Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

Jun. 30, 2024 |

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

AMERICAN BEACON FUNDS

|

|

| Entity Central Index Key |

0000809593

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000210490 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

ARK Transformational Innovation Fund

|

|

| Class Name |

A

|

|

| Trading Symbol |

ADNAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon ARK Transformational Innovation Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$182 |

1.40% | |

|

| Expenses Paid, Amount |

$ 182

|

|

| Expense Ratio, Percent |

1.40%

|

|

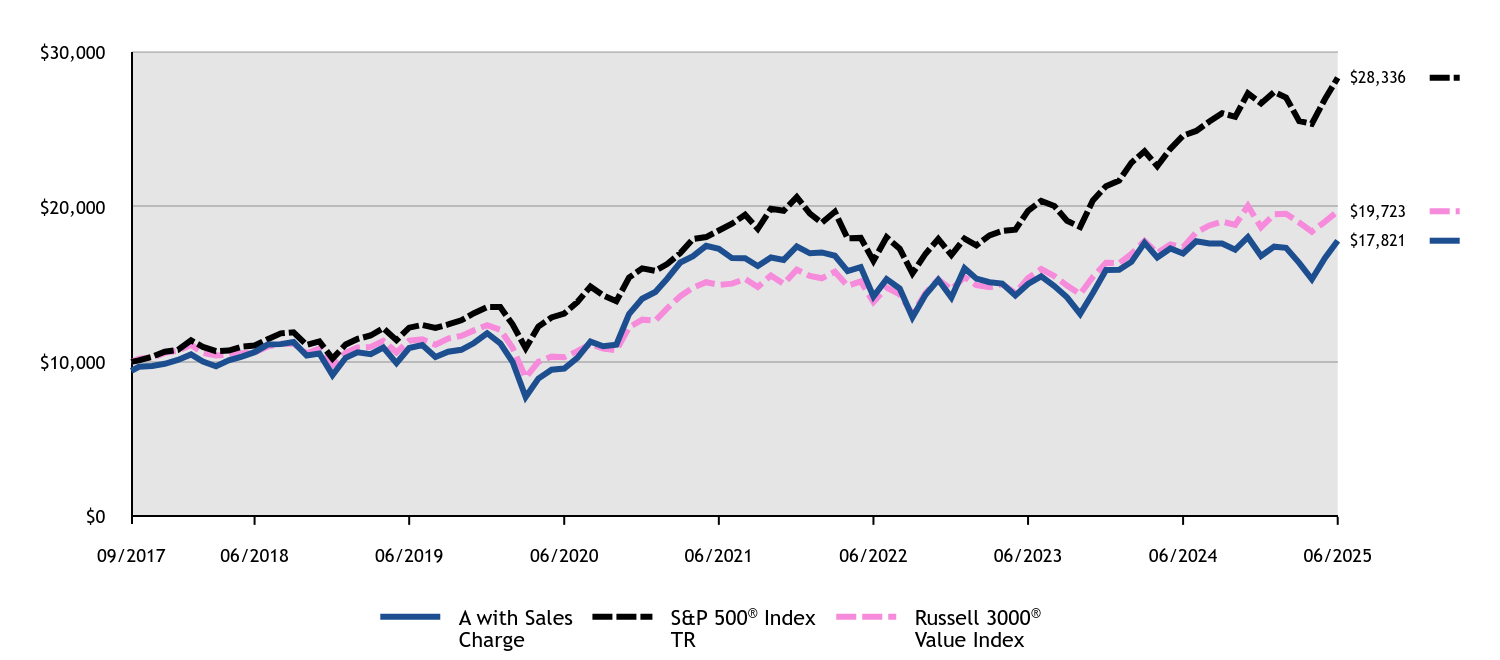

| Factors Affecting Performance [Text Block] |

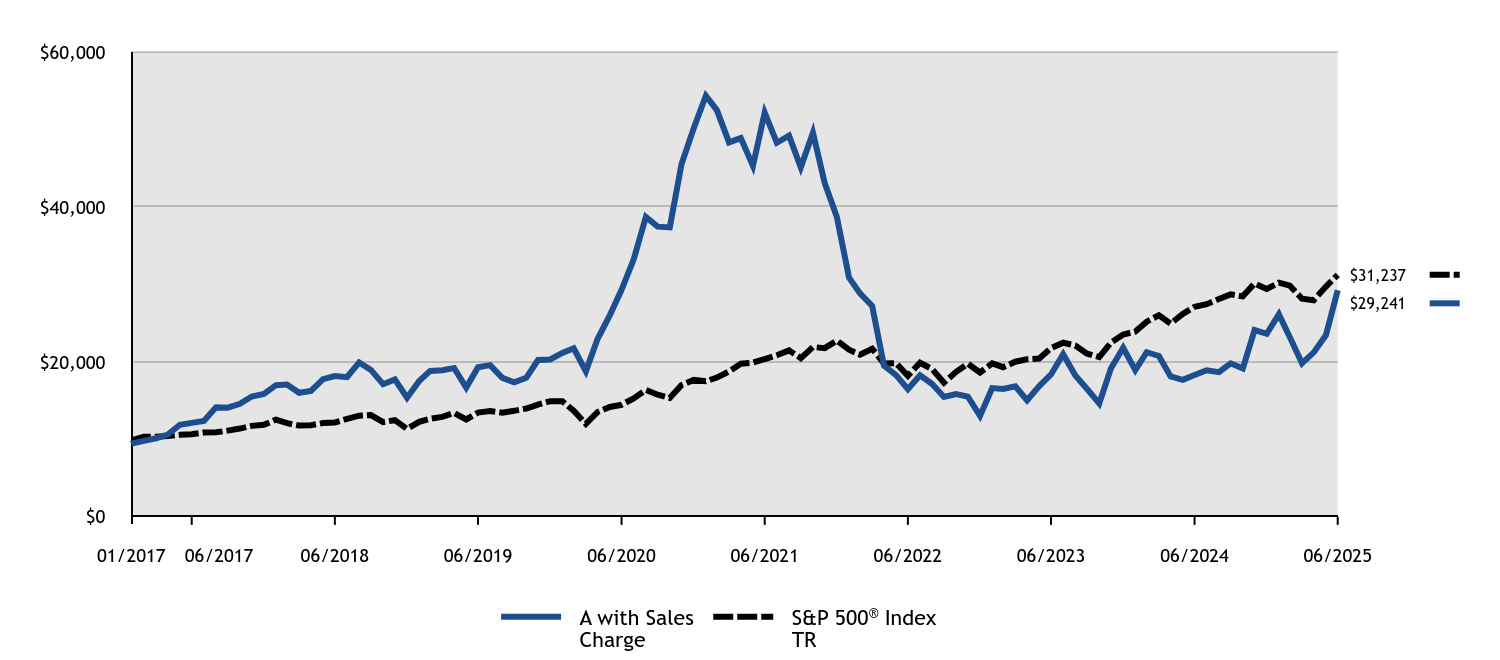

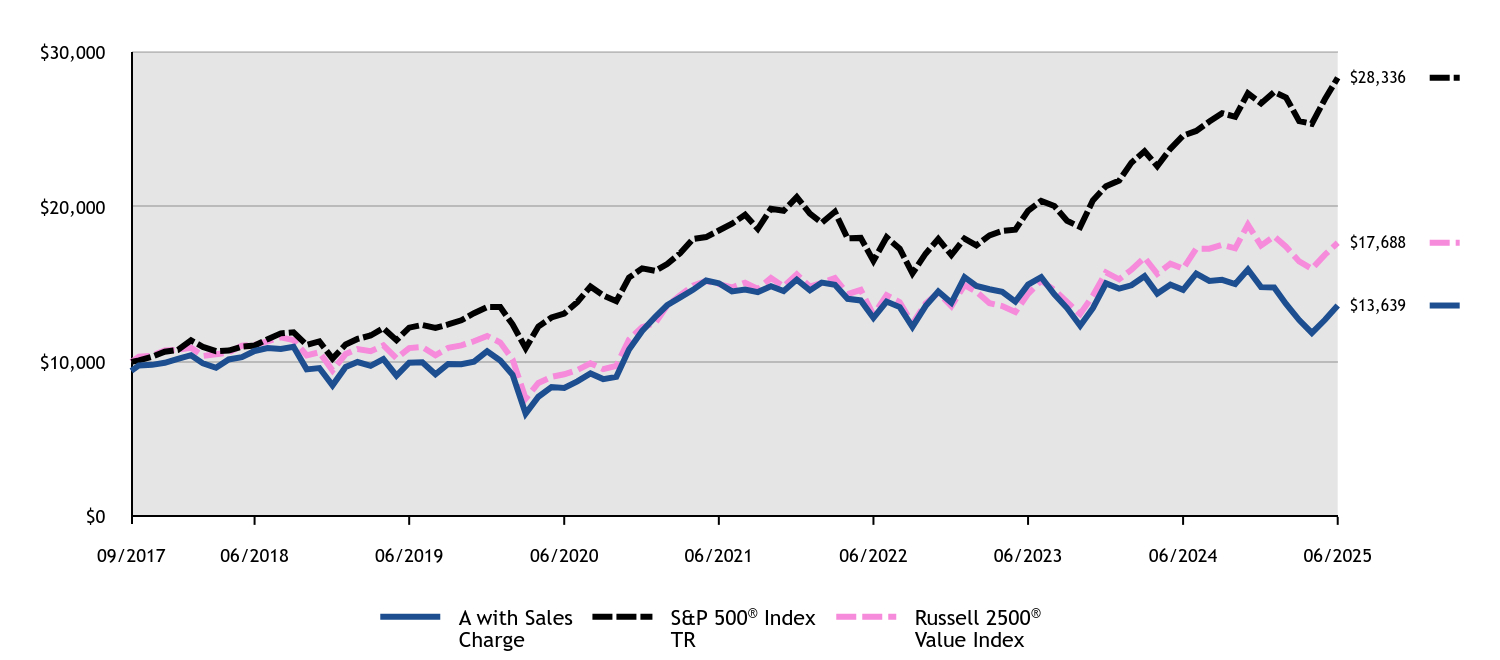

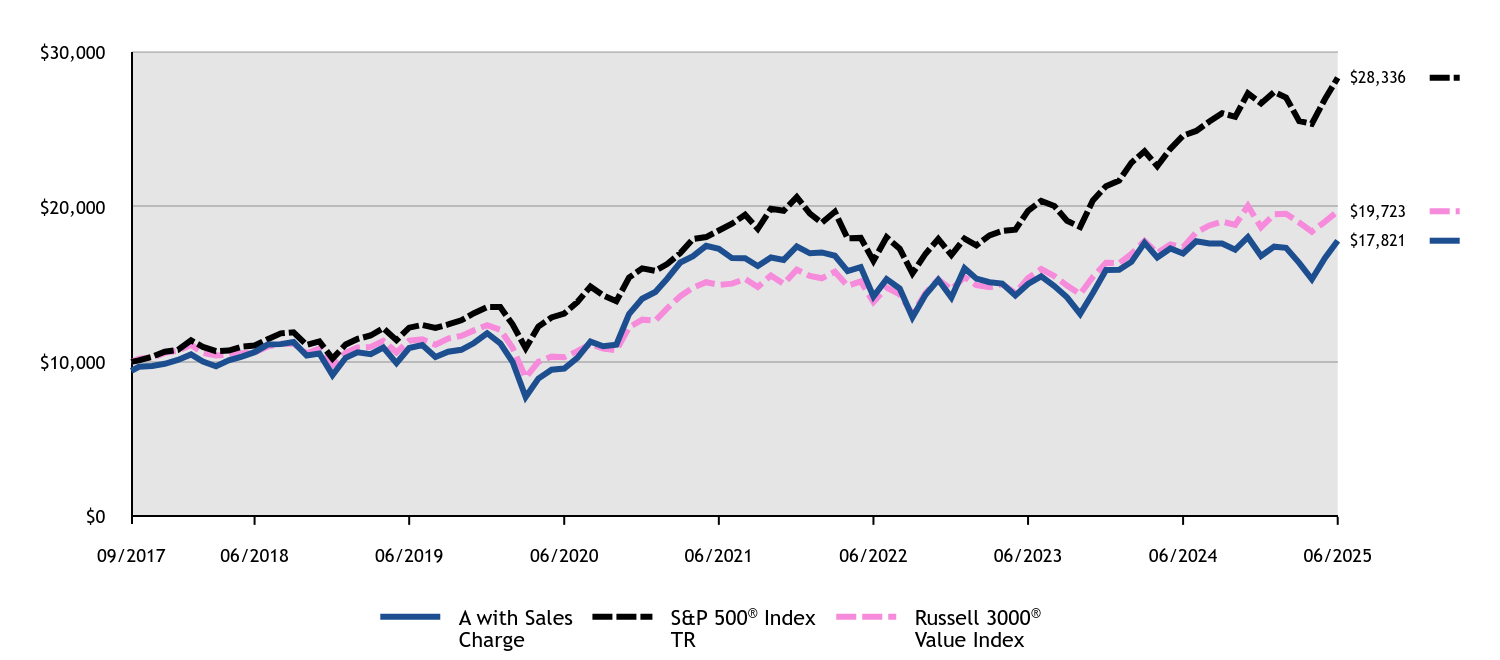

How did the Fund perform and what affected its performance? The A Class of the Fund returned 50.52% (with sales charges) and 59.74% (without sales charges) for the twelve months ended June 30, 2025, compared to the S&P 500 Index return of 15.16%. • The headwinds that once pressured disruptive technologies lessened due to broader market participation, favorable policy shifts around crypto, Artificial Intelligence, and healthcare, coupled with expectations for potential fiscal catalysts like tax cuts. • The Fund’s investments in software and capital markets companies materially helped performance for the period. Conversely, its investments in biotechnology and semiconductors and semiconductor equipment companies detracted from performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

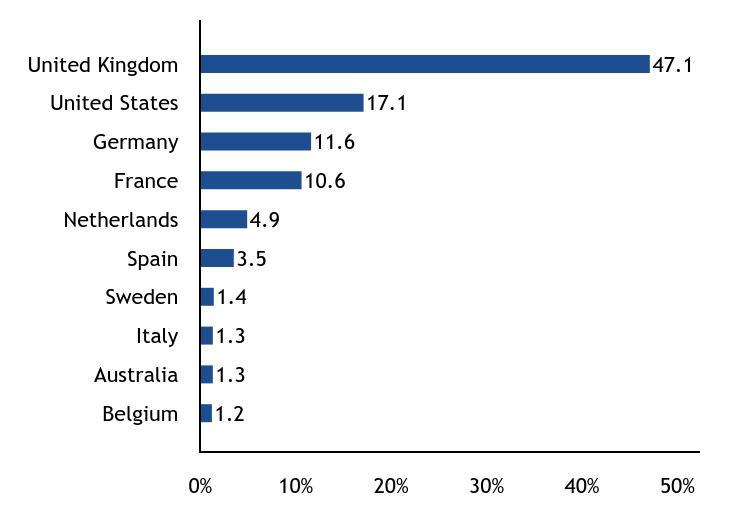

| Line Graph [Table Text Block] |

|

A with Sales Charge |

S&P 500® Index TR |

01/2017 |

$9,425 |

$10,000 |

01/2017 |

$9,500 |

$9,932 |

02/2017 |

$9,802 |

$10,326 |

03/2017 |

$10,141 |

$10,338 |

04/2017 |

$10,622 |

$10,444 |

05/2017 |

$11,894 |

$10,591 |

06/2017 |

$12,130 |

$10,657 |

07/2017 |

$12,385 |

$10,876 |

08/2017 |

$14,138 |

$10,910 |

09/2017 |

$14,090 |

$11,135 |

10/2017 |

$14,590 |

$11,395 |

11/2017 |

$15,533 |

$11,744 |

12/2017 |

$15,861 |

$11,875 |

01/2018 |

$17,003 |

$12,554 |

02/2018 |

$17,081 |

$12,092 |

03/2018 |

$16,017 |

$11,784 |

04/2018 |

$16,251 |

$11,830 |

05/2018 |

$17,775 |

$12,115 |

06/2018 |

$18,165 |

$12,189 |

07/2018 |

$18,029 |

$12,643 |

08/2018 |

$19,943 |

$13,055 |

09/2018 |

$18,966 |

$13,129 |

10/2018 |

$17,120 |

$12,232 |

11/2018 |

$17,745 |

$12,481 |

12/2018 |

$15,388 |

$11,354 |

01/2019 |

$17,538 |

$12,264 |

02/2019 |

$18,839 |

$12,658 |

03/2019 |

$18,933 |

$12,904 |

04/2019 |

$19,216 |

$13,426 |

05/2019 |

$16,688 |

$12,573 |

06/2019 |

$19,321 |

$13,459 |

07/2019 |

$19,583 |

$13,652 |

08/2019 |

$17,937 |

$13,436 |

09/2019 |

$17,370 |

$13,687 |

10/2019 |

$17,947 |

$13,984 |

11/2019 |

$20,244 |

$14,492 |

12/2019 |

$20,312 |

$14,929 |

01/2020 |

$21,157 |

$14,923 |

02/2020 |

$21,752 |

$13,695 |

03/2020 |

$18,795 |

$12,003 |

04/2020 |

$22,987 |

$13,542 |

05/2020 |

$26,010 |

$14,187 |

06/2020 |

$29,303 |

$14,469 |

07/2020 |

$33,246 |

$15,285 |

08/2020 |

$38,706 |

$16,384 |

09/2020 |

$37,460 |

$15,761 |

10/2020 |

$37,363 |

$15,342 |

11/2020 |

$45,552 |

$17,021 |

12/2020 |

$50,167 |

$17,676 |

01/2021 |

$54,351 |

$17,497 |

02/2021 |

$52,504 |

$17,980 |

03/2021 |

$48,341 |

$18,767 |

04/2021 |

$48,885 |

$19,769 |

05/2021 |

$45,298 |

$19,907 |

06/2021 |

$52,167 |

$20,371 |

07/2021 |

$48,287 |

$20,855 |

08/2021 |

$49,211 |

$21,490 |

09/2021 |

$45,113 |

$20,490 |

10/2021 |

$49,591 |

$21,926 |

11/2021 |

$43,081 |

$21,774 |

12/2021 |

$38,699 |

$22,750 |

01/2022 |

$30,883 |

$21,572 |

02/2022 |

$28,850 |

$20,926 |

03/2022 |

$27,230 |

$21,703 |

04/2022 |

$19,527 |

$19,811 |

05/2022 |

$18,291 |

$19,847 |

06/2022 |

$16,486 |

$18,209 |

07/2022 |

$18,277 |

$19,888 |

08/2022 |

$17,140 |

$19,077 |

09/2022 |

$15,477 |

$17,320 |

10/2022 |

$15,846 |

$18,722 |

11/2022 |

$15,520 |

$19,768 |

12/2022 |

$13,024 |

$18,629 |

01/2023 |

$16,622 |

$19,800 |

02/2023 |

$16,498 |

$19,317 |

03/2023 |

$16,856 |

$20,026 |

04/2023 |

$15,049 |

$20,339 |

05/2023 |

$16,872 |

$20,427 |

06/2023 |

$18,383 |

$21,777 |

07/2023 |

$21,000 |

$22,476 |

08/2023 |

$18,258 |

$22,118 |

09/2023 |

$16,513 |

$21,064 |

10/2023 |

$14,644 |

$20,621 |

11/2023 |

$19,193 |

$22,504 |

12/2023 |

$21,826 |

$23,527 |

01/2024 |

$18,944 |

$23,922 |

02/2024 |

$21,249 |

$25,199 |

03/2024 |

$20,766 |

$26,010 |

04/2024 |

$18,118 |

$24,948 |

05/2024 |

$17,682 |

$26,185 |

06/2024 |

$18,305 |

$27,124 |

07/2024 |

$18,928 |

$27,454 |

08/2024 |

$18,679 |

$28,120 |

09/2024 |

$19,816 |

$28,721 |

10/2024 |

$19,146 |

$28,461 |

11/2024 |

$24,116 |

$30,131 |

12/2024 |

$23,633 |

$29,413 |

01/2025 |

$26,141 |

$30,232 |

02/2025 |

$23,181 |

$29,838 |

03/2025 |

$19,832 |

$28,156 |

04/2025 |

$21,234 |

$27,965 |

05/2025 |

$23,462 |

$29,726 |

06/2025 |

$29,241 |

$31,237 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (1/27/17) |

Class A without Sales ChargeFootnote Reference1 |

59.74% |

(0.04)% |

14.39% |

Class A with Maximum Sales Charge - 5.75%Footnote Reference1 |

50.52% |

(1.22)% |

13.59% |

S&P 500® Index TR |

15.16% |

16.64% |

14.48% | |

|

| Performance Inception Date |

Jan. 27, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| AssetsNet |

$ 203,610,644

|

|

| Holdings Count | Holding |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,502,796

