Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Victory Portfolios II

|

|

| Entity Central Index Key |

0001547580

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000116490 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Market Neutral Income Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

CBHAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

|

| Additional Information Phone Number |

800-539-3863

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class A | $79 | 0.76% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 79

|

|

| Expense Ratio, Percent |

0.76%

|

|

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: During the reporting period, the Fund’s total return was driven by positive contribution from the Fund’s Global High Dividend Long/Short portfolio (long global dividend stocks and short equity index futures). In the Global High Dividend Long/Short portfolio, the U.S. Large-Cap, U.S. Small-Cap, International Markets, and Emerging Markets dividend sleeves were positive contributors. The negative contribution from shorting core broad market indexes was offset by the positive contribution of the long positions in dividend stocks.

Top detractors from performance: In the Overlay Strategy, gains from the NASDAQ 100 long futures did not offset the negative contribution from the S&P 500 Index short position, resulting in an overall negative impact on the Fund’s total return.

In addition, the Fund's employment of a derivatives strategy overlay to efficiently manage the overall portfolio risks associated with the Fund's strategy contributed negatively to performance during the year. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

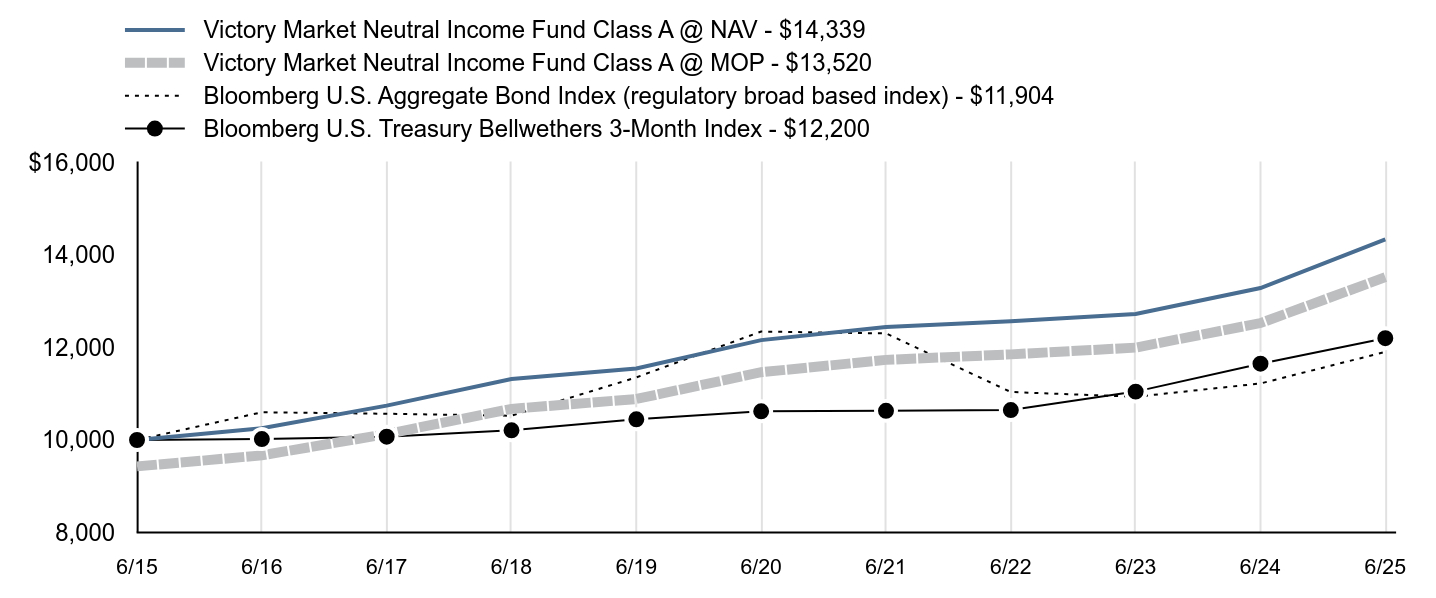

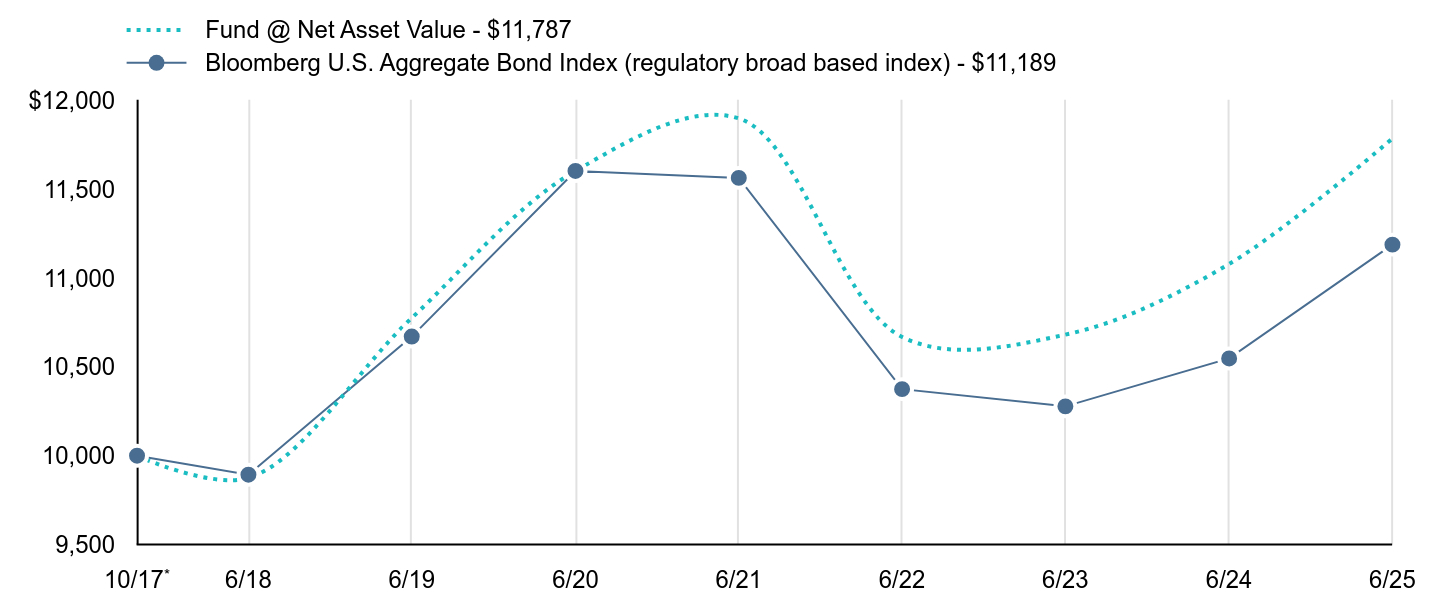

| Line Graph [Table Text Block] |

| Victory Market Neutral Income Fund Class A @ NAV - $14,339 | Victory Market Neutral Income Fund Class A @ MOP - $13,520 | Bloomberg U.S. Aggregate Bond Index (regulatory broad based index) - $11,904 | Bloomberg U.S. Treasury Bellwethers 3-Month Index - $12,200 |

|---|

6/15 | $10,000 | $9,429 | $10,000 | $10,000 |

|---|

6/16 | $10,254 | $9,668 | $10,600 | $10,021 |

|---|

6/17 | $10,743 | $10,129 | $10,567 | $10,072 |

|---|

6/18 | $11,320 | $10,673 | $10,525 | $10,210 |

|---|

6/19 | $11,546 | $10,886 | $11,353 | $10,448 |

|---|

6/20 | $12,159 | $11,465 | $12,345 | $10,620 |

|---|

6/21 | $12,443 | $11,732 | $12,304 | $10,630 |

|---|

6/22 | $12,569 | $11,851 | $11,038 | $10,648 |

|---|

6/23 | $12,723 | $11,997 | $10,934 | $11,046 |

|---|

6/24 | $13,286 | $12,528 | $11,222 | $11,650 |

|---|

6/25 | $14,339 | $13,520 | $11,904 | $12,200 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class A @ NAV | 7.92% | 3.35% | 3.67% |

|---|

Class A @ MOP | 1.75% | 2.13% | 3.06% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | -0.73% | 1.76% |

|---|

Bloomberg U.S. Treasury Bellwethers 3-Month Index | 4.73% | 2.81% | 2.01% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| Previous Investment Adviser [Text Block] |

The maximum offering price (“MOP”) figures reflect a maximum sales charge of 5.75% for Class A. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

|

| AssetsNet |

$ 2,620,750,000

|

|

| Holdings Count | Holding |

421

|

|

| Advisory Fees Paid, Amount |

$ 9,273,000

|

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $2,620,750 |

|---|

Number of Holdings | 421 |

|---|

Investment Advisory Fees | $9,273 |

|---|

Portfolio Turnover | 60% |

|---|

|

|

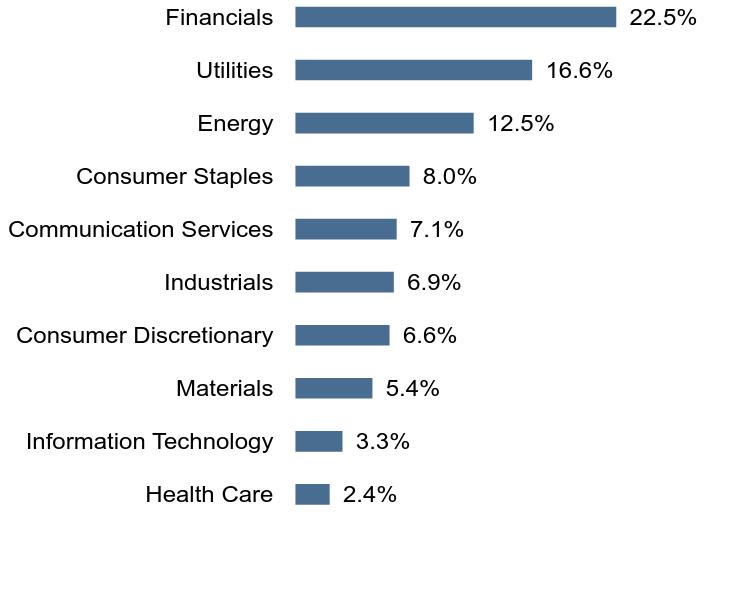

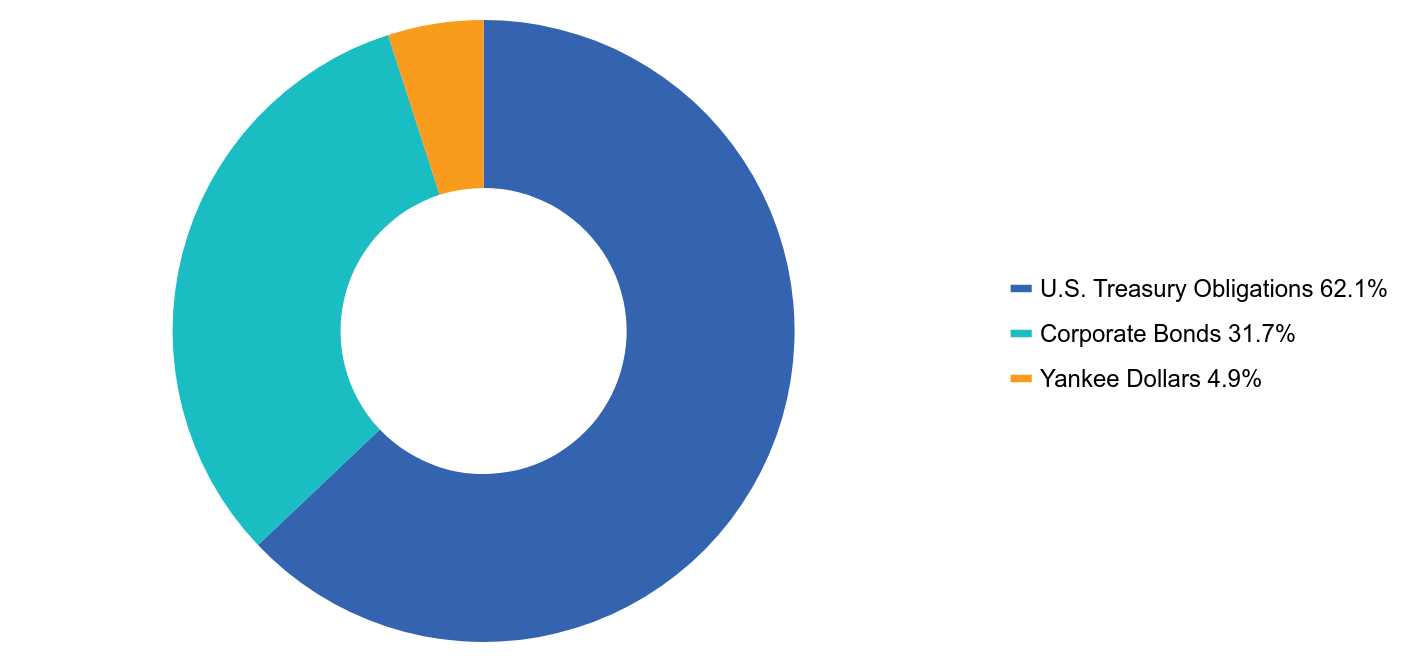

| Holdings [Text Block] |

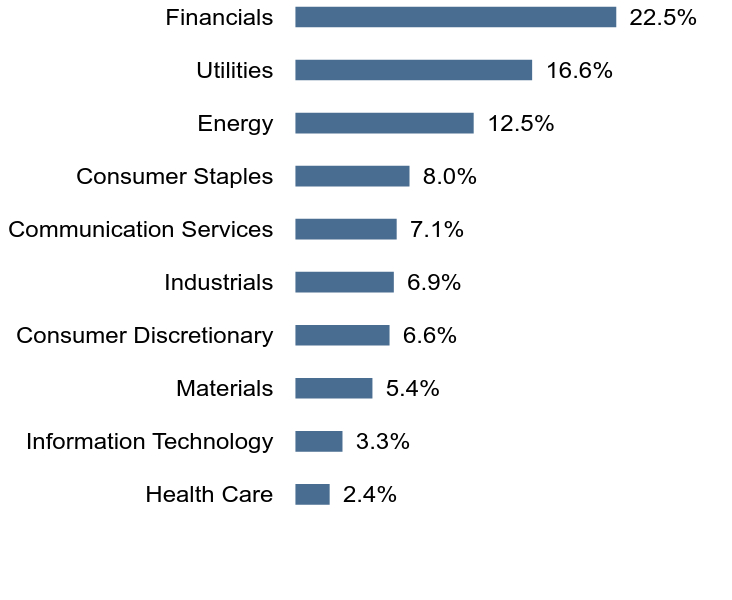

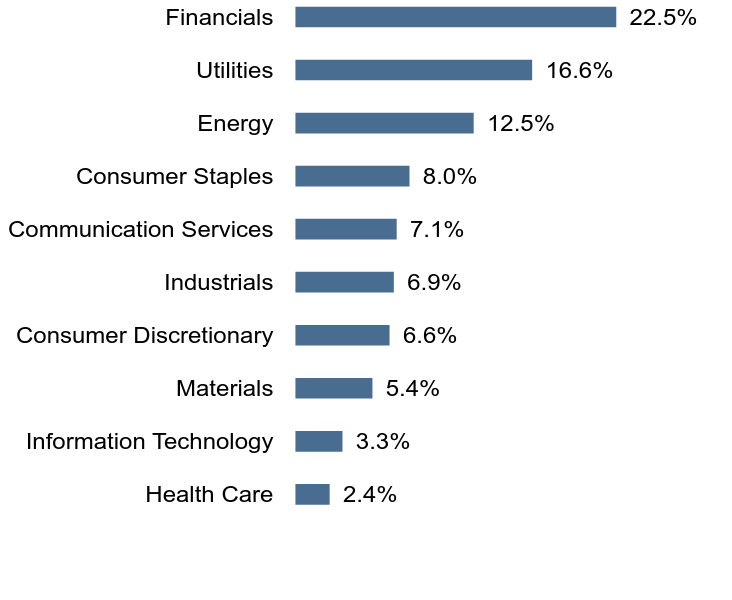

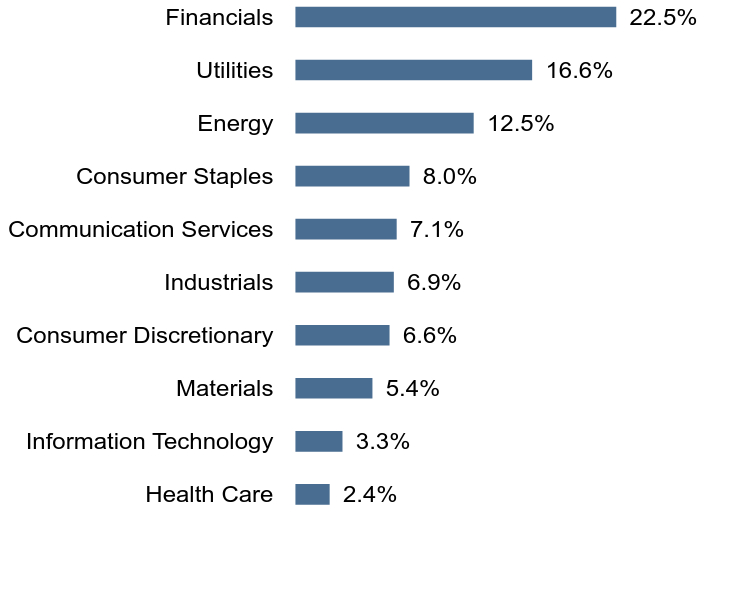

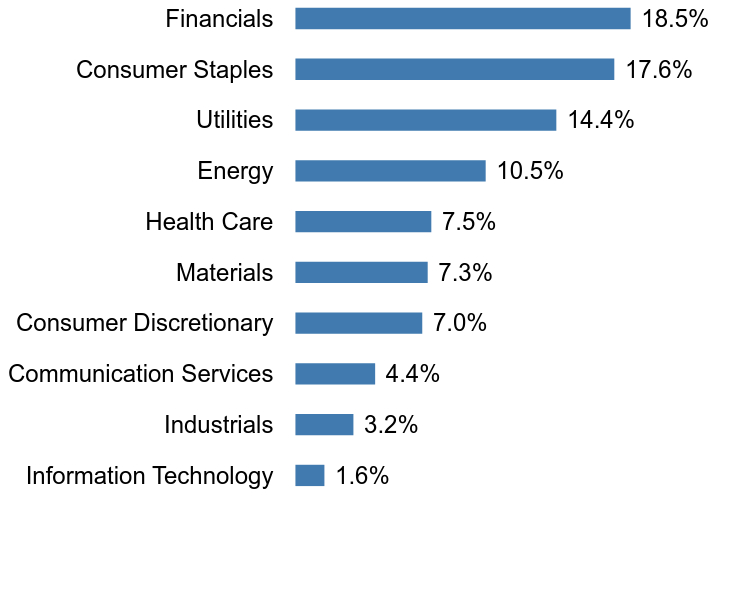

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Health Care | 2.4% | Information Technology | 3.3% | Materials | 5.4% | Consumer Discretionary | 6.6% | Industrials | 6.9% | Communication Services | 7.1% | Consumer Staples | 8.0% | Energy | 12.5% | Utilities | 16.6% | Financials | 22.5% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Taiwan Mobile Co. Ltd. | 0.6% |

|---|

Tenaga Nasional Bhd | 0.5% |

|---|

SCB X PCL | 0.5% |

|---|

Ambev SA | 0.5% |

|---|

BB Seguridade Participacoes SA | 0.5% |

|---|

Spire, Inc. | 0.4% |

|---|

CME Group, Inc. | 0.4% |

|---|

ORLEN SA | 0.4% |

|---|

Orange SA | 0.4% |

|---|

Portland General Electric Co. | 0.4% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000116492 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Market Neutral Income Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

CBHCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

|

| Additional Information Phone Number |

800-539-3863

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class C | $156 | 1.51% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 156

|

|

| Expense Ratio, Percent |

1.51%

|

|

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: During the reporting period, the Fund’s total return was driven by positive contribution from the Fund’s Global High Dividend Long/Short portfolio (long global dividend stocks and short equity index futures). In the Global High Dividend Long/Short portfolio, the U.S. Large-Cap, U.S. Small-Cap, International Markets, and Emerging Markets dividend sleeves were positive contributors. The negative contribution from shorting core broad market indexes was offset by the positive contribution of the long positions in dividend stocks.

