Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Guidestone Funds

|

|

| Entity Central Index Key |

0001131013

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000156358 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity Index Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GIIYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the International Equity Index Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

International Equity Index Fund

(Institutional Class/GIIYX) |

$10 |

0.19% |

|

|

| Expenses Paid, Amount |

$ 10

|

|

| Expense Ratio, Percent |

0.19%

|

|

| Net Assets |

$ 1,492,597,014

|

|

| Holdings Count | Holding |

577

|

|

| Investment Company Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$1,492,597,014 |

| Total number of portfolio holdings |

577 |

| Portfolio turnover rate for the period |

4% |

|

|

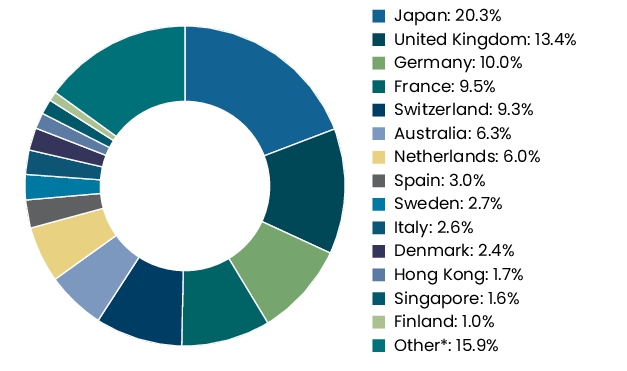

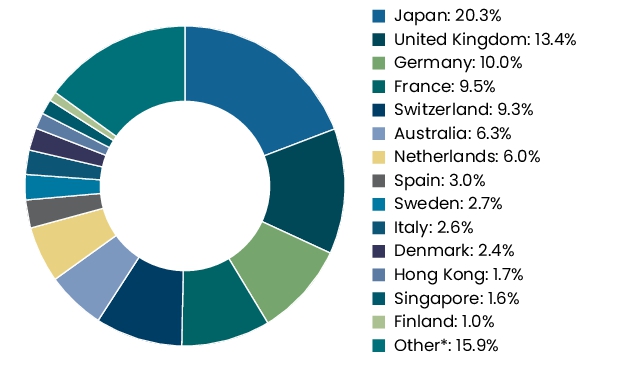

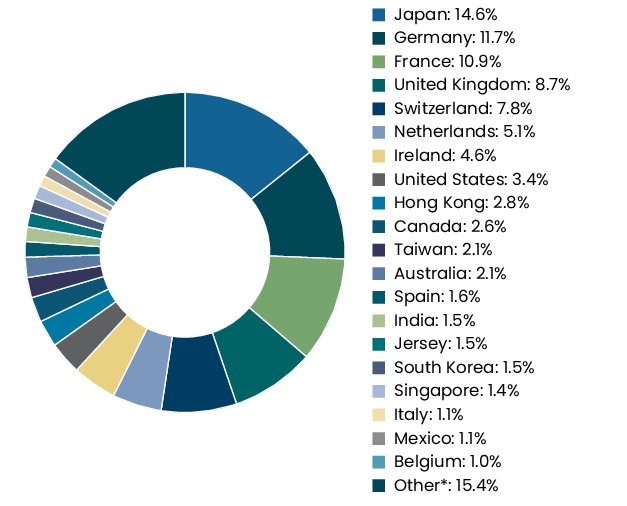

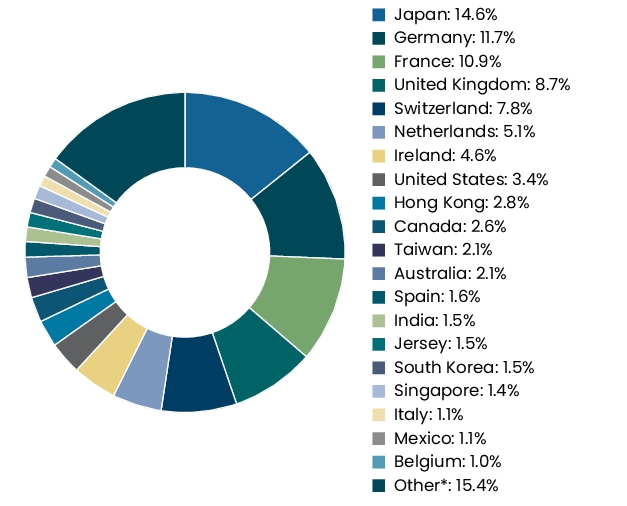

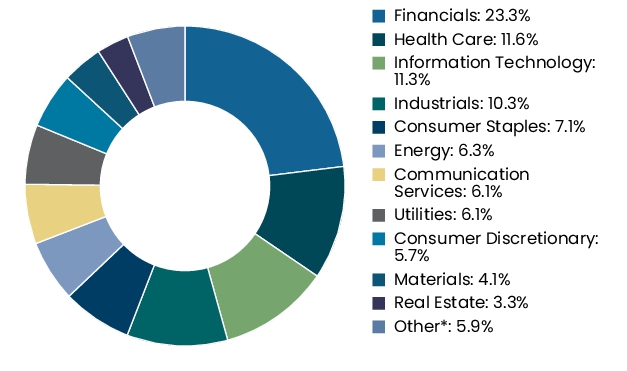

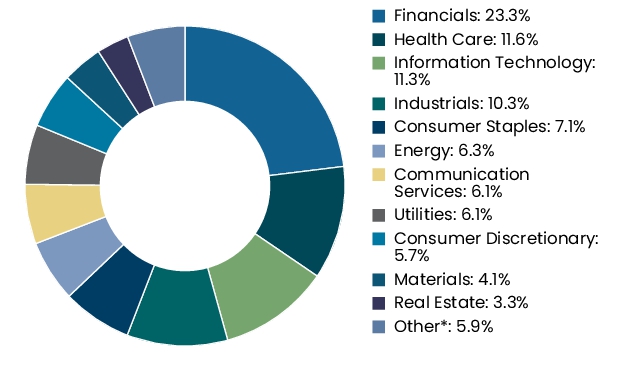

| Holdings [Text Block] |

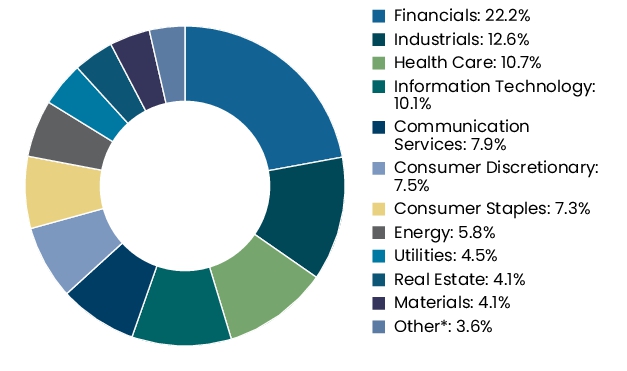

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

| Financials |

23.3% |

| Industrials |

18.3% |

| Health Care |

10.1% |

| Consumer Discretionary |

9.3% |

| Information Technology |

7.9% |

| Consumer Staples |

7.1% |

| Materials |

5.2% |

| Communication Services |

4.7% |

| Utilities |

3.5% |

| Energy |

3.3% |

| Real Estate |

1.4% |

| Other* |

11.6% |

|

105.7% |

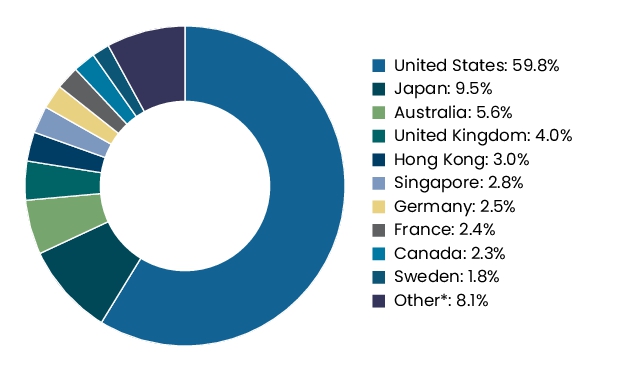

GEOGRAPHIC ALLOCATION

*Includes, as applicable, short-term investments, derivatives and countries and/or categories rounding to less than 1%.

|

|

| C000236040 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity Index Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GIIZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the International Equity Index Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