|

|

| InvestmentCompanyPortfolioTurnover |

46.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$203,610,644 |

# of Portfolio Holdings |

42 |

Portfolio Turnover Rate |

46% |

Total Management Fees Paid |

$1,502,796 | |

|

| Holdings [Text Block] |

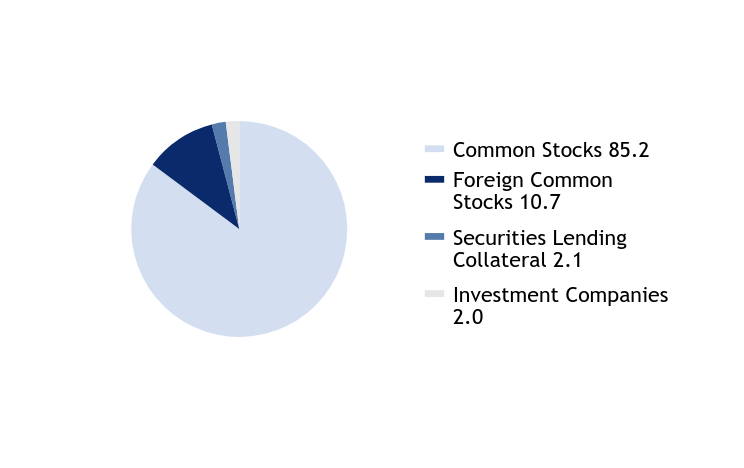

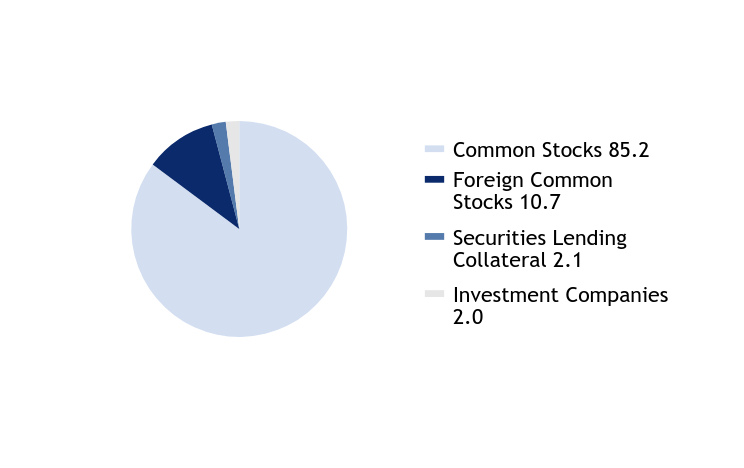

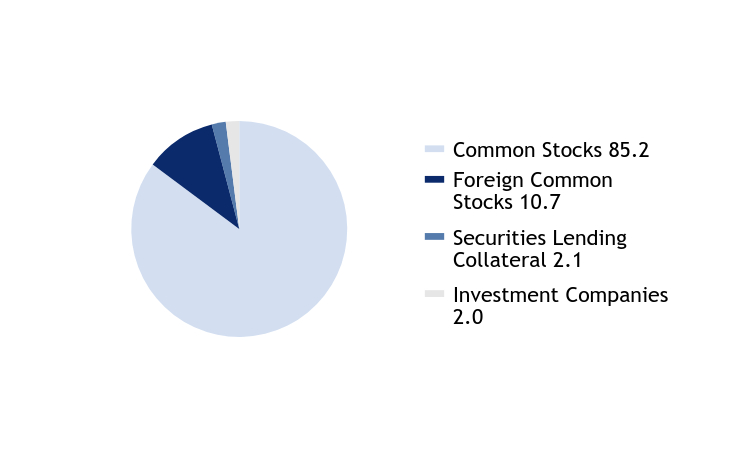

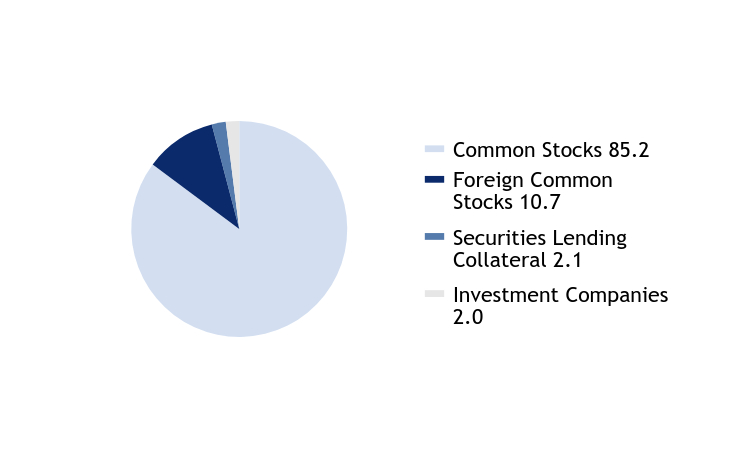

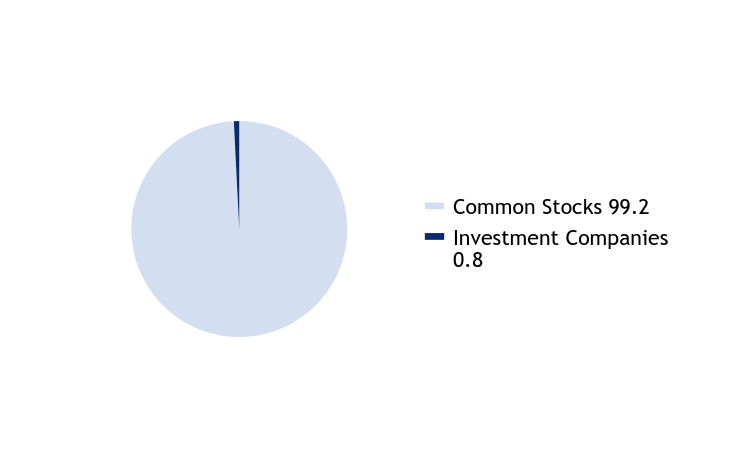

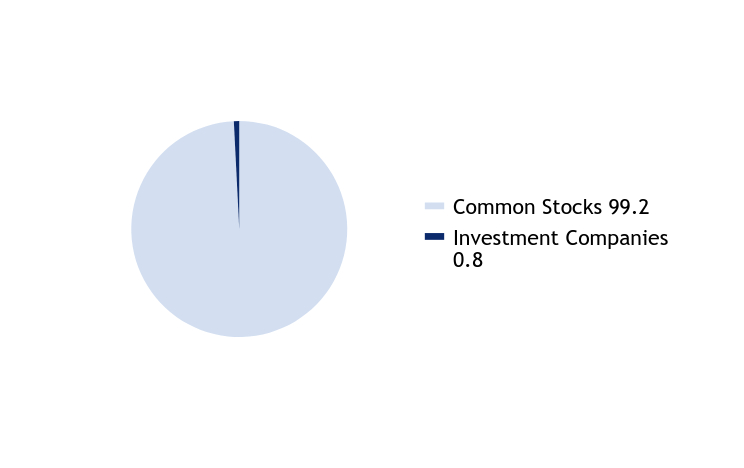

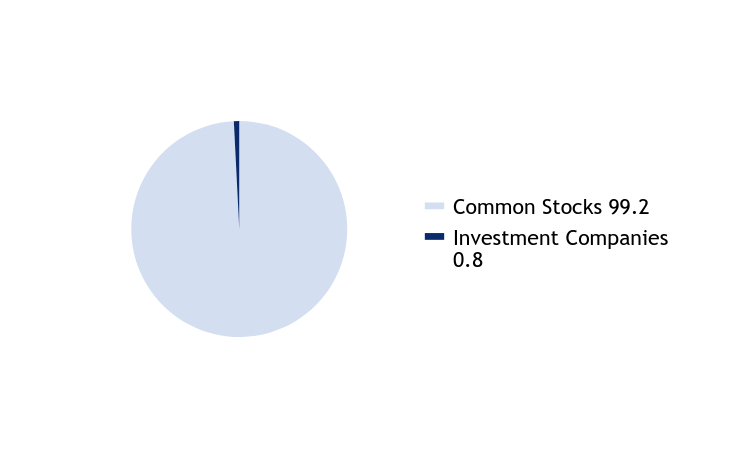

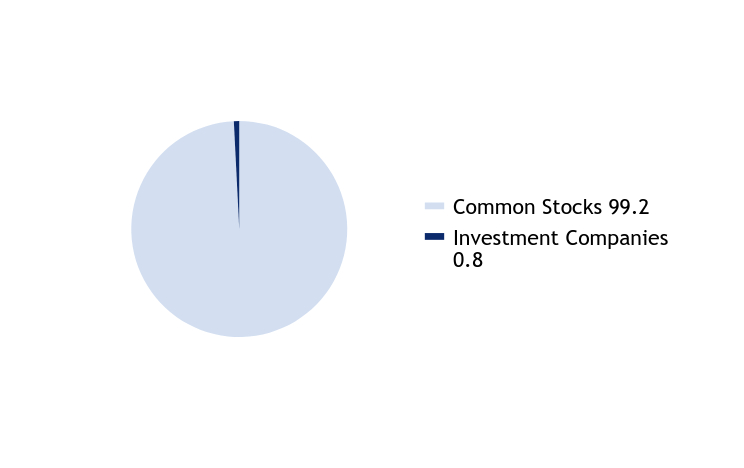

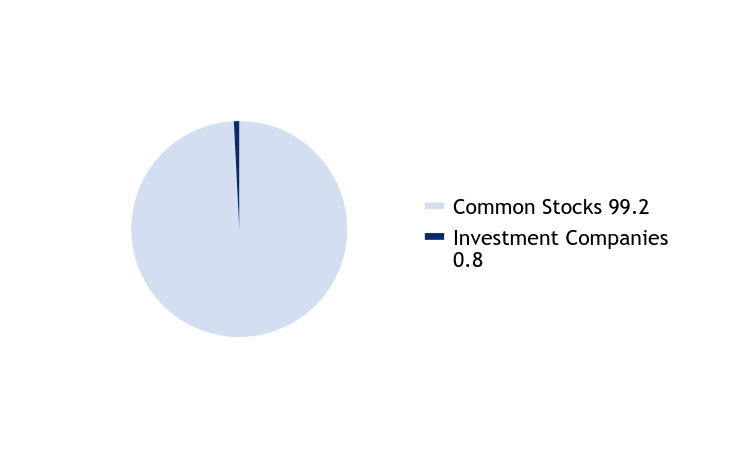

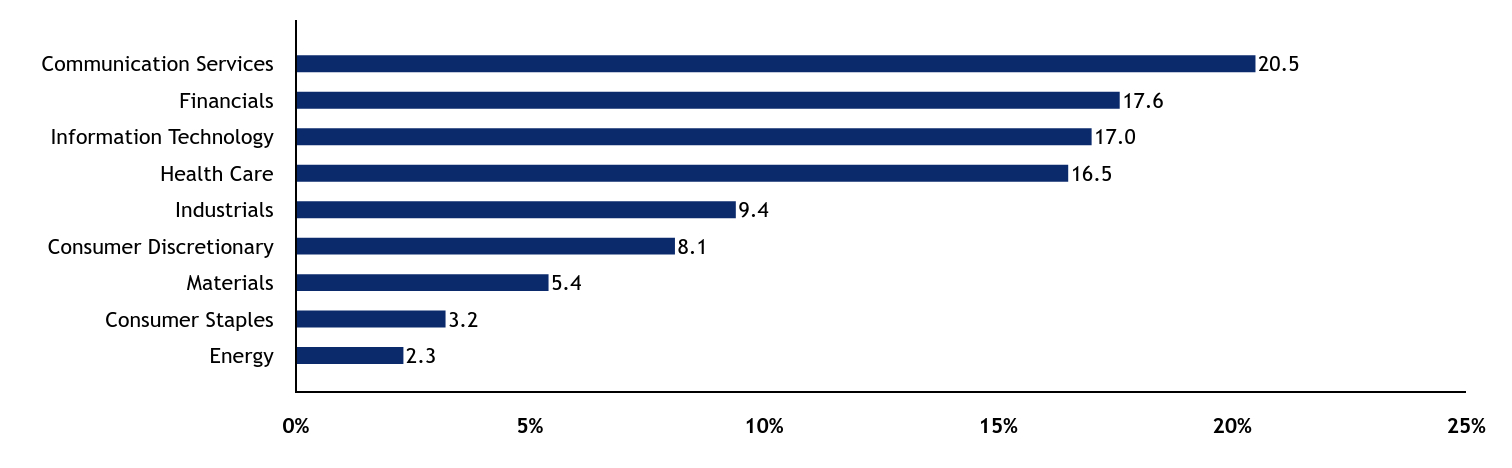

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

85.2 |

Foreign Common Stocks |

10.7 |

Securities Lending Collateral |

2.1 |

Investment Companies |

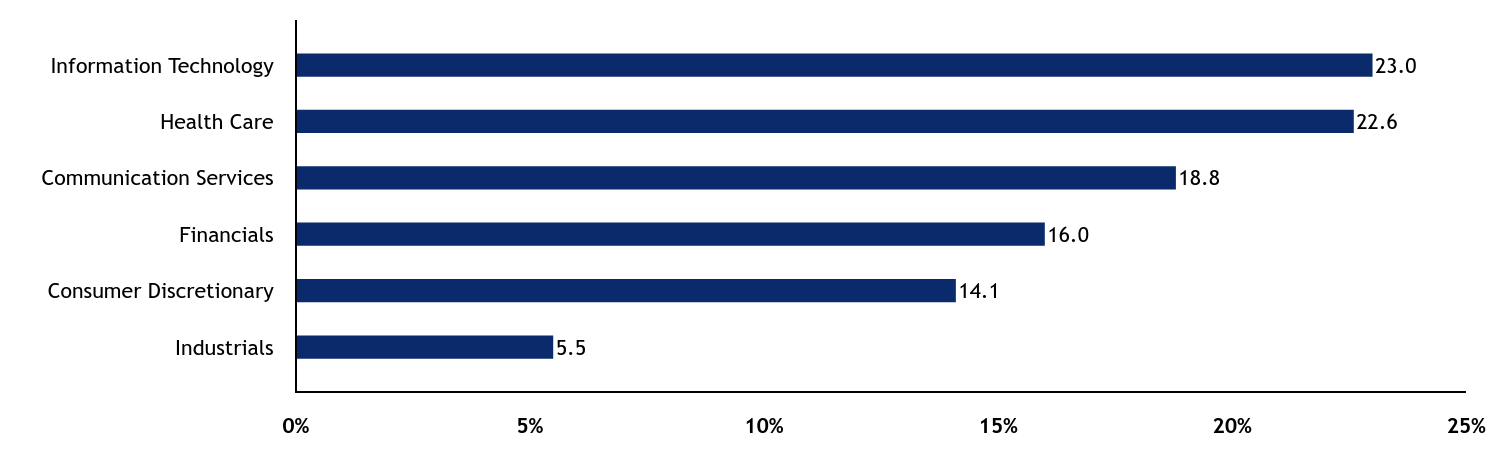

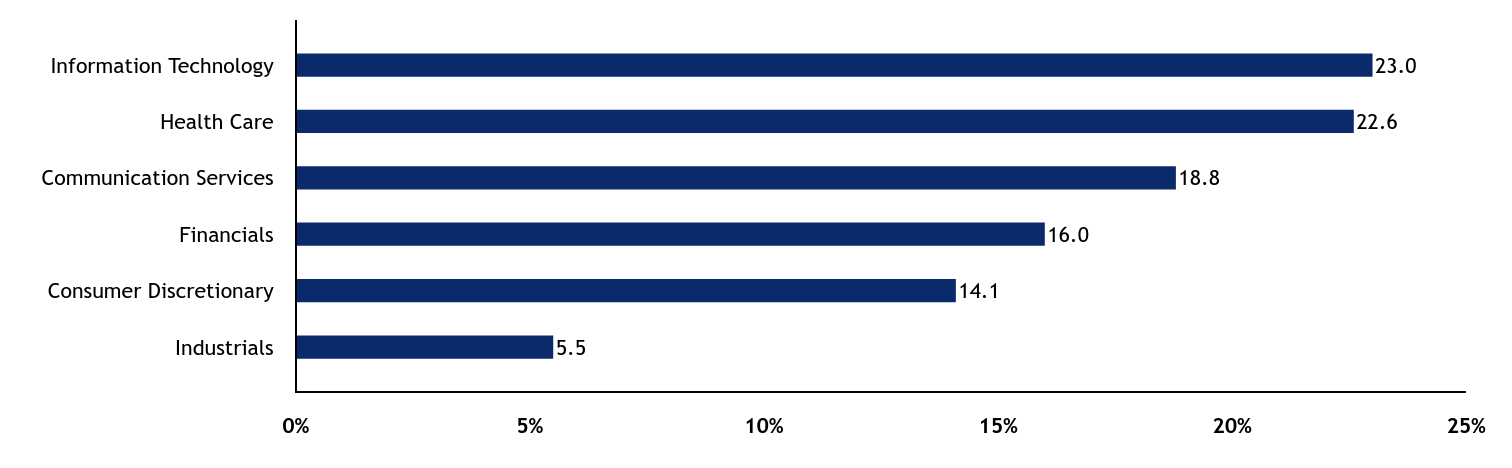

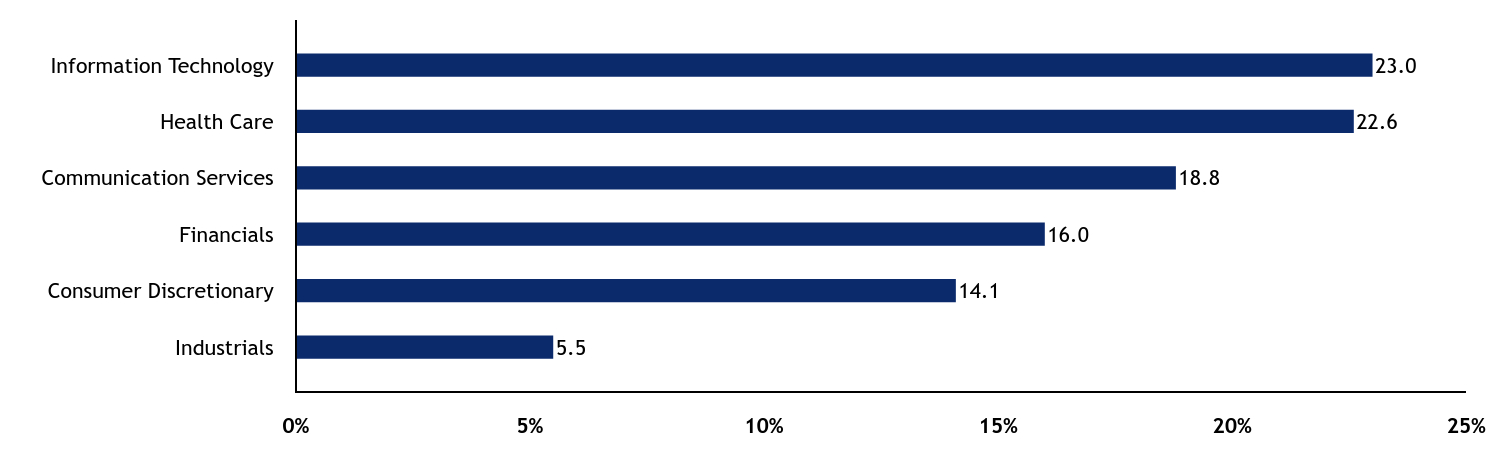

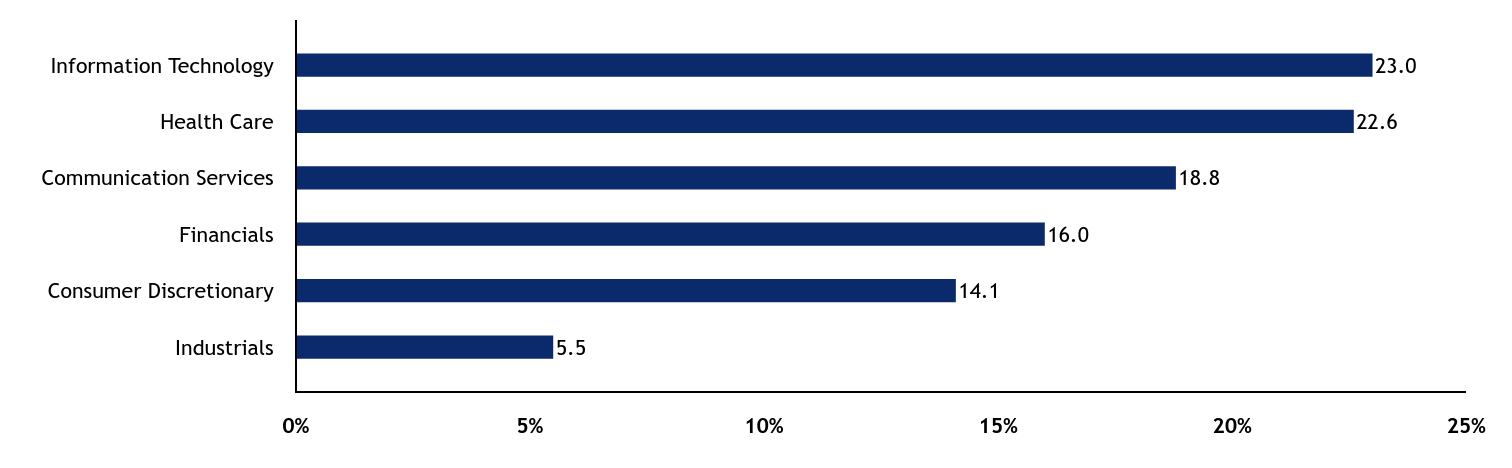

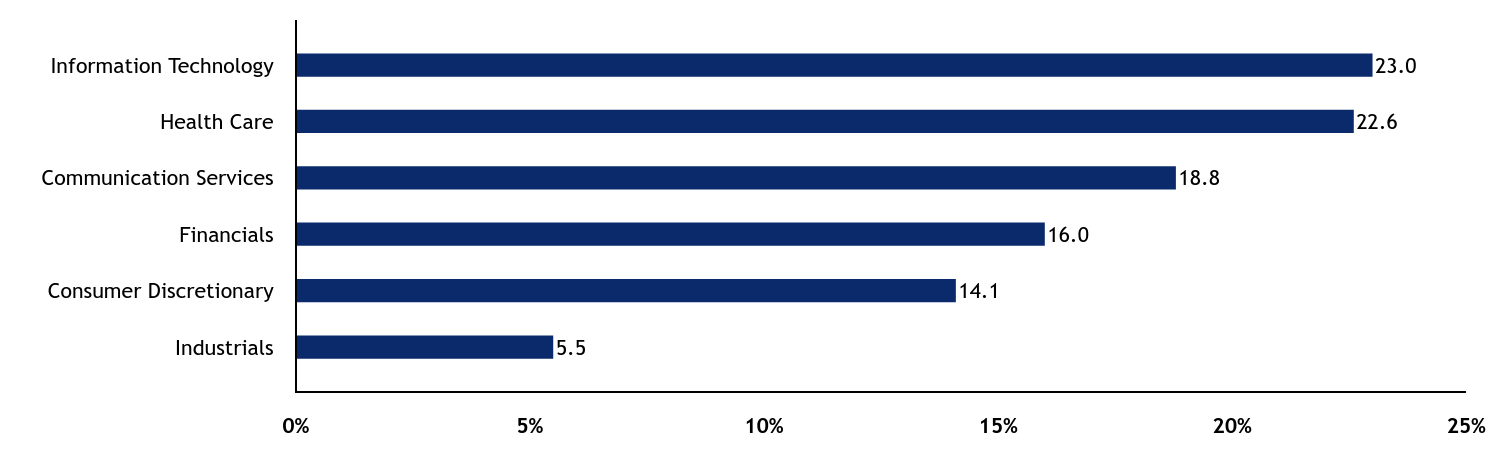

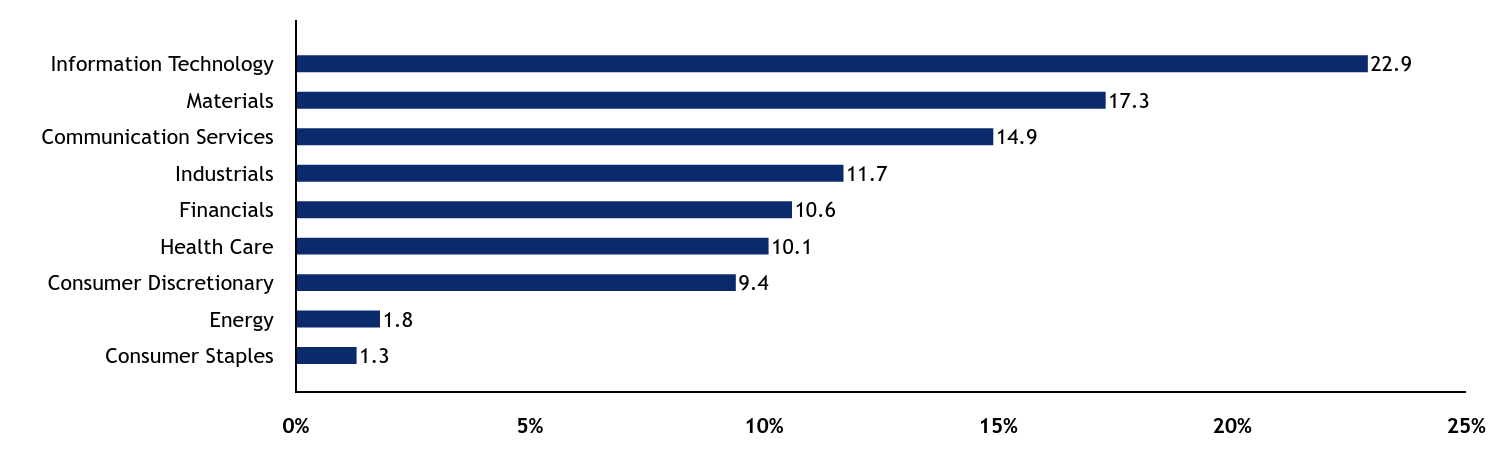

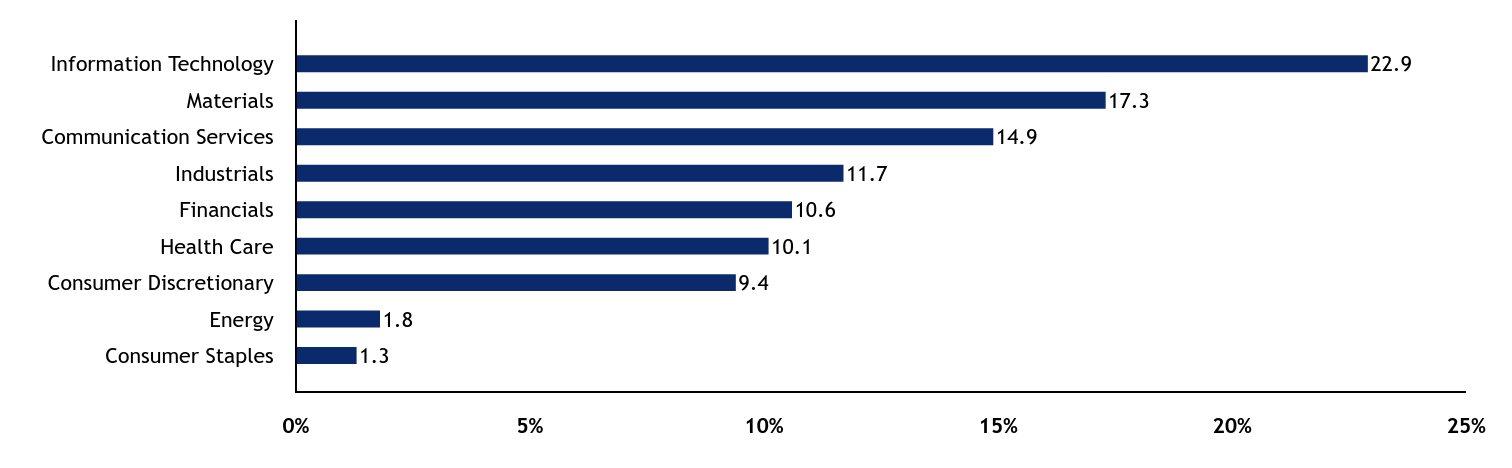

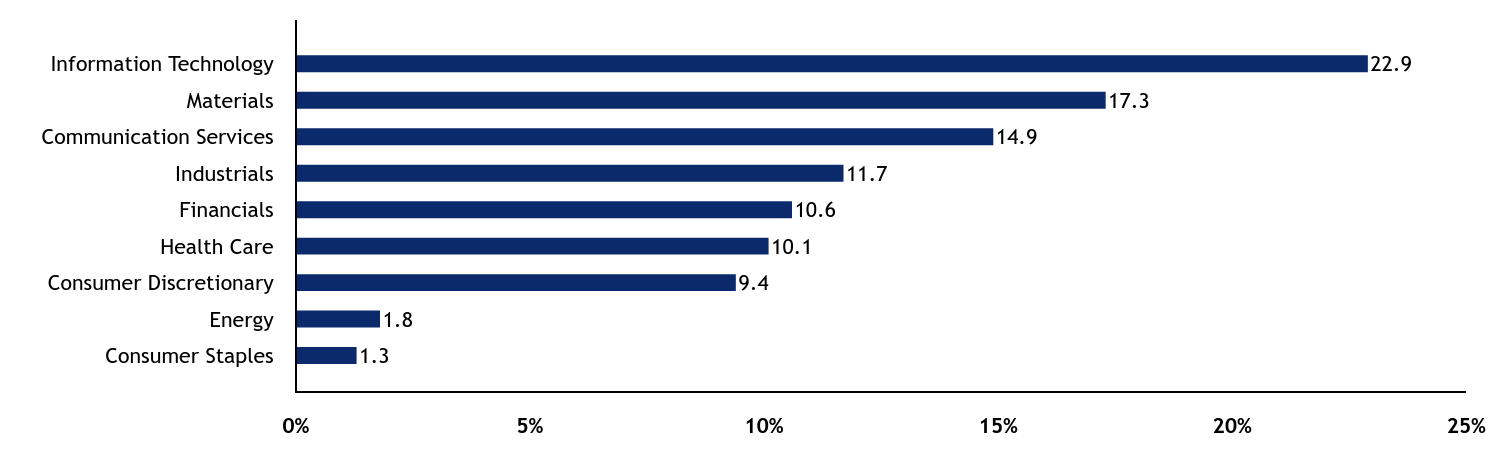

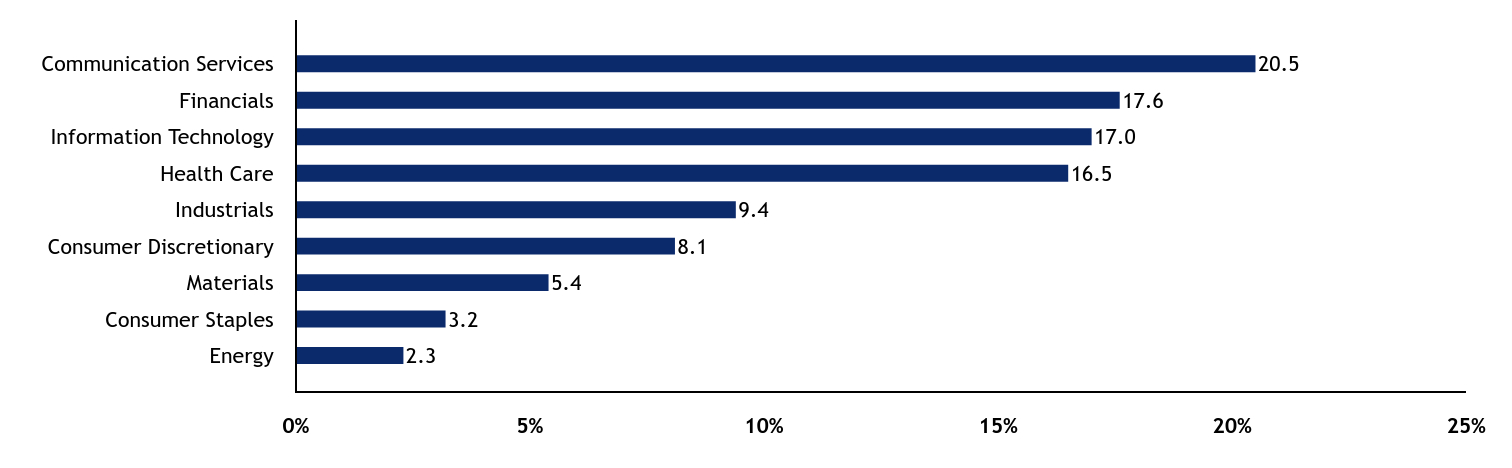

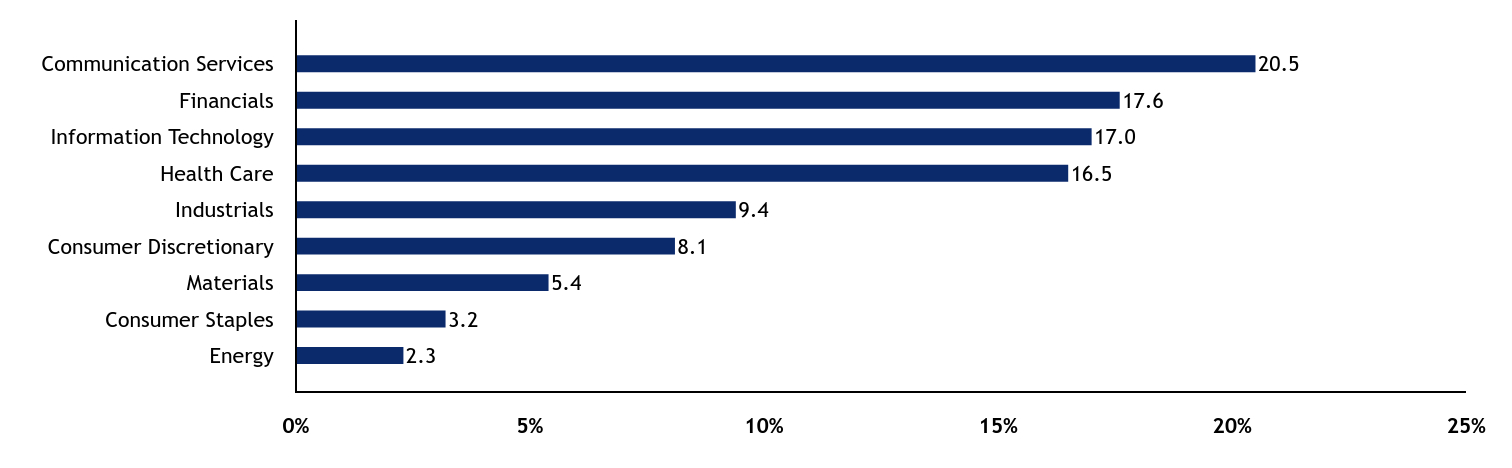

2.0 | Sector Allocation - % Equities

Value |

Value |

Industrials |

5.5 |

Consumer Discretionary |

14.1 |

Financials |

16.0 |

Communication Services |

18.8 |

Health Care |

22.6 |

Information Technology |

23.0 | |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Tesla, Inc. |

9.5 |

Coinbase Global, Inc., Class A |

8.0 |

Roku, Inc. |

7.4 |

ROBLOX Corp., Class A |

6.4 |

Robinhood Markets, Inc., Class A |

5.5 |

CRISPR Therapeutics AG |

5.1 |

Shopify, Inc., Class A |

4.8 |

Tempus AI, Inc. |

4.7 |

Circle Internet Group, Inc. |

4.5 |

Palantir Technologies, Inc., Class A |

4.1 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

| C000210491 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

ARK Transformational Innovation Fund

|

|

| Class Name |

C

|

|

| Trading Symbol |

ADNCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon ARK Transformational Innovation Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$279 |

2.16% | |

|

| Expenses Paid, Amount |

$ 279

|

|

| Expense Ratio, Percent |

2.16%

|

|

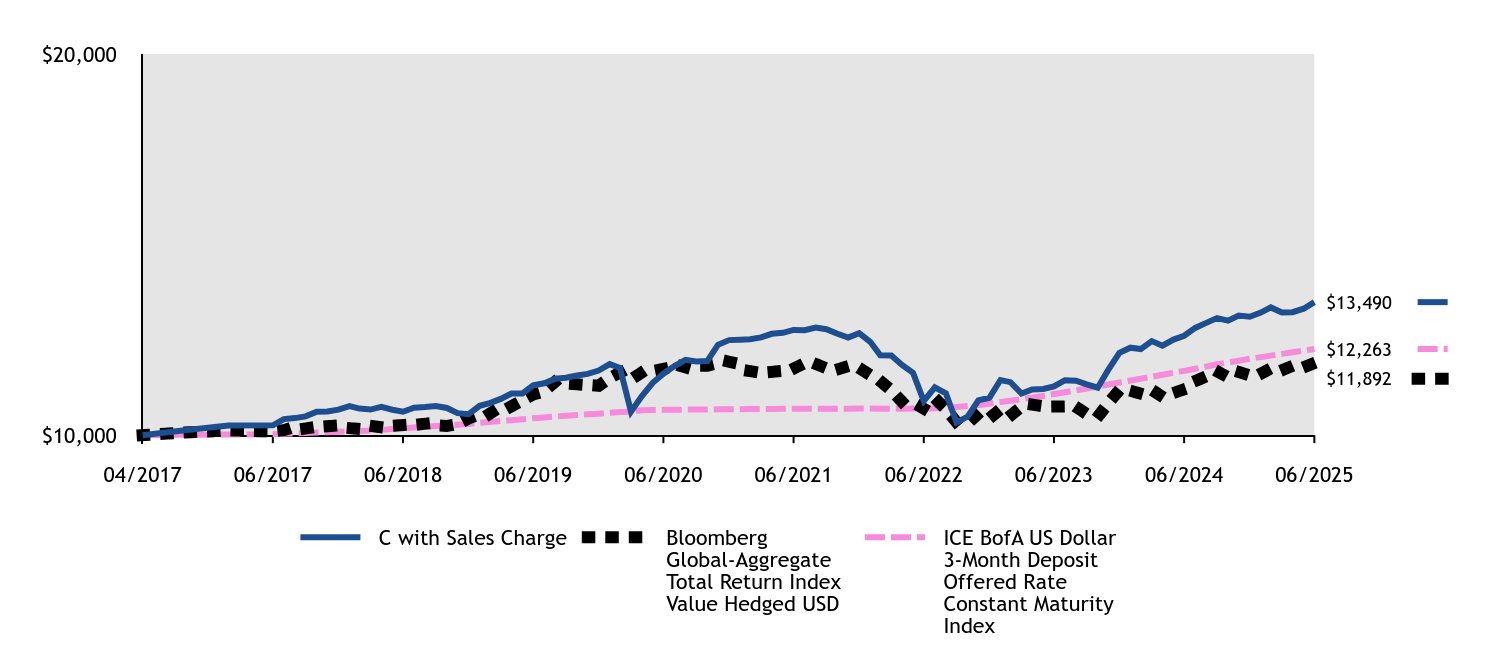

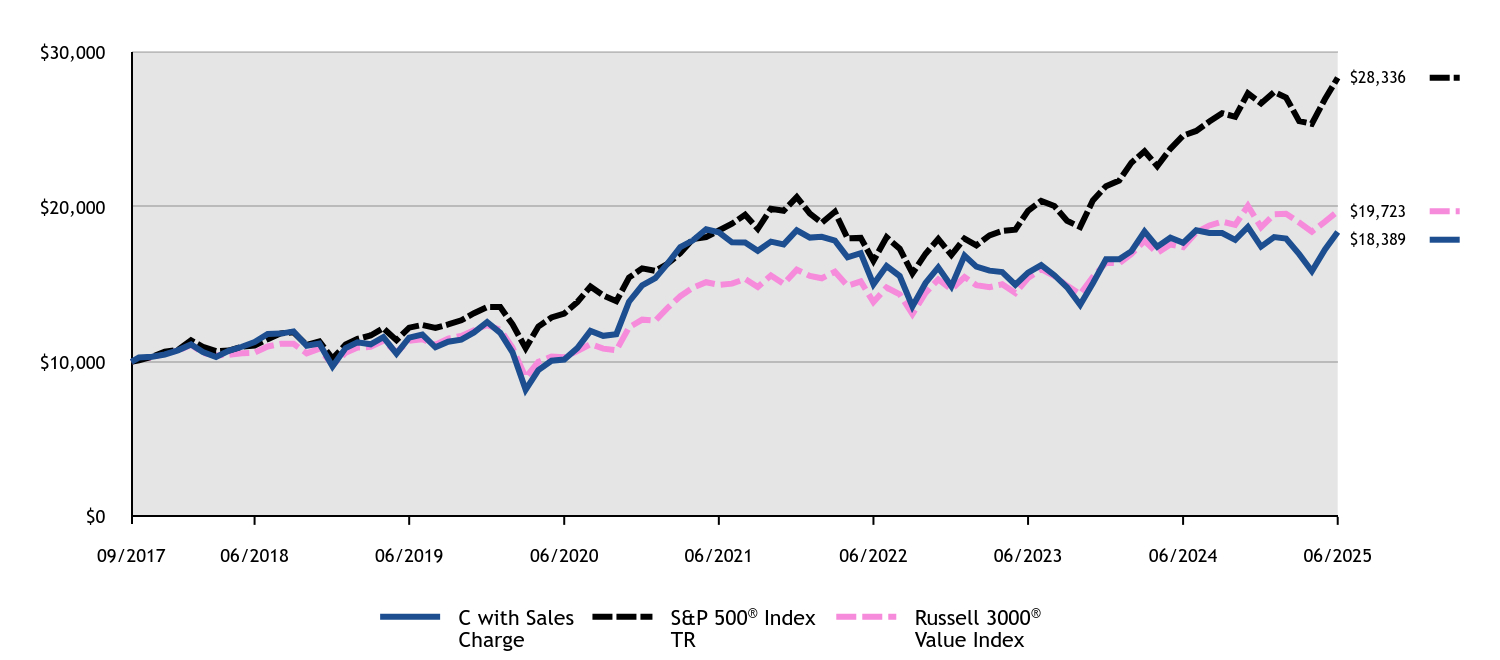

| Factors Affecting Performance [Text Block] |

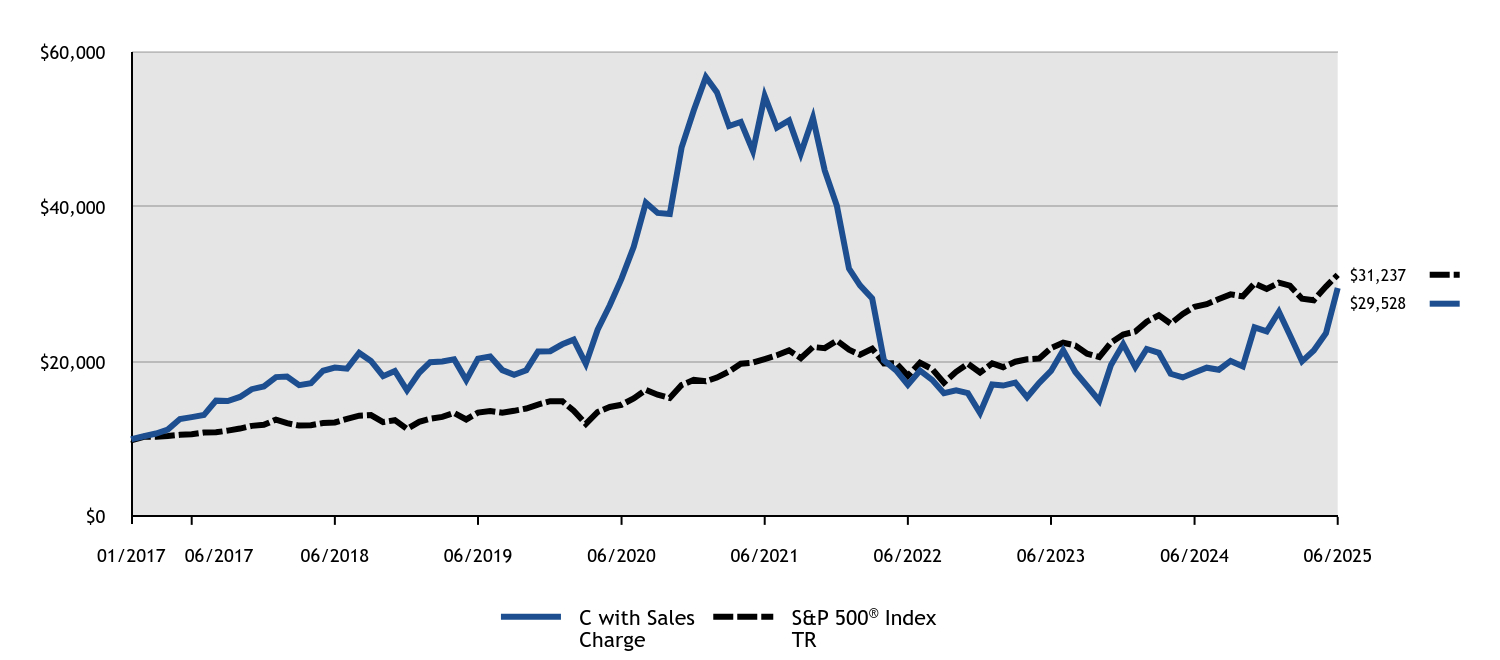

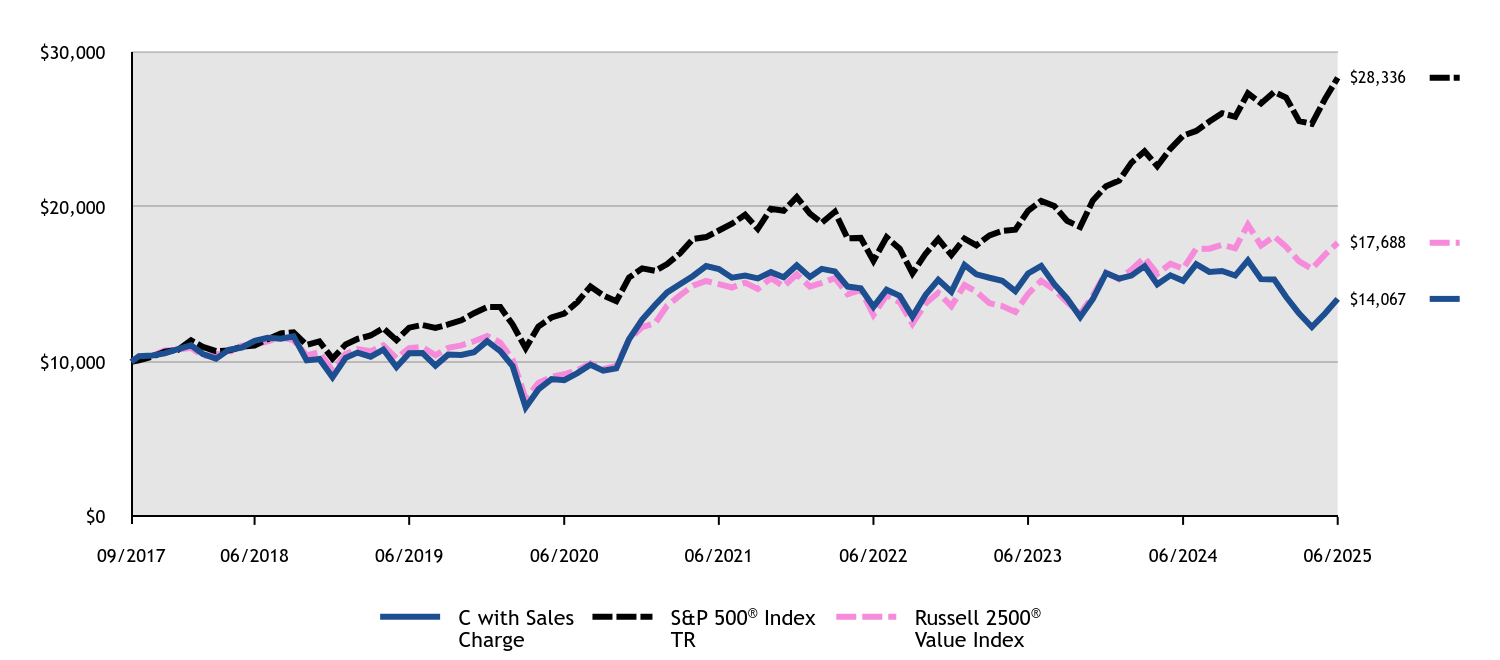

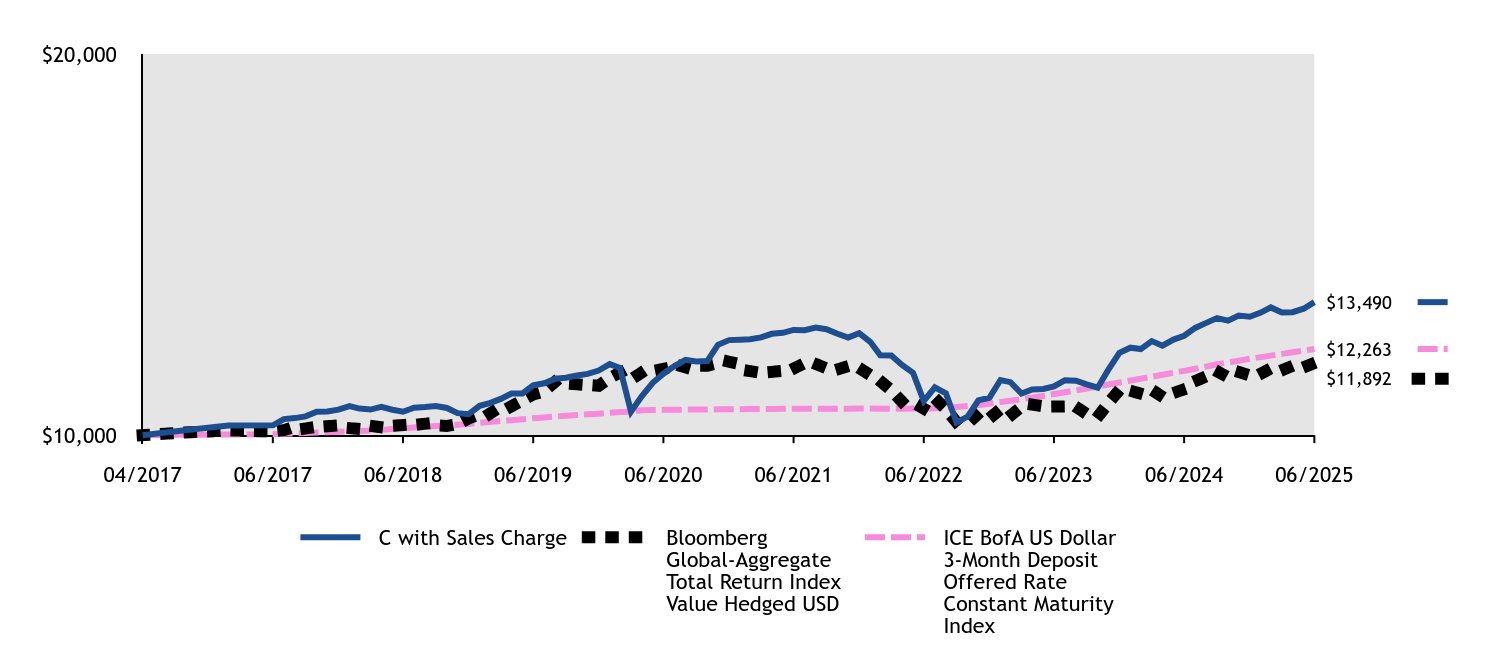

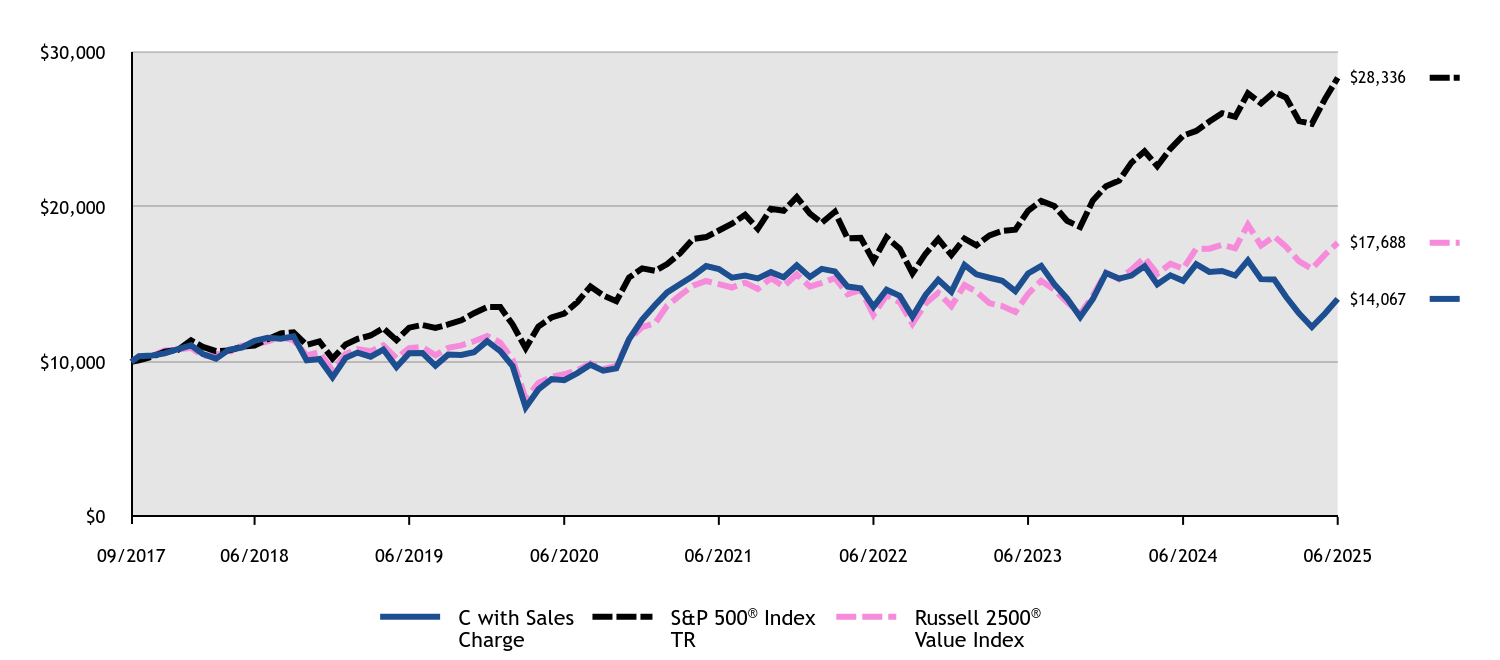

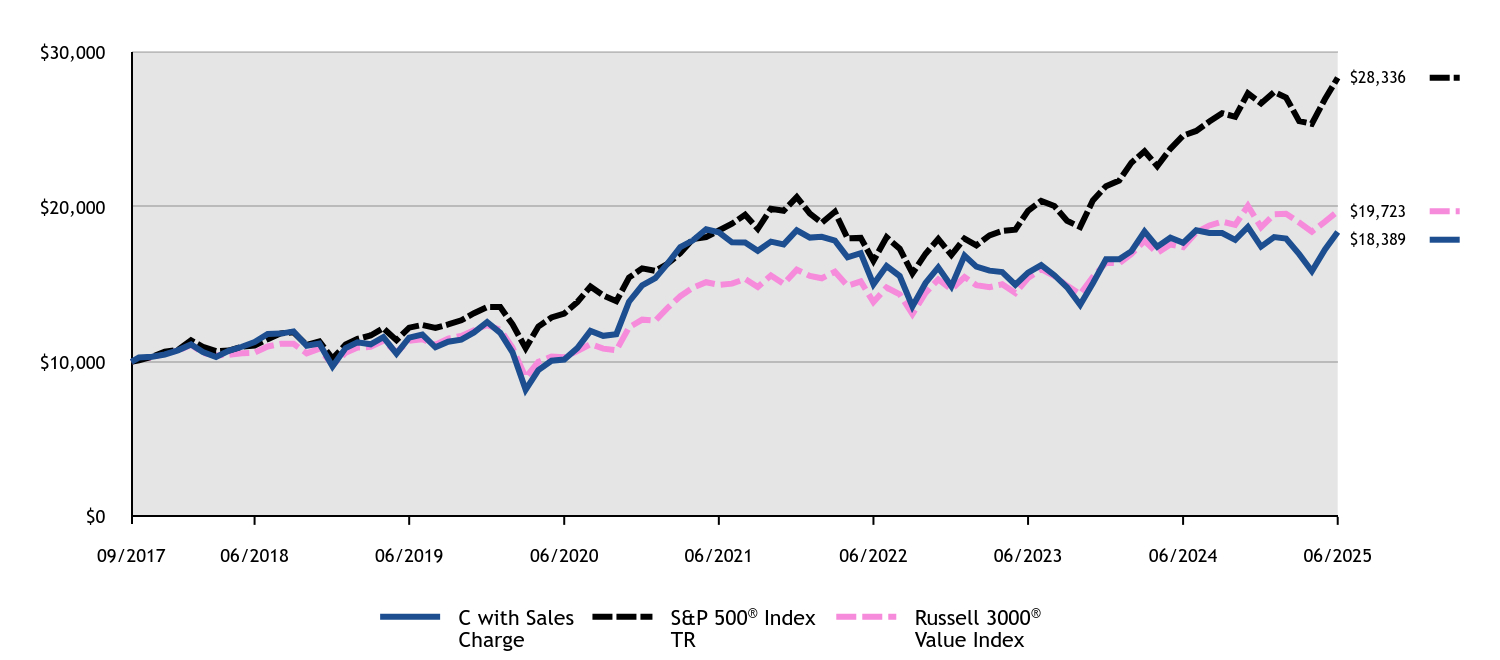

How did the Fund perform and what affected its performance? The C Class of the Fund returned 57.53% (with sales charges) and 58.53% (without sales charges) for the twelve months ended June 30, 2025, compared to the S&P 500 Index return of 15.16%. • The headwinds that once pressured disruptive technologies lessened due to broader market participation, favorable policy shifts around crypto, Artificial Intelligence, and healthcare, coupled with expectations for potential fiscal catalysts like tax cuts. • The Fund’s investments in software and capital markets companies materially helped performance for the period. Conversely, its investments in biotechnology and semiconductors and semiconductor equipment companies detracted from performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