Top detractors from performance: In the Overlay Strategy, gains from the NASDAQ 100 long futures did not offset the negative contribution from the S&P 500 Index short position, resulting in an overall negative impact on the Fund’s total return.

In addition, the Fund's employment of a derivatives strategy overlay to efficiently manage the overall portfolio risks associated with the Fund's strategy contributed negatively to performance during the year. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

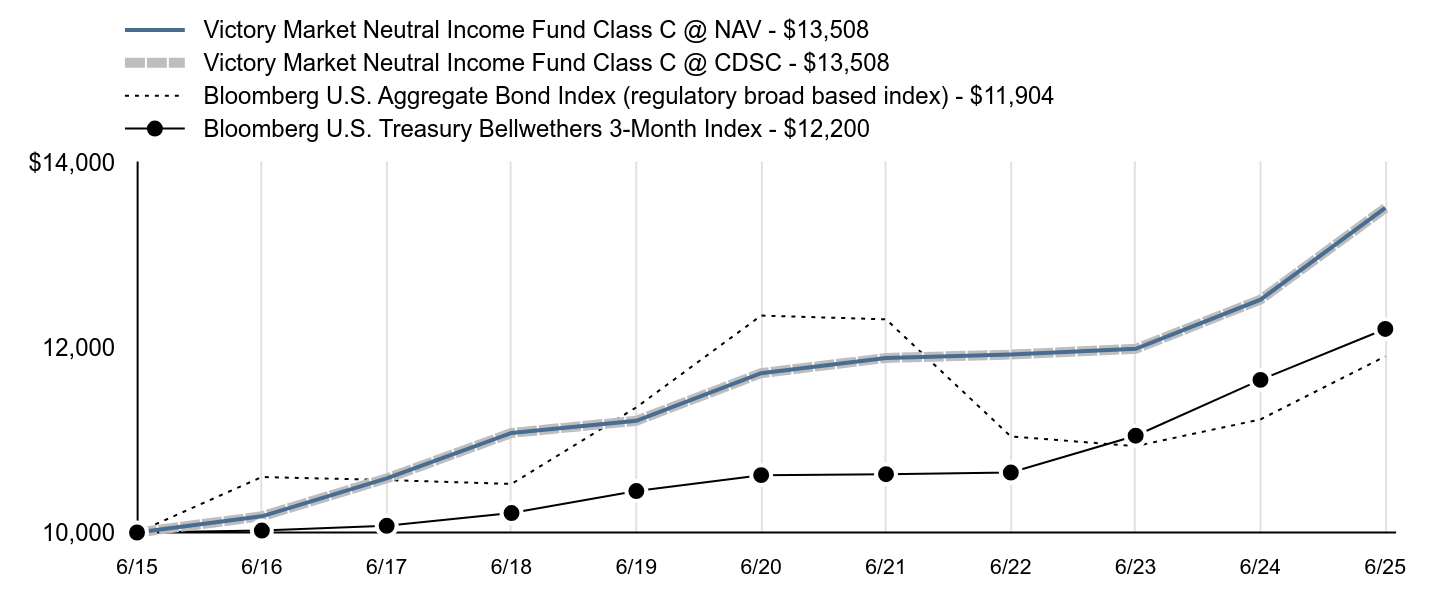

| Line Graph [Table Text Block] |

| Victory Market Neutral Income Fund Class C @ NAV - $13,508 | Victory Market Neutral Income Fund Class C @ CDSC - $13,508 | Bloomberg U.S. Aggregate Bond Index (regulatory broad based index) - $11,904 | Bloomberg U.S. Treasury Bellwethers 3-Month Index - $12,200 |

|---|

6/15 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $10,175 | $10,175 | $10,600 | $10,021 |

|---|

6/17 | $10,585 | $10,585 | $10,567 | $10,072 |

|---|

6/18 | $11,076 | $11,076 | $10,525 | $10,210 |

|---|

6/19 | $11,208 | $11,208 | $11,353 | $10,448 |

|---|

6/20 | $11,722 | $11,722 | $12,345 | $10,620 |

|---|

6/21 | $11,887 | $11,887 | $12,304 | $10,630 |

|---|

6/22 | $11,923 | $11,923 | $11,038 | $10,648 |

|---|

6/23 | $11,986 | $11,986 | $10,934 | $11,046 |

|---|

6/24 | $12,517 | $12,517 | $11,222 | $11,650 |

|---|

6/25 | $13,508 | $13,508 | $11,904 | $12,200 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class C @ NAV | 7.16% | 2.57% | 3.05% |

|---|

Class C @ CDSC | 6.16% | 2.57% | 3.05% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | -0.73% | 1.76% |

|---|

Bloomberg U.S. Treasury Bellwethers 3-Month Index | 4.73% | 2.81% | 2.01% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| Previous Investment Adviser [Text Block] |

Class C is not subject to an initial sales charge, but is subject to Contingent Deferred Sales Charge (“CDSC”) of 1.00% on shares redeemed within one year of purchase. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

|

| AssetsNet |

$ 2,620,750,000

|

|

| Holdings Count | Holding |

421

|

|

| Advisory Fees Paid, Amount |

$ 9,273,000

|

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $2,620,750 |

|---|

Number of Holdings | 421 |

|---|

Investment Advisory Fees | $9,273 |

|---|

Portfolio Turnover | 60% |

|---|

|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Health Care | 2.4% | Information Technology | 3.3% | Materials | 5.4% | Consumer Discretionary | 6.6% | Industrials | 6.9% | Communication Services | 7.1% | Consumer Staples | 8.0% | Energy | 12.5% | Utilities | 16.6% | Financials | 22.5% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Taiwan Mobile Co. Ltd. | 0.6% |

|---|

Tenaga Nasional Bhd | 0.5% |

|---|

SCB X PCL | 0.5% |

|---|

Ambev SA | 0.5% |

|---|

BB Seguridade Participacoes SA | 0.5% |

|---|

Spire, Inc. | 0.4% |

|---|

CME Group, Inc. | 0.4% |

|---|

ORLEN SA | 0.4% |

|---|

Orange SA | 0.4% |

|---|

Portland General Electric Co. | 0.4% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000116493 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Market Neutral Income Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

CBHIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

|

| Additional Information Phone Number |

800-539-3863

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class I | $43 | 0.41% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.41%

|

|

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: During the reporting period, the Fund’s total return was driven by positive contribution from the Fund’s Global High Dividend Long/Short portfolio (long global dividend stocks and short equity index futures). In the Global High Dividend Long/Short portfolio, the U.S. Large-Cap, U.S. Small-Cap, International Markets, and Emerging Markets dividend sleeves were positive contributors. The negative contribution from shorting core broad market indexes was offset by the positive contribution of the long positions in dividend stocks.

Top detractors from performance: In the Overlay Strategy, gains from the NASDAQ 100 long futures did not offset the negative contribution from the S&P 500 Index short position, resulting in an overall negative impact on the Fund’s total return.

In addition, the Fund's employment of a derivatives strategy overlay to efficiently manage the overall portfolio risks associated with the Fund's strategy contributed negatively to performance during the year. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

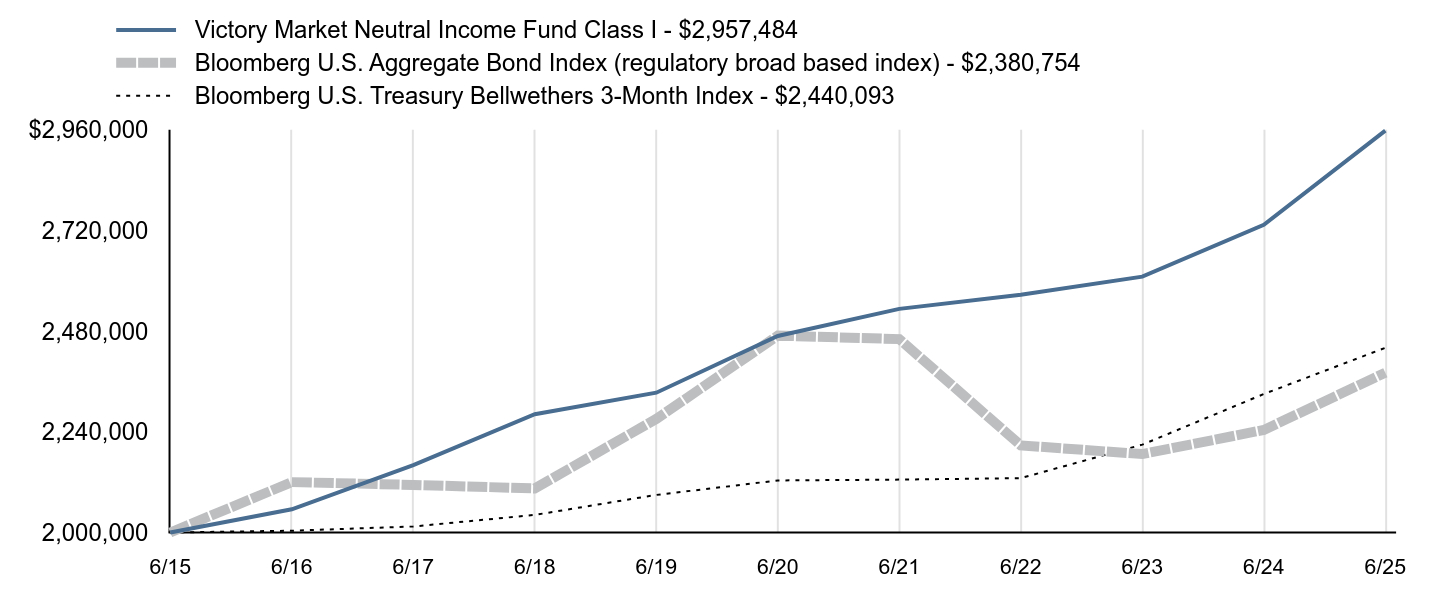

| Line Graph [Table Text Block] |

| Victory Market Neutral Income Fund Class I - $2,957,484 | Bloomberg U.S. Aggregate Bond Index (regulatory broad based index) - $2,380,754 | Bloomberg U.S. Treasury Bellwethers 3-Month Index - $2,440,093 |

|---|

6/15 | $2,000,000 | $2,000,000 | $2,000,000 |

|---|

6/16 | $2,055,344 | $2,120,028 | $2,004,270 |

|---|

6/17 | $2,160,337 | $2,113,357 | $2,014,302 |

|---|

6/18 | $2,281,685 | $2,104,962 | $2,041,939 |

|---|

6/19 | $2,333,100 | $2,270,606 | $2,089,517 |

|---|

6/20 | $2,468,225 | $2,469,049 | $2,124,003 |

|---|

6/21 | $2,532,871 | $2,460,821 | $2,126,017 |

|---|

6/22 | $2,566,346 | $2,207,550 | $2,129,522 |

|---|

6/23 | $2,609,543 | $2,186,848 | $2,209,290 |

|---|

6/24 | $2,733,304 | $2,244,384 | $2,329,949 |

|---|

6/25 | $2,957,484 | $2,380,754 | $2,440,093 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class I | 8.20% | 3.68% | 3.99% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | -0.73% | 1.76% |

|---|

Bloomberg U.S. Treasury Bellwethers 3-Month Index | 4.73% | 2.81% | 2.01% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 2,620,750,000

|

|

| Holdings Count | Holding |

421

|

|

| Advisory Fees Paid, Amount |

$ 9,273,000

|

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $2,620,750 |

|---|

Number of Holdings | 421 |

|---|

Investment Advisory Fees | $9,273 |

|---|

Portfolio Turnover | 60% |

|---|

|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Health Care | 2.4% | Information Technology | 3.3% | Materials | 5.4% | Consumer Discretionary | 6.6% | Industrials | 6.9% | Communication Services | 7.1% | Consumer Staples | 8.0% | Energy | 12.5% | Utilities | 16.6% | Financials | 22.5% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Taiwan Mobile Co. Ltd. | 0.6% |

|---|

Tenaga Nasional Bhd | 0.5% |

|---|

SCB X PCL | 0.5% |

|---|

Ambev SA | 0.5% |

|---|

BB Seguridade Participacoes SA | 0.5% |

|---|

Spire, Inc. | 0.4% |

|---|

CME Group, Inc. | 0.4% |

|---|

ORLEN SA | 0.4% |

|---|

Orange SA | 0.4% |

|---|

Portland General Electric Co. | 0.4% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000219860 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Market Neutral Income Fund

|

|

| Class Name |

Member Class

|

|

| Trading Symbol |

CBHMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-235-8396 or visiting vcm.com/contact-us.

|

|

| Additional Information Phone Number |

800-235-8396

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Member Class | $58 | 0.56% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 58

|

|

| Expense Ratio, Percent |

0.56%

|

|

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: During the reporting period, the Fund’s total return was driven by positive contribution from the Fund’s Global High Dividend Long/Short portfolio (long global dividend stocks and short equity index futures). In the Global High Dividend Long/Short portfolio, the U.S. Large-Cap, U.S. Small-Cap, International Markets, and Emerging Markets dividend sleeves were positive contributors. The negative contribution from shorting core broad market indexes was offset by the positive contribution of the long positions in dividend stocks.

Top detractors from performance: In the Overlay Strategy, gains from the NASDAQ 100 long futures did not offset the negative contribution from the S&P 500 Index short position, resulting in an overall negative impact on the Fund’s total return.

In addition, the Fund's employment of a derivatives strategy overlay to efficiently manage the overall portfolio risks associated with the Fund's strategy contributed negatively to performance during the year. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