International Equity Index Fund

(Investor Class/GIIZX) |

$27 |

0.50% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 27

|

[1] |

| Expense Ratio, Percent |

0.50%

|

[1] |

| Net Assets |

$ 1,492,597,014

|

|

| Holdings Count | Holding |

577

|

|

| Investment Company Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$1,492,597,014 |

| Total number of portfolio holdings |

577 |

| Portfolio turnover rate for the period |

4% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

| Financials |

23.3% |

| Industrials |

18.3% |

| Health Care |

10.1% |

| Consumer Discretionary |

9.3% |

| Information Technology |

7.9% |

| Consumer Staples |

7.1% |

| Materials |

5.2% |

| Communication Services |

4.7% |

| Utilities |

3.5% |

| Energy |

3.3% |

| Real Estate |

1.4% |

| Other* |

11.6% |

|

105.7% |

GEOGRAPHIC ALLOCATION

*Includes, as applicable, short-term investments, derivatives and countries and/or categories rounding to less than 1%.

|

|

| C000129314 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets Equity Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GEMZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Emerging Markets Equity Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Emerging Markets Equity Fund

(Investor Class/GEMZX) |

$70 |

1.31% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 70

|

[2] |

| Expense Ratio, Percent |

1.31%

|

[2] |

| Net Assets |

$ 849,754,316

|

|

| Holdings Count | Holding |

409

|

|

| Investment Company Portfolio Turnover |

31.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$849,754,316 |

| Total number of portfolio holdings |

409 |

| Portfolio turnover rate for the period |

31% |

|

|

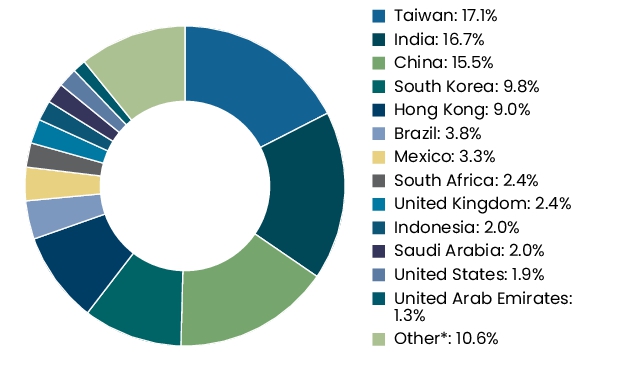

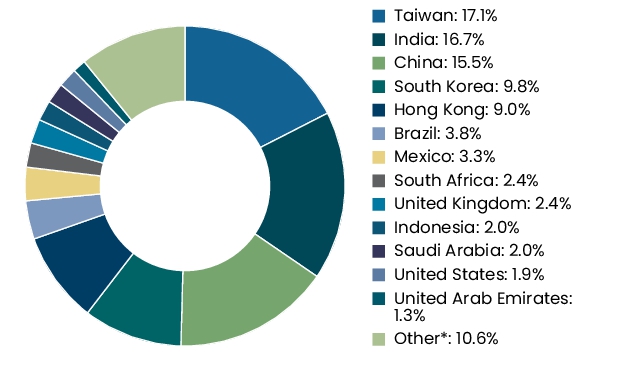

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

| Financials |

25.5% |

| Information Technology |

25.3% |

| Consumer Discretionary |

13.1% |

| Communication Services |

9.0% |

| Consumer Staples |

5.3% |

| Industrials |

5.0% |

| Materials |

2.5% |

| Real Estate |

2.3% |

| Health Care |

2.1% |

| Energy |

1.9% |

| Utilities |

0.6% |

| Other* |

5.2% |

| Warrants |

0.0% |

|

97.8% |

GEOGRAPHIC ALLOCATION

*Includes, as applicable, short-term investments, derivatives and countries and/or categories rounding to less than 1%.

|

|

| C000129313 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets Equity Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GEMYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Emerging Markets Equity Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Emerging Markets Equity Fund

(Institutional Class/GEMYX) |

$57 |

1.06% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 57

|

[3] |

| Expense Ratio, Percent |

1.06%

|

[3] |

| Net Assets |

$ 849,754,316

|

|

| Holdings Count | Holding |

409

|

|

| Investment Company Portfolio Turnover |

31.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$849,754,316 |

| Total number of portfolio holdings |

409 |

| Portfolio turnover rate for the period |

31% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

| Financials |

25.5% |

| Information Technology |

25.3% |

| Consumer Discretionary |

13.1% |

| Communication Services |

9.0% |

| Consumer Staples |

5.3% |

| Industrials |

5.0% |

| Materials |

2.5% |

| Real Estate |

2.3% |

| Health Care |

2.1% |

| Energy |

1.9% |

| Utilities |

0.6% |

| Other* |

5.2% |

| Warrants |

0.0% |

|

97.8% |

GEOGRAPHIC ALLOCATION

*Includes, as applicable, short-term investments, derivatives and countries and/or categories rounding to less than 1%.

|

|

| C000185898 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2055 Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GMGYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2055 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2055 Fund