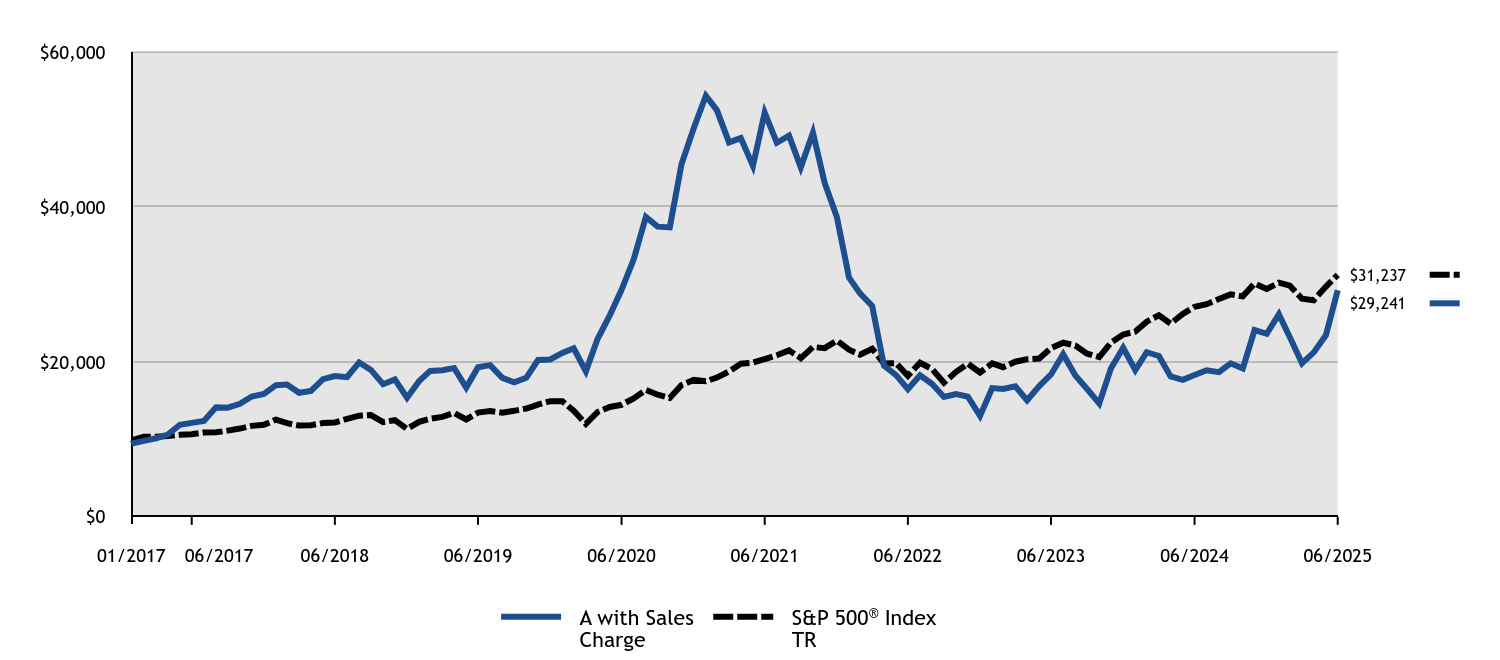

| Line Graph [Table Text Block] |

|

C with Sales Charge |

S&P 500® Index TR |

01/2017 |

$10,000 |

$10,000 |

01/2017 |

$10,080 |

$9,932 |

02/2017 |

$10,400 |

$10,326 |

03/2017 |

$10,760 |

$10,338 |

04/2017 |

$11,270 |

$10,444 |

05/2017 |

$12,620 |

$10,591 |

06/2017 |

$12,870 |

$10,657 |

07/2017 |

$13,140 |

$10,876 |

08/2017 |

$15,000 |

$10,910 |

09/2017 |

$14,950 |

$11,135 |

10/2017 |

$15,480 |

$11,395 |

11/2017 |

$16,480 |

$11,744 |

12/2017 |

$16,828 |

$11,875 |

01/2018 |

$18,040 |

$12,554 |

02/2018 |

$18,123 |

$12,092 |

03/2018 |

$16,994 |

$11,784 |

04/2018 |

$17,243 |

$11,830 |

05/2018 |

$18,859 |

$12,115 |

06/2018 |

$19,274 |

$12,189 |

07/2018 |

$19,128 |

$12,643 |

08/2018 |

$21,159 |

$13,055 |

09/2018 |

$20,123 |

$13,129 |

10/2018 |

$18,165 |

$12,232 |

11/2018 |

$18,828 |

$12,481 |

12/2018 |

$16,327 |

$11,354 |

01/2019 |

$18,597 |

$12,264 |

02/2019 |

$19,966 |

$12,658 |

03/2019 |

$20,055 |

$12,904 |

04/2019 |

$20,333 |

$13,426 |

05/2019 |

$17,651 |

$12,573 |

06/2019 |

$20,422 |

$13,459 |

07/2019 |

$20,689 |

$13,652 |

08/2019 |

$18,942 |

$13,436 |

09/2019 |

$18,330 |

$13,687 |

10/2019 |

$18,931 |

$13,984 |

11/2019 |

$21,335 |

$14,492 |

12/2019 |

$21,387 |

$14,929 |

01/2020 |

$22,271 |

$14,923 |

02/2020 |

$22,879 |

$13,695 |

03/2020 |

$19,745 |

$12,003 |

04/2020 |

$24,153 |

$13,542 |

05/2020 |

$27,310 |

$14,187 |

06/2020 |

$30,743 |

$14,469 |

07/2020 |

$34,852 |

$15,285 |

08/2020 |

$40,558 |

$16,384 |

09/2020 |

$39,226 |

$15,761 |

10/2020 |

$39,100 |

$15,342 |

11/2020 |

$47,652 |

$17,021 |

12/2020 |

$52,439 |

$17,676 |

01/2021 |

$56,769 |

$17,497 |

02/2021 |

$54,823 |

$17,980 |

03/2021 |

$50,446 |

$18,767 |

04/2021 |

$50,976 |

$19,769 |

05/2021 |

$47,210 |

$19,907 |

06/2021 |

$54,316 |

$20,371 |

07/2021 |

$50,250 |

$20,855 |

08/2021 |

$51,172 |

$21,490 |

09/2021 |

$46,899 |

$20,490 |

10/2021 |

$51,506 |

$21,926 |

11/2021 |

$44,722 |

$21,774 |

12/2021 |

$40,139 |

$22,750 |

01/2022 |

$32,030 |

$21,572 |

02/2022 |

$29,887 |

$20,926 |

03/2022 |

$28,193 |

$21,703 |

04/2022 |

$20,204 |

$19,811 |

05/2022 |

$18,915 |

$19,847 |

06/2022 |

$17,042 |

$18,209 |

07/2022 |

$18,870 |

$19,888 |

08/2022 |

$17,686 |

$19,077 |

09/2022 |

$15,963 |

$17,320 |

10/2022 |

$16,337 |

$18,722 |

11/2022 |

$15,978 |

$19,768 |

12/2022 |

$13,405 |

$18,629 |

01/2023 |

$17,094 |

$19,800 |

02/2023 |

$16,946 |

$19,317 |

03/2023 |

$17,325 |

$20,026 |

04/2023 |

$15,447 |

$20,339 |

05/2023 |

$17,308 |

$20,427 |

06/2023 |

$18,840 |

$21,777 |

07/2023 |

$21,507 |

$22,476 |

08/2023 |

$18,691 |

$22,118 |

09/2023 |

$16,896 |

$21,064 |

10/2023 |

$14,986 |

$20,621 |

11/2023 |

$19,614 |

$22,504 |

12/2023 |

$22,298 |

$23,527 |

01/2024 |

$19,334 |

$23,922 |

02/2024 |

$21,672 |

$25,199 |

03/2024 |

$21,178 |

$26,010 |

04/2024 |

$18,461 |

$24,948 |

05/2024 |

$18,000 |

$26,185 |

06/2024 |

$18,626 |

$27,124 |

07/2024 |

$19,251 |

$27,454 |

08/2024 |

$18,988 |

$28,120 |

09/2024 |

$20,124 |

$28,721 |

10/2024 |

$19,416 |

$28,461 |

11/2024 |

$24,455 |

$30,131 |

12/2024 |

$23,945 |

$29,413 |

01/2025 |

$26,481 |

$30,232 |

02/2025 |

$23,467 |

$29,838 |

03/2025 |

$20,075 |

$28,156 |

04/2025 |

$21,475 |

$27,965 |

05/2025 |

$23,714 |

$29,726 |

06/2025 |

$29,528 |

$31,237 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (1/27/17) |

Class C without Deferred Sales ChargeFootnote Reference1 |

58.53% |

(0.80)% |

13.72% |

Class C with Maximum Deferred Sales Charge -1.00%Footnote Reference1 |

57.53% |

(0.80)% |

13.72% |

S&P 500® Index TR |

15.16% |

16.64% |

14.48% | |

|

| Performance Inception Date |

Jan. 27, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| AssetsNet |

$ 203,610,644

|

|

| Holdings Count | Holding |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,502,796

|

|

| InvestmentCompanyPortfolioTurnover |

46.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$203,610,644 |

# of Portfolio Holdings |

42 |

Portfolio Turnover Rate |

46% |

Total Management Fees Paid |

$1,502,796 | |

|

| Holdings [Text Block] |

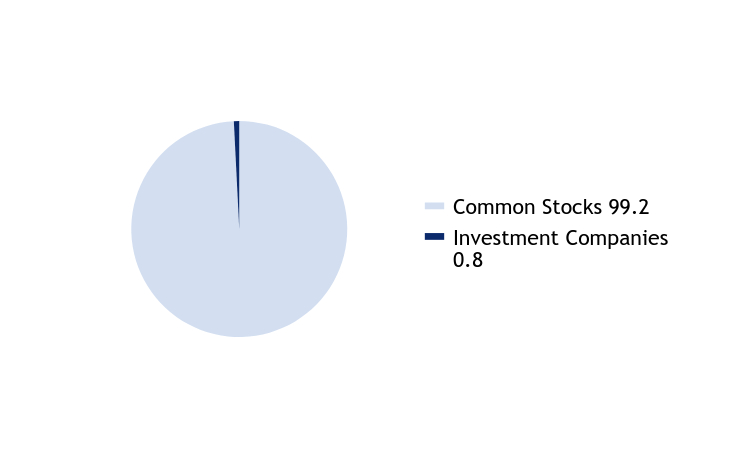

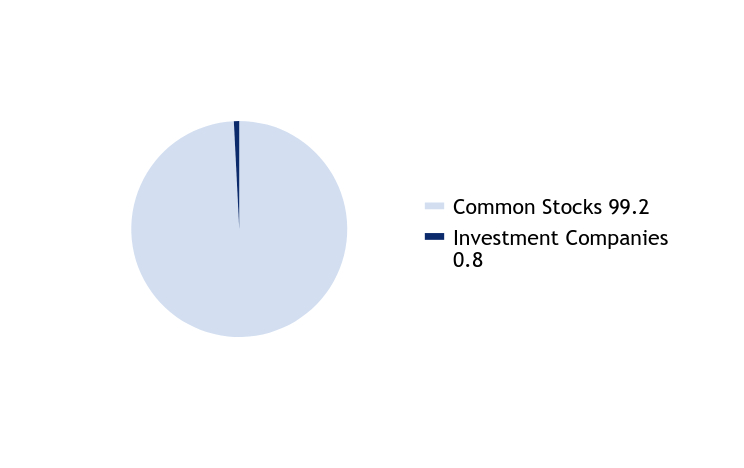

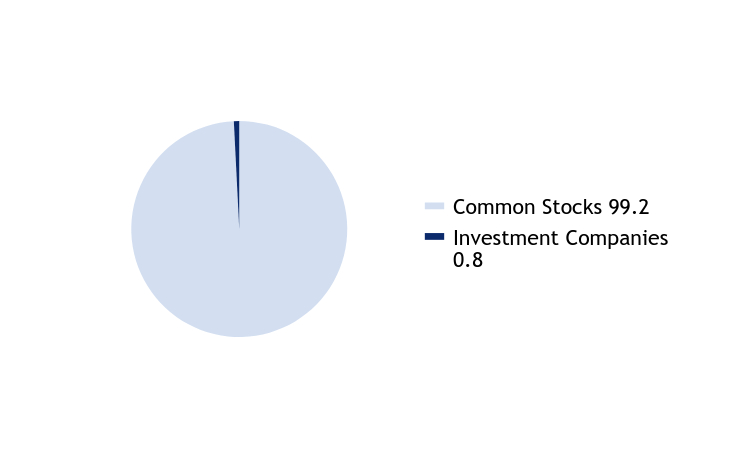

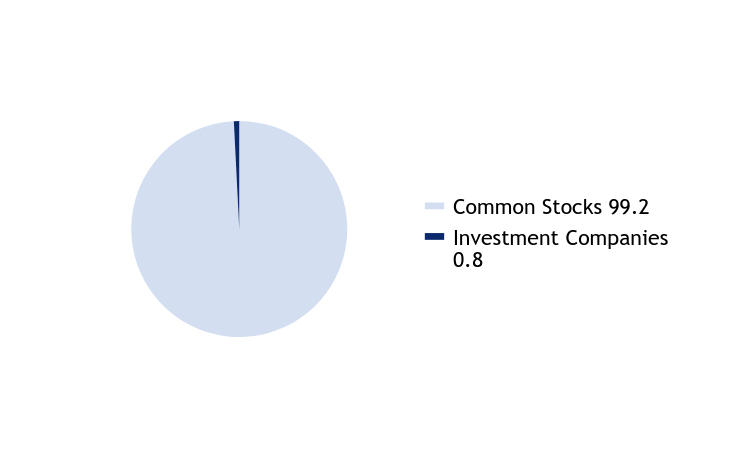

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

85.2 |

Foreign Common Stocks |

10.7 |

Securities Lending Collateral |

2.1 |

Investment Companies |

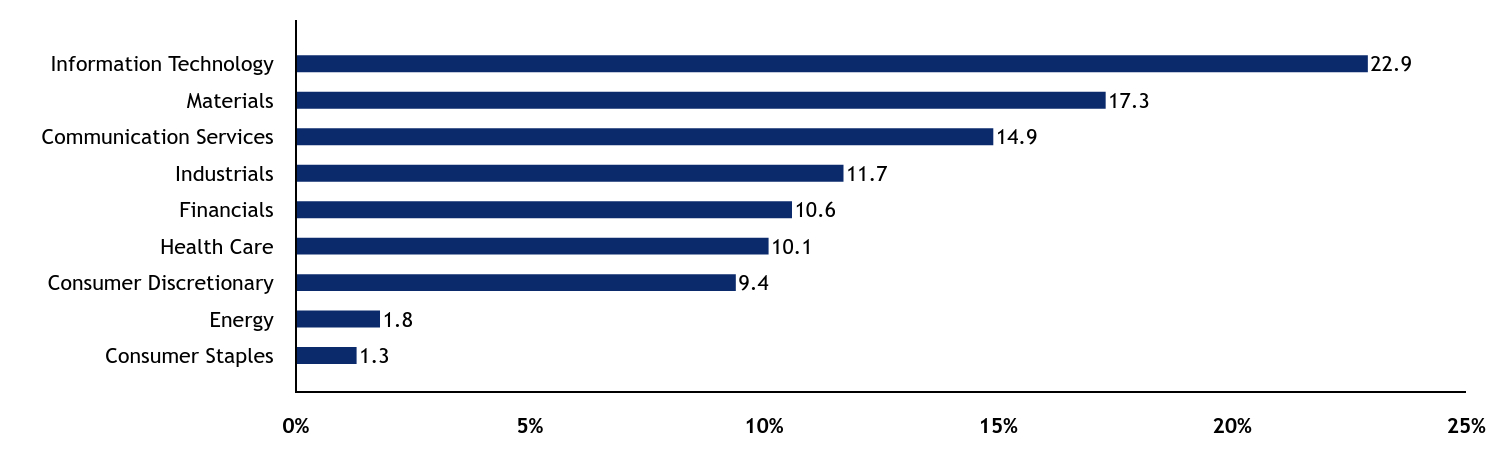

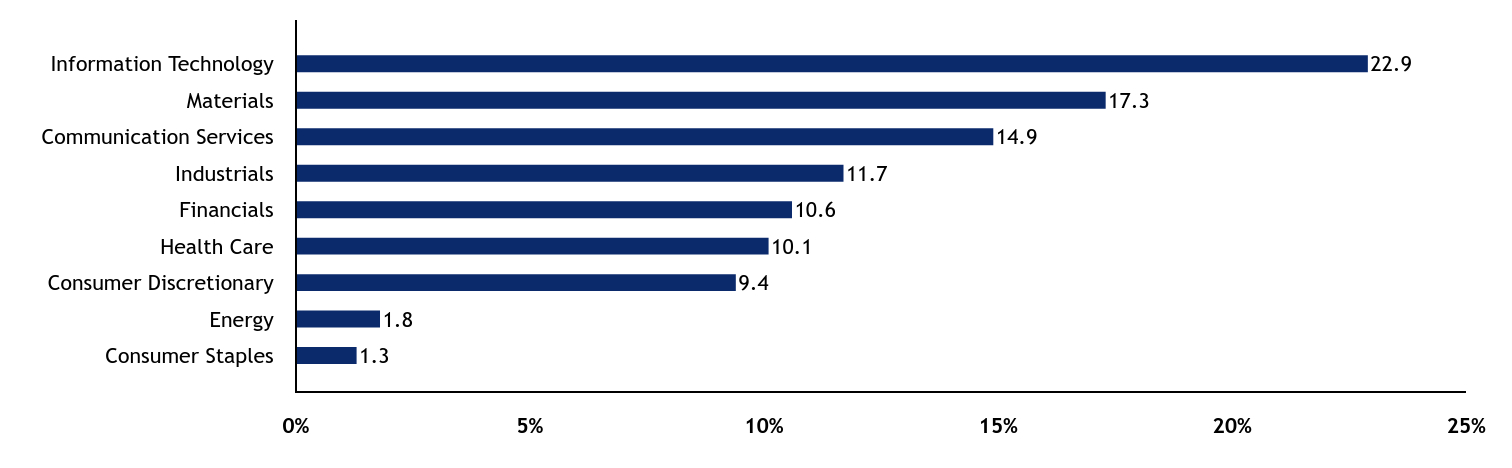

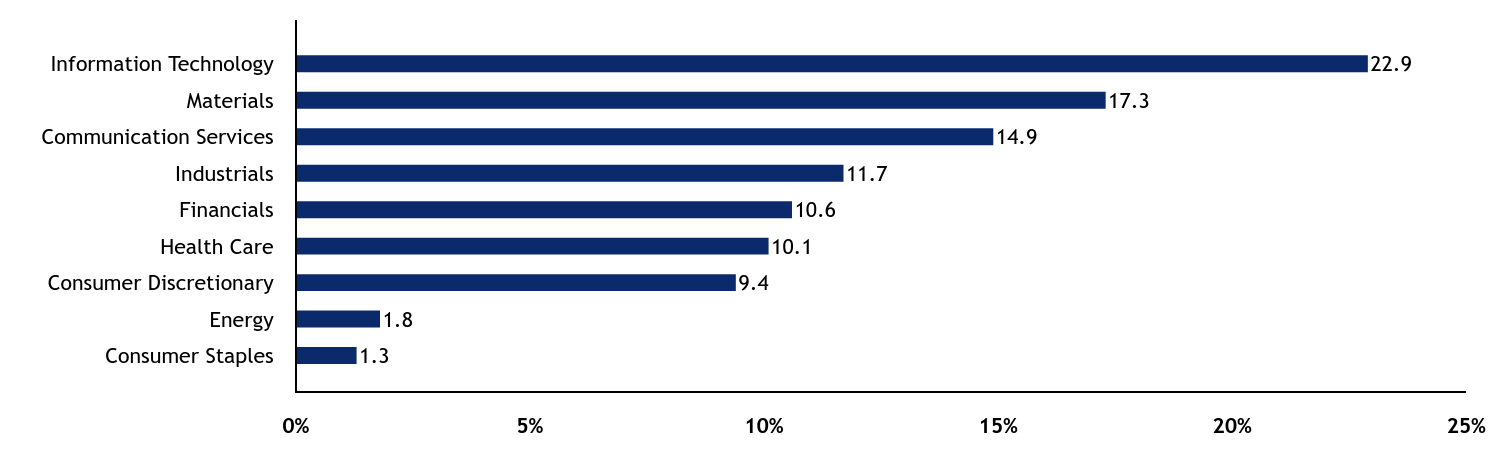

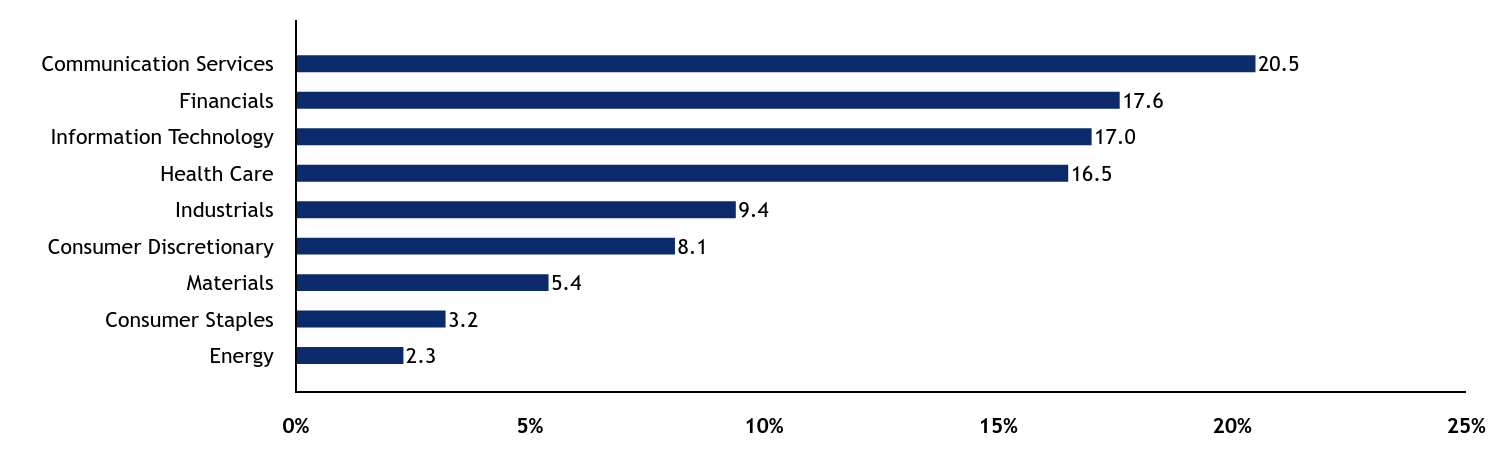

2.0 | Sector Allocation - % Equities

Value |

Value |

Industrials |

5.5 |

Consumer Discretionary |

14.1 |

Financials |

16.0 |

Communication Services |

18.8 |

Health Care |

22.6 |

Information Technology |

23.0 | |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Tesla, Inc. |

9.5 |

Coinbase Global, Inc., Class A |

8.0 |

Roku, Inc. |

7.4 |

ROBLOX Corp., Class A |

6.4 |

Robinhood Markets, Inc., Class A |

5.5 |

CRISPR Therapeutics AG |

5.1 |

Shopify, Inc., Class A |

4.8 |

Tempus AI, Inc. |

4.7 |

Circle Internet Group, Inc. |

4.5 |

Palantir Technologies, Inc., Class A |

4.1 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

| C000176824 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

ARK Transformational Innovation Fund

|

|

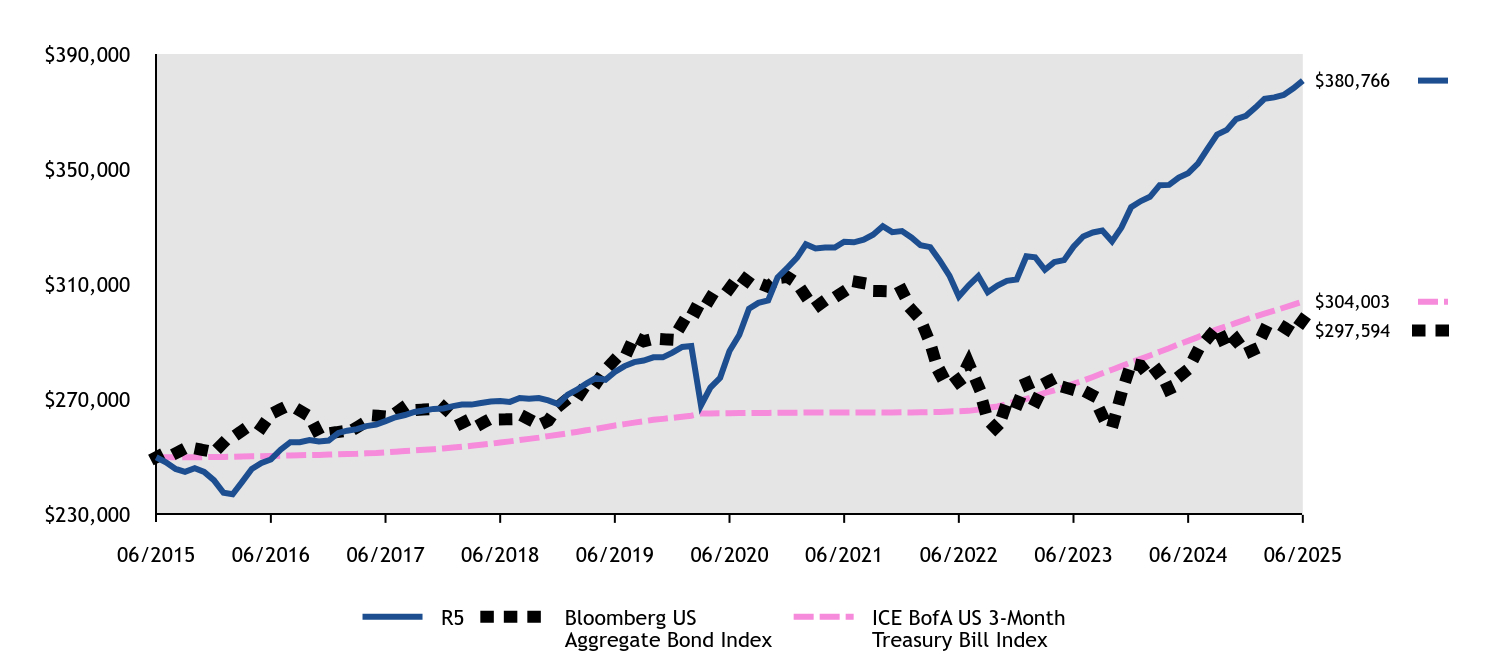

| Class Name |

R5

|

|

| Trading Symbol |

ADNIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon ARK Transformational Innovation Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R5 |

$137 |

1.05% | |

|

| Expenses Paid, Amount |

$ 137

|

|

| Expense Ratio, Percent |

1.05%

|

|

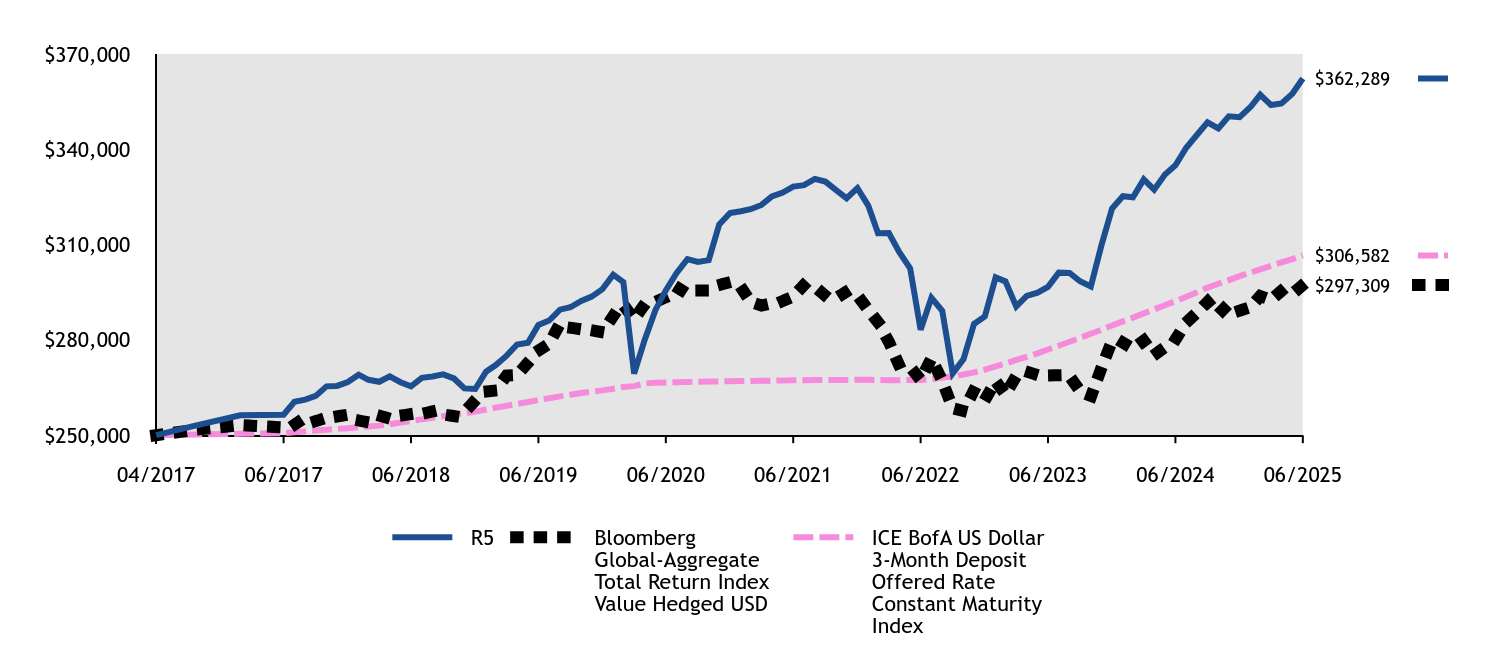

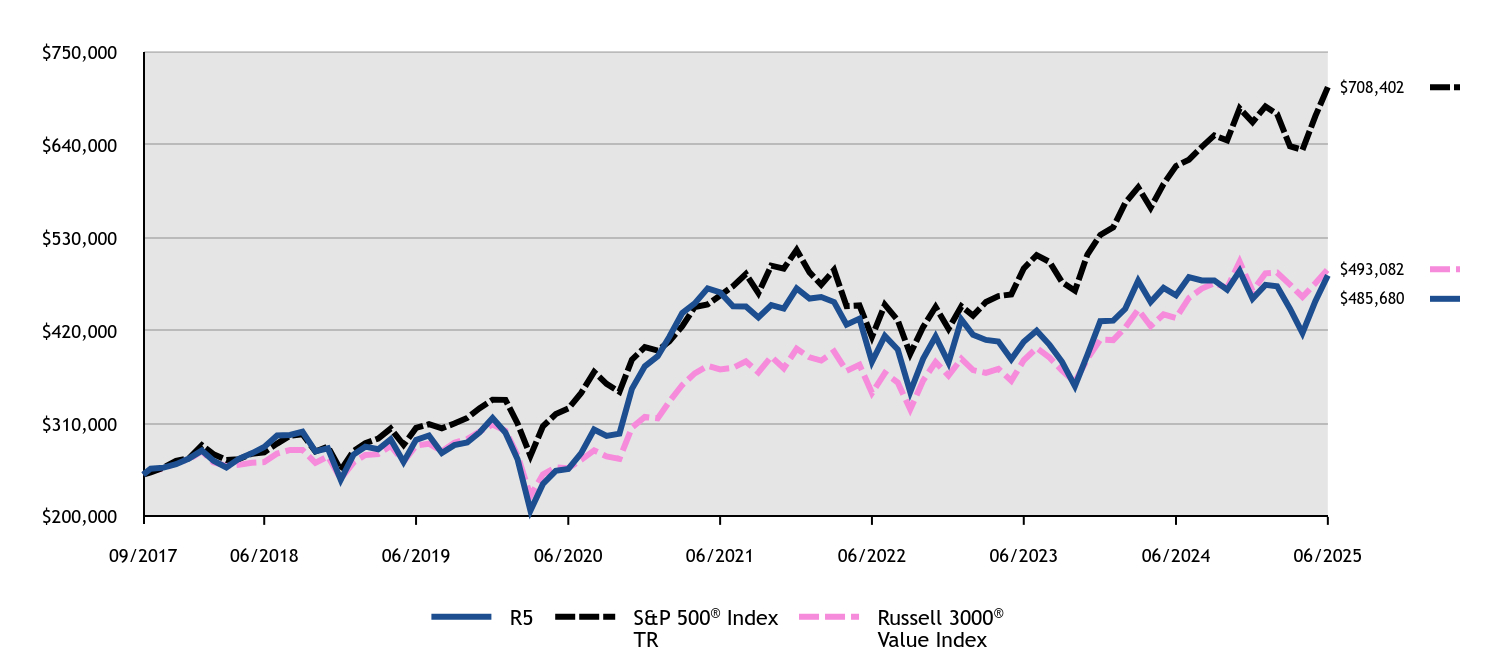

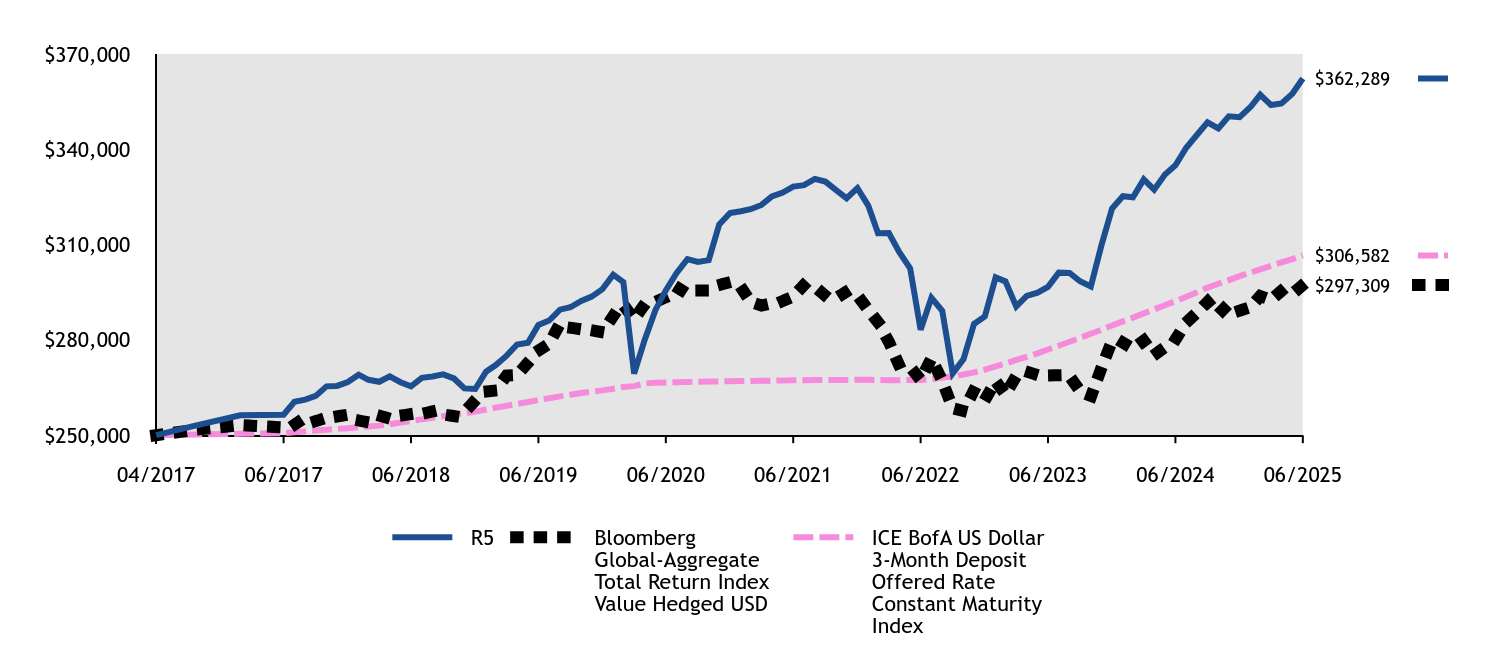

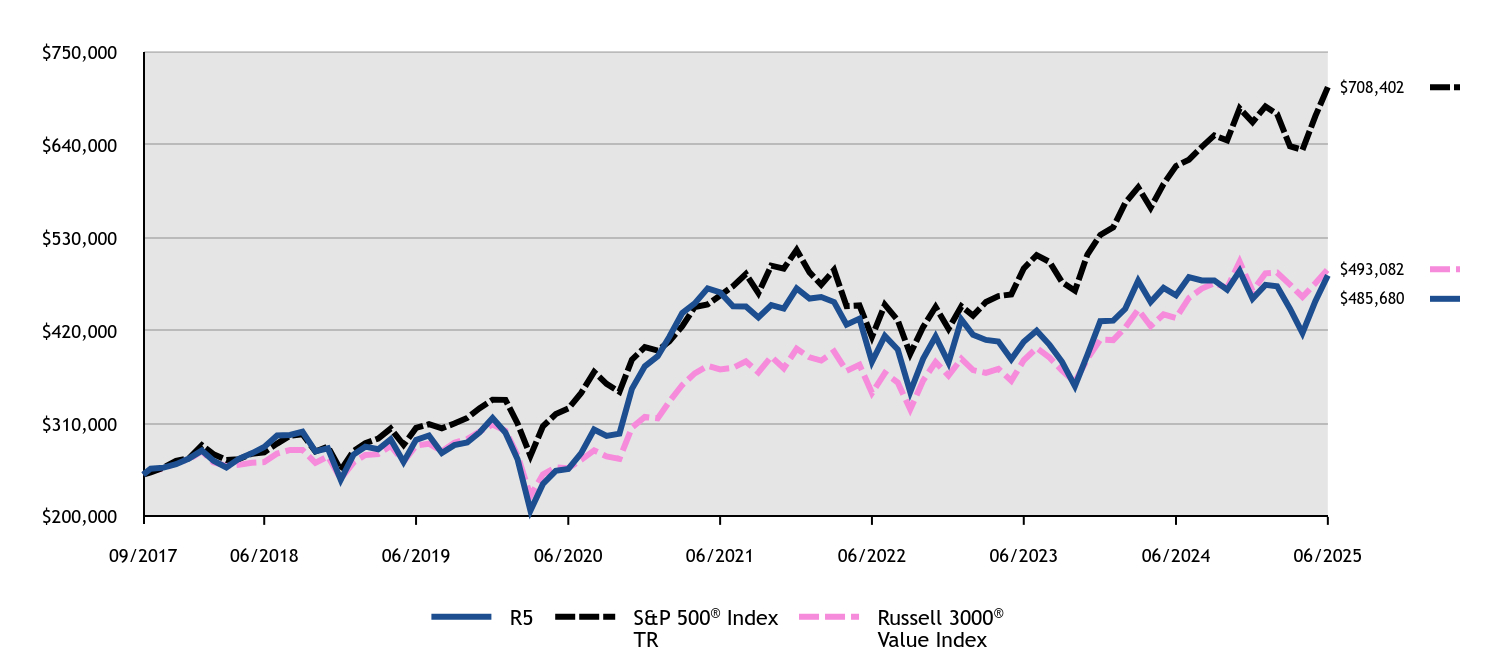

| Factors Affecting Performance [Text Block] |

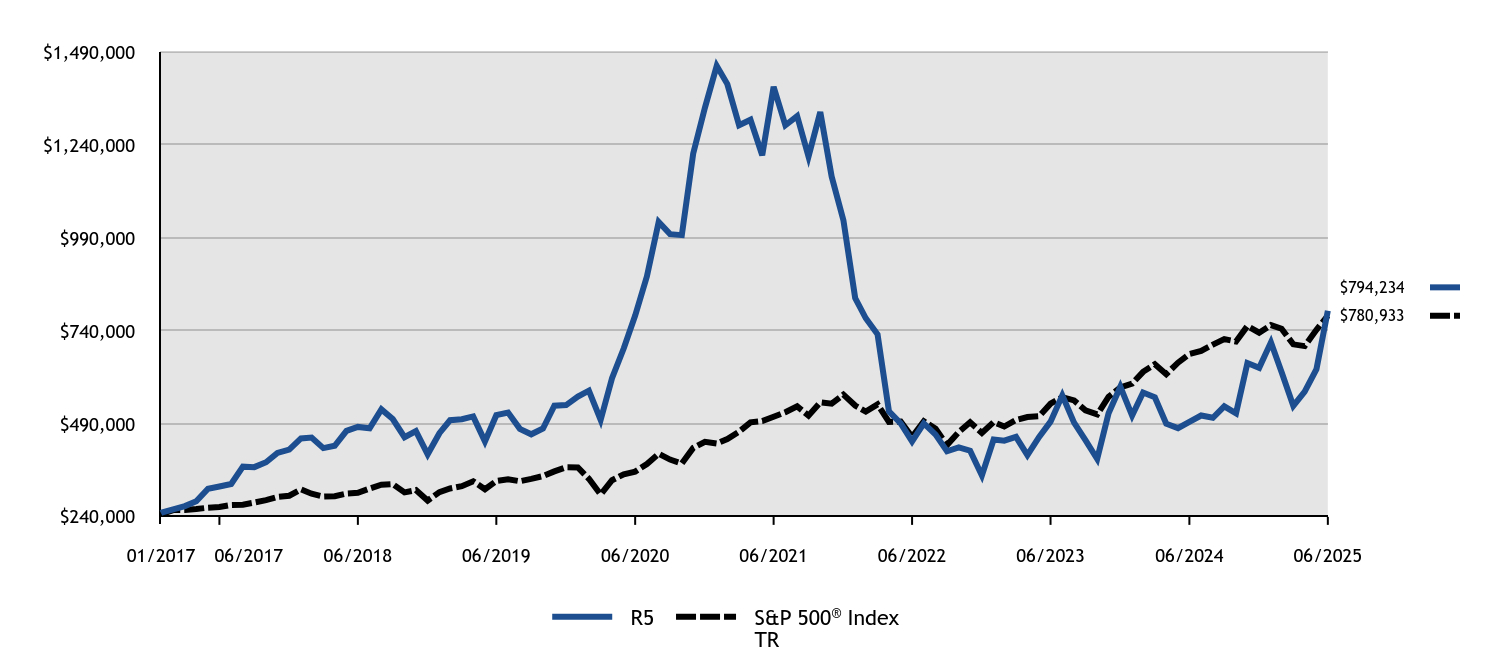

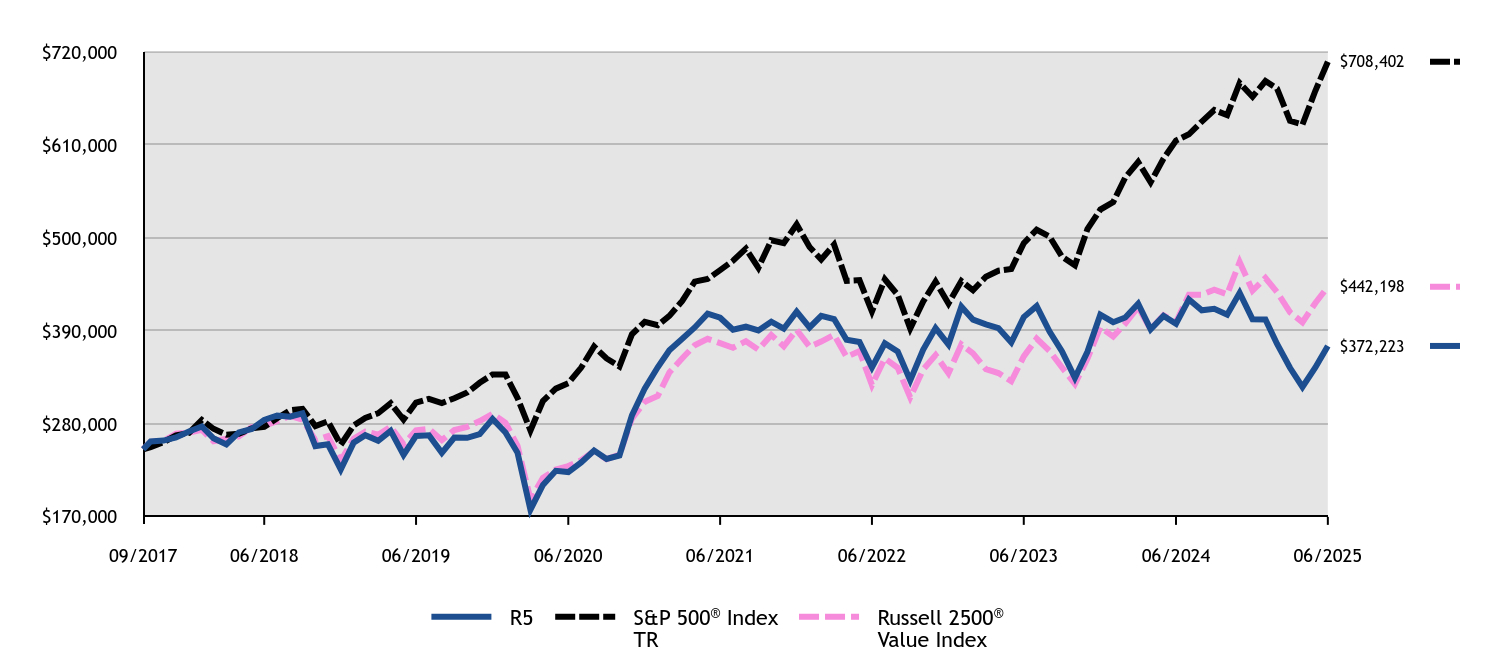

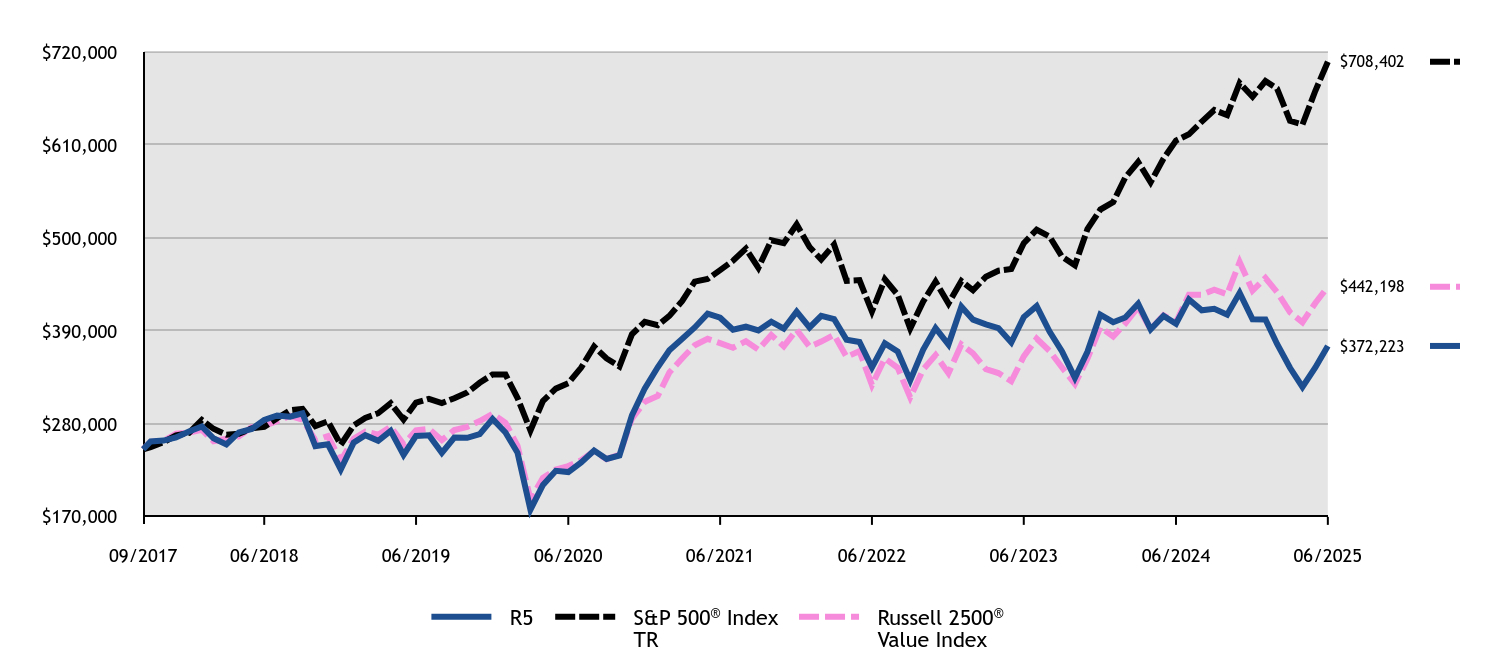

How did the Fund perform and what affected its performance? The R5 Class of the Fund returned 60.22% for the twelve months ended June 30, 2025, compared to the S&P 500 Index return of 15.16%. • The headwinds that once pressured disruptive technologies lessened due to broader market participation, favorable policy shifts around crypto, Artificial Intelligence, and healthcare, coupled with expectations for potential fiscal catalysts like tax cuts. • The Fund’s investments in software and capital markets companies materially helped performance for the period. Conversely, its investments in biotechnology and semiconductors and semiconductor equipment companies detracted from performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

