Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Victory Portfolios

|

| Entity Central Index Key |

0000802716

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000145004 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Discovery Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MMEAX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class A | $169 | 1.59% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 169

|

| Expense Ratio, Percent |

1.59%

|

| Factors Affecting Performance [Text Block] |

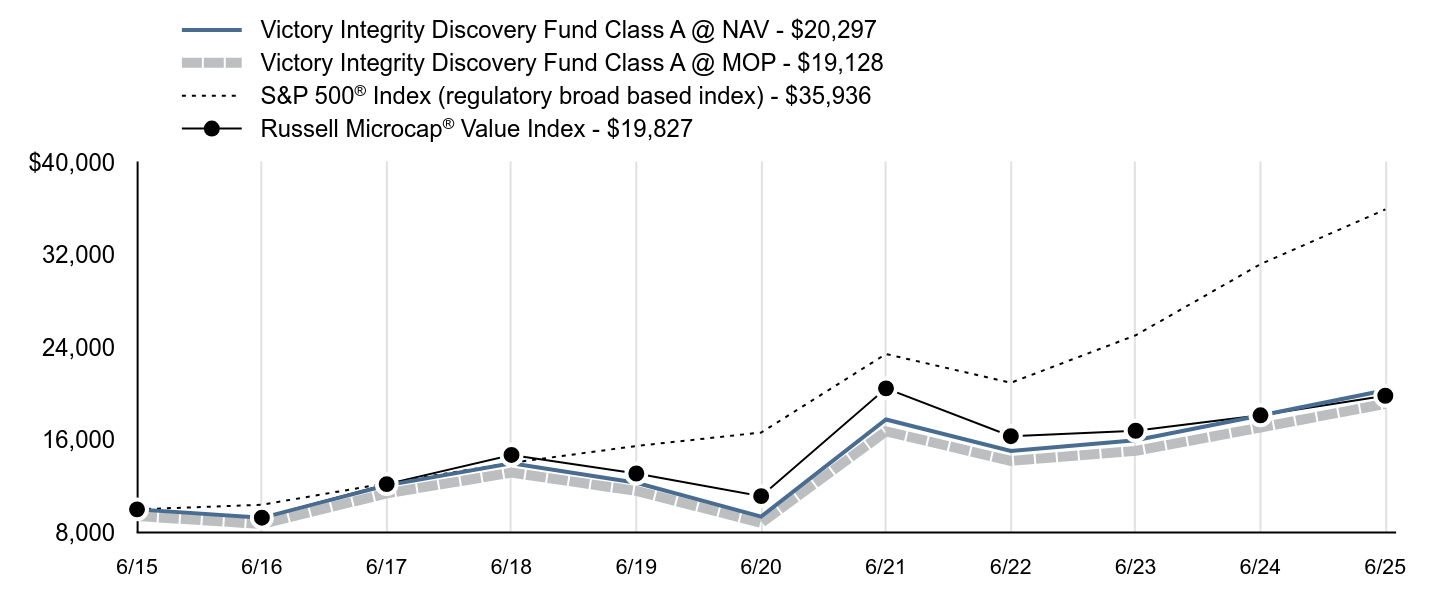

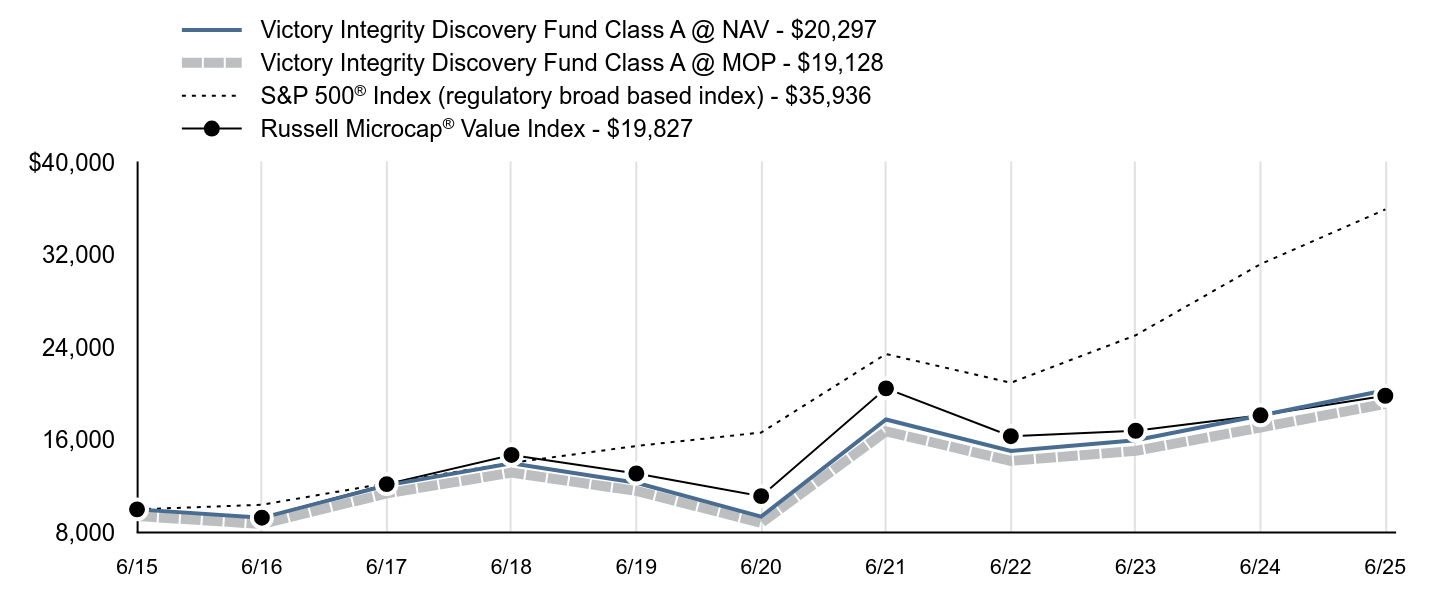

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund outperformed its benchmark, the Russell Microcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. would reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, microcap value stocks underperformed microcap growth stocks. Top contributors to performance: From a benchmark perspective, information technology, consumer staples, and financials were the top performing sectors. Security selection in the health care, financials, and consumer discretionary sectors were the largest positive contributors to the Fund’s relative performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocation to the information technology sector.

Top detractors from performance: From a benchmark perspective, the materials, health care, and consumer discretionary sectors were the largest detractors from relative performance. The information technology sector was the largest detractor from the Fund’s performance. From a style perspective, the Fund’s holdings on average had lower volatility and a higher market capitalization relative to the benchmark and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

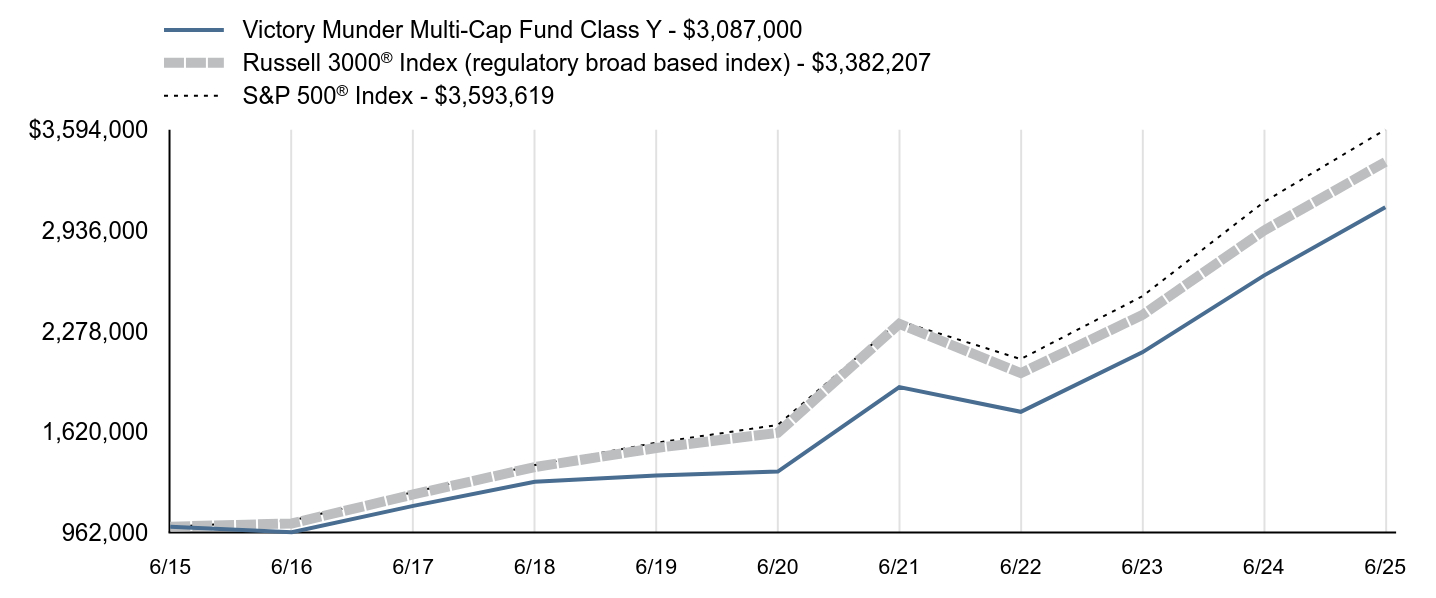

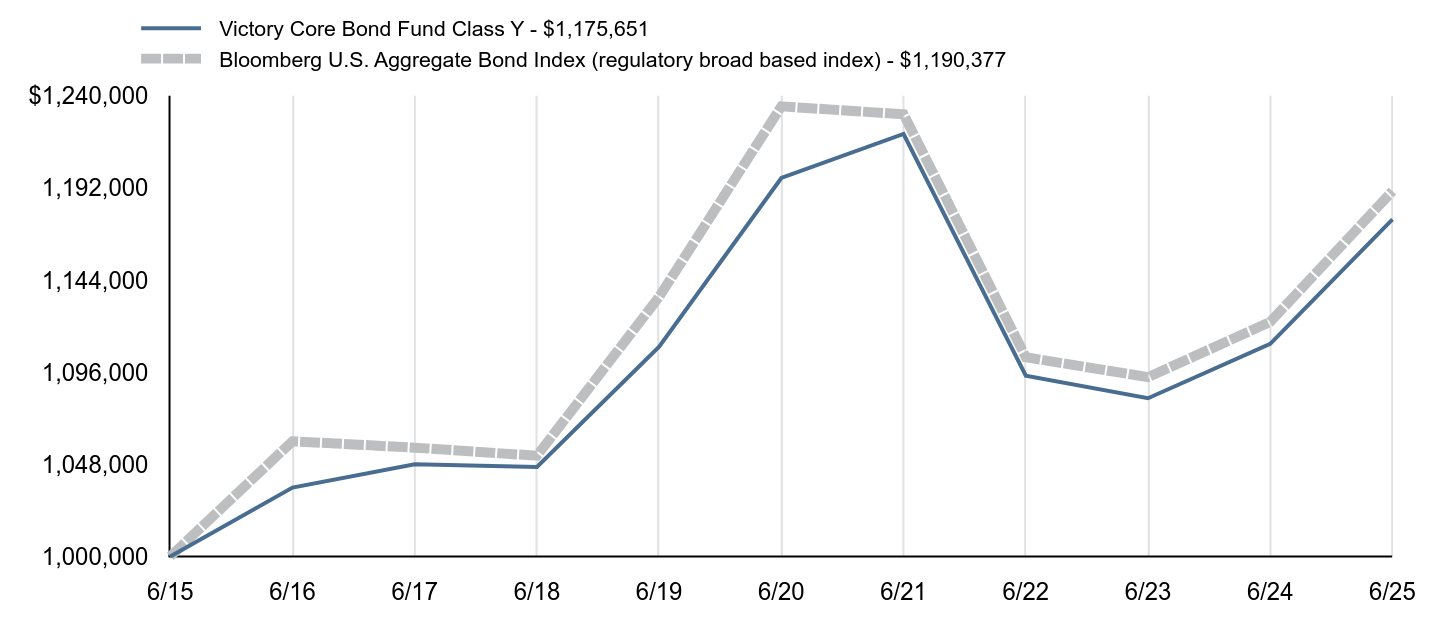

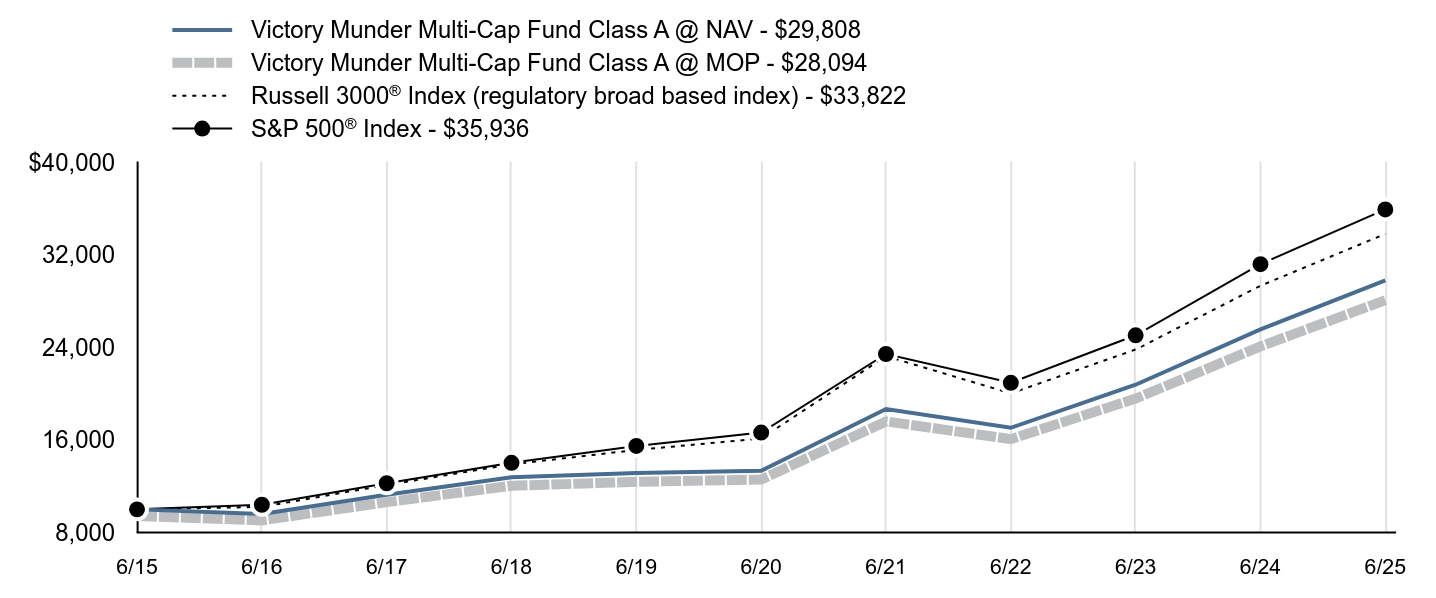

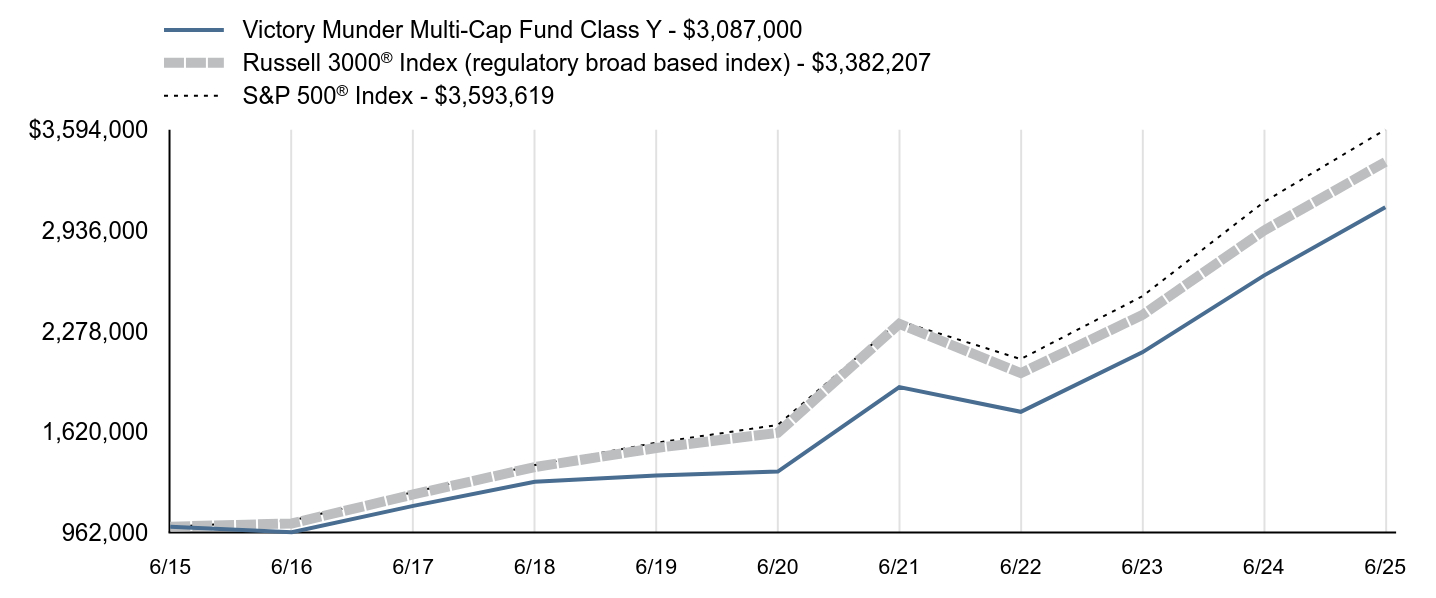

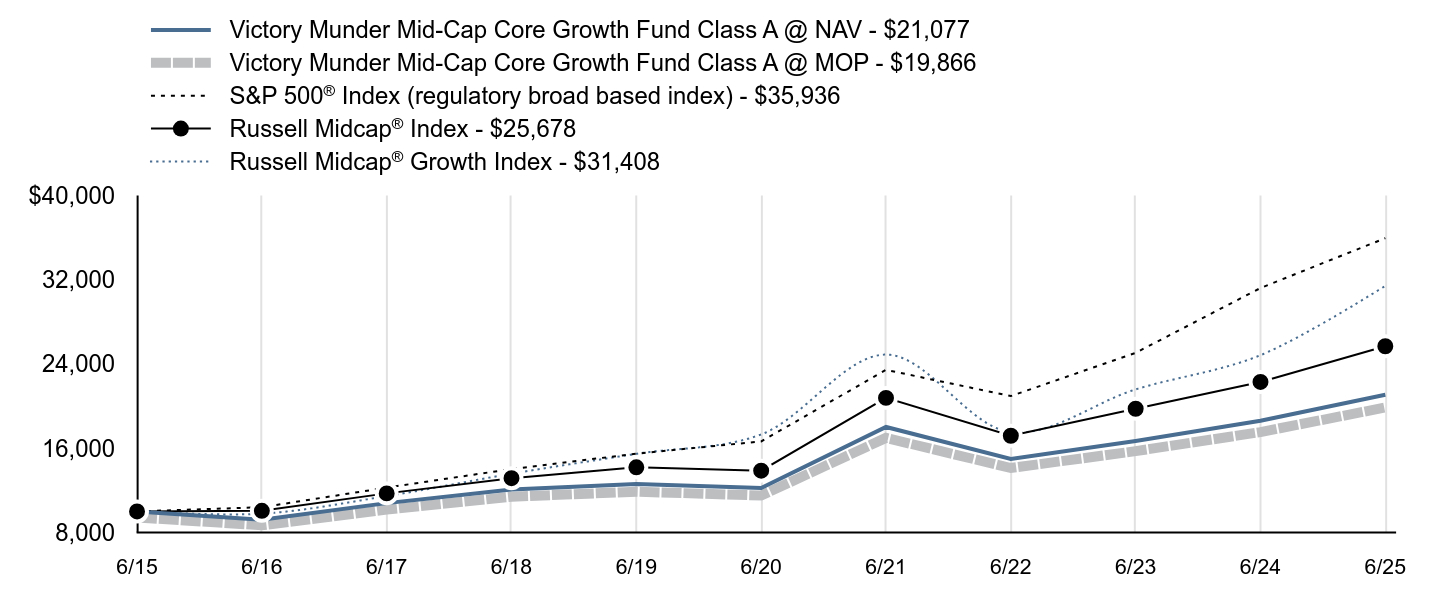

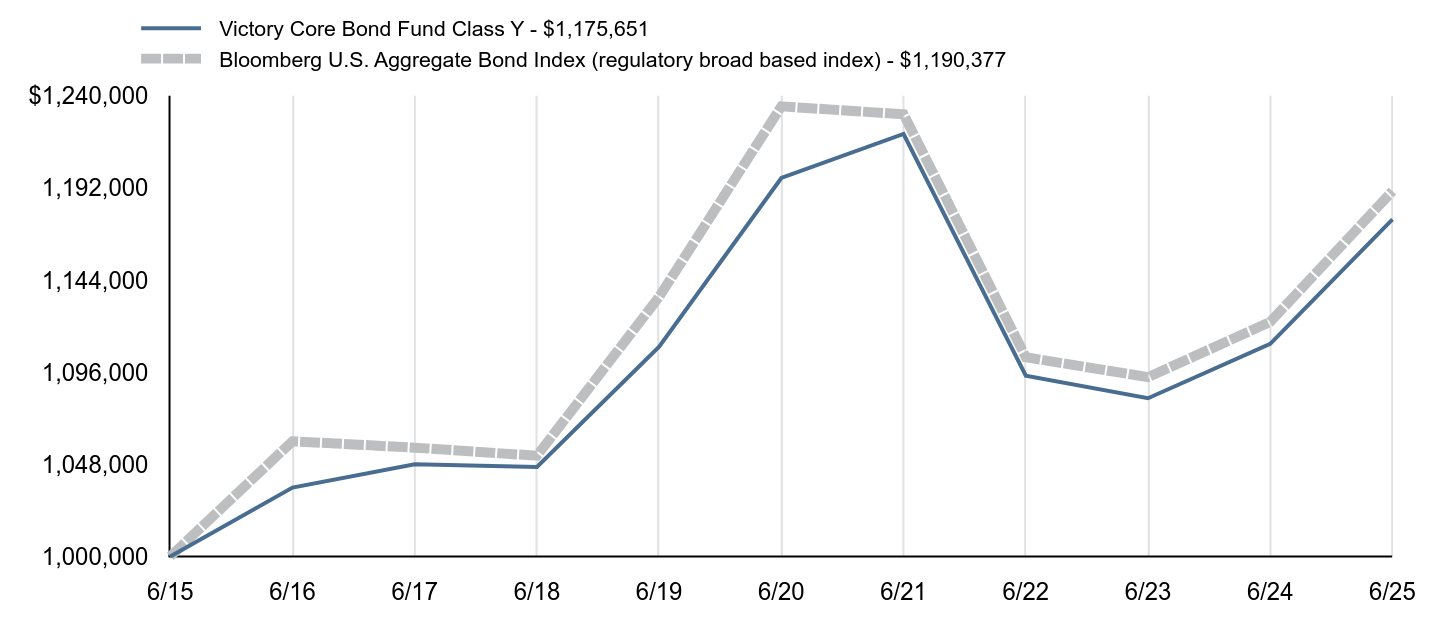

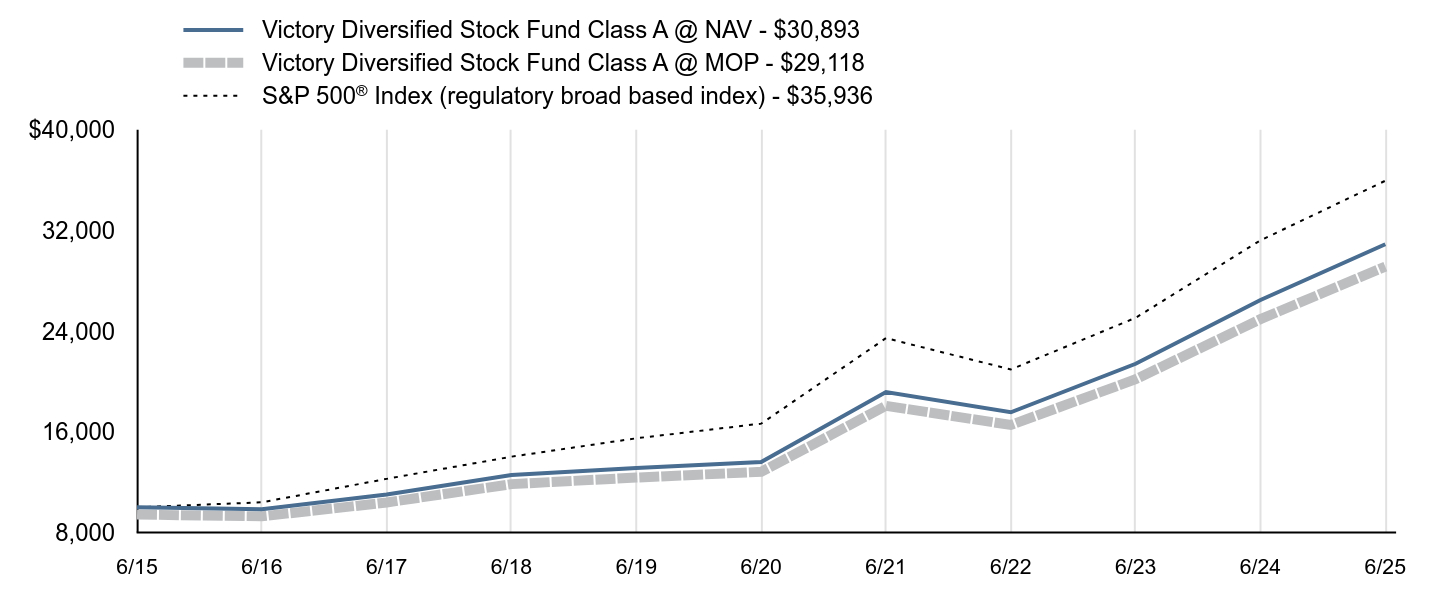

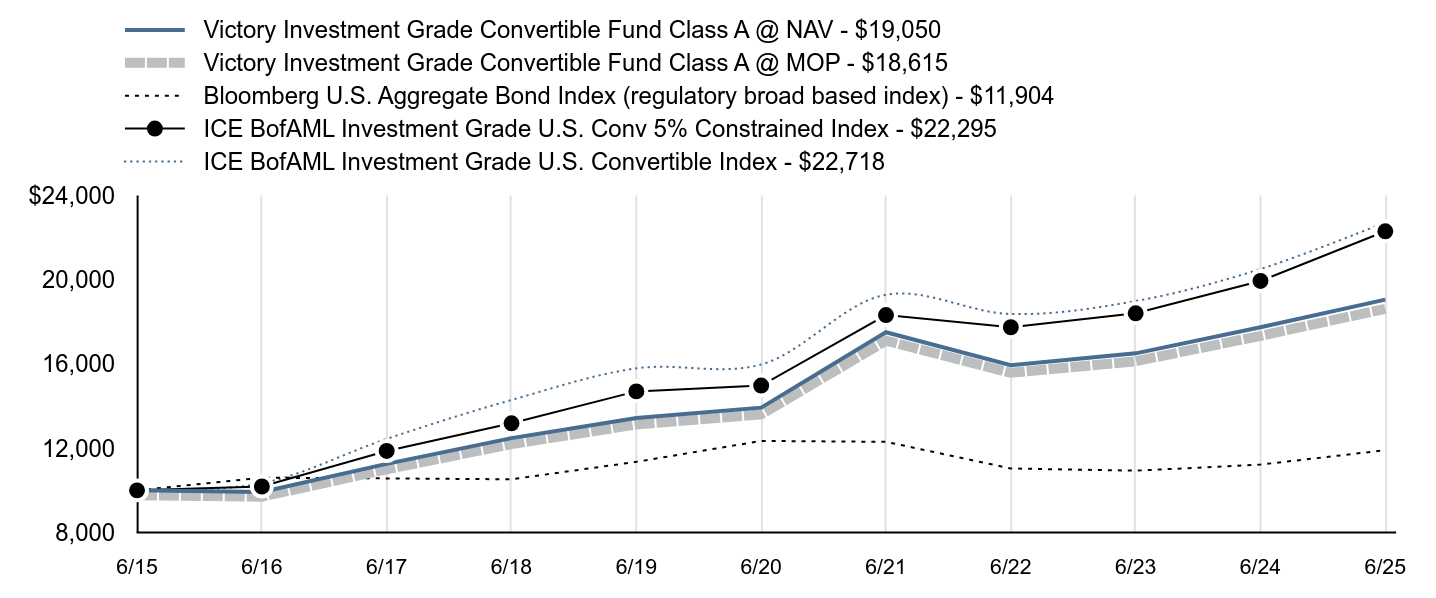

| Line Graph [Table Text Block] |

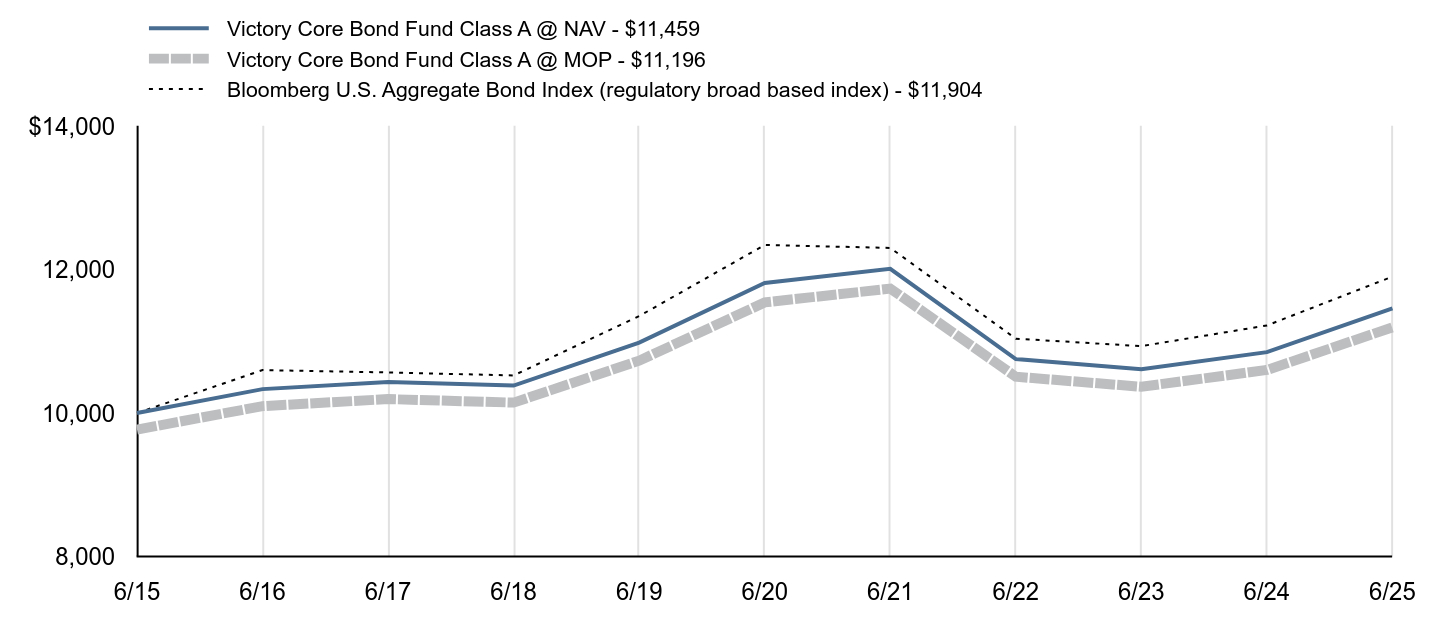

| Victory Integrity Discovery Fund Class A @ NAV - $20,297 | Victory Integrity Discovery Fund Class A @ MOP - $19,128 | S&P 500® Index (regulatory broad based index) - $35,936 | Russell Microcap® Value Index - $19,827 |

|---|

6/15 | $10,000 | $9,424 | $10,000 | $10,000 |

|---|

6/16 | $9,266 | $8,732 | $10,399 | $9,283 |

|---|

6/17 | $12,079 | $11,383 | $12,260 | $12,185 |

|---|

6/18 | $13,983 | $13,178 | $14,023 | $14,706 |

|---|

6/19 | $12,303 | $11,594 | $15,483 | $13,101 |

|---|

6/20 | $9,378 | $8,838 | $16,645 | $11,145 |

|---|

6/21 | $17,772 | $16,749 | $23,436 | $20,464 |

|---|

6/22 | $15,058 | $14,191 | $20,948 | $16,332 |

|---|

6/23 | $15,978 | $15,058 | $25,053 | $16,799 |

|---|

6/24 | $18,124 | $17,080 | $31,204 | $18,136 |

|---|

6/25 | $20,297 | $19,128 | $35,936 | $19,827 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class A @ NAV | 11.99% | 16.70%Footnote Reference | 7.34% |

|---|

Class A @ MOP | 5.55% | 15.32% | 6.70% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Russell Microcap® Value Index | 9.32% | 12.21% | 7.08% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| Previous Investment Adviser [Text Block] |

