Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Matthews International Funds

|

|

| Entity Central Index Key |

0000923184

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000093221 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Pacific Tiger Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MIPTX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Pacific Tiger Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$62 |

1.18%* |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.18%

|

[1] |

| Net Assets |

$ 707,096,808

|

|

| Holdings Count | Holding |

72

|

|

| Investment Company Portfolio Turnover |

64.60%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$707,096,808 |

| Total number of portfolio holdings |

72 |

| Portfolio turnover rate for the reporting period |

64.6% |

|

|

| Holdings [Text Block] |

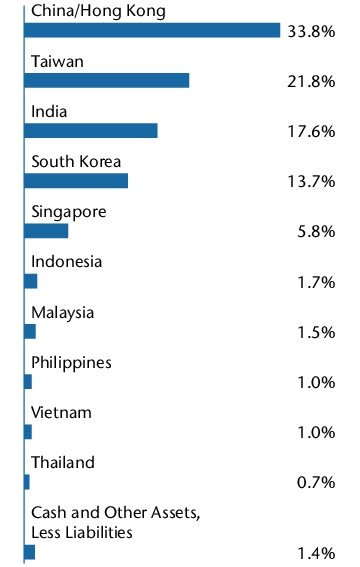

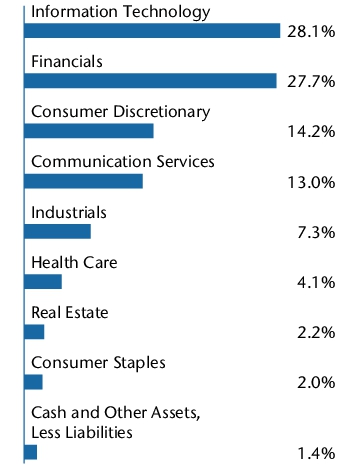

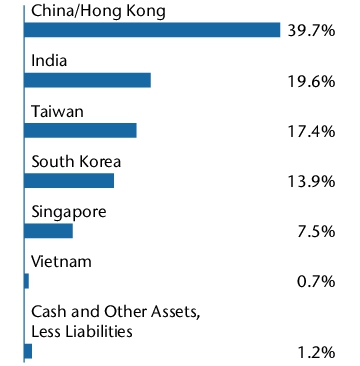

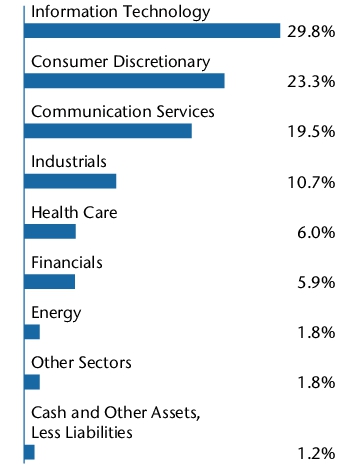

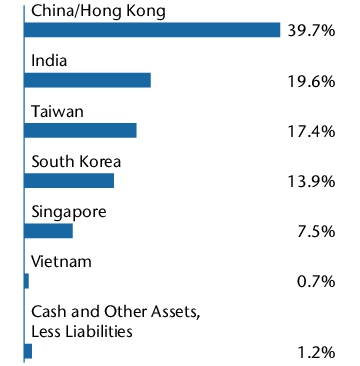

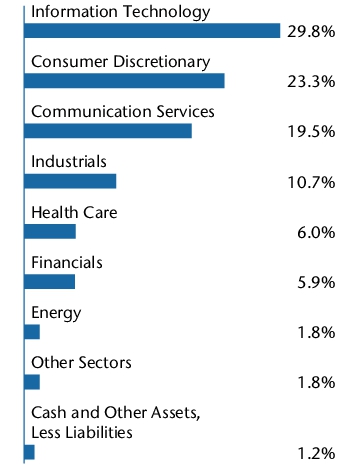

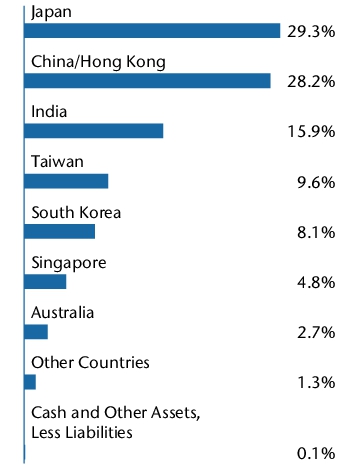

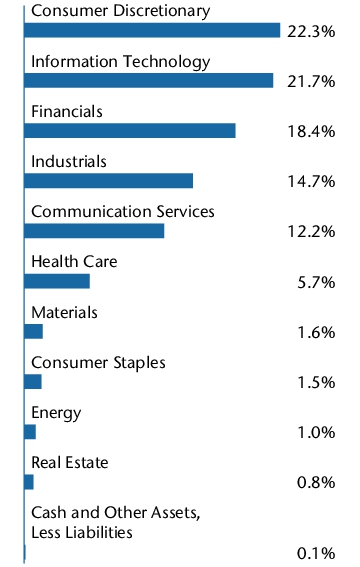

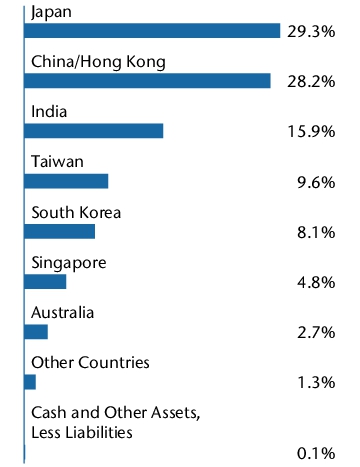

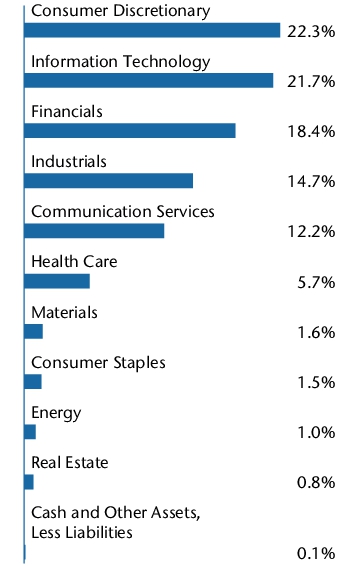

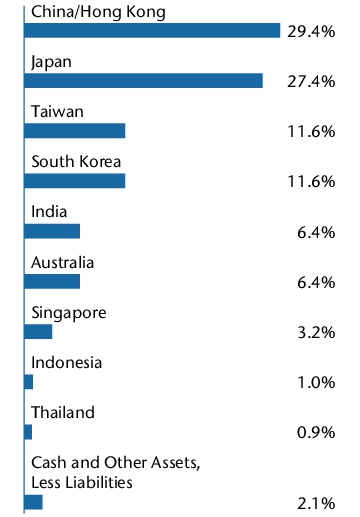

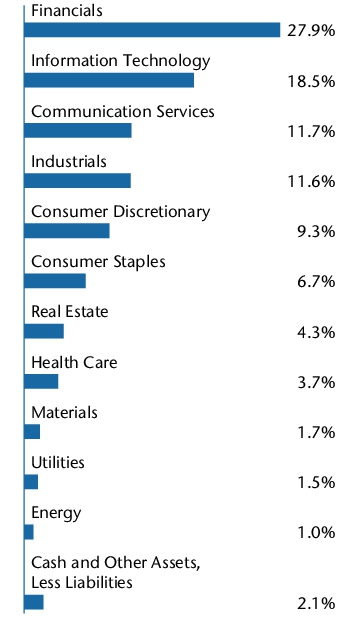

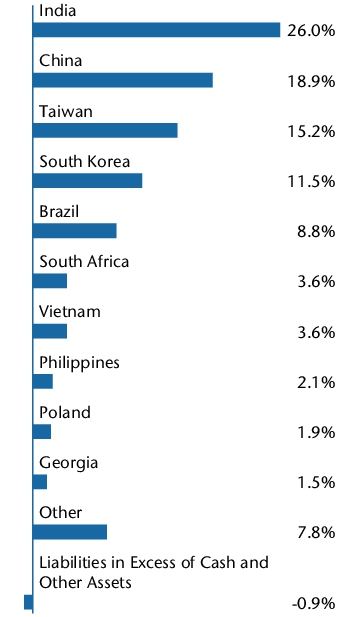

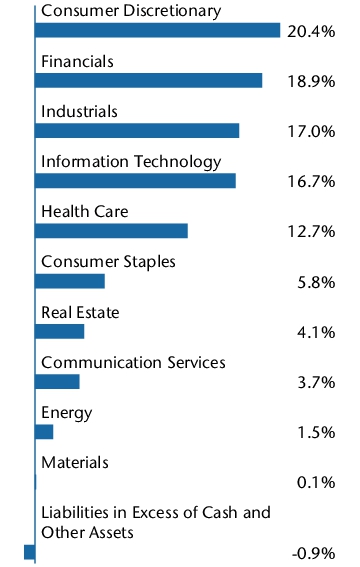

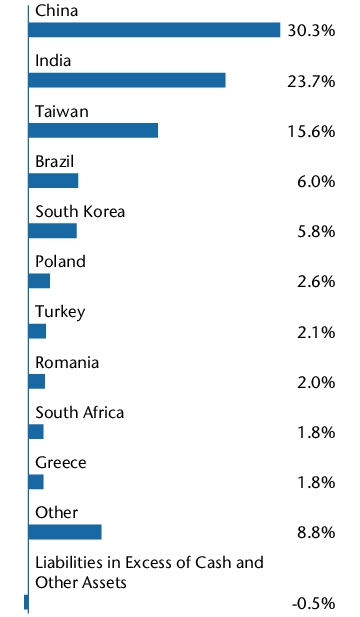

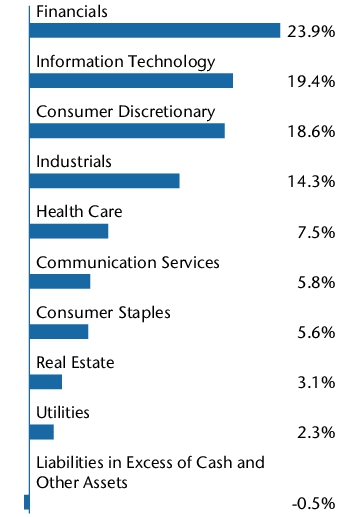

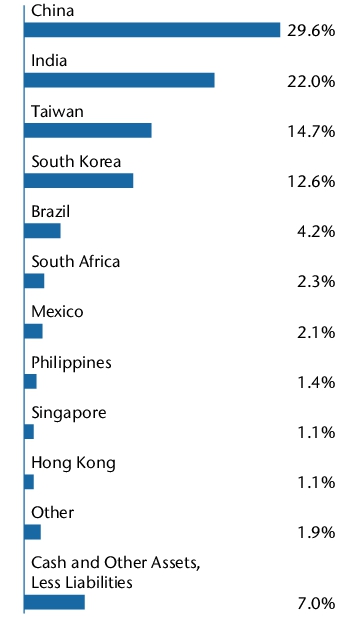

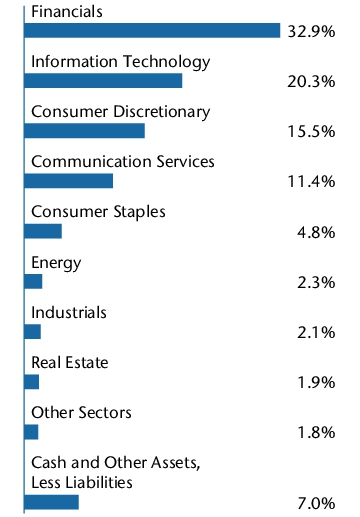

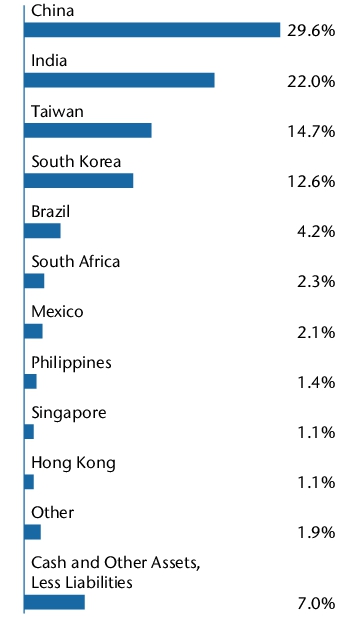

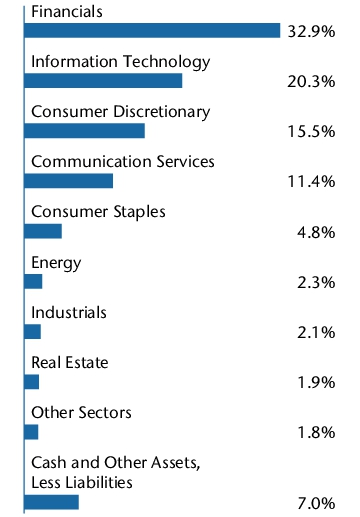

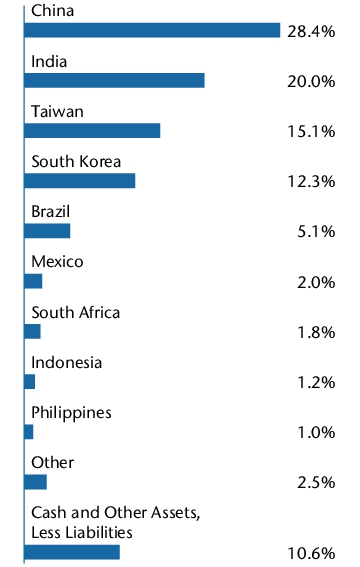

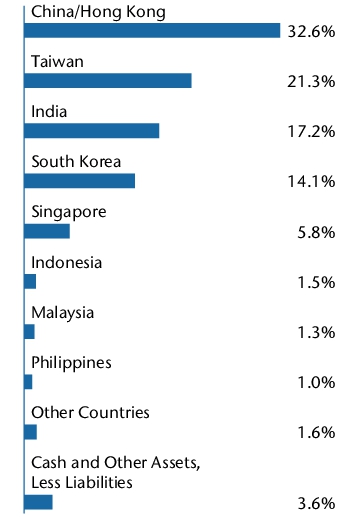

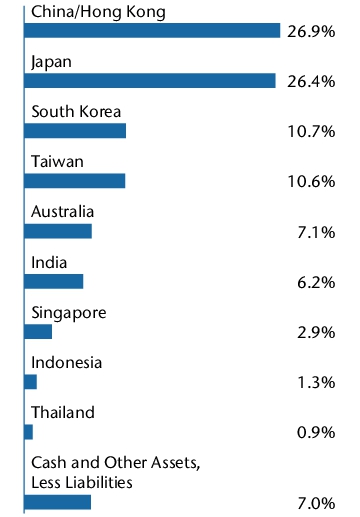

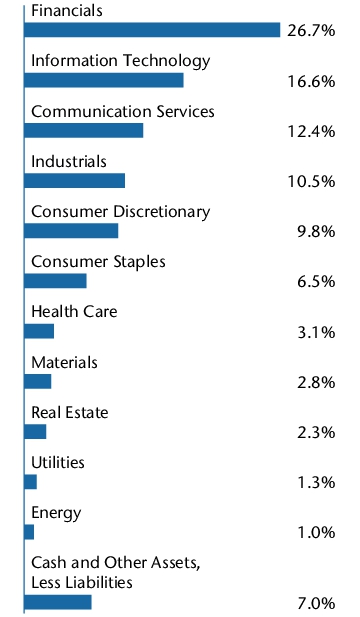

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

12.3% |

| Tencent Holdings, Ltd. |

6.0% |

| Alibaba Group Holding, Ltd. |

3.9% |

| China Merchants Bank Co., Ltd. |

3.8% |

| KB Financial Group, Inc. |

3.1% |

| Samsung Electronics Co., Ltd. |

2.9% |

| SK Hynix, Inc. |

2.7% |

| Bharti Airtel, Ltd. |

2.6% |

| Eternal, Ltd. |

2.5% |

| Sea, Ltd. |

2.5% |

| TOTAL |

42.3% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

