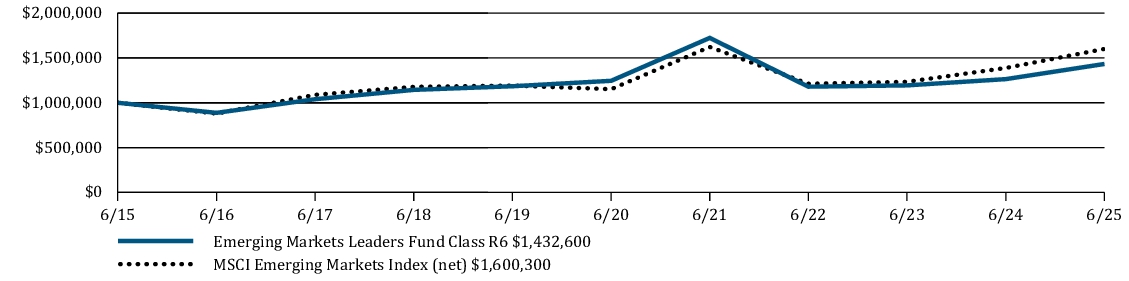

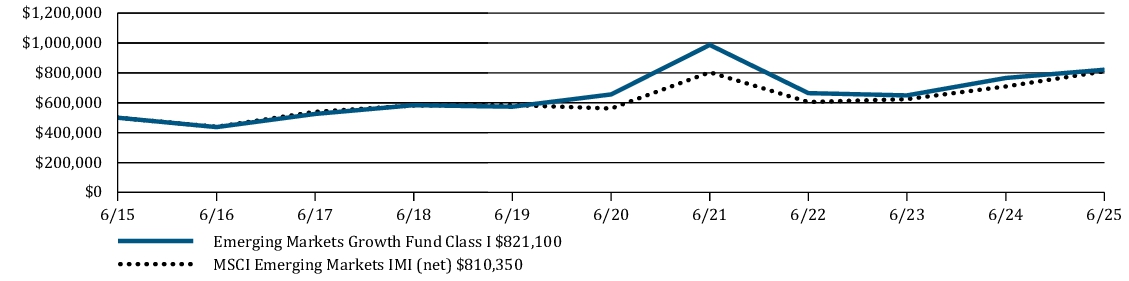

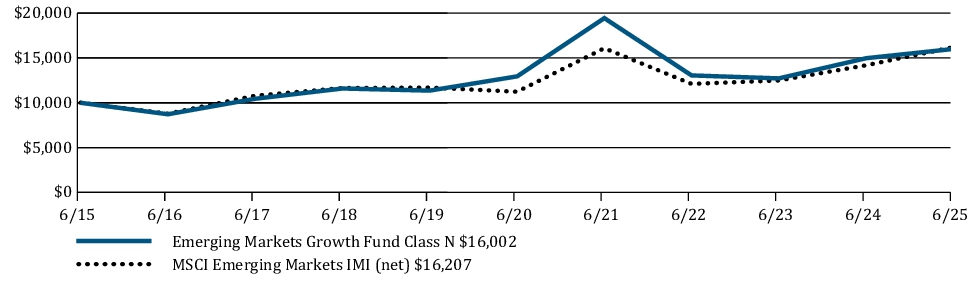

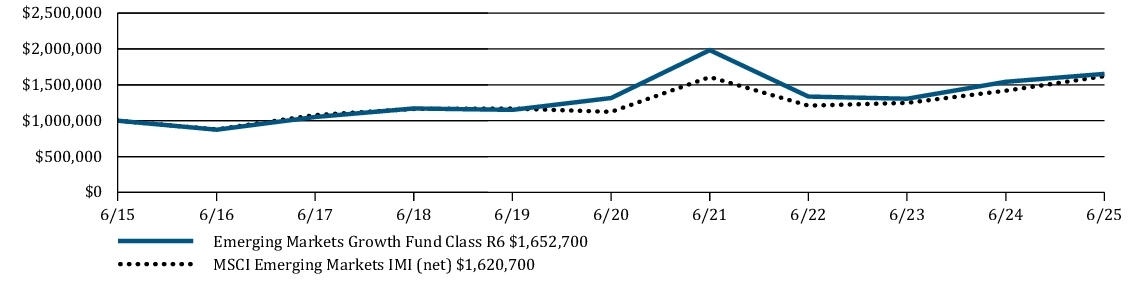

Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

William Blair Funds

|

| Entity Central Index Key |

0000822632

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| William Blair Growth Fund - Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Growth Fund

|

| Class Name |

Class I

|

| Trading Symbol |

BGFIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Growth Fund Class I (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

Fund |

Cost of $10,000 Investment |

Cost of $10,000 Investment as a percentage |

| Growth Fund Class I |

$ 47 |

0.92 % |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.92%

|

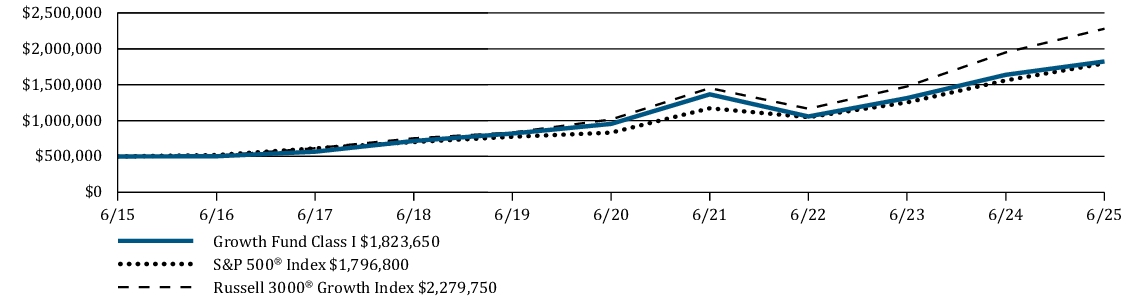

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund returned 3.74% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 3000 ® Growth Index, which returned 5.80% and underperformed the S&P 500 ® Index, a broad measure of market performance, which returned 6.20%. The Fund’s underperformance was driven by a combination of stock-specific dynamics and style factors. From a style perspective, our bias towards small and mid-caps was a headwind. The top detractors for the period came from stock selection in Health Care, including our positions in UnitedHealth Group, West Pharmaceuticals and Agilent Technologies. Other top detractors included ACV Auctions (Industrials) and EPAM Systems (Information Technology). Not owning Netflix (Communication Services) was also a headwind to performance. The top contributors to performance included Cameco (Energy), NVIDIA (Information Technology), Intuit (Information Technology), and Oracle (Information Technology), as well as our underweight to Apple (Information Technology). Not owning Tesla (Consumer Discretionary) was also a tailwind to performance. TOP PERFORMANCE CONTRIBUTORS

Cameco is a company focused on the mining, trading, and processing of uranium, a key input into nuclear power generation. The stock outperformed as the company delivered strong results for the period, supported by higher sales and realized pricing, while maintaining all key 2025 guidance metrics. NVIDIA is a leading fabless semiconductor company specializing in the design and marketing of high-performance graphics processing unit (“GPU”) chipsets and software systems. The stock outperformed due to robust demand for artificial intelligence infrastructure, particularly due to increased inferencing workloads among major partners and customers. TOP PERFORMANCE DETRACTORS

UnitedHealth Group is a diversified healthcare company, operating through UnitedHealthcare, offering health insurance across various markets, and Optum, which provides healthcare services, including software and data consultancy. The stock lagged as results fell short of expectations primarily due to underperformance in Optum Health and Medicare Advantage due to higher-than-expected patient use. West Pharmaceuticals a leading supplier of packaging components for injectable drugs and accessories for prefilled syringes and cartridge components. The stock underperformed as forward guidance was below expectations, driven by the loss of two major contract manufacturing customers and weaker-than-expected incentive payments for its SmartDose manufacturing segment. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