The maximum offering price (“MOP”) figures reflect a maximum sales charge of 5.75% for Class A. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

| AssetsNet |

$ 58,122,000

|

| Holdings Count | Holding |

122

|

| Advisory Fees Paid, Amount |

$ 641,000

|

| InvestmentCompanyPortfolioTurnover |

33.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $58,122 |

|---|

Number of Holdings | 122 |

|---|

Investment Advisory Fees | $641 |

|---|

Portfolio Turnover | 33% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Utilities | 0.7% | Communication Services | 3.4% | Real Estate | 4.5% | Energy | 5.0% | Health Care | 5.0% | Materials | 5.3% | Consumer Discretionary | 12.4% | Information Technology | 12.6% | Industrials | 18.5% | FinancialsFootnote Reference** | 30.9% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)nLight, Inc. | 1.3% |

|---|

Digi International, Inc. | 1.2% |

|---|

Interface, Inc. | 1.2% |

|---|

Ducommun, Inc. | 1.2% |

|---|

Ribbon Communications, Inc. | 1.2% |

|---|

Artivion, Inc. | 1.2% |

|---|

First Mid Bancshares, Inc. | 1.2% |

|---|

Peoples Bancorp, Inc. | 1.2% |

|---|

Great Lakes Dredge & Dock Corp. | 1.1% |

|---|

ConnectOne Bancorp, Inc. | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000145005 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Discovery Fund

|

| Class Name |

Class C

|

| Trading Symbol |

MMECX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class C | $258 | 2.45% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 258

|

| Expense Ratio, Percent |

2.45%

|

| Factors Affecting Performance [Text Block] |

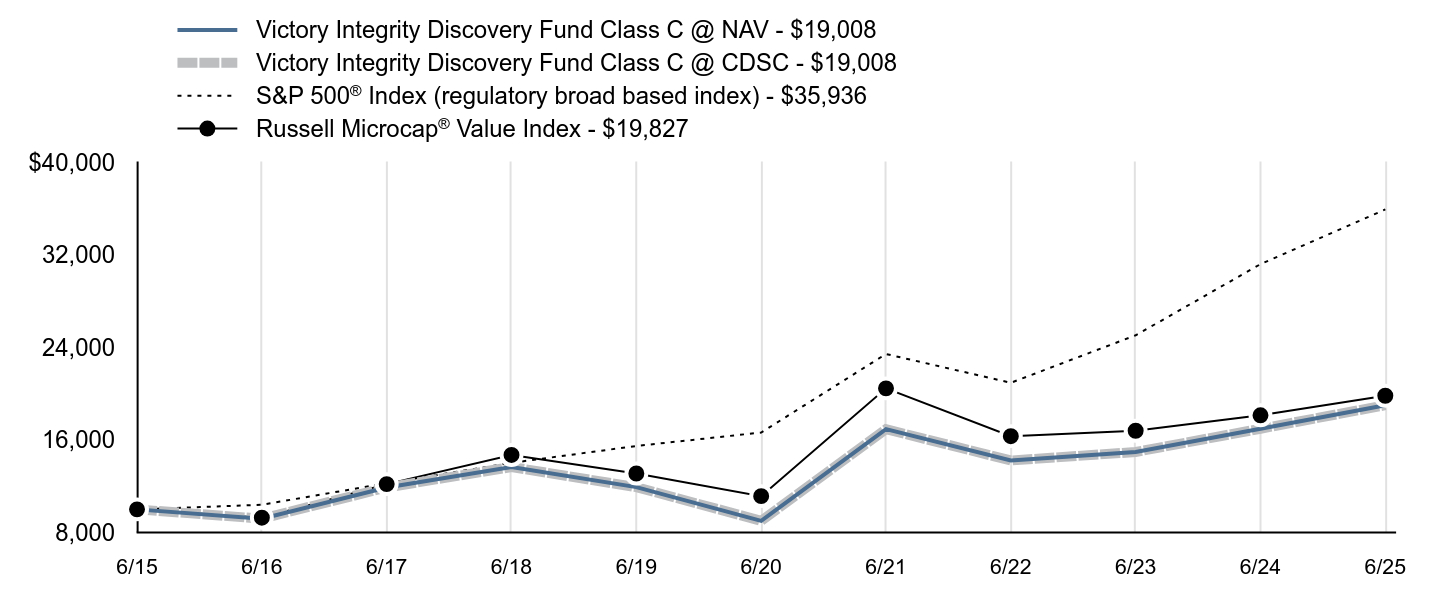

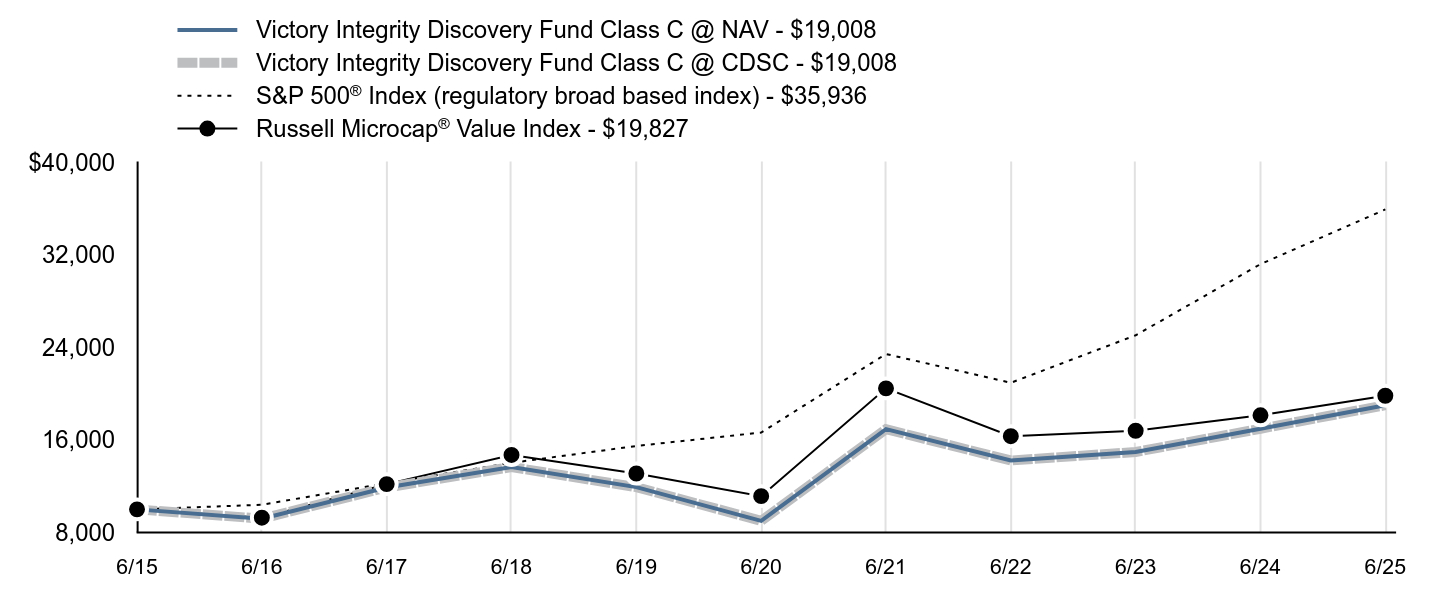

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund outperformed its benchmark, the Russell Microcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. would reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, microcap value stocks underperformed microcap growth stocks. Top contributors to performance: From a benchmark perspective, information technology, consumer staples, and financials were the top performing sectors. Security selection in the health care, financials, and consumer discretionary sectors were the largest positive contributors to the Fund’s relative performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocation to the information technology sector.

Top detractors from performance: From a benchmark perspective, the materials, health care, and consumer discretionary sectors were the largest detractors from relative performance. The information technology sector was the largest detractor from the Fund’s performance. From a style perspective, the Fund’s holdings on average had lower volatility and a higher market capitalization relative to the benchmark and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

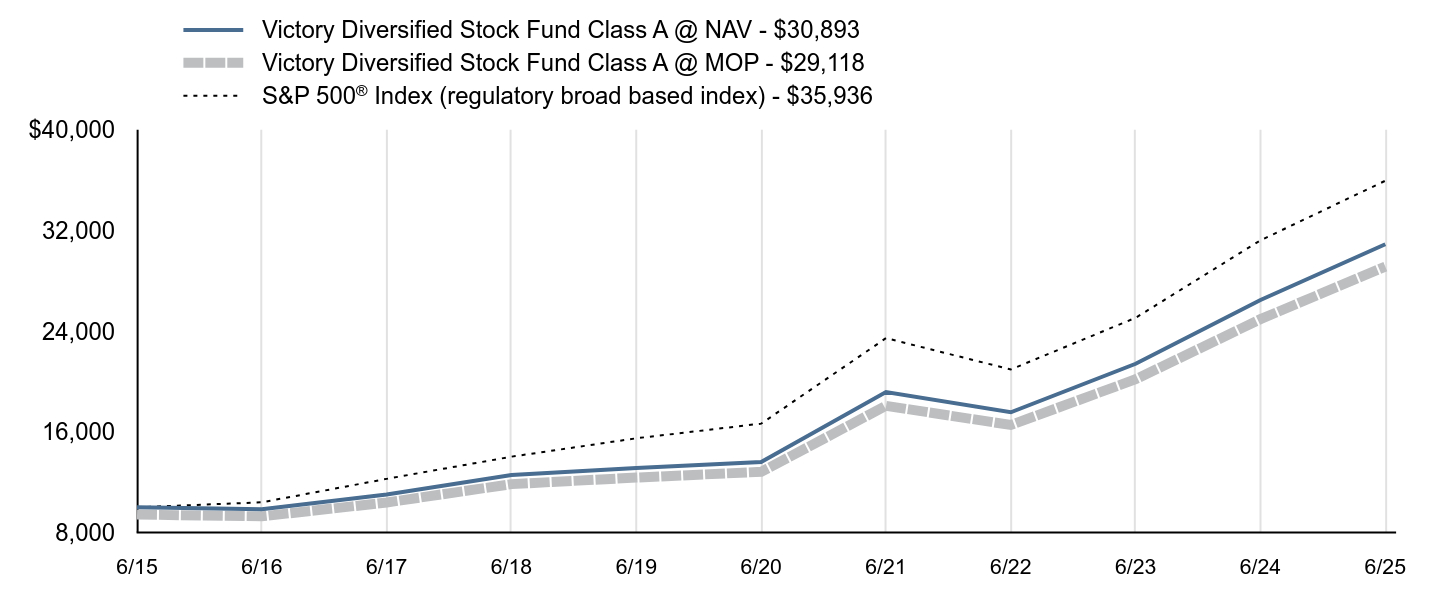

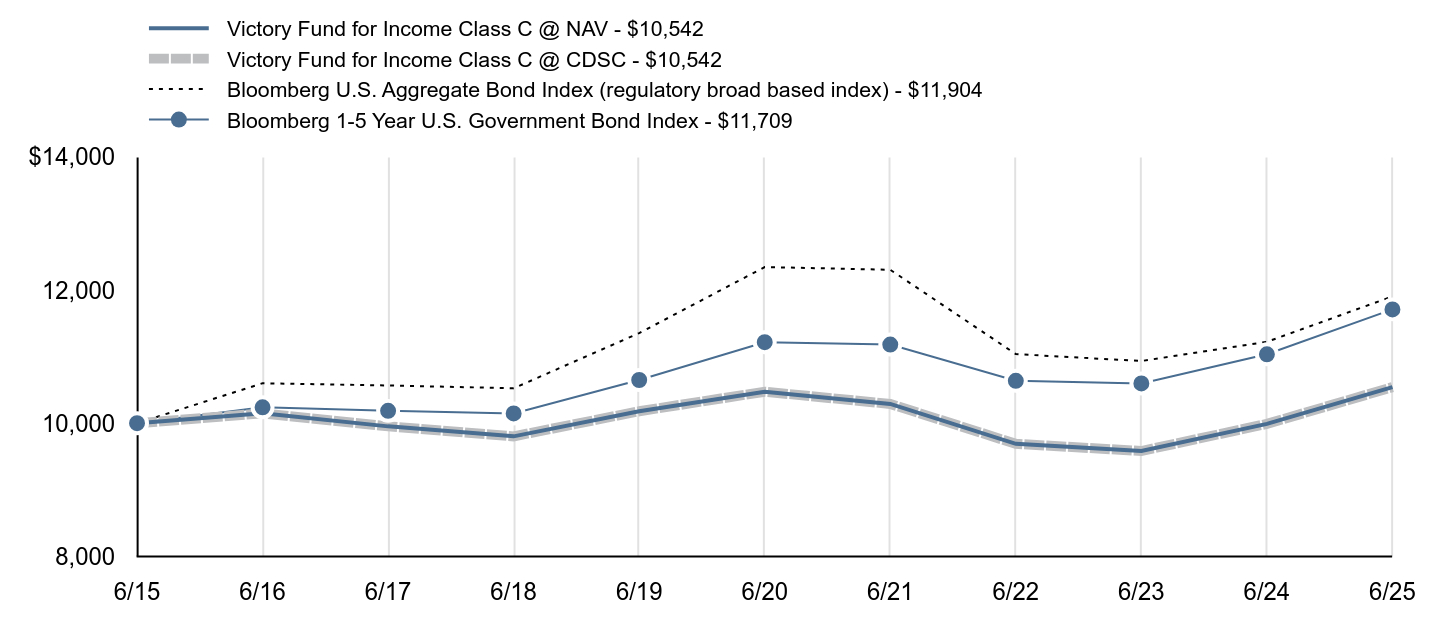

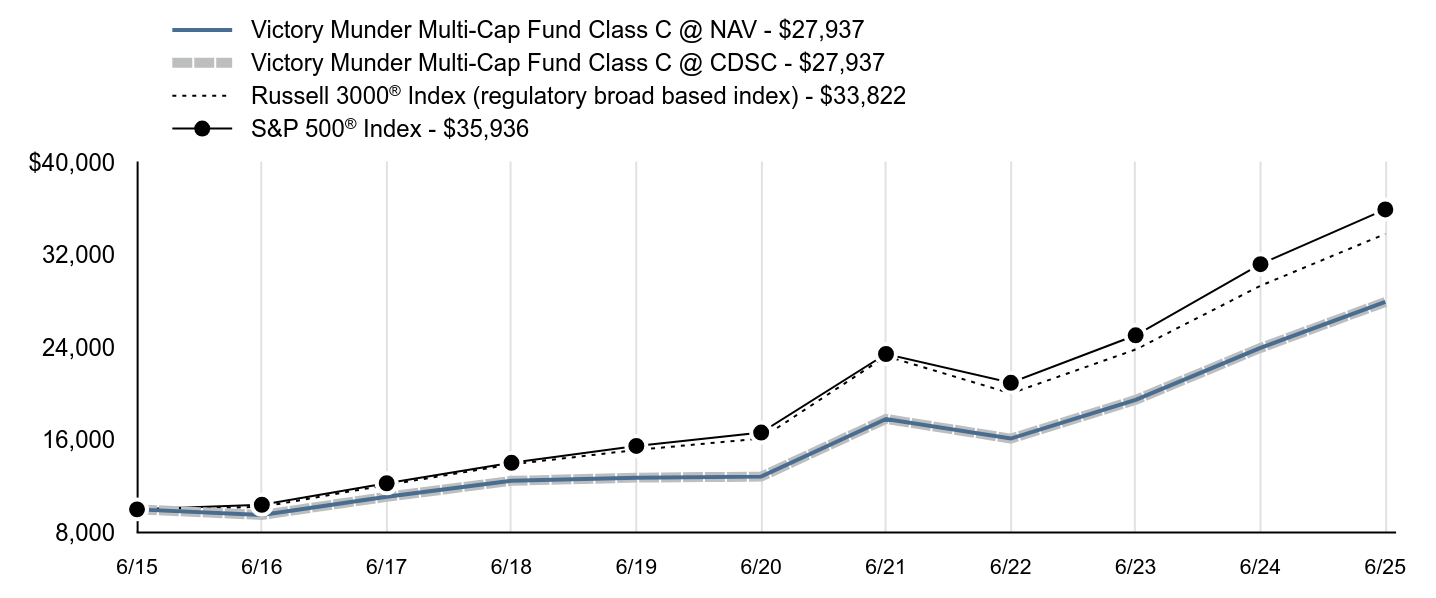

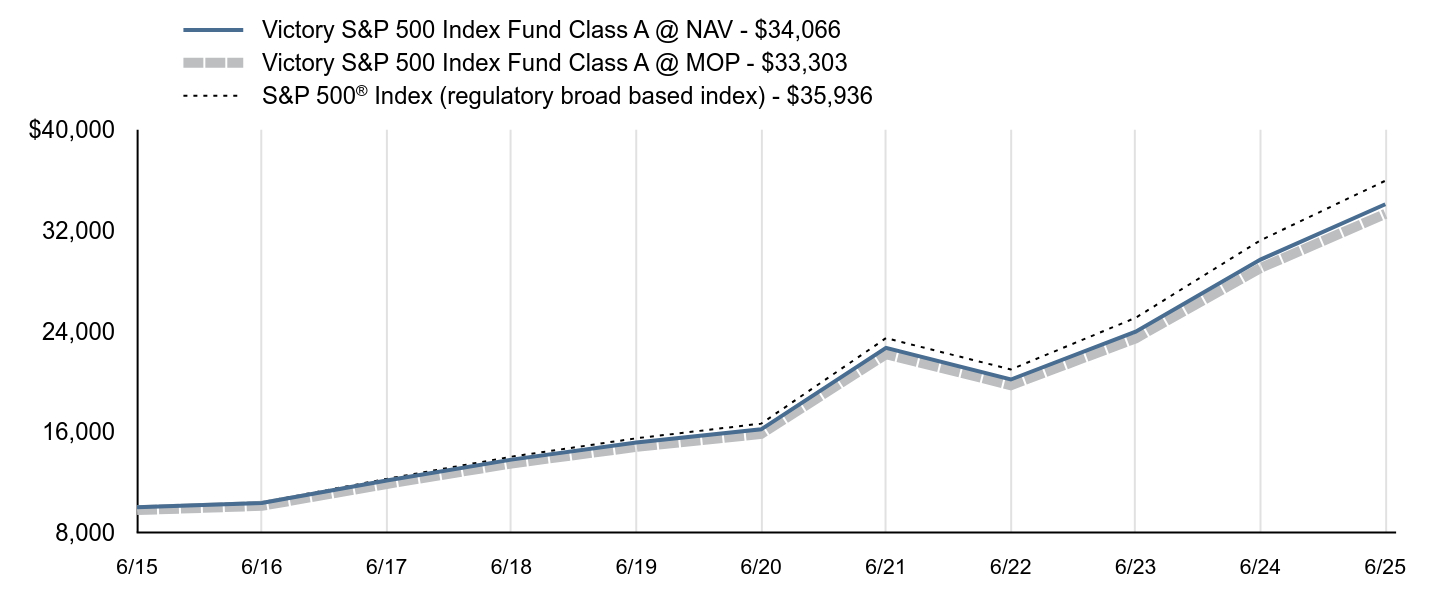

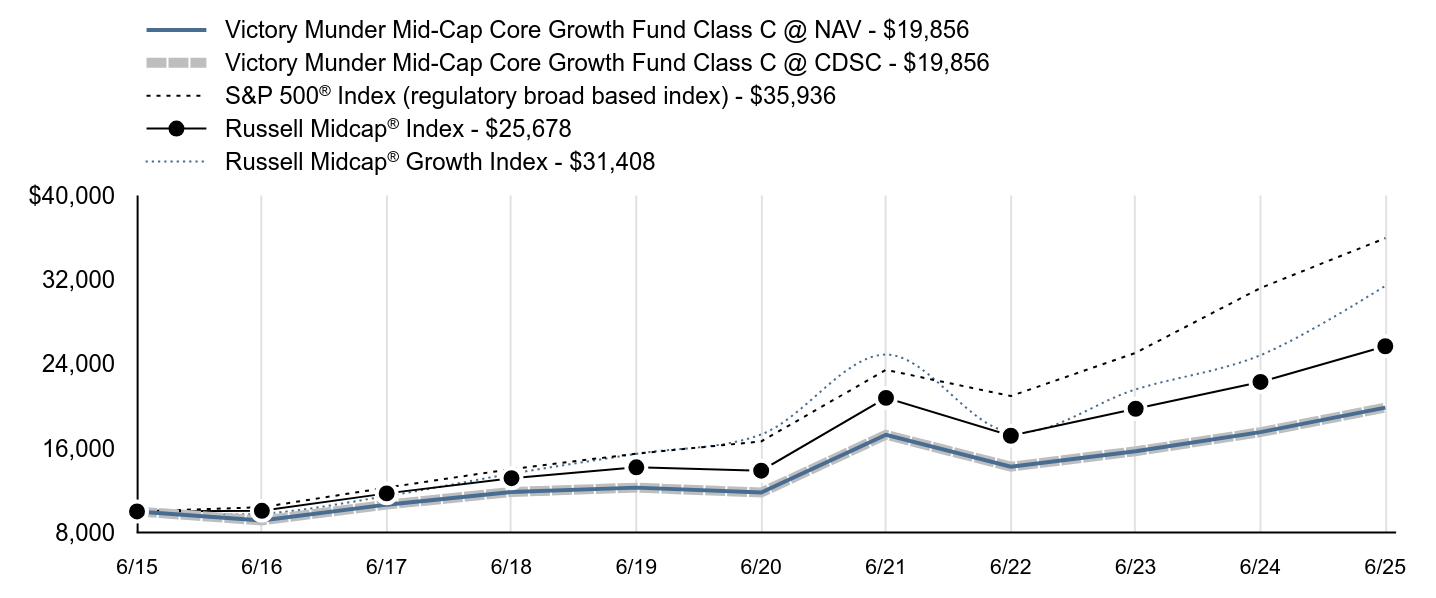

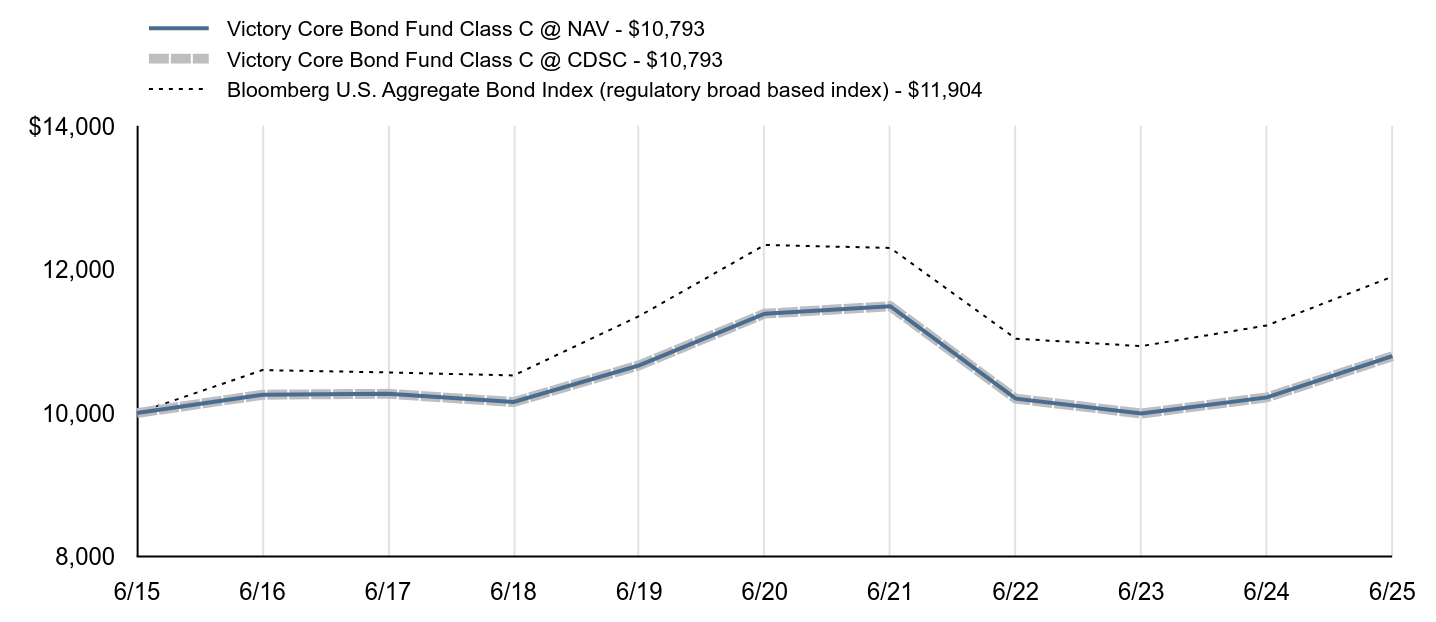

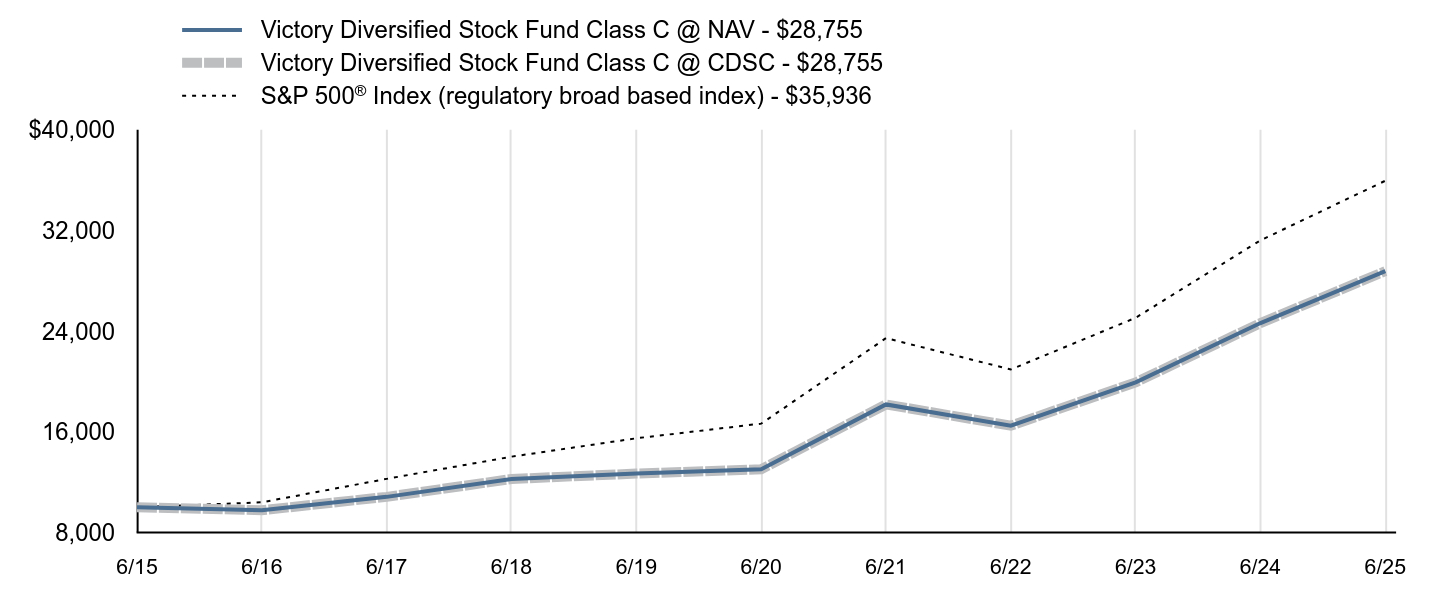

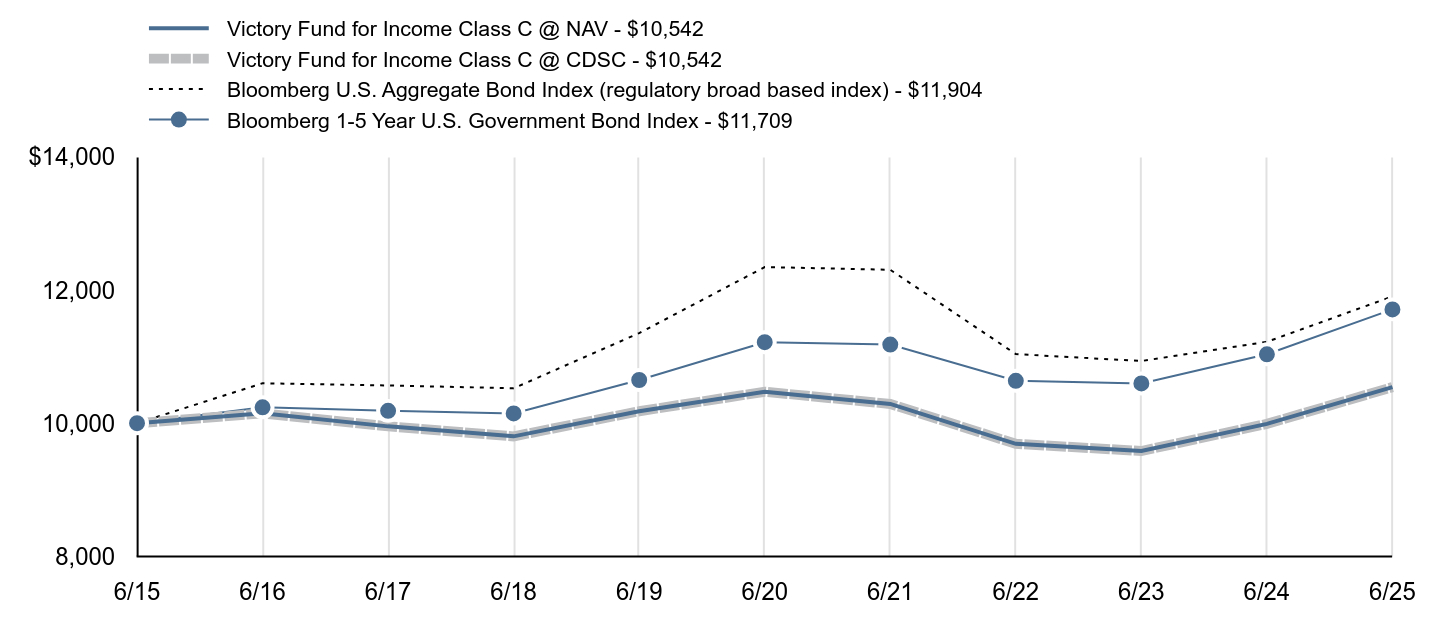

| Line Graph [Table Text Block] |

| Victory Integrity Discovery Fund Class C @ NAV - $19,008 | Victory Integrity Discovery Fund Class C @ CDSC - $19,008 | S&P 500® Index (regulatory broad based index) - $35,936 | Russell Microcap® Value Index - $19,827 |

|---|

6/15 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $9,196 | $9,196 | $10,399 | $9,283 |

|---|

6/17 | $11,893 | $11,893 | $12,260 | $12,185 |

|---|

6/18 | $13,663 | $13,663 | $14,023 | $14,706 |

|---|

6/19 | $11,922 | $11,922 | $15,483 | $13,101 |

|---|

6/20 | $9,011 | $9,011 | $16,645 | $11,145 |

|---|

6/21 | $16,934 | $16,934 | $23,436 | $20,464 |

|---|

6/22 | $14,228 | $14,228 | $20,948 | $16,332 |

|---|

6/23 | $14,963 | $14,963 | $25,053 | $16,799 |

|---|

6/24 | $16,973 | $16,973 | $31,204 | $18,136 |

|---|

6/25 | $19,008 | $19,008 | $35,936 | $19,827 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class C @ NAV | 11.01% | 15.71%Footnote Reference | 6.63% |

|---|

Class C @ CDSC | 10.05% | 15.71% | 6.63% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Russell Microcap® Value Index | 9.32% | 12.21% | 7.08% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| Previous Investment Adviser [Text Block] |

