Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

PIMCO Equity Series

|

|

| Entity Central Index Key |

0001479360

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

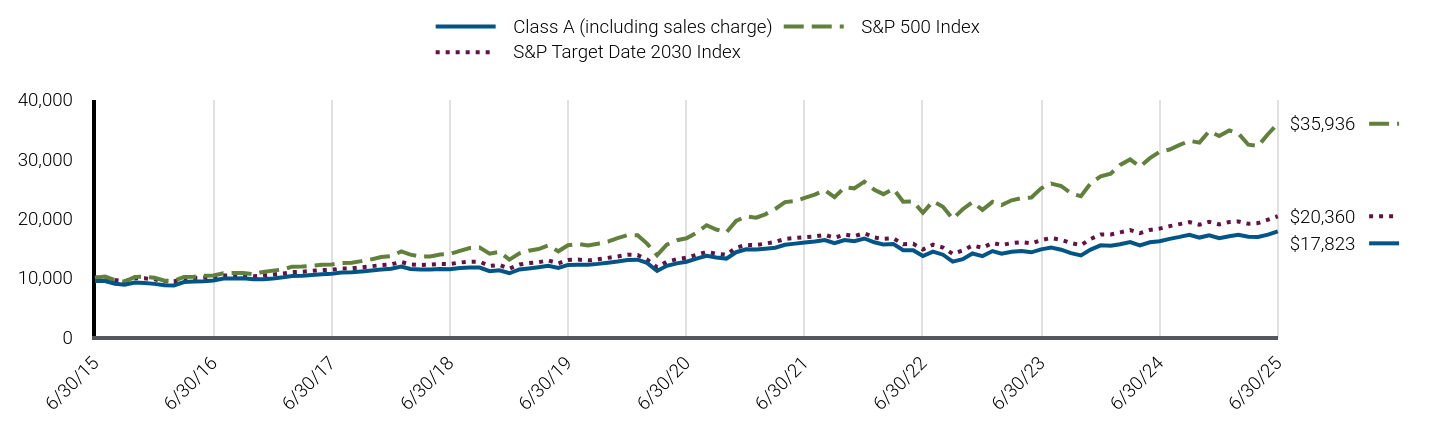

| C000106728 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

PIMCO Dividend and Income Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

PQIZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO Dividend and Income Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025 (the "reporting period").

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Website |

www.pimco.com/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$136 |

1.27% | |

|

| Expenses Paid, Amount |

$ 136

|

|

| Expense Ratio, Percent |

1.27%

|

|

| Factors Affecting Performance [Text Block] |

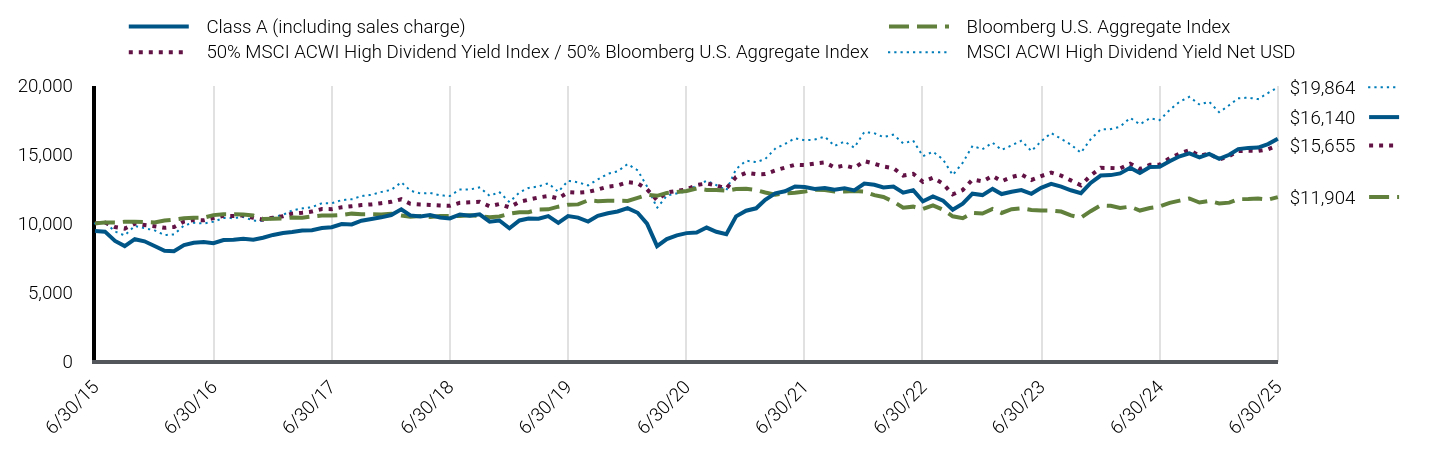

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Long exposure to U.S. equities contributed to performance, as U.S. equities had positive returns during the reporting period. Exposure to the cash interest rate in the U.S. contributed to performance, as the currency outperformed the relevant yield differentials during the reporting period. Long exposure to eurozone equities contributed to performance, as eurozone equities had positive returns during the reporting period. Long exposure to agency mortgage-backed securities, particularly 30-year fixed rate securities, detracted from performance, as U.S. 30-year Treasury yields rose during the reporting period. Long exposure to Taiwanese equities detracted from performance, as Taiwanese equities had negative returns during the reporting period. U.K. duration and curve positioning, particularly long exposure to the 12-year and 15-year portions of the curve over most of the reporting period, detracted from performance, as these interest rates rose during the reporting period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

