Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

FIRST TRUST EXCHANGE-TRADED ALPHADEX FUND II

|

|

| Entity Central Index Key |

0001510337

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000099049 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Emerging Markets AlphaDEX® Fund

|

|

| Class Name |

First Trust Emerging Markets AlphaDEX® Fund

|

|

| Trading Symbol |

FEM

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Emerging Markets AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FEM. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FEM

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Emerging Markets AlphaDEX® Fund |

$42 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.80%

|

[1] |

| Net Assets |

$ 415,524,315

|

|

| Holdings Count | Holding |

158

|

|

| Investment Company Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$415,524,315 |

| Total number of portfolio holdings |

158 |

| Portfolio turnover rate |

53% |

|

|

| Holdings [Text Block] |

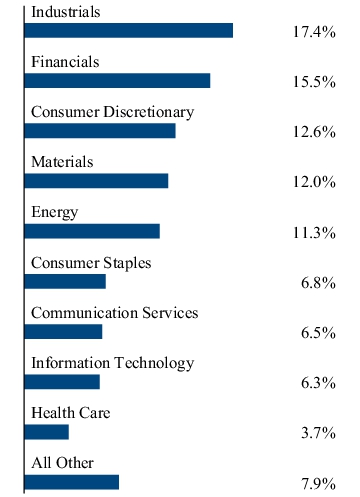

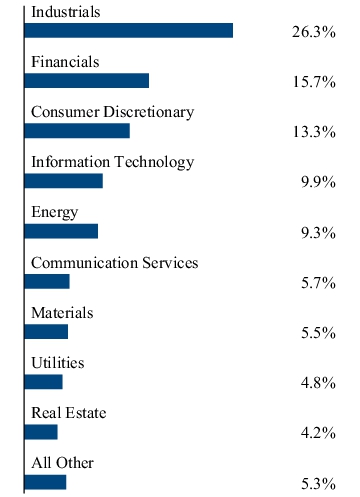

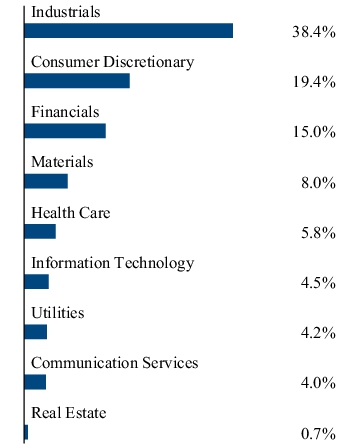

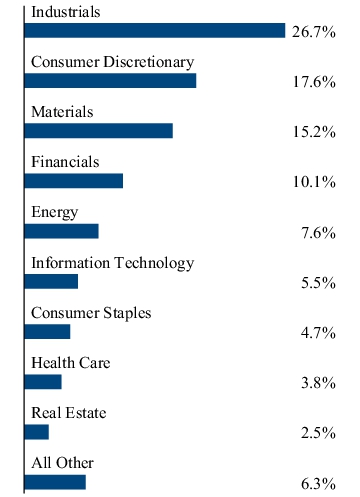

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| JPMorgan Chase & Co. |

2.0% |

| Pop Mart International Group Ltd. |

1.7% |

| Industrias Penoles S.A.B. de C.V. |

1.5% |

| Wan Hai Lines Ltd. |

1.3% |

| Embraer S.A. |

1.2% |

| Xiaomi Corp., Class B |

1.2% |

| Magyar Telekom Telecommunications PLC |

1.2% |

| Aselsan Elektronik Sanayi Ve Ticaret A/S |

1.2% |

| Prologis Property Mexico S.A. de C.V. |

1.2% |

| Shandong Gold Mining Co., Ltd., Class H |

1.2% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| JPMorgan Chase & Co. |

2.0% |

| Pop Mart International Group Ltd. |

1.7% |

| Industrias Penoles S.A.B. de C.V. |

1.5% |

| Wan Hai Lines Ltd. |

1.3% |

| Embraer S.A. |

1.2% |

| Xiaomi Corp., Class B |

1.2% |

| Magyar Telekom Telecommunications PLC |

1.2% |

| Aselsan Elektronik Sanayi Ve Ticaret A/S |

1.2% |

| Prologis Property Mexico S.A. de C.V. |

1.2% |

| Shandong Gold Mining Co., Ltd., Class H |

1.2% |

|

|

| C000099050 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Europe AlphaDEX® Fund

|

|

| Class Name |

First Trust Europe AlphaDEX® Fund

|

|

| Trading Symbol |

FEP

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Europe AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FEP. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FEP