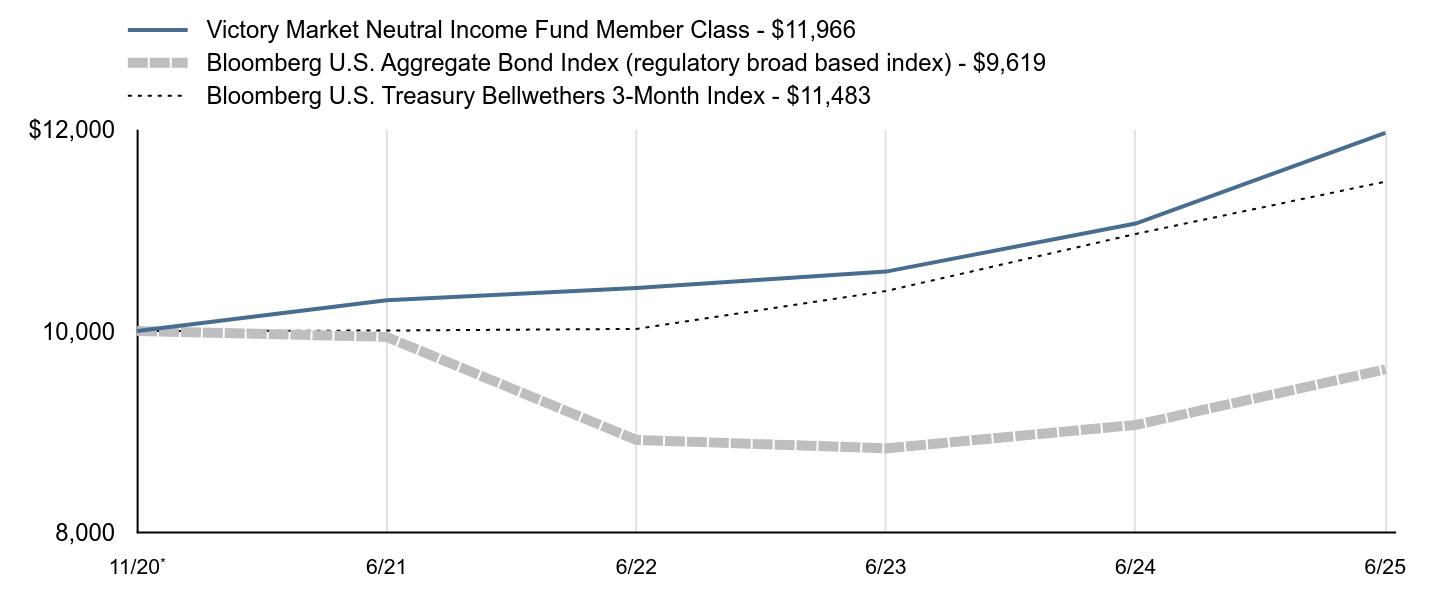

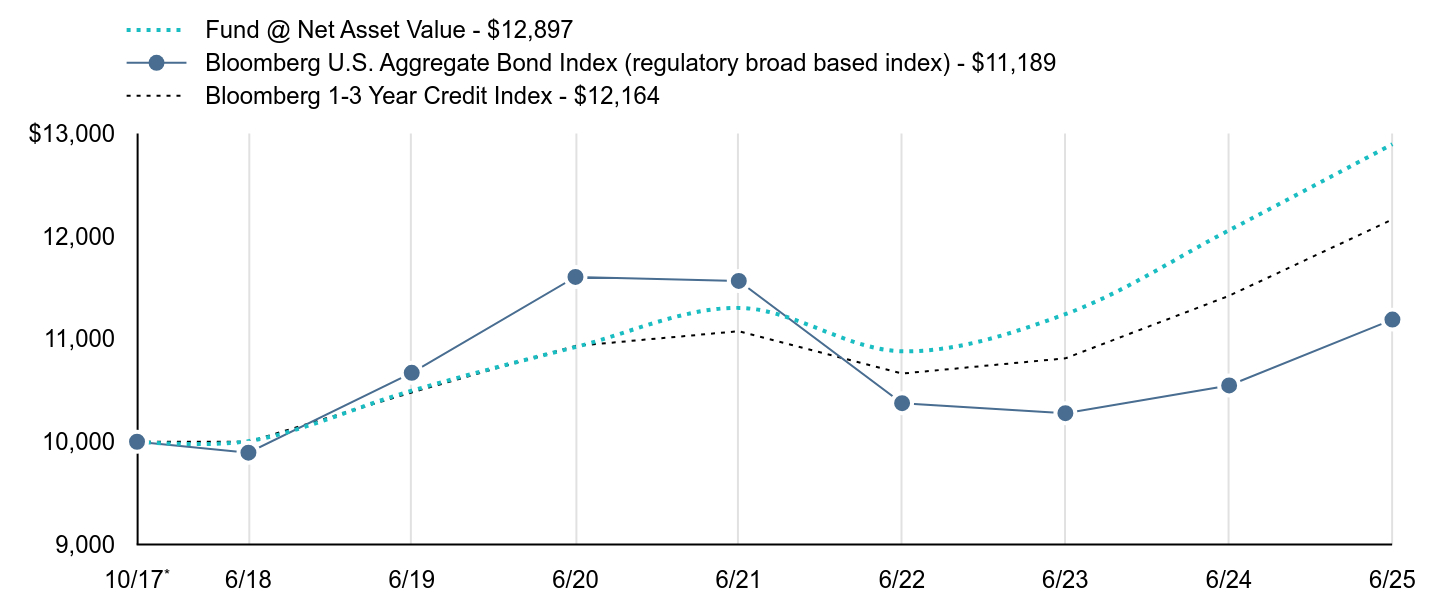

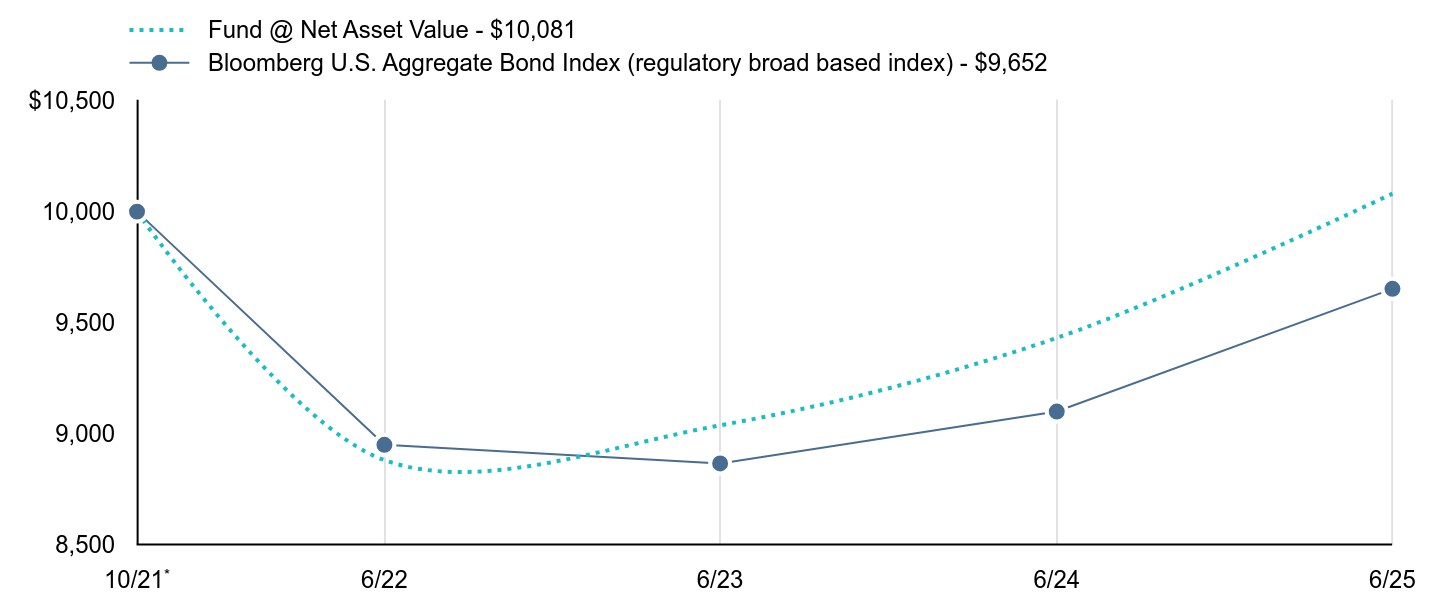

| Line Graph [Table Text Block] |

| Victory Market Neutral Income Fund Member Class - $11,966 | Bloomberg U.S. Aggregate Bond Index (regulatory broad based index) - $9,619 | Bloomberg U.S. Treasury Bellwethers 3-Month Index - $11,483 |

|---|

11/20Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/21 | $10,305 | $9,942 | $10,005 |

|---|

6/22 | $10,428 | $8,919 | $10,021 |

|---|

6/23 | $10,590 | $8,835 | $10,397 |

|---|

6/24 | $11,067 | $9,068 | $10,964 |

|---|

6/25 | $11,966 | $9,619 | $11,483 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | Since Inception |

|---|

Member Class | 8.12% | 3.93% |

|---|

Bloomberg U.S. Aggregate Bond Index | 6.08% | -0.83% |

|---|

Bloomberg U.S. Treasury Bellwethers 3-Month Index | 4.73% | 3.01% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 2,620,750,000

|

|

| Holdings Count | Holding |

421

|

|

| Advisory Fees Paid, Amount |

$ 9,273,000

|

|

| InvestmentCompanyPortfolioTurnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $2,620,750 |

|---|

Number of Holdings | 421 |

|---|

Investment Advisory Fees | $9,273 |

|---|

Portfolio Turnover | 60% |

|---|

|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Health Care | 2.4% | Information Technology | 3.3% | Materials | 5.4% | Consumer Discretionary | 6.6% | Industrials | 6.9% | Communication Services | 7.1% | Consumer Staples | 8.0% | Energy | 12.5% | Utilities | 16.6% | Financials | 22.5% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Taiwan Mobile Co. Ltd. | 0.6% |

|---|

Tenaga Nasional Bhd | 0.5% |

|---|

SCB X PCL | 0.5% |

|---|

Ambev SA | 0.5% |

|---|

BB Seguridade Participacoes SA | 0.5% |

|---|

Spire, Inc. | 0.4% |

|---|

CME Group, Inc. | 0.4% |

|---|

ORLEN SA | 0.4% |

|---|

Orange SA | 0.4% |

|---|

Portland General Electric Co. | 0.4% |

|---|

|

|

| Material Fund Change [Text Block] |

|

|

| C000139051 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares US 500 Volatility Wtd ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

US 500 Volatility Wtd ETF | $37 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

|

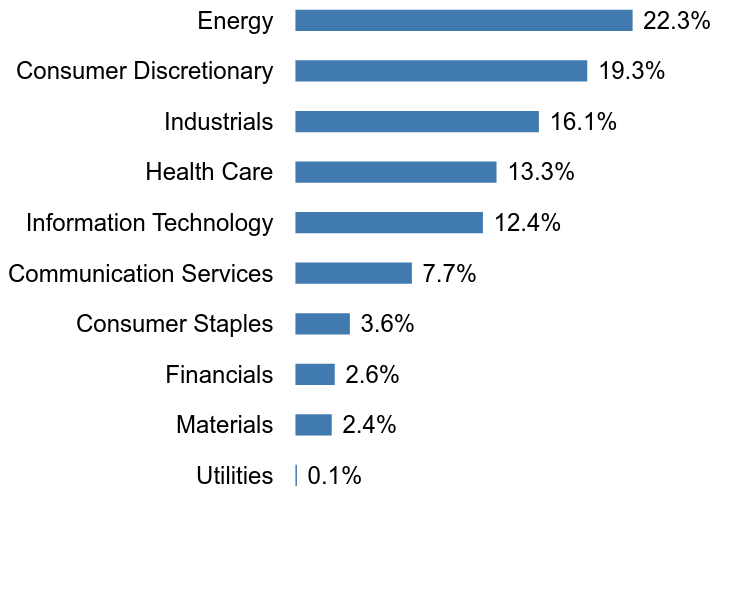

| Factors Affecting Performance [Text Block] |

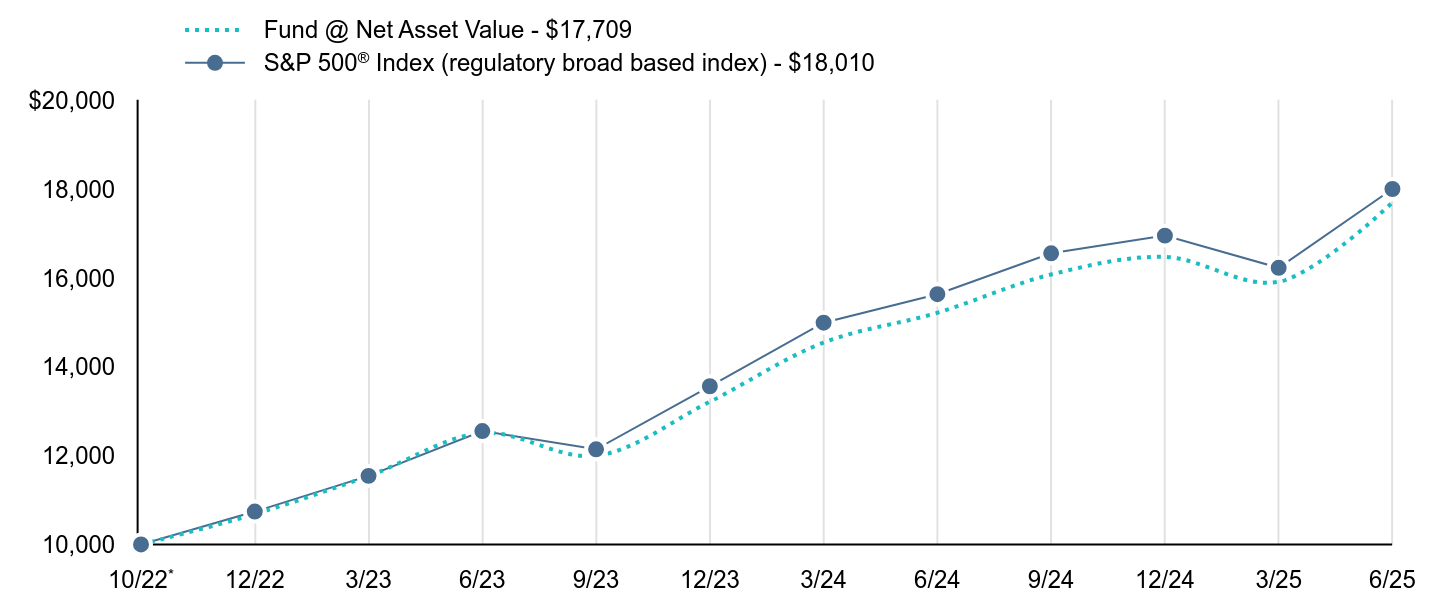

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s overweight allocation to the industrials sector contributed positively to relative performance; and Stock selection in the health care and consumer discretionary sectors was a positive contributor to relative performance.

Top detractors from performance: The Fund’s underweight allocation to the information technology and communication services sectors detracted from relative performance; and Stock selection in the industrials and financials sectors detracted from performance.

The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

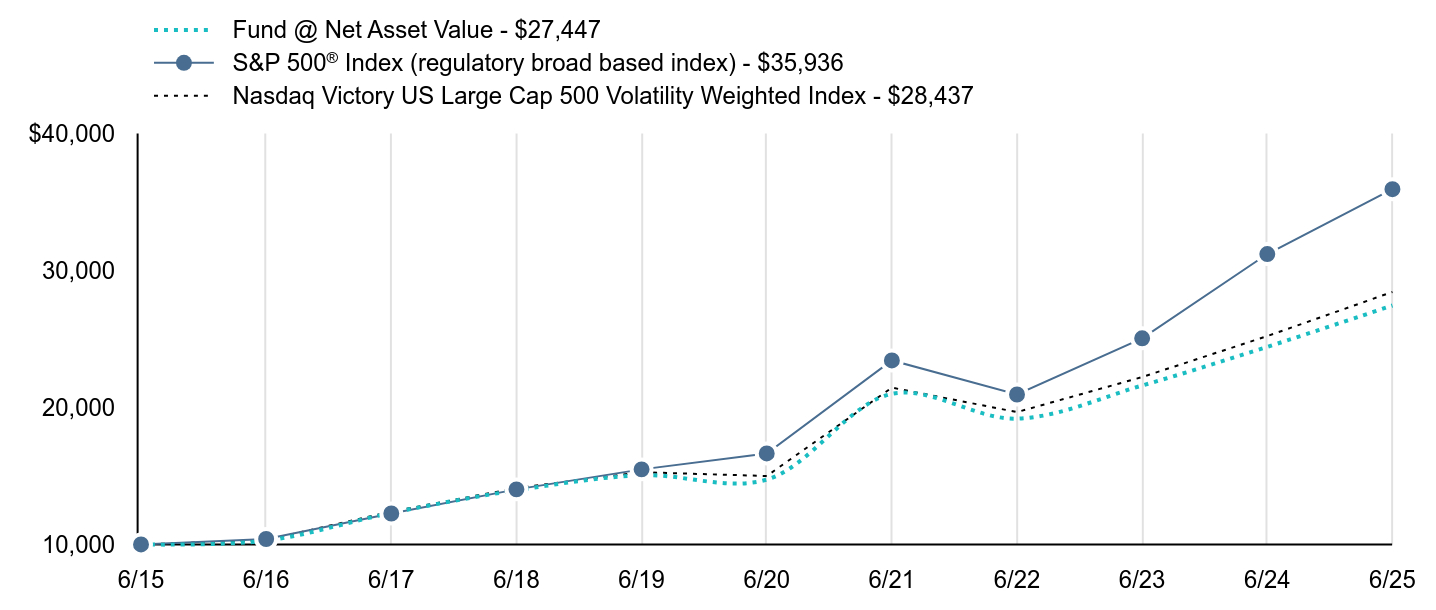

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $27,447 | S&P 500® Index (regulatory broad based index) - $35,936 | Nasdaq Victory US Large Cap 500 Volatility Weighted Index - $28,437 |

|---|

6/15 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $10,278 | $10,399 | $10,319 |

|---|

6/17 | $12,305 | $12,260 | $12,399 |

|---|

6/18 | $13,957 | $14,023 | $14,114 |

|---|

6/19 | $15,053 | $15,483 | $15,276 |

|---|

6/20 | $14,734 | $16,645 | $14,998 |

|---|

6/21 | $20,997 | $23,436 | $21,450 |

|---|

6/22 | $19,184 | $20,948 | $19,666 |

|---|

6/23 | $21,605 | $25,053 | $22,222 |

|---|

6/24 | $24,429 | $31,204 | $25,214 |

|---|

6/25 | $27,447 | $35,936 | $28,437 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Fund @ Net Asset Value | 12.36% | 13.25% | 10.62% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Nasdaq Victory US Large Cap 500 Volatility Weighted Index | 12.78% | 13.65% | 11.02% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 527,538,000