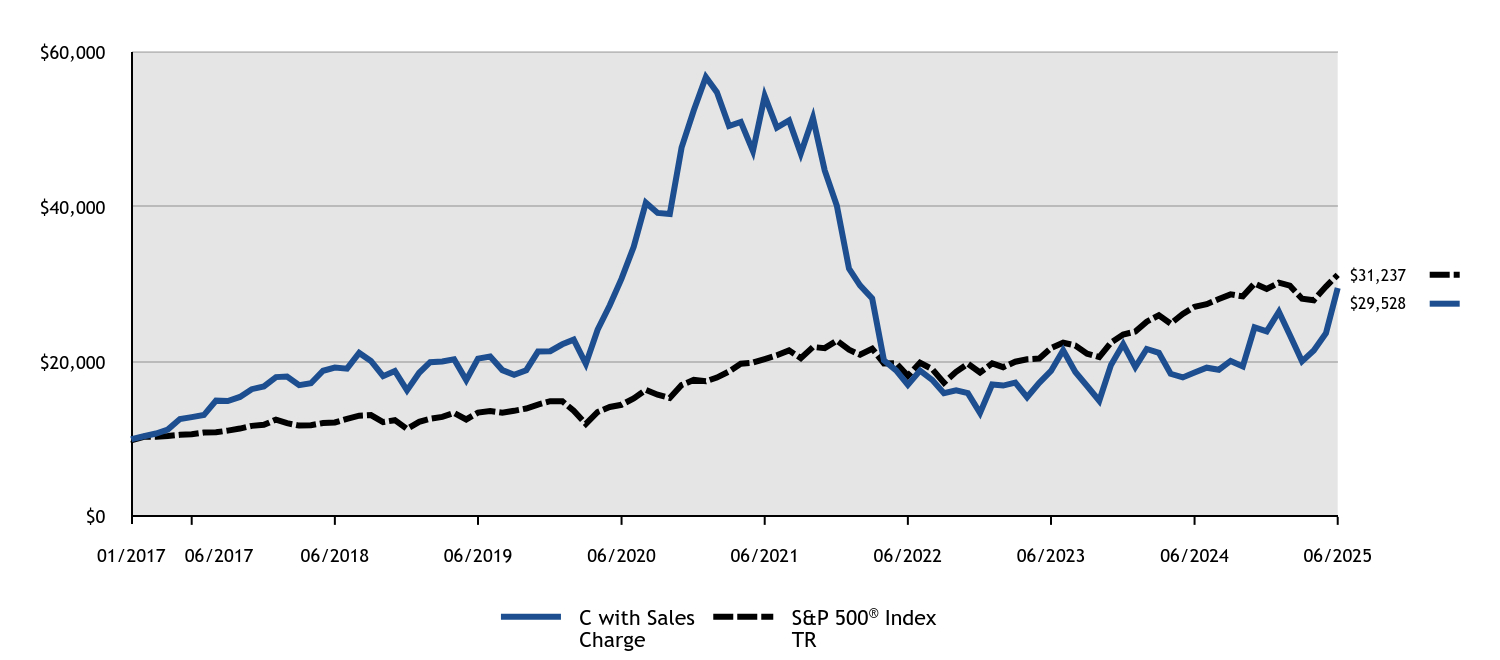

| Line Graph [Table Text Block] |

|

R5 |

S&P 500® Index TR |

01/2017 |

$250,000 |

$250,000 |

01/2017 |

$252,000 |

$248,289 |

02/2017 |

$260,000 |

$258,148 |

03/2017 |

$269,000 |

$258,449 |

04/2017 |

$281,750 |

$261,103 |

05/2017 |

$315,500 |

$264,778 |

06/2017 |

$321,750 |

$266,431 |

07/2017 |

$328,500 |

$271,909 |

08/2017 |

$375,000 |

$272,742 |

09/2017 |

$373,750 |

$278,368 |

10/2017 |

$387,000 |

$284,863 |

11/2017 |

$412,000 |

$293,600 |

12/2017 |

$420,702 |

$296,864 |

01/2018 |

$451,011 |

$313,861 |

02/2018 |

$453,084 |

$302,293 |

03/2018 |

$424,847 |

$294,611 |

04/2018 |

$431,064 |

$295,741 |

05/2018 |

$471,476 |

$302,863 |

06/2018 |

$481,838 |

$304,727 |

07/2018 |

$478,212 |

$316,068 |

08/2018 |

$528,986 |

$326,367 |

09/2018 |

$503,081 |

$328,224 |

10/2018 |

$454,120 |

$305,790 |

11/2018 |

$470,699 |

$312,022 |

12/2018 |

$408,171 |

$283,849 |

01/2019 |

$465,061 |

$306,595 |

02/2019 |

$499,857 |

$316,440 |

03/2019 |

$502,619 |

$322,589 |

04/2019 |

$510,075 |

$335,650 |

05/2019 |

$442,967 |

$314,320 |

06/2019 |

$513,389 |

$336,472 |

07/2019 |

$520,570 |

$341,308 |

08/2019 |

$476,659 |

$335,902 |

09/2019 |

$462,023 |

$342,187 |

10/2019 |

$477,488 |

$349,598 |

11/2019 |

$538,796 |

$362,288 |

12/2019 |

$540,571 |

$373,223 |

01/2020 |

$563,380 |

$373,076 |

02/2020 |

$579,346 |

$342,365 |

03/2020 |

$500,655 |

$300,079 |

04/2020 |

$612,704 |

$338,547 |

05/2020 |

$693,390 |

$354,671 |

06/2020 |

$781,490 |

$361,725 |

07/2020 |

$886,696 |

$382,120 |

08/2020 |

$1,032,958 |

$409,588 |

09/2020 |

$1,000,170 |

$394,025 |

10/2020 |

$997,604 |

$383,546 |

11/2020 |

$1,216,854 |

$425,530 |

12/2020 |

$1,340,451 |

$441,891 |

01/2021 |

$1,452,728 |

$437,430 |

02/2021 |

$1,403,750 |

$449,492 |

03/2021 |

$1,292,905 |

$469,178 |

04/2021 |

$1,307,799 |

$494,217 |

05/2021 |

$1,212,421 |

$497,669 |

06/2021 |

$1,396,303 |

$509,287 |

07/2021 |

$1,292,905 |

$521,385 |

08/2021 |

$1,317,823 |

$537,238 |

09/2021 |

$1,208,697 |

$512,251 |

10/2021 |

$1,328,707 |

$548,141 |

11/2021 |

$1,154,850 |

$544,343 |

12/2021 |

$1,037,513 |

$568,738 |

01/2022 |

$828,361 |

$539,307 |

02/2022 |

$774,011 |

$523,160 |

03/2022 |

$730,907 |

$542,585 |

04/2022 |

$524,004 |

$495,270 |

05/2022 |

$491,394 |

$496,179 |

06/2022 |

$443,042 |

$455,222 |

07/2022 |

$491,394 |

$497,196 |

08/2022 |

$461,033 |

$476,919 |

09/2022 |

$416,429 |

$432,996 |

10/2022 |

$426,924 |

$468,052 |

11/2022 |

$417,929 |

$494,208 |

12/2022 |

$351,398 |

$465,735 |

01/2023 |

$448,166 |

$494,999 |

02/2023 |

$444,886 |

$482,921 |

03/2023 |

$455,137 |

$500,651 |

04/2023 |

$405,933 |

$508,466 |

05/2023 |

$455,137 |

$510,676 |

06/2023 |

$496,140 |

$544,419 |

07/2023 |

$566,666 |

$561,908 |

08/2023 |

$493,270 |

$552,962 |

09/2023 |

$446,116 |

$526,598 |

10/2023 |

$395,682 |

$515,525 |

11/2023 |

$518,692 |

$562,606 |

12/2023 |

$590,038 |

$588,165 |

01/2024 |

$512,541 |

$598,049 |

02/2024 |

$574,456 |

$629,982 |

03/2024 |

$561,745 |

$650,251 |

04/2024 |

$490,400 |

$623,692 |

05/2024 |

$478,509 |

$654,618 |

06/2024 |

$495,730 |

$678,107 |

07/2024 |

$512,541 |

$686,361 |

08/2024 |

$506,391 |

$703,010 |

09/2024 |

$537,143 |

$718,024 |

10/2024 |

$518,692 |

$711,513 |

11/2024 |

$653,593 |

$753,279 |

12/2024 |

$640,882 |

$735,322 |

01/2025 |

$709,357 |

$755,799 |

02/2025 |

$629,401 |

$745,938 |

03/2025 |

$538,373 |

$703,908 |

04/2025 |

$576,506 |

$699,135 |

05/2025 |

$637,191 |

$743,142 |

06/2025 |

$794,234 |

$780,933 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (1/27/17) |

Class R5Footnote Reference1 |

60.22% |

0.32% |

14.71% |

S&P 500® Index TR |

15.16% |

16.64% |

14.48% | |

|

| Performance Inception Date |

Jan. 27, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| AssetsNet |

$ 203,610,644

|

|

| Holdings Count | Holding |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,502,796

|

|

| InvestmentCompanyPortfolioTurnover |

46.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$203,610,644 |

# of Portfolio Holdings |

42 |

Portfolio Turnover Rate |

46% |

Total Management Fees Paid |

$1,502,796 | |

|

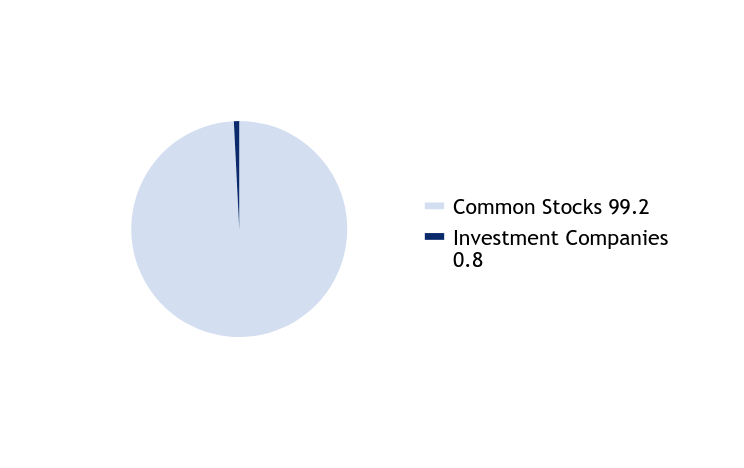

| Holdings [Text Block] |

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

85.2 |

Foreign Common Stocks |

10.7 |

Securities Lending Collateral |

2.1 |

Investment Companies |

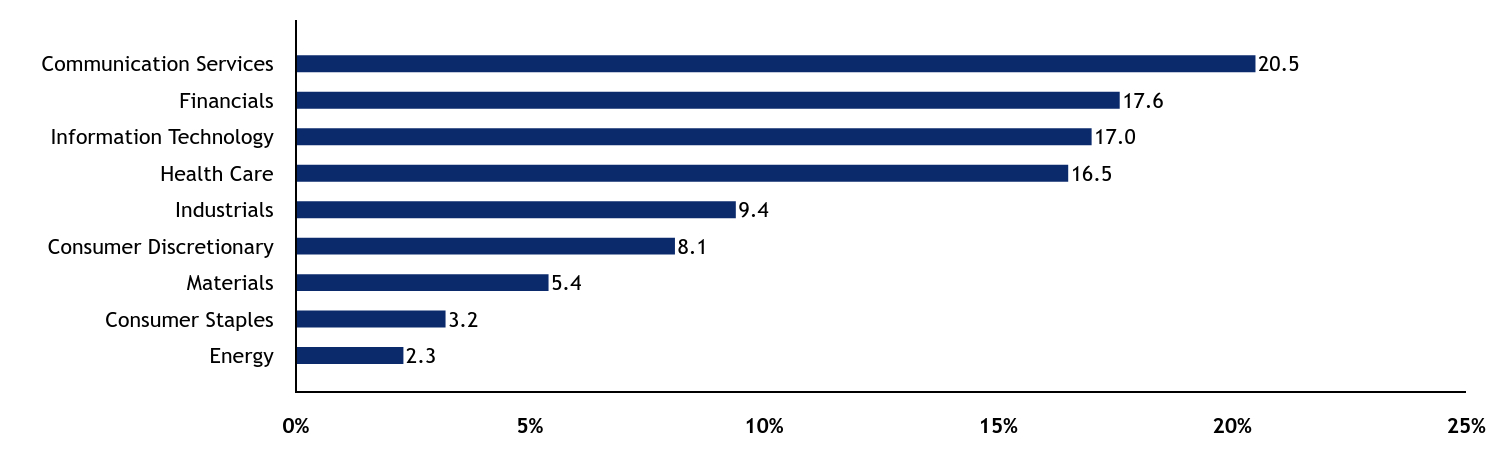

2.0 | Sector Allocation - % Equities

Value |

Value |

Industrials |

5.5 |

Consumer Discretionary |

14.1 |

Financials |

16.0 |

Communication Services |

18.8 |

Health Care |

22.6 |

Information Technology |

23.0 | |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Tesla, Inc. |

9.5 |

Coinbase Global, Inc., Class A |

8.0 |

Roku, Inc. |

7.4 |

ROBLOX Corp., Class A |

6.4 |

Robinhood Markets, Inc., Class A |

5.5 |

CRISPR Therapeutics AG |

5.1 |

Shopify, Inc., Class A |

4.8 |

Tempus AI, Inc. |

4.7 |

Circle Internet Group, Inc. |

4.5 |

Palantir Technologies, Inc., Class A |

4.1 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

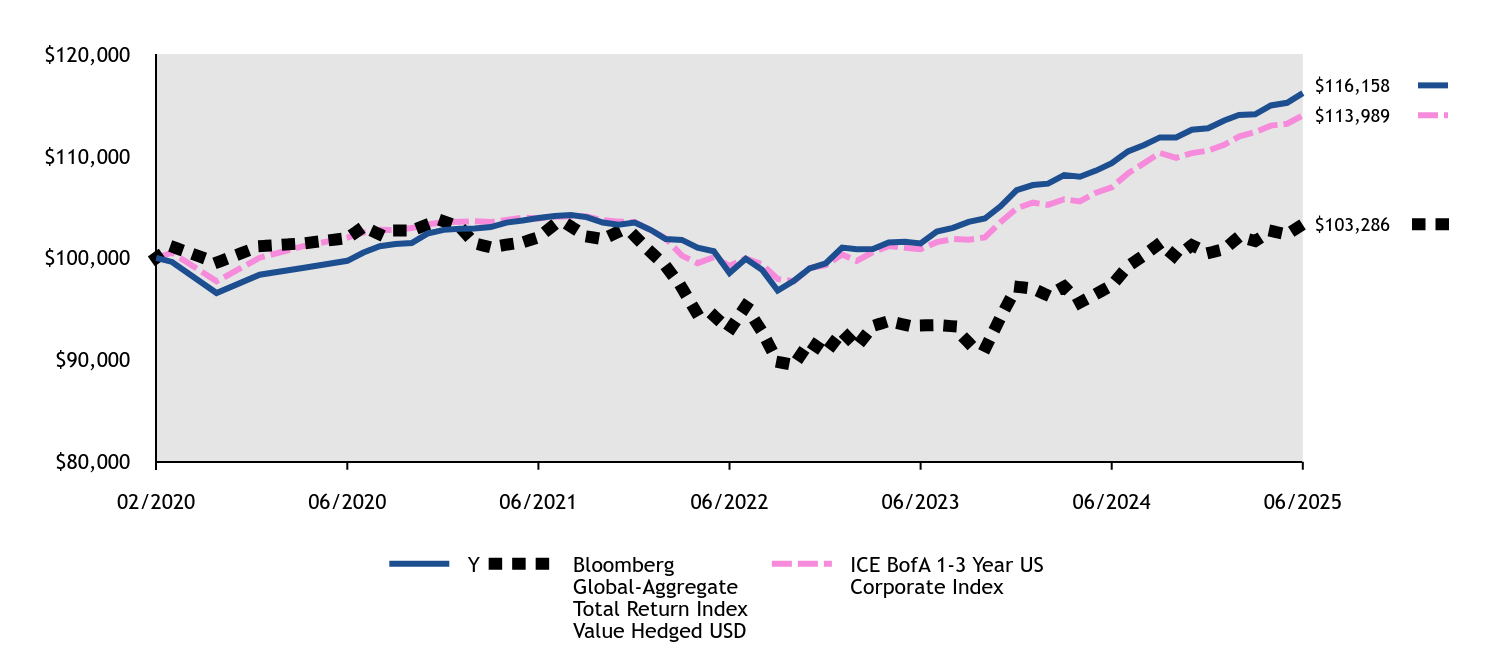

| C000176826 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

ARK Transformational Innovation Fund

|

|

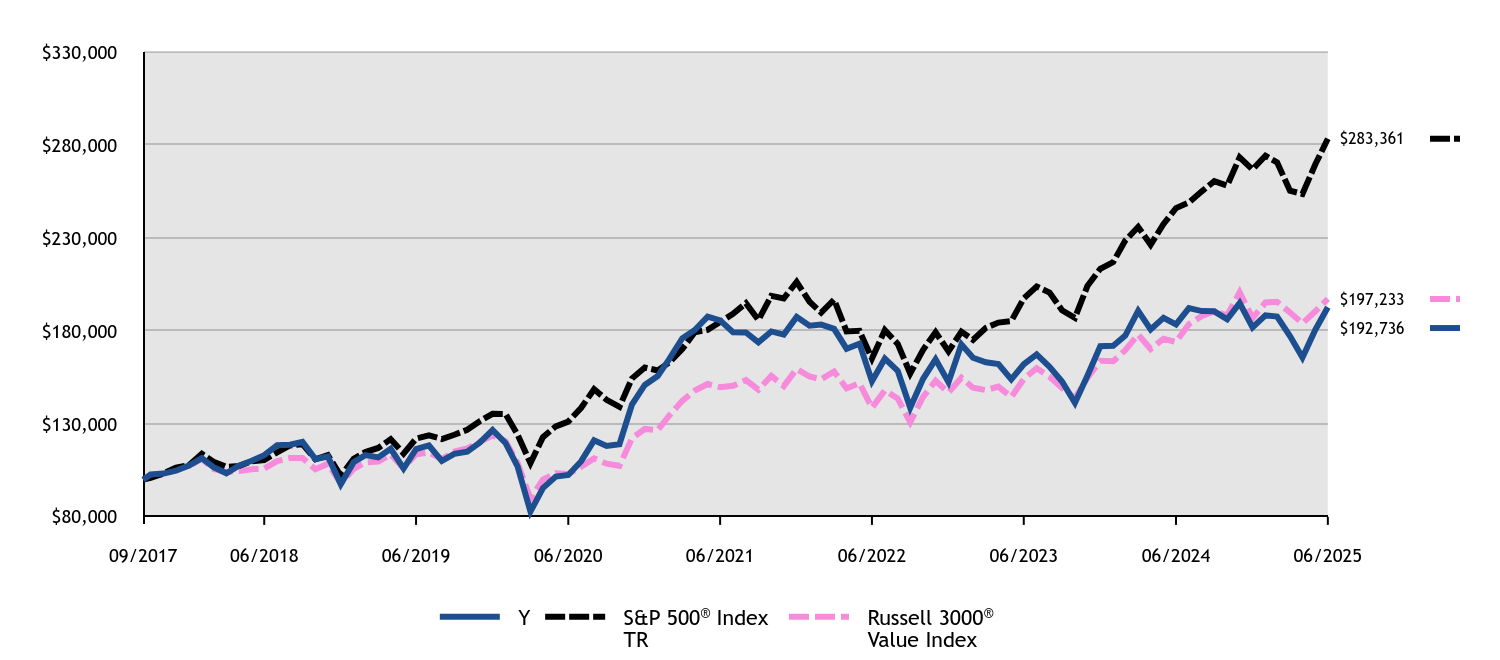

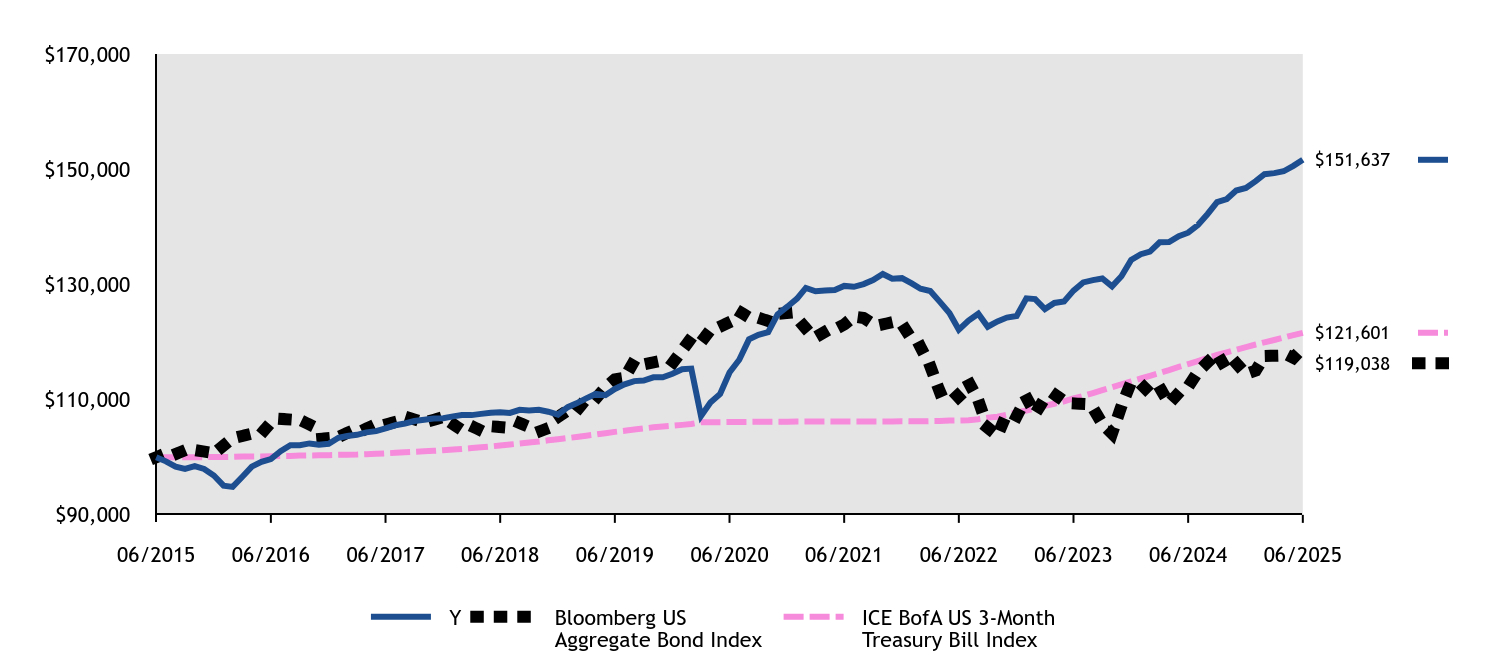

| Class Name |

Y

|

|

| Trading Symbol |

ADNYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon ARK Transformational Innovation Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Y |

