What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|---|---|---|

|

Applied Finance Valuation Large Cap ETF

|

$25

|

0.49%¹

|

| 1 | Annualized. |

Key Fund Statistics

(as of June 30, 2025)

|

Fund Net Assets

|

$256,282,558

|

|

Number of Holdings

|

322

|

|

Total Advisory Fee Paid

|

$559,308

|

|

Portfolio Turnover Rate

|

11.66%

|

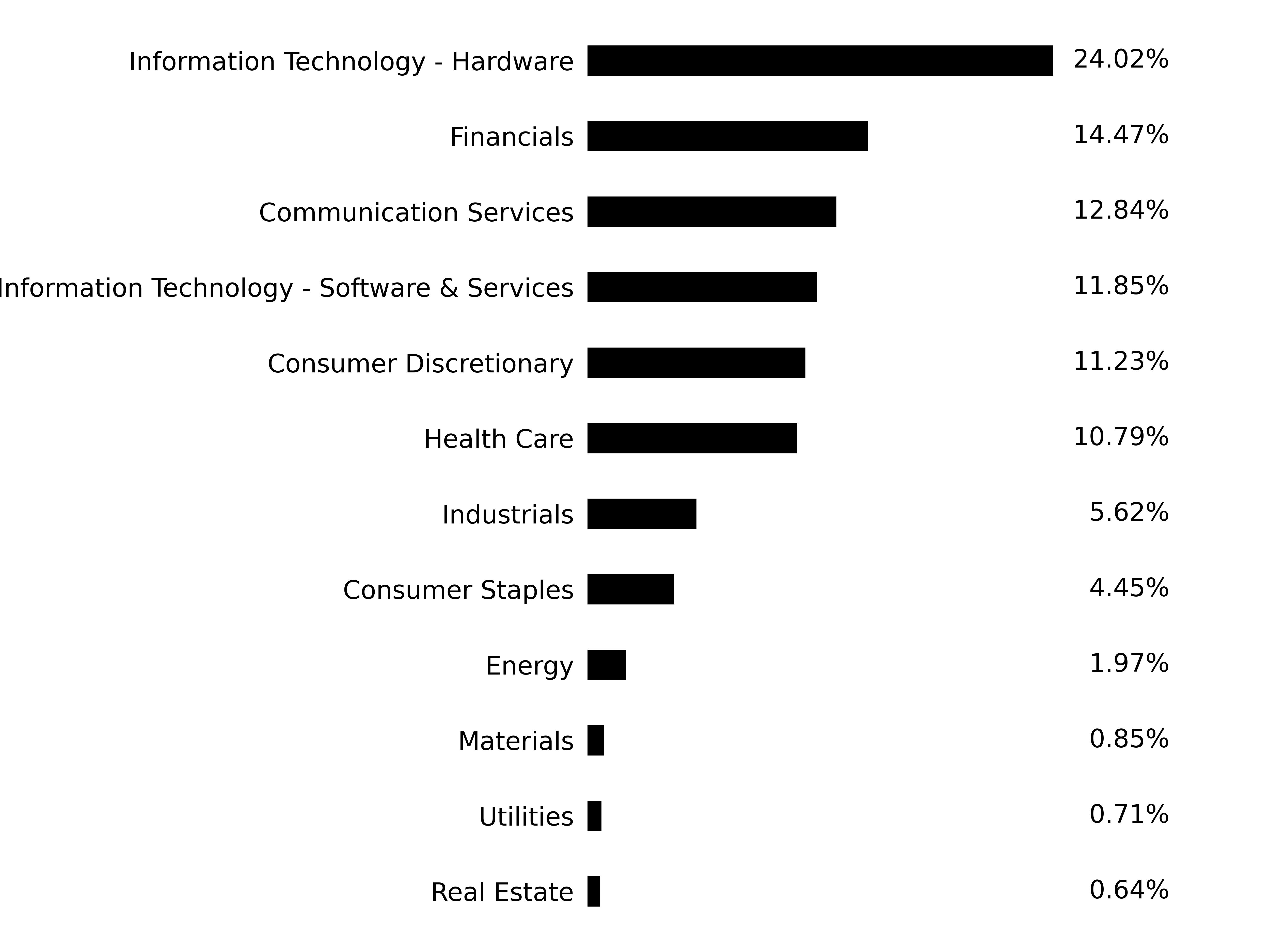

Sector Breakdown

|

Top Ten Holdings

|

|

|---|---|

|

Nvidia Corp.

|

|

|

Microsoft Corp.

|

|

|

Alphabet, Inc. Class A

|

|

|

Apple, Inc.

|

|

|

Broadcom, Inc.

|

|

|

Meta Platforms, Inc.

|

|

|

Amazon.com, Inc.

|

|

|

Visa, Inc. Class A

|

|

|

Mastercard, Inc. Class A

|

|

|

Johnson & Johnson

|

| [1] | Annualized. |