|

|

| Holdings Count | Holding |

507

|

|

| Advisory Fees Paid, Amount |

$ 1,584,000

|

|

| InvestmentCompanyPortfolioTurnover |

24.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $527,538 |

|---|

Number of Holdings | 507 |

|---|

Investment Advisory Fees | $1,584 |

|---|

Portfolio Turnover | 24% |

|---|

|

|

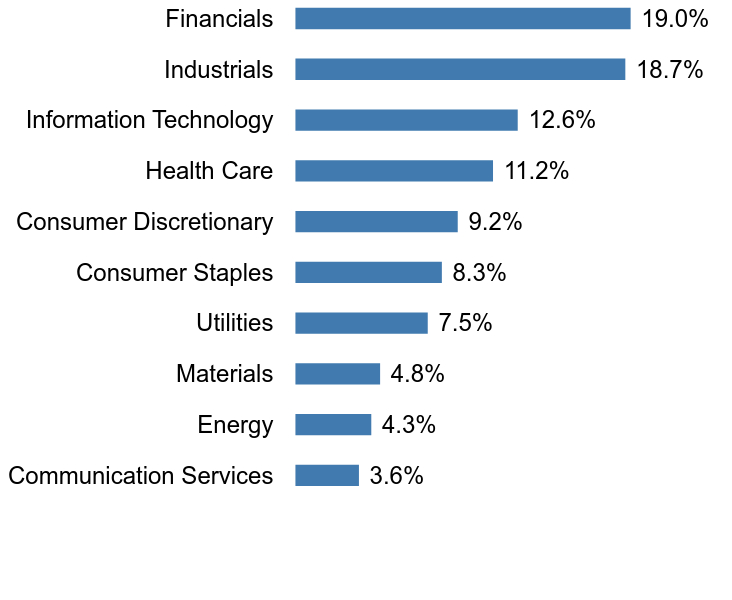

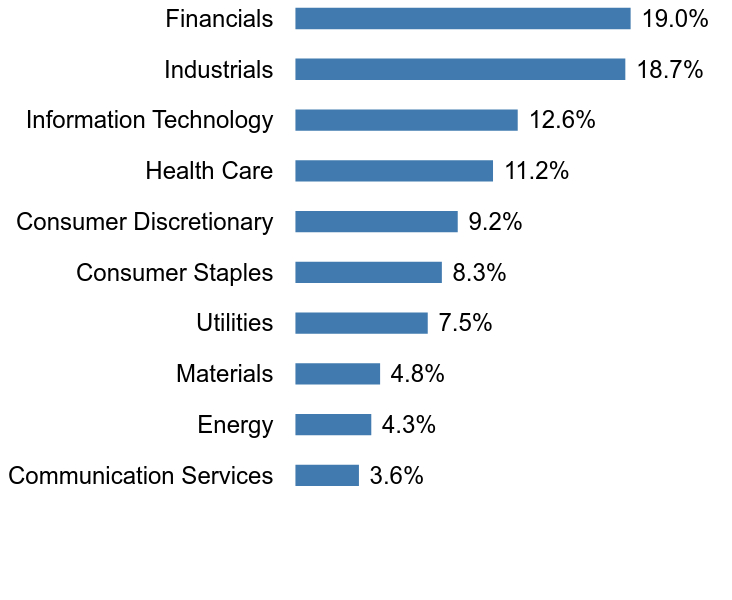

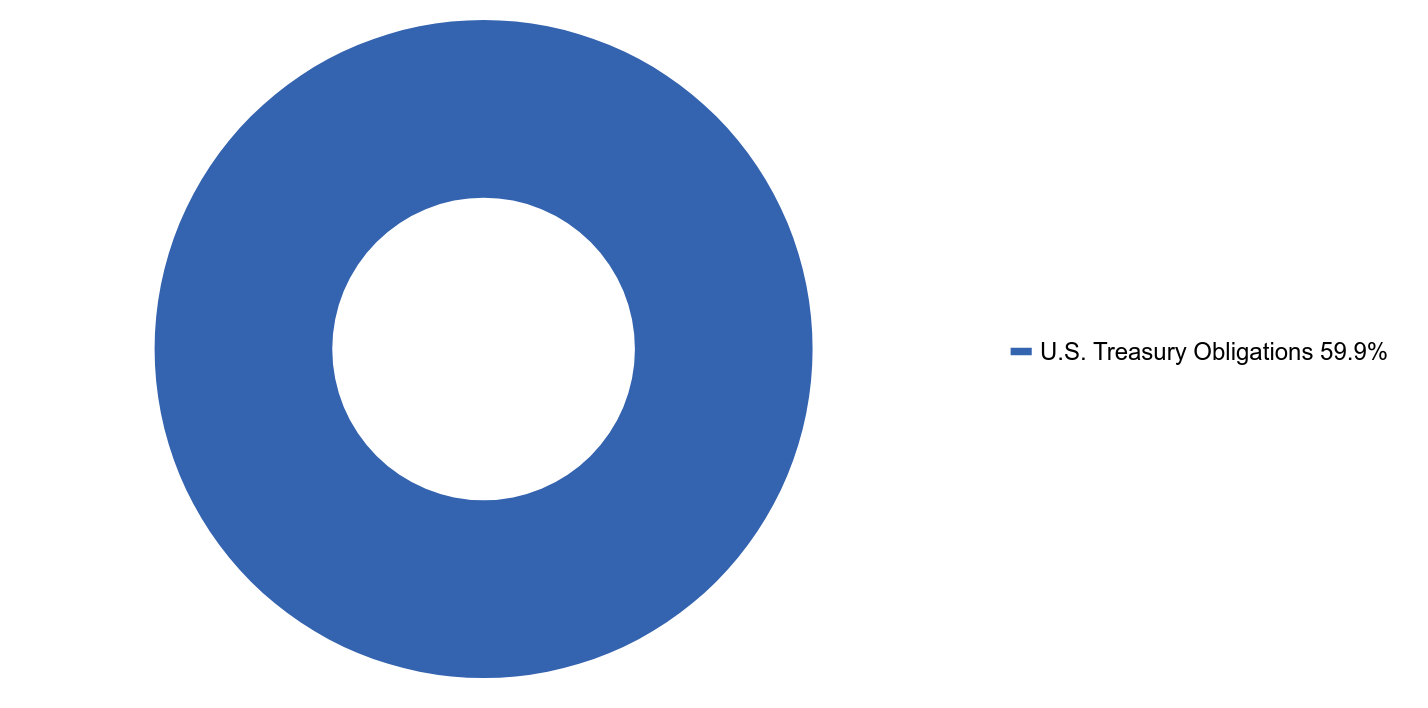

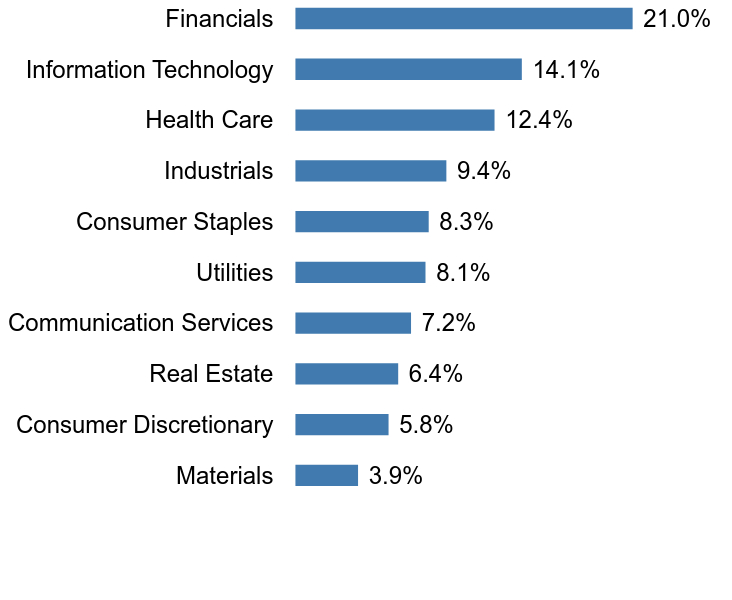

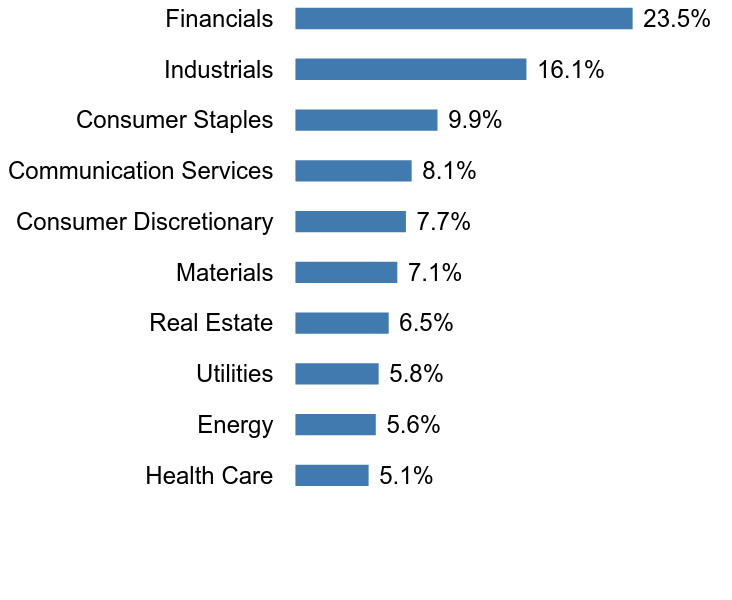

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Communication Services | 3.6% | Energy | 4.3% | Materials | 4.8% | Utilities | 7.5% | Consumer Staples | 8.3% | Consumer Discretionary | 9.2% | Health Care | 11.2% | Information Technology | 12.6% | Industrials | 18.7% | Financials | 19.0% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Evergy, Inc. | 0.4% |

|---|

Linde PLC | 0.4% |

|---|

CME Group, Inc. | 0.4% |

|---|

Atmos Energy Corp. | 0.3% |

|---|

Marsh & McLennan Cos., Inc. | 0.3% |

|---|

Automatic Data Processing, Inc. | 0.3% |

|---|

Cencora, Inc. | 0.3% |

|---|

The Coca-Cola Co. | 0.3% |

|---|

Republic Services, Inc. | 0.3% |

|---|

Intercontinental Exchange, Inc. | 0.3% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000157586 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares International Volatility Wtd ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

International Volatility Wtd ETF | $50 | 0.45% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 50

|

|

| Expense Ratio, Percent |

0.45%

|

|

| Factors Affecting Performance [Text Block] |

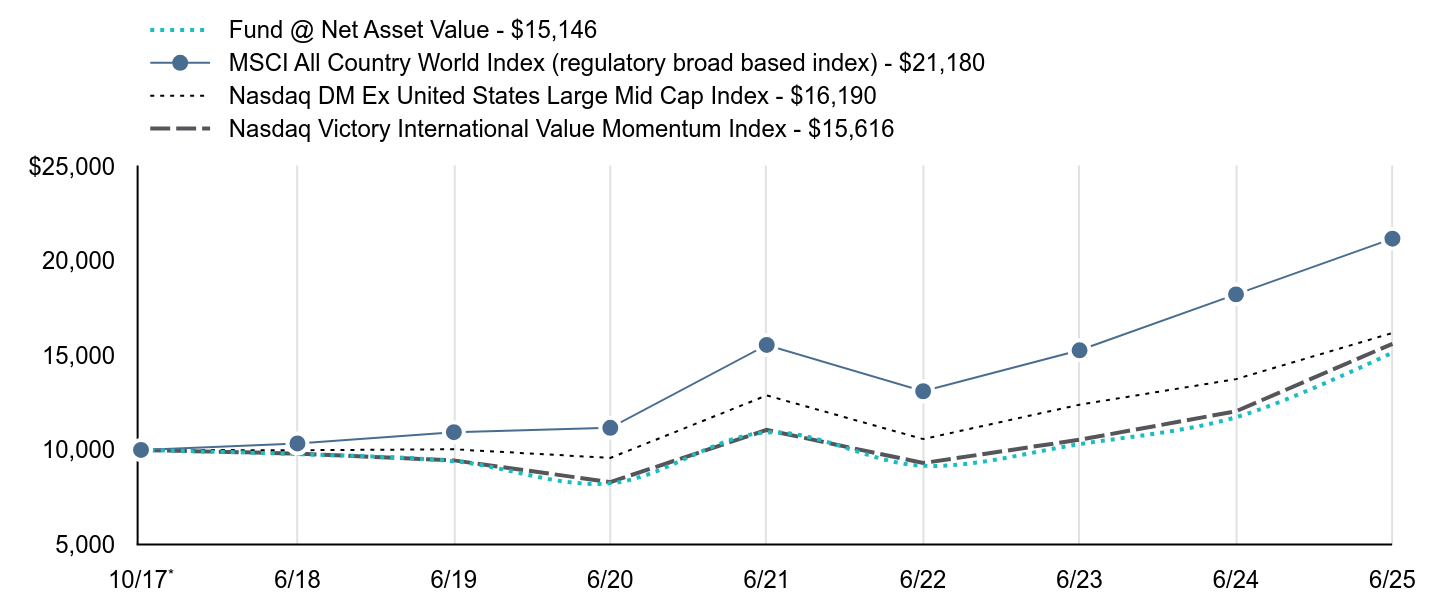

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s underweight allocation to the health care sector was a positive contributor to relative performance; and Stock selection in the health care and materials sectors contributed positively to relative performance.

Top detractors from performance: The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

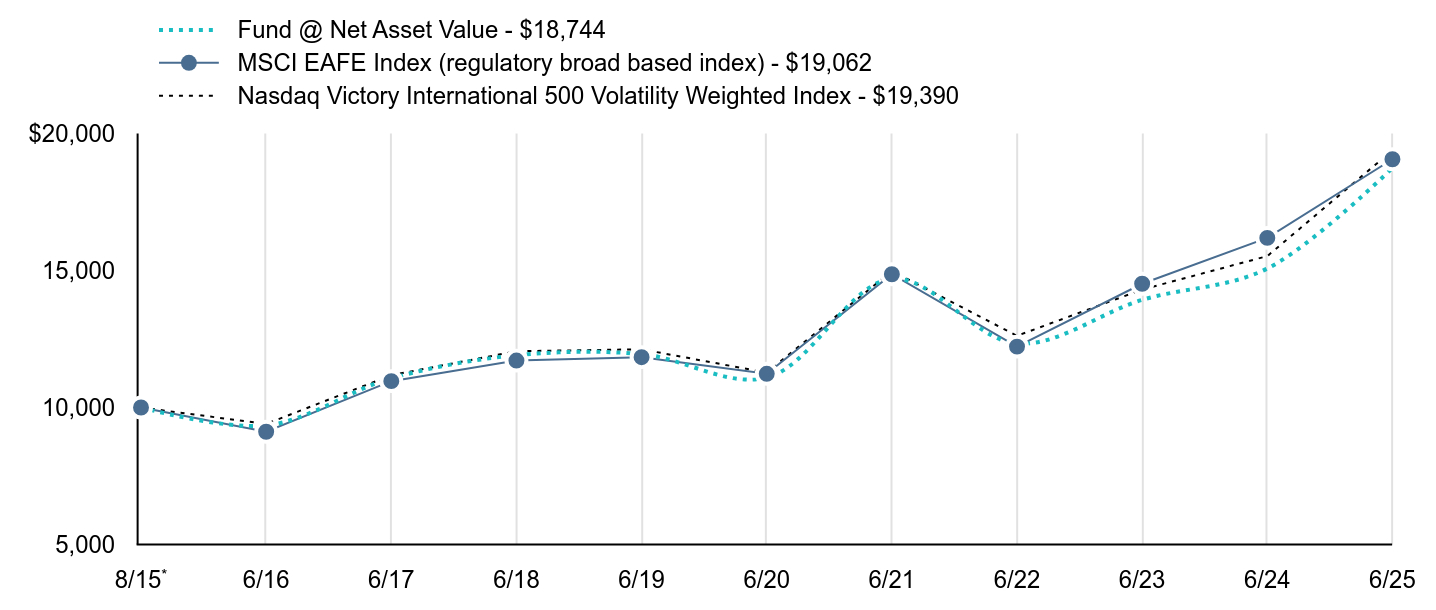

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $18,744 | MSCI EAFE Index (regulatory broad based index) - $19,062 | Nasdaq Victory International 500 Volatility Weighted Index - $19,390 |

|---|

8/15Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $9,342 | $9,115 | $9,399 |

|---|

6/17 | $11,065 | $10,962 | $11,179 |

|---|

6/18 | $11,908 | $11,712 | $12,054 |

|---|

6/19 | $11,950 | $11,838 | $12,125 |

|---|

6/20 | $11,087 | $11,231 | $11,274 |

|---|

6/21 | $14,699 | $14,864 | $14,985 |

|---|

6/22 | $12,333 | $12,223 | $12,616 |

|---|

6/23 | $13,930 | $14,517 | $14,306 |

|---|

6/24 | $15,073 | $16,192 | $15,527 |

|---|

6/25 | $18,744 | $19,062 | $19,390 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Fund @ Net Asset Value | 24.36%Footnote Reference | 11.07% | 6.58% |

|---|

MSCI EAFE Index | 17.73% | 11.16% | 6.76% |

|---|

Nasdaq Victory International 500 Volatility Weighted Index | 24.88% | 11.46% | 6.94% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 113,859,000

|

|

| Holdings Count | Holding |

507

|

|

| Advisory Fees Paid, Amount |

$ 401,000

|

|

| InvestmentCompanyPortfolioTurnover |

27.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $113,859 |

|---|

Number of Holdings | 507 |

|---|

Investment Advisory Fees | $401 |

|---|

Portfolio Turnover | 27% |

|---|

|

|

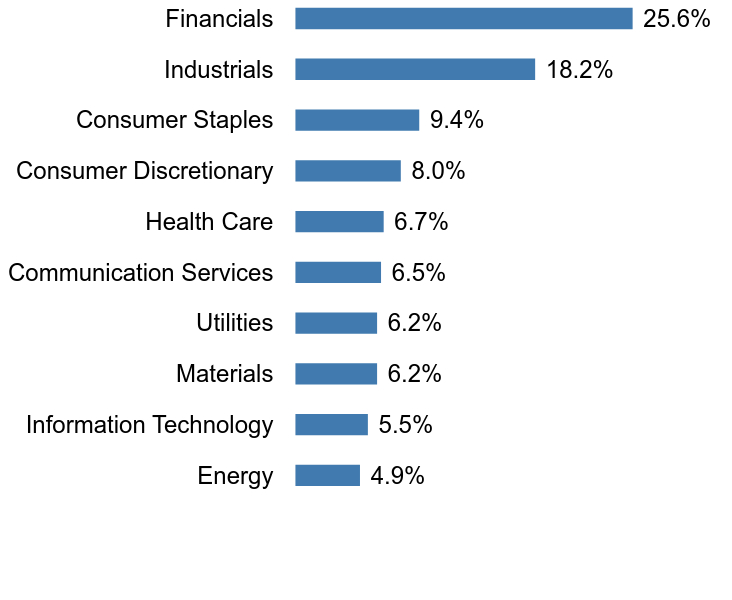

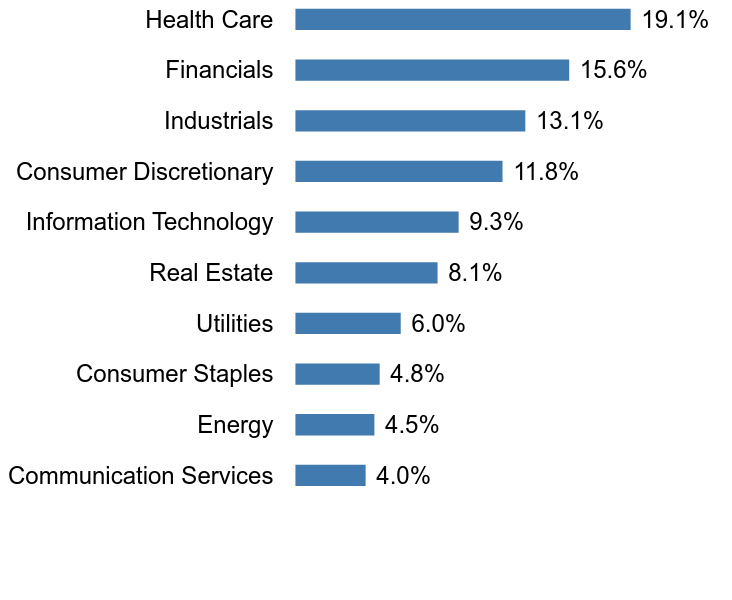

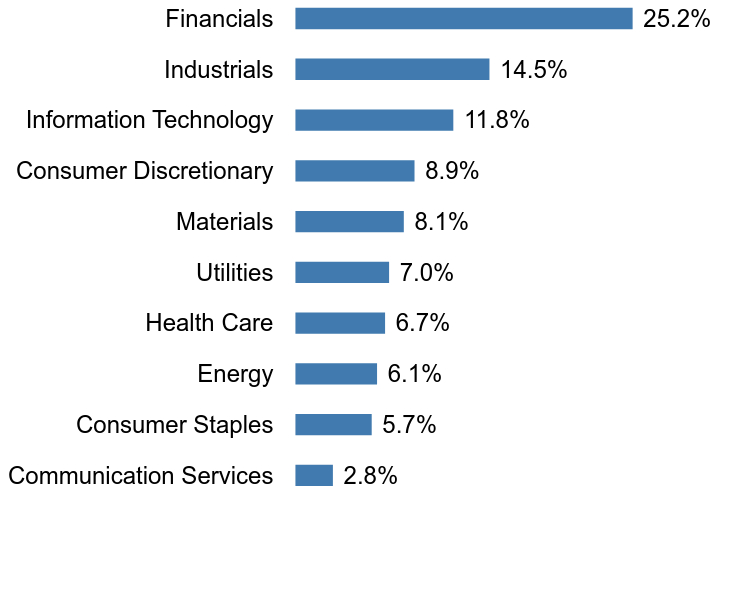

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Energy | 4.9% | Information Technology | 5.5% | Materials | 6.2% | Utilities | 6.2% | Communication Services | 6.5% | Health Care | 6.7% | Consumer Discretionary | 8.0% | Consumer Staples | 9.4% | Industrials | 18.2% | Financials | 25.6% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Swisscom AG, Registered Shares | 0.4% |

|---|

Koninklijke KPN NV | 0.4% |

|---|

Telstra Group Ltd. | 0.4% |

|---|

Coles Group Ltd. | 0.4% |

|---|

Deutsche Boerse AG | 0.4% |

|---|

Danone SA | 0.4% |

|---|

Engie SA | 0.4% |

|---|

Orange SA | 0.4% |

|---|

Terna - Rete Elettrica Nazionale | 0.4% |

|---|

Royal Bank of Canada | 0.4% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000157588 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares US Large Cap High Div Volatility Wtd ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

US Large Cap High Div Volatility Wtd ETF | $37 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

|

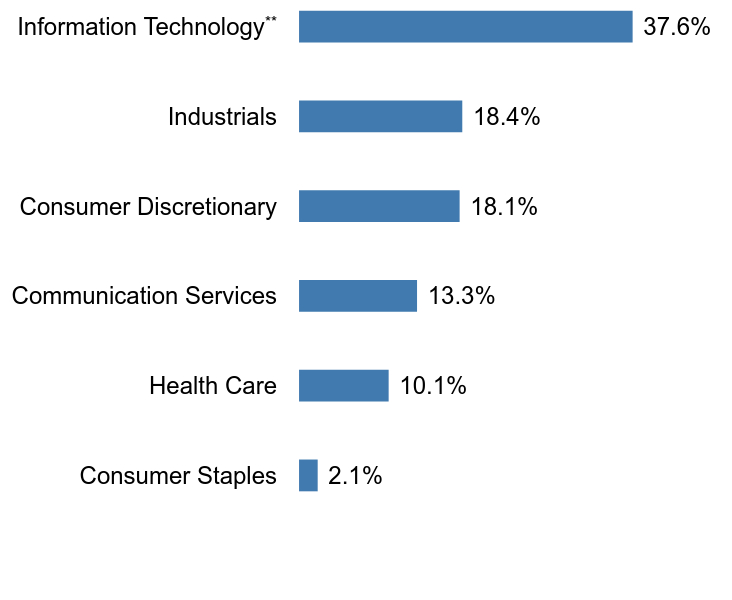

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s underweight allocation to the health care sector, and overweight allocation to the utilities sector, contributed positively to relative performance; and Stock selection in the information technology and health care sectors was a positive contributor to relative performance.