Class C is not subject to an initial sales charge, but is subject to Contingent Deferred Sales Charge (“CDSC”) of 1.00% on shares redeemed within one year of purchase. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

| AssetsNet |

$ 58,122,000

|

| Holdings Count | Holding |

122

|

| Advisory Fees Paid, Amount |

$ 641,000

|

| InvestmentCompanyPortfolioTurnover |

33.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $58,122 |

|---|

Number of Holdings | 122 |

|---|

Investment Advisory Fees | $641 |

|---|

Portfolio Turnover | 33% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Utilities | 0.7% | Communication Services | 3.4% | Real Estate | 4.5% | Energy | 5.0% | Health Care | 5.0% | Materials | 5.3% | Consumer Discretionary | 12.4% | Information Technology | 12.6% | Industrials | 18.5% | FinancialsFootnote Reference** | 30.9% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)nLight, Inc. | 1.3% |

|---|

Digi International, Inc. | 1.2% |

|---|

Interface, Inc. | 1.2% |

|---|

Ducommun, Inc. | 1.2% |

|---|

Ribbon Communications, Inc. | 1.2% |

|---|

Artivion, Inc. | 1.2% |

|---|

First Mid Bancshares, Inc. | 1.2% |

|---|

Peoples Bancorp, Inc. | 1.2% |

|---|

Great Lakes Dredge & Dock Corp. | 1.1% |

|---|

ConnectOne Bancorp, Inc. | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000145007 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Discovery Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

MMEYX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class Y | $150 | 1.41% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 150

|

| Expense Ratio, Percent |

1.41%

|

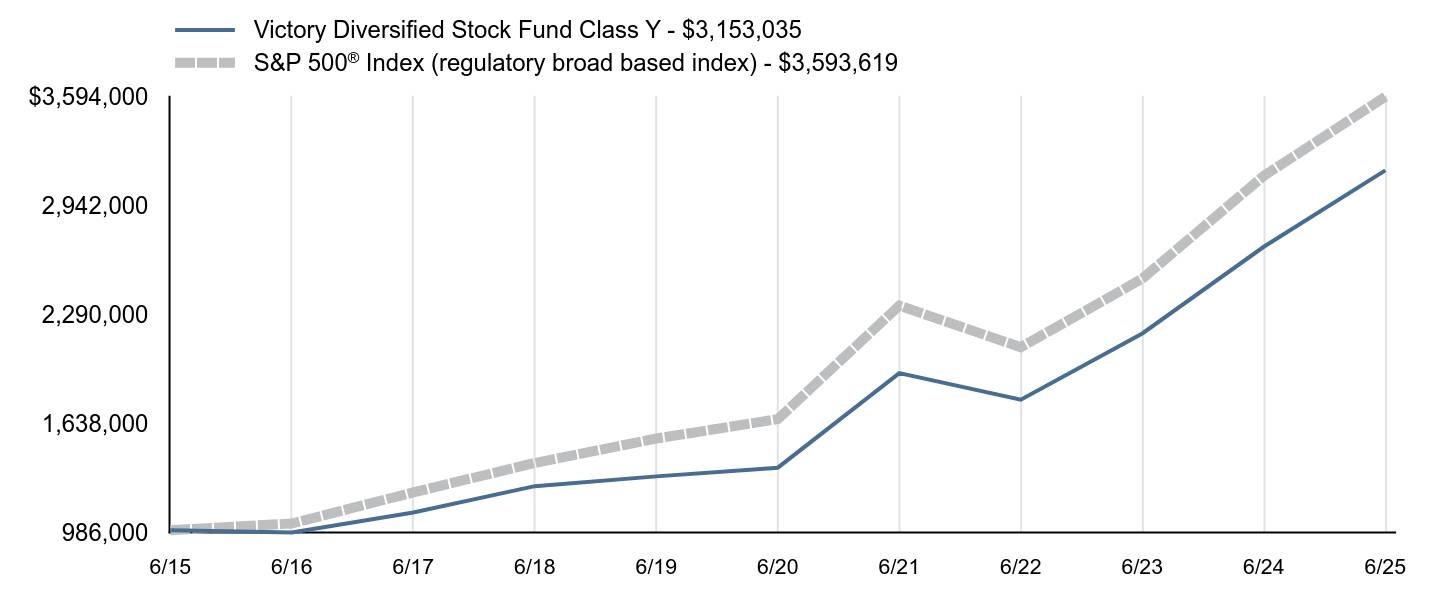

| Factors Affecting Performance [Text Block] |

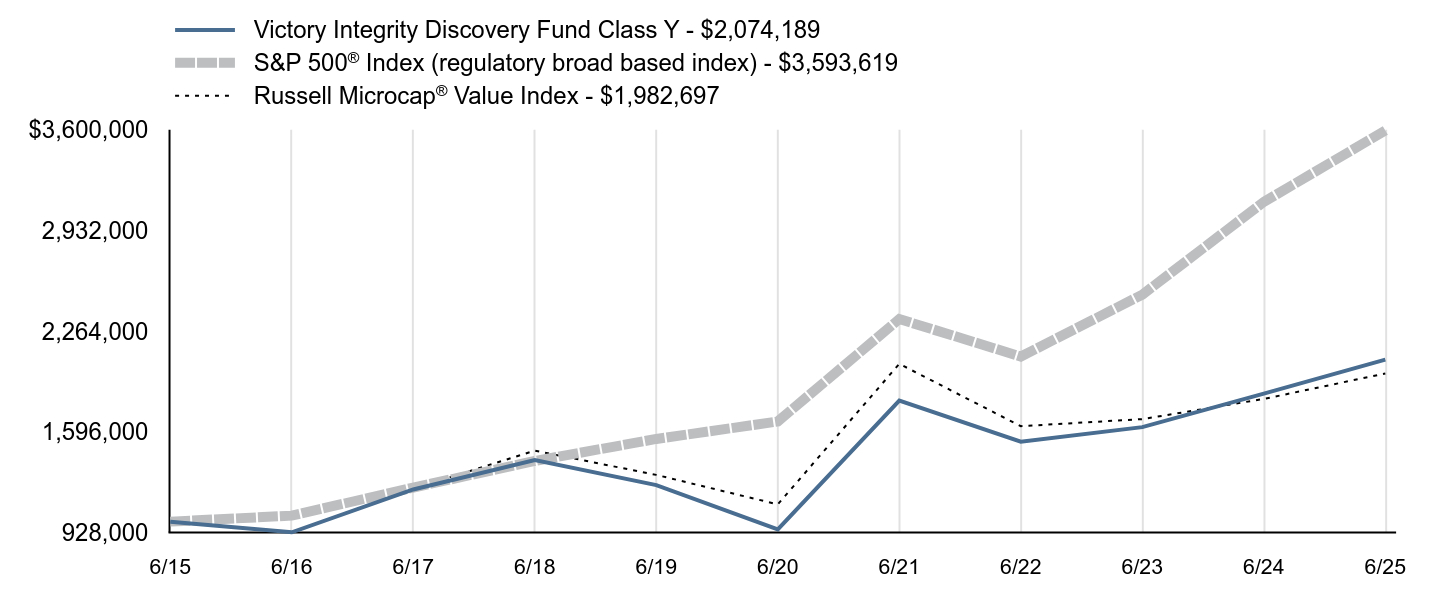

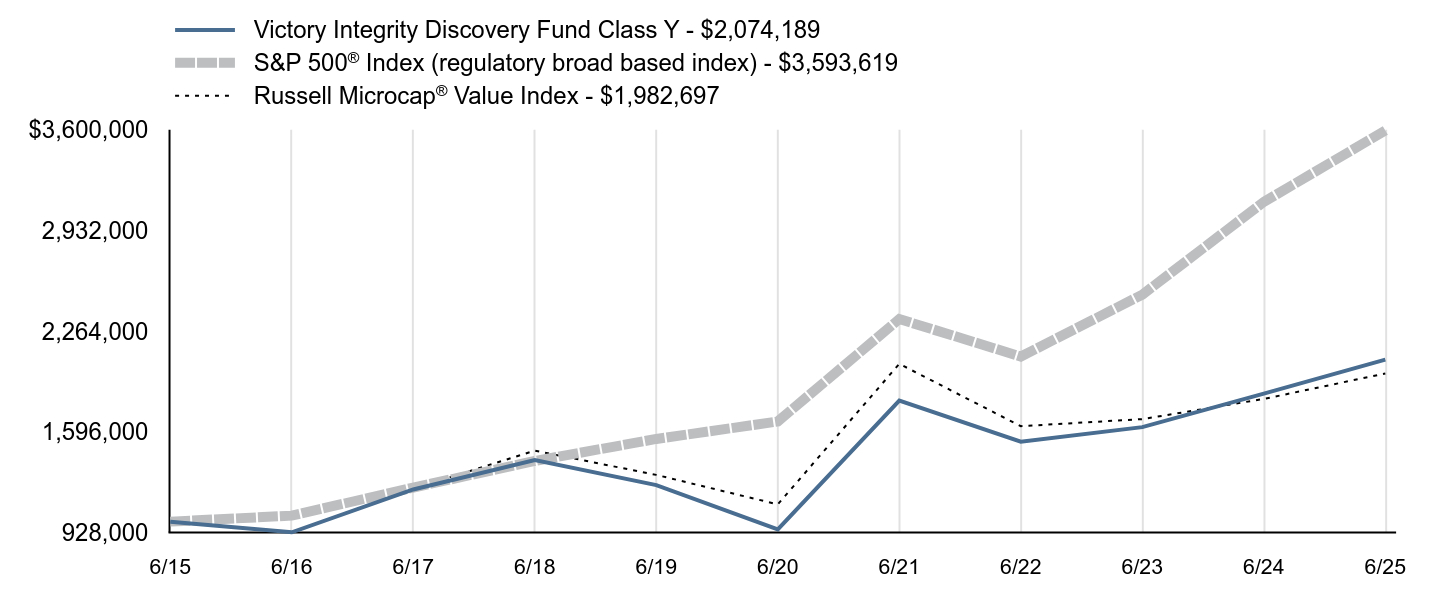

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund outperformed its benchmark, the Russell Microcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. would reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, microcap value stocks underperformed microcap growth stocks. Top contributors to performance: From a benchmark perspective, information technology, consumer staples, and financials were the top performing sectors. Security selection in the health care, financials, and consumer discretionary sectors were the largest positive contributors to the Fund’s relative performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocation to the information technology sector.

Top detractors from performance: From a benchmark perspective, the materials, health care, and consumer discretionary sectors were the largest detractors from relative performance. The information technology sector was the largest detractor from the Fund’s performance. From a style perspective, the Fund’s holdings on average had lower volatility and a higher market capitalization relative to the benchmark and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