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Europe AlphaDEX® Fund |

$47 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.80%

|

[2] |

| Net Assets |

$ 287,950,533

|

|

| Holdings Count | Holding |

203

|

|

| Investment Company Portfolio Turnover |

47.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$287,950,533 |

| Total number of portfolio holdings |

203 |

| Portfolio turnover rate |

47% |

|

|

| Holdings [Text Block] |

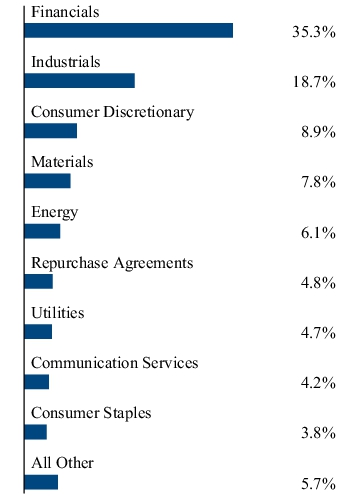

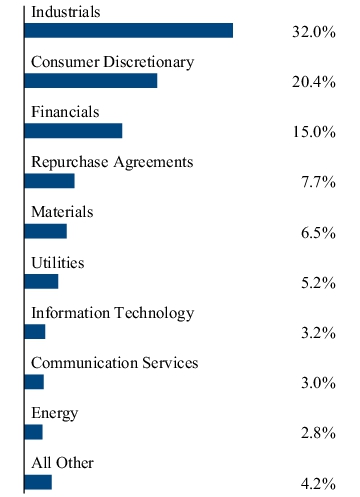

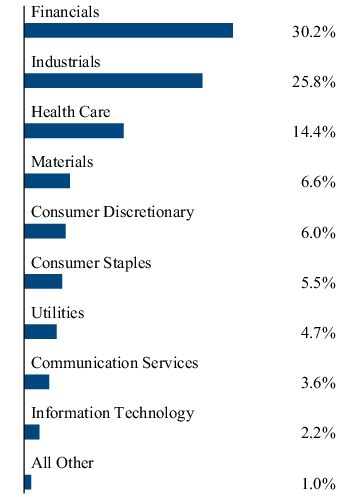

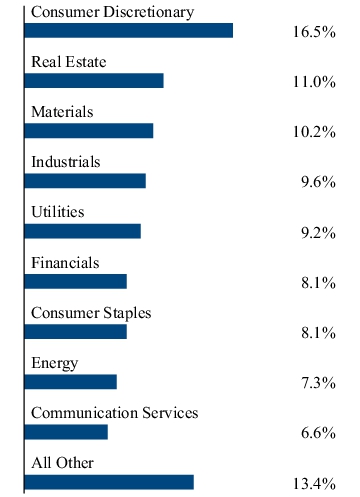

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| JPMorgan Chase & Co. |

4.9% |

| Fresnillo PLC |

1.1% |

| Alpha Bank S.A. |

1.0% |

| Indra Sistemas S.A. |

1.0% |

| Auto1 Group SE |

1.0% |

| STMicroelectronics N.V. |

1.0% |

| Commerzbank AG |

0.9% |

| Hensoldt AG |

0.9% |

| Babcock International Group PLC |

0.9% |

| Vend Marketplaces ASA |

0.9% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| JPMorgan Chase & Co. |

4.9% |

| Fresnillo PLC |

1.1% |

| Alpha Bank S.A. |

1.0% |

| Indra Sistemas S.A. |

1.0% |

| Auto1 Group SE |

1.0% |

| STMicroelectronics N.V. |

1.0% |

| Commerzbank AG |

0.9% |

| Hensoldt AG |

0.9% |

| Babcock International Group PLC |

0.9% |

| Vend Marketplaces ASA |

0.9% |

|

|

| C000099051 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Latin America AlphaDEX® Fund

|

|

| Class Name |

First Trust Latin America AlphaDEX® Fund

|

|

| Trading Symbol |

FLN

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Latin America AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FLN. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FLN

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Latin America AlphaDEX® Fund |