|

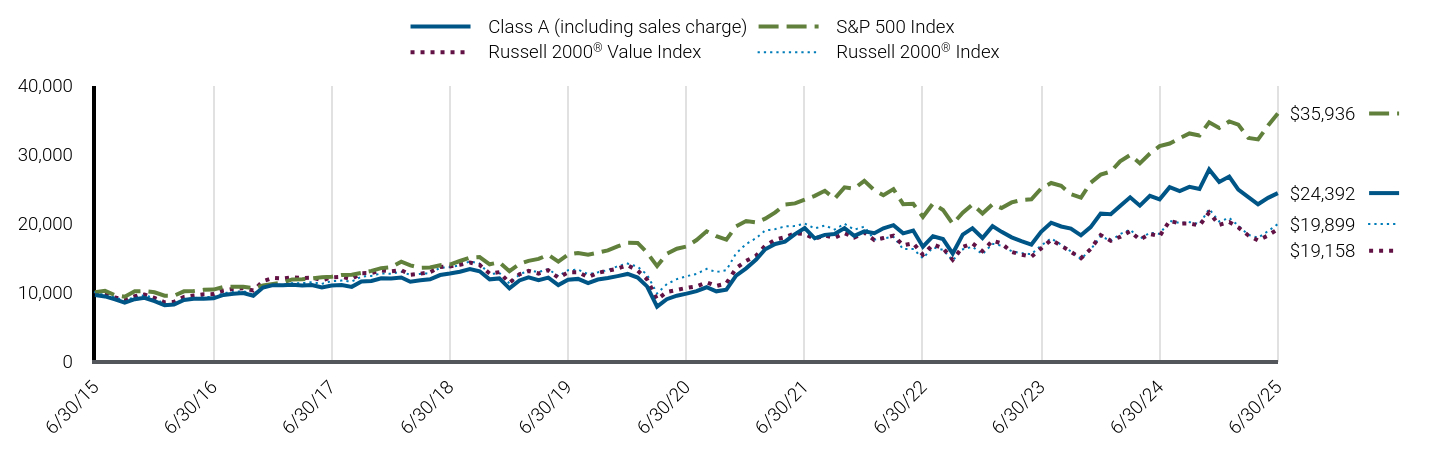

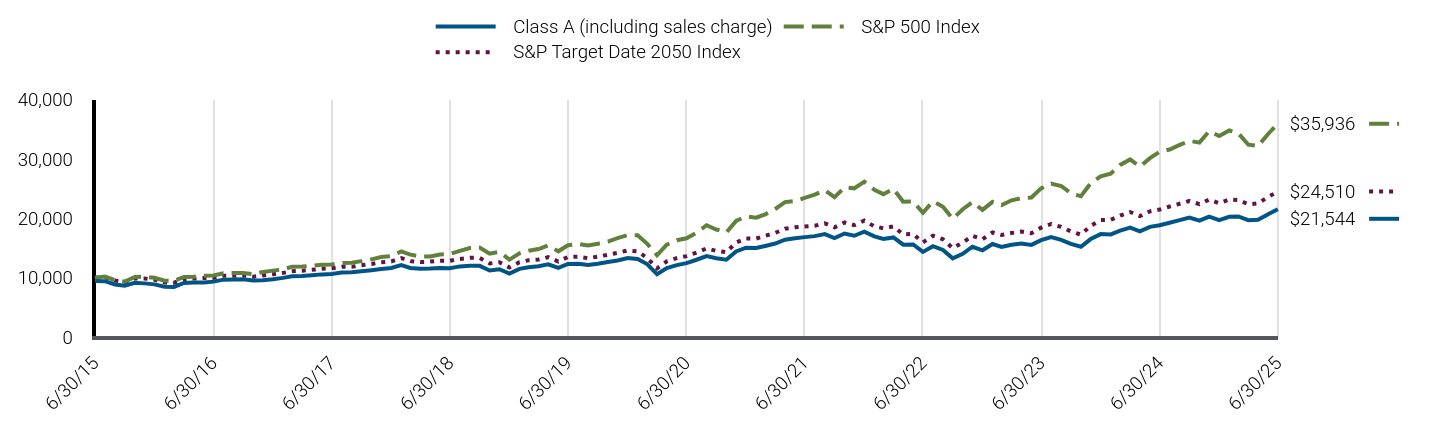

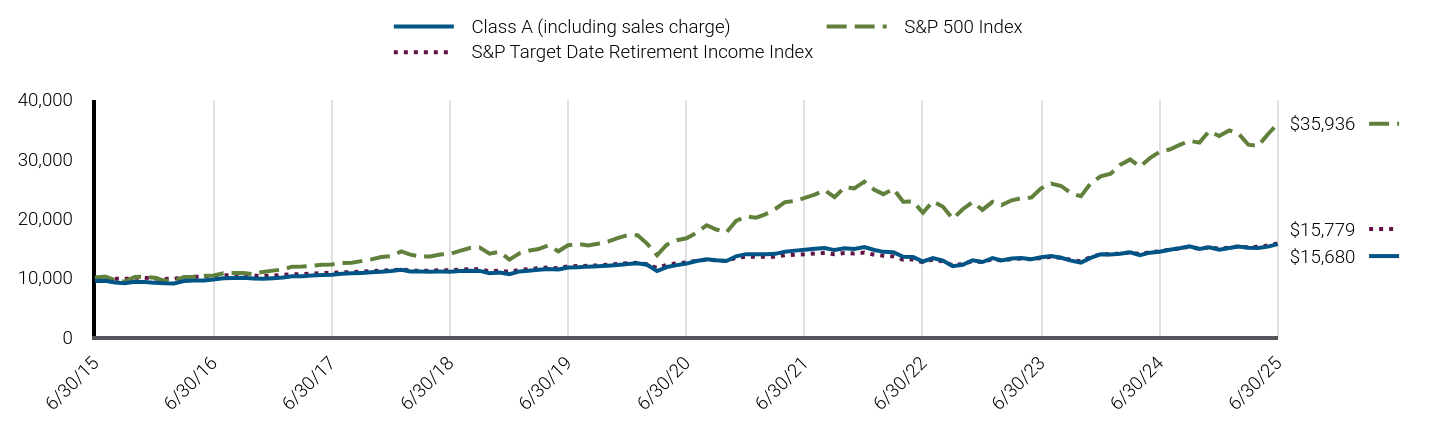

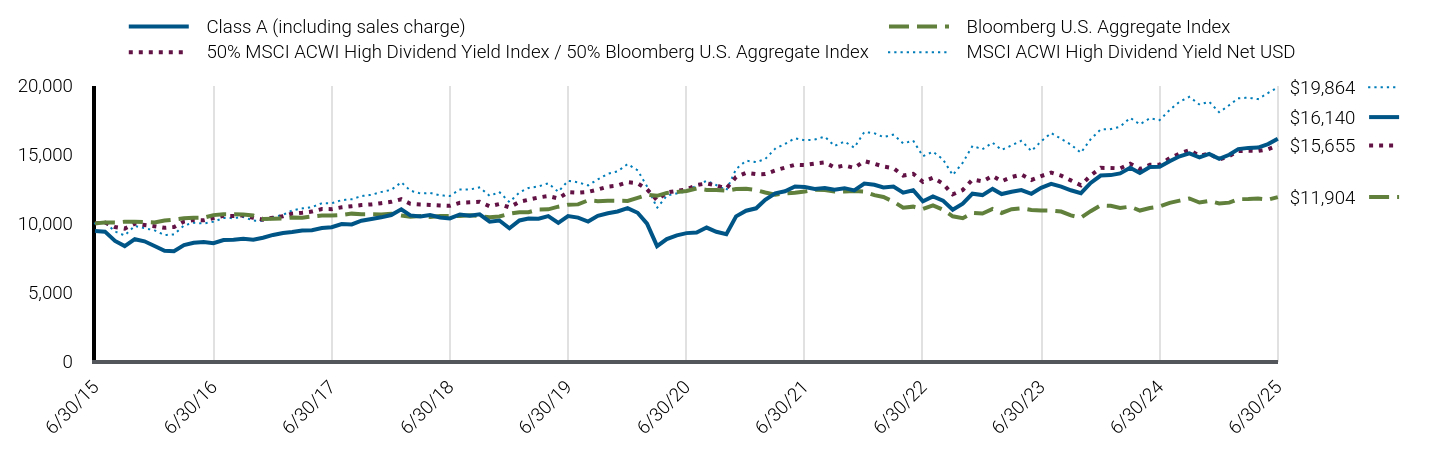

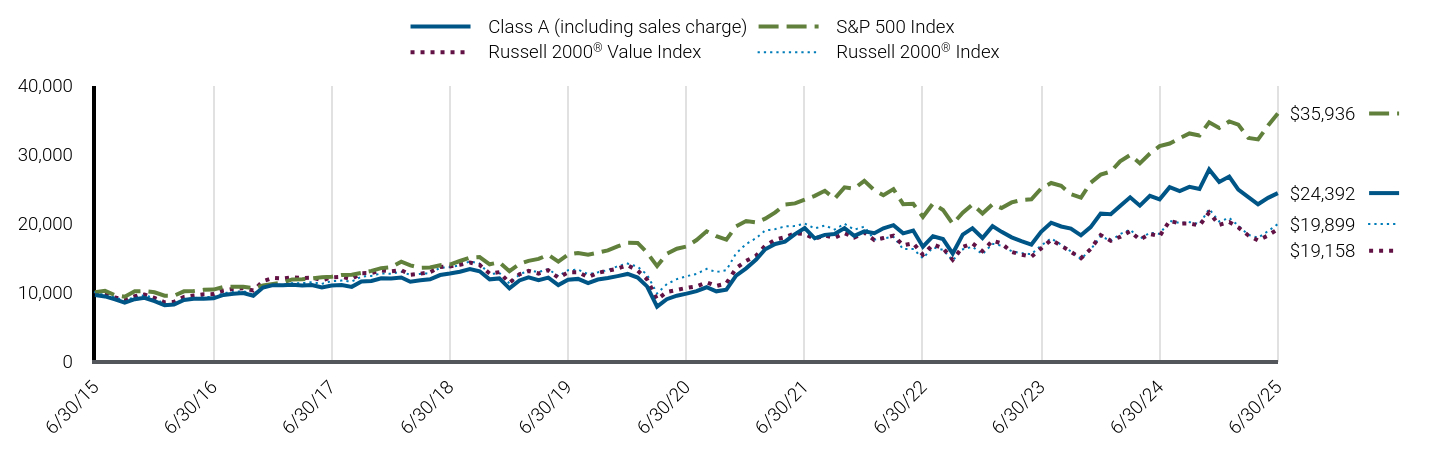

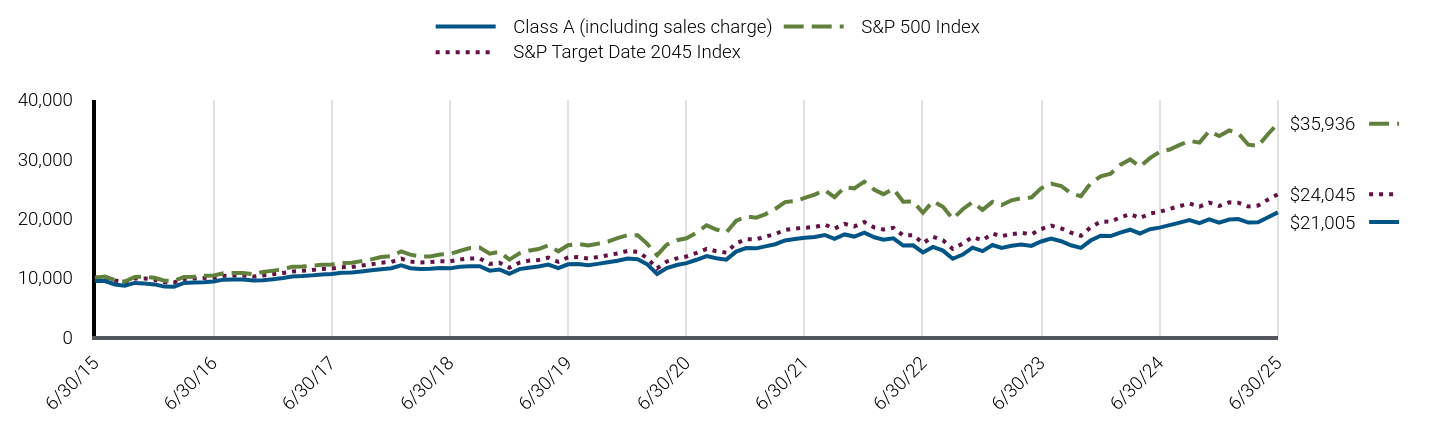

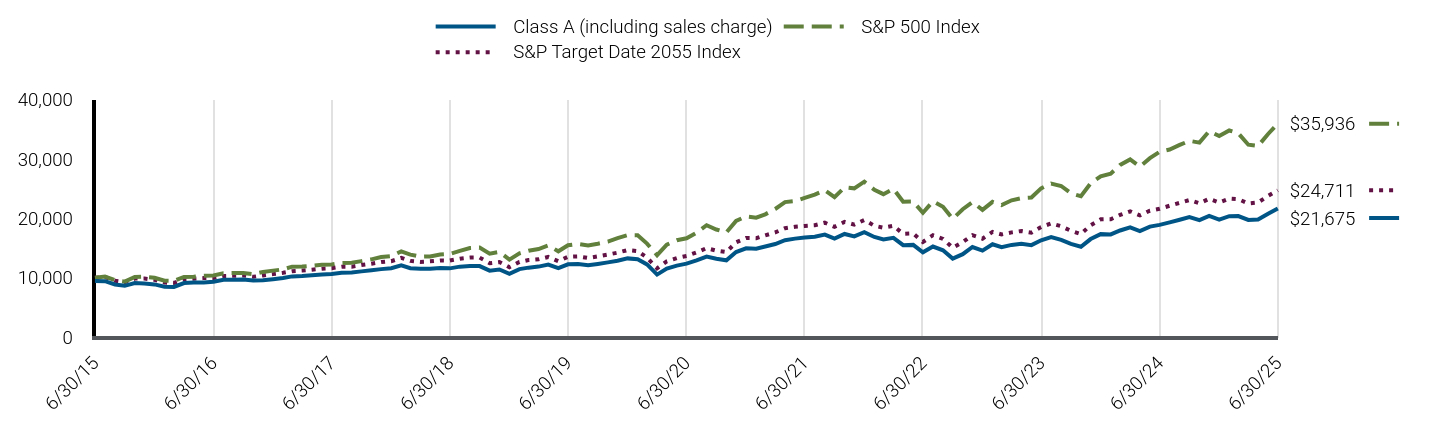

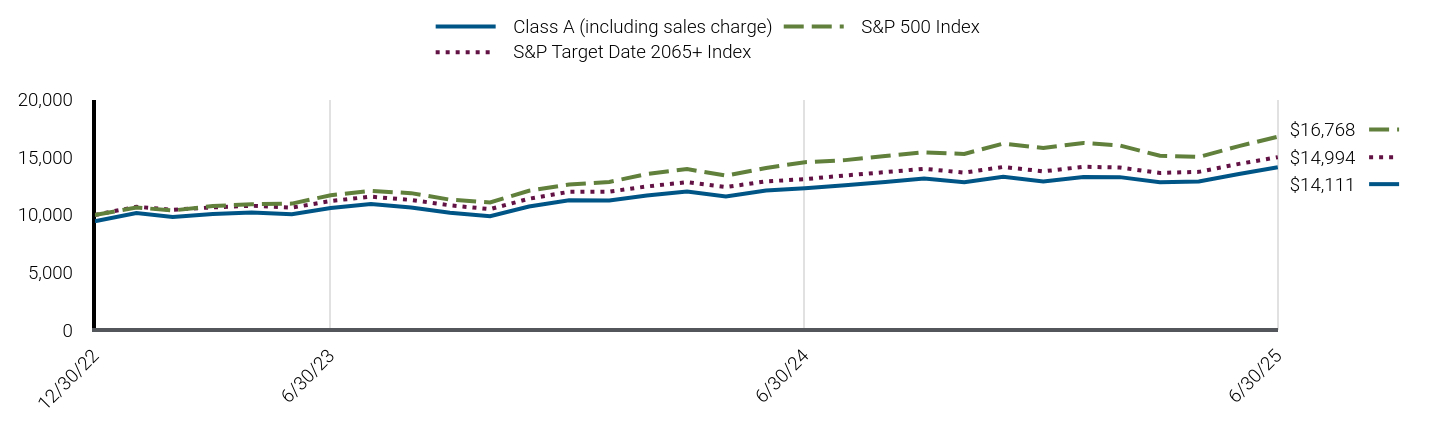

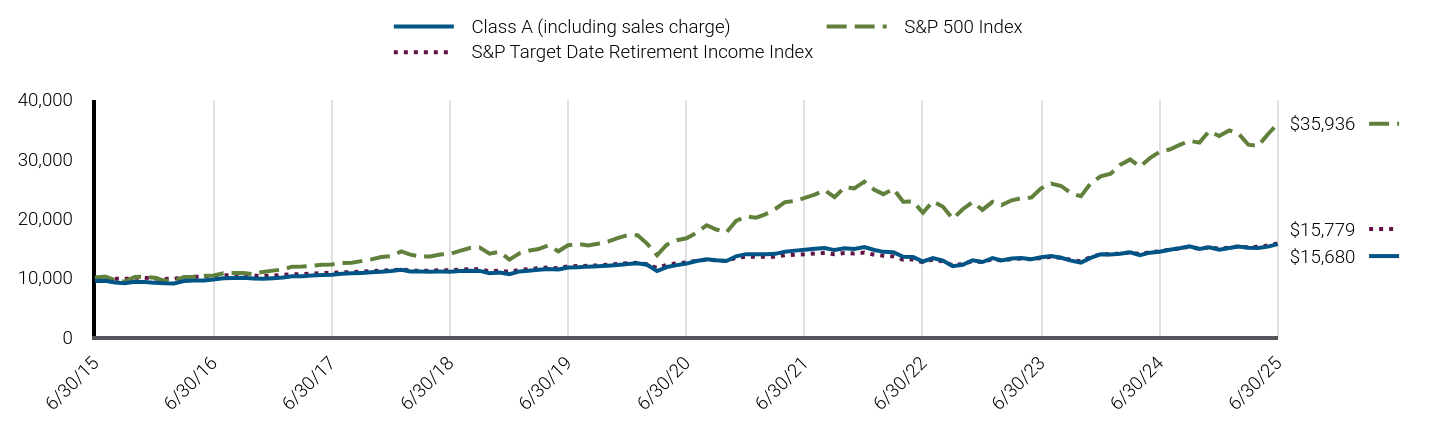

| Line Graph [Table Text Block] |

|

Class A (including sales charge) |

Bloomberg U.S. Aggregate Index |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

MSCI ACWI High Dividend Yield Net USD |

6/30/15 |

$9,447 |

$10,000 |

$10,000 |

$10,000 |

7/31/15 |

$9,402 |

$10,070 |

$10,068 |

$10,066 |

8/31/15 |

$8,728 |

$10,055 |

$9,732 |

$9,409 |

9/30/15 |

$8,355 |

$10,123 |

$9,619 |

$9,127 |

10/31/15 |

$8,854 |

$10,125 |

$9,984 |

$9,818 |

11/30/15 |

$8,701 |

$10,098 |

$9,885 |

$9,650 |

12/31/15 |

$8,363 |

$10,065 |

$9,793 |

$9,500 |

1/31/16 |

$8,014 |

$10,204 |

$9,680 |

$9,151 |

2/29/16 |

$7,985 |

$10,276 |

$9,739 |

$9,198 |

3/31/16 |

$8,422 |

$10,371 |

$10,129 |

$9,850 |

4/30/16 |

$8,591 |

$10,410 |

$10,248 |

$10,043 |

5/31/16 |

$8,641 |

$10,413 |

$10,221 |

$9,988 |

6/30/16 |

$8,561 |

$10,600 |

$10,379 |

$10,118 |

7/31/16 |

$8,793 |

$10,667 |

$10,552 |

$10,390 |

8/31/16 |

$8,810 |

$10,655 |

$10,540 |

$10,379 |

9/30/16 |

$8,879 |

$10,649 |

$10,582 |

$10,468 |

10/31/16 |

$8,810 |

$10,567 |

$10,408 |

$10,203 |

11/30/16 |

$8,957 |

$10,317 |

$10,272 |

$10,178 |

12/31/16 |

$9,163 |

$10,332 |

$10,419 |

$10,455 |

1/31/17 |

$9,303 |

$10,352 |

$10,514 |

$10,624 |

2/28/17 |

$9,372 |

$10,422 |

$10,707 |

$10,943 |

3/31/17 |

$9,483 |

$10,416 |

$10,774 |

$11,086 |

4/30/17 |

$9,509 |

$10,497 |

$10,857 |

$11,172 |

5/31/17 |

$9,658 |

$10,577 |

$11,042 |

$11,466 |

6/30/17 |

$9,720 |

$10,567 |

$11,032 |

$11,458 |

7/31/17 |

$9,948 |

$10,612 |

$11,165 |

$11,685 |

8/31/17 |

$9,921 |

$10,707 |

$11,246 |

$11,750 |

9/30/17 |

$10,191 |

$10,656 |

$11,331 |

$11,982 |

10/31/17 |

$10,315 |

$10,663 |

$11,376 |

$12,072 |

11/30/17 |

$10,438 |

$10,649 |

$11,465 |

$12,275 |

12/31/17 |

$10,605 |

$10,698 |

$11,562 |

$12,427 |

1/31/18 |

$11,025 |

$10,575 |

$11,754 |

$12,982 |

2/28/18 |

$10,578 |

$10,474 |

$11,424 |

$12,376 |

3/31/18 |

$10,494 |

$10,542 |

$11,368 |

$12,169 |

4/30/18 |

$10,610 |

$10,463 |

$11,341 |

$12,209 |

5/31/18 |

$10,432 |

$10,538 |

$11,299 |

$12,031 |

6/30/18 |

$10,361 |

$10,525 |

$11,272 |

$11,988 |

7/31/18 |

$10,648 |

$10,527 |

$11,495 |

$12,459 |

8/31/18 |

$10,550 |

$10,595 |

$11,530 |

$12,455 |

9/30/18 |

$10,653 |

$10,527 |

$11,564 |

$12,609 |

10/31/18 |

$10,128 |

$10,444 |

$11,237 |

$11,996 |

11/30/18 |

$10,209 |

$10,506 |

$11,400 |

$12,273 |

12/31/18 |

$9,646 |

$10,699 |

$11,166 |

$11,543 |

1/31/19 |

$10,210 |

$10,813 |

$11,566 |

$12,246 |

2/28/19 |

$10,348 |

$10,806 |

$11,713 |

$12,566 |

3/31/19 |

$10,345 |

$11,014 |

$11,878 |

$12,678 |

4/30/19 |

$10,529 |

$11,017 |

$11,987 |

$12,907 |

5/31/19 |

$10,039 |

$11,212 |

$11,806 |

$12,289 |

6/30/19 |

$10,528 |

$11,353 |

$12,264 |

$13,087 |

7/31/19 |

$10,416 |

$11,378 |

$12,226 |

$12,978 |

8/31/19 |

$10,135 |

$11,673 |

$12,279 |

$12,754 |

9/30/19 |

$10,547 |

$11,611 |

$12,457 |

$13,192 |

10/31/19 |

$10,734 |

$11,646 |

$12,667 |

$13,598 |

11/30/19 |

$10,866 |

$11,640 |

$12,745 |

$13,772 |

12/31/19 |

$11,105 |

$11,632 |

$12,985 |

$14,300 |

1/31/20 |

$10,770 |

$11,855 |

$12,905 |

$13,849 |

2/29/20 |

$9,986 |

$12,069 |

$12,477 |

$12,681 |

3/31/20 |

$8,350 |

$11,998 |

$11,674 |

$11,124 |

4/30/20 |

$8,857 |

$12,211 |

$12,243 |

$12,010 |

5/31/20 |

$9,135 |

$12,268 |

$12,357 |

$12,177 |

6/30/20 |

$9,294 |

$12,345 |

$12,468 |

$12,320 |

7/31/20 |

$9,342 |

$12,530 |

$12,778 |

$12,748 |

8/31/20 |

$9,697 |

$12,428 |

$12,900 |

$13,093 |

9/30/20 |

$9,392 |

$12,422 |

$12,742 |

$12,781 |

10/31/20 |

$9,209 |

$12,366 |

$12,527 |

$12,406 |

11/30/20 |

$10,509 |

$12,488 |

$13,361 |

$13,937 |

12/31/20 |

$10,916 |

$12,505 |

$13,663 |

$14,547 |

1/31/21 |

$11,093 |

$12,415 |

$13,565 |

$14,444 |

2/28/21 |

$11,711 |

$12,236 |

$13,572 |

$14,667 |

3/31/21 |

$12,177 |

$12,083 |

$13,837 |

$15,422 |

4/30/21 |

$12,324 |

$12,178 |

$14,043 |

$15,759 |

5/31/21 |

$12,679 |

$12,218 |

$14,251 |

$16,171 |

6/30/21 |

$12,630 |

$12,304 |

$14,232 |

$16,019 |

7/31/21 |

$12,501 |

$12,442 |

$14,339 |

$16,081 |

8/31/21 |

$12,560 |

$12,418 |

$14,420 |

$16,293 |

9/30/21 |

$12,444 |

$12,310 |

$14,058 |

$15,615 |

10/31/21 |

$12,554 |

$12,307 |

$14,199 |

$15,932 |

11/30/21 |

$12,394 |

$12,343 |

$14,023 |

$15,491 |

12/31/21 |

$12,890 |

$12,312 |

$14,518 |

$16,625 |

1/31/22 |

$12,798 |

$12,047 |

$14,323 |

$16,536 |

2/28/22 |

$12,605 |

$11,912 |

$14,122 |

$16,257 |

3/31/22 |

$12,670 |

$11,581 |

$14,003 |

$16,435 |

4/30/22 |

$12,231 |

$11,142 |

$13,467 |

$15,800 |

5/31/22 |

$12,405 |

$11,214 |

$13,594 |

$15,996 |

6/30/22 |

$11,599 |

$11,038 |

$13,010 |

$14,873 |

7/31/22 |

$11,958 |

$11,307 |

$13,313 |

$15,202 |

8/31/22 |

$11,651 |

$10,988 |

$12,879 |

$14,639 |

9/30/22 |

$10,984 |

$10,513 |

$12,102 |

$13,505 |

10/31/22 |

$11,428 |

$10,377 |

$12,423 |

$14,397 |

11/30/22 |

$12,152 |

$10,759 |

$13,176 |

$15,612 |

12/31/22 |

$12,051 |

$10,710 |

$13,047 |

$15,379 |

1/31/23 |

$12,501 |

$11,040 |

$13,449 |

$15,852 |

2/28/23 |

$12,126 |

$10,754 |

$13,053 |

$15,328 |

3/31/23 |

$12,298 |

$11,027 |

$13,358 |

$15,656 |

4/30/23 |

$12,417 |

$11,094 |

$13,542 |

$15,992 |

5/31/23 |

$12,147 |

$10,973 |

$13,151 |

$15,243 |

6/30/23 |

$12,582 |

$10,934 |

$13,432 |

$15,948 |

7/31/23 |

$12,865 |

$10,927 |

$13,683 |

$16,555 |

8/31/23 |

$12,669 |

$10,857 |

$13,462 |

$16,127 |

9/30/23 |

$12,401 |

$10,581 |

$13,118 |

$15,713 |

10/31/23 |

$12,192 |

$10,414 |

$12,767 |

$15,121 |

11/30/23 |

$12,929 |

$10,886 |

$13,472 |

$16,105 |

12/31/23 |

$13,467 |

$11,302 |

$14,026 |

$16,812 |

1/31/24 |

$13,501 |

$11,271 |

$14,019 |

$16,842 |

2/29/24 |

$13,624 |

$11,112 |

$13,989 |

$17,008 |

3/31/24 |

$14,030 |

$11,215 |

$14,322 |

$17,653 |

4/30/24 |

$13,656 |

$10,931 |

$13,948 |

$17,183 |

5/31/24 |

$14,087 |

$11,117 |

$14,246 |

$17,627 |

6/30/24 |

$14,099 |

$11,222 |

$14,257 |

$17,488 |

7/31/24 |

$14,511 |

$11,484 |

$14,725 |

$18,226 |

8/31/24 |

$14,866 |

$11,649 |

$15,073 |

$18,828 |

9/30/24 |

$15,083 |

$11,805 |

$15,315 |

$19,179 |

10/31/24 |

$14,783 |

$11,512 |

$14,901 |

$18,617 |

11/30/24 |

$15,036 |

$11,634 |

$15,061 |

$18,822 |

12/31/24 |

$14,680 |

$11,444 |

$14,629 |

$18,050 |

1/31/25 |

$14,974 |

$11,504 |

$14,880 |

$18,572 |

2/28/25 |

$15,386 |

$11,757 |

$15,244 |

$19,073 |

3/31/25 |

$15,474 |

$11,762 |

$15,264 |

$19,116 |

4/30/25 |

$15,498 |

$11,808 |

$15,252 |

$19,012 |

5/31/25 |

$15,748 |

$11,723 |

$15,377 |

$19,459 |

6/30/25 |

$16,140 |

$11,904 |

$15,655 |

$19,864 |

|

|

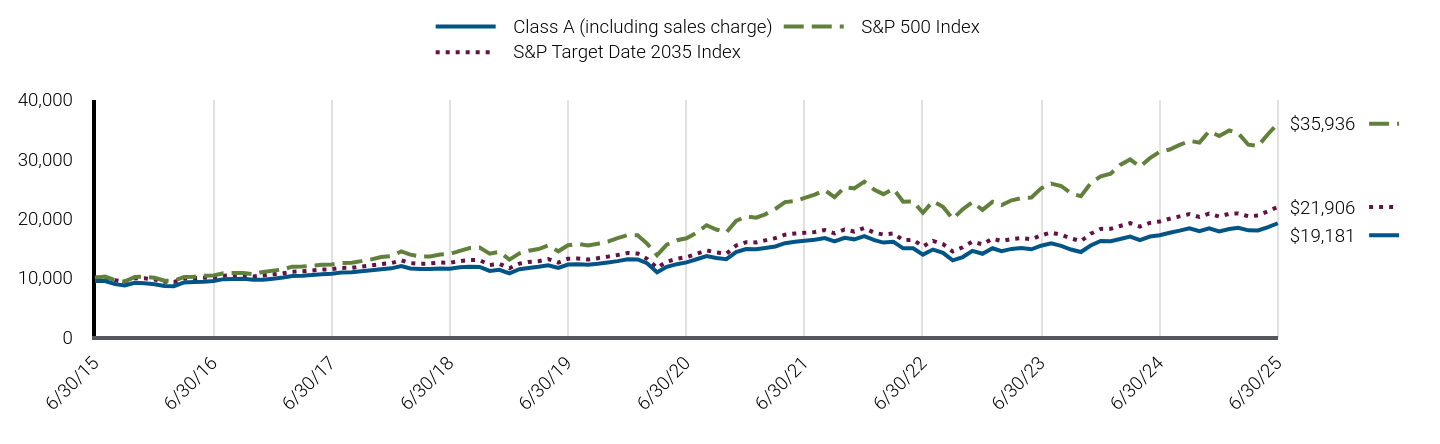

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Class A (excluding sales charge) |

14.47% |

11.67% |

5.50% |

Class A (including sales charge) |

8.15% |

10.42% |

4.90% |

Bloomberg U.S. Aggregate Index |

6.08% |

(0.73%) |

1.76% |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

9.81% |

4.66% |

4.58% |

MSCI ACWI High Dividend Yield Net USD |

13.58% |

10.02% |

7.10% | |

|

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

|

| AssetsNet |

$ 197,166,000

|

|

| Holdings Count | Holding |

1,206

|

|

| Advisory Fees Paid, Amount |

$ 795,000

|

|

| InvestmentCompanyPortfolioTurnover |

436.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$197,166 |

# of Portfolio Holdings |

1,206 |

Portfolio Turnover Rate |

436% |

Total Net Advisory Fees Paid During the Reporting Period |

$795 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

|

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Common Stocks |

45.9% |

U.S. Government Agencies |

28.0% |

Asset-Backed Securities |

14.1% |

Non-Agency Mortgage-Backed Securities |

10.5% |

U.S. Treasury Obligations |

10.5% |

Corporate Bonds & Notes |

5.4% |

Real Estate Investment Trusts |

5.0% |

Sovereign Issues |

3.5% |

Loan Participations and Assignments |

0.6% |

Preferred Stocks |

0.4% |

Other Investments |

0.2% |

Short-Term Instruments |

0.5% |

Affiliated Investments |

2.3% |

Financial Derivative Instruments |

(0.2%) |

Other Assets and Liabilities, Net |

(26.7%) |

Total |

100.0% |

| Footnote |

Description |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626). Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest. |

|

| Material Fund Change Expenses [Text Block] |

Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626).

|

|

| C000106729 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

PIMCO Dividend and Income Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

PQICX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO Dividend and Income Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025 (the "reporting period").