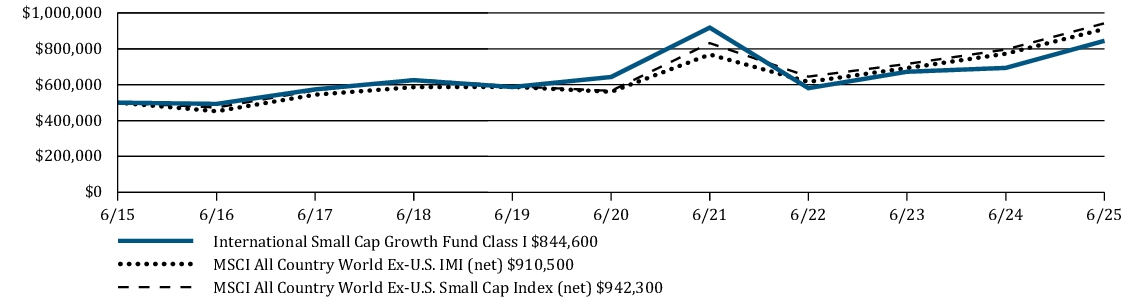

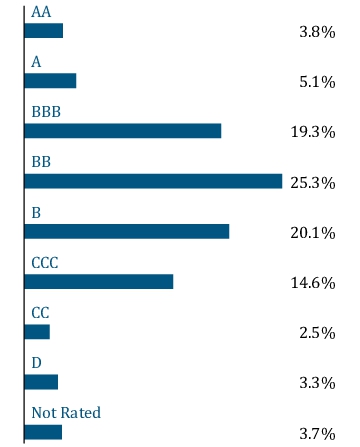

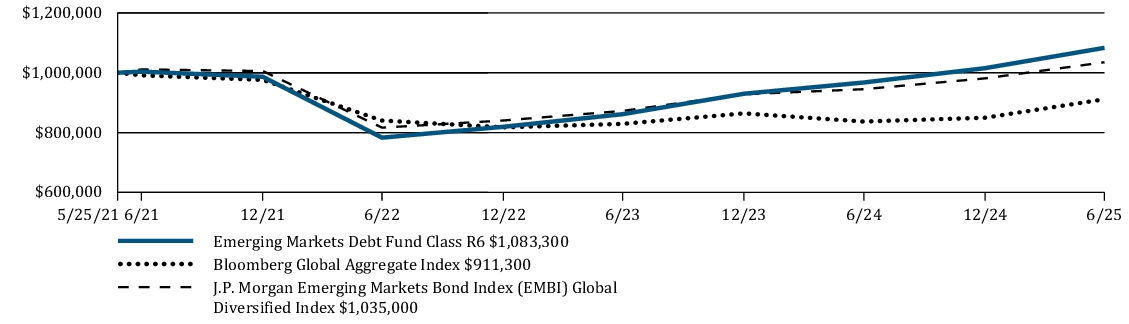

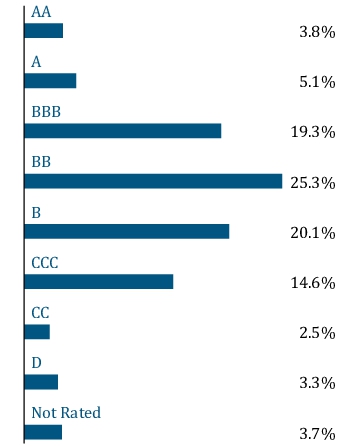

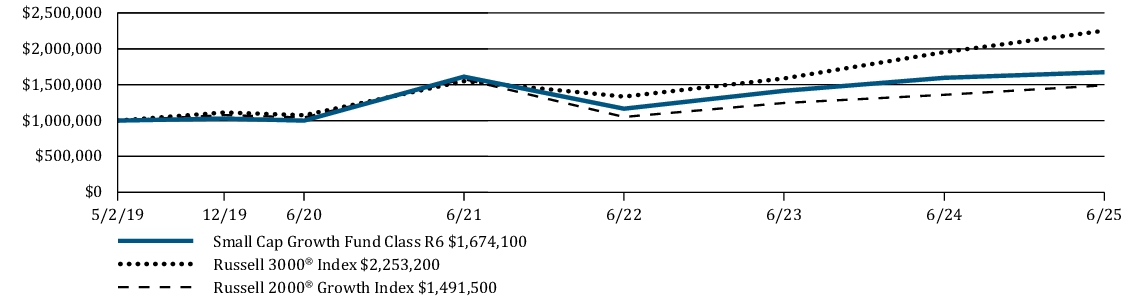

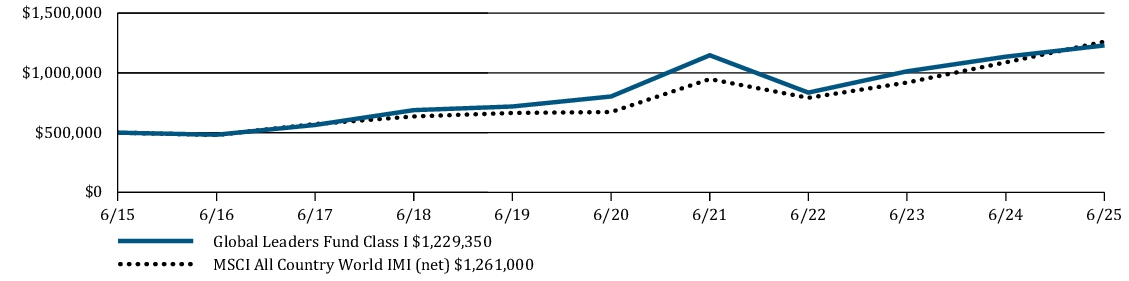

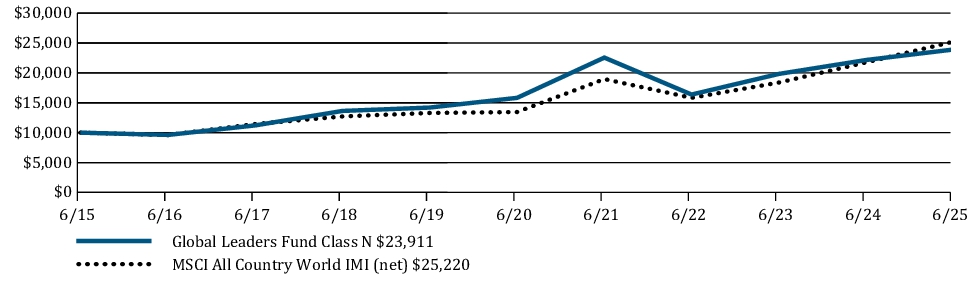

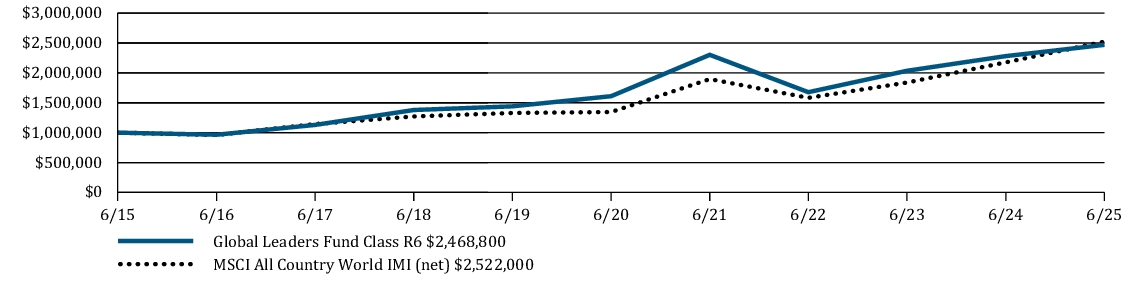

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns |

6 Months |

1 Year |

5 Years |

10 Years |

Growth Fund Class I |

3.74 % |

11.34 % |

13.83 % |

13.81 % |

S&P 500® Index |

6.20 % |

15.16 % |

16.64 % |

13.65 % |

Russell 3000 ® Growth Index |

5.80 % |

16.89 % |

17.55 % |

16.38 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 237,002,000

|

| Holdings Count | Holding |

47

|

| Advisory Fees Paid, Amount |

$ 836,000

|

| Investment Company, Portfolio Turnover |

45.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) |

$ 237,002 |

Number of portfolio holdings |

47 |

Net advisory fees paid (in $000s) |

$ 836 |

Portfolio turnover rate (six months) |

45 % |

|

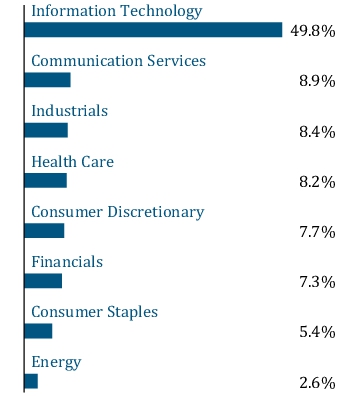

| Holdings [Text Block] |

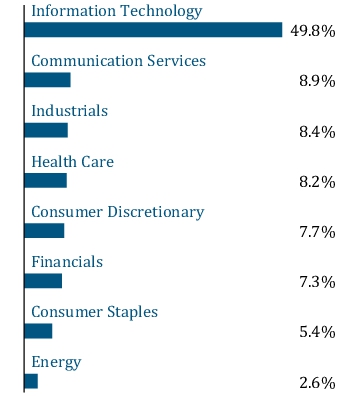

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

| NVIDIA Corp. |

10.7 % |

| Microsoft Corp. |

8.7 % |

| Amazon.com, Inc. |

5.3 % |

| Apple, Inc. |

4.9 % |

| Broadcom, Inc. |

4.8 % |

| Meta Platforms, Inc. |

4.3 % |

| Alphabet, Inc. |

3.5 % |

| Mastercard, Inc. |

3.4 % |

| Walmart, Inc. |

3.3 % |

| ServiceNow, Inc. |

3.0 % |

|

| Largest Holdings [Text Block] |

| NVIDIA Corp. |

10.7 % |

| Microsoft Corp. |

8.7 % |

| Amazon.com, Inc. |

5.3 % |

| Apple, Inc. |

4.9 % |

| Broadcom, Inc. |

4.8 % |

| Meta Platforms, Inc. |

4.3 % |

| Alphabet, Inc. |

3.5 % |

| Mastercard, Inc. |

3.4 % |

| Walmart, Inc. |

3.3 % |

| ServiceNow, Inc. |

3.0 % |

|

| William Blair Growth Fund - Class N |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Growth Fund

|

| Class Name |

Class N

|

| Trading Symbol |

WBGSX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Growth Fund Class N (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Growth Fund Class N | $ 61 | 1.20 % |

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

1.20%

|

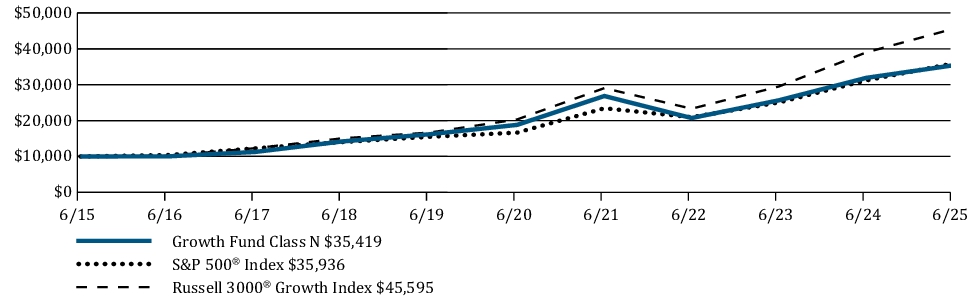

| Factors Affecting Performance [Text Block] |

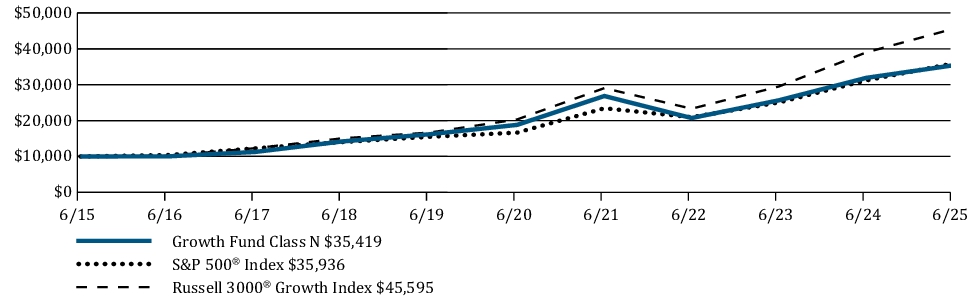

Management’s Discussion of Fund Performance SUMMARY OF RESULTS The Fund returned 3.53% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 3000 ® Growth Index, which returned 5.80% and underperformed the S&P 500 ® Index, a broad measure of market performance, which returned 6.20%. The Fund’s underperformance was driven by a combination of stock-specific dynamics and style factors. From a style perspective, our bias towards small and mid-caps was a headwind. The top detractors for the period came from stock selection in Health Care, including our positions in UnitedHealth Group, West Pharmaceuticals and Agilent Technologies. Other top detractors included ACV Auctions (Industrials) and EPAM Systems (Information Technology). Not owning Netflix (Communication Services) was also a headwind to performance. The top contributors to performance included Cameco (Energy), NVIDIA (Information Technology), Intuit (Information Technology), and Oracle (Information Technology), as well as our underweight to Apple (Information Technology). Not owning Tesla (Consumer Discretionary) was also a tailwind to performance. TOP PERFORMANCE CONTRIBUTORS Cameco is a company focused on the mining, trading, and processing of uranium, a key input into nuclear power generation. The stock outperformed as the company delivered strong results for the period, supported by higher sales and realized pricing, while maintaining all key 2025 guidance metrics. NVIDIA is a leading fabless semiconductor company specializing in the design and marketing of high-performance graphics processing unit (“GPU”) chipsets and software systems. The stock outperformed due to robust demand for artificial intelligence infrastructure, particularly due to increased inferencing workloads among major partners and customers. TOP PERFORMANCE DETRACTORS UnitedHealth Group is a diversified healthcare company, operating through UnitedHealthcare, offering health insurance across various markets, and Optum, which provides healthcare services, including software and data consultancy. The stock lagged as results fell short of expectations primarily due to underperformance in Optum Health and Medicare Advantage due to higher-than-expected patient use. West Pharmaceuticals a leading supplier of packaging components for injectable drugs and accessories for prefilled syringes and cartridge components. The stock underperformed as forward guidance was below expectations, driven by the loss of two major contract manufacturing customers and weaker-than-expected incentive payments for its SmartDose manufacturing segment. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

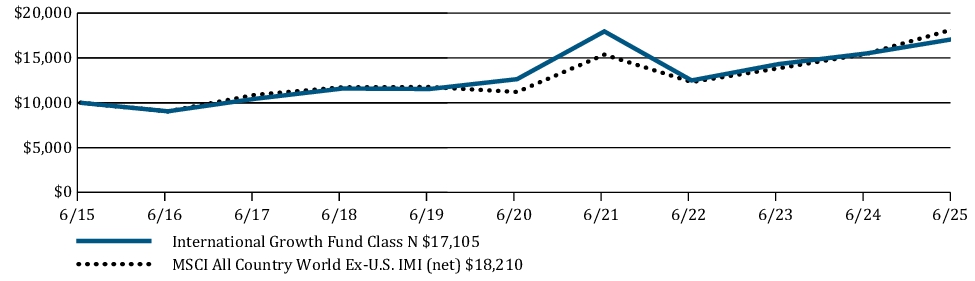

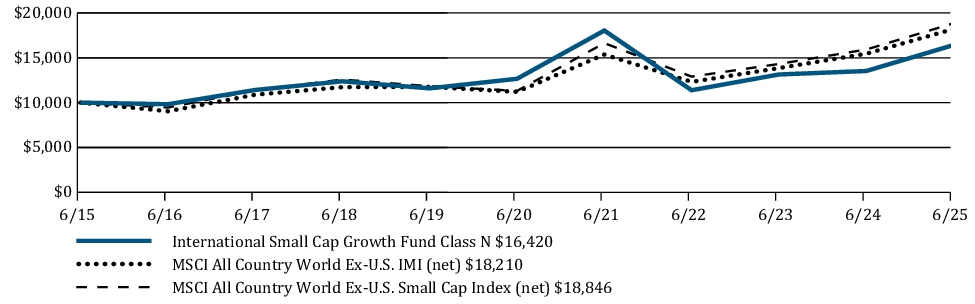

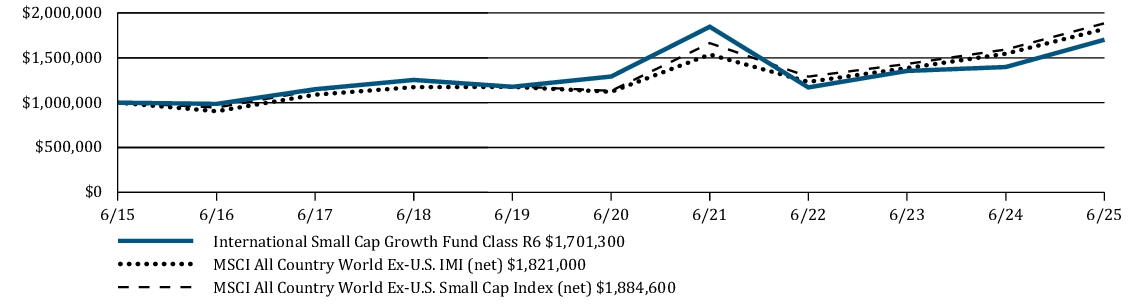

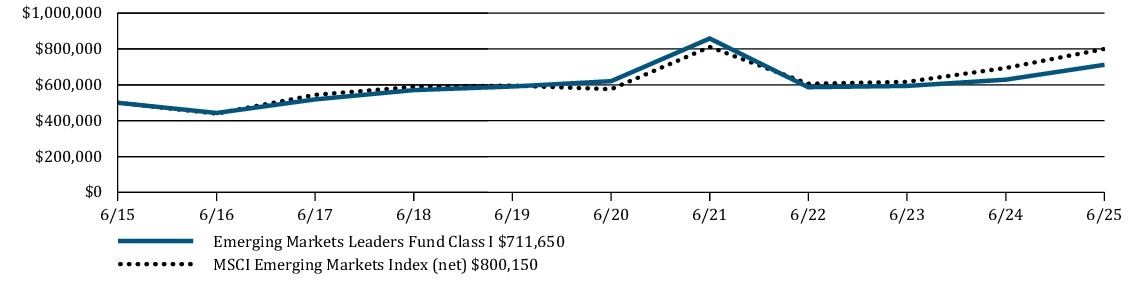

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 6 Months | 1 Year | 5 Years | 10 Years | Growth Fund Class N | 3.53 % | 11.00 % | 13.50 % | 13.48 % | S&P 500® Index | 6.20 % | 15.16 % | 16.64 % | 13.65 % | Russell 3000 ® Growth Index | 5.80 % | 16.89 % | 17.55 % | 16.38 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 237,002,000

|

| Holdings Count | Holding |

47

|

| Advisory Fees Paid, Amount |

$ 836,000

|

| Investment Company, Portfolio Turnover |

45.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) | $ 237,002 | Number of portfolio holdings | 47 | Net advisory fees paid (in $000s) | $ 836 | Portfolio turnover rate (six months) | 45 % |

|

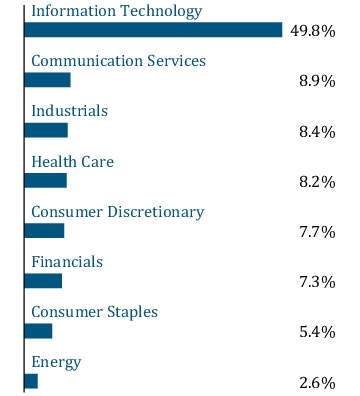

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. | NVIDIA Corp. | 10.7 % | | Microsoft Corp. | 8.7 % | | Amazon.com, Inc. | 5.3 % | | Apple, Inc. | 4.9 % | | Broadcom, Inc. | 4.8 % | | Meta Platforms, Inc. | 4.3 % | | Alphabet, Inc. | 3.5 % | | Mastercard, Inc. | 3.4 % | | Walmart, Inc. | 3.3 % | | ServiceNow, Inc. | 3.0 % |

|

| Largest Holdings [Text Block] |

| NVIDIA Corp. | 10.7 % | | Microsoft Corp. | 8.7 % | | Amazon.com, Inc. | 5.3 % | | Apple, Inc. | 4.9 % | | Broadcom, Inc. | 4.8 % | | Meta Platforms, Inc. | 4.3 % | | Alphabet, Inc. | 3.5 % | | Mastercard, Inc. | 3.4 % | | Walmart, Inc. | 3.3 % | | ServiceNow, Inc. | 3.0 % |

|

| William Blair Growth Fund - Class R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Growth Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

BGFRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Growth Fund Class R6 (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

