What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAUFX | $41 | 0.40% |

How did the Fund perform last year and what affected its performance?

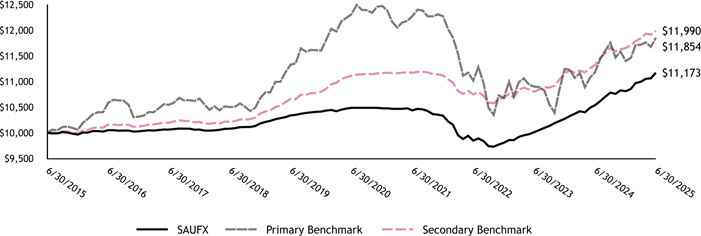

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® US Core Bond IndexSM, which is composed of U.S. dollar-denominated investment grade bonds and is designed to be representative of the U.S. bond market overall. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® US 1-3 Year Composite Government and Corporate Bond IndexSM, which is designed to measure the performance of U.S. dollardenominated government and corporate bonds with maturities between one and three years. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 6.01%, compared to a return of 5.89% for the Fund’s Secondary Benchmark. The Fund outperformed the Secondary Benchmark by 0.12% for the fiscal year primarily due to the Fund’s overweight position in corporate bonds relative to the Secondary Benchmark, particularly those corporate bonds rated A or BBB.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAUFX | 6.01% | 1.27% | 1.12% |

| Primary Benchmark | 6.01% | (0.76%) | 1.72% |

| Secondary Benchmark | 5.89% | 1.53% | 1.83% |

| Key Fund Statistics | |

| Total Net Assets | $452,531,746 |

| # of Portfolio Holdings | 105 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $634,671 |

What did the Fund invest in?

Portfolio Composition (As a % of long-term investments) | |

| Corporate Bonds and Notes | 48.2% |

| U.S. Government & Agency Obligations | 36.7 |

| Yankee Corporate Bonds and Notes | 15.1 |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAXIX | $52 | 0.51% |

How did the Fund perform last year and what affected its performance?

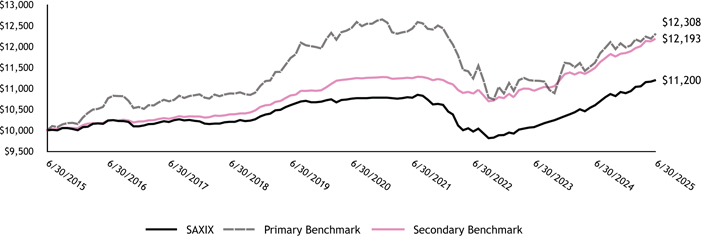

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® Global Core Bond Hedged IndexSM, which is composed of investment grade bonds and is designed to be representative of the global bond market overall. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® Global 1-5 Year Treasury Bond Hedged IndexSM, which is designed to measure the performance of global investment grade government bonds with maturities between one and five years. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 5.67%, compared to a return of 6.11% for the Fund’s Secondary Benchmark. The Fund underperformed the Secondary Benchmark for the fiscal year by 0.44% primarily due to the Fund’s overweight exposure (relative to the benchmark) in higher grade bonds.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | ||||

| 1 Year | 5 Years | 10 Years | ||

| SAXIX | 5.67% | 0.81% | 1.14% | |

| Primary Benchmark | 5.96% | (0.22%) | 2.10% | |

| Secondary Benchmark | 6.11% | 1.66% | 2.00% | |

| Key Fund Statistics | |

| Total Net Assets | $543,289,524 |

| # of Portfolio Holdings | 124 |

| Portfolio Turnover Rate | 77% |

| Total Advisory Fees Paid | $1,445,230 |

What did the Fund invest in?

| Portfolio Composition | |

| (As a % of long-term investments) | |

| Sovereign Bonds and Notes | 54.1% |

| Corporate Bonds and Notes | 25.7 |

| U.S. Government & Agency Obligations | 20.2 |

| Top Ten Largest Countries | |

| (As a % of long-term investments) | |

| United States | 29.7% |

| Canada | 17.6 |

| Supranational | 14.8 |

| Australia | 9.7 |

| France | 8.7 |

| New Zealand | 3.5 |

| Netherlands | 3.1 |

| Norway | 2.8 |

| Finland | 2.7 |

| Others | 7.4 |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAMKX | $71 | 0.67% |

How did the Fund perform last year and what affected its performance?