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Website |

www.pimco.com/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$216 |

2.02% | |

|

| Expenses Paid, Amount |

$ 216

|

|

| Expense Ratio, Percent |

2.02%

|

|

| Factors Affecting Performance [Text Block] |

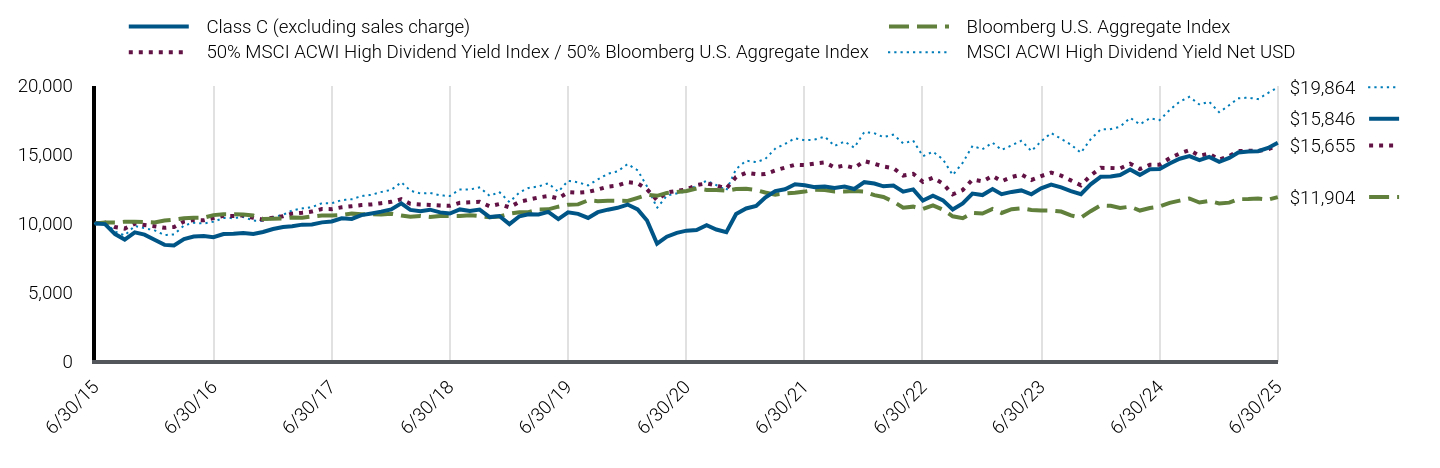

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Long exposure to U.S. equities contributed to performance, as U.S. equities had positive returns during the reporting period. Exposure to the cash interest rate in the U.S. contributed to performance, as the currency outperformed the relevant yield differentials during the reporting period. Long exposure to eurozone equities contributed to performance, as eurozone equities had positive returns during the reporting period. Long exposure to agency mortgage-backed securities, particularly 30-year fixed rate securities, detracted from performance, as U.S. 30-year Treasury yields rose during the reporting period. Long exposure to Taiwanese equities detracted from performance, as Taiwanese equities had negative returns during the reporting period. U.K. duration and curve positioning, particularly long exposure to the 12-year and 15-year portions of the curve over most of the reporting period, detracted from performance, as these interest rates rose during the reporting period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

|

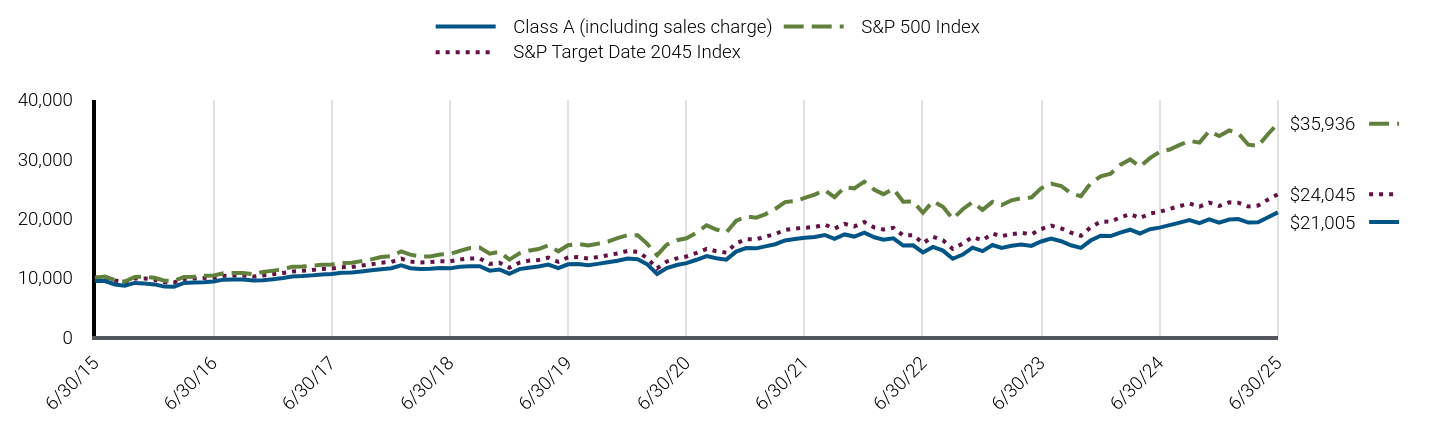

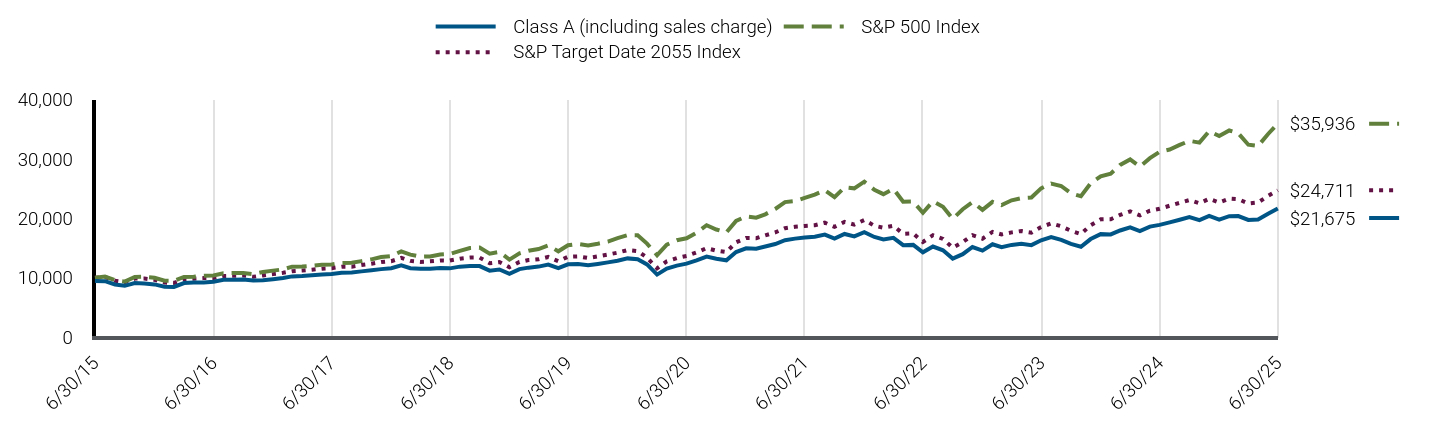

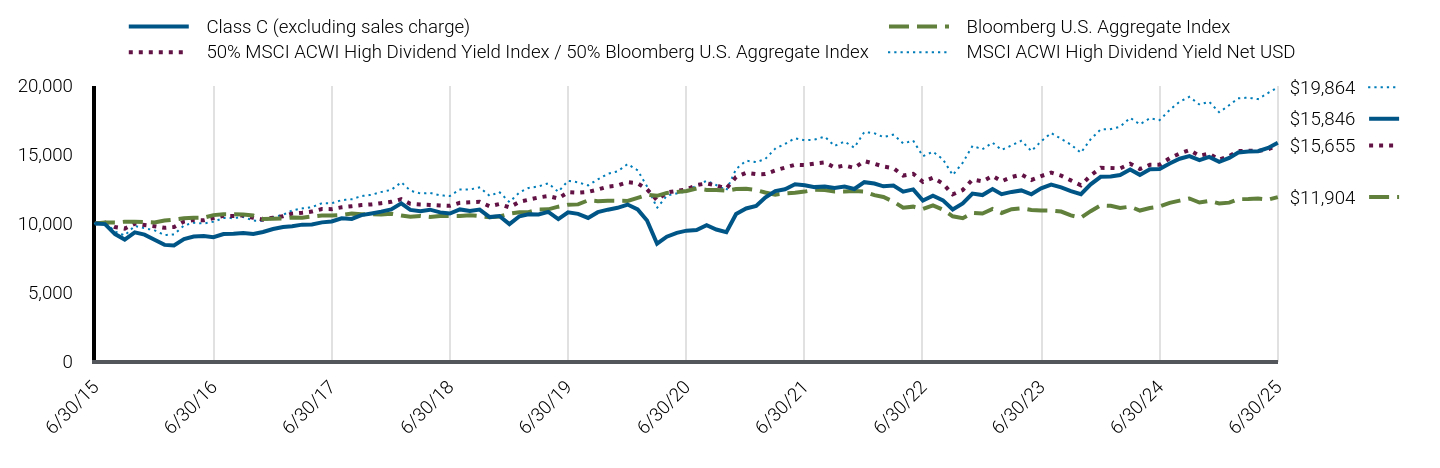

| Line Graph [Table Text Block] |

|

Class C (excluding sales charge) |

Bloomberg U.S. Aggregate Index |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

MSCI ACWI High Dividend Yield Net USD |

6/30/15 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

7/31/15 |

$9,946 |

$10,070 |

$10,068 |

$10,066 |

8/31/15 |

$9,226 |

$10,055 |

$9,732 |

$9,409 |

9/30/15 |

$8,824 |

$10,123 |

$9,619 |

$9,127 |

10/31/15 |

$9,346 |

$10,125 |

$9,984 |

$9,818 |

11/30/15 |

$9,187 |

$10,098 |

$9,885 |

$9,650 |

12/31/15 |

$8,815 |

$10,065 |

$9,793 |

$9,500 |

1/31/16 |

$8,440 |

$10,204 |

$9,680 |

$9,151 |

2/29/16 |

$8,405 |

$10,276 |

$9,739 |

$9,198 |

3/31/16 |

$8,860 |

$10,371 |

$10,129 |

$9,850 |

4/30/16 |

$9,041 |

$10,410 |

$10,248 |

$10,043 |

5/31/16 |

$9,080 |

$10,413 |

$10,221 |

$9,988 |

6/30/16 |

$8,993 |

$10,600 |

$10,379 |

$10,118 |

7/31/16 |

$9,228 |

$10,667 |

$10,552 |

$10,390 |

8/31/16 |

$9,247 |

$10,655 |

$10,540 |

$10,379 |

9/30/16 |

$9,310 |

$10,649 |

$10,582 |

$10,468 |

10/31/16 |

$9,238 |

$10,567 |

$10,408 |

$10,203 |

11/30/16 |

$9,373 |

$10,317 |

$10,272 |

$10,178 |

12/31/16 |

$9,589 |

$10,332 |

$10,419 |

$10,455 |

1/31/17 |

$9,735 |

$10,352 |

$10,514 |

$10,624 |

2/28/17 |

$9,799 |

$10,422 |

$10,707 |

$10,943 |

3/31/17 |

$9,909 |

$10,416 |

$10,774 |

$11,086 |

4/30/17 |

$9,927 |

$10,497 |

$10,857 |

$11,172 |

5/31/17 |

$10,074 |

$10,577 |

$11,042 |

$11,466 |

6/30/17 |

$10,135 |

$10,567 |

$11,032 |

$11,458 |

7/31/17 |

$10,364 |

$10,612 |

$11,165 |

$11,685 |

8/31/17 |

$10,327 |

$10,707 |

$11,246 |

$11,750 |

9/30/17 |

$10,602 |

$10,656 |

$11,331 |

$11,982 |

10/31/17 |

$10,722 |

$10,663 |

$11,376 |

$12,072 |

11/30/17 |

$10,851 |

$10,649 |

$11,465 |

$12,275 |

12/31/17 |

$11,012 |

$10,698 |

$11,562 |

$12,427 |

1/31/18 |

$11,449 |

$10,575 |

$11,754 |

$12,982 |

2/28/18 |

$10,975 |

$10,474 |

$11,424 |

$12,376 |

3/31/18 |

$10,882 |

$10,542 |

$11,368 |

$12,169 |

4/30/18 |

$10,993 |

$10,463 |

$11,341 |

$12,209 |

5/31/18 |

$10,798 |

$10,538 |

$11,299 |

$12,031 |

6/30/18 |

$10,715 |

$10,525 |

$11,272 |

$11,988 |

7/31/18 |

$11,014 |

$10,527 |

$11,495 |

$12,459 |

8/31/18 |

$10,902 |

$10,595 |

$11,530 |

$12,455 |

9/30/18 |

$11,002 |

$10,527 |

$11,564 |

$12,609 |

10/31/18 |

$10,458 |

$10,444 |

$11,237 |

$11,996 |

11/30/18 |

$10,533 |

$10,506 |

$11,400 |

$12,273 |

12/31/18 |

$9,943 |

$10,699 |

$11,166 |

$11,543 |

1/31/19 |

$10,516 |

$10,813 |

$11,566 |

$12,246 |

2/28/19 |

$10,660 |

$10,806 |

$11,713 |

$12,566 |

3/31/19 |

$10,641 |

$11,014 |

$11,878 |

$12,678 |

4/30/19 |

$10,832 |

$11,017 |

$11,987 |

$12,907 |

5/31/19 |

$10,316 |

$11,212 |

$11,806 |

$12,289 |

6/30/19 |

$10,808 |

$11,353 |

$12,264 |

$13,087 |

7/31/19 |

$10,693 |

$11,378 |

$12,226 |

$12,978 |

8/31/19 |

$10,397 |

$11,673 |

$12,279 |

$12,754 |

9/30/19 |

$10,812 |

$11,611 |

$12,457 |

$13,192 |

10/31/19 |

$10,995 |

$11,646 |

$12,667 |

$13,598 |

11/30/19 |

$11,129 |

$11,640 |

$12,745 |

$13,772 |

12/31/19 |

$11,367 |

$11,632 |

$12,985 |

$14,300 |

1/31/20 |

$11,015 |

$11,855 |

$12,905 |

$13,849 |

2/29/20 |

$10,205 |

$12,069 |

$12,477 |

$12,681 |

3/31/20 |

$8,525 |

$11,998 |

$11,674 |

$11,124 |

4/30/20 |

$9,033 |

$12,211 |

$12,243 |

$12,010 |

5/31/20 |

$9,316 |

$12,268 |

$12,357 |

$12,177 |

6/30/20 |

$9,472 |

$12,345 |

$12,468 |

$12,320 |

7/31/20 |

$9,521 |

$12,530 |

$12,778 |

$12,748 |

8/31/20 |

$9,863 |

$12,428 |

$12,900 |

$13,093 |

9/30/20 |

$9,556 |

$12,422 |

$12,742 |

$12,781 |

10/31/20 |

$9,361 |

$12,366 |

$12,527 |

$12,406 |

11/30/20 |

$10,682 |

$12,488 |

$13,361 |

$13,937 |

12/31/20 |

$11,082 |

$12,505 |

$13,663 |

$14,547 |

1/31/21 |

$11,261 |

$12,415 |

$13,565 |

$14,444 |

2/28/21 |

$11,879 |

$12,236 |

$13,572 |

$14,667 |

3/31/21 |

$12,337 |

$12,083 |

$13,837 |

$15,422 |

4/30/21 |

$12,477 |

$12,178 |

$14,043 |

$15,759 |

5/31/21 |

$12,836 |

$12,218 |

$14,251 |

$16,171 |

6/30/21 |

$12,771 |

$12,304 |

$14,232 |

$16,019 |

7/31/21 |

$12,630 |

$12,442 |

$14,339 |

$16,081 |

8/31/21 |

$12,680 |

$12,418 |

$14,420 |

$16,293 |

9/30/21 |

$12,566 |

$12,310 |

$14,058 |

$15,615 |

10/31/21 |

$12,667 |

$12,307 |

$14,199 |

$15,932 |

11/30/21 |

$12,495 |

$12,343 |

$14,023 |

$15,491 |

12/31/21 |

$12,987 |

$12,312 |

$14,518 |

$16,625 |

1/31/22 |

$12,894 |

$12,047 |

$14,323 |

$16,536 |

2/28/22 |

$12,689 |

$11,912 |

$14,122 |

$16,257 |

3/31/22 |

$12,741 |

$11,581 |

$14,003 |

$16,435 |

4/30/22 |

$12,299 |

$11,142 |

$13,467 |

$15,800 |

5/31/22 |

$12,464 |

$11,214 |

$13,594 |

$15,996 |

6/30/22 |

$11,651 |

$11,038 |

$13,010 |

$14,873 |

7/31/22 |

$12,001 |

$11,307 |

$13,313 |

$15,202 |

8/31/22 |

$11,672 |

$10,988 |

$12,879 |

$14,639 |

9/30/22 |

$11,008 |

$10,513 |

$12,102 |

$13,505 |

10/31/22 |

$11,444 |

$10,377 |

$12,423 |

$14,397 |

11/30/22 |

$12,160 |

$10,759 |

$13,176 |

$15,612 |

12/31/22 |

$12,052 |

$10,710 |

$13,047 |

$15,379 |

1/31/23 |

$12,493 |

$11,040 |

$13,449 |

$15,852 |

2/28/23 |

$12,117 |

$10,754 |

$13,053 |

$15,328 |

3/31/23 |

$12,282 |

$11,027 |

$13,358 |

$15,656 |

4/30/23 |

$12,390 |

$11,094 |

$13,542 |

$15,992 |

5/31/23 |

$12,109 |

$10,973 |

$13,151 |

$15,243 |

6/30/23 |

$12,540 |

$10,934 |

$13,432 |

$15,948 |

7/31/23 |

$12,812 |

$10,927 |

$13,683 |

$16,555 |

8/31/23 |

$12,606 |

$10,857 |

$13,462 |

$16,127 |

9/30/23 |

$12,332 |

$10,581 |

$13,118 |

$15,713 |

10/31/23 |

$12,112 |

$10,414 |

$12,767 |

$15,121 |

11/30/23 |

$12,836 |

$10,886 |

$13,472 |

$16,105 |

12/31/23 |

$13,375 |

$11,302 |

$14,026 |

$16,812 |

1/31/24 |

$13,397 |

$11,271 |

$14,019 |

$16,842 |

2/29/24 |

$13,509 |

$11,112 |

$13,989 |

$17,008 |

3/31/24 |

$13,900 |

$11,215 |

$14,322 |

$17,653 |

4/30/24 |

$13,518 |

$10,931 |

$13,948 |

$17,183 |

5/31/24 |

$13,933 |

$11,117 |

$14,246 |

$17,627 |

6/30/24 |

$13,939 |

$11,222 |

$14,257 |

$17,488 |

7/31/24 |

$14,347 |

$11,484 |

$14,725 |

$18,226 |

8/31/24 |

$14,687 |

$11,649 |

$15,073 |

$18,828 |

9/30/24 |

$14,879 |

$11,805 |

$15,315 |

$19,179 |

10/31/24 |

$14,583 |

$11,512 |

$14,901 |

$18,617 |

11/30/24 |

$14,822 |

$11,634 |

$15,061 |

$18,822 |

12/31/24 |

$14,460 |

$11,444 |

$14,629 |

$18,050 |

1/31/25 |

$14,751 |

$11,504 |

$14,880 |

$18,572 |

2/28/25 |

$15,145 |

$11,757 |

$15,244 |

$19,073 |

3/31/25 |

$15,219 |

$11,762 |

$15,264 |

$19,116 |

4/30/25 |

$15,231 |

$11,808 |

$15,252 |

$19,012 |

5/31/25 |

$15,465 |

$11,723 |

$15,377 |

$19,459 |

6/30/25 |

$15,846 |

$11,904 |

$15,655 |

$19,864 |

|

|

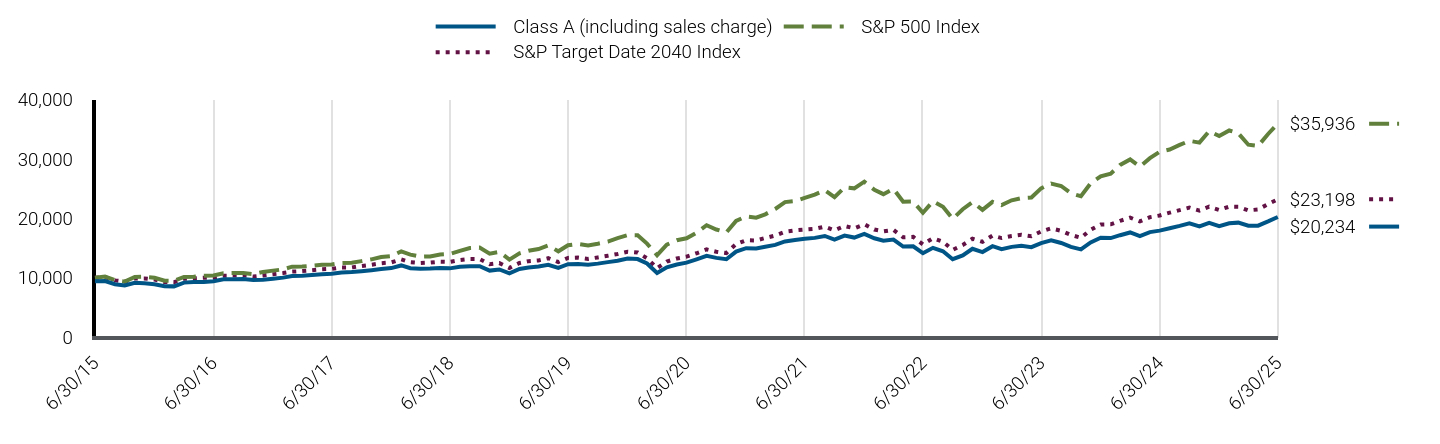

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Class C (excluding sales charge) |

