asset-Backed Securities |

1.5 |

Short-Term Investments |

2.6 |

Corporate Bonds & Notes |

33.4 |

Foreign Government |

59.4 |

Value |

Value |

Brazil |

2.4 |

Turkey |

3.4 |

Colombia |

3.5 |

France |

4.0 |

Canada |

4.1 |

China |

4.4 |

United Kingdom |

5.6 |

Mexico |

5.7 |

United States |

6.7 |

Japan |

9.5 | |

|

| Largest Holdings [Text Block] |

Top 10 Fixed Income Issuers

Japan Government Two Year Bonds |

3.9 |

Petroleos Mexicanos |

3.6 |

China Government Bonds |

3.4 |

U.K. Gilts |

2.9 |

Dominican Republic International Bonds |

2.3 |

Canada Government Bonds |

2.1 |

Japan Government Five Year Bonds |

1.9 |

Colombia Government International Bonds |

1.9 |

Italy Buoni Poliennali Del Tesoro |

1.9 |

Hungary Government International Bonds |

1.8 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030705 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Allspring Mid Cap Value Portfolio

|

|

| Class Name |

Class A

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Allspring Mid Cap Value Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$37 |

0.74%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.74%

|

[4] |

| AssetsNet |

$ 308,017,770

|

|

| Holdings Count | Holding |

88

|

|

| Advisory Fees Paid, Amount |

$ 998,133

|

|

| InvestmentCompanyPortfolioTurnover |

19.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$308,017,770

- # of Portfolio Investments88

- Portfolio Turnover Rate19%

