Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Pacific Select Fund

|

| Entity Central Index Key |

0000813900

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000253928 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Bond Plus Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Bond Plus Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $33 | 0.65% |

|---|

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.65%

|

| AssetsNet |

$ 529,587,451

|

| Holdings Count | Holding |

405

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$529,587,451

- # of Portfolio Holdings405

- Year-to-Date Total Return4.02%

- Portfolio Turnover Rate5%

|

| Holdings [Text Block] |

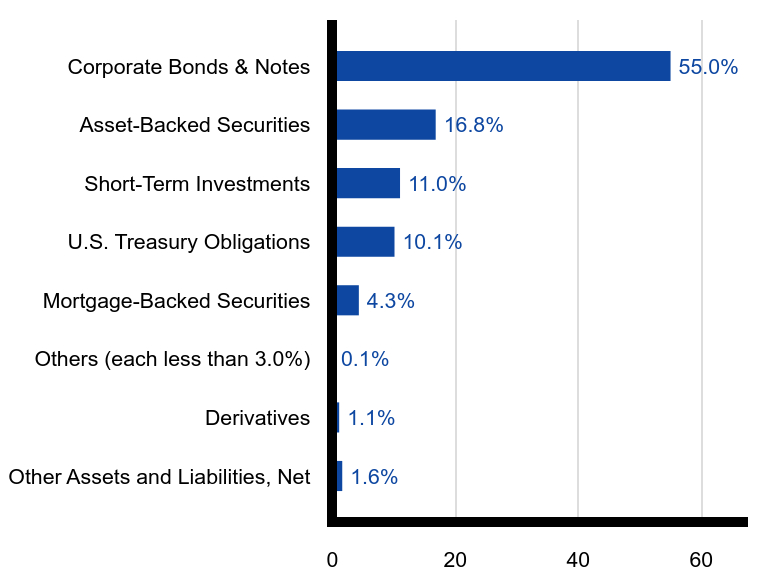

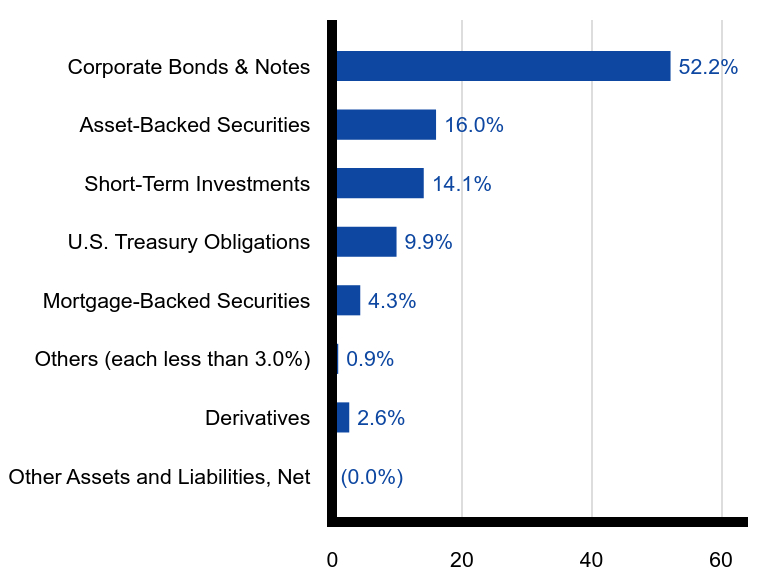

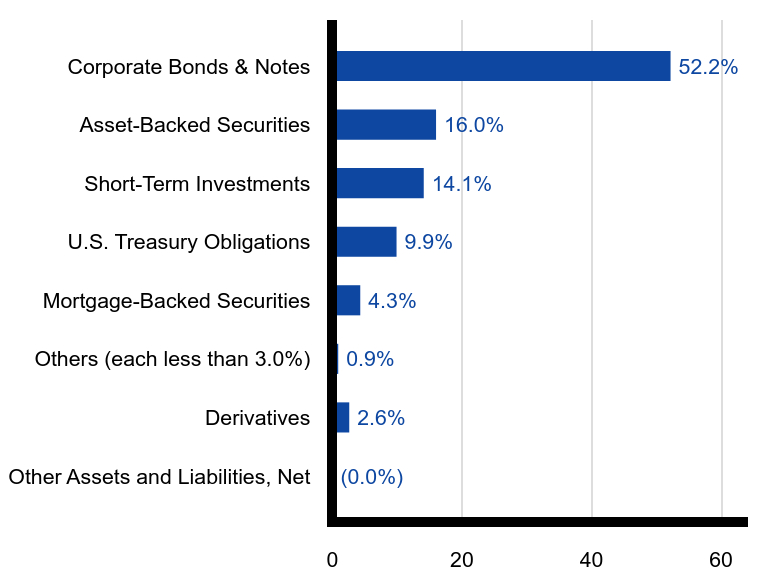

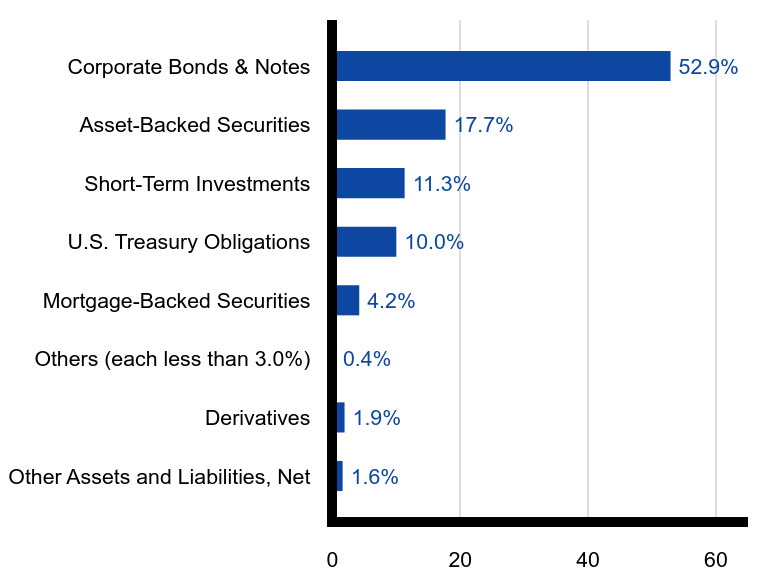

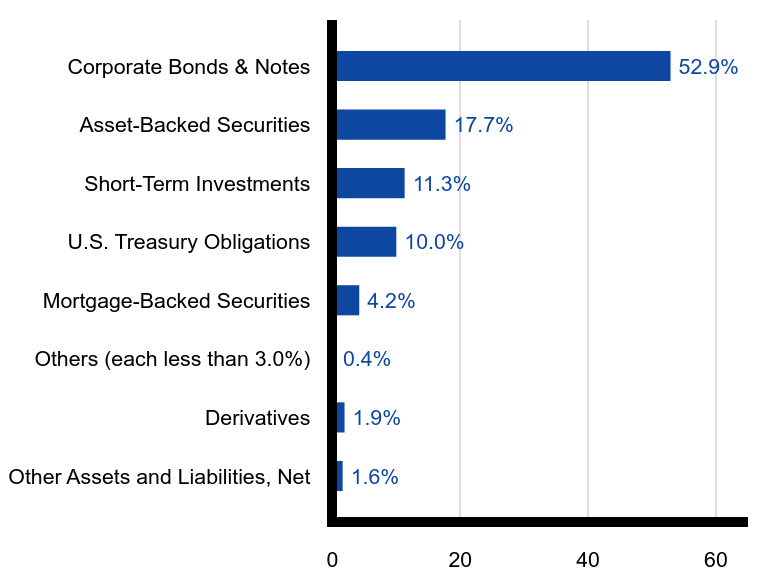

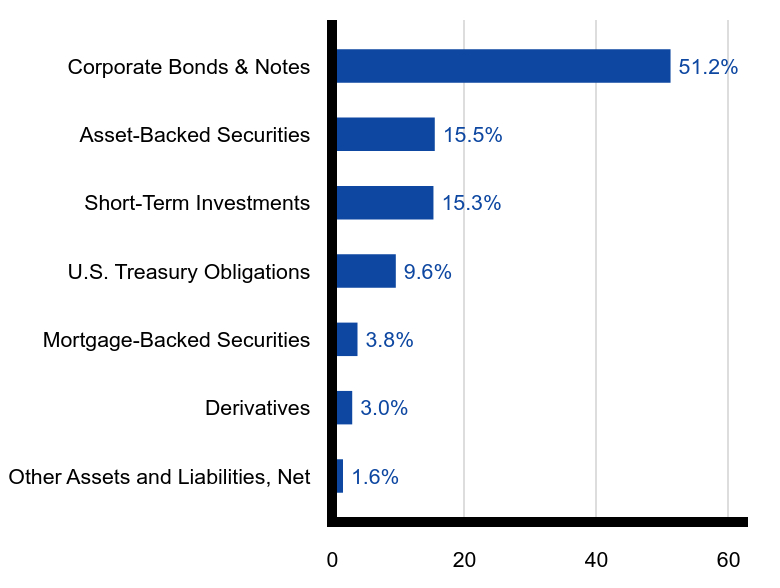

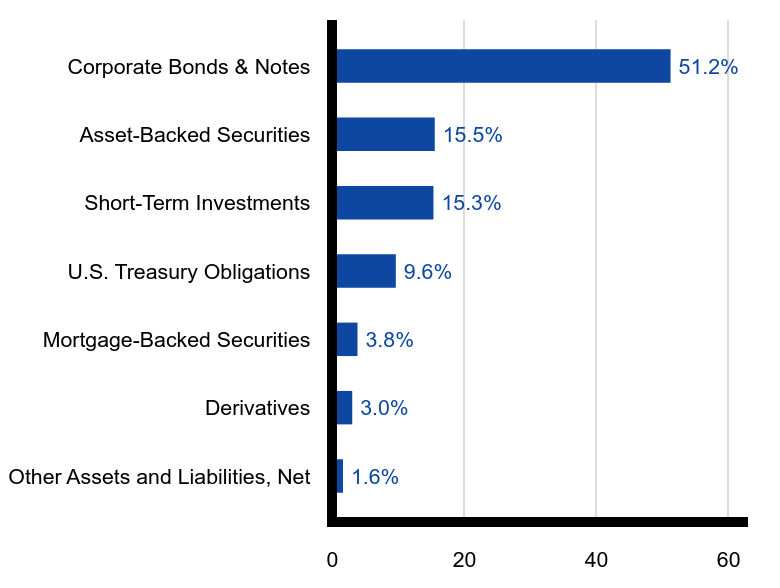

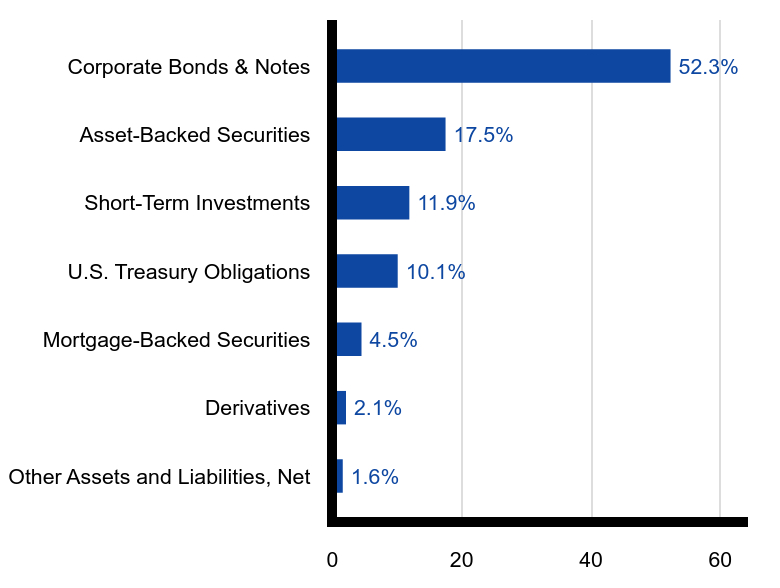

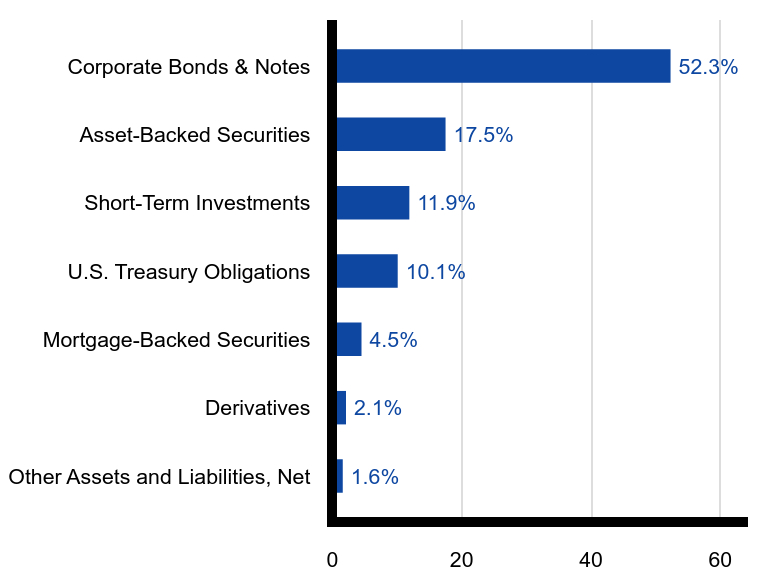

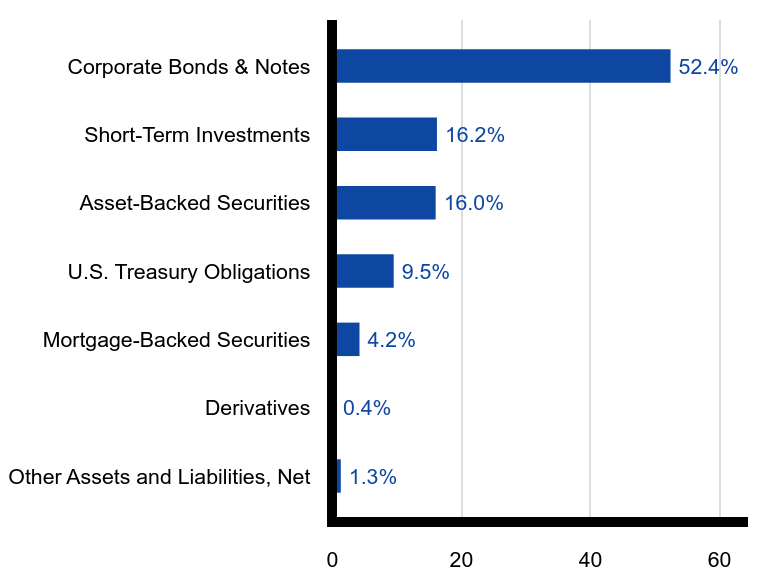

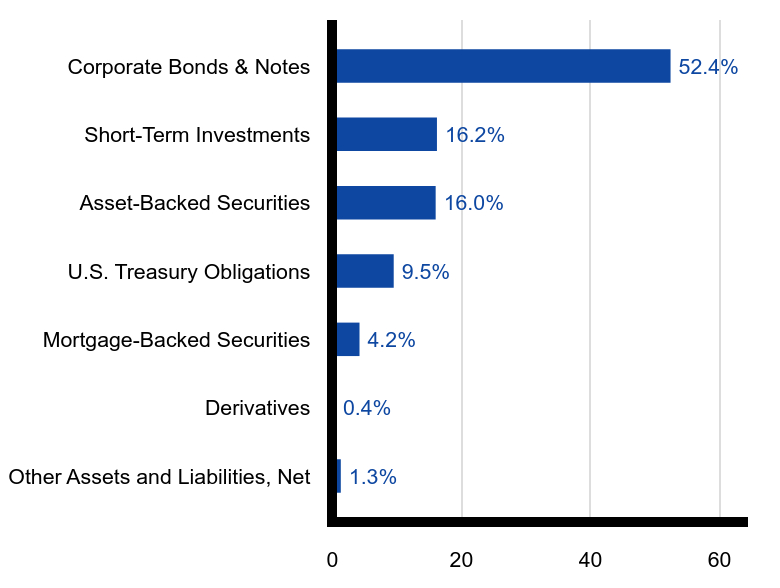

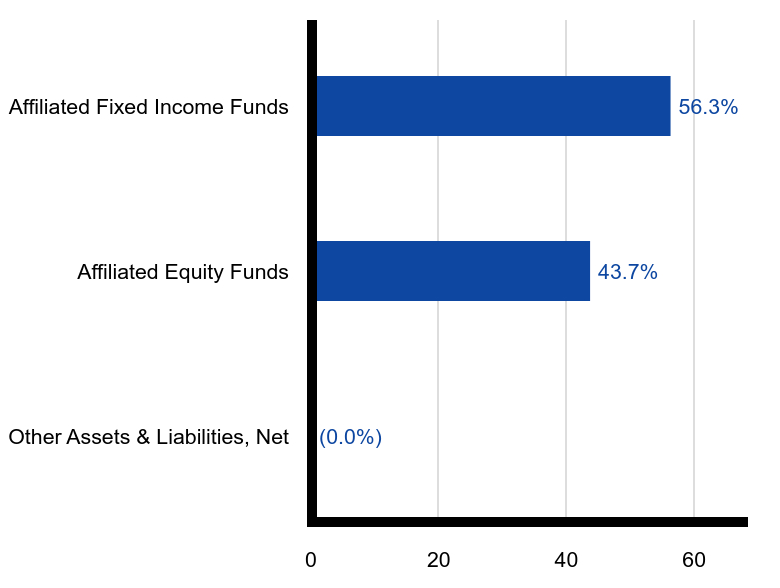

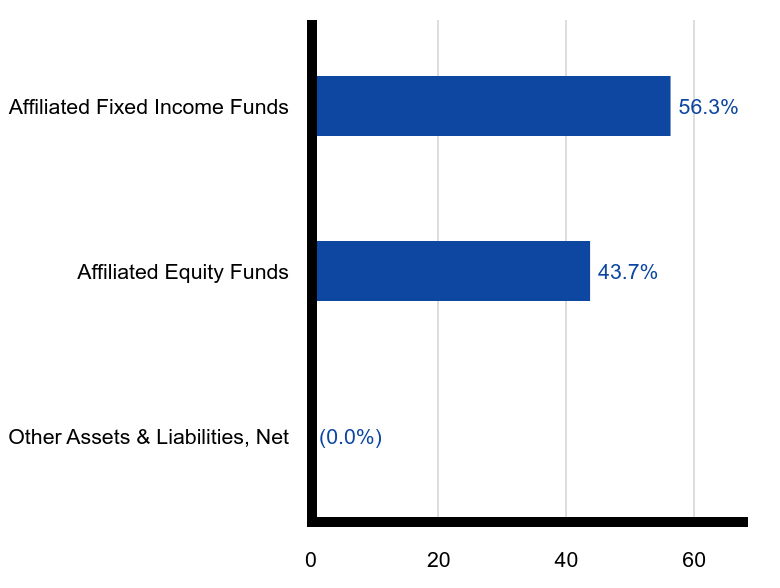

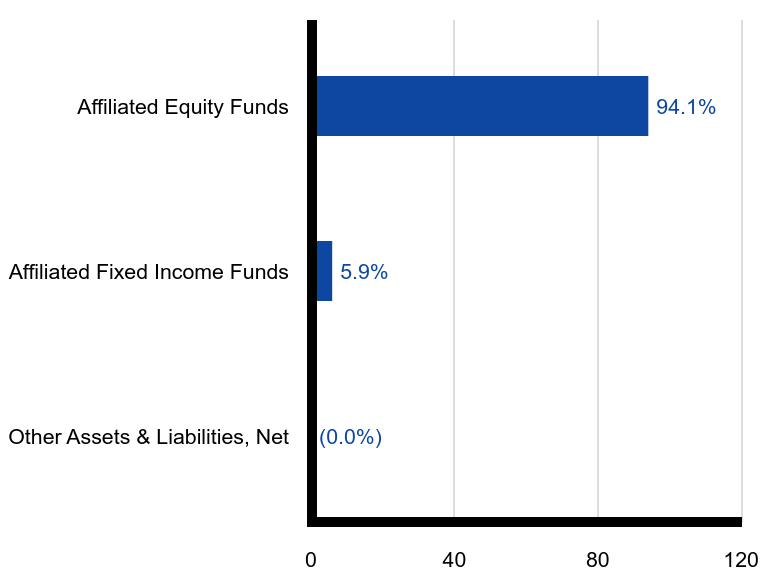

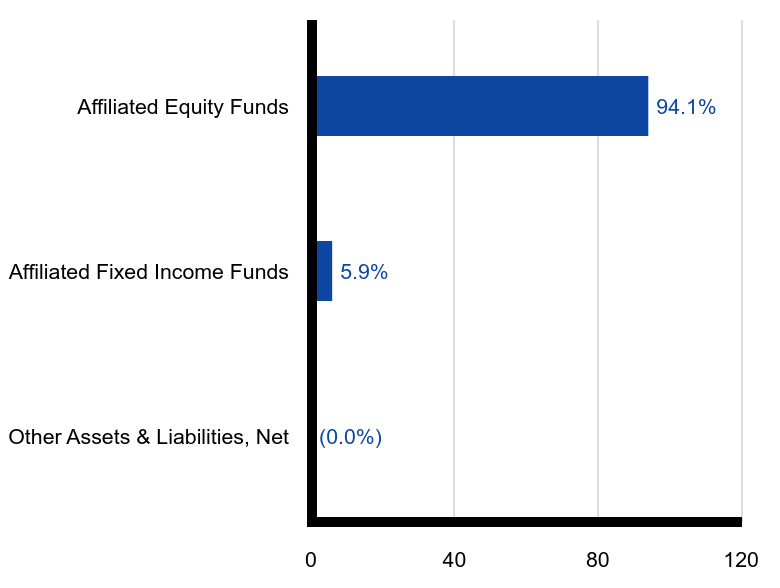

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 1.6% | Derivatives | 1.1% | Others (each less than 3.0%) | 0.1% | Mortgage-Backed Securities | 4.3% | U.S. Treasury Obligations | 10.1% | Short-Term Investments | 11.0% | Asset-Backed Securities | 16.8% | Corporate Bonds & Notes | 55.0% |

|

| C000253927 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Bond Plus Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Bond Plus Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $23 | 0.45% |

|---|

|

| Expenses Paid, Amount |

$ 23

|

| Expense Ratio, Percent |

0.45%

|

| AssetsNet |

$ 529,587,451

|

| Holdings Count | Holding |

405

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$529,587,451

- # of Portfolio Holdings405

- Year-to-Date Total Return4.12%

- Portfolio Turnover Rate5%

|

| Holdings [Text Block] |

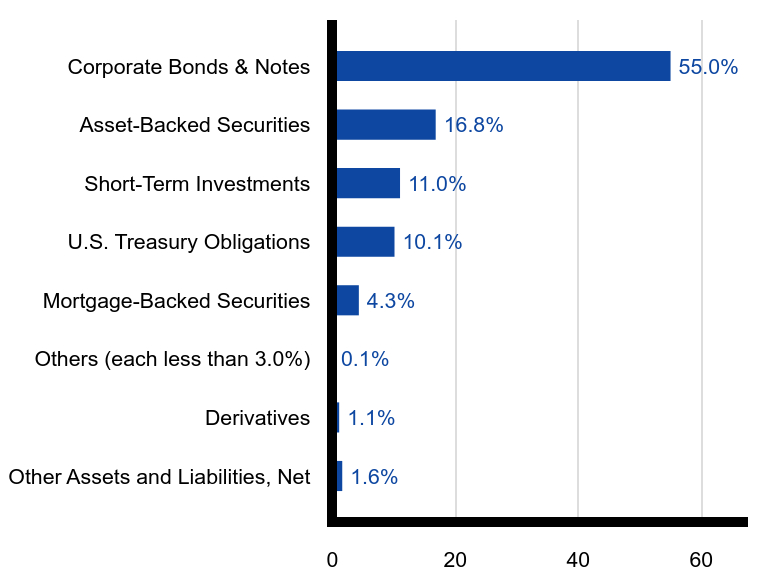

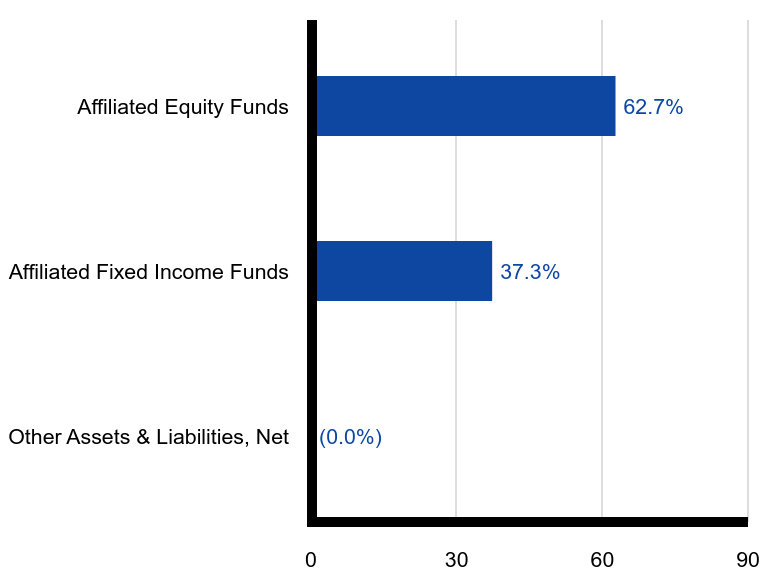

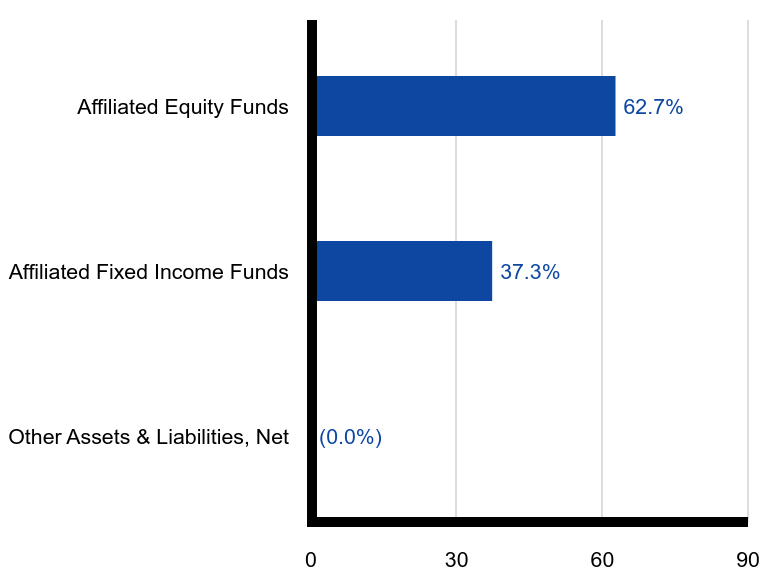

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 1.6% | Derivatives | 1.1% | Others (each less than 3.0%) | 0.1% | Mortgage-Backed Securities | 4.3% | U.S. Treasury Obligations | 10.1% | Short-Term Investments | 11.0% | Asset-Backed Securities | 16.8% | Corporate Bonds & Notes | 55.0% |

|