13.68% |

10.84% |

4.71% |

Class C (including sales charge) |

12.68% |

10.84% |

4.71% |

Bloomberg U.S. Aggregate Index |

6.08% |

(0.73%) |

1.76% |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

9.81% |

4.66% |

4.58% |

MSCI ACWI High Dividend Yield Net USD |

13.58% |

10.02% |

7.10% | |

|

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

|

| AssetsNet |

$ 197,166,000

|

|

| Holdings Count | Holding |

1,206

|

|

| Advisory Fees Paid, Amount |

$ 795,000

|

|

| InvestmentCompanyPortfolioTurnover |

436.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$197,166 |

# of Portfolio Holdings |

1,206 |

Portfolio Turnover Rate |

436% |

Total Net Advisory Fees Paid During the Reporting Period |

$795 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

|

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Common Stocks |

45.9% |

U.S. Government Agencies |

28.0% |

Asset-Backed Securities |

14.1% |

Non-Agency Mortgage-Backed Securities |

10.5% |

U.S. Treasury Obligations |

10.5% |

Corporate Bonds & Notes |

5.4% |

Real Estate Investment Trusts |

5.0% |

Sovereign Issues |

3.5% |

Loan Participations and Assignments |

0.6% |

Preferred Stocks |

0.4% |

Other Investments |

0.2% |

Short-Term Instruments |

0.5% |

Affiliated Investments |

2.3% |

Financial Derivative Instruments |

(0.2%) |

Other Assets and Liabilities, Net |

(26.7%) |

Total |

100.0% |

| Footnote |

Description |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626). Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest. |

|

| Material Fund Change Expenses [Text Block] |

Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626).

|

|

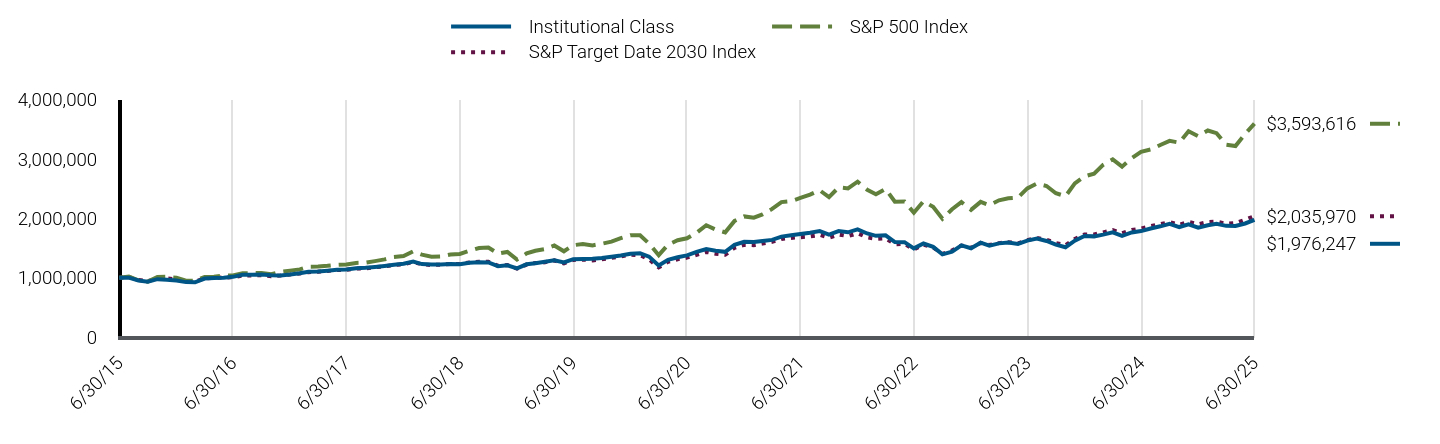

| C000106724 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

PIMCO Dividend and Income Fund

|

|

| Class Name |

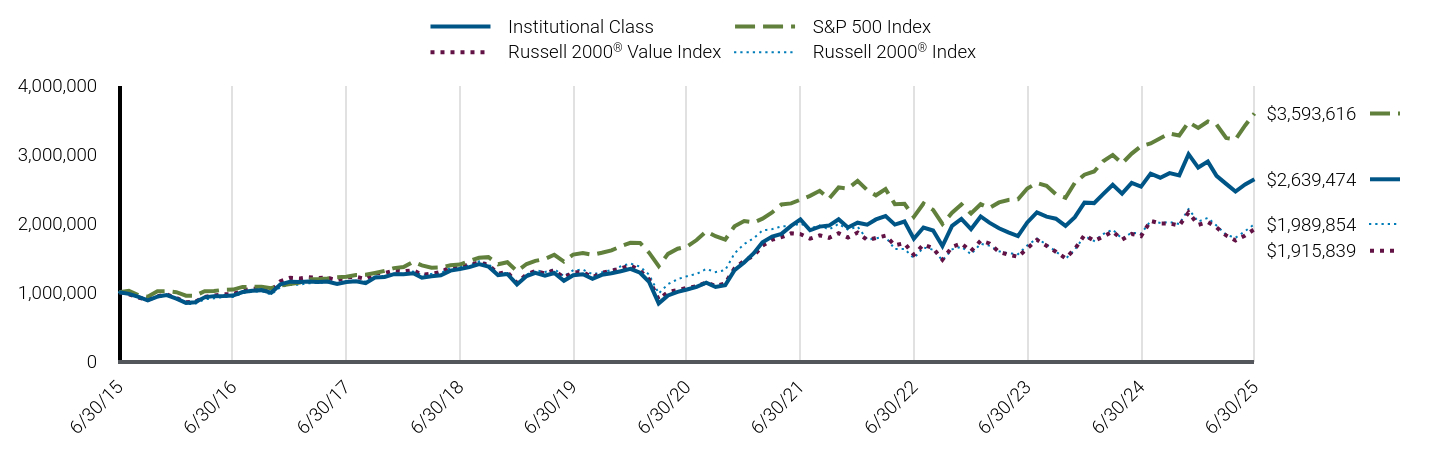

Institutional Class

|

|

| Trading Symbol |

PQIIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO Dividend and Income Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025 (the "reporting period").

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Website |

www.pimco.com/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Institutional Class |

$99 |

0.92% | |

|

| Expenses Paid, Amount |

$ 99

|

|

| Expense Ratio, Percent |

0.92%

|

|

| Factors Affecting Performance [Text Block] |

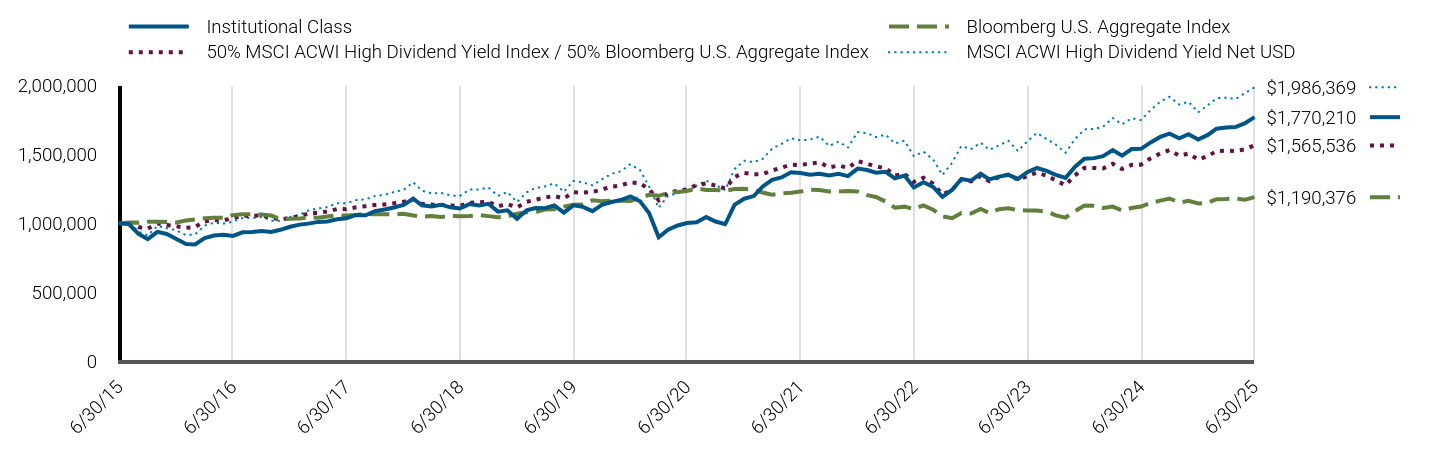

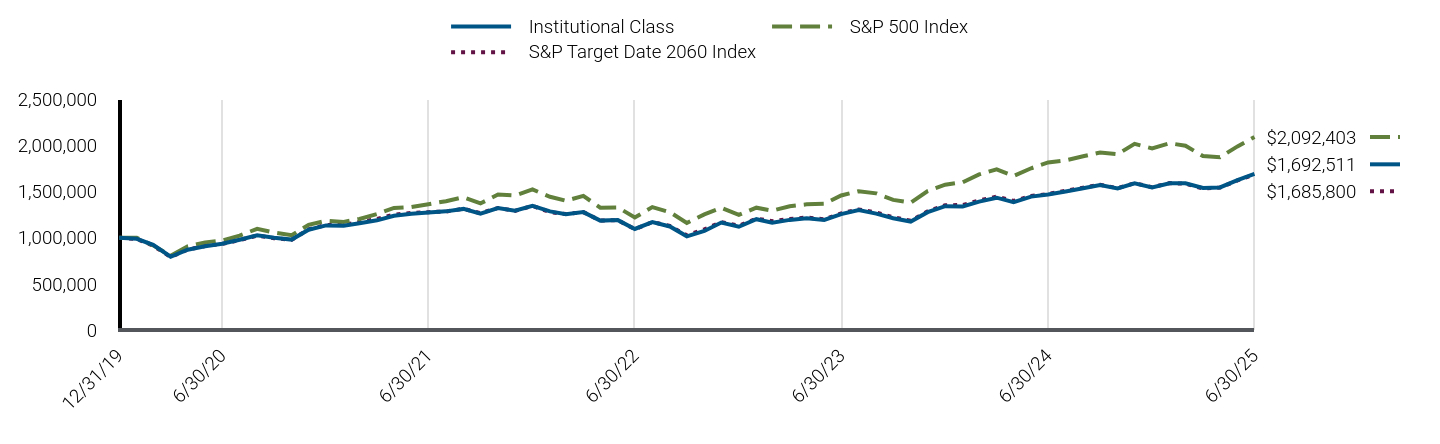

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Long exposure to U.S. equities contributed to performance, as U.S. equities had positive returns during the reporting period. Exposure to the cash interest rate in the U.S. contributed to performance, as the currency outperformed the relevant yield differentials during the reporting period. Long exposure to eurozone equities contributed to performance, as eurozone equities had positive returns during the reporting period. Long exposure to agency mortgage-backed securities, particularly 30-year fixed rate securities, detracted from performance, as U.S. 30-year Treasury yields rose during the reporting period. Long exposure to Taiwanese equities detracted from performance, as Taiwanese equities had negative returns during the reporting period. U.K. duration and curve positioning, particularly long exposure to the 12-year and 15-year portions of the curve over most of the reporting period, detracted from performance, as these interest rates rose during the reporting period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

