What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Class K Shares | $71 | 0.66% |

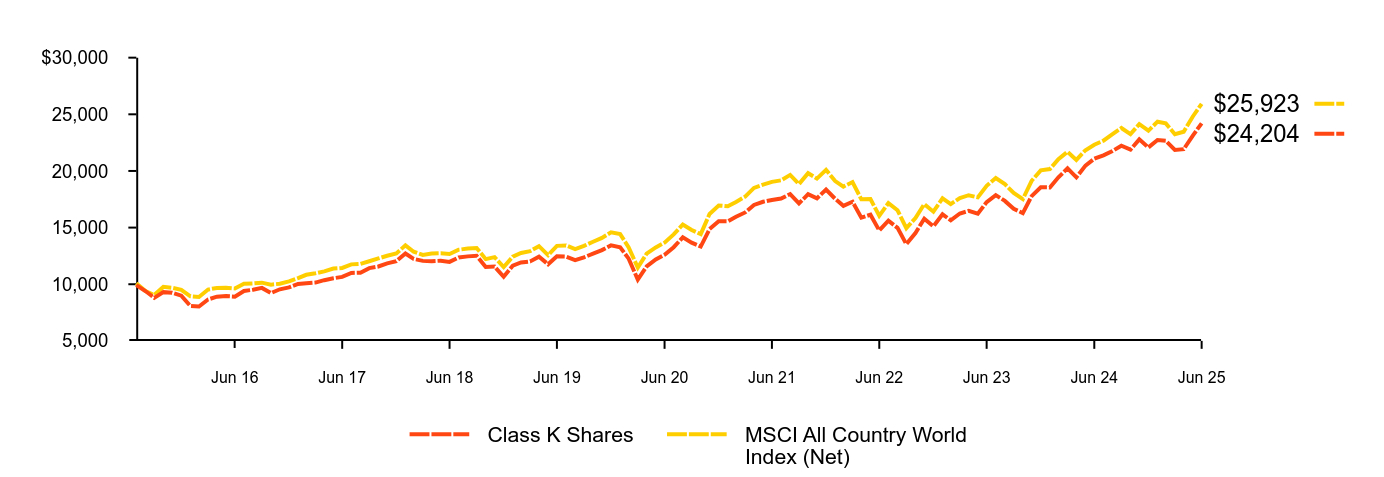

How did the Fund perform last year?

For the reporting period ended June 30, 2025, the Fund's Class K Shares returned 14.82%.

For the same period, the MSCI All Country World Index (Net) returned 16.17%.

What contributed to performance?

Positive contributions to the Fund’s return were driven by sentiment insights. In particular, measures designed to evaluate informed investor positioning spotted a rotation out of crowded momentum trades and into more resilient themes, which benefited holdings of European financials, aerospace and defense firms, as well as Japanese banks. Text-based sentiment measures analyzing brokerage firm reports and conference call transcripts also contributed by steering the portfolio toward consumer staples companies. Alongside these gains from sentiment measures, a quality insight that penalizes companies issuing new shares added stability during periods of market volatility, supporting overall results.

What detracted from performance?

Detractors included fundamental valuation measures that favored lower-priced, lower-volatility stocks such as U.S. homebuilders, as investors chased growth and were willing to pay higher multiples. In addition, macro-thematic insights that track policy shifts, recession odds and bond market credit spreads failed to time the rotation within information technology as the market’s perception of the biggest artificial intelligence beneficiaries shifted.

