Shareholder Report

|

6 Months Ended |

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

Dec. 31, 2024 |

| Shareholder Report [Line Items] |

|

|

|

| Document Type |

|

N-CSRS

|

|

| Amendment Flag |

|

false

|

|

| Registrant Name |

|

AMERICAN BEACON FUNDS

|

|

| Entity Central Index Key |

|

0000809593

|

|

| Entity Investment Company Type |

|

N-1A

|

|

| Document Period End Date |

|

Jun. 30, 2025

|

|

| C000213183 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL TargetRisk Fund

|

|

| Class Name |

|

A

|

|

| Trading Symbol |

|

AHTAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL TargetRisk Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$71 |

1.44%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 71

|

|

| Expense Ratio, Percent |

[1] |

1.44%

|

|

| AssetsNet |

|

$ 231,464,201

|

|

| Holdings Count | Holding |

|

20

|

|

| Advisory Fees Paid, Amount |

|

$ 1,167,613

|

|

| InvestmentCompanyPortfolioTurnover |

|

166.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$231,464,201 |

# of Portfolio Holdings |

20 |

Portfolio Turnover Rate |

166% |

Total Management Fees Paid |

$1,167,613 | |

|

| Holdings [Text Block] |

|

Asset Class Exposure % of VaR*

Header |

Net (%) |

% of VaR |

Stocks |

41.6 |

48.3 |

Credit |

47.3 |

6.1 |

Bonds and Rates |

75.1 |

27.6 |

Commodities |

14.7 |

18.0 |

Value |

Value |

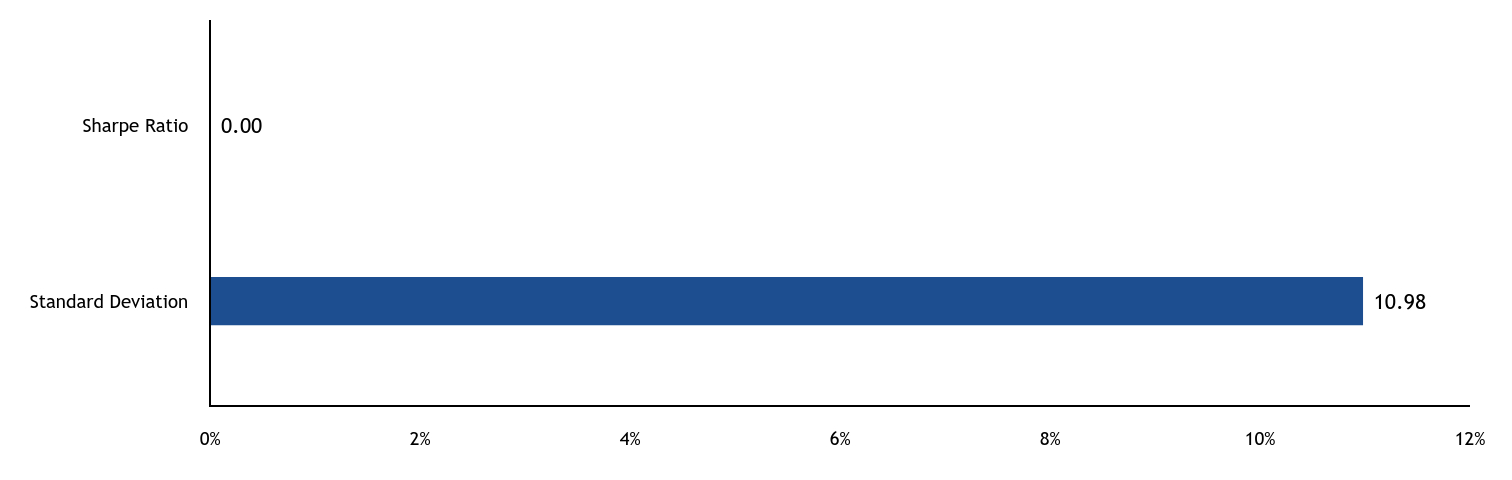

Standard Deviation |

10.98 |

Sharpe Ratio |

0.00 | Sharpe Ratio is a measure of the Fund’s return per unit of total risk. Standard Deviation is a measure of the historical volatility of the Fund’s returns. |

|

| Largest Holdings [Text Block] |

|

Top Ten Exposures - % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

18.0 |

US Treasuries |

Long |

12.4 |

S&P 500 Index |

Long |

7.8 |

Tokyo Stock Exchange Index |

Long |

4.6 |

NASDAQ 100 Index |

Long |

4.6 |

FTSE 100 |

Long |

3.7 |

Euro-STOXX |

Long |

3.6 |

Gilts |

Long |

3.5 |

S&P TSX 60 Index |

Long |

3.4 |

Nikkei |

Long |

3.0 | * Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Material Fund Change [Text Block] |

|

|

|

| C000213182 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL TargetRisk Fund

|

|

| Class Name |

|

C

|

|

| Trading Symbol |

|

AHACX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL TargetRisk Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$108 |

2.22%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 108

|

|

| Expense Ratio, Percent |

[2] |

2.22%

|

|

| AssetsNet |

|

$ 231,464,201

|

|

| Holdings Count | Holding |

|

20

|

|

| Advisory Fees Paid, Amount |

|

$ 1,167,613

|

|

| InvestmentCompanyPortfolioTurnover |

|

166.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$231,464,201 |

# of Portfolio Holdings |

20 |

Portfolio Turnover Rate |

166% |

Total Management Fees Paid |

$1,167,613 | |

|

| Holdings [Text Block] |

|

Asset Class Exposure % of VaR*

Header |

Net (%) |

% of VaR |

Stocks |

41.6 |

48.3 |

Credit |

47.3 |

6.1 |

Bonds and Rates |

75.1 |

27.6 |

Commodities |

14.7 |

18.0 |

Value |

Value |

Standard Deviation |

10.98 |

Sharpe Ratio |

0.00 | Sharpe Ratio is a measure of the Fund’s return per unit of total risk. Standard Deviation is a measure of the historical volatility of the Fund’s returns. |

|

| Largest Holdings [Text Block] |

|

Top Ten Exposures - % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

18.0 |

US Treasuries |

Long |

12.4 |

S&P 500 Index |

Long |

7.8 |

Tokyo Stock Exchange Index |

Long |

4.6 |

NASDAQ 100 Index |

Long |

4.6 |

FTSE 100 |

Long |

3.7 |

Euro-STOXX |

Long |

3.6 |

Gilts |

Long |

3.5 |

S&P TSX 60 Index |

Long |

3.4 |

Nikkei |

Long |

3.0 | * Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Material Fund Change [Text Block] |

|

|

|

| C000207202 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL TargetRisk Fund

|

|

| Class Name |

|

Investor

|

|

| Trading Symbol |

|

AHTPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL TargetRisk Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Investor |

$76 |

1.55%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 76

|

|

| Expense Ratio, Percent |

[3] |

1.55%

|

|

| AssetsNet |

|

$ 231,464,201

|

|

| Holdings Count | Holding |

|

20

|

|

| Advisory Fees Paid, Amount |

|

$ 1,167,613

|

|

| InvestmentCompanyPortfolioTurnover |

|

166.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$231,464,201 |

# of Portfolio Holdings |

20 |

Portfolio Turnover Rate |

166% |

Total Management Fees Paid |

$1,167,613 | |

|

| Holdings [Text Block] |

|

Asset Class Exposure % of VaR*

Header |

Net (%) |

% of VaR |

Stocks |

41.6 |

48.3 |

Credit |

47.3 |

6.1 |

Bonds and Rates |

75.1 |

27.6 |

Commodities |

14.7 |

18.0 |

Value |

Value |

Standard Deviation |

10.98 |

Sharpe Ratio |

0.00 | Sharpe Ratio is a measure of the Fund’s return per unit of total risk. Standard Deviation is a measure of the historical volatility of the Fund’s returns. |

|

| Largest Holdings [Text Block] |

|

Top Ten Exposures - % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

18.0 |

US Treasuries |

Long |

12.4 |

S&P 500 Index |

Long |

7.8 |

Tokyo Stock Exchange Index |

Long |

4.6 |

NASDAQ 100 Index |

Long |

4.6 |

FTSE 100 |

Long |

3.7 |

Euro-STOXX |

Long |

3.6 |

Gilts |

Long |

3.5 |

S&P TSX 60 Index |

Long |

3.4 |

Nikkei |

Long |

3.0 | * Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Material Fund Change [Text Block] |

|

|

|

| C000207200 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL TargetRisk Fund

|

|

| Class Name |

|

R5

|

|

| Trading Symbol |

|

AHTIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL TargetRisk Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R5 |

$51 |

1.04%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 51

|

|

| Expense Ratio, Percent |

[4] |

1.04%

|

|

| AssetsNet |

|

$ 231,464,201

|

|

| Holdings Count | Holding |

|

20

|

|

| Advisory Fees Paid, Amount |

|

$ 1,167,613

|

|

| InvestmentCompanyPortfolioTurnover |

|

166.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$231,464,201 |

# of Portfolio Holdings |

20 |

Portfolio Turnover Rate |

166% |

Total Management Fees Paid |

$1,167,613 | |

|

| Holdings [Text Block] |

|

Asset Class Exposure % of VaR*

Header |

Net (%) |

% of VaR |

Stocks |

41.6 |

48.3 |

Credit |

47.3 |

6.1 |

Bonds and Rates |

75.1 |

27.6 |

Commodities |

14.7 |

18.0 |

Value |

Value |

Standard Deviation |

10.98 |

Sharpe Ratio |

0.00 | Sharpe Ratio is a measure of the Fund’s return per unit of total risk. Standard Deviation is a measure of the historical volatility of the Fund’s returns. |

|

| Largest Holdings [Text Block] |

|

Top Ten Exposures - % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

18.0 |

US Treasuries |

Long |

12.4 |

S&P 500 Index |

Long |

7.8 |

Tokyo Stock Exchange Index |

Long |

4.6 |

NASDAQ 100 Index |

Long |

4.6 |

FTSE 100 |

Long |

3.7 |

Euro-STOXX |

Long |

3.6 |

Gilts |

Long |

3.5 |

S&P TSX 60 Index |

Long |

3.4 |

Nikkei |

Long |

3.0 | * Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Material Fund Change [Text Block] |

|

|

|

| C000207201 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL TargetRisk Fund

|

|

| Class Name |

|

Y

|

|

| Trading Symbol |

|

AHTYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL TargetRisk Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Y |

$59 |

1.21%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 59

|

|

| Expense Ratio, Percent |

[5] |

1.21%

|

|

| AssetsNet |

|

$ 231,464,201

|

|

| Holdings Count | Holding |

|

20

|

|

| Advisory Fees Paid, Amount |

|

$ 1,167,613

|

|

| InvestmentCompanyPortfolioTurnover |

|

166.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$231,464,201 |

# of Portfolio Holdings |

20 |

Portfolio Turnover Rate |

166% |

Total Management Fees Paid |

$1,167,613 | |

|

| Holdings [Text Block] |

|

Asset Class Exposure % of VaR*

Header |

Net (%) |

% of VaR |

Stocks |

41.6 |

48.3 |

Credit |

47.3 |

6.1 |

Bonds and Rates |

75.1 |

27.6 |

Commodities |

14.7 |

18.0 |

Value |

Value |

Standard Deviation |

10.98 |

Sharpe Ratio |

0.00 | Sharpe Ratio is a measure of the Fund’s return per unit of total risk. Standard Deviation is a measure of the historical volatility of the Fund’s returns. |

|

| Largest Holdings [Text Block] |

|

Top Ten Exposures - % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

18.0 |

US Treasuries |

Long |

12.4 |

S&P 500 Index |

Long |

7.8 |

Tokyo Stock Exchange Index |

Long |

4.6 |

NASDAQ 100 Index |

Long |

4.6 |

FTSE 100 |

Long |

3.7 |

Euro-STOXX |

Long |

3.6 |

Gilts |

Long |

3.5 |

S&P TSX 60 Index |

Long |

3.4 |

Nikkei |

Long |

3.0 | * Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Material Fund Change [Text Block] |

|

|

|

| C000244413 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL Multi-Alternatives Fund

|

|

| Class Name |

|

A

|

|

| Trading Symbol |

|

AHMAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL Multi-Alternatives Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 20px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$75 |