$148 |

1.14% | |

|

| Expenses Paid, Amount |

$ 148

|

|

| Expense Ratio, Percent |

1.14%

|

|

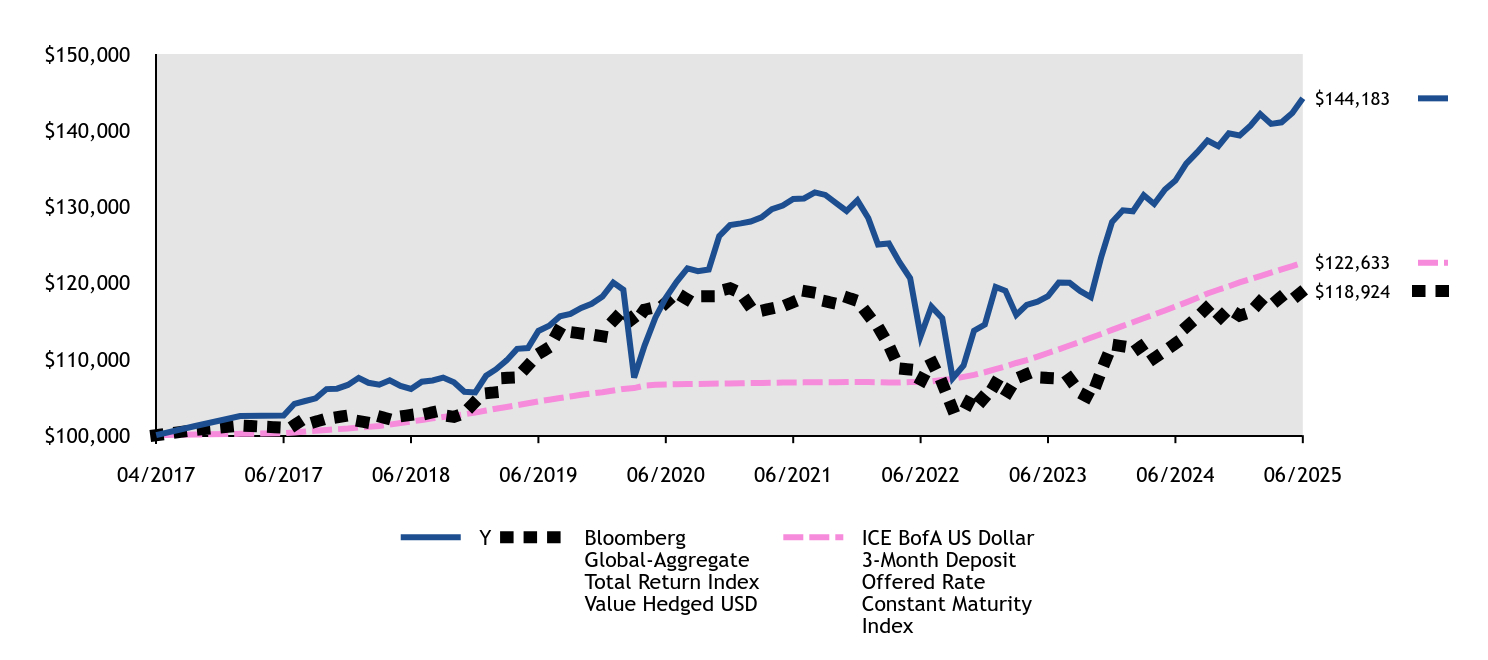

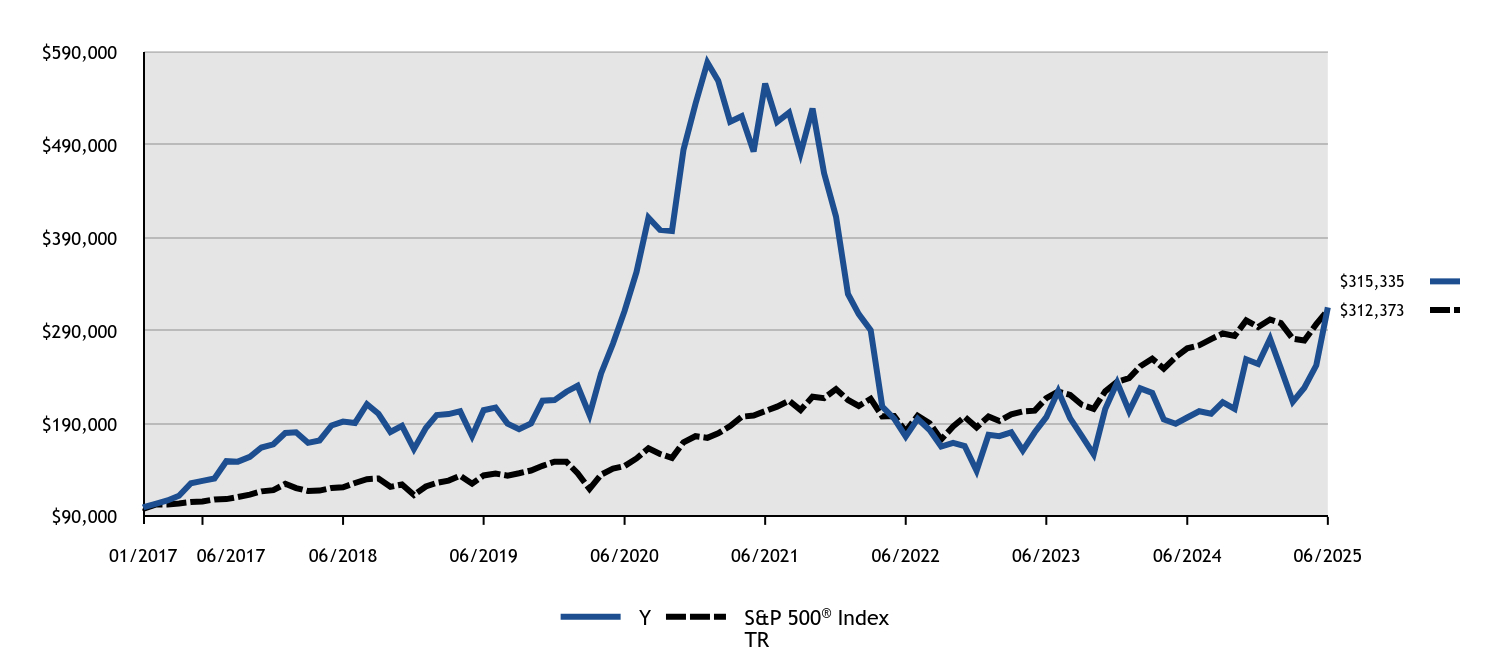

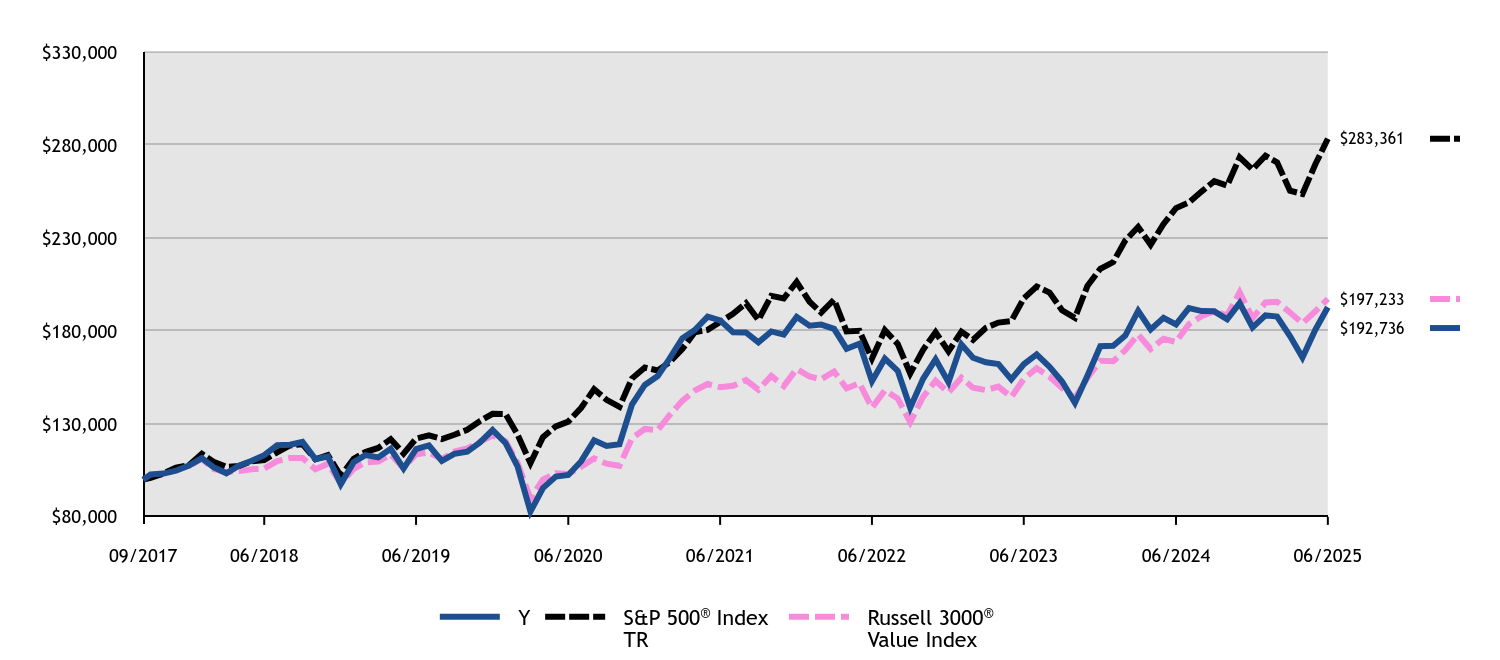

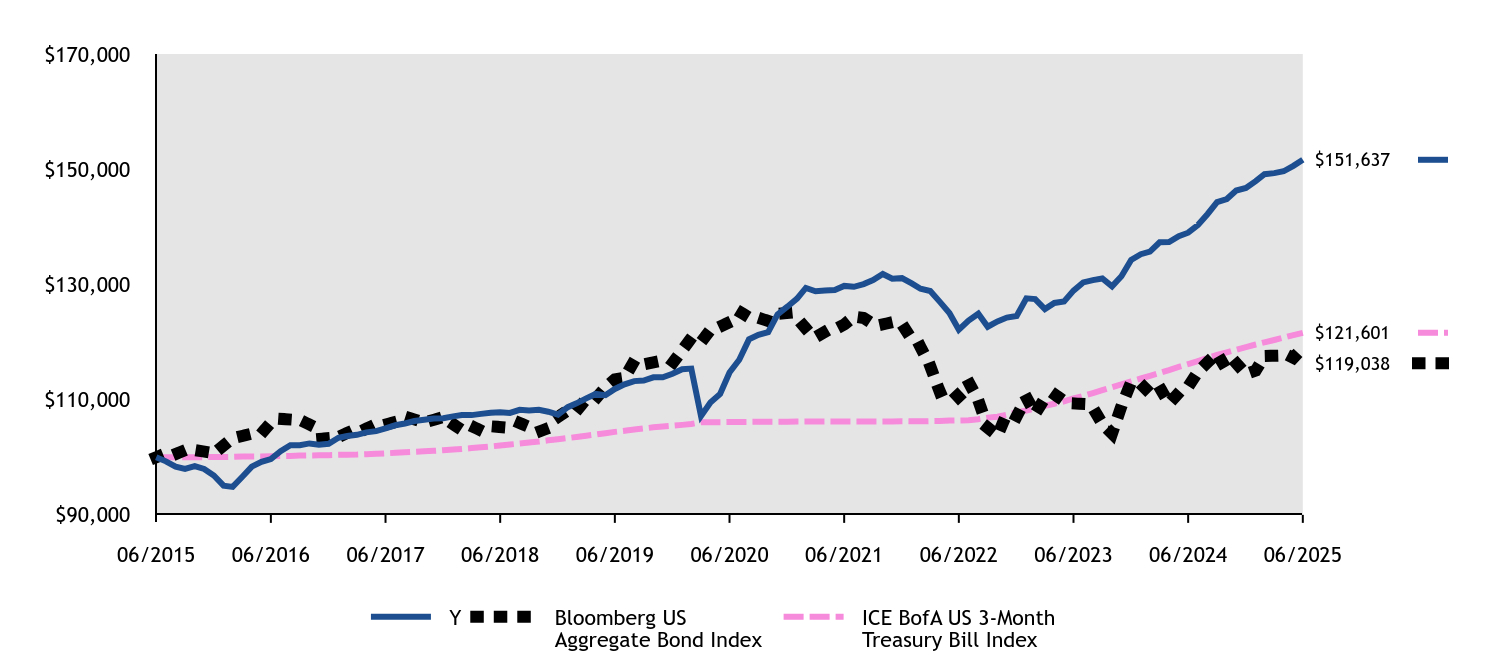

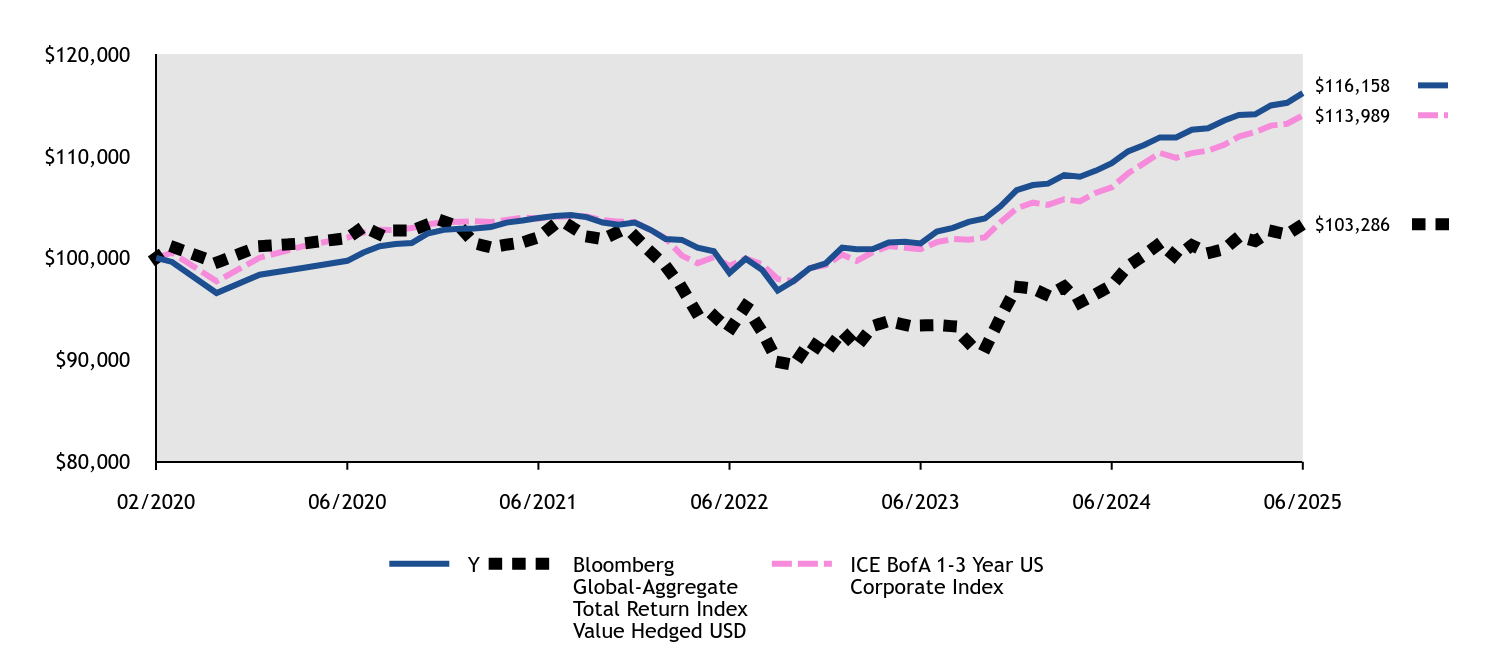

| Factors Affecting Performance [Text Block] |

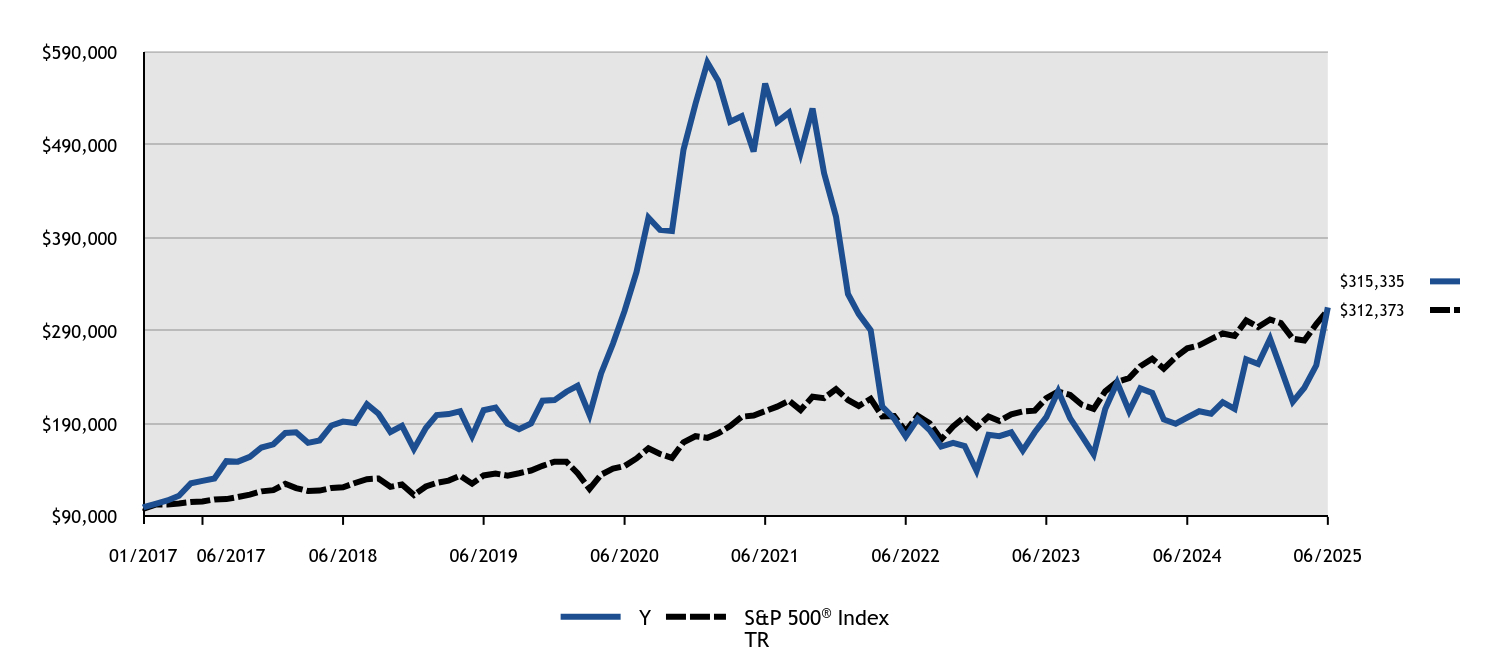

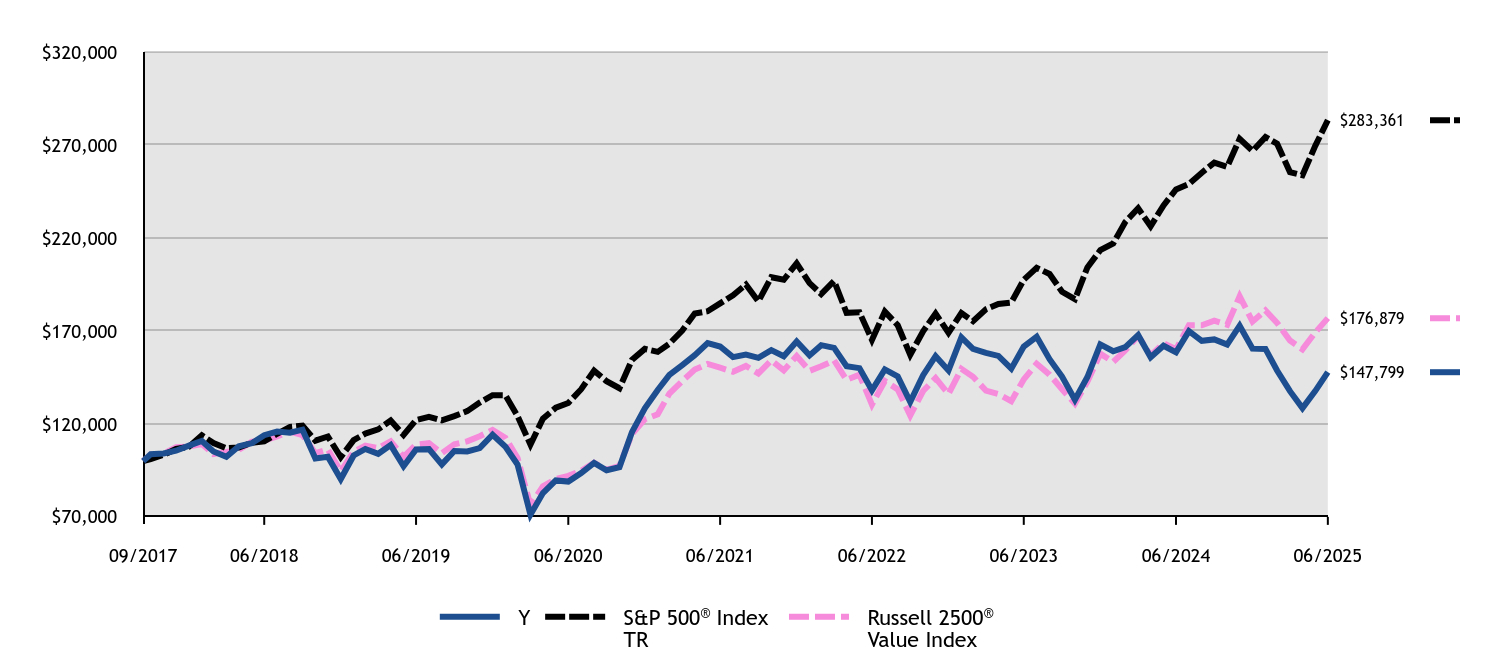

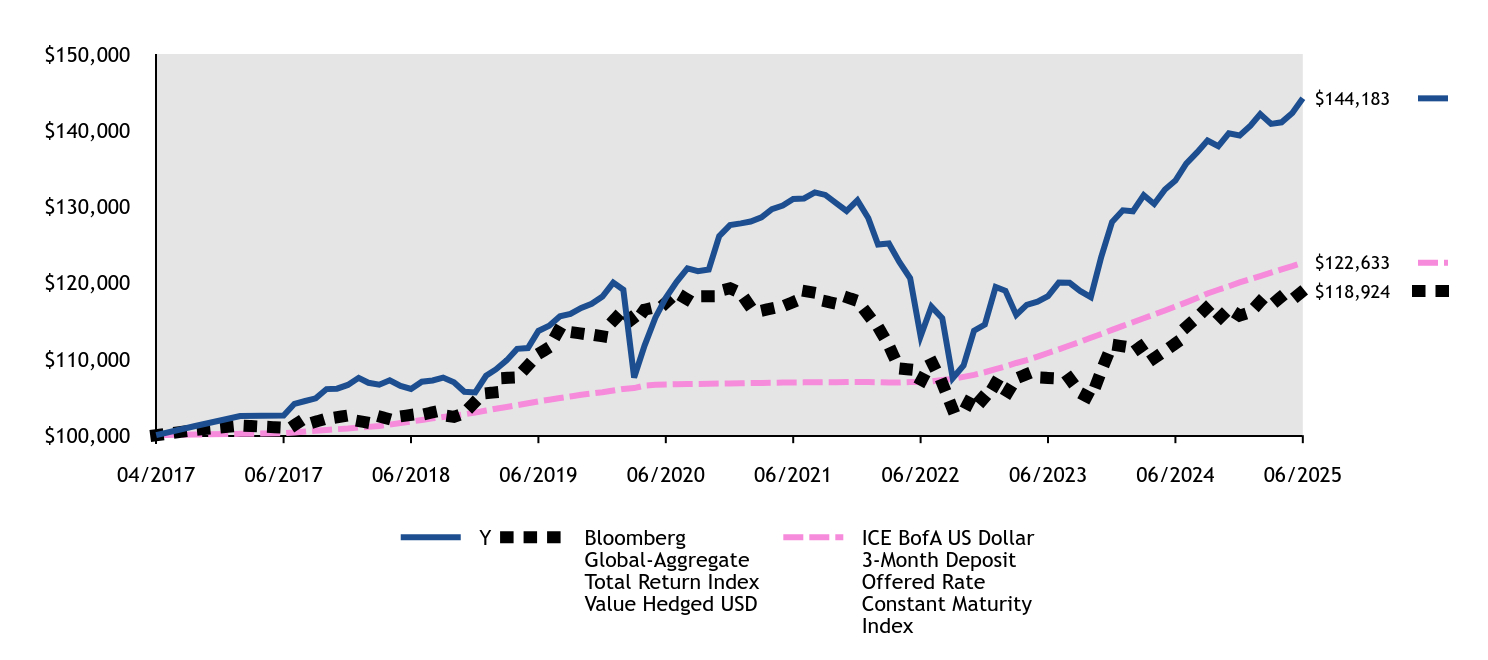

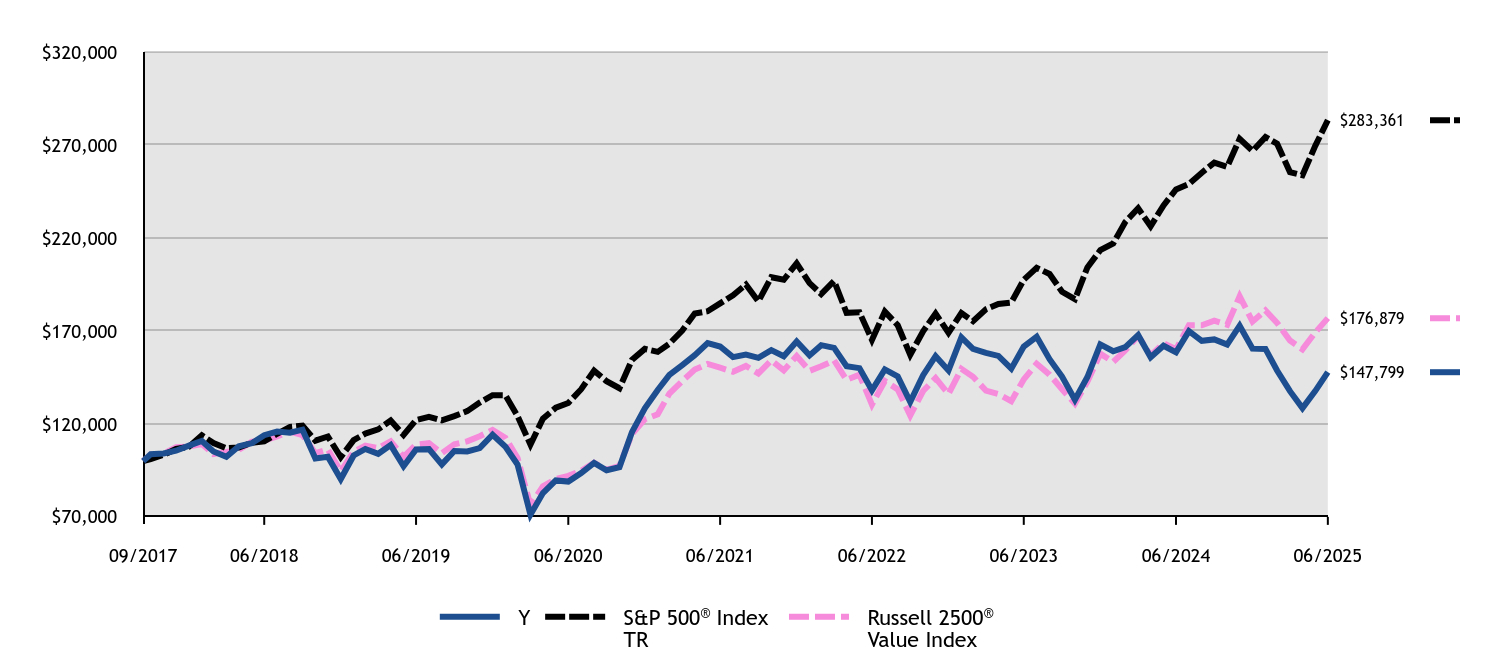

How did the Fund perform and what affected its performance? The Y Class of the Fund returned 60.17% for the twelve months ended June 30, 2025, compared to the S&P 500 Index return of 15.16%. • The headwinds that once pressured disruptive technologies lessened due to broader market participation, favorable policy shifts around crypto, Artificial Intelligence, and healthcare, coupled with expectations for potential fiscal catalysts like tax cuts. • The Fund’s investments in software and capital markets companies materially helped performance for the period. Conversely, its investments in biotechnology and semiconductors and semiconductor equipment companies detracted from performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

| Line Graph [Table Text Block] |

#ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value (#ERROR:Invalid Formula (#!=""), 'Multiple values from an iterator cannot be used in a formula unless they are aggregrated.') |

Y |

S&P 500® Index TR |

01/2017 |

$100,000 |

$100,000 |

01/2017 |

$100,800 |

$99,316 |

02/2017 |

$104,000 |

$103,259 |

03/2017 |

$107,600 |

$103,380 |

04/2017 |

$112,700 |

$104,441 |

05/2017 |

$126,200 |

$105,911 |

06/2017 |

$128,700 |

$106,572 |

07/2017 |

$131,300 |

$108,764 |

08/2017 |

$149,900 |

$109,097 |

09/2017 |

$149,400 |

$111,347 |

10/2017 |

$154,600 |

$113,945 |

11/2017 |

$164,600 |

$117,440 |

12/2017 |

$168,081 |

$118,746 |

01/2018 |

$180,205 |

$125,544 |

02/2018 |

$181,034 |

$120,917 |

03/2018 |

$169,635 |

$117,844 |

04/2018 |

$172,226 |

$118,297 |

05/2018 |

$188,288 |

$121,145 |

06/2018 |

$192,433 |

$121,891 |

07/2018 |

$190,982 |

$126,427 |

08/2018 |

$211,189 |

$130,547 |

09/2018 |

$200,930 |

$131,290 |

10/2018 |

$181,345 |

$122,316 |

11/2018 |

$187,977 |

$124,809 |

12/2018 |

$162,965 |

$113,540 |

01/2019 |

$185,614 |

$122,638 |

02/2019 |

$199,535 |

$126,576 |

03/2019 |

$200,530 |

$129,035 |

04/2019 |

$203,513 |

$134,260 |

05/2019 |

$176,775 |

$125,728 |

06/2019 |

$204,728 |

$134,589 |

07/2019 |

$207,601 |

$136,523 |

08/2019 |

$190,254 |

$134,361 |

09/2019 |

$184,288 |

$136,875 |

10/2019 |

$190,475 |

$139,839 |

11/2019 |

$214,893 |

$144,915 |

12/2019 |

$215,602 |

$149,289 |

01/2020 |

$224,614 |

$149,231 |

02/2020 |

$231,002 |

$136,946 |

03/2020 |

$199,632 |

$120,031 |

04/2020 |

$244,235 |

$135,419 |

05/2020 |

$276,404 |

$141,868 |

06/2020 |

$311,539 |

$144,690 |

07/2020 |

$353,519 |

$152,848 |

08/2020 |

$411,697 |

$163,835 |

09/2020 |

$398,579 |

$157,610 |

10/2020 |

$397,552 |

$153,418 |

11/2020 |

$484,934 |

$170,212 |

12/2020 |

$534,140 |

$176,757 |

01/2021 |

$578,823 |

$174,972 |

02/2021 |

$559,231 |

$179,797 |

03/2021 |

$515,006 |

$187,671 |

04/2021 |

$520,964 |

$197,687 |

05/2021 |

$482,925 |

$199,068 |

06/2021 |

$556,023 |

$203,715 |

07/2021 |

$514,777 |

$208,554 |

08/2021 |

$524,745 |

$214,895 |

09/2021 |

$481,207 |

$204,901 |

10/2021 |

$529,098 |

$219,256 |

11/2021 |

$459,667 |

$217,737 |

12/2021 |

$412,982 |

$227,495 |

01/2022 |

$329,786 |

$215,723 |

02/2022 |

$308,050 |

$209,264 |

03/2022 |

$290,812 |

$217,034 |

04/2022 |

$208,665 |

$198,108 |

05/2022 |

$195,623 |

$198,472 |

06/2022 |

$176,286 |

$182,089 |

07/2022 |

$195,473 |

$198,878 |

08/2022 |

$183,331 |

$190,768 |

09/2022 |

$165,643 |

$173,198 |

10/2022 |

$169,690 |

$187,221 |

11/2022 |

$166,242 |

$197,683 |

12/2022 |

$139,620 |

$186,294 |

01/2023 |

$178,340 |

$197,999 |

02/2023 |

$176,863 |

$193,168 |

03/2023 |

$180,965 |

$200,260 |

04/2023 |

$161,441 |

$203,386 |

05/2023 |

$180,965 |

$204,270 |

06/2023 |

$197,207 |

$217,767 |

07/2023 |

$225,263 |

$224,763 |

08/2023 |

$195,895 |

$221,185 |

09/2023 |

$177,191 |

$210,639 |

10/2023 |

$157,339 |

$206,210 |

11/2023 |

$206,067 |

$225,042 |

12/2023 |

$234,450 |

$235,266 |

01/2024 |

$203,606 |

$239,220 |

02/2024 |

$228,216 |

$251,993 |

03/2024 |

$223,294 |

$260,101 |

04/2024 |

$194,746 |

$249,477 |

05/2024 |

$190,153 |

$261,847 |

06/2024 |

$196,879 |

$271,243 |

07/2024 |

$203,606 |

$274,544 |

08/2024 |

$200,981 |

$281,204 |

09/2024 |

$213,286 |

$287,210 |

10/2024 |

$206,067 |

$284,605 |

11/2024 |

$259,552 |

$301,312 |

12/2024 |

$254,466 |

$294,129 |

01/2025 |

$281,537 |

$302,320 |

02/2025 |

$249,708 |

$298,375 |

03/2025 |

$213,778 |

$281,563 |

04/2025 |

$228,872 |

$279,654 |

05/2025 |

$252,990 |

$297,257 |

06/2025 |

$315,335 |

$312,373 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (1/27/17) |

Class YFootnote Reference1 |

60.17% |

0.24% |

14.61% |

S&P 500® Index TR |

15.16% |

16.64% |

14.48% | |

|

| Performance Inception Date |

Jan. 27, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| AssetsNet |

$ 203,610,644

|

|

| Holdings Count | Holding |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,502,796

|

|

| InvestmentCompanyPortfolioTurnover |

46.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$203,610,644 |

# of Portfolio Holdings |

42 |

Portfolio Turnover Rate |

46% |

Total Management Fees Paid |

$1,502,796 | |

|

| Holdings [Text Block] |

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

85.2 |

Foreign Common Stocks |

10.7 |

Securities Lending Collateral |

2.1 |

Investment Companies |

2.0 | Sector Allocation - % Equities

Value |

Value |

Industrials |

5.5 |

Consumer Discretionary |

14.1 |

Financials |

16.0 |

Communication Services |

18.8 |

Health Care |

22.6 |

Information Technology |

23.0 | |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Tesla, Inc. |

9.5 |

Coinbase Global, Inc., Class A |

8.0 |

Roku, Inc. |

7.4 |

ROBLOX Corp., Class A |

6.4 |

Robinhood Markets, Inc., Class A |

5.5 |

CRISPR Therapeutics AG |

5.1 |

Shopify, Inc., Class A |

4.8 |

Tempus AI, Inc. |

4.7 |

Circle Internet Group, Inc. |

4.5 |

Palantir Technologies, Inc., Class A |

4.1 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

| C000176825 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

ARK Transformational Innovation Fund

|

|

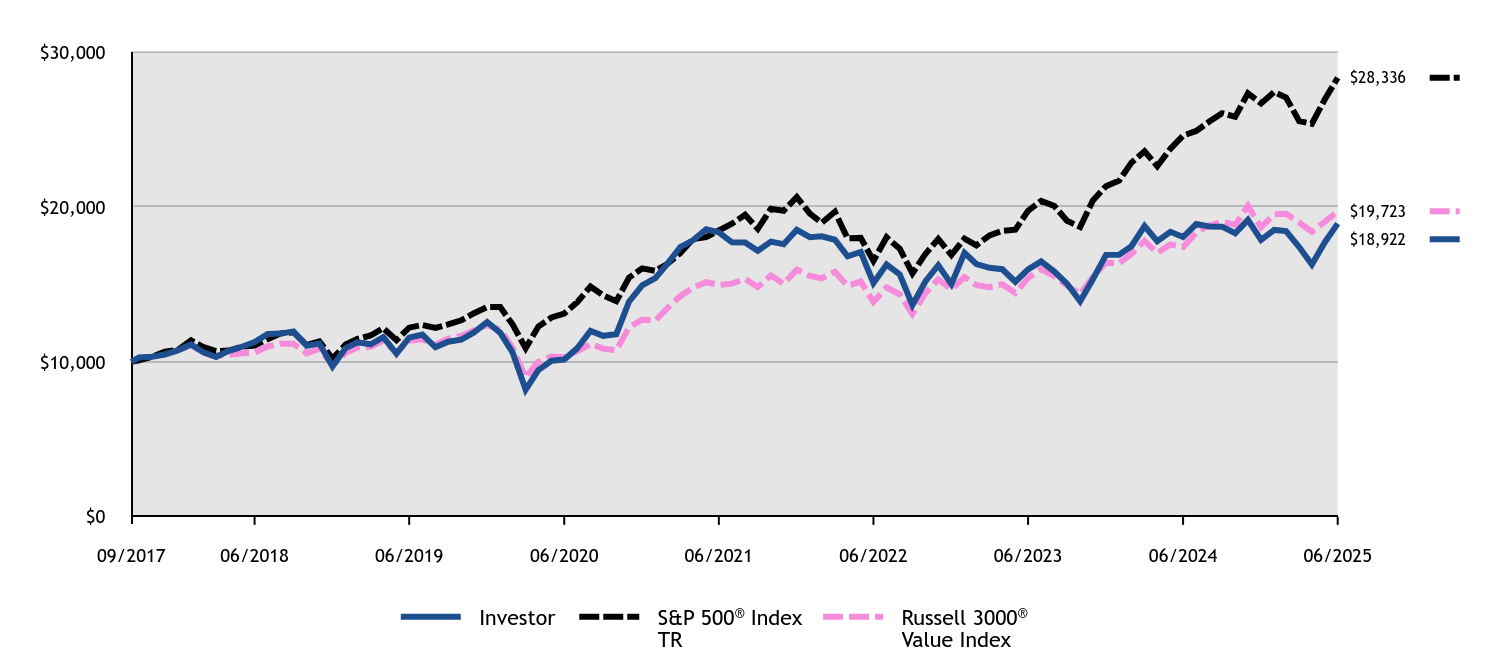

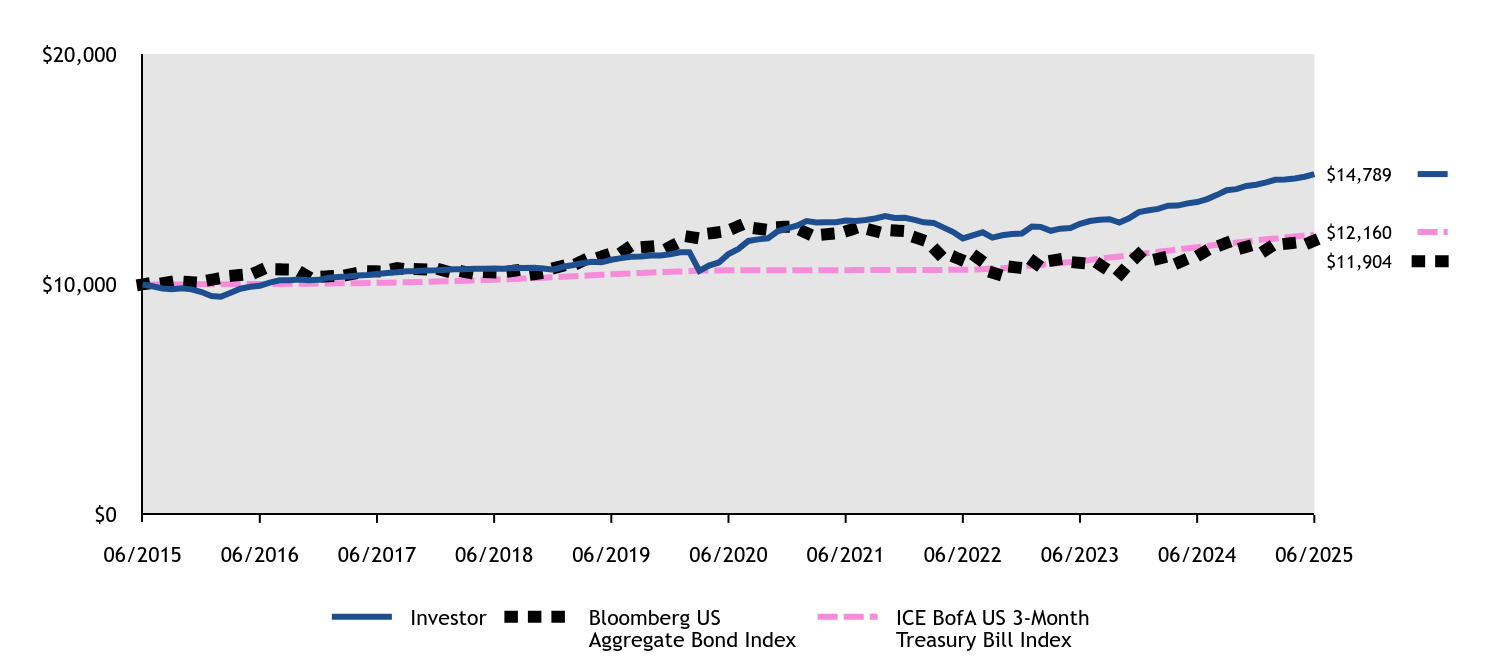

| Class Name |

Investor

|

|

| Trading Symbol |

ADNPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon ARK Transformational Innovation Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Investor |

