Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Nuveen Investment Trust

|

|

| Entity Central Index Key |

0001013881

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000001700 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Multi Cap Value Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

NQVAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen Multi Cap Value Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$123 |

|

1.15% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 123

|

|

| Expense Ratio, Percent |

1.15%

|

[1] |

| Factors Affecting Performance [Text Block] |

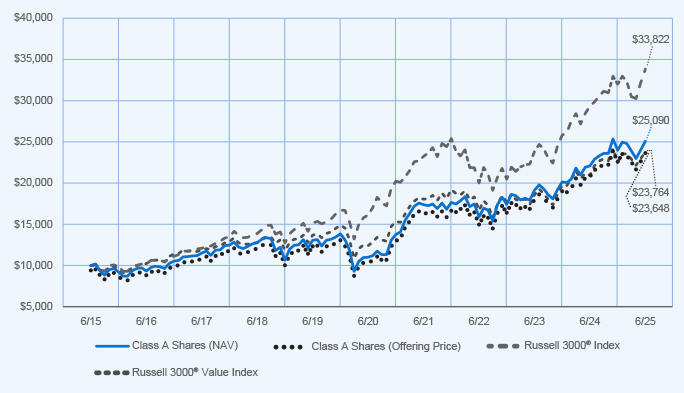

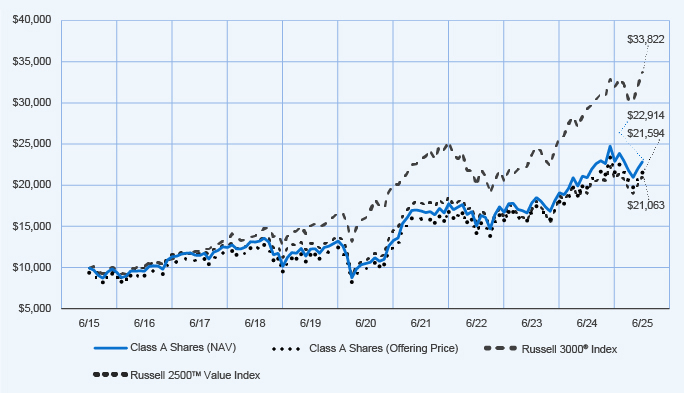

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Multi Cap Value Fund returned 13.69% for Class A Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund outperformed the Russell 3000 Value Index, which returned 13.30%. • Top contributors to relative performance • Out‑of‑benchmark position in ADMA Biologics, Inc. • Overweight to AT&T Inc. • Security selection in the financials sector, led by overweights to Discover Financial Services and Wells Fargo & Company. • Top detractors from relative performance • Although the Fund was underweight UnitedHealth Group Incorporated, which generally underperformed during the reporting period, the timing of when the stock was purchased in December detracted. • Security selection in the materials sector, including an out‑of‑benchmark position in Innospec Inc. • Overweight to Elevance Health, Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

13.69% |

|

17.91% |

|

9.64% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

7.14% |

|

16.52% |

|

8.99% |

| |

|

|

|

| Russell 3000® Index |

|

15.30% |

|

15.96% |

|

12.96% |

| |

|

|

|

| Russell 3000® Value Index |

|

13.30% |

|

13.87% |

|

9.04% |

| |

|

|

|

| Lipper Multi‑Cap Value Funds Classification Average |

|

11.95% |

|

14.53% |

|

8.96% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 521,544,317

|

|

| Holdings Count | Holding |

61

|

|

| Advisory Fees Paid, Amount |

$ 3,421,772

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

521,544,317 |

|

|

|

| Total number of portfolio holdings |

|

|

61 |

|

|

|

| Portfolio turnover (%) |

|

|

30% |

|

|

|

| Total management fees paid for the year |

|

$ |

3,421,772 |

|

|

|

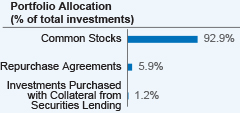

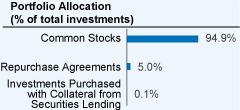

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001702 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Multi Cap Value Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

NQVCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

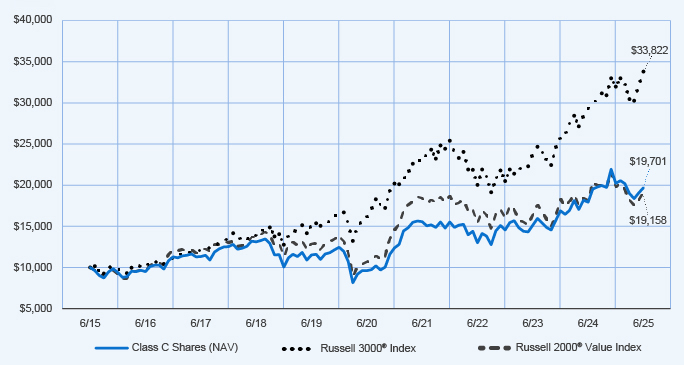

This annual shareholder report contains important information about the Class C Shares of the Nuveen Multi Cap Value Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$202 |

