Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Voya Variable Funds

|

| Entity Central Index Key |

0000002664

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000028787 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Voya Growth and Income Portfolio

|

| Class Name |

Class ADV

|

| Trading Symbol |

IAVGX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Voya Growth and Income Portfolio for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information Phone Number |

1-800-992-0180

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)Class Name | Costs of $10K investment | Costs paid as % of $10K investment (Annualized) |

|---|

Class ADV | $57 | 1.12% |

|---|

|

| Expenses Paid, Amount |

$ 57

|

| Expense Ratio, Percent |

1.12%

|

| AssetsNet |

$ 2,510,425,555

|

| Holdings Count | Holding |

74

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,510,425,555

- # of Portfolio Holdings74

- Portfolio Turnover Rate41%

|

| Holdings [Text Block] |

Value | Value |

|---|

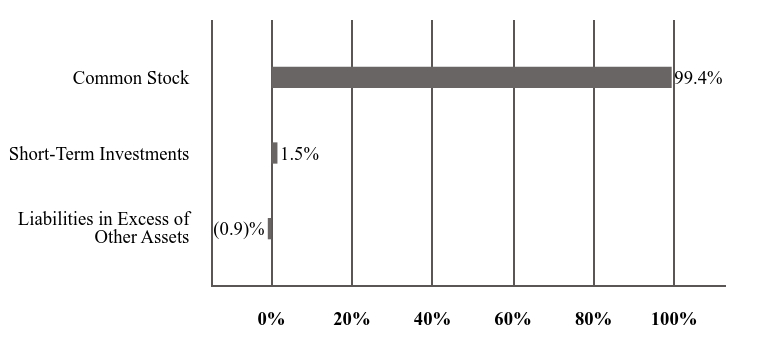

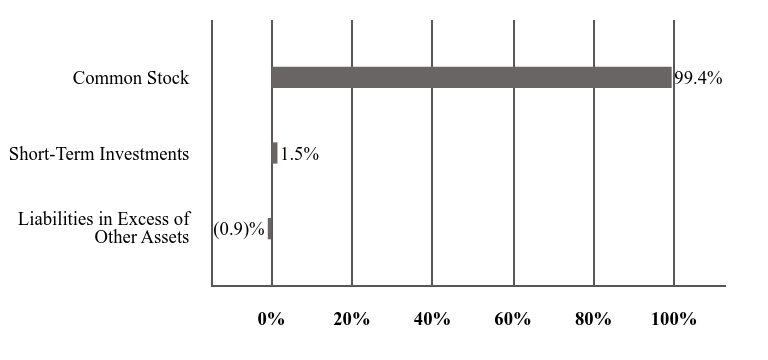

Liabilities in Excess of Other Assets | (0.9)% | Short-Term Investments | 1.5% | Common Stock | 99.4% |