Fund |

Cost of $10,000 Investment |

Cost of $10,000 Investment as a percentage |

| Growth Fund Class R6 |

$ 45 |

0.88 % |

|

| Expenses Paid, Amount |

$ 45

|

| Expense Ratio, Percent |

0.88%

|

| Factors Affecting Performance [Text Block] |

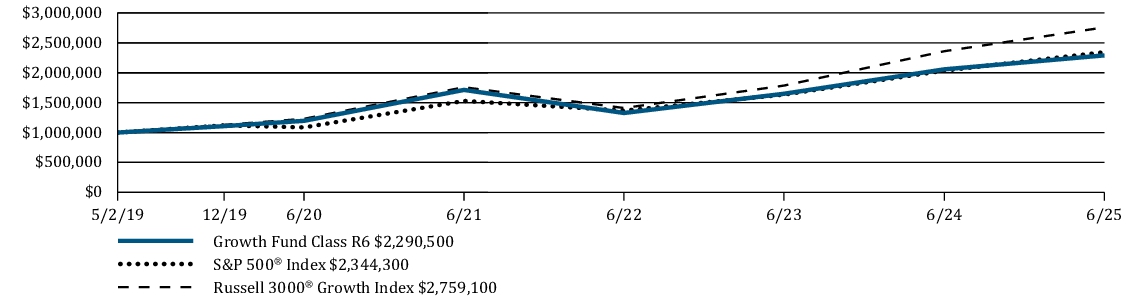

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

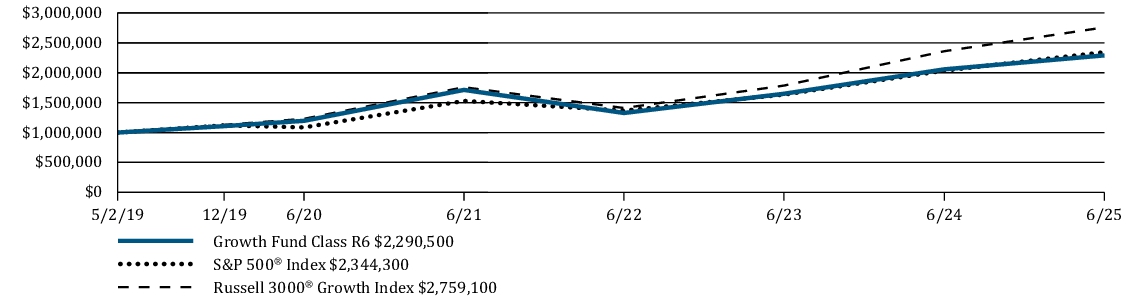

The Fund returned 3.71% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 3000 ® Growth Index, which returned 5.80% and underperformed the S&P 500 ® Index, a broad measure of market performance, which returned 6.20%. The Fund’s underperformance was driven by a combination of stock-specific dynamics and style factors. From a style perspective, our bias towards small and mid-caps was a headwind. The top detractors for the period came from stock selection in Health Care, including our positions in UnitedHealth Group, West Pharmaceuticals and Agilent Technologies. Other top detractors included ACV Auctions (Industrials) and EPAM Systems (Information Technology). Not owning Netflix (Communication Services) was also a headwind to performance. The top contributors to performance included Cameco (Energy), NVIDIA (Information Technology), Intuit (Information Technology), and Oracle (Information Technology), as well as our underweight to Apple (Information Technology). Not owning Tesla (Consumer Discretionary) was also a tailwind to performance. TOP PERFORMANCE CONTRIBUTORS

Cameco is a company focused on the mining, trading, and processing of uranium, a key input into nuclear power generation. The stock outperformed as the company delivered strong results for the period, supported by higher sales and realized pricing, while maintaining all key 2025 guidance metrics. NVIDIA is a leading fabless semiconductor company specializing in the design and marketing of high-performance graphics processing unit (“GPU”) chipsets and software systems. The stock outperformed due to robust demand for artificial intelligence infrastructure, particularly due to increased inferencing workloads among major partners and customers. TOP PERFORMANCE DETRACTORS

UnitedHealth Group is a diversified healthcare company, operating through UnitedHealthcare, offering health insurance across various markets, and Optum, which provides healthcare services, including software and data consultancy. The stock lagged as results fell short of expectations primarily due to underperformance in Optum Health and Medicare Advantage due to higher-than-expected patient use. West Pharmaceuticals a leading supplier of packaging components for injectable drugs and accessories for prefilled syringes and cartridge components. The stock underperformed as forward guidance was below expectations, driven by the loss of two major contract manufacturing customers and weaker-than-expected incentive payments for its SmartDose manufacturing segment. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

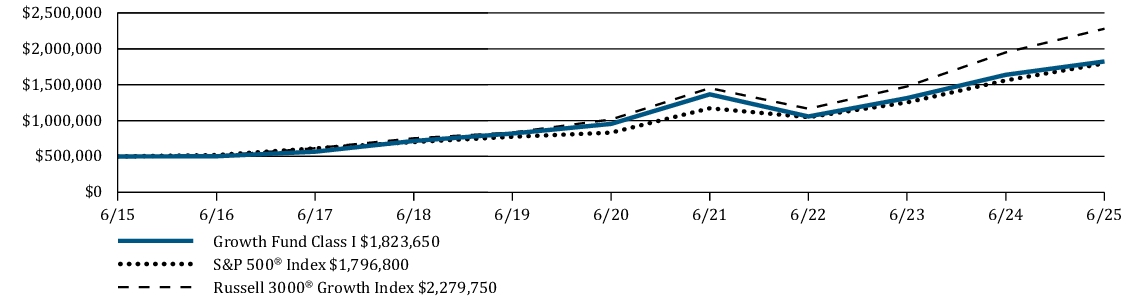

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns |

6 Months |

1 Year |

5 Years |

Since Inception |

Growth Fund Class R6 |

3.71 % |

11.35 % |

13.88 % |

14.39 % |

S&P 500® Index |

6.20 % |

15.16 % |

16.64 % |

14.82 % |

Russell 3000 ® Growth Index |

5.80 % |

16.89 % |

17.55 % |

17.90 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 237,002,000

|

| Holdings Count | Holding |

47

|

| Advisory Fees Paid, Amount |

$ 836,000

|

| Investment Company, Portfolio Turnover |

45.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) |

$ 237,002 |

Number of portfolio holdings |

47 |

Net advisory fees paid (in $000s) |

$ 836 |

Portfolio turnover rate (six months) |

45 % |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

| NVIDIA Corp. |

10.7 % |

| Microsoft Corp. |

8.7 % |

| Amazon.com, Inc. |

5.3 % |

| Apple, Inc. |

4.9 % |

| Broadcom, Inc. |

4.8 % |

| Meta Platforms, Inc. |

4.3 % |

| Alphabet, Inc. |

3.5 % |

| Mastercard, Inc. |

3.4 % |

| Walmart, Inc. |

3.3 % |

| ServiceNow, Inc. |

3.0 % |

|

| Largest Holdings [Text Block] |

| NVIDIA Corp. |

10.7 % |

| Microsoft Corp. |

8.7 % |

| Amazon.com, Inc. |

5.3 % |

| Apple, Inc. |

4.9 % |

| Broadcom, Inc. |

4.8 % |

| Meta Platforms, Inc. |

4.3 % |

| Alphabet, Inc. |

3.5 % |

| Mastercard, Inc. |

3.4 % |

| Walmart, Inc. |

3.3 % |

| ServiceNow, Inc. |

3.0 % |

|

| William Blair Large Cap Growth Fund - Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Large Cap Growth Fund

|

| Class Name |

Class I

|

| Trading Symbol |

LCGFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Large Cap Growth Fund Class I (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

Fund |

Cost of $10,000 Investment |

Cost of $10,000 Investment as a percentage |

| Large Cap Growth Fund Class I |

$ 33 |

0.65 % |

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.65%

|

| Factors Affecting Performance [Text Block] |

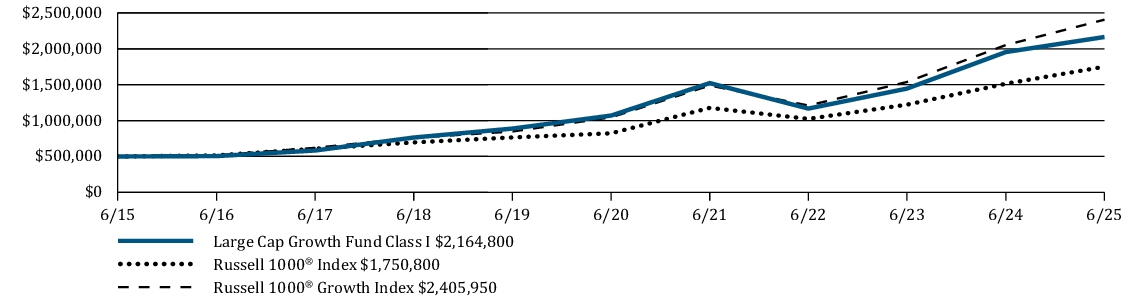

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

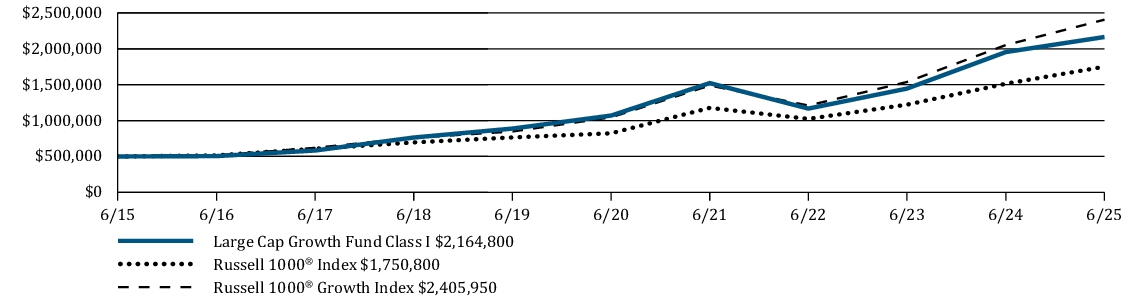

The Fund returned 5.83% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 1000 ® Growth Index (the "Index"), which returned 6.09% and underperformed the Russell 1000 ® Index, a broad measure of market performance, which returned 6.12%. The top detractors for the period came from stock selection in Health Care, including our positions in UnitedHealth Group, West Pharmaceuticals and Agilent Technologies. Other top detractors included Salesforce (Information Technology) and Chipotle Mexican Grill (Consumer Discretionary), as well as not owning Netflix (Communication Services) and Palantir Technologies (Information Technology). The top contributors to performance included Meta Platforms (Communication Services), Uber Technologies (Industrials), IDEXX Laboratories (Health Care), Intuit (Information Technology), as well as our underweight to Apple (Information Technology). Not owning Tesla (Consumer Discretionary) and Alphabet (Communication Services) were also tailwinds to performance. TOP PERFORMANCE CONTRIBUTORS

Meta Platforms is a market leader in social media and digital advertising, best known for its platforms including Facebook, Instagram and WhatsApp. The stock outperformed driven by strong digital advertising growth across its family of apps and early momentum in artificial intelligence initiatives. Uber Technologies is a technology platform that develops and operates networks facilitating the movement of products and people. The stock outperformed due to strong demand across mobility and delivery verticals. TOP PERFORMANCE DETRACTORS

UnitedHealth Group is a diversified healthcare company, operating through UnitedHealthcare, offering health insurance across various markets, and Optum, which provides healthcare services, including software and data consultancy. The stock lagged as results fell short of expectations primarily due to underperformance in Optum Health and Medicare Advantage due to higher-than-expected patient use. West Pharmaceuticals a leading supplier of packaging components for injectable drugs and accessories for prefilled syringes and cartridge components. The stock underperformed as forward guidance was below expectations, driven by the loss of two major contract manufacturing customers and weaker-than-expected incentive payments for its SmartDose manufacturing segment. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

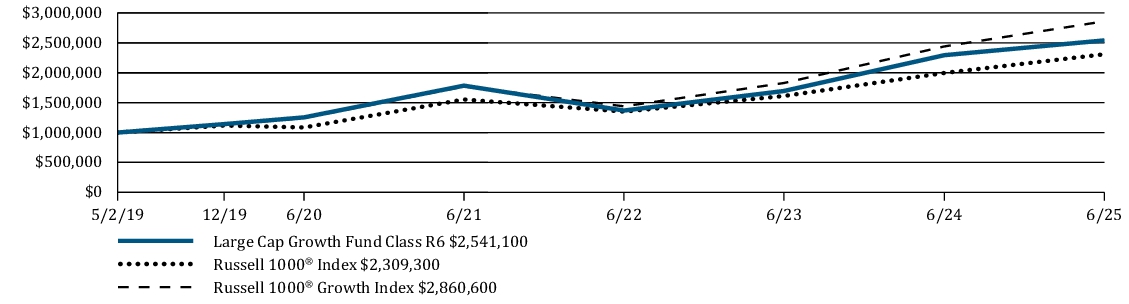

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns |

6 Months |

1 Year |

5 Years |

10 Years |

Large Cap Growth Fund Class I |

5.83 % |

10.74 % |

15.13 % |

15.78 % |

Russell 1000® Index |

6.12 % |

15.66 % |

16.30 % |

13.35 % |

Russell 1000® Growth Index |

6.09 % |

17.22 % |

18.15 % |

17.01 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 2,793,210,000

|

| Holdings Count | Holding |

32

|

| Advisory Fees Paid, Amount |

$ 6,743,000

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) |

$ 2,793,210 |

Number of portfolio holdings |

32 |

Net advisory fees paid (in $000s) |

$ 6,743 |

Portfolio turnover rate (six months) |

20 % |

|

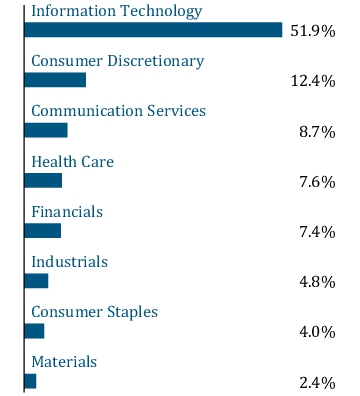

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

| Microsoft Corp. |

13.9 % |

| NVIDIA Corp. |

13.4 % |

| Amazon.com, Inc. |

8.0 % |

| Apple, Inc. |

7.3 % |

| Meta Platforms, Inc. |

6.9 % |

| Broadcom, Inc. |

4.9 % |

| Mastercard, Inc. |

4.5 % |

| Costco Wholesale Corp. |

2.7 % |

| IDEXX Laboratories, Inc. |

2.5 % |

| Intuit, Inc. |

2.5 % |

|

| Largest Holdings [Text Block] |

| Microsoft Corp. |

13.9 % |

| NVIDIA Corp. |

13.4 % |

| Amazon.com, Inc. |

8.0 % |

| Apple, Inc. |

7.3 % |

| Meta Platforms, Inc. |

6.9 % |

| Broadcom, Inc. |

4.9 % |

| Mastercard, Inc. |

4.5 % |

| Costco Wholesale Corp. |

2.7 % |

| IDEXX Laboratories, Inc. |

2.5 % |

| Intuit, Inc. |

2.5 % |

|

| William Blair Large Cap Growth Fund - Class N |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Large Cap Growth Fund

|

| Class Name |

Class N

|

| Trading Symbol |

LCGNX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Large Cap Growth Fund Class N (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Large Cap Growth Fund Class N | $ 46 | 0.90 % |