| C000153750 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Core Income Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Core Income Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $39 | 0.77% |

|---|

|

| Expenses Paid, Amount |

$ 39

|

| Expense Ratio, Percent |

0.77%

|

| AssetsNet |

$ 323,183,748

|

| Holdings Count | Holding |

281

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$323,183,748

- # of Portfolio Holdings281

- Year-to-Date Total Return3.35%

- Portfolio Turnover Rate41%

|

| Holdings [Text Block] |

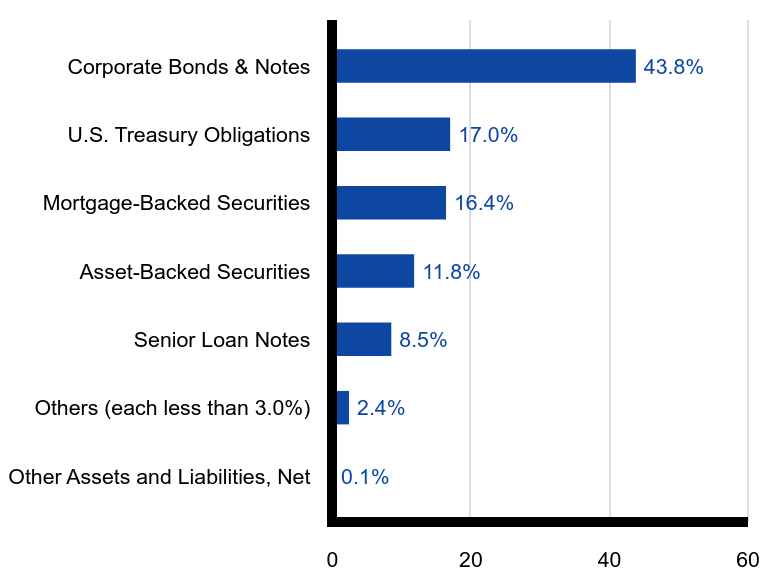

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 0.1% | Others (each less than 3.0%) | 2.4% | Senior Loan Notes | 8.5% | Asset-Backed Securities | 11.8% | Mortgage-Backed Securities | 16.4% | U.S. Treasury Obligations | 17.0% | Corporate Bonds & Notes | 43.8% |

|

| C000153751 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Core Income Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Core Income Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $29 | 0.57% |

|---|

|

| Expenses Paid, Amount |

$ 29

|

| Expense Ratio, Percent |

0.57%

|

| AssetsNet |

$ 323,183,748

|

| Holdings Count | Holding |

281

|

| InvestmentCompanyPortfolioTurnover |

41.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$323,183,748

- # of Portfolio Holdings281

- Year-to-Date Total Return3.46%

- Portfolio Turnover Rate41%

|

| Holdings [Text Block] |

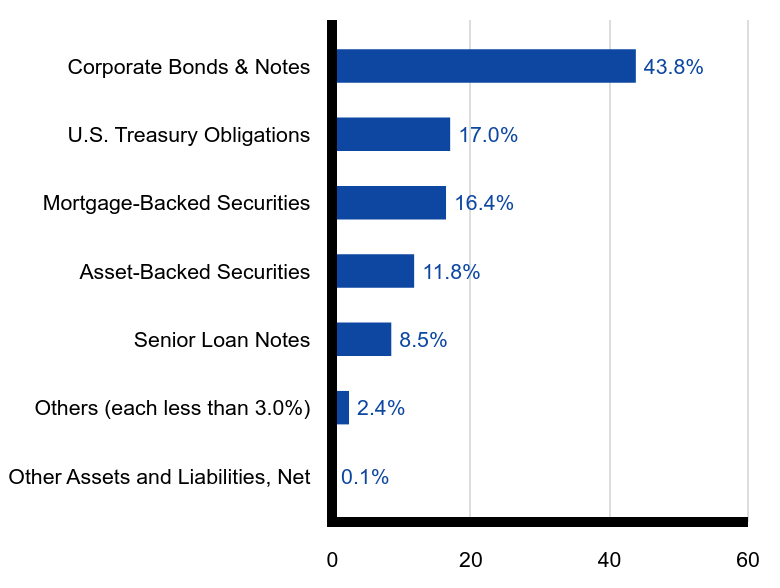

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 0.1% | Others (each less than 3.0%) | 2.4% | Senior Loan Notes | 8.5% | Asset-Backed Securities | 11.8% | Mortgage-Backed Securities | 16.4% | U.S. Treasury Obligations | 17.0% | Corporate Bonds & Notes | 43.8% |

|

| C000078095 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diversified Bond Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Diversified Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $33 | 0.65% |

|---|

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.65%

|

| AssetsNet |

$ 1,771,158,634

|

| Holdings Count | Holding |

1,023

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$1,771,158,634

- # of Portfolio Holdings1,023

- Year-to-Date Total Return4.38%

- Portfolio Turnover Rate60%

|

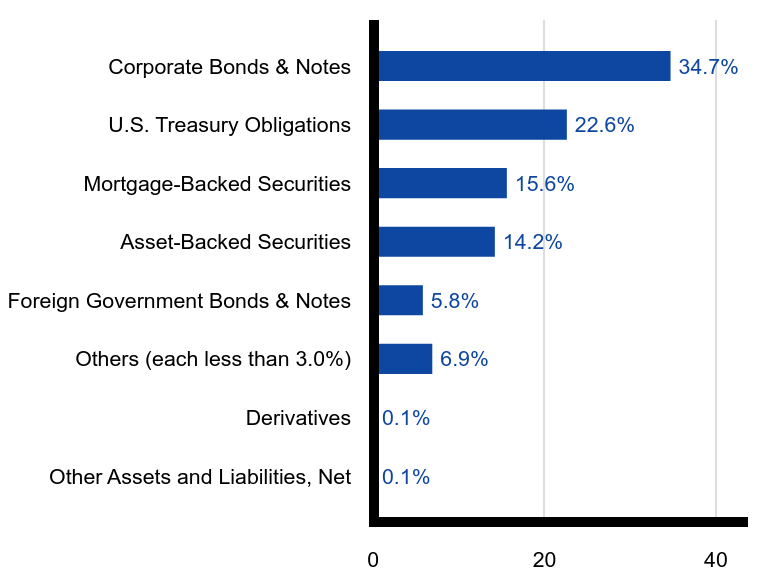

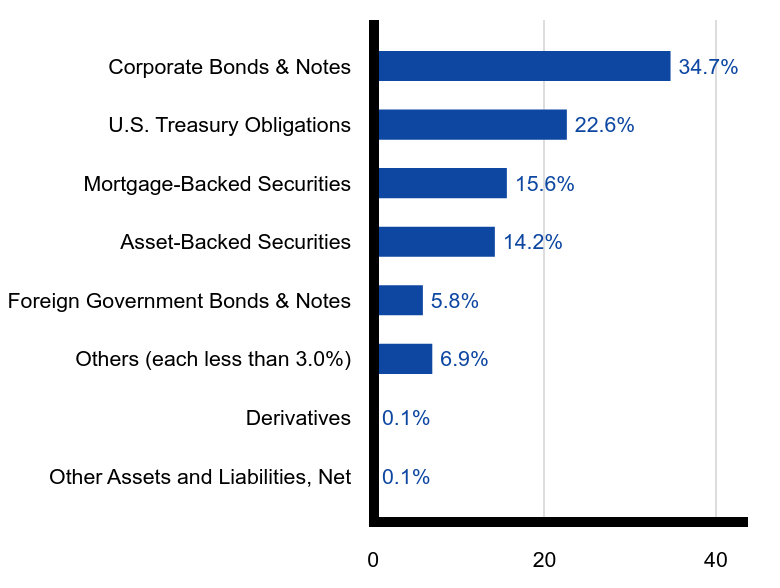

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 0.1% | Derivatives | 0.1% | Others (each less than 3.0%) | 6.9% | Foreign Government Bonds & Notes | 5.8% | Asset-Backed Securities | 14.2% | Mortgage-Backed Securities | 15.6% | U.S. Treasury Obligations | 22.6% | Corporate Bonds & Notes | 34.7% |

