Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Simplify Exchange Traded Funds

|

|

| Entity Central Index Key |

0001810747

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000233894 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Aggregate Bond ETF

|

|

| Class Name |

Simplify Aggregate Bond ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Aggregate Bond ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Aggregate Bond ETF | $26 | 0.25% |

|---|

|

|

| Expenses Paid, Amount |

$ 26

|

|

| Expense Ratio, Percent |

0.25%

|

|

| Factors Affecting Performance [Text Block] |

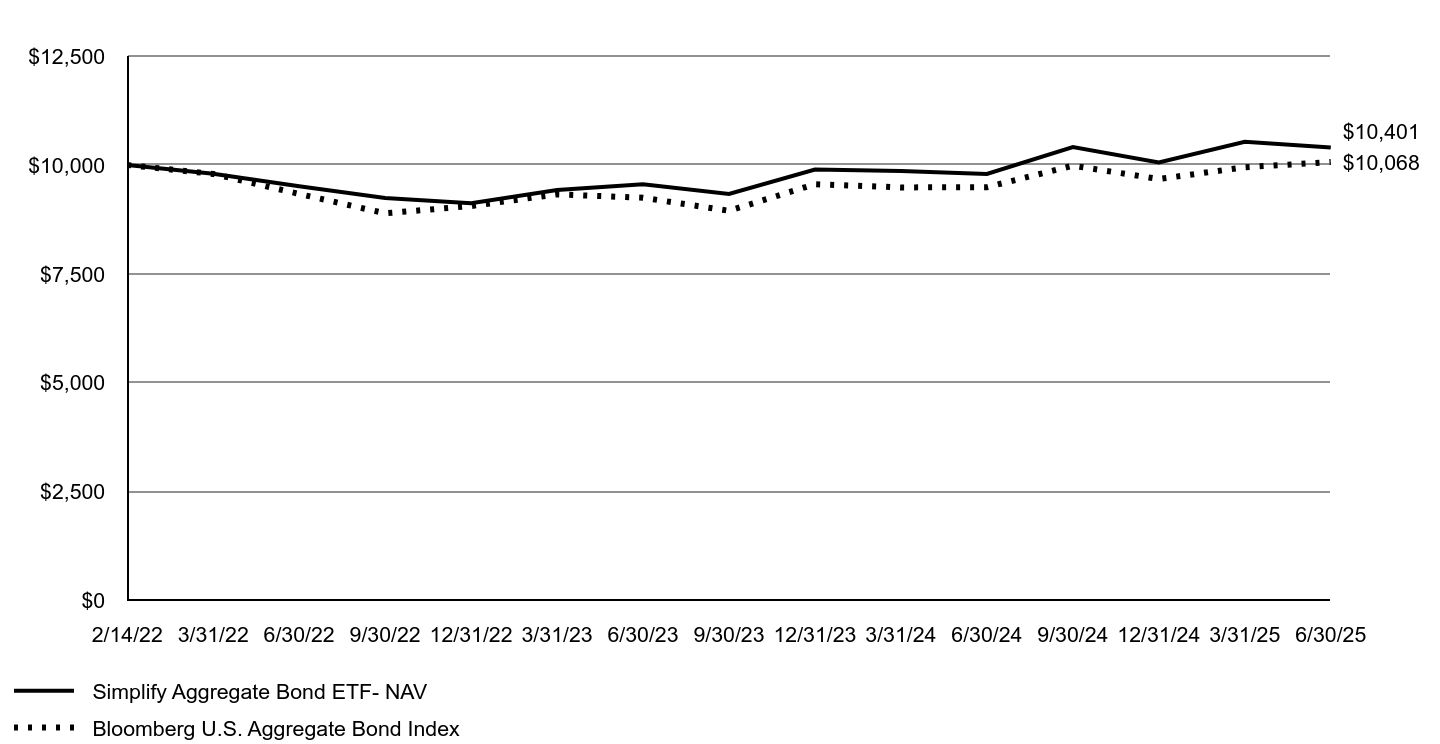

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, AGGH returned 6.19% vs. the Bloomberg U.S. Aggregate Bond Index’s return of 6.08% for the same period, outperforming the index by 0.11%. Rising interest rates were a headwind for AGGH and the bond market in general over the period, especially during the ''Tariff Tantrum'' in early April. AGGH outperformed despite the challenges in structural volatility option-selling strategies, as rate volatility and long-term Treasury rates spiked over just a few days with rates resetting to a higher level. AGGH used structural income opportunities such as more efficient option writing and curve positioning. In the next 12 months, we believe the Federal Reserve will likely restart their rate-cutting cycle, thus reducing front-end rates, however back-end rates may continue to have upward pressures due to the fiscal outlook. AGGH’s structural volatility selling strategies are well-positioned to capture returns as long-term treasury rates stabilize in a higher range. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Aggregate Bond ETF- NAV | Bloomberg U.S. Aggregate Bond Index |

|---|

2/14/22 | $10,000 | $10,000 |

|---|

3/31/22 | $9,797 | $9,795 |

|---|

6/30/22 | $9,511 | $9,335 |

|---|

9/30/22 | $9,243 | $8,892 |

|---|

12/31/22 | $9,124 | $9,058 |

|---|

3/31/23 | $9,424 | $9,326 |

|---|

6/30/23 | $9,558 | $9,248 |

|---|

9/30/23 | $9,336 | $8,949 |

|---|

12/31/23 | $9,897 | $9,559 |

|---|

3/31/24 | $9,861 | $9,485 |

|---|

6/30/24 | $9,795 | $9,491 |

|---|

9/30/24 | $10,411 | $9,984 |

|---|

12/31/24 | $10,057 | $9,678 |

|---|

3/31/25 | $10,533 | $9,948 |

|---|

6/30/25 | $10,401 | $10,068 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

2/14/2022 |

|---|

Simplify Aggregate Bond ETF - NAV | 6.19% | 1.18% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | 0.20% |

|---|

|

|

| Performance Inception Date |

Feb. 14, 2022

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 324,930,843

|

|

| Holdings Count | Holding |

5

|

|

| Advisory Fees Paid, Amount |

$ 667,617

|

|

| InvestmentCompanyPortfolioTurnover |

299.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $324,930,843 |

|---|

Total number of portfolio holdings | 5 |

|---|

Total advisory fee paid | $667,617 |

|---|

Portfolio turnover rate | 299% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Exchange-Traded Funds | 94.9% |

|---|

U.S. Treasury Bills | 4.5% |

|---|

Other Assets in Excess of Liabilities | 0.6% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000259296 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Barrier Income ETF

|

|

| Class Name |

Simplify Barrier Income ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

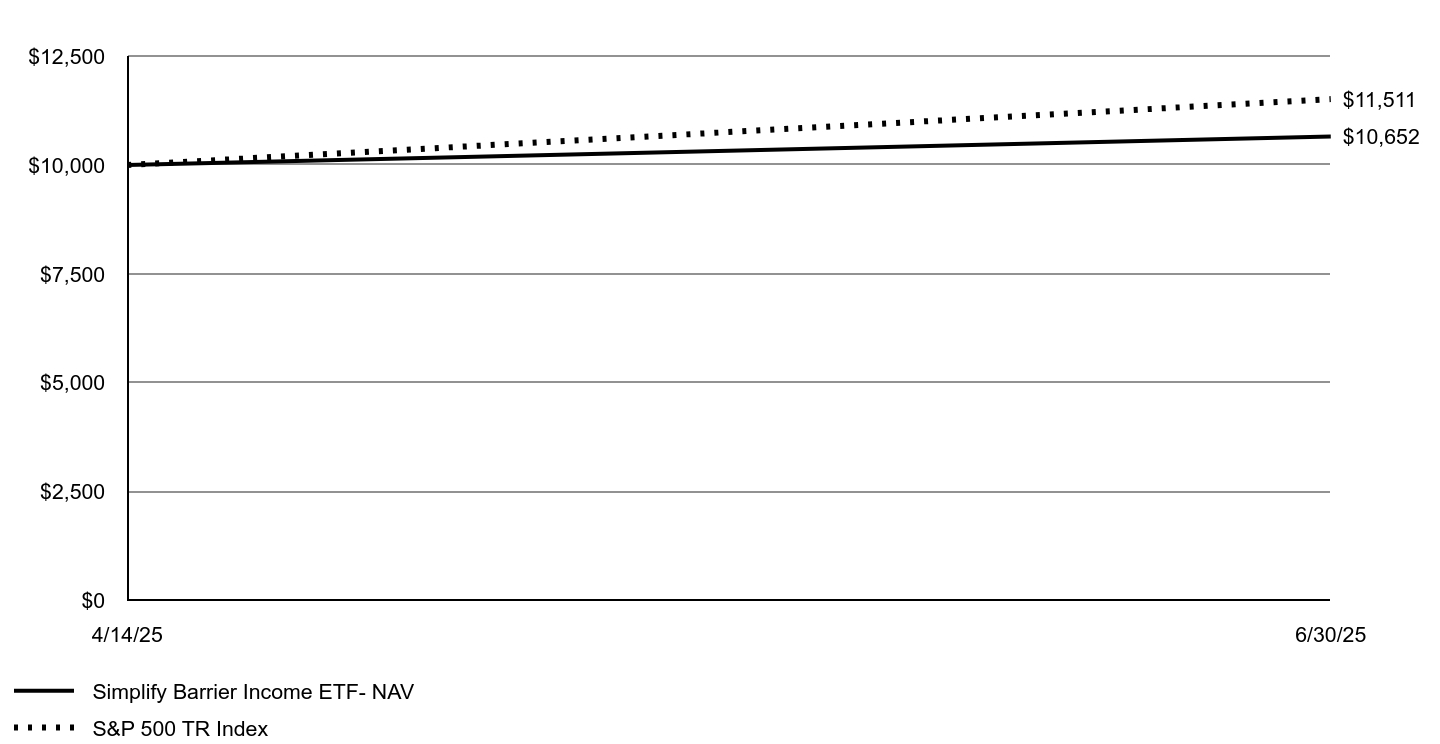

This annual shareholder report contains important information about Simplify Barrier Income ETF (the "Fund") for the period of April 14, 2025 (commencement of operations) to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the period? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Barrier Income ETF | $16Footnote Reference(1) | 0.75% |

|---|

| Footnote | Description | Footnote(1) | Based on the period April 14, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period. |

|

|

| Expenses Paid, Amount |

$ 16

|

[1] |

| Expense Ratio, Percent |

0.75%

|

|

| Expenses Short Period Footnote [Text Block] |

Based on the period April 14, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period.

|

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the period April 14, 2025, to June 30, 2025, SBAR returned 6.52% vs. the return of 15.11% of the S&P 500 Index, underperforming by 8.59%. SBAR’s strong absolute returns were supported by robust equity market performance and a decline in overall market volatility. SBAR's income generation is derived from a combination of Treasury yields and premium income from selling barrier options. On a relative basis, SBAR’s performance has been consistent with expectations, reflecting its income-oriented strategy. Looking ahead, we believe SBAR is well-positioned to appeal to investors seeking high monthly income through barrier option structures, while also offering operational efficiencies typically lacking in traditional structured note investments. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Barrier Income ETF- NAV | S&P 500 TR Index |

|---|

4/14/25 | $10,000 | $10,000 |

|---|

6/30/25 | $10,652 | $11,511 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | Since Inception

4/14/2025 |

|---|

Simplify Barrier Income ETF - NAV | 6.52% |

|---|

S&P 500 TR Index | 15.11% |

|---|

|

|

| Performance Inception Date |

Apr. 14, 2025

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 35,180,297

|

|

| Holdings Count | Holding |

3

|

|

| Advisory Fees Paid, Amount |

$ 46,972

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $35,180,297 |

|---|

Total number of portfolio holdings | 3 |

|---|

Total advisory fee paid | $46,972 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 100.0% |