(Institutional Class/GMGYX) |

$8 |

0.15% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 8

|

[4] |

| Expense Ratio, Percent |

0.15%

|

[4] |

| Net Assets |

$ 963,193,705

|

|

| Holdings Count | Holding |

9

|

|

| Investment Company Portfolio Turnover |

2.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$963,193,705 |

| Total number of portfolio holdings |

9 |

| Portfolio turnover rate for the period |

2% |

|

|

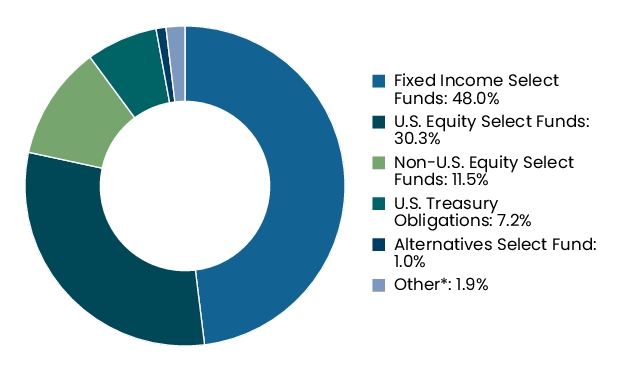

| Holdings [Text Block] |

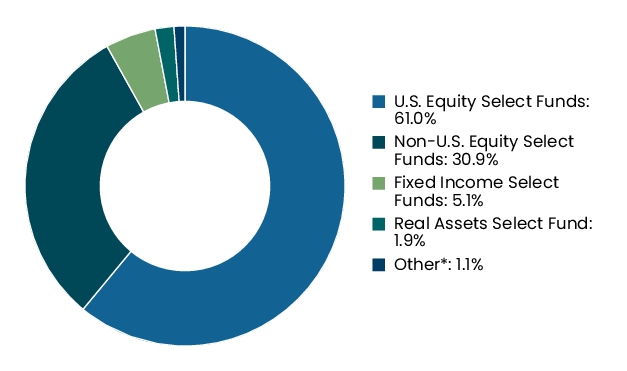

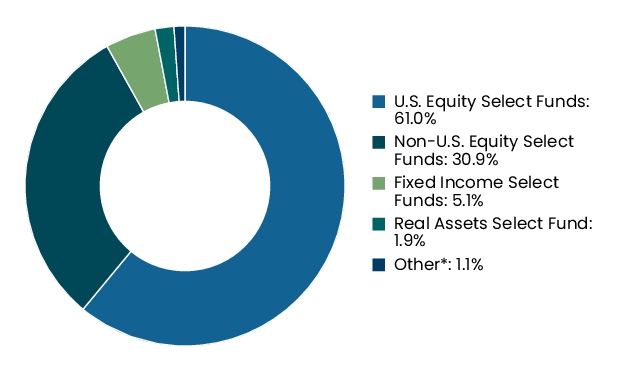

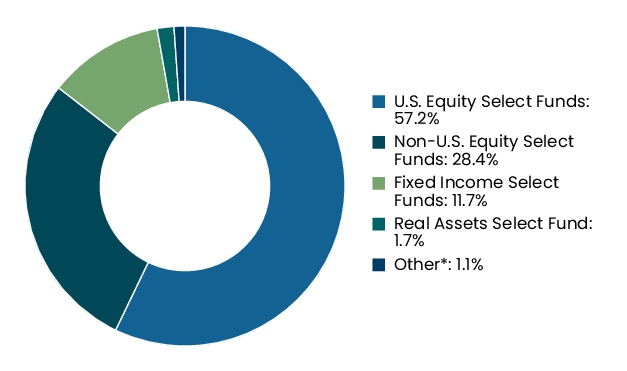

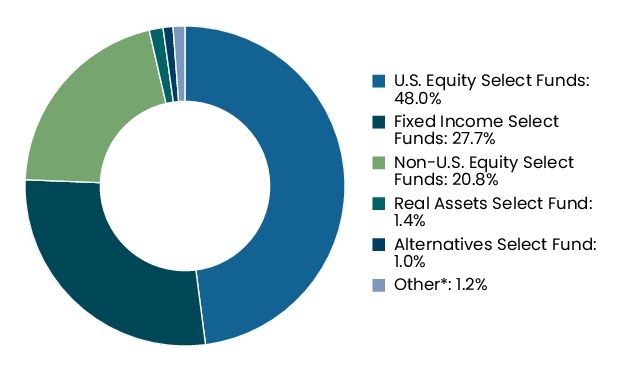

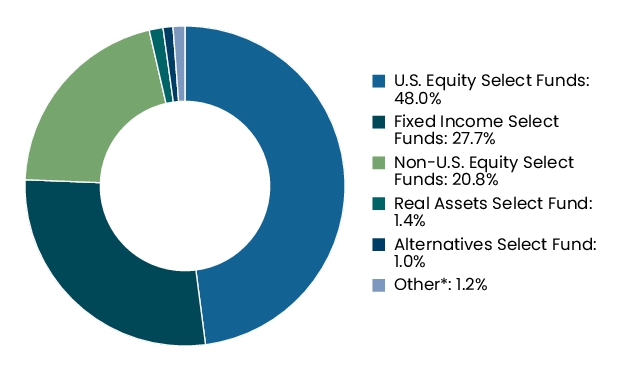

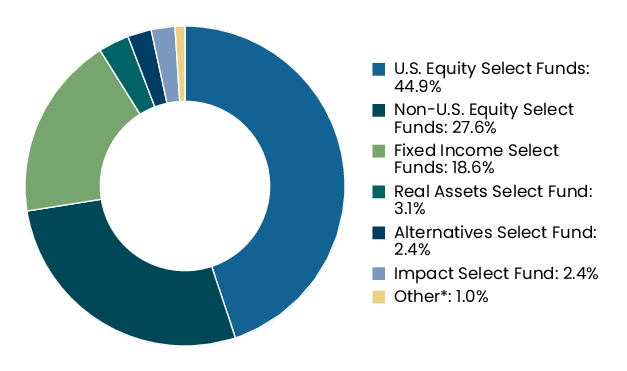

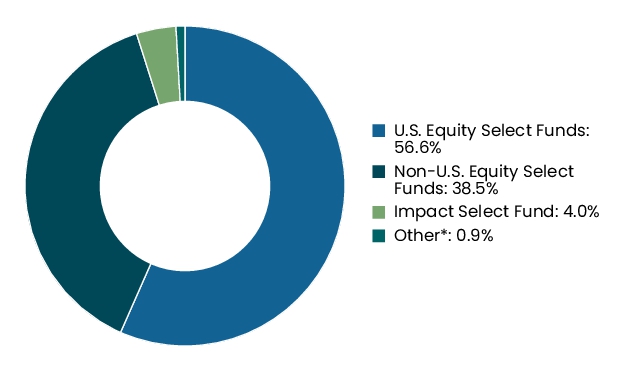

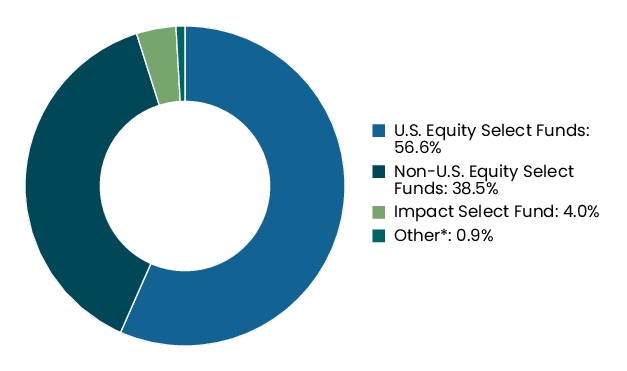

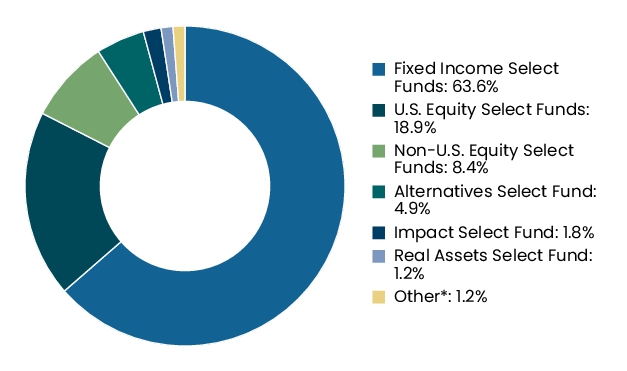

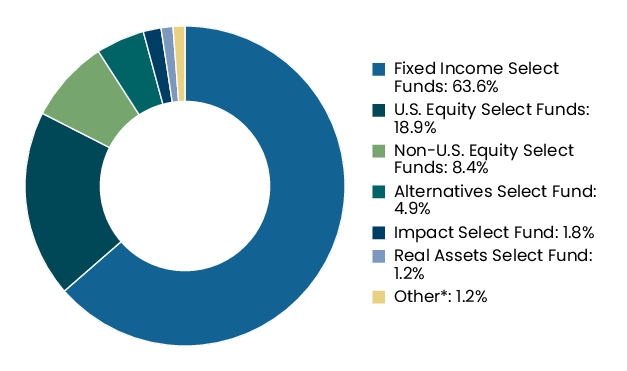

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

50.0% |

| GuideStone International Equity Index Fund |

24.8% |

| GuideStone Emerging Markets Equity Fund |

6.1% |

| GuideStone Small Cap Equity Fund |

6.0% |

| GuideStone Defensive Market Strategies® Fund |

5.0% |

| GuideStone Medium-Duration Bond Fund |

4.1% |

| GuideStone Global Real Estate Securities Fund |

1.9% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

| GuideStone Global Bond Fund |

1.0% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

50.0% |

| GuideStone International Equity Index Fund |

24.8% |

| GuideStone Emerging Markets Equity Fund |

6.1% |

| GuideStone Small Cap Equity Fund |

6.0% |

| GuideStone Defensive Market Strategies® Fund |

5.0% |

| GuideStone Medium-Duration Bond Fund |

4.1% |

| GuideStone Global Real Estate Securities Fund |

1.9% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

| GuideStone Global Bond Fund |

1.0% |

|

|

| C000104140 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Defensive Market Strategies ® Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GDMZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Defensive Market Strategies Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Defensive Market Strategies Fund

