Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

BlackRock Municipal Bond Fund, Inc.

|

| Entity Central Index Key |

0000225635

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000006121 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock National Municipal Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

MANLX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock National Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$46 |

0.46% |

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.46%

|

| Factors Affecting Performance [Text Block] |

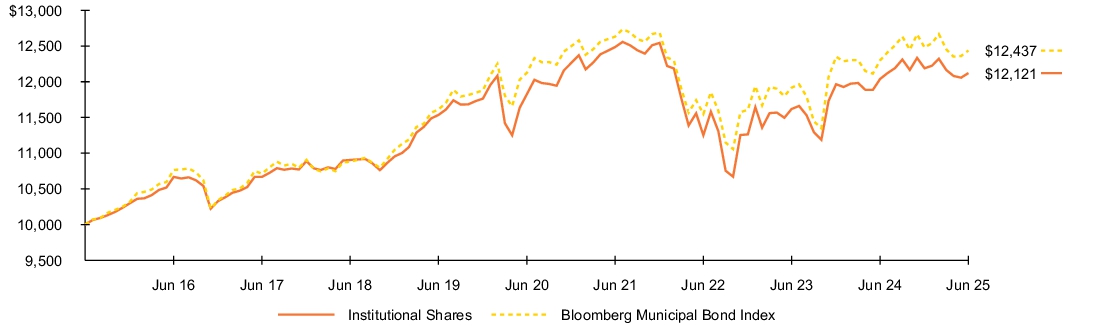

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Institutional Shares returned 0.68%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11%. What contributed to performance? Income was a key contributor to absolute performance at a time in which the prices of longer-term bonds declined. Holdings in short- to intermediate-term securities provided positive total returns. At the sector level, the largest contributions came from transportation and corporate-backed issues due to their large portfolio weightings, higher yields, and price appreciation for intermediate-term securities in the category. The Fund’s cash position had no material impact on performance. What detracted from performance? Longer-maturity, discount bonds and/or securities with longer call features finished with losses due to their higher interest rate sensitivity. In high yield, several holdings in smaller, esoteric loans lost ground. At the sector level, work force housing and charter schools experienced negative absolute returns. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Institutional Shares |

0.68 |

% |

0.49 |

% |

1.94 |

% |

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 6,048,053,509

|

| Holdings Count | Holding |

429

|

| Advisory Fees Paid, Amount |

$ 25,432,538

|

| Investment Company Portfolio Turnover |

46.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$6,048,053,509 |

| Number of Portfolio Holdings |

429 |

| Net Investment Advisory Fees |

$25,432,538 |

| Portfolio Turnover Rate |

46% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Transportation |

27.1 |

% |

| Corporate |

16.5 |

% |

| State |

15.8 |

% |

| Utilities |

12.2 |

% |

| Health |

11.0 |

% |

| Education |

5.7 |

% |

| County/City/Special District/School District |

5.3 |

% |

| Housing |

5.1 |

% |

| Tobacco |

1.3 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

10.5 |

% |

| AA/Aa |

58.0 |

% |

| A |

22.5 |

% |

| BBB/Baa |

3.4 |

% |

| BB/Ba |

0.6 |

% |

| B |

0.2 |

% |

| N/R |

4.8 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| C000100249 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock National Municipal Fund

|

| Class Name |

Service Shares

|

| Trading Symbol |

BNMSX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock National Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Service Shares |