1.56%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 75

|

|

| Expense Ratio, Percent |

[6] |

1.56%

|

|

| AssetsNet |

|

$ 36,358,360

|

|

| Holdings Count | Holding |

|

12

|

|

| Advisory Fees Paid, Amount |

|

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

|

162.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$36,358,360 |

# of Portfolio Holdings |

12 |

Portfolio Turnover Rate |

162% |

Total Management Fees Paid |

$0 | |

|

| Holdings [Text Block] |

|

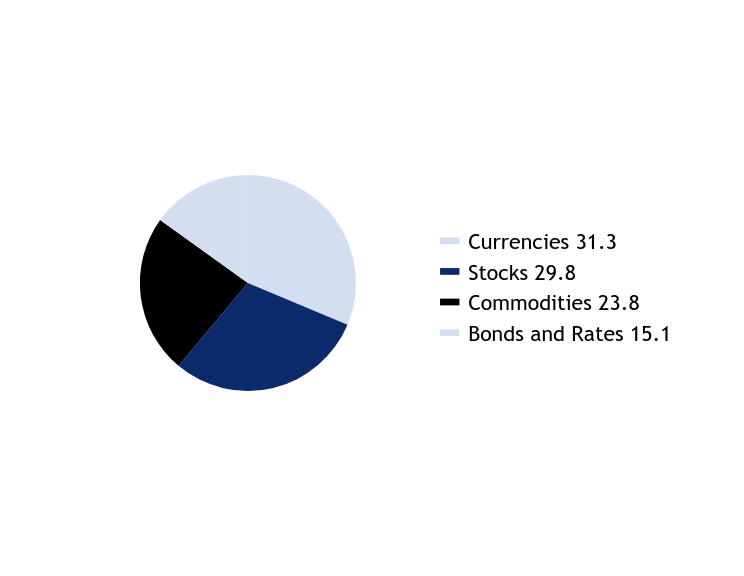

Top Active Exposures by Asset Class % of VaR*

Commodities |

Header |

% of VaR |

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

Silver |

Long |

2.2 |

Wheat |

Short |

2.0 |

Gold |

Long |

1.9 |

Natural Gas |

Short |

1.6 |

Credit |

Header |

% of VaR |

US 5yr CDX Index |

Long |

1.8 |

Currencies |

Header |

% of VaR |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

South African Rand/US Dollar |

Long/Short |

1.7 |

Norwegian Krone/US Dollar |

Long/Short |

1.5 |

UK Sterling/US Dollar |

Long/Short |

1.4 |

Euro/US Dollar |

Long/Short |

1.2 |

Equities |

Header |

% of VaR |

S&P 500 Index |

Long |

4.1 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Fixed Income |

Header |

% of VaR |

US Treasuries |

Long |

3.3 |

Euribor |

Long |

2.3 |

Italian Bonds |

Long |

2.0 |

Australian Bonds |

Long |

1.4 |

French Bonds |

Long |

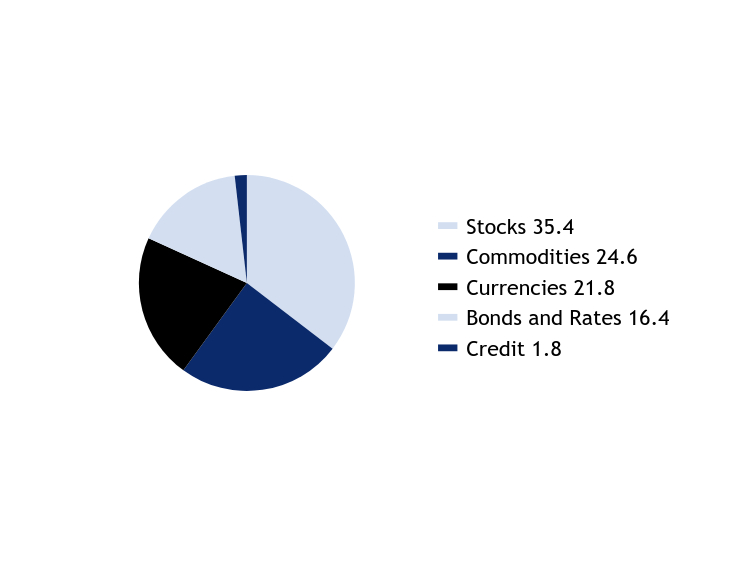

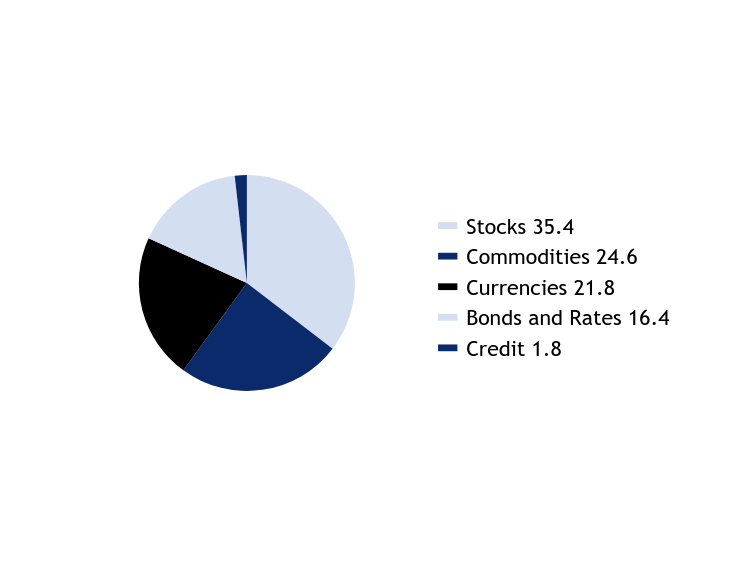

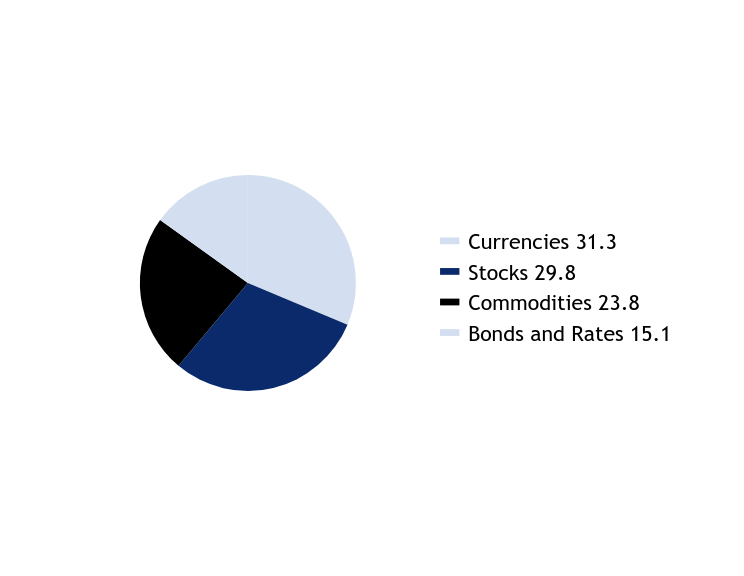

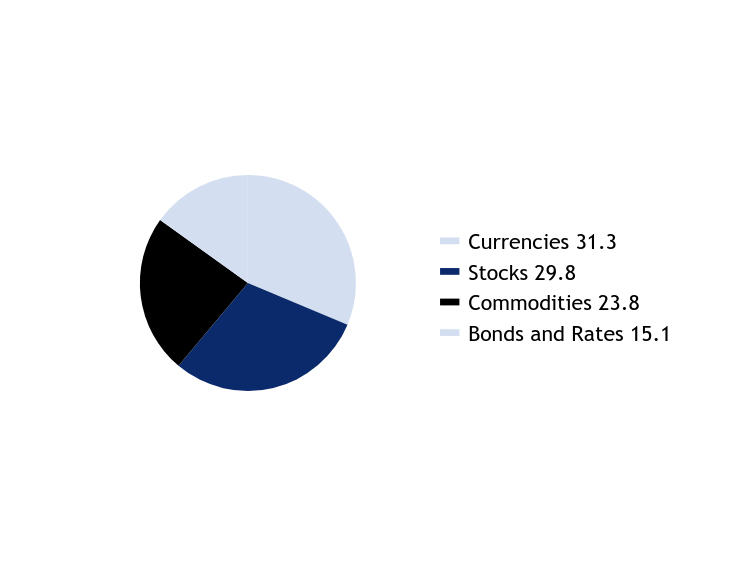

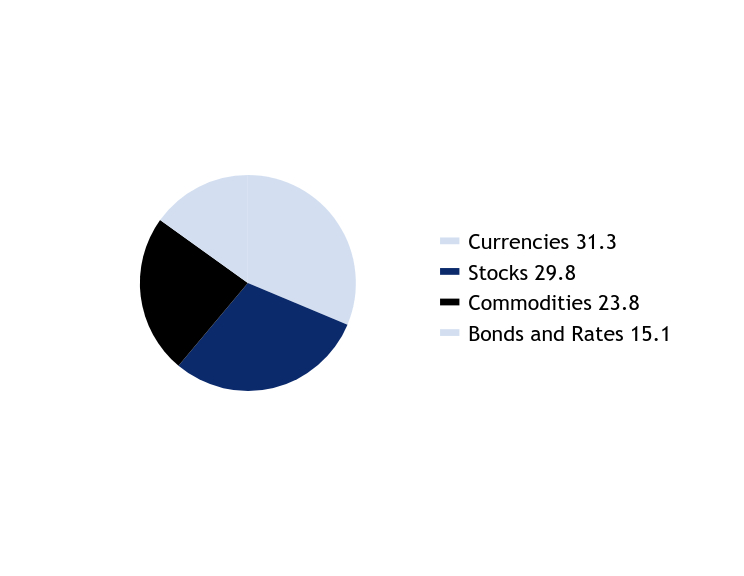

1.3 | Asset Class Exposure % of VaR*

Value |

Value |

Stocks |

35.4 |

Commodities |

24.6 |

Currencies |

21.8 |

Bonds and Rates |

16.4 |

Credit |

1.8 | *Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Largest Holdings [Text Block] |

|

Top 10 Holdings % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

S&P 500 Index |

Long |

4.1 |

US Treasuries |

Long |

3.3 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

Euribor |

Long |

2.3 |

Euro-STOXX |

Long |

2.2 | |

|

| C000244414 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL Multi-Alternatives Fund

|

|

| Class Name |

|

C

|

|

| Trading Symbol |

|

AHMCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL Multi-Alternatives Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 20px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$111 |

2.31%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 111

|

|

| Expense Ratio, Percent |

[7] |

2.31%

|

|

| AssetsNet |

|

$ 36,358,360

|

|

| Holdings Count | Holding |

|

12

|

|

| Advisory Fees Paid, Amount |

|

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

|

162.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$36,358,360 |

# of Portfolio Holdings |

12 |

Portfolio Turnover Rate |

162% |

Total Management Fees Paid |

$0 | |

|

| Holdings [Text Block] |

|

Top Active Exposures by Asset Class % of VaR*

Commodities |

Header |

% of VaR |

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

Silver |

Long |

2.2 |

Wheat |

Short |

2.0 |

Gold |

Long |

1.9 |

Natural Gas |

Short |

1.6 |

Credit |

Header |

% of VaR |

US 5yr CDX Index |

Long |

1.8 |

Currencies |

Header |

% of VaR |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

South African Rand/US Dollar |

Long/Short |

1.7 |

Norwegian Krone/US Dollar |

Long/Short |

1.5 |

UK Sterling/US Dollar |

Long/Short |

1.4 |

Euro/US Dollar |

Long/Short |

1.2 |

Equities |

Header |

% of VaR |

S&P 500 Index |

Long |

4.1 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Fixed Income |

Header |

% of VaR |

US Treasuries |

Long |

3.3 |

Euribor |

Long |

2.3 |

Italian Bonds |

Long |

2.0 |

Australian Bonds |

Long |

1.4 |

French Bonds |

Long |

1.3 | Asset Class Exposure % of VaR*

Value |

Value |

Stocks |

35.4 |

Commodities |

24.6 |

Currencies |

21.8 |

Bonds and Rates |

16.4 |

Credit |

1.8 | *Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Largest Holdings [Text Block] |

|

Top 10 Holdings % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

S&P 500 Index |

Long |

4.1 |

US Treasuries |

Long |

3.3 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

Euribor |

Long |

2.3 |

Euro-STOXX |

Long |

2.2 | |

|

| C000244411 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL Multi-Alternatives Fund

|

|

| Class Name |

|

R6

|

|

| Trading Symbol |

|

AHMRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL Multi-Alternatives Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 20px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R6 |

$59 |

1.23%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 59

|

|

| Expense Ratio, Percent |

[8] |

1.23%

|

|

| AssetsNet |

|

$ 36,358,360

|

|

| Holdings Count | Holding |

|

12

|

|

| Advisory Fees Paid, Amount |

|

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

|

162.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$36,358,360 |

# of Portfolio Holdings |

12 |

Portfolio Turnover Rate |

162% |

Total Management Fees Paid |

$0 | |

|

| Holdings [Text Block] |

|

Top Active Exposures by Asset Class % of VaR*

Commodities |

Header |

% of VaR |

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

Silver |

Long |

2.2 |

Wheat |

Short |

2.0 |

Gold |

Long |

1.9 |

Natural Gas |

Short |

1.6 |

Credit |

Header |

% of VaR |

US 5yr CDX Index |

Long |

1.8 |

Currencies |

Header |

% of VaR |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

South African Rand/US Dollar |

Long/Short |

1.7 |

Norwegian Krone/US Dollar |

Long/Short |

1.5 |

UK Sterling/US Dollar |

Long/Short |

1.4 |

Euro/US Dollar |

Long/Short |

1.2 |

Equities |

Header |

% of VaR |

S&P 500 Index |

Long |

4.1 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Fixed Income |

Header |

% of VaR |

US Treasuries |

Long |

3.3 |

Euribor |

Long |

2.3 |

Italian Bonds |

Long |

2.0 |

Australian Bonds |

Long |

1.4 |

French Bonds |

Long |

1.3 | Asset Class Exposure % of VaR*

Value |

Value |

Stocks |

35.4 |

Commodities |

24.6 |

Currencies |

21.8 |

Bonds and Rates |

16.4 |

Credit |

1.8 | *Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Largest Holdings [Text Block] |

|

Top 10 Holdings % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

S&P 500 Index |

Long |

4.1 |

US Treasuries |

Long |

3.3 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

Euribor |

Long |

2.3 |

Euro-STOXX |

Long |

2.2 | |

|

| C000244412 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

AHL Multi-Alternatives Fund

|

|

| Class Name |

|

Y

|

|

| Trading Symbol |

|

AHMYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about American Beacon AHL Multi-Alternatives Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 20px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Y |

$64 |

1.33%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 64

|

|

| Expense Ratio, Percent |

[9] |

1.33%

|

|

| AssetsNet |

|

$ 36,358,360

|

|

| Holdings Count | Holding |

|

12

|

|

| Advisory Fees Paid, Amount |

|

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

|

162.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$36,358,360 |

# of Portfolio Holdings |

12 |

Portfolio Turnover Rate |

162% |

Total Management Fees Paid |

$0 | |

|

| Holdings [Text Block] |

|

Top Active Exposures by Asset Class % of VaR*

Commodities |

Header |

% of VaR |

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

Silver |

Long |

2.2 |

Wheat |

Short |

2.0 |

Gold |

Long |

1.9 |

Natural Gas |

Short |

1.6 |

Credit |

Header |

% of VaR |

US 5yr CDX Index |

Long |

1.8 |

Currencies |

Header |

% of VaR |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

South African Rand/US Dollar |

Long/Short |

1.7 |

Norwegian Krone/US Dollar |

Long/Short |

1.5 |

UK Sterling/US Dollar |

Long/Short |

1.4 |

Euro/US Dollar |

Long/Short |

1.2 |

Equities |

Header |

% of VaR |

S&P 500 Index |

Long |

4.1 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Fixed Income |

Header |

% of VaR |

US Treasuries |

Long |

3.3 |

Euribor |

Long |

2.3 |

Italian Bonds |

Long |

2.0 |

Australian Bonds |

Long |

1.4 |

French Bonds |

Long |

1.3 | Asset Class Exposure % of VaR*

Value |

Value |

Stocks |

35.4 |

Commodities |

24.6 |

Currencies |

21.8 |

Bonds and Rates |

16.4 |

Credit |

1.8 | *Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

|

| Largest Holdings [Text Block] |

|

Top 10 Holdings % of VaR*

BBG Commodity ex-Agriculturals Index |

Long |

6.6 |

S&P 500 Index |

Long |

4.1 |

US Treasuries |

Long |

3.3 |

FTSE 100 |

Long |

3.0 |

Tokyo Stock Exchange Index |

Long |

2.7 |

S&P TSX 60 Index |

Long |

2.6 |

NASDAQ 100 Index |

Long |

2.4 |

Mexican Peso/US Dollar |

Long/Short |

2.4 |

Euribor |

Long |

2.3 |

Euro-STOXX |

Long |

2.2 | |

|

| C000162332 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Growth Fund

|

|

| Class Name |

|

A

|

|

| Trading Symbol |

|

BLYAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Growth Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$56 |