Class K Shares | MSCI All Country World Index (Net) | |

|---|---|---|

Jul 15 | $9,926 | $10,087 |

Aug 15 | $9,403 | $9,395 |

Sep 15 | $8,798 | $9,055 |

Oct 15 | $9,302 | $9,766 |

Nov 15 | $9,244 | $9,685 |

Dec 15 | $8,995 | $9,510 |

Jan 16 | $8,078 | $8,937 |

Feb 16 | $8,034 | $8,875 |

Mar 16 | $8,657 | $9,533 |

Apr 16 | $8,898 | $9,674 |

May 16 | $8,955 | $9,686 |

Jun 16 | $8,906 | $9,627 |

Jul 16 | $9,407 | $10,042 |

Aug 16 | $9,513 | $10,076 |

Sep 16 | $9,676 | $10,138 |

Oct 16 | $9,220 | $9,966 |

Nov 16 | $9,554 | $10,041 |

Dec 16 | $9,719 | $10,258 |

Jan 17 | $10,028 | $10,539 |

Feb 17 | $10,086 | $10,834 |

Mar 17 | $10,148 | $10,967 |

Apr 17 | $10,358 | $11,138 |

May 17 | $10,527 | $11,384 |

Jun 17 | $10,651 | $11,436 |

Jul 17 | $10,997 | $11,755 |

Aug 17 | $11,018 | $11,800 |

Sep 17 | $11,422 | $12,028 |

Oct 17 | $11,566 | $12,278 |

Nov 17 | $11,838 | $12,516 |

Dec 17 | $12,041 | $12,717 |

Jan 18 | $12,716 | $13,435 |

Feb 18 | $12,234 | $12,871 |

Mar 18 | $12,063 | $12,595 |

Apr 18 | $12,035 | $12,715 |

May 18 | $12,079 | $12,731 |

Jun 18 | $11,974 | $12,662 |

Jul 18 | $12,362 | $13,044 |

Aug 18 | $12,461 | $13,147 |

Sep 18 | $12,511 | $13,204 |

Oct 18 | $11,515 | $12,214 |

Nov 18 | $11,555 | $12,393 |

Dec 18 | $10,663 | $11,520 |

Jan 19 | $11,636 | $12,430 |

Feb 19 | $11,918 | $12,762 |

Mar 19 | $12,015 | $12,923 |

Apr 19 | $12,435 | $13,359 |

May 19 | $11,762 | $12,567 |

Jun 19 | $12,464 | $13,390 |

Jul 19 | $12,441 | $13,429 |

Aug 19 | $12,131 | $13,110 |

Sep 19 | $12,378 | $13,386 |

Oct 19 | $12,694 | $13,752 |

Nov 19 | $13,011 | $14,088 |

Dec 19 | $13,427 | $14,584 |

Jan 20 | $13,269 | $14,423 |

Feb 20 | $12,260 | $13,258 |

Mar 20 | $10,399 | $11,468 |

Apr 20 | $11,567 | $12,697 |

May 20 | $12,195 | $13,249 |

Jun 20 | $12,606 | $13,672 |

Jul 20 | $13,269 | $14,395 |

Aug 20 | $14,137 | $15,277 |

Sep 20 | $13,674 | $14,784 |

Oct 20 | $13,328 | $14,425 |

Nov 20 | $14,864 | $16,203 |

Dec 20 | $15,559 | $16,955 |

Jan 21 | $15,553 | $16,878 |

Feb 21 | $15,950 | $17,269 |

Mar 21 | $16,340 | $17,730 |

Apr 21 | $16,999 | $18,505 |

May 21 | $17,280 | $18,793 |

Jun 21 | $17,439 | $19,041 |

Jul 21 | $17,561 | $19,172 |

Aug 21 | $17,960 | $19,652 |

Sep 21 | $17,131 | $18,840 |

Oct 21 | $17,946 | $19,802 |

Nov 21 | $17,580 | $19,325 |

Dec 21 | $18,358 | $20,098 |

Jan 22 | $17,540 | $19,111 |

Feb 22 | $16,920 | $18,617 |

Mar 22 | $17,283 | $19,020 |

Apr 22 | $15,874 | $17,498 |

May 22 | $16,137 | $17,519 |

Jun 22 | $14,742 | $16,042 |

Jul 22 | $15,618 | $17,162 |

Aug 22 | $14,974 | $16,530 |

Sep 22 | $13,536 | $14,948 |

Oct 22 | $14,523 | $15,850 |

Nov 22 | $15,790 | $17,079 |

Dec 22 | $15,115 | $16,407 |

Jan 23 | $16,174 | $17,583 |

Feb 23 | $15,644 | $17,079 |

Mar 23 | $16,246 | $17,606 |

Apr 23 | $16,478 | $17,859 |

May 23 | $16,224 | $17,668 |

Jun 23 | $17,247 | $18,693 |

Jul 23 | $17,864 | $19,378 |

Aug 23 | $17,356 | $18,836 |

Sep 23 | $16,660 | $18,057 |

Oct 23 | $16,282 | $17,514 |

Nov 23 | $17,777 | $19,131 |

Dec 23 | $18,562 | $20,050 |