(Investor Class/GDMZX) |

$46 |

0.92% |

|

|

| Expenses Paid, Amount |

$ 46

|

|

| Expense Ratio, Percent |

0.92%

|

|

| Net Assets |

$ 1,396,719,297

|

|

| Holdings Count | Holding |

216

|

|

| Investment Company Portfolio Turnover |

37.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$1,396,719,297 |

| Total number of portfolio holdings |

216 |

| Portfolio turnover rate for the period |

37% |

|

|

| Holdings [Text Block] |

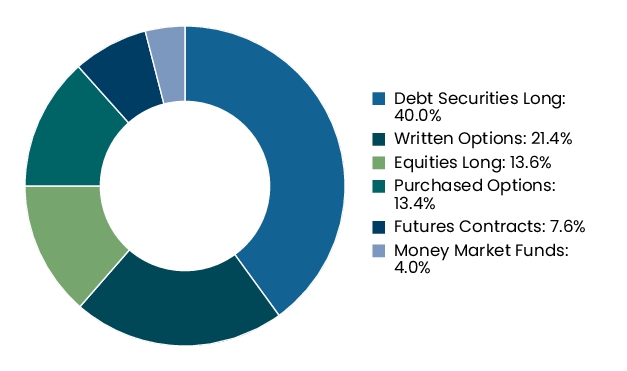

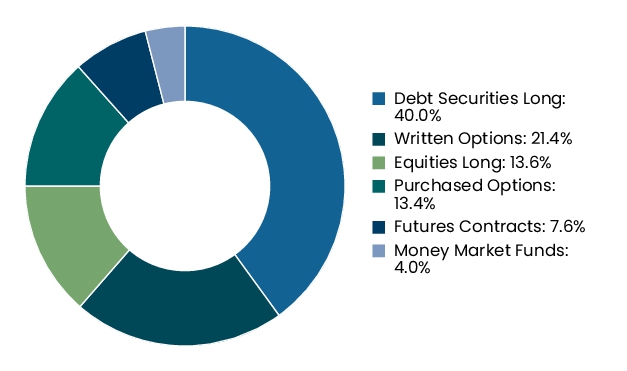

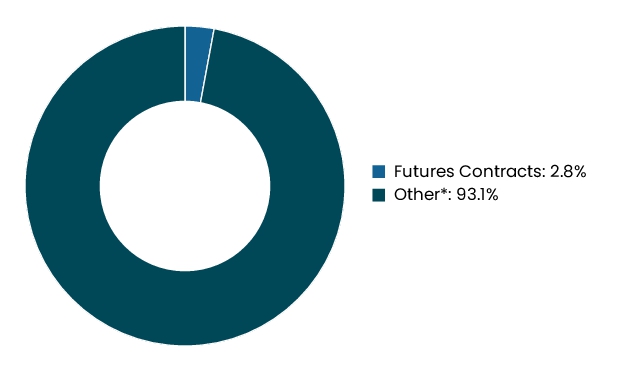

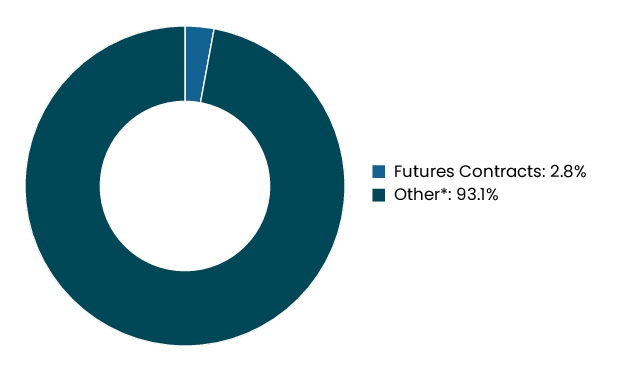

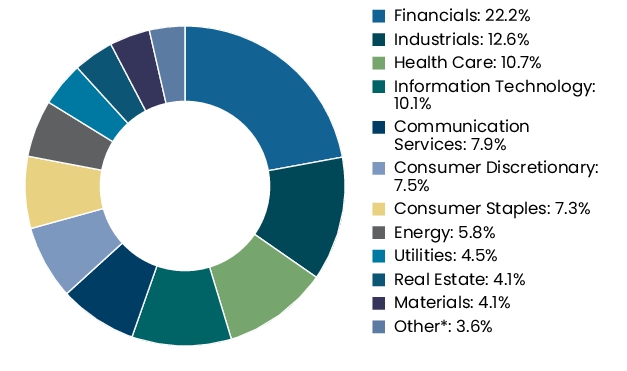

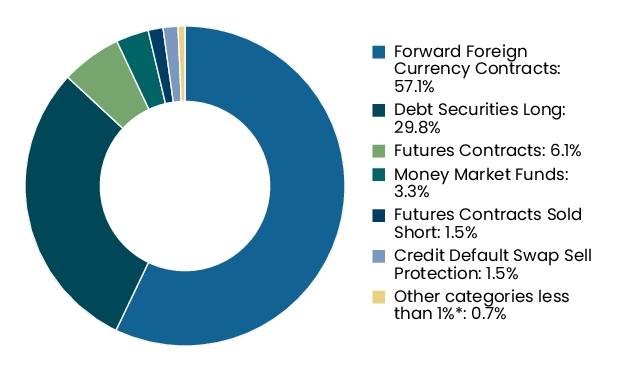

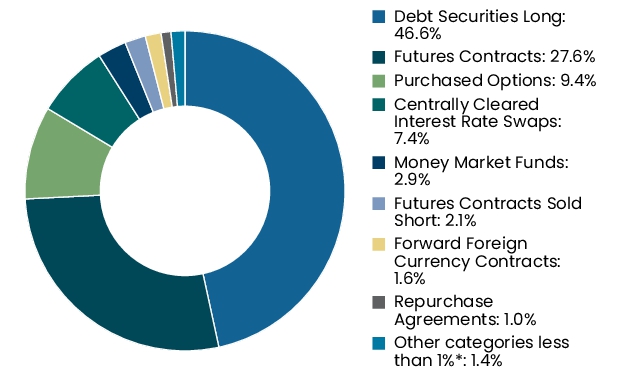

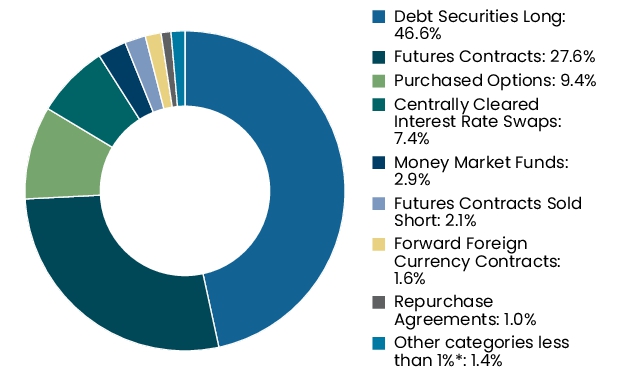

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total exposure of the Fund.

ASSET TYPE ALLOCATION

|

|

| C000108559 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2055 Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GMGZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2055 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2055 Fund

(Investor Class/GMGZX) |

$21 |

0.40% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 21

|

[5] |

| Expense Ratio, Percent |

0.40%

|

[5] |

| Net Assets |

$ 963,193,705

|

|

| Holdings Count | Holding |

9

|

|

| Investment Company Portfolio Turnover |

2.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$963,193,705 |

| Total number of portfolio holdings |

9 |

| Portfolio turnover rate for the period |

2% |

|

|

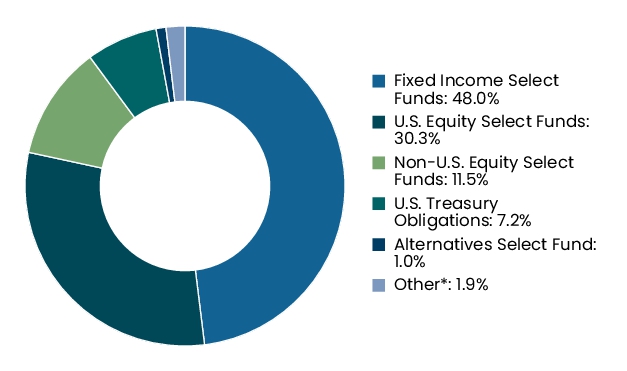

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

50.0% |

| GuideStone International Equity Index Fund |

24.8% |

| GuideStone Emerging Markets Equity Fund |

6.1% |

| GuideStone Small Cap Equity Fund |

6.0% |

| GuideStone Defensive Market Strategies® Fund |

5.0% |

| GuideStone Medium-Duration Bond Fund |

4.1% |

| GuideStone Global Real Estate Securities Fund |

1.9% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

| GuideStone Global Bond Fund |

1.0% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

50.0% |

| GuideStone International Equity Index Fund |

24.8% |

| GuideStone Emerging Markets Equity Fund |

6.1% |

| GuideStone Small Cap Equity Fund |

6.0% |

| GuideStone Defensive Market Strategies® Fund |

5.0% |

| GuideStone Medium-Duration Bond Fund |

4.1% |

| GuideStone Global Real Estate Securities Fund |

1.9% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

| GuideStone Global Bond Fund |

1.0% |

|

|

| C000104139 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Defensive Market Strategies ® Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GDMYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Defensive Market Strategies Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Defensive Market Strategies Fund

(Institutional Class/GDMYX) |

$32 |

0.64% |

|

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.64%

|

|

| Net Assets |

$ 1,396,719,297

|

|

| Holdings Count | Holding |

216

|

|

| Investment Company Portfolio Turnover |

37.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$1,396,719,297 |

| Total number of portfolio holdings |

216 |

| Portfolio turnover rate for the period |

37% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total exposure of the Fund.