|

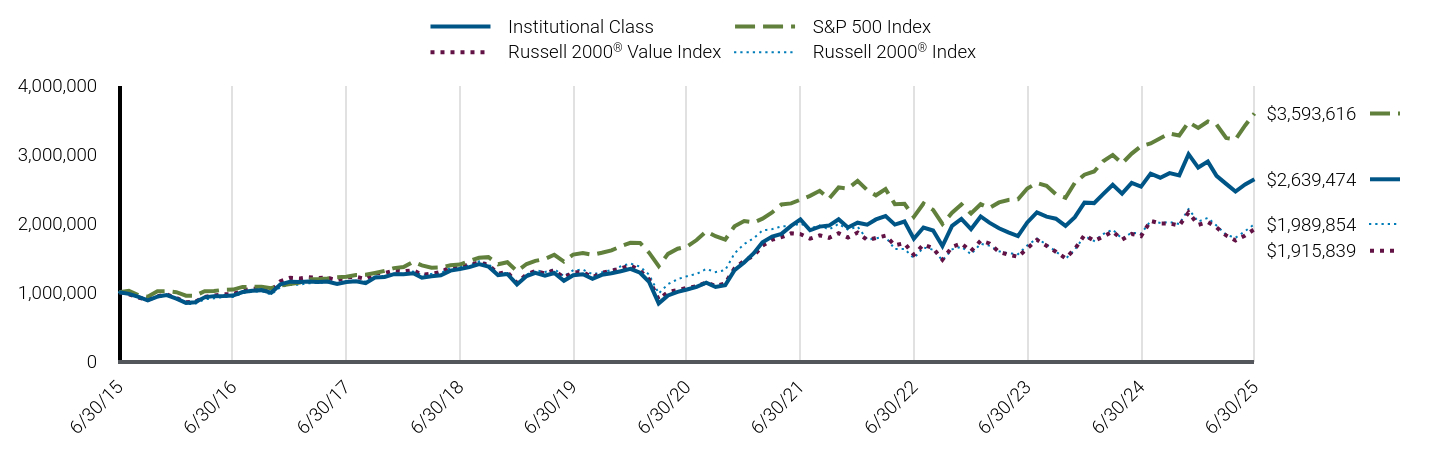

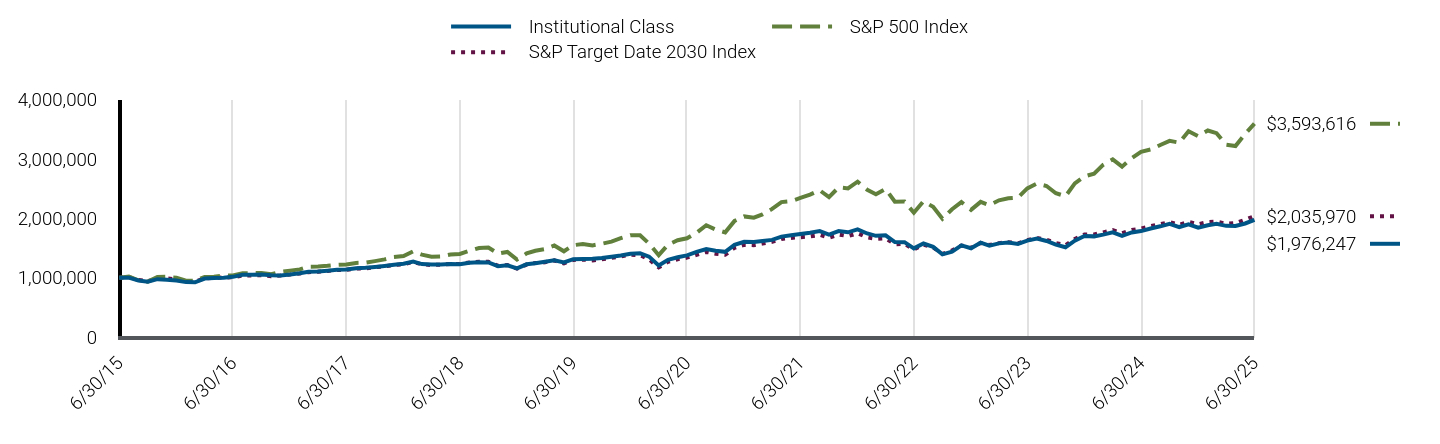

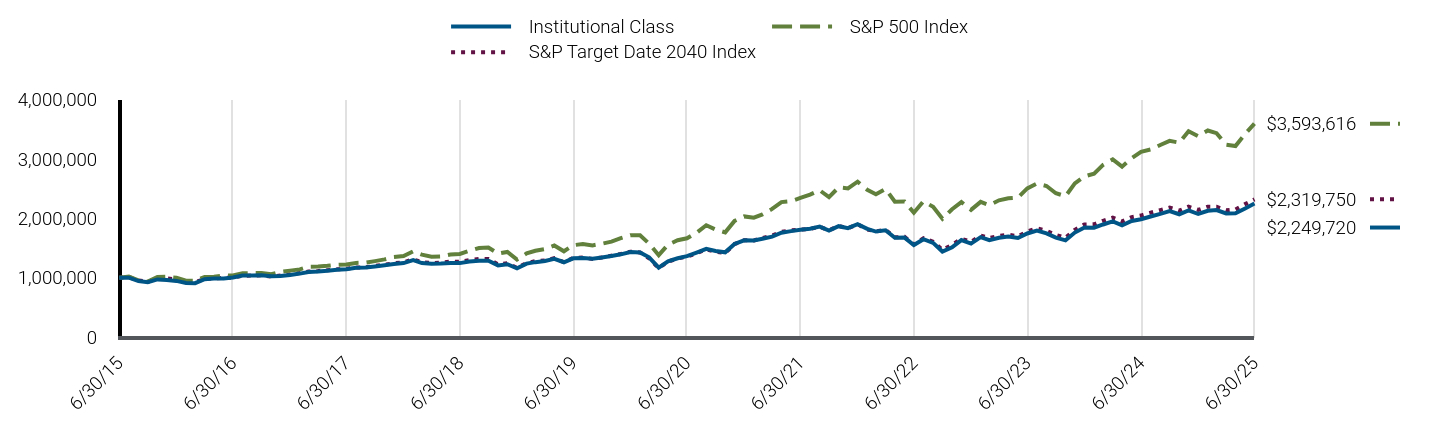

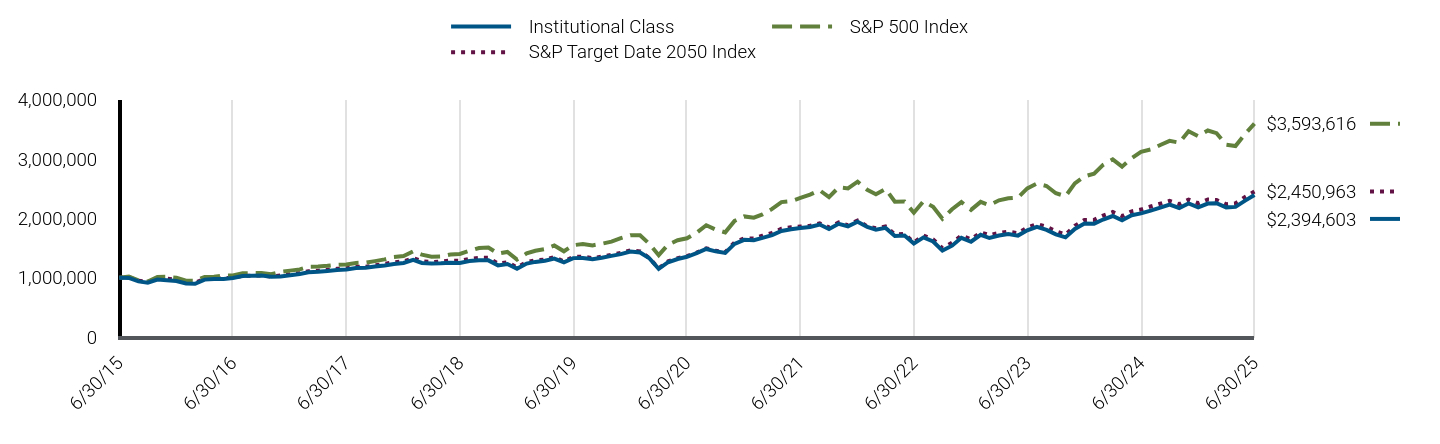

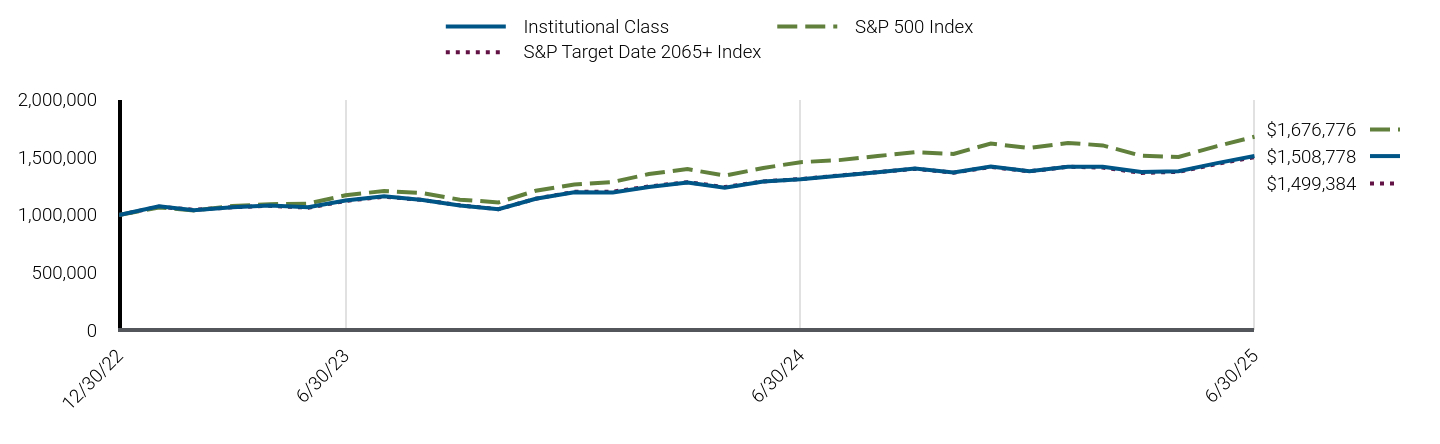

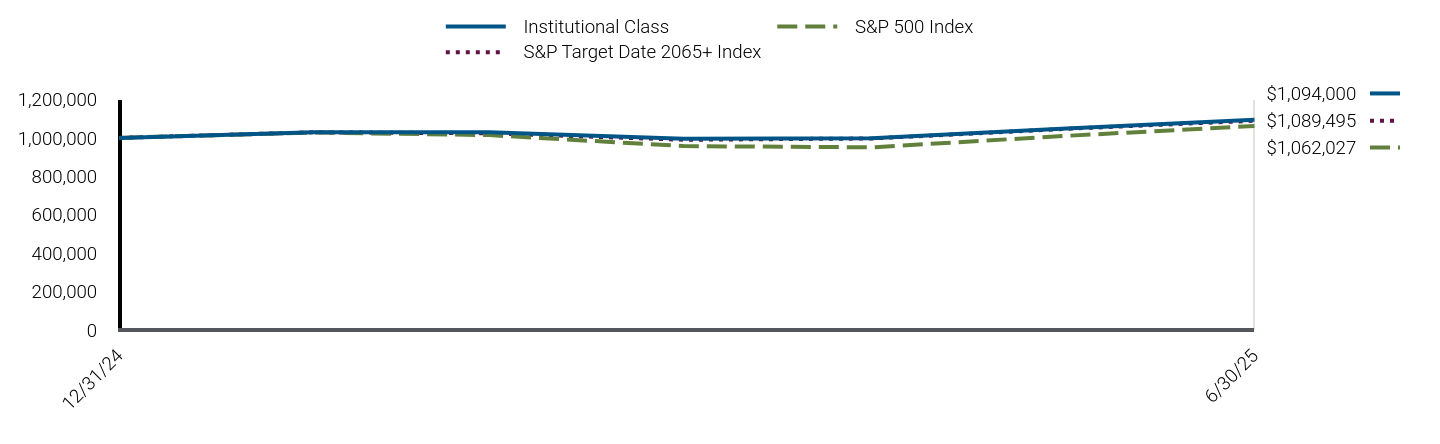

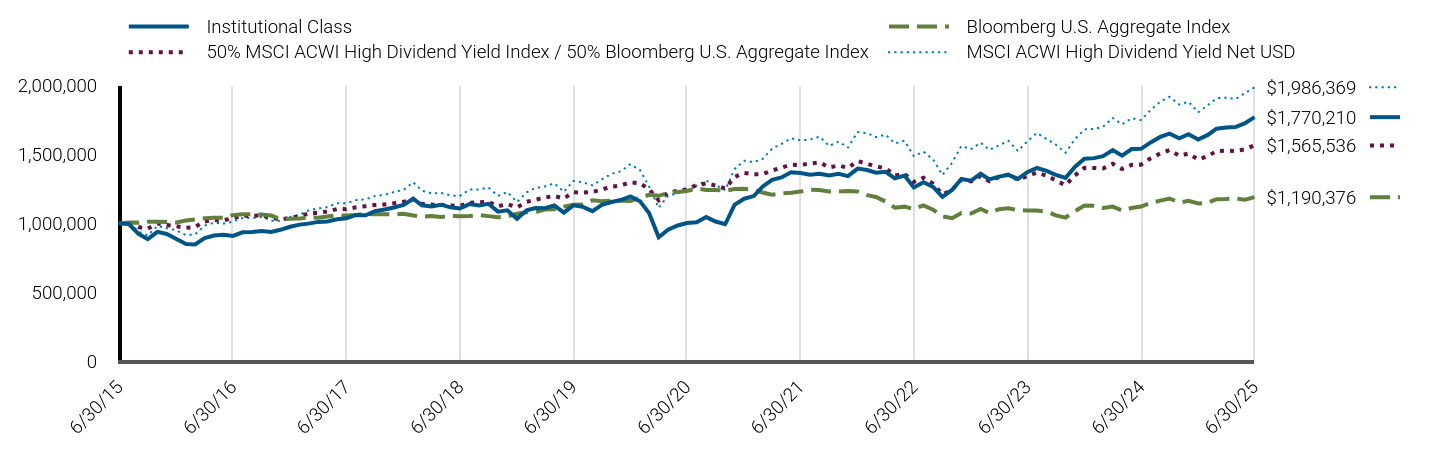

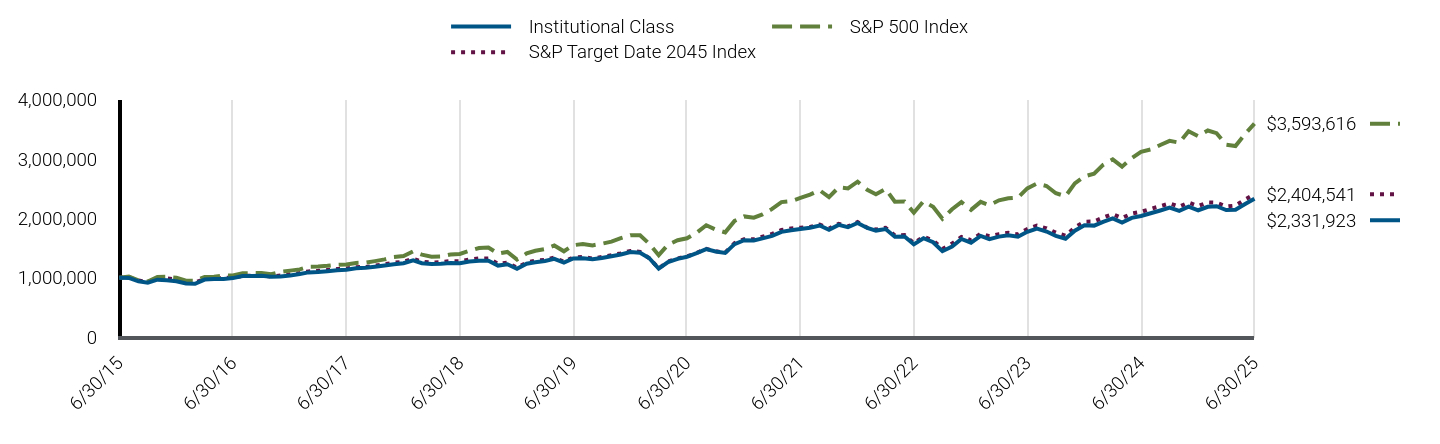

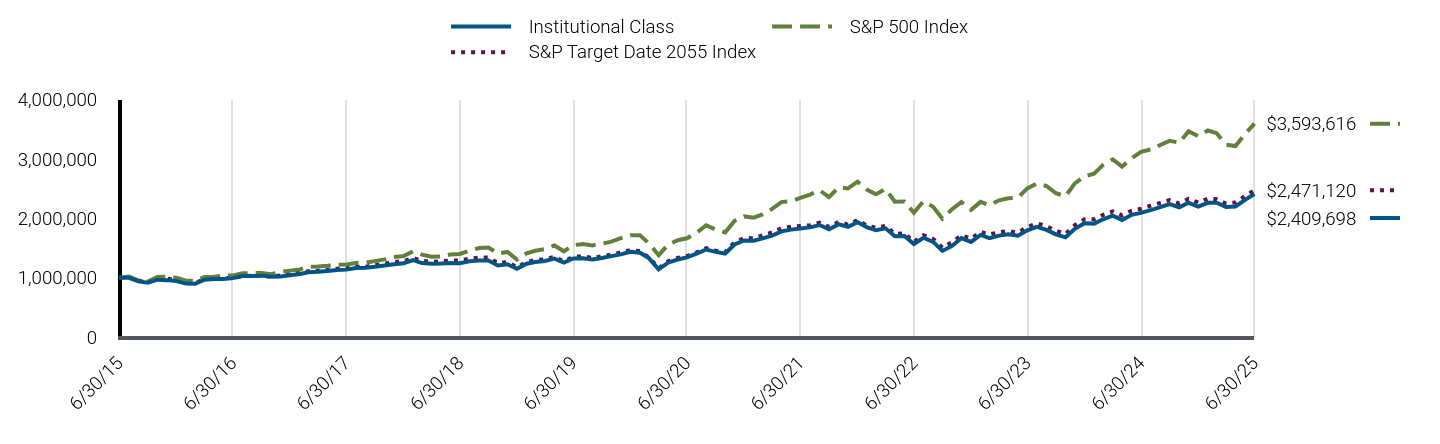

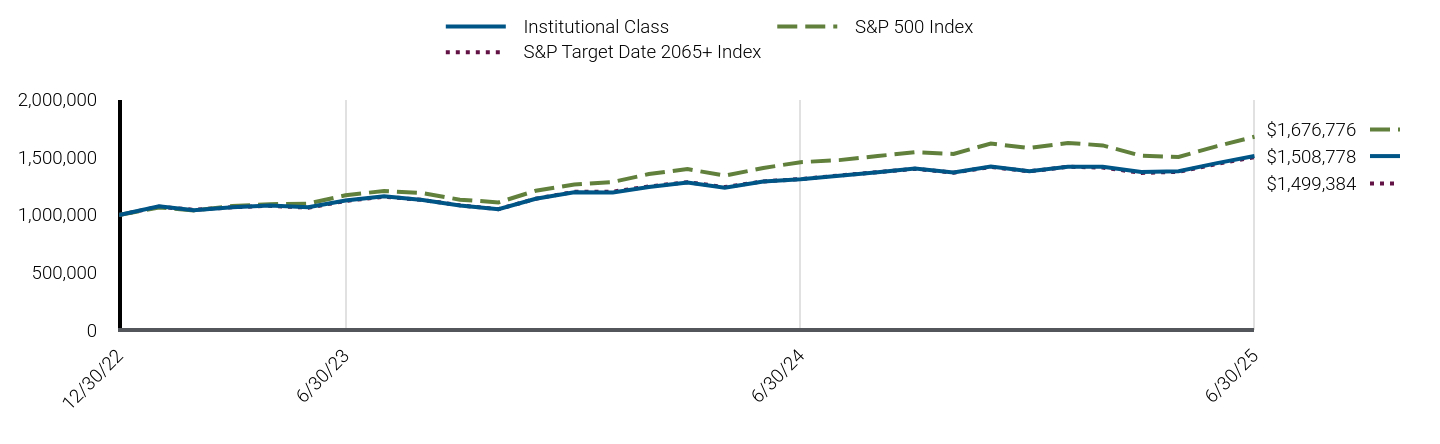

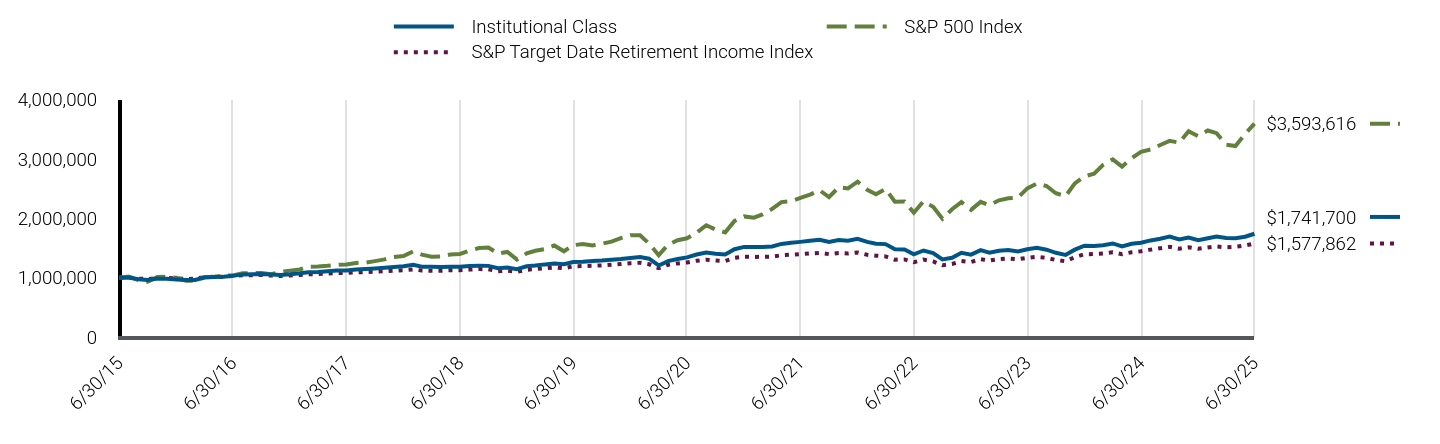

| Line Graph [Table Text Block] |

|

Institutional Class |

Bloomberg U.S. Aggregate Index |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