|

| C000098966 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diversified Bond Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Diversified Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $23 | 0.45% |

|---|

|

| Expenses Paid, Amount |

$ 23

|

| Expense Ratio, Percent |

0.45%

|

| AssetsNet |

$ 1,771,158,634

|

| Holdings Count | Holding |

1,023

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$1,771,158,634

- # of Portfolio Holdings1,023

- Year-to-Date Total Return4.50%

- Portfolio Turnover Rate60%

|

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 0.1% | Derivatives | 0.1% | Others (each less than 3.0%) | 6.9% | Foreign Government Bonds & Notes | 5.8% | Asset-Backed Securities | 14.2% | Mortgage-Backed Securities | 15.6% | U.S. Treasury Obligations | 22.6% | Corporate Bonds & Notes | 34.7% |

|

| C000111629 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Floating Rate Income Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Floating Rate Income Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $47 | 0.93% |

|---|

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.93%

|

| AssetsNet |

$ 348,548,929

|

| Holdings Count | Holding |

127

|

| InvestmentCompanyPortfolioTurnover |

104.00%

|

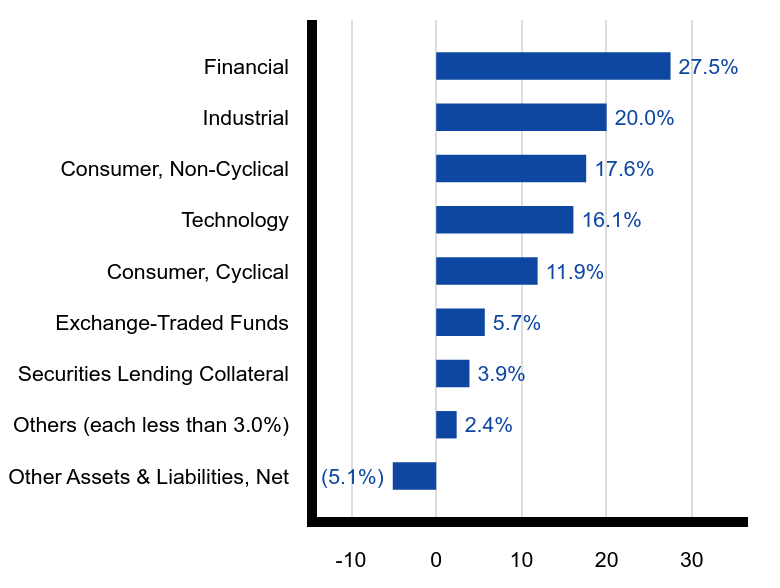

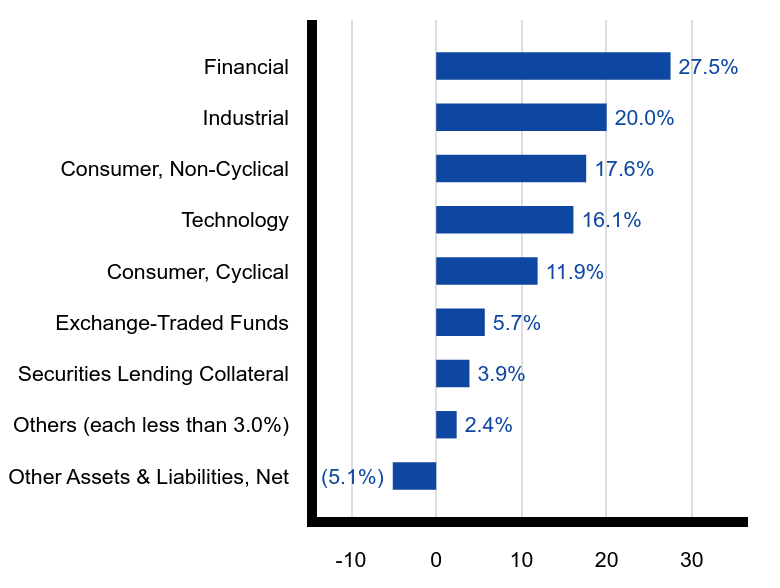

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$348,548,929

- # of Portfolio Holdings127

- Year-to-Date Total Return2.63%

- Portfolio Turnover Rate104%

|

| Holdings [Text Block] |

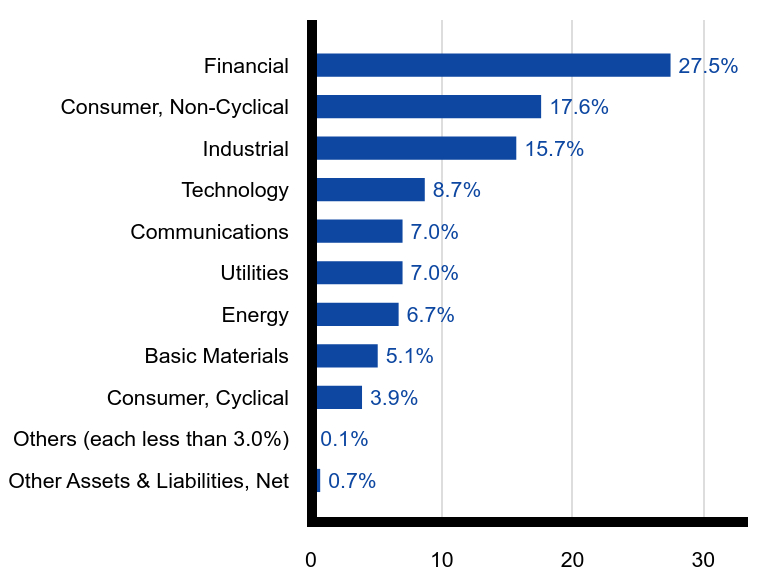

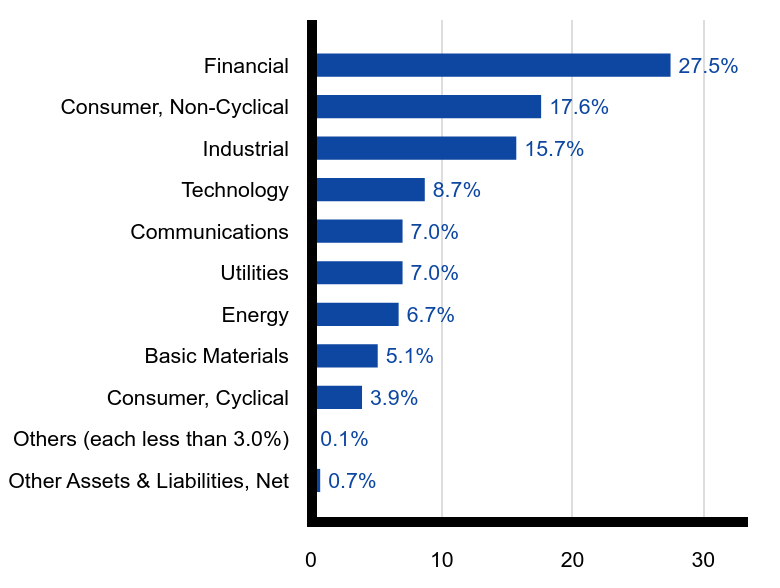

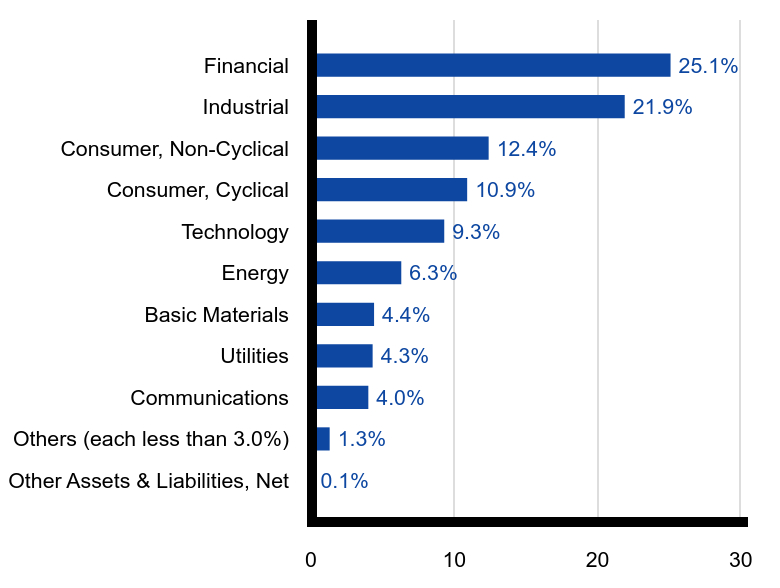

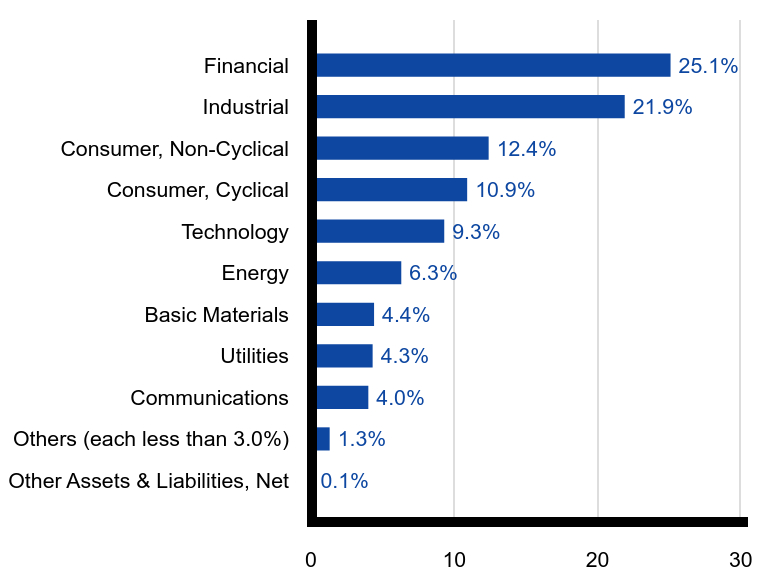

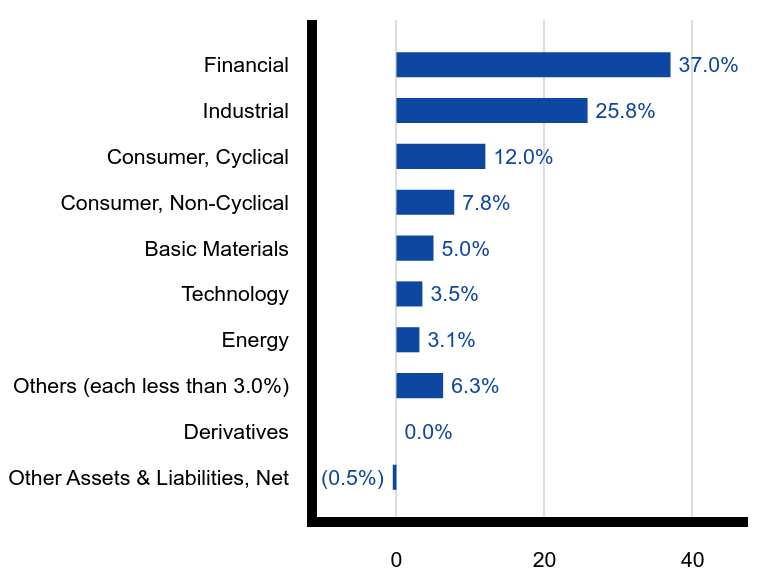

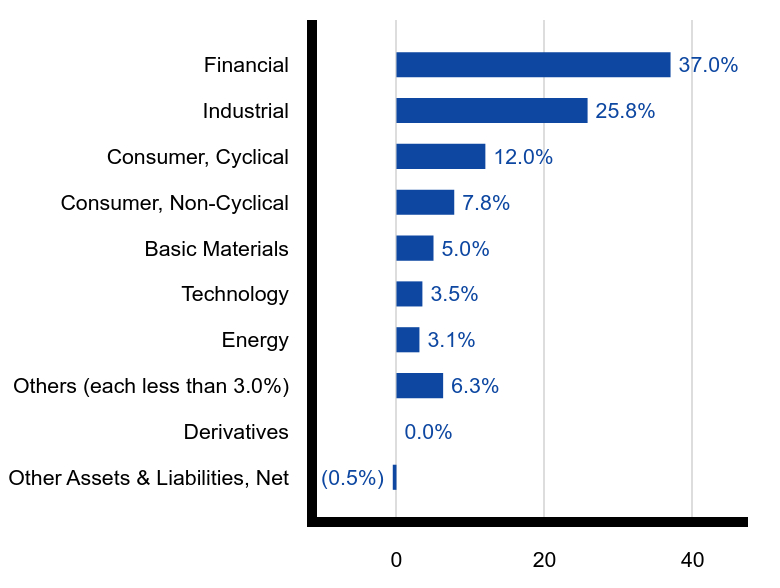

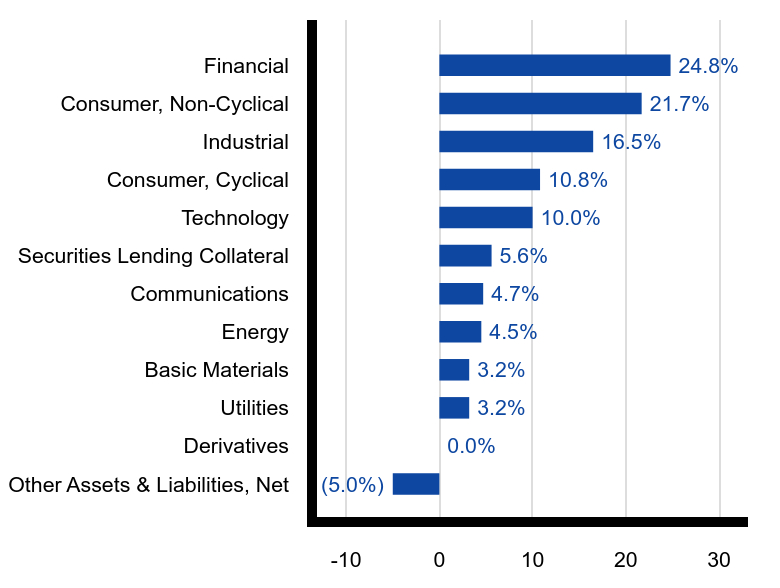

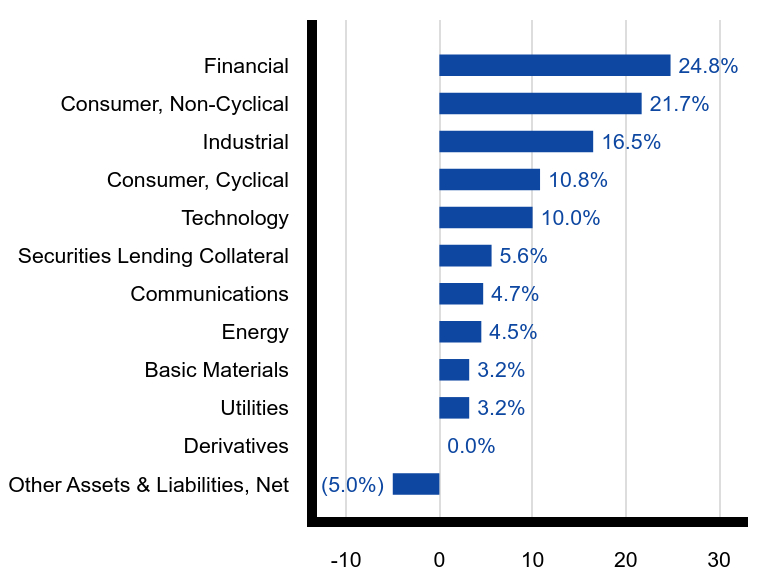

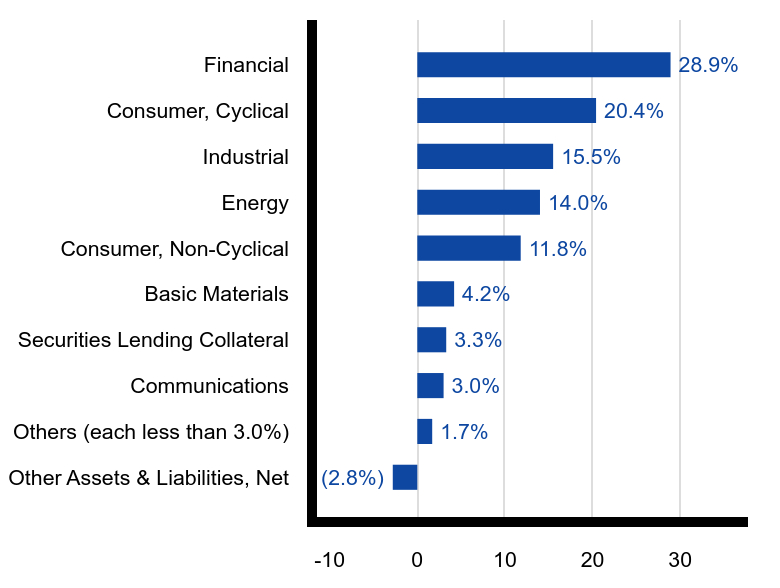

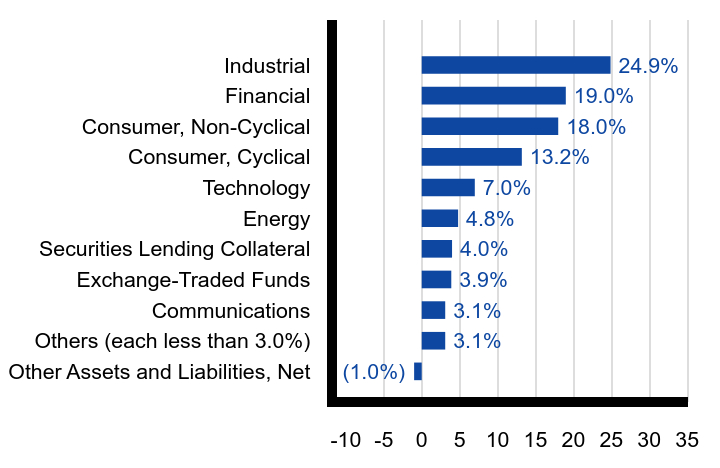

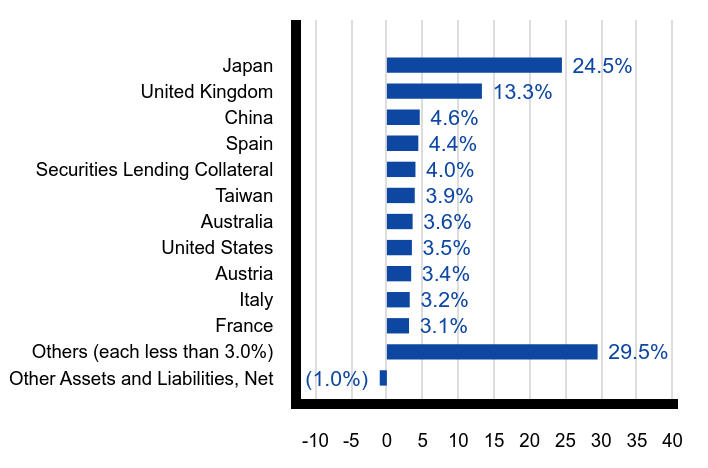

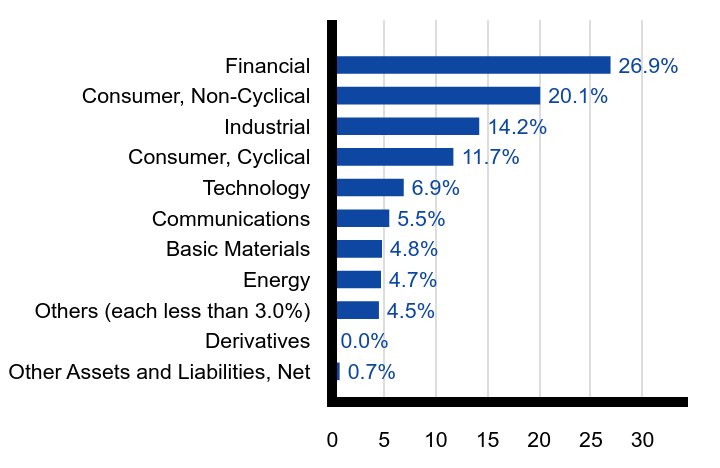

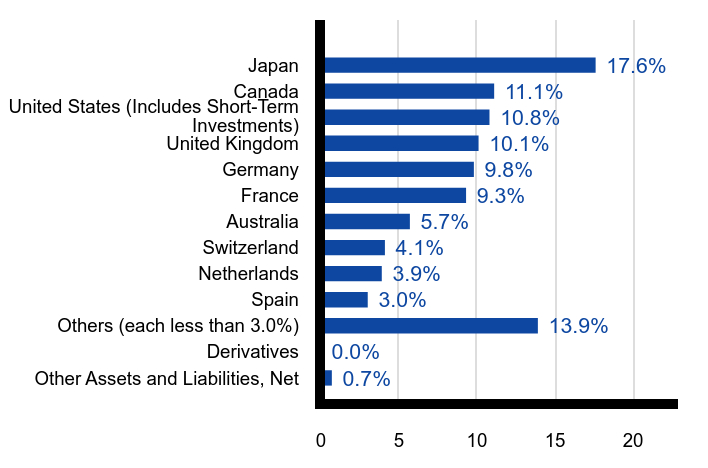

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | (5.1%) | Others (each less than 3.0%) | 2.4% | Securities Lending Collateral | 3.9% | Exchange-Traded Funds | 5.7% | Consumer, Cyclical | 11.9% | Technology | 16.1% | Consumer, Non-Cyclical | 17.6% | Industrial | 20.0% | Financial | 27.5% |

|

| C000111630 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Floating Rate Income Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Floating Rate Income Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $36 | 0.72% |

|---|

|

| Expenses Paid, Amount |

$ 36

|

| Expense Ratio, Percent |

0.72%

|

| AssetsNet |

$ 348,548,929

|

| Holdings Count | Holding |

127

|

| InvestmentCompanyPortfolioTurnover |

104.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$348,548,929