12.3% |

| Tencent Holdings, Ltd. |

6.0% |

| Alibaba Group Holding, Ltd. |

3.9% |

| China Merchants Bank Co., Ltd. |

3.8% |

| KB Financial Group, Inc. |

3.1% |

| Samsung Electronics Co., Ltd. |

2.9% |

| SK Hynix, Inc. |

2.7% |

| Bharti Airtel, Ltd. |

2.6% |

| Eternal, Ltd. |

2.5% |

| Sea, Ltd. |

2.5% |

| TOTAL |

42.3% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000002785 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Pacific Tiger Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MAPTX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Pacific Tiger Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$68 |

1.31%* |

|

|

| Expenses Paid, Amount |

$ 68

|

|

| Expense Ratio, Percent |

1.31%

|

[2] |

| Net Assets |

$ 707,096,808

|

|

| Holdings Count | Holding |

72

|

|

| Investment Company Portfolio Turnover |

64.60%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$707,096,808 |

| Total number of portfolio holdings |

72 |

| Portfolio turnover rate for the reporting period |

64.6% |

|

|

| Holdings [Text Block] |

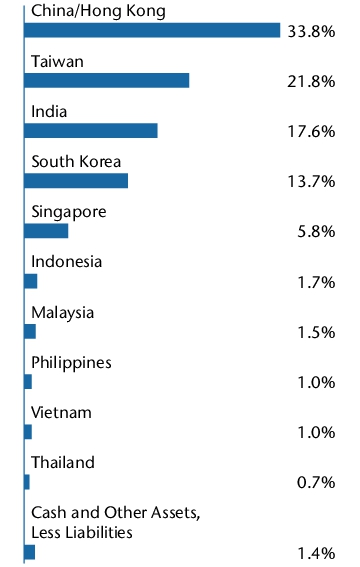

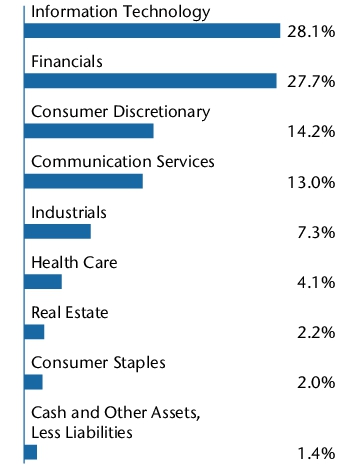

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

12.3% |

| Tencent Holdings, Ltd. |

6.0% |

| Alibaba Group Holding, Ltd. |

3.9% |

| China Merchants Bank Co., Ltd. |

3.8% |

| KB Financial Group, Inc. |

3.1% |

| Samsung Electronics Co., Ltd. |

2.9% |

| SK Hynix, Inc. |

2.7% |

| Bharti Airtel, Ltd. |

2.6% |

| Eternal, Ltd. |

2.5% |

| Sea, Ltd. |

2.5% |

| TOTAL |

42.3% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

12.3% |

| Tencent Holdings, Ltd. |

6.0% |

| Alibaba Group Holding, Ltd. |

3.9% |

| China Merchants Bank Co., Ltd. |

3.8% |

| KB Financial Group, Inc. |

3.1% |

| Samsung Electronics Co., Ltd. |

2.9% |

| SK Hynix, Inc. |

2.7% |

| Bharti Airtel, Ltd. |

2.6% |

| Eternal, Ltd. |

2.5% |

| Sea, Ltd. |

2.5% |

| TOTAL |

42.3% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093224 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews China Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MICFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews China Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$61 |