$46 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 46

|

|

| Expense Ratio, Percent |

0.80%

|

[3] |

| Net Assets |

$ 12,945,382

|

|

| Holdings Count | Holding |

50

|

|

| Investment Company Portfolio Turnover |

40.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$12,945,382 |

| Total number of portfolio holdings |

50 |

| Portfolio turnover rate |

40% |

|

|

| Holdings [Text Block] |

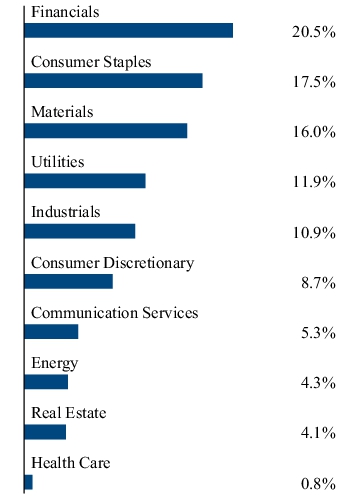

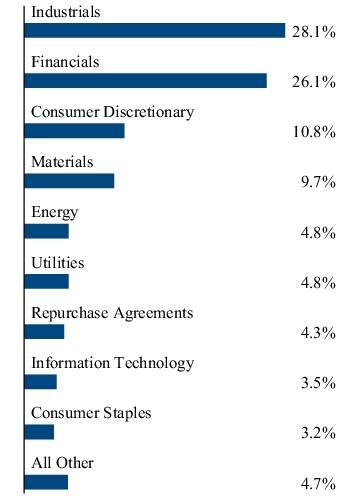

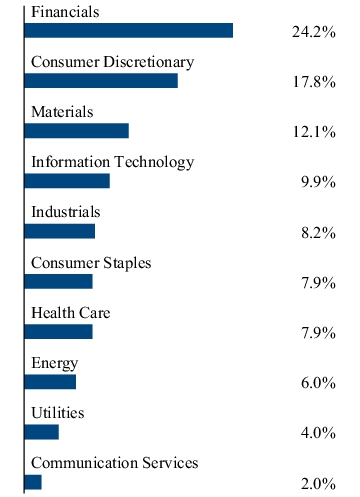

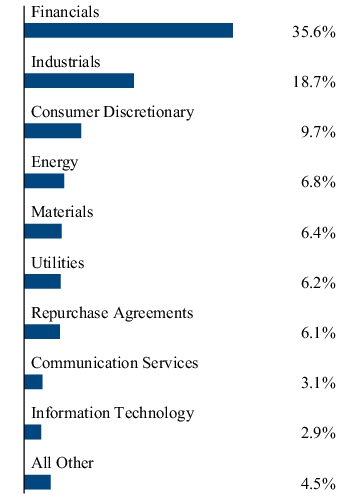

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Industrias Penoles S.A.B. de C.V. |

4.4% |

| Embraer S.A. |

3.6% |

| Prologis Property Mexico S.A. de C.V. |

3.4% |

| Porto Seguro S.A. |

3.4% |

| El Puerto de Liverpool S.A.B. de C.V., Series C1 |

3.4% |

| PRIO S.A. |

3.3% |

| Cencosud S.A. |

3.3% |

| Cia Energetica de Minas Gerais |

3.2% |

| Coca-Cola Femsa S.A.B. de C.V. |

3.1% |

| Telefonica Brasil S.A. |

3.0% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Industrias Penoles S.A.B. de C.V. |

4.4% |

| Embraer S.A. |

3.6% |

| Prologis Property Mexico S.A. de C.V. |

3.4% |

| Porto Seguro S.A. |

3.4% |

| El Puerto de Liverpool S.A.B. de C.V., Series C1 |

3.4% |

| PRIO S.A. |

3.3% |

| Cencosud S.A. |

3.3% |

| Cia Energetica de Minas Gerais |

3.2% |

| Coca-Cola Femsa S.A.B. de C.V. |

3.1% |

| Telefonica Brasil S.A. |

3.0% |

|

|

| C000099052 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Brazil AlphaDEX® Fund

|

|

| Class Name |

First Trust Brazil AlphaDEX® Fund

|

|

| Trading Symbol |

FBZ

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Brazil AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FBZ. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FBZ