MSCI ACWI High Dividend Yield Net USD |

6/30/15 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

7/31/15 |

$995,563 |

$1,006,951 |

$1,006,756 |

$1,006,560 |

8/31/15 |

$924,555 |

$1,005,505 |

$973,220 |

$940,946 |

9/30/15 |

$885,357 |

$1,012,307 |

$961,886 |

$912,666 |

10/31/15 |

$938,492 |

$1,012,475 |

$998,417 |

$981,834 |

11/30/15 |

$923,313 |

$1,009,800 |

$988,542 |

$965,008 |

12/31/15 |

$886,717 |

$1,006,537 |

$979,282 |

$950,046 |

1/31/16 |

$850,232 |

$1,020,388 |

$967,982 |

$915,050 |

2/29/16 |

$847,442 |

$1,027,626 |

$973,918 |

$919,779 |

3/31/16 |

$894,003 |

$1,037,055 |

$1,012,903 |

$984,979 |

4/30/16 |

$912,210 |

$1,041,035 |

$1,024,786 |

$1,004,307 |

5/31/16 |

$917,835 |

$1,041,302 |

$1,022,103 |

$998,791 |

6/30/16 |

$909,432 |

$1,060,012 |

$1,037,940 |

$1,011,797 |

7/31/16 |

$935,050 |

$1,066,714 |

$1,055,160 |

$1,038,972 |

8/31/16 |

$937,794 |

$1,065,494 |

$1,054,028 |

$1,037,929 |

9/30/16 |

$945,114 |

$1,064,870 |

$1,058,216 |

$1,046,788 |

10/31/16 |

$937,794 |

$1,056,725 |

$1,040,767 |

$1,020,275 |

11/30/16 |

$953,348 |

$1,031,729 |

$1,027,191 |

$1,017,787 |

12/31/16 |

$975,165 |

$1,033,185 |

$1,041,903 |

$1,045,508 |

1/31/17 |

$990,923 |

$1,035,212 |

$1,051,350 |

$1,062,415 |

2/28/17 |

$998,339 |

$1,042,169 |

$1,070,681 |

$1,094,344 |

3/31/17 |

$1,010,781 |

$1,041,623 |

$1,077,362 |

$1,108,577 |

4/30/17 |

$1,013,573 |

$1,049,661 |

$1,085,718 |

$1,117,216 |

5/31/17 |

$1,030,326 |

$1,057,741 |

$1,104,155 |

$1,146,564 |

6/30/17 |

$1,036,875 |

$1,056,676 |

$1,103,235 |

$1,145,802 |

7/31/17 |

$1,061,184 |

$1,061,223 |

$1,116,522 |

$1,168,470 |

8/31/17 |

$1,058,379 |

$1,070,742 |

$1,124,623 |

$1,174,951 |

9/30/17 |

$1,087,874 |

$1,065,642 |

$1,133,078 |

$1,198,211 |

10/31/17 |

$1,101,049 |

$1,066,260 |

$1,137,634 |

$1,207,152 |

11/30/17 |

$1,115,165 |

$1,064,891 |

$1,146,489 |

$1,227,496 |

12/31/17 |

$1,133,147 |

$1,069,778 |

$1,156,225 |

$1,242,710 |

1/31/18 |

$1,178,931 |

$1,057,458 |

$1,175,376 |

$1,298,189 |

2/28/18 |

$1,131,239 |

$1,047,434 |

$1,142,360 |

$1,237,560 |

3/31/18 |

$1,122,201 |

$1,054,151 |

$1,136,830 |

$1,216,945 |

4/30/18 |

$1,135,561 |

$1,046,311 |

$1,134,138 |

$1,220,932 |

5/31/18 |

$1,116,476 |

$1,053,778 |

$1,129,880 |

$1,203,055 |

6/30/18 |

$1,108,268 |

$1,052,482 |

$1,127,177 |

$1,198,777 |

7/31/18 |

$1,139,960 |

$1,052,732 |

$1,149,455 |

$1,245,878 |

8/31/18 |

$1,130,356 |

$1,059,506 |

$1,152,973 |

$1,245,486 |

9/30/18 |

$1,142,141 |

$1,052,683 |

$1,156,412 |

$1,260,938 |

10/31/18 |

$1,085,034 |

$1,044,365 |

$1,123,736 |

$1,199,641 |

11/30/18 |

$1,094,713 |

$1,050,599 |

$1,140,038 |

$1,227,289 |

12/31/18 |

$1,033,612 |

$1,069,900 |

$1,116,592 |

$1,154,260 |

1/31/19 |

$1,094,936 |

$1,081,262 |

$1,156,565 |

$1,224,644 |

2/28/19 |

$1,110,761 |

$1,080,635 |

$1,171,330 |

$1,256,622 |

3/31/19 |

$1,110,551 |

$1,101,385 |

$1,187,806 |

$1,267,845 |

4/30/19 |

$1,130,347 |

$1,101,667 |

$1,198,661 |

$1,290,693 |

5/31/19 |

$1,077,888 |

$1,121,224 |

$1,180,598 |

$1,228,880 |

6/30/19 |

$1,131,074 |

$1,135,304 |

$1,226,369 |

$1,308,737 |

7/31/19 |

$1,120,034 |

$1,137,801 |

$1,222,612 |

$1,297,838 |

8/31/19 |

$1,088,922 |

$1,167,284 |

$1,227,876 |

$1,275,382 |

9/30/19 |

$1,133,796 |

$1,161,067 |

$1,245,704 |

$1,319,209 |

10/31/19 |

$1,154,979 |

$1,164,564 |

$1,266,740 |

$1,359,791 |

11/30/19 |

$1,169,102 |

$1,163,971 |

$1,274,513 |

$1,377,174 |

12/31/19 |

$1,195,094 |

$1,163,160 |

$1,298,511 |

$1,429,995 |

1/31/20 |

$1,160,096 |

$1,185,544 |

$1,290,545 |

$1,384,930 |

2/29/20 |

$1,075,688 |

$1,206,882 |

$1,247,728 |

$1,268,105 |

3/31/20 |

$899,158 |

$1,199,780 |

$1,167,435 |

$1,112,361 |

4/30/20 |

$953,809 |

$1,221,108 |

$1,224,345 |

$1,201,037 |

5/31/20 |

$984,743 |

$1,226,793 |

$1,235,699 |

$1,217,722 |

6/30/20 |

$1,002,337 |

$1,234,521 |

$1,246,843 |

$1,232,011 |

7/31/20 |

$1,007,498 |

$1,252,961 |

$1,277,812 |

$1,274,812 |

8/31/20 |

$1,045,693 |

$1,242,847 |

$1,289,953 |

$1,309,329 |

9/30/20 |

$1,013,483 |

$1,242,166 |

$1,274,227 |

$1,278,120 |

10/31/20 |

$993,774 |

$1,236,619 |

$1,252,692 |

$1,240,627 |

11/30/20 |

$1,134,852 |

$1,248,753 |

$1,336,144 |

$1,393,750 |

12/31/20 |

$1,178,906 |

$1,250,474 |

$1,366,301 |

$1,454,745 |

1/31/21 |

$1,197,972 |

$1,241,508 |

$1,356,549 |

$1,444,409 |

2/28/21 |

$1,265,762 |

$1,223,580 |

$1,357,202 |

$1,466,654 |

3/31/21 |

$1,315,733 |

$1,208,302 |

$1,383,703 |

$1,542,248 |

4/30/21 |

$1,332,737 |

$1,217,847 |

$1,404,288 |

$1,575,950 |

5/31/21 |

$1,370,998 |

$1,221,826 |

$1,425,086 |

$1,617,053 |

6/30/21 |

$1,365,869 |

$1,230,411 |

$1,423,230 |

$1,601,907 |

7/31/21 |

$1,352,984 |

$1,244,168 |

$1,433,918 |

$1,608,052 |

8/31/21 |

$1,359,427 |

$1,241,799 |

$1,442,021 |

$1,629,291 |

9/30/21 |

$1,347,714 |

$1,231,048 |

$1,405,783 |

$1,561,513 |

10/31/21 |

$1,359,602 |

$1,230,708 |

$1,419,856 |

$1,593,209 |

11/30/21 |

$1,342,310 |

$1,234,349 |

$1,402,324 |

$1,549,147 |

12/31/21 |

$1,397,195 |

$1,231,191 |

$1,451,814 |

$1,662,451 |

1/31/22 |

$1,387,270 |

$1,204,666 |

$1,432,318 |

$1,653,619 |

2/28/22 |

$1,367,420 |

$1,191,226 |

$1,412,238 |

$1,625,703 |

3/31/22 |

$1,374,093 |

$1,158,132 |

$1,400,342 |

$1,643,484 |

4/30/22 |

$1,326,634 |

$1,114,183 |

$1,346,722 |

$1,579,989 |

5/31/22 |

$1,346,501 |

$1,121,367 |

$1,359,430 |

$1,599,623 |

6/30/22 |

$1,259,923 |

$1,103,775 |

$1,301,036 |

$1,487,293 |

7/31/22 |

$1,298,775 |

$1,130,745 |

$1,331,344 |

$1,520,246 |

8/31/22 |

$1,264,363 |

$1,098,794 |

$1,287,873 |

$1,463,920 |

9/30/22 |

$1,192,789 |

$1,051,319 |

$1,210,174 |

$1,350,534 |

10/31/22 |

$1,242,114 |

$1,037,702 |

$1,242,306 |

$1,439,745 |

11/30/22 |

$1,321,708 |

$1,075,864 |

$1,317,567 |

$1,561,241 |

12/31/22 |

$1,309,907 |

$1,071,012 |

$1,304,734 |

$1,537,870 |

1/31/23 |

$1,359,975 |

$1,103,960 |

$1,344,873 |

$1,585,179 |

2/28/23 |

$1,319,222 |

$1,075,417 |

$1,305,280 |

$1,532,829 |

3/31/23 |

$1,338,952 |

$1,102,735 |

$1,335,820 |

$1,565,624 |

4/30/23 |

$1,351,871 |

$1,109,418 |

$1,354,178 |

$1,599,163 |

5/31/23 |

$1,322,508 |

$1,097,338 |

$1,315,098 |

$1,524,278 |

6/30/23 |

$1,370,870 |

$1,093,425 |

$1,343,169 |

$1,594,789 |

7/31/23 |

$1,401,676 |

$1,092,662 |

$1,368,278 |

$1,655,521 |

8/31/23 |

$1,380,349 |

$1,085,683 |

$1,346,202 |

$1,612,674 |

9/30/23 |

$1,351,979 |

$1,058,094 |

$1,311,818 |

$1,571,279 |

10/31/23 |

$1,329,247 |

$1,041,396 |

$1,276,746 |

$1,512,057 |

11/30/23 |

$1,409,408 |

$1,088,557 |

$1,347,234 |

$1,610,542 |

12/31/23 |

$1,469,458 |

$1,130,226 |

$1,402,588 |

$1,681,236 |

1/31/24 |

$1,473,119 |

$1,127,122 |

$1,401,886 |

$1,684,171 |

2/29/24 |

$1,487,765 |

$1,111,198 |

$1,398,903 |

$1,700,797 |

3/31/24 |

$1,531,852 |

$1,121,459 |

$1,432,159 |

$1,765,258 |

4/30/24 |

$1,491,150 |

$1,093,132 |

$1,394,754 |

$1,718,320 |

5/31/24 |

$1,539,252 |

$1,111,664 |

$1,424,578 |

$1,762,674 |

6/30/24 |

$1,540,644 |

$1,122,189 |

$1,425,721 |

$1,748,810 |

7/31/24 |

$1,586,801 |

$1,148,400 |

$1,472,460 |

$1,822,622 |

8/31/24 |

$1,626,721 |

$1,164,902 |

$1,507,335 |

$1,882,774 |

9/30/24 |

$1,650,257 |

$1,180,499 |

$1,531,483 |

$1,917,888 |

10/31/24 |

$1,617,529 |

$1,151,224 |

$1,490,064 |

$1,861,710 |

11/30/24 |

$1,646,481 |

$1,163,396 |

$1,506,142 |

$1,882,206 |

12/31/24 |

$1,607,999 |

$1,144,356 |

$1,462,936 |

$1,805,019 |

1/31/25 |

$1,641,419 |

$1,150,427 |

$1,487,973 |

$1,857,228 |

2/28/25 |

$1,686,407 |

$1,175,739 |

$1,524,416 |

$1,907,340 |

3/31/25 |

$1,695,986 |

$1,176,181 |

$1,526,418 |

$1,911,627 |

4/30/25 |

$1,698,583 |

$1,180,804 |

$1,525,243 |

$1,901,176 |

5/31/25 |

$1,727,152 |

$1,172,349 |

$1,537,743 |

$1,945,946 |

6/30/25 |

$1,770,210 |

$1,190,376 |

$1,565,536 |

$1,986,369 |

|

|

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Institutional Class |

14.90% |

12.05% |

5.88% |

Bloomberg U.S. Aggregate Index |

6.08% |

(0.73%) |

1.76% |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

9.81% |

4.66% |

4.58% |

MSCI ACWI High Dividend Yield Net USD |

13.58% |

10.02% |

7.10% | |

|

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

|

| AssetsNet |

$ 197,166,000

|

|

| Holdings Count | Holding |

1,206

|

|

| Advisory Fees Paid, Amount |

$ 795,000

|

|

| InvestmentCompanyPortfolioTurnover |

436.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$197,166 |

# of Portfolio Holdings |

1,206 |

Portfolio Turnover Rate |

436% |

Total Net Advisory Fees Paid During the Reporting Period |

$795 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

|

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Common Stocks |

45.9% |

U.S. Government Agencies |

28.0% |

Asset-Backed Securities |

14.1% |

Non-Agency Mortgage-Backed Securities |

10.5% |

U.S. Treasury Obligations |

10.5% |

Corporate Bonds & Notes |

5.4% |

Real Estate Investment Trusts |

5.0% |

Sovereign Issues |

3.5% |

Loan Participations and Assignments |

0.6% |

Preferred Stocks |

0.4% |

Other Investments |

0.2% |

Short-Term Instruments |

0.5% |

Affiliated Investments |

2.3% |

Financial Derivative Instruments |

(0.2%) |

Other Assets and Liabilities, Net |

(26.7%) |

Total |

100.0% |

| Footnote |

Description |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626). Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest. |

|

| Material Fund Change Expenses [Text Block] |

Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626).

|

|

| C000106725 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

PIMCO Dividend and Income Fund

|

|

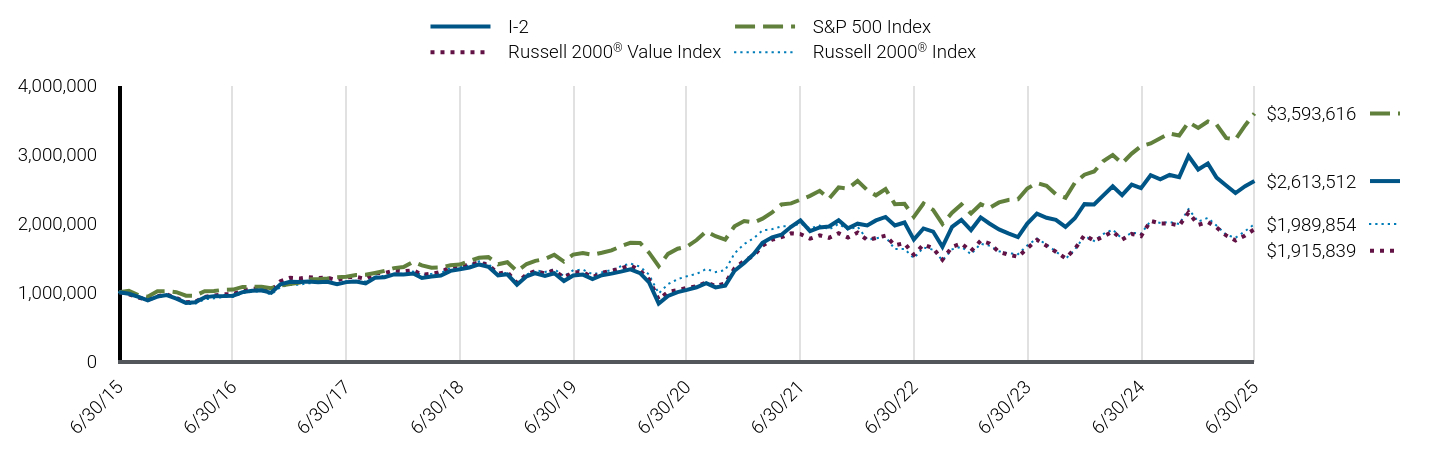

| Class Name |

I-2

|

|

| Trading Symbol |

PQIPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO Dividend and Income Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025 (the "reporting period").

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Website |

www.pimco.com/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

I-2 |

$110 |

1.02% | |

|

| Expenses Paid, Amount |

$ 110

|

|

| Expense Ratio, Percent |

1.02%

|

|

| Factors Affecting Performance [Text Block] |

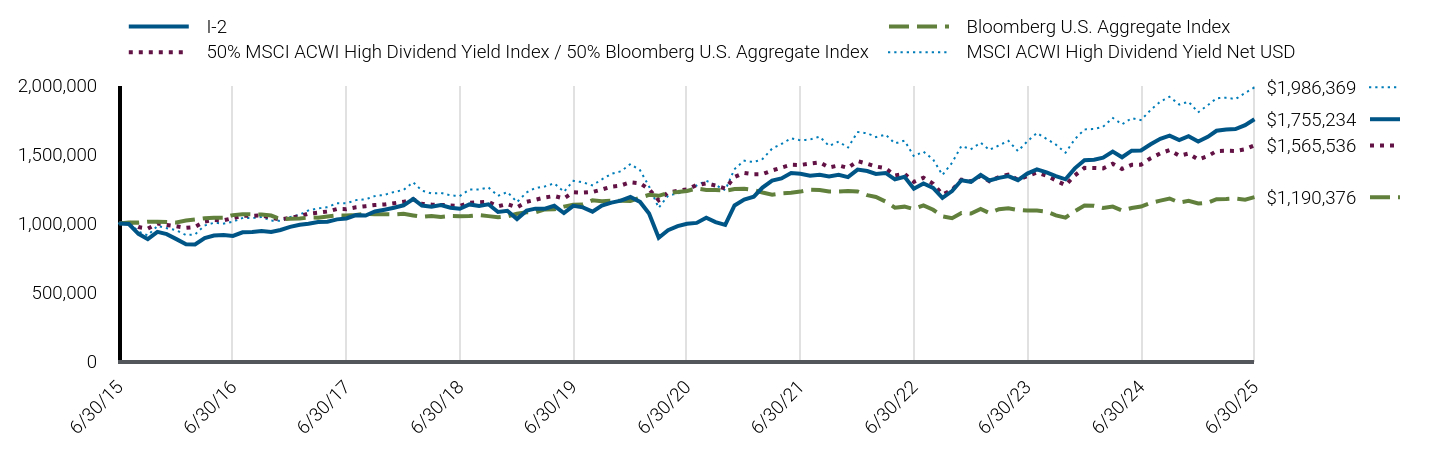

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Long exposure to U.S. equities contributed to performance, as U.S. equities had positive returns during the reporting period. Exposure to the cash interest rate in the U.S. contributed to performance, as the currency outperformed the relevant yield differentials during the reporting period. Long exposure to eurozone equities contributed to performance, as eurozone equities had positive returns during the reporting period. Long exposure to agency mortgage-backed securities, particularly 30-year fixed rate securities, detracted from performance, as U.S. 30-year Treasury yields rose during the reporting period. Long exposure to Taiwanese equities detracted from performance, as Taiwanese equities had negative returns during the reporting period. U.K. duration and curve positioning, particularly long exposure to the 12-year and 15-year portions of the curve over most of the reporting period, detracted from performance, as these interest rates rose during the reporting period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