- Total Advisory Fees Paid$998,133

|

|

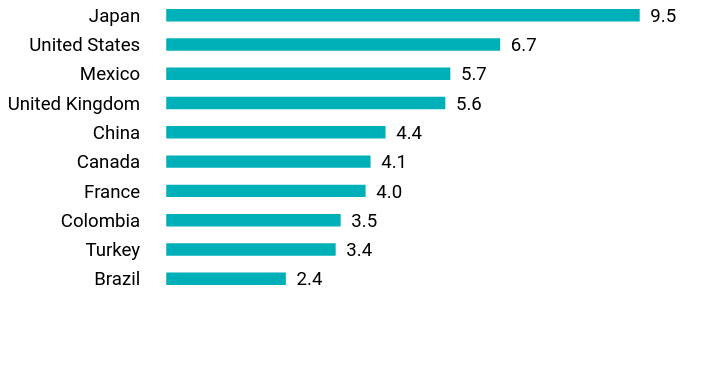

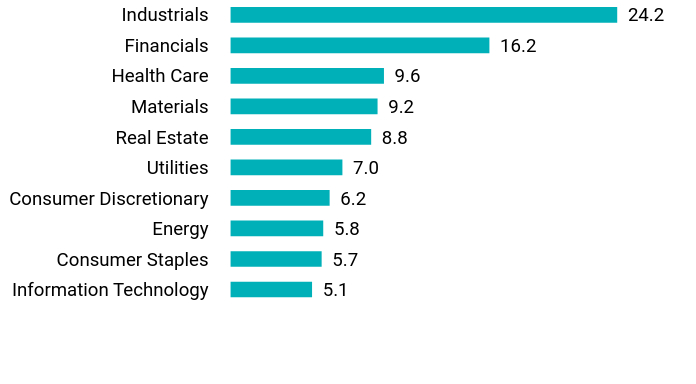

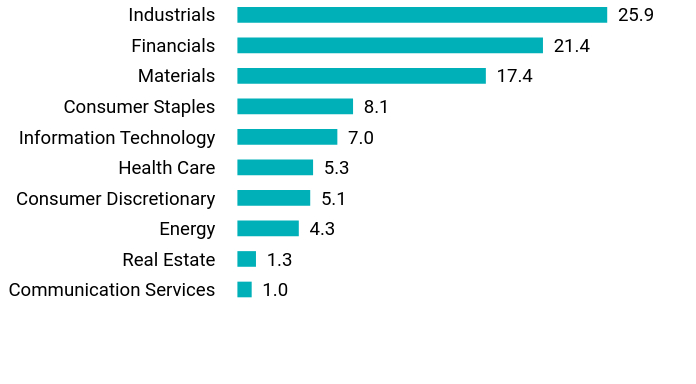

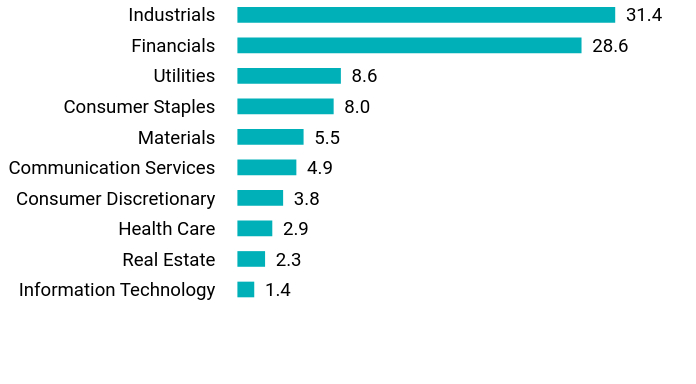

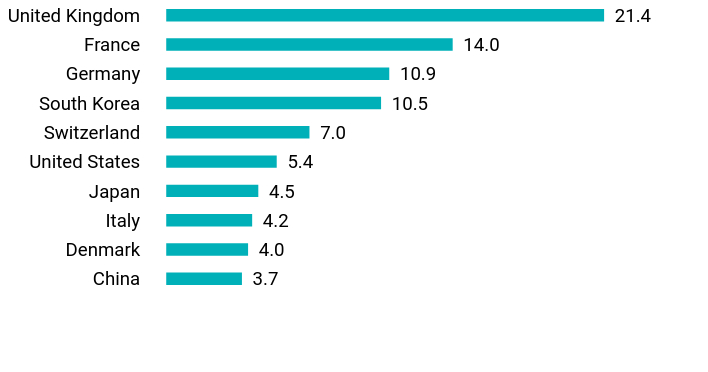

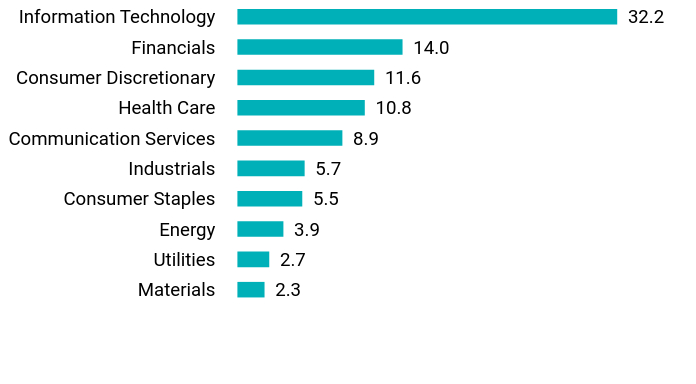

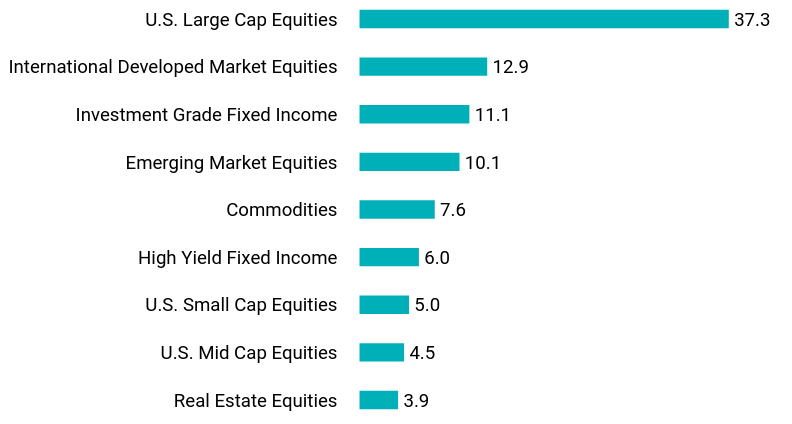

| Holdings [Text Block] |

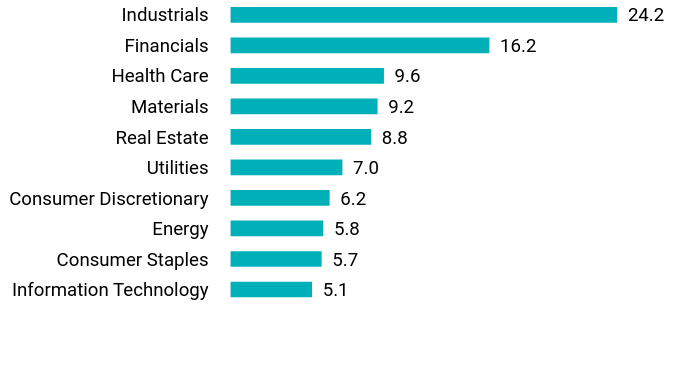

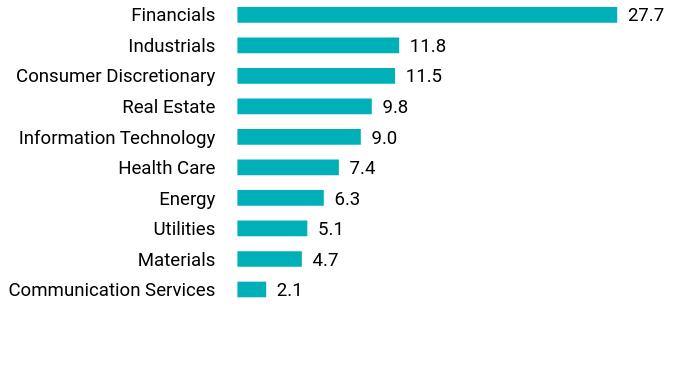

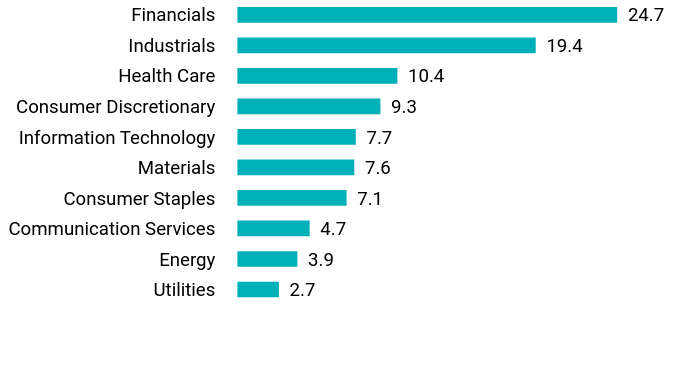

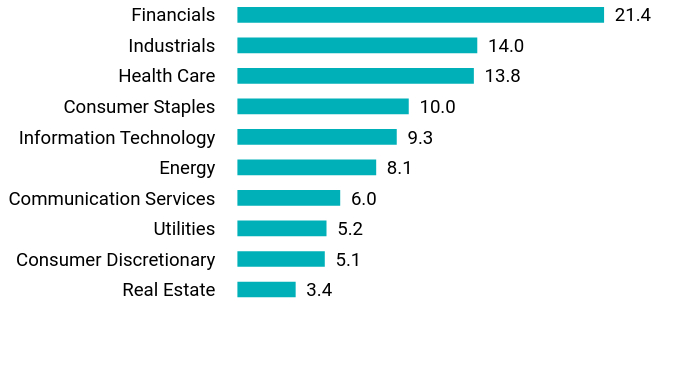

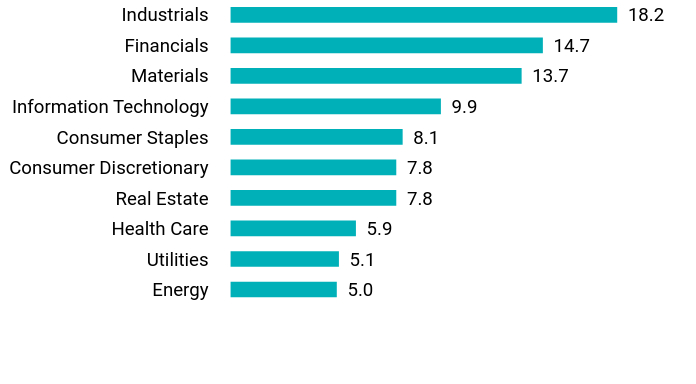

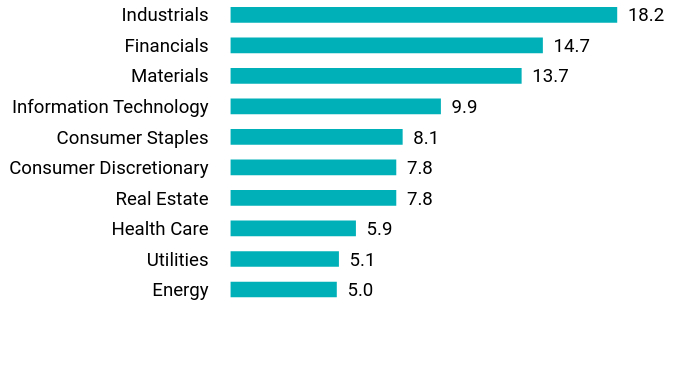

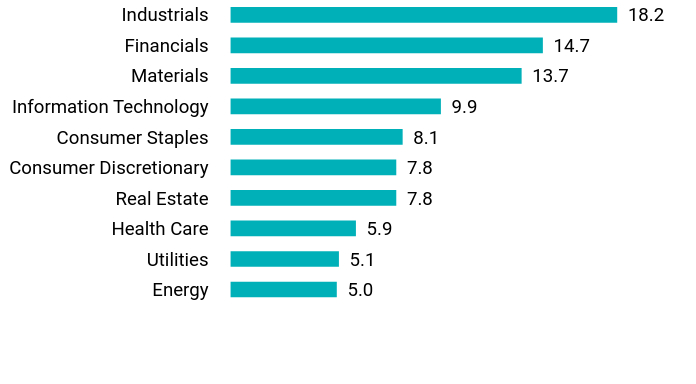

Value |

Value |

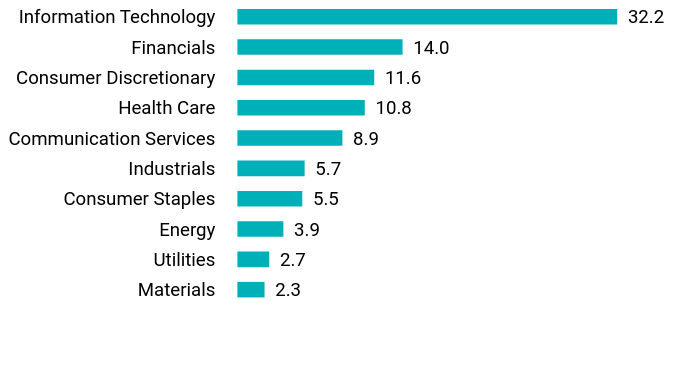

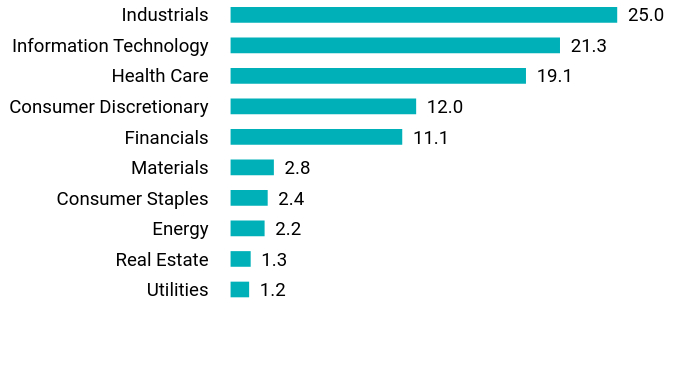

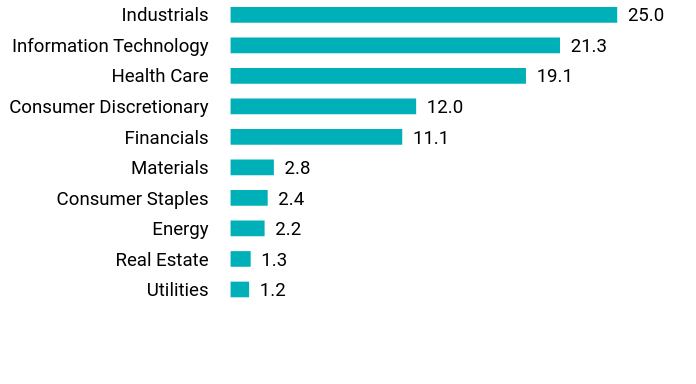

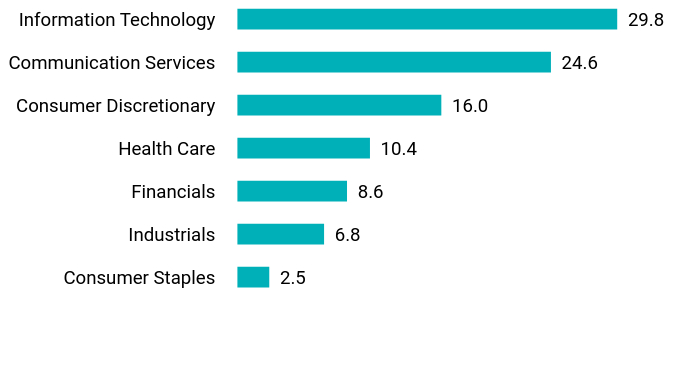

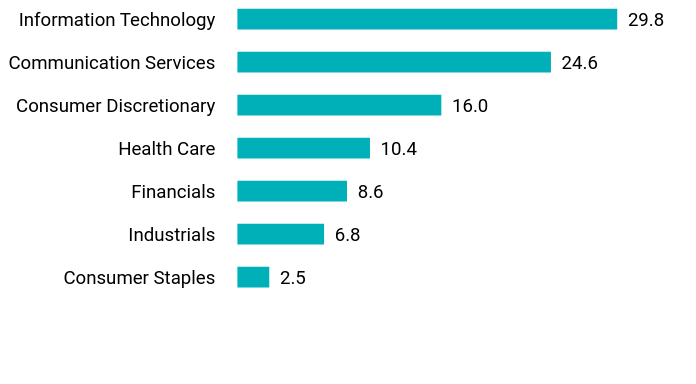

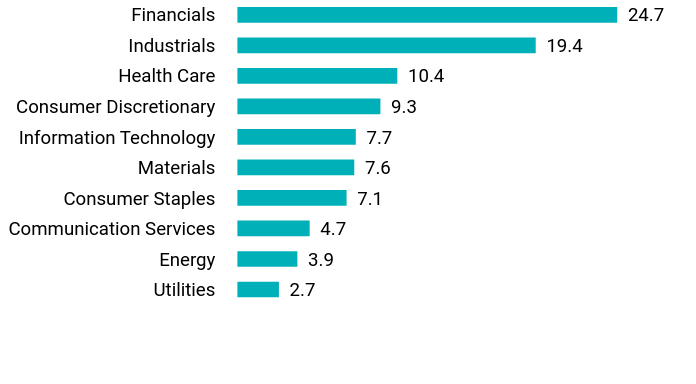

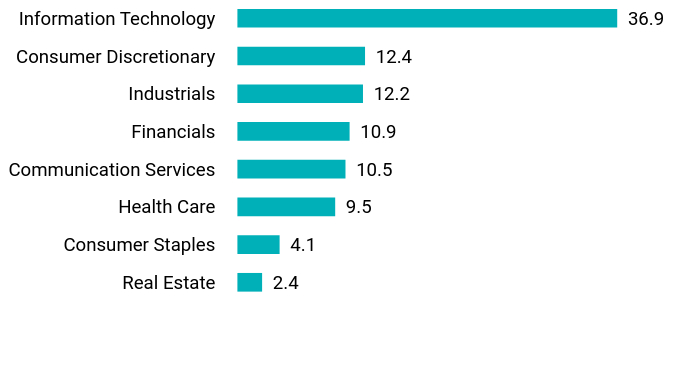

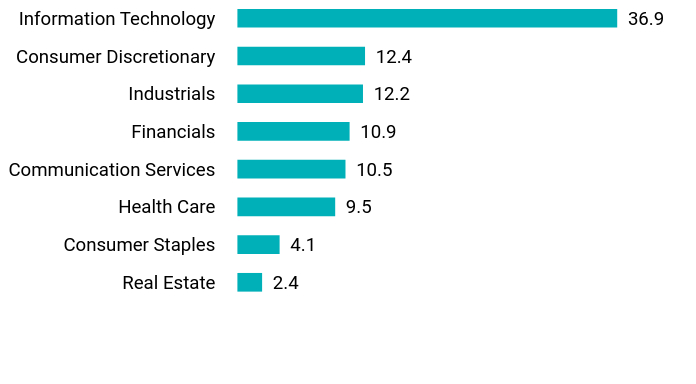

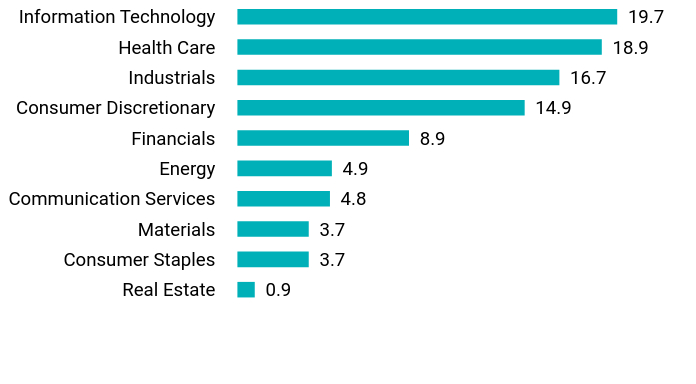

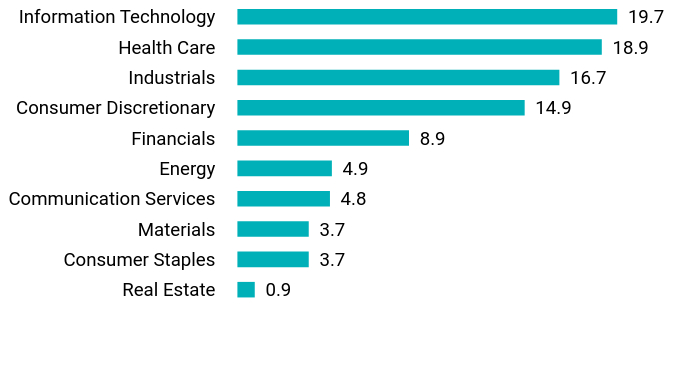

Information Technology |

5.1 |

Consumer Staples |

5.7 |

Energy |

5.8 |

Consumer Discretionary |

6.2 |

Utilities |

7.0 |

Real Estate |

8.8 |

Materials |

9.2 |

Health Care |

9.6 |

Financials |

16.2 |

Industrials |

24.2 |

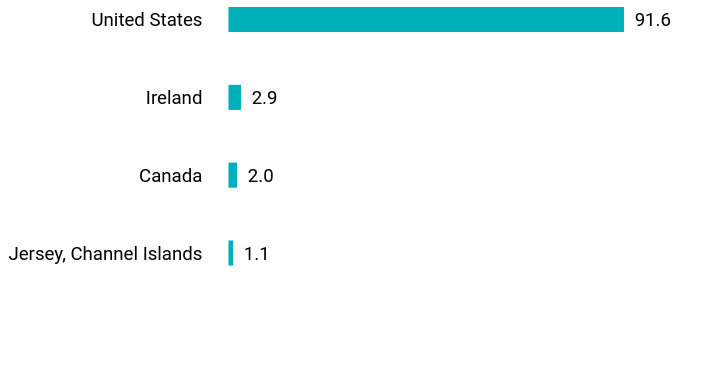

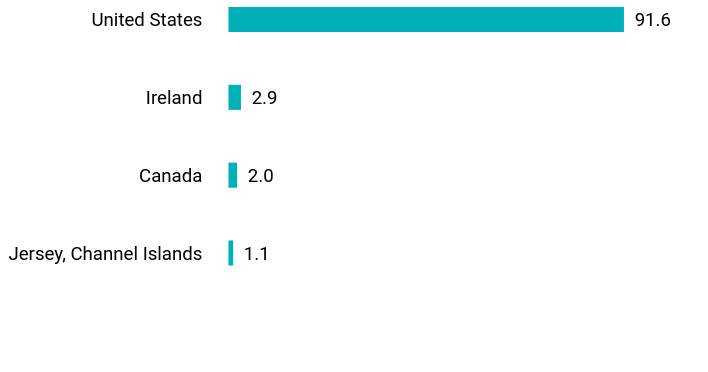

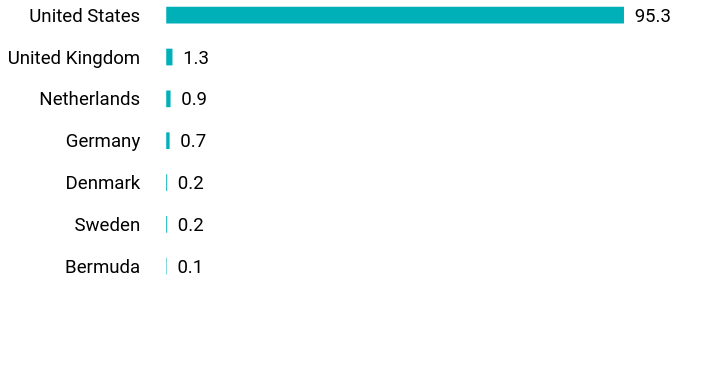