- # of Portfolio Holdings127

- Year-to-Date Total Return2.73%

- Portfolio Turnover Rate104%

|

| Holdings [Text Block] |

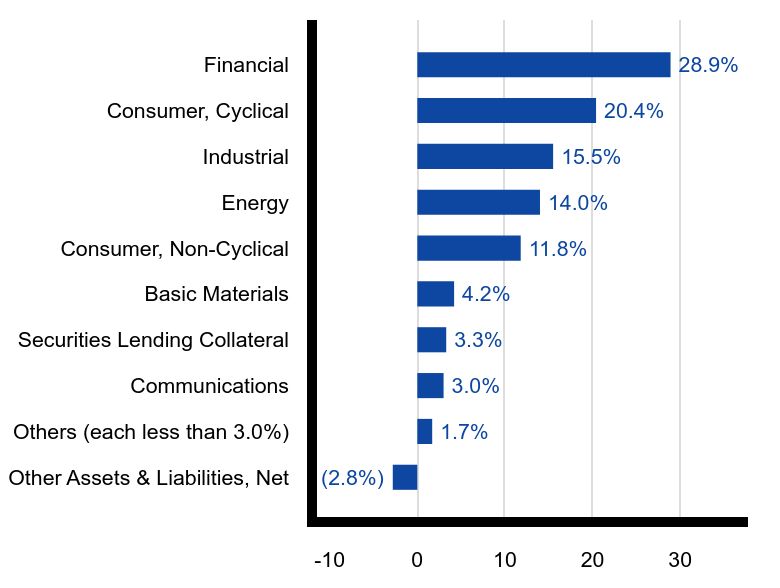

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | (5.1%) | Others (each less than 3.0%) | 2.4% | Securities Lending Collateral | 3.9% | Exchange-Traded Funds | 5.7% | Consumer, Cyclical | 11.9% | Technology | 16.1% | Consumer, Non-Cyclical | 17.6% | Industrial | 20.0% | Financial | 27.5% |

|

| C000078079 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

High Yield Bond Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the High Yield Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $33 | 0.65% |

|---|

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.65%

|

| AssetsNet |

$ 647,948,911

|

| Holdings Count | Holding |

216

|

| InvestmentCompanyPortfolioTurnover |

42.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$647,948,911

- # of Portfolio Holdings216

- Year-to-Date Total Return4.14%

- Portfolio Turnover Rate42%

|

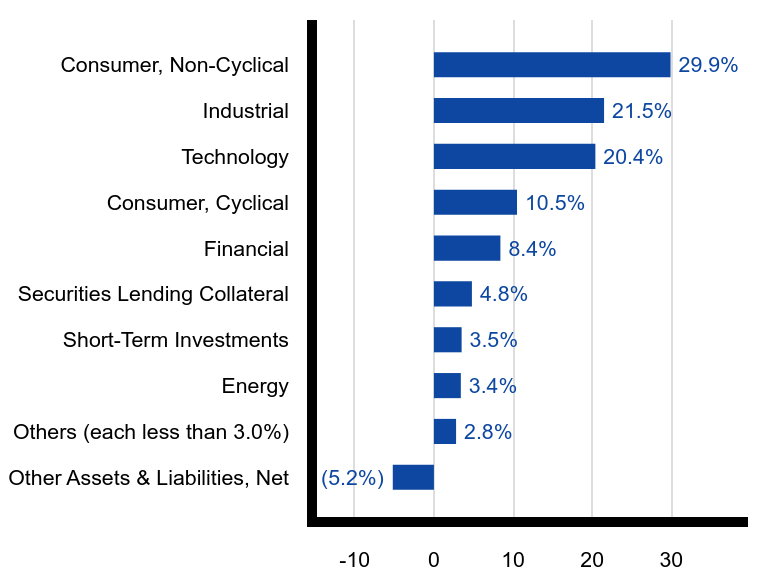

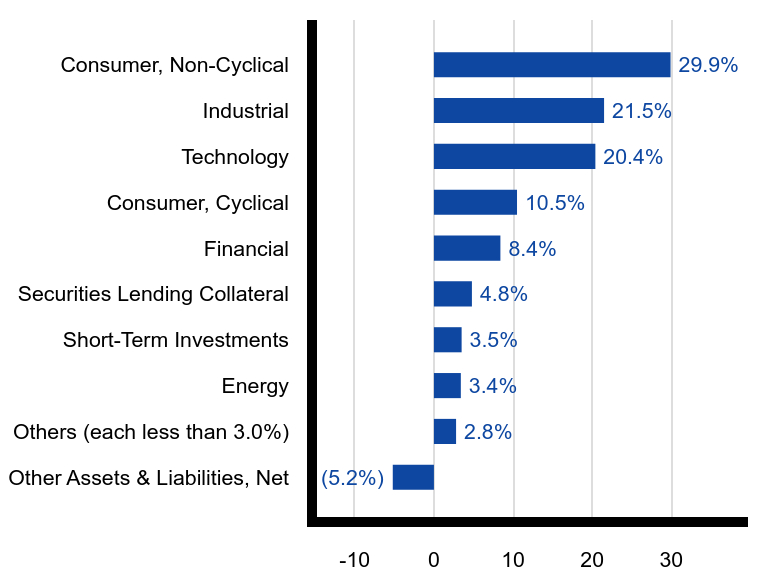

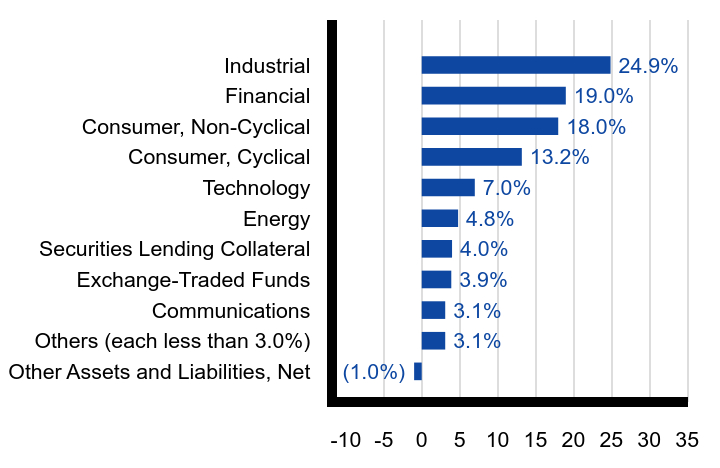

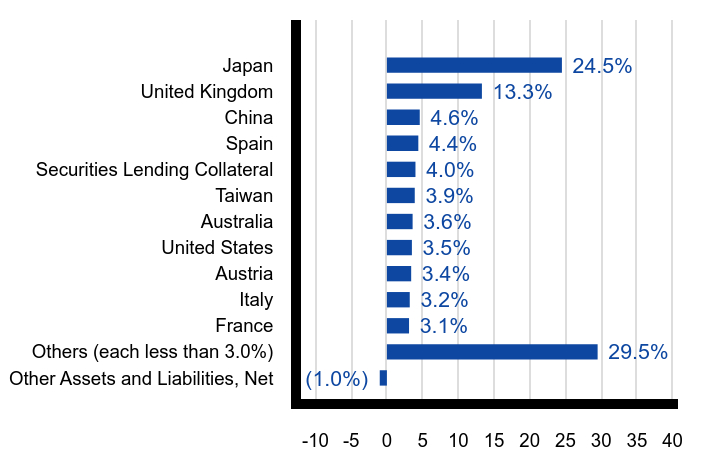

| Holdings [Text Block] |

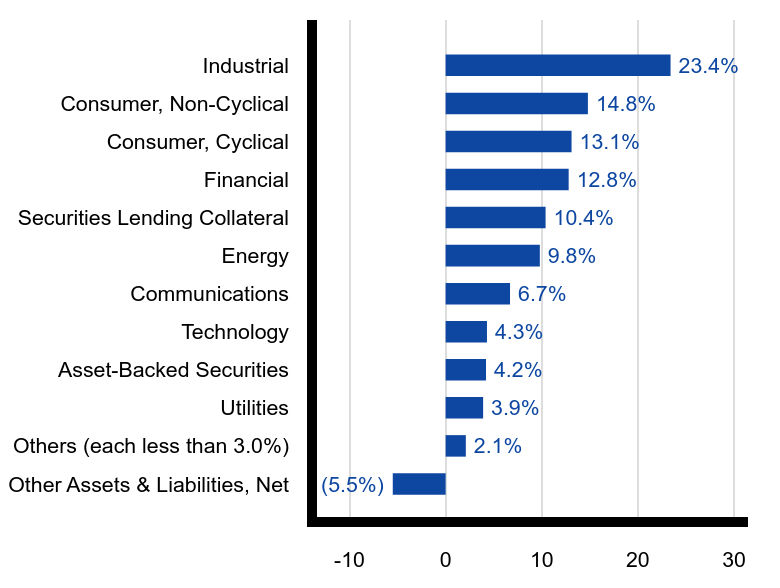

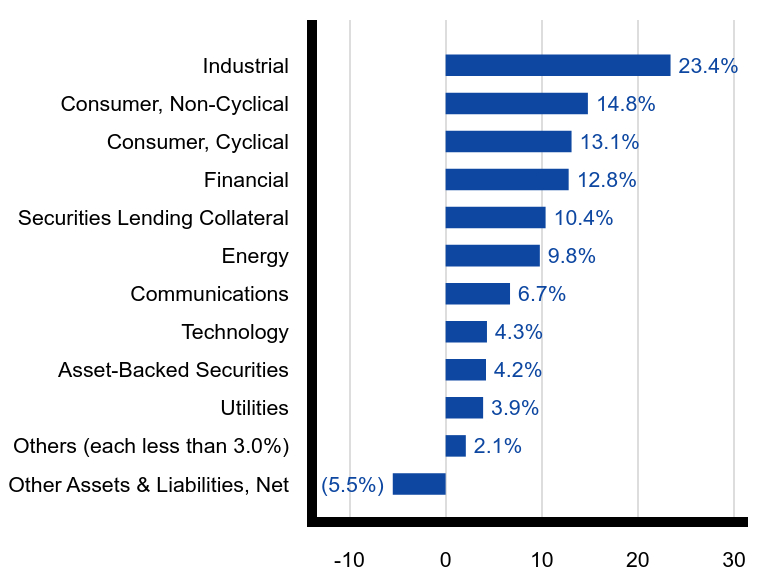

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | (5.5%) | Others (each less than 3.0%) | 2.1% | Utilities | 3.9% | Asset-Backed Securities | 4.2% | Technology | 4.3% | Communications | 6.7% | Energy | 9.8% | Securities Lending Collateral | 10.4% | Financial | 12.8% | Consumer, Cyclical | 13.1% | Consumer, Non-Cyclical | 14.8% | Industrial | 23.4% |

|

| C000098951 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

High Yield Bond Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the High Yield Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $23 | 0.45% |

|---|

|

| Expenses Paid, Amount |

$ 23

|

| Expense Ratio, Percent |

0.45%

|

| AssetsNet |

$ 647,948,911

|

| Holdings Count | Holding |

216

|

| InvestmentCompanyPortfolioTurnover |

42.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$647,948,911

- # of Portfolio Holdings216

- Year-to-Date Total Return4.24%

- Portfolio Turnover Rate42%

|

| Holdings [Text Block] |

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | (5.5%) | Others (each less than 3.0%) | 2.1% | Utilities | 3.9% | Asset-Backed Securities | 4.2% | Technology | 4.3% | Communications | 6.7% | Energy | 9.8% | Securities Lending Collateral | 10.4% | Financial | 12.8% | Consumer, Cyclical | 13.1% | Consumer, Non-Cyclical | 14.8% | Industrial | 23.4% |

|

| C000078081 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Inflation Managed Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Inflation Managed Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $65 | 1.28% |