|

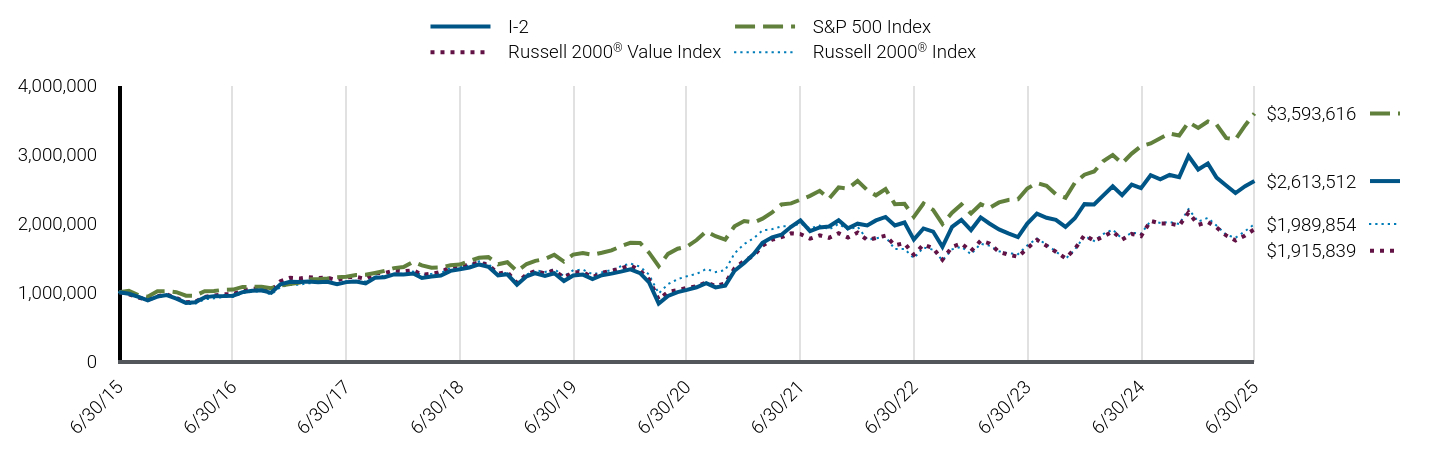

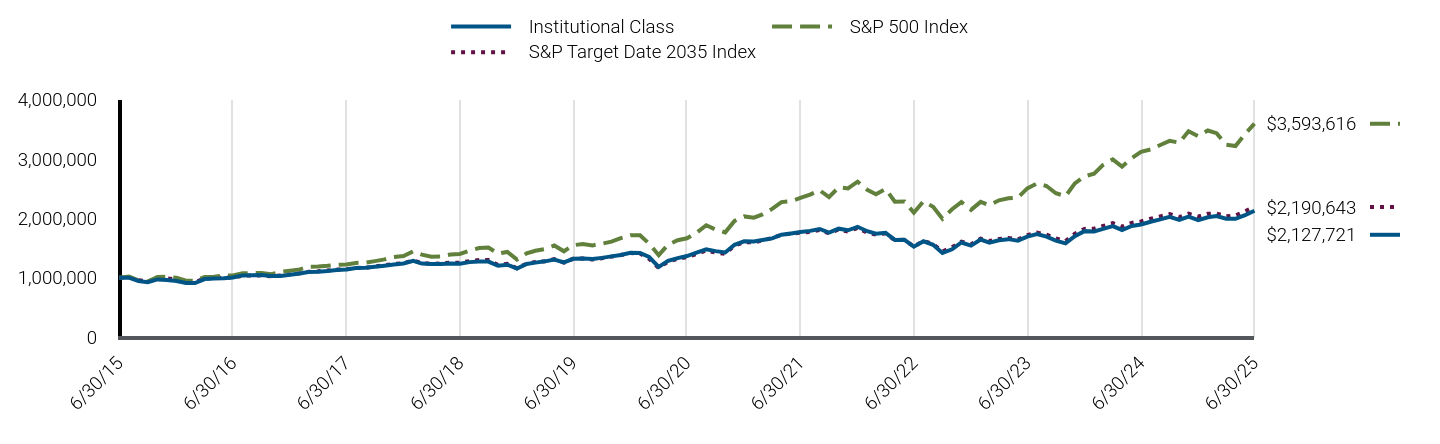

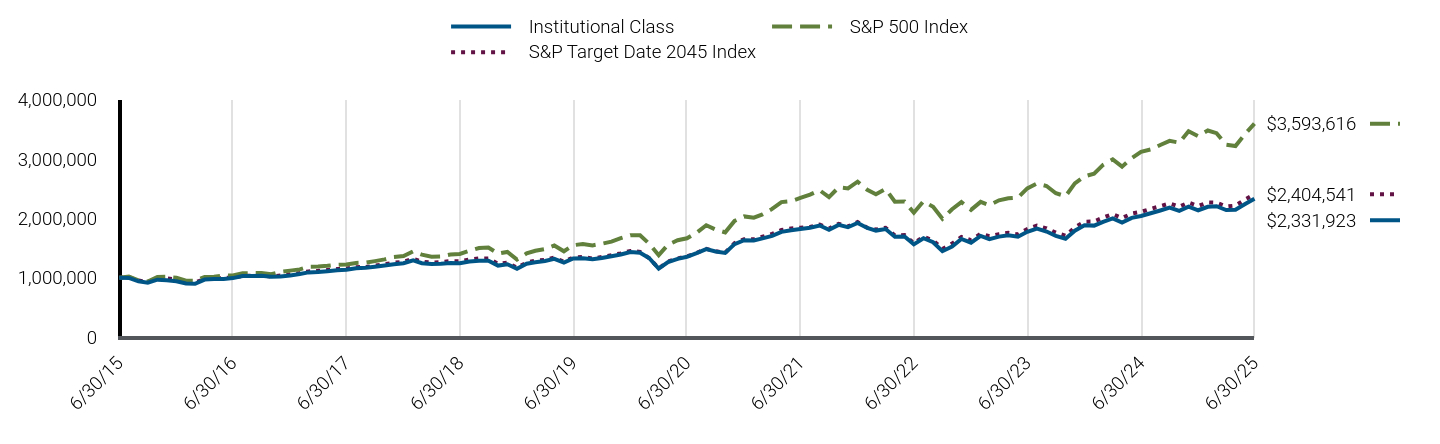

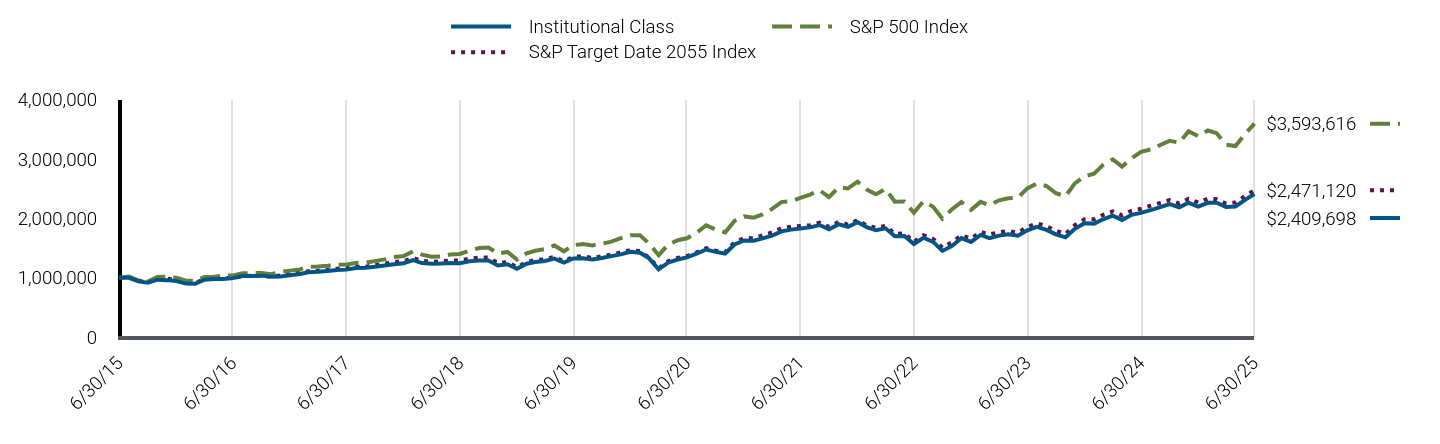

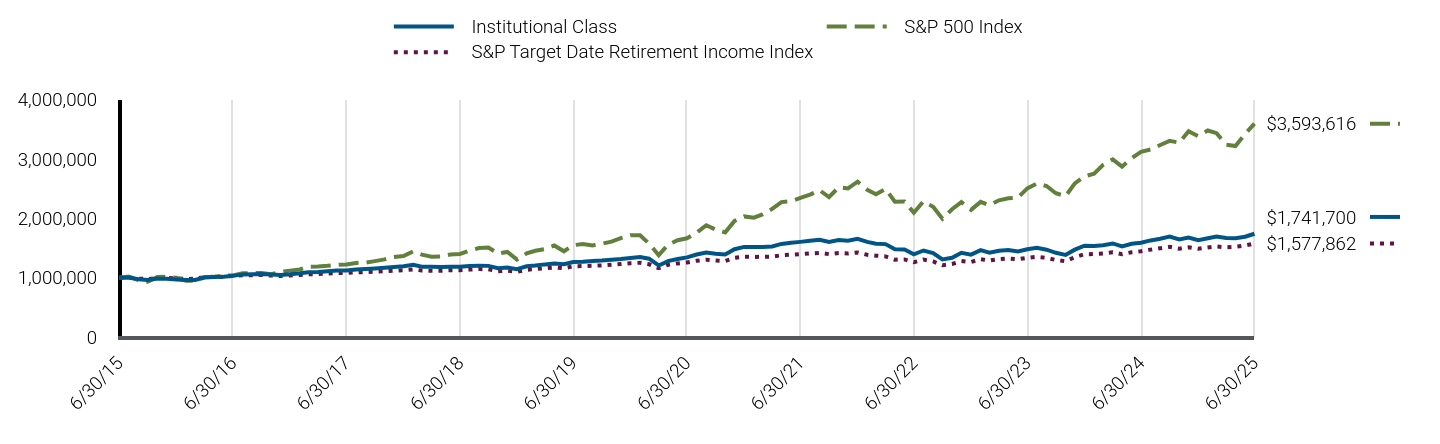

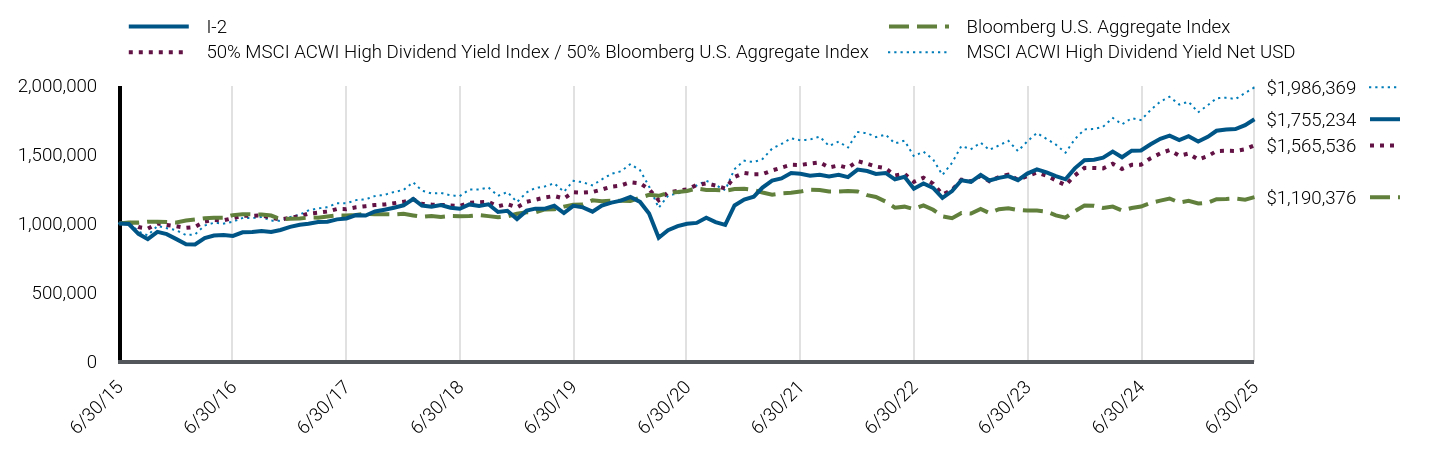

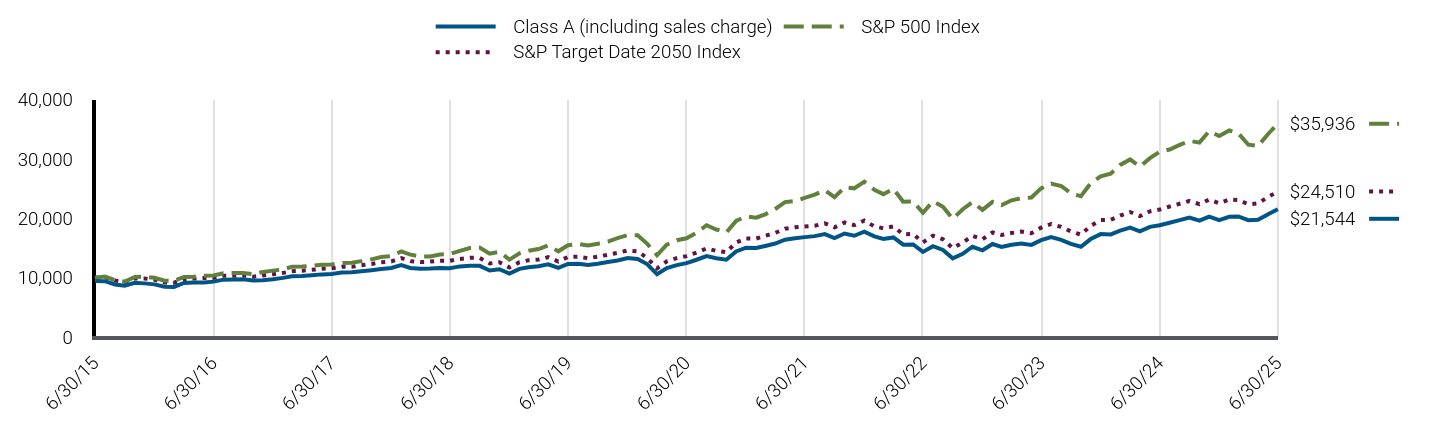

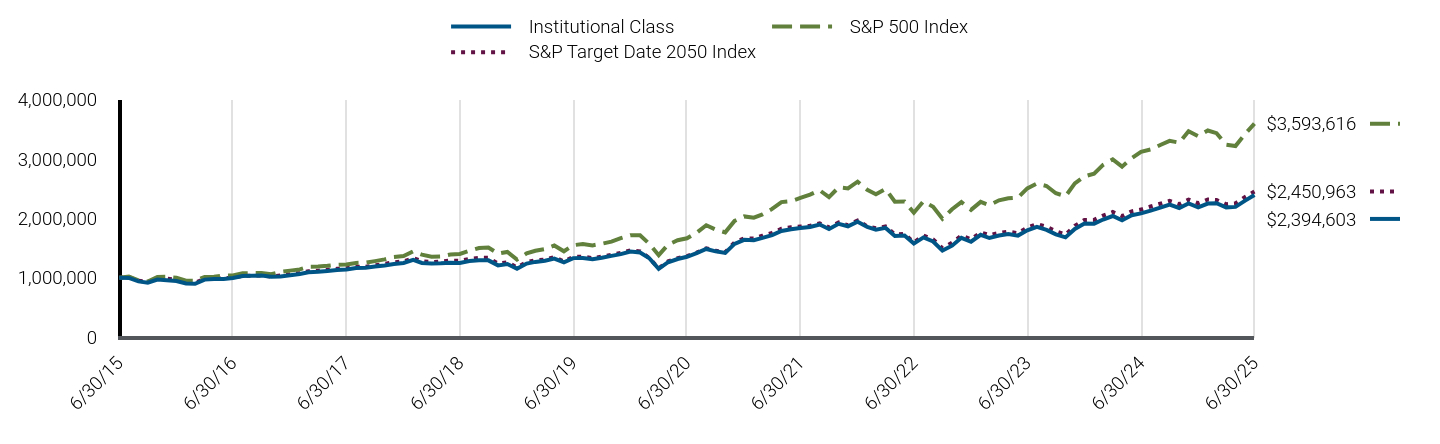

| Line Graph [Table Text Block] |

|

I-2 |

Bloomberg U.S. Aggregate Index |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