1.09%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 56

|

|

| Expense Ratio, Percent |

[10] |

1.09%

|

|

| AssetsNet |

|

$ 199,114,598

|

|

| Holdings Count | Holding |

|

66

|

|

| Advisory Fees Paid, Amount |

|

$ 518,398

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$199,114,598 |

# of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$518,398 | |

|

| Holdings [Text Block] |

|

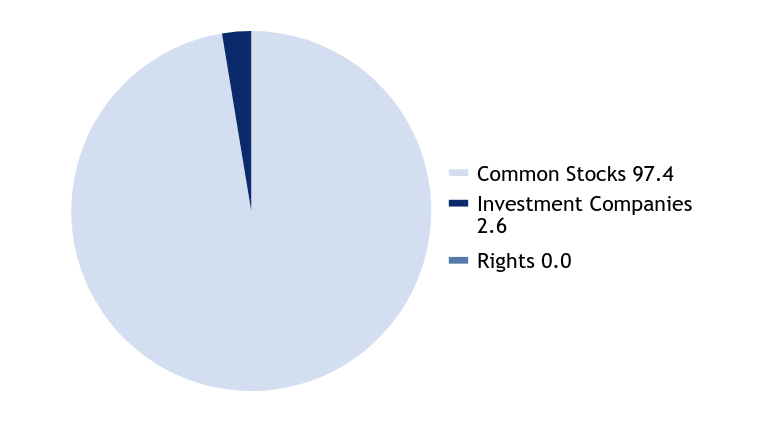

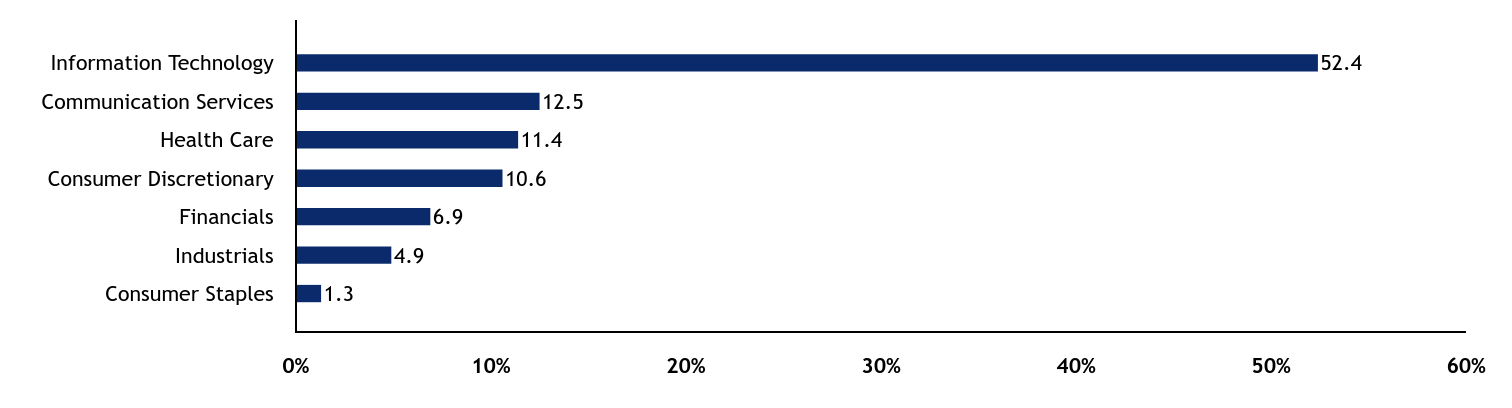

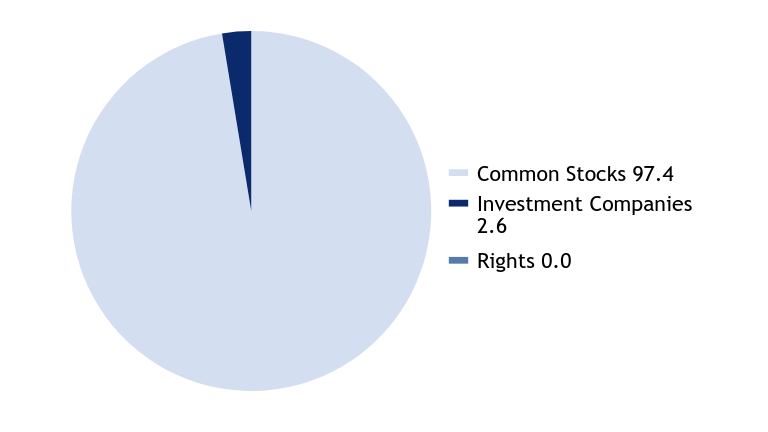

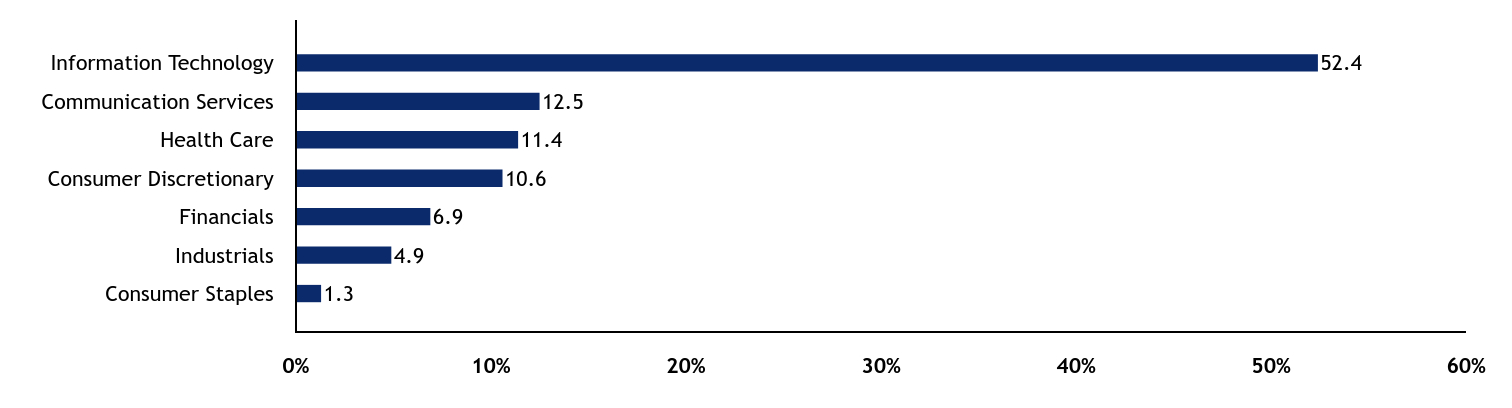

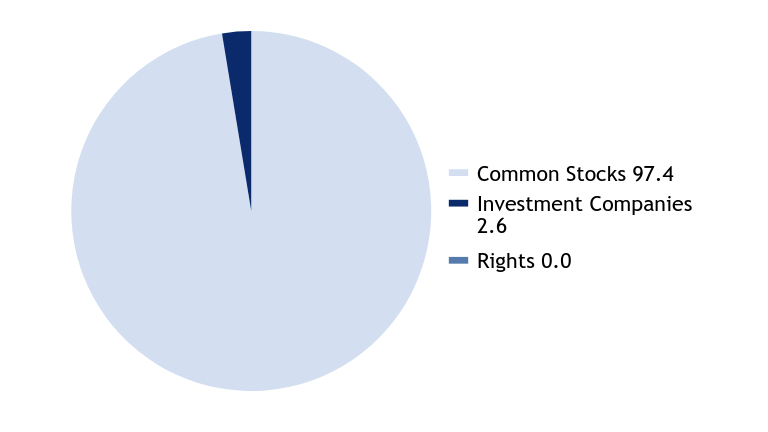

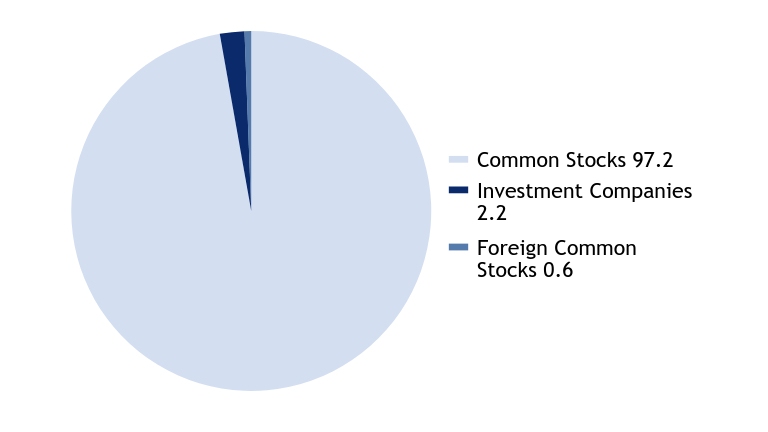

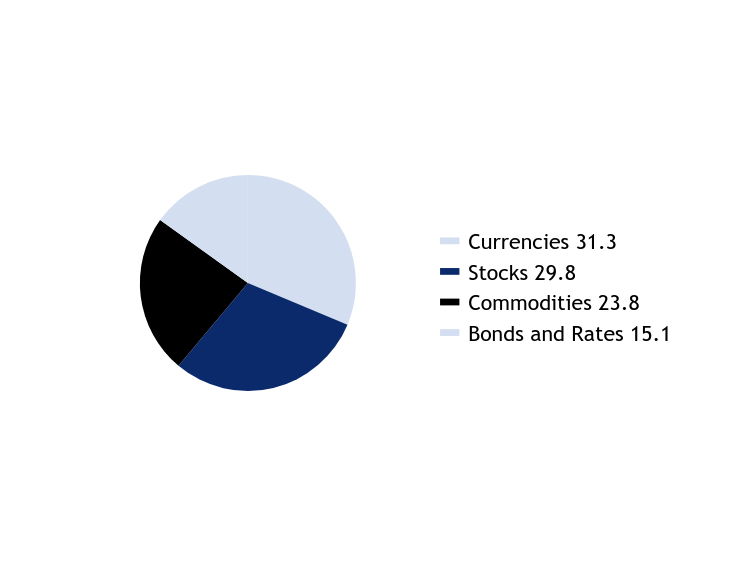

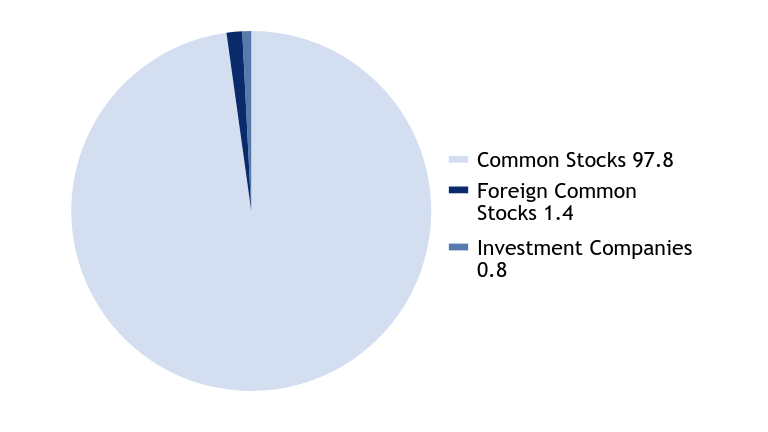

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.4 |

Investment Companies |

2.6 |

Rights |

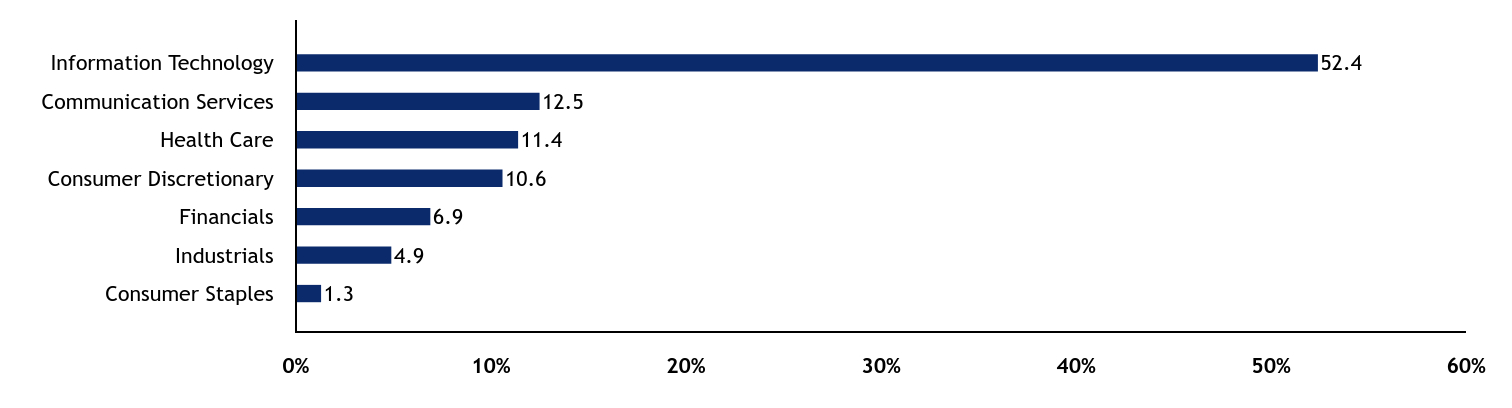

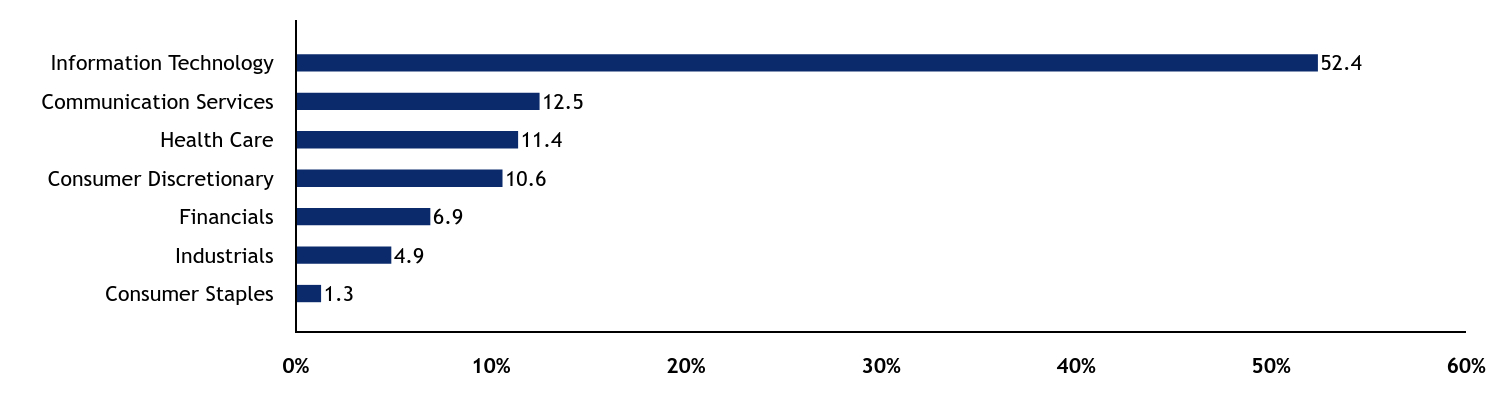

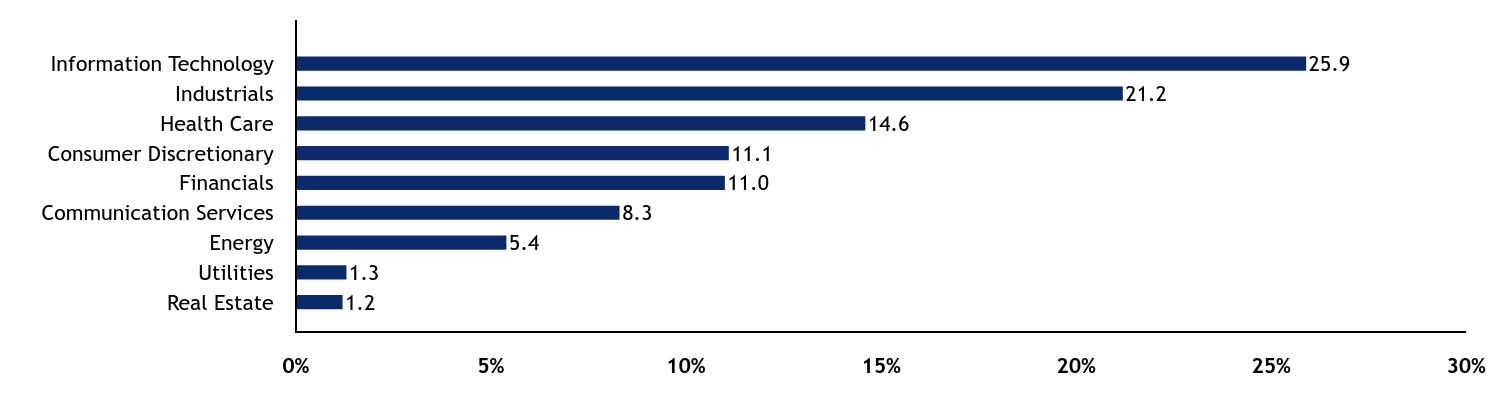

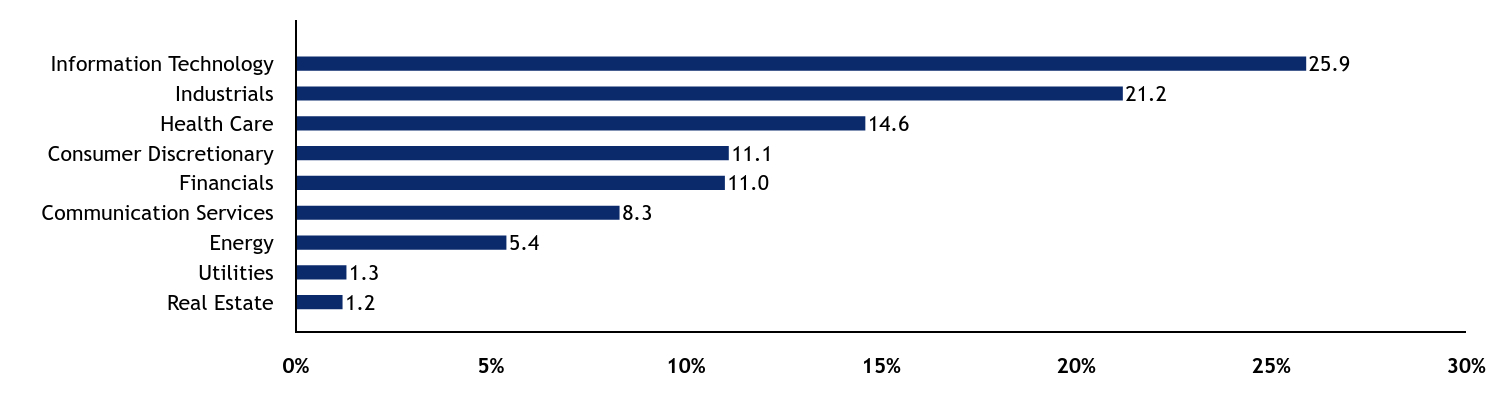

0.0 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Consumer Staples |

1.3 |

Industrials |

4.9 |

Financials |

6.9 |

Consumer Discretionary |

10.6 |

Health Care |

11.4 |

Communication Services |

12.5 |

Information Technology |

52.4 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

NVIDIA Corp. |

6.5 |

Alphabet, Inc., Class A |

6.2 |

Amazon.com, Inc. |

6.0 |

Microsoft Corp. |

5.7 |

Meta Platforms, Inc., Class A |

4.7 |

Apple, Inc. |

4.2 |

Mastercard, Inc., Class A |

3.9 |

Booking Holdings, Inc. |

3.6 |

Fortinet, Inc. |

3.0 |

Veeva Systems, Inc., Class A |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000162333 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Growth Fund

|

|

| Class Name |

|

C

|

|

| Trading Symbol |

|

BLYCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Growth Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$93 |

1.83%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 93

|

|

| Expense Ratio, Percent |

[11] |

1.83%

|

|

| AssetsNet |

|

$ 199,114,598

|

|

| Holdings Count | Holding |

|

66

|

|

| Advisory Fees Paid, Amount |

|

$ 518,398

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$199,114,598 |

# of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$518,398 | |

|

| Holdings [Text Block] |

|

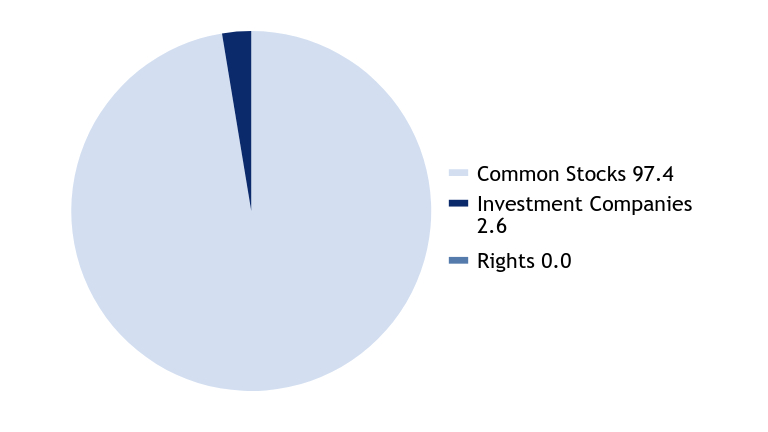

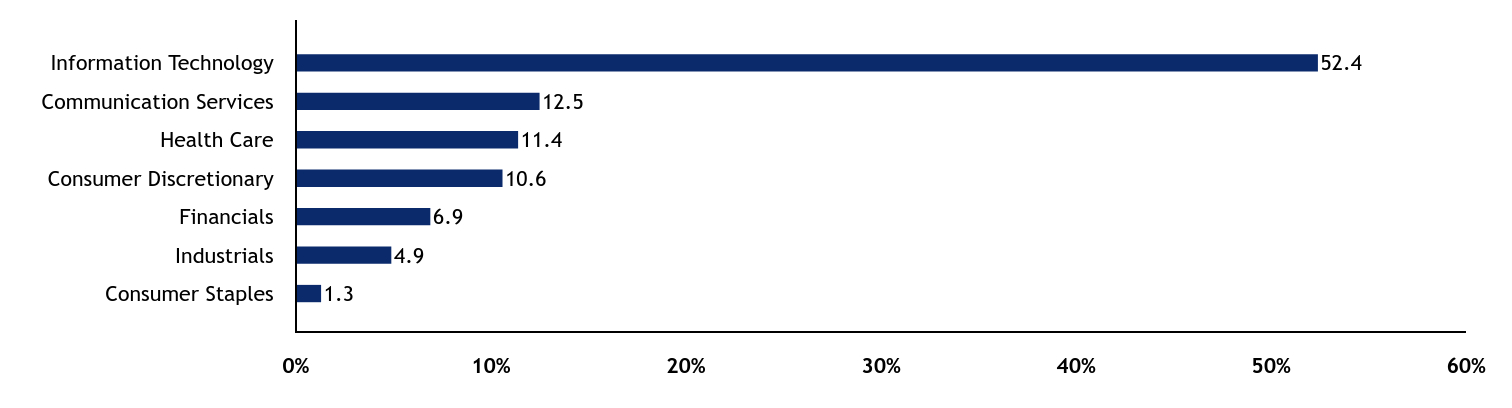

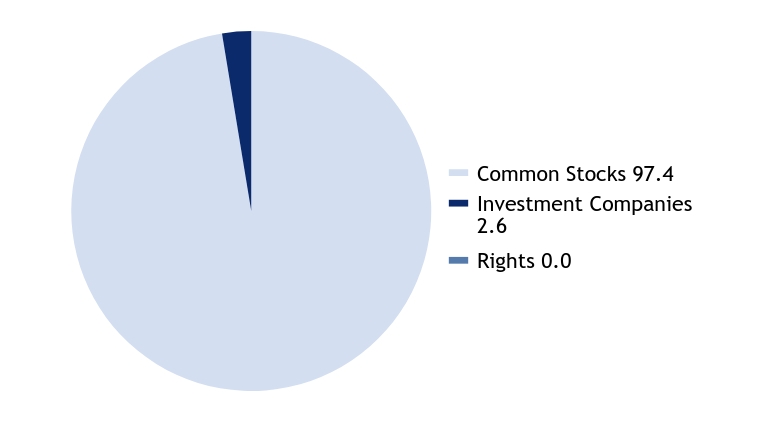

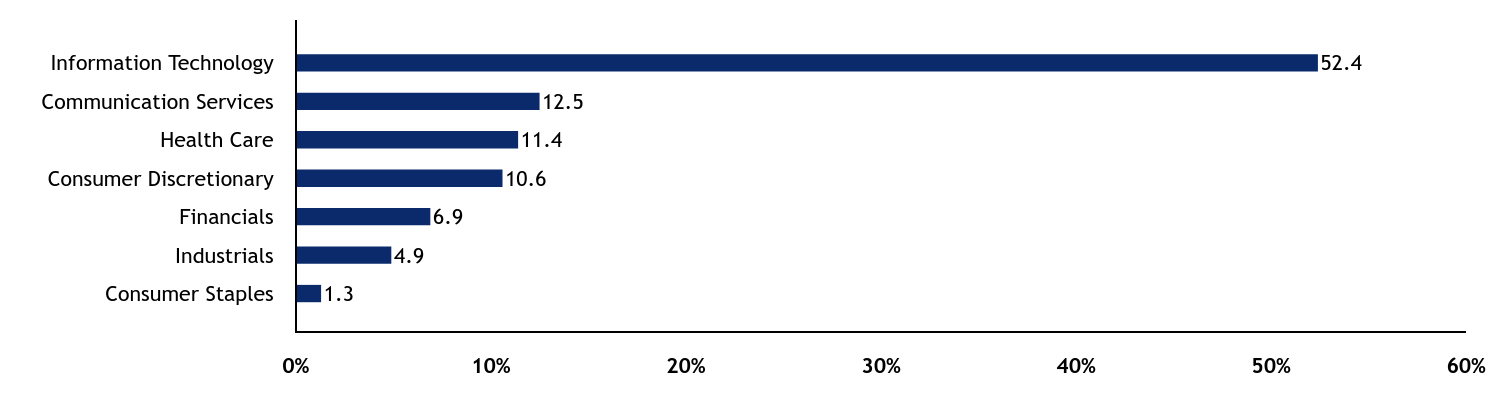