ASSET TYPE ALLOCATION

|

|

| C000240566 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Impact Equity Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GMEYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Impact Equity Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Impact Equity Fund

(Institutional Class/GMEYX) |

$45 |

0.84% |

|

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.84%

|

|

| Net Assets |

$ 120,403,899

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$120,403,899 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate for the period |

12% |

|

|

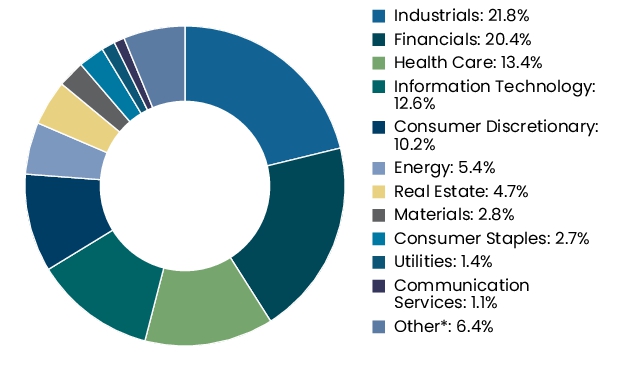

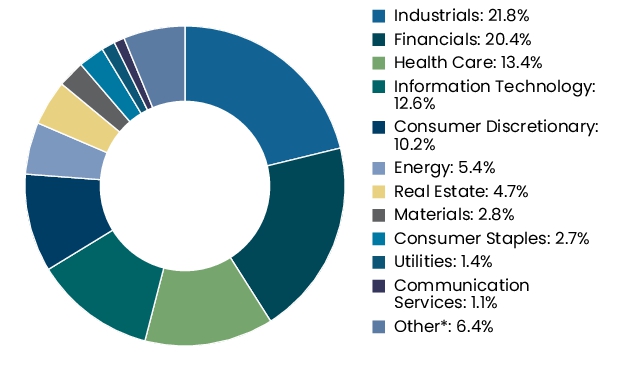

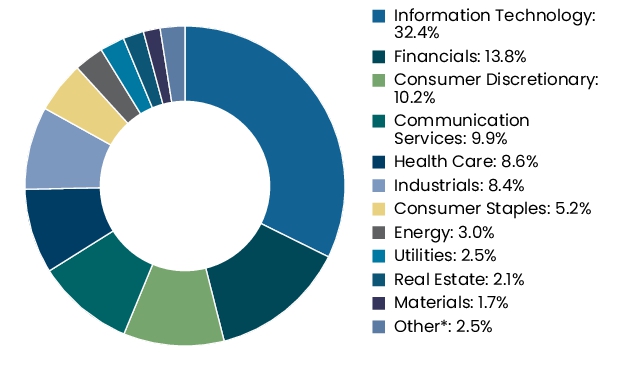

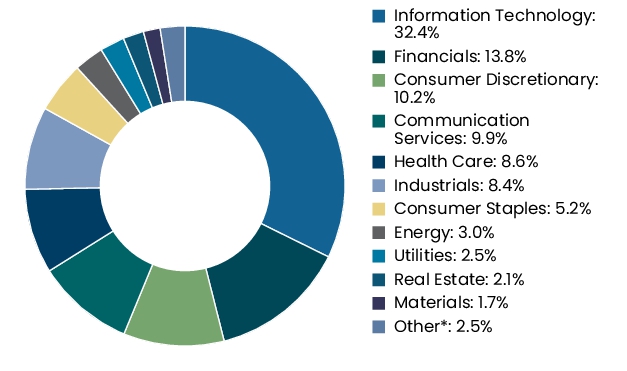

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000240565 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Impact Equity Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GMEZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Impact Equity Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Impact Equity Fund

(Investor Class/GMEZX) |

$64 |

1.21% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 64

|

[6] |

| Expense Ratio, Percent |

1.21%

|

[6] |

| Net Assets |

$ 120,403,899

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$120,403,899 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate for the period |

12% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000240563 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Impact Bond Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GMBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Impact Bond Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Impact Bond Fund

(Investor Class/GMBZX) |

$39 |

0.78% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 39

|

[7] |

| Expense Ratio, Percent |

0.78%

|

[7] |

| Net Assets |

$ 89,587,989

|

|

| Holdings Count | Holding |

171

|

|

| Investment Company Portfolio Turnover |

59.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$89,587,989 |

| Total number of portfolio holdings |

171 |

| Portfolio turnover rate for the period |

59% |

|

|

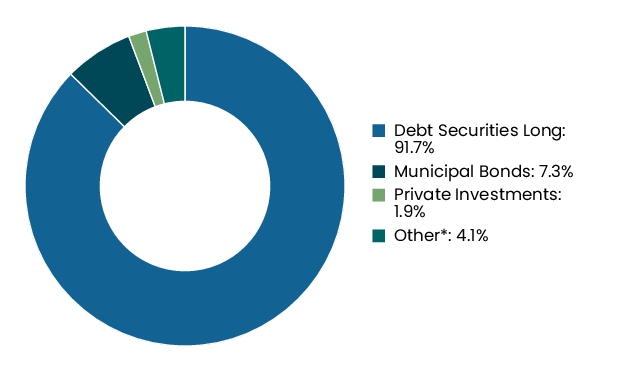

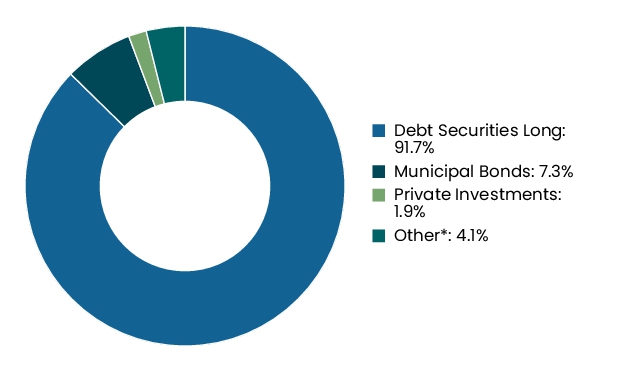

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

ASSET TYPE ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000240564 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Impact Bond Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GMBYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Impact Bond Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Impact Bond Fund

(Institutional Class/GMBYX) |

$25 |

0.49% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 25

|

[8] |

| Expense Ratio, Percent |

0.49%

|

[8] |

| Net Assets |

$ 89,587,989

|

|

| Holdings Count | Holding |

171

|

|

| Investment Company Portfolio Turnover |

59.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$89,587,989 |

| Total number of portfolio holdings |

171 |

| Portfolio turnover rate for the period |

59% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

ASSET TYPE ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000237794 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Growth Equity Index Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GEIYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Growth Equity Index Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Growth Equity Index Fund

(Institutional Class/GEIYX) |

$13 |

0.25% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 13

|

[9] |

| Expense Ratio, Percent |

0.25%

|

[9] |

| Net Assets |

$ 323,745,083

|

|

| Holdings Count | Holding |

357

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$323,745,083 |

| Total number of portfolio holdings |

357 |

| Portfolio turnover rate for the period |

15% |

|

|

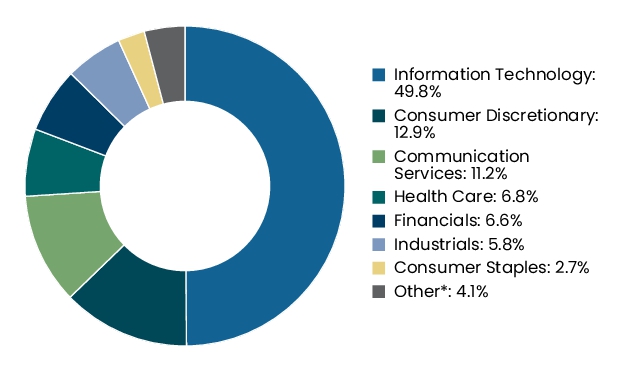

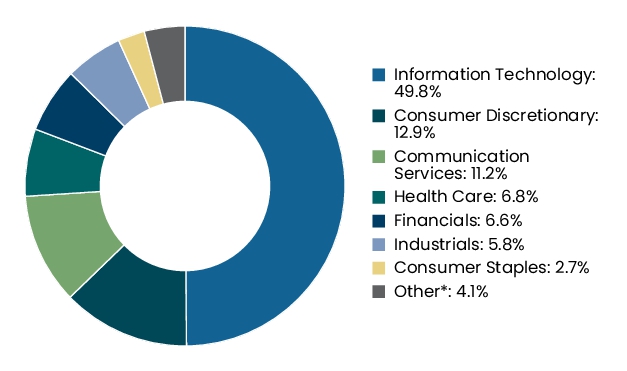

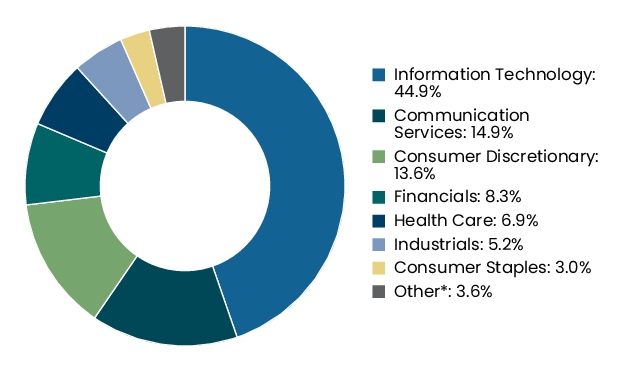

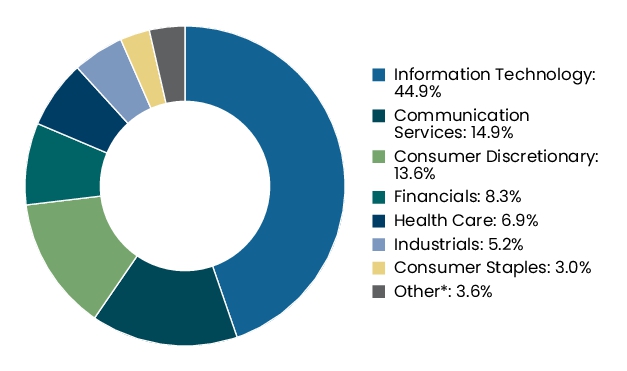

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000237793 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Growth Equity Index Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GEIZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Growth Equity Index Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Growth Equity Index Fund