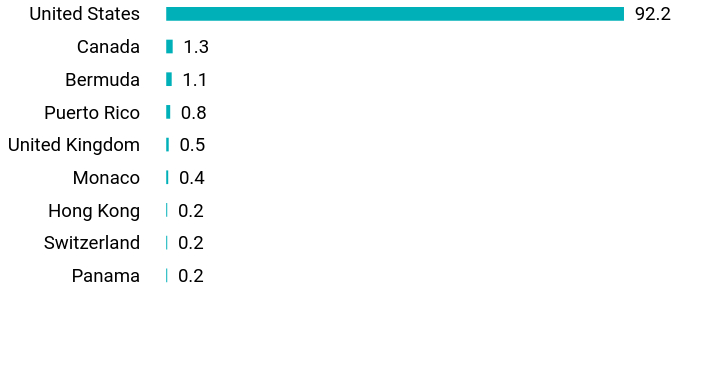

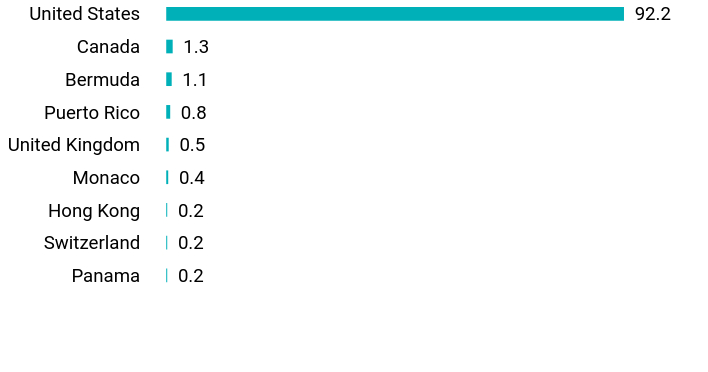

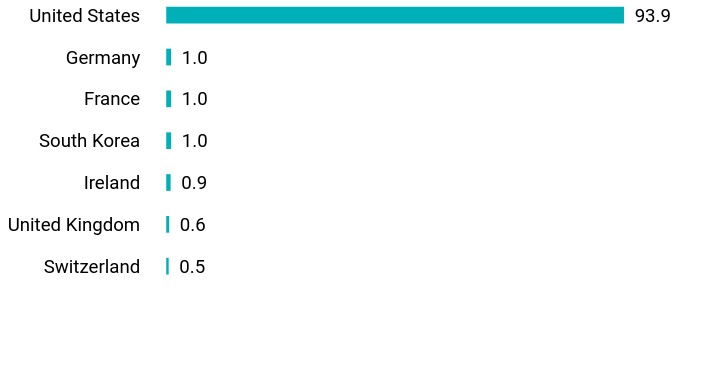

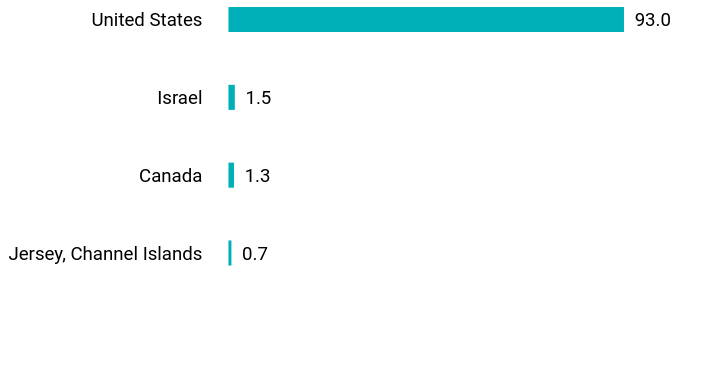

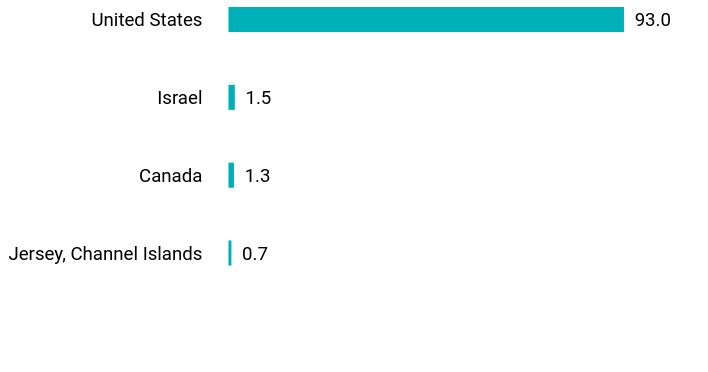

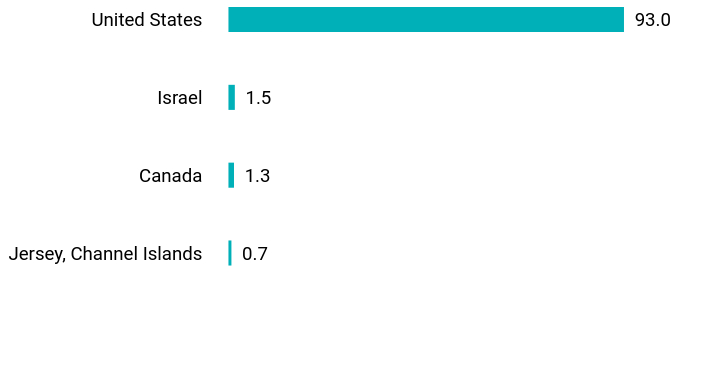

Value |

Value |

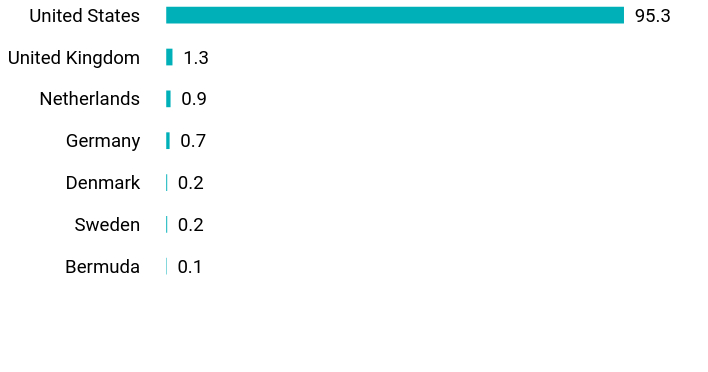

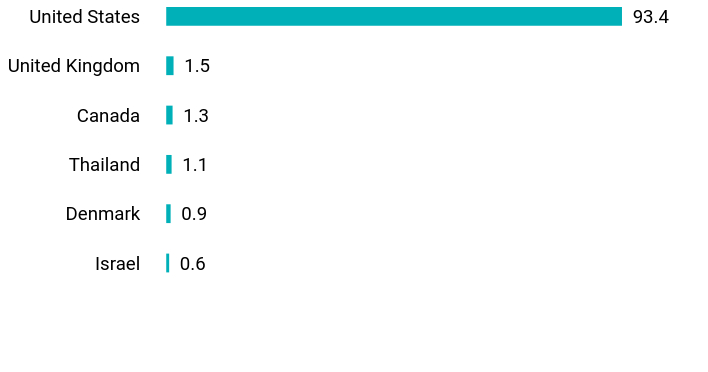

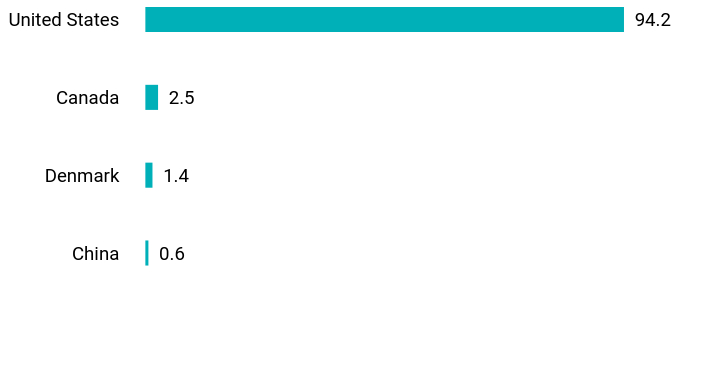

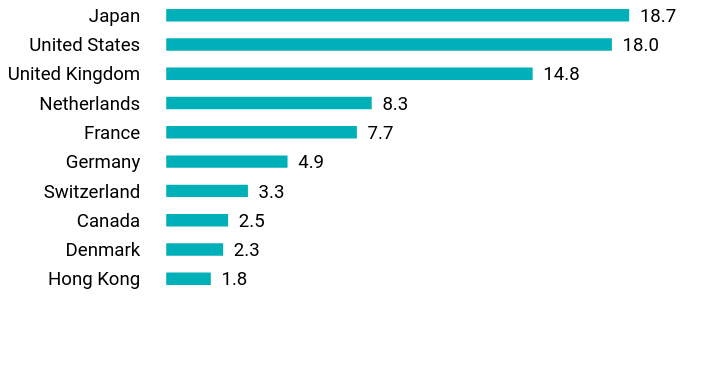

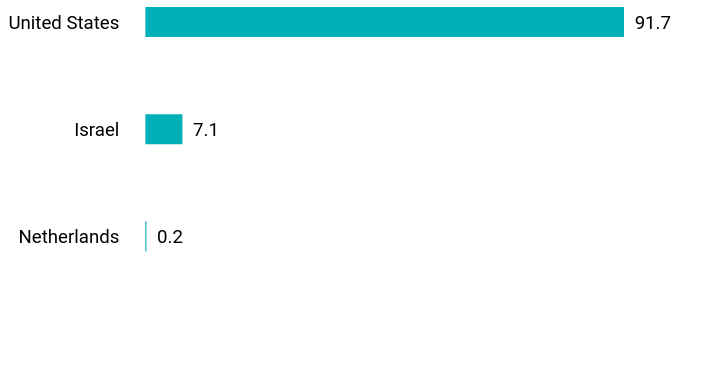

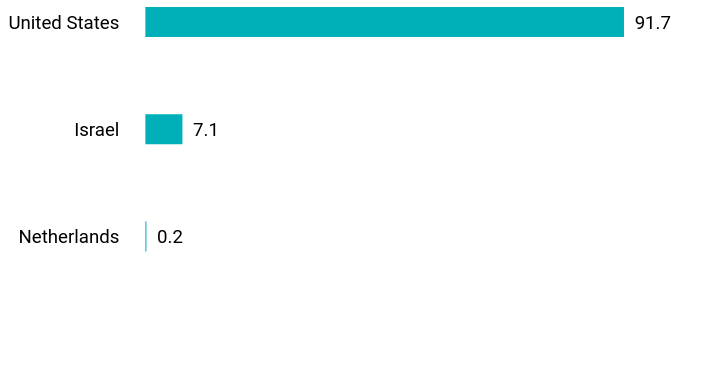

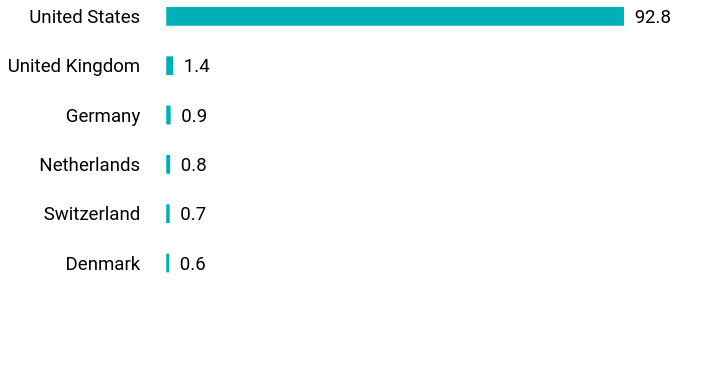

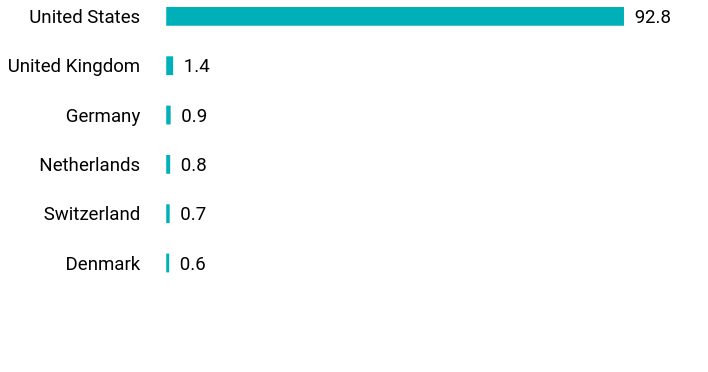

Jersey, Channel Islands |

1.1 |

Canada |

2.0 |

Ireland |

2.9 |

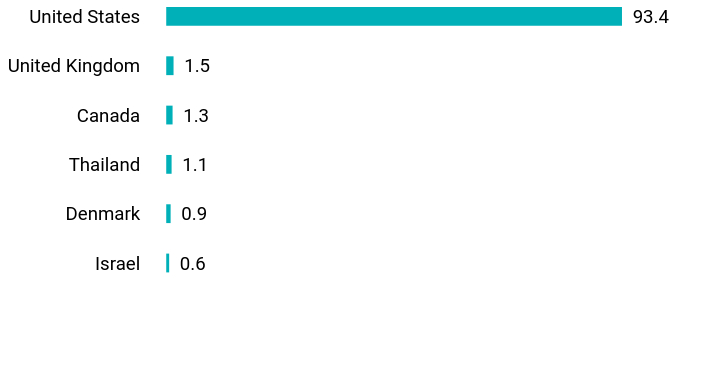

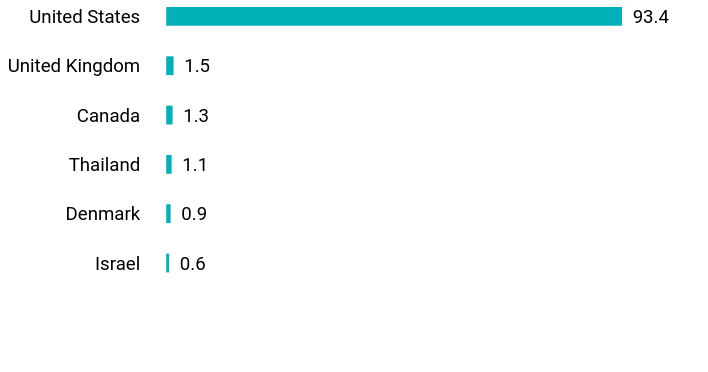

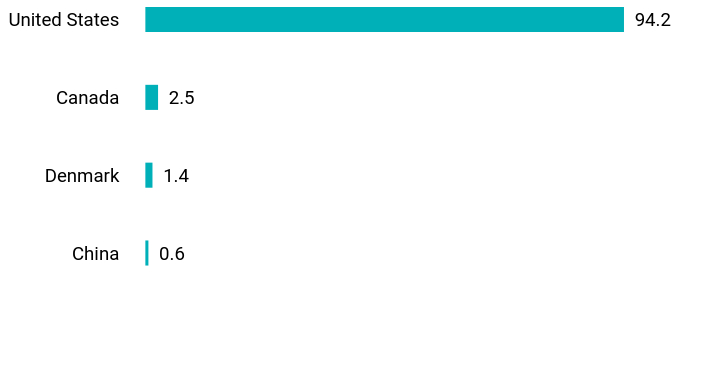

United States |

91.6 | |

|

| Largest Holdings [Text Block] |

Keurig Dr. Pepper, Inc. |

3.1 |

AerCap Holdings NV |

2.9 |

American Electric Power Co., Inc. |

2.9 |

CBRE Group, Inc. |

2.8 |

Labcorp Holdings, Inc. |

2.7 |

Carlisle Cos., Inc. |

2.6 |

Arch Capital Group Ltd. |

2.5 |

Vulcan Materials Co. |

2.4 |

Jefferies Financial Group, Inc. |

2.4 |

Brown & Brown, Inc. |

2.4 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030706 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Allspring Mid Cap Value Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Allspring Mid Cap Value Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$49 |