$179 |

1.38% | |

|

| Expenses Paid, Amount |

$ 179

|

|

| Expense Ratio, Percent |

1.38%

|

|

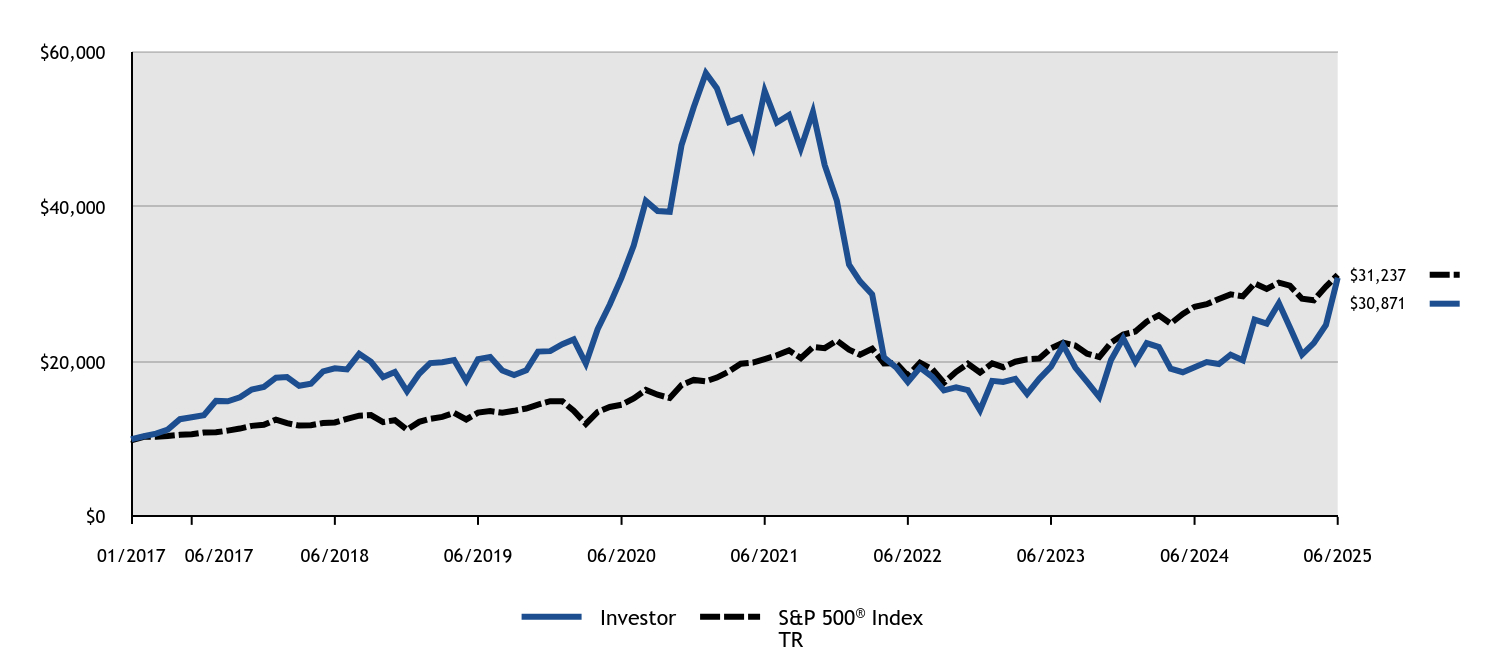

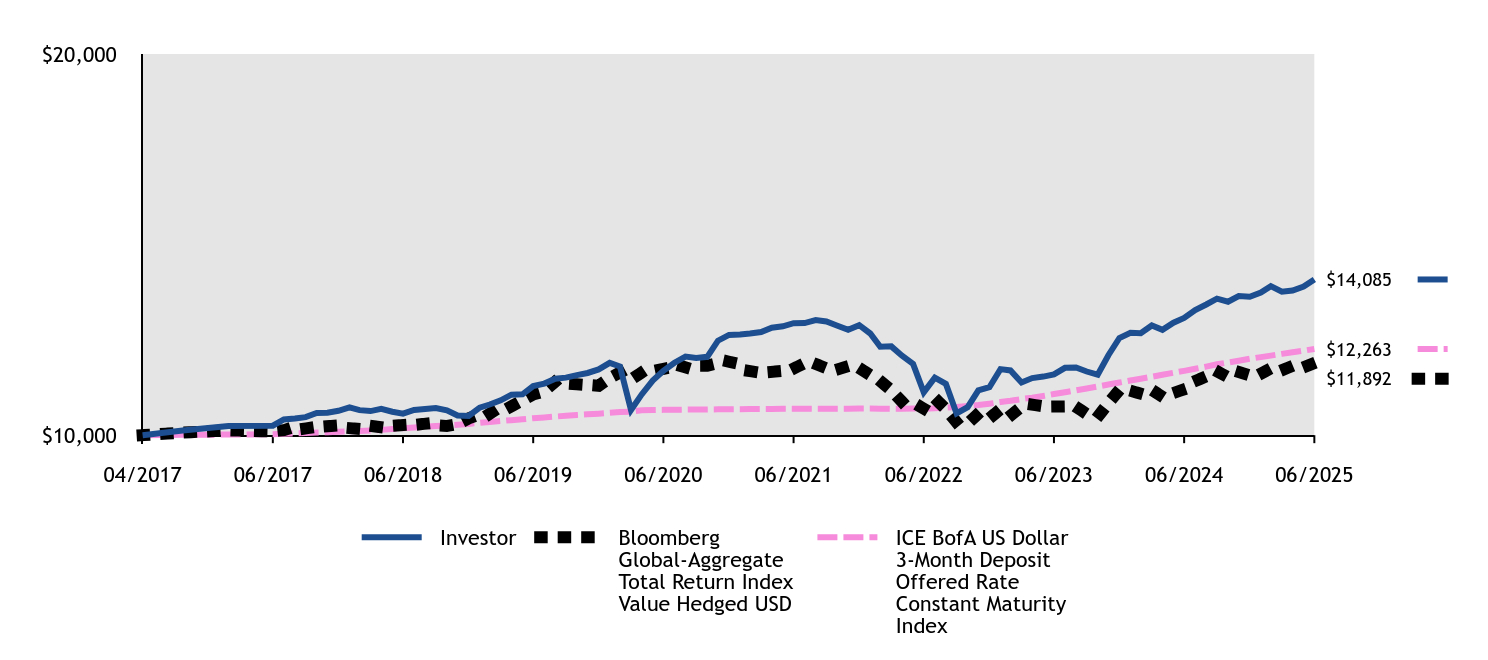

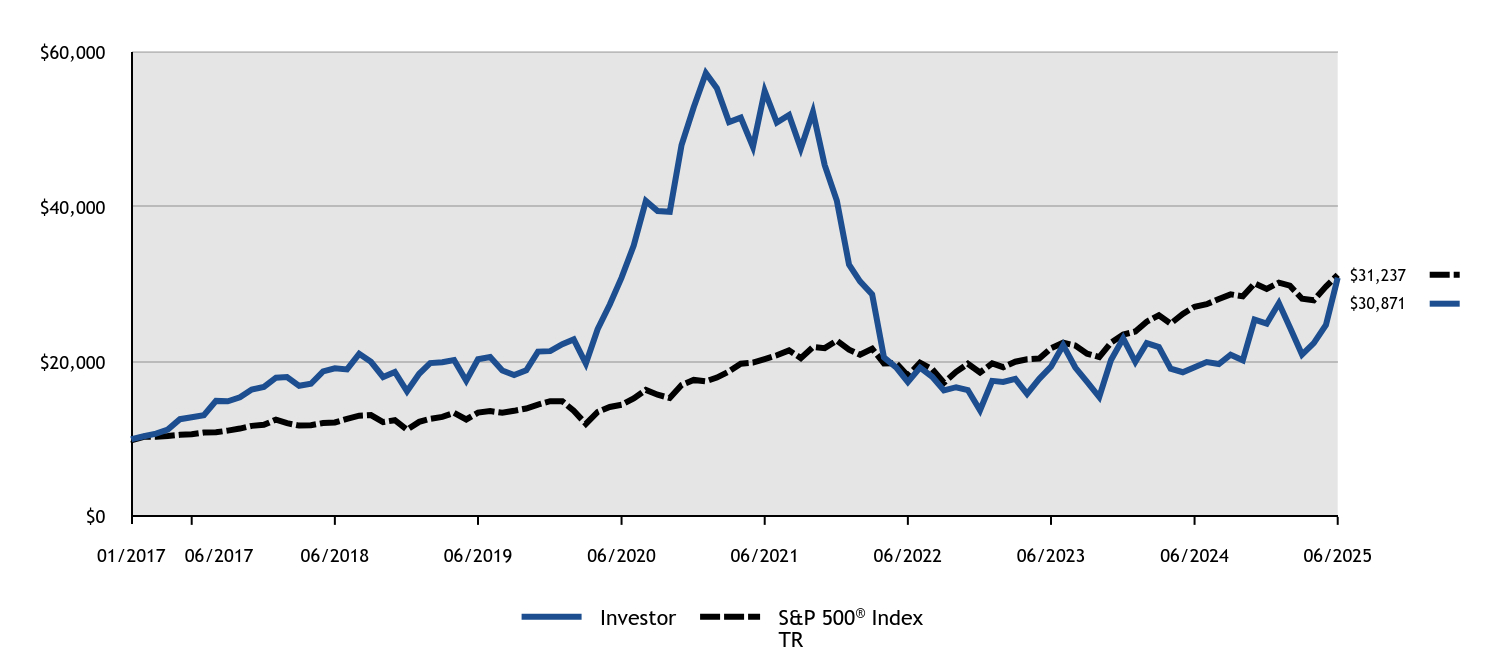

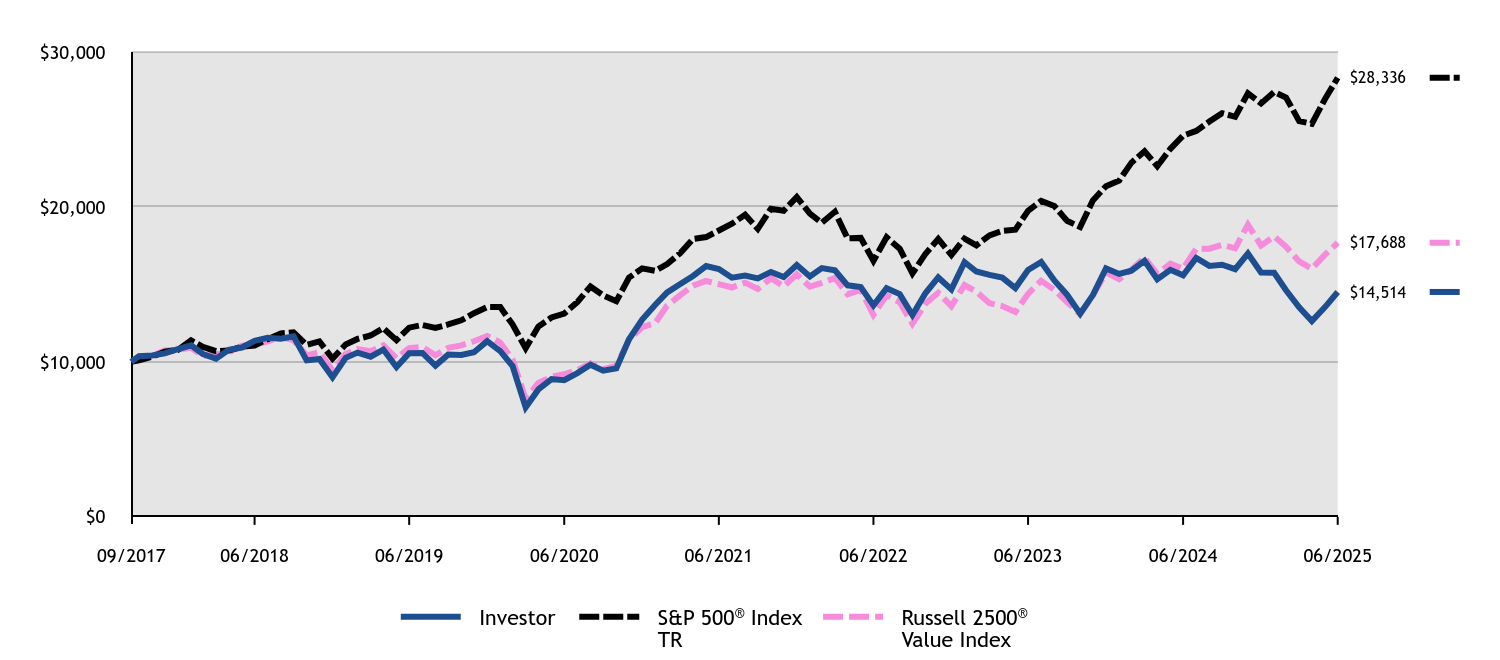

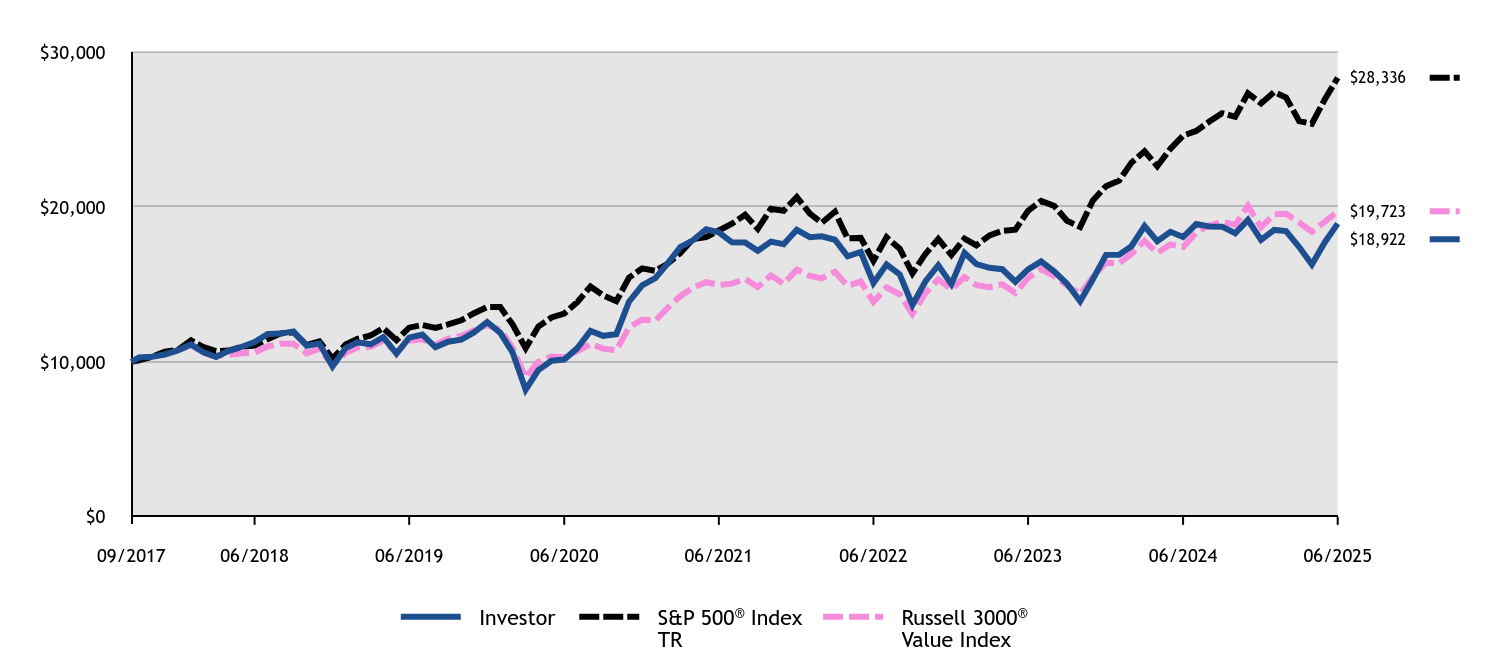

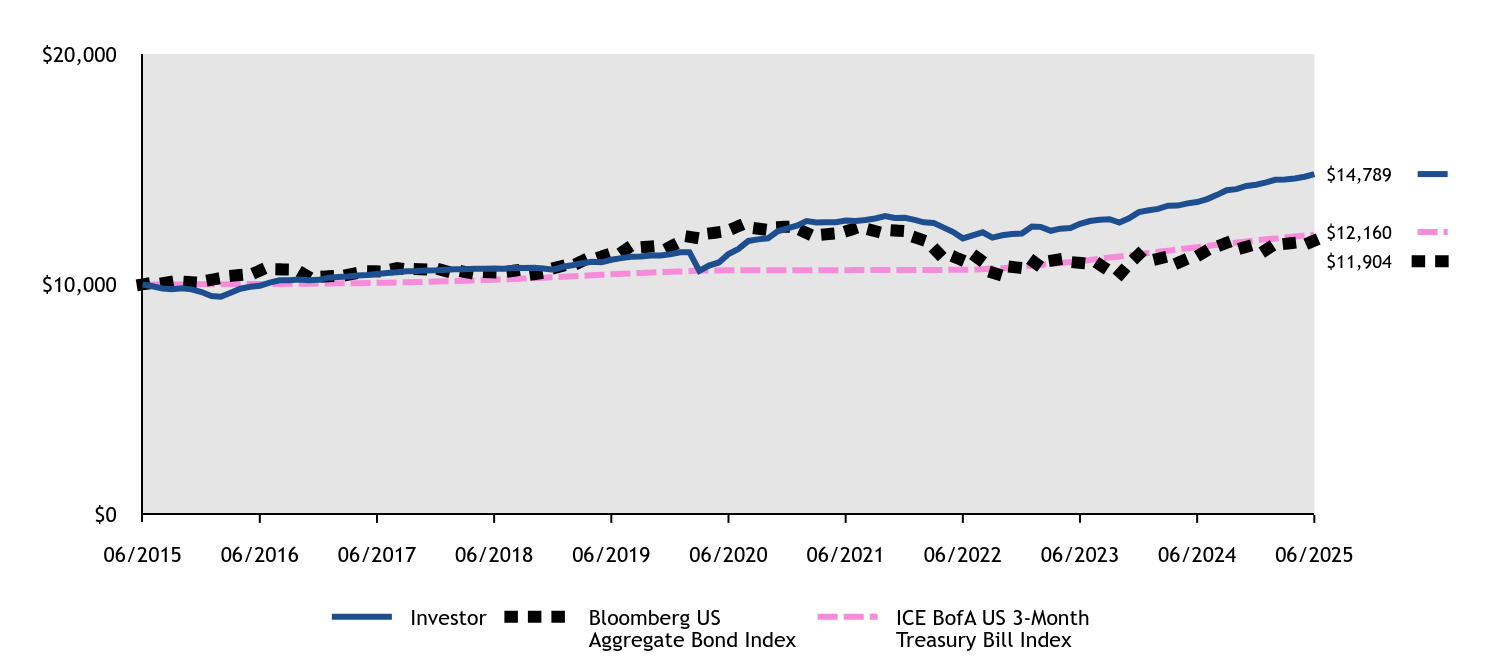

| Factors Affecting Performance [Text Block] |

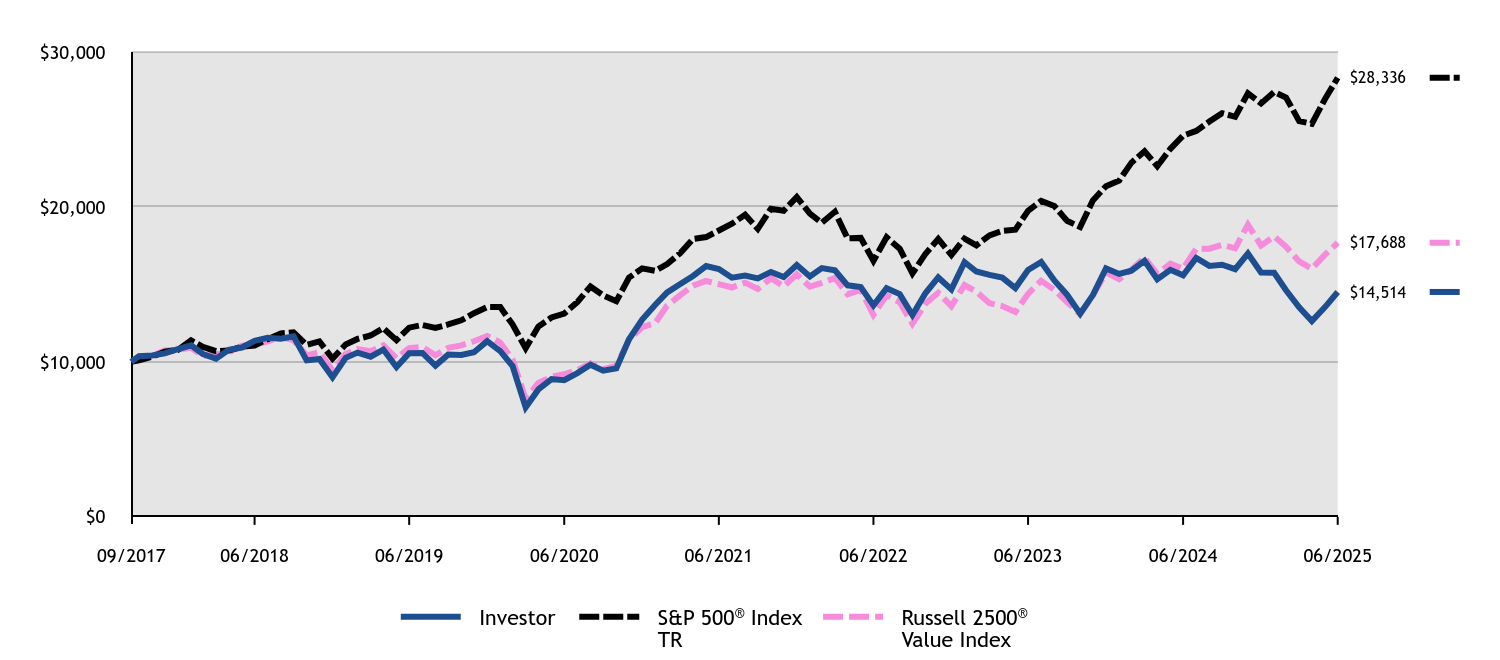

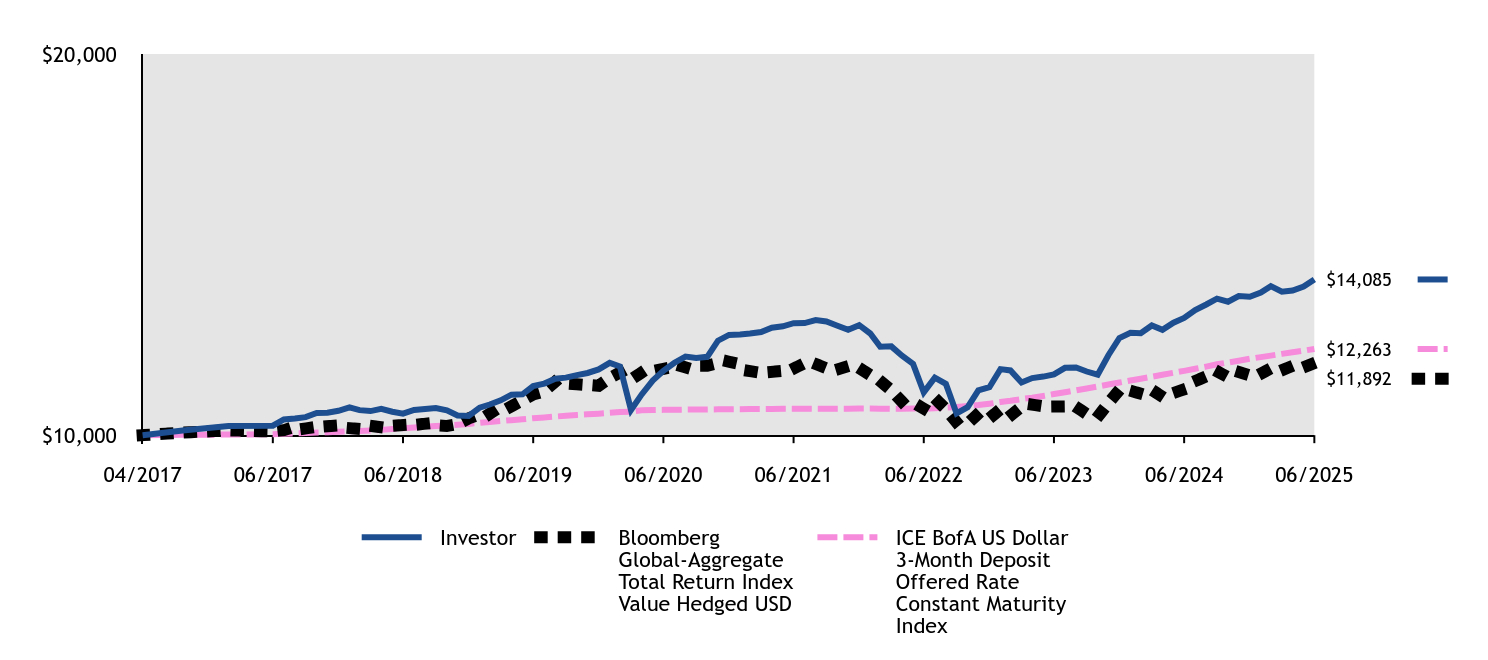

How did the Fund perform and what affected its performance? The Investor Class of the Fund returned 59.76% for the twelve months ended June 30, 2025, compared to the S&P 500 Index return of 15.16%. • The headwinds that once pressured disruptive technologies lessened due to broader market participation, favorable policy shifts around crypto, Artificial Intelligence, and healthcare, coupled with expectations for potential fiscal catalysts like tax cuts. • The Fund’s investments in software and capital markets companies materially helped performance for the period. Conversely, its investments in biotechnology and semiconductors and semiconductor equipment companies detracted from performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

| Line Graph [Table Text Block] |

|

Investor |

S&P 500® Index TR |

01/2017 |

$10,000 |

$10,000 |

01/2017 |

$10,080 |

$9,932 |

02/2017 |

$10,400 |

$10,326 |

03/2017 |

$10,750 |

$10,338 |

04/2017 |

$11,260 |

$10,444 |

05/2017 |

$12,610 |

$10,591 |

06/2017 |

$12,850 |

$10,657 |

07/2017 |

$13,120 |

$10,876 |

08/2017 |

$14,970 |

$10,910 |

09/2017 |

$14,920 |

$11,135 |

10/2017 |

$15,430 |

$11,395 |

11/2017 |

$16,430 |

$11,744 |

12/2017 |

$16,768 |

$11,875 |

01/2018 |

$17,970 |

$12,554 |

02/2018 |

$18,053 |

$12,092 |

03/2018 |

$16,913 |

$11,784 |

04/2018 |

$17,172 |

$11,830 |

05/2018 |

$18,768 |

$12,115 |

06/2018 |

$19,182 |

$12,189 |

07/2018 |

$19,037 |

$12,643 |

08/2018 |

$21,037 |

$13,055 |

09/2018 |

$20,011 |

$13,129 |

10/2018 |

$18,053 |

$12,232 |

11/2018 |

$18,706 |

$12,481 |

12/2018 |

$16,214 |

$11,257 |

01/2019 |

$18,469 |

$12,264 |

02/2019 |

$19,850 |

$12,658 |

03/2019 |

$19,950 |

$12,904 |

04/2019 |

$20,237 |

$13,426 |

05/2019 |

$17,573 |

$12,573 |

06/2019 |

$20,348 |

$13,459 |

07/2019 |

$20,635 |

$13,652 |

08/2019 |

$18,889 |

$13,436 |

09/2019 |

$18,303 |

$13,687 |

10/2019 |

$18,911 |

$13,984 |

11/2019 |

$21,331 |

$14,492 |

12/2019 |

$21,391 |

$14,929 |

01/2020 |

$22,293 |

$14,923 |

02/2020 |

$22,909 |

$13,695 |

03/2020 |

$19,793 |

$12,003 |

04/2020 |

$24,222 |

$13,542 |

05/2020 |

$27,407 |

$14,187 |

06/2020 |

$30,877 |

$14,469 |

07/2020 |

$35,020 |

$15,285 |

08/2020 |

$40,785 |

$16,384 |

09/2020 |

$39,472 |

$15,761 |

10/2020 |

$39,369 |

$15,342 |

11/2020 |

$47,999 |

$17,021 |

12/2020 |

$52,873 |

$17,676 |

01/2021 |

$57,272 |

$17,497 |

02/2021 |

$55,336 |

$17,980 |

03/2021 |

$50,948 |

$18,767 |

04/2021 |

$51,521 |

$19,769 |

05/2021 |

$47,751 |

$19,907 |

06/2021 |

$54,969 |

$20,371 |

07/2021 |

$50,891 |

$20,855 |

08/2021 |

$51,864 |

$21,490 |

09/2021 |

$47,545 |

$20,490 |

10/2021 |

$52,265 |

$21,926 |

11/2021 |

$45,403 |

$21,774 |

12/2021 |

$40,786 |

$22,750 |

01/2022 |

$32,554 |

$21,572 |

02/2022 |

$30,399 |

$20,926 |

03/2022 |

$28,708 |

$21,703 |

04/2022 |

$20,580 |

$19,811 |

05/2022 |

$19,293 |

$19,847 |

06/2022 |

$17,392 |

$18,209 |

07/2022 |

$19,263 |

$19,888 |

08/2022 |

$18,081 |

$19,077 |

09/2022 |

$16,329 |

$17,320 |

10/2022 |

$16,734 |

$18,722 |

11/2022 |

$16,374 |

$19,768 |

12/2022 |

$13,762 |

$18,629 |

01/2023 |

$17,552 |

$19,800 |

02/2023 |

$17,420 |

$19,317 |

03/2023 |

$17,814 |

$20,026 |

04/2023 |

$15,878 |

$20,339 |

05/2023 |

$17,814 |

$20,427 |

06/2023 |

$19,389 |

$21,777 |

07/2023 |

$22,161 |

$22,476 |

08/2023 |

$19,274 |

$22,118 |

09/2023 |

$17,420 |

$21,064 |

10/2023 |

$15,468 |

$20,621 |

11/2023 |

$20,258 |

$22,504 |

12/2023 |

$23,047 |

$23,527 |

01/2024 |

$19,996 |

$23,922 |

02/2024 |

$22,423 |

$25,199 |

03/2024 |

$21,915 |

$26,010 |

04/2024 |

$19,126 |

$24,948 |

05/2024 |

$18,667 |

$26,185 |

06/2024 |

$19,323 |

$27,124 |

07/2024 |

$19,979 |

$27,454 |

08/2024 |

$19,733 |

$28,120 |

09/2024 |

$20,931 |

$28,721 |

10/2024 |

$20,209 |

$28,461 |

11/2024 |

$25,458 |

$30,131 |

12/2024 |

$24,949 |

$29,413 |

01/2025 |

$27,590 |

$30,232 |

02/2025 |

$24,474 |

$29,838 |

03/2025 |

$20,947 |

$28,156 |

04/2025 |

$22,423 |

$27,965 |

05/2025 |

$24,769 |

$29,726 |

06/2025 |

$30,871 |

$31,237 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (1/27/17) |

Investor ClassFootnote Reference1 |

59.76% |

0.00% |

14.32% |

S&P 500® Index TR |

15.16% |

16.64% |

14.48% | |

|

| Performance Inception Date |

Jan. 27, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| AssetsNet |

$ 203,610,644

|

|

| Holdings Count | Holding |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,502,796

|

|

| InvestmentCompanyPortfolioTurnover |

46.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$203,610,644 |

# of Portfolio Holdings |

42 |

Portfolio Turnover Rate |

46% |

Total Management Fees Paid |

$1,502,796 | |

|

| Holdings [Text Block] |

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

85.2 |

Foreign Common Stocks |

10.7 |

Securities Lending Collateral |

2.1 |

Investment Companies |

2.0 | Sector Allocation - % Equities

Value |

Value |

Industrials |

5.5 |

Consumer Discretionary |

14.1 |

Financials |

16.0 |

Communication Services |

18.8 |

Health Care |

22.6 |

Information Technology |

23.0 | |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Tesla, Inc. |

9.5 |

Coinbase Global, Inc., Class A |

8.0 |

Roku, Inc. |

7.4 |

ROBLOX Corp., Class A |

6.4 |

Robinhood Markets, Inc., Class A |

5.5 |

CRISPR Therapeutics AG |

5.1 |

Shopify, Inc., Class A |

4.8 |

Tempus AI, Inc. |

4.7 |

Circle Internet Group, Inc. |

4.5 |

Palantir Technologies, Inc., Class A |

4.1 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

| C000224371 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

ARK Transformational Innovation Fund

|

|

| Class Name |

R6

|

|

| Trading Symbol |

ADNRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon ARK Transformational Innovation Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R6 |

$137 |

1.05% | |

|

| Expenses Paid, Amount |

$ 137

|

|

| Expense Ratio, Percent |

1.05%

|

|

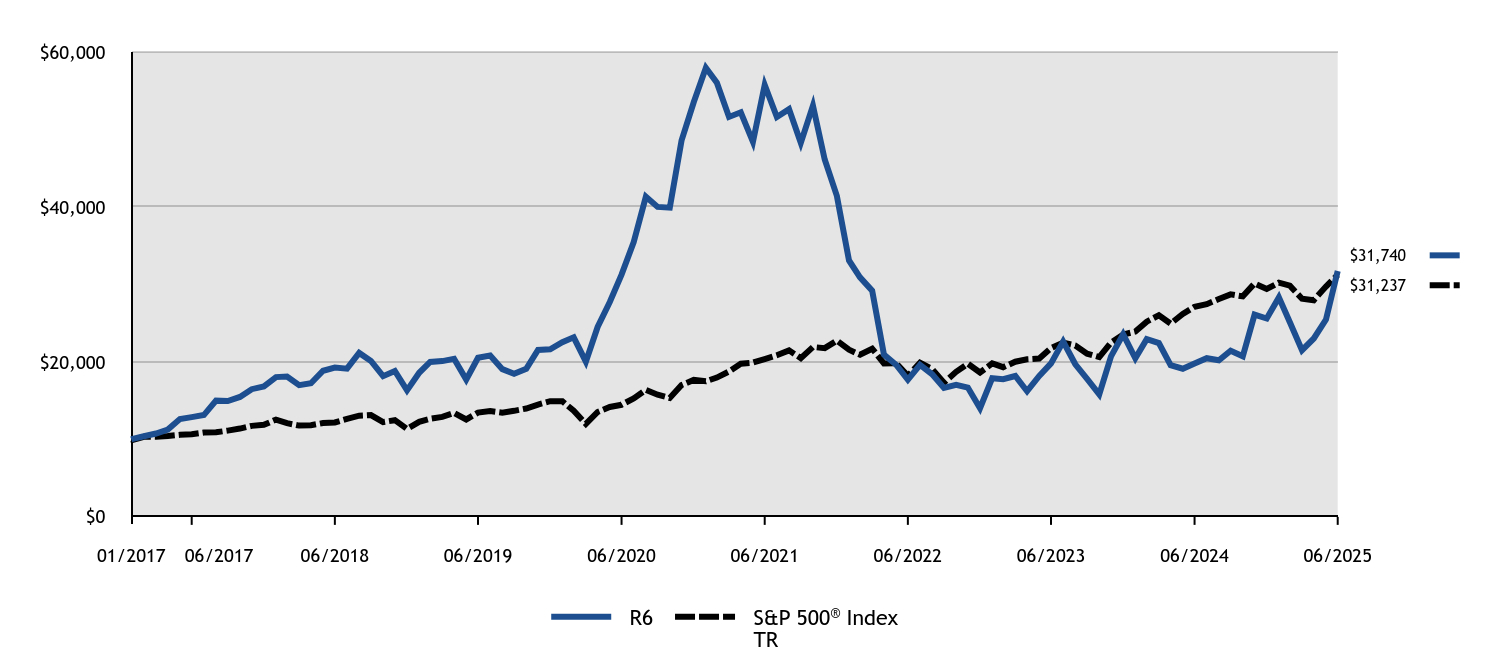

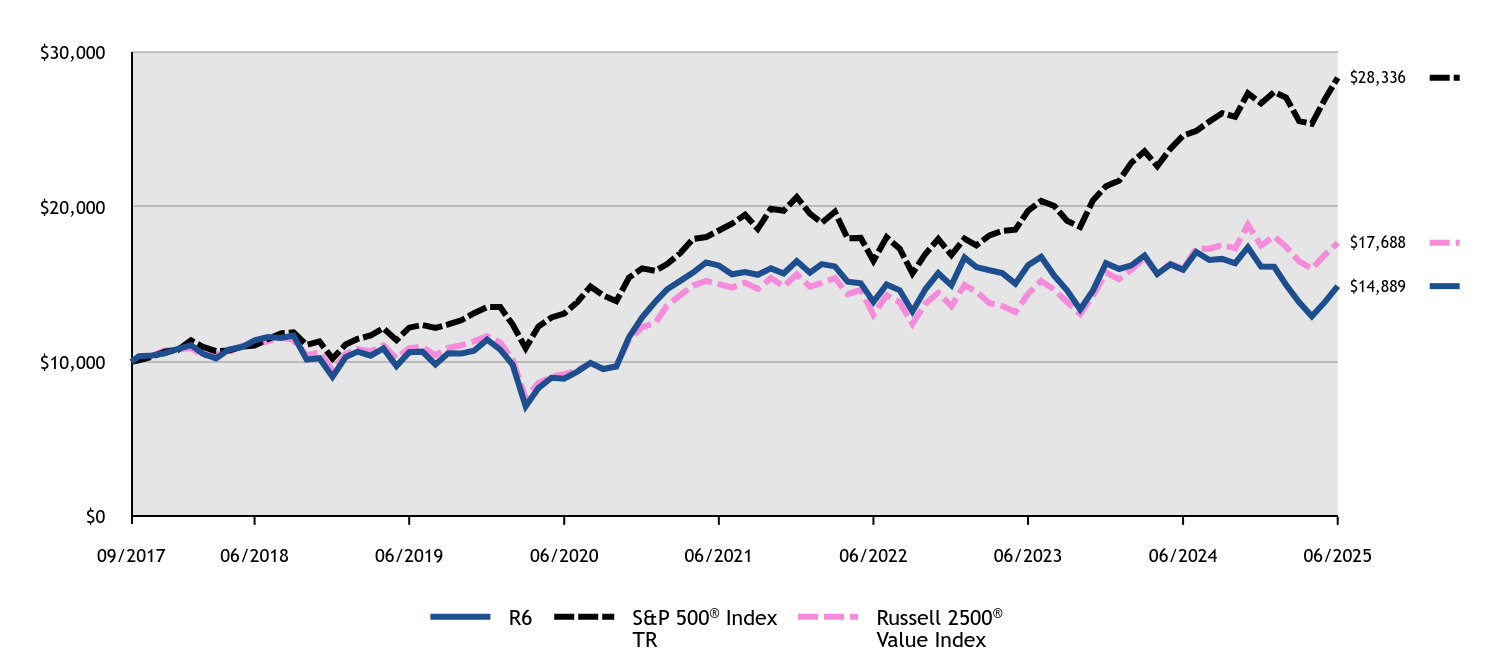

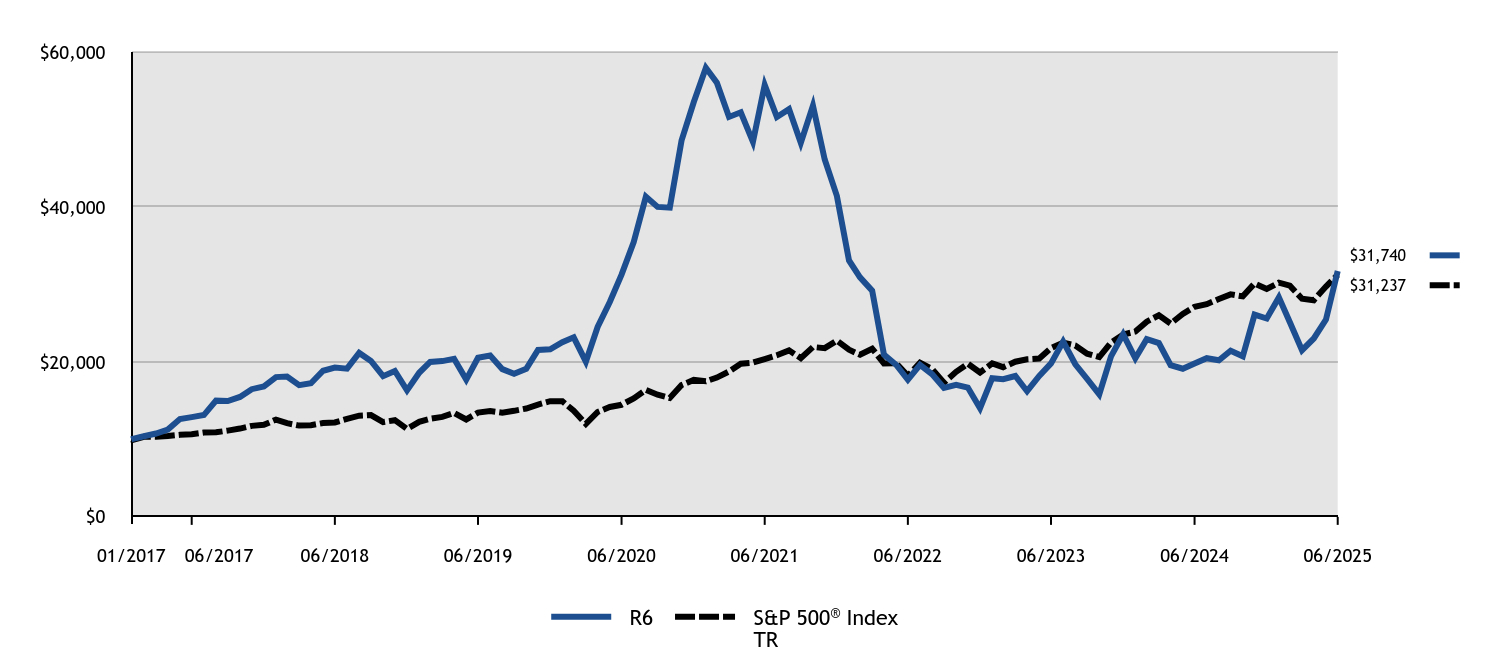

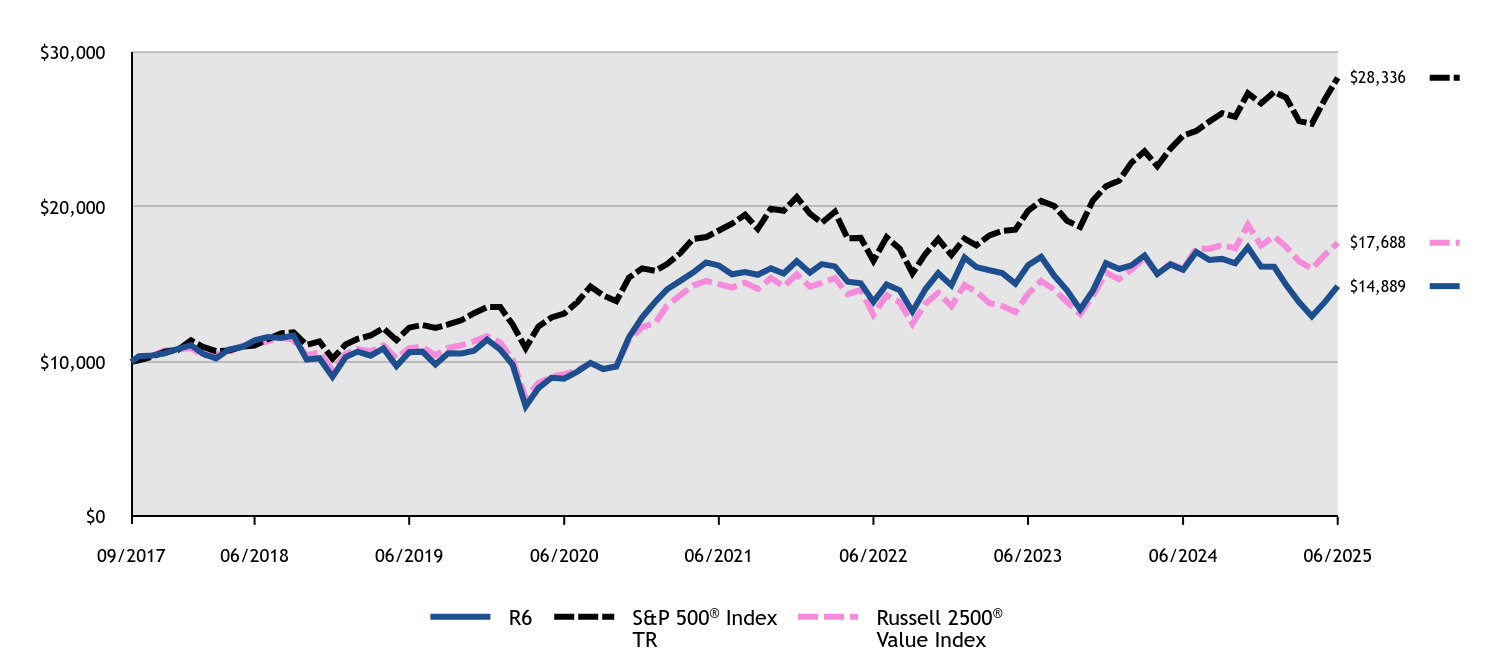

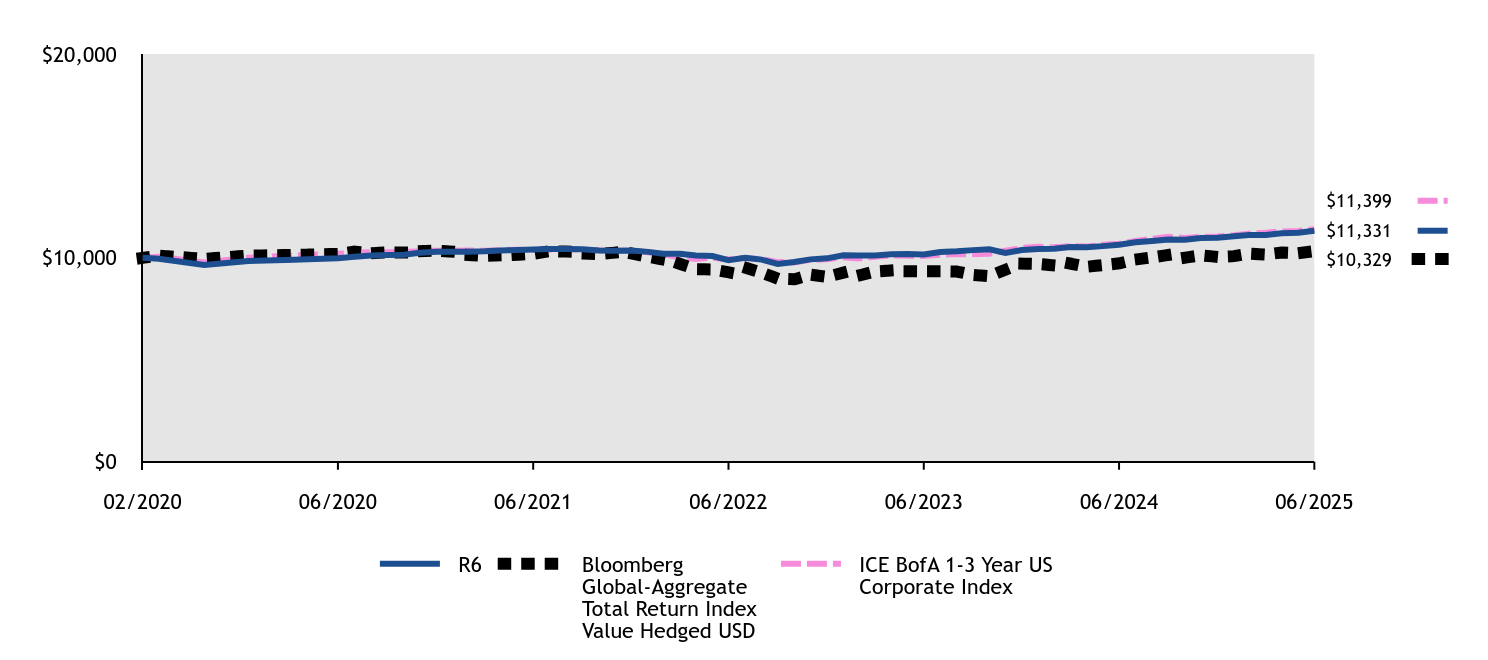

| Factors Affecting Performance [Text Block] |

How did the Fund perform and what affected its performance? The R6 Class of the Fund returned 60.23% for the twelve months ended June 30, 2025, compared to the S&P 500 Index return of 15.16%. • The headwinds that once pressured disruptive technologies lessened due to broader market participation, favorable policy shifts around crypto, Artificial Intelligence, and healthcare, coupled with expectations for potential fiscal catalysts like tax cuts. • The Fund’s investments in software and capital markets companies materially helped performance for the period. Conversely, its investments in biotechnology and semiconductors and semiconductor equipment companies detracted from performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