|---|

Liabilities in Excess of Other Assets | (0.0)%Footnote Reference† |

|---|

Total | 100.0% |

|---|

| Footnote | Description | Footnote† | Less than 0.05% |

|

|

| Material Fund Change [Text Block] |

|

|

| C000254610 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Bond Bull ETF

|

|

| Class Name |

Simplify Bond Bull ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

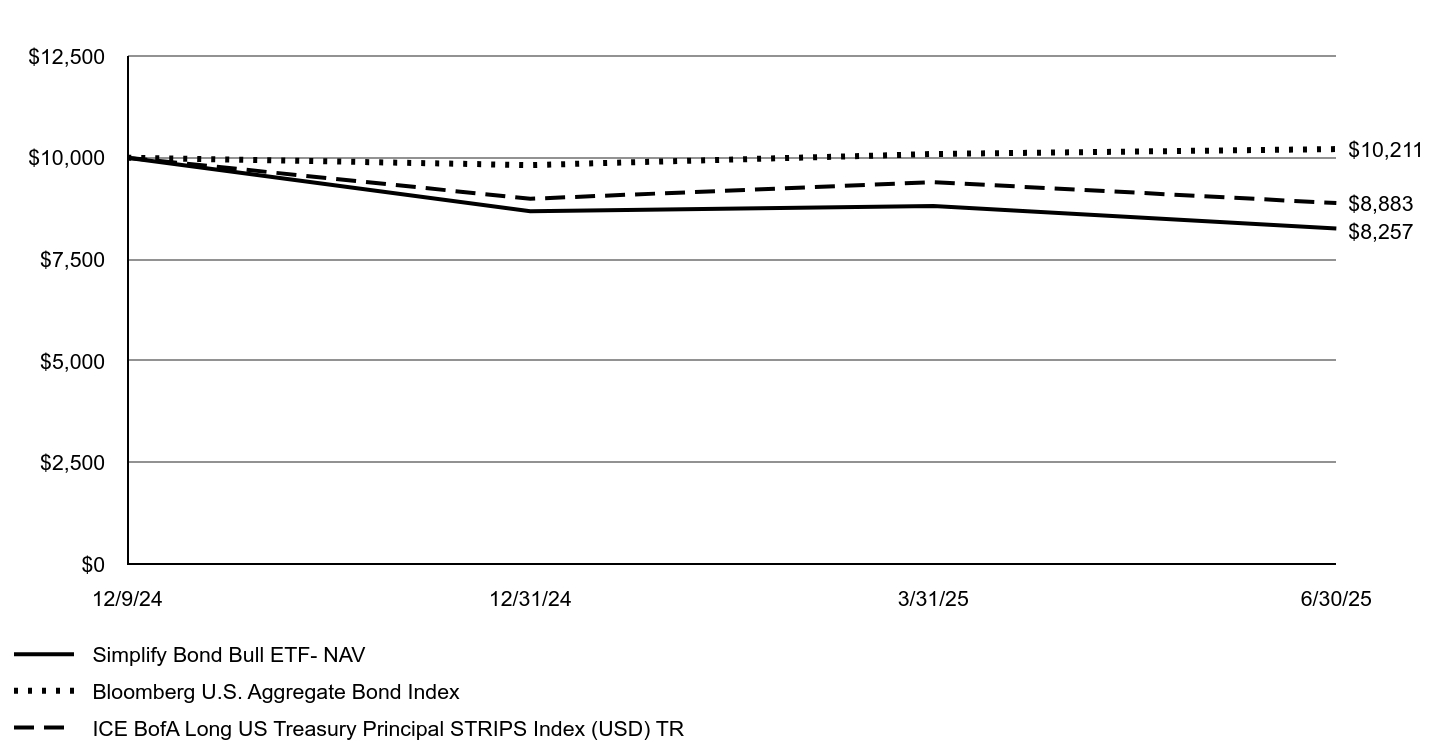

This annual shareholder report contains important information about Simplify Bond Bull ETF (the "Fund") for the period of December 9, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the period? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Bond Bull ETF | $25Footnote Reference(1) | 0.50% |

|---|

| Footnote | Description | Footnote(1) | Based on the period December 9, 2024 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period. |

|

|

| Expenses Paid, Amount |

$ 25

|

[2] |

| Expense Ratio, Percent |

0.50%

|

|

| Expenses Short Period Footnote [Text Block] |

Based on the period December 9, 2024 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period.

|

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the period December 9, 2024, to June 30, 2025, RFIX returned -17.43% vs. the return of -11.7% of the ICE BofA Long US Treasury Principal STRIPS Index for the same period, underperforming the index by 6.26%. The main reason for the difference is that RFIX holds a position in long-term expiry (5 to 7 years) over the counter (OTC) receiver swaptions which function similarly to a long-term call option on the 10-year rate. These swaptions underperformed as the forward interest rates under them increased. Looking forward, we anticipate decreases in rates that drive decreases in the forward rates along with decreases in implied volatilities would be beneficial to RFIX’s performance while increases in forward rates and increases in implied volatilities would be harmful. The path of future interest rates and implied volatilities is notoriously difficult to predict. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Bond Bull ETF- NAV | Bloomberg U.S. Aggregate Bond Index | ICE BofA Long US Treasury Principal STRIPS Index (USD) TR |

|---|

12/9/24 | $10,000 | $10,000 | $10,000 |

|---|

12/31/24 | $8,685 | $9,817 | $8,989 |

|---|

3/31/25 | $8,812 | $10,090 | $9,398 |

|---|

6/30/25 | $8,257 | $10,211 | $8,883 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | Since Inception

12/9/2024 |

|---|

Simplify Bond Bull ETF - NAV | -17.43% |

|---|

Bloomberg U.S. Aggregate Bond Index | 2.11% |

|---|

ICE BofA Long US Treasury Principal STRIPS Index (USD) TR | -11.17% |

|---|

|

|

| Performance Inception Date |

Dec. 09, 2024

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 152,635,408

|

|

| Holdings Count | Holding |

11

|

|

| Advisory Fees Paid, Amount |

$ 312,976

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $152,635,408 |

|---|

Total number of portfolio holdings | 11 |

|---|

Total advisory fee paid | $312,976 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 106.0% |

|---|

Purchased Swaptions | (6.2)% |

|---|

Other Assets in Excess of Liabilities | 0.2% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since December 9, 2024. For more complete information, you may review the Fund's prospectus dated February 20, 2025, which is available at www.simplify.us/resources or upon request at 1 (855)772-8488. (1) The Fund was renamed from Simplify Downside Interest Rate Hedge Strategy ETF to Simplify Bond Bull ETF. (2) In connection with this, the Fund also adopted a non-fundamental policy to invest at least 80% of its assets in bonds and other debt securities and instruments that provide investment exposure to such debt securities including derivatives. |

|

| C000255354 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify China A Shares PLUS Income ETF

|

|

| Class Name |

Simplify China A Shares PLUS Income ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

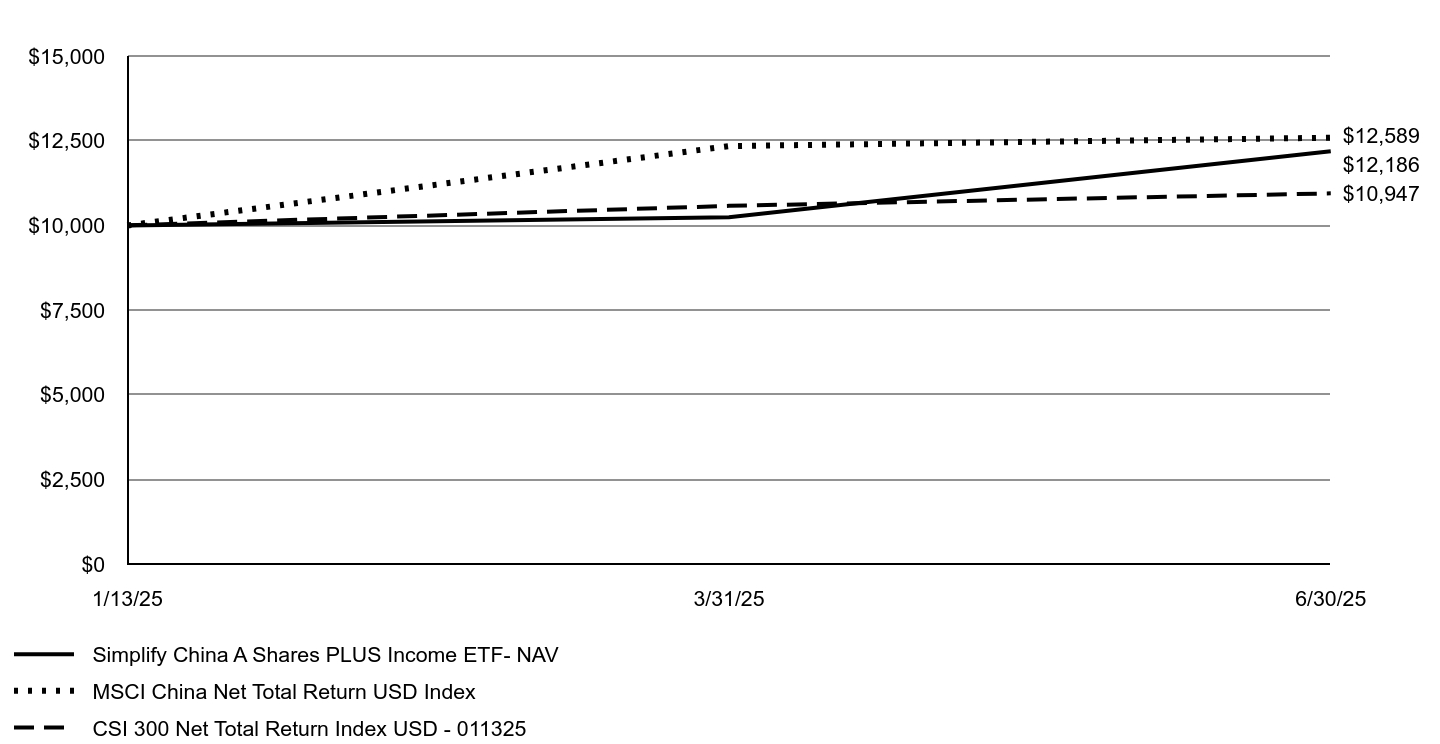

This annual shareholder report contains important information about Simplify China A Shares PLUS Income ETF (the "Fund") for the period of January 13, 2025 (commencement of operations) to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the period? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify China A Shares PLUS Income ETF | $45Footnote Reference(1) | 0.88% |

|---|

| Footnote | Description | Footnote(1) | Based on the period January 13, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period. |

|

|

| Expenses Paid, Amount |

$ 45

|

[3] |

| Expense Ratio, Percent |

0.88%

|

|

| Expenses Short Period Footnote [Text Block] |

Based on the period January 13, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period.

|

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceSince its inception on January 13, 2025, CAS returned 21.86% vs. the CSI 300 Net Total Return Index USD return of 9.73% for the same period. CAS' allocations to the smaller market capitalization indices, including the CSI 500, 1000, and 2000 contributed to performance as each outperformed the CSI 300 index meaningfully over the period. Looking forward, we intend to maintain a diversified exposure within CAS across the various market capitalization segments of the onshore China stock market. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify China A Shares PLUS Income ETF- NAV | MSCI China Net Total Return USD Index | CSI 300 Net Total Return Index USD - 011325 |

|---|

1/13/25 | $10,000 | $10,000 | $10,002 |

|---|

3/31/25 | $10,244 | $12,342 | $10,578 |

|---|

6/30/25 | $12,186 | $12,589 | $10,947 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | Since Inception

1/13/2025 |

|---|

Simplify China A Shares PLUS Income ETF - NAV | 21.86% |

|---|

MSCI China Net Total Return USD Index | 25.89% |

|---|

CSI 300 Net Total Return Index USD - 011325 | 9.73% |

|---|

|

|

| Performance Inception Date |

Jan. 13, 2025

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 11,330,285

|

|

| Holdings Count | Holding |

22

|

|

| Advisory Fees Paid, Amount |

$ 40,387

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $11,330,285 |

|---|

Total number of portfolio holdings | 22 |

|---|

Total advisory fee paid | $40,387 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 93.0% |

|---|

Purchased Options | 3.7% |

|---|

Other Assets in Excess of Liabilities | 3.3% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000254609 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Currency Strategy ETF

|

|

| Class Name |

Simplify Currency Strategy ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Currency Strategy ETF (the "Fund") for the period of February 3, 2025 (commencement of operations) to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the period? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Currency Strategy ETF | $34Footnote Reference(1) | 0.81% |

|---|

| Footnote | Description | Footnote(1) | Based on the period February 3, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period. |

|

|

| Expenses Paid, Amount |

$ 34

|

[4] |

| Expense Ratio, Percent |

0.81%

|

|

| Expenses Short Period Footnote [Text Block] |

Based on the period February 3, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period.

