Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

First Trust Exchange-Traded Fund VI

|

|

| Entity Central Index Key |

0001552740

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000125197 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust BuyWrite Income ETF

|

|

| Class Name |

First Trust BuyWrite Income ETF

|

|

| Trading Symbol |

FTHI

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust BuyWrite Income ETF (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FTHI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FTHI

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust BuyWrite Income ETF |

$38 |

0.75%(1) |

|

|

| Expenses Paid, Amount |

$ 38

|

|

| Expense Ratio, Percent |

0.75%

|

[1] |

| Net Assets |

$ 1,372,041,383

|

|

| Holdings Count | Holding |

223

|

|

| Investment Company Portfolio Turnover |

32.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$1,372,041,383 |

| Total number of portfolio holdings |

223 |

| Portfolio turnover rate |

32% |

|

|

| Holdings [Text Block] |

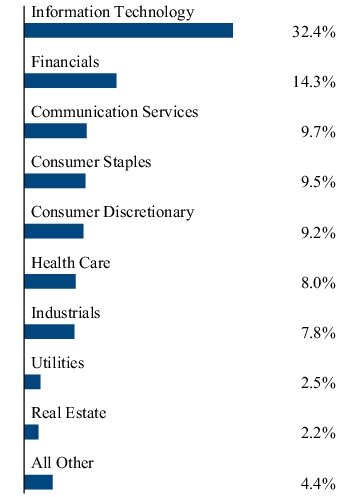

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Microsoft Corp. |

7.0% |

| NVIDIA Corp. |

6.6% |

| Apple, Inc. |

5.5% |

| Amazon.com, Inc. |

3.3% |

| Meta Platforms, Inc., Class A |

3.1% |

| Broadcom, Inc. |

2.6% |

| Alphabet, Inc., Class A |

1.7% |

| JPMorgan Chase & Co. |

1.6% |

| Alphabet, Inc., Class C |

1.4% |

| CME Group, Inc. |

1.2% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

7.0% |

| NVIDIA Corp. |

6.6% |

| Apple, Inc. |

5.5% |

| Amazon.com, Inc. |

3.3% |

| Meta Platforms, Inc., Class A |

3.1% |

| Broadcom, Inc. |

2.6% |

| Alphabet, Inc., Class A |

1.7% |

| JPMorgan Chase & Co. |

1.6% |

| Alphabet, Inc., Class C |

1.4% |

| CME Group, Inc. |

1.2% |

|

|

| C000125204 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Nasdaq BuyWrite Income ETF

|

|

| Class Name |

First Trust Nasdaq BuyWrite Income ETF

|

|

| Trading Symbol |

FTQI

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Nasdaq BuyWrite Income ETF (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FTQI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FTQI

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Nasdaq BuyWrite Income ETF |

$37 |

0.75%(1) |

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.75%

|

[2] |

| Net Assets |

$ 625,904,790

|

|

| Holdings Count | Holding |

194

|

|

| Investment Company Portfolio Turnover |

38.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$625,904,790 |

| Total number of portfolio holdings |

194 |

| Portfolio turnover rate |

38% |

|

|

| Holdings [Text Block] |

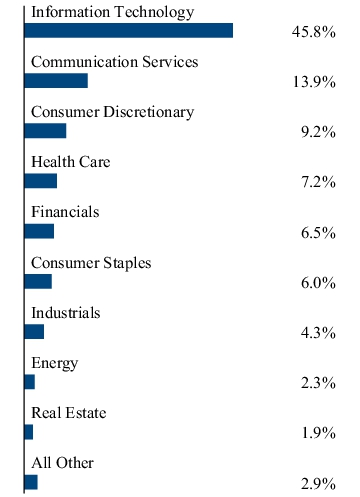

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Microsoft Corp. |

7.4% |

| NVIDIA Corp. |

7.1% |

| Apple, Inc. |

6.9% |

| Broadcom, Inc. |

4.5% |

| Meta Platforms, Inc., Class A |

4.3% |

| Amazon.com, Inc. |

4.1% |

| Netflix, Inc. |

3.4% |

| Advanced Micro Devices, Inc. |

2.9% |

| Tesla, Inc. |

2.9% |

| Costco Wholesale Corp. |

2.6% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

7.4% |

| NVIDIA Corp. |

7.1% |

| Apple, Inc. |

6.9% |

| Broadcom, Inc. |

4.5% |

| Meta Platforms, Inc., Class A |

4.3% |

| Amazon.com, Inc. |

4.1% |

| Netflix, Inc. |

3.4% |

| Advanced Micro Devices, Inc. |

2.9% |

| Tesla, Inc. |

2.9% |

| Costco Wholesale Corp. |

2.6% |

|

|

| C000200399 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Dorsey Wright DALI Equity ETF

|

|

| Class Name |

First Trust Dorsey Wright DALI Equity ETF

|

|

| Trading Symbol |

DALI

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Dorsey Wright DALI Equity ETF (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/DALI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/DALI