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.90%

|

| Factors Affecting Performance [Text Block] |

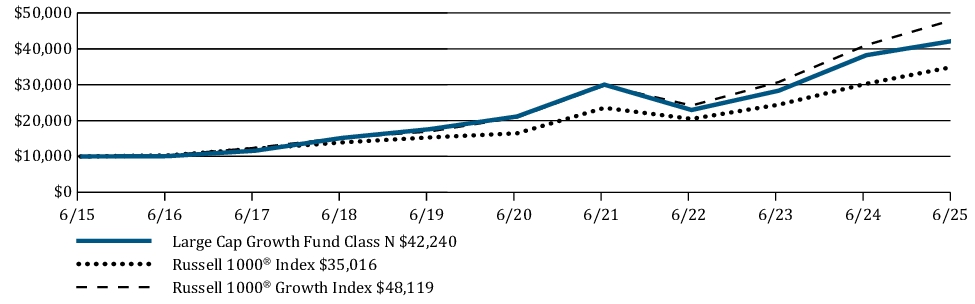

Management’s Discussion of Fund Performance SUMMARY OF RESULTS The Fund returned 5.67% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 1000 ® Growth Index (the "Index"), which returned 6.09% and underperformed the Russell 1000 ® Index, a broad measure of market performance, which returned 6.12%. The top detractors for the period came from stock selection in Health Care, including our positions in UnitedHealth Group, West Pharmaceuticals and Agilent Technologies. Other top detractors included Salesforce (Information Technology) and Chipotle Mexican Grill (Consumer Discretionary), as well as not owning Netflix (Communication Services) and Palantir Tec hnologies (Information Technology). The top contributors to performance included Meta Platforms (Communication Services), Uber Technologies (Industrials), IDEXX Laboratories (Health Care), Intuit (Information Technology), as well as our underweight to Apple (Information Technology). Not owning Tesla (Consumer Discretionary) and Alphabet (Communication Services) were also tailwinds to performance. TOP PERFORMANCE CONTRIBUTORS Meta Platforms is a market leader in social media and digital advertising, best known for its platforms including Facebook, Instagram and WhatsApp. The stock outperformed driven by strong digital advertising growth across its family of apps and early momentum in artificial intelligence initiatives. Uber Technologies is a technology platform that develops and operates networks facilitating the movement of products and people. The stock outperformed due to strong demand across mobility and delivery verticals. TOP PERFORMANCE DETRACTORS UnitedHealth Group is a diversified healthcare company, operating through UnitedHealthcare, offering health insurance across various markets, and Optum, which provides healthcare services, including software and data consultancy. The stock lagged as results fell short of expectations primarily due to underperformance in Optum Health and Medicare Advantage due to higher-than-expected patient use. West Pharmaceuticals a leading supplier of packaging components for injectable drugs and accessories for prefilled syringes and cartridge components. The stock underperformed as forward guidance was below expectations, driven by the loss of two major contract manufacturing customers and weaker-than-expected incentive payments for its SmartDose manufacturing segment. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

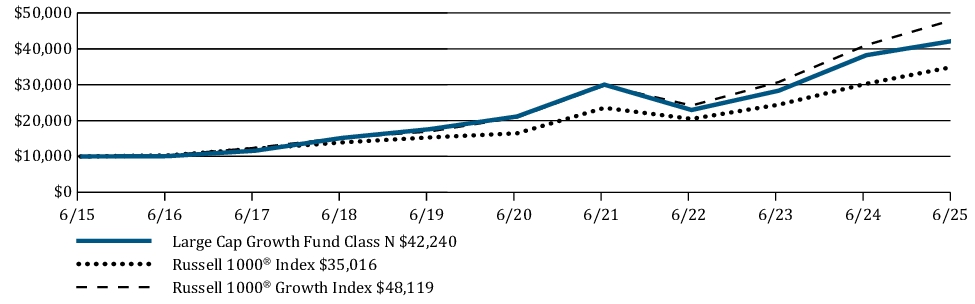

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 6 Months | 1 Year | 5 Years | 10 Years | Large Cap Growth Fund Class N | 5.67 % | 10.49 % | 14.84 % | 15.50 % | Russell 1000® Index | 6.12 % | 15.66 % | 16.30 % | 13.35 % | Russell 1000® Growth Index | 6.09 % | 17.22 % | 18.15 % | 17.01 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 2,793,210,000

|

| Holdings Count | Holding |

32

|

| Advisory Fees Paid, Amount |

$ 6,743,000

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) | $ 2,793,210 | Number of portfolio holdings | 32 | Net advisory fees paid (in $000s) | $ 6,743 | Portfolio turnover rate (six months) | 20 % |

|

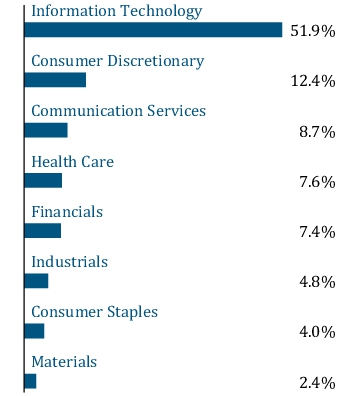

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. | Microsoft Corp. | 13.9 % | | NVIDIA Corp. | 13.4 % | | Amazon.com, Inc. | 8.0 % | | Apple, Inc. | 7.3 % | | Meta Platforms, Inc. | 6.9 % | | Broadcom, Inc. | 4.9 % | | Mastercard, Inc. | 4.5 % | | Costco Wholesale Corp. | 2.7 % | | IDEXX Laboratories, Inc. | 2.5 % | | Intuit, Inc. | 2.5 % |

|

| Largest Holdings [Text Block] |

| Microsoft Corp. | 13.9 % | | NVIDIA Corp. | 13.4 % | | Amazon.com, Inc. | 8.0 % | | Apple, Inc. | 7.3 % | | Meta Platforms, Inc. | 6.9 % | | Broadcom, Inc. | 4.9 % | | Mastercard, Inc. | 4.5 % | | Costco Wholesale Corp. | 2.7 % | | IDEXX Laboratories, Inc. | 2.5 % | | Intuit, Inc. | 2.5 % |

|

| William Blair Large Cap Growth Fund - CLASS R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Large Cap Growth Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

LCGJX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Large Cap Growth Fund Class R6 (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Large Cap Growth Fund Class R6 | $ 31 | 0.60 % |

|

| Expenses Paid, Amount |

$ 31

|

| Expense Ratio, Percent |

0.60%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance SUMMARY OF RESULTS The Fund returned 5.83% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 1000 ® Growth Index (the "Index"), which returned 6.09% and underperformed the Russell 1000 ® Index, a broad measure of market performance, which returned 6.12%. The top detractors for the period came from stock selection in Health Care, including our positions in UnitedHealth Group, West Pharmaceuticals and Agilent Technologies. Other top detractors included Salesforce (Information Technology) and Chipotle Mexican Grill (Consumer Discretionary), as well as not owning Netflix (Communication Services) and Palantir Technologies (Information Technology). The top contributors to performance included Meta Platforms (Communication S er vices), Uber Technologies (Industrials), IDEXX Laboratories (Health Care), Intuit (Information Technology), as well as our underweight to Apple (Information Technology). Not owning Tesla (Consumer Discretionary) and Alphabet (Communication Services) were also tailwinds to performance. Uber Technologies is a technology platform that develops and operates networks facilitating the movement of products and people. The stock outperformed due to strong demand across mobility and delivery verticals. West Pharmaceuticals a leading supplier of packaging components for injectable drugs and accessories for prefilled syringes and cartridge components. The stock underperformed as forward guidance was below expectations, driven by the loss of two major contract manufacturing customers and weaker-than-expected incentive payments for its SmartDose manufacturing segment. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

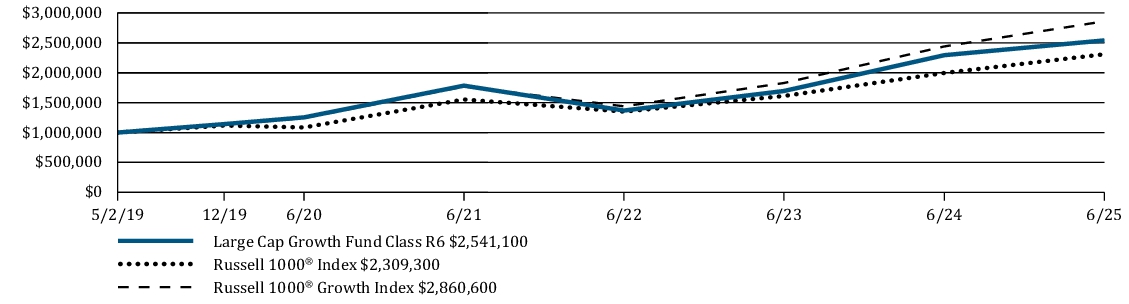

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 6 Months | 1 Year | 5 Years | Since Inception | Large Cap Growth Fund Class R6 | 5.83 % | 10.79 % | 15.18 % | 16.33 % | Russell 1000® Index | 6.12 % | 15.66 % | 16.30 % | 14.53 % | Russell 1000® Growth Index | 6.09 % | 17.22 % | 18.15 % | 18.59 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 2,793,210,000

|

| Holdings Count | Holding |

32

|

| Advisory Fees Paid, Amount |

$ 6,743,000

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) | $ 2,793,210 | Number of portfolio holdings | 32 | Net advisory fees paid (in $000s) | $ 6,743 | Portfolio turnover rate (six months) | 20 % |

|

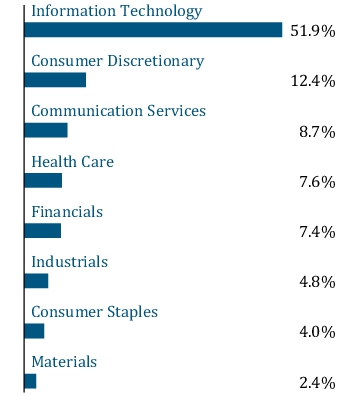

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. | Microsoft Corp. | 13.9 % | | NVIDIA Corp. | 13.4 % | | Amazon.com, Inc. | 8.0 % | | Apple, Inc. | 7.3 % | | Meta Platforms, Inc. | 6.9 % | | Broadcom, Inc. | 4.9 % | | Mastercard, Inc. | 4.5 % | | Costco Wholesale Corp. | 2.7 % | | IDEXX Laboratories, Inc. | 2.5 % | | Intuit, Inc. | 2.5 % |

|

| Largest Holdings [Text Block] |

| Microsoft Corp. | 13.9 % | | NVIDIA Corp. | 13.4 % | | Amazon.com, Inc. | 8.0 % | | Apple, Inc. | 7.3 % | | Meta Platforms, Inc. | 6.9 % | | Broadcom, Inc. | 4.9 % | | Mastercard, Inc. | 4.5 % | | Costco Wholesale Corp. | 2.7 % | | IDEXX Laboratories, Inc. | 2.5 % | | Intuit, Inc. | 2.5 % |

|

| William Blair Mid Cap Value Fund - Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Mid Cap Value Fund

|

| Class Name |

Class I

|

| Trading Symbol |

WVMIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Mid Cap Value Fund Class I (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Mid Cap Value Fund Class I | $ 38 | 0.75 % |

|

| Expenses Paid, Amount |

$ 38

|

| Expense Ratio, Percent |

0.75%

|

| Factors Affecting Performance [Text Block] |

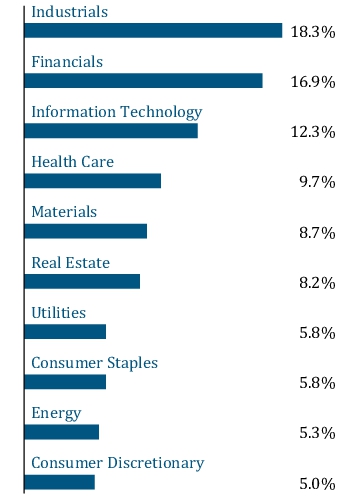

Management’s Discussion of Fund Performance SUMMARY OF RESULTS The Fund returned 1.96% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell Midcap ® Value Index, which returned 3.12% and underperformed the Russell 3000 ® Index, a broad measure of market performance, which returned 5.75%. The Fund’s underperformance versus its benchmark was driven by poor stock selection in the Financials, Consumer Discretionary, and Real Estate sectors. Poor sector allocations in 6 of the 11 Global Industry Classification Standard economic sectors also detracted from relative performance. Conversely, positive stock selection in the Information Technology, Materials, and Health Care sectors contributed to relative performance in the period. TOP PERFORMANCE CONTRIBUTORS Jabil, Inc. is a manufacturing services company, which serves automotive, consumer health, data centers, energy, and aerospace & defense sectors worldwide. Jabil has benefited from its diversified revenue segments with success in their cloud and data centers business fueled by artificial intelligence adoption. CACI International, Inc. engages in the provision of information solutions and services in support of national security missions and government transformation for intelligence, defense, and federal civilian customers. CACI has benefited from increased defense spending caused by geopolitical uncertainty. Johnson Controls International, plc. engages in the provision of products, solutions, and infrastructure which include fire detection & suppression, security, HVAC equipment, building automation and controls, digital, industrial refrigeration, residential & smart home, retail, distributed energy storage, and batteries. Johnson Controls has benefited from strong organic growth and a healthy order backlog. TOP PERFORMANCE DETRACTORS ON Semiconductor Corp. engages in the provision of intelligent power and sensing solutions with a primary focus on automative and industrial markets. The company’s large auto exposure has led to margin contraction, causing an overhang in the stock during most of the year-to-date period. Teleflex, Inc. engages in the provision of medical technology products. Teleflex’s large supply chain exposure to China and Mexico coupled with weakness in their urology, interventional, anesthesia, and OEM businesses have continually hurt the stock. ICON plc. is a clinical research organization, which engages in the provision of outsourced development services to the pharmaceutical, biotechnology, and medical device industries. ICON has suffered from their lowest book-to-bill ratio since 2016 caused by depressed R&D spend post COVID-19. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

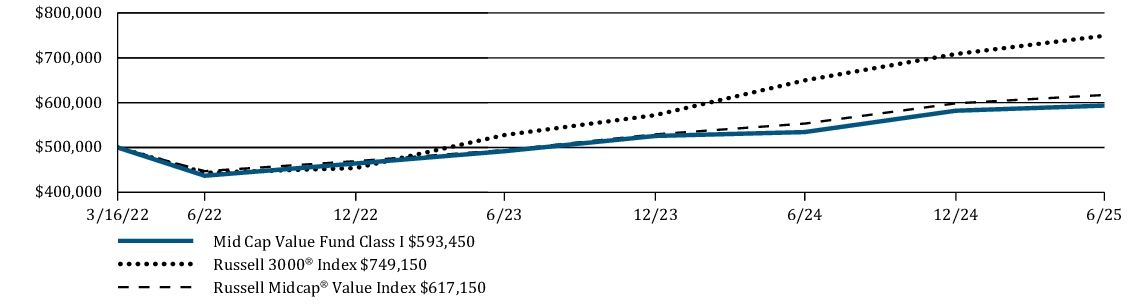

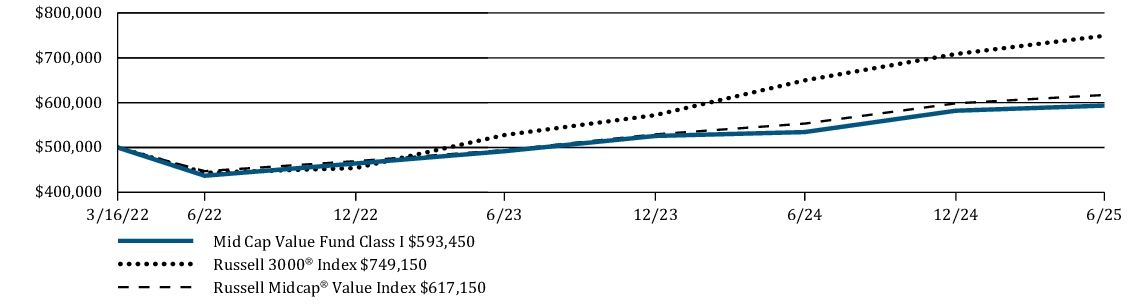

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 6 Months | 1 Year | Since Inception | Mid Cap Value Fund Class I | 1.96 % | 11.05 % | 5.34 % | | 5.75 % | 15.30 % | 13.05 % | Russell Midcap ® Value Index | 3.12 % | 11.53 % | 6.60 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 1,684,000

|

| Holdings Count | Holding |

58

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company, Portfolio Turnover |