1.16%* |

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

1.16%

|

[3] |

| Net Assets |

$ 378,194,465

|

|

| Holdings Count | Holding |

63

|

|

| Investment Company Portfolio Turnover |

15.50%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$378,194,465 |

| Total number of portfolio holdings |

63 |

| Portfolio turnover rate for the reporting period |

15.5% |

|

|

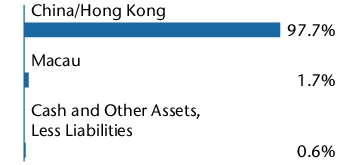

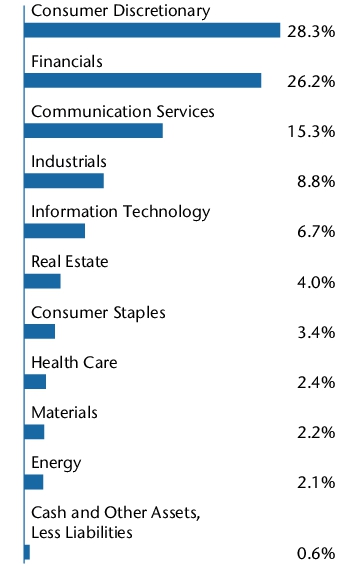

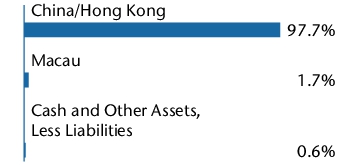

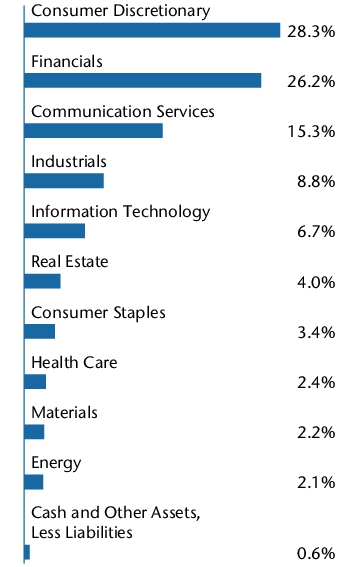

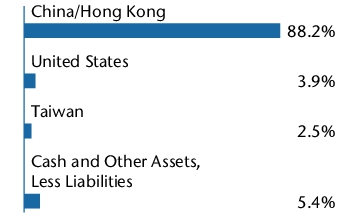

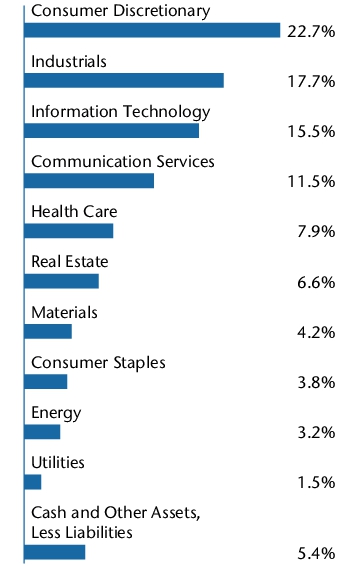

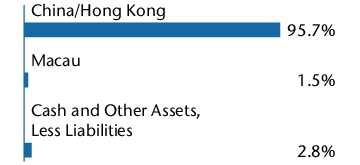

| Holdings [Text Block] |

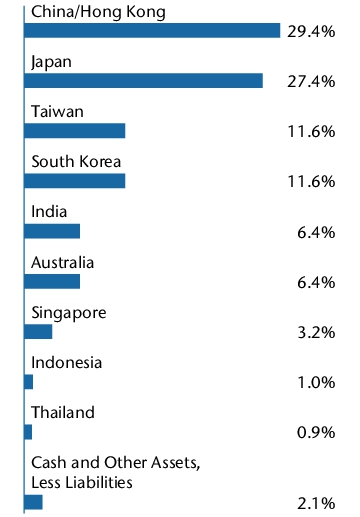

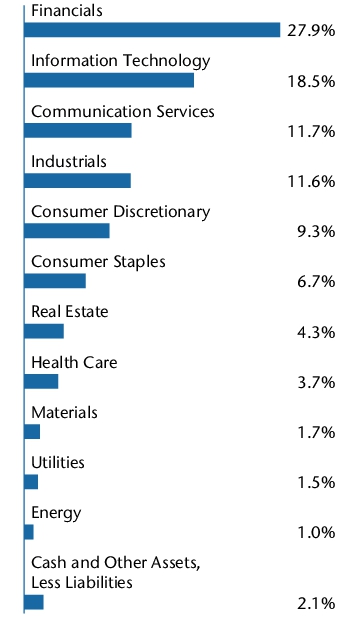

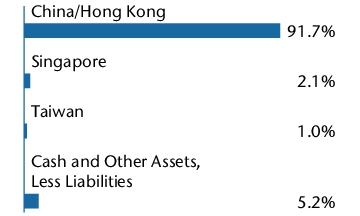

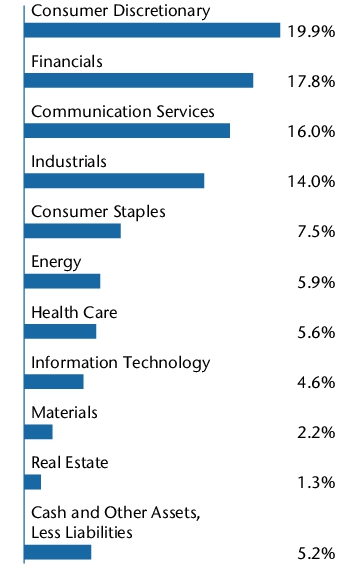

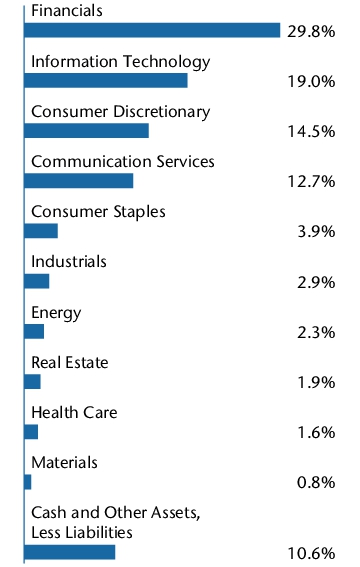

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Tencent Holdings, Ltd. |

10.3% |

| Alibaba Group Holding, Ltd. |

7.6% |

| China Merchants Bank Co., Ltd. |

4.7% |

| China Construction Bank Corp. |

4.5% |

| JD.com, Inc. |

4.2% |

| PDD Holdings, Inc. |

3.8% |

| Ping An Insurance Group Co. of China, Ltd. |

3.6% |

| Meituan |

3.3% |

| New China Life Insurance Co., Ltd. |

3.1% |

| DiDi Global, Inc. ADR |

2.8% |

| TOTAL |

47.9% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Tencent Holdings, Ltd. |

10.3% |

| Alibaba Group Holding, Ltd. |

7.6% |

| China Merchants Bank Co., Ltd. |

4.7% |

| China Construction Bank Corp. |

4.5% |

| JD.com, Inc. |

4.2% |

| PDD Holdings, Inc. |

3.8% |

| Ping An Insurance Group Co. of China, Ltd. |

3.6% |

| Meituan |

3.3% |

| New China Life Insurance Co., Ltd. |

3.1% |

| DiDi Global, Inc. ADR |

2.8% |

| TOTAL |

47.9% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000002790 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews China Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MCHFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews China Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$68 |