$71 |

0.71% |

|

| Expenses Paid, Amount |

$ 71

|

| Expense Ratio, Percent |

0.71%

|

| Factors Affecting Performance [Text Block] |

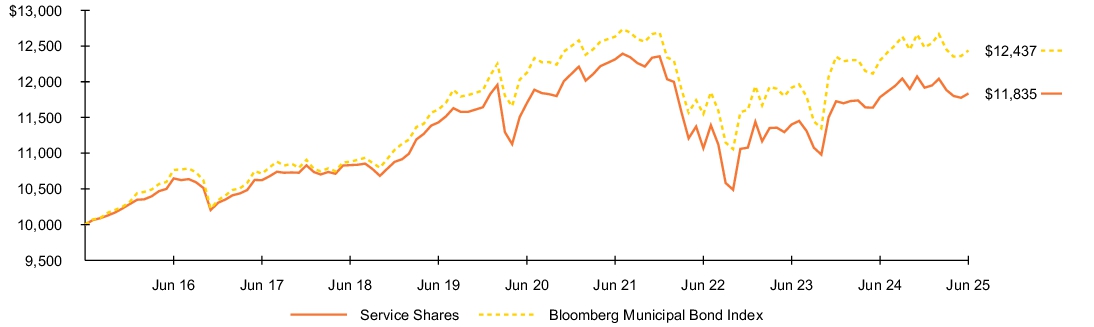

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Service Shares returned 0.43%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11%. What contributed to performance? Income was a key contributor to absolute performance at a time in which the prices of longer-term bonds declined. Holdings in short- to intermediate-term securities provided positive total returns. At the sector level, the largest contributions came from transportation and corporate-backed issues due to their large portfolio weightings, higher yields, and price appreciation for intermediate-term securities in the category. The Fund’s cash position had no material impact on performance. What detracted from performance? Longer-maturity, discount bonds and/or securities with longer call features finished with losses due to their higher interest rate sensitivity. In high yield, several holdings in smaller, esoteric loans lost ground. At the sector level, work force housing and charter schools experienced negative absolute returns. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Service Shares |

0.43 |

% |

0.23 |

% |

1.70 |

% |

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 6,048,053,509

|

| Holdings Count | Holding |

429

|

| Advisory Fees Paid, Amount |

$ 25,432,538

|

| Investment Company Portfolio Turnover |

46.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$6,048,053,509 |

| Number of Portfolio Holdings |

429 |

| Net Investment Advisory Fees |

$25,432,538 |

| Portfolio Turnover Rate |

46% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Transportation |

27.1 |

% |

| Corporate |

16.5 |

% |

| State |

15.8 |

% |

| Utilities |

12.2 |

% |

| Health |

11.0 |

% |

| Education |

5.7 |

% |

| County/City/Special District/School District |

5.3 |

% |

| Housing |

5.1 |

% |

| Tobacco |

1.3 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

10.5 |

% |

| AA/Aa |

58.0 |

% |

| A |

22.5 |

% |

| BBB/Baa |

3.4 |

% |

| BB/Ba |

0.6 |

% |

| B |

0.2 |

% |

| N/R |

4.8 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| C000006118 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock National Municipal Fund

|

| Class Name |

Investor A Shares

|

| Trading Symbol |

MDNLX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock National Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$71 |

0.71% |

|

| Expenses Paid, Amount |

$ 71

|

| Expense Ratio, Percent |

0.71%

|

| Factors Affecting Performance [Text Block] |

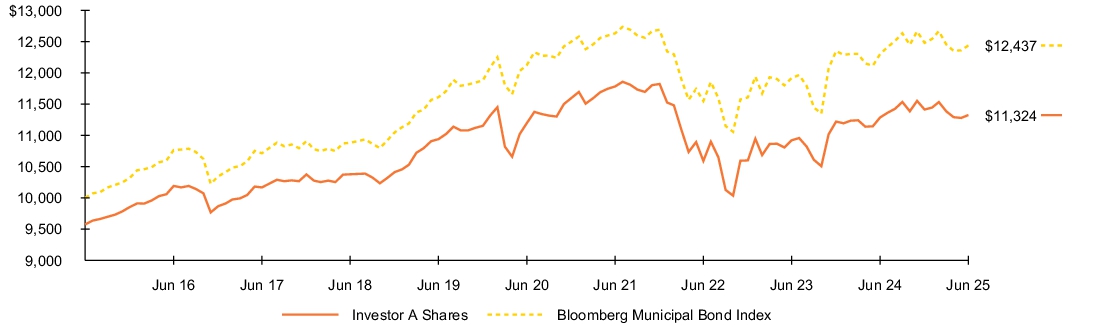

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Investor A Shares returned 0.33%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11%. What contributed to performance? Income was a key contributor to absolute performance at a time in which the prices of longer-term bonds declined. Holdings in short- to intermediate-term securities provided positive total returns. At the sector level, the largest contributions came from transportation and corporate-backed issues due to their large portfolio weightings, higher yields, and price appreciation for intermediate-term securities in the category. The Fund’s cash position had no material impact on performance. What detracted from performance? Longer-maturity, discount bonds and/or securities with longer call features finished with losses due to their higher interest rate sensitivity. In high yield, several holdings in smaller, esoteric loans lost ground. At the sector level, work force housing and charter schools experienced negative absolute returns. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor A Shares |