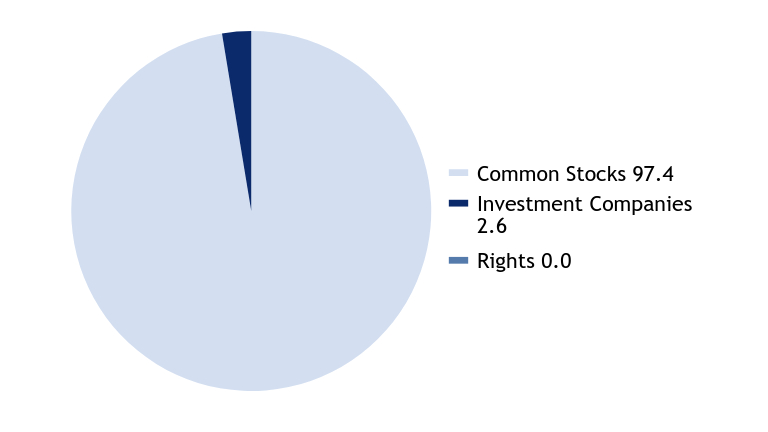

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.4 |

Investment Companies |

2.6 |

Rights |

0.0 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Consumer Staples |

1.3 |

Industrials |

4.9 |

Financials |

6.9 |

Consumer Discretionary |

10.6 |

Health Care |

11.4 |

Communication Services |

12.5 |

Information Technology |

52.4 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

NVIDIA Corp. |

6.5 |

Alphabet, Inc., Class A |

6.2 |

Amazon.com, Inc. |

6.0 |

Microsoft Corp. |

5.7 |

Meta Platforms, Inc., Class A |

4.7 |

Apple, Inc. |

4.2 |

Mastercard, Inc., Class A |

3.9 |

Booking Holdings, Inc. |

3.6 |

Fortinet, Inc. |

3.0 |

Veeva Systems, Inc., Class A |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000162335 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Growth Fund

|

|

| Class Name |

|

Investor

|

|

| Trading Symbol |

|

BLYPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Growth Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Investor |

$57 |

1.12%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 57

|

|

| Expense Ratio, Percent |

[12] |

1.12%

|

|

| AssetsNet |

|

$ 199,114,598

|

|

| Holdings Count | Holding |

|

66

|

|

| Advisory Fees Paid, Amount |

|

$ 518,398

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$199,114,598 |

# of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$518,398 | |

|

| Holdings [Text Block] |

|

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.4 |

Investment Companies |

2.6 |

Rights |

0.0 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Consumer Staples |

1.3 |

Industrials |

4.9 |

Financials |

6.9 |

Consumer Discretionary |

10.6 |

Health Care |

11.4 |

Communication Services |

12.5 |

Information Technology |

52.4 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

NVIDIA Corp. |

6.5 |

Alphabet, Inc., Class A |

6.2 |

Amazon.com, Inc. |

6.0 |

Microsoft Corp. |

5.7 |

Meta Platforms, Inc., Class A |

4.7 |

Apple, Inc. |

4.2 |

Mastercard, Inc., Class A |

3.9 |

Booking Holdings, Inc. |

3.6 |

Fortinet, Inc. |

3.0 |

Veeva Systems, Inc., Class A |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000162334 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Growth Fund

|

|

| Class Name |

|

R5

|

|

| Trading Symbol |

|

BRLGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Growth Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R5 |