Top detractors from performance: The Fund’s underweight allocation to the industrials sector and overweight allocation to the energy sector detracted from relative performance; and Stock selection in the consumer staples and materials sectors detracted from relative performance.

The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

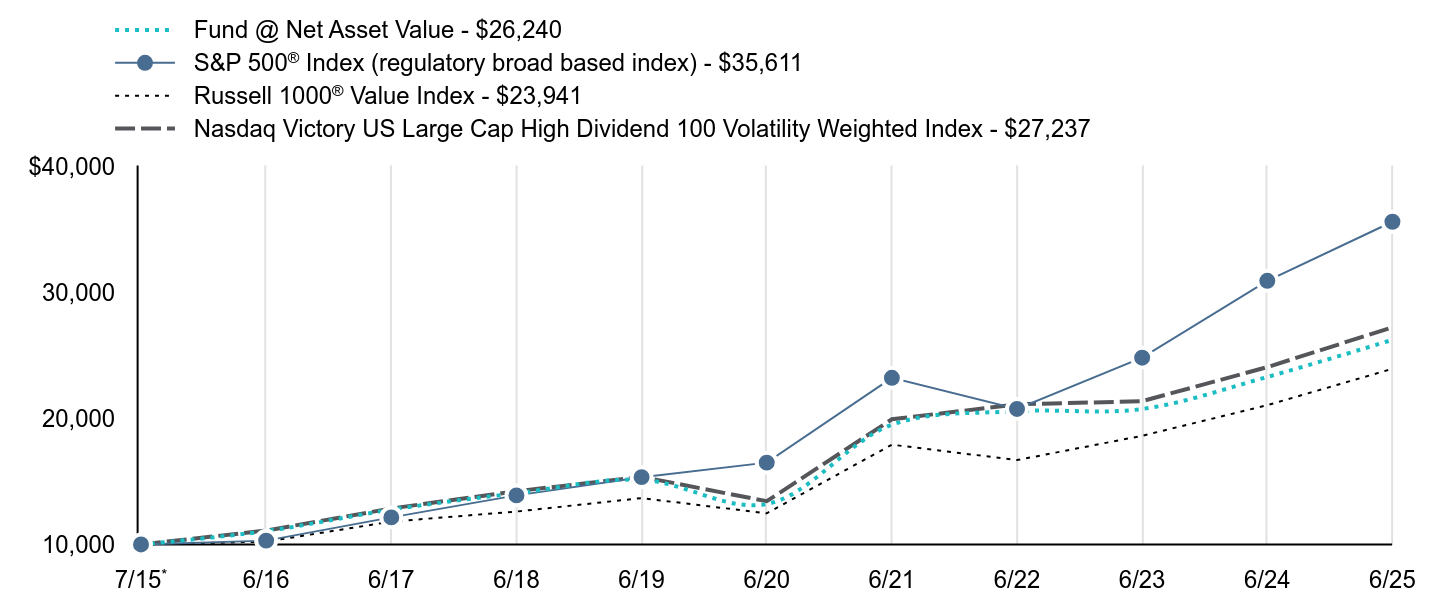

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $26,240 | S&P 500® Index (regulatory broad based index) - $35,611 | Russell 1000® Value Index - $23,941 | Nasdaq Victory US Large Cap High Dividend 100 Volatility Weighted Index - $27,237 |

|---|

7/15Footnote Reference* | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $11,062 | $10,305 | $10,225 | $11,103 |

|---|

6/17 | $12,762 | $12,150 | $11,813 | $12,857 |

|---|

6/18 | $14,067 | $13,896 | $12,613 | $14,226 |

|---|

6/19 | $15,135 | $15,343 | $13,680 | $15,370 |

|---|

6/20 | $13,201 | $16,495 | $12,471 | $13,431 |

|---|

6/21 | $19,503 | $23,224 | $17,919 | $19,934 |

|---|

6/22 | $20,575 | $20,759 | $16,697 | $21,120 |

|---|

6/23 | $20,752 | $24,826 | $18,624 | $21,372 |

|---|

6/24 | $23,293 | $30,922 | $21,055 | $24,075 |

|---|

6/25 | $26,240 | $35,611 | $23,941 | $27,237 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Fund @ Net Asset Value | 12.65% | 14.73% | 10.15% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.57% |

|---|

Russell 1000® Value Index | 13.70% | 13.93% | 9.14% |

|---|

Nasdaq Victory US Large Cap High Dividend 100 Volatility Weighted Index | 13.14% | 15.19% | 10.56% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 349,417,000

|

|

| Holdings Count | Holding |

101

|

|

| Advisory Fees Paid, Amount |

$ 1,039,000

|

|

| InvestmentCompanyPortfolioTurnover |

44.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $349,417 |

|---|

Number of Holdings | 101 |

|---|

Investment Advisory Fees | $1,039 |

|---|

Portfolio Turnover | 44% |

|---|

|

|

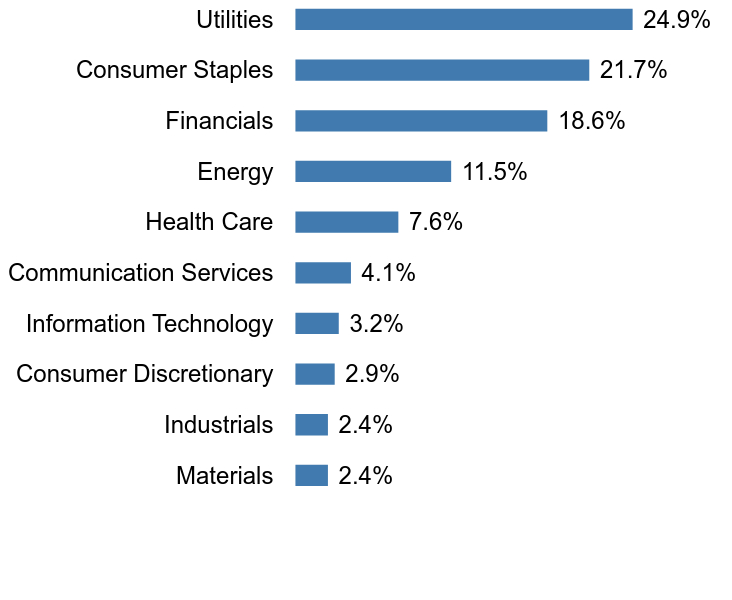

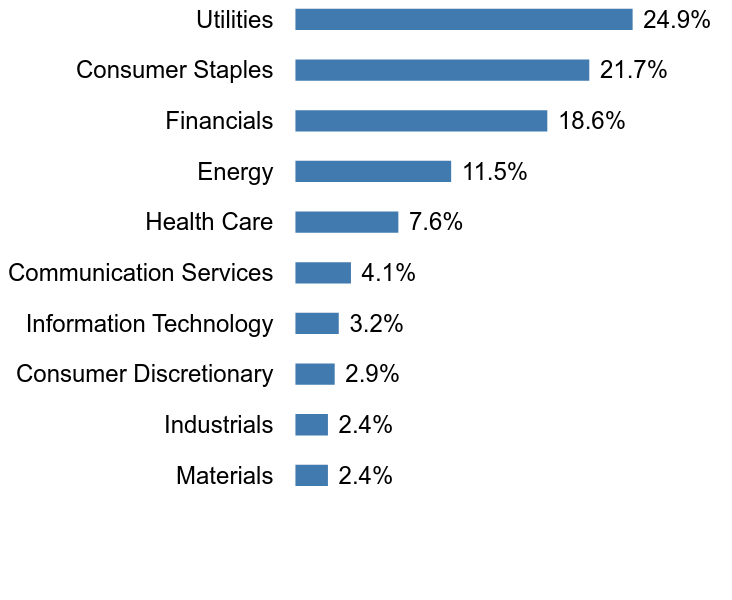

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Materials | 2.4% | Industrials | 2.4% | Consumer Discretionary | 2.9% | Information Technology | 3.2% | Communication Services | 4.1% | Health Care | 7.6% | Energy | 11.5% | Financials | 18.6% | Consumer Staples | 21.7% | Utilities | 24.9% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Evergy, Inc. | 1.8% |

|---|

CME Group, Inc. | 1.6% |

|---|

The Coca-Cola Co. | 1.5% |

|---|

WEC Energy Group, Inc. | 1.5% |

|---|

PPL Corp. | 1.4% |

|---|

CMS Energy Corp. | 1.4% |

|---|

Duke Energy Corp. | 1.4% |

|---|

The Southern Co. | 1.4% |

|---|

DTE Energy Co. | 1.4% |

|---|

Johnson & Johnson | 1.4% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000157589 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares US Small Cap High Div Volatility Wtd ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

US Small Cap High Div Volatility Wtd ETF | $36 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 36

|

|

| Expense Ratio, Percent |

0.35%

|

|

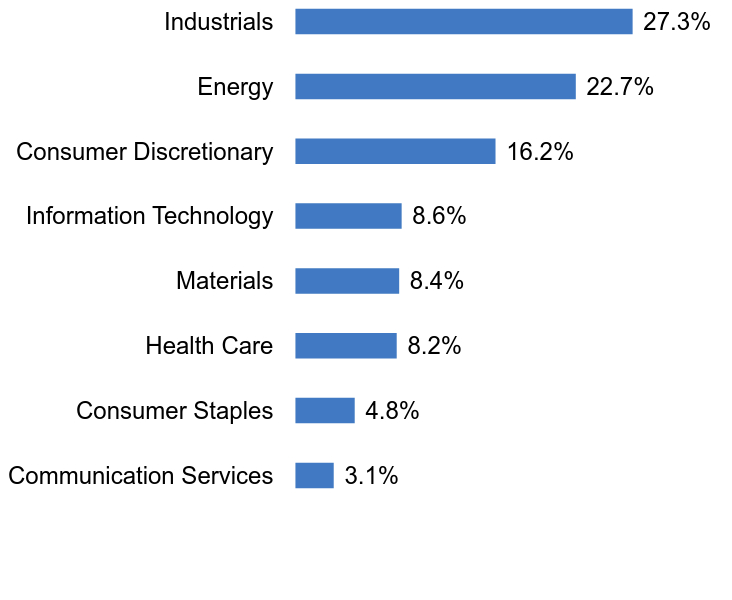

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s underweight allocation to the health care sector contributed positively to relative performance; and Stock selection in the financials sector was a positive contributor to relative performance.

Top detractors from performance: The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

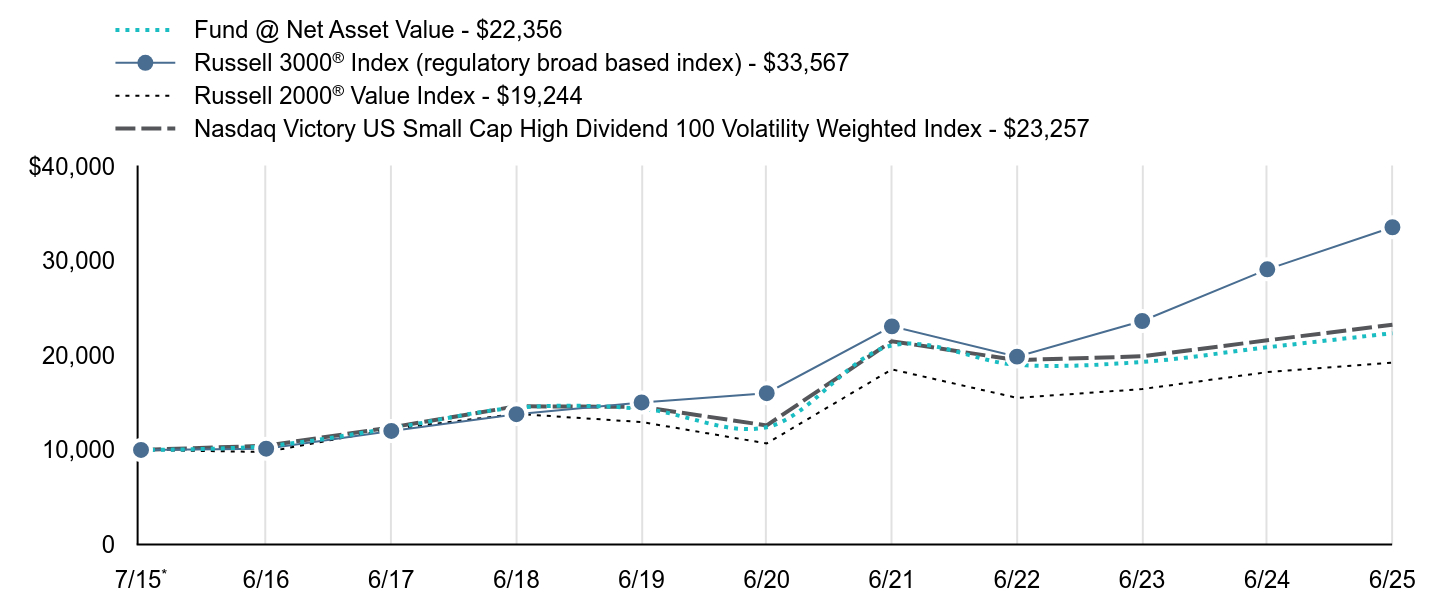

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $22,356 | Russell 3000® Index (regulatory broad based index) - $33,567 | Russell 2000® Value Index - $19,244 | Nasdaq Victory US Small Cap High Dividend 100 Volatility Weighted Index - $23,257 |

|---|

7/15Footnote Reference* | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $10,415 | $10,137 | $9,786 | $10,448 |

|---|

6/17 | $12,298 | $12,013 | $12,218 | $12,389 |

|---|

6/18 | $14,468 | $13,789 | $13,819 | $14,623 |

|---|

6/19 | $14,366 | $15,027 | $12,957 | $14,560 |

|---|

6/20 | $12,411 | $16,008 | $10,693 | $12,596 |

|---|

6/21 | $21,066 | $23,078 | $18,528 | $21,506 |

|---|

6/22 | $19,010 | $19,878 | $15,512 | $19,504 |

|---|

6/23 | $19,317 | $23,646 | $16,443 | $19,910 |

|---|

6/24 | $20,867 | $29,114 | $18,235 | $21,602 |

|---|

6/25 | $22,356 | $33,567 | $19,244 | $23,257 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Fund @ Net Asset Value | 7.14% | 12.49% | 8.39% |

|---|

Russell 3000® Index | 15.30% | 15.96% | 12.90% |

|---|

Russell 2000® Value Index | 5.54% | 12.47% | 6.78% |

|---|

Nasdaq Victory US Small Cap High Dividend 100 Volatility Weighted Index | 7.66% | 13.05% | 8.82% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 271,534,000

|

|

| Holdings Count | Holding |

105

|

|

| Advisory Fees Paid, Amount |

$ 868,000

|

|

| InvestmentCompanyPortfolioTurnover |

66.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $271,534 |

|---|

Number of Holdings | 105 |

|---|

Investment Advisory Fees | $868 |

|---|

Portfolio Turnover | 66% |

|---|

|

|

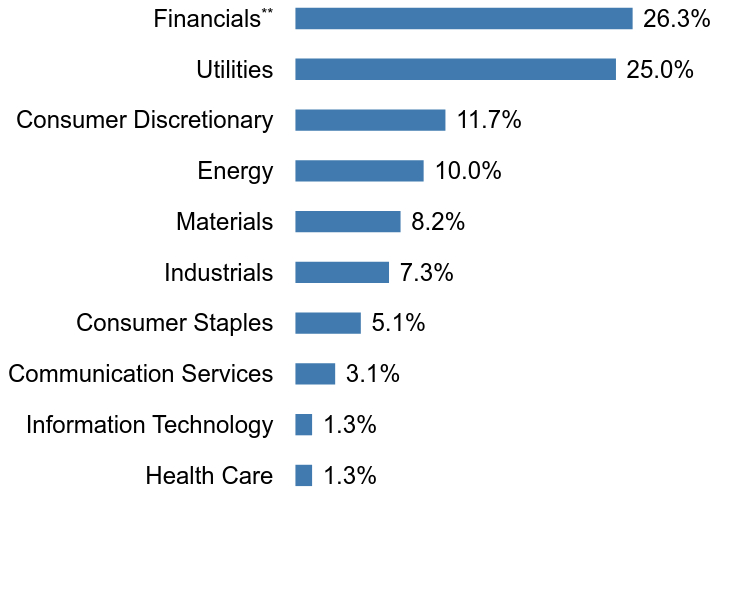

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Health Care | 1.3% | Information Technology | 1.3% | Communication Services | 3.1% | Consumer Staples | 5.1% | Industrials | 7.3% | Materials | 8.2% | Energy | 10.0% | Consumer Discretionary | 11.7% | Utilities | 25.0% | FinancialsFootnote Reference** | 26.3% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)IDACORP, Inc. | 1.9% |

|---|

Sensient Technologies Corp. | 1.8% |

|---|

TXNM Energy, Inc. | 1.8% |

|---|

Portland General Electric Co. | 1.7% |

|---|

New Jersey Resources Corp. | 1.6% |

|---|

Black Hills Corp. | 1.6% |

|---|

Northwest Natural Holding Co. | 1.5% |

|---|

American States Water Co. | 1.5% |

|---|

ONE Gas, Inc. | 1.5% |

|---|

Avista Corp. | 1.5% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000180597 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares Dividend Accelerator ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Dividend Accelerator ETF | $37 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

|

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s overweight allocation to the financials sector was a positive contributor to relative performance; and Stock selection in the health care sector contributed positively to relative performance.

Top detractors from performance: The Fund’s overweight allocation to the consumer staples sector detracted from relative performance; and Stock selection in the consumer staples and industrials sectors detracted from relative performance.