|---|

|

| Expenses Paid, Amount |

$ 65

|

| Expense Ratio, Percent |

1.28%

|

| AssetsNet |

$ 349,567,543

|

| Holdings Count | Holding |

317

|

| InvestmentCompanyPortfolioTurnover |

97.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$349,567,543

- # of Portfolio Holdings317

- Year-to-Date Total Return5.43%

- Portfolio Turnover Rate97%

|

| Holdings [Text Block] |

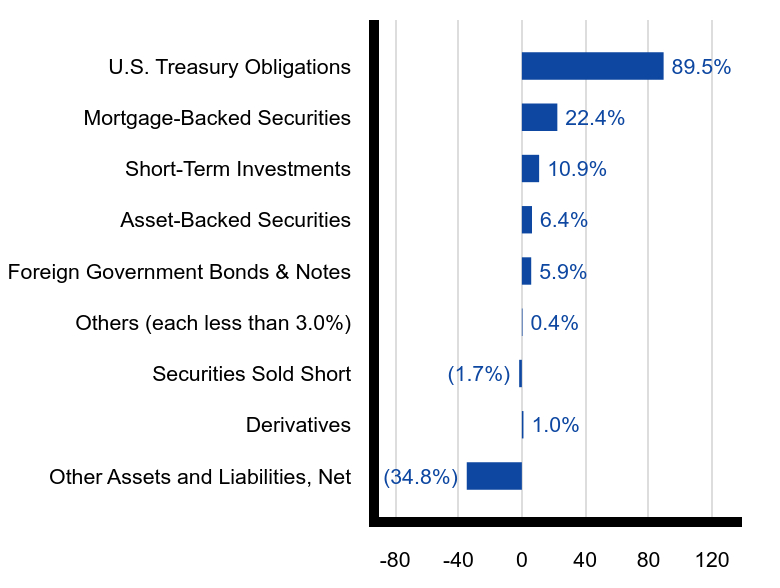

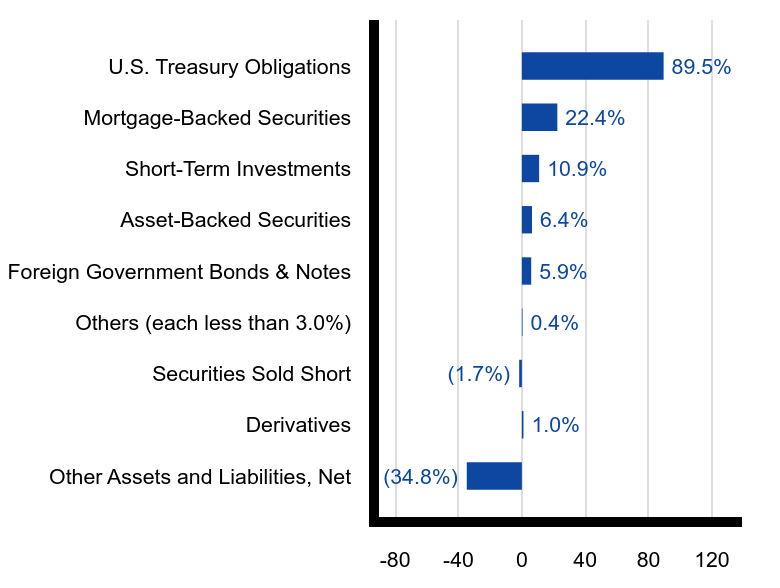

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | (34.8%) | Derivatives | 1.0% | Securities Sold Short | (1.7%) | Others (each less than 3.0%) | 0.4% | Foreign Government Bonds & Notes | 5.9% | Asset-Backed Securities | 6.4% | Short-Term Investments | 10.9% | Mortgage-Backed Securities | 22.4% | U.S. Treasury Obligations | 89.5% |

|

| C000098953 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Inflation Managed Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Inflation Managed Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $55 | 1.08% |

|---|

|

| Expenses Paid, Amount |

$ 55

|

| Expense Ratio, Percent |

1.08%

|

| AssetsNet |

$ 349,567,543

|

| Holdings Count | Holding |

317

|

| InvestmentCompanyPortfolioTurnover |

97.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$349,567,543

- # of Portfolio Holdings317

- Year-to-Date Total Return5.53%

- Portfolio Turnover Rate97%

|

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | (34.8%) | Derivatives | 1.0% | Securities Sold Short | (1.7%) | Others (each less than 3.0%) | 0.4% | Foreign Government Bonds & Notes | 5.9% | Asset-Backed Securities | 6.4% | Short-Term Investments | 10.9% | Mortgage-Backed Securities | 22.4% | U.S. Treasury Obligations | 89.5% |

|

| C000222604 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Intermediate Bond Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Intermediate Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $33 | 0.66% |

|---|

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.66%

|

| AssetsNet |

$ 726,838,652

|

| Holdings Count | Holding |

539

|

| InvestmentCompanyPortfolioTurnover |

84.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$726,838,652

- # of Portfolio Holdings539

- Year-to-Date Total Return3.98%

- Portfolio Turnover Rate84%

|

| Holdings [Text Block] |

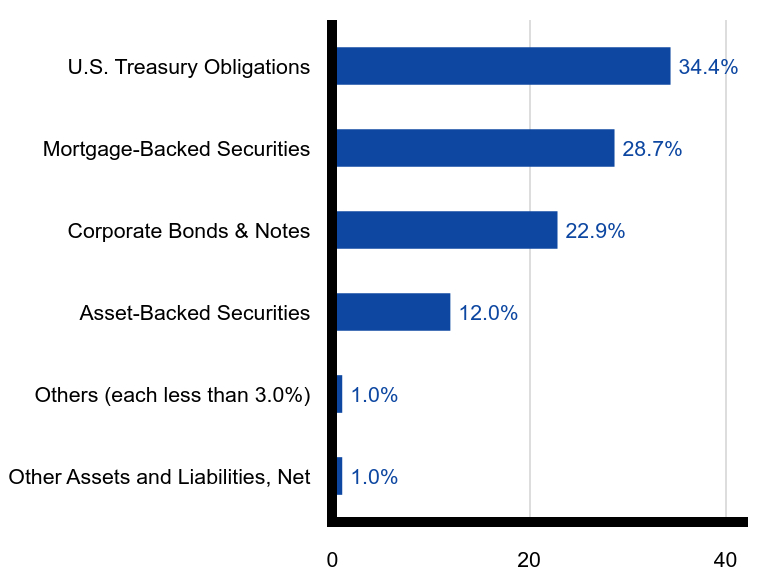

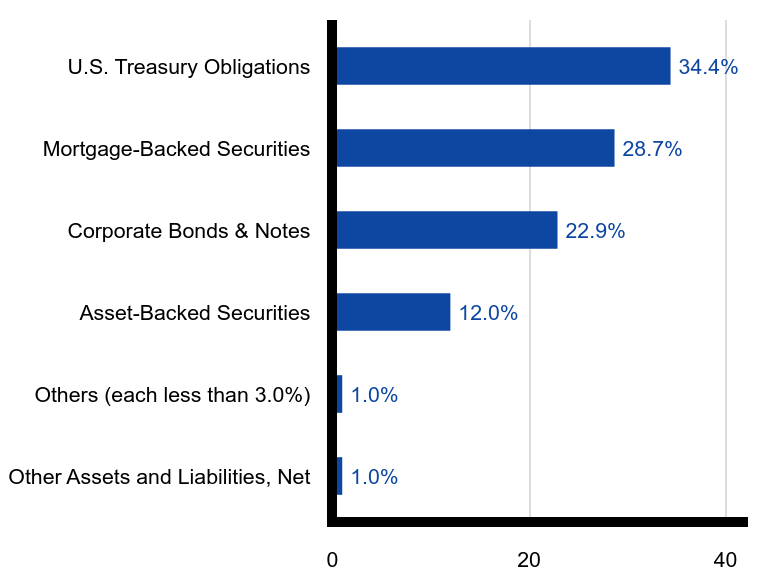

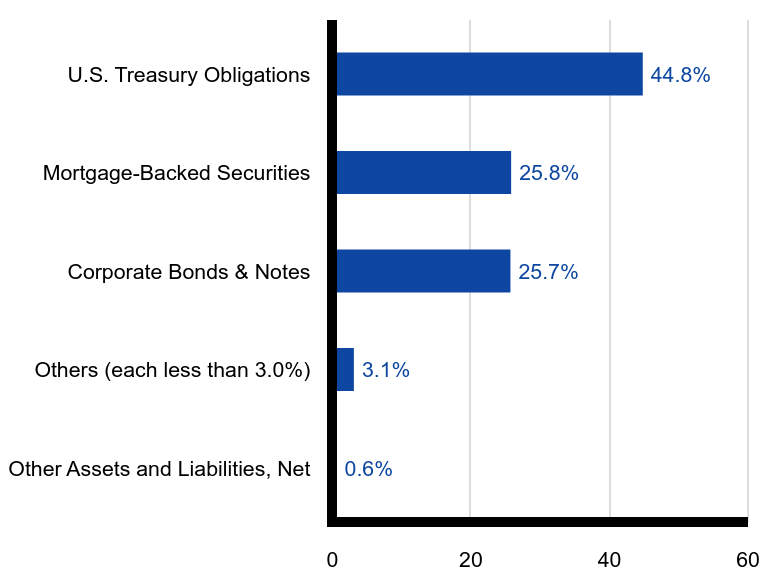

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 1.0% | Others (each less than 3.0%) | 1.0% | Asset-Backed Securities | 12.0% | Corporate Bonds & Notes | 22.9% | Mortgage-Backed Securities | 28.7% | U.S. Treasury Obligations | 34.4% |

|

| C000222605 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Intermediate Bond Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Intermediate Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $23 | 0.45% |

|---|

|

| Expenses Paid, Amount |

$ 23

|

| Expense Ratio, Percent |

0.45%

|

| AssetsNet |

$ 726,838,652

|

| Holdings Count | Holding |

539

|

| InvestmentCompanyPortfolioTurnover |

84.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$726,838,652

- # of Portfolio Holdings539

- Year-to-Date Total Return4.09%

- Portfolio Turnover Rate84%

|

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 1.0% | Others (each less than 3.0%) | 1.0% | Asset-Backed Securities | 12.0% | Corporate Bonds & Notes | 22.9% | Mortgage-Backed Securities | 28.7% | U.S. Treasury Obligations | 34.4% |

|

| C000078080 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Total Return Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Total Return Portfolio (the "Fund"), formerly named Managed Bond Portfolio, for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $61 | 1.20% |

|---|

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

1.20%

|

| AssetsNet |

$ 1,708,251,652

|

| Holdings Count | Holding |

1,267

|

| InvestmentCompanyPortfolioTurnover |

295.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$1,708,251,652

- # of Portfolio Holdings1,267

- Year-to-Date Total Return4.62%

- Portfolio Turnover Rate295%

|

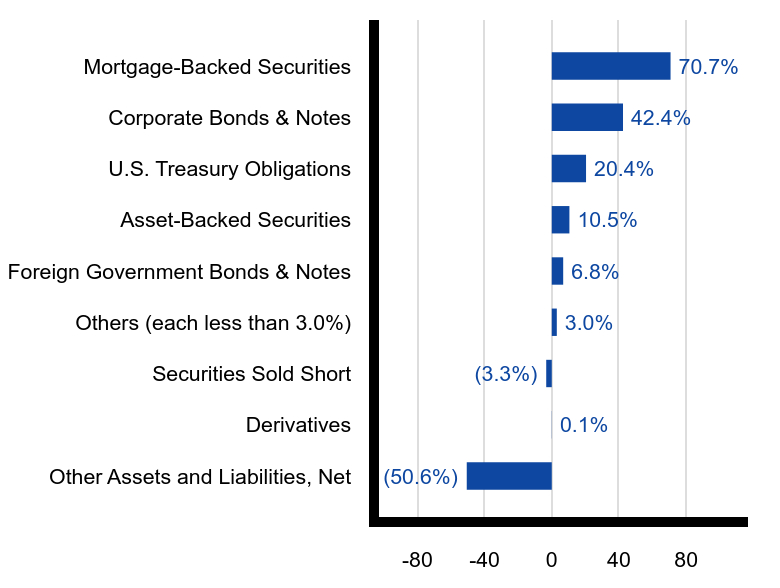

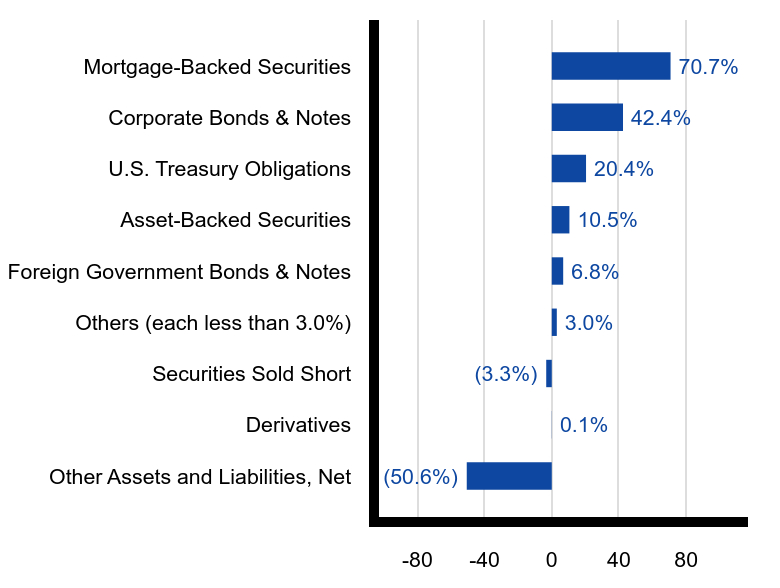

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | (50.6%) | Derivatives | 0.1% | Securities Sold Short | (3.3%) | Others (each less than 3.0%) | 3.0% | Foreign Government Bonds & Notes | 6.8% | Asset-Backed Securities | 10.5% | U.S. Treasury Obligations | 20.4% | Corporate Bonds & Notes | 42.4% | Mortgage-Backed Securities | 70.7% |

|

| C000098952 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Total Return Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Total Return Portfolio (the "Fund"), formerly named Managed Bond Portfolio, for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $51 | 1.00% |

|---|

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

1.00%

|

| AssetsNet |

$ 1,708,251,652

|

| Holdings Count | Holding |

1,267

|

| InvestmentCompanyPortfolioTurnover |

295.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$1,708,251,652

- # of Portfolio Holdings1,267

- Year-to-Date Total Return4.72%

- Portfolio Turnover Rate295%

|

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | (50.6%) | Derivatives | 0.1% | Securities Sold Short | (3.3%) | Others (each less than 3.0%) | 3.0% | Foreign Government Bonds & Notes | 6.8% | Asset-Backed Securities | 10.5% | U.S. Treasury Obligations | 20.4% | Corporate Bonds & Notes | 42.4% | Mortgage-Backed Securities | 70.7% |

|

| C000078082 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Short Duration Bond Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Short Duration Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $32 | 0.64% |

|---|

|

| Expenses Paid, Amount |

$ 32

|

| Expense Ratio, Percent |

0.64%

|

| AssetsNet |

$ 1,456,241,475

|

| Holdings Count | Holding |

809

|

| InvestmentCompanyPortfolioTurnover |

73.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$1,456,241,475

- # of Portfolio Holdings809

- Year-to-Date Total Return2.89%

- Portfolio Turnover Rate73%

|

| Holdings [Text Block] |

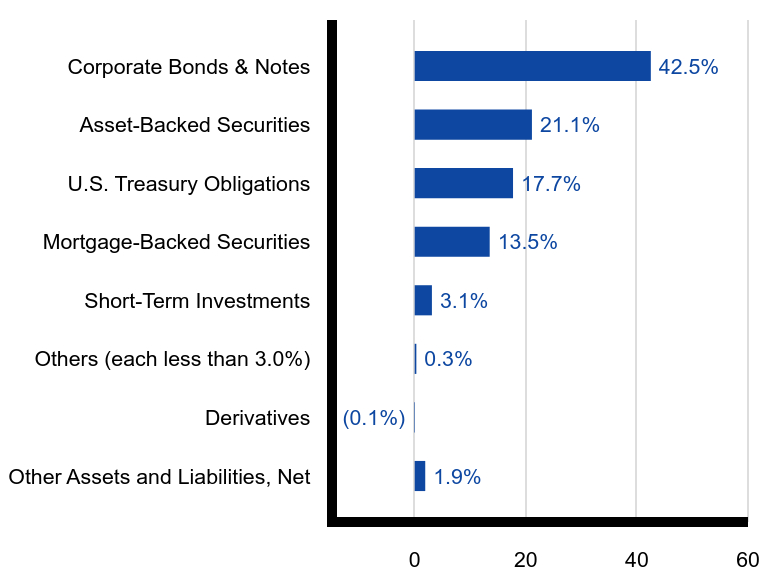

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 1.9% | Derivatives | (0.1%) | Others (each less than 3.0%) | 0.3% | Short-Term Investments | 3.1% | Mortgage-Backed Securities | 13.5% | U.S. Treasury Obligations | 17.7% | Asset-Backed Securities | 21.1% | Corporate Bonds & Notes | 42.5% |

|

| C000098954 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Short Duration Bond Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Short Duration Bond Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $22 | 0.44% |

|---|

|

| Expenses Paid, Amount |

$ 22

|

| Expense Ratio, Percent |

0.44%

|

| AssetsNet |

$ 1,456,241,475

|

| Holdings Count | Holding |

809

|

| InvestmentCompanyPortfolioTurnover |

73.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$1,456,241,475

- # of Portfolio Holdings809

- Year-to-Date Total Return2.99%

- Portfolio Turnover Rate73%

|

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 1.9% | Derivatives | (0.1%) | Others (each less than 3.0%) | 0.3% | Short-Term Investments | 3.1% | Mortgage-Backed Securities | 13.5% | U.S. Treasury Obligations | 17.7% | Asset-Backed Securities | 21.1% | Corporate Bonds & Notes | 42.5% |

|

| C000111627 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Emerging Markets Debt Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Emerging Markets Debt Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $56 | 1.09% |

