NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

QMMM Holdings Limited (The “Group” or the “Company”) was incorporated in the Cayman Island on July 29, 2022 as an investment holding company. The Company conducts its primary operations through two of its indirectly wholly owned subsidiaries ManyMany Creations Limited (“MM”) and Quantum Matrix Limited (“QM”) which are both incorporated and domiciled in the Hong Kong Special Administrative Region (“HK SAR”). The Company is primarily engaged in providing digital media advertising and marketing production services and it is headquartered in Hong Kong

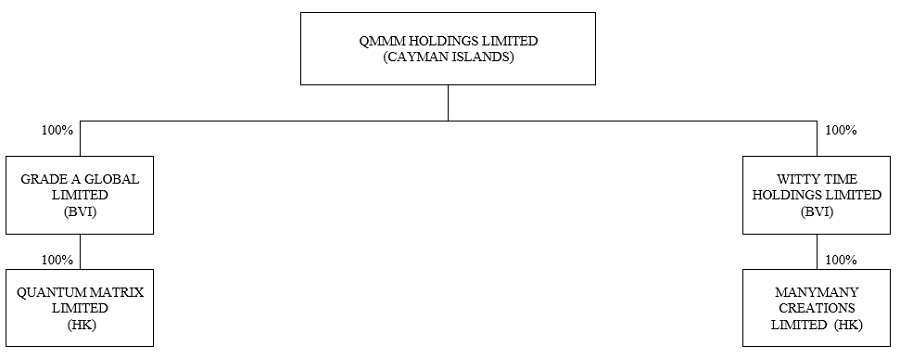

The following is an organization chart of the Company and its subsidiaries:

As of March 31, 2025, the Company’s subsidiaries are detailed in the table as follows:

| Name | Background | Ownership % | Principal activity | |||||

| Grade A Global Limited | ● A BVI company ● Incorporated on July 5, 2022 |

100 | % | Holding Company | ||||

| Witty Time Holdings Limited | ● A BVI company ● Incorporated on July 5, 2022 |

100 | % | Holding Company | ||||

| ManyMany Creations Limited (“MM”) |

● A Hong Kong company ● Incorporated on June 15, 2005 |

100 | % | Digital media advertising and marketing production services | ||||

| Quantum Matrix Limited (“QM”) |

● A Hong Kong company ● Incorporated on March 20, 2014 |

100 | % | Digital media advertising and marketing production services | ||||

The registration statement for the Company’s Initial Public Offering (the “Offering”) was declared effective by the SEC on July 1, 2024. On July 22, 2024, the Company consummated the Offering of ordinary shares at a price to the public of $ per share. On August 8, 2024, the Company further issued ordinary shares at a price of $ per share with underwriter partially exercised the over-allotment option. The aggregate gross proceeds from the Offering amounted to $8,825,368, prior to deducting underwriting discounts, commissions and offering-related expenses.

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2025 AND 2024

(Stated in US Dollars)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

Group reorganization

Pursuant to a group reorganization (the “group reorganization”) to rationalize the structure of the Company and its subsidiary companies (herein collectively referred to as the “Group”) in preparation for the listing of our shares, the Company becomes the holding company of the Group on November 14, 2022. As the Group were under same control of the shareholders and their entire equity interests were also ultimately held by the shareholders immediately prior to the group reorganization, the unaudited condensed consolidated statements of operations and comprehensive loss, unaudited condensed consolidated statements of changes in shareholders’ (deficit) equity and unaudited condensed consolidated statements of cash flows are prepared as if the current group structure had been in existence throughout the beginning of the period, or since the respective dates of incorporation/establishment of the relevant entity, where this is a shorter period

GOING CONCERN

The Company has incurred a net loss of $1,381,918 for the six months ended March 31, 2025. As of March 31, 2025, the Company had an accumulated deficit of $3,895,665; its net cash used in operating activities for the six months ended March 31, 2025 was $402,422. As of the date of this report, there still exists substantial doubt that the Company will continue as going concern. Management plans to focus its resources on more profitable projects. Additionally, the Company plans to raise capital via private placement or public offering in the event that the Company does not have adequate liquidity to meet its current obligations.

The accompanying unaudited condensed consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These unaudited condensed consolidated financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.