1.29%* |

|

|

| Expenses Paid, Amount |

$ 68

|

|

| Expense Ratio, Percent |

1.29%

|

[4] |

| Net Assets |

$ 378,194,465

|

|

| Holdings Count | Holding |

63

|

|

| Investment Company Portfolio Turnover |

15.50%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$378,194,465 |

| Total number of portfolio holdings |

63 |

| Portfolio turnover rate for the reporting period |

15.5% |

|

|

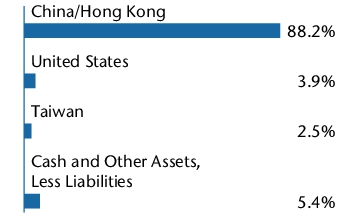

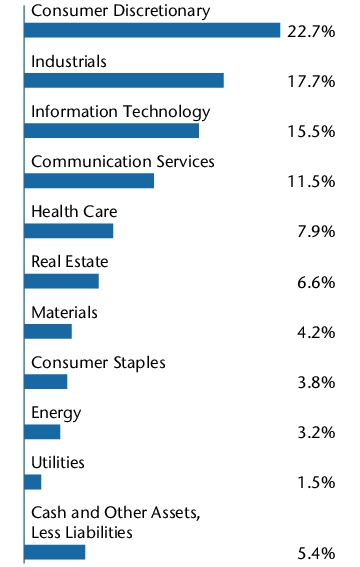

| Holdings [Text Block] |

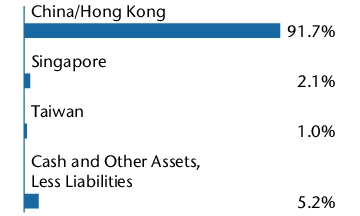

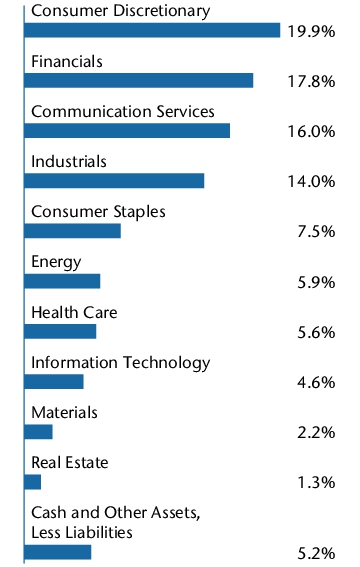

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Tencent Holdings, Ltd. |

10.3% |

| Alibaba Group Holding, Ltd. |

7.6% |

| China Merchants Bank Co., Ltd. |

4.7% |

| China Construction Bank Corp. |

4.5% |

| JD.com, Inc. |

4.2% |

| PDD Holdings, Inc. |

3.8% |

| Ping An Insurance Group Co. of China, Ltd. |

3.6% |

| Meituan |

3.3% |

| New China Life Insurance Co., Ltd. |

3.1% |

| DiDi Global, Inc. ADR |

2.8% |

| TOTAL |

47.9% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Tencent Holdings, Ltd. |

10.3% |

| Alibaba Group Holding, Ltd. |

7.6% |

| China Merchants Bank Co., Ltd. |

4.7% |

| China Construction Bank Corp. |

4.5% |

| JD.com, Inc. |

4.2% |

| PDD Holdings, Inc. |

3.8% |

| Ping An Insurance Group Co. of China, Ltd. |

3.6% |

| Meituan |

3.3% |

| New China Life Insurance Co., Ltd. |

3.1% |

| DiDi Global, Inc. ADR |

2.8% |

| TOTAL |

47.9% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093225 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Japan Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MIJFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Japan Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$58 |

1.10%* |

|

|

| Expenses Paid, Amount |

$ 58

|

|

| Expense Ratio, Percent |

1.10%

|

[5] |

| Net Assets |

$ 682,321,541

|

|

| Holdings Count | Holding |

49

|

|

| Investment Company Portfolio Turnover |

51.70%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$682,321,541 |

| Total number of portfolio holdings |

49 |

| Portfolio turnover rate for the reporting period |

51.7% |

|

|

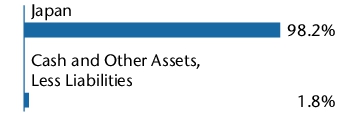

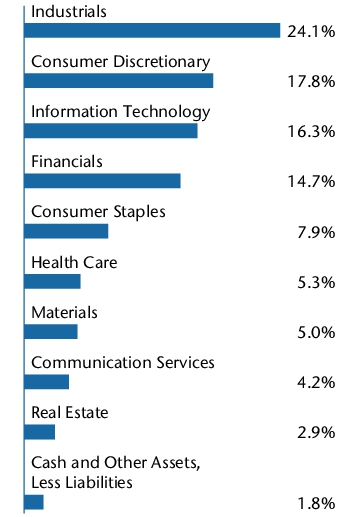

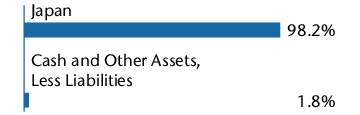

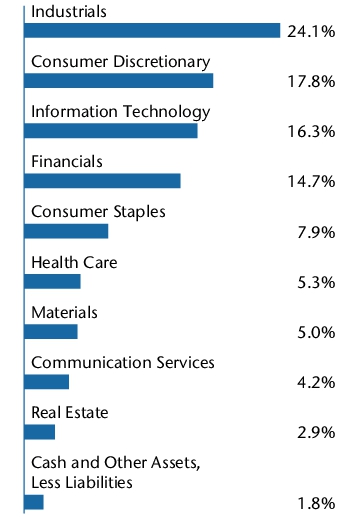

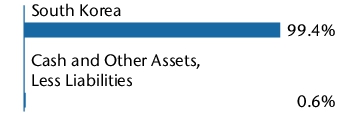

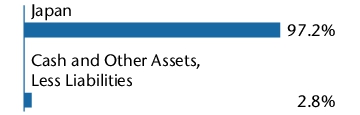

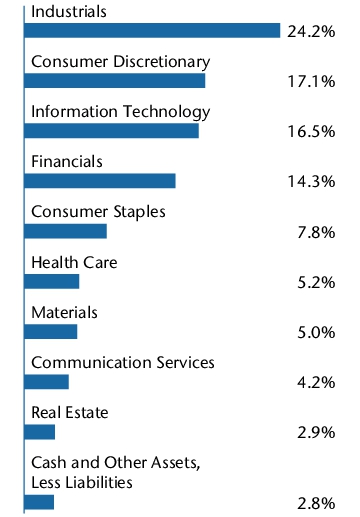

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Sony Group Corp. |

5.8% |

| Tokio Marine Holdings, Inc. |

4.6% |

| Mitsubishi UFJ Financial Group, Inc. |

4.5% |

| Hitachi, Ltd. |

4.4% |

| Tokyo Electron, Ltd. |

4.1% |

| NEC Corp. |

3.3% |

| Ajinomoto Co., Inc. |

3.1% |

| Shin-Etsu Chemical Co., Ltd. |

3.1% |

| Mitsui Fudosan Co., Ltd. |

2.9% |

| ITOCHU Corp. |

2.9% |

| TOTAL |

38.7% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Sony Group Corp. |

5.8% |

| Tokio Marine Holdings, Inc. |

4.6% |

| Mitsubishi UFJ Financial Group, Inc. |

4.5% |

| Hitachi, Ltd. |

4.4% |

| Tokyo Electron, Ltd. |

4.1% |

| NEC Corp. |

3.3% |

| Ajinomoto Co., Inc. |

3.1% |

| Shin-Etsu Chemical Co., Ltd. |

3.1% |

| Mitsui Fudosan Co., Ltd. |

2.9% |

| ITOCHU Corp. |

2.9% |

| TOTAL |

38.7% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000002791 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Japan Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MJFOX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Japan Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$62 |

1.17%* |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.17%

|

[6] |

| Net Assets |

$ 682,321,541

|

|

| Holdings Count | Holding |

49

|

|

| Investment Company Portfolio Turnover |

51.70%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$682,321,541 |

| Total number of portfolio holdings |

49 |

| Portfolio turnover rate for the reporting period |

51.7% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Sony Group Corp. |

5.8% |

| Tokio Marine Holdings, Inc. |

4.6% |

| Mitsubishi UFJ Financial Group, Inc. |

4.5% |

| Hitachi, Ltd. |

4.4% |

| Tokyo Electron, Ltd. |

4.1% |

| NEC Corp. |

3.3% |

| Ajinomoto Co., Inc. |

3.1% |

| Shin-Etsu Chemical Co., Ltd. |

3.1% |

| Mitsui Fudosan Co., Ltd. |

2.9% |

| ITOCHU Corp. |

2.9% |

| TOTAL |

38.7% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Sony Group Corp. |

5.8% |

| Tokio Marine Holdings, Inc. |

4.6% |

| Mitsubishi UFJ Financial Group, Inc. |

4.5% |

| Hitachi, Ltd. |

4.4% |

| Tokyo Electron, Ltd. |

4.1% |

| NEC Corp. |

3.3% |

| Ajinomoto Co., Inc. |

3.1% |

| Shin-Etsu Chemical Co., Ltd. |

3.1% |

| Mitsui Fudosan Co., Ltd. |

2.9% |

| ITOCHU Corp. |

2.9% |

| TOTAL |

38.7% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093226 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Asia Innovators Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MITEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Asia Innovators Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$63 |

1.19%* |

|

|

| Expenses Paid, Amount |

$ 63

|

|

| Expense Ratio, Percent |

1.19%

|

[7] |

| Net Assets |

$ 286,211,376

|

|

| Holdings Count | Holding |

58

|

|

| Investment Company Portfolio Turnover |

50.40%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$286,211,376 |

| Total number of portfolio holdings |

58 |

| Portfolio turnover rate for the reporting period |

50.4% |

|

|

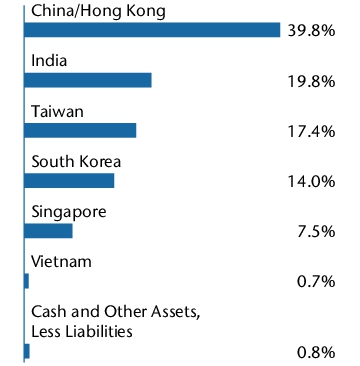

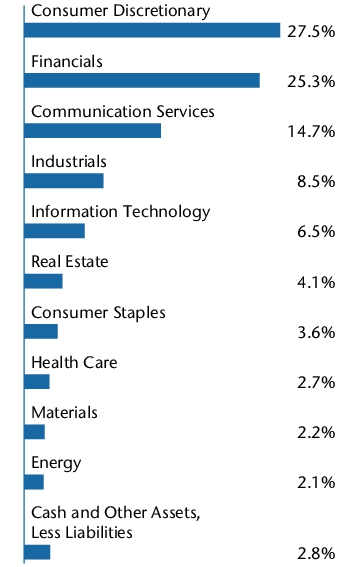

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

10.8% |

| Tencent Holdings, Ltd. |

6.0% |

| Sea, Ltd. |

5.6% |

| Eternal, Ltd. |

4.6% |

| Samsung Electronics Co., Ltd. |

3.5% |

| MakeMyTrip, Ltd. |

3.3% |

| Alibaba Group Holding, Ltd. |

3.0% |

| PDD Holdings, Inc. |

2.9% |

| SK Hynix, Inc. |

2.3% |

| Xiaomi Corp. |

2.0% |

| TOTAL |

44.0% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

10.8% |

| Tencent Holdings, Ltd. |

6.0% |

| Sea, Ltd. |

5.6% |

| Eternal, Ltd. |

4.6% |

| Samsung Electronics Co., Ltd. |

3.5% |

| MakeMyTrip, Ltd. |

3.3% |

| Alibaba Group Holding, Ltd. |

3.0% |

| PDD Holdings, Inc. |

2.9% |

| SK Hynix, Inc. |

2.3% |

| Xiaomi Corp. |

2.0% |

| TOTAL |

44.0% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000002792 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Asia Innovators Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MATFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Asia Innovators Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$69 |