0.99%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

0.99%

|

[5] |

| AssetsNet |

$ 308,017,770

|

|

| Holdings Count | Holding |

88

|

|

| Advisory Fees Paid, Amount |

$ 998,133

|

|

| InvestmentCompanyPortfolioTurnover |

19.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$308,017,770

- # of Portfolio Investments88

- Portfolio Turnover Rate19%

- Total Advisory Fees Paid$998,133

|

|

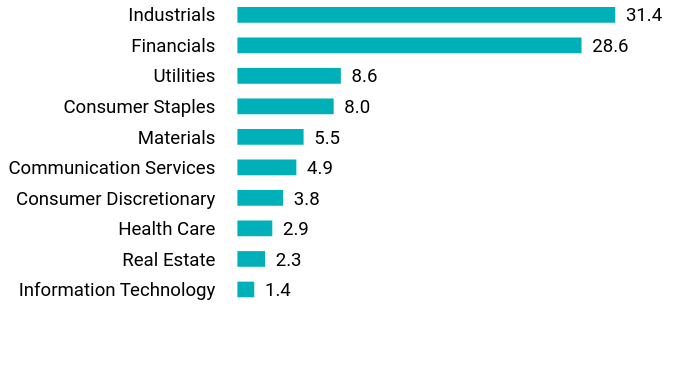

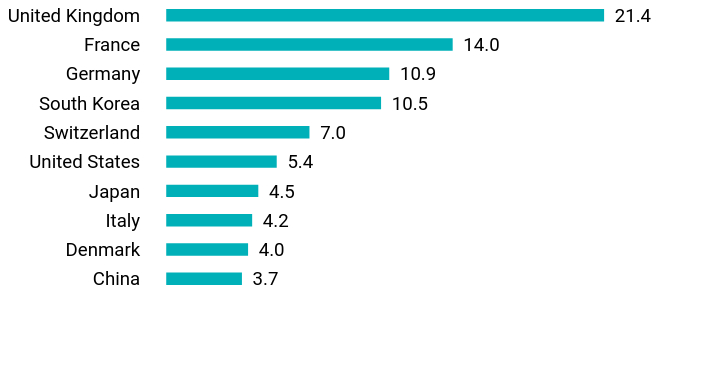

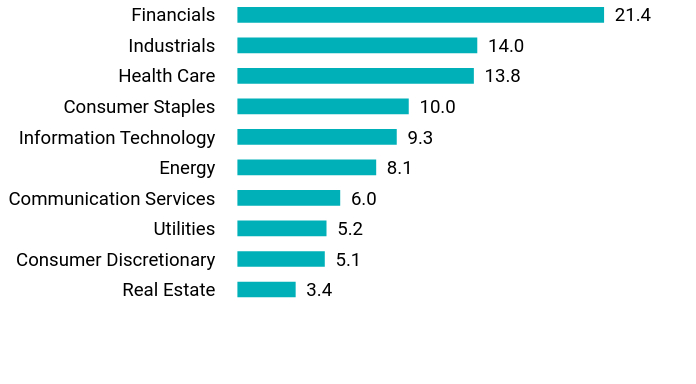

| Holdings [Text Block] |

Value |

Value |

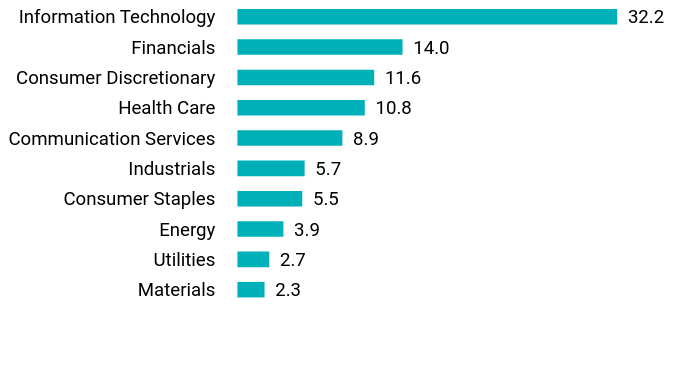

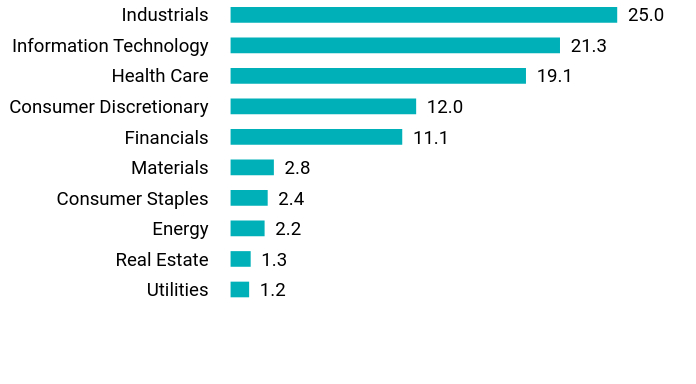

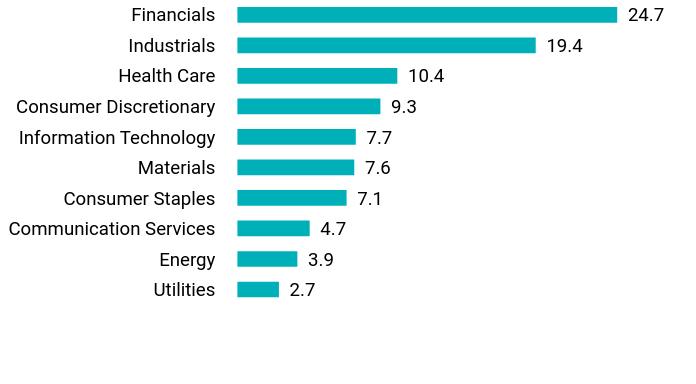

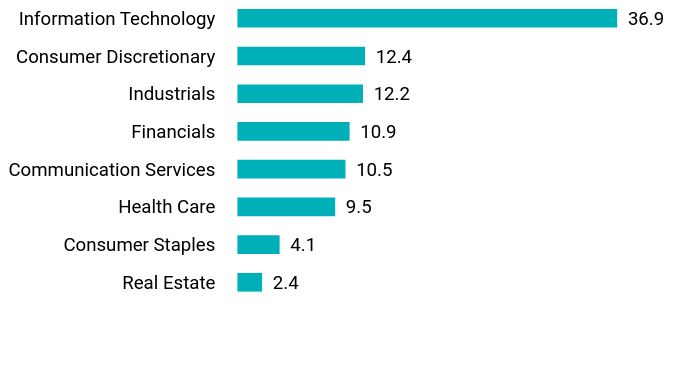

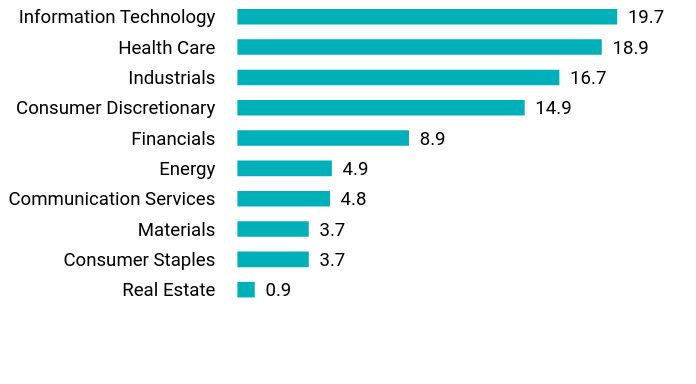

Information Technology |

5.1 |

Consumer Staples |

5.7 |

Energy |

5.8 |

Consumer Discretionary |

6.2 |

Utilities |

7.0 |

Real Estate |

8.8 |

Materials |

9.2 |

Health Care |

9.6 |

Financials |

16.2 |

Industrials |

24.2 |

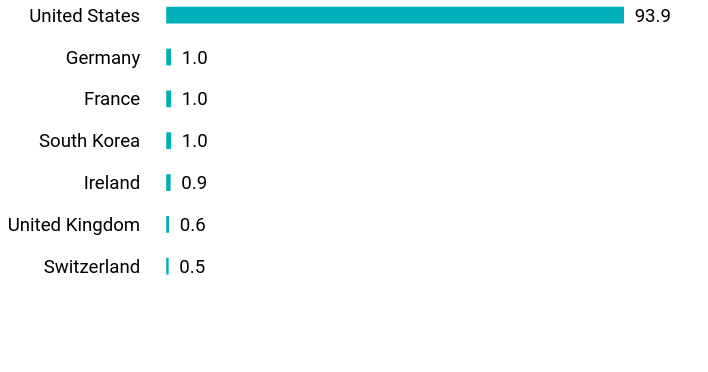

Value |

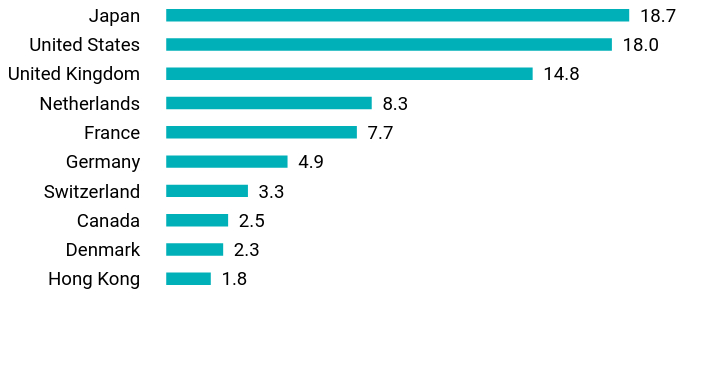

Value |

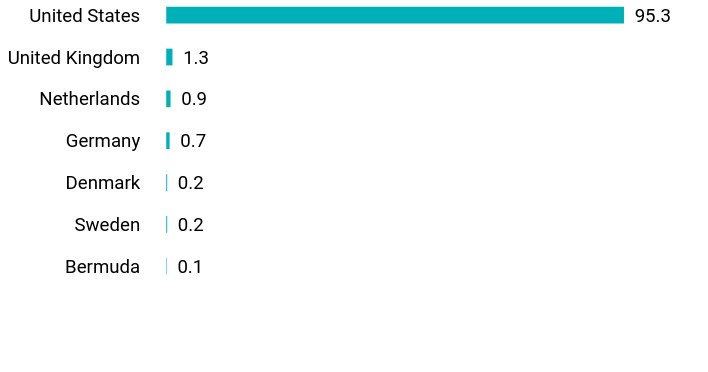

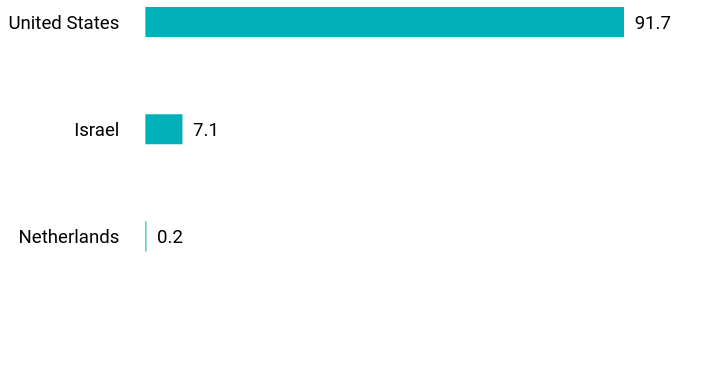

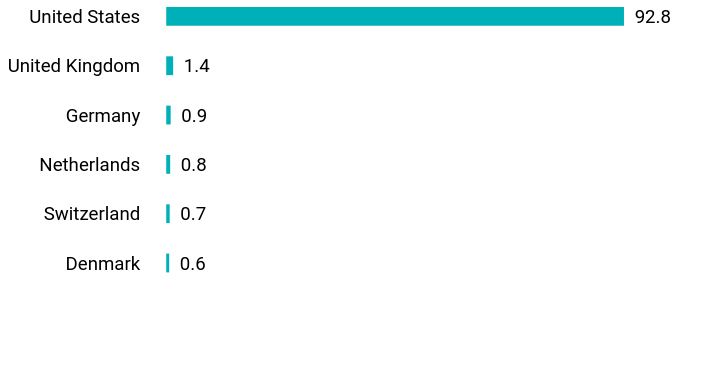

Jersey, Channel Islands |

1.1 |

Canada |

2.0 |

Ireland |

2.9 |

United States |

91.6 | |

|

| Largest Holdings [Text Block] |

Keurig Dr. Pepper, Inc. |

3.1 |

AerCap Holdings NV |

2.9 |

American Electric Power Co., Inc. |

2.9 |

CBRE Group, Inc. |

2.8 |

Labcorp Holdings, Inc. |

2.7 |

Carlisle Cos., Inc. |

2.6 |

Arch Capital Group Ltd. |

2.5 |

Vulcan Materials Co. |

2.4 |

Jefferies Financial Group, Inc. |

2.4 |

Brown & Brown, Inc. |

2.4 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000063063 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Aggressive Allocation Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Aggressive Allocation Portfolio (formerly, American Funds® Growth Allocation Portfolio) (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$17 |

0.32%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.32%

|

[6] |

| AssetsNet |

$ 2,936,659,206

|

|

| Holdings Count | Holding |

14

|

|

| Advisory Fees Paid, Amount |

$ 881,193

|

|

| InvestmentCompanyPortfolioTurnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,936,659,206

- # of Portfolio Investments14

- Portfolio Turnover Rate6%

- Total Advisory Fees Paid$881,193

|

|

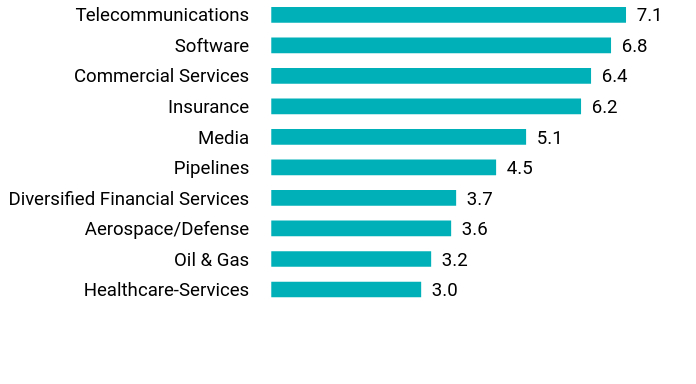

| Holdings [Text Block] |

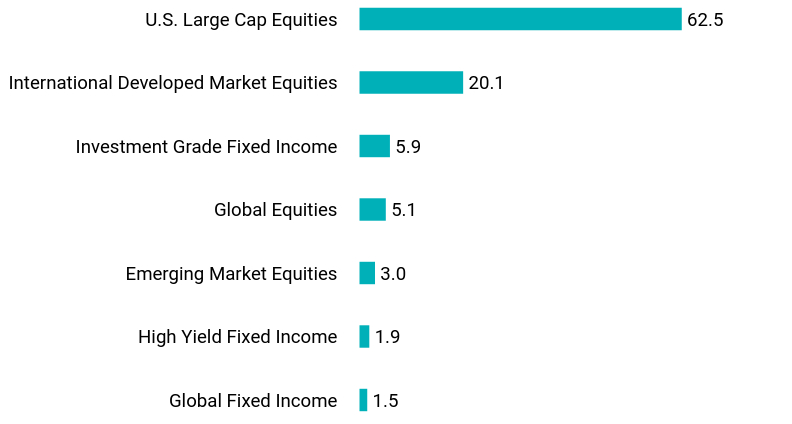

Value |

Value |

Global Fixed Income |

1.5 |

High Yield Fixed Income |

1.9 |

Emerging Market Equities |

3.0 |

Global Equities |

5.1 |

Investment Grade Fixed Income |

5.9 |

International Developed Market Equities |

20.1 |

U.S. Large Cap Equities |

62.5 | |

|

| Largest Holdings [Text Block] |

American Funds AMCAP Fund, Class R-6 |

11.6 |

American Funds Fundamental Investors Fund, Class R-6 |

11.1 |

American Funds International Growth & Income Fund, Class R-6 |

11.0 |

American Funds Growth Fund, Class 1 |

10.6 |

American Funds Growth-Income Fund, Class 1 |

10.1 |

American Funds Washington Mutual Investors Fund, Class 1 |

10.1 |

American Funds International Fund, Class 1 |

9.1 |

American Funds American Mutual Fund, Class R-6 |

9.0 |

American Funds Smallcap World Fund, Inc., Class R6 |

5.1 |

American Funds The Bond Fund of America, Class 1 |

4.5 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000063064 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Aggressive Allocation Portfolio

|

|

| Class Name |

Class C

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Aggressive Allocation Portfolio (formerly, American Funds® Growth Allocation Portfolio) (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$32 |

0.62%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.62%

|

[7] |

| AssetsNet |

$ 2,936,659,206

|

|

| Holdings Count | Holding |

14

|

|

| Advisory Fees Paid, Amount |

$ 881,193

|

|

| InvestmentCompanyPortfolioTurnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,936,659,206

- # of Portfolio Investments14

- Portfolio Turnover Rate6%

- Total Advisory Fees Paid$881,193

|

|

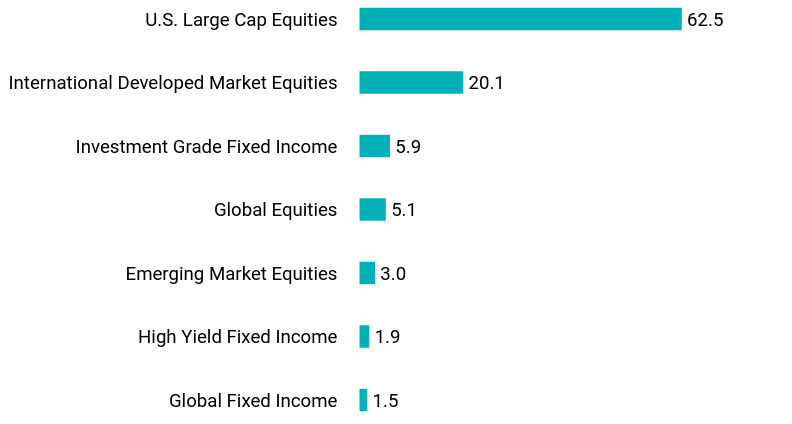

| Holdings [Text Block] |

Value |

Value |

Global Fixed Income |

1.5 |

High Yield Fixed Income |

1.9 |

Emerging Market Equities |

3.0 |