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Brazil AlphaDEX® Fund |

$47 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.80%

|

[4] |

| Net Assets |

$ 7,226,957

|

|

| Holdings Count | Holding |

50

|

|

| Investment Company Portfolio Turnover |

35.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$7,226,957 |

| Total number of portfolio holdings |

50 |

| Portfolio turnover rate |

35% |

|

|

| Holdings [Text Block] |

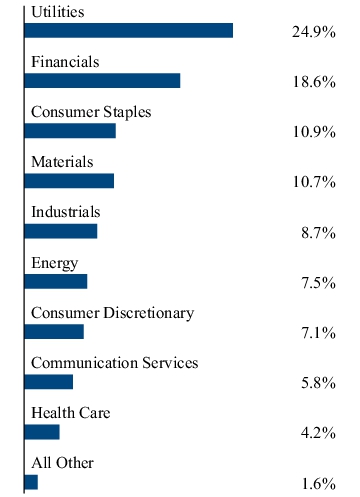

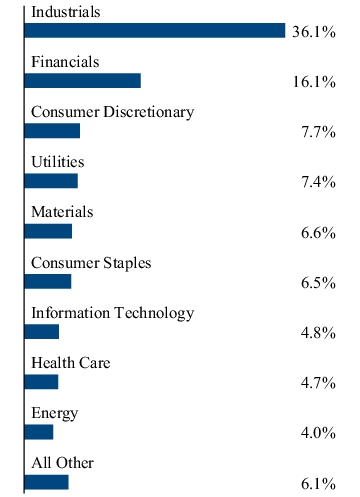

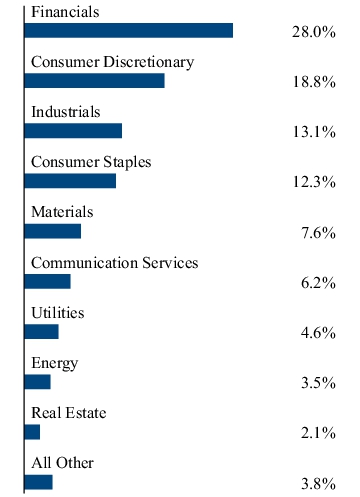

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Porto Seguro S.A. |

4.4% |

| Cia De Sanena Do Parana |

4.0% |

| Embraer S.A. |

4.0% |

| Marfrig Global Foods S.A. |

3.9% |

| Cia de Saneamento de Minas Gerais Copasa MG |

3.9% |

| TIM S.A. |

3.5% |

| Vibra Energia S.A. |

3.5% |

| Pagseguro Digital Ltd., Class A |

3.1% |

| JBS N.V., BDR |

3.1% |

| Cia de Saneamento Basico do Estado de Sao Paulo SABESP |

3.1% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Porto Seguro S.A. |

4.4% |

| Cia De Sanena Do Parana |

4.0% |

| Embraer S.A. |

4.0% |

| Marfrig Global Foods S.A. |

3.9% |

| Cia de Saneamento de Minas Gerais Copasa MG |

3.9% |

| TIM S.A. |

3.5% |

| Vibra Energia S.A. |

3.5% |

| Pagseguro Digital Ltd., Class A |

3.1% |

| JBS N.V., BDR |

3.1% |

| Cia de Saneamento Basico do Estado de Sao Paulo SABESP |

3.1% |

|

|

| C000099053 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust China AlphaDEX® Fund

|

|

| Class Name |

First Trust China AlphaDEX® Fund

|

|

| Trading Symbol |

FCA

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust China AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FCA. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FCA

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust China AlphaDEX® Fund |

$44 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.80%

|

[5] |

| Net Assets |

$ 38,392,019

|

|

| Holdings Count | Holding |

52

|

|

| Investment Company Portfolio Turnover |

59.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$38,392,019 |

| Total number of portfolio holdings |

52 |

| Portfolio turnover rate |

59% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Pop Mart International Group Ltd. |

8.1% |

| Xiaomi Corp., Class B |

4.7% |

| China Hongqiao Group Ltd. |

4.2% |

| People’s Insurance Co. Group of China (The) Ltd., Class H |

3.4% |

| Orient Overseas International Ltd. |

3.2% |

| Goldwind Science & Technology Co., Ltd., Class H |

3.1% |

| China Reinsurance Group Corp., Class H |

3.1% |

| PetroChina Co., Ltd., Class H |

3.0% |

| BOC Aviation Ltd. |

2.9% |

| Geely Automobile Holdings Ltd. |

2.9% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Pop Mart International Group Ltd. |