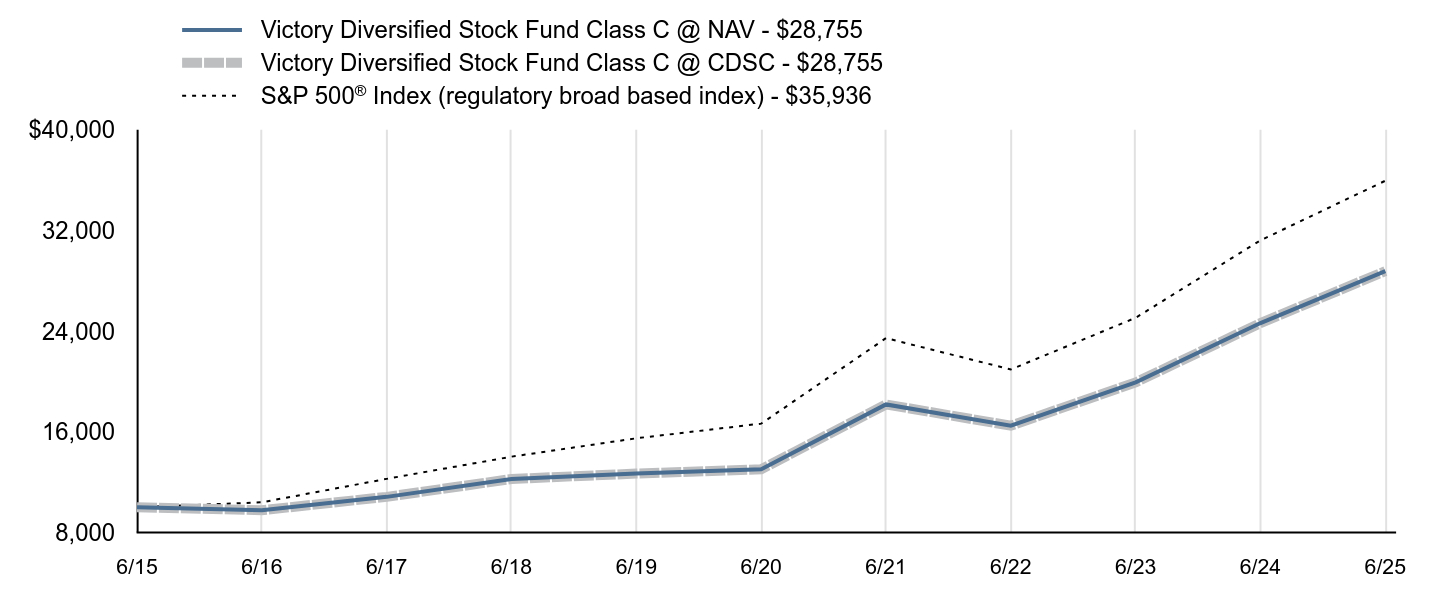

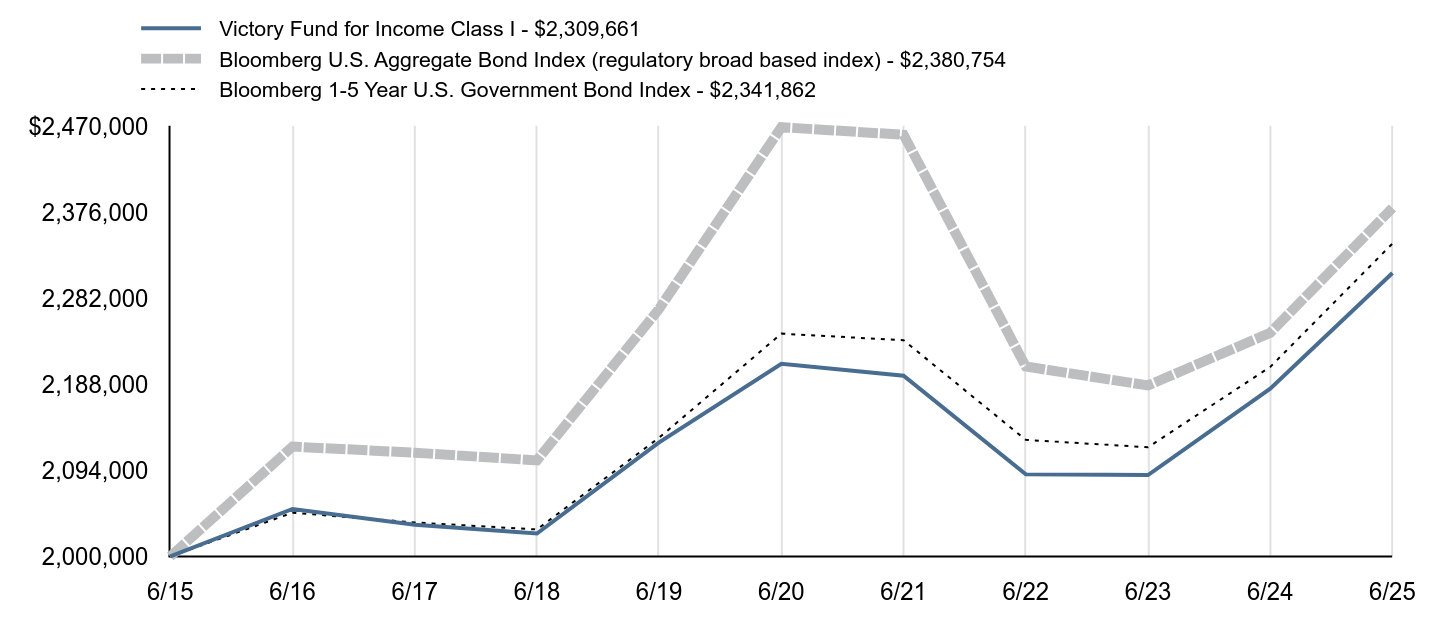

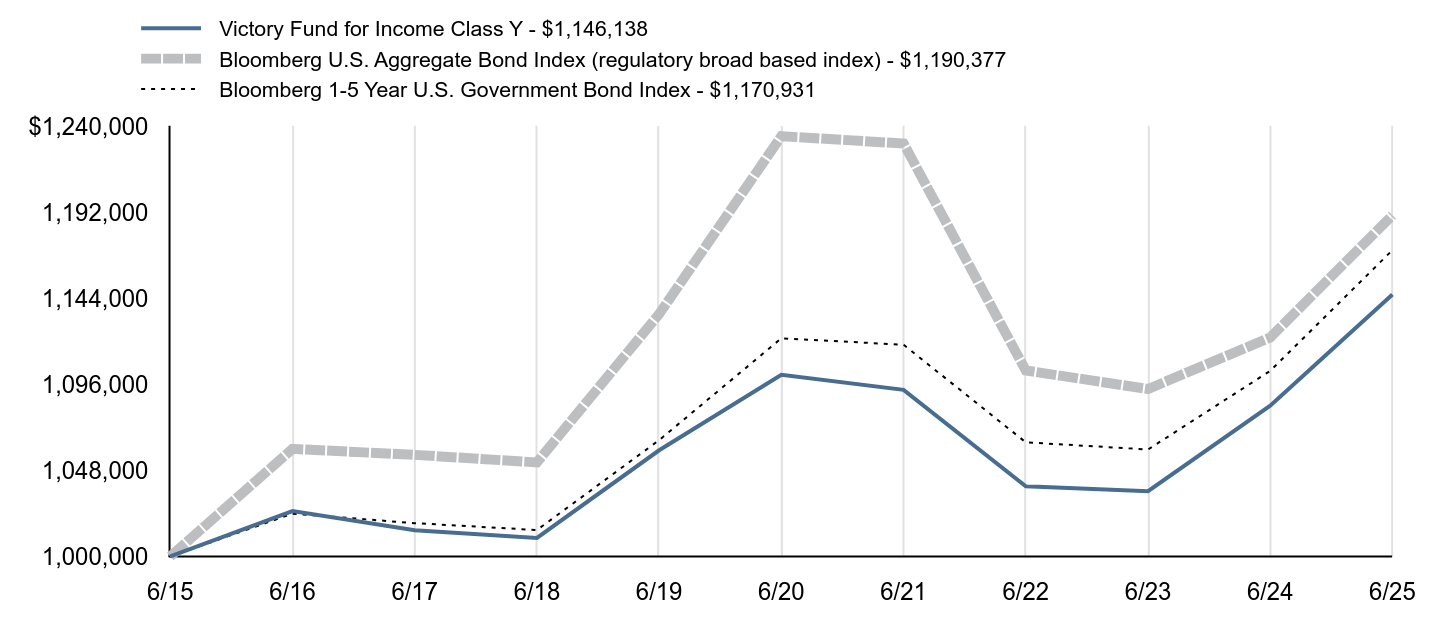

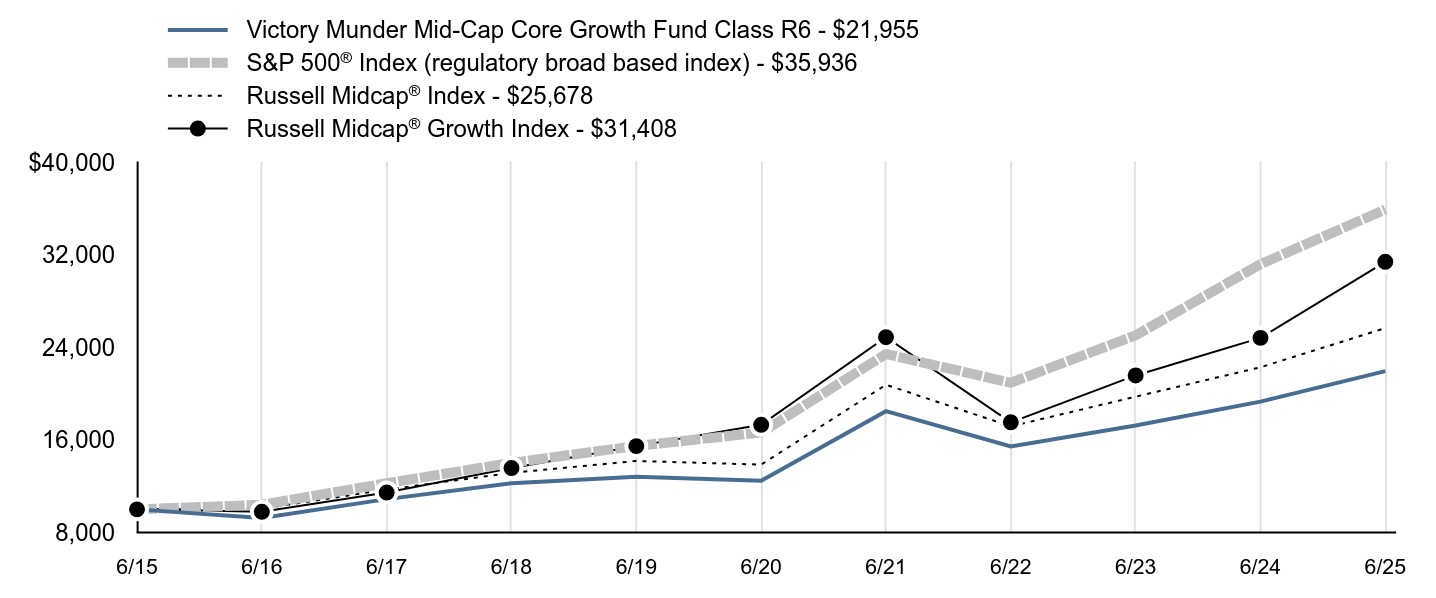

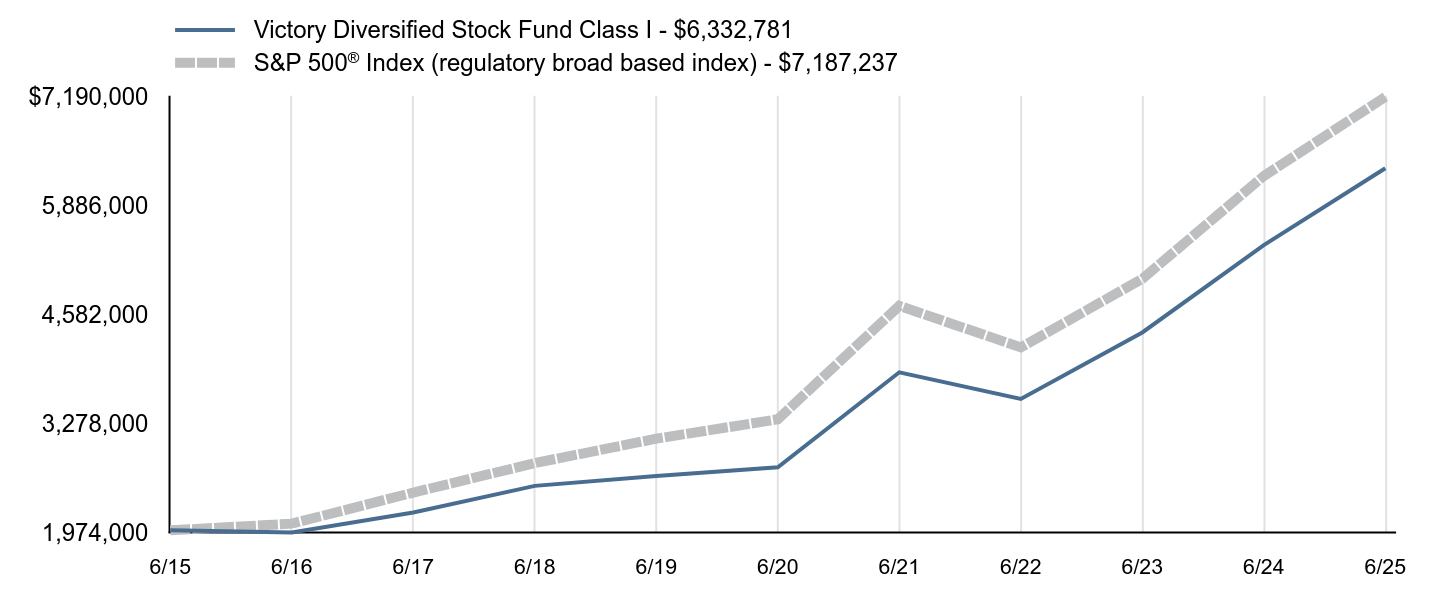

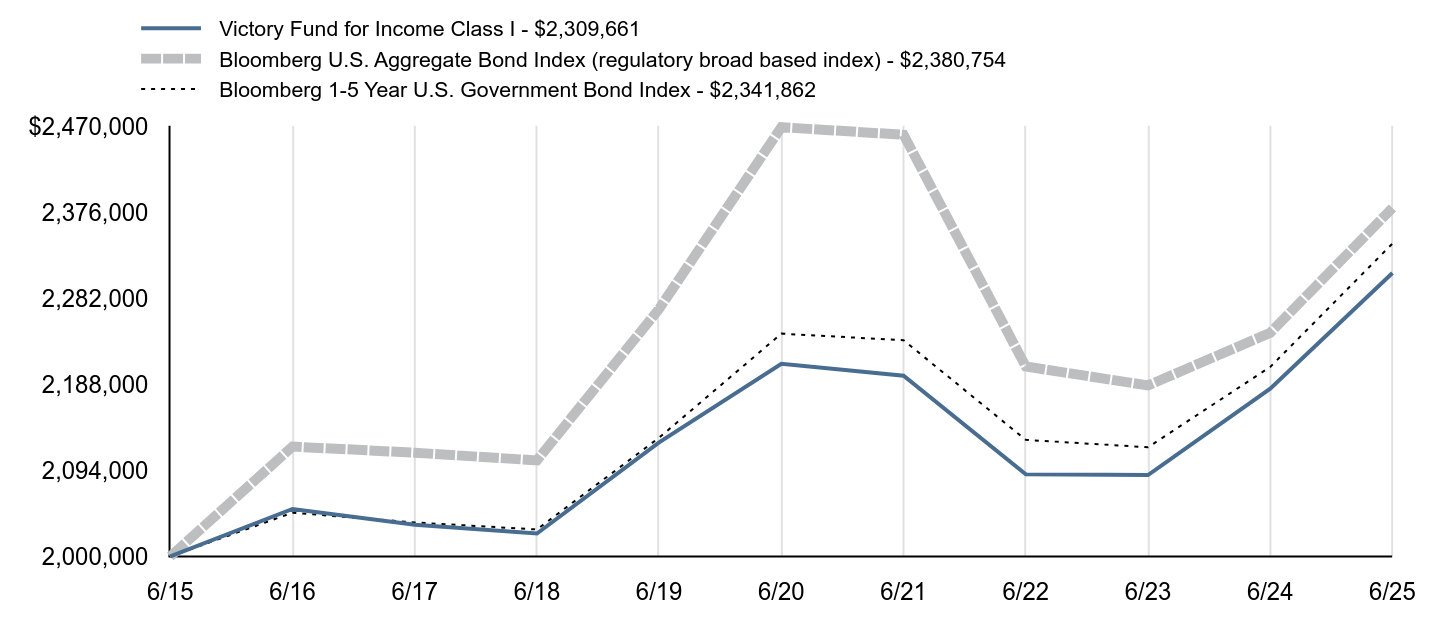

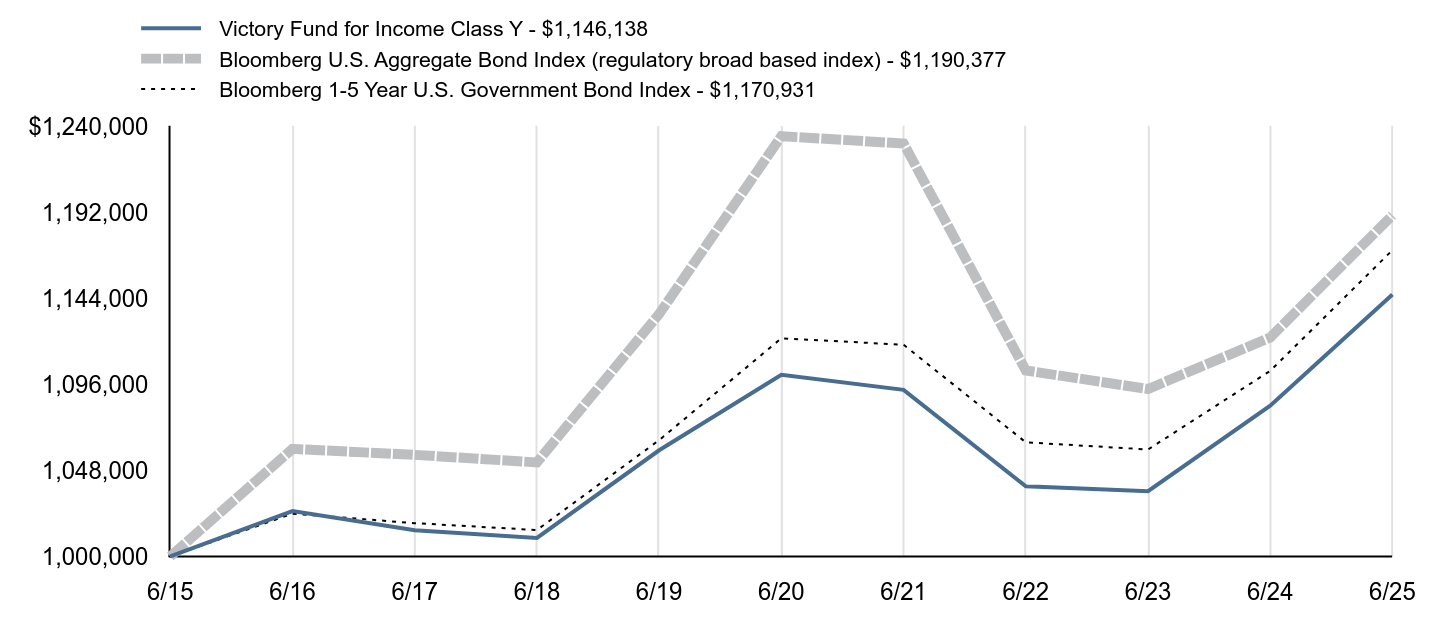

| Line Graph [Table Text Block] |

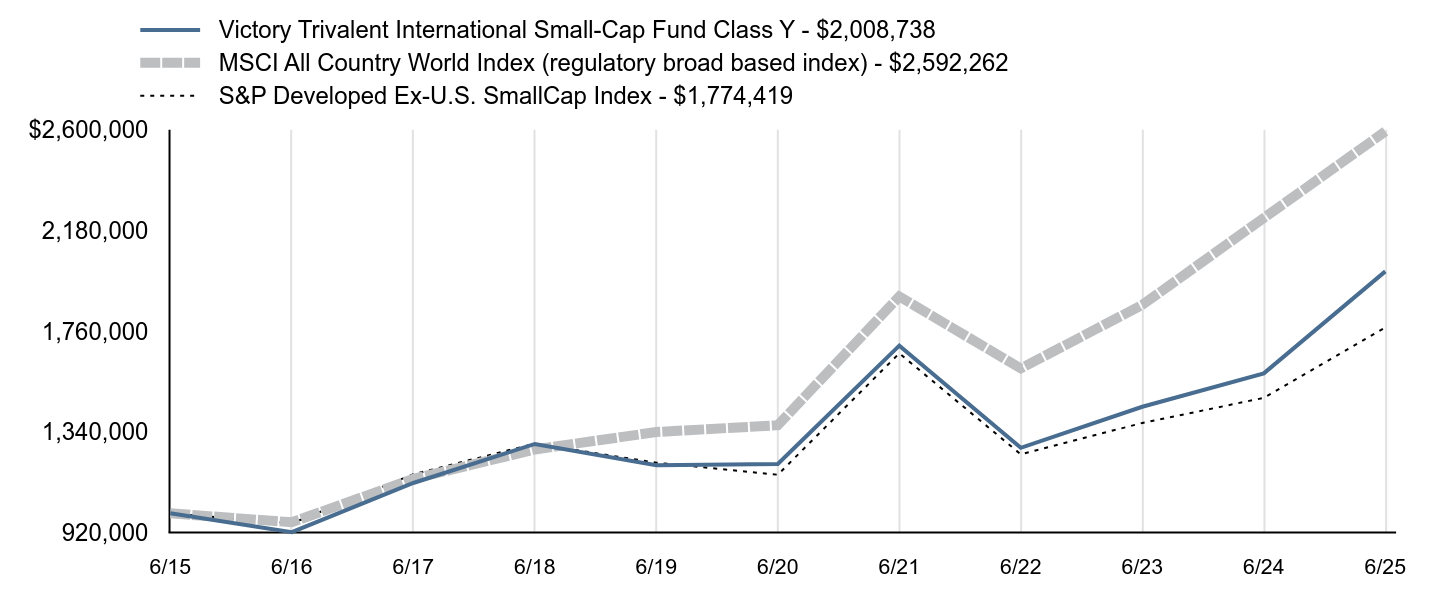

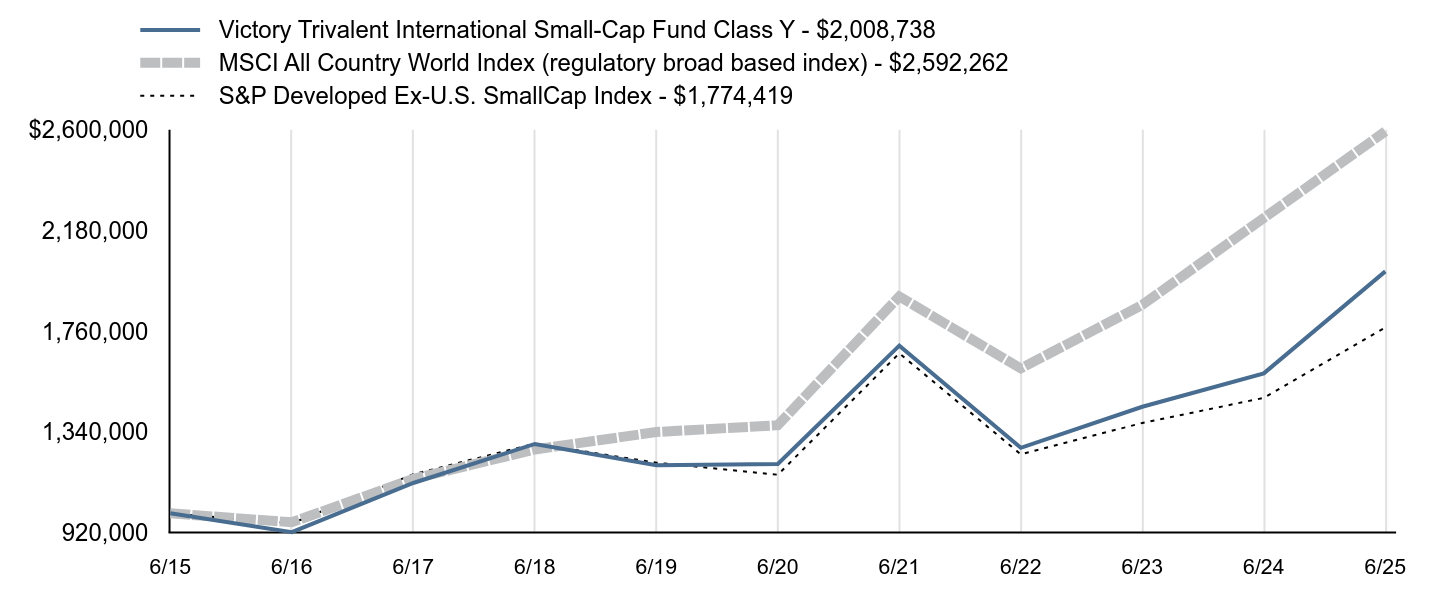

| Victory Integrity Discovery Fund Class Y - $2,074,189 | S&P 500® Index (regulatory broad based index) - $3,593,619 | Russell Microcap® Value Index - $1,982,697 |

|---|

6/15 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

6/16 | $928,992 | $1,039,928 | $928,271 |

|---|

6/17 | $1,213,433 | $1,226,034 | $1,218,471 |

|---|

6/18 | $1,408,513 | $1,402,264 | $1,470,620 |

|---|

6/19 | $1,242,096 | $1,548,344 | $1,310,123 |

|---|

6/20 | $948,498 | $1,664,549 | $1,114,500 |

|---|

6/21 | $1,803,001 | $2,343,588 | $2,046,409 |

|---|

6/22 | $1,530,551 | $2,094,797 | $1,633,197 |

|---|

6/23 | $1,626,788 | $2,505,253 | $1,679,921 |

|---|

6/24 | $1,849,108 | $3,120,445 | $1,813,643 |

|---|

6/25 | $2,074,189 | $3,593,619 | $1,982,697 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class Y | 12.17% | 16.94%Footnote Reference | 7.57% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Russell Microcap® Value Index | 9.32% | 12.21% | 7.08% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| AssetsNet |

$ 58,122,000

|

| Holdings Count | Holding |

122

|

| Advisory Fees Paid, Amount |

$ 641,000

|

| InvestmentCompanyPortfolioTurnover |

33.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $58,122 |

|---|

Number of Holdings | 122 |

|---|

Investment Advisory Fees | $641 |

|---|

Portfolio Turnover | 33% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Utilities | 0.7% | Communication Services | 3.4% | Real Estate | 4.5% | Energy | 5.0% | Health Care | 5.0% | Materials | 5.3% | Consumer Discretionary | 12.4% | Information Technology | 12.6% | Industrials | 18.5% | FinancialsFootnote Reference** | 30.9% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)nLight, Inc. | 1.3% |

|---|

Digi International, Inc. | 1.2% |

|---|

Interface, Inc. | 1.2% |

|---|

Ducommun, Inc. | 1.2% |

|---|

Ribbon Communications, Inc. | 1.2% |

|---|

Artivion, Inc. | 1.2% |

|---|

First Mid Bancshares, Inc. | 1.2% |

|---|

Peoples Bancorp, Inc. | 1.2% |

|---|

Great Lakes Dredge & Dock Corp. | 1.1% |

|---|

ConnectOne Bancorp, Inc. | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000219865 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Discovery Fund

|

| Class Name |

Member Class

|

| Trading Symbol |

MMMMX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-235-8396 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-235-8396

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Member Class | $159 | 1.50% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 159

|

| Expense Ratio, Percent |

1.50%

|

| Factors Affecting Performance [Text Block] |

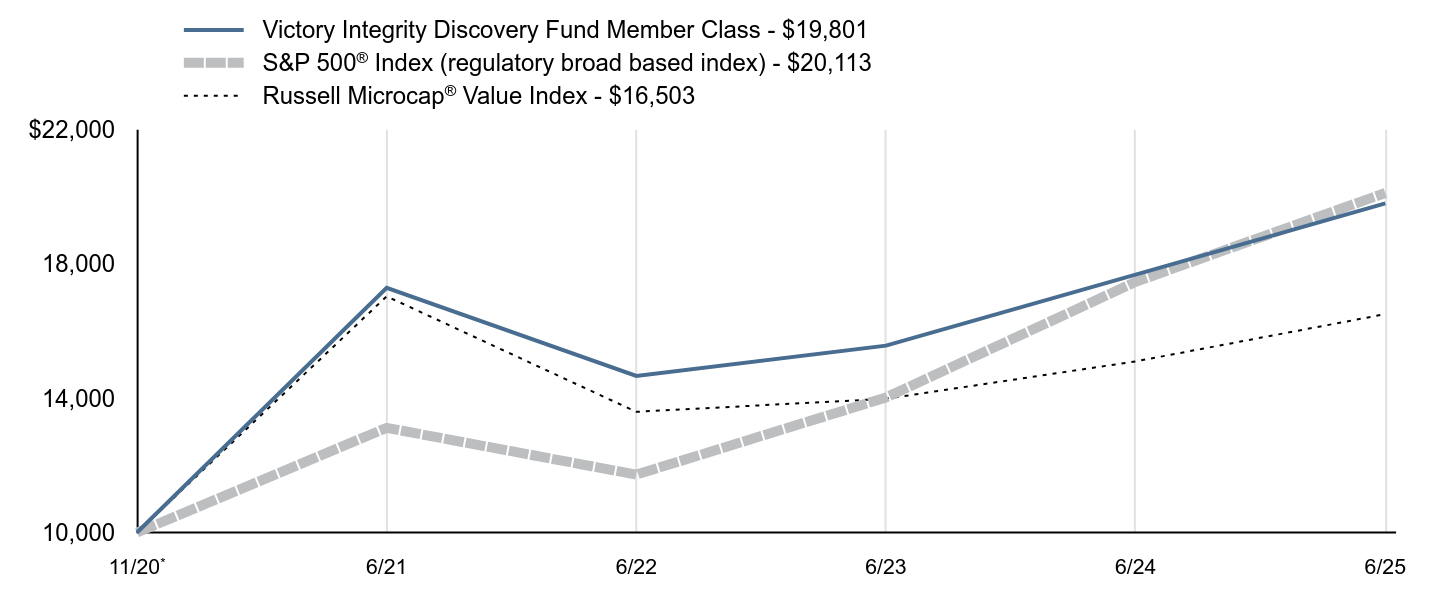

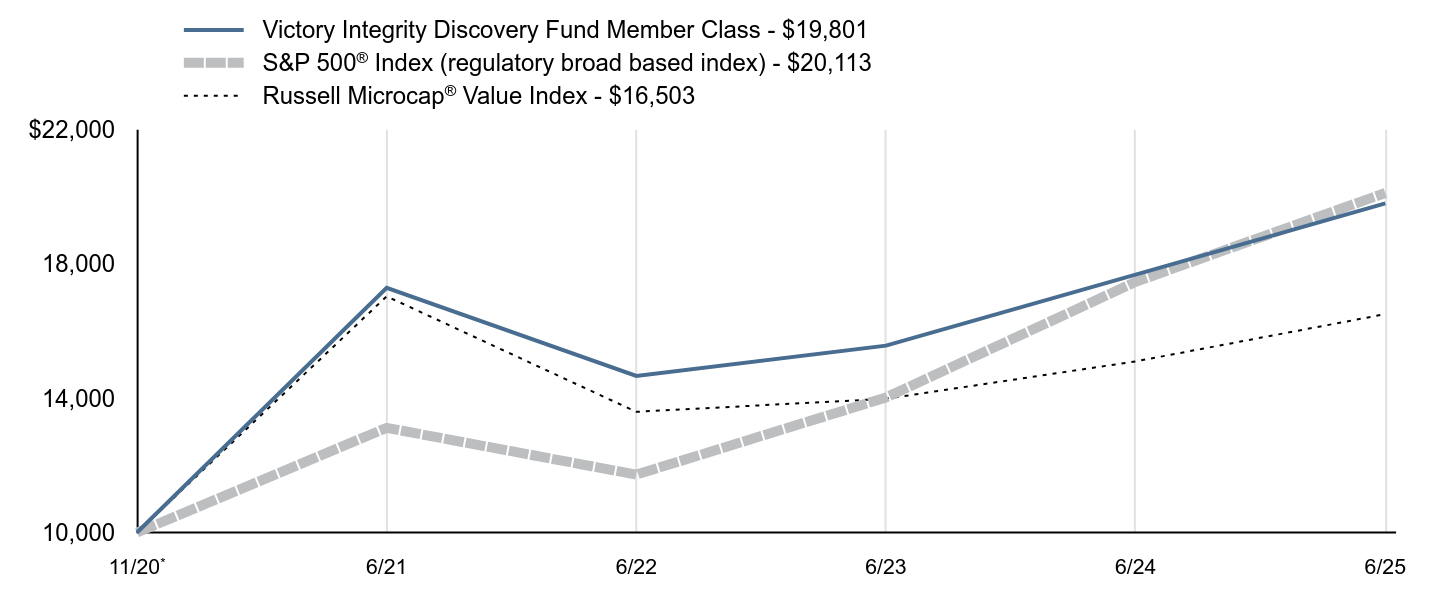

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund outperformed its benchmark, the Russell Microcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. would reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, microcap value stocks underperformed microcap growth stocks. Top contributors to performance: From a benchmark perspective, information technology, consumer staples, and financials were the top performing sectors. Security selection in the health care, financials, and consumer discretionary sectors were the largest positive contributors to the Fund’s relative performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocation to the information technology sector.

Top detractors from performance: From a benchmark perspective, the materials, health care, and consumer discretionary sectors were the largest detractors from relative performance. The information technology sector was the largest detractor from the Fund’s performance. From a style perspective, the Fund’s holdings on average had lower volatility and a higher market capitalization relative to the benchmark and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