|

1.90% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 202

|

|

| Expense Ratio, Percent |

1.90%

|

[2] |

| Factors Affecting Performance [Text Block] |

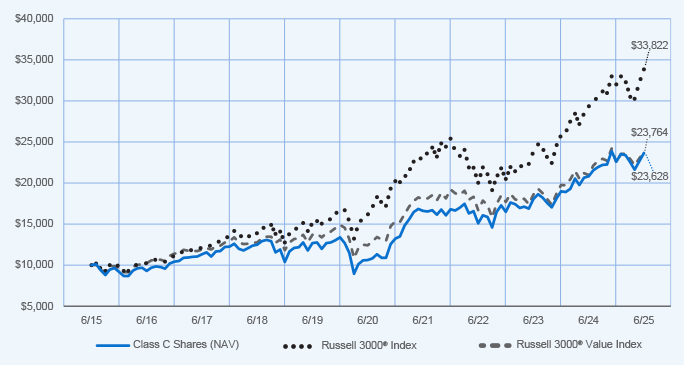

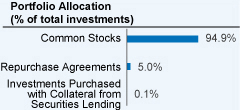

How did the Fund perform last year? What affected the Fund’s performance?

|

|

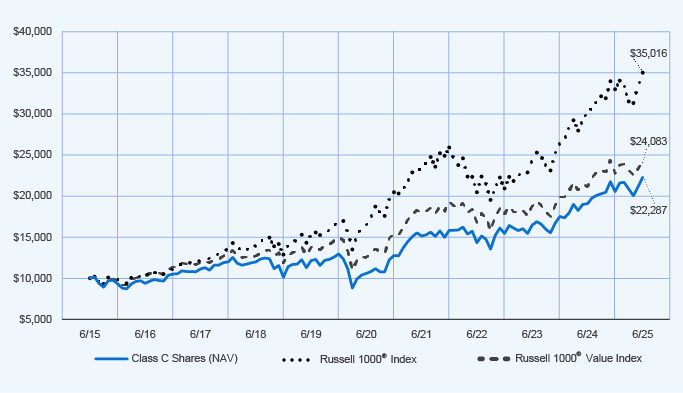

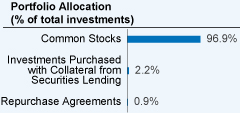

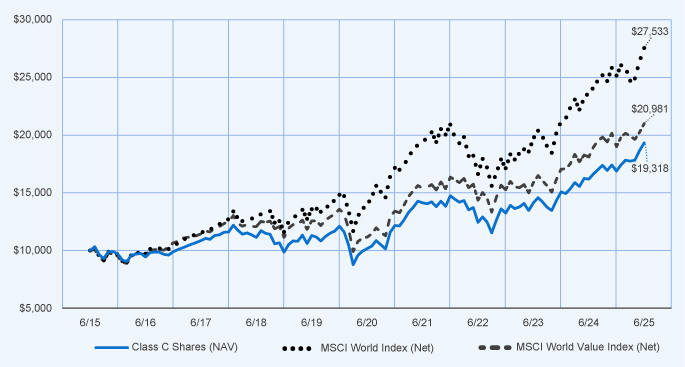

| Performance Highlights • The Nuveen Multi Cap Value Fund returned 12.84% for Class C Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund underperformed the Russell 3000 Value Index, which returned 13.30%. • Top contributors to relative performance • Out‑of‑benchmark position in ADMA Biologics, Inc. • Overweight to AT&T Inc. • Security selection in the financials sector, led by overweights to Discover Financial Services and Wells Fargo & Company. • Top detractors from relative performance • Although the Fund was underweight UnitedHealth Group Incorporated, which generally underperformed during the reporting period, the timing of when the stock was purchased in December detracted. • Security selection in the materials sector, including an out‑of‑benchmark position in Innospec Inc. • Overweight to Elevance Health, Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

12.84% |

|

17.04% |

|

8.98% |

| |

|

|

|

| Russell 3000® Index |

|

15.30% |

|

15.96% |

|

12.96% |

| |

|

|

|

| Russell 3000® Value Index |

|

13.30% |

|

13.87% |

|

9.04% |

| |

|

|

|

| Lipper Multi‑Cap Value Funds Classification Average |

|

11.95% |

|

14.53% |

|

8.96% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 521,544,317

|

|

| Holdings Count | Holding |

61

|

|

| Advisory Fees Paid, Amount |

$ 3,421,772

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

521,544,317 |

|

|

|

| Total number of portfolio holdings |

|

|

61 |

|

|

|

| Portfolio turnover (%) |

|

|

30% |

|

|

|

| Total management fees paid for the year |

|

$ |

3,421,772 |

|

|

|

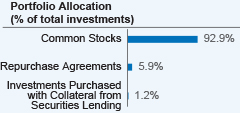

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001703 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Multi Cap Value Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

NQVRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Multi Cap Value Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$96 |

|

0.90% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 96

|

|

| Expense Ratio, Percent |

0.90%

|

[3] |

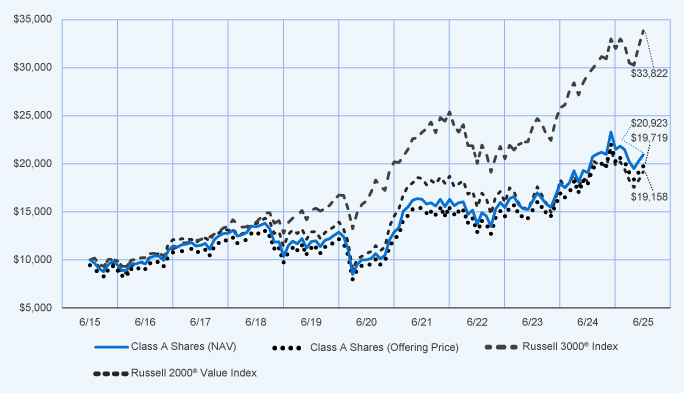

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

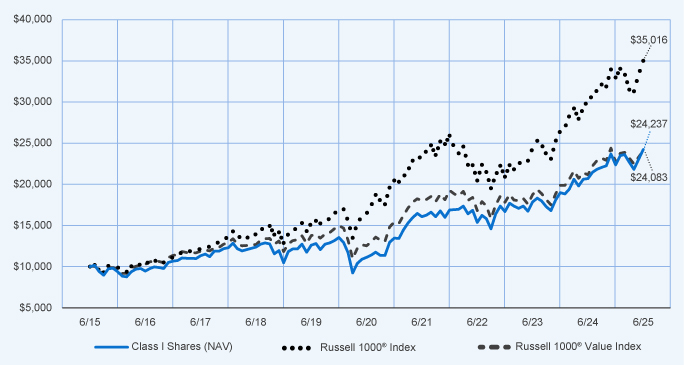

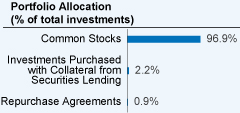

| Performance Highlights • The Nuveen Multi Cap Value Fund returned 13.98% for Class I Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund outperformed the Russell 3000 Value Index, which returned 13.30%. • Top contributors to relative performance • Out‑of‑benchmark position in ADMA Biologics, Inc. • Overweight to AT&T Inc. • Security selection in the financials sector, led by overweights to Discover Financial Services and Wells Fargo & Company. • Top detractors from relative performance • Although the Fund was underweight UnitedHealth Group Incorporated, which generally underperformed during the reporting period, the timing of when the stock was purchased in December detracted. • Security selection in the materials sector, including an out‑of‑benchmark position in Innospec Inc. • Overweight to Elevance Health, Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