Value | Value |

|---|

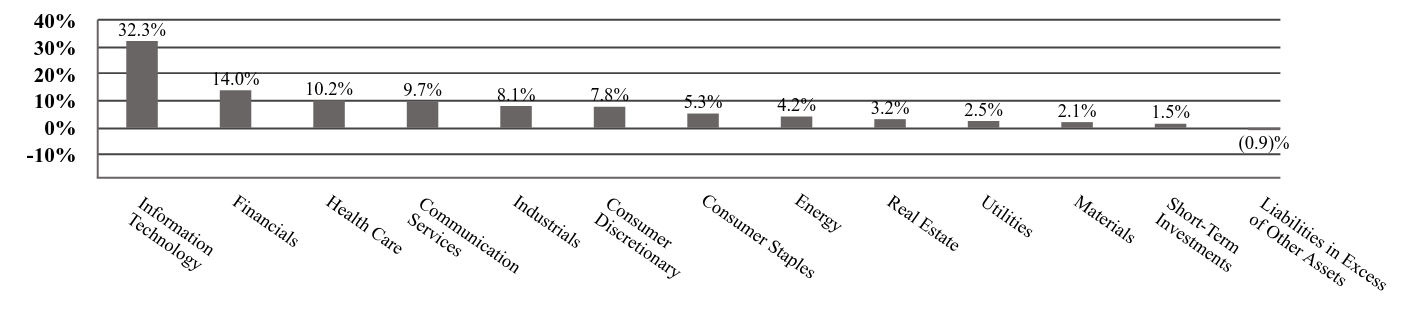

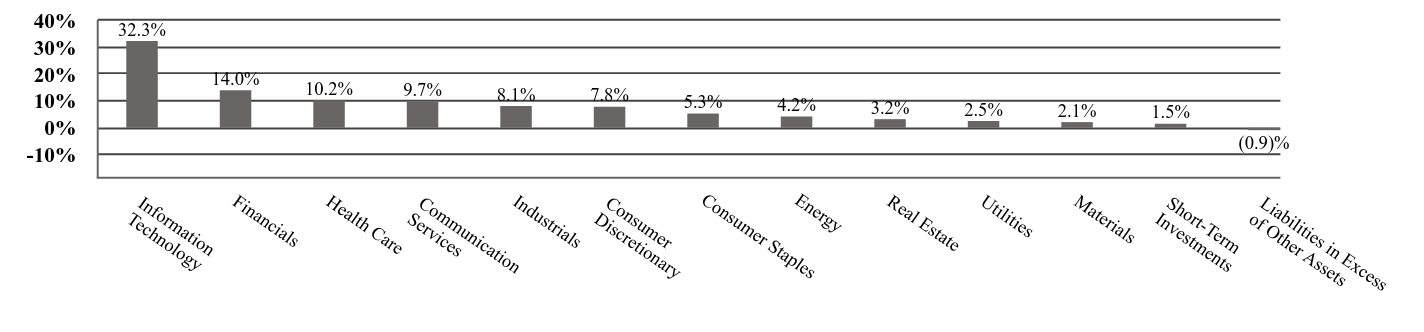

Information Technology | 32.3% | Financials | 14.0% | Health Care | 10.2% | Communication Services | 9.7% | Industrials | 8.1% | Consumer Discretionary | 7.8% | Consumer Staples | 5.3% | Energy | 4.2% | Real Estate | 3.2% | Utilities | 2.5% | Materials | 2.1% | Short-Term Investments | 1.5% | Liabilities in Excess of Other Assets | (0.9)% |

|

| Largest Holdings [Text Block] |

Microsoft Corp. | 8.3% |

|---|

Apple, Inc. | 6.3% |

|---|

Amazon.com, Inc. | 4.7% |

|---|

Meta Platforms, Inc. - Class A | 4.5% |

|---|

Broadcom, Inc. | 4.1% |

|---|

NVIDIA Corp. | 3.6% |

|---|

Taiwan Semiconductor Manufacturing Co. Ltd. | 2.2% |

|---|

AT&T, Inc. | 1.8% |

|---|

Micron Technology, Inc. | 1.9% |

|---|

Boeing Co. | 1.8% |

|---|

|

| C000028788 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Voya Growth and Income Portfolio

|

| Class Name |

Class I

|

| Trading Symbol |

IIVGX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Voya Growth and Income Portfolio for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information Phone Number |

1-800-992-0180

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)Class Name | Costs of $10K investment | Costs paid as % of $10K investment (Annualized) |

|---|

Class I | $34 | 0.67% |

|---|

|

| Expenses Paid, Amount |

$ 34

|

| Expense Ratio, Percent |

0.67%

|

| AssetsNet |

$ 2,510,425,555

|

| Holdings Count | Holding |

74

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,510,425,555

- # of Portfolio Holdings74

- Portfolio Turnover Rate41%

|

| Holdings [Text Block] |

Value | Value |

|---|

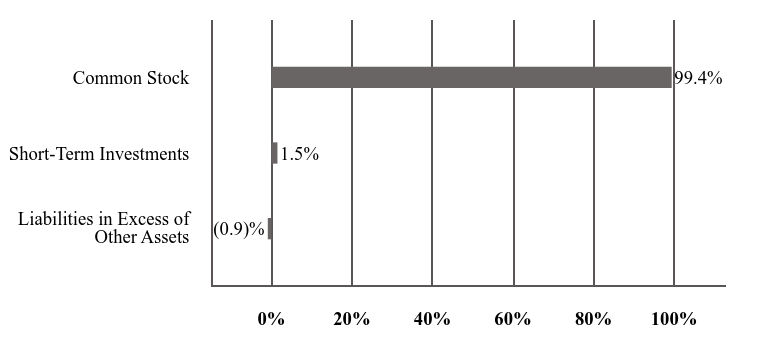

Liabilities in Excess of Other Assets | (0.9)% | Short-Term Investments | 1.5% | Common Stock | 99.4% |

Value | Value |

|---|

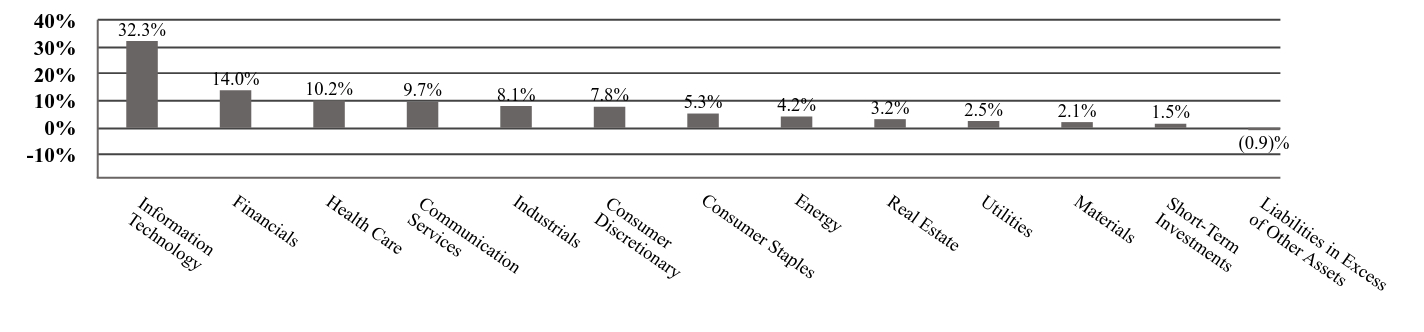

Information Technology | 32.3% | Financials | 14.0% | Health Care | 10.2% | Communication Services | 9.7% | Industrials | 8.1% | Consumer Discretionary | 7.8% | Consumer Staples | 5.3% | Energy | 4.2% | Real Estate | 3.2% | Utilities | 2.5% | Materials | 2.1% | Short-Term Investments | 1.5% | Liabilities in Excess of Other Assets | (0.9)% |