|

|

| Factors Affecting Performance [Text Block] |

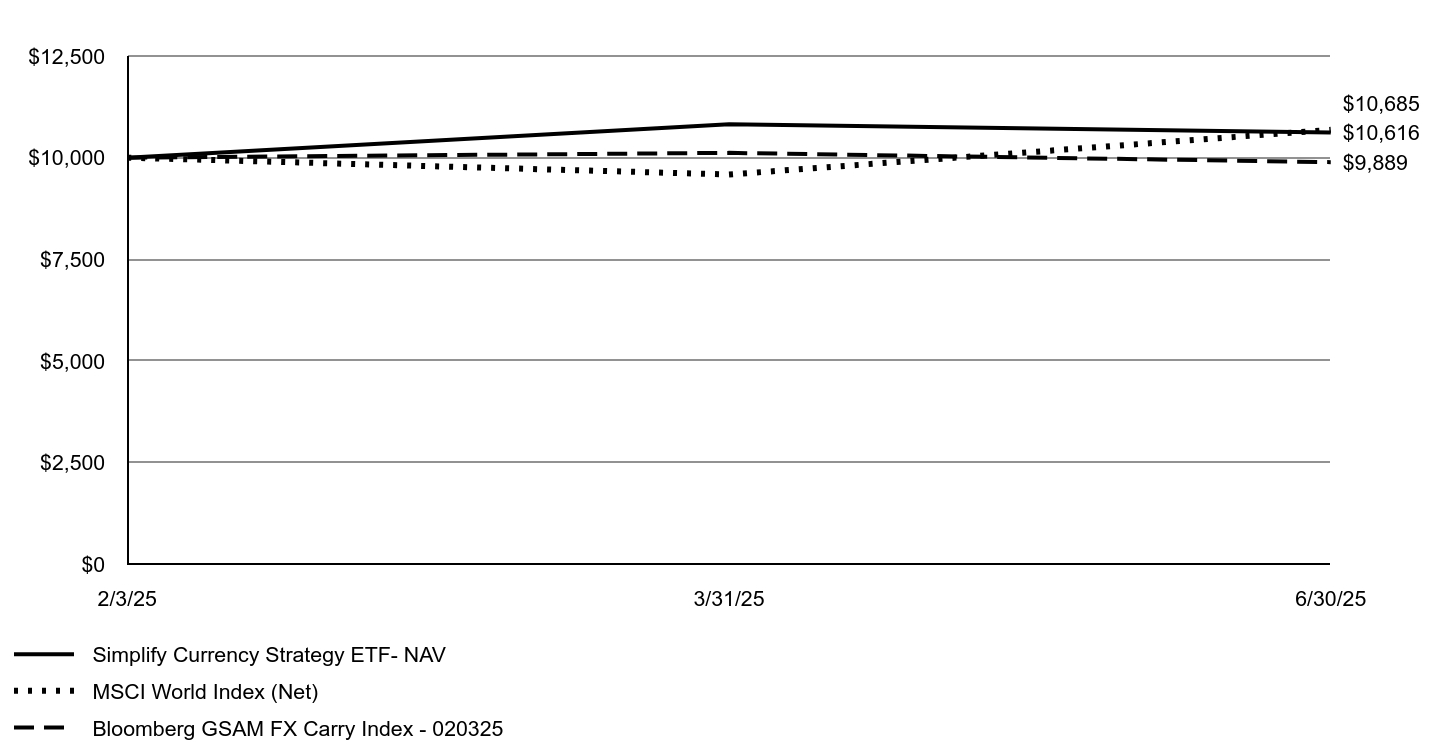

Management's Discussion of Fund PerformanceSince its inception on February 3, 2025, FOXY returned 6.16% vs. the benchmark Bloomberg GSAM FX Carry Index return of -1.12% for the same period. The Fund’s approach of dynamically adjusting its currency exposures benefited performance. Among the G10 currencies, the Japanese Yen, Australian Dollar, and British Pound contributed. Within EM currencies, the Mexican Peso and Brazilian Real rounded out the top contributors. Looking forward, it is intended that FOXY will continue to adhere to its systematic investment approach which aims to harvest yield in the currency market in a volatility managed fashion. Uncertainty over the direction of the U.S. Dollar has risen as a consequence of the current U.S. presidential administration’s pursuit of a new trade arrangements with other countries. And while FOXY is managed on a dollar-neutral basis, it remains to be seen whether changes to trade relationships will present a challenge to the structure of the currency market on which FOXY’s investment strategy is based. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Currency Strategy ETF- NAV | MSCI World Index (Net) | Bloomberg GSAM FX Carry Index - 020325 |

|---|

2/3/25 | $10,000 | $10,000 | $10,000 |

|---|

3/31/25 | $10,819 | $9,586 | $10,118 |

|---|

6/30/25 | $10,616 | $10,685 | $9,889 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | Since Inception

2/3/2025 |

|---|

Simplify Currency Strategy ETF - NAV | 6.16% |

|---|

MSCI World Index (Net) | 6.85% |

|---|

Bloomberg GSAM FX Carry Index - 020325 | -1.12% |

|---|

|

|

| Performance Inception Date |

Feb. 03, 2025

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 14,943,973

|

|

| Holdings Count | Holding |

4

|

|

| Advisory Fees Paid, Amount |

$ 34,712

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $14,943,973 |

|---|

Total number of portfolio holdings | 4 |

|---|

Total advisory fee paid | $34,712 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 97.7% |

|---|

Other Assets in Excess of Liabilities | 2.3% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000238456 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Enhanced Income ETF

|

|

| Class Name |

Simplify Enhanced Income ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Enhanced Income ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Enhanced Income ETF | $52 | 0.50% |

|---|

|

|

| Expenses Paid, Amount |

$ 52

|

|

| Expense Ratio, Percent |

0.50%

|

|

| Factors Affecting Performance [Text Block] |

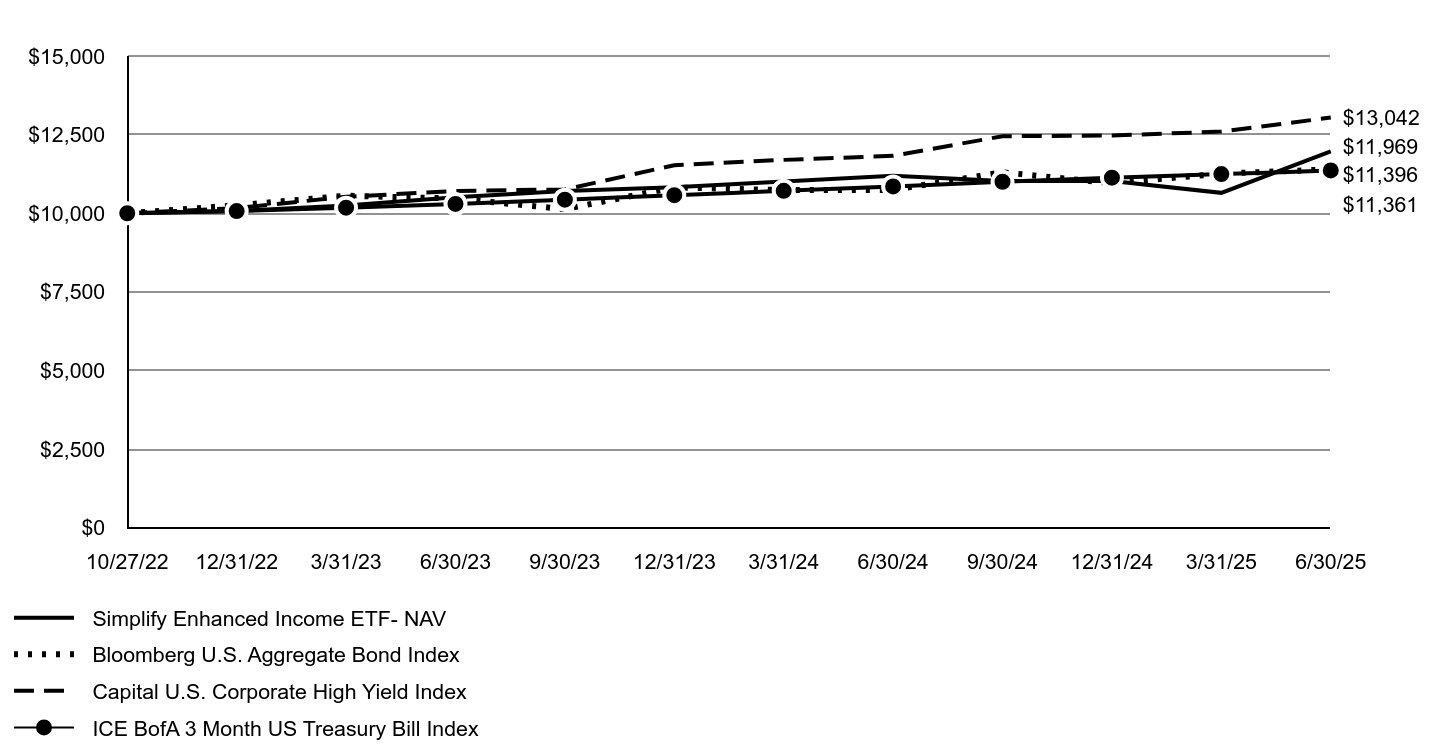

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, HIGH returned 6.95% vs the ICE BofA US 3-Month Treasury Bill Index, return of 4.68% for the same period, outperforming the benchmark by 2.27%. Around August 2024, the Portfolio Management team identified an opportunity to start spending low premium amounts for convex tail hedges on both upside and downside to improve the core income generating component of HIGH’s investment strategy. While this initially detracted from performance, the approach paid off during the ''tariff tantrum'' allowing HIGH to outperform in the first half of 2025. Looking ahead, HIGH aims to maintain a steady NAV and distribution by putting on cost effective hedges to navigate extreme market conditions. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Enhanced Income ETF- NAV | Bloomberg U.S. Aggregate Bond Index | Capital U.S. Corporate High Yield Index | ICE BofA 3 Month US Treasury Bill Index |

|---|

10/27/22 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

12/31/22 | $10,073 | $10,253 | $10,161 | $10,070 |

|---|

3/31/23 | $10,244 | $10,557 | $10,524 | $10,178 |

|---|

6/30/23 | $10,507 | $10,468 | $10,708 | $10,297 |

|---|

9/30/23 | $10,706 | $10,130 | $10,757 | $10,432 |

|---|

12/31/23 | $10,830 | $10,820 | $11,528 | $10,575 |

|---|

3/31/24 | $11,010 | $10,736 | $11,697 | $10,712 |

|---|

6/30/24 | $11,191 | $10,743 | $11,825 | $10,853 |

|---|

9/30/24 | $11,029 | $11,302 | $12,450 | $11,002 |

|---|

12/31/24 | $11,022 | $10,956 | $12,472 | $11,130 |

|---|

3/31/25 | $10,649 | $11,260 | $12,597 | $11,244 |

|---|

6/30/25 | $11,969 | $11,396 | $13,042 | $11,361 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

10/27/2022 |

|---|

Simplify Enhanced Income ETF - NAV | 6.95% | 6.95% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | 5.01% |

|---|

Capital U.S. Corporate High Yield Index | 10.29% | 10.44% |

|---|

ICE BofA 3 Month US Treasury Bill Index | 4.68% | 4.89% |

|---|

|

|

| Performance Inception Date |

Oct. 27, 2022

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 192,166,444

|

|

| Holdings Count | Holding |

22

|

|

| Advisory Fees Paid, Amount |

$ 1,518,590

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $192,166,444 |

|---|

Total number of portfolio holdings | 22 |

|---|

Total advisory fee paid | $1,518,590 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 96.2% |

|---|

Purchased Options | 3.7% |

|---|

Other Assets in Excess of Liabilities | 0.1% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000230898 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Health Care ETF

|

|

| Class Name |

Simplify Health Care ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Health Care ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Health Care ETF | $49 | 0.50% |

|---|

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

0.50%

|

|

| Factors Affecting Performance [Text Block] |

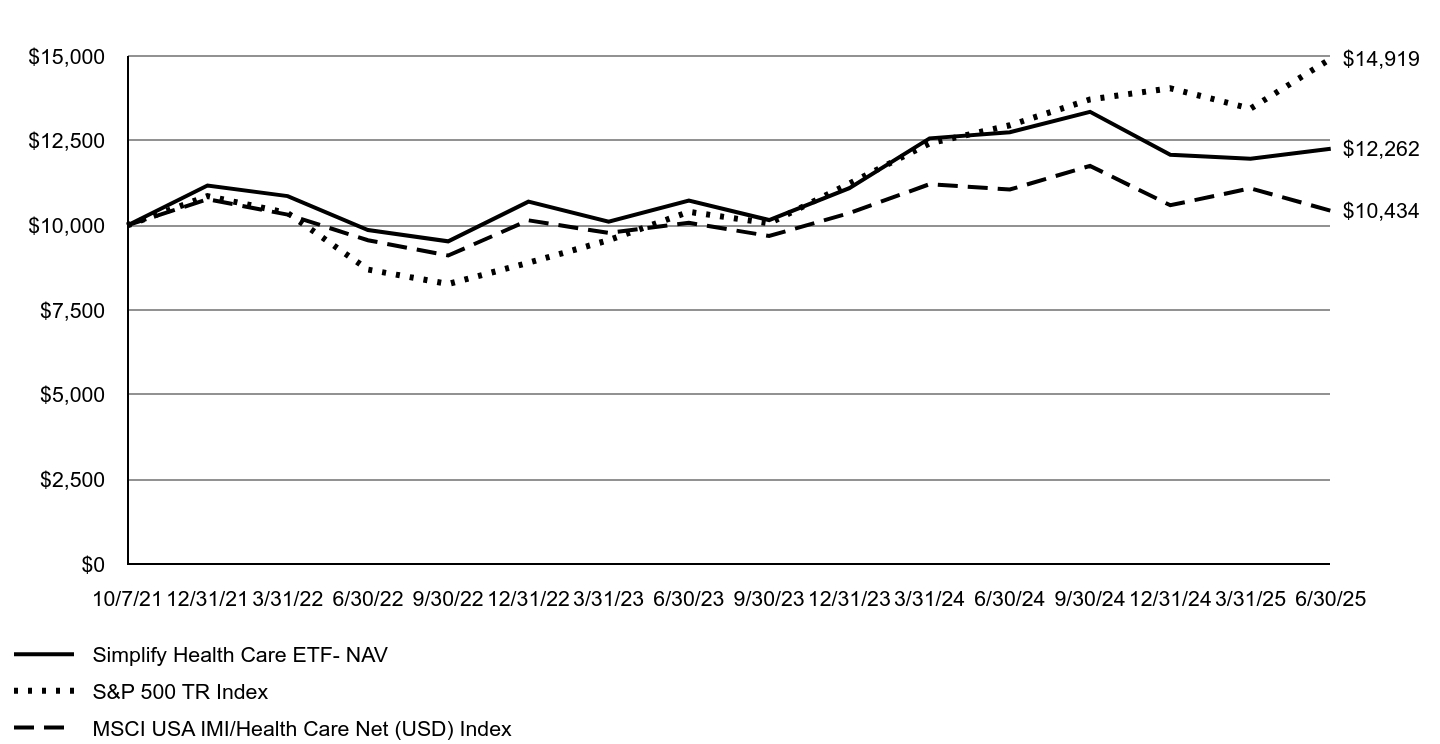

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, PINK returned -3.84% vs the return of -5.66% of MSCI USA IMI/Health Care Net Index for the same period, outperforming the index by 1.82%. PINK's outperformance is attributed to bottoms-up analysis, tactical trading, and strategic weightings in subsectors. In FY2025, stock selection played the most significant role, avoiding major drawdowns and identifying alpha-generating stocks across subsectors. Looking ahead, PINK’s will employ rigorous bottom-up fundamental analysis, leveraging mosaic theory, industry insights, and channel checks seeking to identify high-conviction alpha opportunities. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Health Care ETF- NAV | S&P 500 TR Index | MSCI USA IMI/Health Care Net (USD) Index |

|---|

10/7/21 | $10,000 | $10,000 | $10,000 |

|---|

12/31/21 | $11,178 | $10,866 | $10,774 |

|---|

3/31/22 | $10,865 | $10,366 | $10,318 |

|---|

6/30/22 | $9,863 | $8,697 | $9,563 |

|---|

9/30/22 | $9,531 | $8,272 | $9,112 |

|---|

12/31/22 | $10,701 | $8,898 | $10,151 |

|---|

3/31/23 | $10,109 | $9,565 | $9,778 |

|---|

6/30/23 | $10,731 | $10,401 | $10,076 |

|---|

9/30/23 | $10,159 | $10,060 | $9,689 |

|---|

12/31/23 | $11,102 | $11,237 | $10,364 |

|---|

3/31/24 | $12,570 | $12,423 | $11,218 |

|---|

6/30/24 | $12,752 | $12,955 | $11,060 |

|---|

9/30/24 | $13,352 | $13,718 | $11,758 |

|---|

12/31/24 | $12,087 | $14,048 | $10,596 |

|---|

3/31/25 | $11,967 | $13,448 | $11,095 |

|---|

6/30/25 | $12,262 | $14,919 | $10,434 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