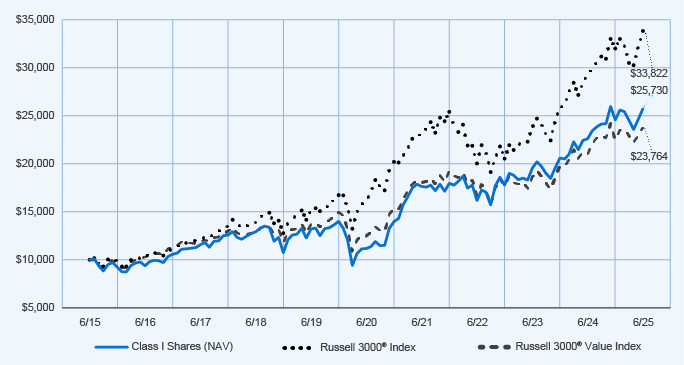

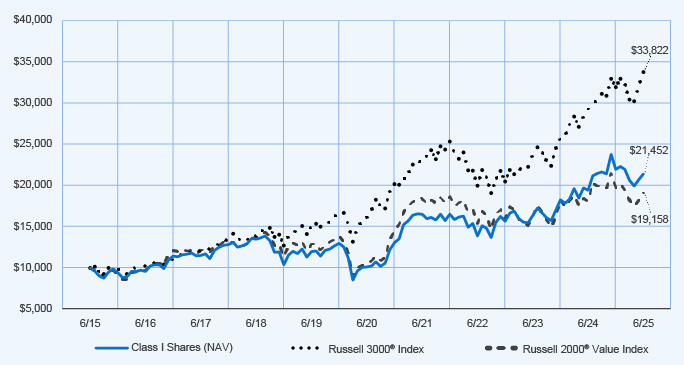

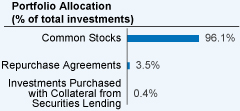

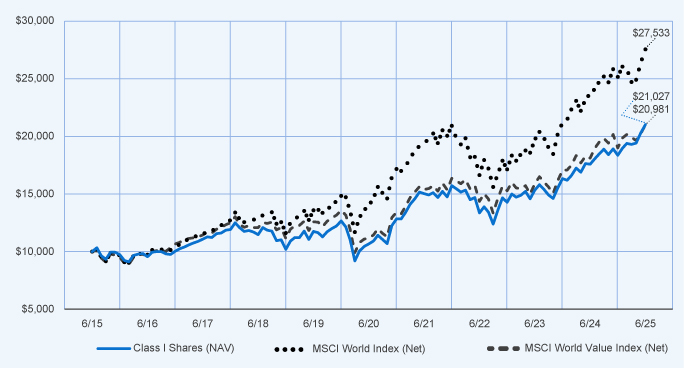

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Class I Shares at NAV |

|

|

13.98 |

% |

|

|

18.21 |

% |

|

|

9.91 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

15.30 |

% |

|

|

15.96 |

% |

|

|

12.96 |

% |

| |

|

|

|

| Russell 3000® Value Index |

|

|

13.30 |

% |

|

|

13.87 |

% |

|

|

9.04 |

% |

| |

|

|

|

| Lipper Multi‑Cap Value Funds Classification Average |

|

|

11.95 |

% |

|

|

14.53 |

% |

|

|

8.96 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 521,544,317

|

|

| Holdings Count | Holding |

61

|

|

| Advisory Fees Paid, Amount |

$ 3,421,772

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

521,544,317 |

|

|

|

| Total number of portfolio holdings |

|

|

61 |

|

|

|

| Portfolio turnover (%) |

|

|

30% |

|

|

|

| Total management fees paid for the year |

|

$ |

3,421,772 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001704 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small Cap Value Opportunities Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

NSCAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en-us/mutual-funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en-us/mutual-funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$126 |

|

1.20% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 126

|

|

| Expense Ratio, Percent |

1.20%

|

[4] |

| Factors Affecting Performance [Text Block] |

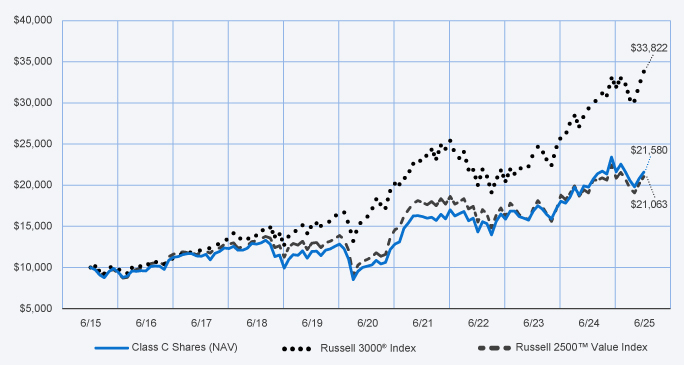

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Small Cap Value Opportunities Fund returned 9.85% for Class A Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund significantly outperformed the Russell 2000 Value Index, which returned 5.54%. • Top contributors to relative performance • Security selection in the health care sector, led by an out‑of‑benchmark position in ADMA Biologics, Inc. • Security selection in the financials sector, led by out‑of‑benchmark positions in Marex Group plc and Western Alliance Bancorp and an overweight to Skyward Specialty Insurance Group, Inc. • Security selection and an underweight allocation to the energy sector, led by an out‑of‑benchmark position in Antero Midstream Corporation. • Top detractors from relative performance • Security selection in the consumer staples sector, including an out‑of‑benchmark position in Grocery Outlet Holding Corp. • Security selection in the materials sector, including an overweight position in Materion Corporation. • Security selection and an underweight allocation to the communication services sector, including an overweight to Vimeo Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

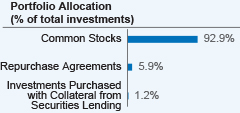

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

9.85% |

|

15.92% |

|

7.66% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

3.53% |

|

14.56% |

|

7.03% |

| |

|

|

|

| Russell 3000® Index |

|

15.30% |

|

15.96% |

|

12.96% |

| |

|

|

|

| Russell 2000® Value Index |

|

5.54% |

|

12.47% |

|

6.72% |

| |

|

|

|

| Lipper Small‑Cap Core Funds Classification Average |

|

6.04% |

|

12.04% |

|

7.23% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 236,210,961

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 1,839,283

|

|

| Investment Company Portfolio Turnover |

96.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$236,210,961 |

|

|

|

| Total number of portfolio holdings |

|

|

65 |

|

|

|

| Portfolio turnover (%) |

|

|

96% |

|

|

|

| Total management fees paid for the year |

|

|

$ 1,839,283 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001706 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small Cap Value Opportunities Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

NSCCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$204 |

|

1.95% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 204

|

|

| Expense Ratio, Percent |

1.95%

|

[5] |

| Factors Affecting Performance [Text Block] |

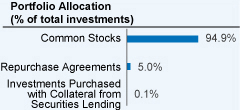

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Small Cap Value Opportunities Fund returned 9.03% for Class C Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund outperformed the Russell 2000 Value Index, which returned 5.54%. • Top contributors to relative performance • Security selection in the health care sector, led by an out‑of‑benchmark position in ADMA Biologics, Inc. • Security selection in the financials sector, led by out‑of‑benchmark positions in Marex Group plc and Western Alliance Bancorp and an overweight to Skyward Specialty Insurance Group, Inc. • Security selection and an underweight allocation to the energy sector, led by an out‑of‑benchmark position in Antero Midstream Corporation. • Top detractors from relative performance • Security selection in the consumer staples sector, including an out‑of‑benchmark position in Grocery Outlet Holding Corp. • Security selection in the materials sector, including an overweight position in Materion Corporation. • Security selection and an underweight allocation to the communication services sector, including an overweight to Vimeo Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

|

9.03 |

% |

|

|

15.06 |

% |

|

|

7.02 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

15.30 |

% |

|

|

15.96 |

% |

|

|

12.96 |

% |

| |

|

|

|

| Russell 2000® Value Index |

|

|

5.54 |

% |

|

|

12.47 |

% |

|

|

6.72 |

% |

| |

|

|

|

| Lipper Small‑Cap Core Funds Classification Average |

|

|

6.04 |

% |

|

|

12.04 |

% |

|

|

7.23 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 236,210,961

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 1,839,283

|

|

| Investment Company Portfolio Turnover |

96.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

236,210,961 |

|

|

|

| Total number of portfolio holdings |

|

|

65 |

|

|

|

| Portfolio turnover (%) |

|

|

96% |

|

|

|

| Total management fees paid for the year |

|

$ |

1,839,283 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000123977 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small Cap Value Opportunities Fund

|

|

| Class Name |

Class R6 Shares

|

|

| Trading Symbol |

NSCFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

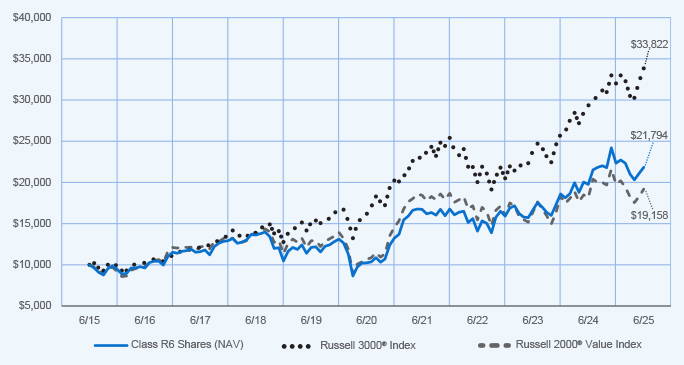

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class R6 Shares |

|

$85 |

|

0.81% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 85

|

|

| Expense Ratio, Percent |

0.81%

|

[6] |

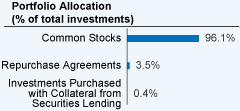

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

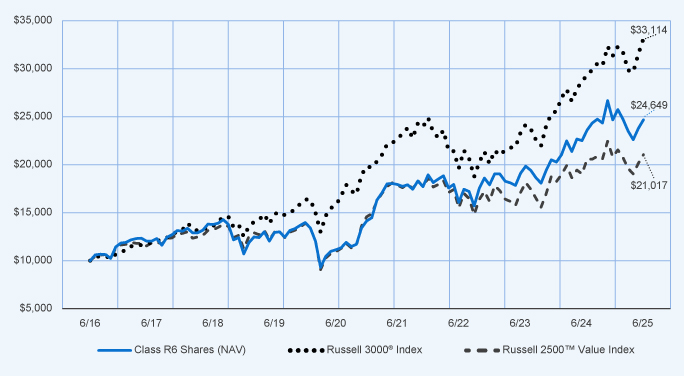

| Performance Highlights • The Nuveen Small Cap Value Opportunities Fund returned 10.28% for Class R6 Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund significantly outperformed the Russell 2000 Value Index, which returned 5.54%. • Top contributors to relative performance • Security selection in the health care sector, led by an out‑of‑benchmark position in ADMA Biologics, Inc. • Security selection in the financials sector, led by out‑of‑benchmark positions in Marex Group plc and Western Alliance Bancorp and an overweight to Skyward Specialty Insurance Group, Inc. • Security selection and an underweight allocation to the energy sector, led by an out‑of‑benchmark position in Antero Midstream Corporation. • Top detractors from relative performance • Security selection in the consumer staples sector, including an out‑of‑benchmark position in Grocery Outlet Holding Corp. • Security selection in the materials sector, including an overweight position in Materion Corporation. • Security selection and an underweight allocation to the communication services sector, including an overweight to Vimeo Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class R6 Shares at NAV |

|

10.28% |

|

16.38% |

|

8.10% |

| |

|

|

|

| Russell 3000® Index |

|

15.30% |

|

15.96% |

|

12.96% |

| |

|

|

|

| Russell 2000® Value Index |

|

5.54% |

|

12.47% |

|

6.72% |

| |

|

|

|

| Lipper Small‑Cap Core Funds Classification Average |

|

6.04% |

|

12.04% |

|

7.23% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 236,210,961

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 1,839,283

|

|

| Investment Company Portfolio Turnover |

96.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

|

$236,210,961 |

|

|

|

| Total number of portfolio holdings |

|

|

65 |

|

|

|

| Portfolio turnover (%) |

|

|

96% |

|

|

|

| Total management fees paid for the year |

|

|

$ 1,839,283 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000001707 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small Cap Value Opportunities Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

NSCRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Small Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$100 |

|

0.95% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 100

|

|

| Expense Ratio, Percent |

0.95%

|

[7] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Small Cap Value Opportunities Fund returned 10.13% for Class I Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund significantly outperformed the Russell 2000 Value Index, which returned 5.54%. • Top contributors to relative performance • Security selection in the health care sector, led by an out‑of‑benchmark position in ADMA Biologics, Inc. • Security selection in the financials sector, led by out‑of‑benchmark positions in Marex Group plc and Western Alliance Bancorp and an overweight to Skyward Specialty Insurance Group, Inc. • Security selection and an underweight allocation to the energy sector, led by an out‑of‑benchmark position in Antero Midstream Corporation. • Top detractors from relative performance • Security selection in the consumer staples sector, including an out‑of‑benchmark position in Grocery Outlet Holding Corp. • Security selection in the materials sector, including an overweight position in Materion Corporation. • Security selection and an underweight allocation to the communication services sector, including an overweight to Vimeo Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class I Shares at NAV |

|

10.13% |

|

16.22% |

|

7.93% |

| |

|

|

|

| Russell 3000® Index |

|

15.30% |

|

15.96% |

|

12.96% |

| |

|

|

|

| Russell 2000® Value Index |

|

5.54% |

|

12.47% |

|

6.72% |

| |

|

|

|

| Lipper Small‑Cap Core Funds Classification Average |

|

6.04% |

|

12.04% |

|

7.23% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 236,210,961

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 1,839,283

|

|

| Investment Company Portfolio Turnover |

96.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

236,210,961 |

|

|

|

| Total number of portfolio holdings |

|

|

65 |

|

|

|

| Portfolio turnover (%) |

|

|

96% |

|

|

|

| Total management fees paid for the year |

|

$ |

1,839,283 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000039982 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Large Cap Value Opportunities Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

NQCAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen Large Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$108 |

|

1.00% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 108

|

|

| Expense Ratio, Percent |

1.00%

|

[8] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

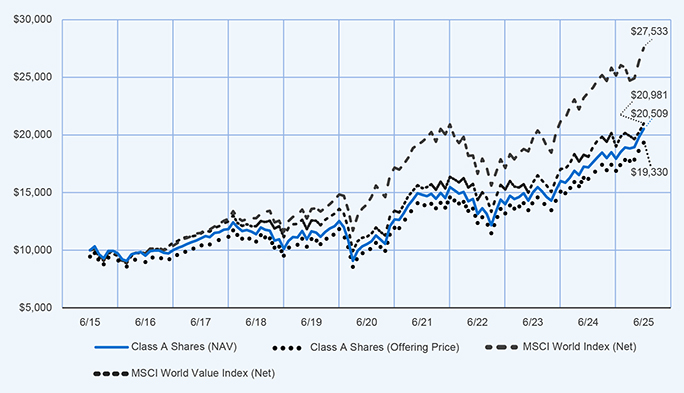

| Performance Highlights • The Nuveen Large Cap Value Opportunities Fund returned 16.97% for Class A Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund outperformed the Russell 1000 Value Index, which returned 13.70%. • Top contributors to relative performance • Security selection in the consumer staples sector, led by an overweight to Walmart Inc. • Security selection in the financials sector, led by overweights to JPMorgan Chase & Co. and Discover Financial Services. • Overweight to AT&T Inc. • Top detractors from relative performance • Overweight to Elevance Health, Inc. • Security selection and an underweight to the industrials sector. • Security selection in the real estate sector, including an overweight to Alexandria Real Estate Equities, Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