|

| Largest Holdings [Text Block] |

Microsoft Corp. | 8.3% |

|---|

Apple, Inc. | 6.3% |

|---|

Amazon.com, Inc. | 4.7% |

|---|

Meta Platforms, Inc. - Class A | 4.5% |

|---|

Broadcom, Inc. | 4.1% |

|---|

NVIDIA Corp. | 3.6% |

|---|

Taiwan Semiconductor Manufacturing Co. Ltd. | 2.2% |

|---|

AT&T, Inc. | 1.8% |

|---|

Micron Technology, Inc. | 1.9% |

|---|

Boeing Co. | 1.8% |

|---|

|

| C000028789 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Voya Growth and Income Portfolio

|

| Class Name |

Class S

|

| Trading Symbol |

ISVGX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Voya Growth and Income Portfolio for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information Phone Number |

1-800-992-0180

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)Class Name | Costs of $10K investment | Costs paid as % of $10K investment (Annualized) |

|---|

Class S | $47 | 0.92% |

|---|

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.92%

|

| AssetsNet |

$ 2,510,425,555

|

| Holdings Count | Holding |

74

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,510,425,555

- # of Portfolio Holdings74

- Portfolio Turnover Rate41%

|

| Holdings [Text Block] |

Value | Value |

|---|

Liabilities in Excess of Other Assets | (0.9)% | Short-Term Investments | 1.5% | Common Stock | 99.4% |

Value | Value |

|---|

Information Technology | 32.3% | Financials | 14.0% | Health Care | 10.2% | Communication Services | 9.7% | Industrials | 8.1% | Consumer Discretionary | 7.8% | Consumer Staples | 5.3% | Energy | 4.2% | Real Estate | 3.2% | Utilities | 2.5% | Materials | 2.1% | Short-Term Investments | 1.5% | Liabilities in Excess of Other Assets | (0.9)% |

|

| Largest Holdings [Text Block] |

Microsoft Corp. | 8.3% |

|---|

Apple, Inc. | 6.3% |

|---|

Amazon.com, Inc. | 4.7% |

|---|

Meta Platforms, Inc. - Class A | 4.5% |

|---|

Broadcom, Inc. | 4.1% |

|---|

NVIDIA Corp. | 3.6% |

|---|

Taiwan Semiconductor Manufacturing Co. Ltd. | 2.2% |

|---|

AT&T, Inc. | 1.8% |

|---|

Micron Technology, Inc. | 1.9% |

|---|

Boeing Co. | 1.8% |

|---|

|

| C000074892 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Voya Growth and Income Portfolio

|

| Class Name |

Class S2

|

| Trading Symbol |

IGISX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Voya Growth and Income Portfolio for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information Phone Number |

1-800-992-0180

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)Class Name | Costs of $10K investment | Costs paid as % of $10K investment (Annualized) |

|---|

Class S2 | $54 | 1.07% |

|---|

|

| Expenses Paid, Amount |

$ 54

|

| Expense Ratio, Percent |

1.07%

|

| AssetsNet |

$ 2,510,425,555

|

| Holdings Count | Holding |

74

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

| Additional Fund Statistics [Text Block] |

- Total Net Assets$2,510,425,555

- # of Portfolio Holdings74

- Portfolio Turnover Rate41%

|

| Holdings [Text Block] |

Value | Value |

|---|

Liabilities in Excess of Other Assets | (0.9)% | Short-Term Investments | 1.5% | Common Stock | 99.4% |

Value | Value |

|---|

Information Technology | 32.3% | Financials | 14.0% | Health Care | 10.2% | Communication Services | 9.7% | Industrials | 8.1% | Consumer Discretionary | 7.8% | Consumer Staples | 5.3% | Energy | 4.2% | Real Estate | 3.2% | Utilities | 2.5% | Materials | 2.1% | Short-Term Investments | 1.5% | Liabilities in Excess of Other Assets | (0.9)% |

|

| Largest Holdings [Text Block] |

Microsoft Corp. | 8.3% |

|---|

Apple, Inc. | 6.3% |

|---|

Amazon.com, Inc. | 4.7% |

|---|

Meta Platforms, Inc. - Class A | 4.5% |

|---|

Broadcom, Inc. | 4.1% |

|---|

NVIDIA Corp. | 3.6% |

|---|

Taiwan Semiconductor Manufacturing Co. Ltd. | 2.2% |

|---|

AT&T, Inc. | 1.8% |

|---|

Micron Technology, Inc. | 1.9% |

|---|

Boeing Co. | 1.8% |

|---|

|