Jan 24 | $18,547 | $20,167 |

Feb 24 | $19,438 | $21,033 |

Mar 24 | $20,226 | $21,693 |

Apr 24 | $19,438 | $20,977 |

May 24 | $20,469 | $21,829 |

Jun 24 | $21,080 | $22,316 |

Jul 24 | $21,382 | $22,675 |

Aug 24 | $21,764 | $23,251 |

Sep 24 | $22,221 | $23,791 |

Oct 24 | $21,882 | $23,257 |

Nov 24 | $22,788 | $24,127 |

Dec 24 | $22,078 | $23,556 |

Jan 25 | $22,731 | $24,347 |

Feb 25 | $22,664 | $24,200 |

Mar 25 | $21,860 | $23,244 |

Apr 25 | $21,919 | $23,461 |

May 25 | $23,124 | $24,810 |

Jun 25 | $24,204 | $25,923 |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Class K Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.82% | 13.94% | 9.24% |

MSCI All Country World Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 16.17 | 13.65 | 9.99 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $473,308,291 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 203 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $2,151,815 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 160% |

Geographic allocation

Ten largest holdings

Country/Geographic Region | Percent of

Net Assets |

|---|---|

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 66.1% |

Japan........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.0 |

Canada........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.8 |

China........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.1 |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 |

Taiwan........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 |

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.2 |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Switzerland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.6 |

South Korea........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.4 |

OtherFootnote Reference(a)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.6 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.1 |

Other Assets Less Liabilities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

SecurityFootnote Reference(b) | Percent of

Net Assets |

|---|---|

NVIDIA Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.5% |

Apple, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.3 |

Microsoft Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.0 |

Amazon.com, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 2.5 |

Bank of America Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.8 |

Pfizer, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.6 |

S&P Global, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.6 |

Alphabet, Inc., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

Morgan Stanley........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

Novartis AG (Registered)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

| Footnote | Description |

Footnote(a) | Ten largest countries/geographic regions are presented. Additional countries/geographic regions are found in Other. |

Footnote(b) | Excludes short-term securities. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Class R Shares | $130 | 1.21% |