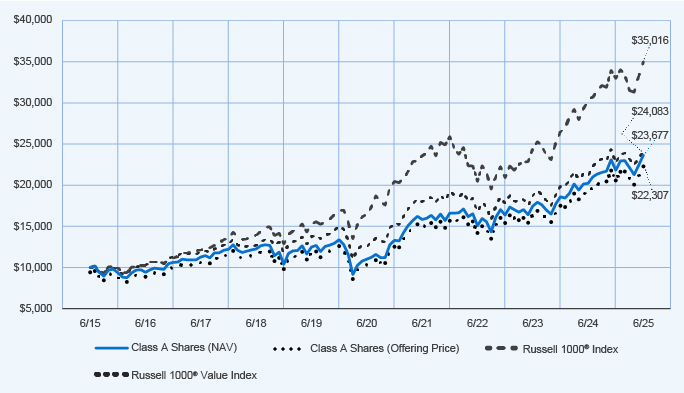

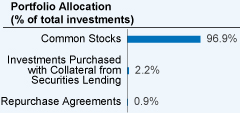

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1-Year |

|

5-Year |

|

10-Year |

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

16.97% |

|

16.58% |

|

9.00% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

10.29% |

|

15.21% |

|

8.35% |

| |

|

|

|

| Russell 1000® Index |

|

15.66% |

|

16.30% |

|

13.35% |

| |

|

|

|

| Russell 1000® Value Index |

|

13.70% |

|

13.93% |

|

9.19% |

| |

|

|

|

| Lipper Multi‑Cap Value Funds Classification Average |

|

11.95% |

|

14.53% |

|

8.96% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 22,535,559

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 145,699

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

22,535,559 |

|

|

|

| Total number of portfolio holdings |

|

|

58 |

|

|

|

| Portfolio turnover (%) |

|

|

25% |

|

|

|

| Total management fees paid for the year |

|

$ |

145,699 |

|

|

|

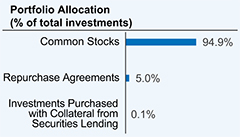

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000039984 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Large Cap Value Opportunities Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

NQCCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C Shares of the Nuveen Large Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$189 |

|

1.75% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 189

|

|

| Expense Ratio, Percent |

1.75%

|

[9] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Large Cap Value Opportunities Fund returned 15.87% for Class C Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund outperformed the Russell 1000 Value Index, which returned 13.70%. • Top contributors to relative performance • Security selection in the consumer staples sector, led by an overweight to Walmart Inc. • Security selection in the financials sector, led by overweights to JPMorgan Chase & Co. and Discover Financial Services. • Overweight to AT&T Inc. • Top detractors from relative performance • Overweight to Elevance Health, Inc. • Security selection and an underweight to the industrials sector. • Security selection in the real estate sector, including an overweight to Alexandria Real Estate Equities, Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

15.87% |

|

15.64% |

|

8.34% |

| |

|

|

|

| Russell 1000® Index |

|

15.66% |

|

16.30% |

|

13.35% |

| |

|

|

|

| Russell 1000® Value Index |

|

13.70% |

|

13.93% |

|

9.19% |

| |

|

|

|

| Lipper Multi‑Cap Value Funds Classification Average |

|

11.95% |

|

14.53% |

|

8.96% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 22,535,559

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 145,699

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

22,535,559 |

|

|

|

| Total number of portfolio holdings |

|

|

58 |

|

|

|

| Portfolio turnover (%) |

|

|

25% |

|

|

|

| Total management fees paid for the year |

|

$ |

145,699 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000039985 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Large Cap Value Opportunities Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

NQCRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Large Cap Value Opportunities Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$81 |

|

0.75% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 81

|

|

| Expense Ratio, Percent |

0.75%

|

[10] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Large Cap Value Opportunities Fund returned 17.09% for Class I Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund outperformed the Russell 1000 Value Index, which returned 13.70%. • Top contributors to relative performance • Security selection in the consumer staples sector, led by an overweight to Walmart Inc. • Security selection in the financials sector, led by overweights to JPMorgan Chase & Co. and Discover Financial Services. • Overweight to AT&T Inc. • Top detractors from relative performance • Overweight to Elevance Health, Inc. • Security selection and an underweight to the industrials sector. • Security selection in the real estate sector, including an overweight to Alexandria Real Estate Equities, Inc. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1-Year |

|

5-Year |

|

10-Year |

| |

|

|

|

| Class I Shares at NAV |

|

17.09% |

|

16.84% |

|

9.26% |

| |

|

|

|

| Russell 1000® Index |

|

15.66% |

|

16.30% |

|

13.35% |

| |

|

|

|

| Russell 1000® Value Index |

|

13.70% |

|

13.93% |

|

9.19% |

| |

|

|

|

| Lipper Multi‑Cap Value Funds Classification Average |

|

11.95% |

|

14.53% |

|

8.96% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 22,535,559

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 145,699

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

22,535,559 |

|

|

|

| Total number of portfolio holdings |

|

|

58 |

|

|

|

| Portfolio turnover (%) |

|

|

25% |

|

|

|

| Total management fees paid for the year |

|

$ |

145,699 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000039986 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small/Mid Cap Value Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

NSMAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class A Shares |

|

$137 |

|

1.31% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 137

|

|

| Expense Ratio, Percent |

1.31%

|

[11] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Small/Mid Cap Value Fund returned 9.17% for Class A Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund underperformed the Russell 2500 Value Index, which returned 10.47%. • Top contributors to relative performance • Security selection in the health care sector, led by an out‑of‑benchmark position in ADMA Biologics, Inc. • Overweight to Curtiss-Wright Corporation. • Security selection in the information technology sector, led by an out‑of‑benchmark position in Seagate Technology Holdings PLC. • Top detractors from relative performance • Security selection in the consumer discretionary sector, including overweights to Wayfair, Inc., Advance Auto Parts, Inc. and Under Armour, Inc. • Security selection in the materials sector, including an overweight to FMC Corporation. • Security selection in the financials sector, including Robinhood Markets, Inc, a security not held by the fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

|

5‑Year |

|

|

10‑Year |

|

| |

|

|

|

| Class A Shares at NAV (excluding maximum sales charge) |

|

|

9.17 |

% |

|

|

16.79 |

% |

|

|

8.65 |

% |

| |

|

|

|

| Class A Shares at maximum sales charge (Offering Price) |

|

|

2.89 |

% |

|

|

15.42 |

% |

|

|

8.00 |

% |

| |

|

|

|

| Russell 3000® Index |

|

|

15.30 |

% |

|

|

15.96 |

% |

|

|

12.96 |

% |

| |

|

|

|

| Russell 2500™ Value Index |

|

|

10.47 |

% |

|

|

13.96 |

% |

|

|

7.73 |

% |

| |

|

|

|

| Lipper Small‑Cap Core Funds Classification Average |

|

|

6.04 |

% |

|

|

12.04 |

% |

|

|

7.23 |

% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 91,129,365

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 756,111

|

|

| Investment Company Portfolio Turnover |

64.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

91,129,365 |

|

|

|

| Total number of portfolio holdings |

|

|

65 |

|

|

|

| Portfolio turnover (%) |

|

|

64% |

|

|

|

| Total management fees paid for the year |

|

$ |

756,111 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000039988 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small/Mid Cap Value Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

NSMCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class C Shares |

|

$215 |

|

2.06% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 215

|

|

| Expense Ratio, Percent |

2.06%

|

[12] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

| Performance Highlights • The Nuveen Small/Mid Cap Value Fund returned 8.38% for Class C Shares at net asset value (NAV) for the 12 months ended June 30, 2025. The Fund underperformed the Russell 2500 Value Index, which returned 10.47%. • Top contributors to relative performance • Security selection in the health care sector, led by an out‑of‑benchmark position in ADMA Biologics, Inc. • Overweight to Curtiss-Wright Corporation. • Security selection in the information technology sector, led by an out‑of‑benchmark position in Seagate Technology Holdings PLC. • Top detractors from relative performance • Security selection in the consumer discretionary sector, including overweights to Wayfair, Inc., Advance Auto Parts, Inc. and Under Armour, Inc. • Security selection in the materials sector, including an overweight to FMC Corporation. • Security selection in the financials sector, including Robinhood Markets, Inc, a security not held by the fund. |

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data shown represents past performance and does not predict or guarantee future results.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

| |

|

1‑Year |

|

5‑Year |

|

10‑Year |

| |

|

|

|

| Class C Shares at NAV (excluding maximum sales charge) |

|

8.38% |

|

15.92% |

|

8.00% |

| |

|

|

|

| Russell 3000® Index |

|

15.30% |

|

15.96% |

|

12.96% |

| |

|

|

|

| Russell 2500™ Value Index |

|

10.47% |

|

13.96% |

|

7.73% |

| |

|

|

|

| Lipper Small‑Cap Core Funds Classification Average |

|

6.04% |

|

12.04% |

|

7.23% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

|

|

| Updated Performance Information Location [Text Block] |

For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

|

|

| Net Assets |

$ 91,129,365

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 756,111

|

|

| Investment Company Portfolio Turnover |

64.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund Statistics (as of June 30, 2025)

|

|

|

|

|

|

|

| Fund net assets |

|

$ |

91,129,365 |

|

|

|

| Total number of portfolio holdings |

|

|

65 |

|

|

|

| Portfolio turnover (%) |

|

|

64% |

|

|

|

| Total management fees paid for the year |

|

$ |

756,111 |

|

|

|

| Holdings [Text Block] |

|

|

| Material Fund Change [Text Block] |

How has the Fund changed? For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 31, 2025 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

|

|

| Updated Prospectus Phone Number |

(800) 257‑8787

|

|

| Updated Prospectus Web Address |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| C000039989 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nuveen Small/Mid Cap Value Fund

|

|

| Class Name |

Class I Shares

|

|

| Trading Symbol |

NSMRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class I Shares of the Nuveen Small/Mid Cap Value Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information athttps://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 257‑8787

|

|

| Additional Information Website |

https://www.nuveen.com/en‑us/mutual‑funds/prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

|

| |

|

Cost of a $10,000 investment |

|

Costs paid as a percentage of

$10,000 investment* |

| |

|

|

| Class I Shares |

|

$111 |

|

1.06% | * Annualized for period less than one year.

|

|

| Expenses Paid, Amount |

$ 111

|

|

| Expense Ratio, Percent |

1.06%

|

[13] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? What affected the Fund’s performance?

|

|