1.31%* |

|

|

| Expenses Paid, Amount |

$ 69

|

|

| Expense Ratio, Percent |

1.31%

|

[8] |

| Net Assets |

$ 286,211,376

|

|

| Holdings Count | Holding |

58

|

|

| Investment Company Portfolio Turnover |

50.40%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$286,211,376 |

| Total number of portfolio holdings |

58 |

| Portfolio turnover rate for the reporting period |

50.4% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

10.8% |

| Tencent Holdings, Ltd. |

6.0% |

| Sea, Ltd. |

5.6% |

| Eternal, Ltd. |

4.6% |

| Samsung Electronics Co., Ltd. |

3.5% |

| MakeMyTrip, Ltd. |

3.3% |

| Alibaba Group Holding, Ltd. |

3.0% |

| PDD Holdings, Inc. |

2.9% |

| SK Hynix, Inc. |

2.3% |

| Xiaomi Corp. |

2.0% |

| TOTAL |

44.0% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

10.8% |

| Tencent Holdings, Ltd. |

6.0% |

| Sea, Ltd. |

5.6% |

| Eternal, Ltd. |

4.6% |

| Samsung Electronics Co., Ltd. |

3.5% |

| MakeMyTrip, Ltd. |

3.3% |

| Alibaba Group Holding, Ltd. |

3.0% |

| PDD Holdings, Inc. |

2.9% |

| SK Hynix, Inc. |

2.3% |

| Xiaomi Corp. |

2.0% |

| TOTAL |

44.0% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093227 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Asia Growth Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MIAPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Asia Growth Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$62 |

1.20%* |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.20%

|

[9] |

| Net Assets |

$ 209,146,328

|

|

| Holdings Count | Holding |

79

|

|

| Investment Company Portfolio Turnover |

43.70%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$209,146,328 |

| Total number of portfolio holdings |

79 |

| Portfolio turnover rate for the reporting period |

43.7% |

|

|

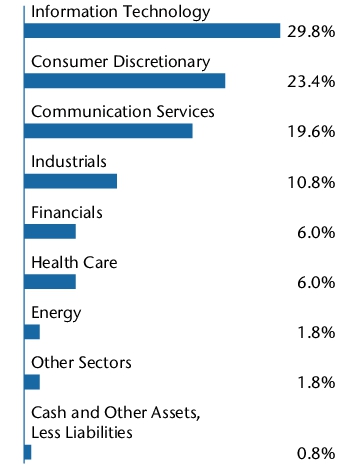

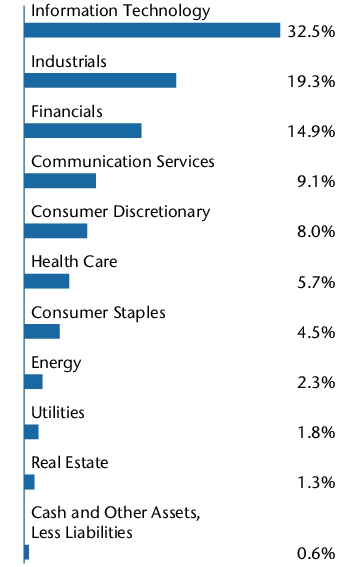

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

7.1% |

| Tencent Holdings, Ltd. |

4.2% |

| Sea, Ltd. |

3.8% |

| Eternal, Ltd. |

2.9% |

| Sony Group Corp. |

2.9% |

| Hitachi, Ltd. |

2.8% |

| Mitsubishi UFJ Financial Group, Inc. |

2.2% |

| Samsung Electronics Co., Ltd. |

2.2% |

| MakeMyTrip, Ltd. |

1.9% |

| Tokyo Electron, Ltd. |

1.9% |

| TOTAL |

31.9% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

7.1% |

| Tencent Holdings, Ltd. |

4.2% |

| Sea, Ltd. |

3.8% |

| Eternal, Ltd. |

2.9% |

| Sony Group Corp. |

2.9% |

| Hitachi, Ltd. |

2.8% |

| Mitsubishi UFJ Financial Group, Inc. |

2.2% |

| Samsung Electronics Co., Ltd. |

2.2% |

| MakeMyTrip, Ltd. |

1.9% |

| Tokyo Electron, Ltd. |

1.9% |

| TOTAL |

31.9% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000002793 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Asia Growth Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MPACX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Asia Growth Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$71 |

1.38%* |

|

|

| Expenses Paid, Amount |

$ 71

|

|

| Expense Ratio, Percent |

1.38%

|

[10] |

| Net Assets |

$ 209,146,328

|

|

| Holdings Count | Holding |

79

|

|

| Investment Company Portfolio Turnover |

43.70%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$209,146,328 |

| Total number of portfolio holdings |

79 |

| Portfolio turnover rate for the reporting period |

43.7% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

7.1% |

| Tencent Holdings, Ltd. |

4.2% |

| Sea, Ltd. |

3.8% |

| Eternal, Ltd. |

2.9% |

| Sony Group Corp. |

2.9% |

| Hitachi, Ltd. |

2.8% |

| Mitsubishi UFJ Financial Group, Inc. |

2.2% |

| Samsung Electronics Co., Ltd. |

2.2% |

| MakeMyTrip, Ltd. |

1.9% |

| Tokyo Electron, Ltd. |

1.9% |

| TOTAL |

31.9% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

7.1% |

| Tencent Holdings, Ltd. |

4.2% |

| Sea, Ltd. |

3.8% |

| Eternal, Ltd. |

2.9% |

| Sony Group Corp. |

2.9% |

| Hitachi, Ltd. |

2.8% |

| Mitsubishi UFJ Financial Group, Inc. |

2.2% |

| Samsung Electronics Co., Ltd. |

2.2% |

| MakeMyTrip, Ltd. |

1.9% |

| Tokyo Electron, Ltd. |

1.9% |

| TOTAL |

31.9% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093228 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews India Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MIDNX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews India Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$58 |