Global Equities |

5.1 |

Investment Grade Fixed Income |

5.9 |

International Developed Market Equities |

20.1 |

U.S. Large Cap Equities |

62.5 | |

|

| Largest Holdings [Text Block] |

American Funds AMCAP Fund, Class R-6 |

11.6 |

American Funds Fundamental Investors Fund, Class R-6 |

11.1 |

American Funds International Growth & Income Fund, Class R-6 |

11.0 |

American Funds Growth Fund, Class 1 |

10.6 |

American Funds Growth-Income Fund, Class 1 |

10.1 |

American Funds Washington Mutual Investors Fund, Class 1 |

10.1 |

American Funds International Fund, Class 1 |

9.1 |

American Funds American Mutual Fund, Class R-6 |

9.0 |

American Funds Smallcap World Fund, Inc., Class R6 |

5.1 |

American Funds The Bond Fund of America, Class 1 |

4.5 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000063060 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Balanced Allocation Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Balanced Allocation Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$17 |

0.32%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.32%

|

[8] |

| AssetsNet |

$ 4,048,959,117

|

|

| Holdings Count | Holding |

14

|

|

| Advisory Fees Paid, Amount |

$ 1,160,181

|

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$4,048,959,117

- # of Portfolio Investments14

- Portfolio Turnover Rate5%

- Total Advisory Fees Paid$1,160,181

|

|

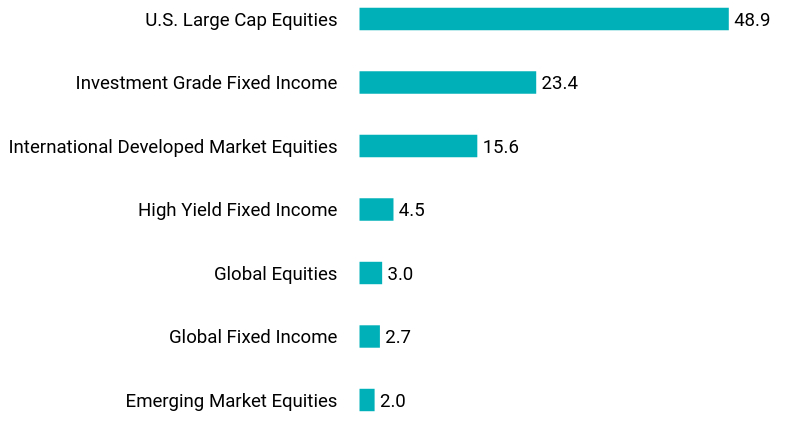

| Holdings [Text Block] |

Value |

Value |

Emerging Market Equities |

2.0 |

Global Fixed Income |

2.7 |

Global Equities |

3.0 |

High Yield Fixed Income |

4.5 |

International Developed Market Equities |

15.6 |

Investment Grade Fixed Income |

23.4 |

U.S. Large Cap Equities |

48.9 | |

|

| Largest Holdings [Text Block] |

American Funds The Bond Fund of America, Class 1 |

13.1 |

American Funds U.S. Government Securities Fund, Class R-6 |

10.3 |

American Funds Growth-Income Fund, Class 1 |

9.1 |

American Funds International Growth & Income Fund, Class R-6 |

8.7 |

American Funds Growth Fund, Class 1 |

8.6 |

American Funds Fundamental Investors Fund, Class R-6 |

8.1 |

American Funds AMCAP Fund, Class R-6 |

8.1 |

American Funds Washington Mutual Investors Fund, Class 1 |

8.0 |

American Funds American Mutual Fund, Class R-6 |

7.0 |

American Funds International Fund, Class 1 |

6.8 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000063061 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Balanced Allocation Portfolio

|

|

| Class Name |

Class C

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Balanced Allocation Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$32 |

0.62%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.62%

|

[9] |

| AssetsNet |

$ 4,048,959,117

|

|

| Holdings Count | Holding |

14

|

|

| Advisory Fees Paid, Amount |

$ 1,160,181

|

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$4,048,959,117

- # of Portfolio Investments14

- Portfolio Turnover Rate5%

- Total Advisory Fees Paid$1,160,181

|

|

| Holdings [Text Block] |

Value |

Value |

Emerging Market Equities |

2.0 |

Global Fixed Income |

2.7 |

Global Equities |

3.0 |

High Yield Fixed Income |

4.5 |

International Developed Market Equities |

15.6 |

Investment Grade Fixed Income |

23.4 |

U.S. Large Cap Equities |

48.9 | |

|

| Largest Holdings [Text Block] |

American Funds The Bond Fund of America, Class 1 |

13.1 |

American Funds U.S. Government Securities Fund, Class R-6 |

10.3 |

American Funds Growth-Income Fund, Class 1 |

9.1 |

American Funds International Growth & Income Fund, Class R-6 |

8.7 |

American Funds Growth Fund, Class 1 |

8.6 |

American Funds Fundamental Investors Fund, Class R-6 |

8.1 |

American Funds AMCAP Fund, Class R-6 |

8.1 |

American Funds Washington Mutual Investors Fund, Class 1 |

8.0 |

American Funds American Mutual Fund, Class R-6 |

7.0 |

American Funds International Fund, Class 1 |

6.8 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030657 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Growth Portfolio

|

|

| Class Name |

Class C

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Growth Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment. The expense table below reflects the expenses of both the American Funds Growth Portfolio (the "Feeder Fund") and the Master Fund.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$47 |