$41 |

0.80%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 41

|

|

| Expense Ratio, Percent |

[13] |

0.80%

|

|

| AssetsNet |

|

$ 199,114,598

|

|

| Holdings Count | Holding |

|

66

|

|

| Advisory Fees Paid, Amount |

|

$ 518,398

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$199,114,598 |

# of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$518,398 | |

|

| Holdings [Text Block] |

|

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.4 |

Investment Companies |

2.6 |

Rights |

0.0 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Consumer Staples |

1.3 |

Industrials |

4.9 |

Financials |

6.9 |

Consumer Discretionary |

10.6 |

Health Care |

11.4 |

Communication Services |

12.5 |

Information Technology |

52.4 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

NVIDIA Corp. |

6.5 |

Alphabet, Inc., Class A |

6.2 |

Amazon.com, Inc. |

6.0 |

Microsoft Corp. |

5.7 |

Meta Platforms, Inc., Class A |

4.7 |

Apple, Inc. |

4.2 |

Mastercard, Inc., Class A |

3.9 |

Booking Holdings, Inc. |

3.6 |

Fortinet, Inc. |

3.0 |

Veeva Systems, Inc., Class A |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000202403 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Growth Fund

|

|

| Class Name |

|

R6

|

|

| Trading Symbol |

|

BLYRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Growth Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R6 |

$39 |

0.77%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 39

|

|

| Expense Ratio, Percent |

[14] |

0.77%

|

|

| AssetsNet |

|

$ 199,114,598

|

|

| Holdings Count | Holding |

|

66

|

|

| Advisory Fees Paid, Amount |

|

$ 518,398

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$199,114,598 |

# of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$518,398 | |

|

| Holdings [Text Block] |

|

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.4 |

Investment Companies |

2.6 |

Rights |

0.0 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Consumer Staples |

1.3 |

Industrials |

4.9 |

Financials |

6.9 |

Consumer Discretionary |

10.6 |

Health Care |

11.4 |

Communication Services |

12.5 |

Information Technology |

52.4 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

NVIDIA Corp. |

6.5 |

Alphabet, Inc., Class A |

6.2 |

Amazon.com, Inc. |

6.0 |

Microsoft Corp. |

5.7 |

Meta Platforms, Inc., Class A |

4.7 |

Apple, Inc. |

4.2 |

Mastercard, Inc., Class A |

3.9 |

Booking Holdings, Inc. |

3.6 |

Fortinet, Inc. |

3.0 |

Veeva Systems, Inc., Class A |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000162336 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Growth Fund

|

|

| Class Name |

|

Y

|

|

| Trading Symbol |

|

BLYYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Growth Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Y |

$42 |

0.83%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 42

|

|

| Expense Ratio, Percent |

[15] |

0.83%

|

|

| AssetsNet |

|

$ 199,114,598

|

|

| Holdings Count | Holding |

|

66

|

|

| Advisory Fees Paid, Amount |

|

$ 518,398

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$199,114,598 |

# of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$518,398 | |

|

| Holdings [Text Block] |

|

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.4 |

Investment Companies |

2.6 |

Rights |

0.0 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Consumer Staples |

1.3 |

Industrials |

4.9 |

Financials |

6.9 |

Consumer Discretionary |

10.6 |

Health Care |

11.4 |

Communication Services |

12.5 |

Information Technology |

52.4 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

NVIDIA Corp. |

6.5 |

Alphabet, Inc., Class A |

6.2 |

Amazon.com, Inc. |

6.0 |

Microsoft Corp. |

5.7 |

Meta Platforms, Inc., Class A |

4.7 |

Apple, Inc. |

4.2 |

Mastercard, Inc., Class A |

3.9 |

Booking Holdings, Inc. |

3.6 |

Fortinet, Inc. |

3.0 |

Veeva Systems, Inc., Class A |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000110036 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Value Fund

|

|

| Class Name |

|

A

|

|

| Trading Symbol |

|

BWLAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Value Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$56 |

