What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|---|---|---|

|

SMI 3Fourteen REAL Asset Allocation ETF

|

$27¹

|

0.77%²

|

Key Fund Statistics

(as of June 30, 2025)

|

Fund Net Assets

|

$438,074,993

|

|

Number of Holdings

|

170

|

|

Total Advisory Fee Paid

|

$972,667

|

|

Portfolio Turnover Rate

|

72.21%

|

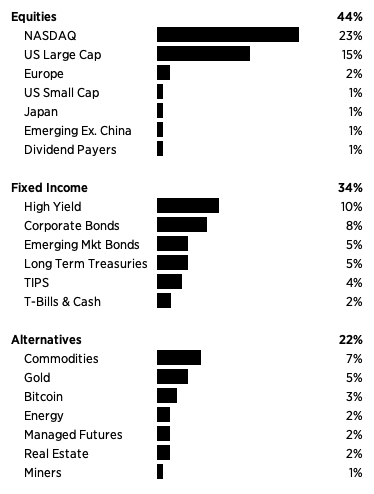

What did the Fund invest in?

(% of Net Assets as of June 30, 2025)

Sector Breakdown

|

Top Ten Holdings

|

|

|---|---|

|

BNY Mellon US Large Cap Core Equity ETF

|

|

|

Schwab High Yield Bond ETF

|

|

|

Vanguard International Corporate Bond Index

|

|

|

Invesco Optimum Yield Diversified Commodity Strategy

No K-1 ETF

|

|

|

Sprott Physical Gold Trust

|

|

|

iShares J.P. Morgan USD Emerging Markets Bond ETF

|

|

|

Schwab Long-Term U.S. Treasury ETF

|

|

|

Schwab U.S. TIPS ETF

|

|

|

Grayscale Bitcoin Mini Trust ETF

|

|

|

US Treasury 3 Month Bill ETF

|

| [1] | Costs are for the period of February 26, 2025 to June 30, 2025. Costs for a full semi-annual period would be higher. |

| [2] | Annualized. |