8.1% |

| Xiaomi Corp., Class B |

4.7% |

| China Hongqiao Group Ltd. |

4.2% |

| People’s Insurance Co. Group of China (The) Ltd., Class H |

3.4% |

| Orient Overseas International Ltd. |

3.2% |

| Goldwind Science & Technology Co., Ltd., Class H |

3.1% |

| China Reinsurance Group Corp., Class H |

3.1% |

| PetroChina Co., Ltd., Class H |

3.0% |

| BOC Aviation Ltd. |

2.9% |

| Geely Automobile Holdings Ltd. |

2.9% |

|

|

| C000099054 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Japan AlphaDEX® Fund

|

|

| Class Name |

First Trust Japan AlphaDEX® Fund

|

|

| Trading Symbol |

FJP

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Japan AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FJP. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FJP

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Japan AlphaDEX® Fund |

$43 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.80%

|

[6] |

| Net Assets |

$ 176,787,048

|

|

| Holdings Count | Holding |

101

|

|

| Investment Company Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$176,787,048 |

| Total number of portfolio holdings |

101 |

| Portfolio turnover rate |

45% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| JPMorgan Chase & Co. |

7.7% |

| IHI Corp. |

2.5% |

| Ryohin Keikaku Co., Ltd. |

2.3% |

| Kawasaki Heavy Industries Ltd. |

2.2% |

| Sanrio Co., Ltd. |

1.9% |

| T&D Holdings, Inc. |

1.6% |

| Central Japan Railway Co. |

1.6% |

| Sumitomo Electric Industries Ltd. |

1.6% |

| Chubu Electric Power Co., Inc. |

1.6% |

| Sompo Holdings, Inc. |

1.6% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| JPMorgan Chase & Co. |

7.7% |

| IHI Corp. |

2.5% |

| Ryohin Keikaku Co., Ltd. |

2.3% |

| Kawasaki Heavy Industries Ltd. |

2.2% |

| Sanrio Co., Ltd. |

1.9% |

| T&D Holdings, Inc. |

1.6% |

| Central Japan Railway Co. |

1.6% |

| Sumitomo Electric Industries Ltd. |

1.6% |

| Chubu Electric Power Co., Inc. |

1.6% |

| Sompo Holdings, Inc. |

1.6% |

|

|

| C000099056 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Developed Markets ex-US AlphaDEX® Fund

|

|

| Class Name |

First Trust Developed Markets ex-US AlphaDEX® Fund

|

|

| Trading Symbol |

FDT

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Developed Markets ex-US AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FDT. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FDT

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Developed Markets ex-US AlphaDEX® Fund |

$45 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.80%

|

[7] |

| Net Assets |

$ 521,015,066

|

|

| Holdings Count | Holding |

302

|

|

| Investment Company Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$521,015,066 |

| Total number of portfolio holdings |

302 |

| Portfolio turnover rate |

53% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| JPMorgan Chase & Co. |

4.3% |

| SK Square Co., Ltd. |

1.0% |

| Hyundai Rotem Co., Ltd. |

0.9% |

| Fresnillo PLC |

0.8% |

| Siemens Energy AG |

0.7% |

| Hanwha Systems Co., Ltd. |

0.7% |

| IHI Corp. |

0.7% |

| Phoenix Financial Ltd. |

0.7% |

| Indra Sistemas S.A. |

0.7% |

| Alpha Bank S.A. |

0.7% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| JPMorgan Chase & Co. |

4.3% |

| SK Square Co., Ltd. |

1.0% |

| Hyundai Rotem Co., Ltd. |

0.9% |

| Fresnillo PLC |

0.8% |

| Siemens Energy AG |

0.7% |

| Hanwha Systems Co., Ltd. |

0.7% |

| IHI Corp. |

0.7% |

| Phoenix Financial Ltd. |

0.7% |

| Indra Sistemas S.A. |

0.7% |

| Alpha Bank S.A. |

0.7% |

|

|

| C000099057 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Asia Pacific ex-Japan AlphaDEX® Fund

|

|

| Class Name |

First Trust Asia Pacific ex-Japan AlphaDEX® Fund

|

|

| Trading Symbol |

FPA

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Asia Pacific ex-Japan AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FPA. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FPA