1.10%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 56

|

|

| Expense Ratio, Percent |

[16] |

1.10%

|

|

| AssetsNet |

|

$ 223,748,141

|

|

| Holdings Count | Holding |

|

99

|

|

| Advisory Fees Paid, Amount |

|

$ 619,548

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$223,748,141 |

# of Portfolio Holdings |

99 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$619,548 | |

|

| Holdings [Text Block] |

|

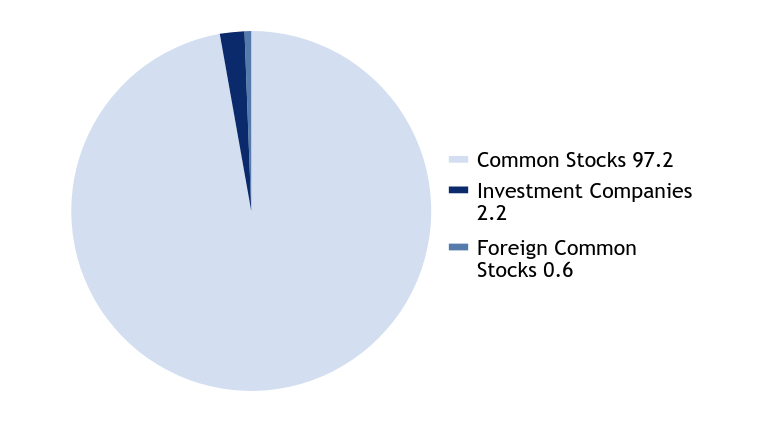

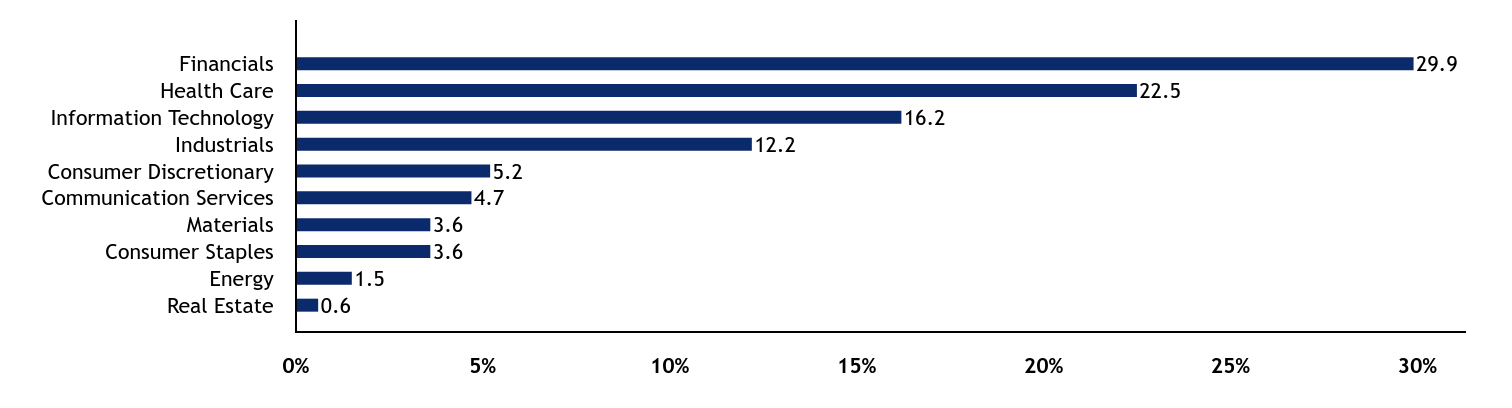

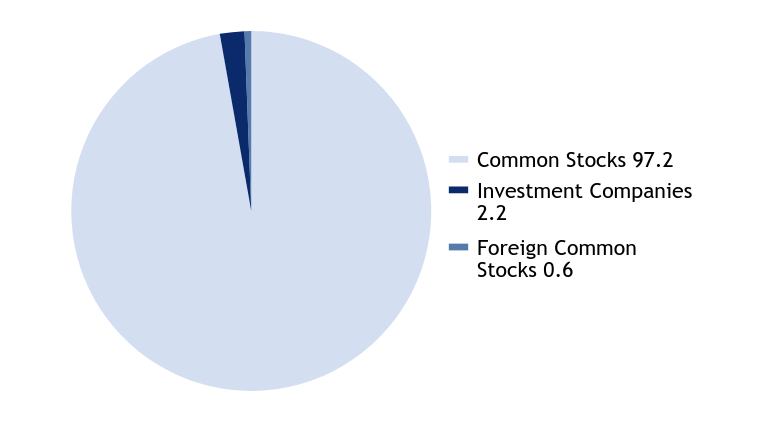

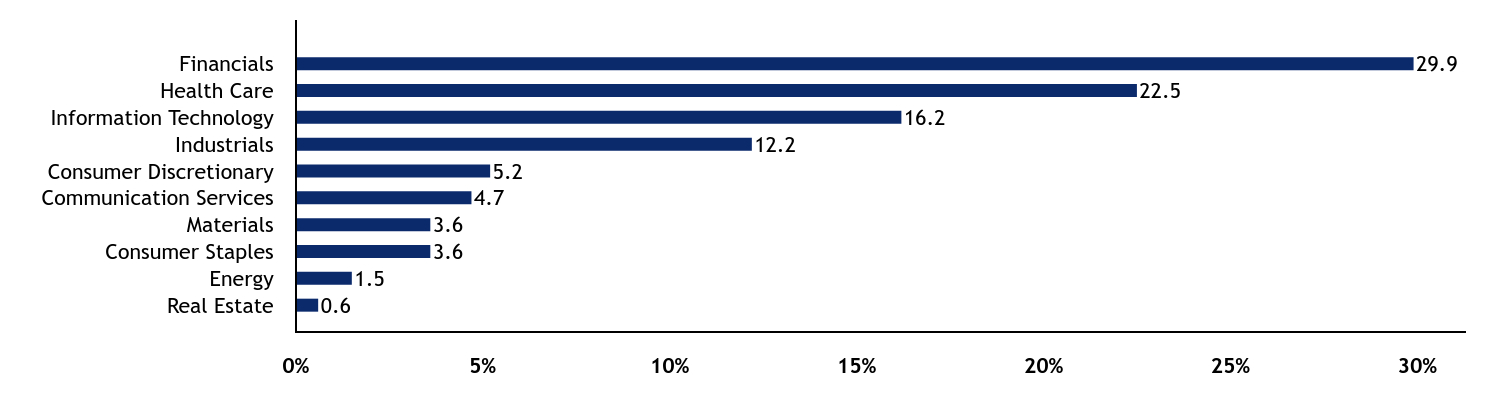

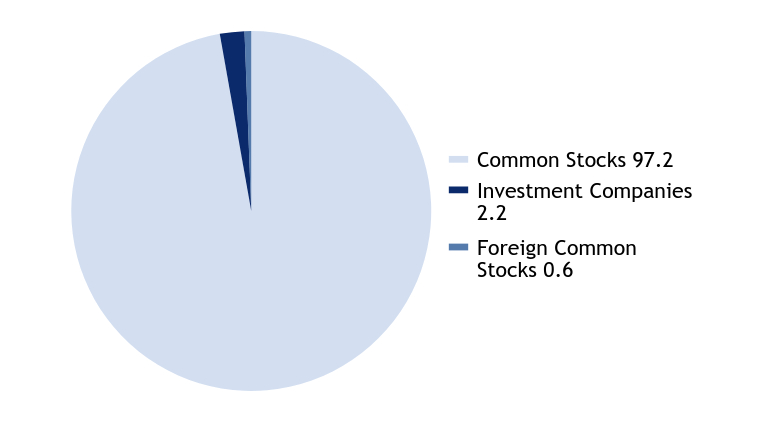

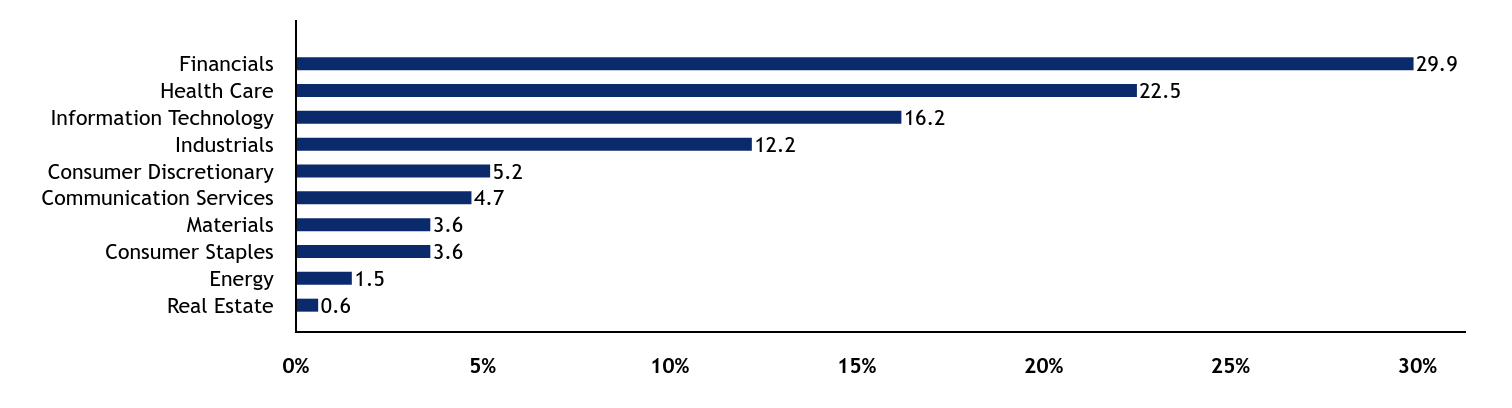

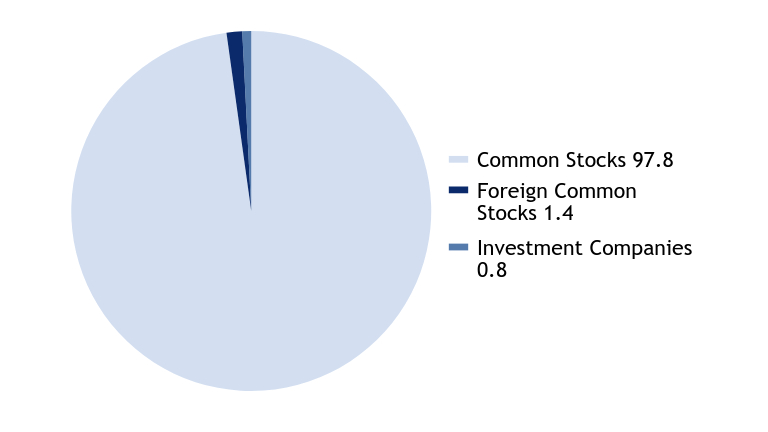

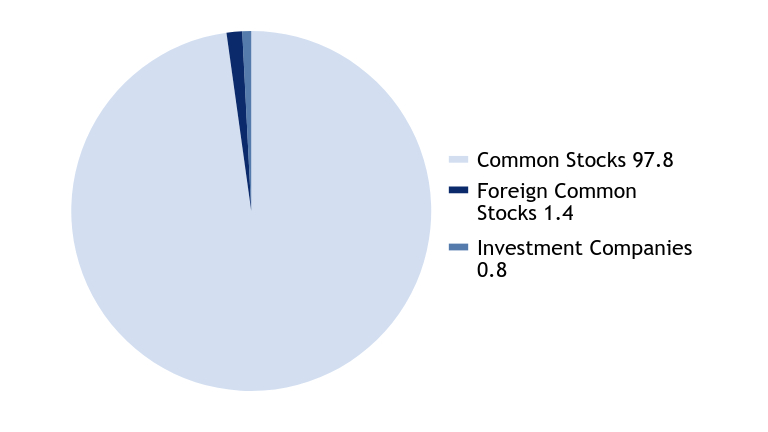

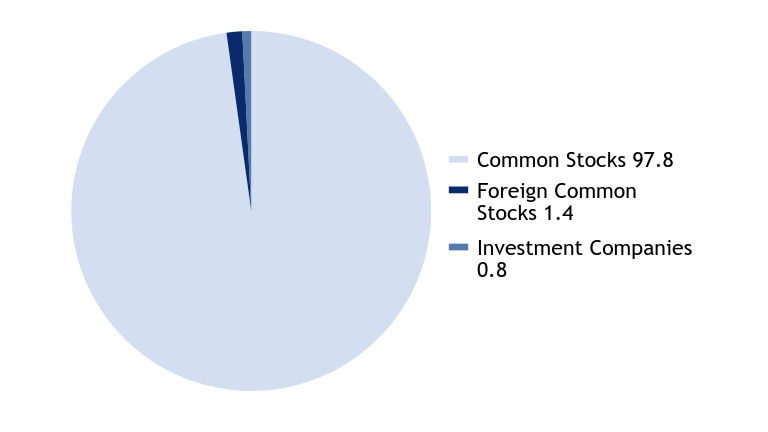

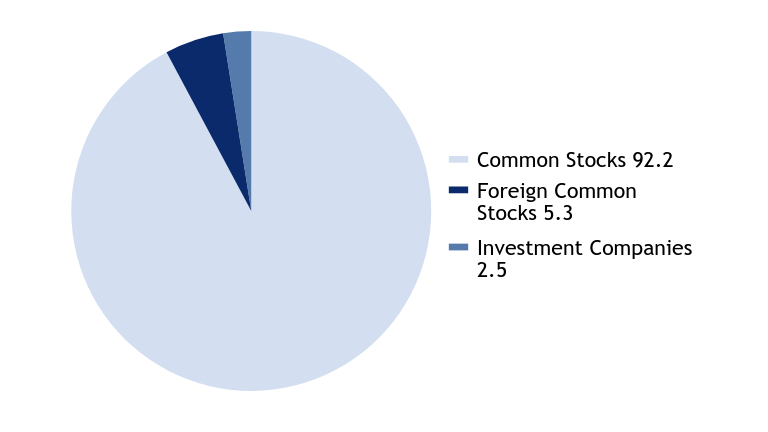

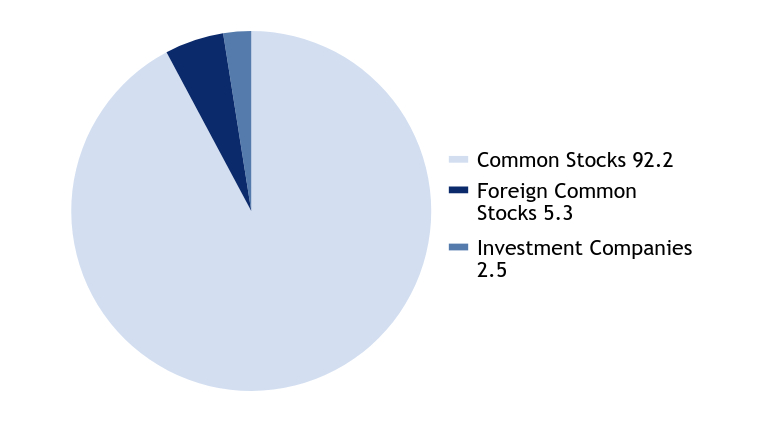

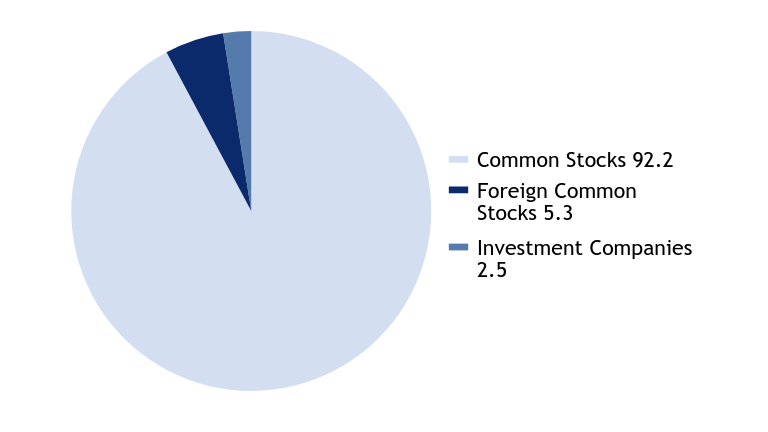

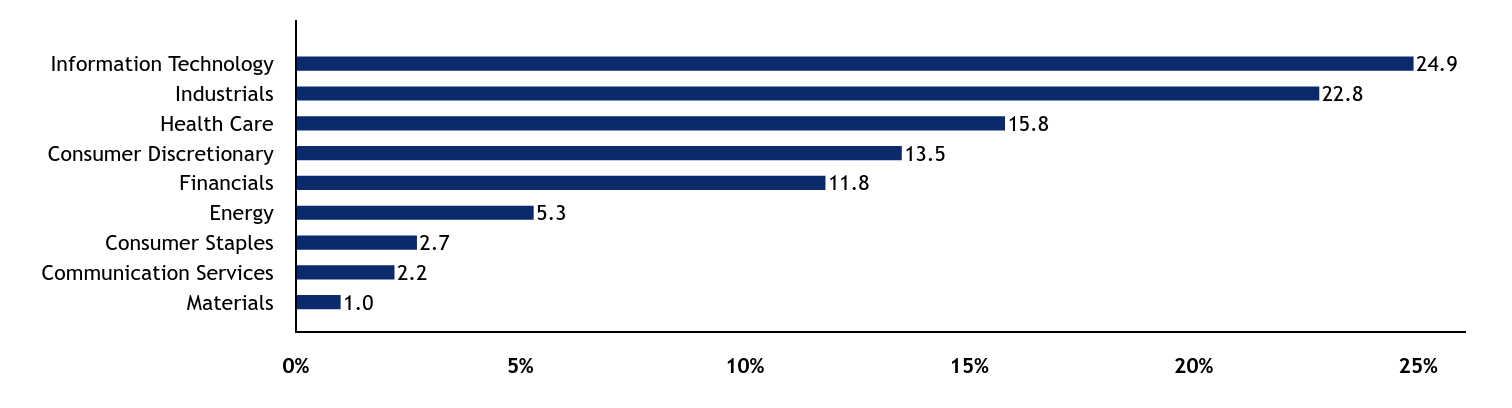

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.2 |

Investment Companies |

2.2 |

Foreign Common Stocks |

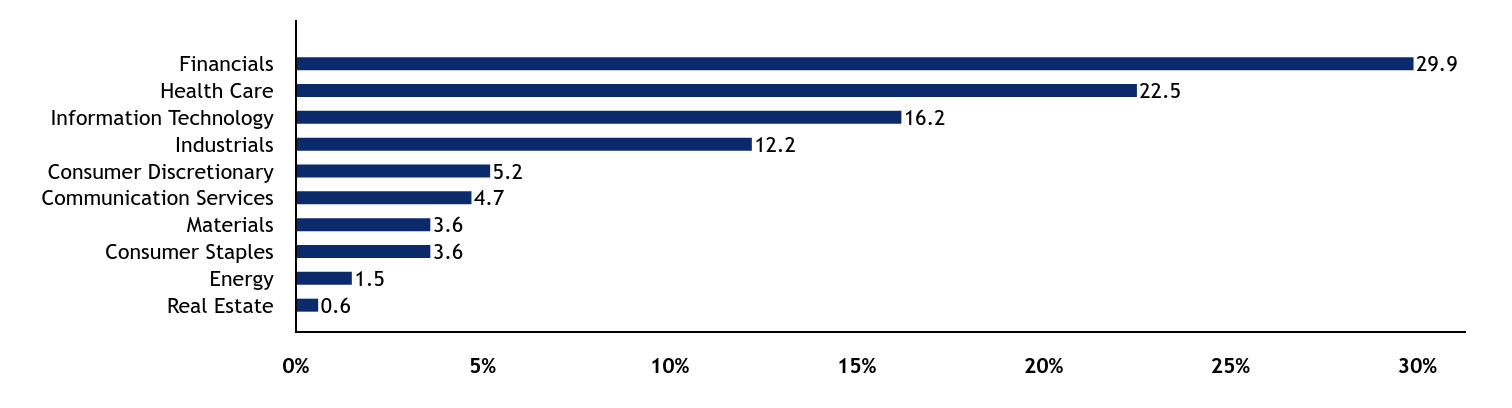

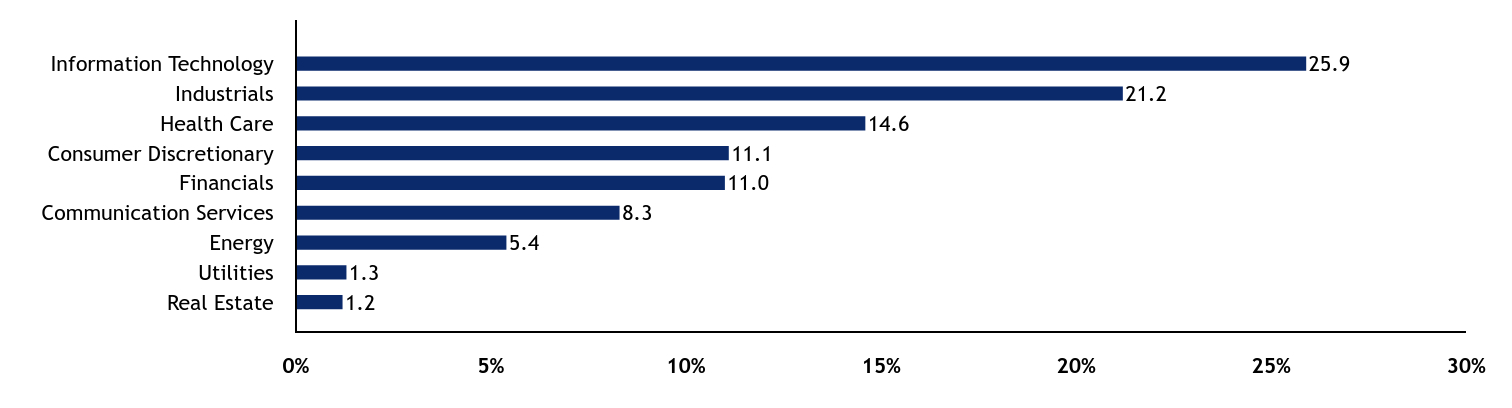

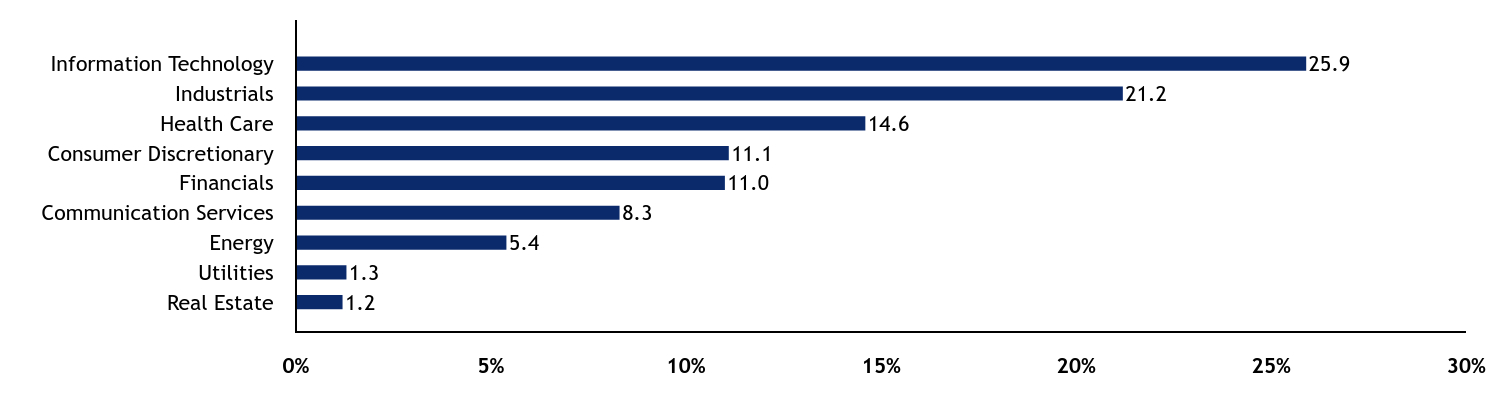

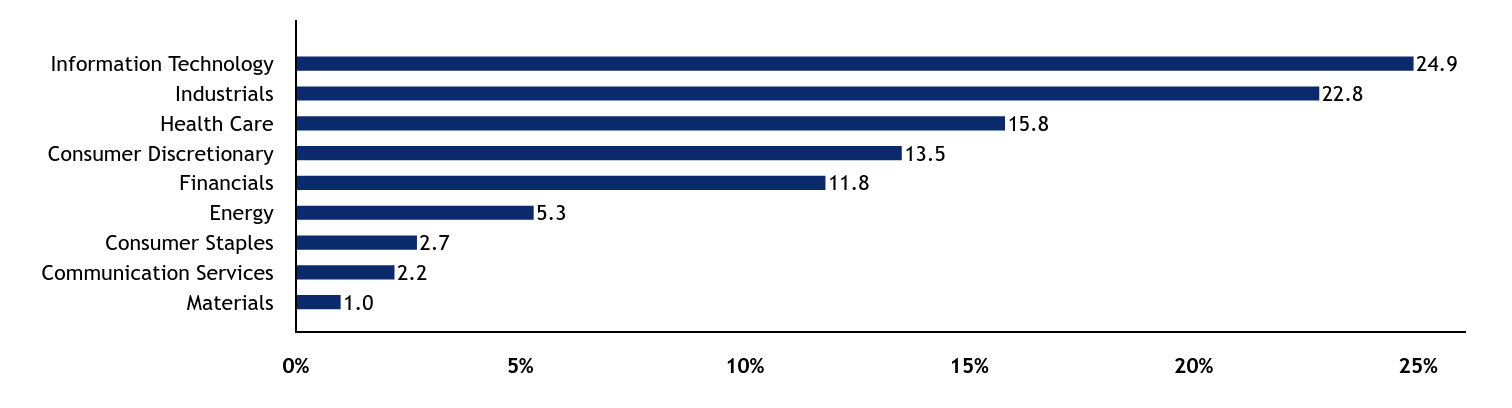

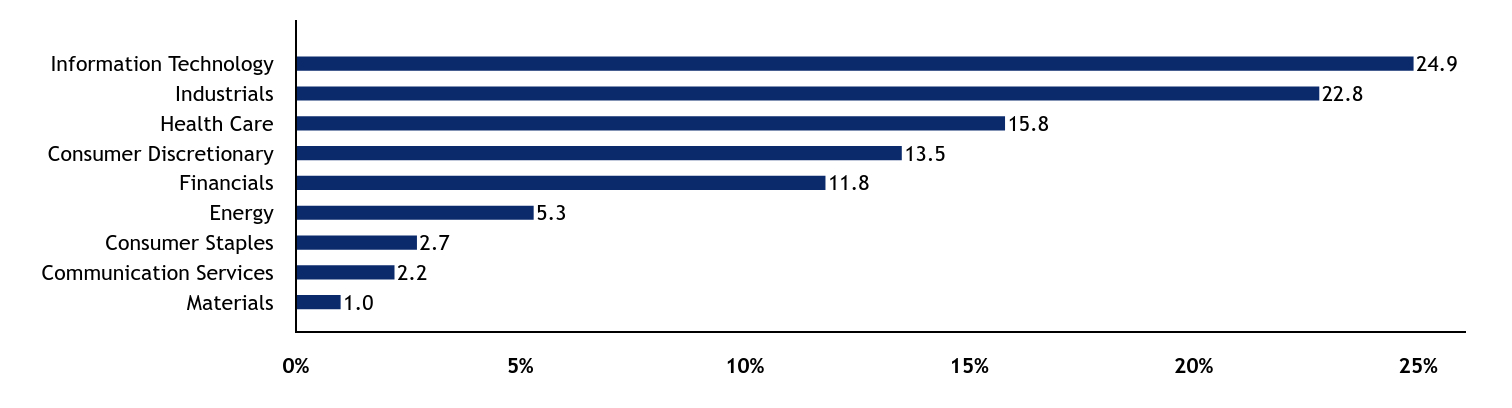

0.6 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Real Estate |

0.6 |

Energy |

1.5 |

Consumer Staples |

3.6 |

Materials |

3.6 |

Communication Services |

4.7 |

Consumer Discretionary |

5.2 |

Industrials |

12.2 |

Information Technology |

16.2 |

Health Care |

22.5 |

Financials |

29.9 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

RTX Corp. |

3.5 |

Cisco Systems, Inc. |

3.3 |

Synchrony Financial |

3.2 |

eBay, Inc. |

2.6 |

Salesforce, Inc. |

2.5 |

Capital One Financial Corp. |

2.5 |

Gilead Sciences, Inc. |

2.4 |

MetLife, Inc. |

2.2 |

Johnson & Johnson |

2.2 |

Cardinal Health, Inc. |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000110037 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Value Fund