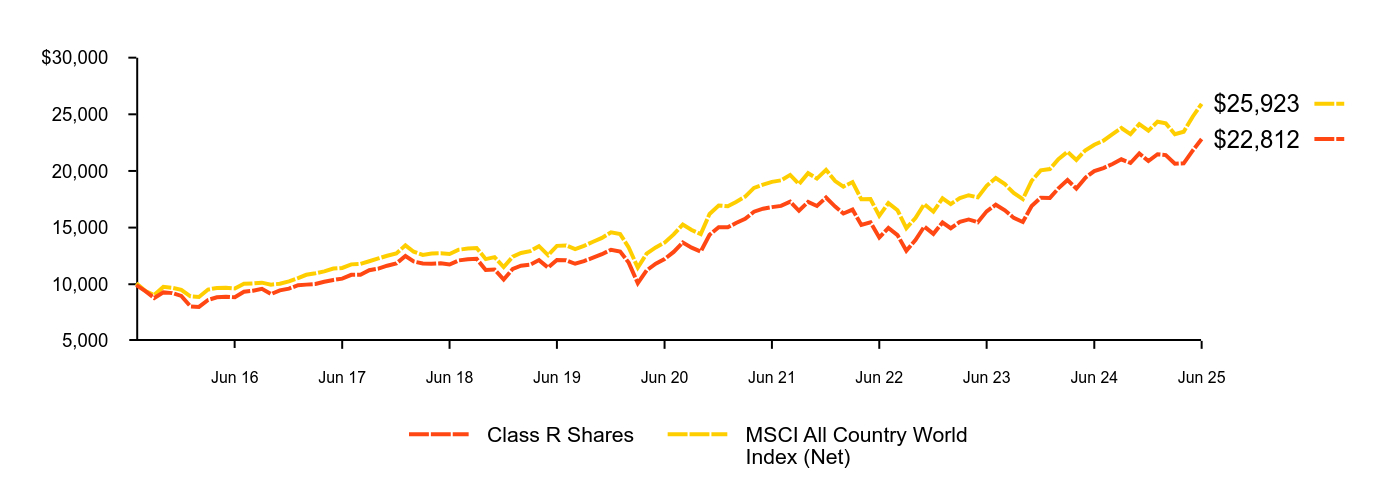

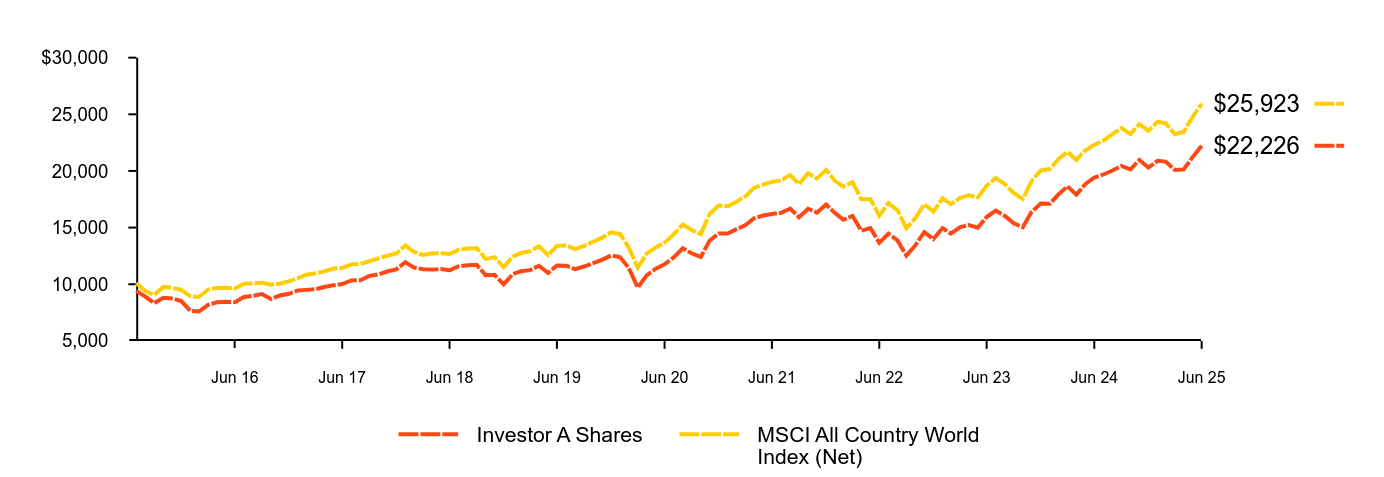

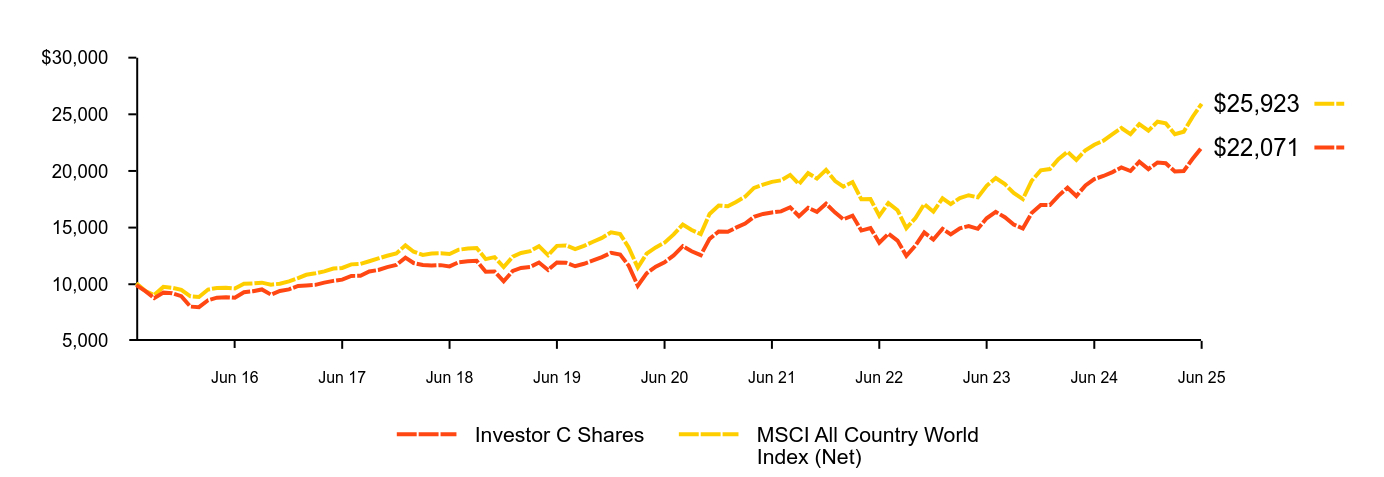

How did the Fund perform last year?

For the reporting period ended June 30, 2025, the Fund's Class R Shares returned 14.15%.

For the same period, the MSCI All Country World Index (Net) returned 16.17%.