|---|

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.09%

|

| AssetsNet |

$ 206,914,817

|

| Holdings Count | Holding |

236

|

| InvestmentCompanyPortfolioTurnover |

72.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$206,914,817

- # of Portfolio Holdings236

- Year-to-Date Total Return7.41%

- Portfolio Turnover Rate72%

|

| Holdings [Text Block] |

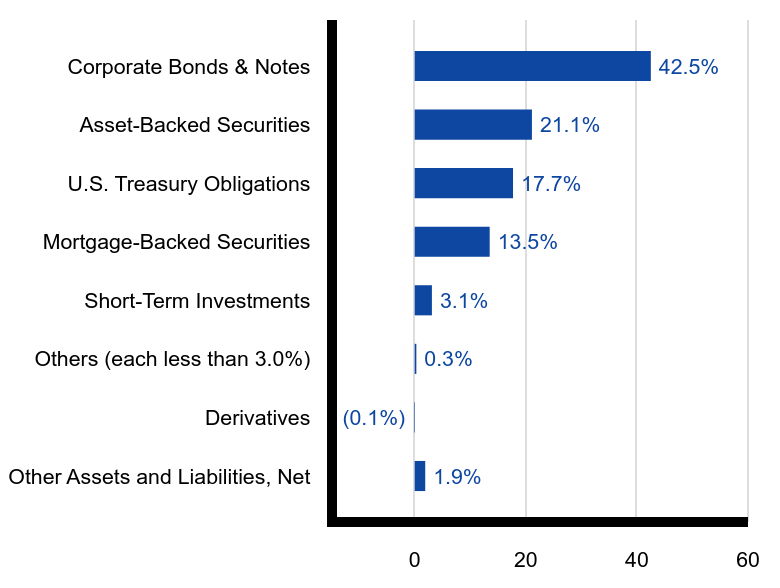

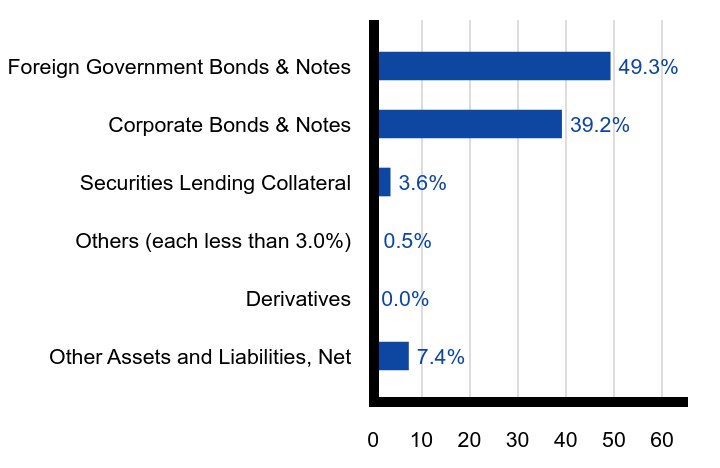

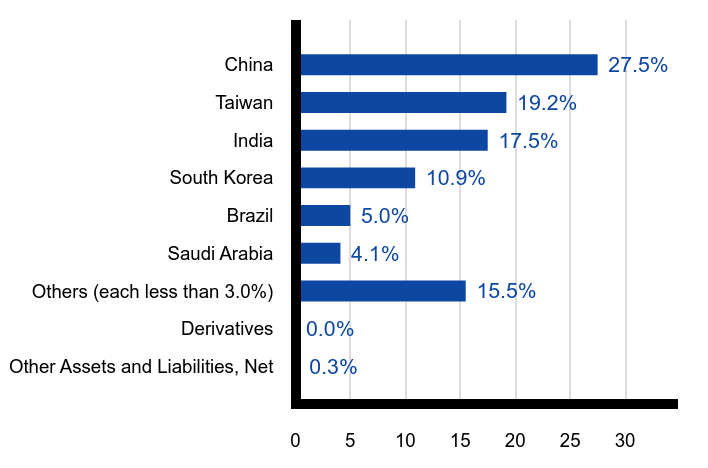

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 7.4% | Derivatives | 0.0% | Others (each less than 3.0%) | 0.5% | Securities Lending Collateral | 3.6% | Corporate Bonds & Notes | 39.2% | Foreign Government Bonds & Notes | 49.3% |

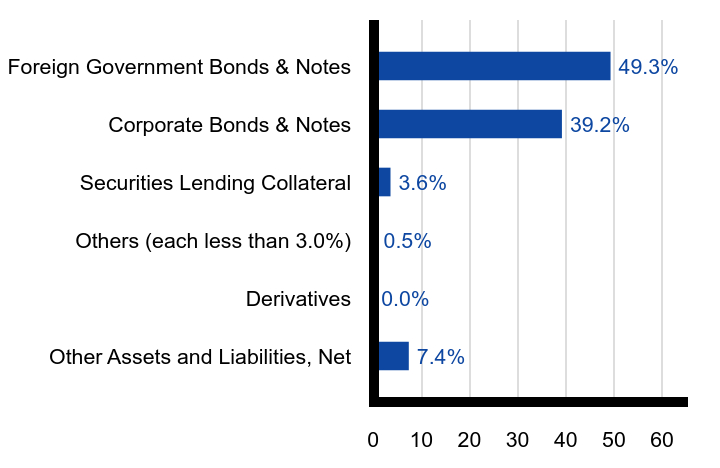

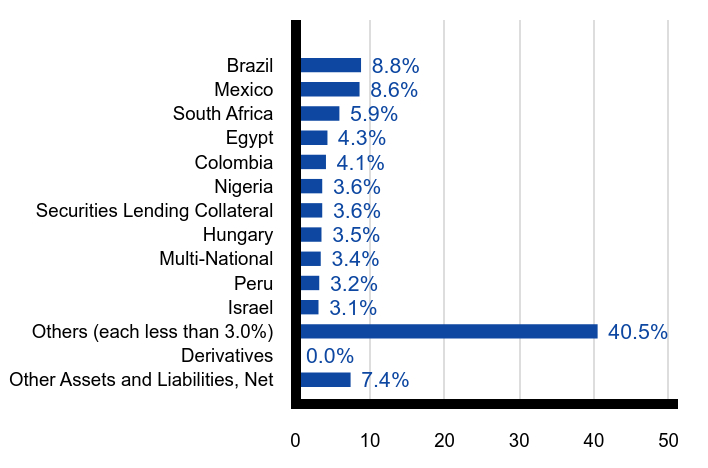

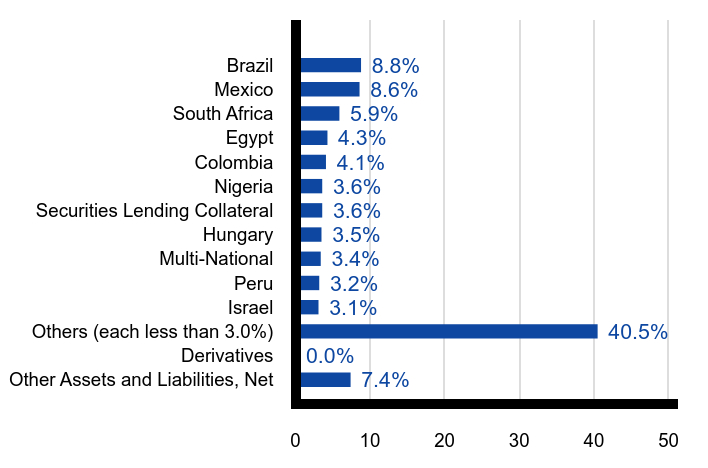

Country of Risk (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 7.4% | Derivatives | 0.0% | Others (each less than 3.0%) | 40.5% | Israel | 3.1% | Peru | 3.2% | Multi-National | 3.4% | Hungary | 3.5% | Securities Lending Collateral | 3.6% | Nigeria | 3.6% | Colombia | 4.1% | Egypt | 4.3% | South Africa | 5.9% | Mexico | 8.6% | Brazil | 8.8% |

|

| C000111628 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Emerging Markets Debt Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Emerging Markets Debt Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $45 | 0.88% |

|---|

|

| Expenses Paid, Amount |

$ 45

|

| Expense Ratio, Percent |

0.88%

|

| AssetsNet |

$ 206,914,817

|

| Holdings Count | Holding |

236

|

| InvestmentCompanyPortfolioTurnover |

72.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$206,914,817

- # of Portfolio Holdings236

- Year-to-Date Total Return7.51%

- Portfolio Turnover Rate72%

|

| Holdings [Text Block] |

Fund's Composition (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 7.4% | Derivatives | 0.0% | Others (each less than 3.0%) | 0.5% | Securities Lending Collateral | 3.6% | Corporate Bonds & Notes | 39.2% | Foreign Government Bonds & Notes | 49.3% |

Country of Risk (% of Total Net Assets)Value | Value |

|---|

Other Assets and Liabilities, Net | 7.4% | Derivatives | 0.0% | Others (each less than 3.0%) | 40.5% | Israel | 3.1% | Peru | 3.2% | Multi-National | 3.4% | Hungary | 3.5% | Securities Lending Collateral | 3.6% | Nigeria | 3.6% | Colombia | 4.1% | Egypt | 4.3% | South Africa | 5.9% | Mexico | 8.6% | Brazil | 8.8% |

|

| C000078089 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Dividend Growth Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Dividend Growth Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $45 | 0.88% |