0.90%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.90%

|

[10] |

| AssetsNet |

$ 1,974,405,348

|

|

| Holdings Count | Holding |

1

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,974,405,348

- # of Portfolio Investments1

- Portfolio Turnover Rate6%

- Total Advisory Fees Paid$0

|

|

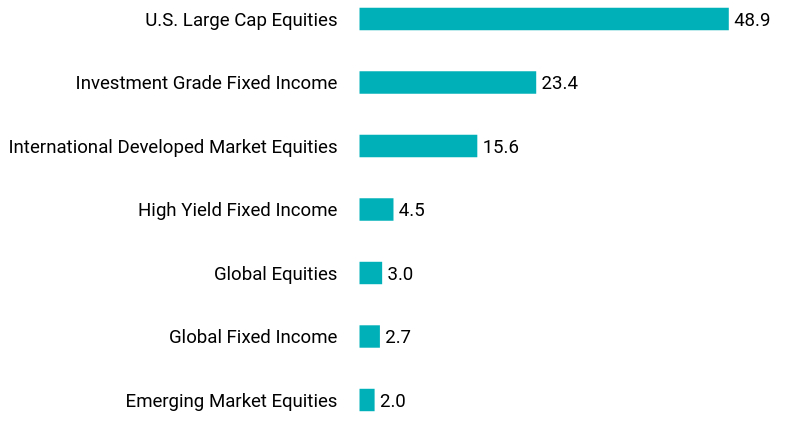

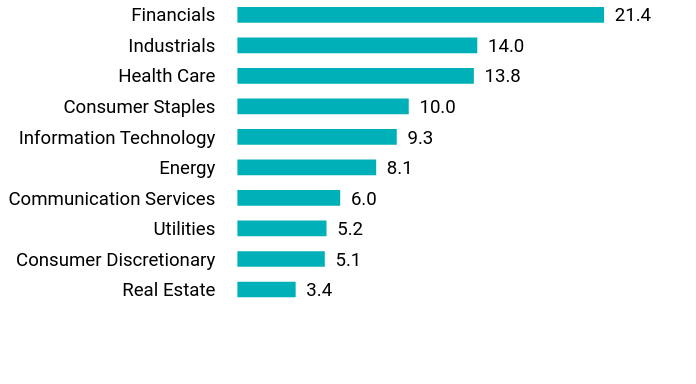

| Holdings [Text Block] |

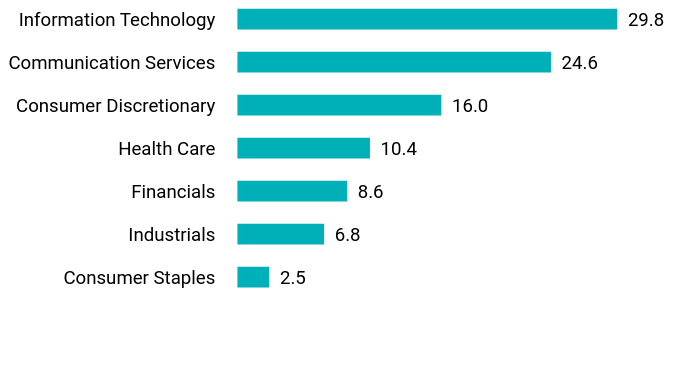

Value |

Value |

Utilities |

0.7 |

Materials |

1.4 |

Energy |

2.0 |

Consumer Staples |

2.0 |

Financials |

8.0 |

Industrials |

10.5 |

Health Care |

11.1 |

Consumer Discretionary |

13.8 |

Communication Services |

20.0 |

Information Technology |

27.4 |

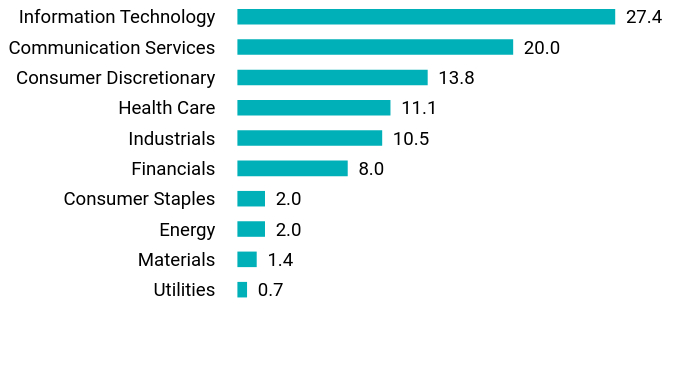

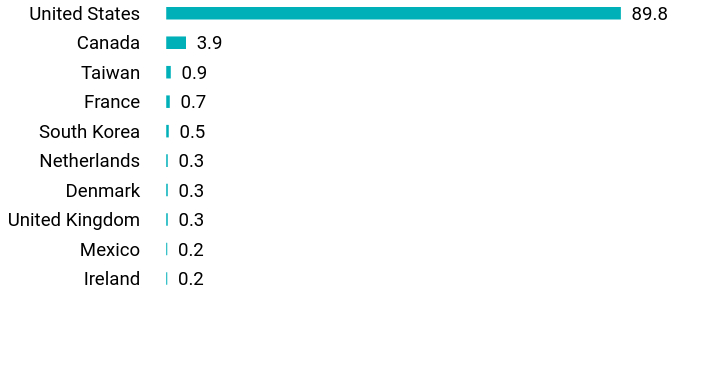

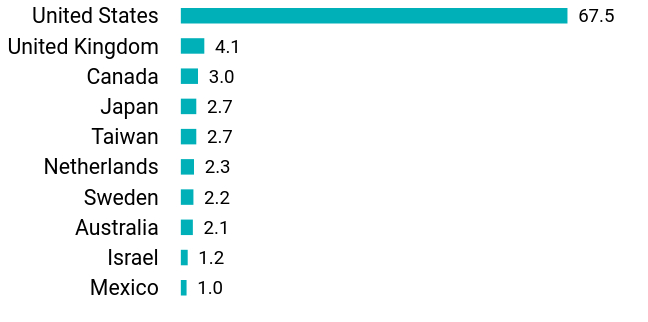

Value |

Value |

Ireland |

0.2 |

Mexico |

0.2 |

United Kingdom |

0.3 |

Denmark |

0.3 |

Netherlands |

0.3 |

South Korea |

0.5 |

France |

0.7 |

Taiwan |

0.9 |

Canada |

3.9 |

United States |

89.8 | |

|

| Largest Holdings [Text Block] |

Meta Platforms, Inc. |

9.3 |

NVIDIA Corp. |

5.1 |

Microsoft Corp. |

4.7 |

Tesla, Inc. |

4.7 |

Netflix, Inc. |

4.4 |

Broadcom, Inc. |

4.2 |

Alphabet, Inc. |

4.0 |

Amazon.com, Inc. |

2.4 |

TransDigm Group, Inc. |

2.1 |

Intuitive Surgical, Inc. |

2.1 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000063057 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Moderate Allocation Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Moderate Allocation Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$17 |

0.33%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.33%

|

[11] |

| AssetsNet |

$ 1,946,674,353

|

|

| Holdings Count | Holding |

14

|

|

| Advisory Fees Paid, Amount |

$ 658,793

|

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,946,674,353

- # of Portfolio Investments14

- Portfolio Turnover Rate4%

- Total Advisory Fees Paid$658,793

|

|

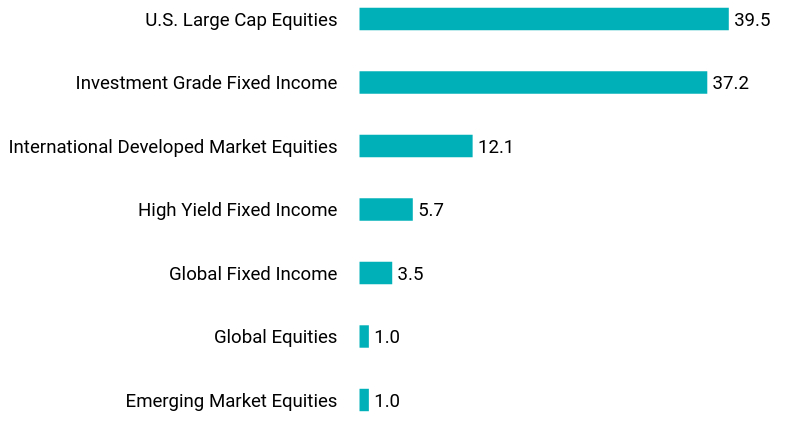

| Holdings [Text Block] |

Value |

Value |

Emerging Market Equities |

1.0 |

Global Equities |

1.0 |

Global Fixed Income |

3.5 |

High Yield Fixed Income |

5.7 |

International Developed Market Equities |

12.1 |

Investment Grade Fixed Income |

37.2 |

U.S. Large Cap Equities |

39.5 | |

|

| Largest Holdings [Text Block] |

American Funds U.S. Government Securities Fund, Class R-6 |

18.8 |

American Funds The Bond Fund of America, Class 1 |

18.3 |

American Funds Growth-Income Fund, Class 1 |

8.1 |

American Funds Washington Mutual Investors Fund, Class 1 |

8.1 |

American Funds American Mutual Fund, Class R-6 |

8.1 |

American Funds International Growth & Income Fund, Class R-6 |

6.5 |

American Funds High-Income Trust Fund, Class R-6 |

5.7 |

American Funds International Fund, Class 1 |

5.6 |

American Funds Growth Fund, Class 1 |

5.1 |

American Funds AMCAP Fund, Class R-6 |

5.1 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000063058 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">®</sup> Moderate Allocation Portfolio

|

|

| Class Name |

Class C

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the American Funds® Moderate Allocation Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$32 |

0.63%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.63%

|

[12] |

| AssetsNet |

$ 1,946,674,353

|

|

| Holdings Count | Holding |

14

|

|

| Advisory Fees Paid, Amount |

$ 658,793

|

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,946,674,353

- # of Portfolio Investments14

- Portfolio Turnover Rate4%

- Total Advisory Fees Paid$658,793

|

|

| Holdings [Text Block] |

Value |

Value |

Emerging Market Equities |

1.0 |

Global Equities |

1.0 |

Global Fixed Income |

3.5 |

High Yield Fixed Income |

5.7 |

International Developed Market Equities |

12.1 |

Investment Grade Fixed Income |

37.2 |

U.S. Large Cap Equities |

39.5 | |

|

| Largest Holdings [Text Block] |

American Funds U.S. Government Securities Fund, Class R-6 |

18.8 |

American Funds The Bond Fund of America, Class 1 |

18.3 |

American Funds Growth-Income Fund, Class 1 |

8.1 |

American Funds Washington Mutual Investors Fund, Class 1 |

8.1 |

American Funds American Mutual Fund, Class R-6 |

8.1 |

American Funds International Growth & Income Fund, Class R-6 |

6.5 |

American Funds High-Income Trust Fund, Class R-6 |

5.7 |

American Funds International Fund, Class 1 |

5.6 |

American Funds Growth Fund, Class 1 |

5.1 |

American Funds AMCAP Fund, Class R-6 |

5.1 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000100078 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BlackRock Global Tactical Strategies Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the BlackRock Global Tactical Strategies Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$45 |