What contributed to performance?

Positive contributions to the Fund’s return were driven by sentiment insights. In particular, measures designed to evaluate informed investor positioning spotted a rotation out of crowded momentum trades and into more resilient themes, which benefited holdings of European financials, aerospace and defense firms, as well as Japanese banks. Text-based sentiment measures analyzing brokerage firm reports and conference call transcripts also contributed by steering the portfolio toward consumer staples companies. Alongside these gains from sentiment measures, a quality insight that penalizes companies issuing new shares added stability during periods of market volatility, supporting overall results.

What detracted from performance?

Detractors included fundamental valuation measures that favored lower-priced, lower-volatility stocks such as U.S. homebuilders, as investors chased growth and were willing to pay higher multiples. In addition, macro-thematic insights that track policy shifts, recession odds and bond market credit spreads failed to time the rotation within information technology as the market’s perception of the biggest artificial intelligence beneficiaries shifted.

Class R Shares | MSCI All Country World Index (Net) | |

|---|---|---|

Jul 15 | $9,918 | $10,087 |

Aug 15 | $9,390 | $9,395 |

Sep 15 | $8,784 | $9,055 |

Oct 15 | $9,282 | $9,766 |

Nov 15 | $9,218 | $9,685 |

Dec 15 | $8,964 | $9,510 |

Jan 16 | $8,047 | $8,937 |

Feb 16 | $7,997 | $8,875 |

Mar 16 | $8,615 | $9,533 |

Apr 16 | $8,846 | $9,674 |

May 16 | $8,896 | $9,686 |

Jun 16 | $8,846 | $9,627 |

Jul 16 | $9,337 | $10,042 |

Aug 16 | $9,432 | $10,076 |

Sep 16 | $9,591 | $10,138 |

Oct 16 | $9,132 | $9,966 |

Nov 16 | $9,459 | $10,041 |

Dec 16 | $9,615 | $10,258 |

Jan 17 | $9,916 | $10,539 |

Feb 17 | $9,966 | $10,834 |

Mar 17 | $10,020 | $10,967 |

Apr 17 | $10,221 | $11,138 |

May 17 | $10,380 | $11,384 |

Jun 17 | $10,498 | $11,436 |

Jul 17 | $10,830 | $11,755 |

Aug 17 | $10,844 | $11,800 |

Sep 17 | $11,240 | $12,028 |

Oct 17 | $11,377 | $12,278 |

Nov 17 | $11,636 | $12,516 |

Dec 17 | $11,831 | $12,717 |

Jan 18 | $12,487 | $13,435 |

Feb 18 | $12,008 | $12,871 |

Mar 18 | $11,837 | $12,595 |

Apr 18 | $11,799 | $12,715 |

May 18 | $11,844 | $12,731 |

Jun 18 | $11,736 | $12,662 |

Jul 18 | $12,102 | $13,044 |

Aug 18 | $12,197 | $13,147 |

Sep 18 | $12,241 | $13,204 |

Oct 18 | $11,263 | $12,214 |

Nov 18 | $11,297 | $12,393 |

Dec 18 | $10,418 | $11,520 |

Jan 19 | $11,362 | $12,430 |

Feb 19 | $11,638 | $12,762 |

Mar 19 | $11,723 | $12,923 |

Apr 19 | $12,130 | $13,359 |

May 19 | $11,467 | $12,567 |

Jun 19 | $12,149 | $13,390 |

Jul 19 | $12,117 | $13,429 |

Aug 19 | $11,808 | $13,110 |

Sep 19 | $12,044 | $13,386 |

Oct 19 | $12,346 | $13,752 |

Nov 19 | $12,653 | $14,088 |

Dec 19 | $13,046 | $14,584 |

Jan 20 | $12,886 | $14,423 |

Feb 20 | $11,906 | $13,258 |

Mar 20 | $10,093 | $11,468 |

Apr 20 | $11,219 | $12,697 |

May 20 | $11,819 | $13,249 |

Jun 20 | $12,219 | $13,672 |

Jul 20 | $12,853 | $14,395 |

Aug 20 | $13,686 | $15,277 |

Sep 20 | $13,233 | $14,784 |

Oct 20 | $12,886 | $14,425 |

Nov 20 | $14,371 | $16,203 |

Dec 20 | $15,037 | $16,955 |

Jan 21 | $15,023 | $16,878 |

Feb 21 | $15,404 | $17,269 |

Mar 21 | $15,772 | $17,730 |

Apr 21 | $16,403 | $18,505 |

May 21 | $16,666 | $18,793 |

Jun 21 | $16,805 | $19,041 |

Jul 21 | $16,916 | $19,172 |

Aug 21 | $17,292 | $19,652 |

Sep 21 | $16,483 | $18,840 |

Oct 21 | $17,260 | $19,802 |

Nov 21 | $16,908 | $19,325 |

Dec 21 | $17,648 | $20,098 |

Jan 22 | $16,852 | $19,111 |

Feb 22 | $16,239 | $18,617 |

Mar 22 | $16,587 | $19,020 |