10/7/2021 |

|---|

Simplify Health Care ETF - NAV | -3.84% | 5.62% |

|---|

S&P 500 TR Index | 15.16% | 11.33% |

|---|

MSCI USA IMI/Health Care Net (USD) Index | -5.66% | 1.15% |

|---|

|

|

| Performance Inception Date |

Oct. 07, 2021

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 130,567,740

|

|

| Holdings Count | Holding |

65

|

|

| Advisory Fees Paid, Amount |

$ 832,382

|

|

| InvestmentCompanyPortfolioTurnover |

201.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $130,567,740 |

|---|

Total number of portfolio holdings | 65 |

|---|

Total advisory fee paid | $832,382 |

|---|

Portfolio turnover rate | 201% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

Common Stocks | 96.0% |

|---|

Money Market Funds | 4.0% |

|---|

Other Assets in Excess of Liabilities | 0.0%Footnote Reference† |

|---|

Total | 100.0% |

|---|

| Footnote | Description | Footnote† | Less than 0.05% |

|

|

| Material Fund Change [Text Block] |

|

|

| C000231201 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Hedged Equity ETF

|

|

| Class Name |

Simplify Hedged Equity ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Hedged Equity ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Hedged Equity ETF | $45 | 0.42% |

|---|

|

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.42%

|

|

| Factors Affecting Performance [Text Block] |

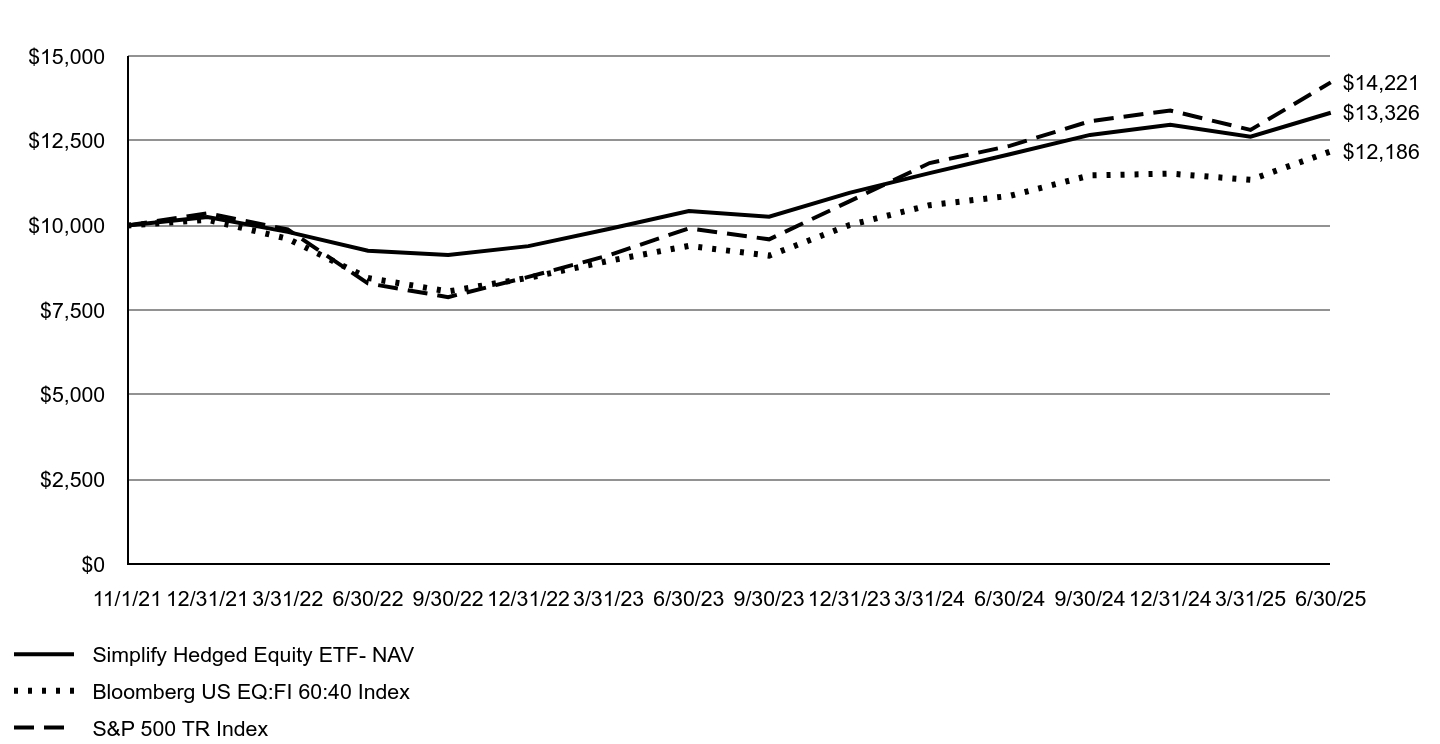

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, HEQT returned 10.13% vs Bloomberg US EQ:FI 60:40 Index, which had a return of 12.07% for the same period, under-performing the index by 1.94%. Over the past year, U.S. equities have demonstrated resilience and recovery following a turbulent early 2025 period. The large-cap market rebounded approximately 25% from spring lows, supported by easing tariff concerns, strong earnings, and labor market data. After declining nearly 19% in April due to the unexpected “Liberation Day” tariffs, markets recovered on policy adjustments and coordinated intervention, reaching record highs by late June. During the drawdown, HEQT provided downside protection through its systematic collar strategy. As equities rebounded, HEQT lagged due to capped upside exposure, a trade-off of its risk-managed design. Nonetheless, HEQT reduced portfolio volatility and drawdown risk. Looking ahead, HEQT will seek to continue to allow investors access to U.S. large cap U.S. equities while hedging downside volatility with a risk-managed options overlay. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Hedged Equity ETF- NAV | Bloomberg US EQ:FI 60:40 Index | S&P 500 TR Index |

|---|

11/1/21 | $10,000 | $10,000 | $10,000 |

|---|

12/31/21 | $10,251 | $10,168 | $10,357 |

|---|

3/31/22 | $9,810 | $9,606 | $9,881 |

|---|

6/30/22 | $9,254 | $8,449 | $8,290 |

|---|

9/30/22 | $9,128 | $8,053 | $7,885 |

|---|

12/31/22 | $9,389 | $8,454 | $8,481 |

|---|

3/31/23 | $9,895 | $8,953 | $9,117 |

|---|

6/30/23 | $10,425 | $9,398 | $9,914 |

|---|

9/30/23 | $10,258 | $9,108 | $9,590 |

|---|

12/31/23 | $10,961 | $10,010 | $10,711 |

|---|

3/31/24 | $11,545 | $10,597 | $11,841 |

|---|

6/30/24 | $12,101 | $10,873 | $12,349 |

|---|

9/30/24 | $12,671 | $11,476 | $13,076 |

|---|

12/31/24 | $12,968 | $11,529 | $13,391 |

|---|

3/31/25 | $12,620 | $11,346 | $12,819 |

|---|

6/30/25 | $13,326 | $12,186 | $14,221 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

11/1/2021 |

|---|

Simplify Hedged Equity ETF - NAV | 10.13% | 8.16% |

|---|

S&P 500 TR Index | 15.16% | 10.10% |

|---|

Bloomberg US EQ:FI 60:40 Index | 12.07% | 5.55% |

|---|

|

|

| Performance Inception Date |

Nov. 01, 2021

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 331,626,457

|

|

| Holdings Count | Holding |

5

|

|

| Advisory Fees Paid, Amount |

$ 1,258,330

|

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $331,626,457 |

|---|

Total number of portfolio holdings | 5 |

|---|

Total advisory fee paid | $1,258,330 |

|---|

Portfolio turnover rate | 5% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Exchange-Traded Funds | 104.8% |

|---|

Purchased Options | 0.4% |

|---|

Money Market Funds | 0.1% |

|---|

Liabilities in Excess of Other Assets | (5.3)% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000233895 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify High Yield ETF

|

|

| Class Name |

Simplify High Yield ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify High Yield ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify High Yield ETF | $27 | 0.25% |

|---|

|

|

| Expenses Paid, Amount |

$ 27

|

|

| Expense Ratio, Percent |

0.25%

|

|

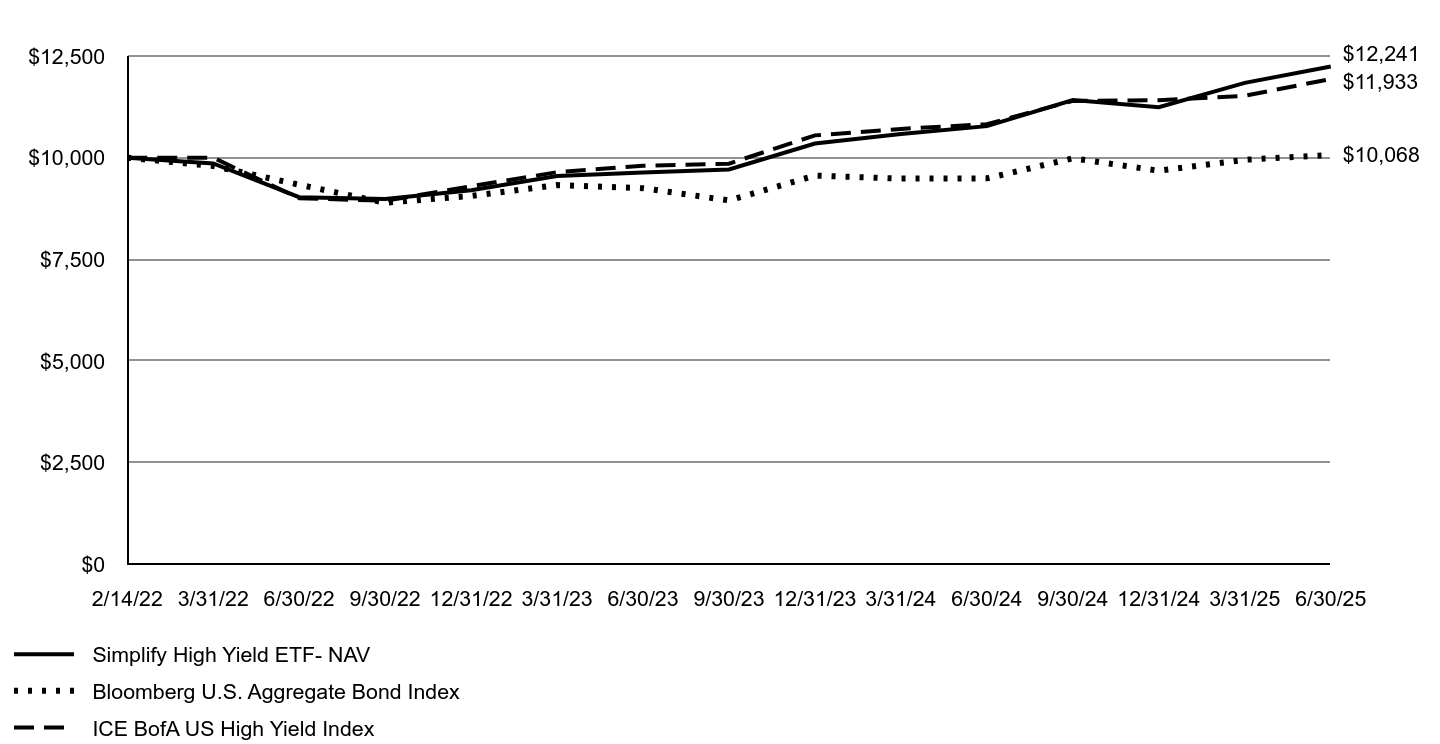

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, CDX returned 13.60% vs the ICE BofA U.S. High Yield Index return of 10.24% for the same period, outperforming the benchmark by +3.36%. Over the period, High Yield spreads were relatively unchanged starting the fiscal year at 3.09% and ending the year at 2.90%. However, there were two impactful periods of spread widening occurring in August of 2024 and April 2025, which led to strong returns from CDX. The two key drivers of outperformance continue to be the embedded credit hedge overlay, referred to as ‘Quality minus Junk’ or ‘Q-J’ as well as the favorable funding received on the Total Return Swap for iShares iBoxx $ High Yield Corporate Bond ETF. Over the trailing 12-month period, the Quality basket of the hedge returned +11.97% while the short Junk basket of the hedge returned +0.03%, providing a performance tailwind as the strategy is long Quality and short Junk. Looking forward, CDX is modestly over-hedged due to tight credit spreads and deteriorating US growth. Tight conditions and high bankruptcy filings suggest outperformance if spreads widen. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify High Yield ETF- NAV | Bloomberg U.S. Aggregate Bond Index | ICE BofA US High Yield Index |

