|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Monetta Fund

|

$71

|

1.33%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

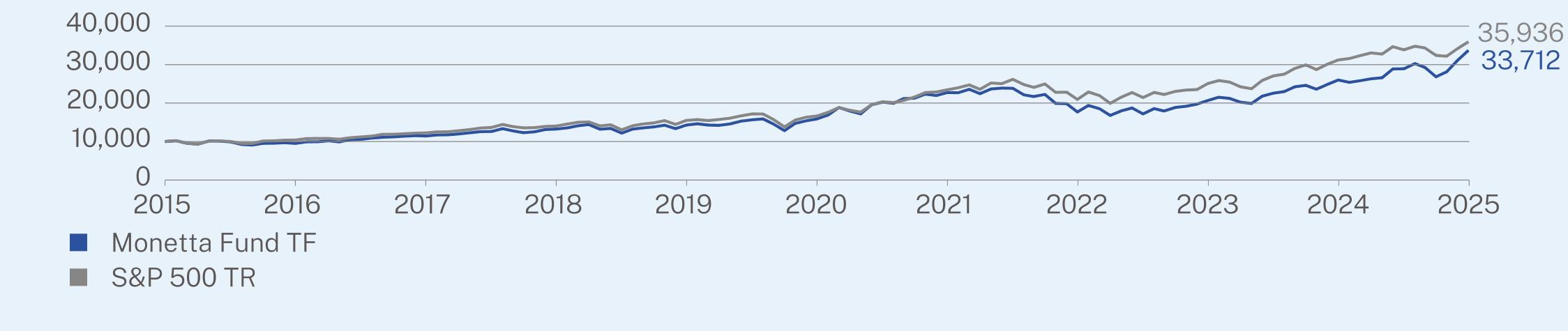

Monetta Fund

|

29.71

|

16.25

|

12.92

|

|

S&P 500 Index

|

15.16

|

16.64

|

13.65

|

|

Net Assets

|

$97,383,920

|

|

Number of Holdings

|

52

|

|

Portfolio Turnover

|

28%

|

|

Top 10 Issuers (% of net assets)

|

|

|

Amazon.com, Inc.

|

7.1%

|

|

Palantir Technologies, Inc.

|

6.0%

|

|

NVIDIA Corp.

|

5.7%

|

|

JPMorgan Chase & Co.

|

4.5%

|

|

Alphabet, Inc. - CL C

|

4.2%

|

|

Netflix, Inc.

|

4.1%

|

|

Microsoft Corp.

|

4.1%

|

|

Meta Platforms, Inc. - CL A

|

3.8%

|

|

Apple, Inc.

|

3.5%

|

|

Costco Wholesale Corp.

|

3.0%

|

|

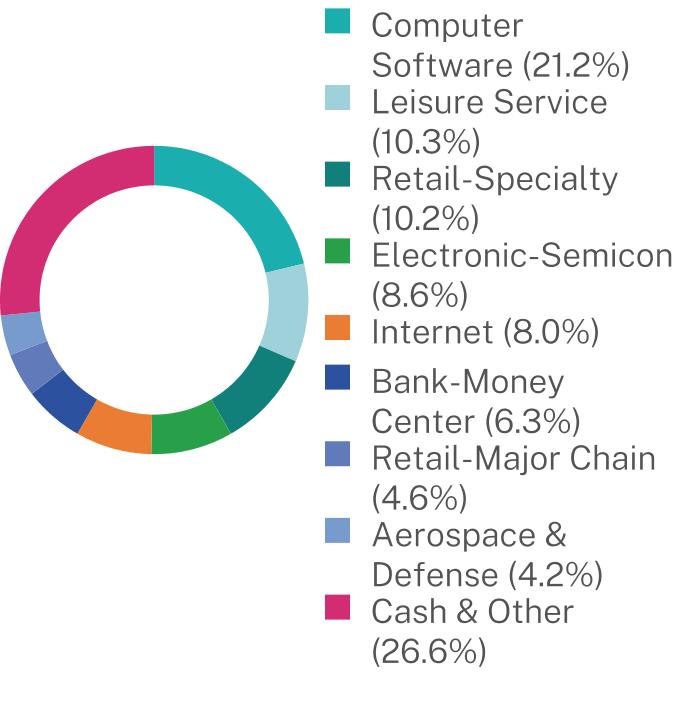

Industry (% of net assets)

|

|

|

Technology

|

41.3%

|

|

Retail

|

17.7%

|

|

Consumer Cyclical

|

13.8%

|

|

Financial

|

12.9%

|

|

Capital Equipment

|

6.5%

|

|

Healthcare

|

3.2%

|

|

Energy

|

2.6%

|

|

Utility

|

1.4%

|

|

Cash & Other

|

0.6%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Monetta Young Investor Growth Fund

