What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Ticker | Costs of a $10,000 investment* | Costs paid as a percentage of a $10,000 investment* |

| BTAL | $135 | 1.40% |

| * | This includes short expenses |

How did the Fund perform last year?

The AGF U.S. Market Neutral Anti-Beta Fund (“BTAL” or the“Fund”) finished the reporting period (July 01, 2024 to Jun 30. 2025) down -6.23%. The Fund had a negative return over the 12- month period but outperformed its benchmark index the Dow Jones U.S. Thematic Market Neutral Low Beta Index, which returned -8.97% during that period. The broad U.S. equity market, as represented by the Standard and Poor’s (S&P) 500 Index, finished the reporting period with a return of 15.16%. During the reporting period, the broad U.S. equity market generally trended upwards but at times exhibited some volatility, especially in April 2025 around the announcement of Liberation Day tariffs. During these periods of volatility, BTAL performed as expected and reduced drawdowns compared to pure broad equity market exposure. However, given the general upward trend in the U.S. equity market, BTAL underperformed the S&P 500 for the overall reporting period due to its objective of providing consistent negative beta exposure to the U.S. equity market and its inherent anti-beta bias.

|

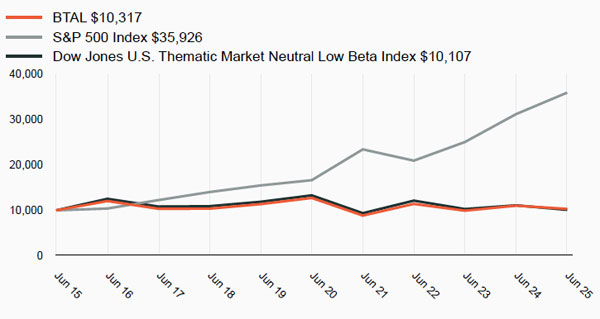

How did the Fund perform over the past 10 years?

The chart below shows the Fund’s performance over the last 10 years and is based on the Fund’s net asset value (“NAV”).

| Total Return Based on a $10,000 Investment |

|

| The above chart represents historical performance of a hypothetical $10,000 investment in the Fund over the past 10 years. The fund's past performance is not a good predictor of how the fund will perform in the future. The chart and Average Annual Total Return table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Average Annual Total Returns | |||

| 1 Year | 5 years | 10 Years | |

| BTAL NAV Return | -6.23% | -4.07% | 0.31% |

| S&P 500 Index | 15.16% | 16.64% | 13.64% |

| Dow Jones U.S. Thematic Market Neutral Low Beta Index | -8.97% | -5.34% | 0.11% |

| Key Fund Statistics | ||

| Net Assets | $296,220,413 | |

| Number of Portfolio Holdings | 403 | |

| Portfolio Turnover Rate | 93% | |

| Net Investment Advisory Fees | $705,068 | |

| Fund Sector Weights (Based on Net Assets) | ||

| % of Long Weight | % of Short Weight | |

| Communication Services | 3.9% | -4.1% |

| Consumer Discretionary | 10.7% | -11.5% |

| Consumer Staples | 5.1% | -5.5% |

| Energy | 3.9% | -3.8% |

| Financials | 14.7% | -16.6% |

| Health Care | 10.2% | -11.2% |

| Industrials | 16.4% | -17.8% |

| Information Technology | 13.2% | -14.9% |

| Materials | 5.1% | -5.0% |

| Real Estate | 5.6% | -5.9% |

| Utilities | 4.1% | -4.5% |

| Top Ten Holdings (Based on Net Assets) | ||||

| Long | Short | |||

| HEICO Corp. | 0.6% | Joby Aviation, Inc. | -0.7% | |

| Iridium Communications, Inc. | 0.5% | Insmed, Inc. | -0.7% | |

| International Business Machines Corp. | 0.5% | Reddit, Inc. | -0.7% | |

| Guidewire Software, Inc. | 0.5% | Robinhood Markets, Inc. | -0.7% | |

| Dollar General Corp. | 0.5% | SoFi Technologies, Inc. | -0.6% | |

| Sunrun, Inc. | 0.5% | Coinbase Global, Inc. | -0.6% | |

| Bentley Systems, Inc. | 0.5% | Affirm Holdings, Inc. | -0.6% | |

| Juniper Networks, Inc. | 0.5% | elf Beauty, Inc. | -0.6% | |

| Royalty Pharma plc | 0.5% | Guardant Health, Inc. | -0.6% | |

| RTX Corp. | 0.5% | CRISPR Therapeutics AG | -0.6% | |

| [1] | This includes short expenses |