Apr 22 | $15,228 | $17,498 |

May 22 | $15,469 | $17,519 |

Jun 22 | $14,126 | $16,042 |

Jul 22 | $14,963 | $17,162 |

Aug 22 | $14,337 | $16,530 |

Sep 22 | $12,957 | $14,948 |

Oct 22 | $13,896 | $15,850 |

Nov 22 | $15,093 | $17,079 |

Dec 22 | $14,447 | $16,407 |

Jan 23 | $15,450 | $17,583 |

Feb 23 | $14,944 | $17,079 |

Mar 23 | $15,509 | $17,606 |

Apr 23 | $15,719 | $17,859 |

May 23 | $15,466 | $17,668 |

Jun 23 | $16,435 | $18,693 |

Jul 23 | $17,016 | $19,378 |

Aug 23 | $16,528 | $18,836 |

Sep 23 | $15,854 | $18,057 |

Oct 23 | $15,492 | $17,514 |

Nov 23 | $16,899 | $19,131 |

Dec 23 | $17,639 | $20,050 |

Jan 24 | $17,622 | $20,167 |

Feb 24 | $18,460 | $21,033 |

Mar 24 | $19,196 | $21,693 |

Apr 24 | $18,443 | $20,977 |

May 24 | $19,410 | $21,829 |

Jun 24 | $19,984 | $22,316 |

Jul 24 | $20,258 | $22,675 |

Aug 24 | $20,617 | $23,251 |

Sep 24 | $21,028 | $23,791 |

Oct 24 | $20,703 | $23,257 |

Nov 24 | $21,550 | $24,127 |

Dec 24 | $20,874 | $23,556 |

Jan 25 | $21,474 | $24,347 |

Feb 25 | $21,404 | $24,200 |

Mar 25 | $20,635 | $23,244 |

Apr 25 | $20,675 | $23,461 |

May 25 | $21,813 | $24,810 |

Jun 25 | $22,812 | $25,923 |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Class R Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.15% | 13.30% | 8.60% |

MSCI All Country World Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 16.17 | 13.65 | 9.99 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $473,308,291 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 203 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $2,151,815 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 160% |

Geographic allocation

Ten largest holdings

Country/Geographic Region | Percent of

Net Assets |

|---|---|

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 66.1% |

Japan........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.0 |

Canada........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.8 |

China........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.1 |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 |

Taiwan........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 |

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.2 |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Switzerland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.6 |

South Korea........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.4 |

OtherFootnote Reference(a)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.6 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.1 |

Other Assets Less Liabilities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

SecurityFootnote Reference(b) | Percent of

Net Assets |

|---|---|

NVIDIA Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.5% |

Apple, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.3 |

Microsoft Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.0 |

Amazon.com, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 2.5 |

Bank of America Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.8 |

Pfizer, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.6 |

S&P Global, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.6 |

Alphabet, Inc., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

Morgan Stanley........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

Novartis AG (Registered)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

| Footnote | Description |

Footnote(a) | Ten largest countries/geographic regions are presented. Additional countries/geographic regions are found in Other. |

Footnote(b) | Excludes short-term securities. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Institutional Shares | $77 | 0.71% |