The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

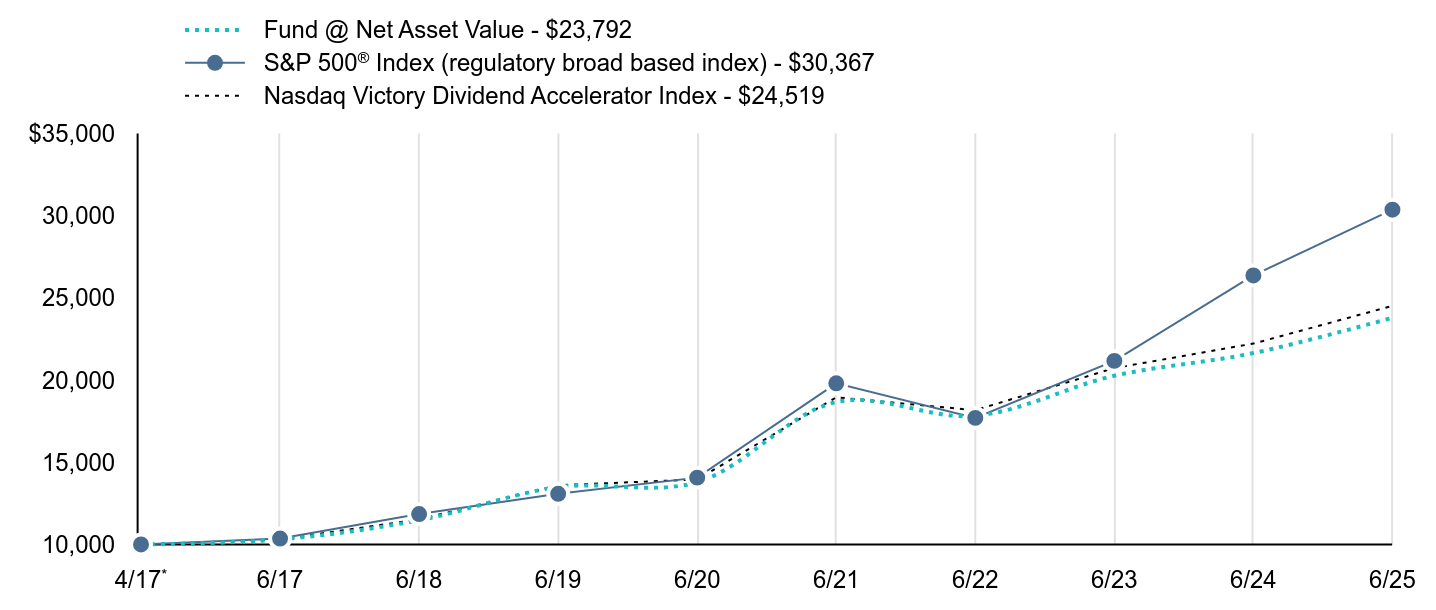

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $23,792 | S&P 500® Index (regulatory broad based index) - $30,367 | Nasdaq Victory Dividend Accelerator Index - $24,519 |

|---|

4/17Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/17 | $10,305 | $10,360 | $10,310 |

|---|

6/18 | $11,473 | $11,850 | $11,521 |

|---|

6/19 | $13,492 | $13,084 | $13,604 |

|---|

6/20 | $13,793 | $14,066 | $13,954 |

|---|

6/21 | $18,666 | $19,804 | $18,952 |

|---|

6/22 | $17,827 | $17,702 | $18,169 |

|---|

6/23 | $20,265 | $21,170 | $20,732 |

|---|

6/24 | $21,645 | $26,369 | $22,221 |

|---|

6/25 | $23,792 | $30,367 | $24,519 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Fund @ Net Asset Value | 9.92% | 11.52% | 11.15% |

|---|

S&P 500® Index | 15.16% | 16.64% | 14.50% |

|---|

Nasdaq Victory Dividend Accelerator Index | 10.34% | 11.93% | 11.55% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 238,219,000

|

|

| Holdings Count | Holding |

76

|

|

| Advisory Fees Paid, Amount |

$ 738,000

|

|

| InvestmentCompanyPortfolioTurnover |

39.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $238,219 |

|---|

Number of Holdings | 76 |

|---|

Investment Advisory Fees | $738 |

|---|

Portfolio Turnover | 39% |

|---|

|

|

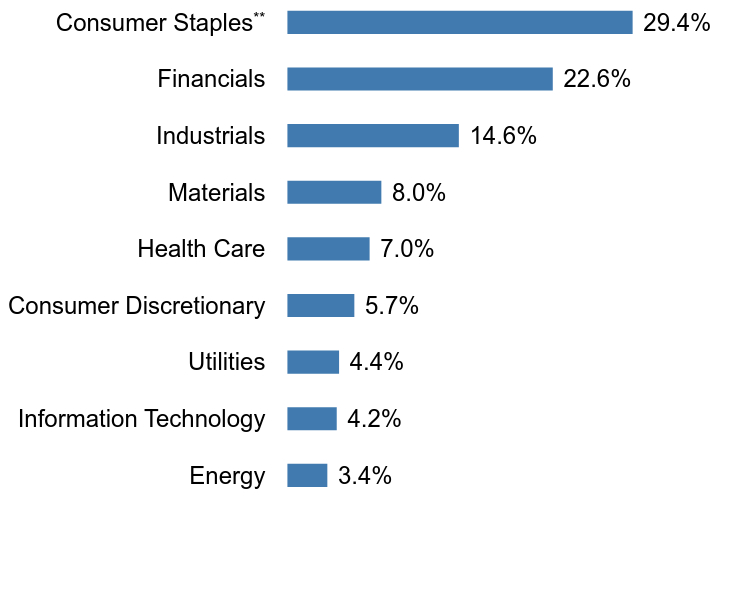

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Energy | 3.4% | Information Technology | 4.2% | Utilities | 4.4% | Consumer Discretionary | 5.7% | Health Care | 7.0% | Materials | 8.0% | Industrials | 14.6% | Financials | 22.6% | Consumer StaplesFootnote Reference** | 29.4% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Franklin Resources, Inc. | 4.5% |

|---|

T. Rowe Price Group, Inc. | 3.5% |

|---|

Altria Group, Inc. | 3.5% |

|---|

Hormel Foods Corp. | 2.9% |

|---|

Archer-Daniels-Midland Co. | 2.6% |

|---|

Target Corp. | 2.4% |

|---|

Medtronic PLC | 2.2% |

|---|

Stanley Black & Decker, Inc. | 2.1% |

|---|

Kimberly-Clark Corp. | 2.1% |

|---|

Emerson Electric Co. | 2.0% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000180594 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares US Multi-Factor Minimum Volatility ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

US Multi-Factor Minimum Volatility ETF | $37 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

|

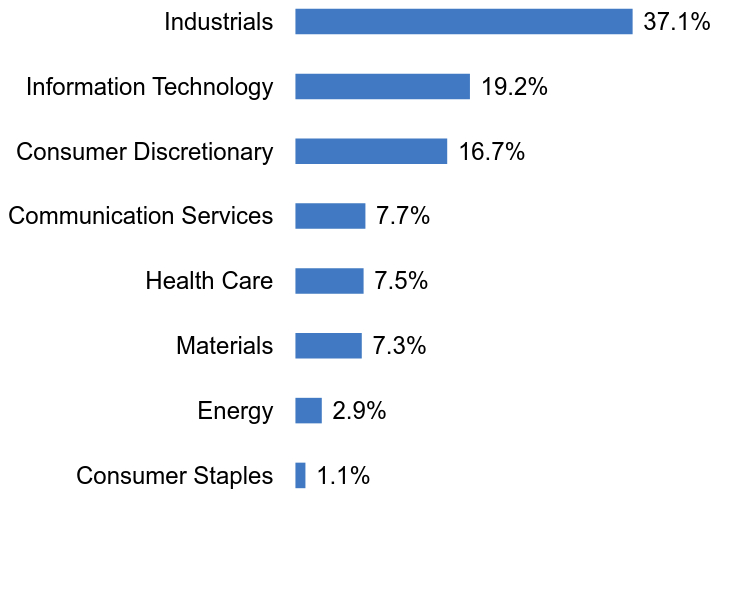

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: An overweight allocation to the industrials sector contributed positively to relative performance; and Stock selection in health care and consumer staples sectors was a positive contributor to relative performance.

Top detractors from performance: The Fund’s overweight allocation to the health care sector and underweight allocation to the financials sector detracted from relative performance; and Stock selection in the information technology sector detracted from relative performance.

The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

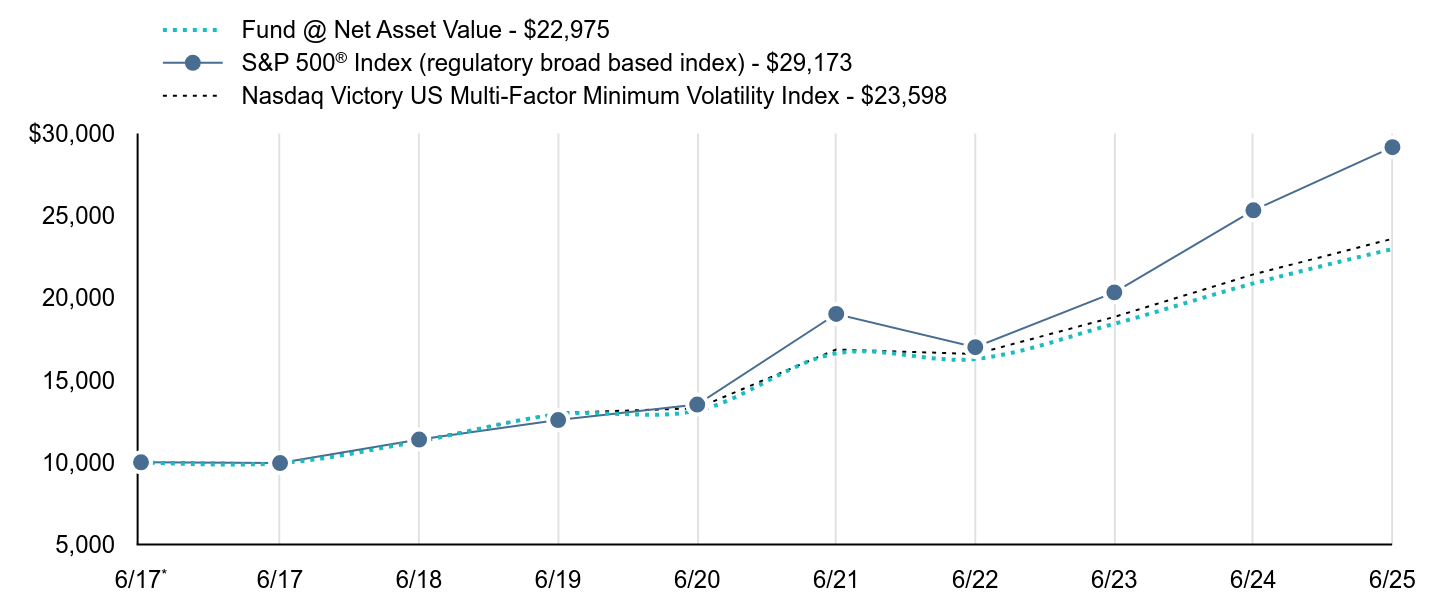

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $22,975 | S&P 500® Index (regulatory broad based index) - $29,173 | Nasdaq Victory US Multi-Factor Minimum Volatility Index - $23,598 |

|---|

6/17Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/17 | $9,946 | $9,953 | $9,947 |

|---|

6/18 | $11,279 | $11,384 | $11,322 |

|---|

6/19 | $12,911 | $12,569 | $13,008 |

|---|

6/20 | $13,146 | $13,513 | $13,287 |

|---|

6/21 | $16,626 | $19,025 | $16,864 |

|---|

6/22 | $16,286 | $17,005 | $16,586 |

|---|

6/23 | $18,427 | $20,338 | $18,844 |

|---|

6/24 | $20,884 | $25,332 | $21,432 |

|---|

6/25 | $22,975 | $29,173 | $23,598 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Fund @ Net Asset Value | 10.01% | 11.81% | 10.92% |

|---|

S&P 500® Index | 15.16% | 16.64% | 14.27% |

|---|

Nasdaq Victory US Multi-Factor Minimum Volatility Index | 10.11% | 12.17% | 11.29% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 110,893,000

|

|

| Holdings Count | Holding |

63

|

|

| Advisory Fees Paid, Amount |

$ 365,000

|

|

| InvestmentCompanyPortfolioTurnover |

71.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $110,893 |

|---|

Number of Holdings | 63 |

|---|

Investment Advisory Fees | $365 |

|---|

Portfolio Turnover | 71% |

|---|

|

|

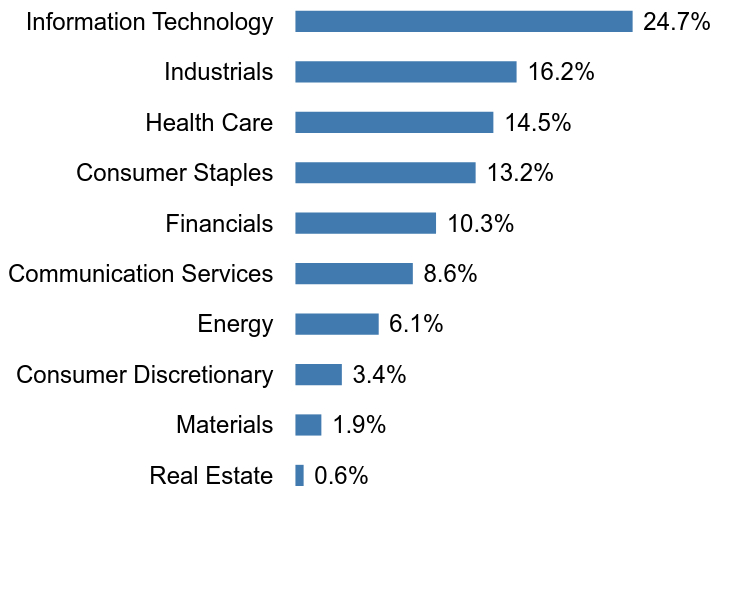

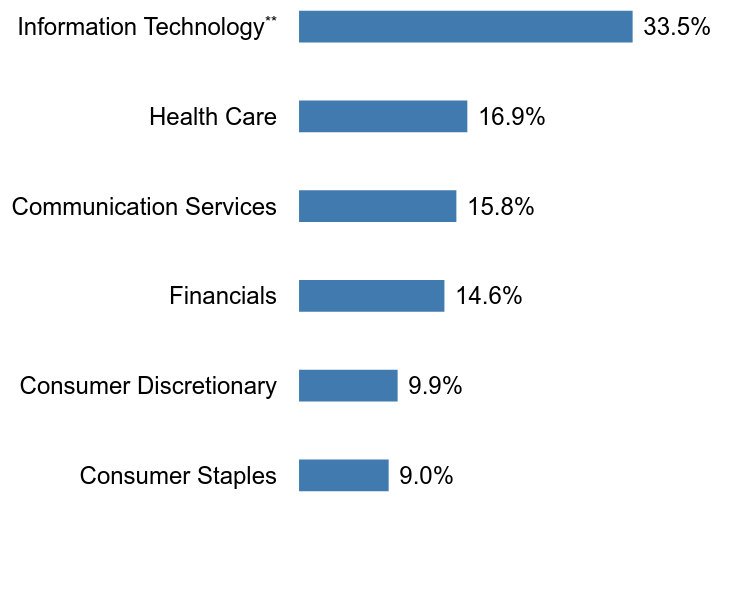

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Real Estate | 0.6% | Materials | 1.9% | Consumer Discretionary | 3.4% | Energy | 6.1% | Communication Services | 8.6% | Financials | 10.3% | Consumer Staples | 13.2% | Health Care | 14.5% | Industrials | 16.2% | Information Technology | 24.7% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Apple, Inc. | 9.0% |

|---|

Alphabet, Inc., Class A | 5.5% |

|---|

Walmart, Inc. | 4.2% |

|---|

The Procter & Gamble Co. | 3.5% |

|---|

Johnson & Johnson | 3.5% |

|---|

Lockheed Martin Corp. | 3.3% |

|---|

AbbVie, Inc. | 3.3% |

|---|

Exxon Mobil Corp. | 3.2% |

|---|

The Cigna Group | 3.2% |

|---|

Republic Services, Inc. | 3.1% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000139053 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares US 500 Enhanced Volatility Wtd ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

US 500 Enhanced Volatility Wtd ETF | $37 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

|

| Factors Affecting Performance [Text Block] |

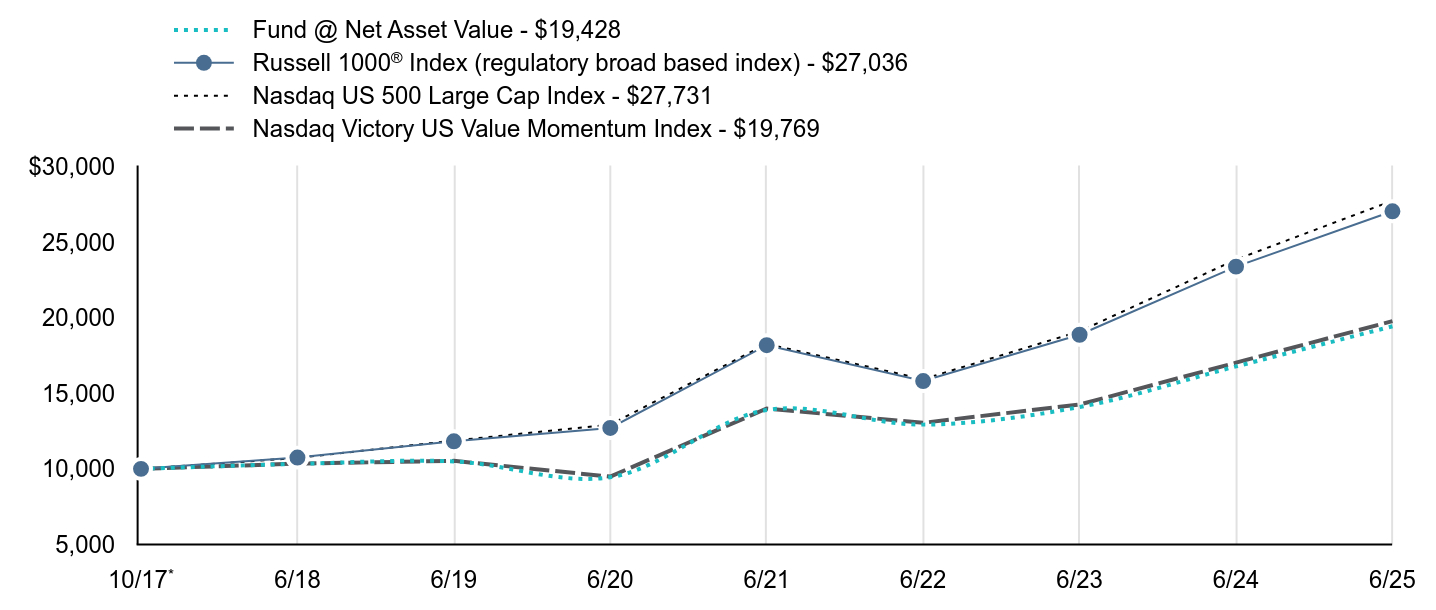

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s overweight allocation to the industrials sector contributed positively to relative performance; and Stock selection in the health care and consumer discretionary sectors was a positive contributor to relative performance.