0.33 |

% |

0.23 |

% |

1.69 |

% |

| Investor A Shares (with sales charge) |

(3.94 |

) |

(0.64 |

) |

1.25 |

|

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 6,048,053,509

|

| Holdings Count | Holding |

429

|

| Advisory Fees Paid, Amount |

$ 25,432,538

|

| Investment Company Portfolio Turnover |

46.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$6,048,053,509 |

| Number of Portfolio Holdings |

429 |

| Net Investment Advisory Fees |

$25,432,538 |

| Portfolio Turnover Rate |

46% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Transportation |

27.1 |

% |

| Corporate |

16.5 |

% |

| State |

15.8 |

% |

| Utilities |

12.2 |

% |

| Health |

11.0 |

% |

| Education |

5.7 |

% |

| County/City/Special District/School District |

5.3 |

% |

| Housing |

5.1 |

% |

| Tobacco |

1.3 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

10.5 |

% |

| AA/Aa |

58.0 |

% |

| A |

22.5 |

% |

| BBB/Baa |

3.4 |

% |

| BB/Ba |

0.6 |

% |

| B |

0.2 |

% |

| N/R |

4.8 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| C000038033 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock National Municipal Fund

|

| Class Name |

Investor C Shares

|

| Trading Symbol |

MFNLX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock National Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares |

$146 |

1.46% |

|

| Expenses Paid, Amount |

$ 146

|

| Expense Ratio, Percent |

1.46%

|

| Factors Affecting Performance [Text Block] |

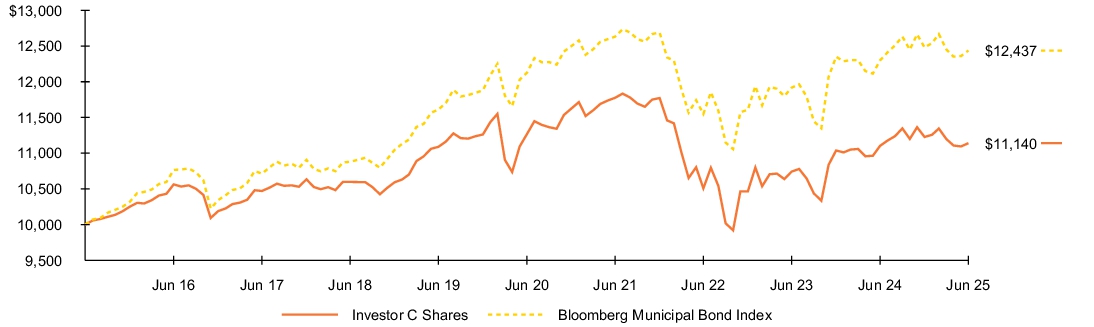

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Investor C Shares returned (0.42)%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11%. What contributed to performance? Income was a key contributor to absolute performance at a time in which the prices of longer-term bonds declined. Holdings in short- to intermediate-term securities provided positive total returns. At the sector level, the largest contributions came from transportation and corporate-backed issues due to their large portfolio weightings, higher yields, and price appreciation for intermediate-term securities in the category. The Fund’s cash position had no material impact on performance. What detracted from performance? Longer-maturity, discount bonds and/or securities with longer call features finished with losses due to their higher interest rate sensitivity. In high yield, several holdings in smaller, esoteric loans lost ground. At the sector level, work force housing and charter schools experienced negative absolute returns. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