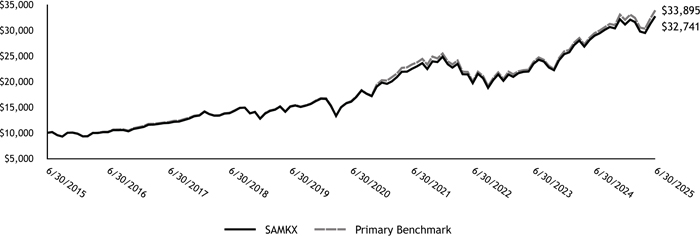

Investment performance of the Fund is judged against the performance of a broad-based securities market index. For this Fund, performance is compared to the Morningstar® US Market Extended IndexSM (the "Primary Benchmark"), which is composed of large, mid, and small cap U.S. stocks. The benchmark index is unmanaged and does not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 13.13% compared to a return of 15.15% for the Fund’s Primary Benchmark. The Fund underperformed the Primary Benchmark during the fiscal year by 2.02%, after deducting the Fund’s net operating expenses for the year. Across the fiscal year the Fund had more exposure to stocks of companies with higher levels of operating profitability ("high profitability stocks") and less exposure to stocks of companies with lower levels of operating profitability ("low profitability stocks") compared to the Primary Benchmark. However, during the fiscal year, the returns of low profitability stocks were stronger than the returns of higher profitability stocks, hence the Fund's lower exposure to low profitability stocks caused the underperformance of the Fund to its Primary Benchmark.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAMKX | 13.13% | 15.29% | 12.59% |

| Primary Benchmark | 15.15% | 15.93% | 12.98% |

| Key Fund Statistics | |

| Total Net Assets | $669,637,380 |

| # of Portfolio Holdings | 832 |

| Portfolio Turnover Rate | 1% |

| Total Advisory Fees Paid | $2,691,835 |

What did the Fund invest in?

| Top Ten Largest Sectors | ||

| (As a % of long-term investments) | ||

| Information Technology | 29.1% | |

| Financials | 16.8 | |

| Consumer Discretionary | 10.7 | |

| Communication Services | 10.7 | |

| Health Care | 9.6 | |

| Industrials | 9.3 | |

| Consumer Staples | 6.5 | |

| Utilities | 2.8 | |

| Energy | 2.5 | |

| Materials | 1.9 | |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SABTX | $77 | 0.74% |

How did the Fund perform last year and what affected its performance?

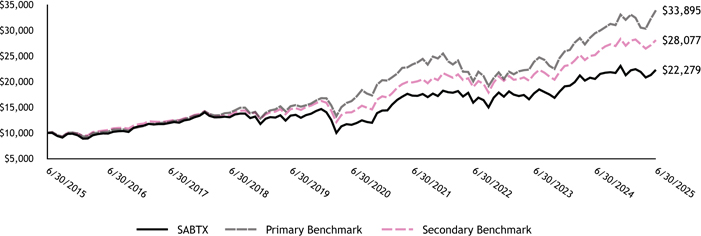

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® US Market Extended IndexSM, which is composed of large, mid, and small cap U.S. stocks. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® US Large-Mid Cap Broad Value IndexSM, which is designed to measure the performance of value stocks within the large and mid-capitalization segment of the U.S. stock market. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 8.58%, compared to a return of 11.57% for the Fund’s Secondary Benchmark. The Fund underperformed this Secondary Benchmark during the fiscal year by 2.99%, after deducting the Fund’s net operating expenses for the year. Across the fiscal year the Fund held larger positions in the stocks of companies whose ratio of price-to-book-value was below the median price-to-book value of stocks ("deeper value stocks") found in the Secondary Benchmark. These deeper value stocks - particularly those selected to be held in the Fund - significantly underperformed the stocks in the Secondary Benchmark, leading to the Fund's underperformance relative to the Secondary Benchmark.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SABTX | 8.58% | 14.00% | 8.34% |

| Primary Benchmark | 15.15% | 15.93% | 12.98% |

| Secondary Benchmark | 11.57% | 14.92% | 10.88% |

| Key Fund Statistics | |

| Total Net Assets | $524,067,789 |

| # of Portfolio Holdings | 272 |

| Portfolio Turnover Rate | 11% |

| Total Advisory Fees Paid | $2,183,649 |

What did the Fund invest in?