Top detractors from performance: The Fund’s underweight position in the information technology and communication services sectors detracted from relative performance; and Stock selection in the industrials and financials sectors detracted from relative performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

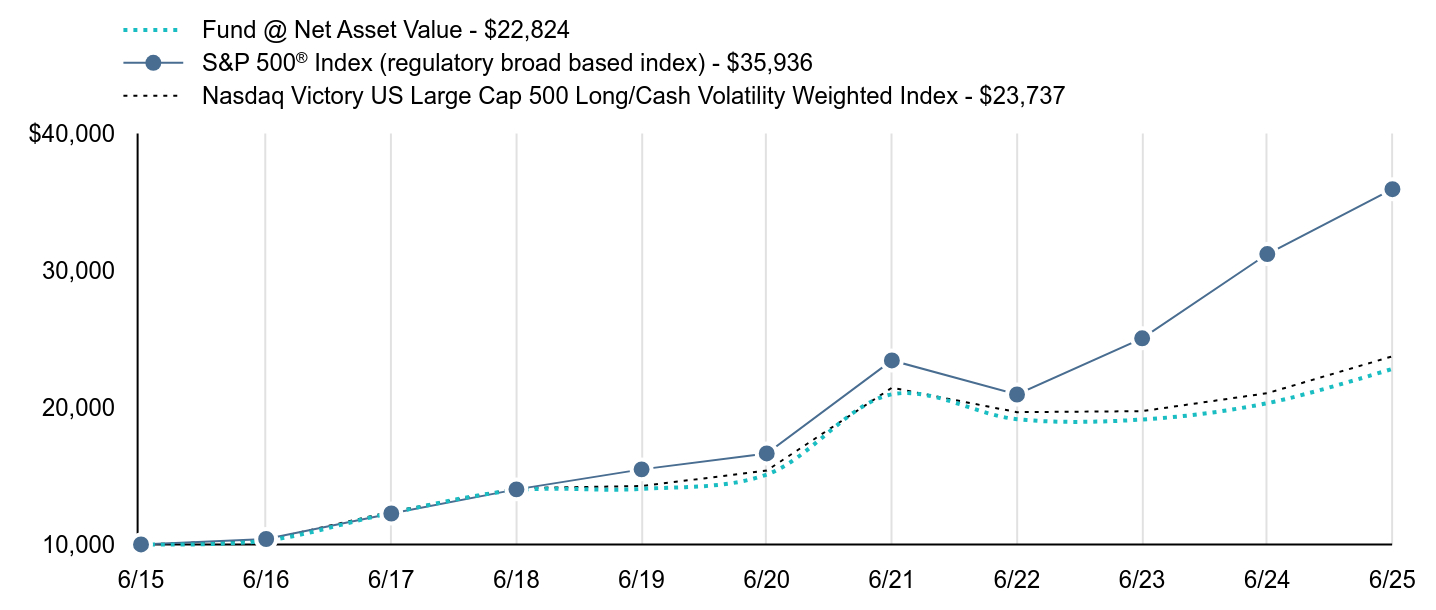

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $22,824 | S&P 500® Index (regulatory broad based index) - $35,936 | Nasdaq Victory US Large Cap 500 Long/Cash Volatility Weighted Index - $23,737 |

|---|

6/15 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $10,279 | $10,399 | $10,319 |

|---|

6/17 | $12,306 | $12,260 | $12,399 |

|---|

6/18 | $13,958 | $14,023 | $14,114 |

|---|

6/19 | $14,054 | $15,483 | $14,265 |

|---|

6/20 | $15,107 | $16,645 | $15,394 |

|---|

6/21 | $20,965 | $23,436 | $21,443 |

|---|

6/22 | $19,147 | $20,948 | $19,659 |

|---|

6/23 | $19,123 | $25,053 | $19,733 |

|---|

6/24 | $20,314 | $31,204 | $21,047 |

|---|

6/25 | $22,824 | $35,936 | $23,737 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Fund @ Net Asset Value | 12.36% | 8.60% | 8.60% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Nasdaq Victory US Large Cap 500 Long/Cash Volatility Weighted Index | 12.78% | 9.05% | 9.03% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 416,923,000

|

|

| Holdings Count | Holding |

508

|

|

| Advisory Fees Paid, Amount |

$ 1,284,000

|

|

| InvestmentCompanyPortfolioTurnover |

24.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $416,923 |

|---|

Number of Holdings | 508 |

|---|

Investment Advisory Fees | $1,284 |

|---|

Portfolio Turnover | 24% |

|---|

|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Communication Services | 3.6% | Energy | 4.3% | Materials | 4.8% | Utilities | 7.5% | Consumer Staples | 8.3% | Consumer Discretionary | 9.2% | Health Care | 11.2% | Information Technology | 12.6% | Industrials | 18.7% | Financials | 19.0% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Evergy, Inc. | 0.4% |

|---|

Linde PLC | 0.4% |

|---|

CME Group, Inc. | 0.4% |

|---|

Atmos Energy Corp. | 0.3% |

|---|

Marsh & McLennan Cos., Inc. | 0.3% |

|---|

Automatic Data Processing, Inc. | 0.3% |

|---|

Cencora, Inc. | 0.3% |

|---|

The Coca-Cola Co. | 0.3% |

|---|

Republic Services, Inc. | 0.3% |

|---|

Intercontinental Exchange, Inc. | 0.3% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of the Adviser, replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000139055 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares US EQ Income Enhanced Volatility Wtd ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

US EQ Income Enhanced Volatility Wtd ETF | $37 | 0.35% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.35%

|

|

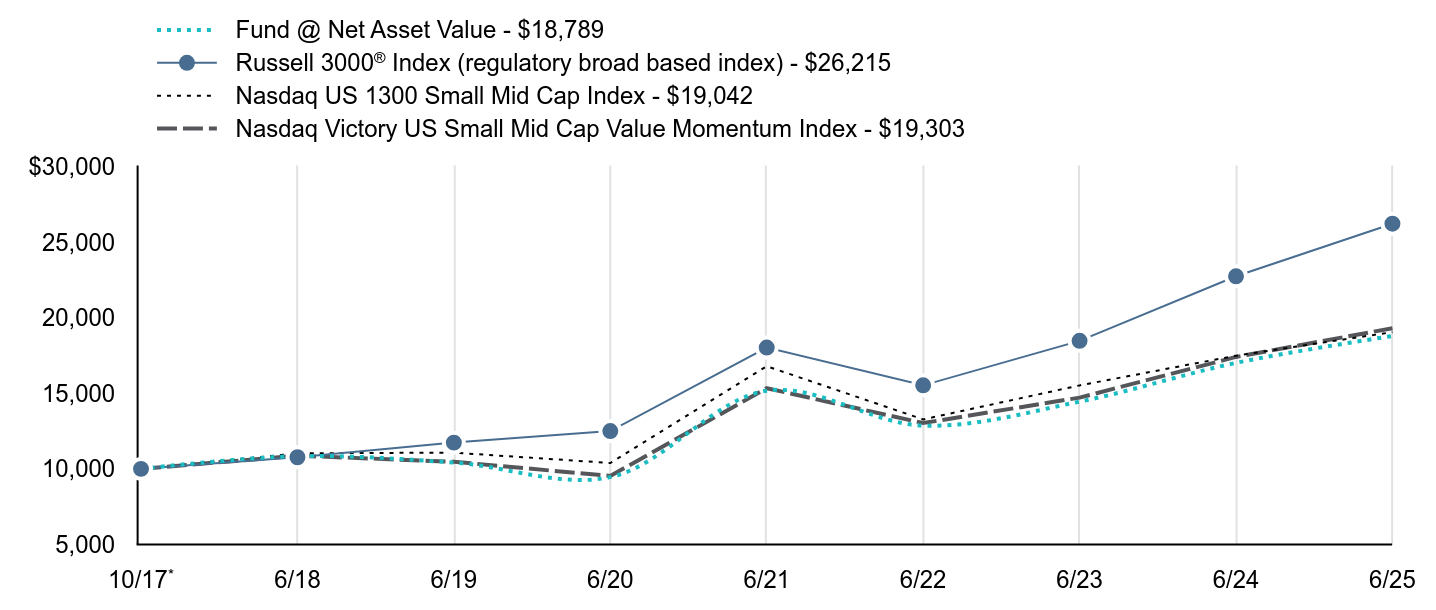

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s underweight allocation to the health care sector, and overweight allocation to the utilities sector, contributed positively to relative performance; and Stock selection in the information technology and health care sectors was a positive contributor to relative performance.

Top detractors from performance: The Fund’s underweight allocation to the industrials sector, and overweight allocation to the energy sector, detracted from relative performance; and Stock selection in the consumer staples and materials sectors detracted from relative performance.

The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

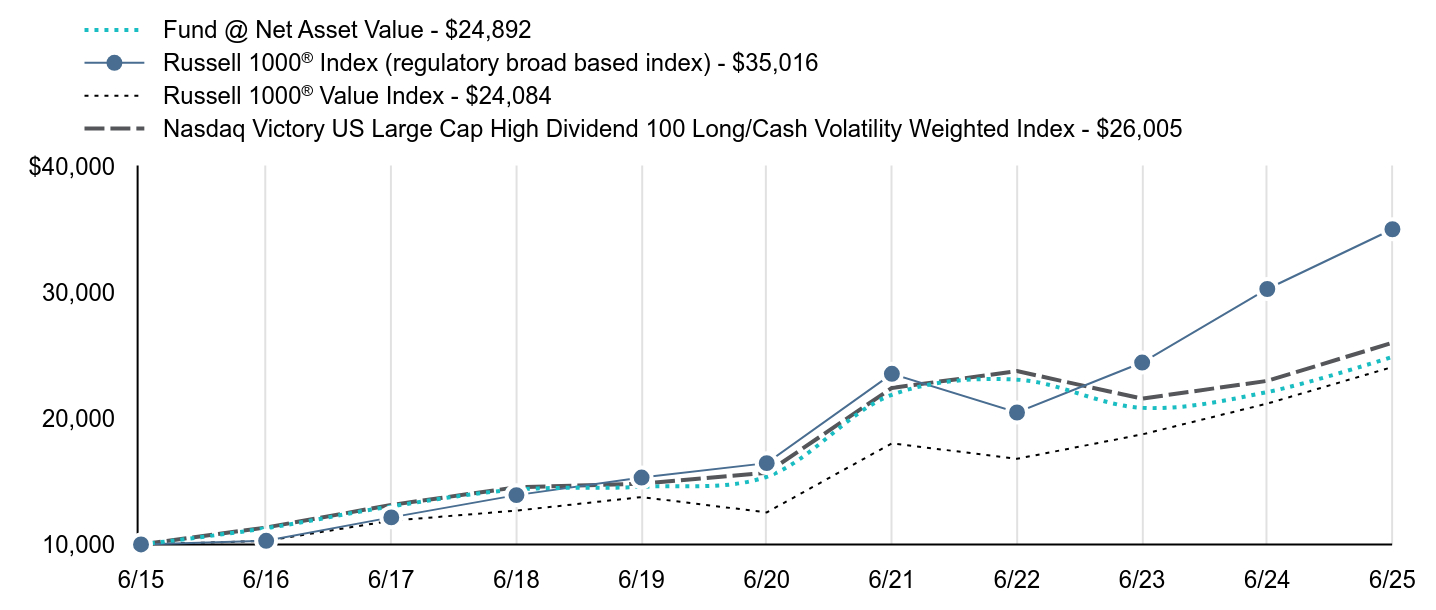

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $24,892 | Russell 1000® Index (regulatory broad based index) - $35,016 | Russell 1000® Value Index - $24,084 | Nasdaq Victory US Large Cap High Dividend 100 Long/Cash Volatility Weighted Index - $26,005 |

|---|

6/15 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $11,289 | $10,293 | $10,286 | $11,346 |

|---|

6/17 | $13,023 | $12,149 | $11,883 | $13,138 |

|---|

6/18 | $14,355 | $13,916 | $12,688 | $14,537 |

|---|

6/19 | $14,574 | $15,310 | $13,762 | $14,825 |

|---|

6/20 | $15,375 | $16,455 | $12,546 | $15,683 |

|---|

6/21 | $21,880 | $23,543 | $18,026 | $22,421 |

|---|

6/22 | $23,080 | $20,474 | $16,797 | $23,755 |

|---|

6/23 | $20,842 | $24,438 | $18,735 | $21,575 |

|---|

6/24 | $22,095 | $30,274 | $21,181 | $22,986 |

|---|

6/25 | $24,892 | $35,016 | $24,084 | $26,005 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Fund @ Net Asset Value | 12.66% | 10.12% | 9.55% |

|---|

Russell 1000® Index | 15.66% | 16.30% | 13.35% |

|---|

Russell 1000® Value Index | 13.70% | 13.93% | 9.19% |

|---|

Nasdaq Victory US Large Cap High Dividend 100 Long/Cash Volatility Weighted Index | 13.14% | 10.64% | 10.03% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 733,712,000

|

|

| Holdings Count | Holding |

102

|

|

| Advisory Fees Paid, Amount |

$ 2,361,000

|

|

| InvestmentCompanyPortfolioTurnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $733,712 |

|---|

Number of Holdings | 102 |

|---|

Investment Advisory Fees | $2,361 |

|---|

Portfolio Turnover | 45% |

|---|

|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Materials | 2.4% | Industrials | 2.4% | Consumer Discretionary | 2.9% | Information Technology | 3.2% | Communication Services | 4.1% | Health Care | 7.6% | Energy | 11.5% | Financials | 18.6% | Consumer Staples | 21.7% | Utilities | 24.9% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Evergy, Inc. | 1.8% |

|---|

CME Group, Inc. | 1.6% |

|---|

The Coca-Cola Co. | 1.5% |

|---|

WEC Energy Group, Inc. | 1.5% |

|---|

PPL Corp. | 1.4% |

|---|

CMS Energy Corp. | 1.4% |

|---|

Duke Energy Corp. | 1.4% |

|---|

The Southern Co. | 1.4% |

|---|

DTE Energy Co. | 1.4% |

|---|

Johnson & Johnson | 1.4% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000243210 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares Free Cash Flow ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Free Cash Flow ETF | $42 | 0.39% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.39%

|

|

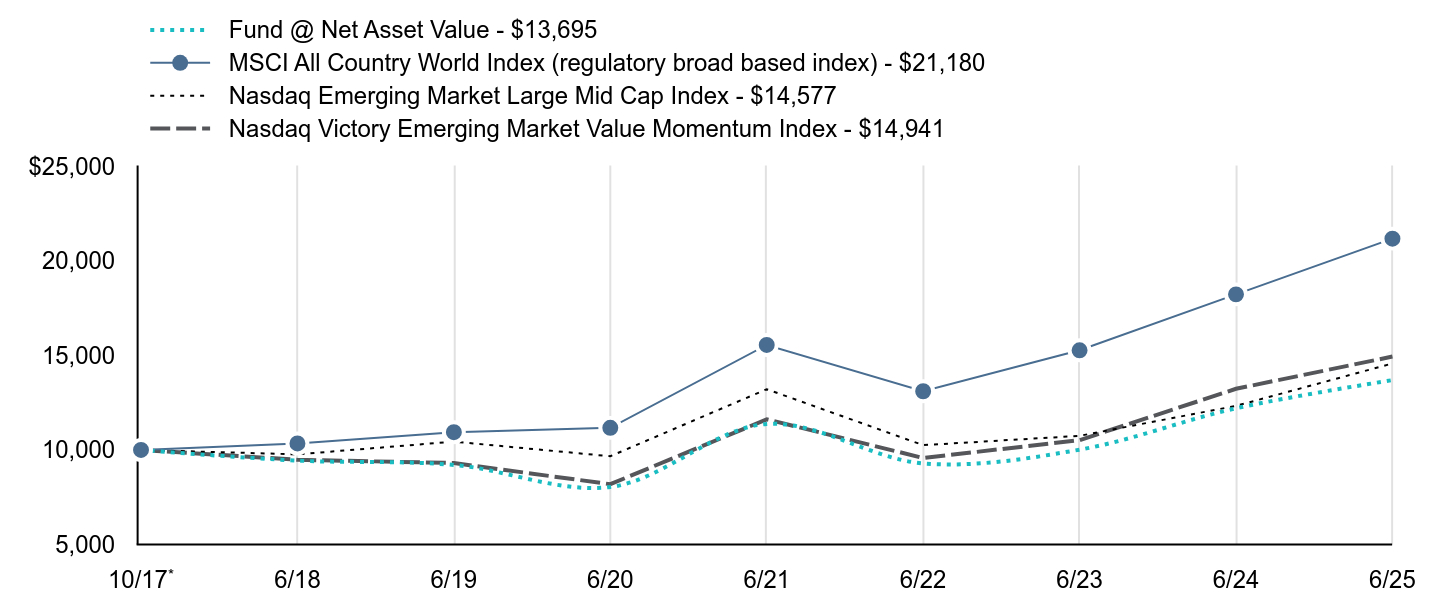

| Factors Affecting Performance [Text Block] |

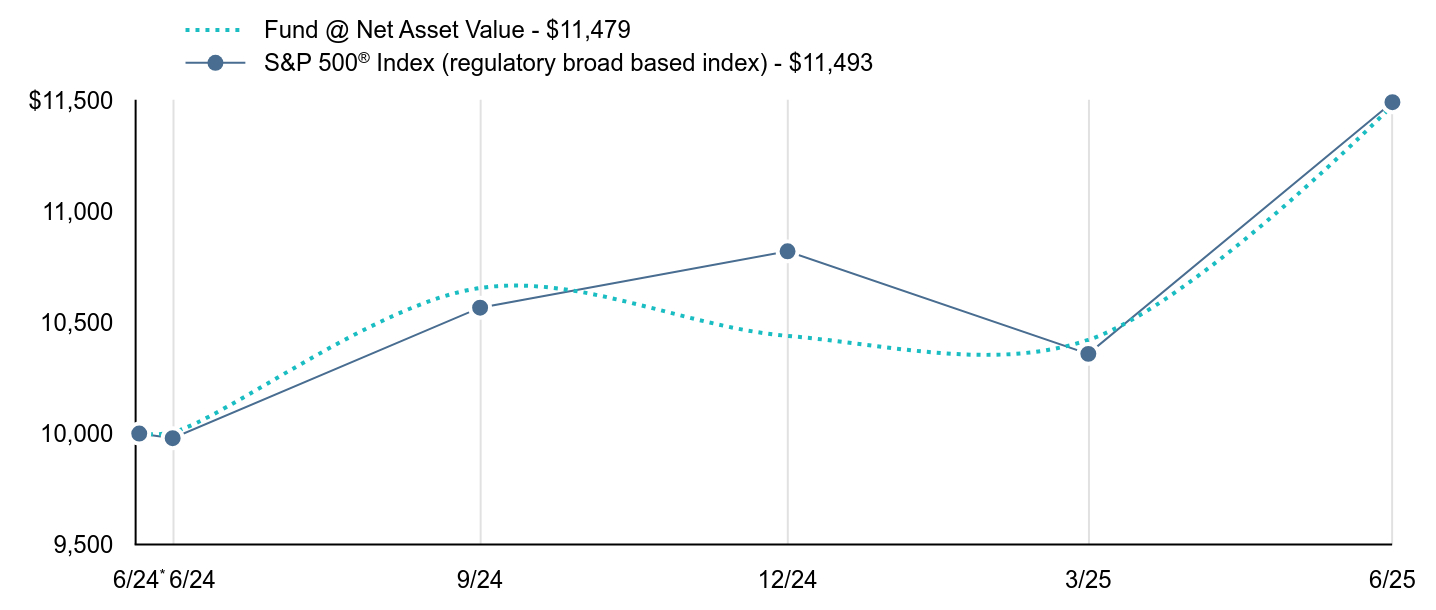

What affected the Fund’s performance during the last year?Top contributors to performance: The Fund’s overweight allocation to the information technology sector contributed positively to relative performance; and Stock selection in the information technology sector was a positive contributor to relative performance.