1.16%* |

|

|

| Expenses Paid, Amount |

$ 58

|

|

| Expense Ratio, Percent |

1.16%

|

[11] |

| Net Assets |

$ 788,147,516

|

|

| Holdings Count | Holding |

71

|

|

| Investment Company Portfolio Turnover |

31.50%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$788,147,516 |

| Total number of portfolio holdings |

71 |

| Portfolio turnover rate for the reporting period |

31.5% |

|

|

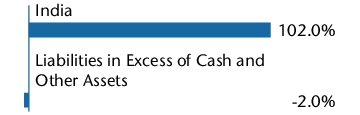

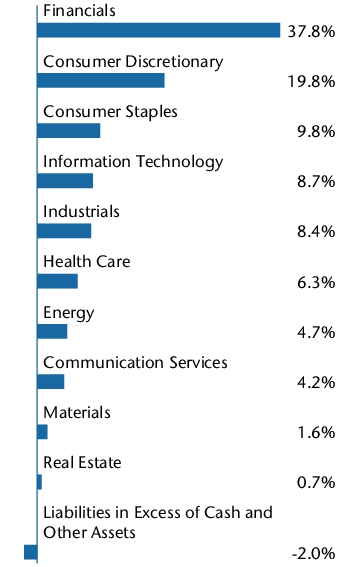

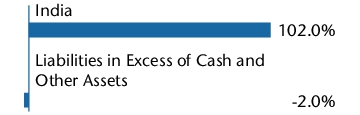

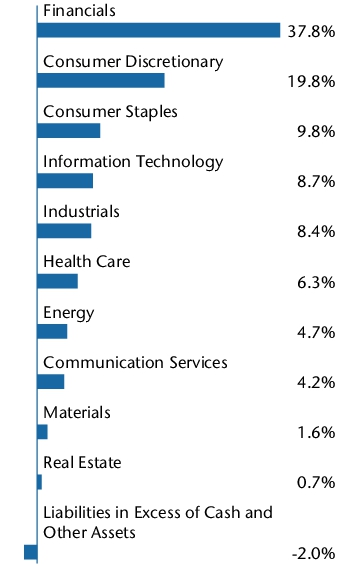

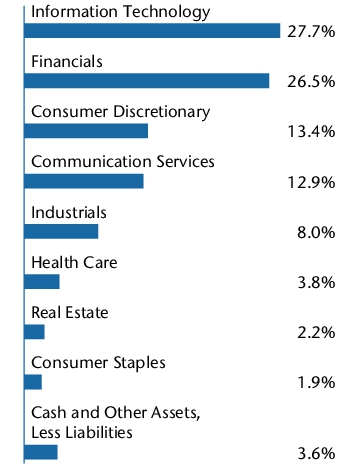

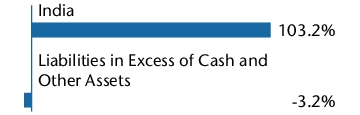

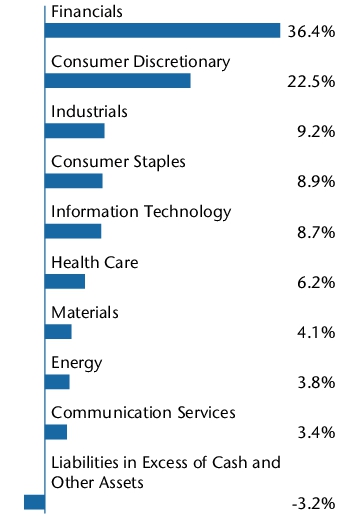

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| HDFC Bank, Ltd. |

8.5% |

| ICICI Bank, Ltd. |

6.3% |

| Eternal, Ltd. |

5.3% |

| Shriram Finance, Ltd. |

4.8% |

| Reliance Industries, Ltd. |

4.7% |

| Swiggy, Ltd. |

4.2% |

| Bharti Airtel, Ltd. |

4.2% |

| Bajaj Finance, Ltd. |

4.1% |

| Infosys, Ltd. |

3.6% |

| Mahindra & Mahindra, Ltd. |

3.2% |

| TOTAL |

48.9% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| HDFC Bank, Ltd. |

8.5% |

| ICICI Bank, Ltd. |

6.3% |

| Eternal, Ltd. |

5.3% |

| Shriram Finance, Ltd. |

4.8% |

| Reliance Industries, Ltd. |

4.7% |

| Swiggy, Ltd. |

4.2% |

| Bharti Airtel, Ltd. |

4.2% |

| Bajaj Finance, Ltd. |

4.1% |

| Infosys, Ltd. |

3.6% |

| Mahindra & Mahindra, Ltd. |

3.2% |

| TOTAL |

48.9% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000002794 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews India Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MINDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews India Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$65 |

1.30%* |

|

|

| Expenses Paid, Amount |

$ 65

|

|

| Expense Ratio, Percent |

1.30%

|

[12] |

| Net Assets |

$ 788,147,516

|

|

| Holdings Count | Holding |

71

|

|

| Investment Company Portfolio Turnover |

31.50%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$788,147,516 |

| Total number of portfolio holdings |

71 |

| Portfolio turnover rate for the reporting period |

31.5% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| HDFC Bank, Ltd. |

8.5% |

| ICICI Bank, Ltd. |

6.3% |

| Eternal, Ltd. |

5.3% |

| Shriram Finance, Ltd. |

4.8% |

| Reliance Industries, Ltd. |

4.7% |

| Swiggy, Ltd. |

4.2% |

| Bharti Airtel, Ltd. |

4.2% |

| Bajaj Finance, Ltd. |

4.1% |

| Infosys, Ltd. |

3.6% |

| Mahindra & Mahindra, Ltd. |

3.2% |

| TOTAL |

48.9% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| HDFC Bank, Ltd. |

8.5% |

| ICICI Bank, Ltd. |

6.3% |

| Eternal, Ltd. |

5.3% |

| Shriram Finance, Ltd. |

4.8% |

| Reliance Industries, Ltd. |

4.7% |

| Swiggy, Ltd. |

4.2% |

| Bharti Airtel, Ltd. |

4.2% |

| Bajaj Finance, Ltd. |

4.1% |

| Infosys, Ltd. |

3.6% |

| Mahindra & Mahindra, Ltd. |

3.2% |

| TOTAL |

48.9% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093229 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Asia Dividend Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MIPIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Asia Dividend Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$60 |

1.13%* |

|

|

| Expenses Paid, Amount |

$ 60

|

|

| Expense Ratio, Percent |

1.13%

|

[13] |

| Net Assets |

$ 560,144,914

|

|

| Holdings Count | Holding |

64

|

|

| Investment Company Portfolio Turnover |

49.10%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$560,144,914 |

| Total number of portfolio holdings |

64 |

| Portfolio turnover rate for the reporting period |

49.1% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

9.3% |

| Tencent Holdings, Ltd. |

5.2% |

| Hana Financial Group, Inc. |

3.2% |

| Samsung Electronics Co., Ltd. |

2.4% |

| NEC Corp. |

2.3% |

| AIA Group, Ltd. |

2.0% |

| ITOCHU Corp. |

2.0% |

| Commonwealth Bank of Australia |

2.0% |

| Hikari Tsushin, Inc. |

1.9% |

| Telstra Group, Ltd. |

1.8% |

| TOTAL |

32.1% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

9.3% |

| Tencent Holdings, Ltd. |

5.2% |

| Hana Financial Group, Inc. |

3.2% |

| Samsung Electronics Co., Ltd. |

2.4% |

| NEC Corp. |

2.3% |

| AIA Group, Ltd. |

2.0% |

| ITOCHU Corp. |

2.0% |

| Commonwealth Bank of Australia |

2.0% |

| Hikari Tsushin, Inc. |

1.9% |

| Telstra Group, Ltd. |

1.8% |

| TOTAL |

32.1% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000038018 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Asia Dividend Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MAPIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Asia Dividend Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$66 |

1.26%* |

|

|

| Expenses Paid, Amount |

$ 66

|

|

| Expense Ratio, Percent |

1.26%

|

[14] |

| Net Assets |

$ 560,144,914

|

|

| Holdings Count | Holding |

64

|

|

| Investment Company Portfolio Turnover |

49.10%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$560,144,914 |

| Total number of portfolio holdings |

64 |

| Portfolio turnover rate for the reporting period |

49.1% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

9.3% |

| Tencent Holdings, Ltd. |

5.2% |

| Hana Financial Group, Inc. |

3.2% |

| Samsung Electronics Co., Ltd. |

2.4% |

| NEC Corp. |

2.3% |

| AIA Group, Ltd. |

2.0% |

| ITOCHU Corp. |

2.0% |

| Commonwealth Bank of Australia |

2.0% |

| Hikari Tsushin, Inc. |

1.9% |

| Telstra Group, Ltd. |

1.8% |

| TOTAL |

32.1% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

9.3% |

| Tencent Holdings, Ltd. |

5.2% |

| Hana Financial Group, Inc. |

3.2% |

| Samsung Electronics Co., Ltd. |

2.4% |

| NEC Corp. |

2.3% |

| AIA Group, Ltd. |

2.0% |

| ITOCHU Corp. |

2.0% |

| Commonwealth Bank of Australia |

2.0% |

| Hikari Tsushin, Inc. |

1.9% |

| Telstra Group, Ltd. |

1.8% |

| TOTAL |

32.1% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093230 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Emerging Markets Small Companies Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MISMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Emerging Markets Small Companies Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$62 |