0.88%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.88%

|

[13] |

| AssetsNet |

$ 2,910,929,825

|

|

| Holdings Count | Holding |

83

|

|

| Advisory Fees Paid, Amount |

$ 8,790,807

|

|

| InvestmentCompanyPortfolioTurnover |

8.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,910,929,825

- # of Portfolio Investments83

- Portfolio Turnover Rate8%

- Total Advisory Fees Paid$8,790,807

|

|

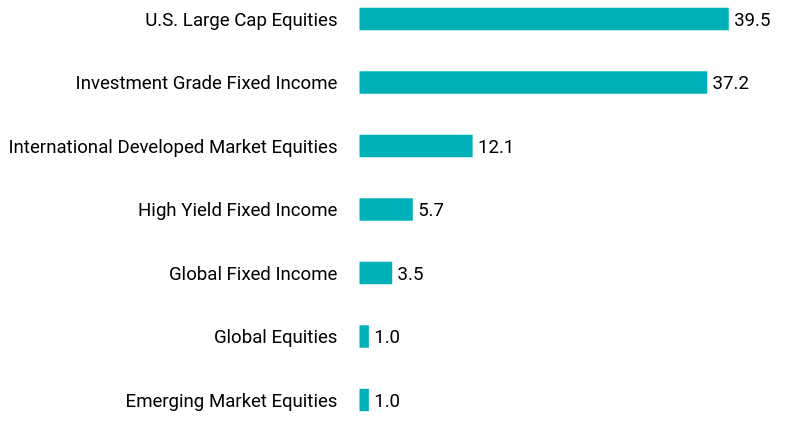

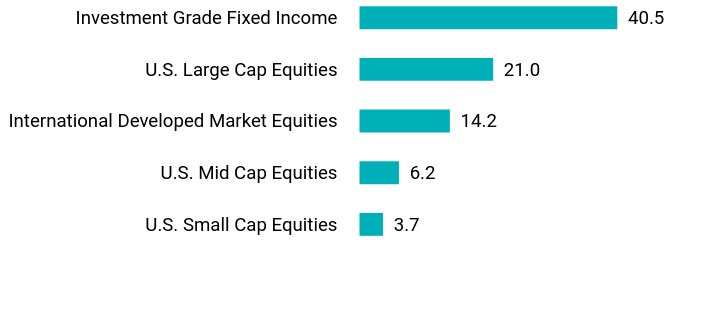

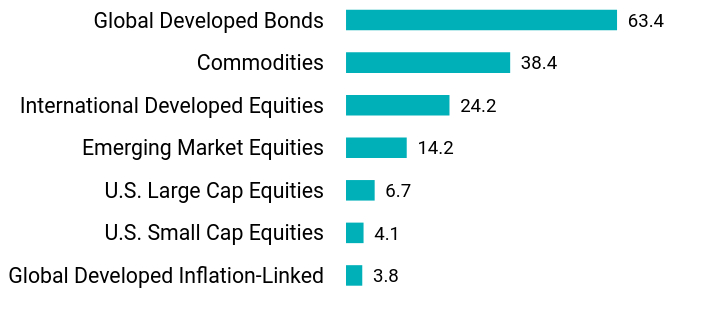

| Holdings [Text Block] |

Value |

Value |

U.S. Small Cap Equities |

1.6 |

Real Estate Equities |

2.0 |

Commodities |

3.9 |

Investment Grade Fixed Income |

24.4 |

U.S. Large Cap Equities |

26.4 |

International Developed Market Equities |

28.9 | |

|

| Largest Holdings [Text Block] |

iShares Core MSCI EAFE ETF |

24.5 |

Vanguard Total Bond Market ETF |

20.0 |

iShares Core S&P 500 ETF |

19.6 |

iShares Core U.S. Aggregate Bond ETF |

15.4 |

Technology Select Sector SPDR Fund |

2.5 |

iShares U.S. Real Estate ETF |

2.0 |

Financial Select Sector SPDR Fund |

1.2 |

Communication Services Select Sector SPDR Fund |

1.0 |

Consumer Discretionary Select Sector SPDR Fund |

0.9 |

Health Care Select Sector SPDR Fund |

0.8 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030750 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BlackRock High Yield Portfolio

|

|

| Class Name |

Class A

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the BlackRock High Yield Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$32 |

0.63%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.63%

|

[14] |

| AssetsNet |

$ 1,013,764,759

|

|

| Holdings Count | Holding |

1,209

|

|

| Advisory Fees Paid, Amount |

$ 2,796,185

|

|

| InvestmentCompanyPortfolioTurnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,013,764,759

- # of Portfolio Investments1,209

- Portfolio Turnover Rate26%

- Total Advisory Fees Paid$2,796,185

|

|

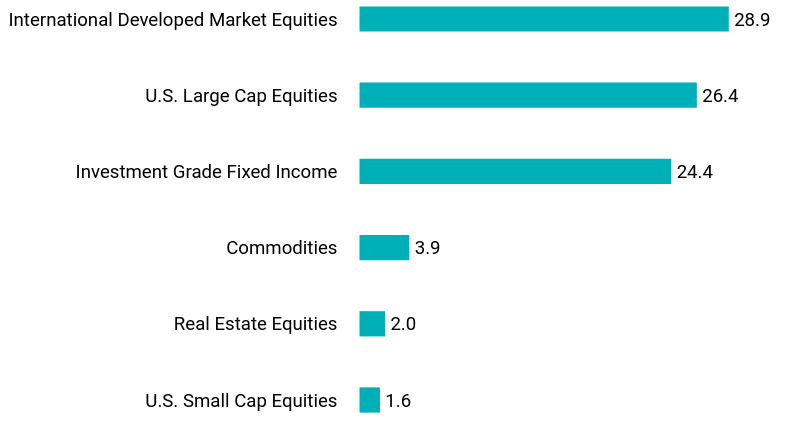

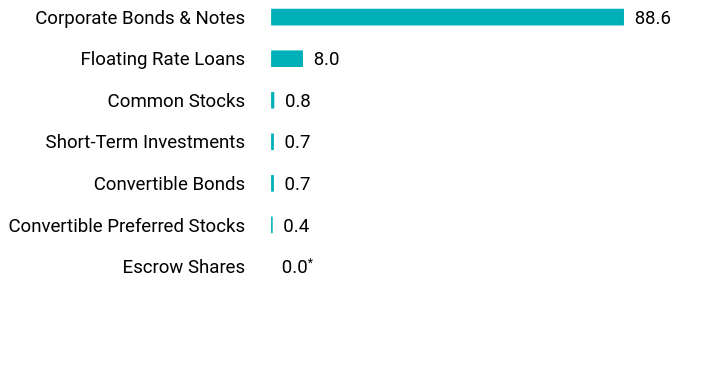

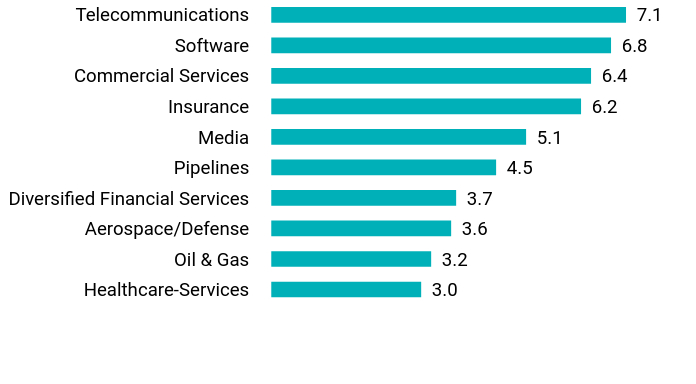

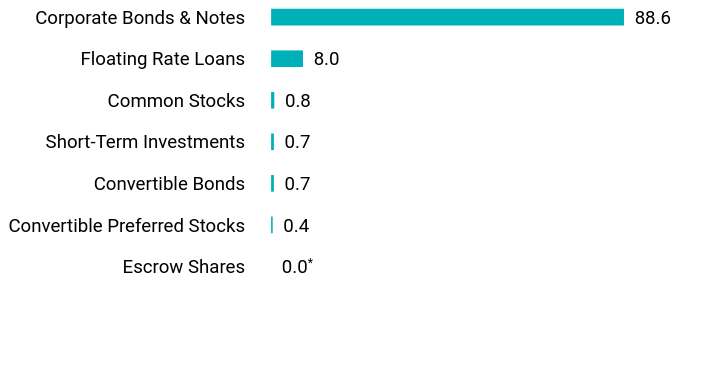

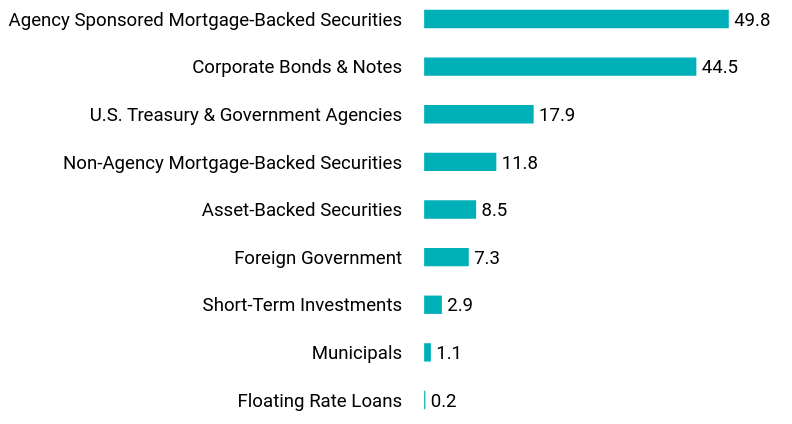

| Holdings [Text Block] |

Value |

Value |

Healthcare-Services |

3.0 |

Oil & Gas |

3.2 |

Aerospace/Defense |

3.6 |

Diversified Financial Services |

3.7 |

Pipelines |

4.5 |

Media |

5.1 |

Insurance |

6.2 |

Commercial Services |

6.4 |

Software |

6.8 |

Telecommunications |

7.1 |

Value |

Value |

Escrow Shares |

0.0Footnote Reference* |

Convertible Preferred Stocks |

0.4 |

Convertible Bonds |

0.7 |

Short-Term Investments |

0.7 |

Common Stocks |

0.8 |

Floating Rate Loans |

8.0 |

Corporate Bonds & Notes |

88.6 |

| Footnote |

Description |

Footnote* |

Amount rounds to less than 0.1% | |

|

| Largest Holdings [Text Block] |

Top 10 Fixed Income Issuers

Cloud Software Group, Inc. |

2.1 |

HUB International Ltd. |

1.9 |

TransDigm, Inc. |

1.9 |

Venture Global LNG, Inc. |

1.7 |

Level 3 Financing, Inc. |

1.7 |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer |

1.1 |

AthenaHealth Group, Inc. |

1.1 |

CCO Holdings LLC/CCO Holdings Capital Corp. |

1.1 |

Clear Channel Outdoor Holdings, Inc. |

1.0 |

Fortress Transportation & Infrastructure Investors LLC |

1.0 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030751 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BlackRock High Yield Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the BlackRock High Yield Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$45 |

0.88%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.88%

|

[15] |

| AssetsNet |

$ 1,013,764,759

|

|

| Holdings Count | Holding |

1,209

|

|

| Advisory Fees Paid, Amount |

$ 2,796,185

|

|

| InvestmentCompanyPortfolioTurnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,013,764,759

- # of Portfolio Investments1,209

- Portfolio Turnover Rate26%

- Total Advisory Fees Paid$2,796,185

|

|

| Holdings [Text Block] |

Value |

Value |

Healthcare-Services |

3.0 |

Oil & Gas |

3.2 |

Aerospace/Defense |

3.6 |

Diversified Financial Services |

3.7 |

Pipelines |

4.5 |

Media |

5.1 |

Insurance |

6.2 |

Commercial Services |

6.4 |

Software |

6.8 |

Telecommunications |

7.1 |

Value |

Value |

Escrow Shares |

0.0Footnote Reference* |

Convertible Preferred Stocks |

0.4 |

Convertible Bonds |

0.7 |

Short-Term Investments |

0.7 |

Common Stocks |

0.8 |

Floating Rate Loans |

8.0 |

Corporate Bonds & Notes |

88.6 |

| Footnote |

Description |

Footnote* |

Amount rounds to less than 0.1% | |

|

| Largest Holdings [Text Block] |

Top 10 Fixed Income Issuers

Cloud Software Group, Inc. |

2.1 |

HUB International Ltd. |

1.9 |

TransDigm, Inc. |

1.9 |

Venture Global LNG, Inc. |

1.7 |

Level 3 Financing, Inc. |

1.7 |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer |

1.1 |

AthenaHealth Group, Inc. |

1.1 |

CCO Holdings LLC/CCO Holdings Capital Corp. |

1.1 |

Clear Channel Outdoor Holdings, Inc. |

1.0 |

Fortress Transportation & Infrastructure Investors LLC |

1.0 | |

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030680 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Brighthouse Asset Allocation 100 Portfolio

|

|

| Class Name |

Class A

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Brighthouse Asset Allocation 100 Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$4 |

0.08%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 4

|

|

| Expense Ratio, Percent |

0.08%

|

[16] |

| AssetsNet |

$ 1,748,124,832

|

|

| Holdings Count | Holding |

30

|

|

| Advisory Fees Paid, Amount |

$ 601,006

|

|

| InvestmentCompanyPortfolioTurnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,748,124,832