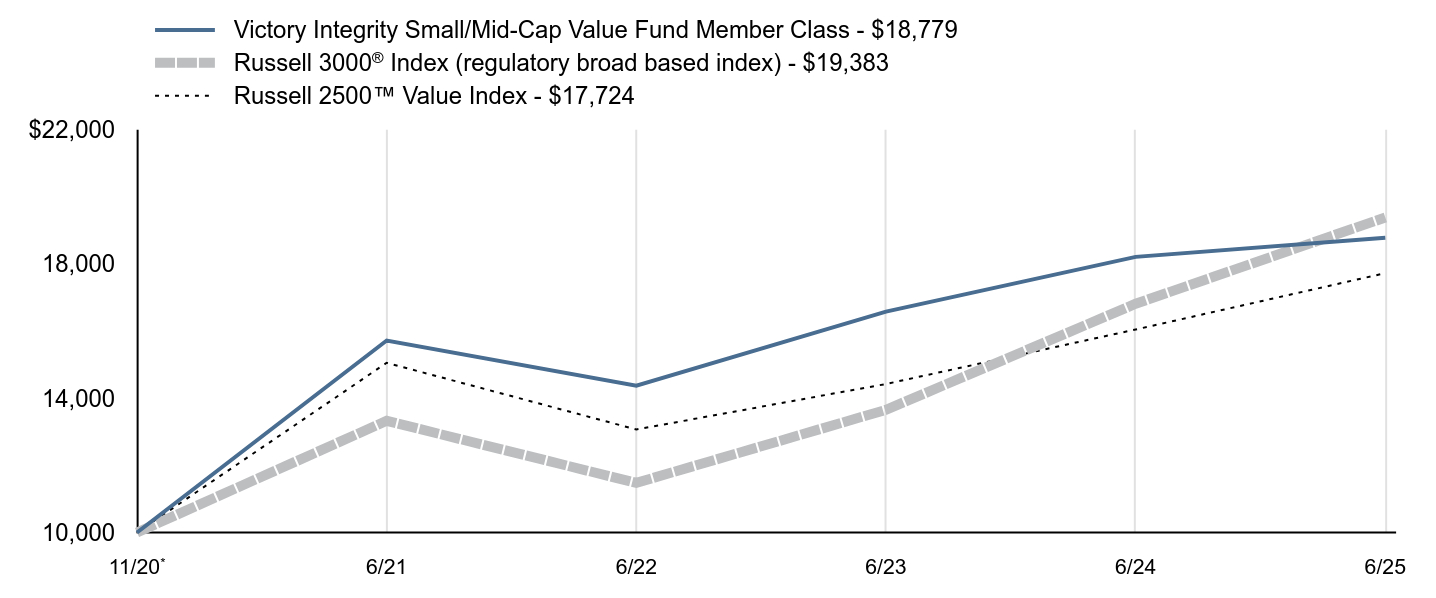

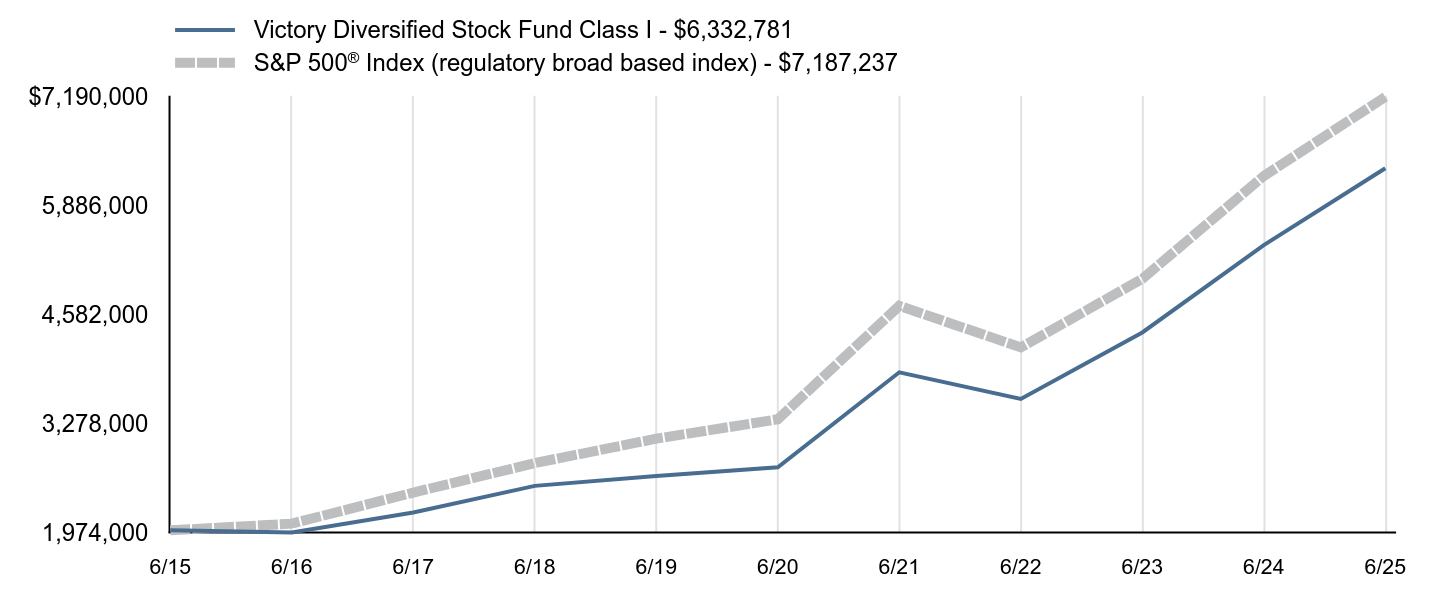

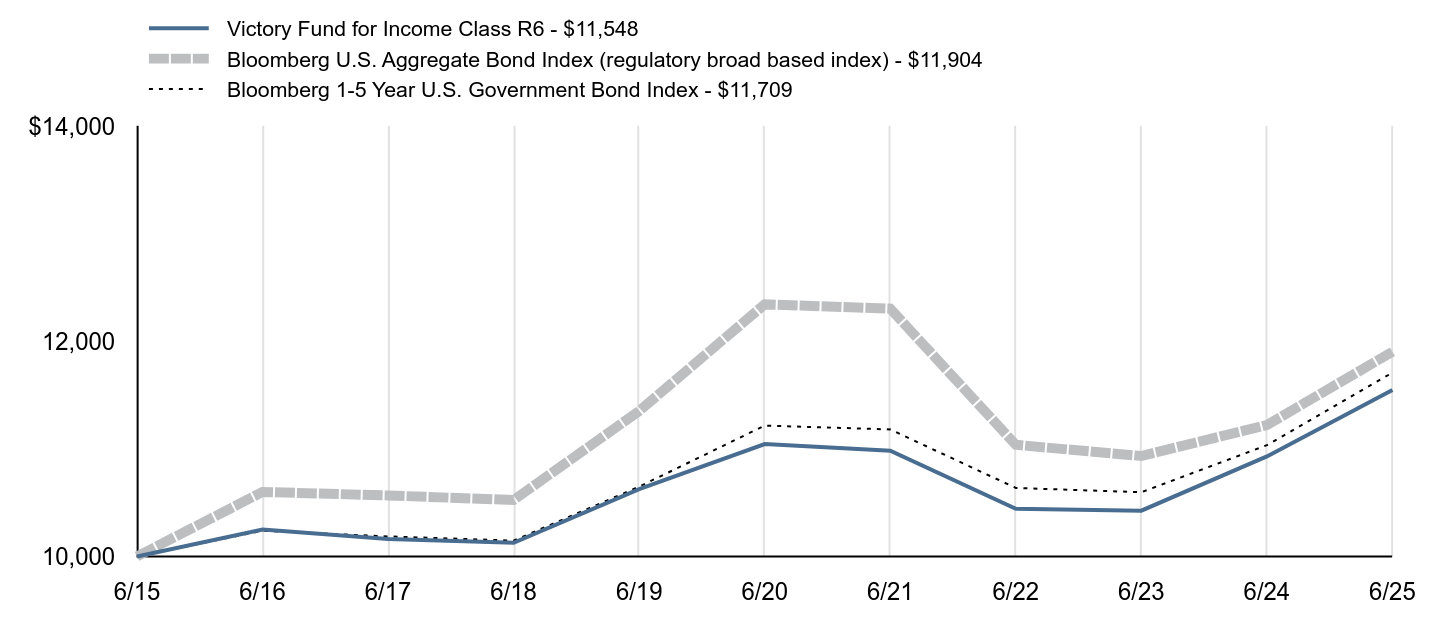

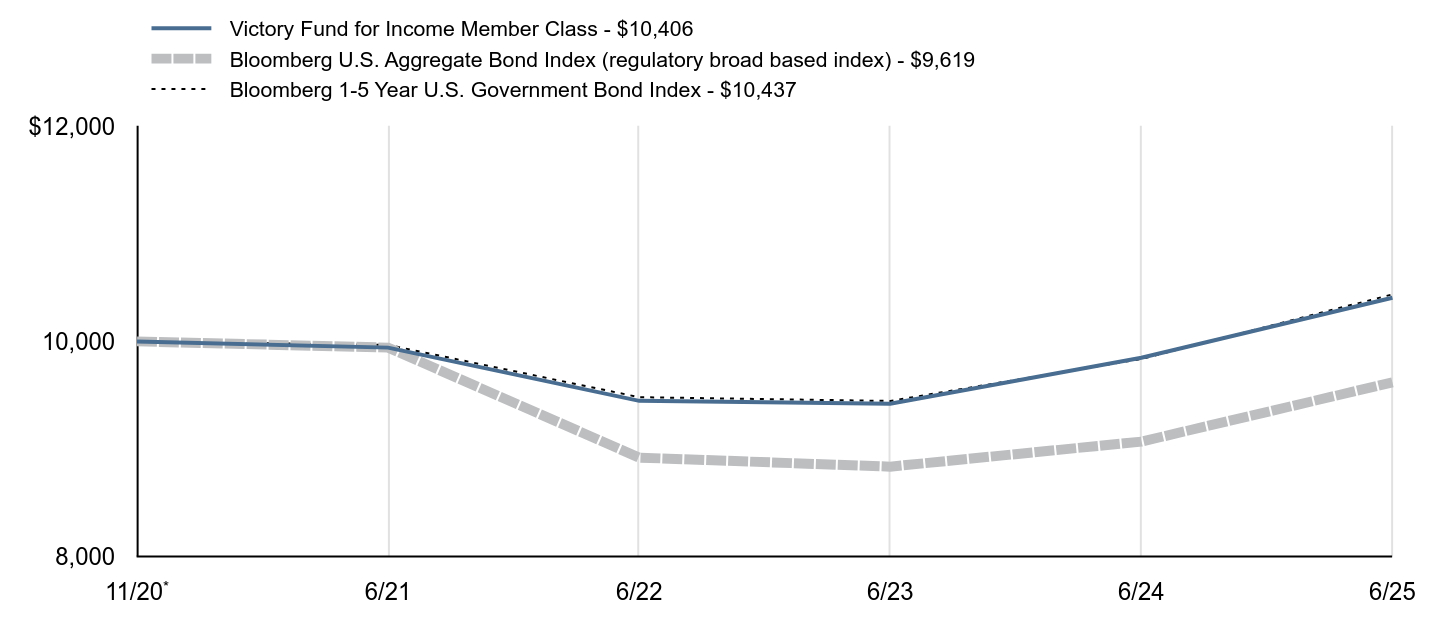

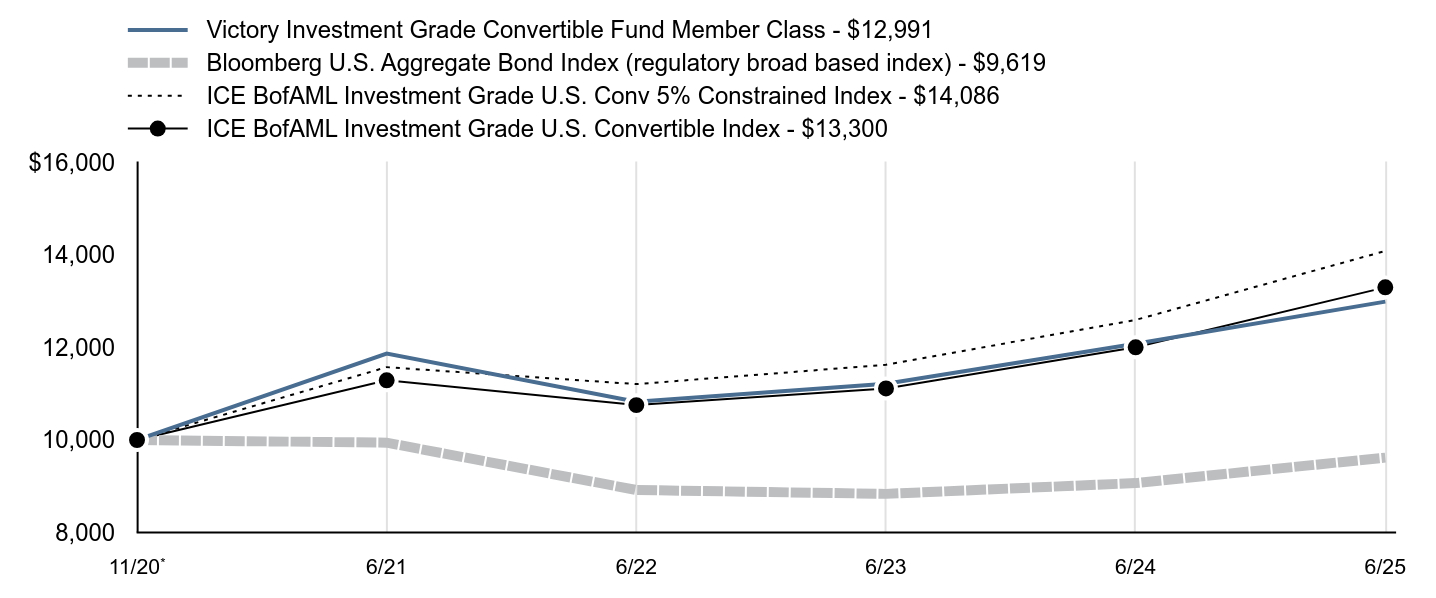

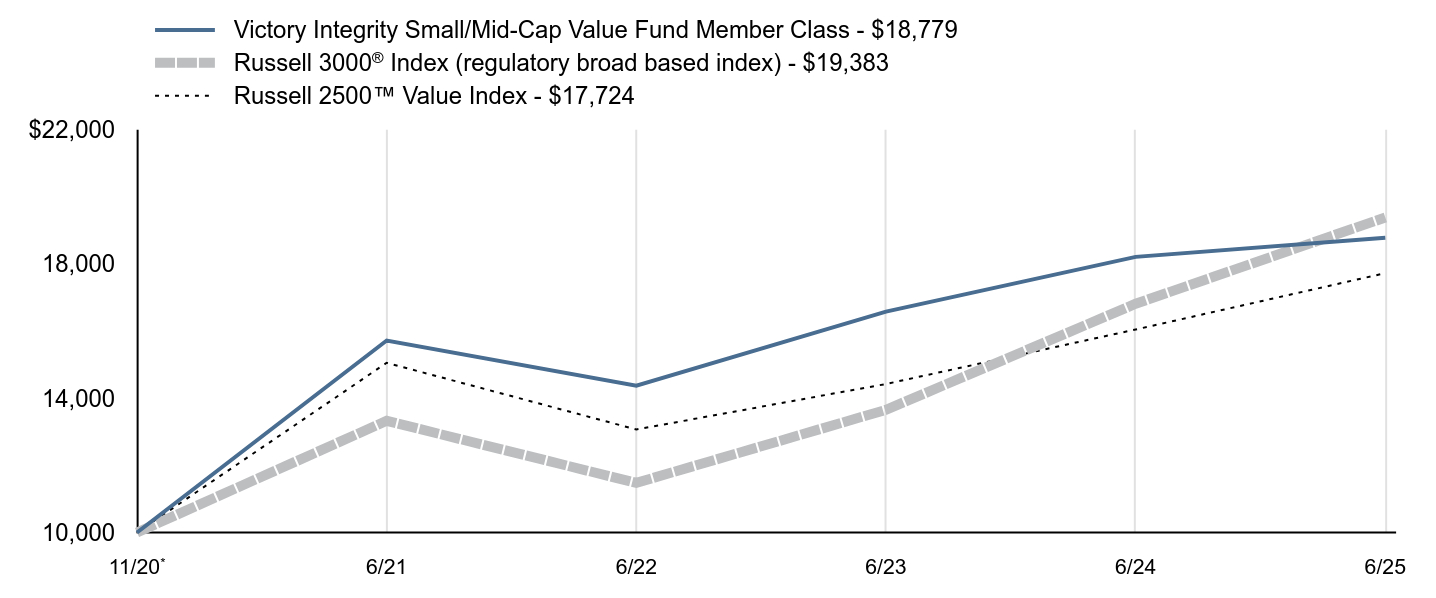

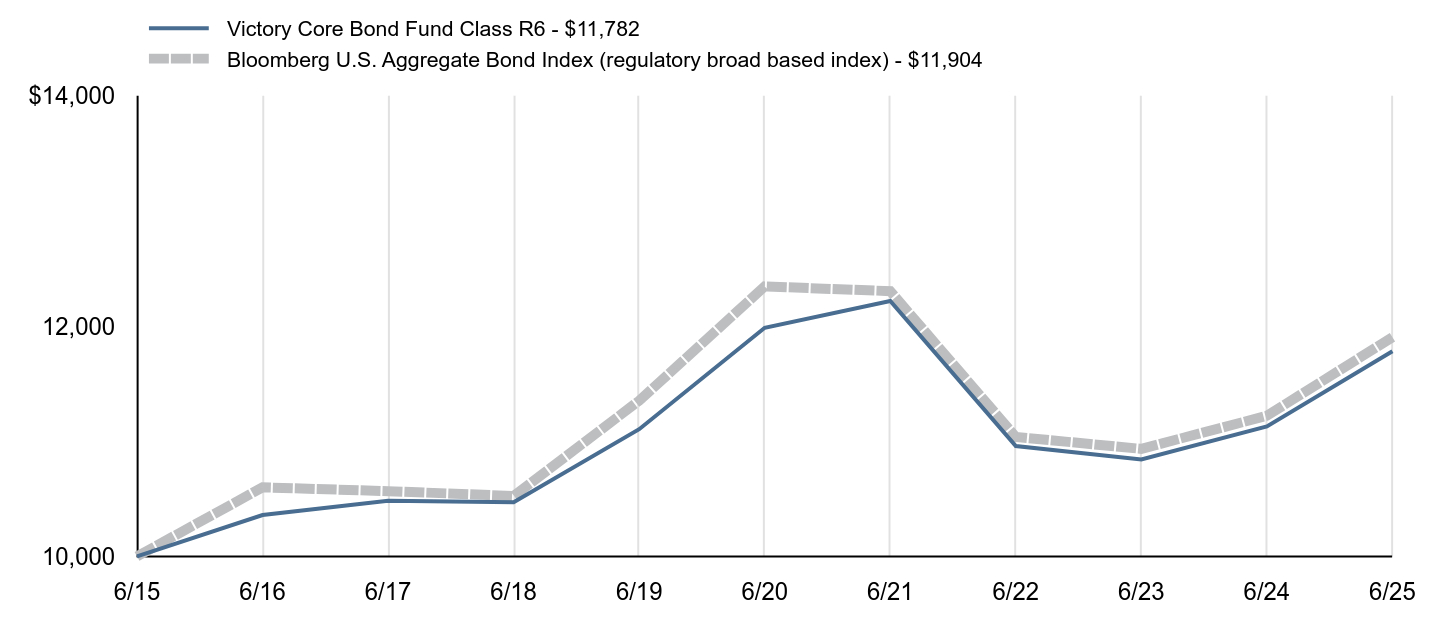

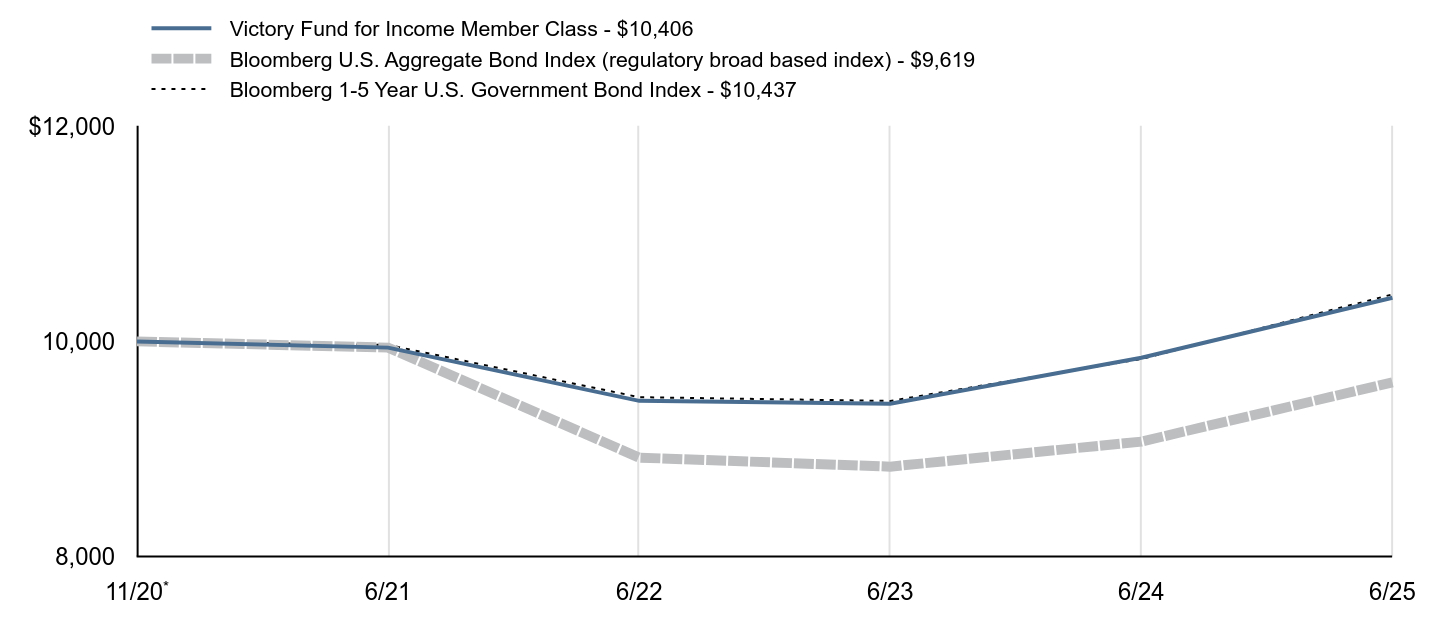

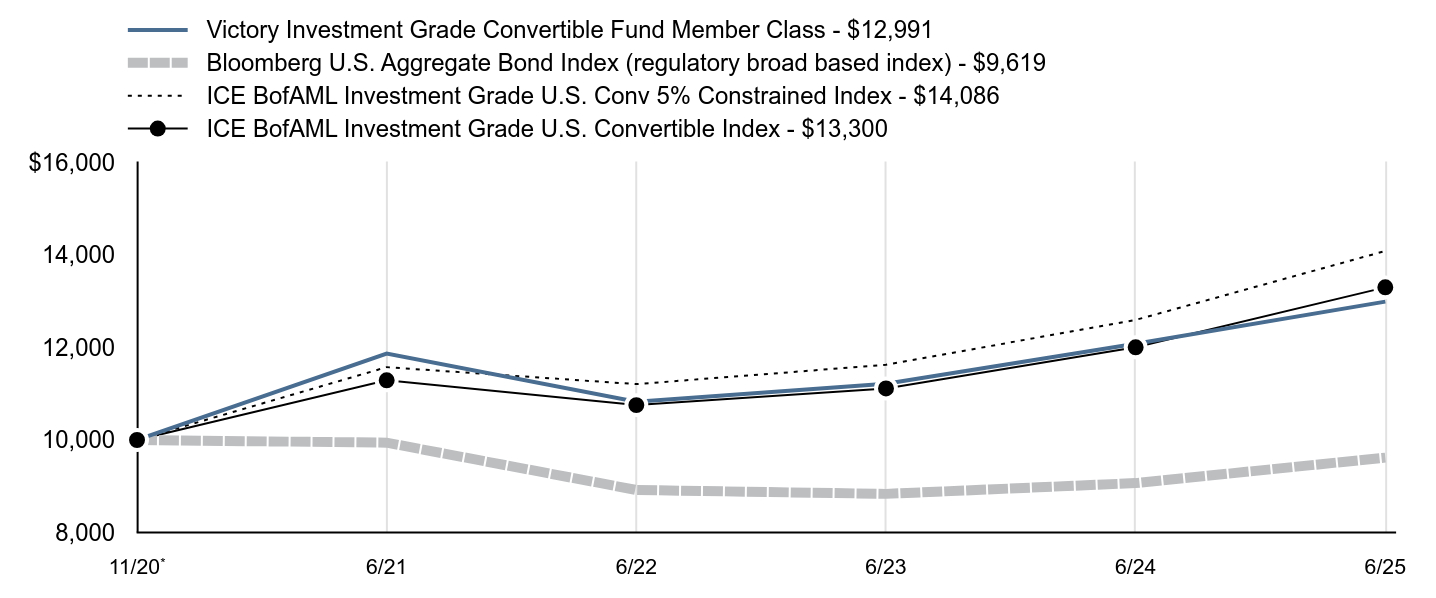

| Line Graph [Table Text Block] |

| Victory Integrity Discovery Fund Member Class - $19,801 | S&P 500® Index (regulatory broad based index) - $20,113 | Russell Microcap® Value Index - $16,503 |

|---|

11/20Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/21 | $17,285 | $13,117 | $17,034 |

|---|

6/22 | $14,663 | $11,724 | $13,594 |

|---|

6/23 | $15,566 | $14,021 | $13,983 |

|---|

6/24 | $17,679 | $17,465 | $15,096 |

|---|

6/25 | $19,801 | $20,113 | $16,503 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | Since Inception |

|---|

Member Class | 12.00% | 15.80%Footnote Reference |

|---|

S&P 500® Index | 15.16% | 16.19% |

|---|

Russell Microcap® Value Index | 9.32% | 11.36% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| AssetsNet |

$ 58,122,000

|

| Holdings Count | Holding |

122

|

| Advisory Fees Paid, Amount |

$ 641,000

|

| InvestmentCompanyPortfolioTurnover |

33.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $58,122 |

|---|

Number of Holdings | 122 |

|---|

Investment Advisory Fees | $641 |

|---|

Portfolio Turnover | 33% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Utilities | 0.7% | Communication Services | 3.4% | Real Estate | 4.5% | Energy | 5.0% | Health Care | 5.0% | Materials | 5.3% | Consumer Discretionary | 12.4% | Information Technology | 12.6% | Industrials | 18.5% | FinancialsFootnote Reference** | 30.9% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)nLight, Inc. | 1.3% |

|---|

Digi International, Inc. | 1.2% |

|---|

Interface, Inc. | 1.2% |

|---|

Ducommun, Inc. | 1.2% |

|---|

Ribbon Communications, Inc. | 1.2% |

|---|

Artivion, Inc. | 1.2% |

|---|

First Mid Bancshares, Inc. | 1.2% |

|---|

Peoples Bancorp, Inc. | 1.2% |

|---|

Great Lakes Dredge & Dock Corp. | 1.1% |

|---|

ConnectOne Bancorp, Inc. | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000144991 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Mid-Cap Value Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MAIMX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class A | $104 | 1.00% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 104

|

| Expense Ratio, Percent |

1.00%

|

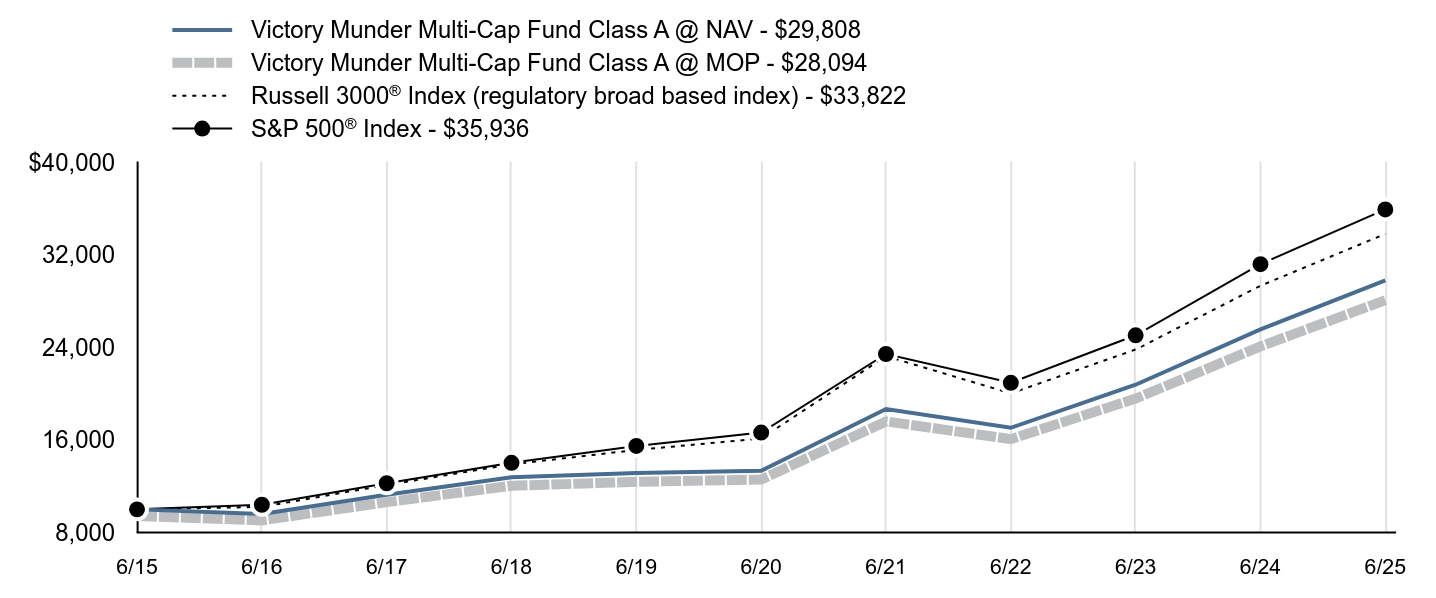

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell Midcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, mid-cap value stocks underperformed mid-cap growth stocks. Top contributors to performance: From a benchmark perspective, financials, communication services, and utilities were the top performing sectors. The consumer staples, health care, and utilities sectors were the largest positive contributors to the Fund’s relative performance.

Top detractors from performance: The health care and materials sectors were the largest detractors from relative performance. Security selection in the consumer discretionary, industrials, and energy sectors were the largest detractors from the Fund’s performance. Sector weights detracted from the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the financials and communication services sectors. The Fund’s higher volatility and lower market capitalization relative to the Index were style headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

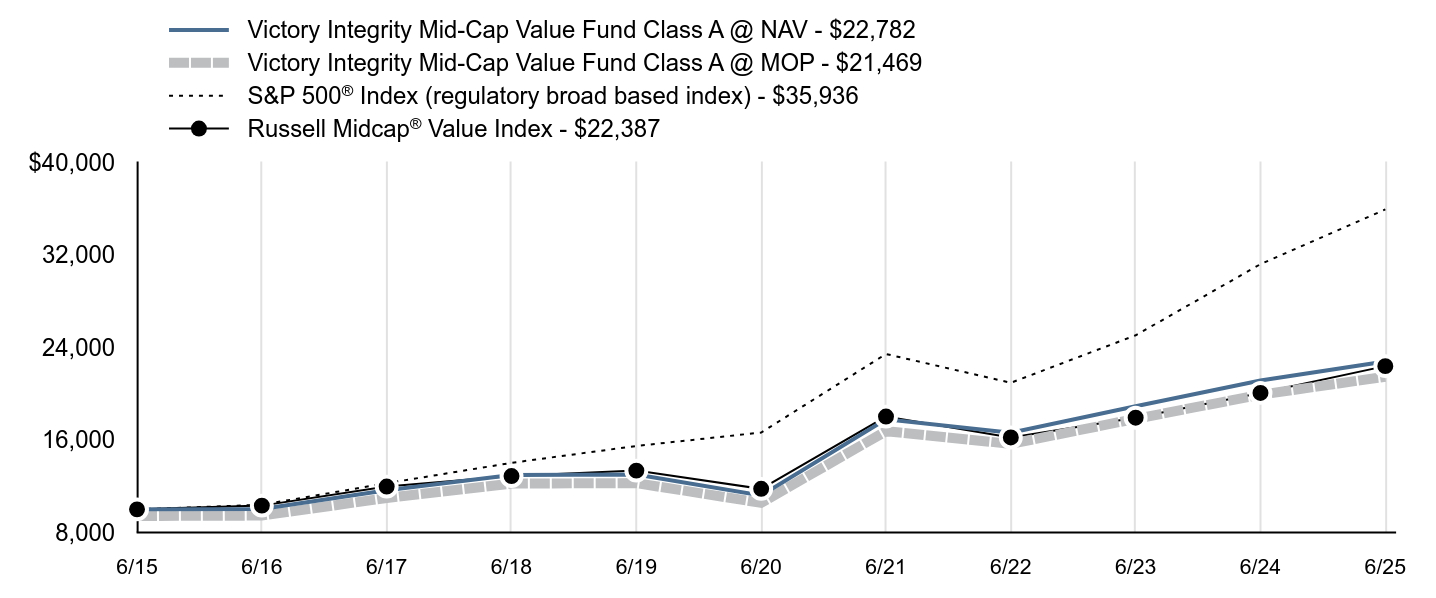

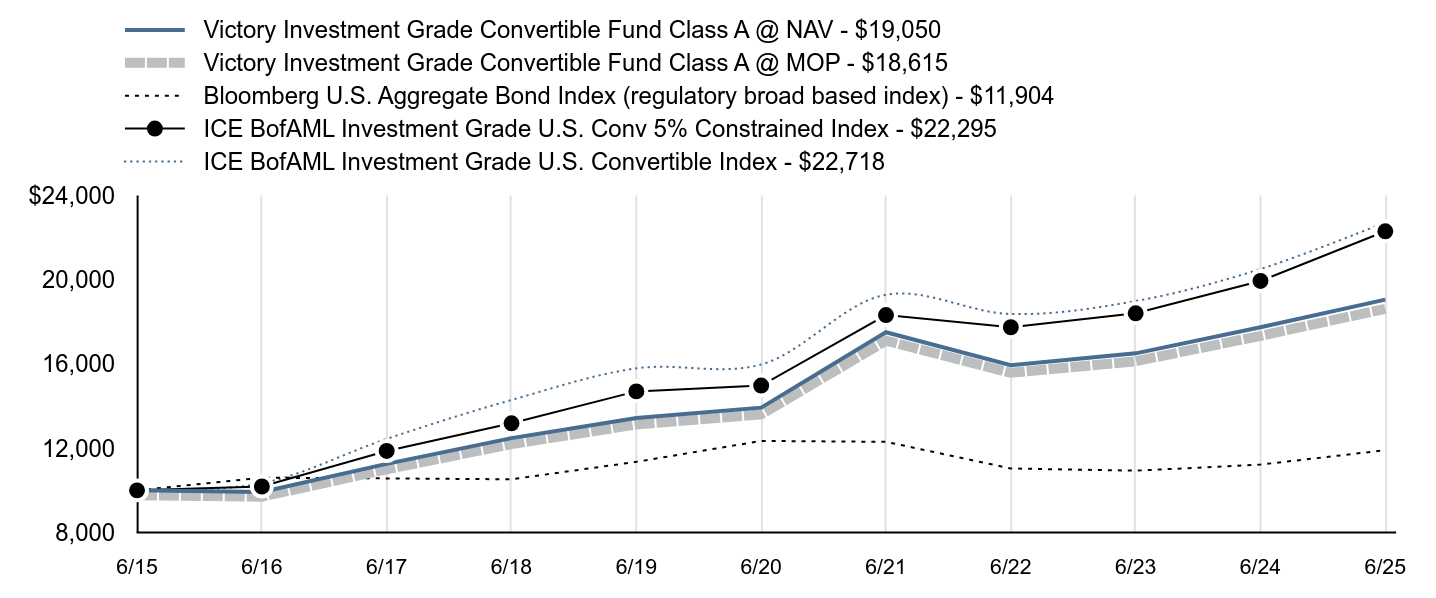

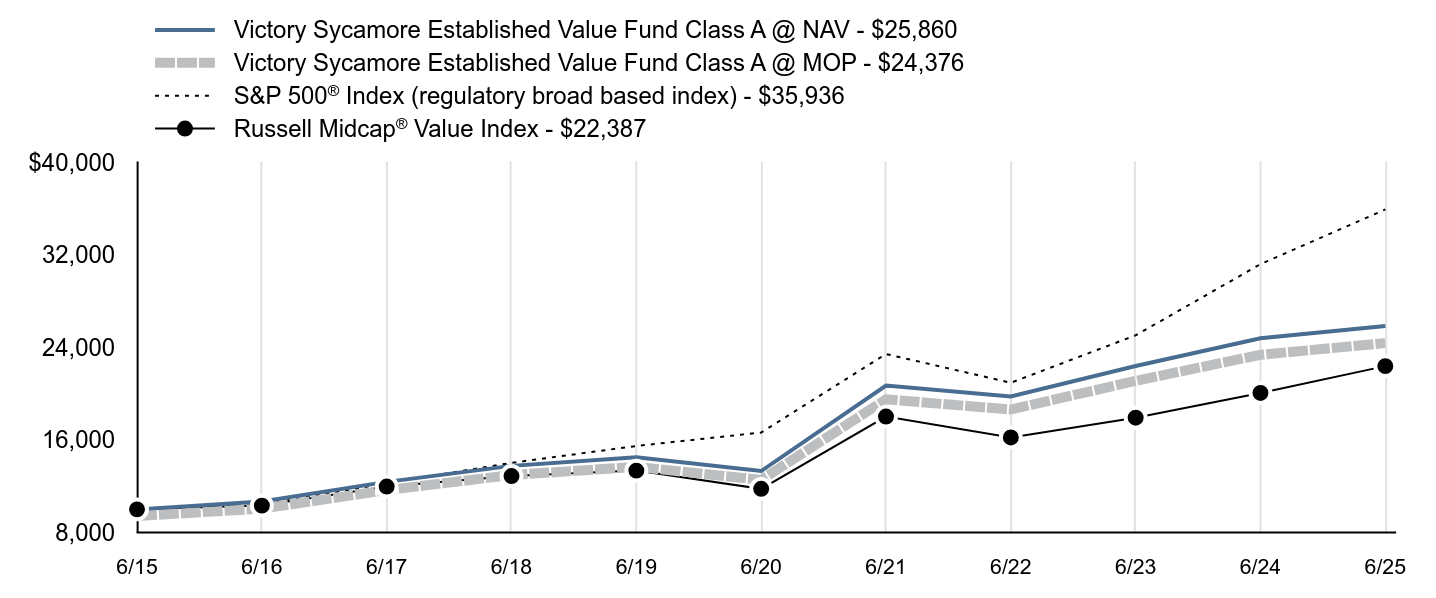

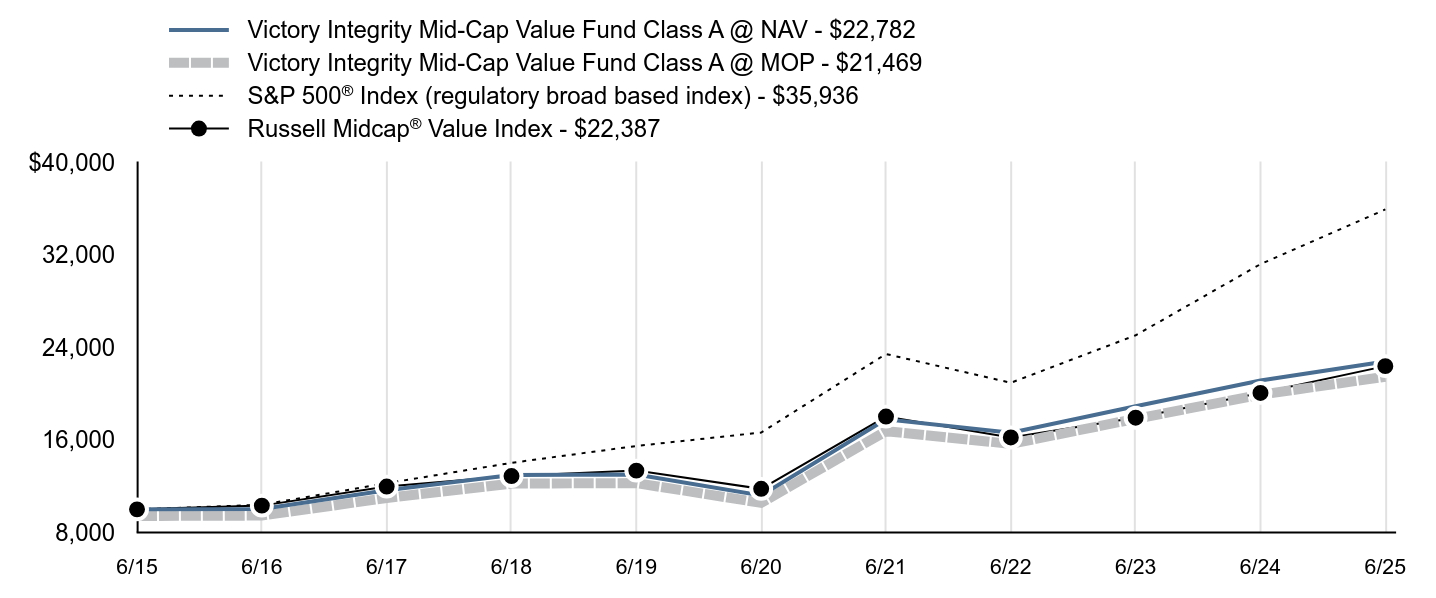

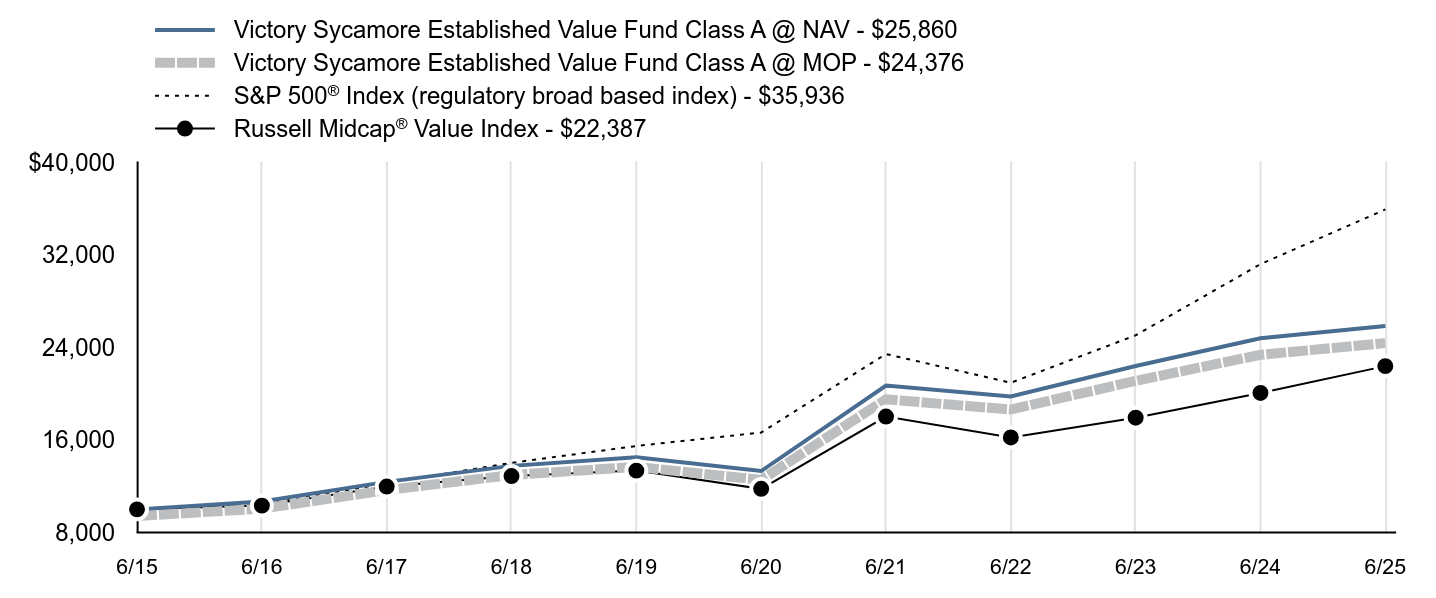

| Line Graph [Table Text Block] |

| Victory Integrity Mid-Cap Value Fund Class A @ NAV - $22,782 | Victory Integrity Mid-Cap Value Fund Class A @ MOP - $21,469 | S&P 500® Index (regulatory broad based index) - $35,936 | Russell Midcap® Value Index - $22,387 |

|---|

6/15 | $10,000 | $9,424 | $10,000 | $10,000 |

|---|

6/16 | $10,041 | $9,463 | $10,399 | $10,325 |

|---|

6/17 | $11,655 | $10,984 | $12,260 | $11,969 |

|---|

6/18 | $12,975 | $12,227 | $14,023 | $12,878 |

|---|

6/19 | $13,022 | $12,272 | $15,483 | $13,352 |

|---|

6/20 | $11,212 | $10,566 | $16,645 | $11,775 |

|---|

6/21 | $17,788 | $16,763 | $23,436 | $18,023 |

|---|

6/22 | $16,622 | $15,664 | $20,948 | $16,221 |

|---|

6/23 | $18,920 | $17,830 | $25,053 | $17,925 |

|---|

6/24 | $21,137 | $19,919 | $31,204 | $20,072 |

|---|

6/25 | $22,782 | $21,469 | $35,936 | $22,387 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class A @ NAV | 7.78% | 15.23%Footnote Reference | 8.58% |

|---|

Class A @ MOP | 1.60% | 13.88% | 7.94% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Russell Midcap® Value Index | 11.53% | 13.71% | 8.39% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| Previous Investment Adviser [Text Block] |

The maximum offering price (“MOP”) figures reflect a maximum sales charge of 5.75% for Class A. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

| AssetsNet |

$ 313,979,000

|

| Holdings Count | Holding |

112

|

| Advisory Fees Paid, Amount |

$ 2,350,000

|

| InvestmentCompanyPortfolioTurnover |

49.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $313,979 |

|---|

Number of Holdings | 112 |

|---|

Investment Advisory Fees | $2,350 |

|---|

Portfolio Turnover | 49% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 6.6% | Energy | 6.7% | Materials | 6.7% | Utilities | 7.2% | Health Care | 8.2% | Consumer Discretionary | 8.3% | Real Estate | 9.2% | Information Technology | 10.2% | Financials | 15.1% | Industrials | 18.3% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Realty Income Corp. | 1.6% |

|---|

M&T Bank Corp. | 1.4% |

|---|

Raymond James Financial, Inc. | 1.4% |

|---|

Huntington Bancshares, Inc. | 1.4% |

|---|

Xcel Energy, Inc. | 1.3% |

|---|

VICI Properties, Inc. | 1.3% |

|---|

WP Carey, Inc. | 1.2% |

|---|

State Street Corp. | 1.2% |

|---|

STERIS PLC | 1.2% |

|---|

Nasdaq, Inc. | 1.2% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000217047 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Mid-Cap Value Fund

|

| Class Name |

Class C

|

| Trading Symbol |

MCIMX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class C | $181 | 1.75% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 181

|

| Expense Ratio, Percent |

1.75%

|

| Factors Affecting Performance [Text Block] |

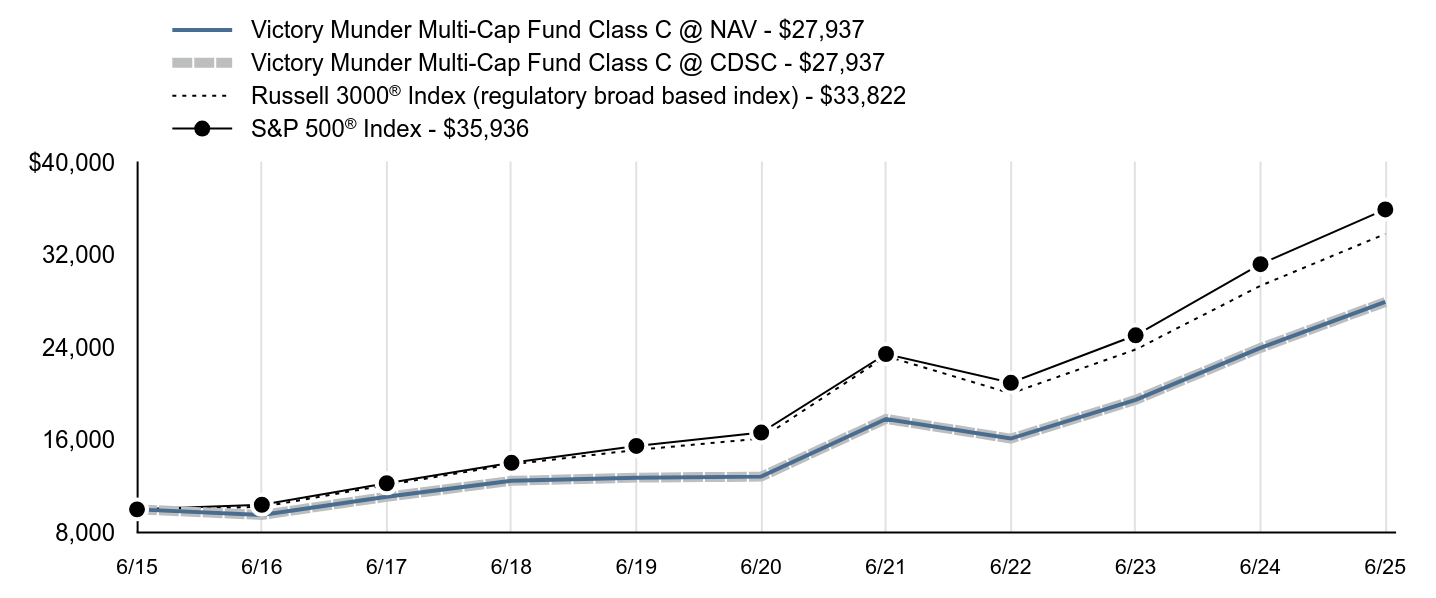

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell Midcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, mid-cap value stocks underperformed mid-cap growth stocks. Top contributors to performance: From a benchmark perspective, financials, communication services, and utilities were the top performing sectors. The consumer staples, health care, and utilities sectors were the largest positive contributors to the Fund’s relative performance.