|---|

2/14/22 | $10,000 | $10,000 | $10,000 |

|---|

3/31/22 | $9,859 | $9,795 | $9,999 |

|---|

6/30/22 | $9,027 | $9,335 | $9,002 |

|---|

9/30/22 | $8,983 | $8,892 | $8,941 |

|---|

12/31/22 | $9,200 | $9,058 | $9,297 |

|---|

3/31/23 | $9,551 | $9,326 | $9,643 |

|---|

6/30/23 | $9,636 | $9,248 | $9,800 |

|---|

9/30/23 | $9,709 | $8,949 | $9,852 |

|---|

12/31/23 | $10,347 | $9,559 | $10,548 |

|---|

3/31/24 | $10,583 | $9,485 | $10,707 |

|---|

6/30/24 | $10,775 | $9,491 | $10,824 |

|---|

9/30/24 | $11,417 | $9,984 | $11,395 |

|---|

12/31/24 | $11,239 | $9,678 | $11,413 |

|---|

3/31/25 | $11,839 | $9,948 | $11,521 |

|---|

6/30/25 | $12,241 | $10,068 | $11,933 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

2/14/2022 |

|---|

Simplify High Yield ETF - NAV | 13.60% | 6.18% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | 0.20% |

|---|

ICE BofA US High Yield Index | 10.24% | 5.38% |

|---|

|

|

| Performance Inception Date |

Feb. 14, 2022

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 245,327,789

|

|

| Holdings Count | Holding |

9

|

|

| Advisory Fees Paid, Amount |

$ 358,952

|

|

| InvestmentCompanyPortfolioTurnover |

622.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $245,327,789 |

|---|

Total number of portfolio holdings | 9 |

|---|

Total advisory fee paid | $358,952 |

|---|

Portfolio turnover rate | 622% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 97.5% |

|---|

U.S. Exchange-Traded Funds | 0.6% |

|---|

Money Market Funds | 0.5% |

|---|

Purchased Options | 0.2% |

|---|

Other Assets in Excess of Liabilities | 1.2% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund's prospectus dated February 12, 2025, which is available at www.simplify.us/resources or upon request at 1 (855) 772-8488. 1) The Fund changed its name from Simplify High Yield PLUS Credit Hedge ETF to Simplify High Yield ETF, and 2) The Fund added an income generating option strategy to its principal investment strategies and also expanded option-related risk disclosures. |

|

| C000227299 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Interest Rate Hedge ETF

|

|

| Class Name |

Simplify Interest Rate Hedge ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Interest Rate Hedge ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Interest Rate Hedge ETF | $54 | 0.50% |

|---|

|

|

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

0.50%

|

|

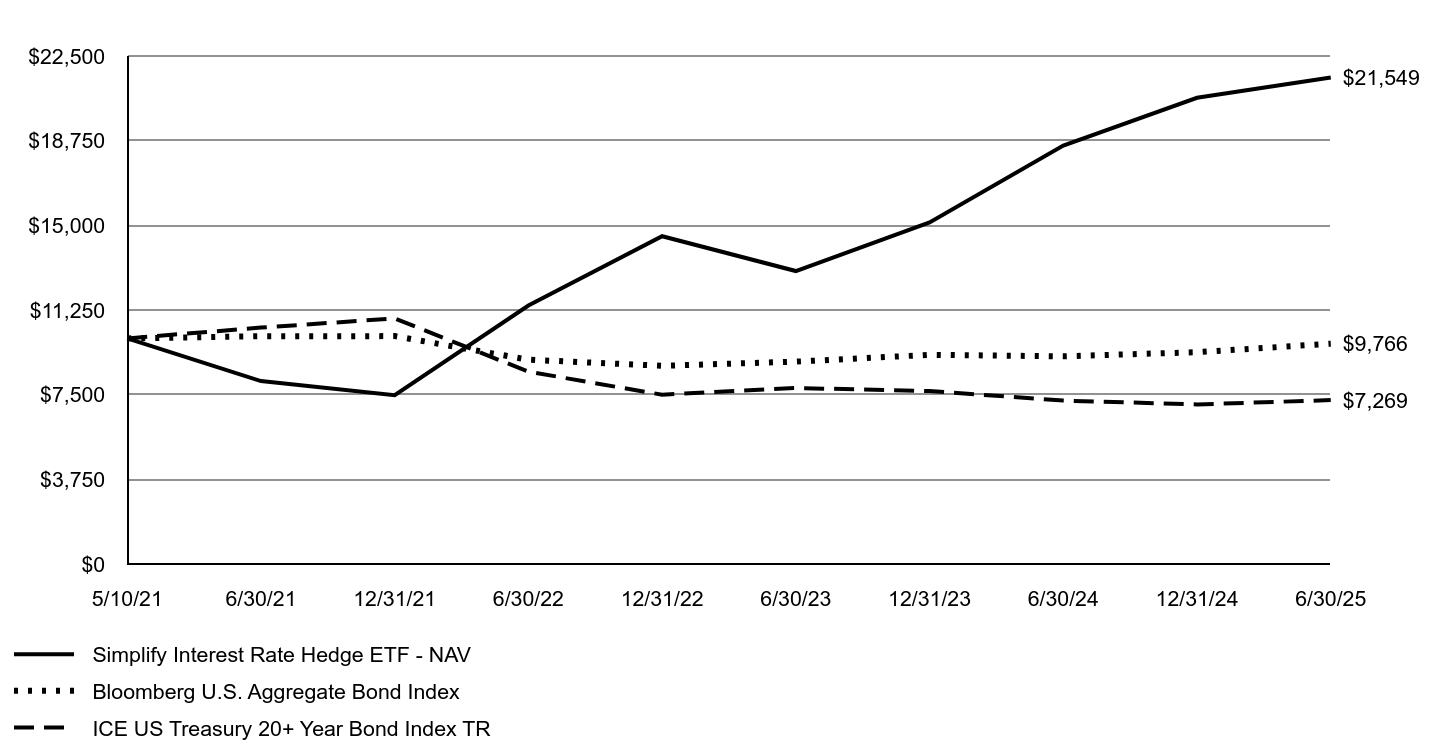

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, PFIX returned 16.28% vs. the ICE U.S. Treasury 20+ Year Bond Index return of 0.30% for the same period, outperforming the index by 15.96%. The main reason for the difference is that PFIX holds a position in long-term expiry (5 to 7 years) over the counter (OTC) payer swaptions which function similarly to a long-term put option on the 20-year rate. These swaptions performed well as the forward interest rates that underly them increased. These increases were offset somewhat by time decay on the options and increases in the interest rates used to discount the option payoff. Looking forward, increases in interest rates that drive increases in the forward rates along with increases in implied volatilities would be beneficial to PFIX's performance while decreases in forward rates and declines in implied volatilities would be harmful. The path of future interest rates and implied volatilities is notoriously difficult to predict. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Interest Rate Hedge ETF - NAV | Bloomberg U.S. Aggregate Bond Index | ICE US Treasury 20+ Year Bond Index TR |

|---|

5/10/21 | $10,000 | $10,000 | $10,000 |

|---|

6/30/21 | $8,111 | $10,095 | $10,478 |

|---|

12/31/21 | $7,489 | $10,101 | $10,885 |

|---|

6/30/22 | $11,452 | $9,056 | $8,527 |

|---|

12/31/22 | $14,523 | $8,787 | $7,506 |

|---|

6/30/23 | $12,981 | $8,971 | $7,805 |

|---|

12/31/23 | $15,133 | $9,273 | $7,669 |

|---|

6/30/24 | $18,534 | $9,207 | $7,247 |

|---|

12/31/24 | $20,650 | $9,389 | $7,076 |

|---|

6/30/25 | $21,549 | $9,766 | $7,269 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

5/10/2021 |

|---|

Simplify Interest Rate Hedge ETF - NAV | 16.28% | 20.38% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | -0.57% |

|---|

ICE US Treasury 20+ Year Bond Index TR | 0.30% | -7.42% |

|---|

|

|

| Performance Inception Date |

May 10, 2021

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 156,051,239

|

|

| Holdings Count | Holding |

12

|

|

| Advisory Fees Paid, Amount |

$ 754,832

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $156,051,239 |

|---|

Total number of portfolio holdings | 12 |

|---|

Total advisory fee paid | $754,832 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 61.1% |

|---|

U.S. Government Obligations | 28.1% |

|---|

Purchased Swaptions | 10.1% |

|---|

Money Market Funds | 0.2% |

|---|

Other Assets in Excess of Liabilities | 0.5% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund's prospectus dated February 12, 2025, which is available at www.simplify.us/resources or upon request at 1 (855) 772-8488. Changes were made to the Fund’s investment strategy to enhance the description of asset allocation, swaptions and the potential impact of interest rate risk on the Fund’s investments. |

|

| C000230231 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Intermediate Term Treasury Futures Strategy ETF

|

|

| Class Name |

Simplify Intermediate Term Treasury Futures Strategy ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

CboeBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Intermediate Term Treasury Futures Strategy ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Intermediate Term Treasury Futures Strategy ETF | $16 | 0.15% |

|---|

|

|

| Expenses Paid, Amount |

$ 16

|

|

| Expense Ratio, Percent |

0.15%

|

|

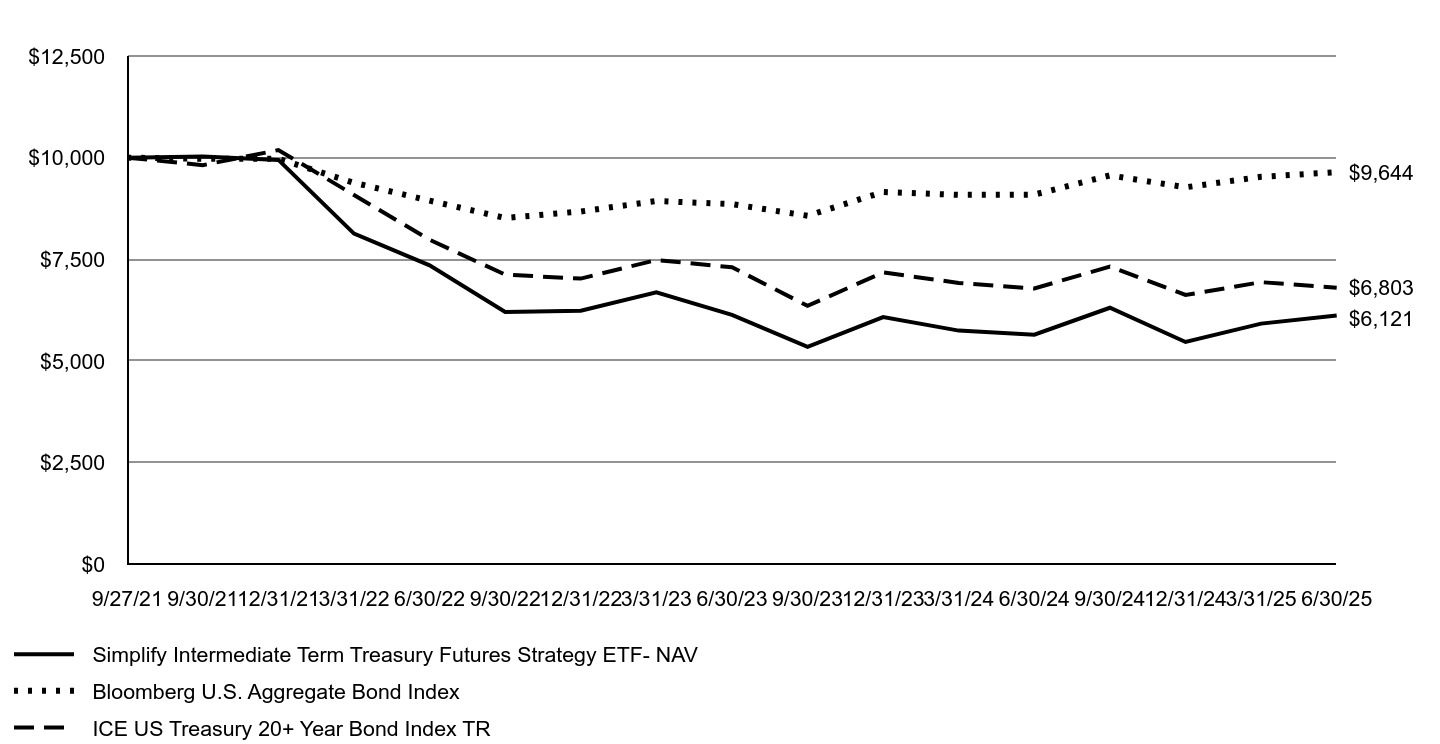

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, TYA returned 8.42% vs. the ICE U.S. Treasury 20+ Year Bond Index's return of 0.30% for the same period, outperforming the index by 8.12%. The primary drivers of return were TYA’s long position in near-to-expiry 10-year U.S. Treasury futures and its holdings of short-term Treasuries and cash. A long futures position earns the return of the cheapest-to-deliver bond in exchange for paying a short-term financing rate. The intermediate part of the yield curve was most attractive this year, as long-term rates remained elevated amid concerns over tariff-driven inflation and the U.S. fiscal outlook. TYA benefited from its positioning, leveraged up to three times, as the intermediate sector presented a more favorable risk-reward tradeoff than owning long-duration bonds outright. Looking forward, TYA’s future performance will depend on interest rate movements—declines and curve steepening would benefit returns, while rising intermediate rates would detract. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Intermediate Term Treasury Futures Strategy ETF- NAV | Bloomberg U.S. Aggregate Bond Index | ICE US Treasury 20+ Year Bond Index TR |