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Asia Pacific ex-Japan AlphaDEX® Fund |

$46 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 46

|

|

| Expense Ratio, Percent |

0.80%

|

[8] |

| Net Assets |

$ 22,988,637

|

|

| Holdings Count | Holding |

101

|

|

| Investment Company Portfolio Turnover |

48.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$22,988,637 |

| Total number of portfolio holdings |

101 |

| Portfolio turnover rate |

48% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| SK Square Co., Ltd. |

2.8% |

| Hyundai Rotem Co., Ltd. |

2.7% |

| Hanwha Systems Co., Ltd. |

2.6% |

| Doosan Enerbility Co., Ltd. |

2.5% |

| Samyang Foods Co., Ltd. |

2.3% |

| Korea Electric Power Corp. |

2.1% |

| Hanwha Aerospace Co., Ltd. |

2.0% |

| Samsung Heavy Industries Co., Ltd. |

1.8% |

| SK Hynix, Inc. |

1.8% |

| Hanwha Ocean Co., Ltd. |

1.7% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| SK Square Co., Ltd. |

2.8% |

| Hyundai Rotem Co., Ltd. |

2.7% |

| Hanwha Systems Co., Ltd. |

2.6% |

| Doosan Enerbility Co., Ltd. |

2.5% |

| Samyang Foods Co., Ltd. |

2.3% |

| Korea Electric Power Corp. |

2.1% |

| Hanwha Aerospace Co., Ltd. |

2.0% |

| Samsung Heavy Industries Co., Ltd. |

1.8% |

| SK Hynix, Inc. |

1.8% |

| Hanwha Ocean Co., Ltd. |

1.7% |

|

|

| C000111808 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Germany AlphaDEX® Fund

|

|

| Class Name |

First Trust Germany AlphaDEX® Fund

|

|

| Trading Symbol |

FGM

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Germany AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FGM. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FGM

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Germany AlphaDEX® Fund |

$49 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

0.80%

|

[9] |

| Net Assets |

$ 61,898,782

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$61,898,782 |

| Total number of portfolio holdings |

40 |

| Portfolio turnover rate |

12% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Rheinmetall AG |

9.7% |

| Siemens Energy AG |

6.5% |

| Deutsche Bank AG |

4.8% |

| Heidelberg Materials AG |

4.4% |

| Commerzbank AG |

4.4% |

| HOCHTIEF AG |

4.3% |

| Volkswagen AG |

3.3% |

| RWE AG |

3.3% |

| Bayerische Motoren Werke AG |

3.2% |

| Deutsche Lufthansa AG |

3.1% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Rheinmetall AG |

9.7% |

| Siemens Energy AG |

6.5% |

| Deutsche Bank AG |

4.8% |

| Heidelberg Materials AG |

4.4% |

| Commerzbank AG |

4.4% |

| HOCHTIEF AG |

4.3% |

| Volkswagen AG |

3.3% |

| RWE AG |

3.3% |

| Bayerische Motoren Werke AG |

3.2% |

| Deutsche Lufthansa AG |

3.1% |

|

|

| C000111810 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Switzerland AlphaDEX® Fund

|

|

| Class Name |

First Trust Switzerland AlphaDEX® Fund

|

|

| Trading Symbol |

FSZ

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Switzerland AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FSZ. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FSZ

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Switzerland AlphaDEX® Fund |

$44 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.80%

|

[10] |

| Net Assets |

$ 68,684,996

|

|

| Holdings Count | Holding |

40

|

|

| Investment Company Portfolio Turnover |

42.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$68,684,996 |

| Total number of portfolio holdings |

40 |

| Portfolio turnover rate |

42% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Swissquote Group Holding S.A. |

5.2% |

| Accelleron Industries AG |

4.8% |

| BKW AG |

4.7% |

| Holcim AG |

4.6% |

| Novartis AG |

4.4% |

| Swiss Re AG |

4.2% |

| Helvetia Holding AG |

4.0% |

| Sandoz Group AG |

3.8% |

| Julius Baer Group Ltd. |

3.7% |

| Swisscom AG |

3.6% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Swissquote Group Holding S.A. |