Top detractors from performance: The health care and materials sectors were the largest detractors from relative performance. Security selection in the consumer discretionary, industrials, and energy sectors were the largest detractors from the Fund’s performance. Sector weights detracted from the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the financials and communication services sectors. The Fund’s higher volatility and lower market capitalization relative to the Index were style headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

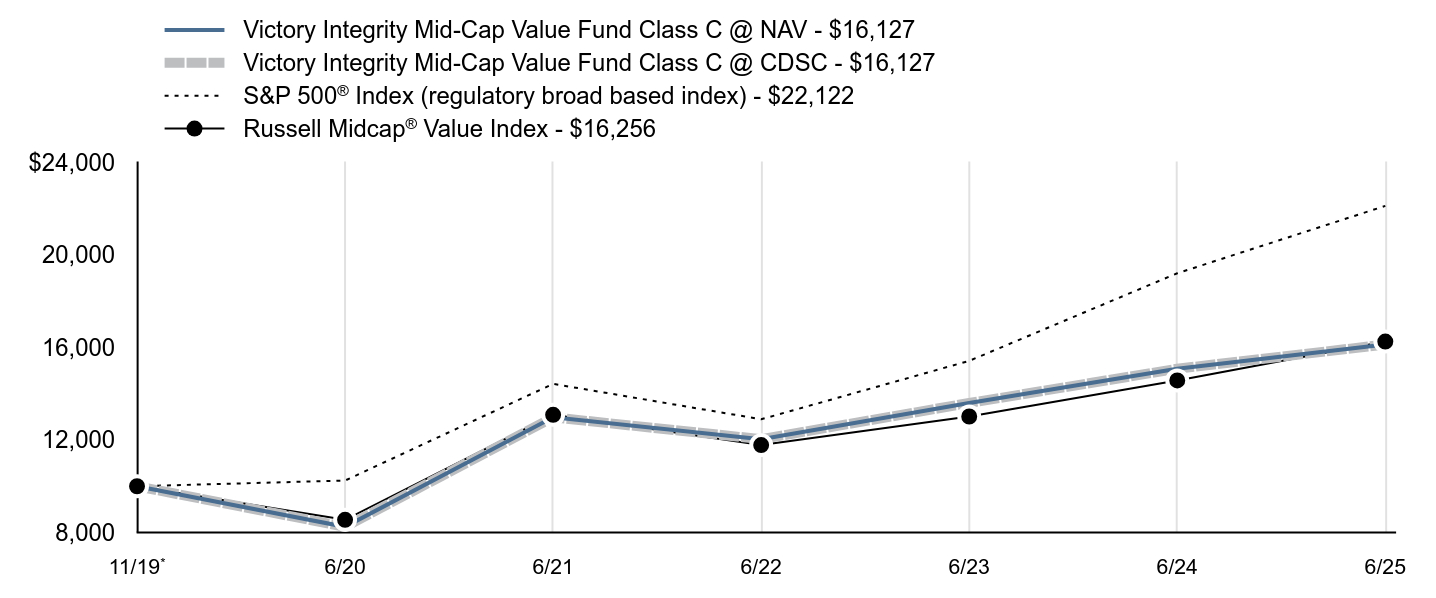

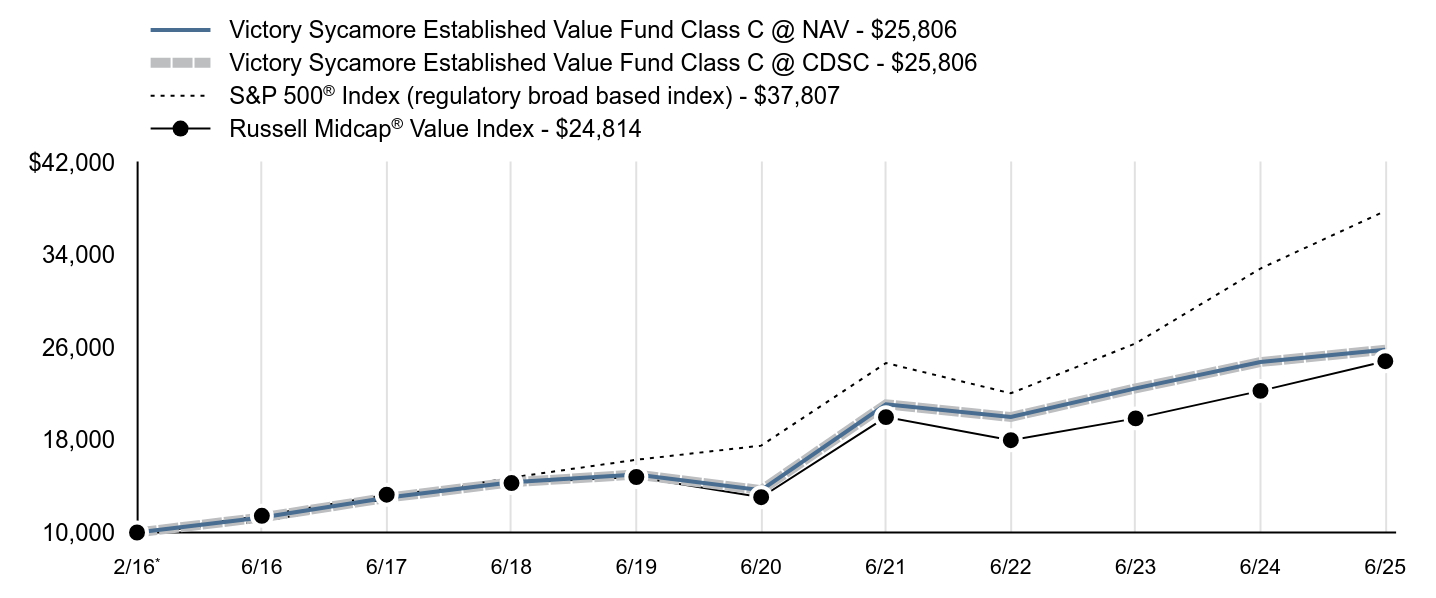

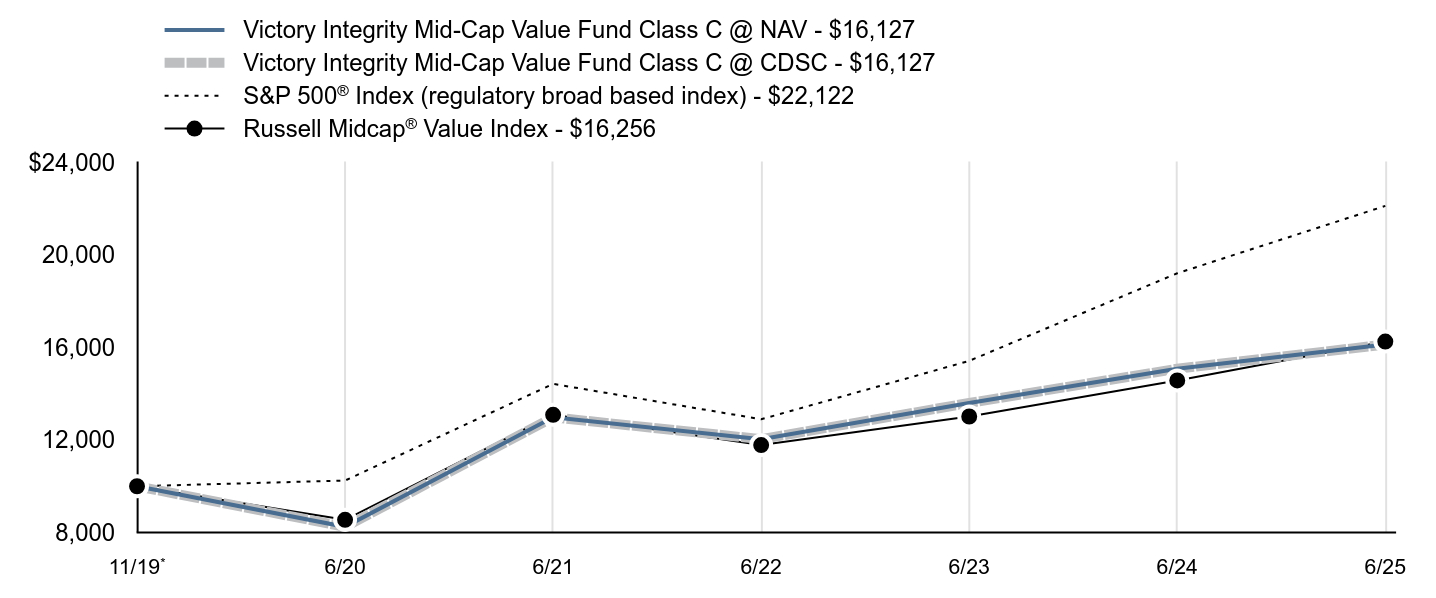

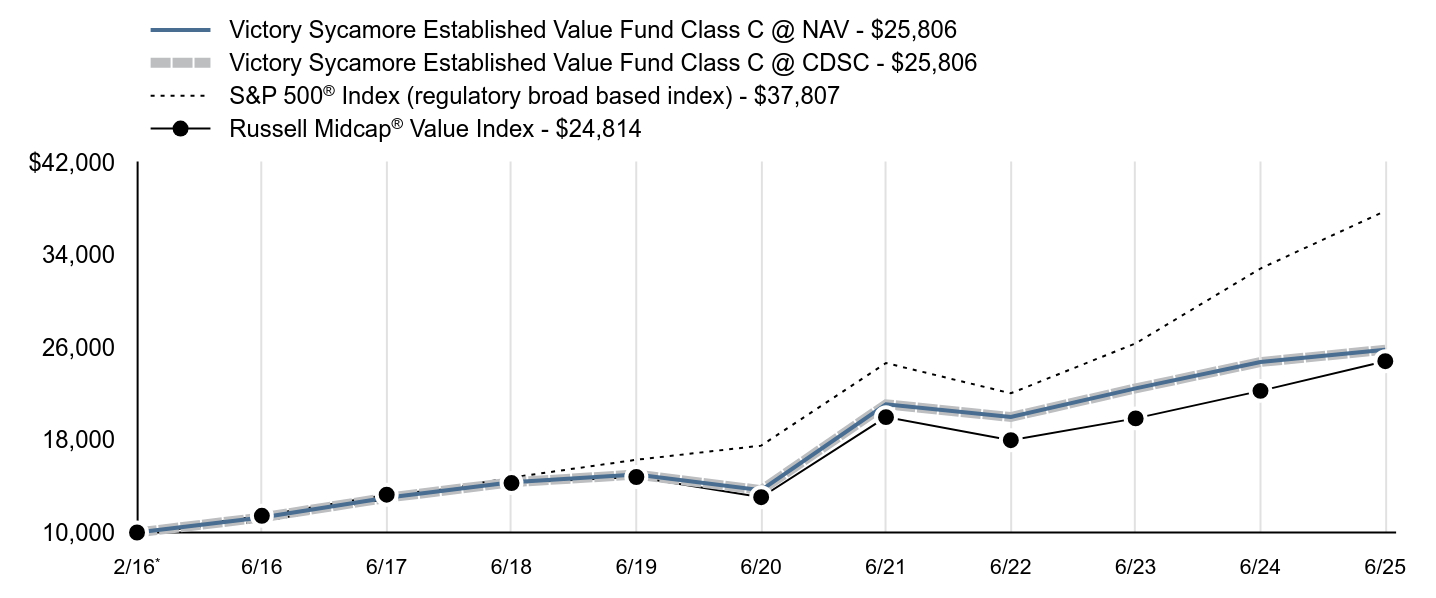

| Line Graph [Table Text Block] |

| Victory Integrity Mid-Cap Value Fund Class C @ NAV - $16,127 | Victory Integrity Mid-Cap Value Fund Class C @ CDSC - $16,127 | S&P 500® Index (regulatory broad based index) - $22,122 | Russell Midcap® Value Index - $16,256 |

|---|

11/19Footnote Reference* | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/20 | $8,245 | $8,245 | $10,247 | $8,550 |

|---|

6/21 | $12,979 | $12,979 | $14,427 | $13,088 |

|---|

6/22 | $12,036 | $12,036 | $12,896 | $11,779 |

|---|

6/23 | $13,599 | $13,599 | $15,422 | $13,016 |

|---|

6/24 | $15,081 | $15,081 | $19,209 | $14,575 |

|---|

6/25 | $16,127 | $16,127 | $22,122 | $16,256 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Class C @ NAV | 6.94% | 14.36% | 8.81% |

|---|

Class C @ CDSC | 6.02% | 14.36% | 8.81% |

|---|

S&P 500® Index | 15.16% | 16.64% | 15.05% |

|---|

Russell Midcap® Value Index | 11.53% | 13.71% | 8.96% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| Previous Investment Adviser [Text Block] |

Class C is not subject to an initial sales charge, but is subject to Contingent Deferred Sales Charge (“CDSC”) of 1.00% on shares redeemed within one year of purchase. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

| AssetsNet |

$ 313,979,000

|

| Holdings Count | Holding |

112

|

| Advisory Fees Paid, Amount |

$ 2,350,000

|

| InvestmentCompanyPortfolioTurnover |

49.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $313,979 |

|---|

Number of Holdings | 112 |

|---|

Investment Advisory Fees | $2,350 |

|---|

Portfolio Turnover | 49% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 6.6% | Energy | 6.7% | Materials | 6.7% | Utilities | 7.2% | Health Care | 8.2% | Consumer Discretionary | 8.3% | Real Estate | 9.2% | Information Technology | 10.2% | Financials | 15.1% | Industrials | 18.3% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Realty Income Corp. | 1.6% |

|---|

M&T Bank Corp. | 1.4% |

|---|

Raymond James Financial, Inc. | 1.4% |

|---|

Huntington Bancshares, Inc. | 1.4% |

|---|

Xcel Energy, Inc. | 1.3% |

|---|

VICI Properties, Inc. | 1.3% |

|---|

WP Carey, Inc. | 1.2% |

|---|

State Street Corp. | 1.2% |

|---|

STERIS PLC | 1.2% |

|---|

Nasdaq, Inc. | 1.2% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000164741 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Mid-Cap Value Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

MRIMX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class R6 | $62 | 0.60% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 62

|

| Expense Ratio, Percent |

0.60%

|

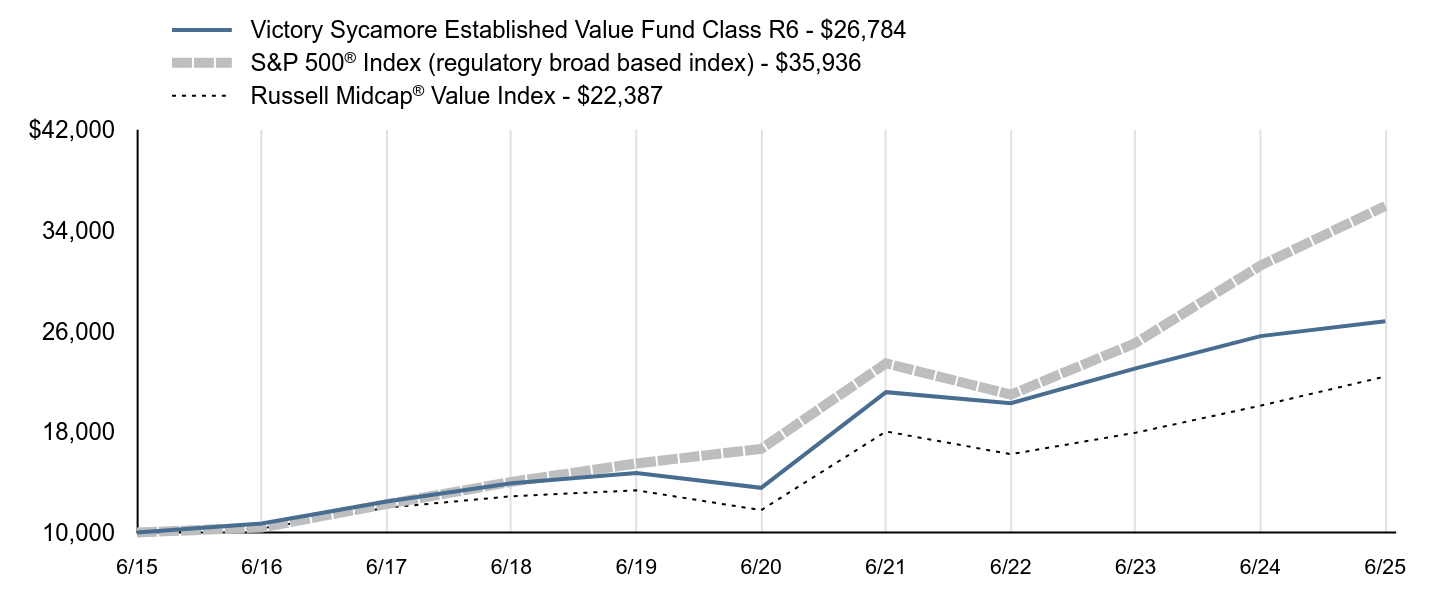

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell Midcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, mid-cap value stocks underperformed mid-cap growth stocks. Top contributors to performance: From a benchmark perspective, financials, communication services, and utilities were the top performing sectors. The consumer staples, health care, and utilities sectors were the largest positive contributors to the Fund’s relative performance.

Top detractors from performance: The health care and materials sectors were the largest detractors from relative performance. Security selection in the consumer discretionary, industrials, and energy sectors were the largest detractors from the Fund’s performance. Sector weights detracted from the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the financials and communication services sectors. The Fund’s higher volatility and lower market capitalization relative to the Index were style headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

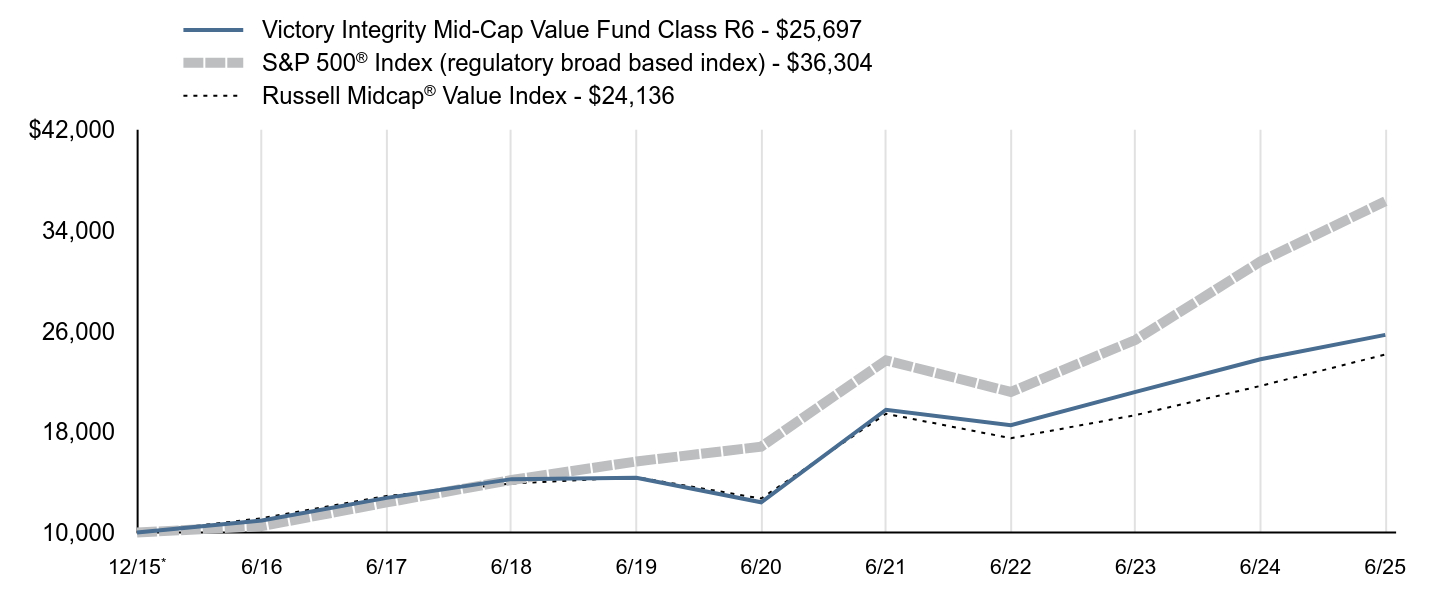

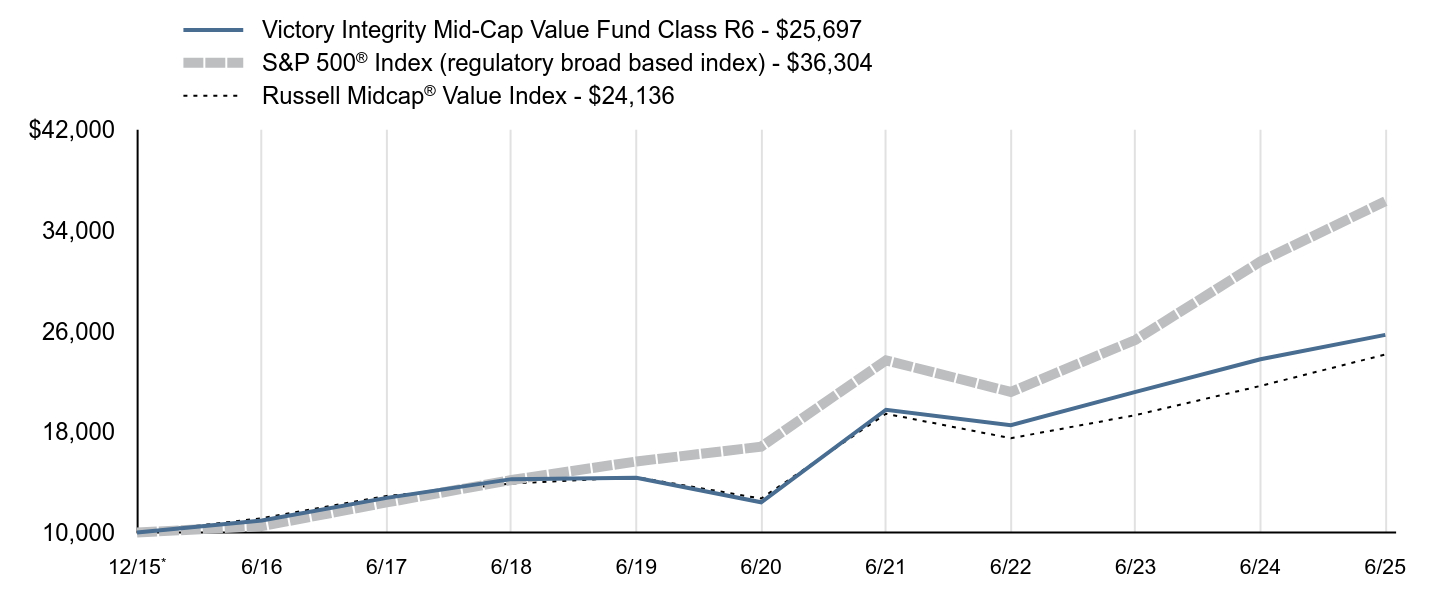

| Line Graph [Table Text Block] |

| Victory Integrity Mid-Cap Value Fund Class R6 - $25,697 | S&P 500® Index (regulatory broad based index) - $36,304 | Russell Midcap® Value Index - $24,136 |

|---|

12/15Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $10,950 | $10,506 | $11,131 |

|---|

6/17 | $12,749 | $12,386 | $12,904 |

|---|

6/18 | $14,238 | $14,166 | $13,884 |

|---|

6/19 | $14,341 | $15,642 | $14,395 |

|---|

6/20 | $12,401 | $16,816 | $12,695 |

|---|

6/21 | $19,748 | $23,676 | $19,431 |

|---|

6/22 | $18,523 | $21,162 | $17,488 |

|---|

6/23 | $21,170 | $25,309 | $19,325 |

|---|

6/24 | $23,754 | $31,524 | $21,640 |

|---|

6/25 | $25,697 | $36,304 | $24,136 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | Since Inception |

|---|

Class R6 | 8.18% | 15.69%Footnote Reference | 10.39% |

|---|

S&P 500® Index | 15.16% | 16.64% | 14.46% |

|---|

Russell Midcap® Value Index | 11.53% | 13.71% | 9.67% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| AssetsNet |

$ 313,979,000

|

| Holdings Count | Holding |

112

|

| Advisory Fees Paid, Amount |

$ 2,350,000

|

| InvestmentCompanyPortfolioTurnover |

49.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $313,979 |

|---|

Number of Holdings | 112 |

|---|

Investment Advisory Fees | $2,350 |

|---|

Portfolio Turnover | 49% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 6.6% | Energy | 6.7% | Materials | 6.7% | Utilities | 7.2% | Health Care | 8.2% | Consumer Discretionary | 8.3% | Real Estate | 9.2% | Information Technology | 10.2% | Financials | 15.1% | Industrials | 18.3% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Realty Income Corp. | 1.6% |

|---|

M&T Bank Corp. | 1.4% |

|---|

Raymond James Financial, Inc. | 1.4% |

|---|

Huntington Bancshares, Inc. | 1.4% |

|---|

Xcel Energy, Inc. | 1.3% |

|---|

VICI Properties, Inc. | 1.3% |

|---|

WP Carey, Inc. | 1.2% |

|---|

State Street Corp. | 1.2% |

|---|

STERIS PLC | 1.2% |

|---|

Nasdaq, Inc. | 1.2% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000144992 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Mid-Cap Value Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