|

$75

|

1.47%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

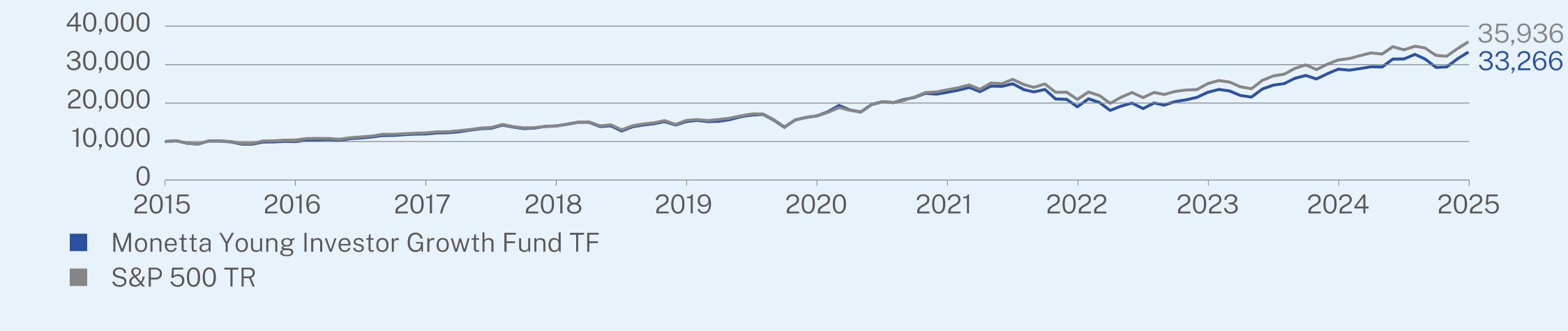

Monetta Young Investor Growth Fund

|

15.39

|

14.81

|

12.77

|

|

S&P 500 Index

|

15.16

|

16.64

|

13.65

|

|

Net Assets

|

$41,842,070

|

|

Number of Holdings

|

19

|

|

Portfolio Turnover

|

2%

|

|

Top 10 Issuers (% of net assets)

|

|

|

SPDR S&P 500 Trust

|

31.5%

|

|

Vanguard S&P 500

|

18.3%

|

|

Amazon.com, Inc.

|

10.5%

|

|

JPMorgan Chase & Co.

|

5.9%

|

|

Alphabet, Inc. - CL C

|

4.7%

|

|

Netflix, Inc.

|

4.5%

|

|

Microsoft Corp.

|

4.2%

|

|

Apple, Inc.

|

3.9%

|

|

Costco Wholesale Corp.

|

3.5%

|

|

Meta Platforms, Inc. - CL A

|

2.1%

|

|

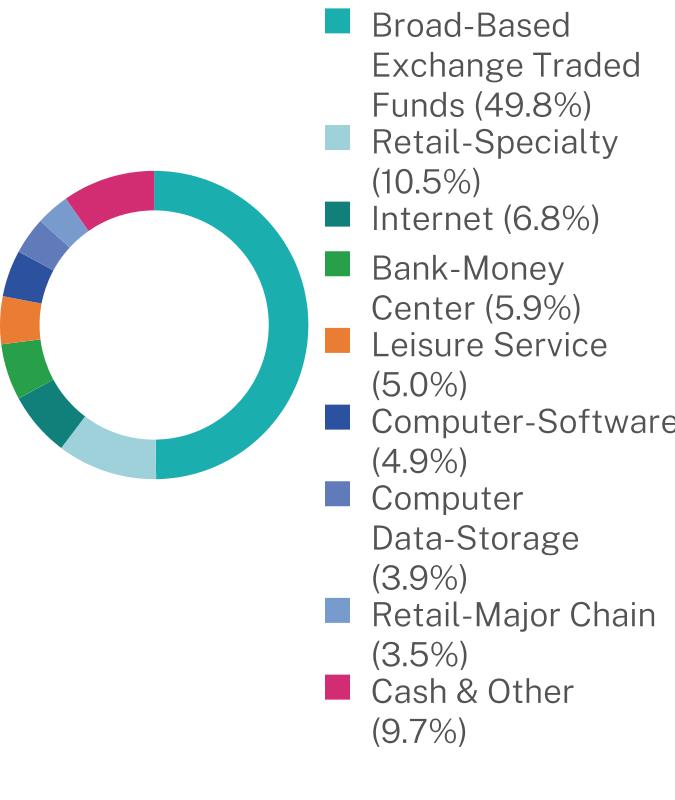

Industry (% of net assets)

|

|

|

Broad-Based Exchange Traded Funds

|

49.8%

|

|

Technology

|

17.5%

|

|

Retail

|

14.0%

|

|

Consumer Cyclical

|

8.2%

|

|

Financial

|

6.8%

|

|

Utility

|

0.9%

|

|

Capital Equipment

|

0.5%

|

|

Cash & Other

|

2.3%

|

| [1] |

|

||

| [2] |

|