Top Ten Largest Sectors (As a % of long-term investments) | |

| Financials | 26.1% |

| Health Care | 15.0 |

| Industrials | 12.5 |

| Energy | 11.2 |

| Information Technology | 9.7 |

| Communication Services | 7.7 |

| Materials | 7.6 |

| Consumer Discretionary | 5.0 |

| Consumer Staples | 4.6 |

| Real Estate | 0.6 |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAUMX | $93 | 0.89% |

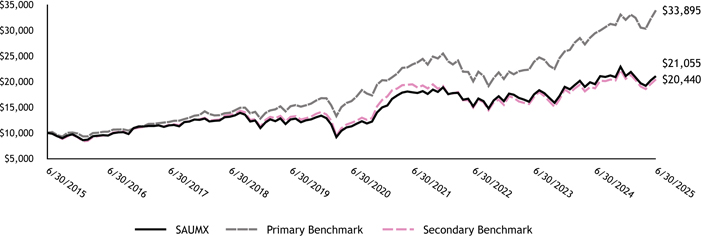

How did the Fund perform last year and what affected its performance?

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® US Market Extended IndexSM, which is composed of large, mid, and small cap U.S. stocks. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® US Small Cap Extended IndexSM, which is designed to measure the performance of small cap stocks within the U.S. stock market. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 7.99%, compared to a return of 9.35% for the Fund’s Secondary Benchmark. The Fund underperformed this benchmark during the fiscal year by 1.36% after deducting the Fund’s net operating expenses for the year. The Fund’s underperformance relative to its Secondary Benchmark over the fiscal year was the result of the Fund’s tendency to avoid holding smaller cap stocks that exhibit both lower levels of profitability and also higher levels of price-to-book ratios (“growth-oriented low profit stocks”). However, these growth-oriented low profit stocks are found in the Secondary Benchmark, and during the fiscal year, these stocks performed well, leading to the returns of the Secondary Benchmark outperforming the returns of the Fund.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAUMX | 7.99% | 13.31% | 7.73% |

| Primary Benchmark | 15.15% | 15.93% | 12.98% |

| Secondary Benchmark | 9.35% | 11.30% | 7.41% |

| Key Fund Statistics | |

| Total Net Assets | $295,676,287 |

| # of Portfolio Holdings | 1,445 |

| Portfolio Turnover Rate | 3% |

| Total Advisory Fees Paid | $1,240,169 |

| What did the Fund invest in? | ||

| Top Ten Largest Sectors | ||

| (As a % of long-term investments) | ||

| Industrials | 22.4% | |

| Financials | 21.4 | |

| Consumer Discretionary | 15.0 | |

| Information Technology | 11.8 | |

| Health Care | 8.7 | |

| Materials | 5.6 | |

| Consumer Staples | 5.4 | |

| Utilities | 3.7 | |

| Energy | 3.2 | |

| Communication Services | 2.2 | |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAHMX | $101 | 0.91% |

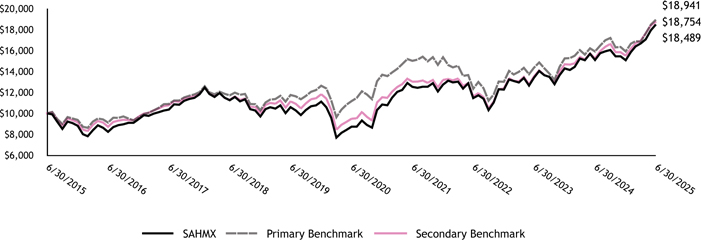

How did the Fund perform last year and what affected its performance?

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® Developed Markets ex-US All Cap Target Market Exposure IndexSM, which is composed of large, mid, and small cap stocks trading in international developed markets. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® Developed Markets ex-US Value Target Market Exposure IndexSM, which is designed to measure the performance of value stocks within the large and mid-capitalization segments of the international developed markets. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 22.47%, compared to a return of 22.95% for the Fund’s Secondary Benchmark. The Fund underperformed the Secondary Benchmark during the fiscal year by 0.48% after deducting the Fund’s net operating expenses for the year. The Fund's underperformance relative to the Secondary Benchmark during the fiscal year was primarily the result of the fact that the Fund charges net operating expenses while the Secondary Benchmark does not.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAHMX | 22.47% | 16.21% | 6.34% |