MYIMX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class Y | $78 | 0.75% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 78

|

| Expense Ratio, Percent |

0.75%

|

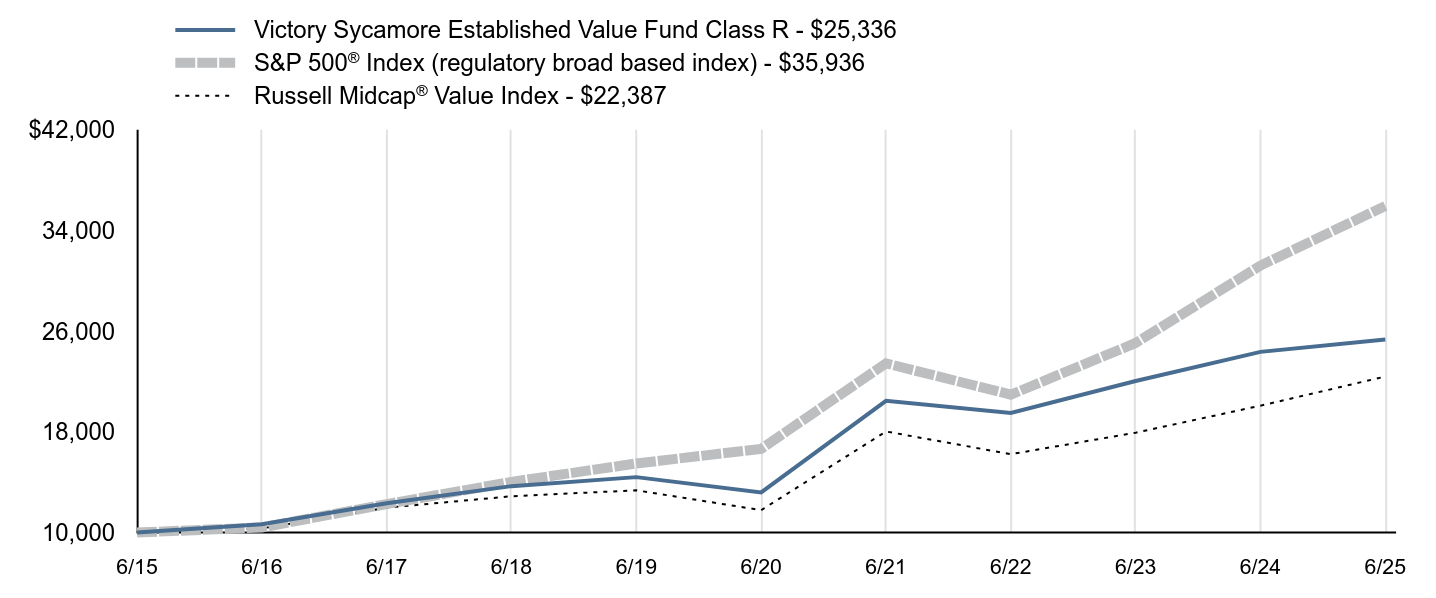

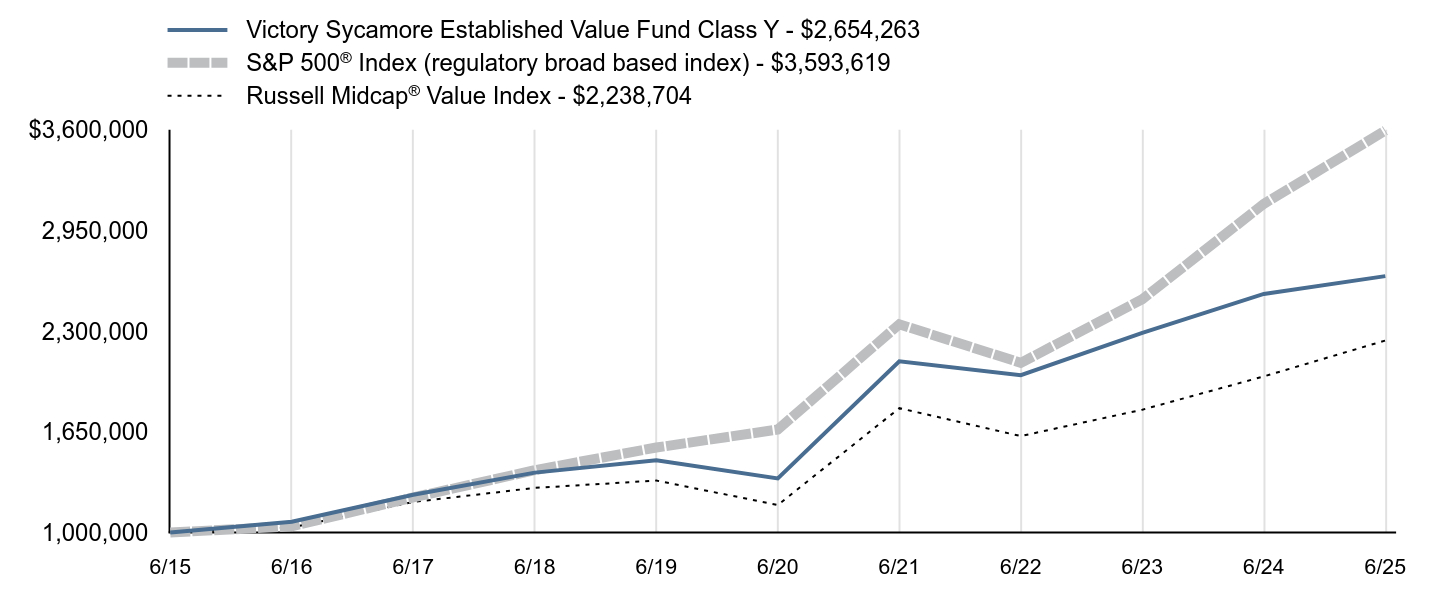

| Factors Affecting Performance [Text Block] |

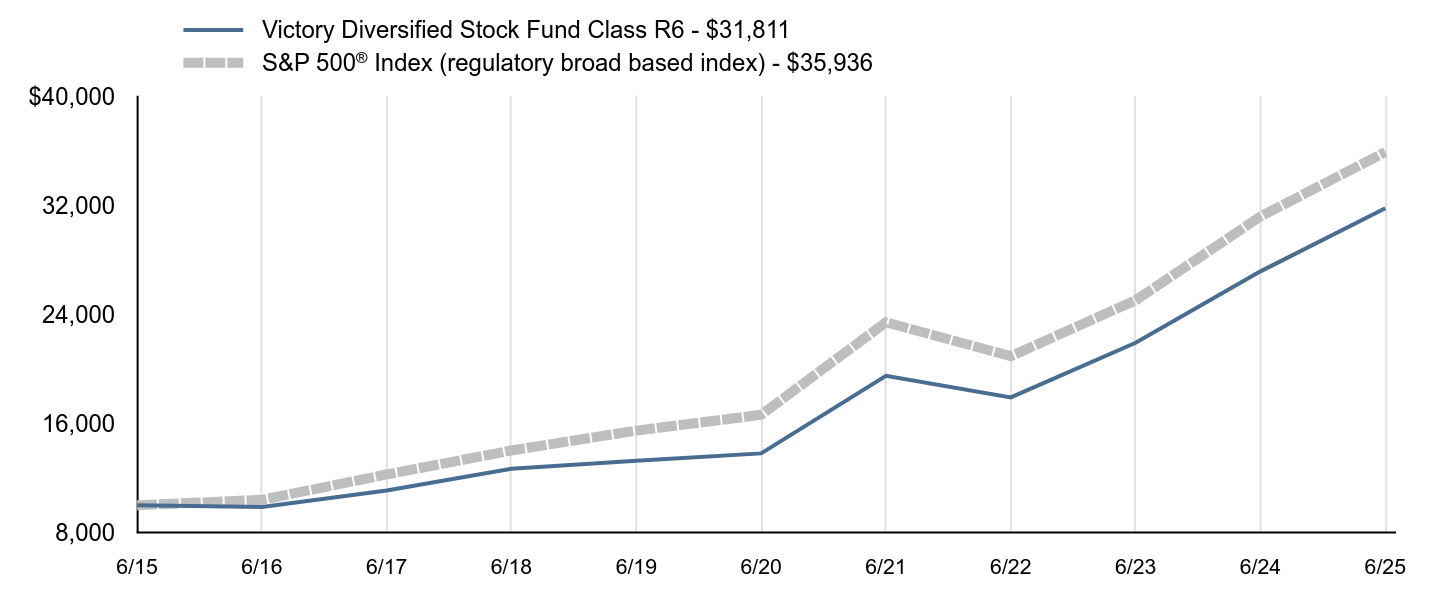

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell Midcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, mid-cap value stocks underperformed mid-cap growth stocks. Top contributors to performance: From a benchmark perspective, financials, communication services, and utilities were the top performing sectors. The consumer staples, health care, and utilities sectors were the largest positive contributors to the Fund’s relative performance.

Top detractors from performance: The health care and materials sectors were the largest detractors from relative performance. Security selection in the consumer discretionary, industrials, and energy sectors were the largest detractors from the Fund’s performance. Sector weights detracted from the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the financials and communication services sectors. The Fund’s higher volatility and lower market capitalization relative to the Index were style headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