|---|

|

| Expenses Paid, Amount |

$ 45

|

| Expense Ratio, Percent |

0.88%

|

| AssetsNet |

$ 715,372,151

|

| Holdings Count | Holding |

95

|

| InvestmentCompanyPortfolioTurnover |

9.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$715,372,151

- # of Portfolio Holdings95

- Year-to-Date Total Return7.51%

- Portfolio Turnover Rate9%

|

| Holdings [Text Block] |

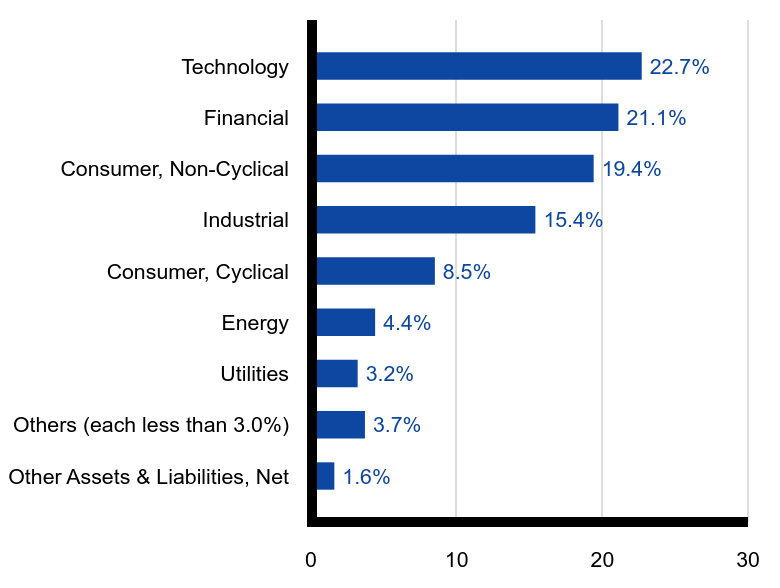

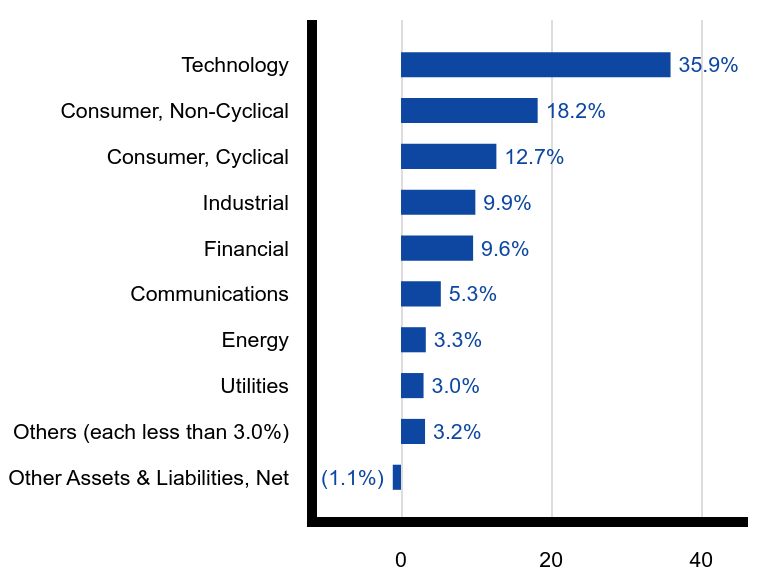

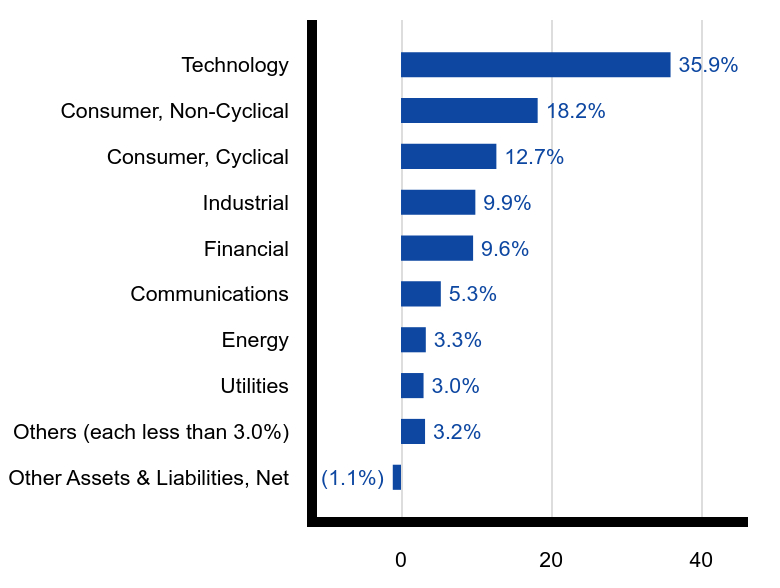

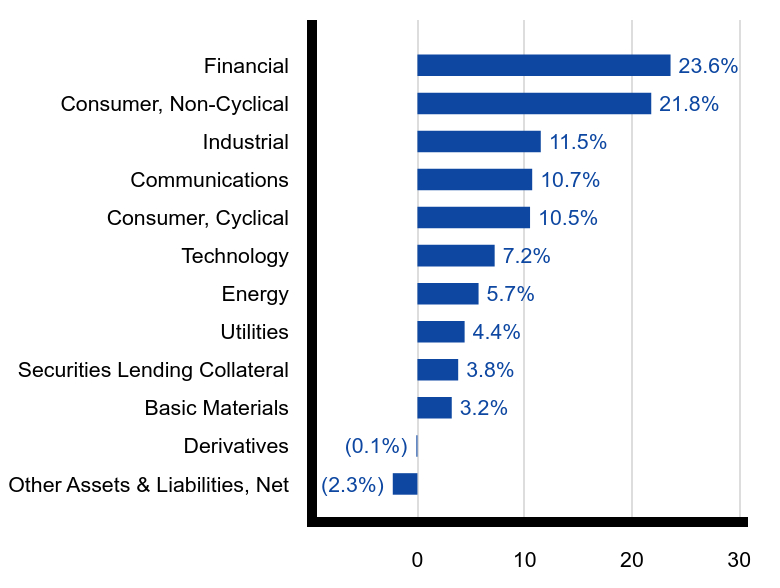

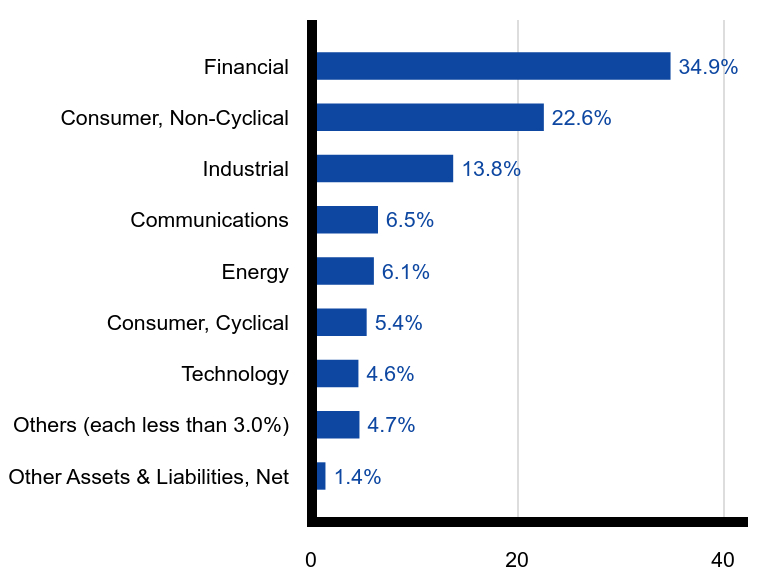

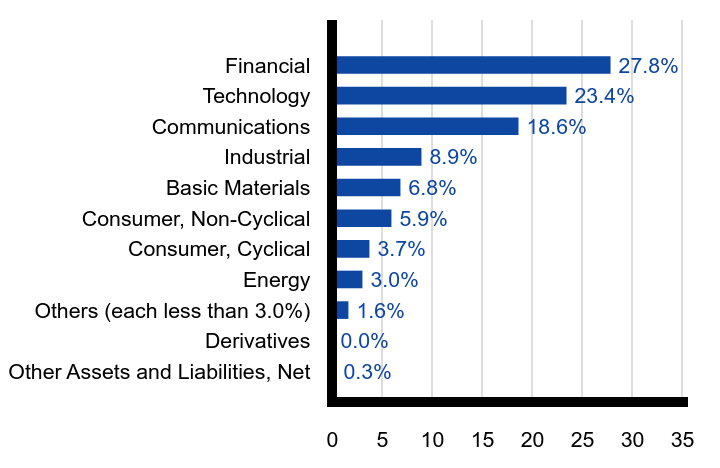

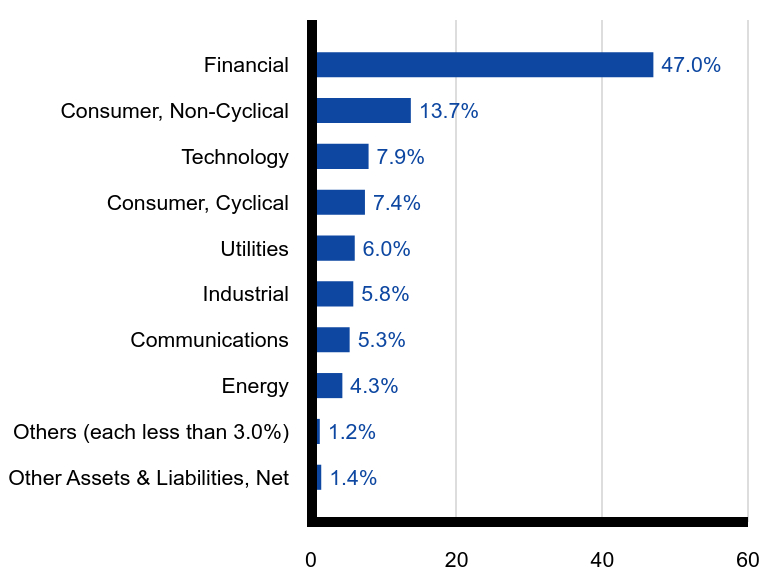

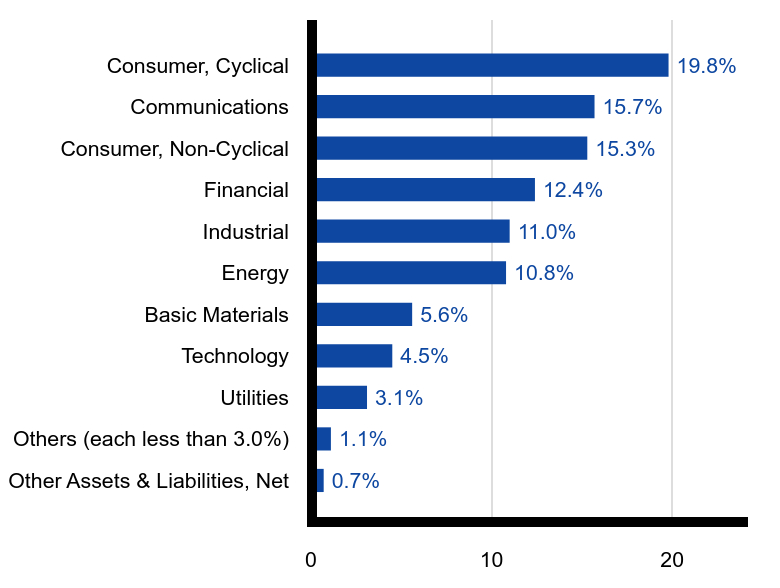

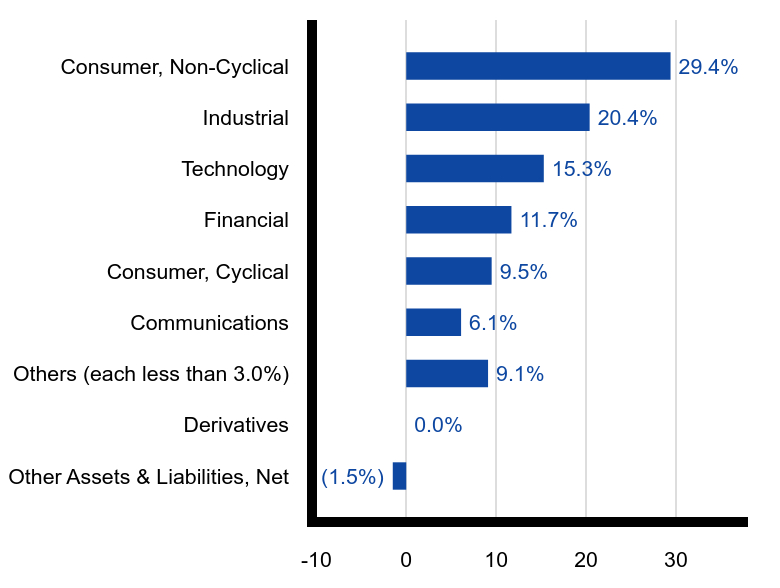

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | 1.6% | Others (each less than 3.0%) | 3.7% | Utilities | 3.2% | Energy | 4.4% | Consumer, Cyclical | 8.5% | Industrial | 15.4% | Consumer, Non-Cyclical | 19.4% | Financial | 21.1% | Technology | 22.7% |

|

| C000098960 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Dividend Growth Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Dividend Growth Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $35 | 0.68% |

|---|

|

| Expenses Paid, Amount |

$ 35

|

| Expense Ratio, Percent |

0.68%

|

| AssetsNet |

$ 715,372,151

|

| Holdings Count | Holding |

95

|

| InvestmentCompanyPortfolioTurnover |

9.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$715,372,151

- # of Portfolio Holdings95

- Year-to-Date Total Return7.64%

- Portfolio Turnover Rate9%

|

| Holdings [Text Block] |

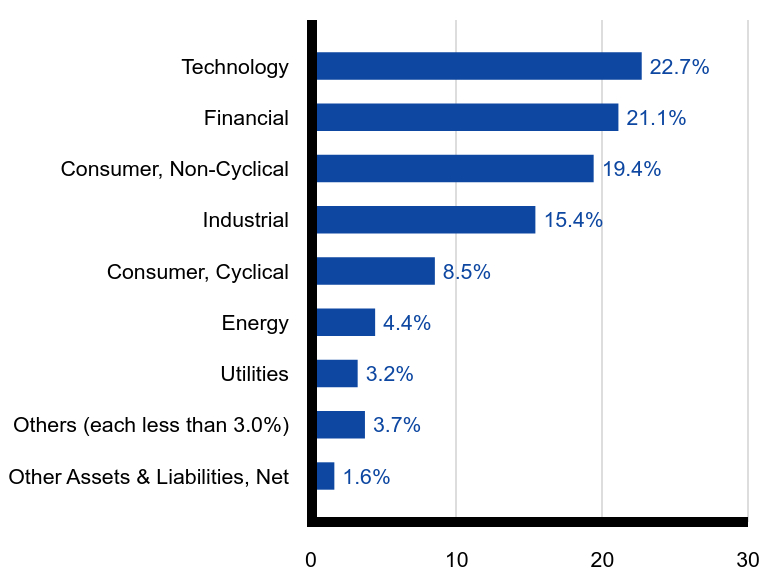

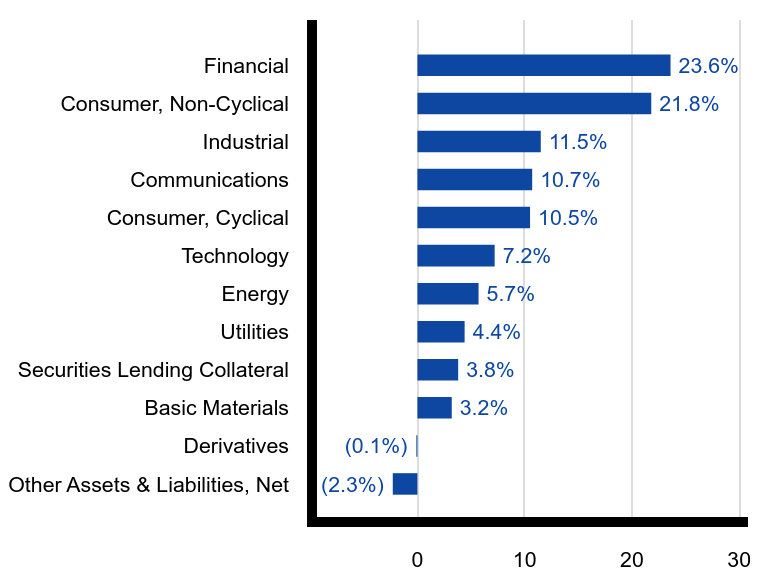

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | 1.6% | Others (each less than 3.0%) | 3.7% | Utilities | 3.2% | Energy | 4.4% | Consumer, Cyclical | 8.5% | Industrial | 15.4% | Consumer, Non-Cyclical | 19.4% | Financial | 21.1% | Technology | 22.7% |

|

| C000078115 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Equity Index Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Equity Index Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $14 | 0.28% |

|---|

|

| Expenses Paid, Amount |

$ 14

|

| Expense Ratio, Percent |

0.28%

|

| AssetsNet |

$ 5,383,847,680

|

| Holdings Count | Holding |

507

|

| InvestmentCompanyPortfolioTurnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$5,383,847,680

