What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|---|---|---|

|

SMI 3Fourteen Full-Cycle Trend ETF

|

$43

|

0.85%¹

|

| ¹ | Annualized. |

Key Fund Statistics

(as of June 30, 2025)

|

Fund Net Assets

|

$425,548,947

|

|

Number of Holdings

|

20

|

|

Total Advisory Fee Paid

|

$1,819,685

|

|

Portfolio Turnover Rate

|

177.22%

|

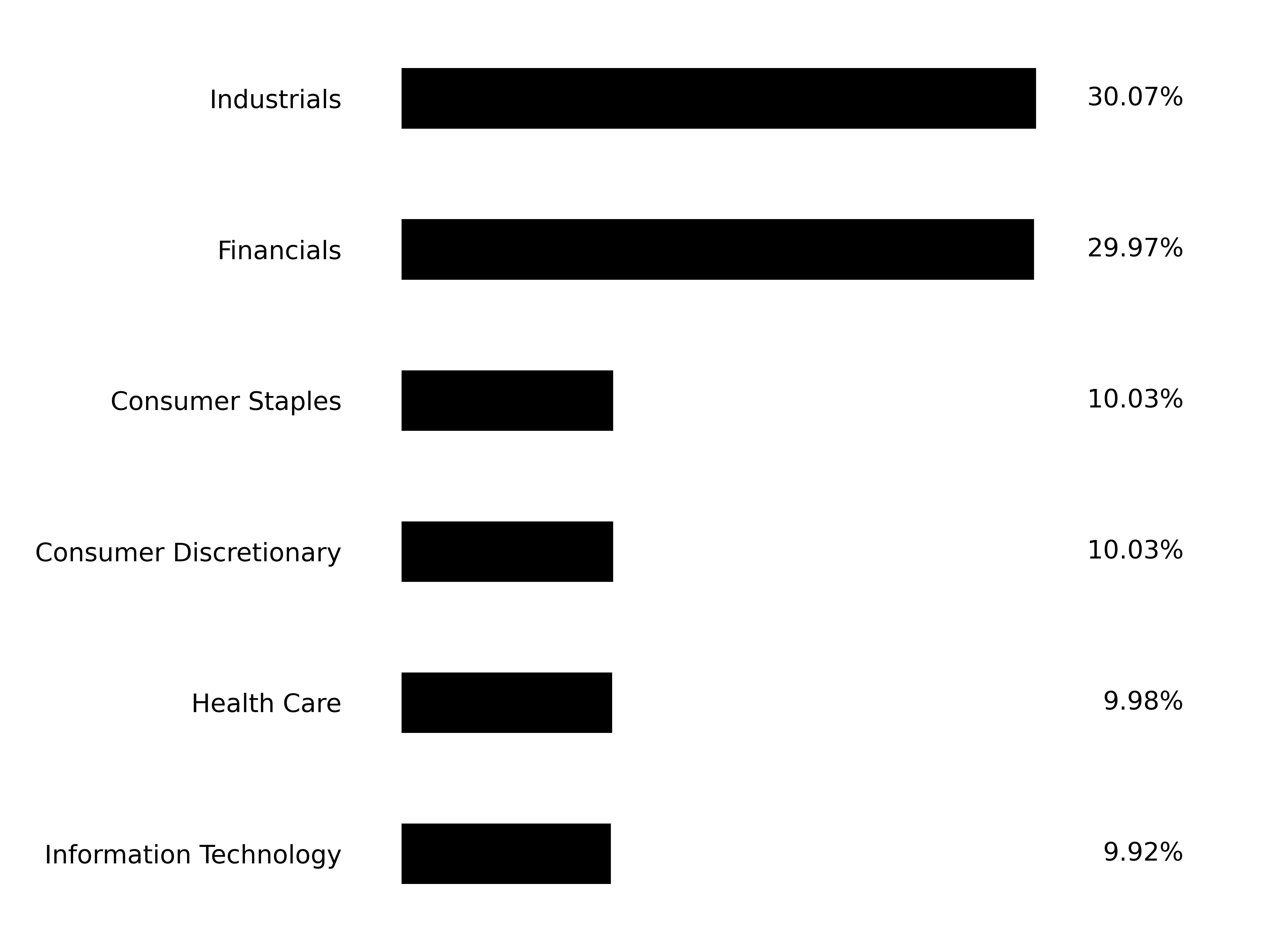

Sector Breakdown

|

Top Ten Holdings

|

|

|---|---|

|

Copart, Inc.

|

|

|

Walmart, Inc.

|

|

|

Snap-on, Inc.

|

|

|

Autozone, Inc.

|

|

|

Automatic Data Processing, Inc.

|

|

|

O'Reilly Automotive, Inc.

|

|

|

Brown & Brown, Inc.

|

|

|

Paychex, Inc.

|

|

|

Costco Wholesale Corp.

|

|

|

Mastercard, Inc. Class A

|

| [1] | Annualized. |