(Investor Class/GEIZX) |

$26 |

0.50% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 26

|

[10] |

| Expense Ratio, Percent |

0.50%

|

[10] |

| Net Assets |

$ 323,745,083

|

|

| Holdings Count | Holding |

357

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$323,745,083 |

| Total number of portfolio holdings |

357 |

| Portfolio turnover rate for the period |

15% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000183274 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Strategic Alternatives Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GFSYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Strategic Alternatives Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Strategic Alternatives Fund

(Institutional Class/GFSYX) |

$67 |

1.34% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 67

|

[11] |

| Expense Ratio, Percent |

1.34%

|

[11] |

| Net Assets |

$ 286,768,663

|

|

| Holdings Count | Holding |

649

|

|

| Investment Company Portfolio Turnover |

194.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$286,768,663 |

| Total number of portfolio holdings |

649 |

| Portfolio turnover rate for the period |

194% |

|

|

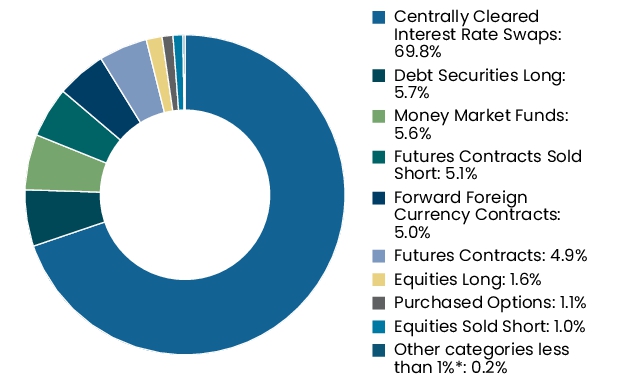

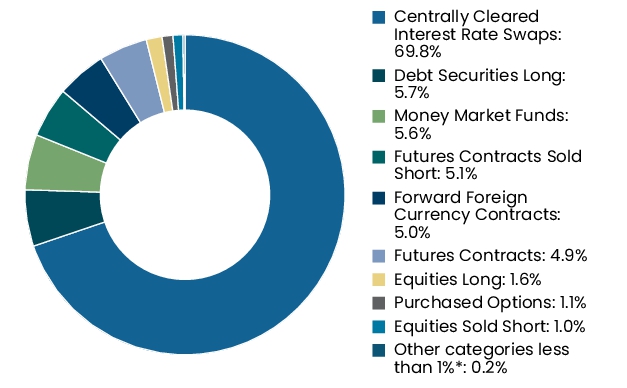

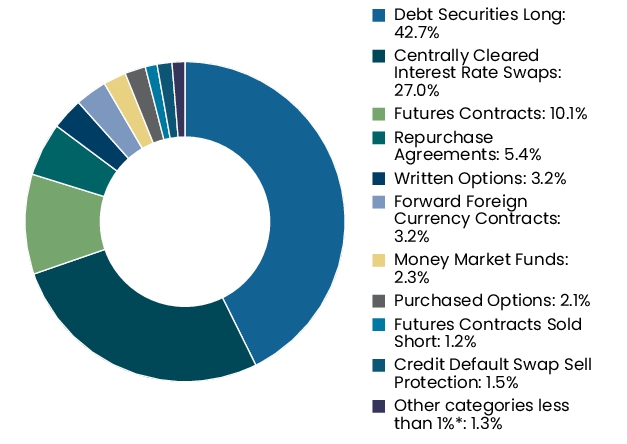

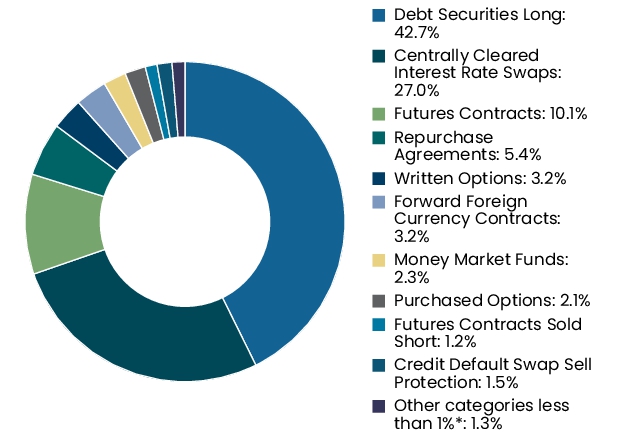

| Holdings [Text Block] |

Graphical Representation of Holdings The table below shows the investment makeup of the Fund, representing percentage of the total exposure of the Fund. ASSET TYPE ALLOCATION

|

|

| C000183275 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Strategic Alternatives Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GFSZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Strategic Alternatives Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Strategic Alternatives Fund

(Investor Class/GFSZX) |

$80 |

1.59% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 80

|

[12] |

| Expense Ratio, Percent |

1.59%

|

[12] |

| Net Assets |

$ 286,768,663

|

|

| Holdings Count | Holding |

649

|

|

| Investment Company Portfolio Turnover |

194.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$286,768,663 |

| Total number of portfolio holdings |

649 |

| Portfolio turnover rate for the period |

194% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The table below shows the investment makeup of the Fund, representing percentage of the total exposure of the Fund. ASSET TYPE ALLOCATION

|

|

| C000237792 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Value Equity Index Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GVIYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Value Equity Index Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Value Equity Index Fund

(Institutional Class/GVIYX) |

$13 |

0.25% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 13

|

[13] |

| Expense Ratio, Percent |

0.25%

|

[13] |

| Net Assets |

$ 207,794,820

|

|

| Holdings Count | Holding |

816

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$207,794,820 |

| Total number of portfolio holdings |

816 |

| Portfolio turnover rate for the period |

17% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000237791 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Value Equity Index Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GVIZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Value Equity Index Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

Value Equity Index Fund

(Investor Class/GVIZX) |

$25 |

0.50% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 25

|

[14] |

| Expense Ratio, Percent |

0.50%

|

[14] |

| Net Assets |

$ 207,794,820

|

|

| Holdings Count | Holding |

816

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$207,794,820 |

| Total number of portfolio holdings |

816 |

| Portfolio turnover rate for the period |

17% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000039452 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Bond Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GGBFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Bond Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Global Bond Fund