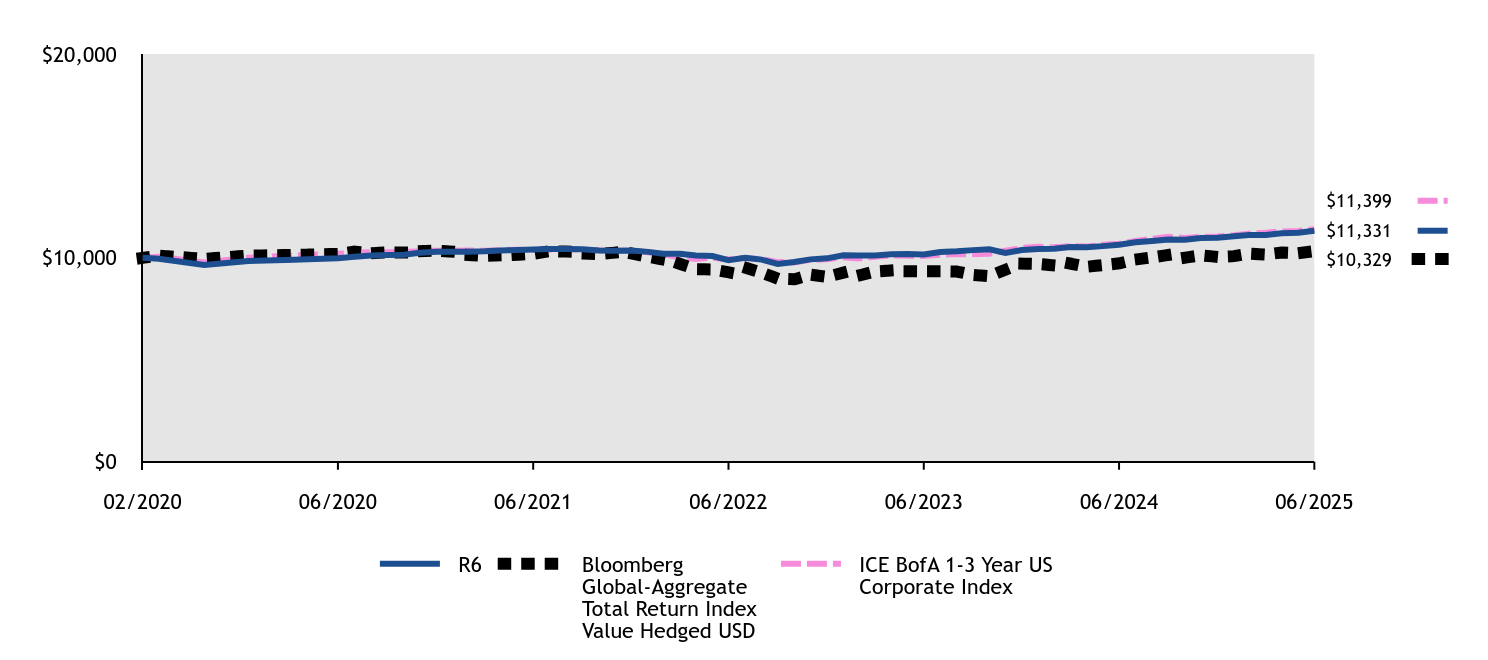

| Line Graph [Table Text Block] |

|

R6 |

S&P 500® Index TR |

01/2017 |

$10,000 |

$10,000 |

01/2017 |

$10,080 |

$9,932 |

02/2017 |

$10,400 |

$10,326 |

03/2017 |

$10,760 |

$10,338 |

04/2017 |

$11,270 |

$10,444 |

05/2017 |

$12,620 |

$10,591 |

06/2017 |

$12,870 |

$10,657 |

07/2017 |

$13,140 |

$10,876 |

08/2017 |

$15,000 |

$10,910 |

09/2017 |

$14,950 |

$11,135 |

10/2017 |

$15,480 |

$11,395 |

11/2017 |

$16,480 |

$11,744 |

12/2017 |

$16,828 |

$11,875 |

01/2018 |

$18,040 |

$12,554 |

02/2018 |

$18,123 |

$12,092 |

03/2018 |

$16,994 |

$11,784 |

04/2018 |

$17,243 |

$11,830 |

05/2018 |

$18,859 |

$12,115 |

06/2018 |

$19,274 |

$12,189 |

07/2018 |

$19,128 |

$12,643 |

08/2018 |

$21,159 |

$13,055 |

09/2018 |

$20,123 |

$13,129 |

10/2018 |

$18,165 |

$12,232 |

11/2018 |

$18,828 |

$12,481 |

12/2018 |

$16,327 |

$11,354 |

01/2019 |

$18,602 |

$12,264 |

02/2019 |

$19,994 |

$12,658 |

03/2019 |

$20,105 |

$12,904 |

04/2019 |

$20,403 |

$13,426 |

05/2019 |

$17,719 |

$12,573 |

06/2019 |

$20,536 |

$13,459 |

07/2019 |

$20,823 |

$13,652 |

08/2019 |

$19,066 |

$13,436 |

09/2019 |

$18,481 |

$13,687 |

10/2019 |

$19,100 |

$13,984 |

11/2019 |

$21,552 |

$14,492 |

12/2019 |

$21,623 |

$14,929 |

01/2020 |

$22,535 |

$14,923 |

02/2020 |

$23,174 |

$13,695 |

03/2020 |

$20,026 |

$12,003 |

04/2020 |

$24,508 |

$13,542 |

05/2020 |

$27,736 |

$14,187 |

06/2020 |

$31,260 |

$14,469 |

07/2020 |

$35,468 |

$15,285 |

08/2020 |

$41,318 |

$16,384 |

09/2020 |

$40,007 |

$15,761 |

10/2020 |

$39,904 |

$15,342 |

11/2020 |

$48,583 |

$17,021 |

12/2020 |

$53,508 |

$17,676 |

01/2021 |

$57,965 |

$17,497 |

02/2021 |

$56,040 |

$17,980 |

03/2021 |

$51,618 |

$18,767 |

04/2021 |

$52,214 |

$19,769 |

05/2021 |

$48,411 |

$19,907 |

06/2021 |

$55,754 |

$20,371 |

07/2021 |

$51,618 |

$20,855 |

08/2021 |

$52,626 |

$21,490 |

09/2021 |

$48,273 |

$20,490 |

10/2021 |

$53,073 |

$21,926 |

11/2021 |

$46,120 |

$21,774 |

12/2021 |

$41,428 |

$22,750 |

01/2022 |

$33,089 |

$21,572 |

02/2022 |

$30,914 |

$20,926 |

03/2022 |

$29,189 |

$21,703 |

04/2022 |

$20,939 |

$19,811 |

05/2022 |

$19,634 |

$19,847 |

06/2022 |

$17,699 |

$18,209 |

07/2022 |

$19,619 |

$19,888 |

08/2022 |

$18,404 |

$19,077 |

09/2022 |

$16,634 |

$17,320 |

10/2022 |

$17,039 |

$18,722 |

11/2022 |

$16,694 |

$19,768 |

12/2022 |

$14,032 |

$18,629 |

01/2023 |

$17,905 |

$19,800 |

02/2023 |

$17,774 |

$19,317 |

03/2023 |

$18,184 |

$20,026 |

04/2023 |

$16,215 |

$20,339 |

05/2023 |

$18,184 |

$20,427 |

06/2023 |

$19,809 |

$21,777 |

07/2023 |

$22,632 |

$22,476 |

08/2023 |

$19,694 |

$22,118 |

09/2023 |

$17,807 |

$21,064 |

10/2023 |

$15,804 |

$20,621 |

11/2023 |

$20,711 |

$22,504 |

12/2023 |

$23,567 |

$23,527 |

01/2024 |

$20,465 |

$23,922 |

02/2024 |

$22,943 |

$25,199 |

03/2024 |

$22,435 |

$26,010 |

04/2024 |

$19,579 |

$24,948 |

05/2024 |

$19,120 |

$26,185 |

06/2024 |

$19,809 |

$27,124 |

07/2024 |

$20,482 |

$27,454 |

08/2024 |

$20,219 |

$28,120 |

09/2024 |

$21,450 |

$28,721 |

10/2024 |

$20,728 |

$28,461 |

11/2024 |

$26,111 |

$30,131 |

12/2024 |

$25,602 |

$29,413 |

01/2025 |

$28,326 |

$30,232 |

02/2025 |

$25,126 |

$29,838 |

03/2025 |

$21,516 |

$28,156 |

04/2025 |

$23,025 |

$27,965 |

05/2025 |

$25,454 |

$29,726 |

06/2025 |

$31,740 |

$31,237 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (1/27/17) |

R6 ClassFootnote Reference1 |

60.23% |

0.31% |

14.70% |

S&P 500® Index TR |

15.16% |

16.64% |

14.48% | |

|

| Performance Inception Date |

Jan. 27, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| AssetsNet |

$ 203,610,644

|

|

| Holdings Count | Holding |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,502,796

|

|

| InvestmentCompanyPortfolioTurnover |

46.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$203,610,644 |

# of Portfolio Holdings |

42 |

Portfolio Turnover Rate |

46% |

Total Management Fees Paid |

$1,502,796 | |

|

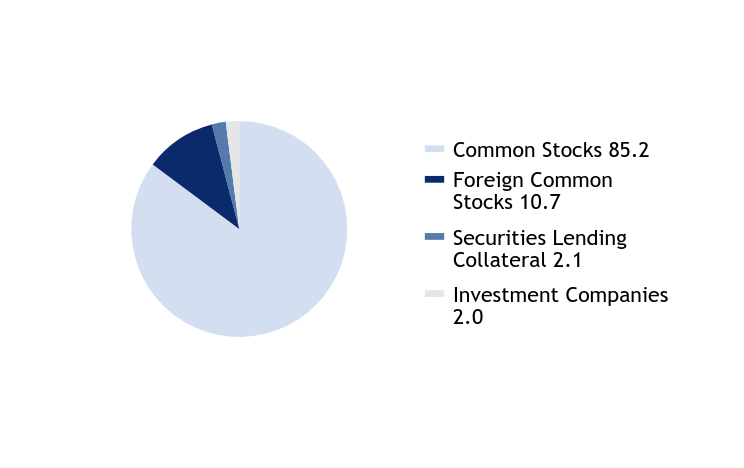

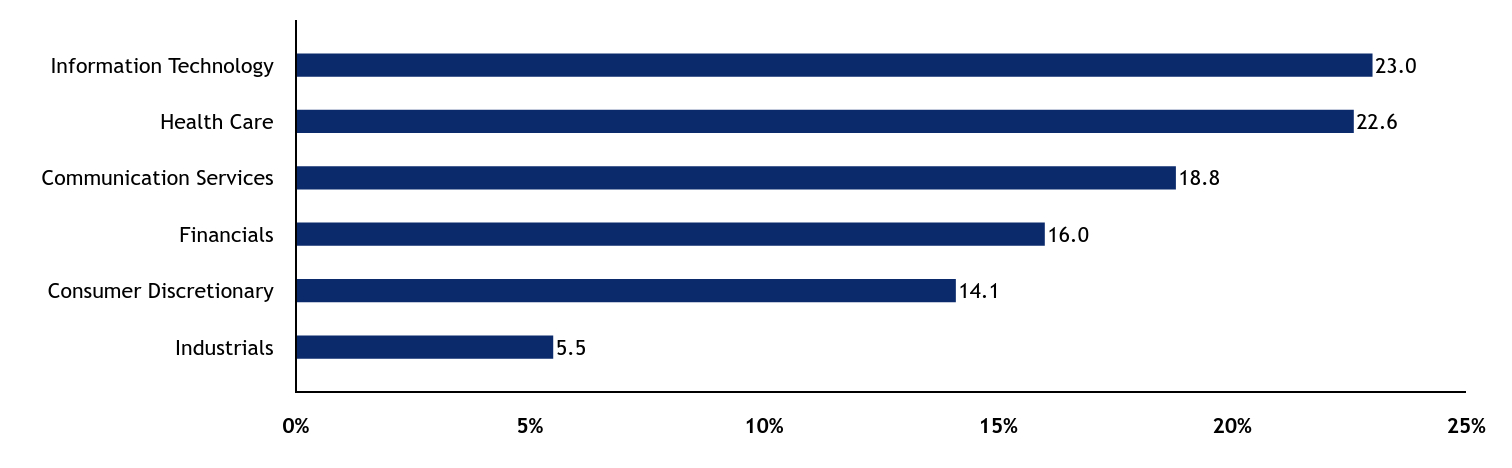

| Holdings [Text Block] |

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

85.2 |

Foreign Common Stocks |

10.7 |

Securities Lending Collateral |

2.1 |

Investment Companies |

2.0 | Sector Allocation - % Equities

Value |

Value |

Industrials |

5.5 |

Consumer Discretionary |

14.1 |

Financials |

16.0 |

Communication Services |

18.8 |

Health Care |

22.6 |

Information Technology |

23.0 | |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Tesla, Inc. |

9.5 |

Coinbase Global, Inc., Class A |

8.0 |

Roku, Inc. |

7.4 |

ROBLOX Corp., Class A |

6.4 |

Robinhood Markets, Inc., Class A |

5.5 |

CRISPR Therapeutics AG |

5.1 |

Shopify, Inc., Class A |

4.8 |

Tempus AI, Inc. |

4.7 |

Circle Internet Group, Inc. |

4.5 |

Palantir Technologies, Inc., Class A |

4.1 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

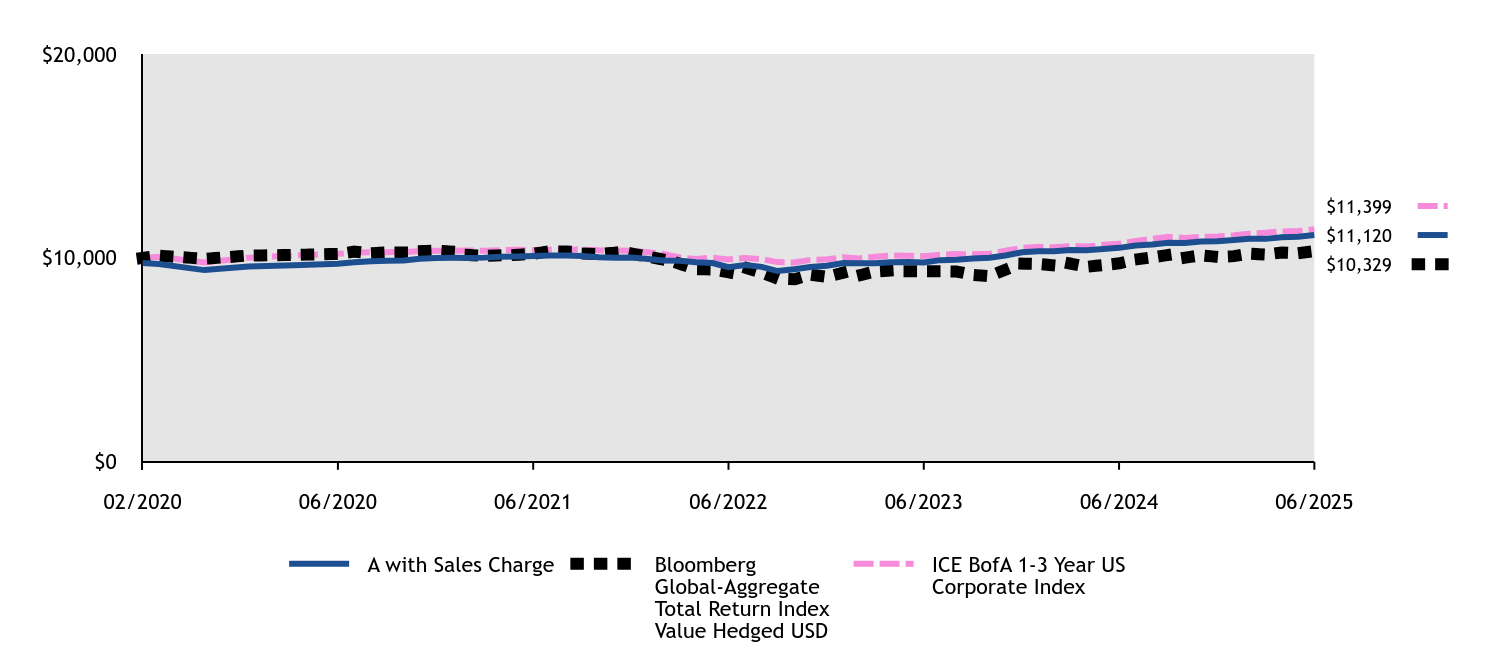

| C000205755 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

TwentyFour Strategic Income Fund

|

|

| Class Name |

A

|

|

| Trading Symbol |

TFSAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon TwentyFour Strategic Income Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-658-5811

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$104 |

1.00% | |

|

| Expenses Paid, Amount |

$ 104

|

|

| Expense Ratio, Percent |

1.00%

|

|

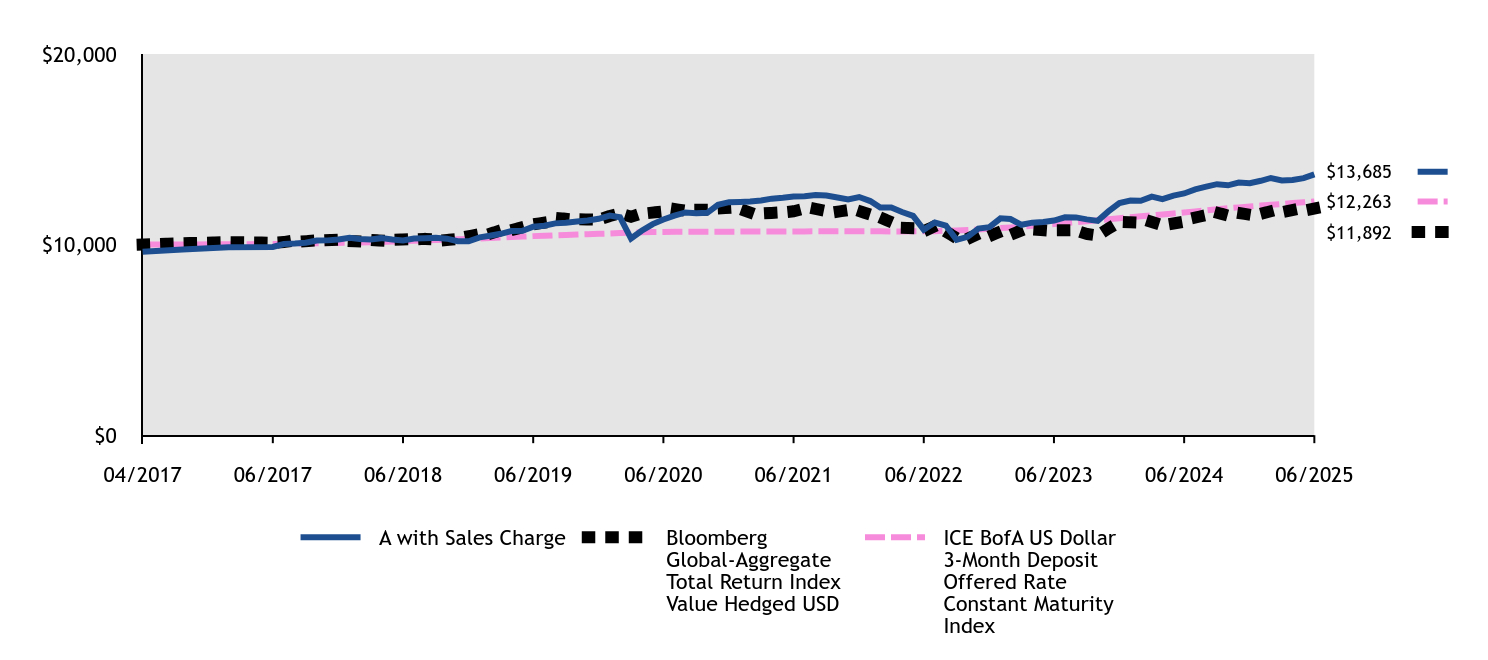

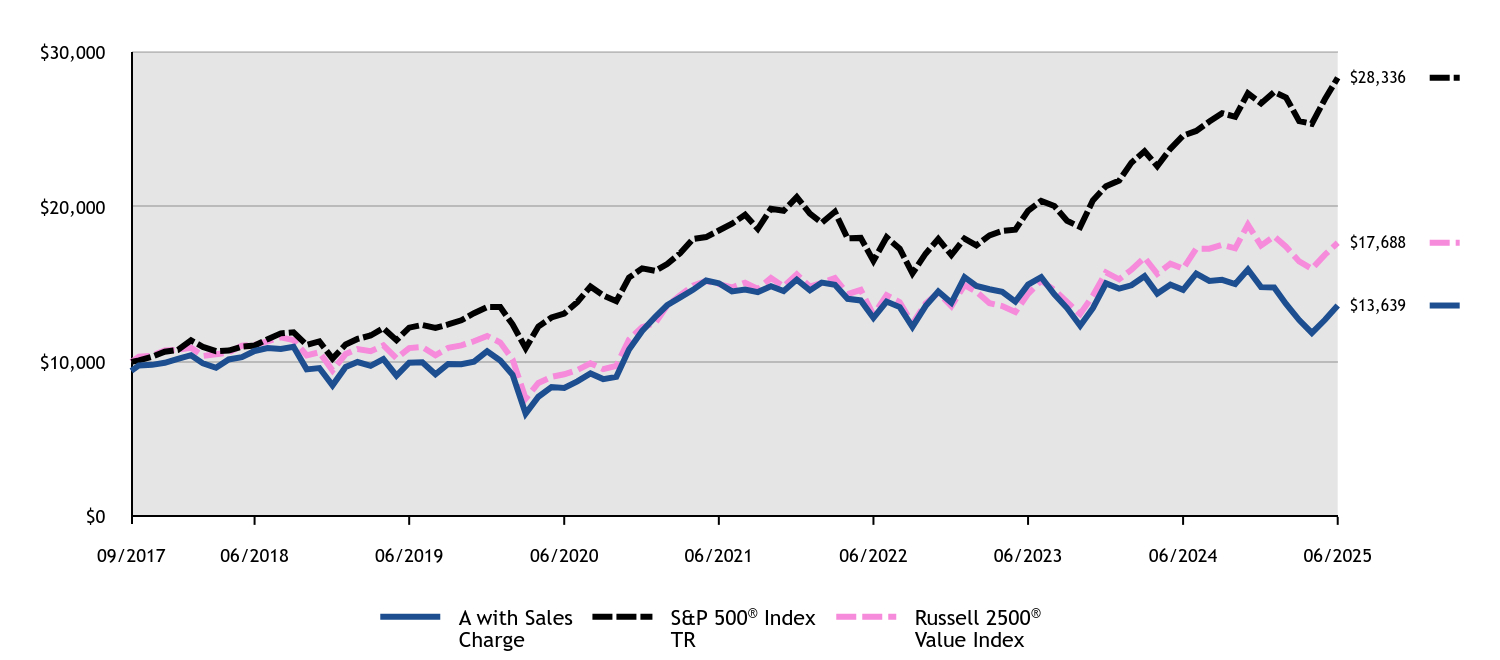

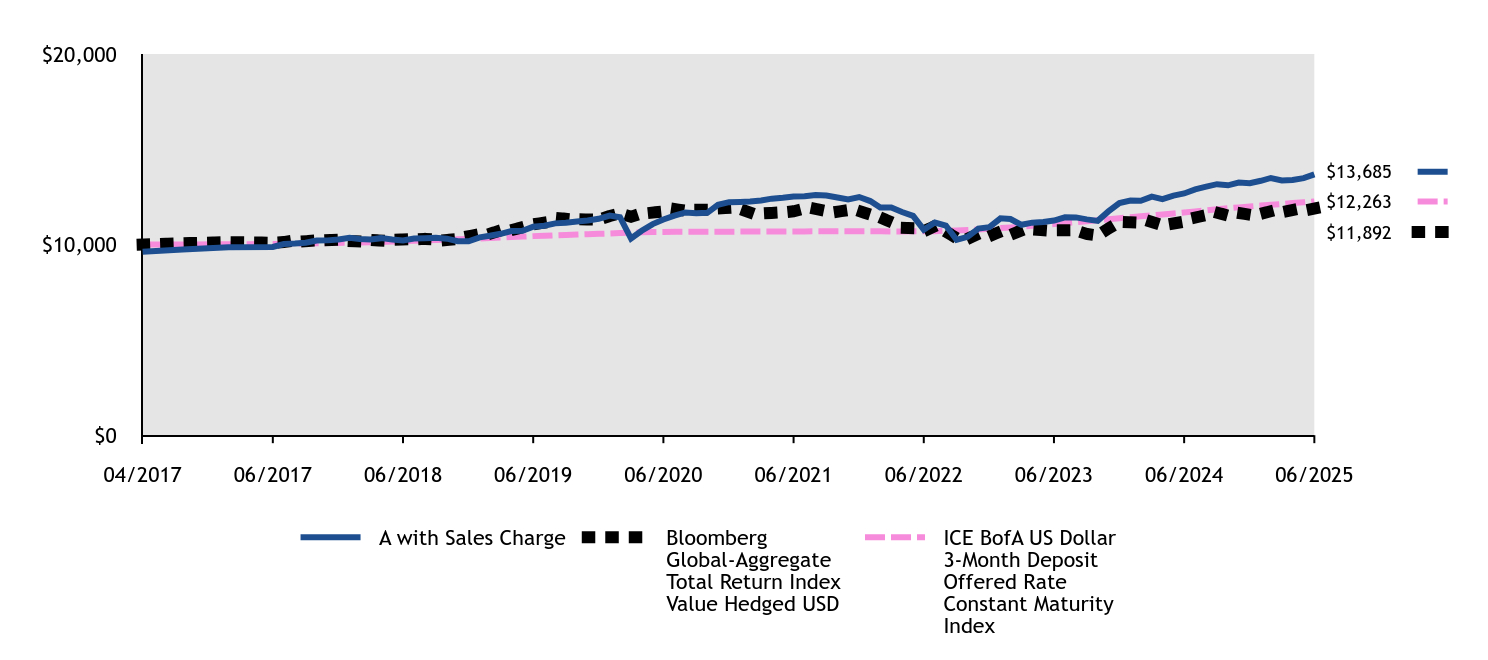

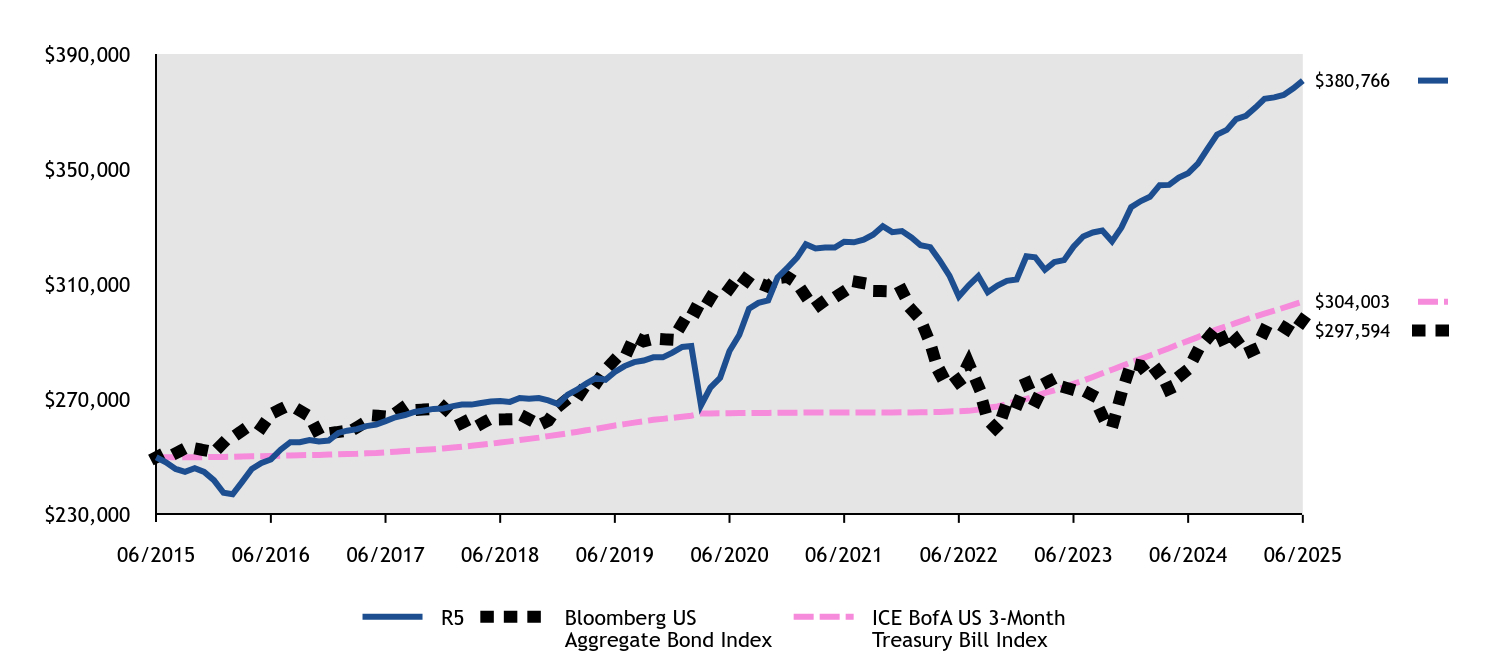

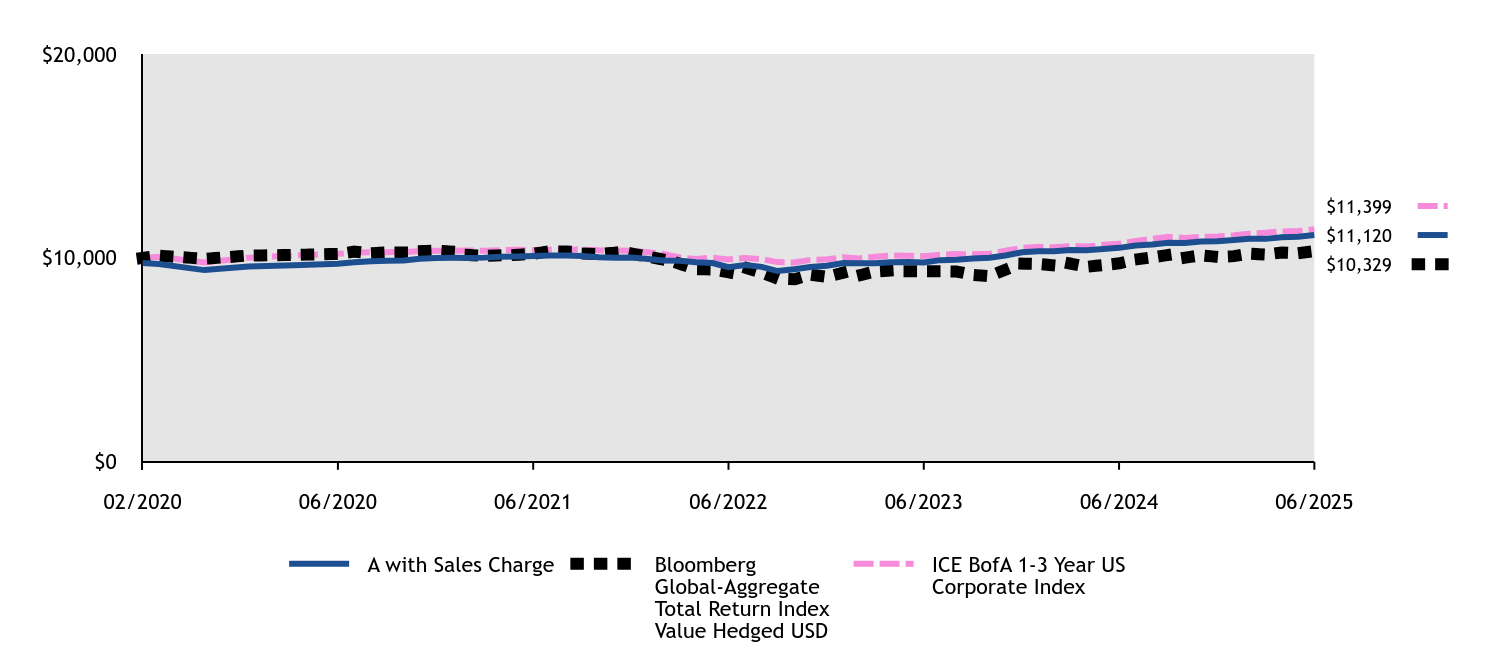

| Factors Affecting Performance [Text Block] |

How did the Fund perform and what affected its performance? The A Class of the Fund returned 3.82% (with sales charges) and 7.90% (without sales charges) for the twelve months ended June 30, 2025, compared to the Bloomberg Global-Aggregate Total Return Index Value Hedged USD return of 6.15%. • The Fund’s lower-duration investments benefited during the period as interest rates rose at the longer end of the yield curve. • The Fund held a variety of exposures across credit sectors that the sub-advisor deemed to offer attractive yield, and most sectors contributed positively to total returns given strong credit markets. • Additional Tier-1 bonds issued by European banks generated the largest contribution to the Fund’s return, followed by European Collateralized Loan Obligations, which generated the next highest contribution to return. |

|

| Performance Past Does Not Indicate Future [Text] |

Performance shown is historical and is not indicative of future returns.

|

|

| Line Graph [Table Text Block] |

|

A with Sales Charge |

Bloomberg Global-Aggregate Total Return Index Value Hedged USD |

ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index |

04/2017 |

$9,625 |

$10,000 |

$10,000 |

04/2017 |

$9,740 |

$10,068 |

$10,008 |

05/2017 |

$9,866 |

$10,127 |

$10,017 |

06/2017 |

$9,873 |

$10,098 |

$10,026 |

07/2017 |

$10,030 |

$10,131 |

$10,037 |

08/2017 |

$10,056 |

$10,224 |

$10,048 |

09/2017 |

$10,100 |

$10,177 |

$10,058 |

10/2017 |

$10,216 |

$10,219 |

$10,069 |

11/2017 |

$10,221 |

$10,235 |

$10,079 |

12/2017 |

$10,269 |

$10,258 |

$10,087 |

01/2018 |

$10,358 |

$10,185 |

$10,100 |

02/2018 |

$10,296 |

$10,162 |

$10,109 |

03/2018 |

$10,272 |

$10,246 |

$10,120 |

04/2018 |

$10,338 |

$10,208 |

$10,139 |

05/2018 |

$10,266 |

$10,246 |

$10,160 |

06/2018 |

$10,217 |

$10,265 |

$10,179 |

07/2018 |

$10,320 |

$10,268 |

$10,199 |

08/2018 |

$10,335 |

$10,300 |

$10,220 |

09/2018 |

$10,361 |

$10,260 |

$10,239 |

10/2018 |

$10,312 |

$10,240 |

$10,256 |

11/2018 |

$10,181 |

$10,290 |

$10,274 |

12/2018 |

$10,171 |

$10,439 |

$10,296 |

01/2019 |

$10,382 |

$10,550 |

$10,323 |

02/2019 |

$10,461 |

$10,562 |

$10,347 |

03/2019 |

$10,565 |

$10,751 |

$10,371 |

04/2019 |

$10,710 |

$10,758 |

$10,394 |

05/2019 |

$10,721 |

$10,913 |

$10,418 |

06/2019 |

$10,938 |

$11,066 |

$10,444 |

07/2019 |

$10,992 |

$11,153 |

$10,465 |

08/2019 |

$11,113 |

$11,406 |

$10,488 |

09/2019 |

$11,143 |

$11,353 |

$10,508 |

10/2019 |

$11,208 |

$11,333 |

$10,531 |

11/2019 |

$11,262 |

$11,320 |

$10,547 |

12/2019 |

$11,351 |

$11,297 |

$10,564 |

01/2020 |

$11,526 |

$11,501 |

$10,585 |

02/2020 |

$11,435 |

$11,641 |

$10,607 |

03/2020 |

$10,318 |

$11,460 |

$10,617 |

04/2020 |

$10,724 |

$11,646 |

$10,651 |

05/2020 |

$11,075 |

$11,679 |

$10,660 |

06/2020 |

$11,314 |

$11,737 |

$10,664 |

07/2020 |

$11,519 |

$11,865 |

$10,668 |

08/2020 |

$11,687 |

$11,779 |

$10,671 |

09/2020 |

$11,639 |

$11,822 |

$10,673 |

10/2020 |

$11,669 |

$11,823 |

$10,675 |

11/2020 |

$12,089 |

$11,891 |

$10,677 |

12/2020 |

$12,225 |

$11,927 |

$10,679 |

01/2021 |

$12,237 |

$11,863 |

$10,681 |

02/2021 |

$12,259 |

$11,679 |

$10,684 |

03/2021 |

$12,310 |

$11,633 |

$10,685 |

04/2021 |

$12,411 |

$11,663 |

$10,687 |

05/2021 |

$12,457 |

$11,689 |

$10,690 |

06/2021 |

$12,528 |

$11,746 |

$10,691 |

07/2021 |

$12,532 |

$11,892 |

$10,693 |

08/2021 |

$12,606 |

$11,868 |

$10,694 |

09/2021 |

$12,572 |

$11,756 |

$10,694 |

10/2021 |

$12,467 |

$11,725 |

$10,696 |

11/2021 |

$12,364 |

$11,809 |

$10,696 |

12/2021 |

$12,495 |

$11,761 |

$10,697 |

01/2022 |

$12,284 |

$11,576 |

$10,697 |

02/2022 |

$11,947 |

$11,422 |

$10,695 |

03/2022 |

$11,947 |

$11,176 |

$10,691 |

04/2022 |

$11,712 |

$10,876 |

$10,690 |

05/2022 |

$11,505 |

$10,861 |

$10,697 |

06/2022 |

$10,782 |

$10,696 |

$10,696 |

07/2022 |

$11,157 |

$10,968 |

$10,705 |

08/2022 |

$10,998 |

$10,682 |

$10,726 |

09/2022 |

$10,249 |

$10,339 |

$10,739 |

10/2022 |

$10,409 |

$10,304 |

$10,765 |

11/2022 |

$10,837 |

$10,566 |

$10,790 |

12/2022 |

$10,916 |

$10,442 |

$10,826 |

01/2023 |

$11,377 |

$10,682 |

$10,868 |

02/2023 |

$11,343 |

$10,512 |

$10,902 |

03/2023 |

$11,038 |

$10,745 |

$10,947 |

04/2023 |

$11,151 |

$10,800 |

$10,984 |

05/2023 |

$11,189 |

$10,758 |

$11,030 |

06/2023 |

$11,260 |

$10,751 |

$11,079 |

07/2023 |

$11,430 |

$10,755 |

$11,126 |

08/2023 |

$11,427 |

$10,741 |

$11,176 |

09/2023 |

$11,324 |

$10,556 |

$11,224 |

10/2023 |

$11,245 |

$10,481 |

$11,277 |

11/2023 |

$11,740 |

$10,841 |

$11,328 |

12/2023 |

$12,180 |

$11,188 |

$11,381 |

01/2024 |

$12,313 |

$11,166 |

$11,434 |

02/2024 |

$12,300 |

$11,089 |

$11,481 |

03/2024 |

$12,516 |

$11,189 |

$11,534 |

04/2024 |

$12,389 |

$11,009 |

$11,584 |

05/2024 |

$12,572 |

$11,107 |

$11,636 |

06/2024 |

$12,683 |

$11,203 |

$11,688 |

07/2024 |

$12,896 |

$11,419 |

$11,742 |

08/2024 |

$13,037 |

$11,544 |

$11,799 |

09/2024 |

$13,170 |

$11,678 |

$11,859 |

10/2024 |

$13,111 |

$11,520 |

$11,907 |

11/2024 |

$13,256 |

$11,657 |

$11,953 |

12/2024 |

$13,224 |

$11,568 |

$12,004 |

01/2025 |

$13,348 |

$11,613 |

$12,048 |

02/2025 |

$13,495 |

$11,752 |

$12,087 |

03/2025 |

$13,368 |

$11,703 |

$12,133 |

04/2025 |

$13,385 |

$11,819 |

$12,176 |

05/2025 |

$13,486 |

$11,780 |

$12,218 |

06/2025 |

$13,685 |

$11,892 |

$12,263 |

|

|

| Average Annual Return [Table Text Block] |

HEADER |

1 Year |

5 Years |

Since Inception (4/3/17) |

Class A without Sales ChargeFootnote Reference1 |

7.90% |

3.88% |

4.36% |

Class A with Maximum Sales Charge - 3.75%Footnote Reference1 |

3.82% |

3.08% |

3.88% |

Bloomberg Global-Aggregate Total Return Index Value Hedged USD |

6.15% |

0.26% |

2.12% |

ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index |

4.92% |

2.83% |

2.51% | |

|

| Performance Inception Date |

Apr. 03, 2017

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

The Bloomberg Global-Aggregate Total Return Index Value Hedged USD has replaced the ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index as broad-based securities market index to comply with a new regulatory requirement.