MSCI ACWI High Dividend Yield Net USD |

6/30/15 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

7/31/15 |

$995,478 |

$1,006,951 |

$1,006,756 |

$1,006,560 |

8/31/15 |

$924,451 |

$1,005,505 |

$973,220 |

$940,946 |

9/30/15 |

$885,206 |

$1,012,307 |

$961,886 |

$912,666 |

10/31/15 |

$938,207 |

$1,012,475 |

$998,417 |

$981,834 |

11/30/15 |

$922,157 |

$1,009,800 |

$988,542 |

$965,008 |

12/31/15 |

$885,763 |

$1,006,537 |

$979,282 |

$950,046 |

1/31/16 |

$848,892 |

$1,020,388 |

$967,982 |

$915,050 |

2/29/16 |

$846,925 |

$1,027,626 |

$973,918 |

$919,779 |

3/31/16 |

$893,361 |

$1,037,055 |

$1,012,903 |

$984,979 |

4/30/16 |

$911,460 |

$1,041,035 |

$1,024,786 |

$1,004,307 |

5/31/16 |

$916,101 |

$1,041,302 |

$1,022,103 |

$998,791 |

6/30/16 |

$909,482 |

$1,060,012 |

$1,037,940 |

$1,011,797 |

7/31/16 |

$935,050 |

$1,066,714 |

$1,055,160 |

$1,038,972 |

8/31/16 |

$936,876 |

$1,065,494 |

$1,054,028 |

$1,037,929 |

9/30/16 |

$944,181 |

$1,064,870 |

$1,058,216 |

$1,046,788 |

10/31/16 |

$937,789 |

$1,056,725 |

$1,040,767 |

$1,020,275 |

11/30/16 |

$952,399 |

$1,031,729 |

$1,027,191 |

$1,017,787 |

12/31/16 |

$974,404 |

$1,033,185 |

$1,041,903 |

$1,045,508 |

1/31/17 |

$990,120 |

$1,035,212 |

$1,051,350 |

$1,062,415 |

2/28/17 |

$997,516 |

$1,042,169 |

$1,070,681 |

$1,094,344 |

3/31/17 |

$1,009,732 |

$1,041,623 |

$1,077,362 |

$1,108,577 |

4/30/17 |

$1,012,516 |

$1,049,661 |

$1,085,718 |

$1,117,216 |

5/31/17 |

$1,029,221 |

$1,057,741 |

$1,104,155 |

$1,146,564 |

6/30/17 |

$1,035,557 |

$1,056,676 |

$1,103,235 |

$1,145,802 |

7/31/17 |

$1,059,792 |

$1,061,223 |

$1,116,522 |

$1,168,470 |

8/31/17 |

$1,056,996 |

$1,070,742 |

$1,124,623 |

$1,174,951 |

9/30/17 |

$1,086,214 |

$1,065,642 |

$1,133,078 |

$1,198,211 |

10/31/17 |

$1,099,346 |

$1,066,260 |

$1,137,634 |

$1,207,152 |

11/30/17 |

$1,113,416 |

$1,064,891 |

$1,146,489 |

$1,227,496 |

12/31/17 |

$1,131,044 |

$1,069,778 |

$1,156,225 |

$1,242,710 |

1/31/18 |

$1,176,666 |

$1,057,458 |

$1,175,376 |

$1,298,189 |

2/28/18 |

$1,129,143 |

$1,047,434 |

$1,142,360 |

$1,237,560 |

3/31/18 |

$1,120,155 |

$1,054,151 |

$1,136,830 |

$1,216,945 |

4/30/18 |

$1,132,516 |

$1,046,311 |

$1,134,138 |

$1,220,932 |

5/31/18 |

$1,113,498 |

$1,053,778 |

$1,129,880 |

$1,203,055 |

6/30/18 |

$1,106,004 |

$1,052,482 |

$1,127,177 |

$1,198,777 |

7/31/18 |

$1,137,577 |

$1,052,732 |

$1,149,455 |

$1,245,878 |

8/31/18 |

$1,127,052 |

$1,059,506 |

$1,152,973 |

$1,245,486 |

9/30/18 |

$1,138,568 |

$1,052,683 |

$1,156,412 |

$1,260,938 |

10/31/18 |

$1,082,652 |

$1,044,365 |

$1,123,736 |

$1,199,641 |

11/30/18 |

$1,091,329 |

$1,050,599 |

$1,140,038 |

$1,227,289 |

12/31/18 |

$1,031,159 |

$1,069,900 |

$1,116,592 |

$1,154,260 |

1/31/19 |

$1,092,221 |

$1,081,262 |

$1,156,565 |

$1,224,644 |

2/28/19 |

$1,106,994 |

$1,080,635 |

$1,171,330 |

$1,256,622 |

3/31/19 |

$1,106,736 |

$1,101,385 |

$1,187,806 |

$1,267,845 |

4/30/19 |

$1,127,432 |

$1,101,667 |

$1,198,661 |

$1,290,693 |

5/31/19 |

$1,075,199 |

$1,121,224 |

$1,180,598 |

$1,228,880 |

6/30/19 |

$1,127,118 |

$1,135,304 |

$1,226,369 |

$1,308,737 |

7/31/19 |

$1,116,136 |

$1,137,801 |

$1,222,612 |

$1,297,838 |

8/31/19 |

$1,085,188 |

$1,167,284 |

$1,227,876 |

$1,275,382 |

9/30/19 |

$1,129,689 |

$1,161,067 |

$1,245,704 |

$1,319,209 |

10/31/19 |

$1,150,758 |

$1,164,564 |

$1,266,740 |

$1,359,791 |

11/30/19 |

$1,164,804 |

$1,163,971 |

$1,274,513 |

$1,377,174 |

12/31/19 |

$1,191,266 |

$1,163,160 |

$1,298,511 |

$1,429,995 |

1/31/20 |

$1,155,446 |

$1,185,544 |

$1,290,545 |

$1,384,930 |

2/29/20 |

$1,071,525 |

$1,206,882 |

$1,247,728 |

$1,268,105 |

3/31/20 |

$895,842 |

$1,199,780 |

$1,167,435 |

$1,112,361 |

4/30/20 |

$950,167 |

$1,221,108 |

$1,224,345 |

$1,201,037 |

5/31/20 |

$979,892 |

$1,226,793 |

$1,235,699 |

$1,217,722 |

6/30/20 |

$997,237 |

$1,234,521 |

$1,246,843 |

$1,232,011 |

7/31/20 |

$1,003,393 |

$1,252,961 |

$1,277,812 |

$1,274,812 |

8/31/20 |

$1,041,354 |

$1,242,847 |

$1,289,953 |

$1,309,329 |

9/30/20 |

$1,009,163 |

$1,242,166 |

$1,274,227 |

$1,278,120 |

10/31/20 |

$989,578 |

$1,236,619 |

$1,252,692 |

$1,240,627 |

11/30/20 |

$1,129,768 |

$1,248,753 |

$1,336,144 |

$1,393,750 |

12/31/20 |

$1,173,151 |

$1,250,474 |

$1,366,301 |

$1,454,745 |

1/31/21 |

$1,193,142 |

$1,241,508 |

$1,356,549 |

$1,444,409 |

2/28/21 |

$1,259,428 |

$1,223,580 |

$1,357,202 |

$1,466,654 |

3/31/21 |

$1,309,849 |

$1,208,302 |

$1,383,703 |

$1,542,248 |

4/30/21 |

$1,325,681 |

$1,217,847 |

$1,404,288 |

$1,575,950 |

5/31/21 |

$1,364,733 |

$1,221,826 |

$1,425,086 |

$1,617,053 |

6/30/21 |

$1,359,217 |

$1,230,411 |

$1,423,230 |

$1,601,907 |

7/31/21 |

$1,345,358 |

$1,244,168 |

$1,433,918 |

$1,608,052 |

8/31/21 |

$1,351,755 |

$1,241,799 |

$1,442,021 |

$1,629,291 |

9/30/21 |

$1,339,860 |

$1,231,048 |

$1,405,783 |

$1,561,513 |

10/31/21 |

$1,352,733 |

$1,230,708 |

$1,419,856 |

$1,593,209 |

11/30/21 |

$1,335,569 |

$1,234,349 |

$1,402,324 |

$1,549,147 |

12/31/21 |

$1,389,671 |

$1,231,191 |

$1,451,814 |

$1,662,451 |

1/31/22 |

$1,379,823 |

$1,204,666 |

$1,432,318 |

$1,653,619 |

2/28/22 |

$1,359,032 |

$1,191,226 |

$1,412,238 |

$1,625,703 |

3/31/22 |

$1,365,581 |

$1,158,132 |

$1,400,342 |

$1,643,484 |

4/30/22 |

$1,319,588 |

$1,114,183 |

$1,346,722 |

$1,579,989 |

5/31/22 |

$1,338,204 |

$1,121,367 |

$1,359,430 |

$1,599,623 |

6/30/22 |

$1,251,389 |

$1,103,775 |

$1,301,036 |

$1,487,293 |

7/31/22 |

$1,289,944 |

$1,130,745 |

$1,331,344 |

$1,520,246 |

8/31/22 |

$1,256,896 |

$1,098,794 |

$1,287,873 |

$1,463,920 |

9/30/22 |

$1,185,655 |

$1,051,319 |

$1,210,174 |

$1,350,534 |

10/31/22 |

$1,234,593 |

$1,037,702 |

$1,242,306 |

$1,439,745 |

11/30/22 |

$1,312,451 |

$1,075,864 |

$1,317,567 |

$1,561,241 |

12/31/22 |

$1,301,339 |

$1,071,012 |

$1,304,734 |

$1,537,870 |

1/31/23 |

$1,350,991 |

$1,103,960 |

$1,344,873 |

$1,585,179 |

2/28/23 |

$1,310,576 |

$1,075,417 |

$1,305,280 |

$1,532,829 |

3/31/23 |

$1,329,836 |

$1,102,735 |

$1,335,820 |

$1,565,624 |

4/30/23 |

$1,342,645 |

$1,109,418 |

$1,354,178 |

$1,599,163 |

5/31/23 |

$1,313,533 |

$1,097,338 |

$1,315,098 |

$1,524,278 |

6/30/23 |

$1,361,149 |

$1,093,425 |

$1,343,169 |

$1,594,789 |

7/31/23 |

$1,391,684 |

$1,092,662 |

$1,368,278 |

$1,655,521 |

8/31/23 |

$1,370,545 |

$1,085,683 |

$1,346,202 |

$1,612,674 |

9/30/23 |

$1,342,277 |

$1,058,094 |

$1,311,818 |

$1,571,279 |

10/31/23 |

$1,319,748 |

$1,041,396 |

$1,276,746 |

$1,512,057 |

11/30/23 |

$1,399,193 |

$1,088,557 |

$1,347,234 |

$1,610,542 |

12/31/23 |

$1,458,235 |

$1,130,226 |

$1,402,588 |

$1,681,236 |

1/31/24 |

$1,461,862 |

$1,127,122 |

$1,401,886 |

$1,684,171 |

2/29/24 |

$1,476,372 |

$1,111,198 |

$1,398,903 |

$1,700,797 |

3/31/24 |

$1,520,962 |

$1,121,459 |

$1,432,159 |

$1,765,258 |

4/30/24 |

$1,479,426 |

$1,093,132 |

$1,394,754 |

$1,718,320 |

5/31/24 |

$1,527,070 |

$1,111,664 |

$1,424,578 |

$1,762,674 |

6/30/24 |

$1,528,131 |

$1,122,189 |

$1,425,721 |

$1,748,810 |

7/31/24 |

$1,573,839 |

$1,148,400 |

$1,472,460 |

$1,822,622 |

8/31/24 |

$1,613,370 |

$1,164,902 |

$1,507,335 |

$1,882,774 |

9/30/24 |

$1,636,371 |

$1,180,499 |

$1,531,483 |

$1,917,888 |

10/31/24 |

$1,603,968 |

$1,151,224 |

$1,490,064 |

$1,861,710 |

11/30/24 |

$1,632,632 |

$1,163,396 |

$1,506,142 |

$1,882,206 |

12/31/24 |

$1,594,132 |

$1,144,356 |

$1,462,936 |

$1,805,019 |

1/31/25 |

$1,627,210 |

$1,150,427 |

$1,487,973 |

$1,857,228 |

2/28/25 |

$1,671,739 |

$1,175,739 |

$1,524,416 |

$1,907,340 |

3/31/25 |

$1,680,937 |

$1,176,181 |

$1,526,418 |

$1,911,627 |

4/30/25 |

$1,683,507 |

$1,180,804 |

$1,525,243 |

$1,901,176 |

5/31/25 |

$1,711,780 |

$1,172,349 |

$1,537,743 |

$1,945,946 |

6/30/25 |

$1,755,234 |

$1,190,376 |

$1,565,536 |

$1,986,369 |

|

|

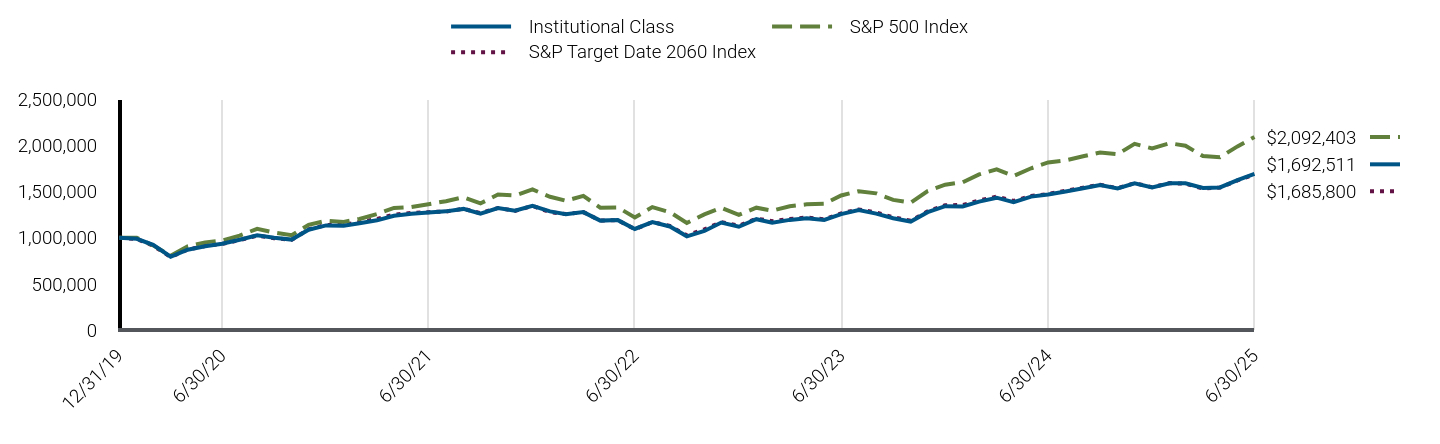

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

I-2 |

14.86% |

11.97% |

5.79% |

Bloomberg U.S. Aggregate Index |

6.08% |

(0.73%) |

1.76% |

50% MSCI ACWI High Dividend Yield Index / 50% Bloomberg U.S. Aggregate Index |

9.81% |

4.66% |

4.58% |

MSCI ACWI High Dividend Yield Net USD |

13.58% |

10.02% |

7.10% | |

|

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

|

| AssetsNet |

$ 197,166,000

|

|

| Holdings Count | Holding |

1,206

|

|

| Advisory Fees Paid, Amount |

$ 795,000

|

|

| InvestmentCompanyPortfolioTurnover |

436.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$197,166 |

# of Portfolio Holdings |

1,206 |

Portfolio Turnover Rate |

436% |

Total Net Advisory Fees Paid During the Reporting Period |

$795 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

|

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Common Stocks |

45.9% |

U.S. Government Agencies |

28.0% |

Asset-Backed Securities |

14.1% |

Non-Agency Mortgage-Backed Securities |

10.5% |

U.S. Treasury Obligations |

10.5% |

Corporate Bonds & Notes |

5.4% |

Real Estate Investment Trusts |

5.0% |

Sovereign Issues |

3.5% |

Loan Participations and Assignments |

0.6% |

Preferred Stocks |

0.4% |

Other Investments |

0.2% |

Short-Term Instruments |

0.5% |

Affiliated Investments |

2.3% |

Financial Derivative Instruments |

(0.2%) |

Other Assets and Liabilities, Net |

(26.7%) |

Total |

100.0% |

| Footnote |

Description |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626). Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest. |

|

| Material Fund Change Expenses [Text Block] |

Changes to Total Annual Fund Operating Expenses. Annual fund operating expenses increased during the year by 0.10% as a result of higher expenses related to interest.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes and planned changes of the Fund since the beginning of the reporting period. For more information, you may refer to the Fund's next prospectus, which we expect to be available by October 31, 2025 or upon request at 888.87.PIMCO (888.877.4626).

|

|

| C000154254 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

PIMCO RAE Emerging Markets Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

PEAFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO RAE Emerging Markets Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025 (the "reporting period").

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

|

| Additional Information Website |

www.pimco.com/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$116 |

1.10% | |

|

| Expenses Paid, Amount |

$ 116

|

|

| Expense Ratio, Percent |

1.10%

|

|

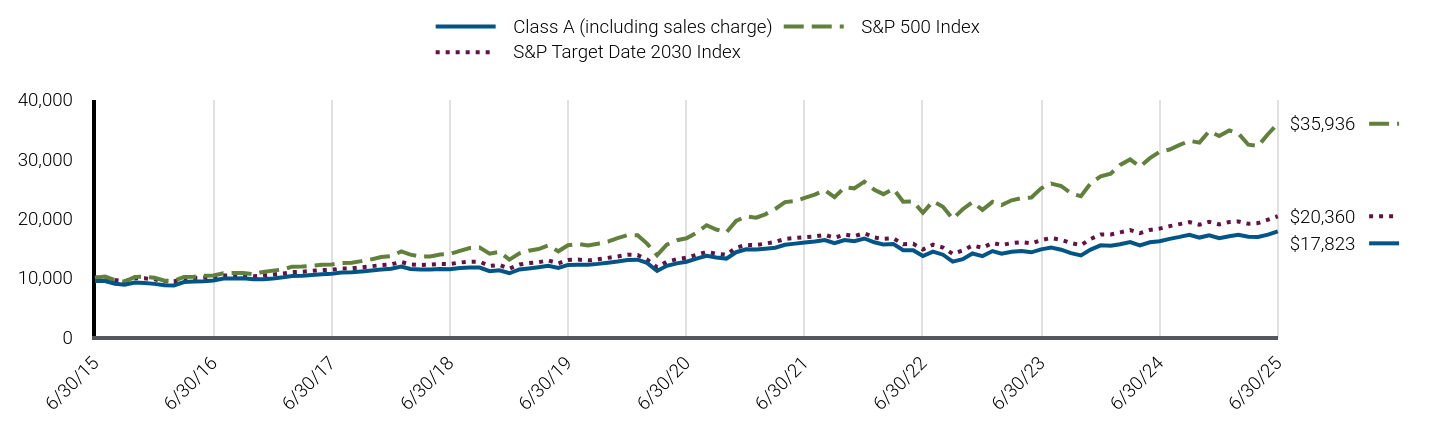

| Factors Affecting Performance [Text Block] |

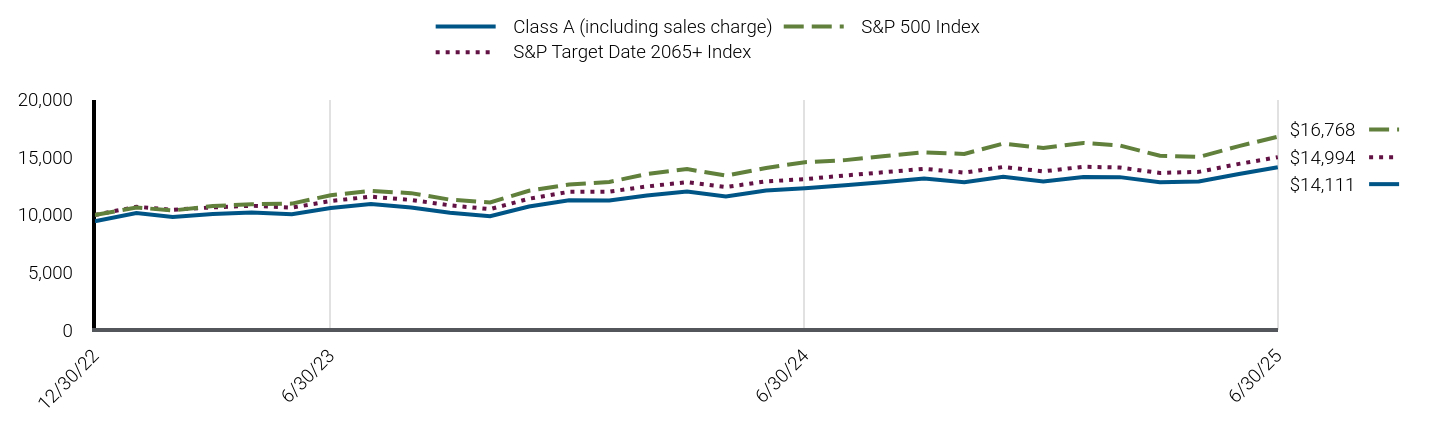

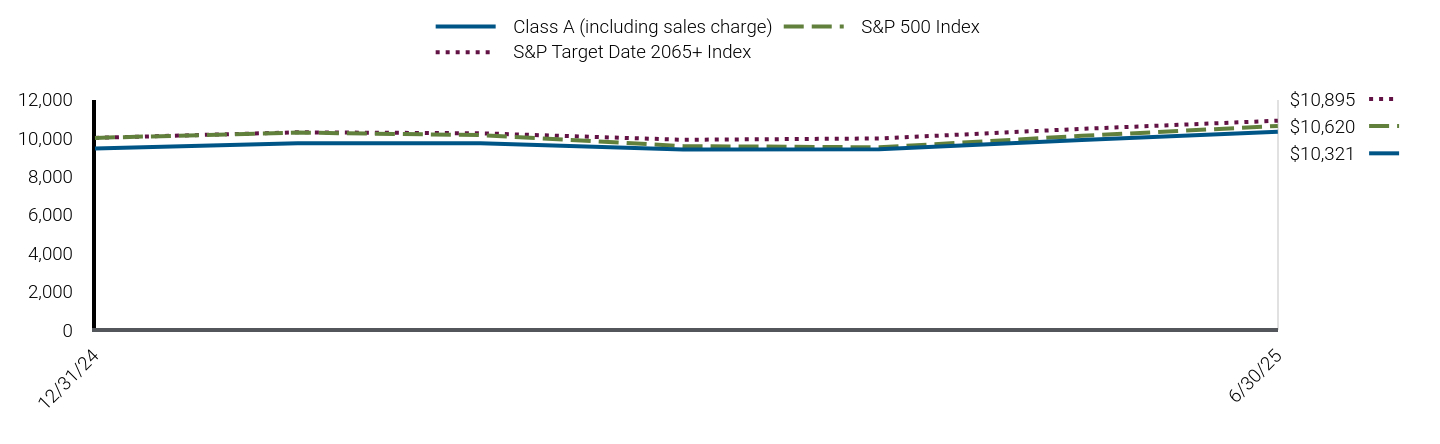

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Security selection in the industrials sector contributed to relative returns, as the Fund's holdings outperformed the MSCI Emerging Markets Value Index (the "Index"). Underweight exposure to the information technology sector contributed to relative returns, as the sector underperformed the Index. Security selection in the consumer staples sector contributed to relative returns, as the Fund's holdings outperformed the Index. Underweight exposure to, and security selection in, the consumer discretionary sector detracted from relative returns, as the sector outperformed the Index and the Fund's holdings underperformed the Index. Underweight exposure to, and security selection in, the financials sector detracted from relative returns, as the sector outperformed the Index and the Fund's holdings underperformed the Index. Overweight exposure to the energy sector detracted from relative returns, as the sector underperformed the Index.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

|

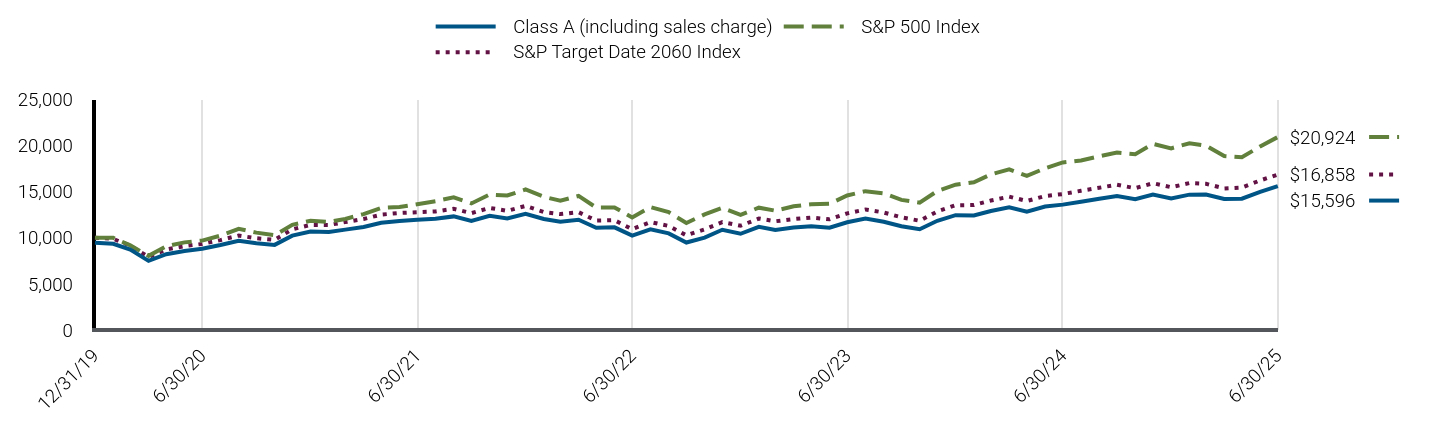

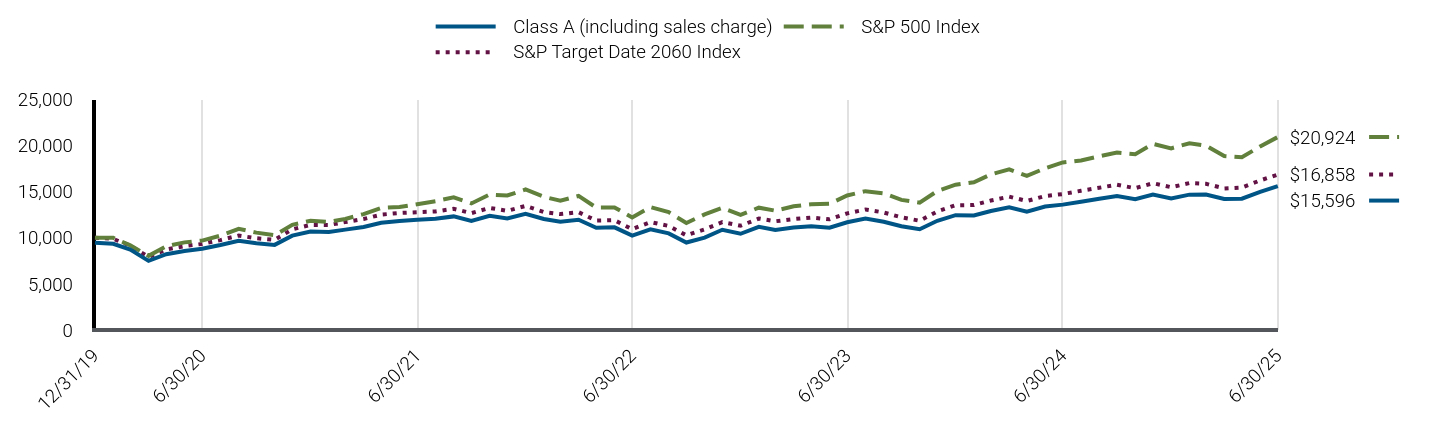

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Class A (excluding sales charge) |

10.05% |

14.52% |

7.05% |

Class A (including sales charge) |

5.92% |

13.65% |

6.64% |

MSCI Emerging Markets Index |

15.29% |

6.81% |

4.81% |

MSCI Emerging Markets Value Index |

12.66% |

9.07% |

4.01% | |

|

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

|

| AssetsNet |

$ 2,360,499,000

|

|

| Holdings Count | Holding |

369

|

|

| Advisory Fees Paid, Amount |

$ 10,463,000

|

|

| InvestmentCompanyPortfolioTurnover |

48.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$2,360,499 |

# of Portfolio Holdings |

369 |

Portfolio Turnover Rate |

48% |

Total Net Advisory Fees Paid During the Reporting Period |

$10,463 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

|

| Holdings [Text Block] |

Geographic Breakdown (% of Net Asset Value)Footnote Reference*

China |

26.8% |

Brazil |

17.6% |

South Korea |

14.2% |

India |

9.7% |

Taiwan |

8.1% |

Thailand |

6.1% |

South Africa |

6.1% |

Hong Kong |

2.1% |

Indonesia |

1.9% |

Mexico |

1.5% |

Chile |

1.2% |

Other Countries |

3.7% |

Short-Term Instruments |

0.0%Footnote Reference^ |

Affiliated Investments |

0.7% |

Other Assets and Liabilities, Net |

0.3% |

Total |

100.0% |

| Footnote |

Description |

Footnote* |