21.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) | $ 1,684 | Number of portfolio holdings | 58 | Net advisory fees paid (in $000s) | $ 0 | Portfolio turnover rate (six months) | 21 % |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund , representing percentage of the total net assets of the Fund. | STMicroelectronics N.V. | 2.2 % | | Kirby Corporation | 2.1 % | | KKR & Co., Inc. | 2.1 % | | Amdocs Ltd. | 2.0 % | | Regency Centers Corp. | 2.0 % | | Flex Ltd. | 2.0 % | | State Street Corporation | 2.0 % | | Willis Towers Watson PLC | 2.0 % | | Everest Group Ltd. | 2.0 % | | Encompass Health Corp. | 2.0 % |

|

| Largest Holdings [Text Block] |

| STMicroelectronics N.V. | 2.2 % | | Kirby Corporation | 2.1 % | | KKR & Co., Inc. | 2.1 % | | Amdocs Ltd. | 2.0 % | | Regency Centers Corp. | 2.0 % | | Flex Ltd. | 2.0 % | | State Street Corporation | 2.0 % | | Willis Towers Watson PLC | 2.0 % | | Everest Group Ltd. | 2.0 % | | Encompass Health Corp. | 2.0 % |

|

| William Blair Mid Cap Value Fund - Class R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Mid Cap Value Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

WVMRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Mid Cap Value Fund Class R6 (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

Fund |

Cost of $10,000 Investment |

Cost of $10,000 Investment as a percentage |

| Mid Cap Value Fund Class R6 |

$ 35 |

0.70 % |

|

| Expenses Paid, Amount |

$ 35

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

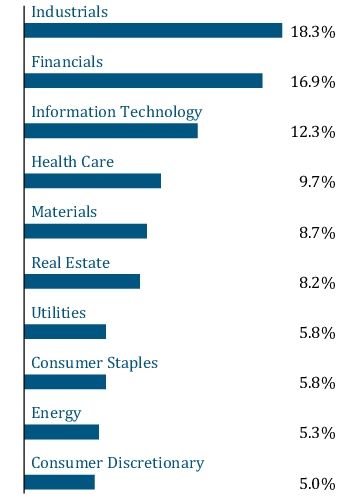

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund returned 1.96% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell Midcap ® Value Index, which returned 3.12% and underperformed the Russell 3000 ® Index, a broad measure of market performance, which returned 5.75%. The Fund’s underperformance versus its benchmark was driven by poor stock selection in the Financials, Consumer Discretionary, and Real Estate sectors. Poor sector allocations in 6 of the 11 Global Industry Classification Standard economic sectors also detracted from relative performance. Conversely, positive stock selection in the Information Technology, Materials, and Health Care sectors contributed to relative performance in the period. TOP PERFORMANCE CONTRIBUTORS

Jabil, Inc. is a manufacturing services company, which serves automotive, consumer health, data centers, energy, and aerospace & defense sectors worldwide. Jabil has benefited from its diversified revenue segments with success in their cloud and data centers business fueled by artificial intelligence adoption. CACI International, Inc. engages in the provision of information solutions and services in support of national security missions and government transformation for intelligence, defense, and federal civilian customers. CACI has benefited from increased defense spending caused by geopolitical uncertainty. Johnson Controls International, plc. engages in the provision of products, solutions, and infrastructure which include fire detection & suppression, security, HVAC equipment, building automation and controls, digital, industrial refrigeration, residential & smart home, retail, distributed energy storage, and batteries. Johnson Controls has benefited from strong organic growth and a healthy order backlog. TOP PERFORMANCE DETRACTORS

ON Semiconductor Corp. engages in the provision of intelligent power and sensing solutions with a primary focus on automative and industrial markets. The company’s large auto exposure has led to margin contraction, causing an overhang in the stock during most of the year-to-date period. Teleflex, Inc. engages in the provision of medical technology products. Teleflex’s large supply chain exposure to China and Mexico coupled with weakness in their urology, interventional, anesthesia, and OEM businesses have continually hurt the stock. ICON plc. is a clinical research organization, which engages in the provision of outsourced development services to the pharmaceutical, biotechnology, and medical device industries. ICON has suffered from their lowest book-to-bill ratio since 2016 caused by depressed R&D spend post COVID-19. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

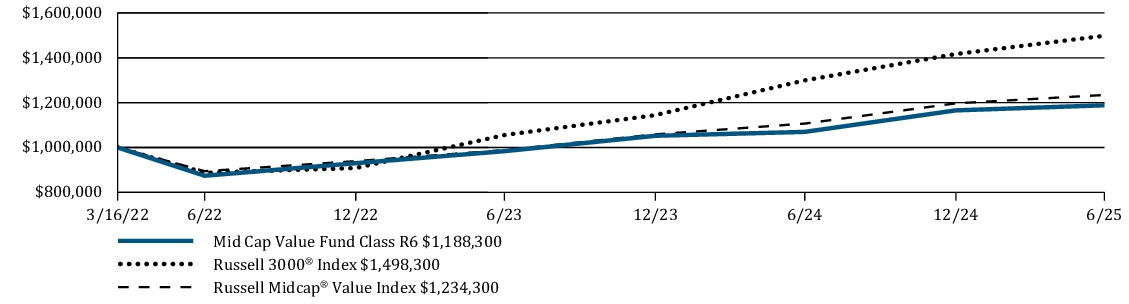

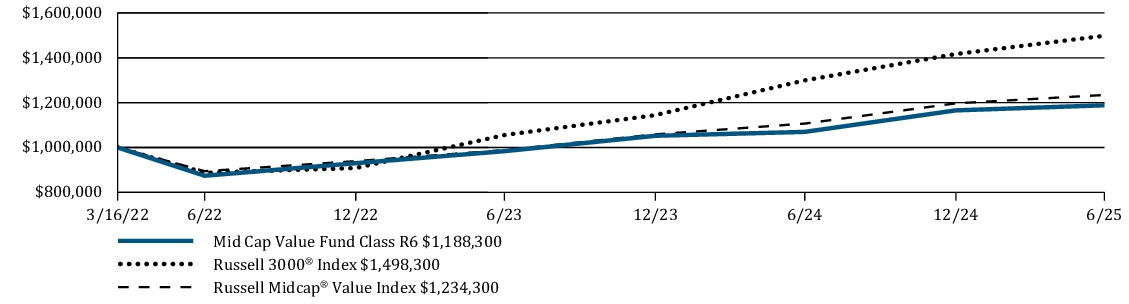

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns |

6 Months |

1 Year |

Since Inception |

Mid Cap Value Fund Class R6 |

1.96 % |

11.10 % |

5.37 % |

|

5.75 % |

15.30 % |

13.05 % |

Russell Midcap ® Value Index |

3.12 % |

11.53 % |

6.60 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 1,684,000

|

| Holdings Count | Holding |

58

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company, Portfolio Turnover |

21.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) |

$ 1,684 |

Number of portfolio holdings |

58 |

Net advisory fees paid (in $000s) |

$ 0 |

Portfolio turnover rate (six months) |

21 % |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund , representing percentage of the total net assets of the Fund.

| STMicroelectronics N.V. |

2.2 % |

| Kirby Corporation |

2.1 % |

| KKR & Co., Inc. |

2.1 % |

| Amdocs Ltd. |

2.0 % |

| Regency Centers Corp. |

2.0 % |

| Flex Ltd. |

2.0 % |

| State Street Corporation |

2.0 % |

| Willis Towers Watson PLC |

2.0 % |

| Everest Group Ltd. |

2.0 % |

| Encompass Health Corp. |

2.0 % |

|

| Largest Holdings [Text Block] |

| STMicroelectronics N.V. |

2.2 % |

| Kirby Corporation |

2.1 % |

| KKR & Co., Inc. |

2.1 % |

| Amdocs Ltd. |

2.0 % |

| Regency Centers Corp. |

2.0 % |

| Flex Ltd. |

2.0 % |

| State Street Corporation |

2.0 % |

| Willis Towers Watson PLC |

2.0 % |

| Everest Group Ltd. |

2.0 % |

| Encompass Health Corp. |

2.0 % |

|

| William Blair Small-Mid Cap Core Fund - Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Small-Mid CapCore Fund

|

| Class Name |

Class I

|

| Trading Symbol |

WBCIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Small-Mid Cap Core Fund Class I (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

Fund |

Cost of $10,000 Investment |

Cost of $10,000 Investment as a percentage |

| Small-Mid Cap Core Fund Class I |

$ 47 |

0.95 % |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.95%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund returned -3.08% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 2500 ™ Index, which returned 0.44% and underperformed the Russell 3000 ® Index, a broad measure of market performance, which returned 5.75%. Relative performance was driven by a combination of stock-specific dynamics and style headwinds. From a style perspective, our underweight to unprofitable companies and bias towards more consistent business models were headwinds, which were concentrated in the latter half of the period. The Fund notably outperformed during the acute market correction from late February through the April 8th bottom but lagged during the strong recovery that followed, from April 9th to the end of the period. From a stock-specific perspective, our top individual detractors included New Fortress (Energy), Embecta (Health Care), e.l.f. Beauty (Consumer Staples), Neogen (Health Care) and ACV Auctions (Industrials). Stock selection in Consumer Staples and Information Technology also detracted from relative returns. Our top individual contributors included Talen Energy (Utilities), Gogo (Communication Services), Marex Group (Financials), Cameco (Energy) and Stride (Consumer Discretionary). TOP PERFORMANCE CONTRIBUTORS

Talen Energy is an integrated independent power producer that sells to utilities and end users. Shares advanced during the period, in part due to an expanded relationship with Amazon. Talen announced a long-term power purchase agreement for its Susquehanna nuclear plant to provide carbon-free power to Amazon Web Services data centers in the region. Gogo Inc. is a provider of telecommunication services (e.g., internet, phone, text) to personal and business jets via an owned network of air-to-ground cellular towers and Low-Earth-Orbit (“LEO”) satellites. The company reported earnings results that exceeded expectations, reiterated 2025 revenue guidance and provided commentary on a strong and growing pipeline for its LEO satellite internet product, Galileo. TOP PERFORMANCE DETRACTORS

New Fortress Energy develops, finances and constructs liquified natural gas (LNG) assets and related infrastructure. Shares were pressured during the period as the likelihood of the company winning a material long-term gas contract with Puerto Rico declined, in part due to uncertainty regarding the terms of the contract. We liquidated our position. Embecta is a manufacturer of the consumable needle used with multidose insulin and GLP-1 pens. The company reduced guidance in anticipation of store closures following the recent private equity purchase of Walgreens. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