|

|

| Class Name |

|

C

|

|

| Trading Symbol |

|

BWLCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Value Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$94 |

1.84%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 94

|

|

| Expense Ratio, Percent |

[17] |

1.84%

|

|

| AssetsNet |

|

$ 223,748,141

|

|

| Holdings Count | Holding |

|

99

|

|

| Advisory Fees Paid, Amount |

|

$ 619,548

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$223,748,141 |

# of Portfolio Holdings |

99 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$619,548 | |

|

| Holdings [Text Block] |

|

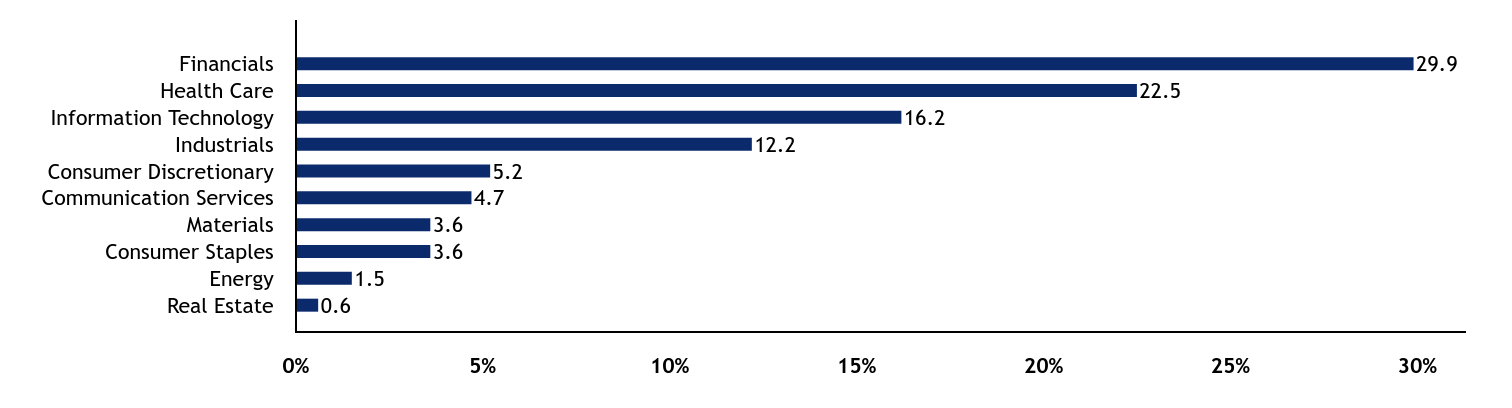

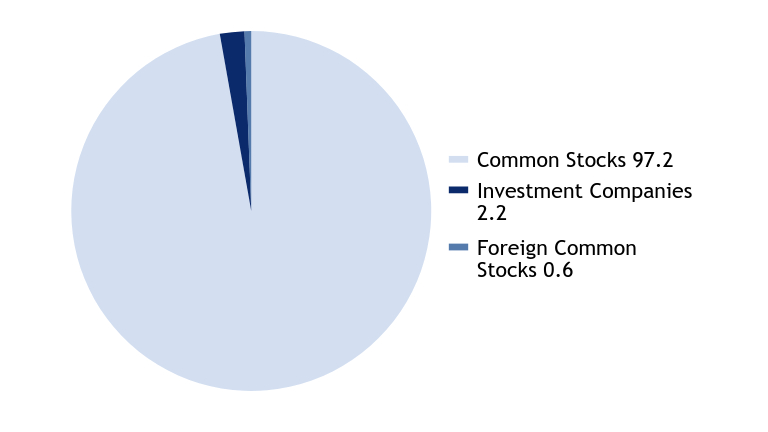

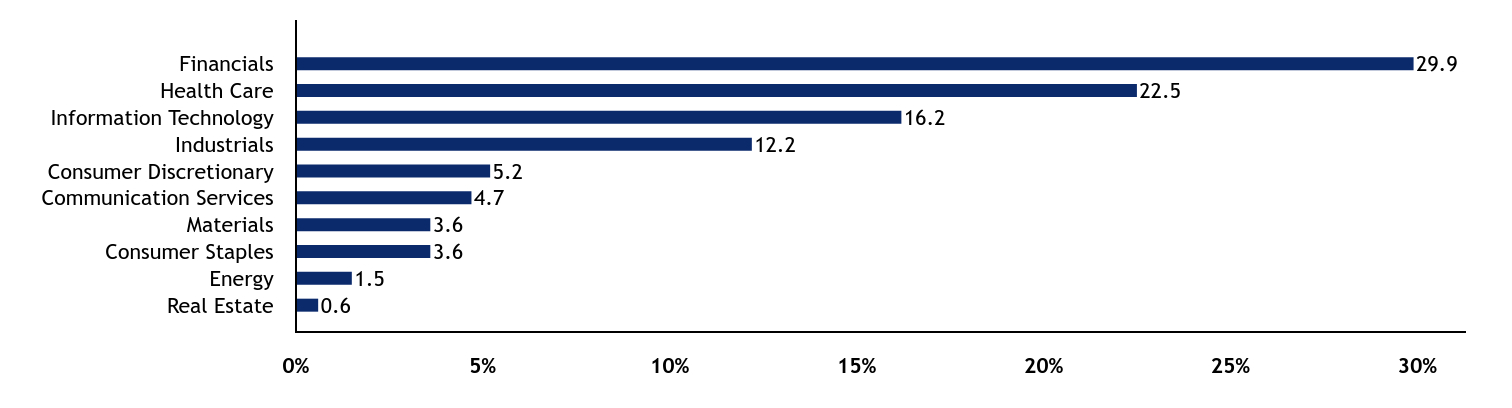

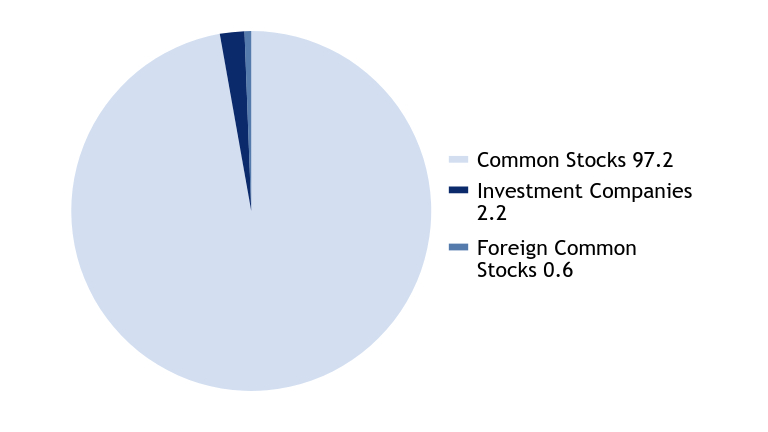

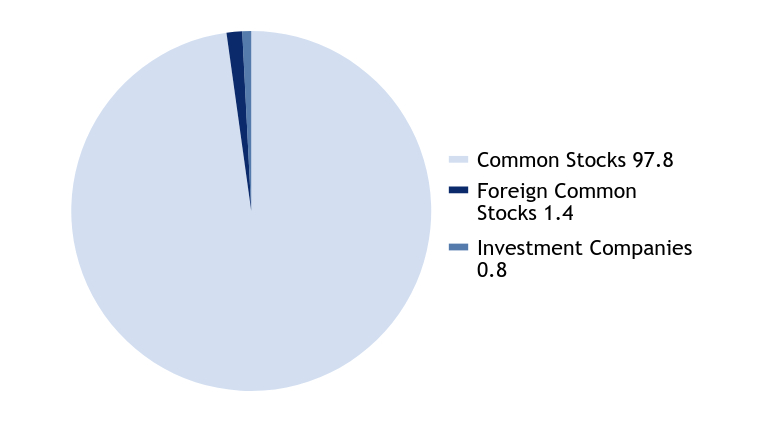

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.2 |

Investment Companies |

2.2 |

Foreign Common Stocks |

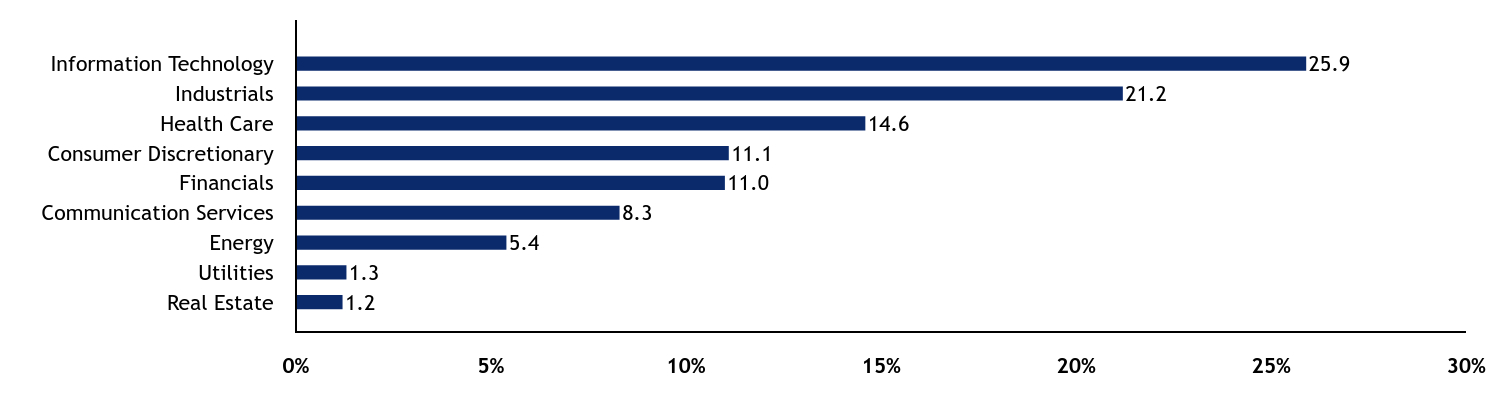

0.6 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Real Estate |

0.6 |

Energy |

1.5 |

Consumer Staples |

3.6 |

Materials |

3.6 |

Communication Services |

4.7 |

Consumer Discretionary |

5.2 |

Industrials |

12.2 |

Information Technology |

16.2 |

Health Care |

22.5 |

Financials |

29.9 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

RTX Corp. |

3.5 |

Cisco Systems, Inc. |

3.3 |

Synchrony Financial |

3.2 |

eBay, Inc. |

2.6 |

Salesforce, Inc. |

2.5 |

Capital One Financial Corp. |

2.5 |

Gilead Sciences, Inc. |

2.4 |

MetLife, Inc. |

2.2 |

Johnson & Johnson |

2.2 |

Cardinal Health, Inc. |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000110040 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Value Fund

|

|

| Class Name |

|

Investor

|

|

| Trading Symbol |

|

BWLIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Value Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Investor |