(Investor Class/GGBFX) |

$48 |

0.95% |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.95%

|

|

| Net Assets |

$ 632,741,348

|

|

| Holdings Count | Holding |

1,505

|

|

| Investment Company Portfolio Turnover |

35.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$632,741,348 |

| Total number of portfolio holdings |

1,505 |

| Portfolio turnover rate for the period |

35% |

|

|

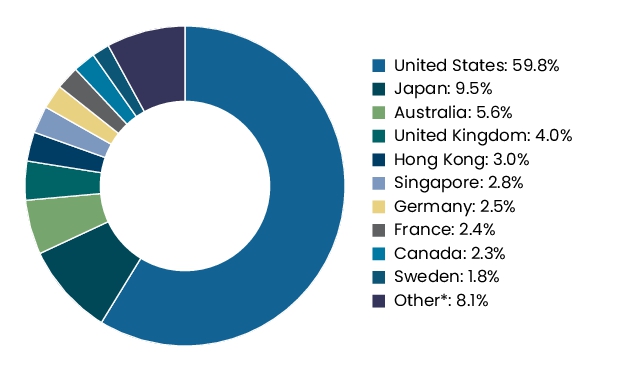

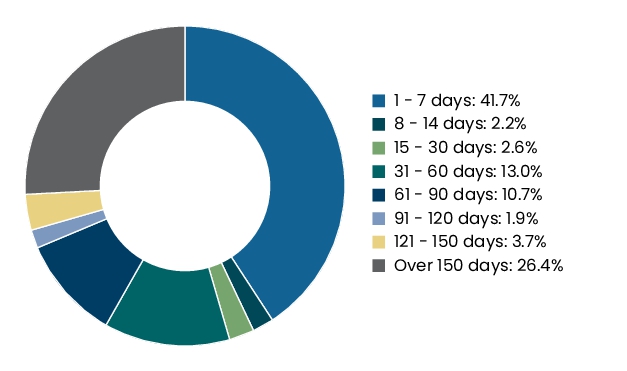

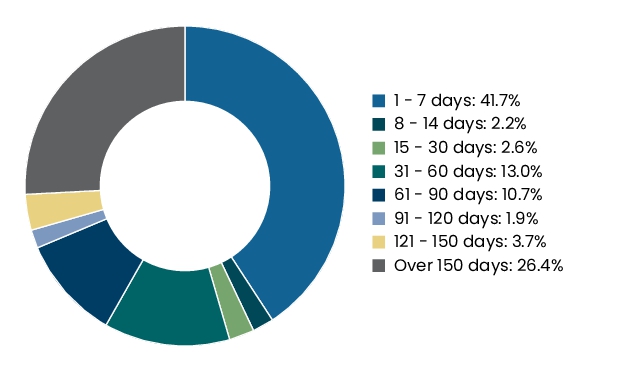

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total exposure of the Fund.

ASSET TYPE ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000158247 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Real Estate Securities Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GREYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Real Estate Securities Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Global Real Estate Securities Fund

(Institutional Class/GREYX) |

$45 |

0.88% |

|

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.88%

|

|

| Net Assets |

$ 306,925,105

|

|

| Holdings Count | Holding |

154

|

|

| Investment Company Portfolio Turnover |

72.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$306,925,105 |

| Total number of portfolio holdings |

154 |

| Portfolio turnover rate for the period |

72% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

| Real Estate |

94.8% |

| Health Care |

1.5% |

| Information Technology |

0.2% |

| Consumer Discretionary |

0.3% |

| Other* |

5.0% |

|

101.8% |

GEOGRAPHIC ALLOCATION

*Includes, as applicable, short-term investments, derivatives and countries and/or categories rounding to less than 1%.

|

|

| C000039453 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Real Estate Securities Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GREZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Real Estate Securities Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Global Real Estate Securities Fund

(Investor Class/GREZX) |

$61 |

1.20% |

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

1.20%

|

|

| Net Assets |

$ 306,925,105

|

|

| Holdings Count | Holding |

154

|

|

| Investment Company Portfolio Turnover |

72.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$306,925,105 |

| Total number of portfolio holdings |

154 |

| Portfolio turnover rate for the period |

72% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

INDUSTRY SECTOR ALLOCATION

| Real Estate |

94.8% |

| Health Care |

1.5% |

| Information Technology |

0.2% |

| Consumer Discretionary |

0.3% |

| Other* |

5.0% |

|

101.8% |

GEOGRAPHIC ALLOCATION

*Includes, as applicable, short-term investments, derivatives and countries and/or categories rounding to less than 1%.

|

|

| C000158246 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Bond Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GGBEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Bond Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment |

Cost of $10,000 investment

as a percentage |

Global Bond Fund

(Institutional Class/GGBEX) |

$32 |

0.63% |

|

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.63%

|

|

| Net Assets |

$ 632,741,348

|

|

| Holdings Count | Holding |

1,505

|

|

| Investment Company Portfolio Turnover |

35.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$632,741,348 |

| Total number of portfolio holdings |

1,505 |

| Portfolio turnover rate for the period |

35% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table below shows the investment makeup of the Fund, representing percentage of the total exposure of the Fund.

ASSET TYPE ALLOCATION

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| C000185897 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2045 Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GMYYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2045 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2045 Fund

(Institutional Class/GMYYX) |

$6 |

0.12% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 6

|

[15] |

| Expense Ratio, Percent |

0.12%

|

[15] |

| Net Assets |

$ 1,826,216,758

|

|

| Holdings Count | Holding |

9

|

|

| Investment Company Portfolio Turnover |

3.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$1,826,216,758 |

| Total number of portfolio holdings |

9 |

| Portfolio turnover rate for the period |

3% |

|

|

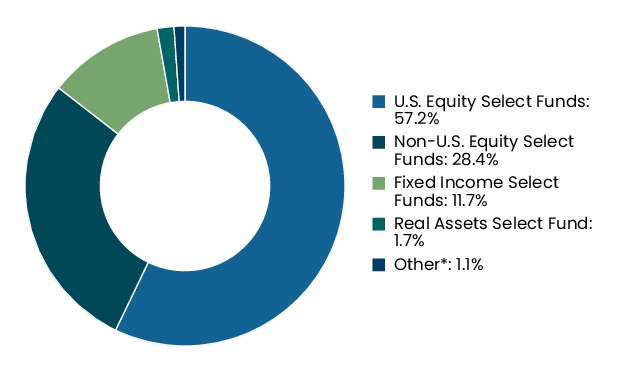

| Holdings [Text Block] |

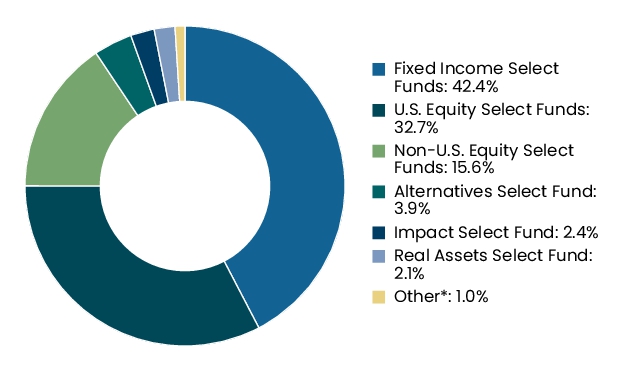

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

46.4% |

| GuideStone International Equity Index Fund |

22.8% |

| GuideStone Medium-Duration Bond Fund |

9.4% |

| GuideStone Emerging Markets Equity Fund |

5.6% |

| GuideStone Small Cap Equity Fund |

5.5% |

| GuideStone Defensive Market Strategies® Fund |

5.3% |

| GuideStone Global Bond Fund |

2.3% |

| GuideStone Global Real Estate Securities Fund |

1.7% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

46.4% |

| GuideStone International Equity Index Fund |

22.8% |

| GuideStone Medium-Duration Bond Fund |

9.4% |

| GuideStone Emerging Markets Equity Fund |

5.6% |

| GuideStone Small Cap Equity Fund |

5.5% |

| GuideStone Defensive Market Strategies® Fund |

5.3% |

| GuideStone Global Bond Fund |

2.3% |

| GuideStone Global Real Estate Securities Fund |

1.7% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

|

|

| C000039449 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2045 Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GMFZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2045 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2045 Fund

(Investor Class/GMFZX) |

$20 |

0.38% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 20

|

[16] |

| Expense Ratio, Percent |

0.38%

|

[16] |

| Net Assets |

$ 1,826,216,758

|

|

| Holdings Count | Holding |

9

|

|

| Investment Company Portfolio Turnover |

3.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$1,826,216,758 |

| Total number of portfolio holdings |

9 |

| Portfolio turnover rate for the period |

3% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

46.4% |

| GuideStone International Equity Index Fund |

22.8% |

| GuideStone Medium-Duration Bond Fund |

9.4% |

| GuideStone Emerging Markets Equity Fund |

5.6% |

| GuideStone Small Cap Equity Fund |

5.5% |

| GuideStone Defensive Market Strategies® Fund |

5.3% |

| GuideStone Global Bond Fund |

2.3% |

| GuideStone Global Real Estate Securities Fund |

1.7% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

46.4% |

| GuideStone International Equity Index Fund |

22.8% |

| GuideStone Medium-Duration Bond Fund |

9.4% |

| GuideStone Emerging Markets Equity Fund |

5.6% |

| GuideStone Small Cap Equity Fund |

5.5% |

| GuideStone Defensive Market Strategies® Fund |

5.3% |

| GuideStone Global Bond Fund |

2.3% |

| GuideStone Global Real Estate Securities Fund |

1.7% |

| GuideStone Money Market Fund, 4.25% |

1.1% |

|

|

| C000185896 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2035 Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GMHYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2035 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2035 Fund