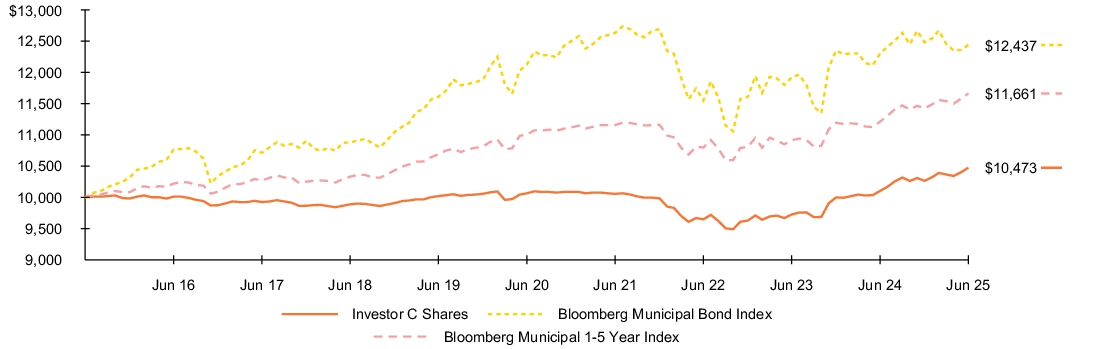

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor C Shares |

(0.42 |

)% |

(0.52 |

)% |

1.09 |

% |

| Investor C Shares (with sales charge) |

(1.39 |

) |

(0.52 |

) |

1.09 |

|

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 6,048,053,509

|

| Holdings Count | Holding |

429

|

| Advisory Fees Paid, Amount |

$ 25,432,538

|

| Investment Company Portfolio Turnover |

46.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$6,048,053,509 |

| Number of Portfolio Holdings |

429 |

| Net Investment Advisory Fees |

$25,432,538 |

| Portfolio Turnover Rate |

46% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Transportation |

27.1 |

% |

| Corporate |

16.5 |

% |

| State |

15.8 |

% |

| Utilities |

12.2 |

% |

| Health |

11.0 |

% |

| Education |

5.7 |

% |

| County/City/Special District/School District |

5.3 |

% |

| Housing |

5.1 |

% |

| Tobacco |

1.3 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

10.5 |

% |

| AA/Aa |

58.0 |

% |

| A |

22.5 |

% |

| BBB/Baa |

3.4 |

% |

| BB/Ba |

0.6 |

% |

| B |

0.2 |

% |

| N/R |

4.8 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| C000100250 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock National Municipal Fund

|

| Class Name |

Class K Shares

|

| Trading Symbol |

BNMLX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock National Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$41 |

0.41% |

|

| Expenses Paid, Amount |

$ 41

|

| Expense Ratio, Percent |

0.41%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Class K Shares returned 0.73%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11%. What contributed to performance? Income was a key contributor to absolute performance at a time in which the prices of longer-term bonds declined. Holdings in short- to intermediate-term securities provided positive total returns. At the sector level, the largest contributions came from transportation and corporate-backed issues due to their large portfolio weightings, higher yields, and price appreciation for intermediate-term securities in the category. The Fund’s cash position had no material impact on performance. What detracted from performance? Longer-maturity, discount bonds and/or securities with longer call features finished with losses due to their higher interest rate sensitivity. In high yield, several holdings in smaller, esoteric loans lost ground. At the sector level, work force housing and charter schools experienced negative absolute returns. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

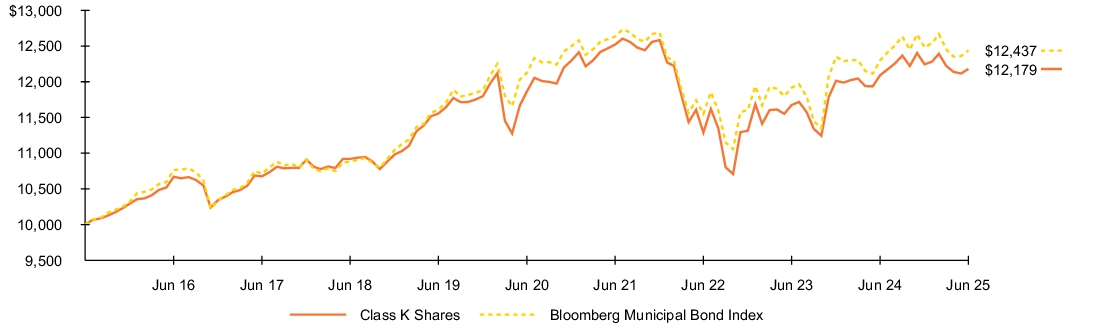

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Class K Shares |

0.73 |

% |

0.53 |

% |

1.99 |

% |

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 6,048,053,509

|

| Holdings Count | Holding |

429

|

| Advisory Fees Paid, Amount |

$ 25,432,538

|

| Investment Company Portfolio Turnover |

46.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$6,048,053,509 |

| Number of Portfolio Holdings |

429 |

| Net Investment Advisory Fees |

$25,432,538 |

| Portfolio Turnover Rate |

46% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Transportation |

27.1 |

% |

| Corporate |

16.5 |

% |

| State |

15.8 |

% |

| Utilities |

12.2 |

% |

| Health |

11.0 |

% |

| Education |

5.7 |

% |

| County/City/Special District/School District |

5.3 |

% |

| Housing |

5.1 |

% |

| Tobacco |

1.3 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

10.5 |

% |

| AA/Aa |

58.0 |

% |

| A |

22.5 |

% |

| BBB/Baa |

3.4 |

% |

| BB/Ba |

0.6 |

% |

| B |

0.2 |

% |

| N/R |

4.8 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| C000006125 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Short Duration Muni Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

MALMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Short Duration Muni Fund (the “Fund”) (formerly known as BlackRock Short-Term Municipal Fund) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$37 |

0.36% |

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.36%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Institutional Shares returned 4.02%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11% and the Municipal 1-5 Year Bond Index, returned 4.01%. What contributed to performance? Income was the largest contributor to the Fund’s absolute return. Positions in lower-quality bonds, which benefited from both higher income and spread compression—particularly for shorter-maturity issues—also contributed. At the sector level, holdings in corporate-backed issues, which includes prepaid gas bonds, were the most notable contributors. The Fund tactically shifted its duration stance during the period, which further helped results. (Duration is a measure of interest rate sensitivity.) The Fund’s cash position had no material impact on performance. What detracted from performance? Holdings in bonds with seven to 10-year maturities were the primary detractors from absolute performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

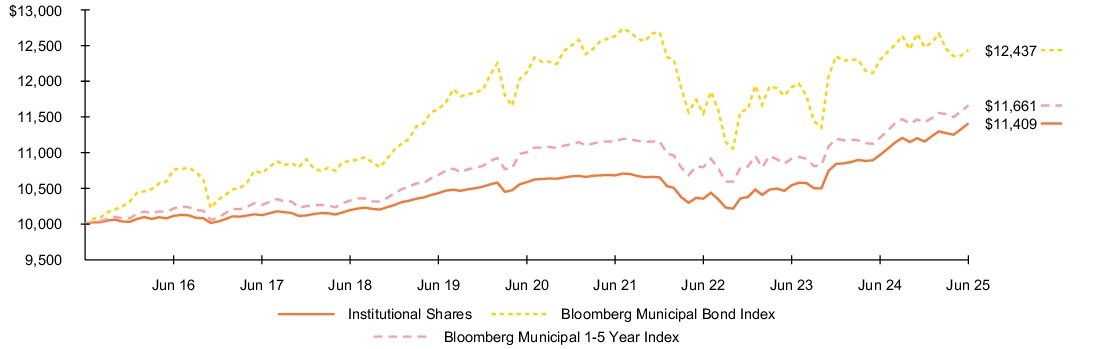

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Institutional Shares |

4.02 |

% |

1.51 |

% |

1.33 |

% |

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

| Bloomberg Municipal 1-5 Year Index |

4.01 |

|

1.16 |

|

1.55 |

|

| Short-Term Customized Reference Benchmark |

3.88 |

|

1.33 |

|

N/A |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 463,683,419

|

| Holdings Count | Holding |

195

|

| Advisory Fees Paid, Amount |

$ 1,084,115

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$463,683,419 |

| Number of Portfolio Holdings |

195 |

| Net Investment Advisory Fees |

$1,084,115 |

| Portfolio Turnover Rate |

66% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Corporate |

25.5 |

% |

| Transportation |

19.7 |

% |

| Health |

16.1 |

% |

| Utilities |

12.7 |

% |

| County/City/Special District/School District |

8.5 |

% |

| State |

7.5 |

% |

| Housing |

7.5 |

% |

| Education |

1.9 |

% |

| Tobacco |

0.6 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

8.9 |

% |

| AA/Aa |

35.1 |

% |

| A |

43.3 |

% |

| BBB/Baa |

8.9 |

% |

| BB/Ba |

0.6 |

% |

| N/R |

3.2 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Material Fund Change Name [Text Block] |

On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000038034 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Short Duration Muni Fund

|

| Class Name |

Investor A Shares

|

| Trading Symbol |

MELMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Short Duration Muni Fund (the “Fund”) (formerly known as BlackRock Short-Term Municipal Fund) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$61 |

0.60% |

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

0.60%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Investor A Shares returned 3.66%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11% and the Municipal 1-5 Year Bond Index, returned 4.01%. What contributed to performance? Income was the largest contributor to the Fund’s absolute return. Positions in lower-quality bonds, which benefited from both higher income and spread compression—particularly for shorter-maturity issues—also contributed. At the sector level, holdings in corporate-backed issues, which includes prepaid gas bonds, were the most notable contributors. The Fund tactically shifted its duration stance during the period, which further helped results. (Duration is a measure of interest rate sensitivity.) The Fund’s cash position had no material impact on performance. What detracted from performance? Holdings in bonds with seven to 10-year maturities were the primary detractors from absolute performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