|---|

9/27/21 | $10,000 | $10,000 | $10,000 |

|---|

9/30/21 | $10,031 | $9,973 | $9,816 |

|---|

12/31/21 | $9,944 | $9,974 | $10,187 |

|---|

3/31/22 | $8,132 | $9,382 | $9,083 |

|---|

6/30/22 | $7,353 | $8,942 | $7,981 |

|---|

9/30/22 | $6,204 | $8,517 | $7,123 |

|---|

12/31/22 | $6,238 | $8,677 | $7,026 |

|---|

3/31/23 | $6,688 | $8,934 | $7,483 |

|---|

6/30/23 | $6,132 | $8,858 | $7,305 |

|---|

9/30/23 | $5,345 | $8,572 | $6,356 |

|---|

12/31/23 | $6,078 | $9,156 | $7,177 |

|---|

3/31/24 | $5,747 | $9,085 | $6,920 |

|---|

6/30/24 | $5,646 | $9,091 | $6,783 |

|---|

9/30/24 | $6,309 | $9,564 | $7,322 |

|---|

12/31/24 | $5,468 | $9,271 | $6,623 |

|---|

3/31/25 | $5,919 | $9,529 | $6,938 |

|---|

6/30/25 | $6,121 | $9,644 | $6,803 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

9/27/2021 |

|---|

Simplify Intermediate Term Treasury Futures Strategy ETF - NAV | 8.42% | -12.25% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | -0.96% |

|---|

ICE US Treasury 20+ Year Bond Index TR | 0.30% | -9.75% |

|---|

|

|

| Performance Inception Date |

Sep. 27, 2021

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 152,686,772

|

|

| Holdings Count | Holding |

6

|

|

| Advisory Fees Paid, Amount |

$ 179,227

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $152,686,772 |

|---|

Total number of portfolio holdings | 6 |

|---|

Total advisory fee paid | $179,227 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 98.6% |

|---|

Money Market Funds | 0.1% |

|---|

Other Assets in Excess of Liabilities | 1.3% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000246389 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify MBS ETF

|

|

| Class Name |

Simplify MBS ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify MBS ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify MBS ETF | $15 | 0.15% |

|---|

|

|

| Expenses Paid, Amount |

$ 15

|

|

| Expense Ratio, Percent |

0.15%

|

|

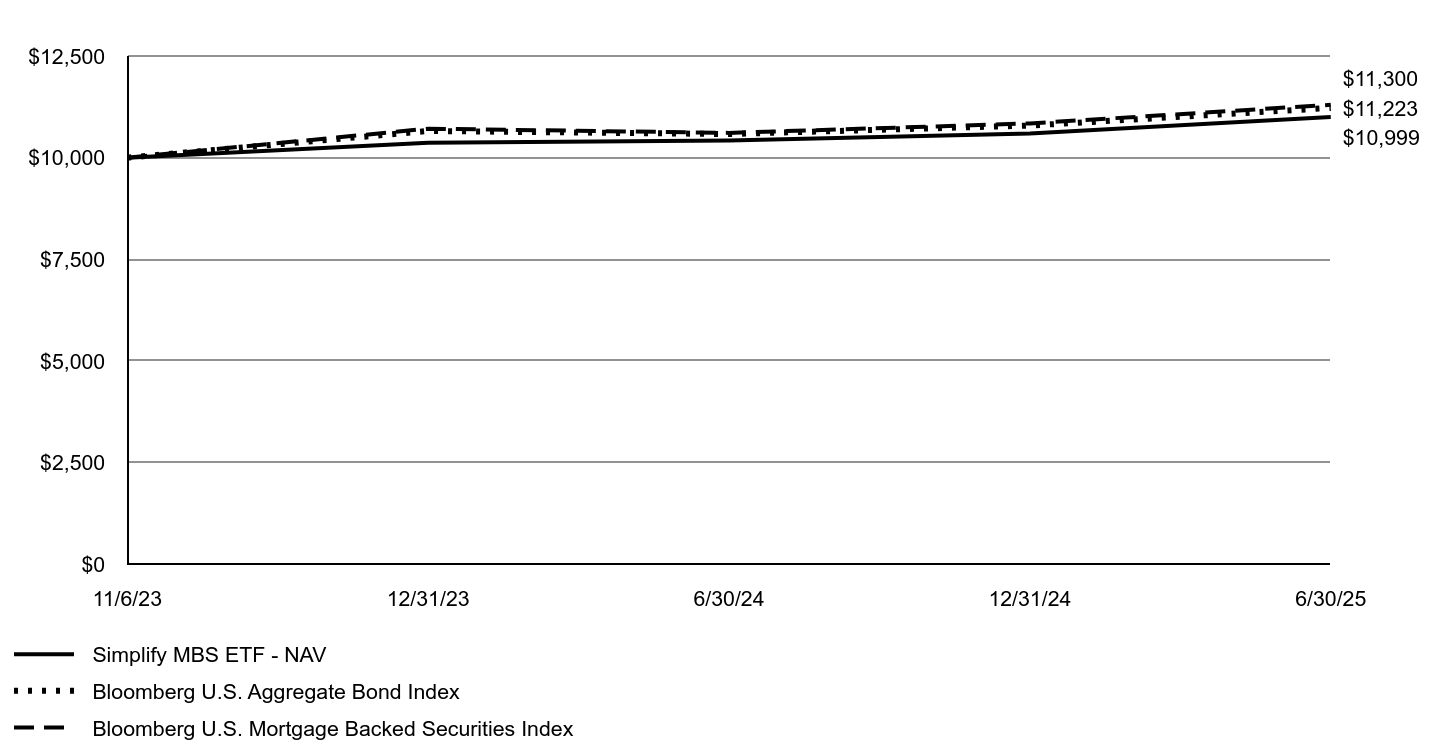

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, MTBA returned 5.52% vs. the 6.52% return of the Bloomberg U.S. Mortgage Backed Securities Index for the same period, underperforming the index by 1.00%. MTBA invests in current coupon agency mortgage-backed securities (MBS) via TBA – “To-Be-Announced” contracts in the over-the-counter market. These positions accrue mortgage interest, incur financing charges, and experience mark-to-market gains and losses from interest rate changes.Mortgage rates were volatile over the period but the rates hovered above 6% generating attractive yield. TBA positions are notional, leaving cash to be invested in short-term treasuries. Looking forward, we believe MTBA's performance is sensitive to changes in fixed-rate mortgage rates and short-term financing rates. Mortgage rates depend on multiple points on the term structure, volatilities, and supply-demand dynamics, all of which are challenging to predict. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify MBS ETF - NAV | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

11/6/23 | $10,000 | $10,000 | $10,000 |

|---|

12/31/23 | $10,367 | $10,656 | $10,713 |

|---|

6/30/24 | $10,424 | $10,581 | $10,609 |

|---|

12/31/24 | $10,595 | $10,790 | $10,842 |

|---|

6/30/25 | $10,999 | $11,223 | $11,300 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

11/6/2023 |

|---|

Simplify MBS ETF - NAV | 5.52% | 5.95% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | 7.25% |

|---|

Bloomberg U.S. Mortgage Backed Securities Index | 6.52% | 7.69% |

|---|

|

|

| Performance Inception Date |

Nov. 06, 2023

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 1,372,905,745

|

|

| Holdings Count | Holding |

10

|

|

| Advisory Fees Paid, Amount |

$ 2,152,579

|

|

| InvestmentCompanyPortfolioTurnover |

1376.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $1,372,905,745 |

|---|

Total number of portfolio holdings | 10 |

|---|

Total advisory fee paid | $2,152,579 |

|---|

Portfolio turnover rate | 1376% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Government Agency Mortgage Backed Securities | 99.7% |

|---|

U.S. Treasury Bills | 98.3% |

|---|

Money Market Funds | 0.1% |

|---|

Liabilities in Excess of Other Assets | (98.1)% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000249114 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify NEXT Intangible Core Index ETF

|

|

| Class Name |

Simplify NEXT Intangible Core Index ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

CboeBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify NEXT Intangible Core Index ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify NEXT Intangible Core Index ETF | $28 | 0.25% |

|---|

|

|

| Expenses Paid, Amount |

$ 28

|

|

| Expense Ratio, Percent |

0.25%

|

|

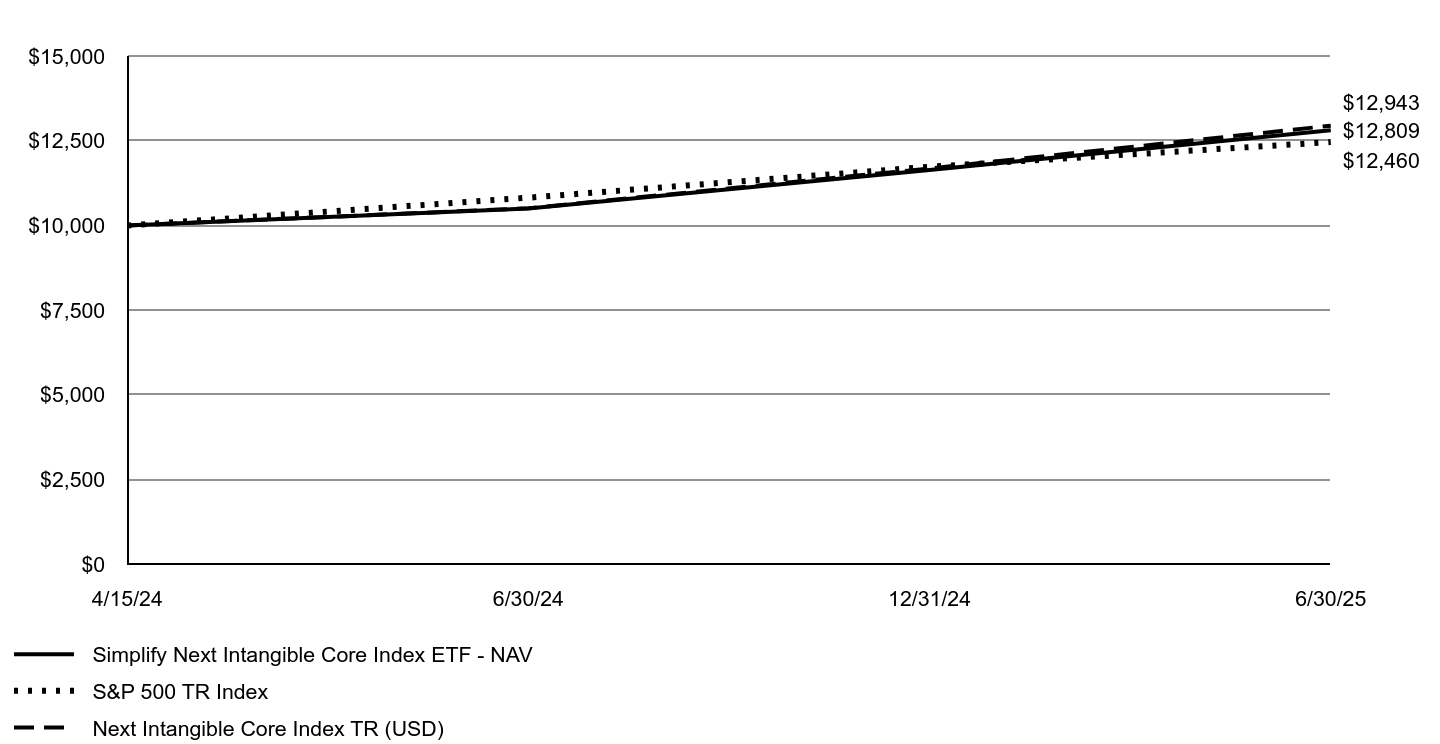

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, NXTI returned 21.95% vs. the S&P 500 index return of 15.16%, out-performing by 6.79%. NXTI delivered positive returns across all sectors, with particularly strong stock selection in Information Technology, Healthcare, Consumer Staples, Communication Services, Energy, and Industrials. Key contributors to performance included Palantir Technologies, Walmart, and IBM, which collectively supported the fund’s outperformance. Offsetting some of these gains were negative contributions from Adobe, UnitedHealth Group, and Sarepta Therapeutics. Looking ahead, NXTI will continue to seek companies with high intangible capital-to-book asset ratios within their respective sectors. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify NEXT Intangible Core Index ETF - NAV | S&P 500 TR Index | Next Intangible Core Index TR (USD) |

|---|

4/15/24 | $10,000 | $10,000 | $10,000 |

|---|

6/30/24 | $10,503 | $10,819 | $10,505 |

|---|

12/31/24 | $11,635 | $11,732 | $11,682 |

|---|

6/30/25 | $12,809 | $12,460 | $12,943 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