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Dorsey Wright DALI Equity ETF |

$15(1) |

0.30%(1) (2) |

|

(1) |

Excludes any Acquired Fund Fees and Expenses of underlying investment companies in which the Fund invests. |

|

(2) |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 15

|

[3] |

| Expense Ratio, Percent |

0.30%

|

[3],[4] |

| Net Assets |

$ 111,144,010

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company Portfolio Turnover |

27.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$111,144,010 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

27% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The table below shows the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| First Trust Small Cap Growth AlphaDEX® Fund |

18.2% |

| First Trust Large Cap Growth AlphaDEX® Fund |

18.0% |

| First Trust Dow Jones Internet Index Fund |

14.1% |

| First Trust Financials AlphaDEX® Fund |

12.8% |

| First Trust Industrials/Producer Durables AlphaDEX® Fund |

12.8% |

| First Trust NASDAQ-100 Ex-Technology Sector Index Fund |

12.3% |

| First Trust Utilities AlphaDEX® Fund |

11.7% |

| Dreyfus Government Cash Management Fund, Institutional Shares, Class I |

0.1% |

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| First Trust Small Cap Growth AlphaDEX® Fund |

18.2% |

| First Trust Large Cap Growth AlphaDEX® Fund |

18.0% |

| First Trust Dow Jones Internet Index Fund |

14.1% |

| First Trust Financials AlphaDEX® Fund |

12.8% |

| First Trust Industrials/Producer Durables AlphaDEX® Fund |

12.8% |

| First Trust NASDAQ-100 Ex-Technology Sector Index Fund |

12.3% |

| First Trust Utilities AlphaDEX® Fund |

11.7% |

| Dreyfus Government Cash Management Fund, Institutional Shares, Class I |

0.1% |

|

|

| C000257781 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Small Cap BuyWrite Income ETF

|

|

| Class Name |

First Trust Small Cap BuyWrite Income ETF

|

|

| Trading Symbol |

FTKI

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Small Cap BuyWrite Income ETF (the “Fund”) for the period of February 26, 2025 (commencement of investment operations) to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FTKI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FTKI

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Small Cap BuyWrite Income ETF |

$29(1) |

0.85%(2) |

|

(1) |

The Fund commenced investment operations on February 26, 2025. Had the Fund been in operation for a complete six months, the cost of a $10,000 investment would have been higher. |

|

(2) |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 29

|

[5] |

| Expense Ratio, Percent |

0.85%

|

[6] |

| Net Assets |

$ 938,335

|

|

| Holdings Count | Holding |

234

|

|

| Investment Company Portfolio Turnover |

63.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of June 30, 2025)

| Fund net assets |

$938,335 |

| Total number of portfolio holdings |

234 |

| Portfolio turnover rate |

63% |

|

|

| Holdings [Text Block] |

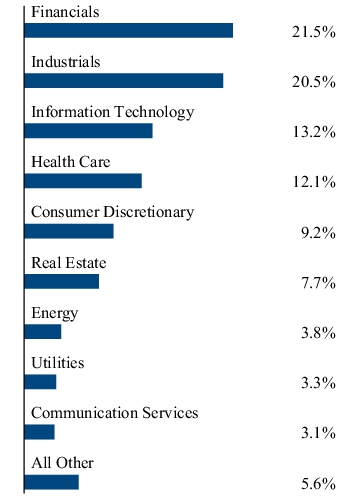

WHAT DID THE FUND INVEST IN? (As of June 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Argan, Inc. |

1.2% |

| Integer Holdings Corp. |

1.2% |

| AGNC Investment Corp. |

1.2% |

| Bentley Systems, Inc., Class B |

1.1% |

| Agree Realty Corp. |

1.1% |

| Monarch Casino & Resort, Inc. |

1.1% |

| CareTrust REIT, Inc. |

1.0% |

| Graco, Inc. |

1.0% |

| AptarGroup, Inc. |

1.0% |

| Stride, Inc. |

1.0% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Argan, Inc. |

1.2% |

| Integer Holdings Corp. |

1.2% |

| AGNC Investment Corp. |

1.2% |

| Bentley Systems, Inc., Class B |

1.1% |

| Agree Realty Corp. |

1.1% |

| Monarch Casino & Resort, Inc. |

1.1% |

| CareTrust REIT, Inc. |

1.0% |

| Graco, Inc. |

1.0% |

| AptarGroup, Inc. |

1.0% |

| Stride, Inc. |

1.0% |

|

|

|

|