1.17%* |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.17%

|

[15] |

| Net Assets |

$ 512,689,484

|

|

| Holdings Count | Holding |

74

|

|

| Investment Company Portfolio Turnover |

15.60%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$512,689,484 |

| Total number of portfolio holdings |

74 |

| Portfolio turnover rate for the reporting period |

15.6% |

|

|

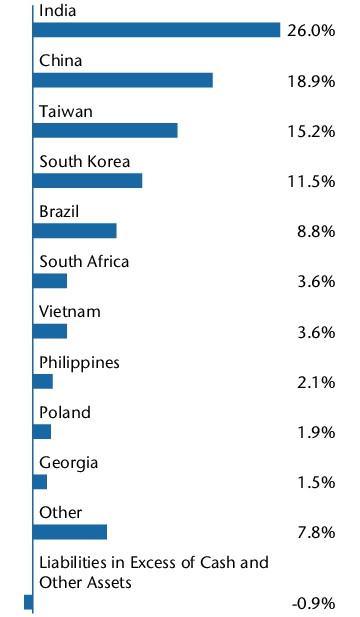

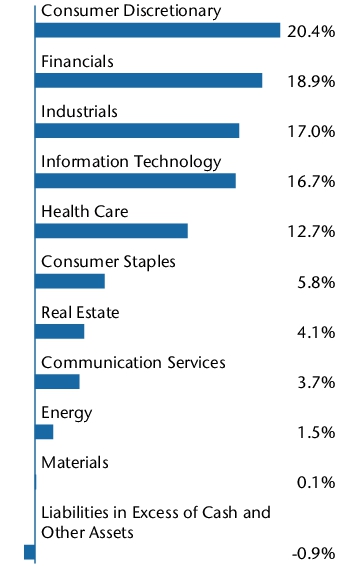

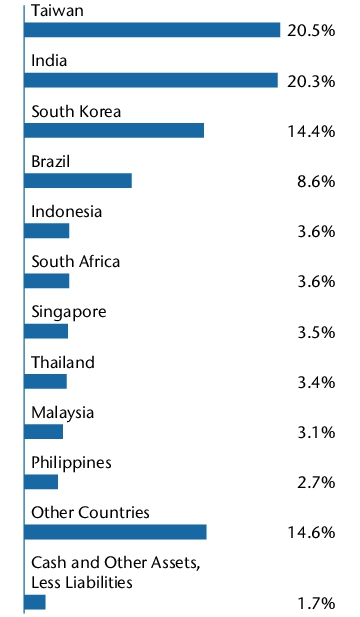

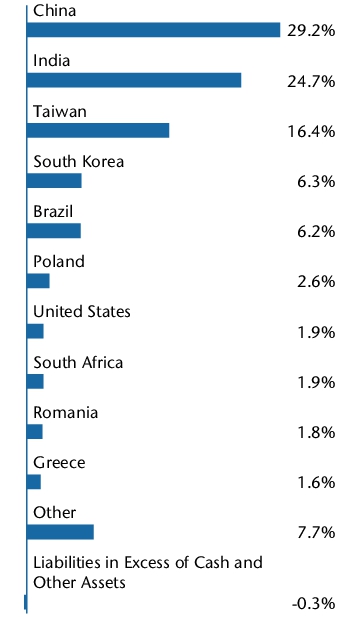

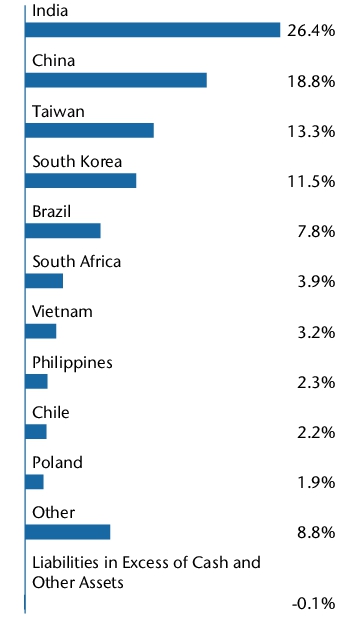

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Bandhan Bank, Ltd. |

7.9% |

| Hugel, Inc. |

5.1% |

| Legend Biotech Corp. |

5.0% |

| YDUQS Participacoes SA |

2.7% |

| We Buy Cars Holdings, Ltd. |

2.5% |

| Grupo SBF SA |

2.5% |

| Cartrade Tech, Ltd. |

2.4% |

| Elite Material Co., Ltd. |

2.2% |

| Radico Khaitan, Ltd. |

2.2% |

| Full Truck Alliance Co., Ltd. |

2.2% |

| TOTAL |

34.7% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bandhan Bank, Ltd. |

7.9% |

| Hugel, Inc. |

5.1% |

| Legend Biotech Corp. |

5.0% |

| YDUQS Participacoes SA |

2.7% |

| We Buy Cars Holdings, Ltd. |

2.5% |

| Grupo SBF SA |

2.5% |

| Cartrade Tech, Ltd. |

2.4% |

| Elite Material Co., Ltd. |

2.2% |

| Radico Khaitan, Ltd. |

2.2% |

| Full Truck Alliance Co., Ltd. |

2.2% |

| TOTAL |

34.7% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000068052 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Emerging Markets Small Companies Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MSMLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Emerging Markets Small Companies Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$74 |

1.41%* |

|

|

| Expenses Paid, Amount |

$ 74

|

|

| Expense Ratio, Percent |

1.41%

|

[16] |

| Net Assets |

$ 512,689,484

|

|

| Holdings Count | Holding |

74

|

|

| Investment Company Portfolio Turnover |

15.60%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$512,689,484 |

| Total number of portfolio holdings |

74 |

| Portfolio turnover rate for the reporting period |

15.6% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Bandhan Bank, Ltd. |

7.9% |

| Hugel, Inc. |

5.1% |

| Legend Biotech Corp. |

5.0% |

| YDUQS Participacoes SA |

2.7% |

| We Buy Cars Holdings, Ltd. |

2.5% |

| Grupo SBF SA |

2.5% |

| Cartrade Tech, Ltd. |

2.4% |

| Elite Material Co., Ltd. |

2.2% |

| Radico Khaitan, Ltd. |

2.2% |

| Full Truck Alliance Co., Ltd. |

2.2% |

| TOTAL |

34.7% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bandhan Bank, Ltd. |

7.9% |

| Hugel, Inc. |

5.1% |

| Legend Biotech Corp. |

5.0% |

| YDUQS Participacoes SA |

2.7% |

| We Buy Cars Holdings, Ltd. |

2.5% |

| Grupo SBF SA |

2.5% |

| Cartrade Tech, Ltd. |

2.4% |

| Elite Material Co., Ltd. |

2.2% |

| Radico Khaitan, Ltd. |

2.2% |

| Full Truck Alliance Co., Ltd. |

2.2% |

| TOTAL |

34.7% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000093231 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews China Dividend Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MICDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews China Dividend Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$64 |

1.20%* |

|

|

| Expenses Paid, Amount |

$ 64

|

|

| Expense Ratio, Percent |

1.20%

|

[17] |

| Net Assets |

$ 90,371,597

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

28.60%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$90,371,597 |

| Total number of portfolio holdings |

40 |

| Portfolio turnover rate for the reporting period |

28.6% |

|

|

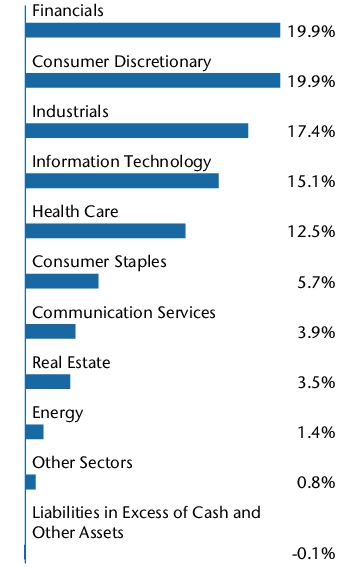

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Tencent Holdings, Ltd. |

11.4% |

| Alibaba Group Holding, Ltd. |

8.5% |

| Ping An Insurance Group Co. of China, Ltd. |

5.0% |

| China Merchants Bank Co., Ltd. |

4.3% |

| China Construction Bank Corp. |

4.2% |

| Anhui Expressway Co., Ltd. |

3.5% |

| China Suntien Green Energy Corp., Ltd. |

3.1% |

| Industrial & Commercial Bank of China, Ltd. |

3.1% |

| China Everbright Environment Group, Ltd. |

2.9% |

| PetroChina Co., Ltd. |

2.8% |

| TOTAL |

48.8% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Tencent Holdings, Ltd. |

11.4% |

| Alibaba Group Holding, Ltd. |

8.5% |

| Ping An Insurance Group Co. of China, Ltd. |

5.0% |

| China Merchants Bank Co., Ltd. |

4.3% |

| China Construction Bank Corp. |

4.2% |

| Anhui Expressway Co., Ltd. |

3.5% |

| China Suntien Green Energy Corp., Ltd. |

3.1% |

| Industrial & Commercial Bank of China, Ltd. |

3.1% |

| China Everbright Environment Group, Ltd. |

2.9% |

| PetroChina Co., Ltd. |

2.8% |

| TOTAL |

48.8% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000081250 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews China Dividend Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MCDFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews China Dividend Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$71 |

1.34%* |

|

|

| Expenses Paid, Amount |

$ 71

|

|

| Expense Ratio, Percent |

1.34%

|

[18] |

| Net Assets |

$ 90,371,597

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

28.60%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$90,371,597 |

| Total number of portfolio holdings |

40 |

| Portfolio turnover rate for the reporting period |

28.6% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Tencent Holdings, Ltd. |

11.4% |

| Alibaba Group Holding, Ltd. |

8.5% |

| Ping An Insurance Group Co. of China, Ltd. |

5.0% |

| China Merchants Bank Co., Ltd. |

4.3% |

| China Construction Bank Corp. |

4.2% |

| Anhui Expressway Co., Ltd. |

3.5% |

| China Suntien Green Energy Corp., Ltd. |

3.1% |

| Industrial & Commercial Bank of China, Ltd. |

3.1% |

| China Everbright Environment Group, Ltd. |

2.9% |

| PetroChina Co., Ltd. |

2.8% |

| TOTAL |

48.8% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Tencent Holdings, Ltd. |

11.4% |

| Alibaba Group Holding, Ltd. |

8.5% |

| Ping An Insurance Group Co. of China, Ltd. |

5.0% |

| China Merchants Bank Co., Ltd. |

4.3% |

| China Construction Bank Corp. |

4.2% |

| Anhui Expressway Co., Ltd. |

3.5% |

| China Suntien Green Energy Corp., Ltd. |

3.1% |

| Industrial & Commercial Bank of China, Ltd. |

3.1% |

| China Everbright Environment Group, Ltd. |

2.9% |

| PetroChina Co., Ltd. |

2.8% |

| TOTAL |

48.8% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000195803 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews China Small Companies Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MICHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews China Small Companies Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$63 |

1.20%* |

|

|

| Expenses Paid, Amount |

$ 63

|

|

| Expense Ratio, Percent |

1.20%

|

[19] |

| Net Assets |

$ 62,281,859

|

|

| Holdings Count | Holding |

57

|

|

| Investment Company Portfolio Turnover |

11.80%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$62,281,859 |

| Total number of portfolio holdings |

57 |

| Portfolio turnover rate for the reporting period |

11.8% |

|

|

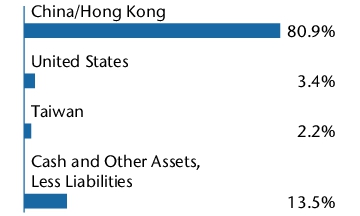

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| NetEase Cloud Music, Inc. |

5.2% |

| Hongfa Technology Co., Ltd. |

4.0% |

| Atour Lifestyle Holdings, Ltd. |

3.8% |

| DPC Dash, Ltd. |

3.5% |

| ACM Research, Inc. |

3.3% |

| Full Truck Alliance Co., Ltd. |

3.2% |

| Yantai Jereh Oilfield Services Group Co., Ltd. |

3.2% |

| Tongcheng Travel Holdings, Ltd. |

3.1% |

| Zhejiang Shuanghuan Driveline Co., Ltd. |

2.8% |

| Kanzhun, Ltd. |

2.4% |

| TOTAL |

34.5% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| NetEase Cloud Music, Inc. |