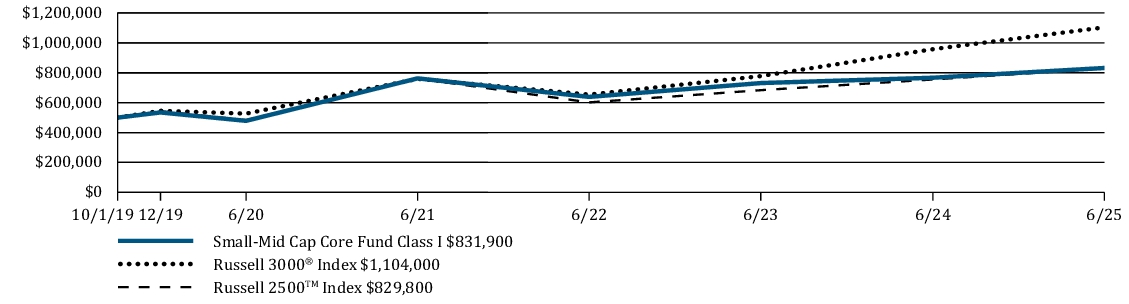

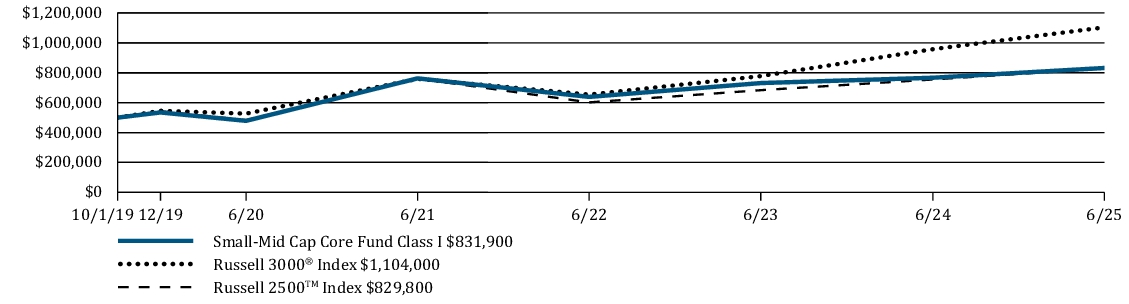

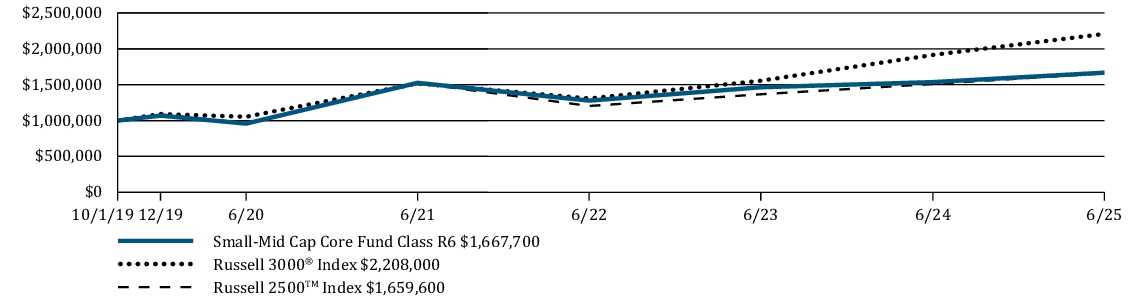

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns |

6 Months |

1 Year |

5 Years |

Since Inception |

Small-Mid Cap Core Fund Class I |

-3.08 % |

8.52 % |

11.71 % |

9.26 % |

|

5.75 % |

15.30 % |

15.96 % |

14.76 % |

|

0.44 % |

9.91 % |

11.44 % |

9.21 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 128,710,000

|

| Holdings Count | Holding |

85

|

| Advisory Fees Paid, Amount |

$ 391,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) |

$ 128,710 |

Number of portfolio holdings |

85 |

Net advisory fees paid (in $000s) |

$ 391 |

Portfolio turnover rate (six months) |

40 % |

|

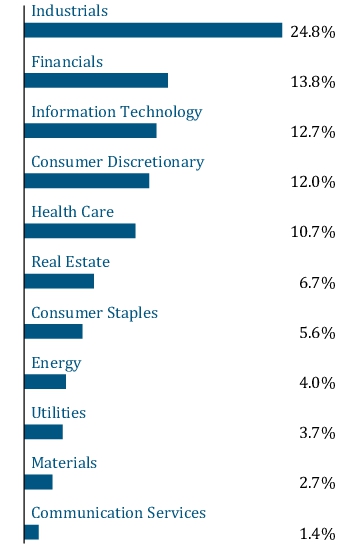

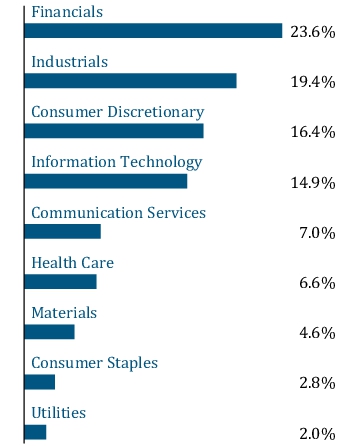

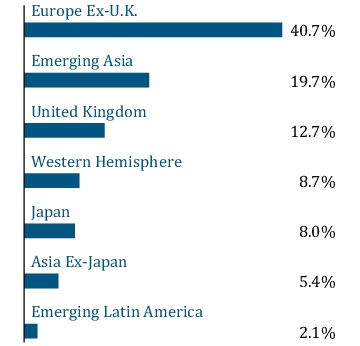

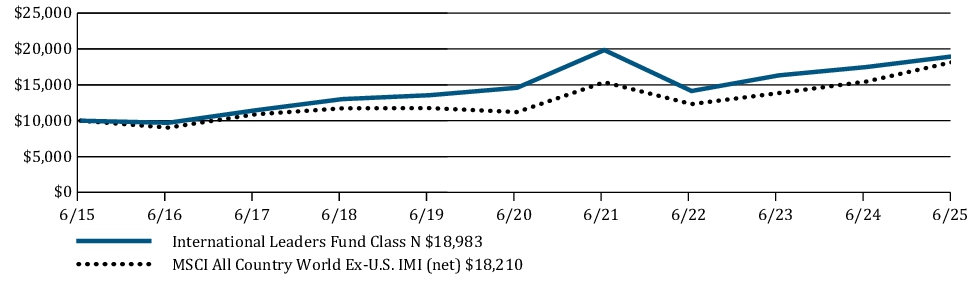

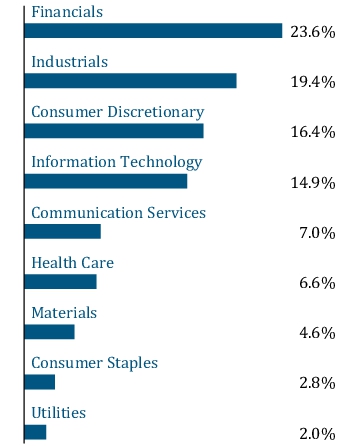

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

| Talen Energy Corporation |

2.2 % |

| Baldwin Insurance Group, Inc. |

2.0 % |

| Everest Group Ltd. |

2.0 % |

| CACI International, Inc. |

1.9 % |

| Primo Brands Corporation |

1.9 % |

| Diebold Nixdorf, Inc. |

1.9 % |

| Carlyle Group, Inc. |

1.8 % |

| Doximity, Inc. |

1.8 % |

| Western Alliance Bancorp |

1.8 % |

| SharkNinja, Inc. |

1.7 % |

|

| Largest Holdings [Text Block] |

| Talen Energy Corporation |

2.2 % |

| Baldwin Insurance Group, Inc. |

2.0 % |

| Everest Group Ltd. |

2.0 % |

| CACI International, Inc. |

1.9 % |

| Primo Brands Corporation |

1.9 % |

| Diebold Nixdorf, Inc. |

1.9 % |

| Carlyle Group, Inc. |

1.8 % |

| Doximity, Inc. |

1.8 % |

| Western Alliance Bancorp |

1.8 % |

| SharkNinja, Inc. |

1.7 % |

|

| William Blair Small-Mid Cap Core Fund - Class R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Small-Mid CapCore Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

WBCRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Small-Mid Cap Core Fund Class R6 (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Small-Mid Cap Core Fund Class R6 | $ 44 | 0.90 % |

|

| Expenses Paid, Amount |

$ 44

|

| Expense Ratio, Percent |

0.90%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance SUMMARY OF RESULTS The Fund returned -3.07% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 2500 ™ Index, which returned 0.44% and underperformed the Russell 3000 ® Index, a broad measure of market performance, which returned 5.75%. Relative performance was driven by a combination of stock-specific dynamics and style headwinds. From a style perspective, our underweight to unprofitable companies and bias towards more consistent business models were headwinds, which were concentrated in the latter half of the period. The Fund notably outperformed during the acute market correction from late February through the April 8th bottom but lagged during the strong recovery that followed, from April 9th to the end of the period. From a stock-specific perspective, our top individual detractors included New Fortress (Energy), Embecta (Health Care), e.l.f. Beauty (Consumer Staples), Neogen (Health Care) and ACV Auctions (Industrials). Stock selection in Consumer Staples and Information Technology also detracted from relative returns. Our top individual contributors included Talen Energy (Utilities), Gogo (Communication Services), Marex Group (Financials), Cameco (Energy) and Stride (Consumer Discretionary). TOP PERFORMANCE CONTRIBUTORS Talen Energy is an integrated independent power producer that sells to utilities and end users. Shares advanced during the period, in part due to an expanded relationship with Amazon. Talen announced a long-term power purchase agreement for its Susquehanna nuclear plant to provide carbon-free power to Amazon Web Services data centers in the region. Gogo Inc. is a provider of telecommunication services (e.g., internet, phone, text) to personal and business jets via an owned network of air-to-ground cellular towers and Low-Earth-Orbit (“LEO”) satellites. The company reported earnings results that exceeded expectations, reiterated 2025 revenue guidance and provided commentary on a strong and growing pipeline for its LEO satellite internet product, Galileo. TOP PERFORMANCE DETRACTORS New Fortress Energy develops, finances and constructs liquified natural gas (LNG) assets and related infrastructure. Shares were pressured during the period as the likelihood of the company winning a material long-term gas contract with Puerto Rico declined, in part due to uncertainty regarding the terms of the contract. We liquidated our position. Embecta is a manufacturer of the consumable needle used with multidose insulin and GLP-1 pens. The company reduced guidance in anticipation of store closures following the recent private equity purchase of Walgreens. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

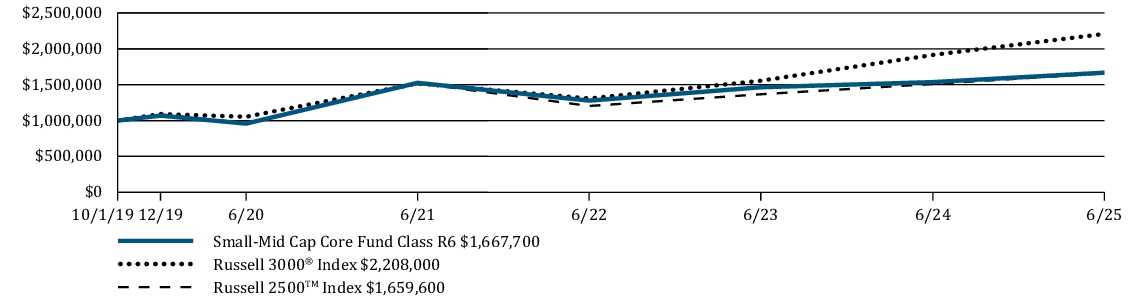

| Line Graph [Table Text Block] |

|

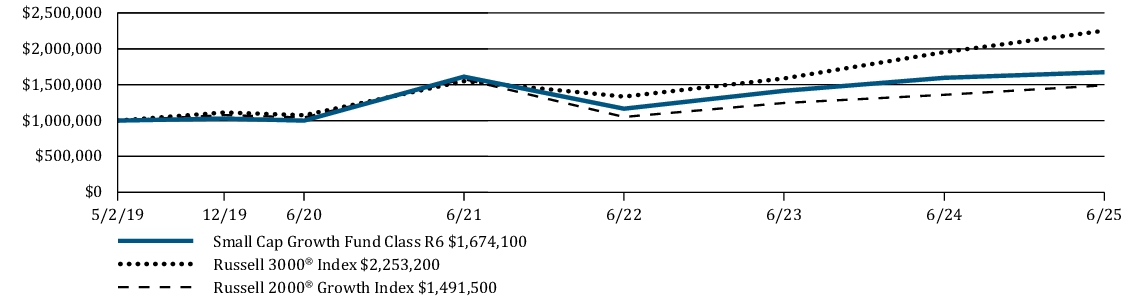

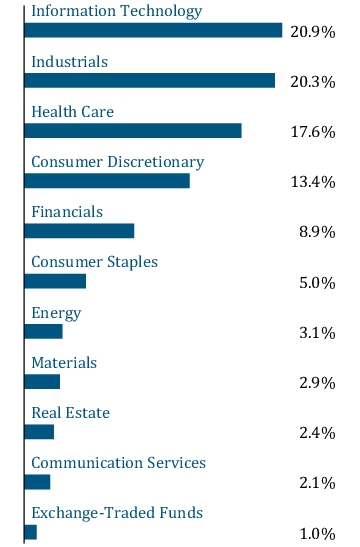

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 6 Months | 1 Year | 5 Years | Since Inception | Small-Mid Cap Core Fund Class R6 | -3.07 % | 8.57 % | 11.73 % | 9.30 % | | 5.75 % | 15.30 % | 15.96 % | 14.76 % | | 0.44 % | 9.91 % | 11.44 % | 9.21 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 128,710,000

|

| Holdings Count | Holding |

85

|

| Advisory Fees Paid, Amount |

$ 391,000

|

| Investment Company, Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) | $ 128,710 | Number of portfolio holdings | 85 | Net advisory fees paid (in $000s) | $ 391 | Portfolio turnover rate (six months) | 40 % |

|

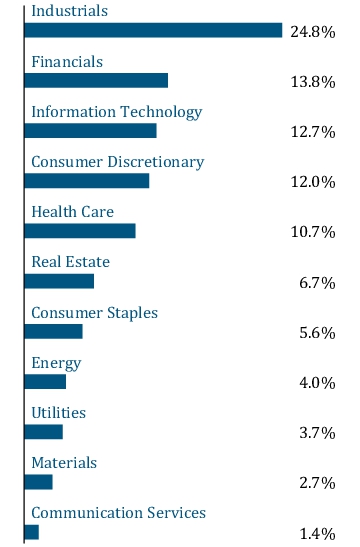

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. | Talen Energy Corporation | 2.2 % | | Baldwin Insurance Group, Inc. | 2.0 % | | Everest Group Ltd. | 2.0 % | | CACI International, Inc. | 1.9 % | | Primo Brands Corporation | 1.9 % | | Diebold Nixdorf, Inc. | 1.9 % | | Carlyle Group, Inc. | 1.8 % | | Doximity, Inc. | 1.8 % | | Western Alliance Bancorp | 1.8 % | | SharkNinja, Inc. | 1.7 % |

|

| Largest Holdings [Text Block] |

| Talen Energy Corporation | 2.2 % | | Baldwin Insurance Group, Inc. | 2.0 % | | Everest Group Ltd. | 2.0 % | | CACI International, Inc. | 1.9 % | | Primo Brands Corporation | 1.9 % | | Diebold Nixdorf, Inc. | 1.9 % | | Carlyle Group, Inc. | 1.8 % | | Doximity, Inc. | 1.8 % | | Western Alliance Bancorp | 1.8 % | | SharkNinja, Inc. | 1.7 % |

|

| William Blair Small-Mid Cap Growth Fund - Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Small-Mid CapGrowth Fund

|

| Class Name |

Class I

|

| Trading Symbol |

WSMDX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Small-Mid Cap Growth Fund Class I (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