Top detractors from performance: The Fund had a small allocation to derivatives during the period that did not have a material impact on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

|

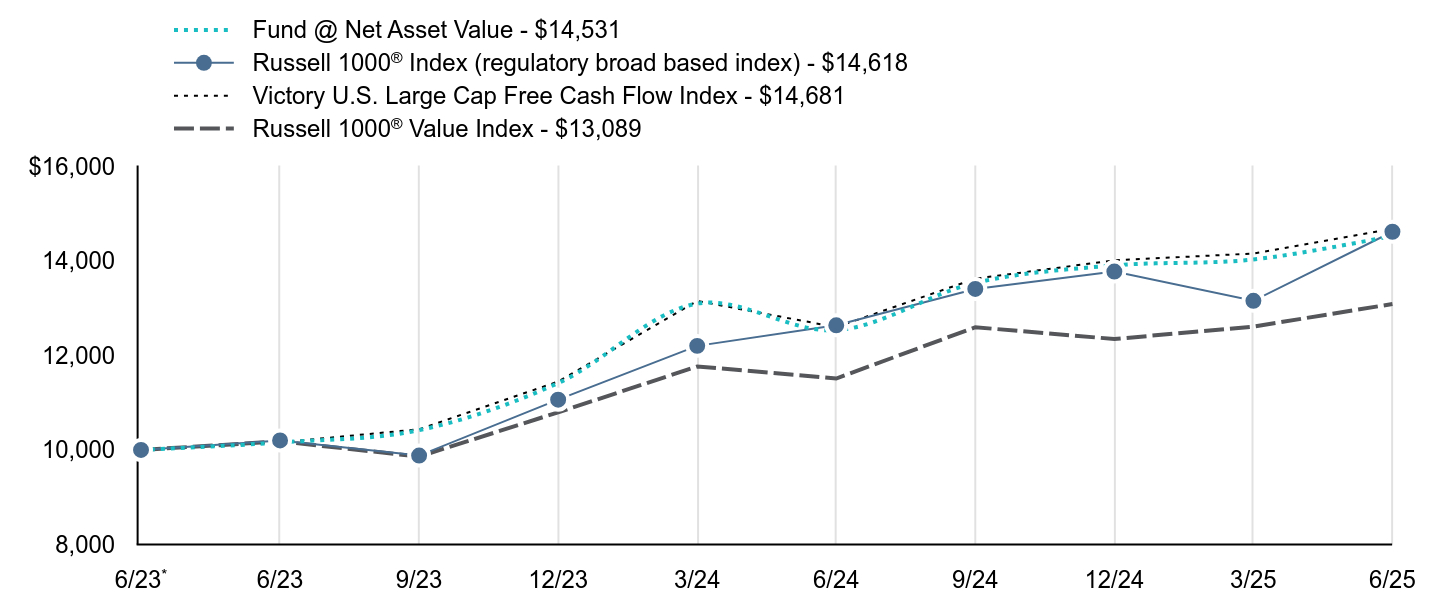

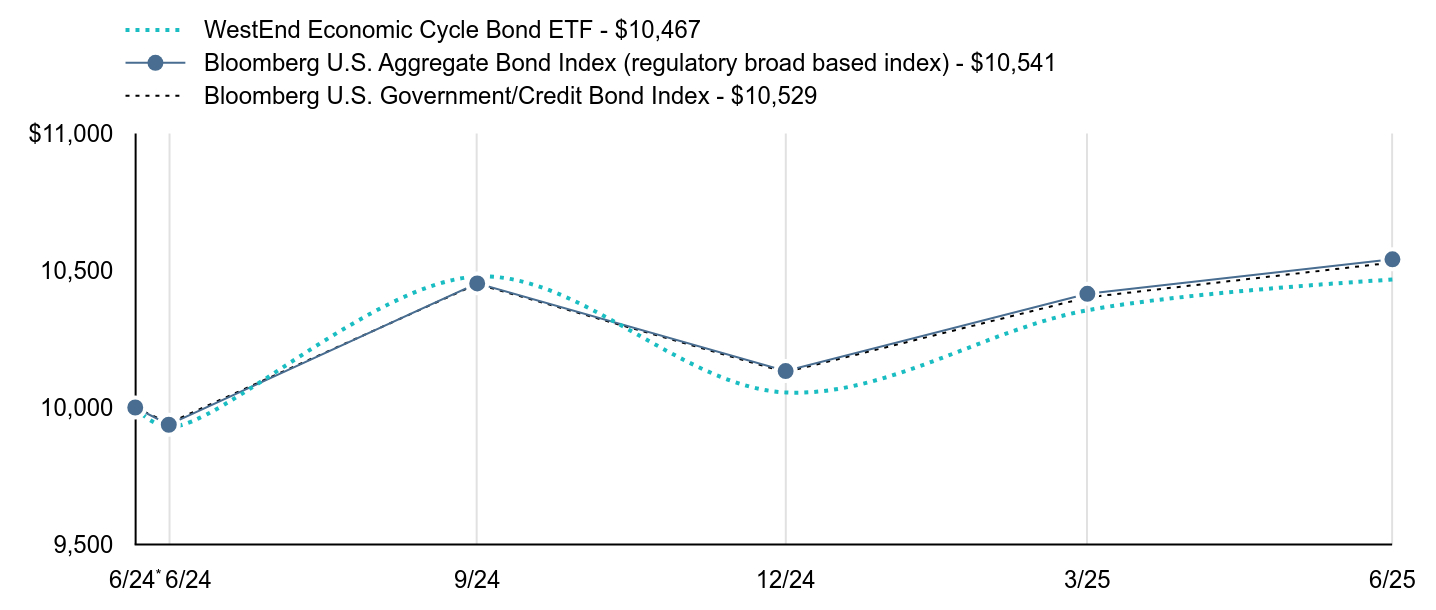

| Line Graph [Table Text Block] |

| Fund @ Net Asset Value - $14,531 | Russell 1000® Index (regulatory broad based index) - $14,618 | Victory U.S. Large Cap Free Cash Flow Index - $14,681 | Russell 1000® Value Index - $13,089 |

|---|

6/23Footnote Reference* | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/23 | $10,159 | $10,202 | $10,161 | $10,182 |

|---|

9/23 | $10,419 | $9,881 | $10,438 | $9,860 |

|---|

12/23 | $11,416 | $11,064 | $11,448 | $10,796 |

|---|

3/24 | $13,098 | $12,203 | $13,153 | $11,767 |

|---|

6/24 | $12,535 | $12,638 | $12,599 | $11,512 |

|---|

9/24 | $13,537 | $13,407 | $13,625 | $12,597 |

|---|

12/24 | $13,906 | $13,775 | $14,013 | $12,348 |

|---|

3/25 | $14,031 | $13,157 | $14,158 | $12,611 |

|---|

6/25 | $14,531 | $14,618 | $14,681 | $13,089 |

|---|

|

|

| Average Annual Return [Table Text Block] |

| 1 Year | Since Inception |

|---|

Fund @ Net Asset Value | 15.93%Footnote Reference | 20.27%Footnote Reference |

|---|

Russell 1000® Index | 15.66% | 20.63% |

|---|

Victory U.S. Large Cap Free Cash Flow Index | 16.52% | 20.88% |

|---|

Russell 1000® Value Index | 13.70% | 14.22% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

|

| AssetsNet |

$ 4,303,779,000

|

|

| Holdings Count | Holding |

51

|

|

| Advisory Fees Paid, Amount |

$ 7,366,000

|

|

| InvestmentCompanyPortfolioTurnover |

142.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $4,303,779 |

|---|

Number of Holdings | 51 |

|---|

Investment Advisory Fees | $7,366 |

|---|

Portfolio Turnover | 142% |

|---|

|

|

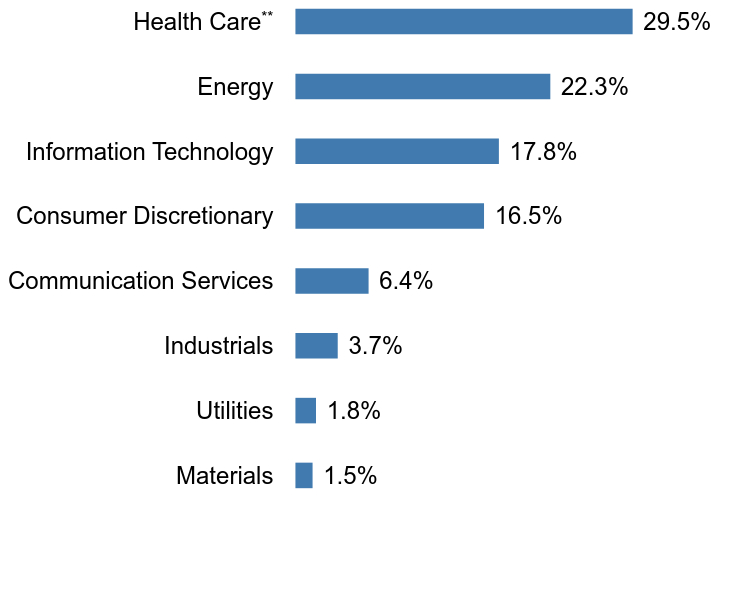

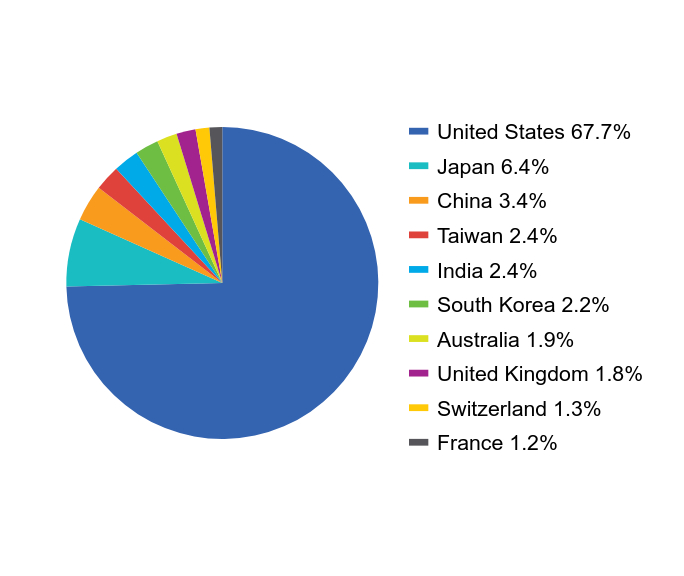

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Materials | 1.5% | Utilities | 1.8% | Industrials | 3.7% | Communication Services | 6.4% | Consumer Discretionary | 16.5% | Information Technology | 17.8% | Energy | 22.3% | Health CareFootnote Reference** | 29.5% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)QUALCOMM, Inc. | 4.0% |

|---|

The Cigna Group | 3.9% |

|---|

UnitedHealth Group, Inc. | 3.7% |

|---|

Merck & Co., Inc. | 3.6% |

|---|

Expedia Group, Inc. | 3.1% |

|---|

Royalty Pharma PLC, Class A | 2.9% |

|---|

Zoom Communications, Inc. | 2.8% |

|---|

Exxon Mobil Corp. | 2.6% |

|---|

Omnicom Group, Inc. | 2.5% |

|---|

Amgen, Inc. | 2.5% |

|---|

|

|

| Material Fund Change [Text Block] |

Foreside Fund Services, LLC ("Foreside") served as the Fund’s distributor. Effective March 1, 2025, Victory Capital Services, Inc., an affiliate of Victory Capital Management Inc., replaced Foreside and now serves as Distributor for the Fund pursuant to a Distribution Agreement between the Distributor and the Trust. |

|

| C000243212 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

VictoryShares Small Cap Free Cash Flow ETF

|

|

| No Trading Symbol [Flag] |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/etf-prospectuses. You may also request more information by calling 866-376-7890 or visiting vcm.com/contact-us.

This report describes changes to the Fund that occurred during the period.

|

|

| Additional Information Phone Number |

866-376-7890

|

|

| Additional Information Website |

vcm.com

|

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Small Cap Free Cash Flow ETF | $49 | 0.49% |

|---|

| | |

|---|

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

0.49%

|

|

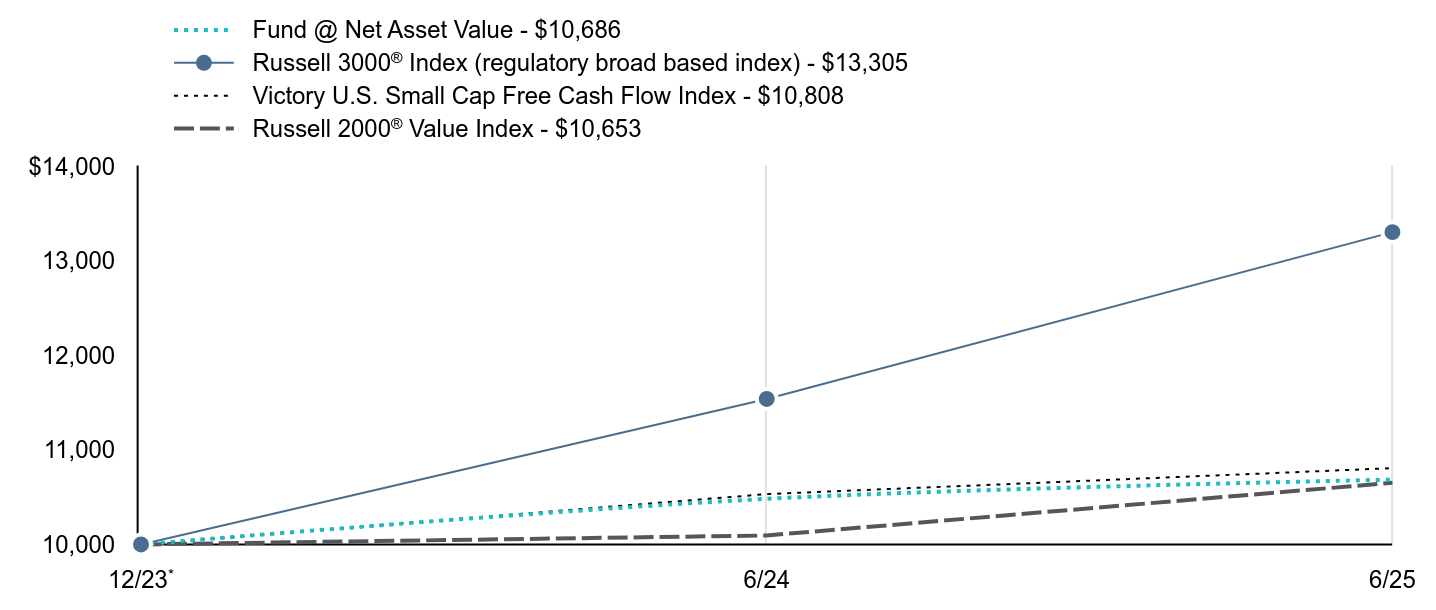

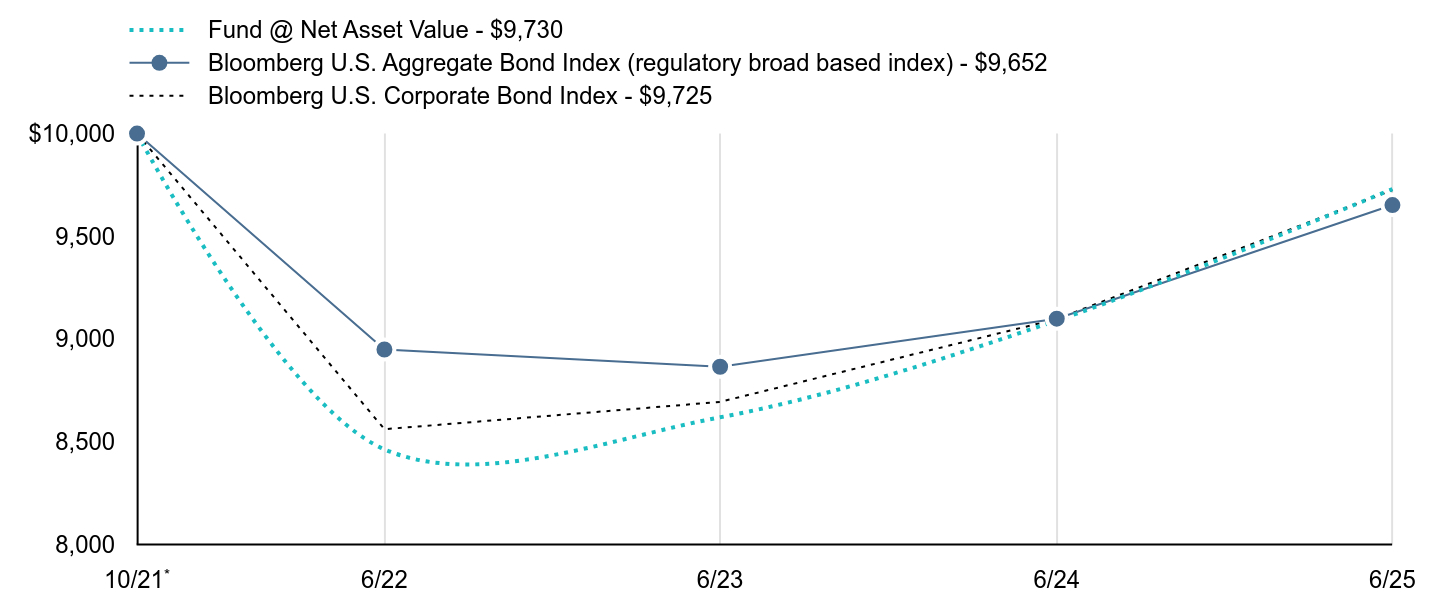

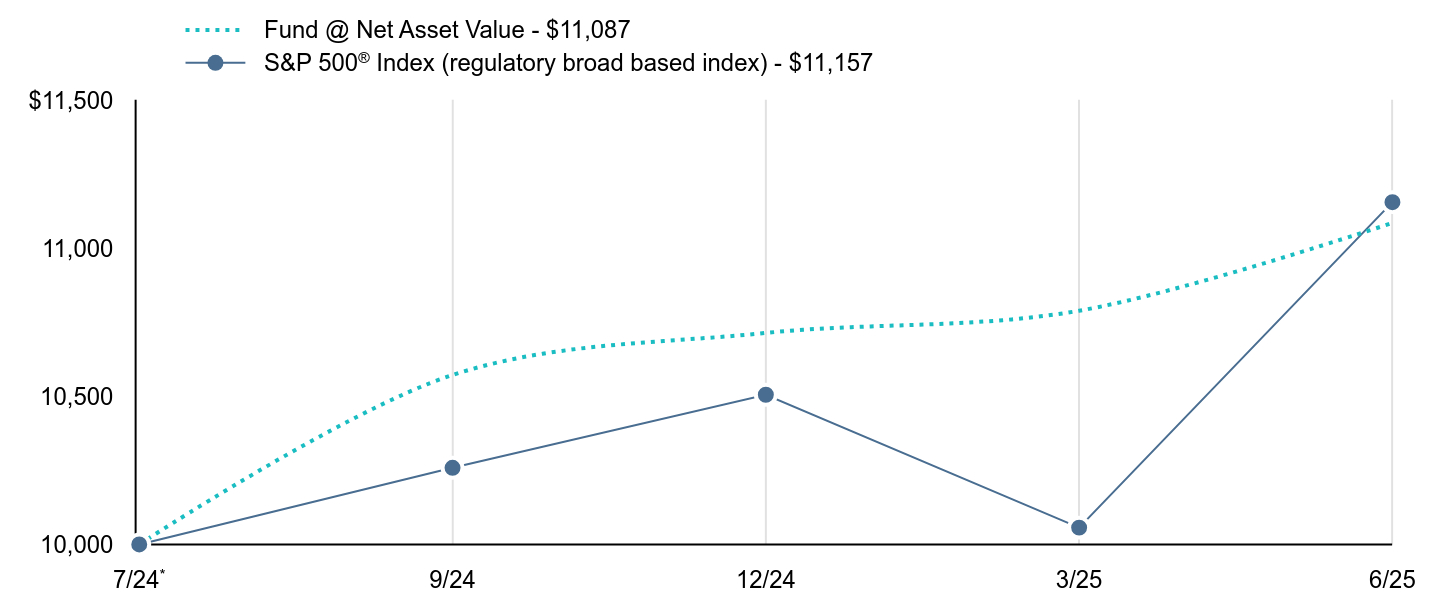

| Factors Affecting Performance [Text Block] |