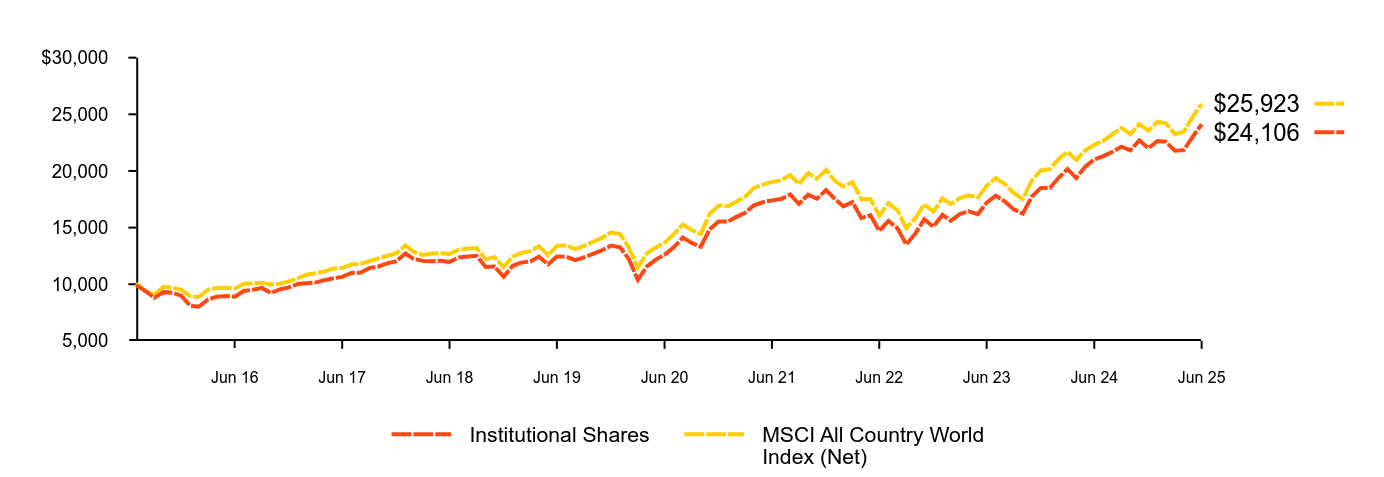

How did the Fund perform last year?

For the reporting period ended June 30, 2025, the Fund's Institutional Shares returned 14.73%.

For the same period, the MSCI All Country World Index (Net) returned 16.17%.

What contributed to performance?

Positive contributions to the Fund’s return were driven by sentiment insights. In particular, measures designed to evaluate informed investor positioning spotted a rotation out of crowded momentum trades and into more resilient themes, which benefited holdings of European financials, aerospace and defense firms, as well as Japanese banks. Text-based sentiment measures analyzing brokerage firm reports and conference call transcripts also contributed by steering the portfolio toward consumer staples companies. Alongside these gains from sentiment measures, a quality insight that penalizes companies issuing new shares added stability during periods of market volatility, supporting overall results.

What detracted from performance?

Detractors included fundamental valuation measures that favored lower-priced, lower-volatility stocks such as U.S. homebuilders, as investors chased growth and were willing to pay higher multiples. In addition, macro-thematic insights that track policy shifts, recession odds and bond market credit spreads failed to time the rotation within information technology as the market’s perception of the biggest artificial intelligence beneficiaries shifted.