Fund |

Cost of $10,000 Investment |

Cost of $10,000 Investment as a percentage |

| Small-Mid Cap Growth Fund Class I |

$ 48 |

0.99 % |

|

| Expenses Paid, Amount |

$ 48

|

| Expense Ratio, Percent |

0.99%

|

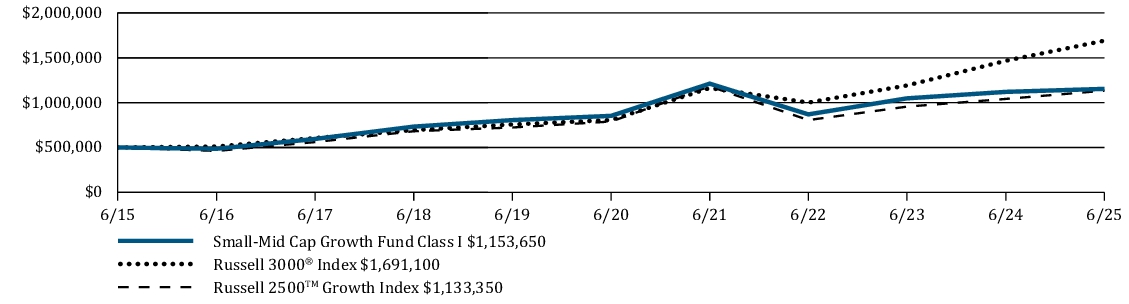

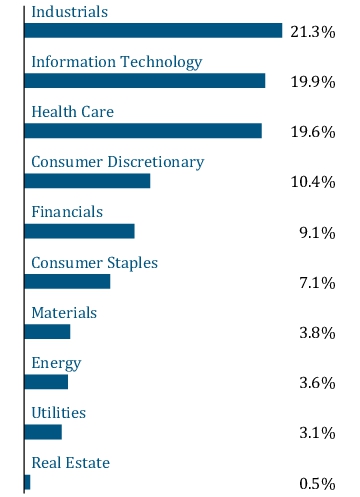

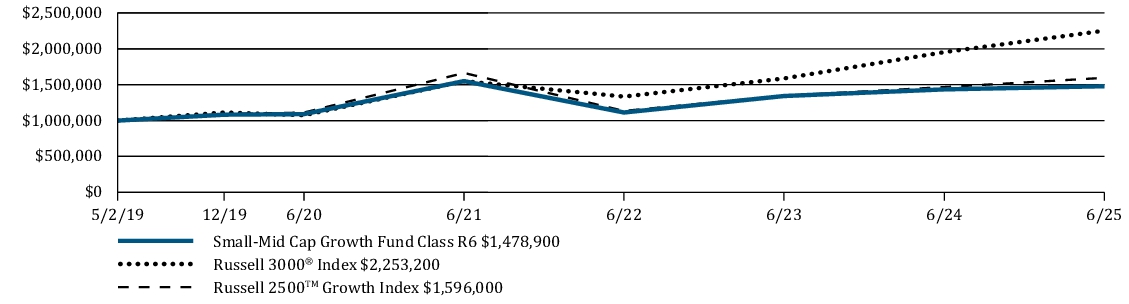

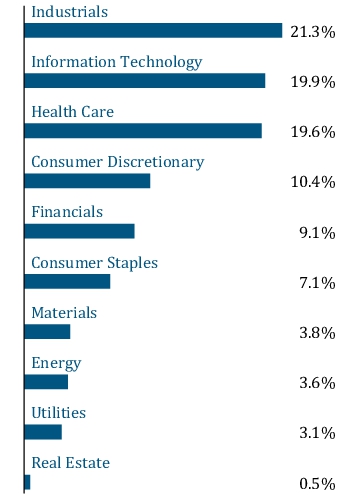

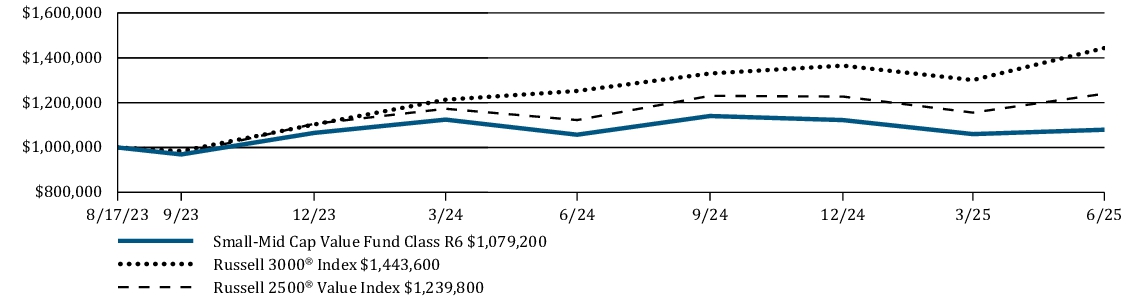

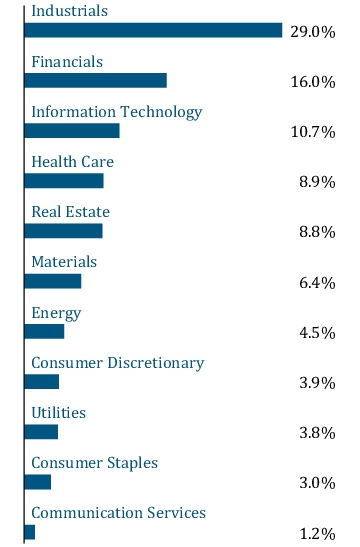

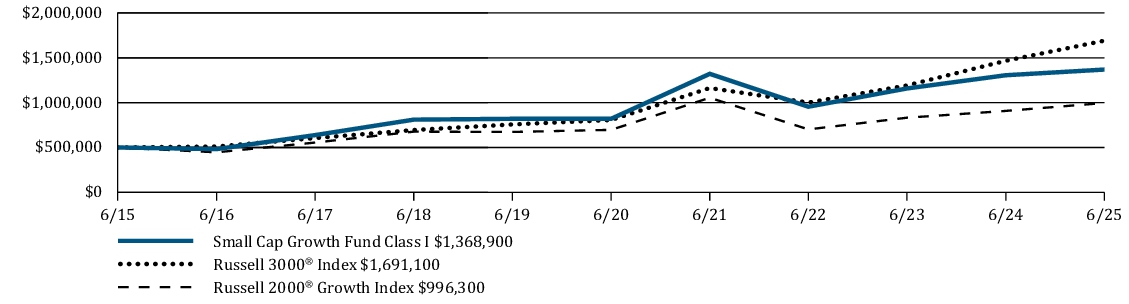

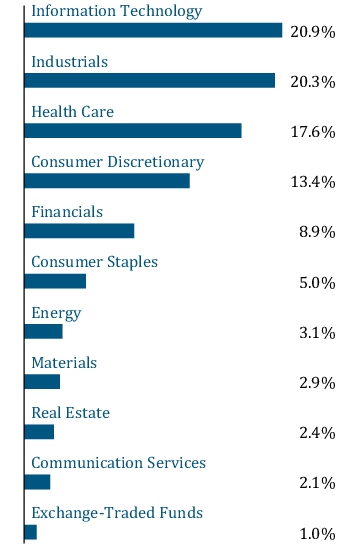

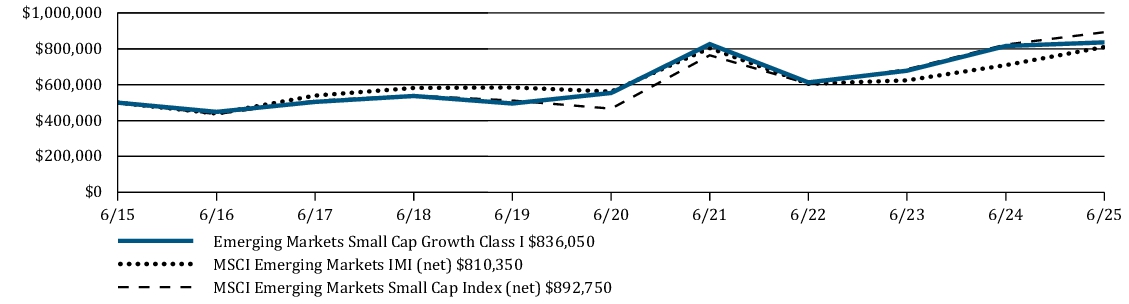

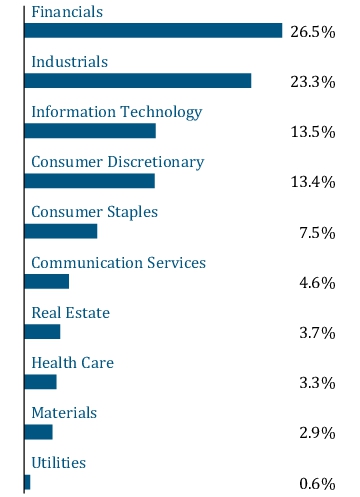

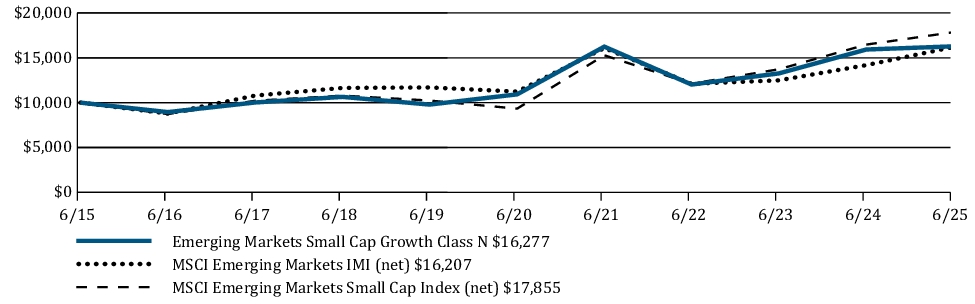

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund returned -6.39% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 2500 ™ Growth Index, which returned -0.71% and underperformed the Russell 3000 ® Index, a broad measure of market performance, which returned 5.75%. The Fund's relative performance was driven by a combination of stock-specific dynamics and style headwinds. From a style perspective, our underweight to unprofitable companies and bias towards more consistent business models were headwinds, which were concentrated in the latter half of the period. The Fund notably outperformed during the acute market correction from late February through the April 8th bottom but lagged during the strong recovery that followed, from April 9th to the end of the period. From a stock-specific perspective, our selection in Consumer Staples, including our positions in e.l.f. Beauty and Freshpet, and Financials, including our position in Flywire, detracted from relative performance. Other laggards included New Fortress (Energy) and Neogen (Health Care). Our top individual contributors included Talen Energy (Utilities), Stride (Consumer Discretionary), Cameco (Energy), Curtiss-Wright (Industrials) and Blueprint Medicines (Health Care).

TOP PERFORMANCE CONTRIBUTORS

Talen Energy is an integrated independent power producer that sells to utilities and end users. Shares advanced during the period, in part due to an expanded relationship with Amazon. Talen announced a long-term power purchase agreement for its Susquehanna nuclear plant to provide carbon-free power to Amazon Web Services data centers in the region. Stride is a leading provider of online and blended education programs. The company reported strong enrollment growth across its general and career education segments. TOP PERFORMANCE DETRACTORS

New Fortress Energy develops, finances and constructs liquified natural gas (LNG) assets and related infrastructure. Shares were pressured during the period as the likelihood of the company winning a material long-term gas contract with Puerto Rico declined, in part due to uncertainty regarding the terms of the contract. We liquidated our position. e.l.f. Beauty designs and manufactures premium quality cosmetic and skincare products with broad appeal at accessible price points under the e.l.f., Well People, Keys Soulcare and Naturium brands. Shares declined during the period on disappointing new product innovations and tariff headwinds. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

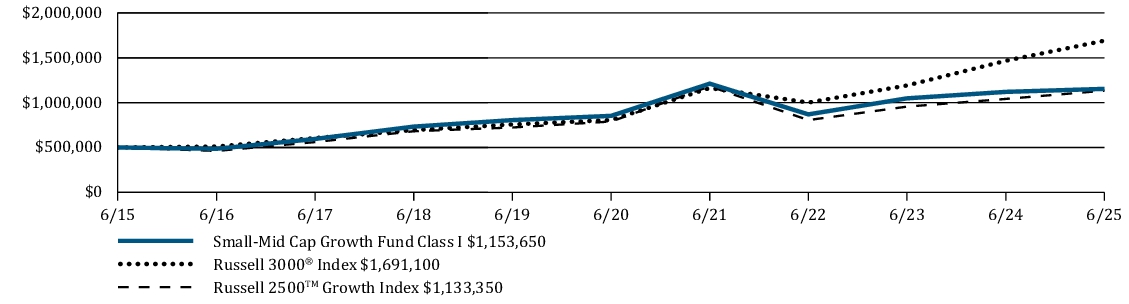

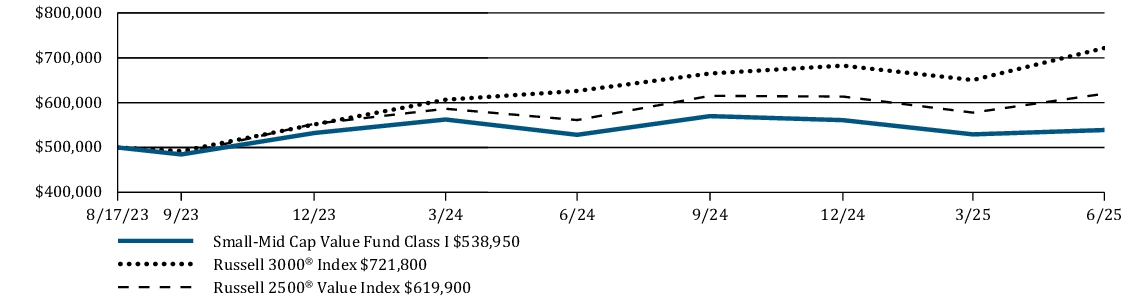

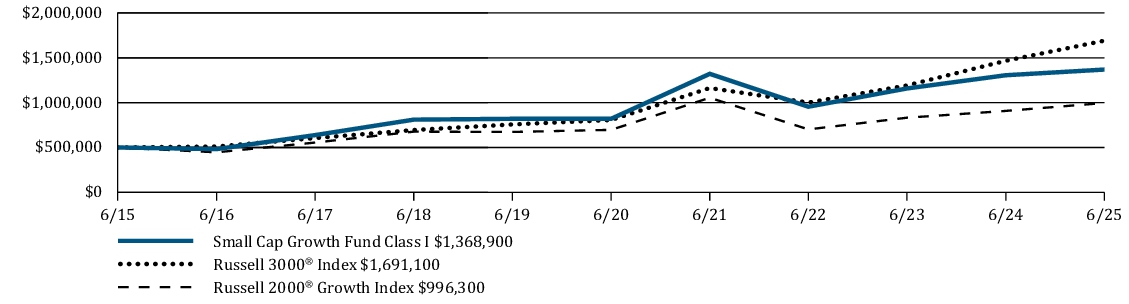

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns |

6 Months |

1 Year |

5 Years |

10 Years |

Small-Mid Cap Growth Fund Class I |

-6.39 % |

3.01 % |

6.23 % |

8.72 % |

|

5.75 % |

15.30 % |

15.96 % |

12.96 % |

Russell 2500 ™ Growth Index |

-0.71 % |

8.81 % |

7.50 % |

8.53 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 1,443,299,000

|

| Holdings Count | Holding |

75

|

| Advisory Fees Paid, Amount |

$ 6,371,000

|

| Investment Company, Portfolio Turnover |

29.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) |

$ 1,443,299 |

Number of portfolio holdings |

75 |

Net advisory fees paid (in $000s) |

$ 6,371 |

Portfolio turnover rate (six months) |

29 % |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

| Talen Energy Corporation |

3.1 % |

| Pure Storage, Inc. |

2.6 % |

| Cameco Corp. |

2.5 % |

| Primo Brands Corporation |

2.4 % |

| Doximity, Inc. |

2.4 % |

| nVent Electric PLC |

2.1 % |

| Mercury Systems, Inc. |

2.0 % |

| Dynatrace, Inc. |

2.0 % |

| Ciena Corporation |

2.0 % |

| Manhattan Associates, Inc. |

1.9 % |

|

| Largest Holdings [Text Block] |

| Talen Energy Corporation |

3.1 % |

| Pure Storage, Inc. |

2.6 % |

| Cameco Corp. |

2.5 % |

| Primo Brands Corporation |

2.4 % |

| Doximity, Inc. |

2.4 % |

| nVent Electric PLC |

2.1 % |

| Mercury Systems, Inc. |

2.0 % |

| Dynatrace, Inc. |

2.0 % |

| Ciena Corporation |

2.0 % |

| Manhattan Associates, Inc. |

1.9 % |

|

| William Blair Small-Mid Cap Growth Fund - Class N |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Small-Mid CapGrowth Fund

|

| Class Name |

Class N

|

| Trading Symbol |

WSMNX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Small-Mid Cap Growth Fund Class N (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Small-Mid Cap Growth Fund Class N | $ 60 | 1.24 % |

|

| Expenses Paid, Amount |

$ 60

|

| Expense Ratio, Percent |

1.24%

|

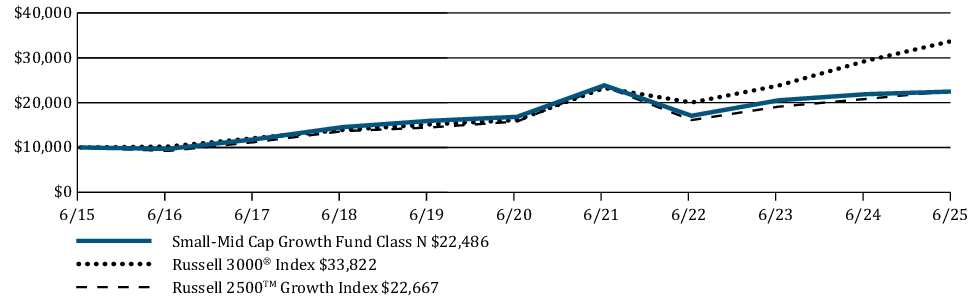

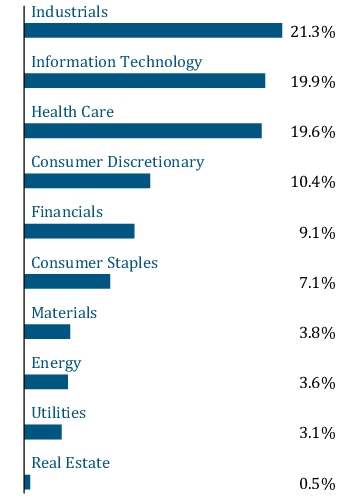

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance SUMMARY OF RESULTS The Fund returned -6.52% (net of fees) for the 6 months ended June 30, 2025. The Fund underperformed its benchmark, the Russell 2500 ™ Growth Index, which returned -0.71% and underperformed the Russell 3000 ® Index, a broad measure of market performance, which returned 5.75%. The Fund's relative performance was driven by a combination of stock-specific dynamics and style headwinds. From a style perspective, our underweight to unprofitable companies and bias towards more consistent business models were headwinds, which were concentrated in the latter half of the period. The Fund notably outperformed during the acute market correction from late February through the April 8th bottom but lagged during the strong recovery that followed, from April 9th to the end of the period. From a stock-specific perspective, our selection in Consumer Staples, including our positions in e.l.f. Beauty and Freshpet, and Financials, including our position in Flywire, detracted from relative performance. Other laggards included New Fortress (Energy) and Neogen (Health Care). Our top individual contributors included Talen Energy (Utilities), Stride (Consumer Discretionary), Cameco (Energy), Curtiss-Wright (Industrials) and Blueprint Medicines (Health Care). TOP PERFORMANCE CONTRIBUTORS Talen Energy is an integrated independent power producer that sells to utilities and end users. Shares advanced during the period, in part due to an expanded relationship with Amazon. Talen announced a long-term power purchase agreement for its Susquehanna nuclear plant to provide carbon-free power to Amazon Web Services data centers in the region. Stride is a leading provider of online and blended education programs. The company reported strong enrollment growth across its general and career education segments. TOP PERFORMANCE DETRACTORS New Fortress Energy develops, finances and constructs liquified natural gas (LNG) assets and related infrastructure. Shares were pressured during the period as the likelihood of the company winning a material long-term gas contract with Puerto Rico declined, in part due to uncertainty regarding the terms of the contract. We liquidated our position. e.l.f. Beauty designs and manufactures premium quality cosmetic and skincare products with broad appeal at accessible price points under the e.l.f., Well People, Keys Soulcare and Naturium brands. Shares declined during the period on disappointing new product innovations and tariff headwinds. |