|

|

| Material Change Date |

|

Jun. 30, 2024

|

| AssetsNet |

$ 481,131,572

|

|

| Holdings Count | Holding |

298

|

|

| Advisory Fees Paid, Amount |

$ 1,993,331

|

|

| InvestmentCompanyPortfolioTurnover |

74.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets |

$481,131,572 |

# of Portfolio Holdings |

298 |

Portfolio Turnover Rate |

74% |

Total Management Fees Paid |

$1,993,331 | |

|

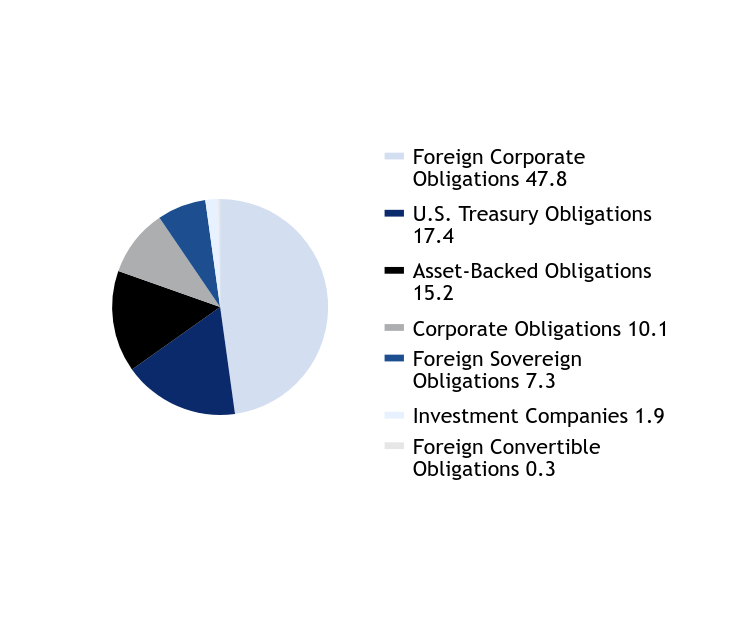

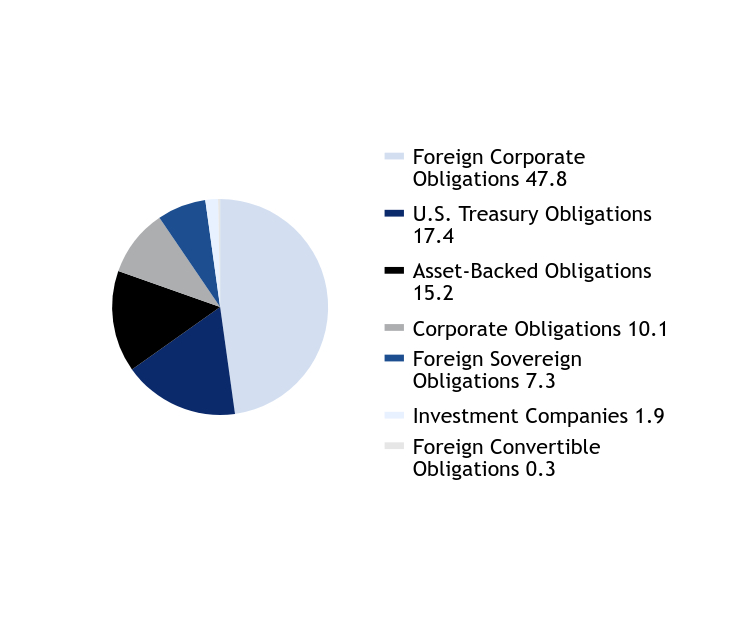

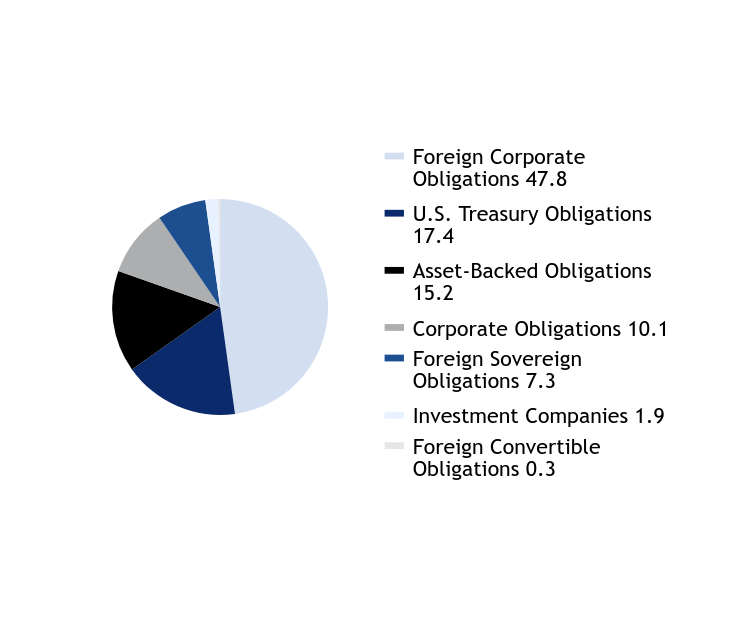

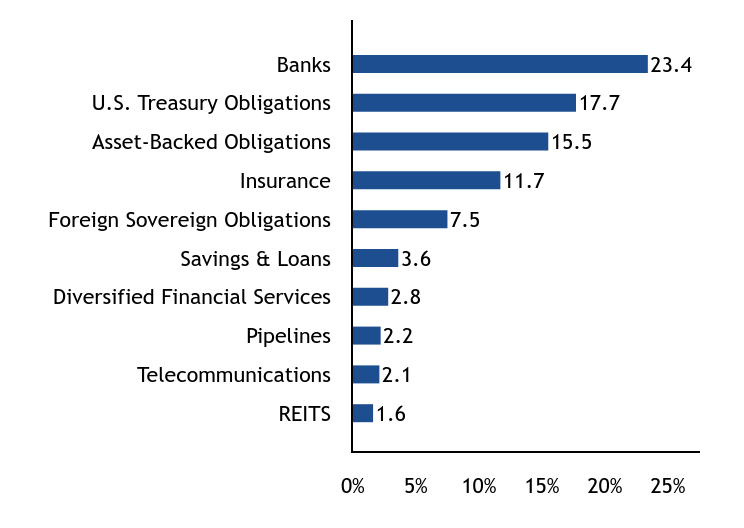

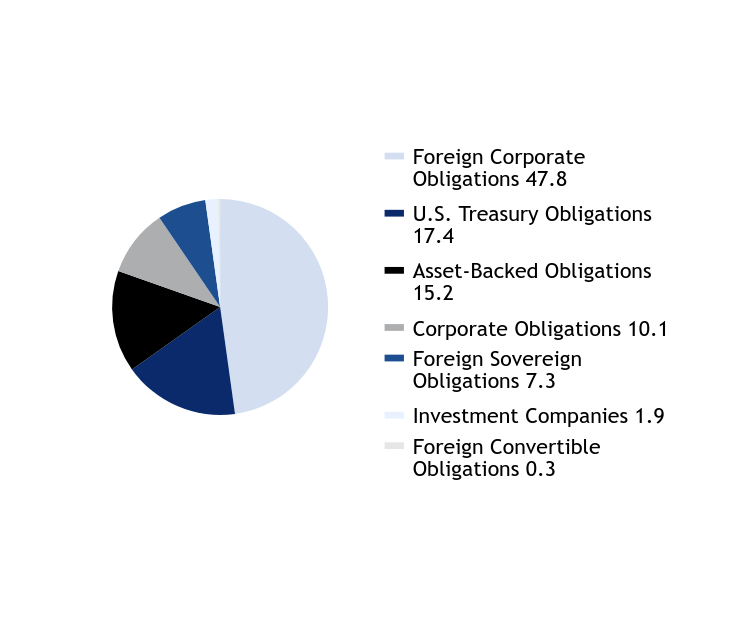

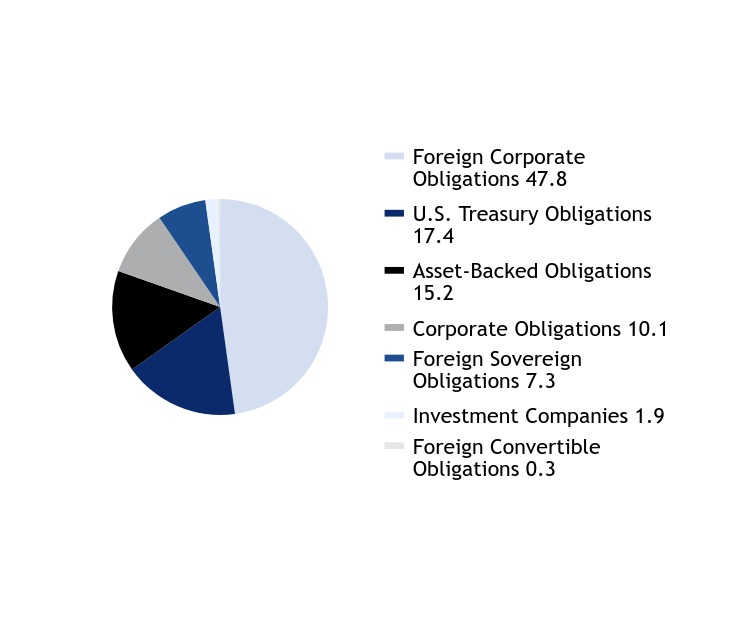

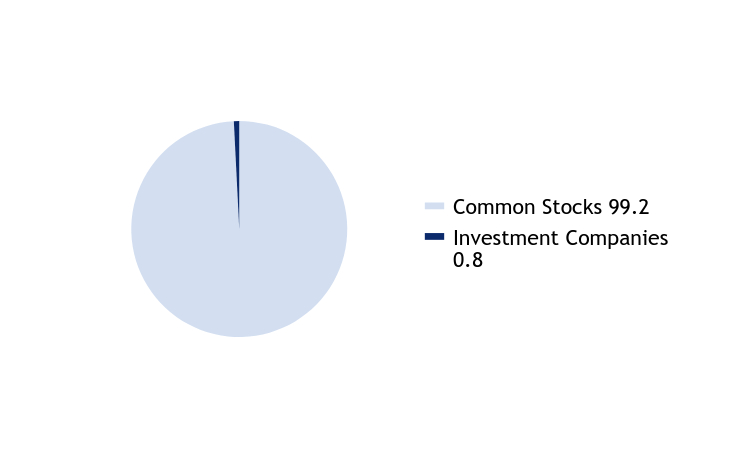

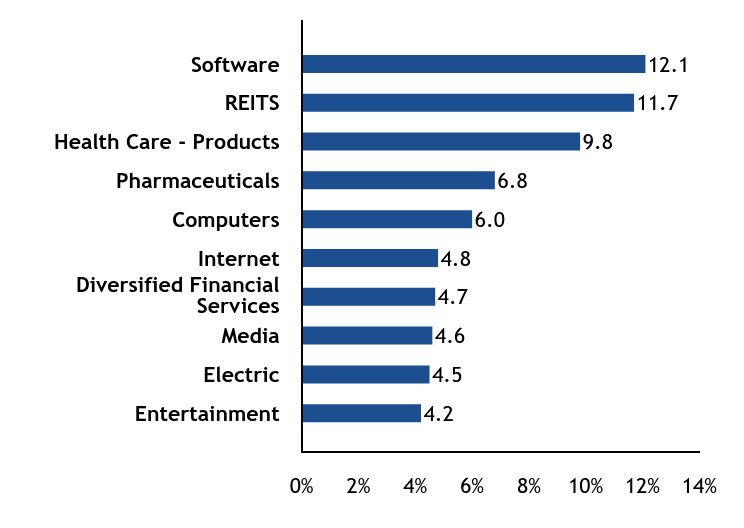

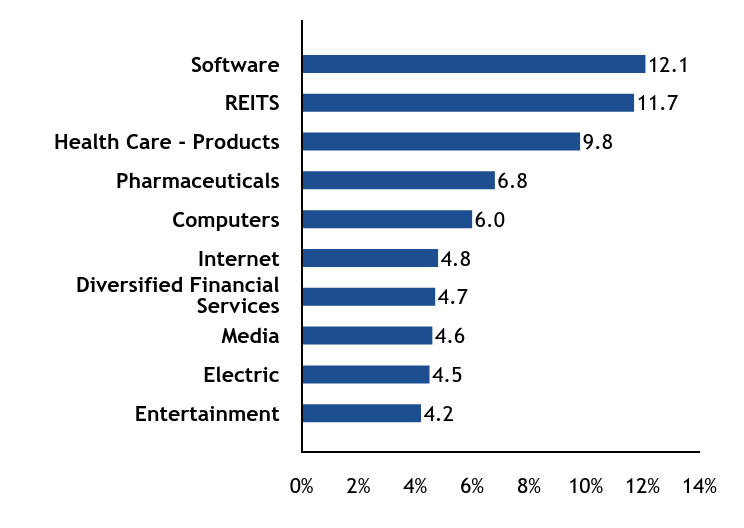

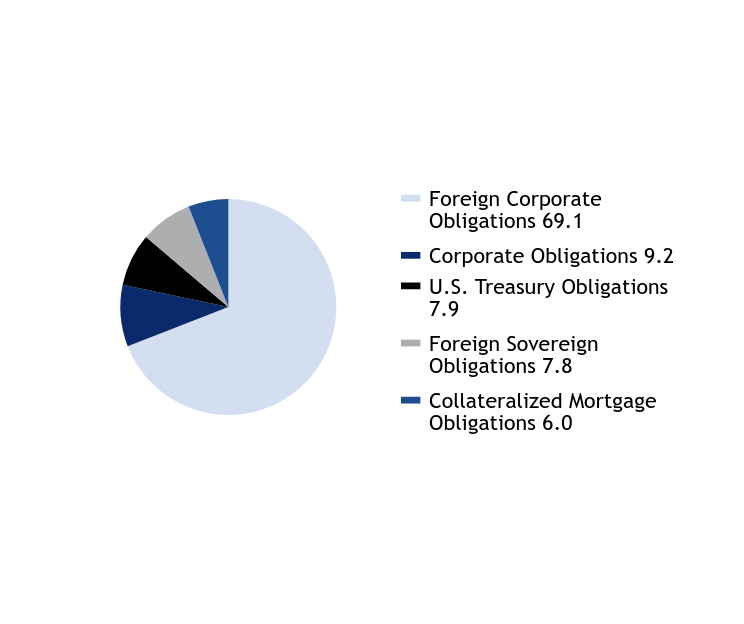

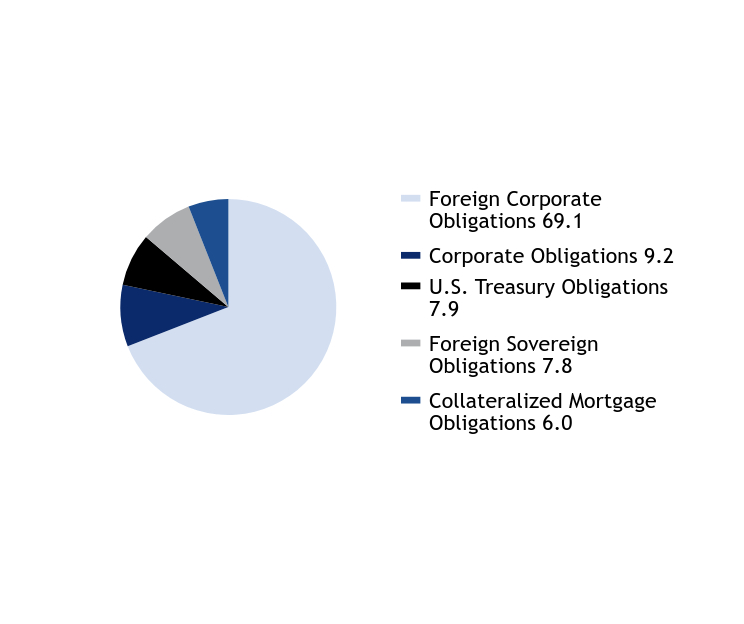

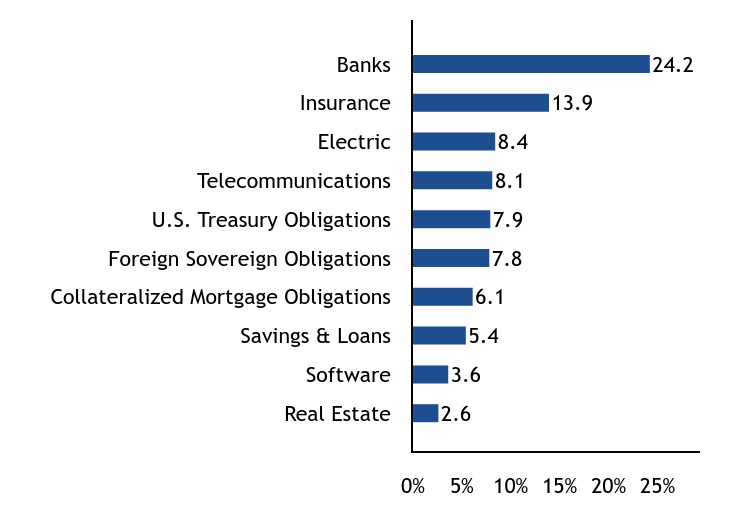

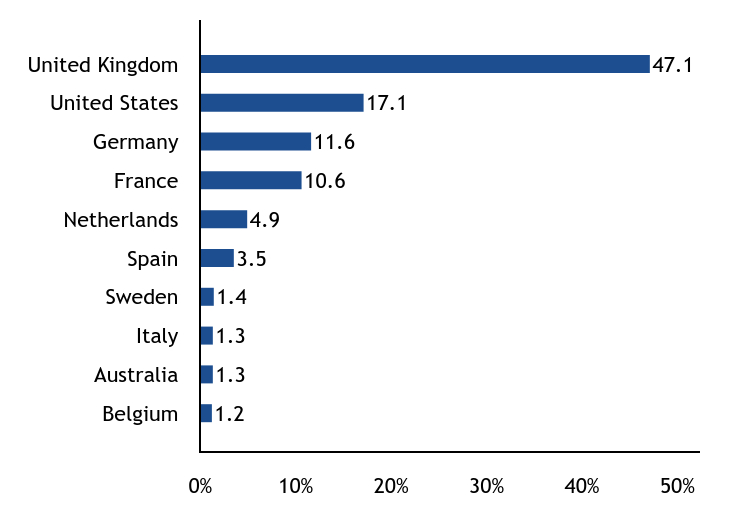

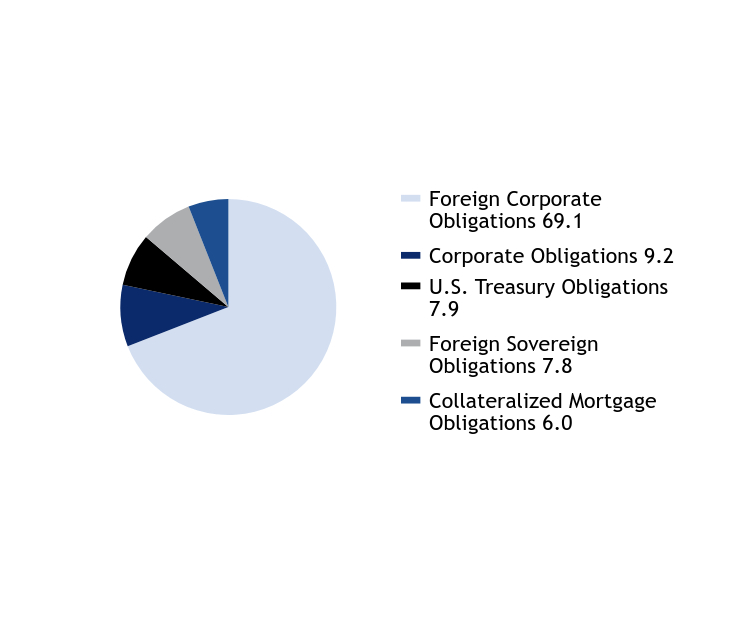

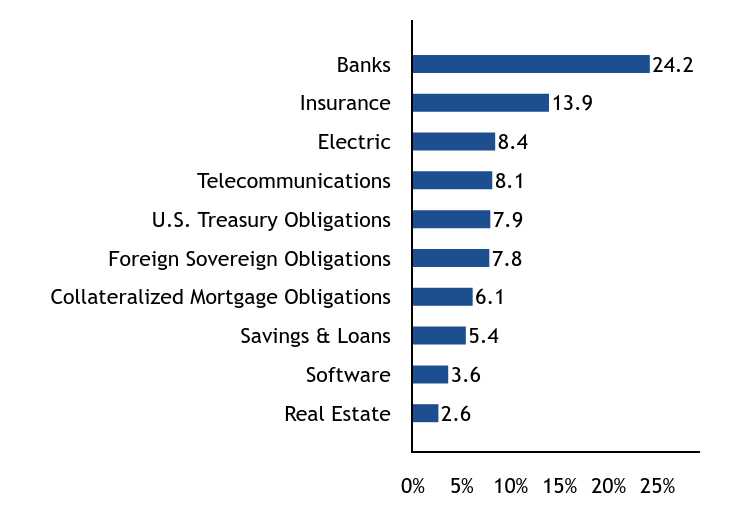

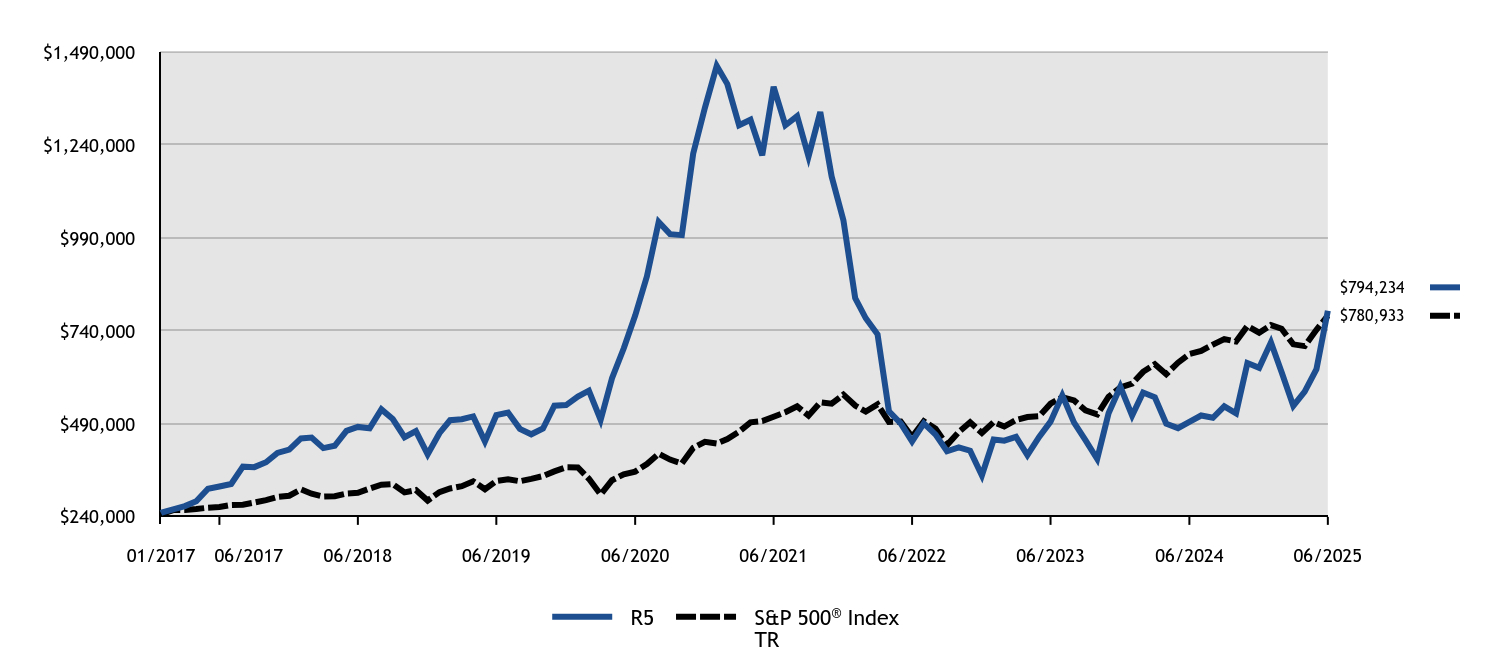

| Holdings [Text Block] |

Asset Allocation - % Investments

Value |

Value |

Foreign Corporate Obligations |

47.8 |

U.S. Treasury Obligations |

17.4 |

Asset-Backed Obligations |

15.2 |

Corporate Obligations |

10.1 |

Foreign Sovereign Obligations |

7.3 |

Investment Companies |

1.9 |

Foreign Convertible Obligations |

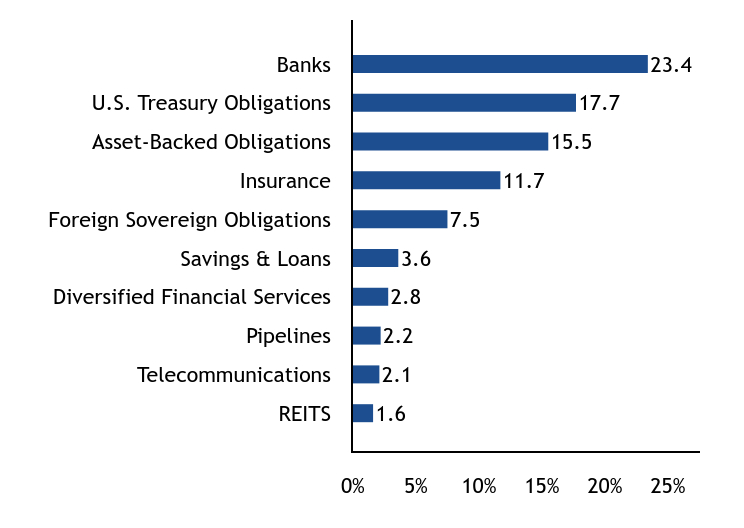

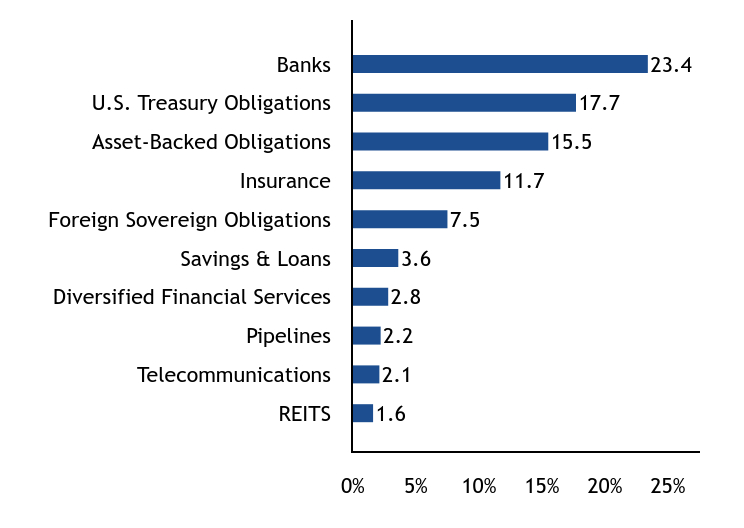

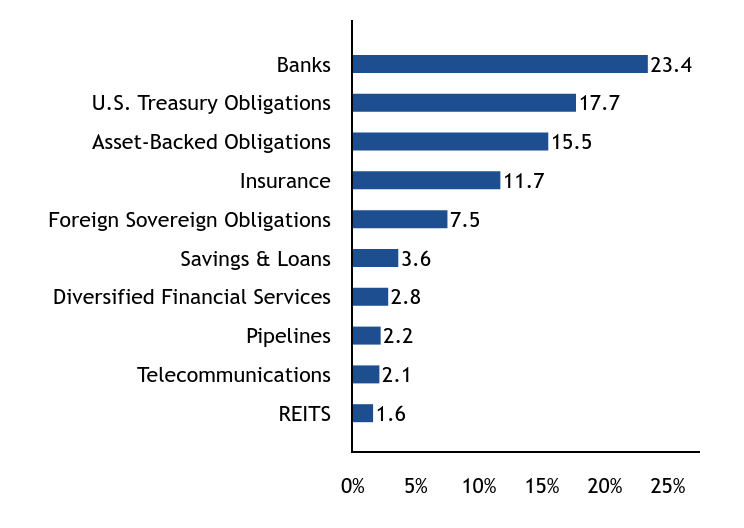

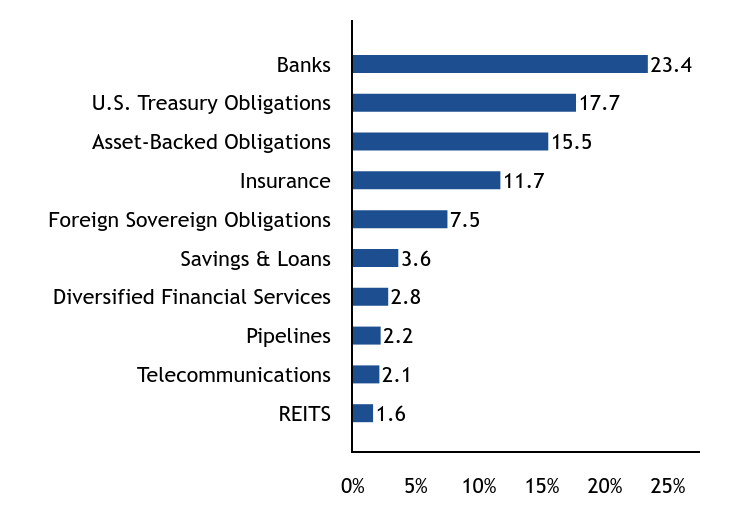

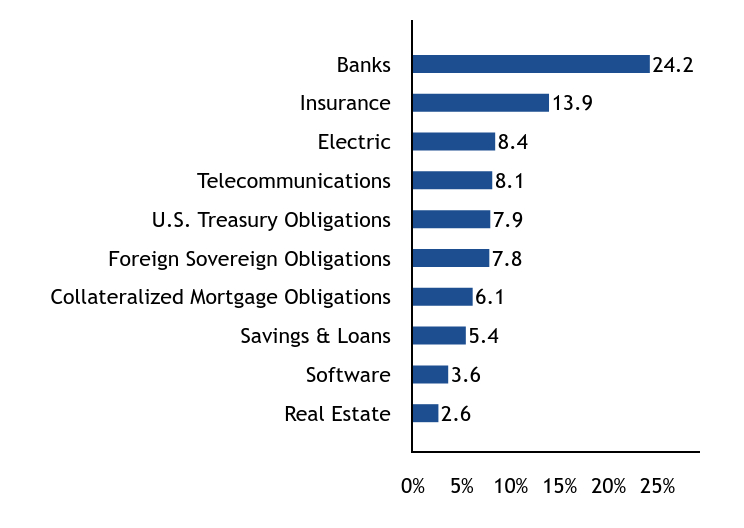

0.3 | Top Ten Industry Allocations - % Investments

Value |

Value |

REITS |

1.6 |

Telecommunications |

2.1 |

Pipelines |

2.2 |

Diversified Financial Services |

2.8 |

Savings & Loans |

3.6 |

Foreign Sovereign Obligations |

7.5 |

Insurance |

11.7 |

Asset-Backed Obligations |

15.5 |

U.S. Treasury Obligations |

17.7 |

Banks |

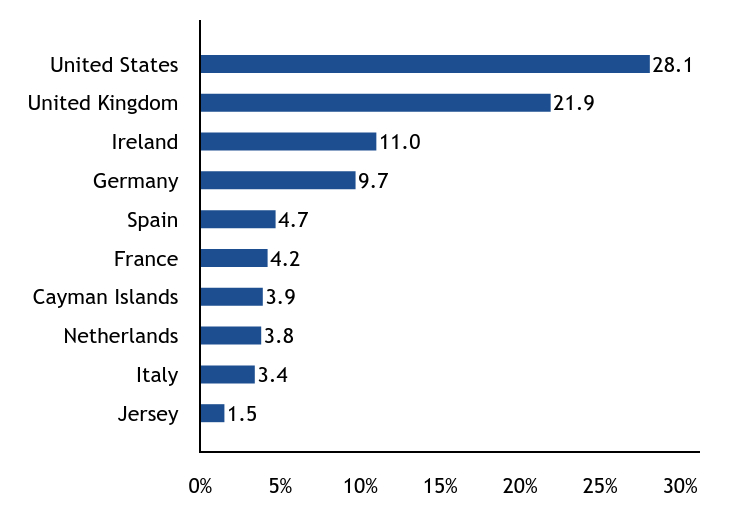

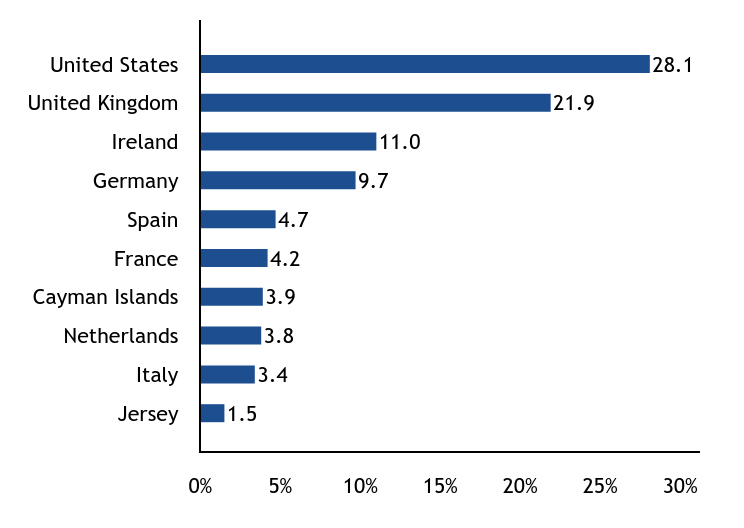

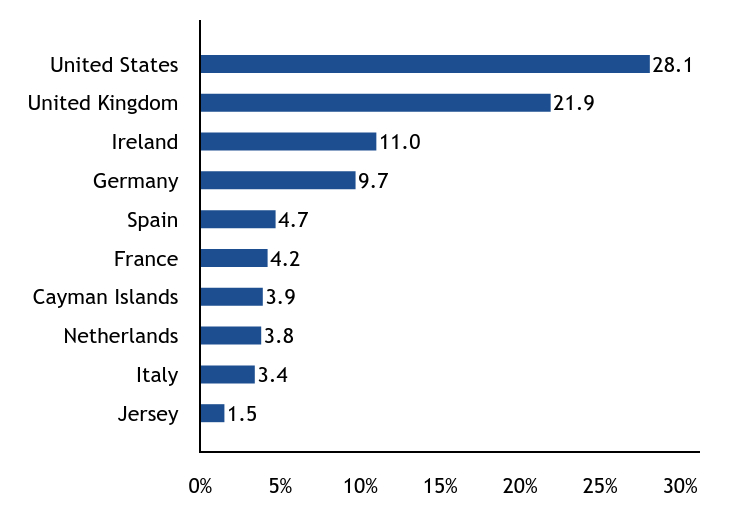

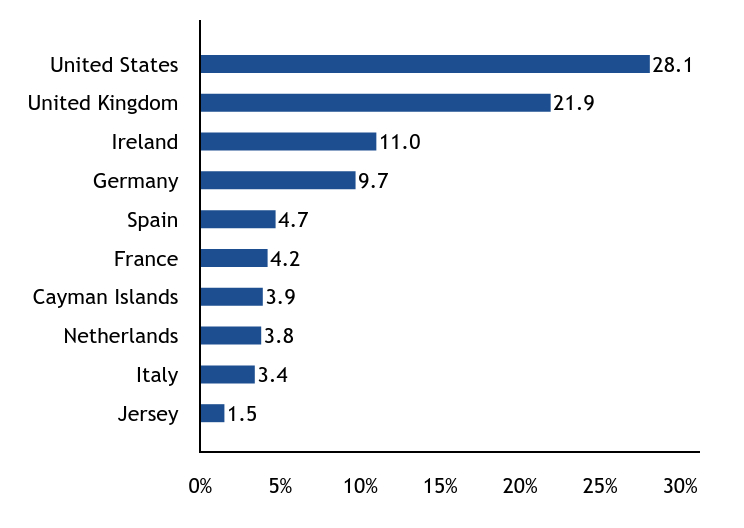

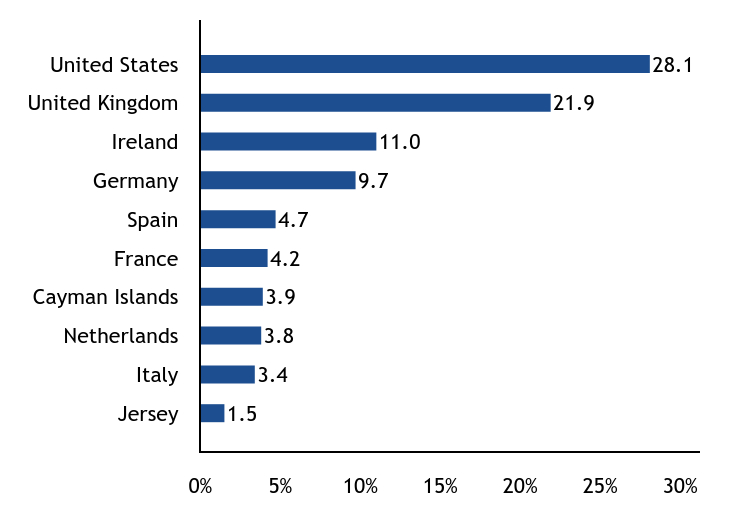

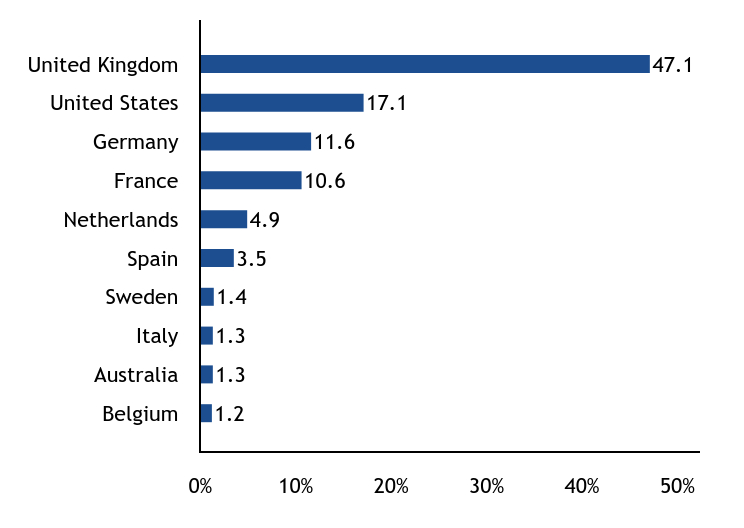

23.4 | Top Ten Country Exposure - % Investments

Value |

Value |

Jersey |

1.5 |

Italy |

3.4 |

Netherlands |

3.8 |

Cayman Islands |

3.9 |

France |

4.2 |

Spain |

4.7 |

Germany |

9.7 |

Ireland |

11.0 |

United Kingdom |

21.9 |

United States |

28.1 | Exludes currency forwards |

|

| Largest Holdings [Text Block] |

Top Ten Holdings - % Net Assets

Bundesrepublik Deutschland Bundesanleihe, 2.600%, Due 8/15/2034 |

5.0 |

U.S. Treasury Notes, 4.625%, Due 2/15/2035 |

4.7 |

U.S. Treasury Bonds, 4.500%, Due 11/15/2054 |

3.3 |

U.S. Treasury Notes, 4.250%, Due 11/15/2034 |

2.7 |

U.S. Treasury Bonds, 4.625%, Due 2/15/2055 |

2.5 |

U.S. Treasury Bills, 4.351%, Due 9/4/2025 |

2.4 |

Bundesrepublik Deutschland Bundesanleihe, 2.500%, Due 2/15/2035 |

2.3 |

U.S. Treasury Bills, 4.305%, Due 8/26/2025 |

1.9 |

Rothesay Life PLC, 5.000%, Due 10/13/2031 |

1.3 |

Nationwide Building Society, 7.500%, Due 12/20/2030 |

1.2 | Excludes cash equivalents and derivatives. |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811. Prior to July 1, 2024, the American Beacon TwentyFour Strategic Income Fund (the “Fund”) assessed a front-end sales load on purchases of A Class shares less than $1 million, and a contingent deferred sales charge (“CDSC”) of 0.50% on certain purchases of $1 million or more of A Class shares that are redeemed in whole or in part within 18 months of purchase. Beginning July 1, 2024, the Fund will no longer assess a front-end sales load on purchases of A Class shares of $500,000 or more but will assess a CDSC of 1.00% on certain purchases of $500,000 or more of A Class shares that are redeemed in whole or in part within 18 months of purchase. |

|

| Material Fund Change Expenses [Text Block] |

Prior to July 1, 2024, the American Beacon TwentyFour Strategic Income Fund (the “Fund”) assessed a front-end sales load on purchases of A Class shares less than $1 million, and a contingent deferred sales charge (“CDSC”) of 0.50% on certain purchases of $1 million or more of A Class shares that are redeemed in whole or in part within 18 months of purchase. Beginning July 1, 2024, the Fund will no longer assess a front-end sales load on purchases of A Class shares of $500,000 or more but will assess a CDSC of 1.00% on certain purchases of $500,000 or more of A Class shares that are redeemed in whole or in part within 18 months of purchase.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since June 30, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

|

This is a summary of certain changes to the Fund since June 30, 2024.

|

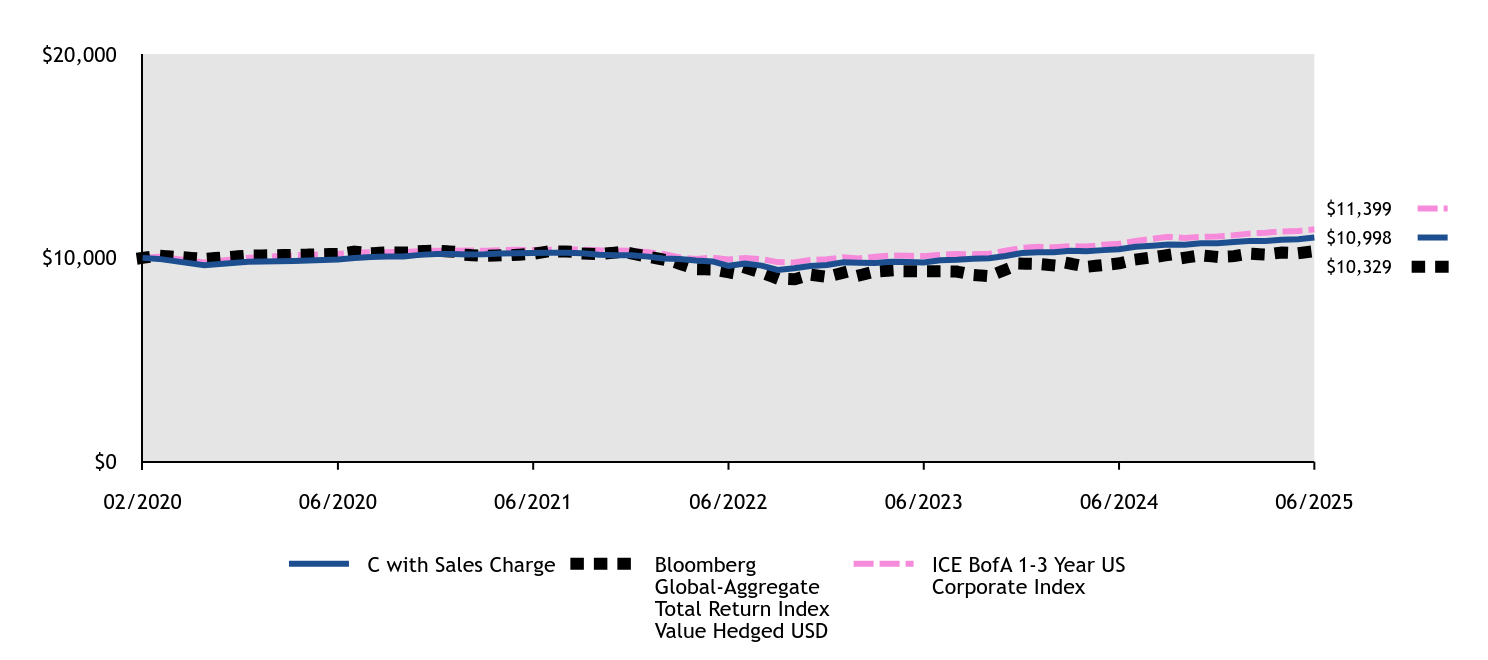

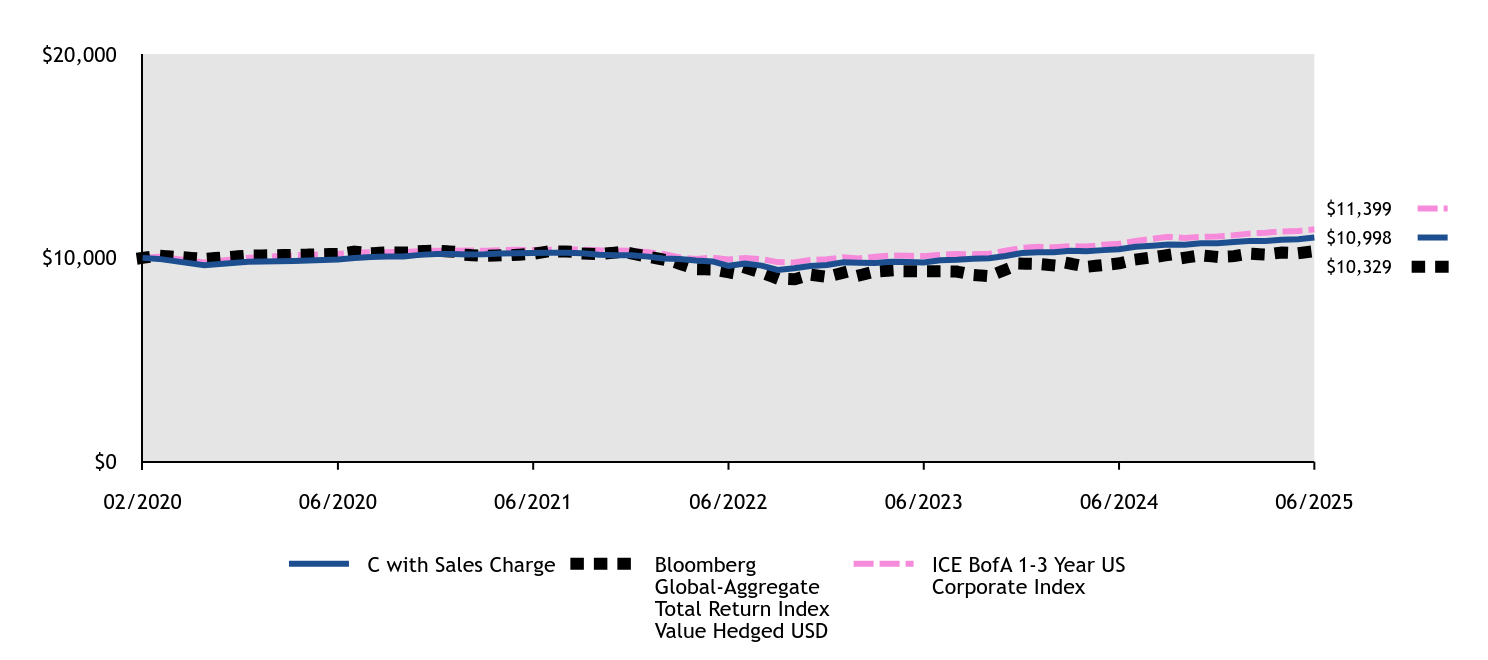

| C000205756 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

TwentyFour Strategic Income Fund

|

|

| Class Name |

C

|

|

| Trading Symbol |

TFGCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about American Beacon TwentyFour Strategic Income Fund for the period of July 1, 2024 to June 30, 2025.

|