$55 |

1.07%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 55

|

|

| Expense Ratio, Percent |

[18] |

1.07%

|

|

| AssetsNet |

|

$ 223,748,141

|

|

| Holdings Count | Holding |

|

99

|

|

| Advisory Fees Paid, Amount |

|

$ 619,548

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$223,748,141 |

# of Portfolio Holdings |

99 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$619,548 | |

|

| Holdings [Text Block] |

|

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.2 |

Investment Companies |

2.2 |

Foreign Common Stocks |

0.6 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

Value |

Value |

Real Estate |

0.6 |

Energy |

1.5 |

Consumer Staples |

3.6 |

Materials |

3.6 |

Communication Services |

4.7 |

Consumer Discretionary |

5.2 |

Industrials |

12.2 |

Information Technology |

16.2 |

Health Care |

22.5 |

Financials |

29.9 | |

|

| Largest Holdings [Text Block] |

|

Top Ten Holdings - % Net Assets

RTX Corp. |

3.5 |

Cisco Systems, Inc. |

3.3 |

Synchrony Financial |

3.2 |

eBay, Inc. |

2.6 |

Salesforce, Inc. |

2.5 |

Capital One Financial Corp. |

2.5 |

Gilead Sciences, Inc. |

2.4 |

MetLife, Inc. |

2.2 |

Johnson & Johnson |

2.2 |

Cardinal Health, Inc. |

2.0 | Excludes cash equivalents. |

|

| Material Fund Change [Text Block] |

|

|

|

| C000110038 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

Man Large Cap Value Fund

|

|

| Class Name |

|

R5

|

|

| Trading Symbol |

|

BRLVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

|

This semi-annual shareholder report contains important information about Man Large Cap Value Fund for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

|

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

|

|

| Additional Information Phone Number |

|

800-658-5811

|

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">www.americanbeaconfunds.com/literature</span>

|

|

| Expenses [Text Block] |

|

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

R5 |

$38 |

0.75%Footnote Reference* |

| Footnote |

Description |

Footnote* |

Annualized. | |

|

| Expenses Paid, Amount |

|

$ 38

|

|

| Expense Ratio, Percent |

[19] |

0.75%

|

|

| AssetsNet |

|

$ 223,748,141

|

|

| Holdings Count | Holding |

|

99

|

|

| Advisory Fees Paid, Amount |

|

$ 619,548

|

|

| InvestmentCompanyPortfolioTurnover |

|

12.00%

|

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$223,748,141 |

# of Portfolio Holdings |

99 |

Portfolio Turnover Rate |

12% |

Total Management Fees Paid |

$619,548 | |

|

| Holdings [Text Block] |

|

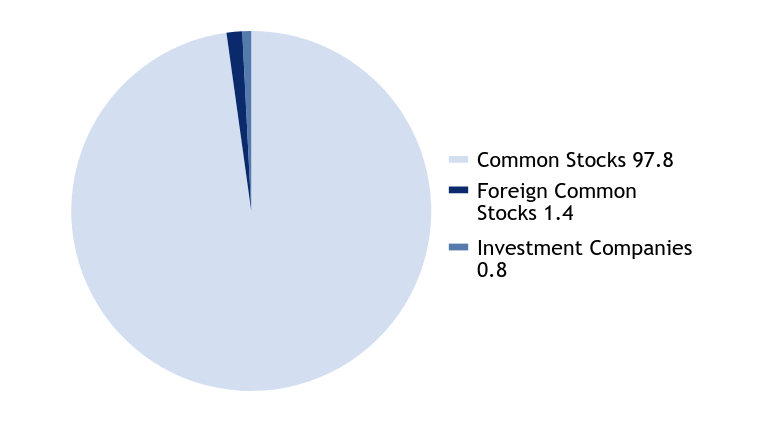

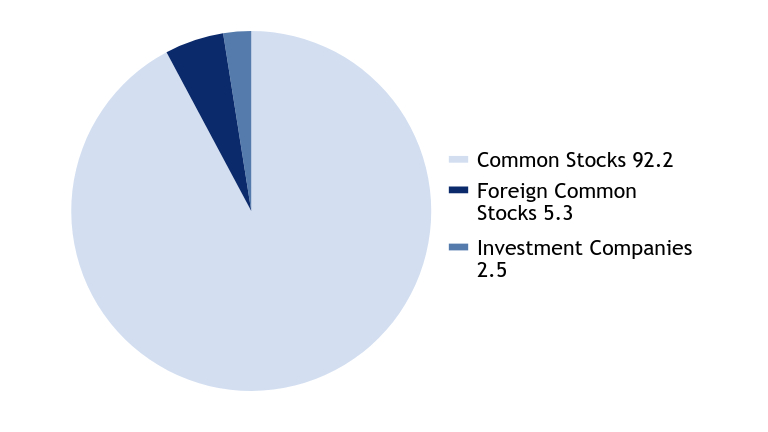

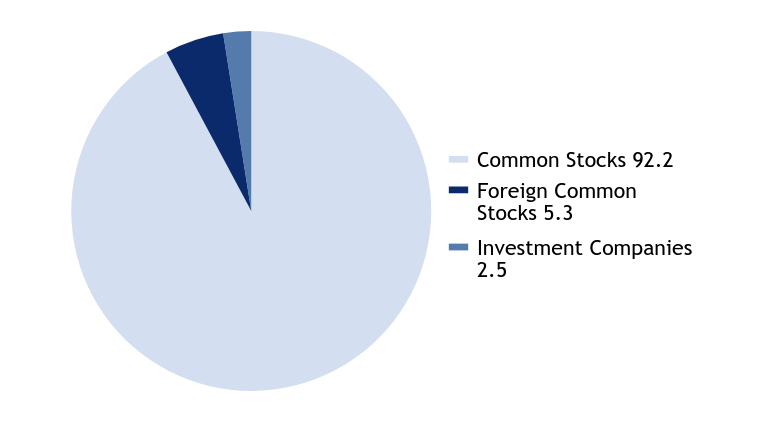

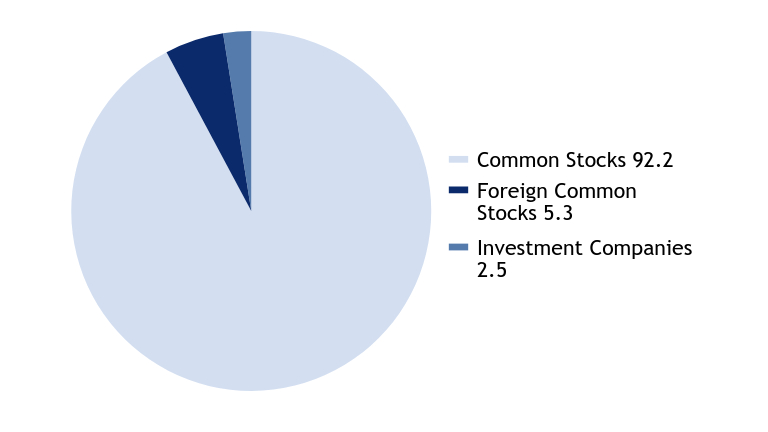

Asset Allocation - % Investments

Value |

Value |

Common Stocks |

97.2 |

Investment Companies |

2.2 |

Foreign Common Stocks |

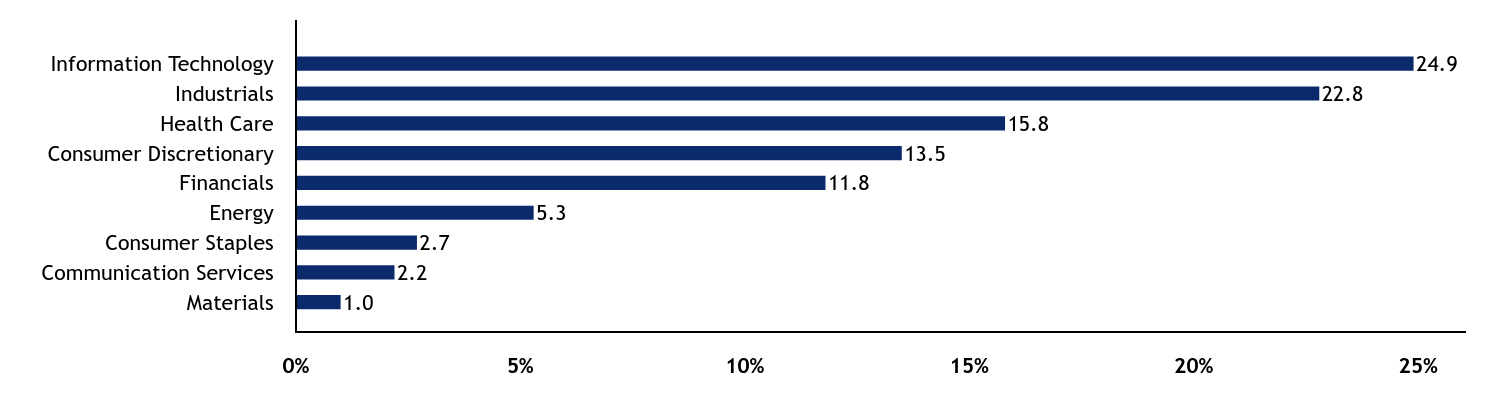

0.6 | The Fund may purchase and sell futures contracts to gain market exposure on cash balances. Sector Allocation - % Equities

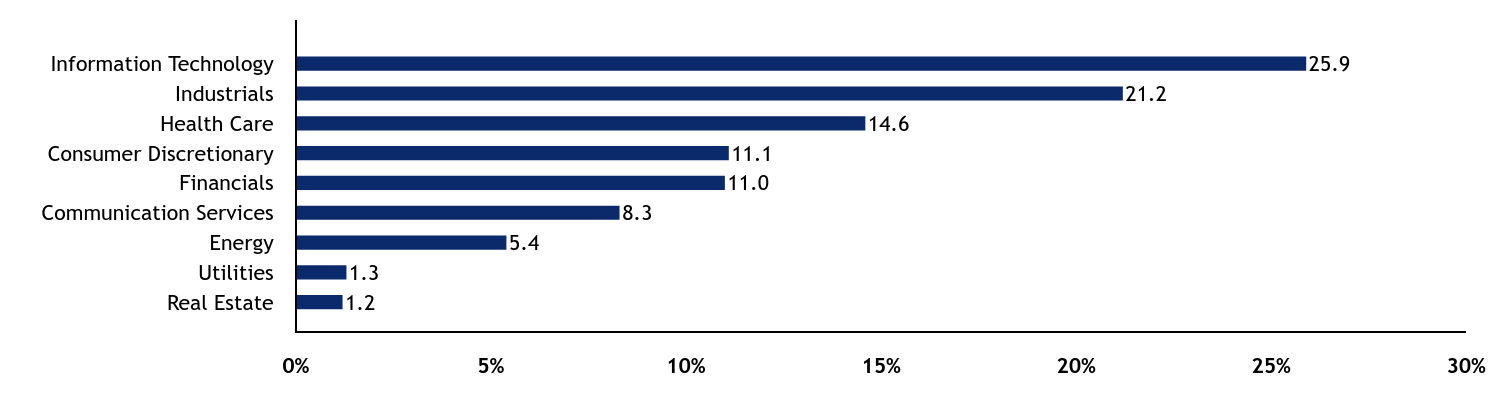

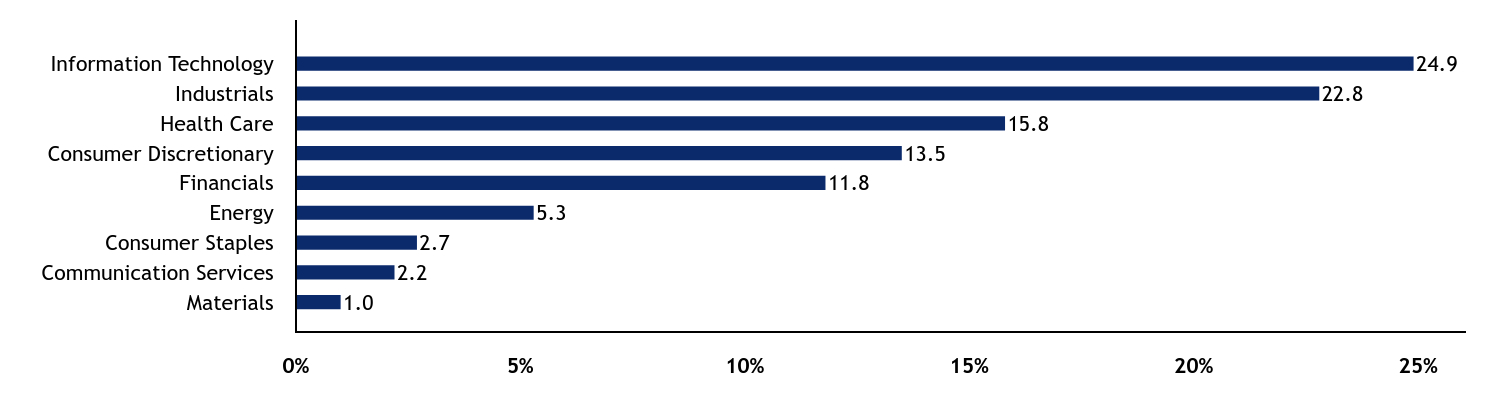

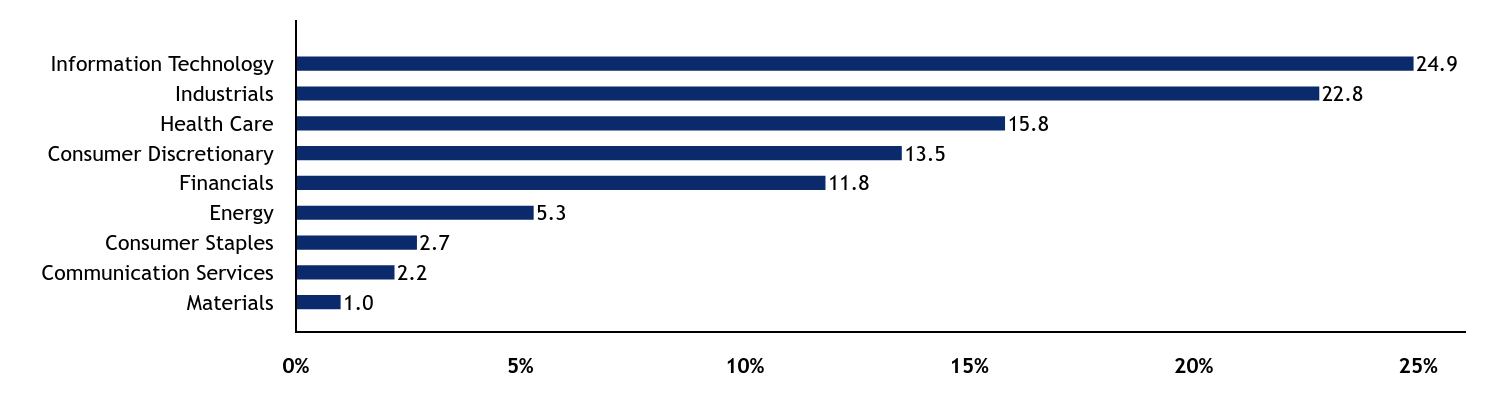

Value |

Value |

Real Estate |

0.6 |