| Primary Benchmark | 19.04% | 11.15% | 6.60% |

| Secondary Benchmark | 22.95% | 14.61% | 6.49% |

| Key Fund Statistics | |

| Total Net Assets | $577,005,303 |

| # of Portfolio Holdings | 433 |

| Portfolio Turnover Rate | 9% |

| Total Advisory Fees Paid | $2,480,531 |

| What did the Fund invest in? |

| Top Ten Largest Sectors | |

| (As a % of long-term investments) | |

| Financials | 35.2% |

| Energy | 13.0 |

| Materials | 12.3 |

| Consumer Discretionary | 10.8 |

| Industrials | 9.4 |

| Health Care | 5.9 |

| Consumer Staples | 5.0 |

| Communication Services | 3.0 |

| Utilities | 2.1 |

| Real Estate | 2.0 |

| Top Ten Largest Countries | |

| (As a % of long-term investments) | |

| Japan | 20.4% |

| United Kingdom | 12.4 |

| France | 10.7 |

| Canada | 10.6 |

| Switzerland | 9.4 |

| Germany | 8.6 |

| Australia | 6.1 |

| Netherlands | 4.7 |

| Spain | 3.4 |

| Others | 13.7 |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAISX | $59 | 0.53% |

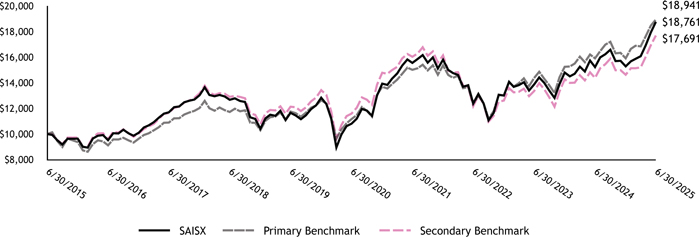

How did the Fund perform last year and what affected its performance?

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® Developed Markets ex-US All Cap Target Market Exposure IndexSM, which is composed of large, mid, and small cap stocks trading in international developed markets. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® Developed Markets ex-US Small Cap Target Market Exposure IndexSM, which is designed to measure the performance of small cap stocks within the international developed markets. The Secondary Benchmark is more representative of the investment universe of the series of The DFA Investment Trust Company through which the Fund invests. Please see the following page for additional information about these series. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 23.19%, compared to a return of 23.04% for the Fund’s Secondary Benchmark. The Fund outperformed the Secondary Benchmark during the fiscal year by 0.15% after deducting the Fund’s net operating expenses for the year. The Fund’s performance during the fiscal year was relatively similar to the performance of the Secondary Benchmark, as a result of positive returns in the Fund roughly offsetting the fees paid by the Fund. The Fund’s performance relative to the Secondary Benchmark was primarily the result of the Fund’s avoidance of REITs and growth-oriented low profitability stocks.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAISX | 23.19% | 11.66% | 6.49% |

| Primary Benchmark | 19.04% | 11.15% | 6.60% |

| Secondary Benchmark | 23.04% | 8.82% | 5.87% |

| Key Fund Statistics | |

| Total Net Assets | $271,544,757 |

| # of Portfolio Holdings | 1 |

| Portfolio Turnover Rate | 4% |

| Total Advisory Fees Paid | $631,768 |

What did the Fund invest in?

Largest Holdings (As a % of total investments) | |

| DFA International Small Company Portfolio, Class Institutional * | 100.0 |

| * | The Fund pursues its goal by investing substantially all its assets in the International Small Company Portfolio of DFA Investment Dimensions Group Inc. (the “DFA Portfolio”), a separate registered investment company with the same investment objective and investment policies as the Fund. The DFA Portfolio invests substantially all its assets in the following series of The DFA Investment Trust Company: The Japanese Small Company Series, The United Kingdom Small Company Series, The Continental Small Company Series, The Asia Pacific Small Company Series and The Canadian Small Company Series. Financial statements and other information about the DFA International Small Company Portfolio, including its portfolio holdings, are available at https://www.dimensional.com/usen/funds/dfisx/international-small-company-portfolio-i. |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

Fund Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

SAEMX |

$109 |

1.04% |

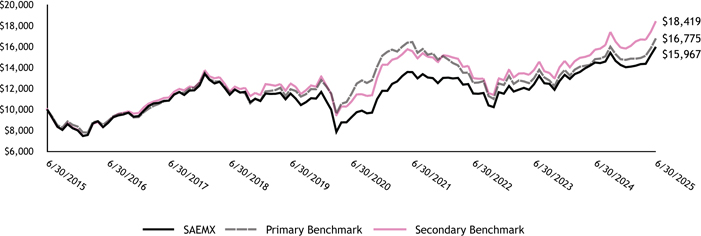

How did the Fund perform last year and what affected its performance?