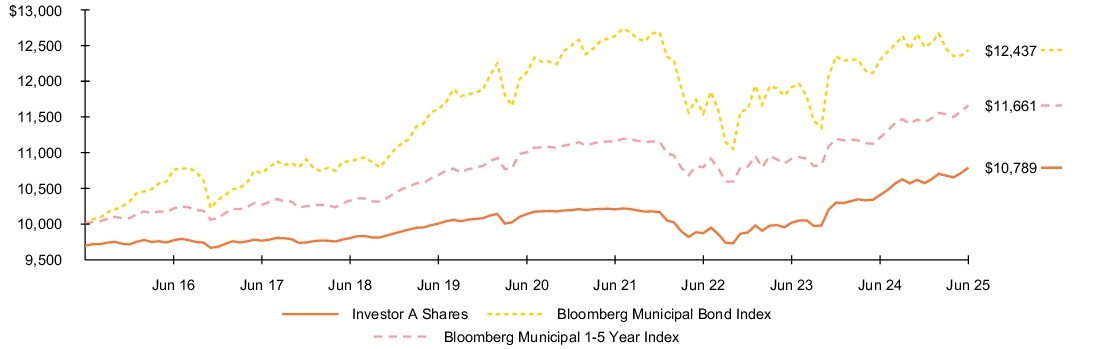

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor A Shares |

3.66 |

% |

1.25 |

% |

1.07 |

% |

| Investor A Shares (with sales charge) |

0.56 |

|

0.63 |

|

0.76 |

|

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

| Bloomberg Municipal 1-5 Year Index |

4.01 |

|

1.16 |

|

1.55 |

|

| Short-Term Customized Reference Benchmark |

3.88 |

|

1.33 |

|

N/A |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 463,683,419

|

| Holdings Count | Holding |

195

|

| Advisory Fees Paid, Amount |

$ 1,084,115

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$463,683,419 |

| Number of Portfolio Holdings |

195 |

| Net Investment Advisory Fees |

$1,084,115 |

| Portfolio Turnover Rate |

66% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Corporate |

25.5 |

% |

| Transportation |

19.7 |

% |

| Health |

16.1 |

% |

| Utilities |

12.7 |

% |

| County/City/Special District/School District |

8.5 |

% |

| State |

7.5 |

% |

| Housing |

7.5 |

% |

| Education |

1.9 |

% |

| Tobacco |

0.6 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

8.9 |

% |

| AA/Aa |

35.1 |

% |

| A |

43.3 |

% |

| BBB/Baa |

8.9 |

% |

| BB/Ba |

0.6 |

% |

| N/R |

3.2 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Material Fund Change Name [Text Block] |

On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000006122 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Short Duration Muni Fund

|

| Class Name |

Investor A1 Shares

|

| Trading Symbol |

MDLMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Short Duration Muni Fund (the “Fund”) (formerly known as BlackRock Short-Term Municipal Fund) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A1 Shares |

$47 |

0.46% |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.46%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Investor A1 Shares returned 3.91%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11% and the Municipal 1-5 Year Bond Index, returned 4.01%. What contributed to performance? Income was the largest contributor to the Fund’s absolute return. Positions in lower-quality bonds, which benefited from both higher income and spread compression—particularly for shorter-maturity issues—also contributed. At the sector level, holdings in corporate-backed issues, which includes prepaid gas bonds, were the most notable contributors. The Fund tactically shifted its duration stance during the period, which further helped results. (Duration is a measure of interest rate sensitivity.) The Fund’s cash position had no material impact on performance. What detracted from performance? Holdings in bonds with seven to 10-year maturities were the primary detractors from absolute performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