- # of Portfolio Holdings507

- Year-to-Date Total Return6.06%

- Portfolio Turnover Rate1%

|

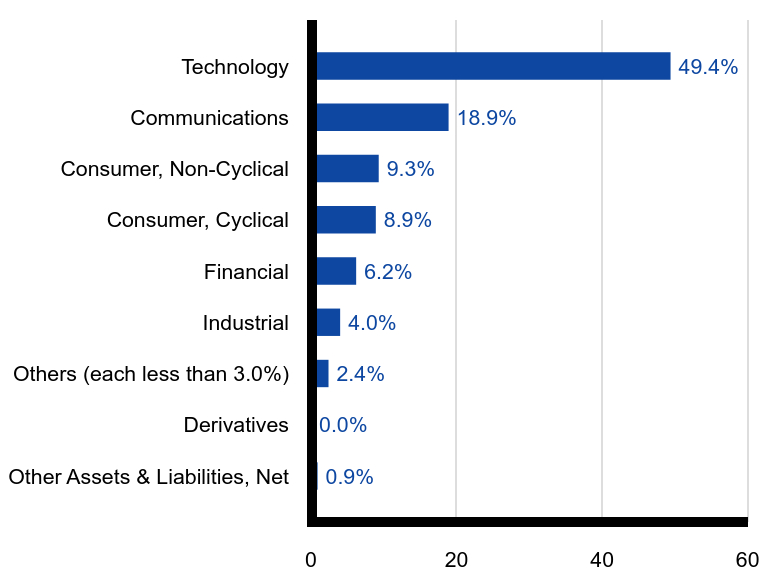

| Holdings [Text Block] |

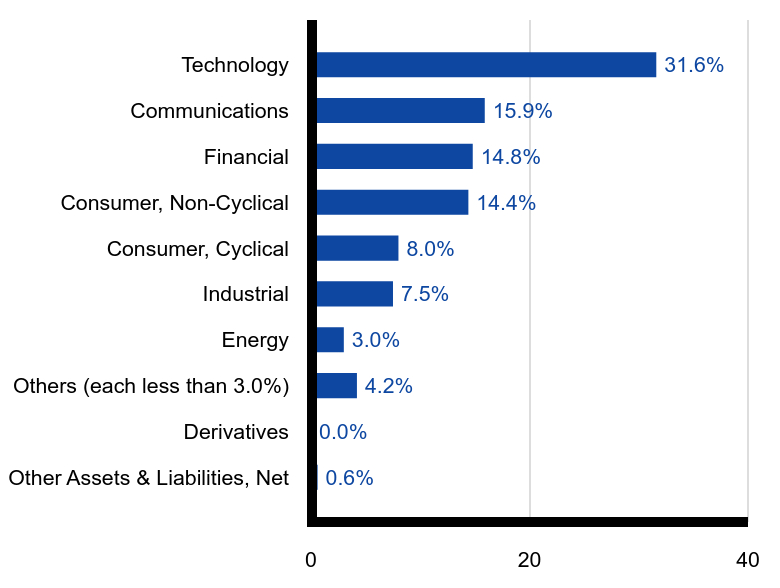

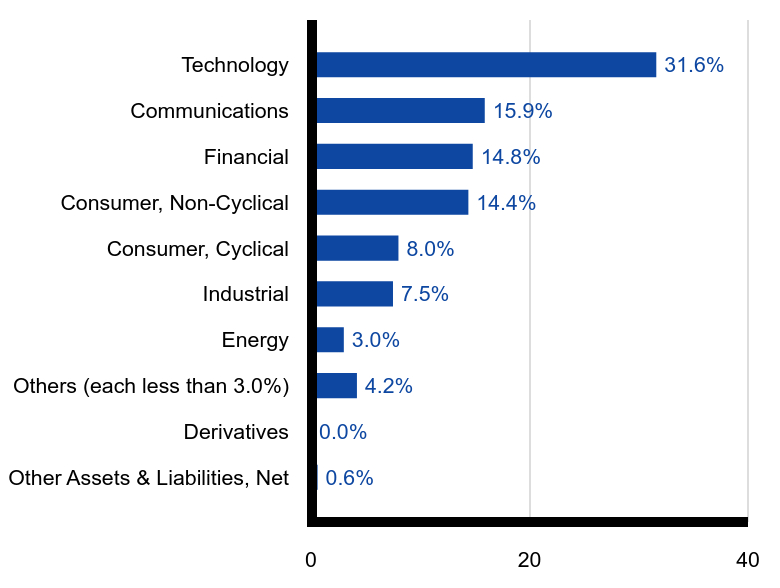

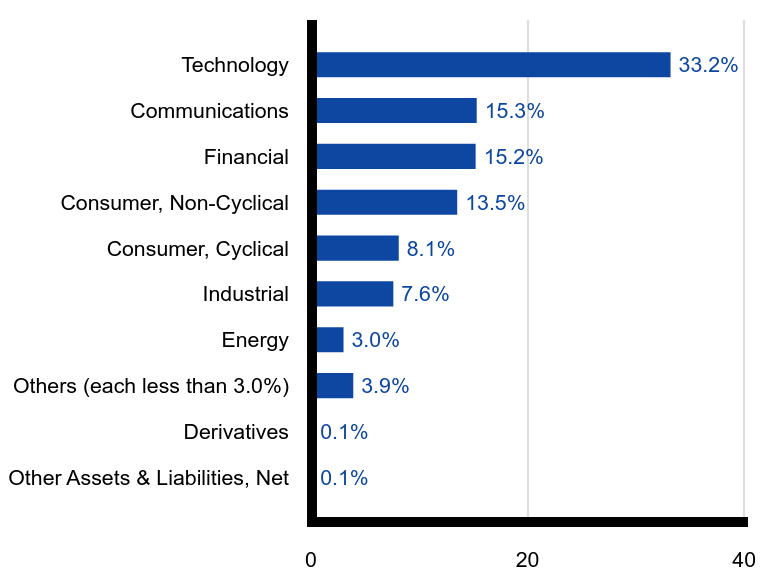

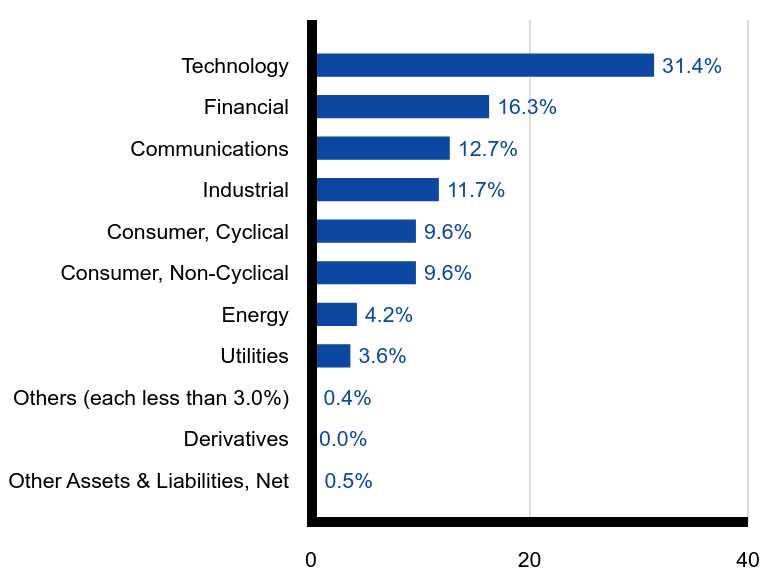

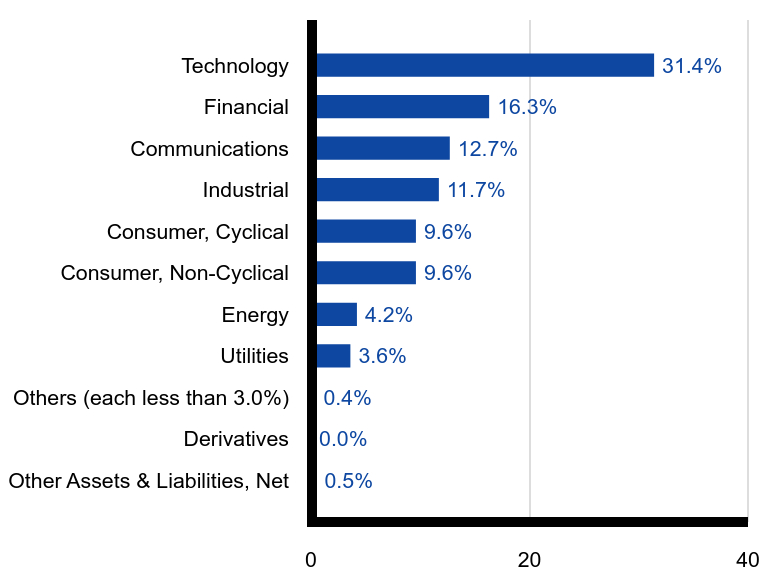

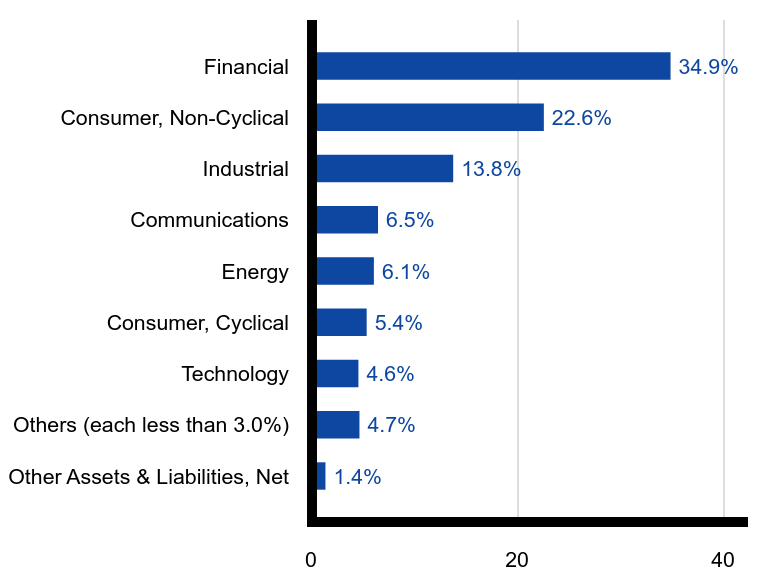

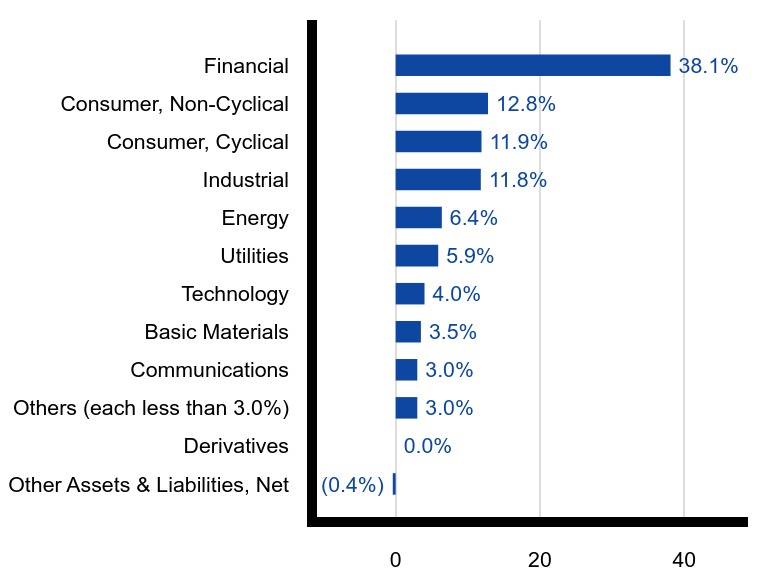

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | 0.6% | Derivatives | 0.0% | Others (each less than 3.0%) | 4.2% | Energy | 3.0% | Industrial | 7.5% | Consumer, Cyclical | 8.0% | Consumer, Non-Cyclical | 14.4% | Financial | 14.8% | Communications | 15.9% | Technology | 31.6% |

|

| C000098974 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Equity Index Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Equity Index Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $4 | 0.08% |

|---|

|

| Expenses Paid, Amount |

$ 4

|

| Expense Ratio, Percent |

0.08%

|

| AssetsNet |

$ 5,383,847,680

|

| Holdings Count | Holding |

507

|

| InvestmentCompanyPortfolioTurnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$5,383,847,680

- # of Portfolio Holdings507

- Year-to-Date Total Return6.16%

- Portfolio Turnover Rate1%

|

| Holdings [Text Block] |

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | 0.6% | Derivatives | 0.0% | Others (each less than 3.0%) | 4.2% | Energy | 3.0% | Industrial | 7.5% | Consumer, Cyclical | 8.0% | Consumer, Non-Cyclical | 14.4% | Financial | 14.8% | Communications | 15.9% | Technology | 31.6% |

|

| C000078104 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Focused Growth Portfolio

|

| Class Name |

Class I

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Focused Growth Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $50 | 0.97% |

|---|

|

| Expenses Paid, Amount |

$ 50

|

| Expense Ratio, Percent |

0.97%

|

| AssetsNet |

$ 462,628,589

|

| Holdings Count | Holding |

38

|

| InvestmentCompanyPortfolioTurnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$462,628,589

- # of Portfolio Holdings38

- Year-to-Date Total Return8.43%

- Portfolio Turnover Rate17%

|

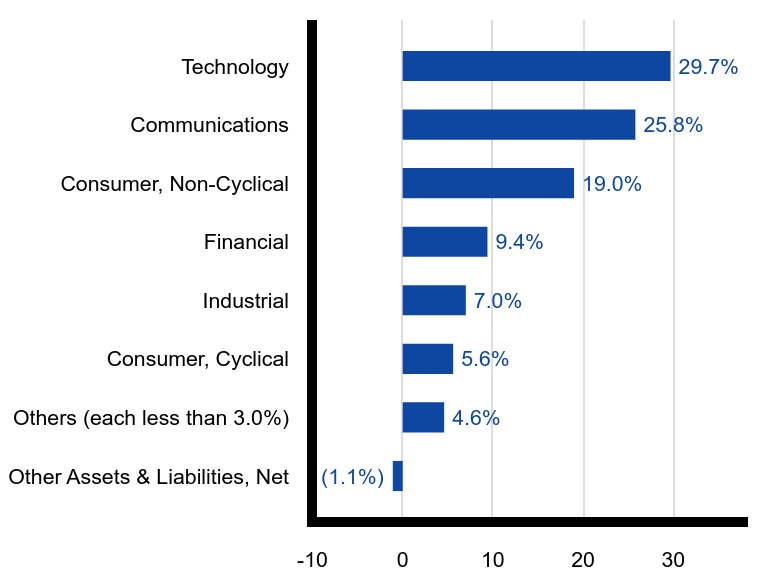

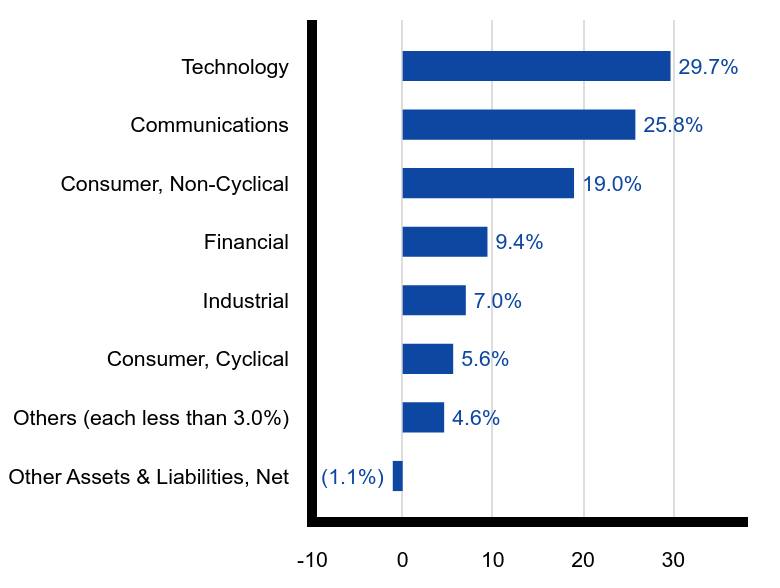

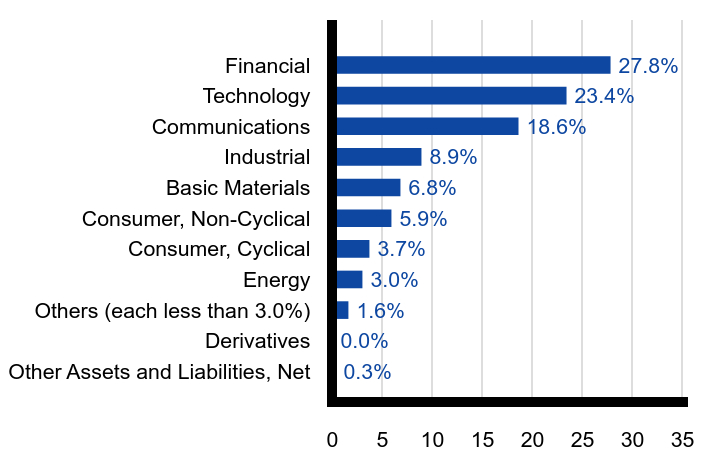

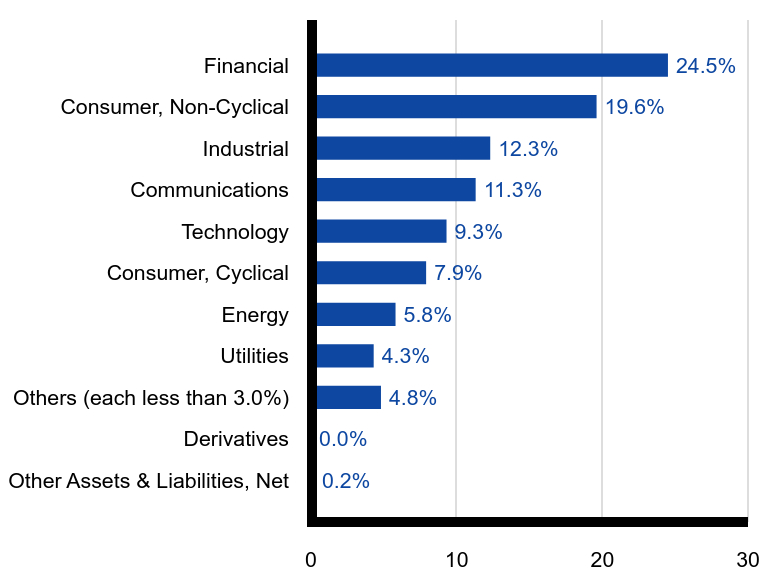

| Holdings [Text Block] |

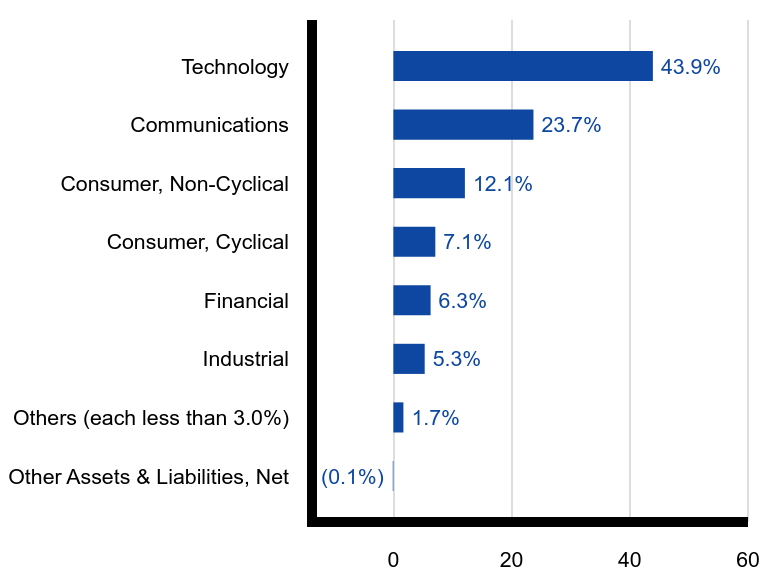

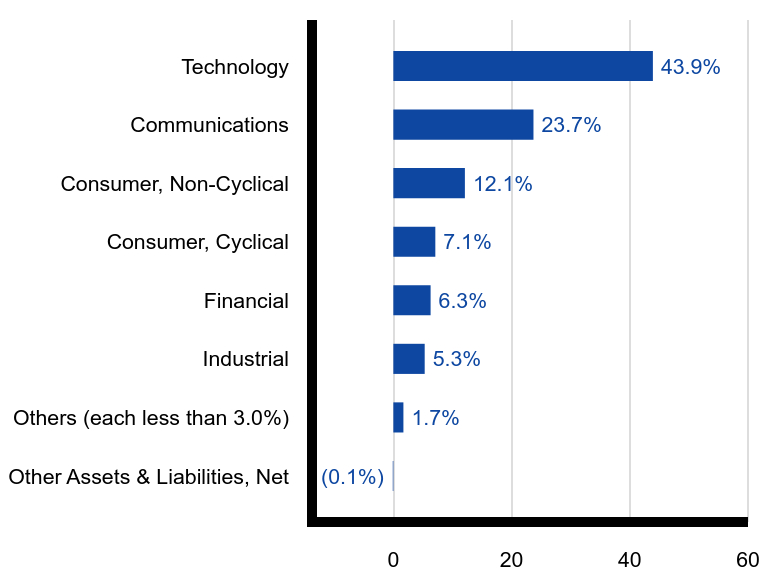

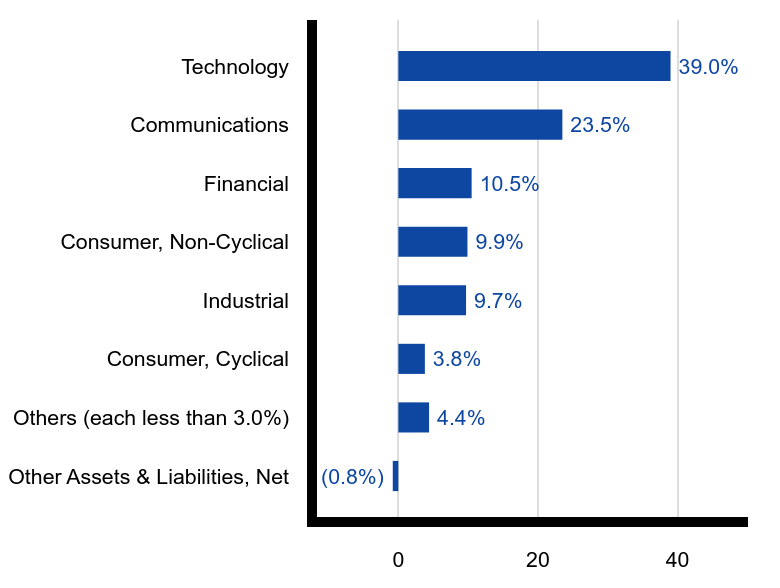

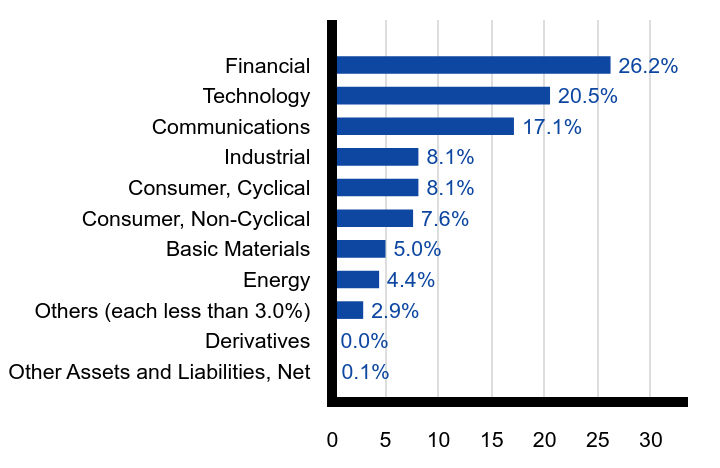

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | (0.1%) | Others (each less than 3.0%) | 1.7% | Industrial | 5.3% | Financial | 6.3% | Consumer, Cyclical | 7.1% | Consumer, Non-Cyclical | 12.1% | Communications | 23.7% | Technology | 43.9% |

|

| C000098970 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Focused Growth Portfolio

|

| Class Name |

Class P

|

| No Trading Symbol [Flag] |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Focused Growth Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://www.pacificlife.com/pacificselectfund.html. You can also request this information free of charge by contacting us toll-free at 800-722-4448 or sending an email request to PSFdocumentrequest@pacificlife.com.

|

| Additional Information Phone Number |

800-722-4448

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">PSFdocumentrequest@pacificlife.com</span>

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">http://www.pacificlife.com/pacificselectfund.html</span>

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment; costs paid as a percentage of a $10,000 investment is annualized) Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class P | $40 | 0.77% |

|---|

|

| Expenses Paid, Amount |

$ 40

|

| Expense Ratio, Percent |

0.77%

|

| AssetsNet |

$ 462,628,589

|

| Holdings Count | Holding |

38

|

| InvestmentCompanyPortfolioTurnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of June 30, 2025- Total Net Assets$462,628,589

- # of Portfolio Holdings38

- Year-to-Date Total Return8.54%

- Portfolio Turnover Rate17%

|

| Holdings [Text Block] |

Sector Allocation (% of Total Net Assets)Value | Value |

|---|

Other Assets & Liabilities, Net | (0.1%) | Others (each less than 3.0%) | 1.7% | Industrial | 5.3% | Financial | 6.3% | Consumer, Cyclical | 7.1% | Consumer, Non-Cyclical | 12.1% | Communications | 23.7% | Technology | 43.9% |

|

| C000078093 |

|