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® Emerging Markets All Cap Target Market Exposure IndexSM, which is composed of large, mid, and small cap stocks trading in emerging markets. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® Emerging Markets Value Target Market Exposure IndexSM, which is designed to measure the performance of value stocks within the large and mid-capitalization segment of the emerging markets. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 10.33%, compared to a return of 17.33% for the Fund’s Secondary Benchmark. The Fund underperformed the Secondary Benchmark by 7.00% after deducting the Fund’s net operating expenses for the year. Across the fiscal year the Fund maintained a larger position than that of the Secondary Benchmark in the stocks of companies whose ratio of price-to-book-value were among the lowest in the Secondary Benchmark (known as “deeper value stocks"), while also minimizing exposure to stocks of companies whose price-to-book-value ratio was above the median ratio of companies in the Secondary Benchmark. During the fiscal year, returns of companies with price-to-book-value ratios above the median of the Secondary Benchmark were particularly strong, contributing to the Fund’s underperformance relative to the Secondary Benchmark.

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAEMX | 10.33% | 11.53% | 4.79% |

| Primary Benchmark | 13.40% | 7.86% | 5.31% |

| Secondary Benchmark | 17.33% | 11.37% | 6.30% |

|

Key Fund Statistics | |

| Total Net Assets | $203,591,960 |

| # of Portfolio Holdings | 1,806 |

| Portfolio Turnover Rate | 17% |

| Total Advisory Fees Paid | $308,010 |

What did the Fund invest in?

| Top Ten Largest Sectors (As a % of long-term investments) |

|

| Financials | 30.5% |

| Information Technology | 14.0 |

| Consumer Discretionary | 12.4 |

| Materials | 11.2 |

| Energy | 9.4 |

| Industrials | 9.4 |

| Health Care | 3.5 |

| Communication Services | 2.8 |

| Real Estate | 2.8 |

| Consumer Staples | 2.4 |

|

Top Ten Largest Countries (As a % of long-term investments) | |

| China | 28.4% |

| India | 21.7 |

| Taiwan | 19.8 |

| Korea | 11.2 |

| South Africa | 3.4 |

| Brazil | 3.1 |

| Mexico | 1.8 |

| United Arab Emirates | 1.5 |

| Indonesia | 1.5 |

| Others | 7.6 |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAREX | $80 | 0.77% |

How did the Fund perform last year and what affected its performance?

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® US Market Extended IndexSM, which is composed of large, mid, and small cap U.S. stocks. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® US REIT IndexSM, which is designed to measure the performance of real estate stocks within the U.S. stock market. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 8.29%, compared to a return of 9.66% for the Fund’s Secondary Benchmark. The Fund underperformed the Secondary Benchmark during the fiscal year by 1.37% after deducting the Fund’s net operating expenses for the year. Part of the Fund's underperformance to the Secondary Benchmark during the fiscal year was due to the fact that the Fund pays operating expenses while the Secondary Benchmark does not. The remainder of the underperformance was due to the fact that the Fund held a small percentage of stocks that are not included in the Secondary Benchmark, and these stocks had significantly underperformed the Secondary Benchmark.

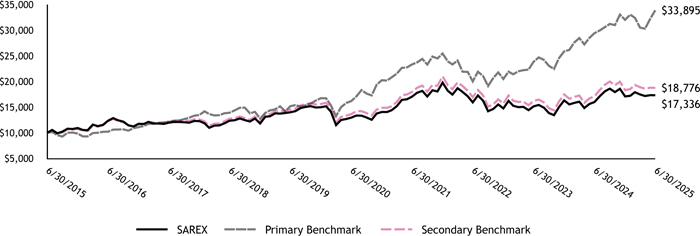

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the past ten years. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | 10 Years | |

| SAREX | 8.29% | 5.98% | 5.66% |

| Primary Benchmark | 15.15% | 15.93% | 12.98% |

| Secondary Benchmark | 9.66% | 6.59% | 6.50% |

| Key Fund Statistics | |

| Total Net Assets | $118,724,719 |

| # of Portfolio Holdings | 133 |

| Portfolio Turnover Rate | 5% |

| Total Advisory Fees Paid | $335,224 |

What did the Fund invest in?