Institutional Shares | MSCI All Country World Index (Net) | |

|---|---|---|

Jul 15 | $9,926 | $10,087 |

Aug 15 | $9,403 | $9,395 |

Sep 15 | $8,798 | $9,055 |

Oct 15 | $9,302 | $9,766 |

Nov 15 | $9,244 | $9,685 |

Dec 15 | $8,995 | $9,510 |

Jan 16 | $8,078 | $8,937 |

Feb 16 | $8,034 | $8,875 |

Mar 16 | $8,657 | $9,533 |

Apr 16 | $8,898 | $9,674 |

May 16 | $8,955 | $9,686 |

Jun 16 | $8,906 | $9,627 |

Jul 16 | $9,407 | $10,042 |

Aug 16 | $9,513 | $10,076 |

Sep 16 | $9,676 | $10,138 |

Oct 16 | $9,220 | $9,966 |

Nov 16 | $9,554 | $10,041 |

Dec 16 | $9,719 | $10,258 |

Jan 17 | $10,028 | $10,539 |

Feb 17 | $10,086 | $10,834 |

Mar 17 | $10,148 | $10,967 |

Apr 17 | $10,358 | $11,138 |

May 17 | $10,527 | $11,384 |

Jun 17 | $10,651 | $11,436 |

Jul 17 | $10,997 | $11,755 |

Aug 17 | $11,018 | $11,800 |

Sep 17 | $11,422 | $12,028 |

Oct 17 | $11,566 | $12,278 |

Nov 17 | $11,838 | $12,516 |

Dec 17 | $12,041 | $12,717 |

Jan 18 | $12,716 | $13,435 |

Feb 18 | $12,234 | $12,871 |

Mar 18 | $12,063 | $12,595 |

Apr 18 | $12,030 | $12,715 |

May 18 | $12,079 | $12,731 |

Jun 18 | $11,974 | $12,662 |

Jul 18 | $12,356 | $13,044 |

Aug 18 | $12,456 | $13,147 |

Sep 18 | $12,506 | $13,204 |

Oct 18 | $11,515 | $12,214 |

Nov 18 | $11,554 | $12,393 |

Dec 18 | $10,657 | $11,520 |

Jan 19 | $11,629 | $12,430 |

Feb 19 | $11,910 | $12,762 |

Mar 19 | $12,008 | $12,923 |

Apr 19 | $12,428 | $13,359 |

May 19 | $11,755 | $12,567 |

Jun 19 | $12,457 | $13,390 |

Jul 19 | $12,434 | $13,429 |

Aug 19 | $12,123 | $13,110 |

Sep 19 | $12,365 | $13,386 |

Oct 19 | $12,687 | $13,752 |

Nov 19 | $13,002 | $14,088 |

Dec 19 | $13,412 | $14,584 |

Jan 20 | $13,254 | $14,423 |

Feb 20 | $12,246 | $13,258 |

Mar 20 | $10,387 | $11,468 |

Apr 20 | $11,554 | $12,697 |

May 20 | $12,175 | $13,249 |

Jun 20 | $12,592 | $13,672 |

Jul 20 | $13,254 | $14,395 |

Aug 20 | $14,116 | $15,277 |

Sep 20 | $13,653 | $14,784 |

Oct 20 | $13,307 | $14,425 |

Nov 20 | $14,840 | $16,203 |

Dec 20 | $15,541 | $16,955 |

Jan 21 | $15,528 | $16,878 |

Feb 21 | $15,924 | $17,269 |

Mar 21 | $16,314 | $17,730 |

Apr 21 | $16,972 | $18,505 |

May 21 | $17,252 | $18,793 |

Jun 21 | $17,405 | $19,041 |

Jul 21 | $17,527 | $19,172 |

Aug 21 | $17,927 | $19,652 |

Sep 21 | $17,100 | $18,840 |

Oct 21 | $17,914 | $19,802 |

Nov 21 | $17,548 | $19,325 |

Dec 21 | $18,320 | $20,098 |

Jan 22 | $17,503 | $19,111 |

Feb 22 | $16,878 | $18,617 |

Mar 22 | $17,247 | $19,020 |

Apr 22 | $15,841 | $17,498 |

May 22 | $16,096 | $17,519 |

Jun 22 | $14,704 | $16,042 |

Jul 22 | $15,585 | $17,162 |

Aug 22 | $14,939 | $16,530 |

Sep 22 | $13,504 | $14,948 |

Oct 22 | $14,489 | $15,850 |

Nov 22 | $15,745 | $17,079 |

Dec 22 | $15,075 | $16,407 |

Jan 23 | $16,131 | $17,583 |

Feb 23 | $15,603 | $17,079 |

Mar 23 | $16,204 | $17,606 |

Apr 23 | $16,428 | $17,859 |

May 23 | $16,182 | $17,668 |

Jun 23 | $17,195 | $18,693 |

Jul 23 | $17,817 | $19,378 |

Aug 23 | $17,303 | $18,836 |

Sep 23 | $16,616 | $18,057 |

Oct 23 | $16,233 | $17,514 |

Nov 23 | $17,723 | $19,131 |

Dec 23 | $18,501 | $20,050 |

Jan 24 | $18,486 | $20,167 |

Feb 24 | $19,375 | $21,033 |

Mar 24 | $20,160 | $21,693 |

Apr 24 | $19,375 | $20,977 |

May 24 | $20,403 | $21,829 |

Jun 24 | $21,012 | $22,316 |

Jul 24 | $21,313 | $22,675 |

Aug 24 | $21,695 | $23,251 |

Sep 24 | $22,143 | $23,791 |

Oct 24 | $21,812 | $23,257 |

Nov 24 | $22,708 | $24,127 |

Dec 24 | $22,004 | $23,556 |

Jan 25 | $22,646 | $24,347 |

Feb 25 | $22,579 | $24,200 |

Mar 25 | $21,778 | $23,244 |

Apr 25 | $21,837 | $23,461 |

May 25 | $23,038 | $24,810 |

Jun 25 | $24,106 | $25,923 |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|