4/15/2024 |

|---|

Simplify NEXT Intangible Core Index ETF - NAV | 21.95% | 22.75% |

|---|

S&P 500 TR Index | 15.16% | 19.96% |

|---|

NEXT Intangible Core Index TR (USD) | 23.20% | 23.80% |

|---|

|

|

| Performance Inception Date |

Apr. 15, 2024

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 1,538,687

|

|

| Holdings Count | Holding |

201

|

|

| Advisory Fees Paid, Amount |

$ 3,880

|

|

| InvestmentCompanyPortfolioTurnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $1,538,687 |

|---|

Total number of portfolio holdings | 201 |

|---|

Total advisory fee paid | $3,880 |

|---|

Portfolio turnover rate | 34% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

Common Stocks | 99.6% |

|---|

Money Market Funds | 0.4% |

|---|

Other Assets in Excess of Liabilities | 0.0%Footnote Reference† |

|---|

Total | 100.0% |

|---|

| Footnote | Description | Footnote† | Less than 0.05% |

|

|

| Material Fund Change [Text Block] |

|

|

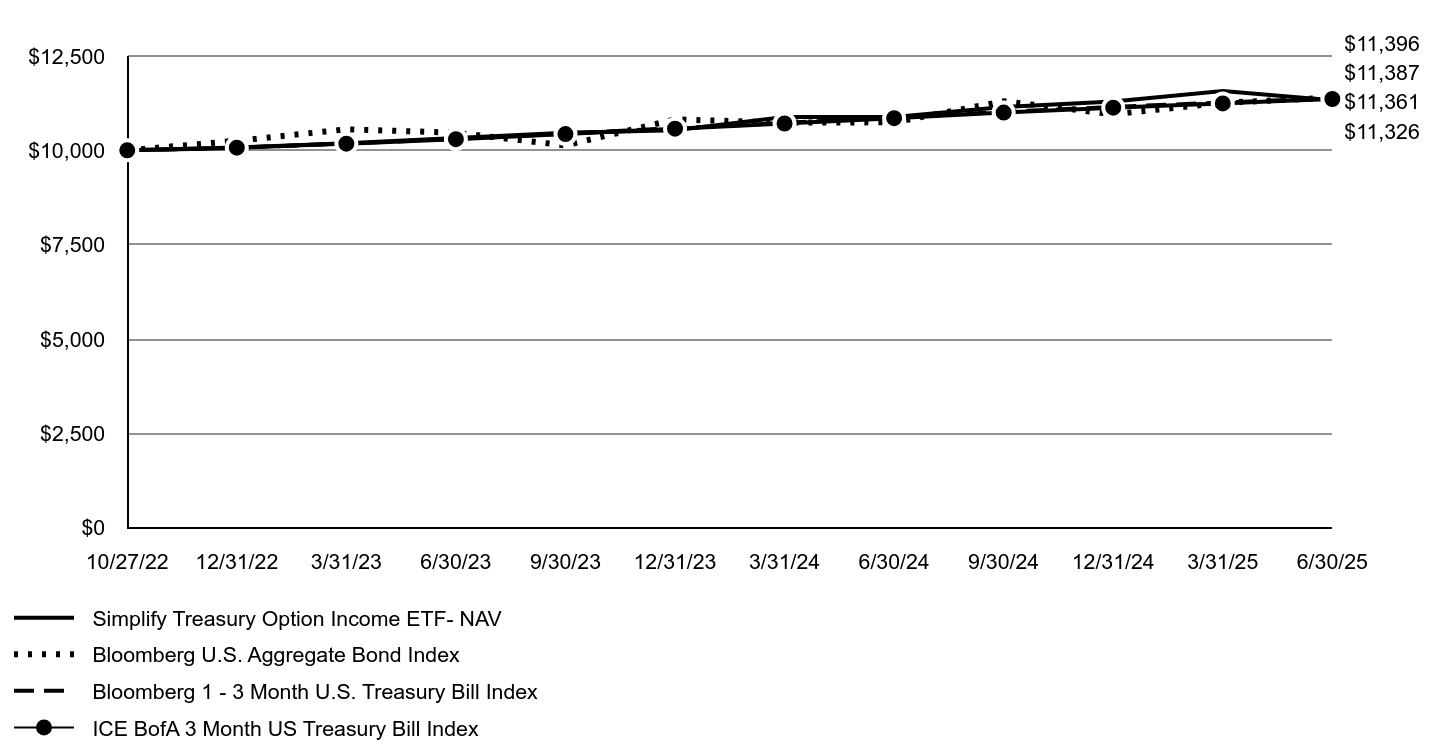

| C000238444 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Short Term Treasury Futures Strategy ETF

|

|

| Class Name |

Simplify Short Term Treasury Futures Strategy ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Short Term Treasury Futures Strategy ETF (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Short Term Treasury Futures Strategy ETF | $16 | 0.15% |

|---|

|

|

| Expenses Paid, Amount |

$ 16

|

|

| Expense Ratio, Percent |

0.15%

|

|

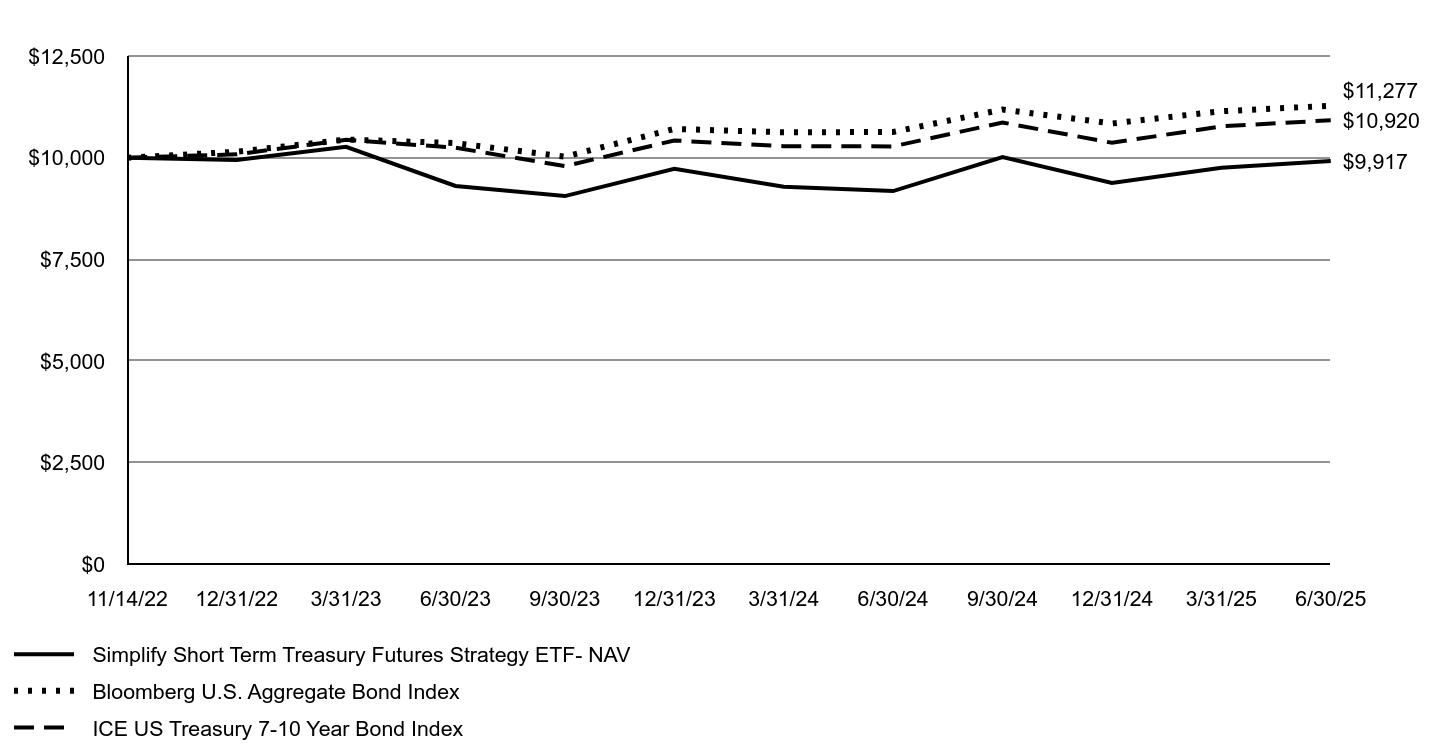

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund PerformanceFor the year ended June 30, 2025, TUA returned 8.04% vs. the 6.28% return of ICE U.S. Treasury 7-10 Year Bond Index for the same period, outperforming the index by 1.76%. The primary drivers of return were TUA’s long position in the most liquid, near-to-expiry 2-year U.S. Treasury futures contract and its holdings of short-term treasuries and cash. A long position in Treasury futures earns returns on the cheapest to deliver bond in exchange for paying a short-term financing rate. The strategy continues to face headwinds with an inverted yield curve (2-year rates below the Federal Funds rate), causing the coupon earned to be lower than the borrowing rate. However, 2-year rates decreased over the period benefiting TUA’s long exposure to this part of the yield curve, which is leveraged up 5 times. Looking forward, TUA’s performance will depend on interest rates movements. Increases in rates and/or further inversions will generally be harmful and decreases accompanied by steepening would be beneficial. Anticipating the future path interest rates may take and their term structure is challenging. |

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of future performance.

|

|

| Line Graph [Table Text Block] |

| Simplify Short Term Treasury Futures Strategy ETF- NAV | Bloomberg U.S. Aggregate Bond Index | ICE US Treasury 7-10 Year Bond Index |

|---|

11/14/22 | $10,000 | $10,000 | $10,000 |

|---|

12/31/22 | $9,940 | $10,146 | $10,081 |

|---|

3/31/23 | $10,267 | $10,446 | $10,438 |

|---|

6/30/23 | $9,303 | $10,358 | $10,244 |

|---|

9/30/23 | $9,055 | $10,024 | $9,792 |

|---|

12/31/23 | $9,725 | $10,707 | $10,422 |

|---|

3/31/24 | $9,286 | $10,624 | $10,283 |

|---|

6/30/24 | $9,179 | $10,631 | $10,277 |

|---|

9/30/24 | $10,014 | $11,183 | $10,864 |

|---|

12/31/24 | $9,380 | $10,841 | $10,366 |

|---|

3/31/25 | $9,753 | $11,142 | $10,770 |

|---|

6/30/25 | $9,917 | $11,277 | $10,920 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURN

Fund/Index | 1 Year | Since Inception

11/14/2022 |

|---|

Simplify Short Term Treasury Futures Strategy ETF - NAV | 8.04% | -0.32% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | 4.68% |

|---|

ICE US Treasury 7-10 Year Bond Index | 6.26% | 3.41% |

|---|

|

|

| Performance Inception Date |

Nov. 14, 2022

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| AssetsNet |

$ 666,170,733

|

|

| Holdings Count | Holding |

5

|

|

| Advisory Fees Paid, Amount |

$ 914,002

|

|

| InvestmentCompanyPortfolioTurnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to. Fund net assets | $666,170,733 |

|---|

Total number of portfolio holdings | 5 |

|---|

Total advisory fee paid | $914,002 |

|---|

Portfolio turnover rate | 0% |

|---|

|

|

| Holdings [Text Block] |

Investment Categories | % of Net Assets |

|---|

U.S. Treasury Bills | 99.8% |

|---|

Other Assets in Excess of Liabilities | 0.2% |

|---|

Total | 100.0% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000259297 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Simplify Target 15 Distribution ETF

|

|

| Class Name |

Simplify Target 15 Distribution ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Security Exchange Name |