Largest Industry Holdings (As a % of long-term investments) | |

| Specialized REITs | 39.5% |

| Retail REITs | 15.7 |

| Residential REITs | 14.3 |

| Health Care REITs | 11.7 |

| Industrial REITs | 10.7 |

| Office REITs | 3.5 |

| Diversified REITs | 2.3 |

| Hotel & Resort REITs | 2.3 |

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| SAWMX | $0* | 0.00%* |

| * | Focus Partners Advisor Solutions, LLC, (the "Adviser") has contractually agreed to waive fees and/or reimburse expenses to the Fund's total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expense and extraordinary expenses). Shareholders would have paid $75, or 0.71% when considering the acquired fund fees. |

How did the Fund perform last year and what affected its performance?

Investment performance of the Fund is judged against the performance of certain market indexes. For this Fund, performance is compared to a broad-based securities market index (the “Primary Benchmark”) known as the Morningstar® Global Markets IndexSM, which is composed of large, mid, and small cap stocks and is designed to be representative of the global stock market overall. The Fund’s performance is also compared to an additional index (the “Secondary Benchmark”) known as the Morningstar® US Moderate Target Allocation IndexSM, which is designed to measure the performance of a portfolio holding 60% global stocks and 40% global bonds. The Secondary Benchmark is closer in scope to the universe of securities chosen within the Fund. The benchmark indexes are unmanaged and do not involve fees and expenses like the Fund.

For the fiscal year ended June 30, 2025, the Fund had a net return of 11.69%, compared to a return of 12.16% for the Fund’s Secondary Benchmark. Since the Fund invests exclusively in shares of the SA Fund family (the “Underlying Funds”), the performance of the Fund relative to the Secondary Benchmark is driven primarily by the performance of each of the Underlying Funds against the relevant components of that Secondary Benchmark. For the fiscal year, two of the eight Underlying Funds contributed positively to relative performance, notably the SA International Value Fund. Six of the eight Underlying Funds contributed negatively to relative performance for the fiscal year, most notably the SA US Core Market Fund and the SA Global Fixed Income Fund.

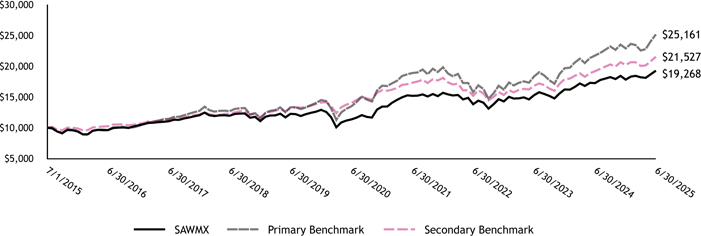

Fund Performance

The following line chart and table are intended to help you understand the risks of investing in the Fund. The chart shows the growth of $10,000 over the period since the Fund's inception. The table shows the total return for the selected time periods for the SA Fund as well as for the Primary Benchmark and the Secondary Benchmark.

| Average Annual Total Returns | |||

| 1 Year | 5 Years | Since Inception 7/1/15 |

|

| SAWMX | 11.69% | 11.15% | 6.78% |

| Primary Benchmark | 15.76% | 13.28% | 9.67% |

| Secondary Benchmark | 12.16% | 8.98% | 7.97% |

| Key Fund Statistics | |

| Total Net Assets | $21,148,705 |

| # of Portfolio Holdings | 8 |

| Portfolio Turnover Rate | 9% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

Largest Holdings (As a % of total investments) | |

| SA International Value Fund | 20.2 |

| SA U.S. Core Market Fund | 16.9 |

| SA U.S. Value Fund | 16.9 |

| SA U.S. Fixed Income Fund | 14.9 |

| SA Global Fixed Income Fund | 14.8 |

| SA Emerging Markets Value Fund | 6.7 |

| SA U.S. Small Company Fund | 6.7 |

| SA Real Estate Securities Fund | 2.9 |

| [1] | Focus Partners Advisor Solutions, LLC, (the "Adviser") has contractually agreed to waive fees and/or reimburse expenses to the Fund's total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expense and extraordinary expenses). Shareholders would have paid $75, or 0.71% when considering the acquired fund fees. |