5.2% |

| Accelleron Industries AG |

4.8% |

| BKW AG |

4.7% |

| Holcim AG |

4.6% |

| Novartis AG |

4.4% |

| Swiss Re AG |

4.2% |

| Helvetia Holding AG |

4.0% |

| Sandoz Group AG |

3.8% |

| Julius Baer Group Ltd. |

3.7% |

| Swisscom AG |

3.6% |

|

|

| C000111811 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust India NIFTY 50 Equal Weight ETF

|

|

| Class Name |

First Trust India NIFTY 50 Equal Weight ETF

|

|

| Trading Symbol |

NFTY

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust India NIFTY 50 Equal Weight ETF (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/NFTY. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/NFTY

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust India NIFTY 50 Equal Weight ETF |

$41 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.80%

|

[11] |

| Net Assets |

$ 212,915,126

|

|

| Holdings Count | Holding |

50

|

|

| Investment Company Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$212,915,126 |

| Total number of portfolio holdings |

50 |

| Portfolio turnover rate |

9% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Jio Financial Services Ltd. |

2.1% |

| IndusInd Bank Ltd. |

2.1% |

| Shriram Finance Ltd. |

2.1% |

| Adani Ports & Special Economic Zone Ltd. |

2.1% |

| Bharat Electronics Ltd. |

2.1% |

| HDFC Life Insurance Co., Ltd. |

2.0% |

| Adani Enterprises Ltd. |

2.0% |

| Power Grid Corp. of India Ltd. |

2.0% |

| UltraTech Cement Ltd. |

2.0% |

| Hindalco Industries Ltd. |

2.0% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Jio Financial Services Ltd. |

2.1% |

| IndusInd Bank Ltd. |

2.1% |

| Shriram Finance Ltd. |

2.1% |

| Adani Ports & Special Economic Zone Ltd. |

2.1% |

| Bharat Electronics Ltd. |

2.1% |

| HDFC Life Insurance Co., Ltd. |

2.0% |

| Adani Enterprises Ltd. |

2.0% |

| Power Grid Corp. of India Ltd. |

2.0% |

| UltraTech Cement Ltd. |

2.0% |

| Hindalco Industries Ltd. |

2.0% |

|

|

| C000111812 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust United Kingdom AlphaDEX® Fund

|

|

| Class Name |

First Trust United Kingdom AlphaDEX® Fund

|

|

| Trading Symbol |

FKU

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust United Kingdom AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FKU. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FKU

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust United Kingdom AlphaDEX® Fund |

$44 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.80%

|

[12] |

| Net Assets |

$ 62,833,424

|

|

| Holdings Count | Holding |

77

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$62,833,424 |

| Total number of portfolio holdings |

77 |

| Portfolio turnover rate |

34% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Fresnillo PLC |

2.9% |

| St. James's Place PLC |

2.7% |

| Rolls-Royce Holdings PLC |

2.7% |

| NatWest Group PLC |

2.5% |

| Standard Chartered PLC |

2.4% |

| Kingfisher PLC |

2.3% |

| Hiscox Ltd. |

2.3% |

| 3i Group PLC |

2.3% |

| Beazley PLC |

2.3% |

| Vodafone Group PLC |

2.3% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Fresnillo PLC |

2.9% |

| St. James's Place PLC |

2.7% |

| Rolls-Royce Holdings PLC |

2.7% |

| NatWest Group PLC |

2.5% |

| Standard Chartered PLC |

2.4% |

| Kingfisher PLC |

2.3% |

| Hiscox Ltd. |

2.3% |

| 3i Group PLC |

2.3% |

| Beazley PLC |

2.3% |

| Vodafone Group PLC |

2.3% |

|

|

| C000112036 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund

|

|

| Class Name |

First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund

|

|

| Trading Symbol |

FDTS

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FDTS. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FDTS