NYSEArca

|

|

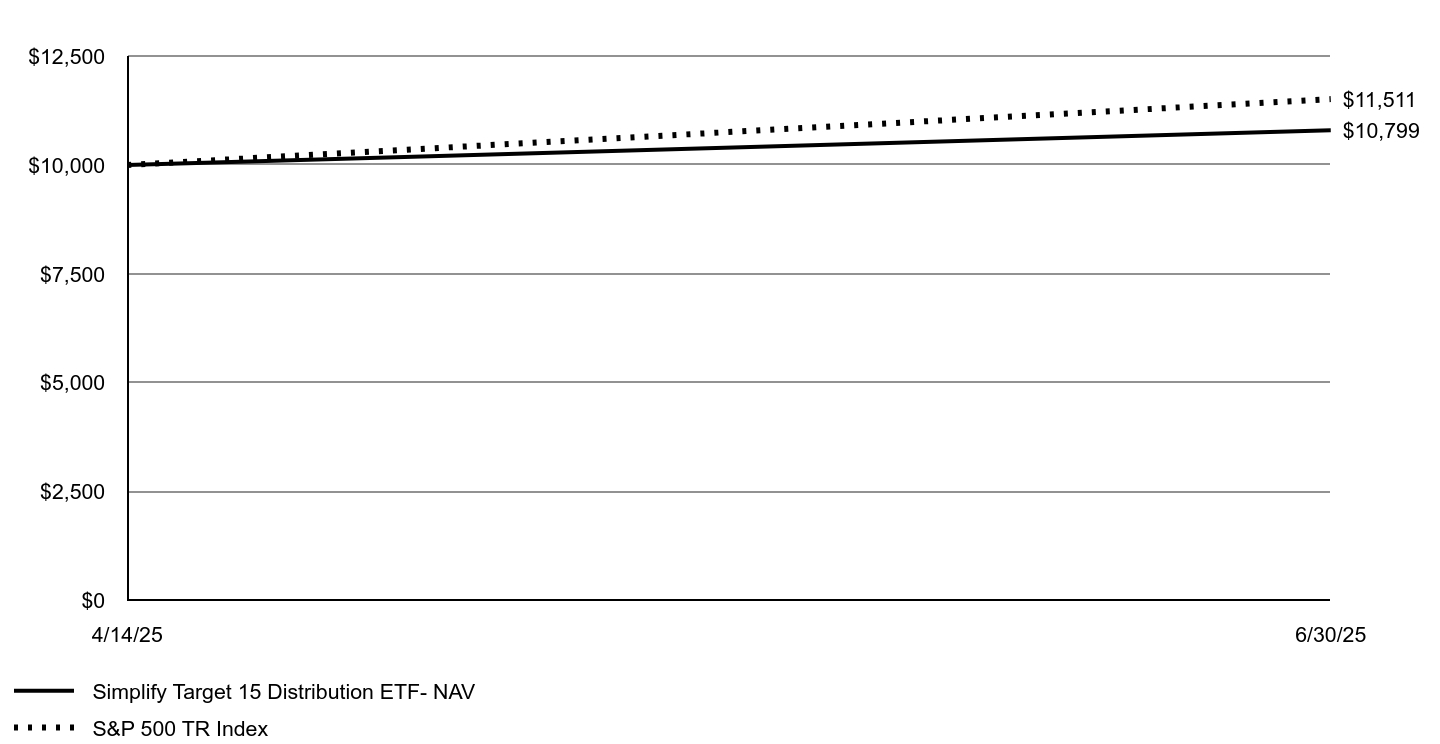

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Simplify Target 15 Distribution ETF (the "Fund") for the period of April 14, 2025 (commencement of operations) to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

|

|

| Additional Information Phone Number |

(855) 772-8488

|

|

| Additional Information Website |

www.simplify.us/resources

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the period? (based on a hypothetical $10,000 investment) Fund | Costs of a $10,000 investment | Costs paid as a

percentage of a $10,000 investment |

|---|

Simplify Target 15 Distribution ETF | $16Footnote Reference(1) | 0.75% |

|---|

| Footnote | Description | Footnote(1) | Based on the period April 14, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period. |

|

|

| Expenses Paid, Amount |

$ 16

|

[5] |

| Expense Ratio, Percent |

0.75%

|

|

| Expenses Short Period Footnote [Text Block] |

Based on the period April 14, 2025 (commencement of operations) through June 30, 2025. Expenses would have been higher if based on the full reporting period.

|

|

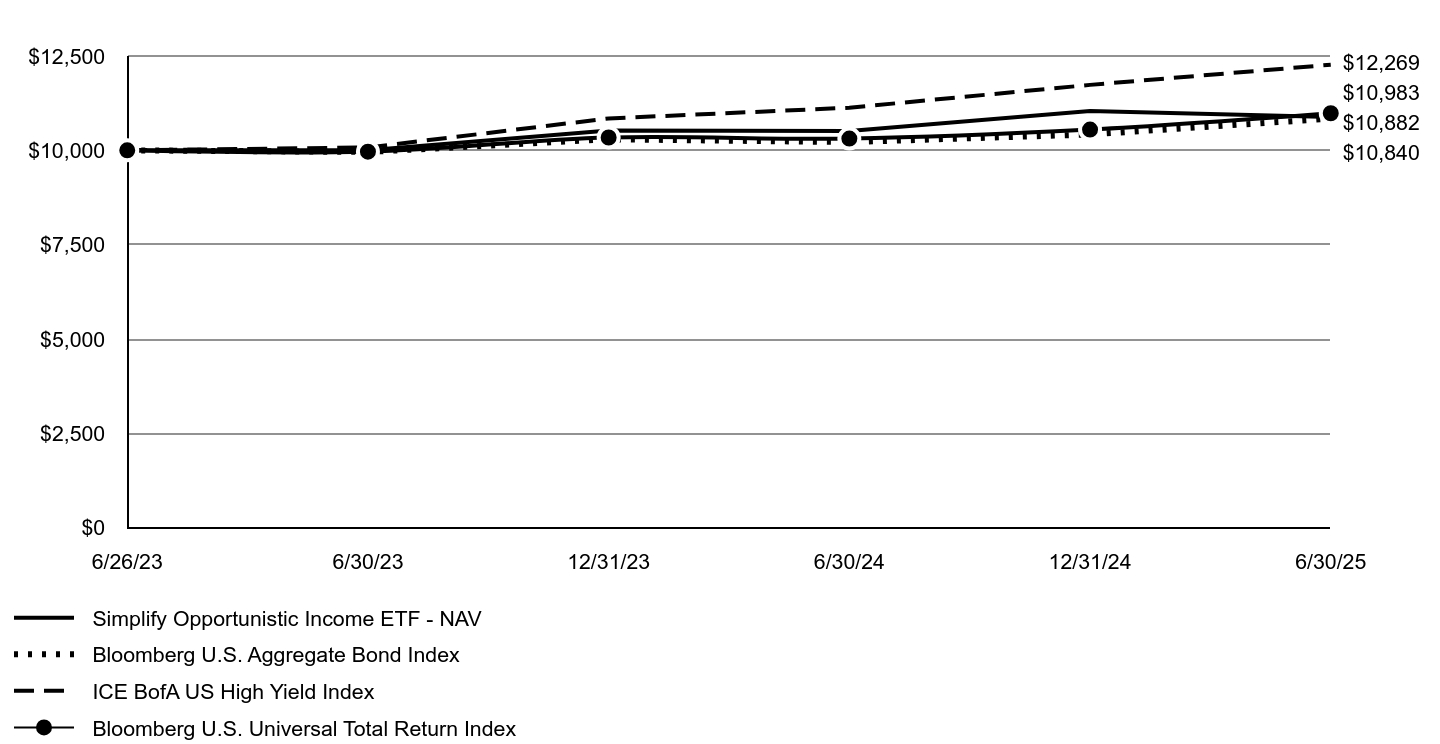

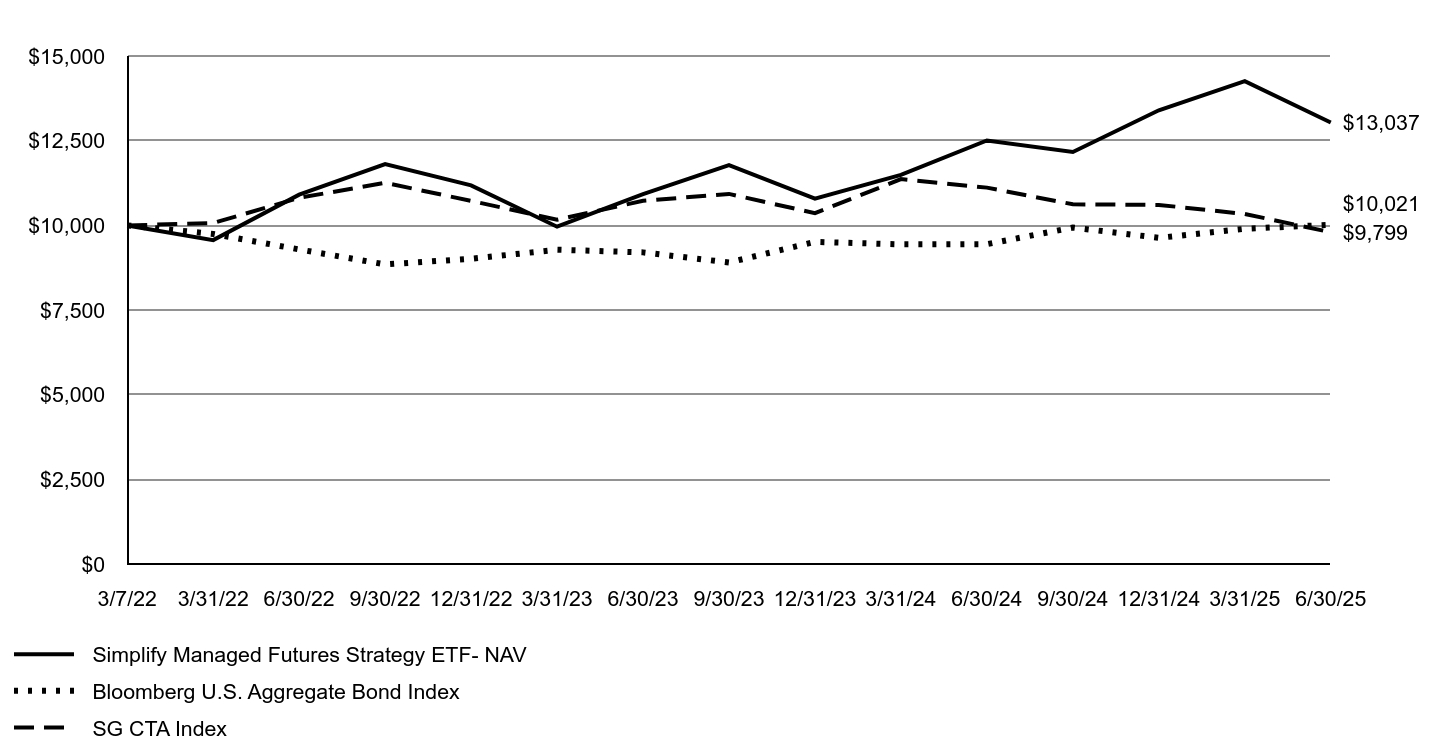

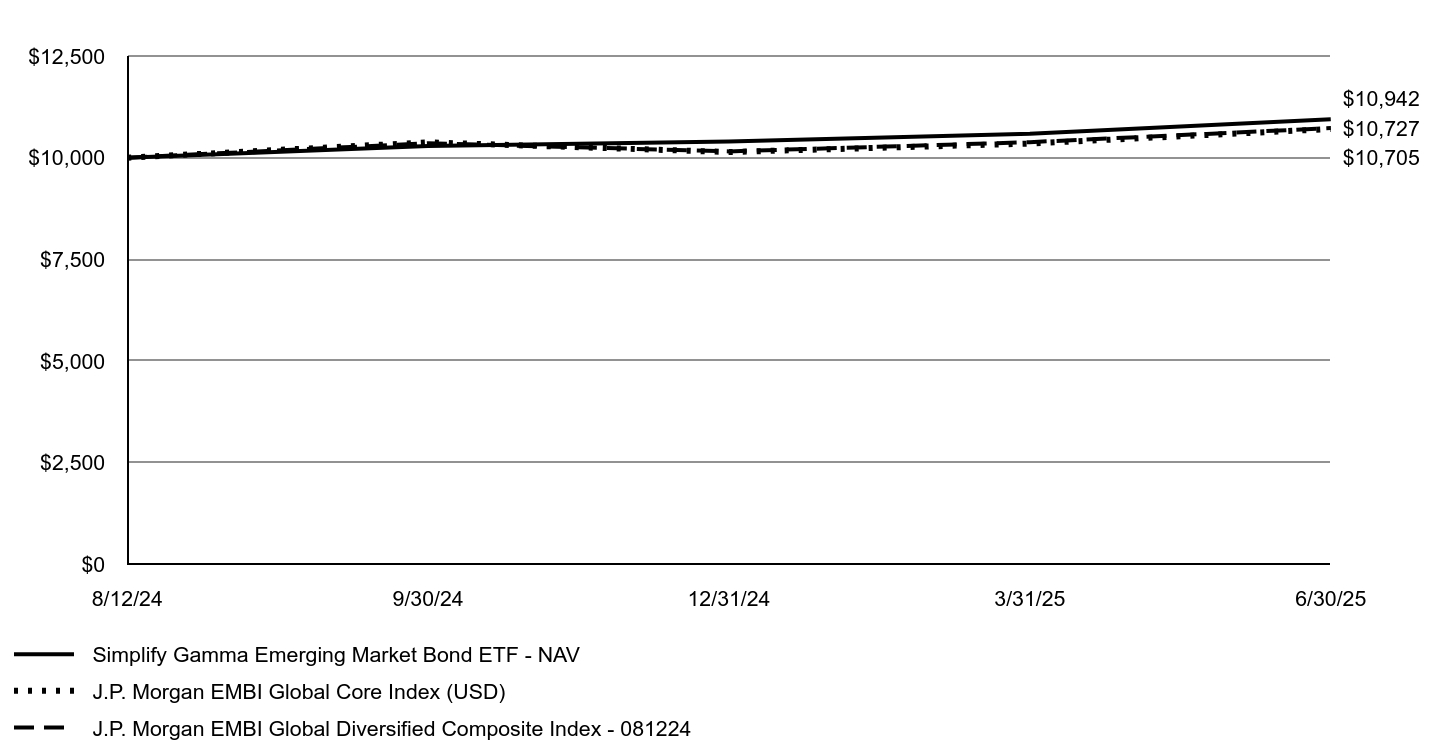

| Factors Affecting Performance [Text Block] |