5.2% |

| Hongfa Technology Co., Ltd. |

4.0% |

| Atour Lifestyle Holdings, Ltd. |

3.8% |

| DPC Dash, Ltd. |

3.5% |

| ACM Research, Inc. |

3.3% |

| Full Truck Alliance Co., Ltd. |

3.2% |

| Yantai Jereh Oilfield Services Group Co., Ltd. |

3.2% |

| Tongcheng Travel Holdings, Ltd. |

3.1% |

| Zhejiang Shuanghuan Driveline Co., Ltd. |

2.8% |

| Kanzhun, Ltd. |

2.4% |

| TOTAL |

34.5% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000101279 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews China Small Companies Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MCSMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews China Small Companies Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$75 |

1.43%* |

|

|

| Expenses Paid, Amount |

$ 75

|

|

| Expense Ratio, Percent |

1.43%

|

[20] |

| Net Assets |

$ 62,281,859

|

|

| Holdings Count | Holding |

57

|

|

| Investment Company Portfolio Turnover |

11.80%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$62,281,859 |

| Total number of portfolio holdings |

57 |

| Portfolio turnover rate for the reporting period |

11.8% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| NetEase Cloud Music, Inc. |

5.2% |

| Hongfa Technology Co., Ltd. |

4.0% |

| Atour Lifestyle Holdings, Ltd. |

3.8% |

| DPC Dash, Ltd. |

3.5% |

| ACM Research, Inc. |

3.3% |

| Full Truck Alliance Co., Ltd. |

3.2% |

| Yantai Jereh Oilfield Services Group Co., Ltd. |

3.2% |

| Tongcheng Travel Holdings, Ltd. |

3.1% |

| Zhejiang Shuanghuan Driveline Co., Ltd. |

2.8% |

| Kanzhun, Ltd. |

2.4% |

| TOTAL |

34.5% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| NetEase Cloud Music, Inc. |

5.2% |

| Hongfa Technology Co., Ltd. |

4.0% |

| Atour Lifestyle Holdings, Ltd. |

3.8% |

| DPC Dash, Ltd. |

3.5% |

| ACM Research, Inc. |

3.3% |

| Full Truck Alliance Co., Ltd. |

3.2% |

| Yantai Jereh Oilfield Services Group Co., Ltd. |

3.2% |

| Tongcheng Travel Holdings, Ltd. |

3.1% |

| Zhejiang Shuanghuan Driveline Co., Ltd. |

2.8% |

| Kanzhun, Ltd. |

2.4% |

| TOTAL |

34.5% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000154926 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Emerging Markets Sustainable Future Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MISFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Emerging Markets Sustainable Future Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Institutional Class |

$61 |

1.16%* |

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

1.16%

|

[21] |

| Net Assets |

$ 209,956,166

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

29.90%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$209,956,166 |

| Total number of portfolio holdings |

60 |

| Portfolio turnover rate for the reporting period |

29.9% |

|

|

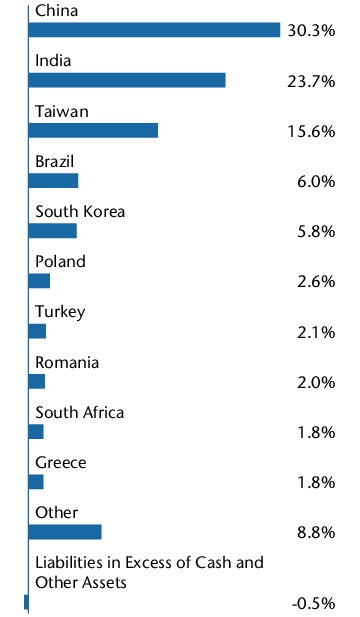

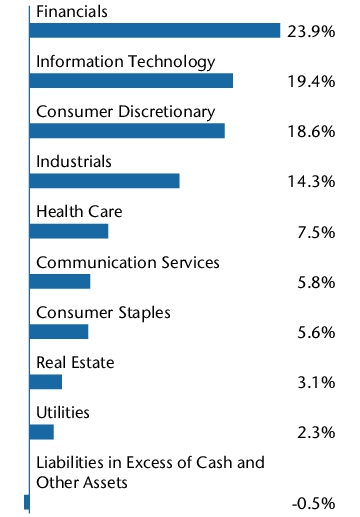

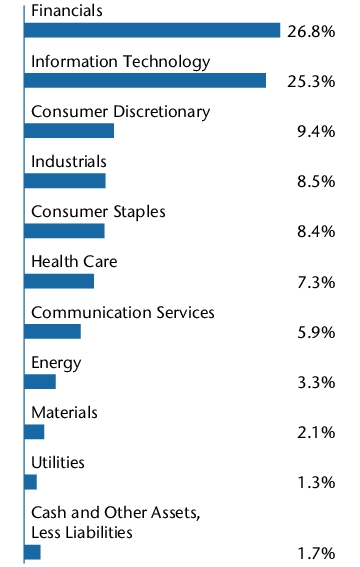

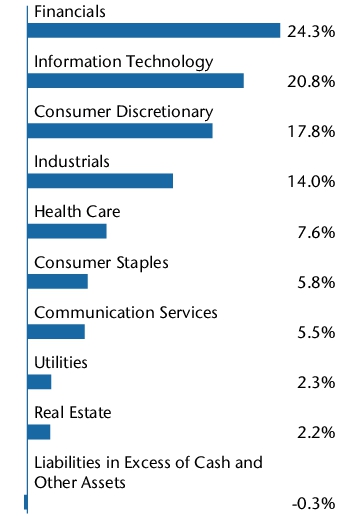

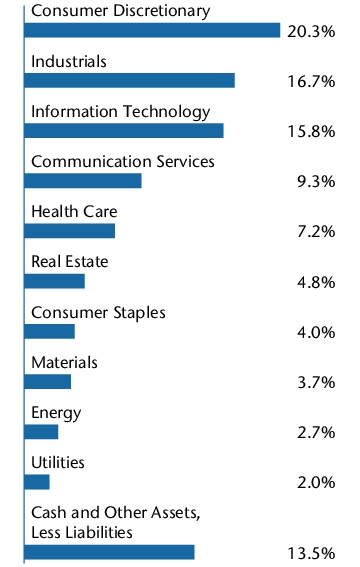

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Bandhan Bank, Ltd. |

7.8% |

| Taiwan Semiconductor Manufacturing Co., Ltd. |

6.2% |

| Meituan |

5.6% |

| Legend Biotech Corp. |

4.9% |

| JD Health International, Inc. |

4.8% |

| Indus Towers, Ltd. |

3.2% |

| Alibaba Group Holding, Ltd. |

2.9% |

| YDUQS Participacoes SA |

2.8% |

| Full Truck Alliance Co., Ltd. |

2.7% |

| Swiggy, Ltd. |

2.7% |

| TOTAL |

43.6% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bandhan Bank, Ltd. |

7.8% |

| Taiwan Semiconductor Manufacturing Co., Ltd. |

6.2% |

| Meituan |

5.6% |

| Legend Biotech Corp. |

4.9% |

| JD Health International, Inc. |

4.8% |

| Indus Towers, Ltd. |

3.2% |

| Alibaba Group Holding, Ltd. |

2.9% |

| YDUQS Participacoes SA |

2.8% |

| Full Truck Alliance Co., Ltd. |

2.7% |

| Swiggy, Ltd. |

2.7% |

| TOTAL |

43.6% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000154925 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Emerging Markets Sustainable Future Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

MASGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Emerging Markets Sustainable Future Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at matthewsasia.com/documents. You can also request this information by contacting us at 1-800-789-2742.

|

|

| Additional Information Phone Number |

1-800-789-2742

|

|

| Additional Information Website |

matthewsasia.com/documents

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months (Based on a hypothetical $10,000 investment)

| Class |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Investor Class |

$73 |

1.40%* |

|

|

| Expenses Paid, Amount |

$ 73

|

|

| Expense Ratio, Percent |

1.40%

|

[22] |

| Net Assets |

$ 209,956,166

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

29.90%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$209,956,166 |

| Total number of portfolio holdings |

60 |

| Portfolio turnover rate for the reporting period |

29.9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, represented as a percentage of the total net assets of the Fund. Top Ten Holdings

| Bandhan Bank, Ltd. |

7.8% |

| Taiwan Semiconductor Manufacturing Co., Ltd. |

6.2% |

| Meituan |

5.6% |

| Legend Biotech Corp. |

4.9% |

| JD Health International, Inc. |

4.8% |

| Indus Towers, Ltd. |

3.2% |

| Alibaba Group Holding, Ltd. |

2.9% |

| YDUQS Participacoes SA |

2.8% |

| Full Truck Alliance Co., Ltd. |

2.7% |

| Swiggy, Ltd. |

2.7% |

| TOTAL |

43.6% | Country Allocation Sector Allocation Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bandhan Bank, Ltd. |

7.8% |

| Taiwan Semiconductor Manufacturing Co., Ltd. |

6.2% |

| Meituan |

5.6% |

| Legend Biotech Corp. |

4.9% |

| JD Health International, Inc. |

4.8% |

| Indus Towers, Ltd. |

3.2% |

| Alibaba Group Holding, Ltd. |

2.9% |

| YDUQS Participacoes SA |

2.8% |

| Full Truck Alliance Co., Ltd. |

2.7% |

| Swiggy, Ltd. |

2.7% |

| TOTAL |

43.6% | Top ten holdings may combine more than one security from the same issuer and related depository receipts.

|

|

| C000219130 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Matthews Emerging Markets Equity Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

MIEFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Matthews Emerging Markets Equity Fund (the "Fund") for the period of January 01, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|