(Institutional Class/GMHYX) |

$4 |

0.08% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 4

|

[17] |

| Expense Ratio, Percent |

0.08%

|

[17] |

| Net Assets |

$ 2,157,348,591

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$2,157,348,591 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate for the period |

6% |

|

|

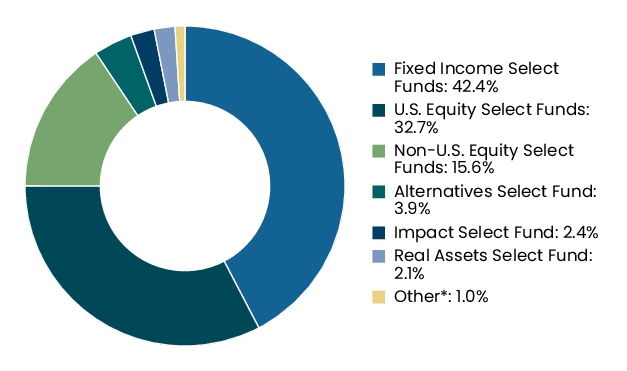

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

33.5% |

| GuideStone Medium-Duration Bond Fund |

22.3% |

| GuideStone International Equity Index Fund |

16.7% |

| GuideStone Defensive Market Strategies® Fund |

10.6% |

| GuideStone Global Bond Fund |

5.3% |

| GuideStone Emerging Markets Equity Fund |

4.1% |

| GuideStone Small Cap Equity Fund |

3.9% |

| GuideStone Global Real Estate Securities Fund |

1.4% |

| GuideStone Strategic Alternatives Fund |

1.0% |

| GuideStone Money Market Fund, 4.25% |

1.0% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

33.5% |

| GuideStone Medium-Duration Bond Fund |

22.3% |

| GuideStone International Equity Index Fund |

16.7% |

| GuideStone Defensive Market Strategies® Fund |

10.6% |

| GuideStone Global Bond Fund |

5.3% |

| GuideStone Emerging Markets Equity Fund |

4.1% |

| GuideStone Small Cap Equity Fund |

3.9% |

| GuideStone Global Real Estate Securities Fund |

1.4% |

| GuideStone Strategic Alternatives Fund |

1.0% |

| GuideStone Money Market Fund, 4.25% |

1.0% |

|

|

| C000039446 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2035 Fund

|

|

| Class Name |

INVESTOR

|

|

| Trading Symbol |

GMHZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2035 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2035 Fund

(Investor Class/GMHZX) |

$19 |

0.37% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 19

|

[18] |

| Expense Ratio, Percent |

0.37%

|

[18] |

| Net Assets |

$ 2,157,348,591

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$2,157,348,591 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate for the period |

6% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

33.5% |

| GuideStone Medium-Duration Bond Fund |

22.3% |

| GuideStone International Equity Index Fund |

16.7% |

| GuideStone Defensive Market Strategies® Fund |

10.6% |

| GuideStone Global Bond Fund |

5.3% |

| GuideStone Emerging Markets Equity Fund |

4.1% |

| GuideStone Small Cap Equity Fund |

3.9% |

| GuideStone Global Real Estate Securities Fund |

1.4% |

| GuideStone Strategic Alternatives Fund |

1.0% |

| GuideStone Money Market Fund, 4.25% |

1.0% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Equity Index Fund |

33.5% |

| GuideStone Medium-Duration Bond Fund |

22.3% |

| GuideStone International Equity Index Fund |

16.7% |

| GuideStone Defensive Market Strategies® Fund |

10.6% |

| GuideStone Global Bond Fund |

5.3% |

| GuideStone Emerging Markets Equity Fund |

4.1% |

| GuideStone Small Cap Equity Fund |

3.9% |

| GuideStone Global Real Estate Securities Fund |

1.4% |

| GuideStone Strategic Alternatives Fund |

1.0% |

| GuideStone Money Market Fund, 4.25% |

1.0% |

|

|

| C000185895 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MyDestination 2025 Fund

|

|

| Class Name |

INSTITUTIONAL

|

|

| Trading Symbol |

GMWYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the MyDestination 2025 Fund (“Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at GuideStoneFunds.com/Fund-Literature. You can also request this information by contacting us at 1-888-GS-FUNDS.

|

|

| Additional Information Phone Number |

1-888-GS-FUNDS

|

|

| Additional Information Website |

GuideStoneFunds.com/Fund-Literature

|

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of $10,000 Investment1 |

Cost of $10,000 investment

as a percentage1 |

MyDestination 2025 Fund

(Institutional Class/GMWYX) |

$4 |

0.07% |

|

1

|

Reflects applicable expense reimbursements and fee waivers.

|

|

|

| Expenses Paid, Amount |

$ 4

|

[19] |

| Expense Ratio, Percent |

0.07%

|

[19] |

| Net Assets |

$ 2,008,002,397

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund Net Assets |

$2,008,002,397 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate for the period |

9% |

|

|

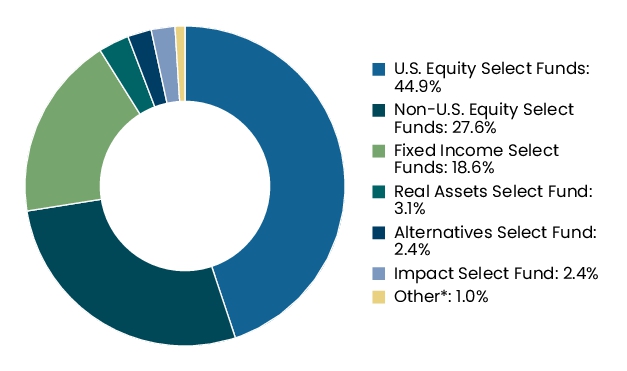

| Holdings [Text Block] |

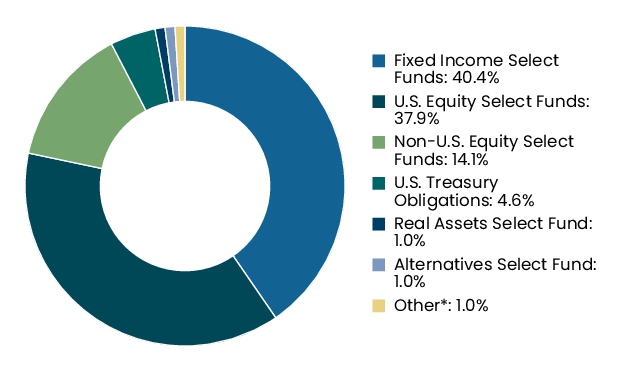

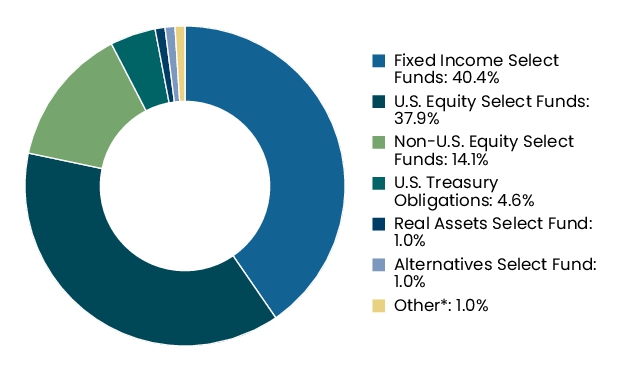

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| GuideStone Medium-Duration Bond Fund |

30.7% |

| GuideStone Equity Index Fund |

22.4% |

| GuideStone Defensive Market Strategies® Fund |

13.0% |

| GuideStone International Equity Index Fund |

11.4% |

| GuideStone Global Bond Fund |

5.3% |

| GuideStone Low-Duration Bond Fund |

4.4% |

| GuideStone Emerging Markets Equity Fund |

2.7% |

| GuideStone Small Cap Equity Fund |

2.5% |

| GuideStone Global Real Estate Securities Fund |

1.0% |

| GuideStone Strategic Alternatives Fund |

1.0% |

PORTFOLIO SUMMARY

*Includes, if any, short-term investments, derivatives and categories rounding to less than 1%.

|

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| GuideStone Medium-Duration Bond Fund |

30.7% |

| GuideStone Equity Index Fund |

22.4% |

| GuideStone Defensive Market Strategies® Fund |

13.0% |

| GuideStone International Equity Index Fund |

11.4% |

| GuideStone Global Bond Fund |

5.3% |

| GuideStone Low-Duration Bond Fund |

4.4% |

| GuideStone Emerging Markets Equity Fund |

2.7% |

| GuideStone Small Cap Equity Fund |

2.5% |