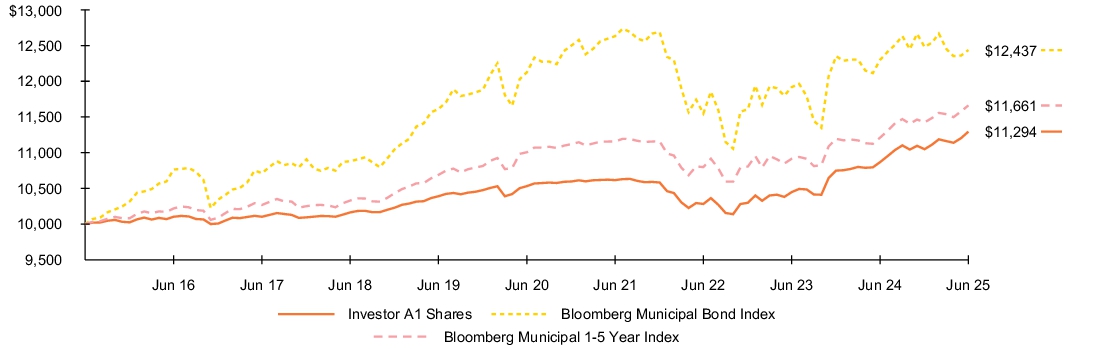

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor A1 Shares |

3.91 |

% |

1.41 |

% |

1.22 |

% |

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

| Bloomberg Municipal 1-5 Year Index |

4.01 |

|

1.16 |

|

1.55 |

|

| Short-Term Customized Reference Benchmark |

3.88 |

|

1.33 |

|

N/A |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 463,683,419

|

| Holdings Count | Holding |

195

|

| Advisory Fees Paid, Amount |

$ 1,084,115

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$463,683,419 |

| Number of Portfolio Holdings |

195 |

| Net Investment Advisory Fees |

$1,084,115 |

| Portfolio Turnover Rate |

66% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Corporate |

25.5 |

% |

| Transportation |

19.7 |

% |

| Health |

16.1 |

% |

| Utilities |

12.7 |

% |

| County/City/Special District/School District |

8.5 |

% |

| State |

7.5 |

% |

| Housing |

7.5 |

% |

| Education |

1.9 |

% |

| Tobacco |

0.6 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

8.9 |

% |

| AA/Aa |

35.1 |

% |

| A |

43.3 |

% |

| BBB/Baa |

8.9 |

% |

| BB/Ba |

0.6 |

% |

| N/R |

3.2 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Material Fund Change Name [Text Block] |

On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000006124 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Short Duration Muni Fund

|

| Class Name |

Investor C Shares

|

| Trading Symbol |

MFLMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Short Duration Muni Fund (the “Fund”) (formerly known as BlackRock Short-Term Municipal Fund) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares |

$138 |

1.36% |

|

| Expenses Paid, Amount |

$ 138

|

| Expense Ratio, Percent |

1.36%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Investor C Shares returned 2.90%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11% and the Municipal 1-5 Year Bond Index, returned 4.01%. What contributed to performance? Income was the largest contributor to the Fund’s absolute return. Positions in lower-quality bonds, which benefited from both higher income and spread compression—particularly for shorter-maturity issues—also contributed. At the sector level, holdings in corporate-backed issues, which includes prepaid gas bonds, were the most notable contributors. The Fund tactically shifted its duration stance during the period, which further helped results. (Duration is a measure of interest rate sensitivity.) The Fund’s cash position had no material impact on performance. What detracted from performance? Holdings in bonds with seven to 10-year maturities were the primary detractors from absolute performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Investor C Shares |

2.90 |

% |

0.48 |

% |

0.46 |

% |

| Investor C Shares (with sales charge) |

1.90 |

|

0.48 |

|

0.46 |

|

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

| Bloomberg Municipal 1-5 Year Index |

4.01 |

|

1.16 |

|

1.55 |

|

| Short-Term Customized Reference Benchmark |

3.88 |

|

1.33 |

|

N/A |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 463,683,419

|

| Holdings Count | Holding |

195

|

| Advisory Fees Paid, Amount |

$ 1,084,115

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$463,683,419 |

| Number of Portfolio Holdings |

195 |

| Net Investment Advisory Fees |

$1,084,115 |

| Portfolio Turnover Rate |

66% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Corporate |

25.5 |

% |

| Transportation |

19.7 |

% |

| Health |

16.1 |

% |

| Utilities |

12.7 |

% |

| County/City/Special District/School District |

8.5 |

% |

| State |

7.5 |

% |

| Housing |

7.5 |

% |

| Education |

1.9 |

% |

| Tobacco |

0.6 |

% |

| Credit quality allocation |

| Credit Rating(c) |

Percent of Total

Investments(b) |

|

| AAA/Aaa |

8.9 |

% |

| AA/Aa |

35.1 |

% |

| A |

43.3 |

% |

| BBB/Baa |

8.9 |

% |

| BB/Ba |

0.6 |

% |

| N/R |

3.2 |

% |

| (a) |

For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

| (b) |

Excludes short-term securities. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762. On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Material Fund Change Name [Text Block] |