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund |

$45 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.80%

|

[13] |

| Net Assets |

$ 7,596,163

|

|

| Holdings Count | Holding |

403

|

|

| Investment Company Portfolio Turnover |

56.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$7,596,163 |

| Total number of portfolio holdings |

403 |

| Portfolio turnover rate |

56% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Bank of America Corp. |

1.4% |

| Metaplanet, Inc. |

0.9% |

| Hanwha Corp. |

0.8% |

| Hyundai Engineering & Construction Co., Ltd. |

0.8% |

| Hyosung Heavy Industries Corp. |

0.6% |

| Harel Insurance Investments & Financial Services Ltd. |

0.6% |

| Nissin Corp. |

0.6% |

| HDC Holdings Co., Ltd. |

0.6% |

| Food & Life Cos., Ltd. |

0.6% |

| Oki Electric Industry Co., Ltd. |

0.6% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp. |

1.4% |

| Metaplanet, Inc. |

0.9% |

| Hanwha Corp. |

0.8% |

| Hyundai Engineering & Construction Co., Ltd. |

0.8% |

| Hyosung Heavy Industries Corp. |

0.6% |

| Harel Insurance Investments & Financial Services Ltd. |

0.6% |

| Nissin Corp. |

0.6% |

| HDC Holdings Co., Ltd. |

0.6% |

| Food & Life Cos., Ltd. |

0.6% |

| Oki Electric Industry Co., Ltd. |

0.6% |

|

|

| C000112037 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Emerging Markets Small Cap AlphaDEX® Fund

|

|

| Class Name |

First Trust Emerging Markets Small Cap AlphaDEX® Fund

|

|

| Trading Symbol |

FEMS

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Emerging Markets Small Cap AlphaDEX® Fund (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FEMS. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FEMS

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Emerging Markets Small Cap AlphaDEX® Fund |

$41 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.80%

|

[14] |

| Net Assets |

$ 247,649,295

|

|

| Holdings Count | Holding |

205

|

|

| Investment Company Portfolio Turnover |

52.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$247,649,295 |

| Total number of portfolio holdings |

205 |

| Portfolio turnover rate |

52% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Bank of America Corp. |

1.9% |

| Newborn Town, Inc. |

1.2% |

| 3SBio, Inc. |

1.2% |

| Cia de Saneamento de Minas Gerais Copasa MG |

1.1% |

| Cia De Sanena Do Parana |

1.1% |

| XD, Inc. |

1.1% |

| Tauron Polska Energia S.A. |

1.1% |

| DigiPlus Interactive Corp. |

1.1% |

| Cogna Educacao S.A. |

1.0% |

| MAS PLC |

1.0% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp. |

1.9% |

| Newborn Town, Inc. |

1.2% |

| 3SBio, Inc. |

1.2% |

| Cia de Saneamento de Minas Gerais Copasa MG |

1.1% |

| Cia De Sanena Do Parana |

1.1% |

| XD, Inc. |

1.1% |

| Tauron Polska Energia S.A. |

1.1% |

| DigiPlus Interactive Corp. |

1.1% |

| Cogna Educacao S.A. |

1.0% |

| MAS PLC |

1.0% |

|

|

| C000147004 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Eurozone AlphaDEX® ETF

|

|

| Class Name |

First Trust Eurozone AlphaDEX® ETF

|

|

| Trading Symbol |

FEUZ

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Eurozone AlphaDEX® ETF (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FEUZ. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FEUZ

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Eurozone AlphaDEX® ETF |

$47 |

0.80%(1) |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.80%

|

[15] |

| Net Assets |

$ 60,503,864

|

|

| Holdings Count | Holding |

152

|

|

| Investment Company Portfolio Turnover |

48.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$60,503,864 |

| Total number of portfolio holdings |

152 |

| Portfolio turnover rate |

48% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Bank of America Corp. |

6.1% |

| Alpha Bank S.A. |

1.3% |

| Indra Sistemas S.A. |

1.3% |

| Rheinmetall AG |

1.3% |

| Auto1 Group SE |

1.3% |

| STMicroelectronics N.V. |

1.2% |

| Commerzbank AG |

1.2% |

| Lottomatica Group S.p.A. |

1.2% |

| Hensoldt AG |

1.2% |

| Sofina S.A. |

1.1% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp. |

6.1% |

| Alpha Bank S.A. |

1.3% |

| Indra Sistemas S.A. |

1.3% |

| Rheinmetall AG |

1.3% |

| Auto1 Group SE |

1.3% |

| STMicroelectronics N.V. |

1.2% |

| Commerzbank AG |

1.2% |

| Lottomatica Group S.p.A. |

1.2% |

| Hensoldt AG |

1.2% |

| Sofina S.A. |

1.1% |

|

|

|

|