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

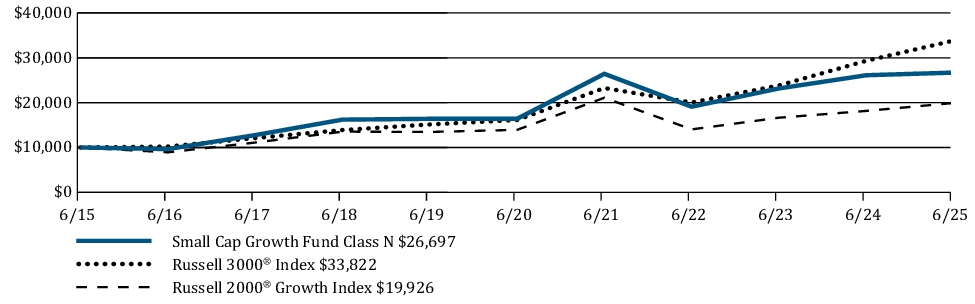

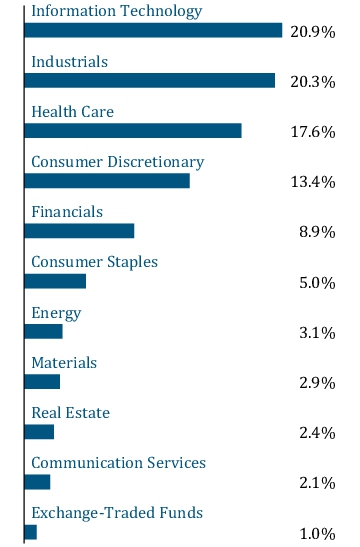

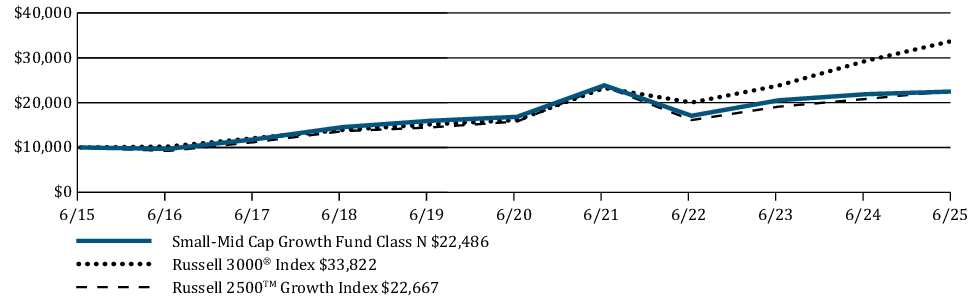

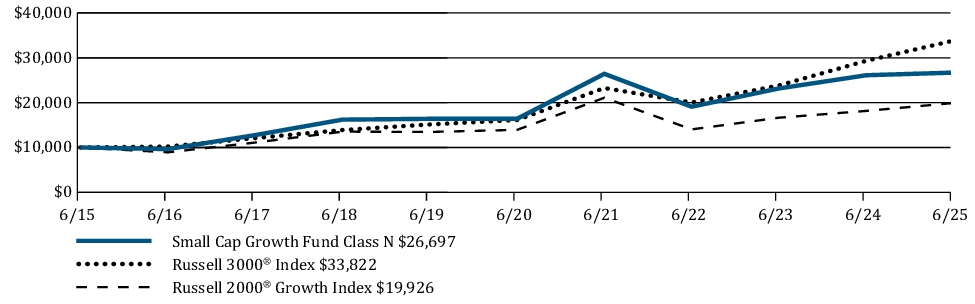

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 6 Months | 1 Year | 5 Years | 10 Years | Small-Mid Cap Growth Fund Class N | -6.52 % | 2.73 % | 5.96 % | 8.44 % | | 5.75 % | 15.30 % | 15.96 % | 12.96 % | Russell 2500 ™ Growth Index | -0.71 % | 8.81 % | 7.50 % | 8.53 % |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit www.williamblairfunds.com/funds/total-returns |

| Net Assets |

$ 1,443,299,000

|

| Holdings Count | Holding |

75

|

| Advisory Fees Paid, Amount |

$ 6,371,000

|

| Investment Company, Portfolio Turnover |

29.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets (in $000s) | $ 1,443,299 | Number of portfolio holdings | 75 | Net advisory fees paid (in $000s) | $ 6,371 | Portfolio turnover rate (six months) | 29 % |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. | Talen Energy Corporation | 3.1 % | | Pure Storage, Inc. | 2.6 % | | Cameco Corp. | 2.5 % | | Primo Brands Corporation | 2.4 % | | Doximity, Inc. | 2.4 % | | nVent Electric PLC | 2.1 % | | Mercury Systems, Inc. | 2.0 % | | Dynatrace, Inc. | 2.0 % | | Ciena Corporation | 2.0 % | | Manhattan Associates, Inc. | 1.9 % |

|

| Largest Holdings [Text Block] |

| Talen Energy Corporation | 3.1 % | | Pure Storage, Inc. | 2.6 % | | Cameco Corp. | 2.5 % | | Primo Brands Corporation | 2.4 % | | Doximity, Inc. | 2.4 % | | nVent Electric PLC | 2.1 % | | Mercury Systems, Inc. | 2.0 % | | Dynatrace, Inc. | 2.0 % | | Ciena Corporation | 2.0 % | | Manhattan Associates, Inc. | 1.9 % |

|

| William Blair Small-Mid Cap Growth Fund - Class R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

William Blair Small-Mid CapGrowth Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

WSMRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about William Blair Small-Mid Cap Growth Fund Class R6 (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.williamblairfunds.com/literature/forms 1-800-742-7272 .

|

| Additional Information Phone Number |

1-800-742-7272

|

| Additional Information Website |

https://www.williamblairfunds.com/literature/forms

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment) Fund | Cost of $10,000 Investment | Cost of $10,000 Investment as a percentage | | Small-Mid Cap Growth Fund Class R6 | $ 46 | 0.94 % |

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.94%

|

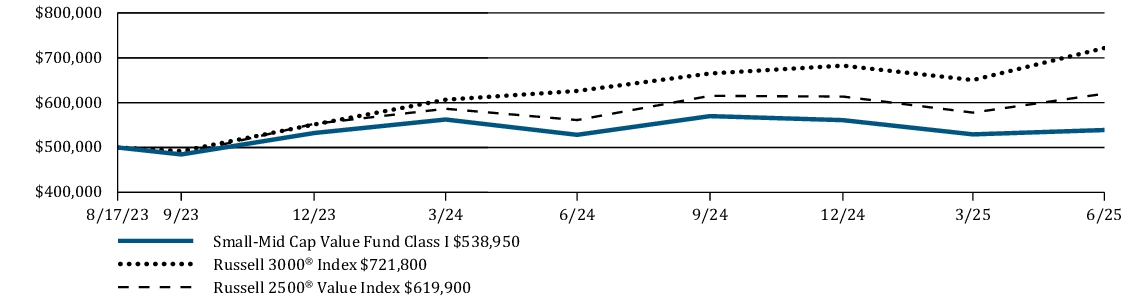

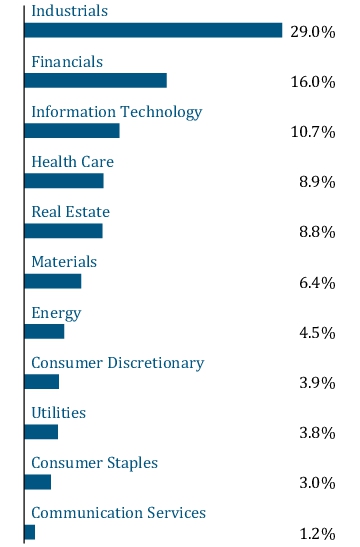

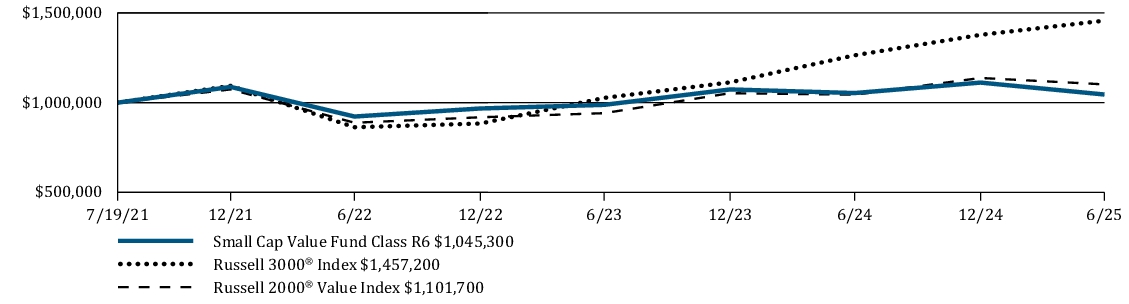

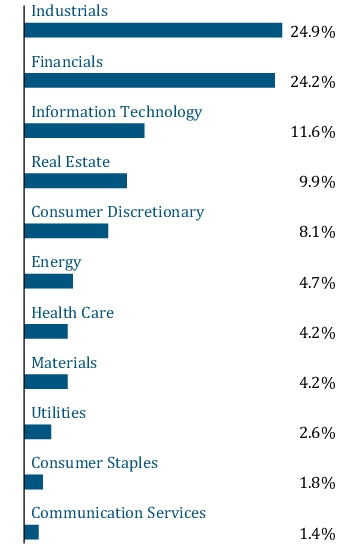

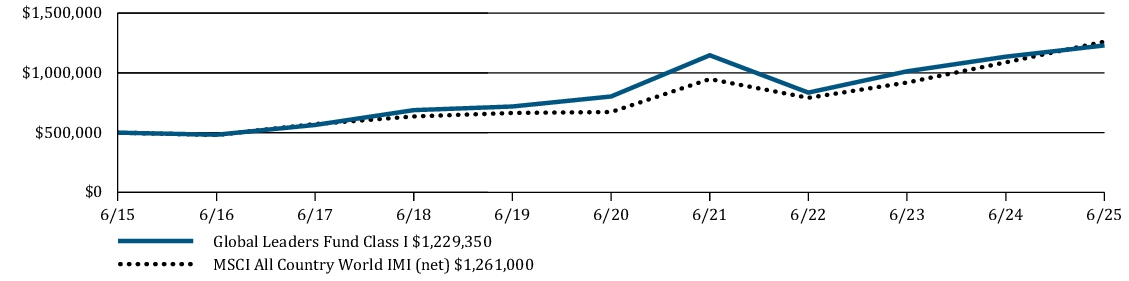

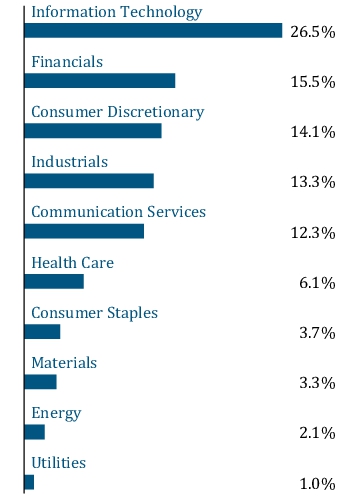

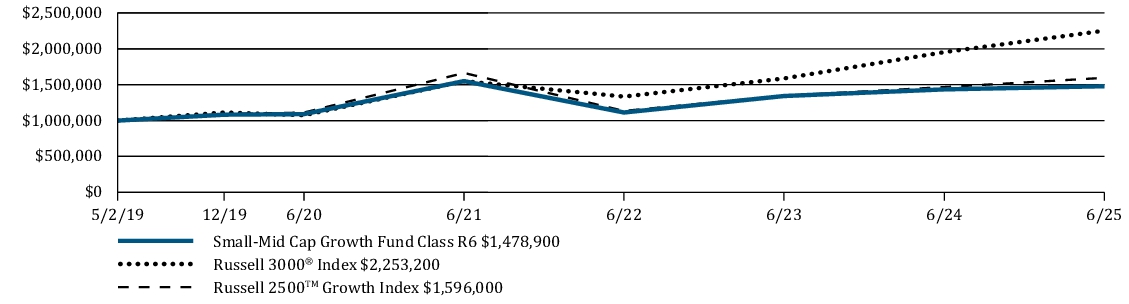

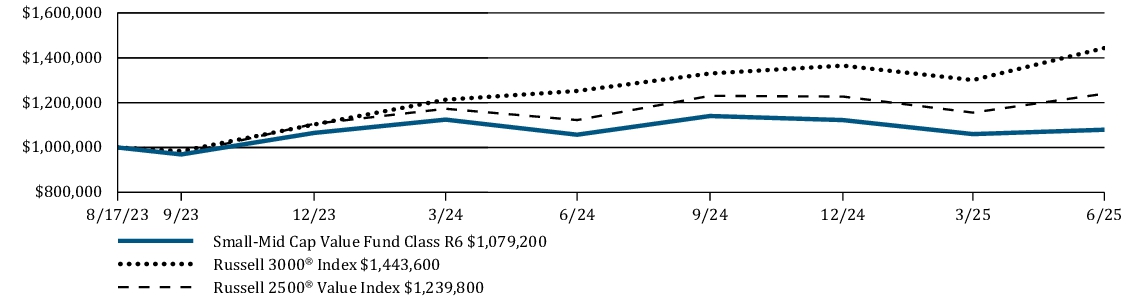

| Factors Affecting Performance [Text Block] |