On November 22, 2024, the Fund's Board approved a change in the name of the Fund from BlackRock Short-Term Municipal Fund to BlackRock Short Duration Muni Fund and certain changes to the Fund’s investment policy. These changes became effective on February 1, 2025.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after June 30, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 441-7762.

|

| Updated Prospectus Phone Number |

(800) 441-7762

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

| C000038035 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Short Duration Muni Fund

|

| Class Name |

Class K Shares

|

| Trading Symbol |

MPLMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Short Duration Muni Fund (the “Fund”) (formerly known as BlackRock Short-Term Municipal Fund) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year ? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$32 |

0.31% |

|

| Expenses Paid, Amount |

$ 32

|

| Expense Ratio, Percent |

0.31%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year ? -

For the reporting period ended June 30, 2025, the Fund’s Class K Shares returned 4.07%. -

For the same period, the Fund’s benchmark, the Bloomberg Municipal Bond Index, returned 1.11% and the Municipal 1-5 Year Bond Index, returned 4.01%. What contributed to performance? Income was the largest contributor to the Fund’s absolute return. Positions in lower-quality bonds, which benefited from both higher income and spread compression—particularly for shorter-maturity issues—also contributed. At the sector level, holdings in corporate-backed issues, which includes prepaid gas bonds, were the most notable contributors. The Fund tactically shifted its duration stance during the period, which further helped results. (Duration is a measure of interest rate sensitivity.) The Fund’s cash position had no material impact on performance. What detracted from performance? Holdings in bonds with seven to 10-year maturities were the primary detractors from absolute performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

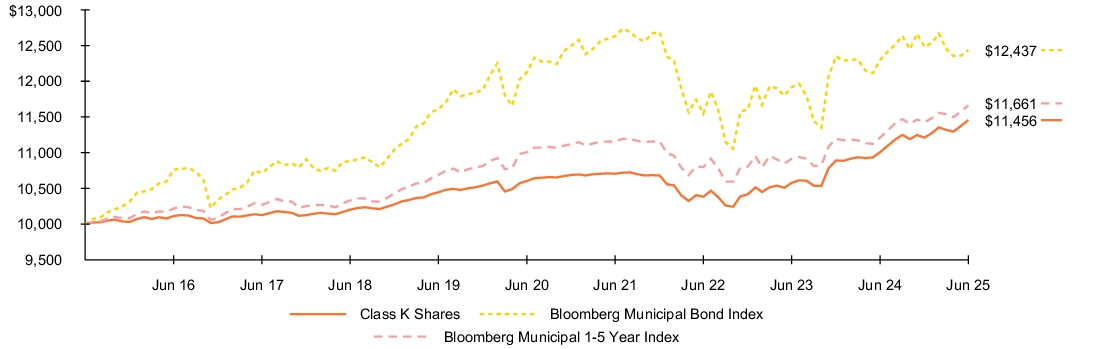

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 1, 2015 through June 30, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

| Class K Shares |

4.07 |

% |

1.56 |

% |

1.37 |

% |

| Bloomberg Municipal Bond Index |

1.11 |

|

0.51 |

|

2.20 |

|

| Bloomberg Municipal 1-5 Year Index |

4.01 |

|

1.16 |

|

1.55 |

|

| Short-Term Customized Reference Benchmark |

3.88 |

|

1.33 |

|

N/A |

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Material Change Date |

Feb. 01, 2025

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 463,683,419

|

| Holdings Count | Holding |

195

|

| Advisory Fees Paid, Amount |

$ 1,084,115

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$463,683,419 |

| Number of Portfolio Holdings |

195 |

| Net Investment Advisory Fees |

$1,084,115 |

| Portfolio Turnover Rate |

66% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of June 30, 2025)

| Sector allocation |

| Sector(a) |

Percent of Total

Investments(b) |

|

| Corporate |

25.5 |

% |

| Transportation |

19.7 |

% |

| Health |

16.1 |

% |

| Utilities |

12.7 |

% |

| County/City/Special District/School District |

8.5 |

% |

| State |

7.5 |

% |

| Housing |

7.5 |

% |

| Education |

1.9 |

% |

| Tobacco |

0.6 |

% |