- # of Portfolio Investments30

- Portfolio Turnover Rate7%

- Total Advisory Fees Paid$601,006

|

|

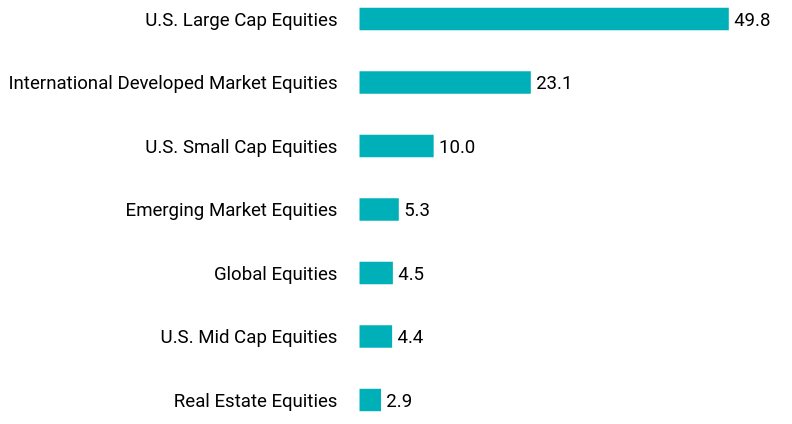

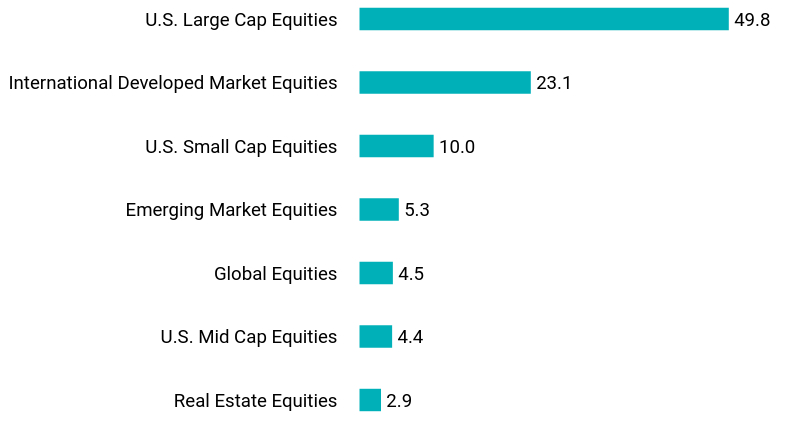

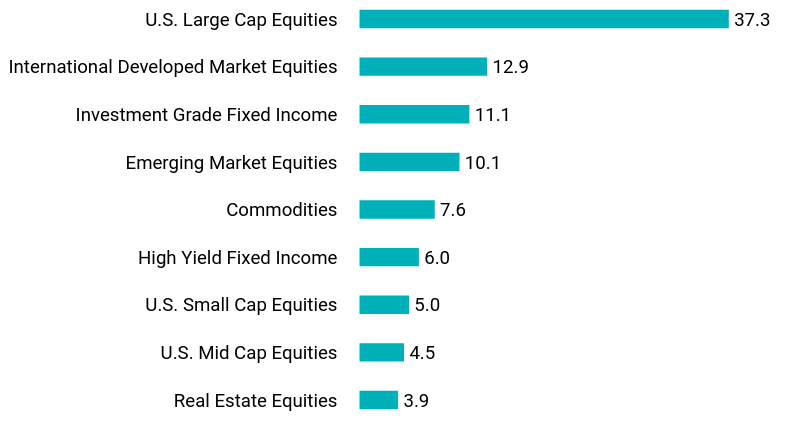

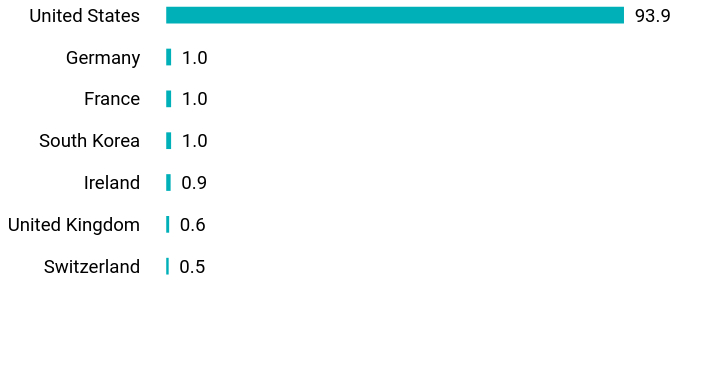

| Holdings [Text Block] |

Value |

Value |

Real Estate Equities |

2.9 |

U.S. Mid Cap Equities |

4.4 |

Global Equities |

4.5 |

Emerging Market Equities |

5.3 |

U.S. Small Cap Equities |

10.0 |

International Developed Market Equities |

23.1 |

U.S. Large Cap Equities |

49.8 | |

|

| Largest Holdings [Text Block] |

Loomis Sayles Growth Portfolio, Class A |

6.3 |

MFS Value Portfolio, Class A |

6.3 |

Jennison Growth Portfolio, Class A |

6.1 |

Invesco Comstock Portfolio, Class A |

6.0 |

T. Rowe Price Large Cap Value Portfolio, Class A |

5.7 |

Harris Oakmark International Portfolio, Class A |

5.6 |

T. Rowe Price Large Cap Growth Portfolio, Class A |

5.5 |

SSGA Emerging Markets Enhanced Index Portfolio, Class A |

5.3 |

Brighthouse/Dimensional International Small Company Portfolio, Class A |

5.1 |

Brighthouse/Wellington Core Equity Opportunities Portfolio, Class A |

5.0 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030681 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Brighthouse Asset Allocation 100 Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Brighthouse Asset Allocation 100 Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$17 |

0.33%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.33%

|

[17] |

| AssetsNet |

$ 1,748,124,832

|

|

| Holdings Count | Holding |

30

|

|

| Advisory Fees Paid, Amount |

$ 601,006

|

|

| InvestmentCompanyPortfolioTurnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$1,748,124,832

- # of Portfolio Investments30

- Portfolio Turnover Rate7%

- Total Advisory Fees Paid$601,006

|

|

| Holdings [Text Block] |

Value |

Value |

Real Estate Equities |

2.9 |

U.S. Mid Cap Equities |

4.4 |

Global Equities |

4.5 |

Emerging Market Equities |

5.3 |

U.S. Small Cap Equities |

10.0 |

International Developed Market Equities |

23.1 |

U.S. Large Cap Equities |

49.8 | |

|

| Largest Holdings [Text Block] |

Loomis Sayles Growth Portfolio, Class A |

6.3 |

MFS Value Portfolio, Class A |

6.3 |

Jennison Growth Portfolio, Class A |

6.1 |

Invesco Comstock Portfolio, Class A |

6.0 |

T. Rowe Price Large Cap Value Portfolio, Class A |

5.7 |

Harris Oakmark International Portfolio, Class A |

5.6 |

T. Rowe Price Large Cap Growth Portfolio, Class A |

5.5 |

SSGA Emerging Markets Enhanced Index Portfolio, Class A |

5.3 |

Brighthouse/Dimensional International Small Company Portfolio, Class A |

5.1 |

Brighthouse/Wellington Core Equity Opportunities Portfolio, Class A |

5.0 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000100083 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Brighthouse Balanced Plus Portfolio

|

|

| Class Name |

Class B

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Brighthouse Balanced Plus Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |

What were the Portfolio costs for last six months?This example shows the expenses you would have paid over the reporting period based on a hypothetical $10,000 investment.

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class B |

$37 |

0.73%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.73%

|

[18] |

| AssetsNet |

$ 4,876,581,316

|

|

| Holdings Count | Holding |

119

|

|

| Advisory Fees Paid, Amount |

$ 5,757,684

|

|

| InvestmentCompanyPortfolioTurnover |

32.00%

|

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$4,876,581,316

- # of Portfolio Investments119

- Portfolio Turnover Rate32%

- Total Advisory Fees Paid$5,757,684

|

|

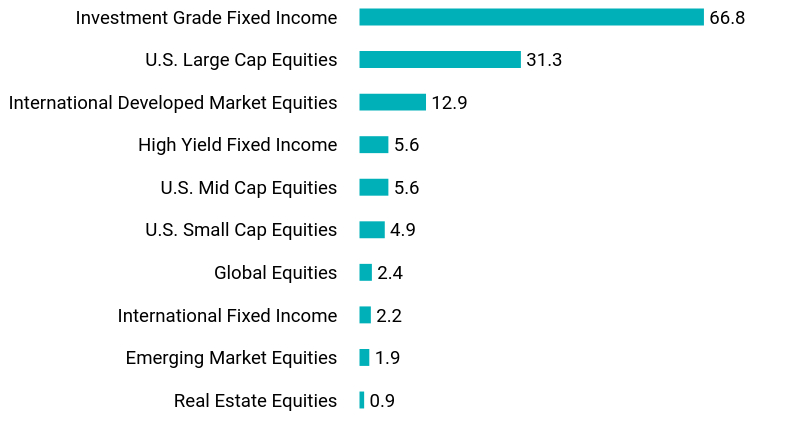

| Holdings [Text Block] |

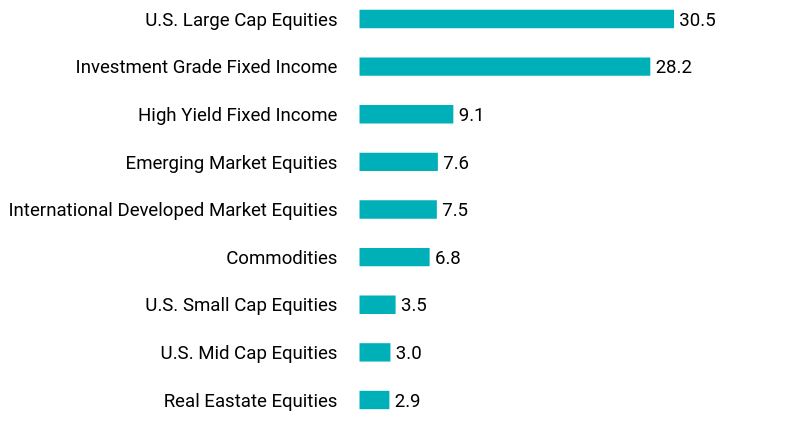

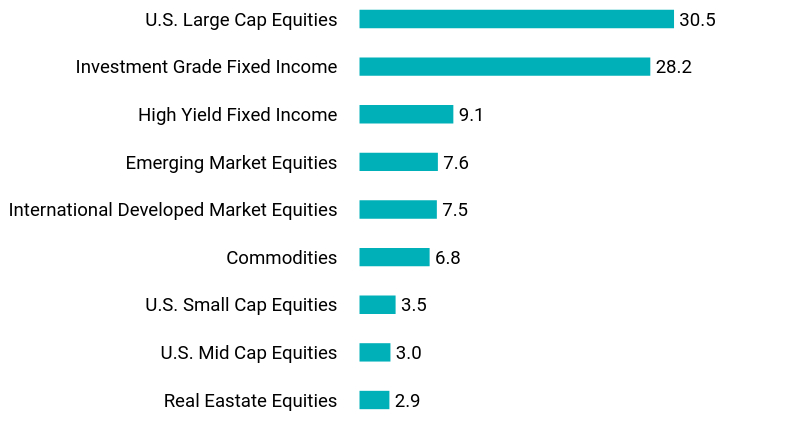

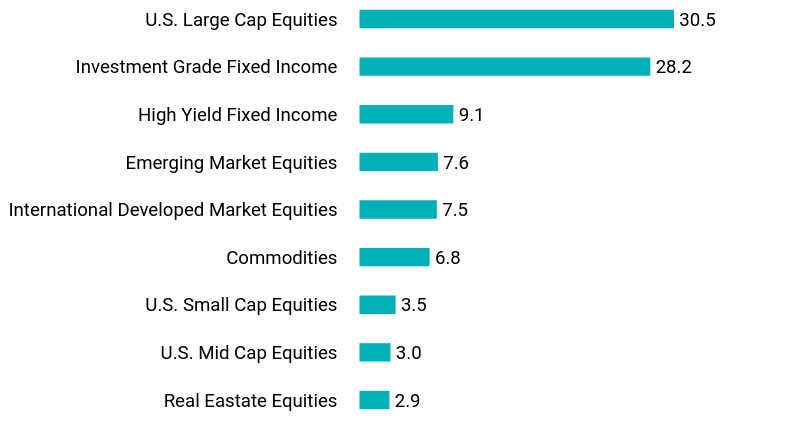

Value |

Value |

Real Estate Equities |

0.9 |

Emerging Market Equities |

1.9 |

International Fixed Income |

2.2 |

Global Equities |

2.4 |

U.S. Small Cap Equities |

4.9 |

U.S. Mid Cap Equities |

5.6 |

High Yield Fixed Income |

5.6 |

International Developed Market Equities |

12.9 |

U.S. Large Cap Equities |

31.3 |

Investment Grade Fixed Income |

66.8 | |

|

| Largest Holdings [Text Block] |

U.S. Treasury Notes |

18.2 |

U.S. Treasury Bonds |

12.8 |

BlackRock Bond Income Portfolio, Class A |

7.4 |

TCW Core Fixed Income Portfolio, Class A |

6.0 |

PIMCO Total Return Portfolio, Class A |

5.5 |

JPMorgan Core Bond Portfolio, Class A |

4.3 |

Harris Oakmark International Portfolio, Class A |

3.9 |

Western Asset Management U.S. Government Portfolio, Class A |

3.5 |

Western Asset Management Strategic Bond Opportunities Portfolio, Class A |

3.1 |

Baillie Gifford International Stock Portfolio, Class A |

2.9 | |

|

| Updated Prospectus Phone Number |

1-888-243-1956

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| C000030660 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Brighthouse Small Cap Value Portfolio

|

|

| Class Name |

Class A

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Brighthouse Small Cap Value Portfolio (the "Portfolio") for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at https://dfinview.com/BHFT. You can also request this information by contacting us at 1-888-243-1956.

|

|

| Additional Information Phone Number |

1-888-243-1956

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">https://dfinview.com/BHFT</span>

|

|

| Expenses [Text Block] |