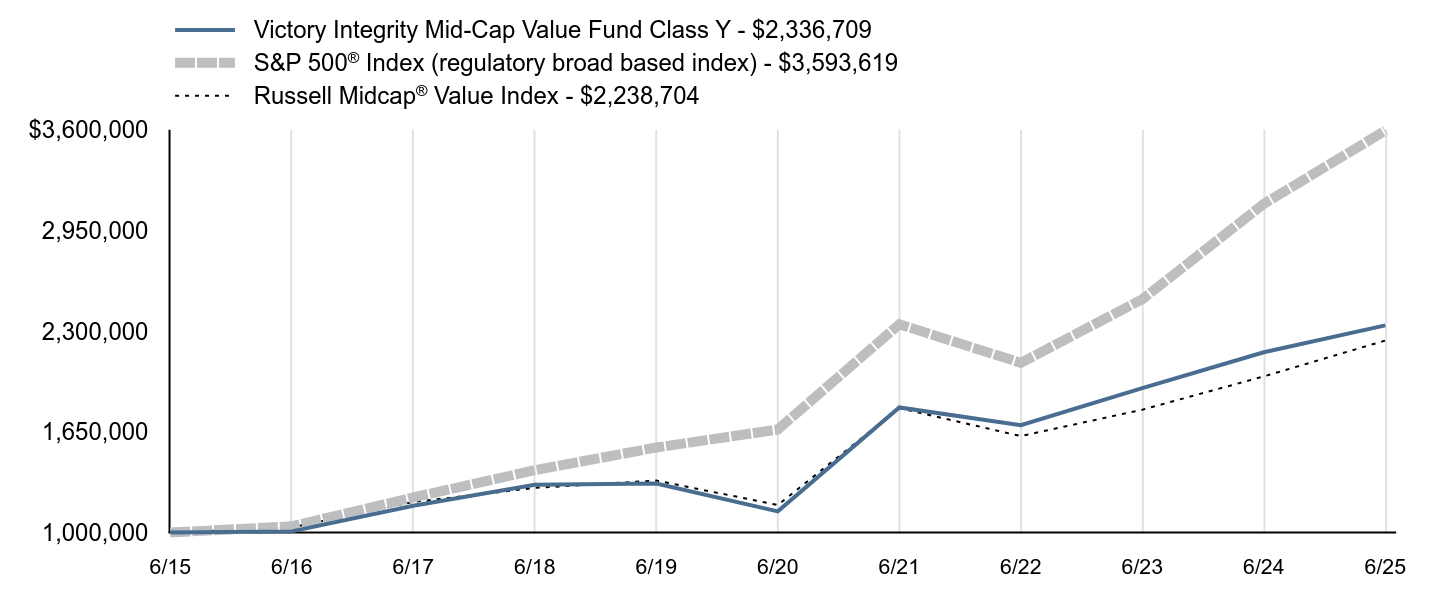

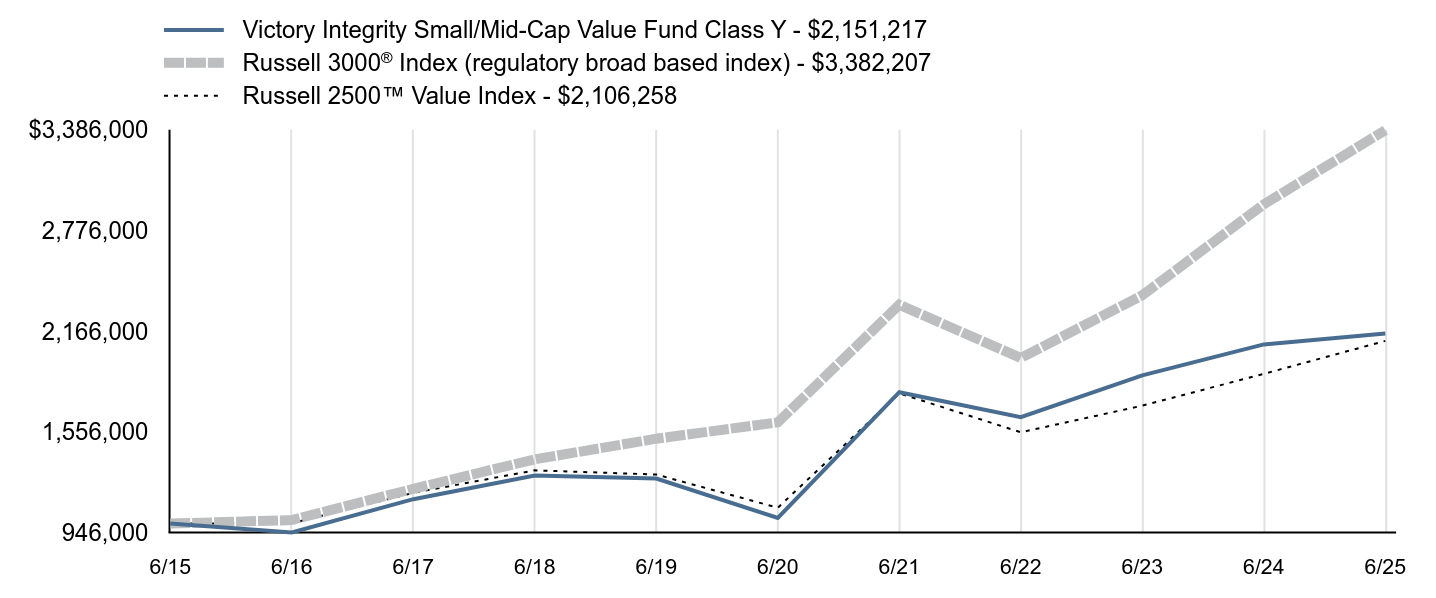

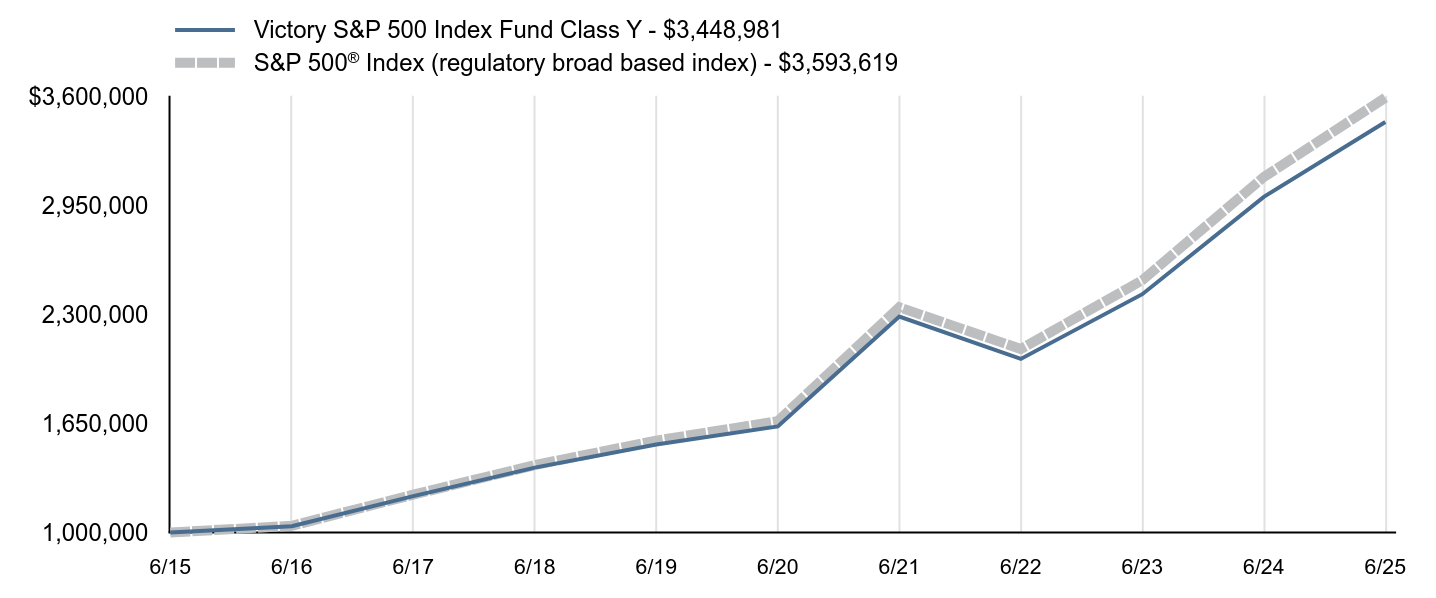

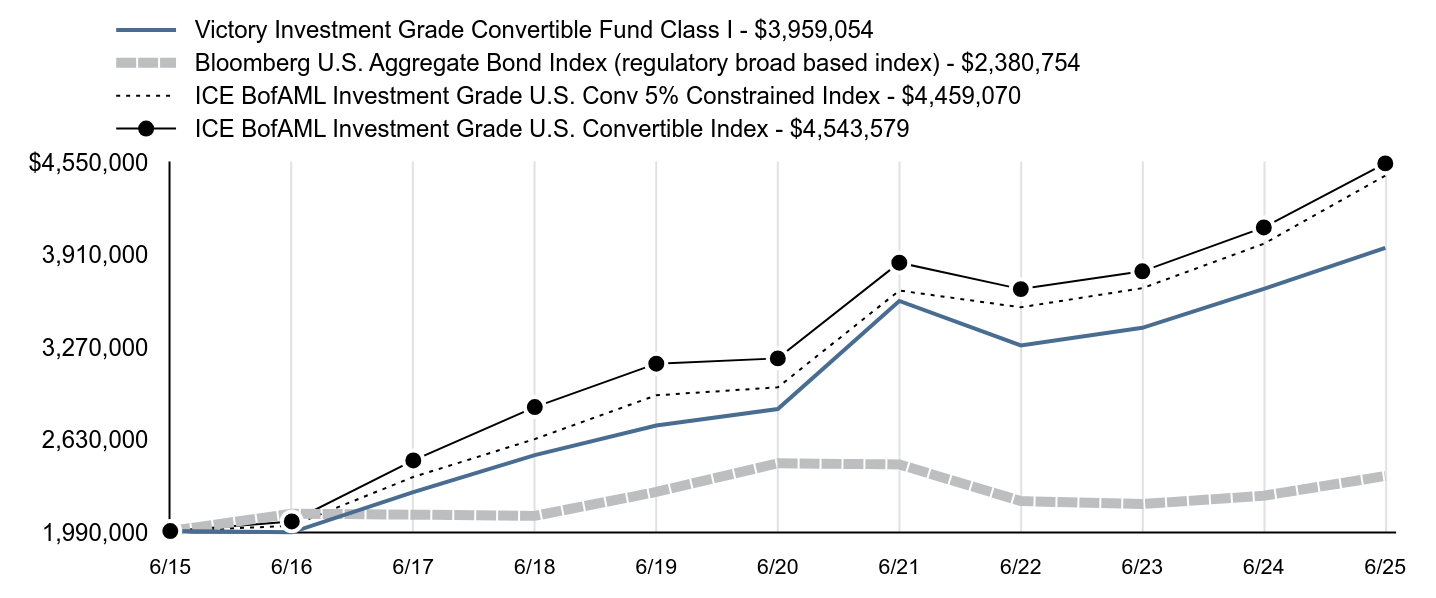

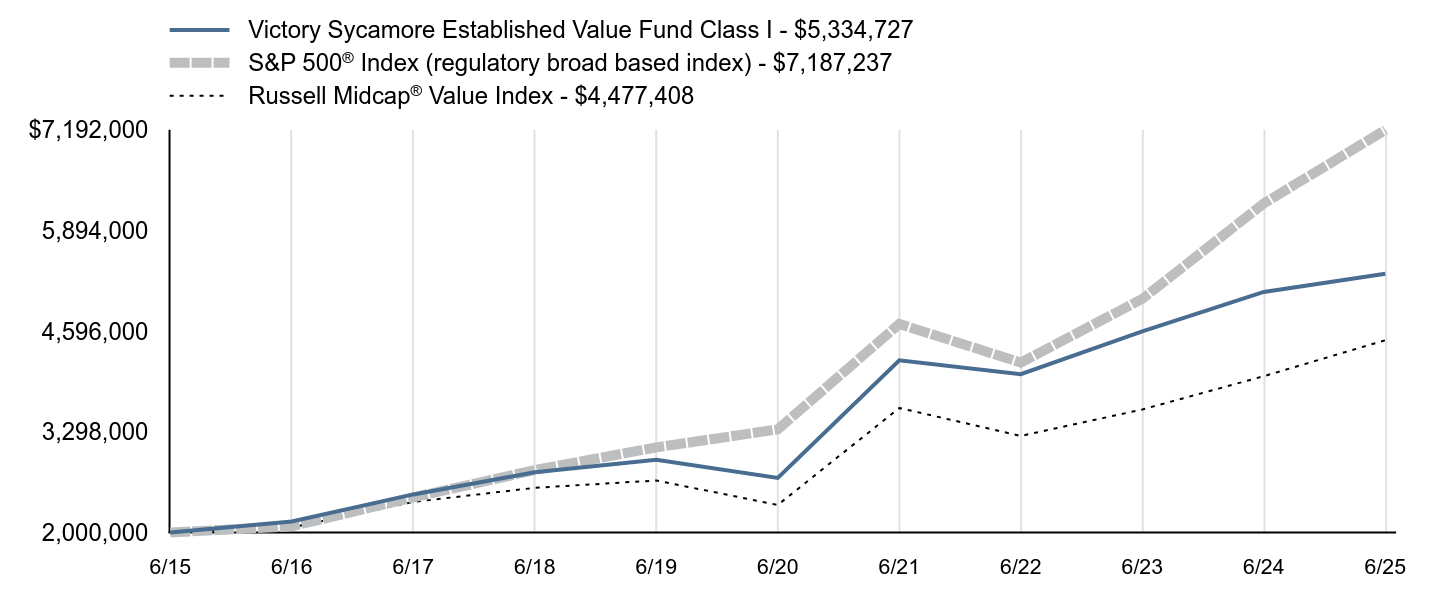

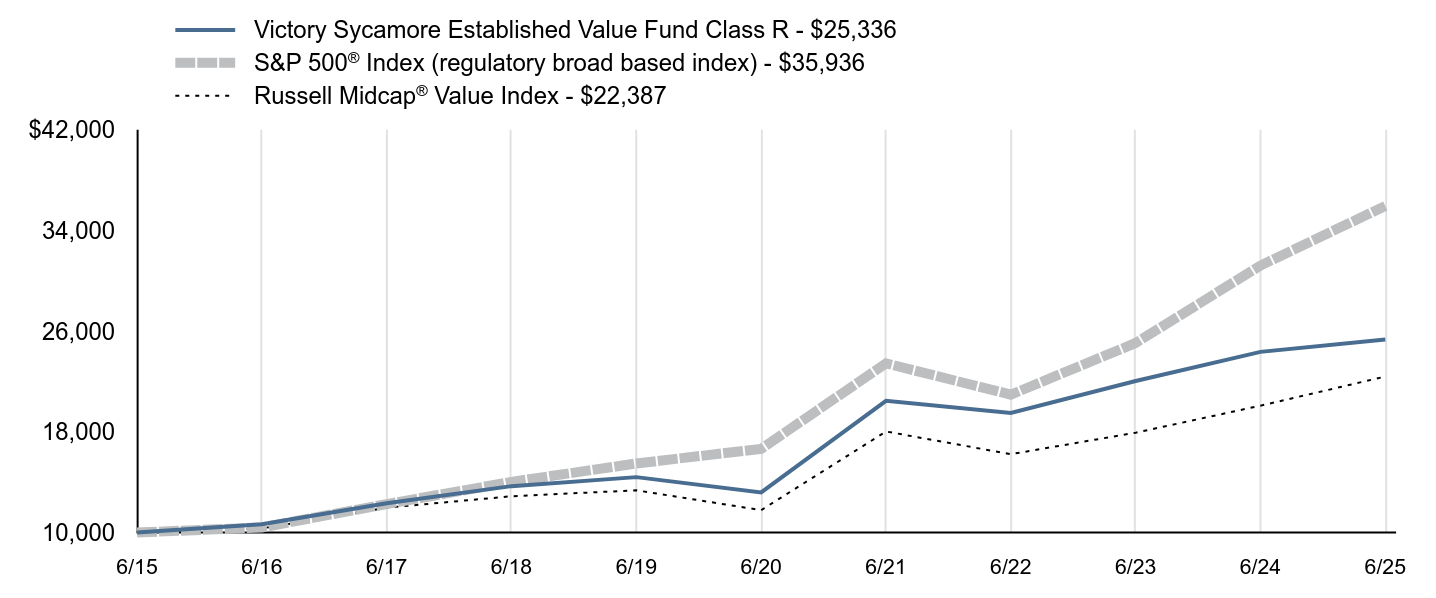

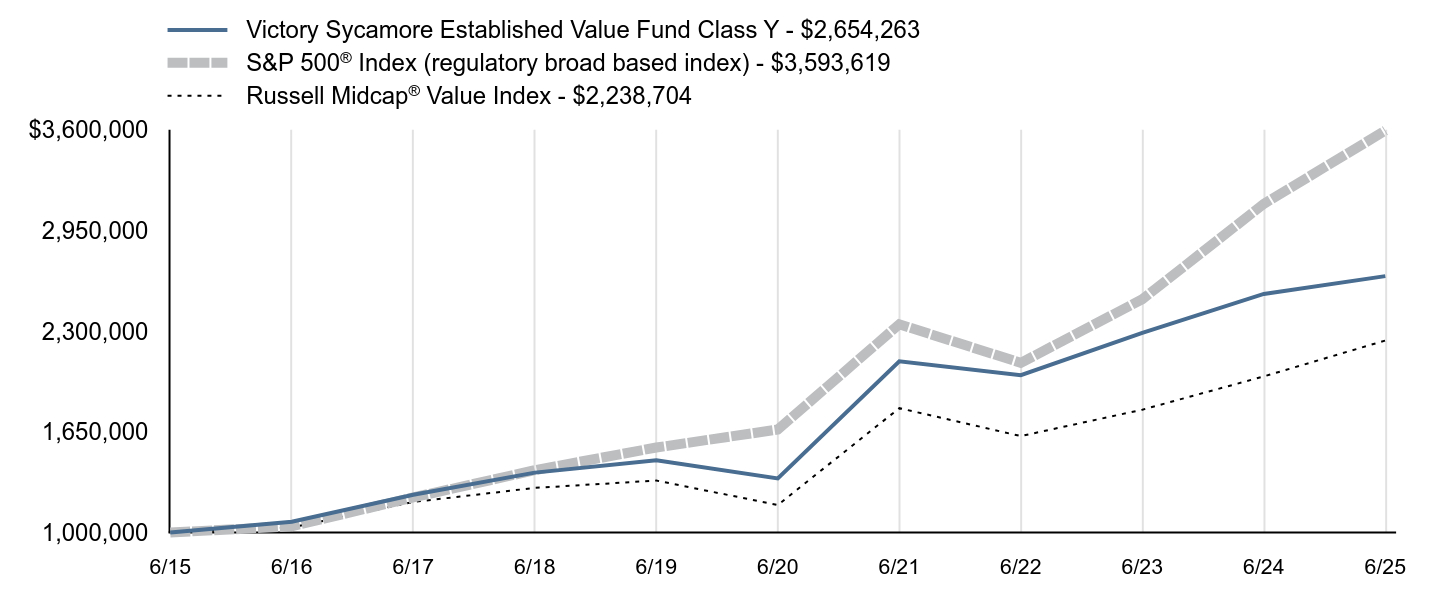

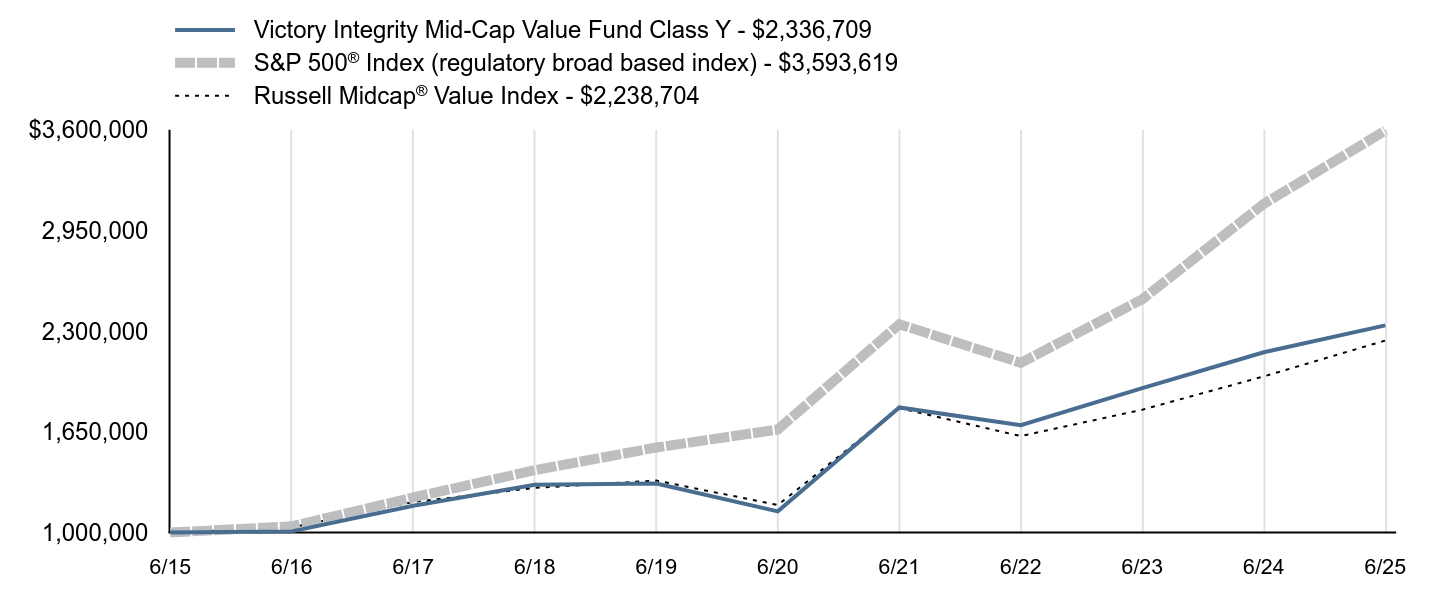

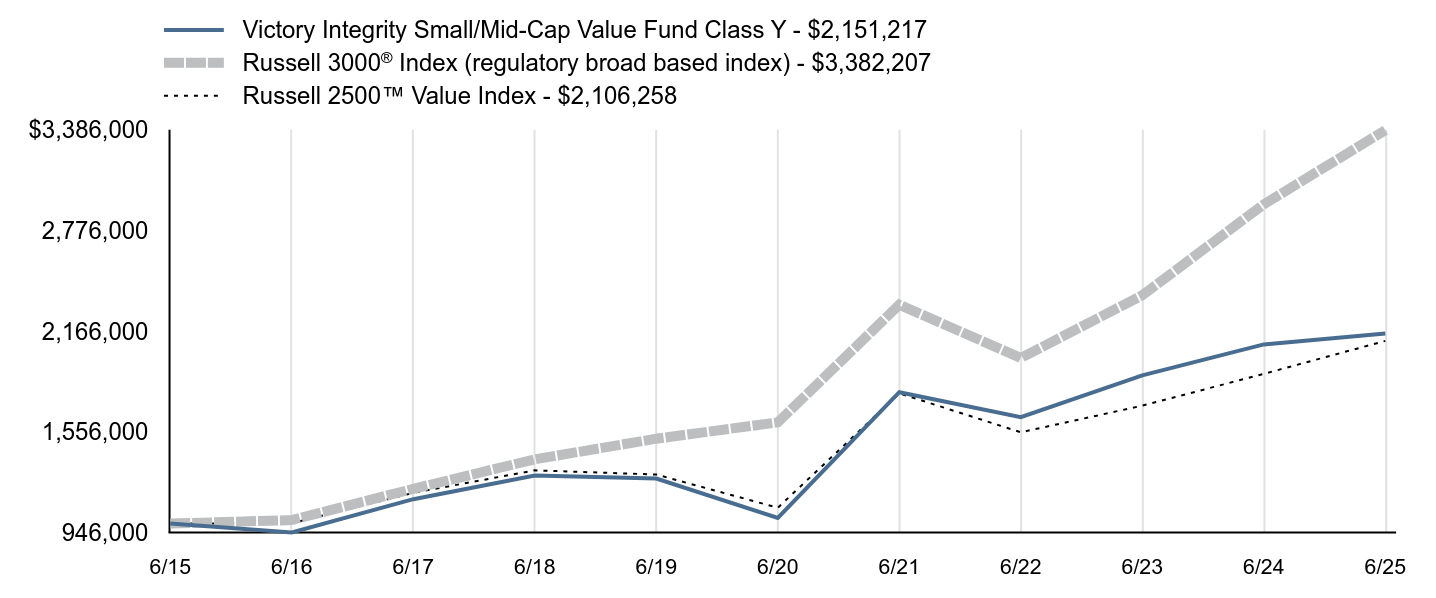

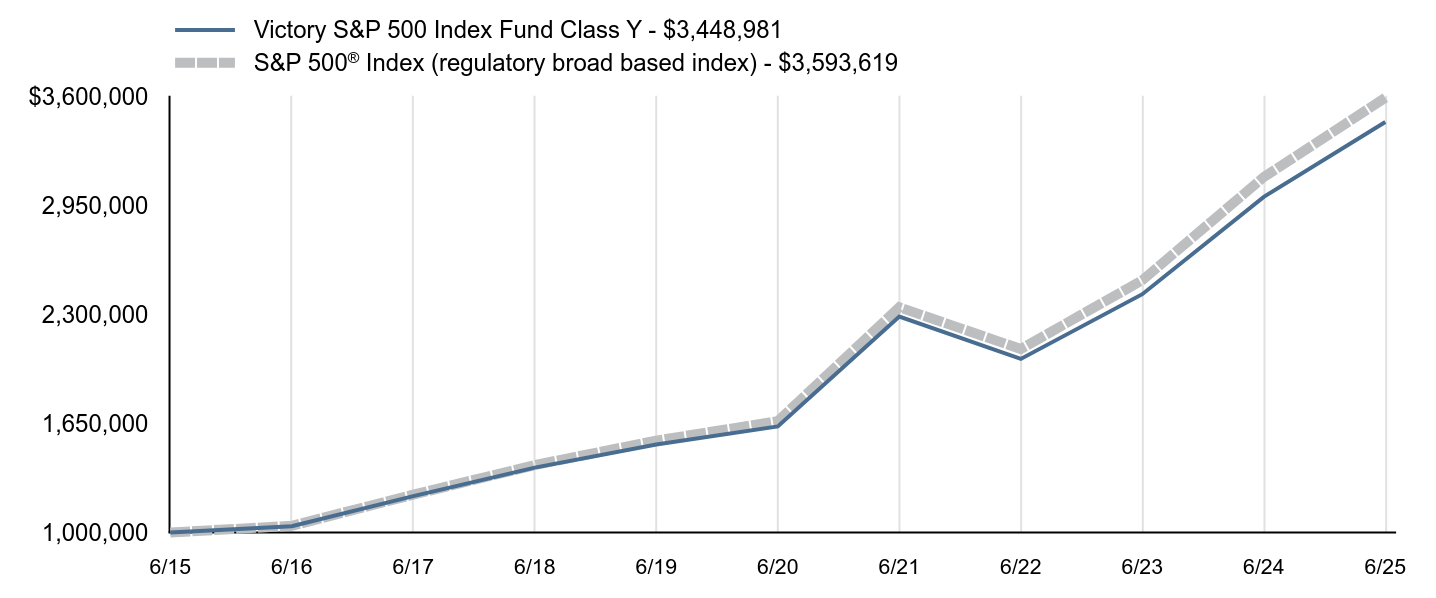

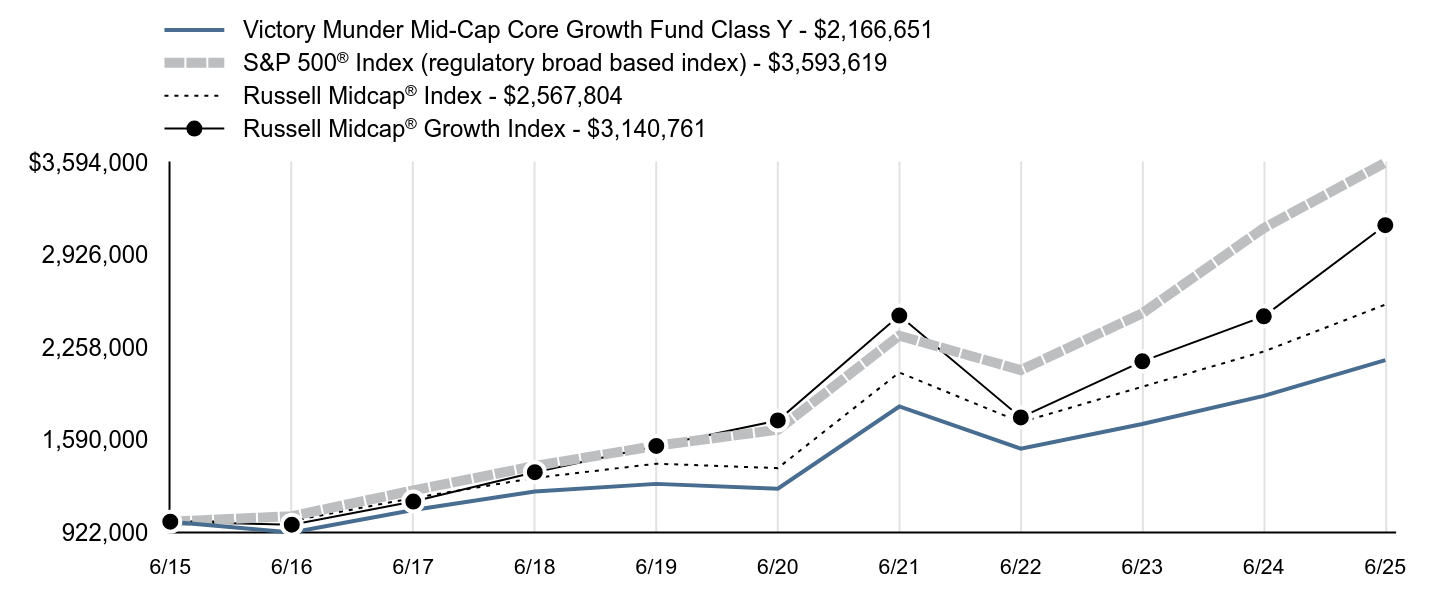

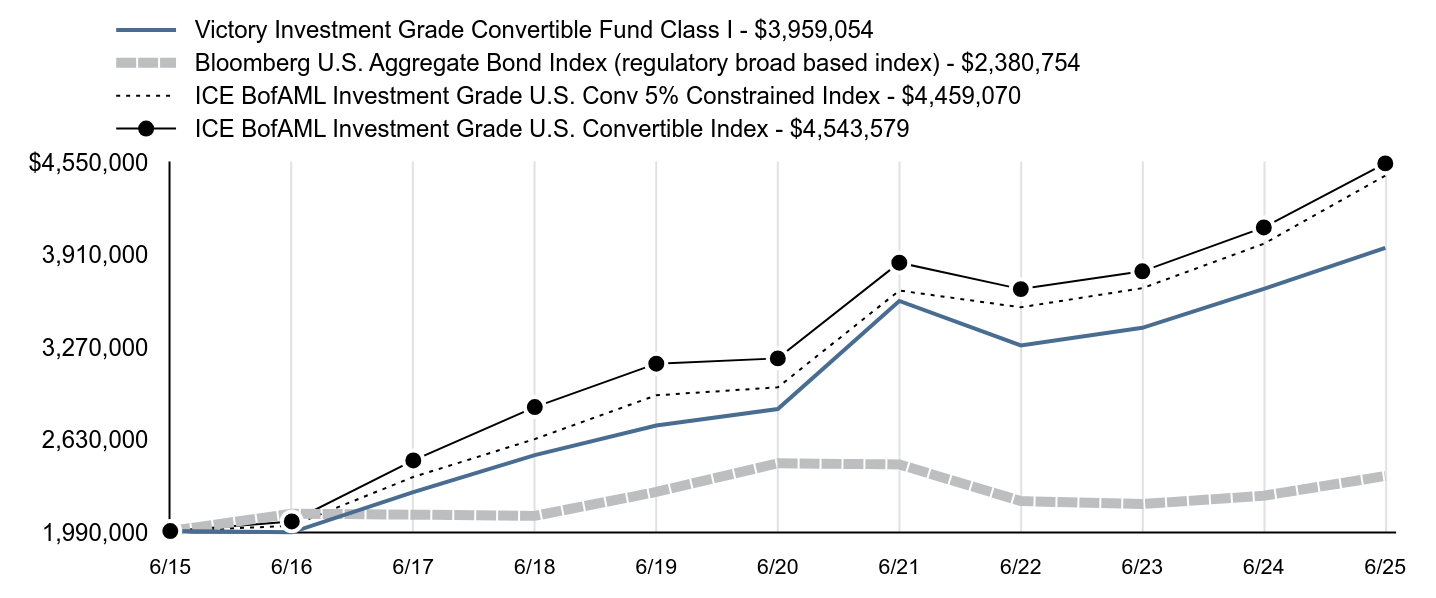

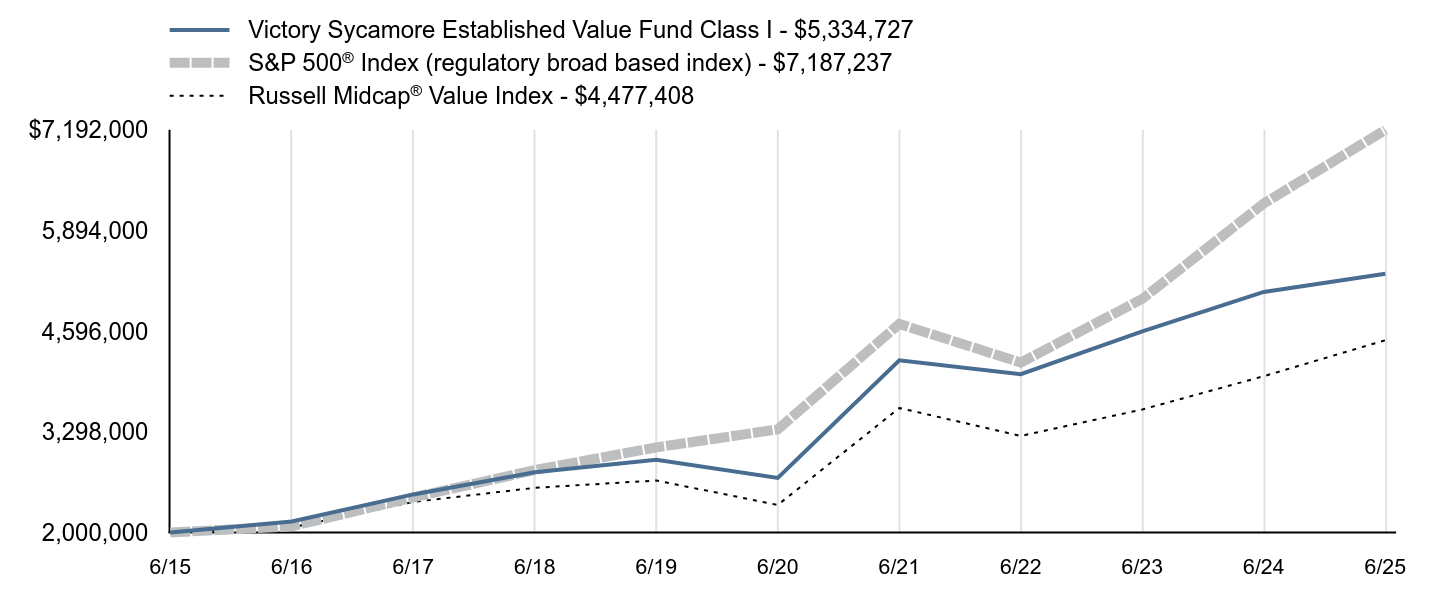

| Line Graph [Table Text Block] |

| Victory Integrity Mid-Cap Value Fund Class Y - $2,336,709 | S&P 500® Index (regulatory broad based index) - $3,593,619 | Russell Midcap® Value Index - $2,238,704 |

|---|

6/15 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

6/16 | $1,007,255 | $1,039,928 | $1,032,458 |

|---|

6/17 | $1,172,760 | $1,226,034 | $1,196,883 |

|---|

6/18 | $1,308,586 | $1,402,264 | $1,287,789 |

|---|

6/19 | $1,316,157 | $1,548,344 | $1,335,196 |

|---|

6/20 | $1,136,243 | $1,664,549 | $1,177,484 |

|---|

6/21 | $1,806,996 | $2,343,588 | $1,802,305 |

|---|

6/22 | $1,692,215 | $2,094,797 | $1,622,130 |

|---|

6/23 | $1,931,477 | $2,505,253 | $1,792,497 |

|---|

6/24 | $2,162,961 | $3,120,445 | $2,007,194 |

|---|

6/25 | $2,336,709 | $3,593,619 | $2,238,704 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class Y | 8.03% | 15.51%Footnote Reference | 8.86% |

|---|

S&P 500® Index | 15.16% | 16.64% | 13.65% |

|---|

Russell Midcap® Value Index | 11.53% | 13.71% | 8.39% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| AssetsNet |

$ 313,979,000

|

| Holdings Count | Holding |

112

|

| Advisory Fees Paid, Amount |

$ 2,350,000

|

| InvestmentCompanyPortfolioTurnover |

49.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $313,979 |

|---|

Number of Holdings | 112 |

|---|

Investment Advisory Fees | $2,350 |

|---|

Portfolio Turnover | 49% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 6.6% | Energy | 6.7% | Materials | 6.7% | Utilities | 7.2% | Health Care | 8.2% | Consumer Discretionary | 8.3% | Real Estate | 9.2% | Information Technology | 10.2% | Financials | 15.1% | Industrials | 18.3% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Realty Income Corp. | 1.6% |

|---|

M&T Bank Corp. | 1.4% |

|---|

Raymond James Financial, Inc. | 1.4% |

|---|

Huntington Bancshares, Inc. | 1.4% |

|---|

Xcel Energy, Inc. | 1.3% |

|---|

VICI Properties, Inc. | 1.3% |

|---|

WP Carey, Inc. | 1.2% |

|---|

State Street Corp. | 1.2% |

|---|

STERIS PLC | 1.2% |

|---|

Nasdaq, Inc. | 1.2% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000219863 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Mid-Cap Value Fund

|

| Class Name |

Member Class

|

| Trading Symbol |

MMIJX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-235-8396 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-235-8396

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Member Class | $88 | 0.85% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 88

|

| Expense Ratio, Percent |

0.85%

|

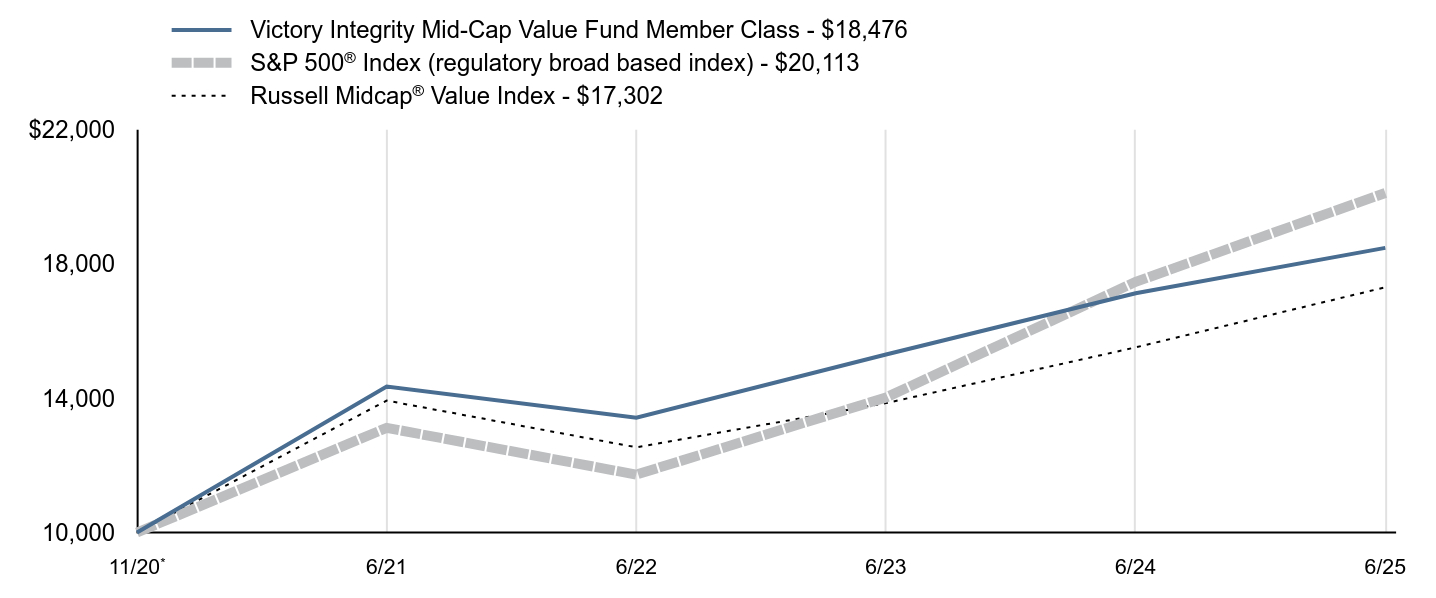

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell Midcap® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, mid-cap value stocks underperformed mid-cap growth stocks. Top contributors to performance: From a benchmark perspective, financials, communication services, and utilities were the top performing sectors. The consumer staples, health care, and utilities sectors were the largest positive contributors to the Fund’s relative performance.

Top detractors from performance: The health care and materials sectors were the largest detractors from relative performance. Security selection in the consumer discretionary, industrials, and energy sectors were the largest detractors from the Fund’s performance. Sector weights detracted from the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the financials and communication services sectors. The Fund’s higher volatility and lower market capitalization relative to the Index were style headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

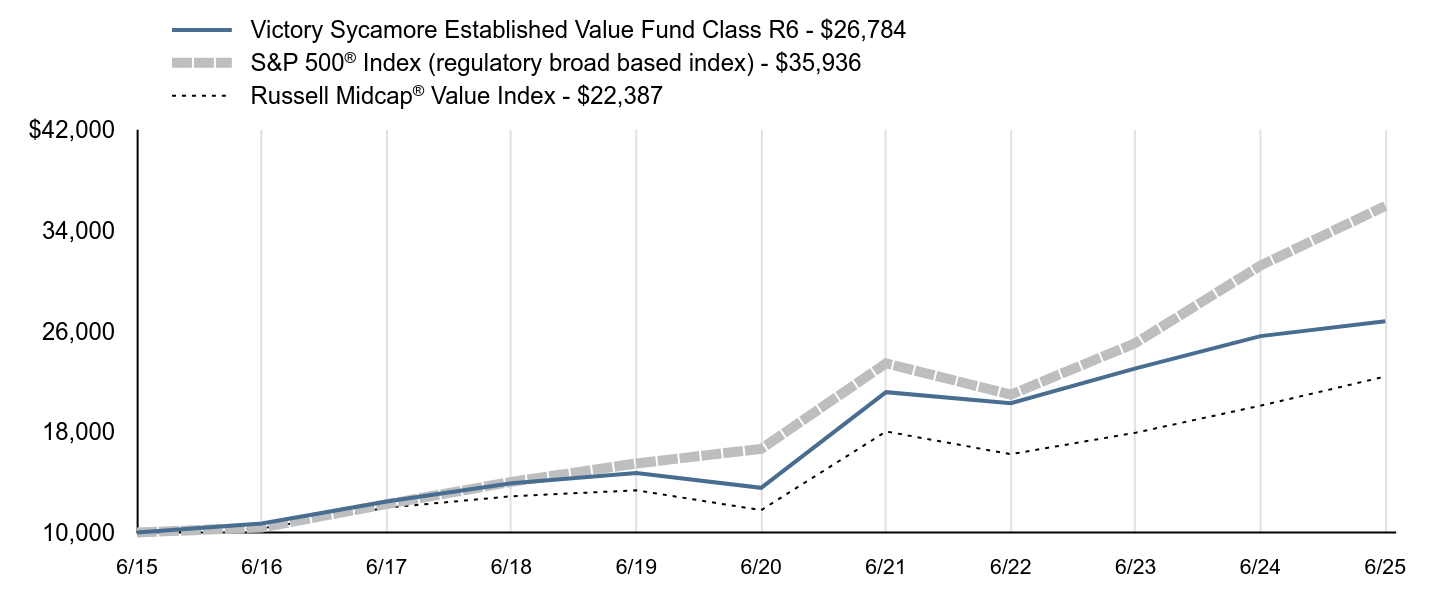

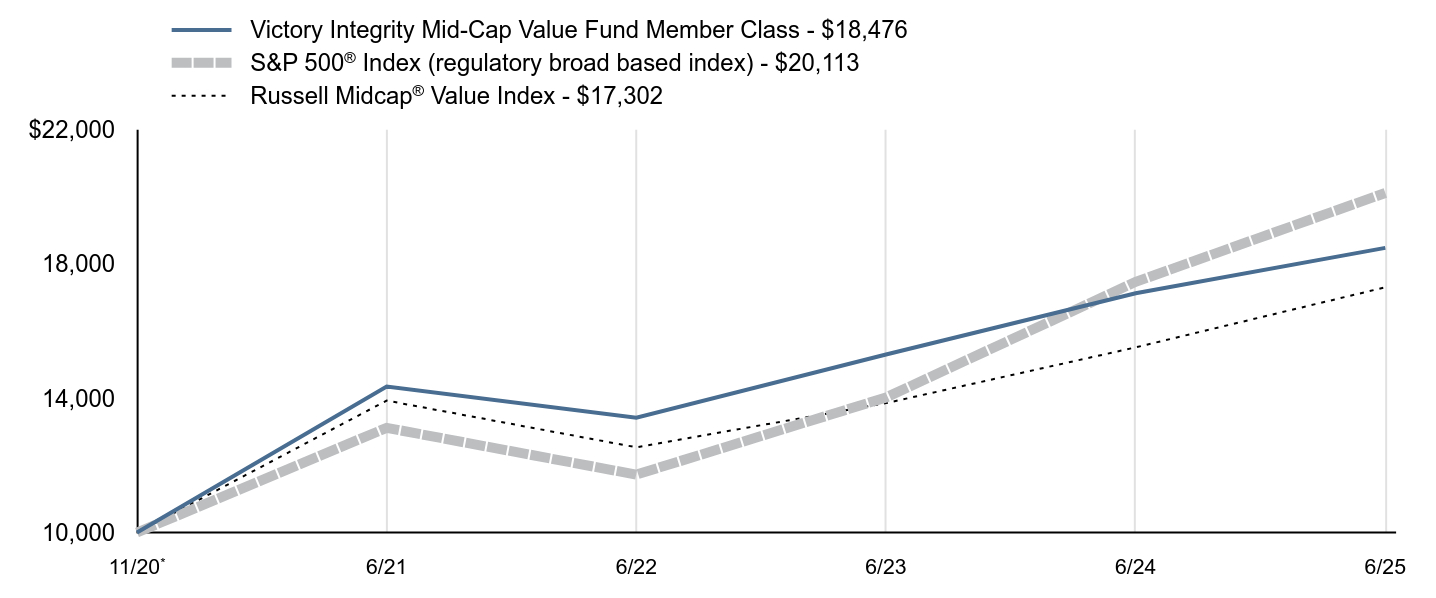

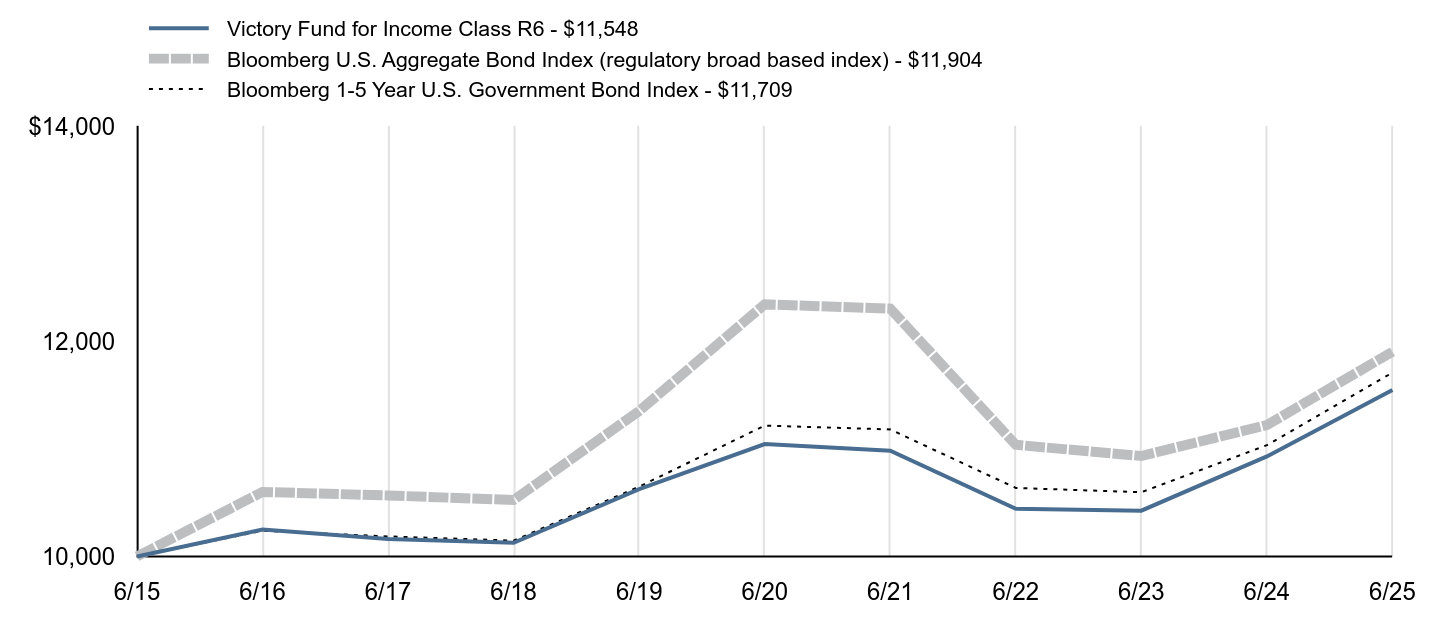

| Line Graph [Table Text Block] |

| Victory Integrity Mid-Cap Value Fund Member Class - $18,476 | S&P 500® Index (regulatory broad based index) - $20,113 | Russell Midcap® Value Index - $17,302 |

|---|

11/20Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

6/21 | $14,346 | $13,117 | $13,929 |

|---|

6/22 | $13,420 | $11,724 | $12,537 |

|---|

6/23 | $15,301 | $14,021 | $13,853 |

|---|

6/24 | $17,124 | $17,465 | $15,513 |

|---|

6/25 | $18,476 | $20,113 | $17,302 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | Since Inception |

|---|

Member Class | 7.89% | 14.09% |

|---|

S&P 500® Index | 15.16% | 16.19% |

|---|

Russell Midcap® Value Index | 11.53% | 12.49% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| AssetsNet |

$ 313,979,000

|

| Holdings Count | Holding |

112

|

| Advisory Fees Paid, Amount |

$ 2,350,000

|

| InvestmentCompanyPortfolioTurnover |

49.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $313,979 |

|---|

Number of Holdings | 112 |

|---|

Investment Advisory Fees | $2,350 |

|---|

Portfolio Turnover | 49% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 6.6% | Energy | 6.7% | Materials | 6.7% | Utilities | 7.2% | Health Care | 8.2% | Consumer Discretionary | 8.3% | Real Estate | 9.2% | Information Technology | 10.2% | Financials | 15.1% | Industrials | 18.3% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Realty Income Corp. | 1.6% |

|---|

M&T Bank Corp. | 1.4% |

|---|

Raymond James Financial, Inc. | 1.4% |

|---|

Huntington Bancshares, Inc. | 1.4% |

|---|

Xcel Energy, Inc. | 1.3% |

|---|

VICI Properties, Inc. | 1.3% |

|---|

WP Carey, Inc. | 1.2% |

|---|

State Street Corp. | 1.2% |

|---|

STERIS PLC | 1.2% |

|---|

Nasdaq, Inc. | 1.2% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000144977 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Small-Cap Value Fund

|

| Class Name |

Class A

|

| Trading Symbol |

VSCVX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class A | $141 | 1.43% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 141

|

| Expense Ratio, Percent |

1.43%

|

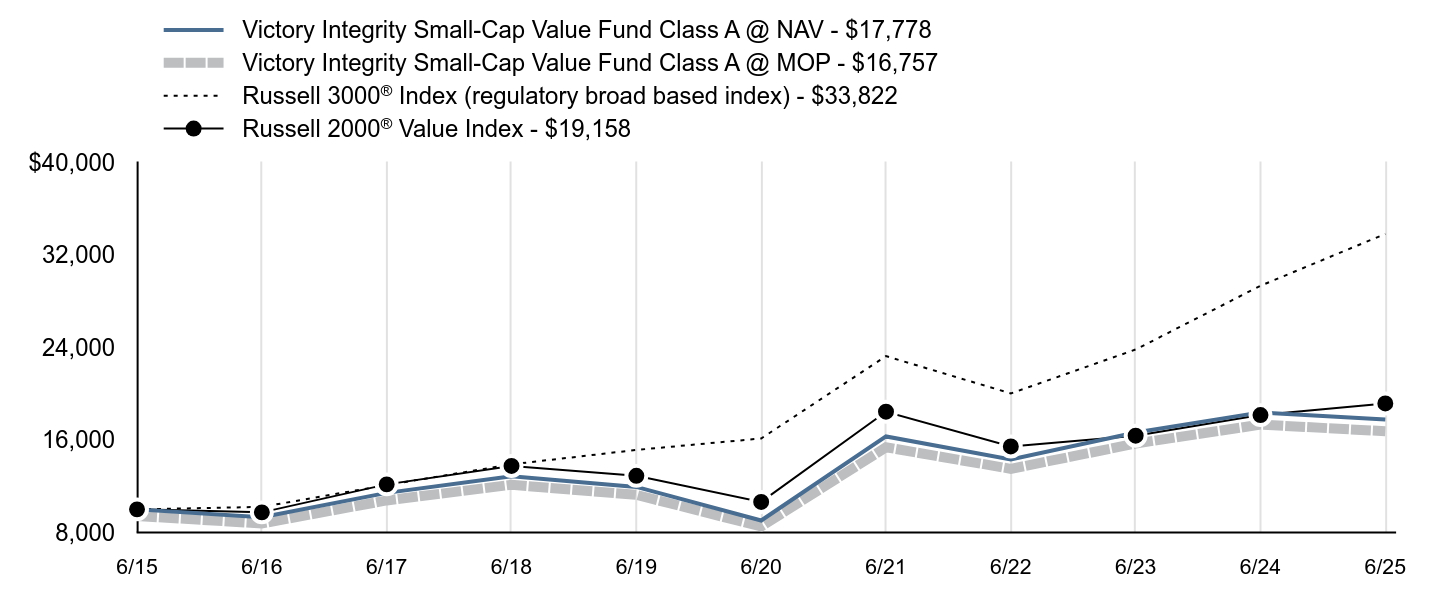

| Factors Affecting Performance [Text Block] |

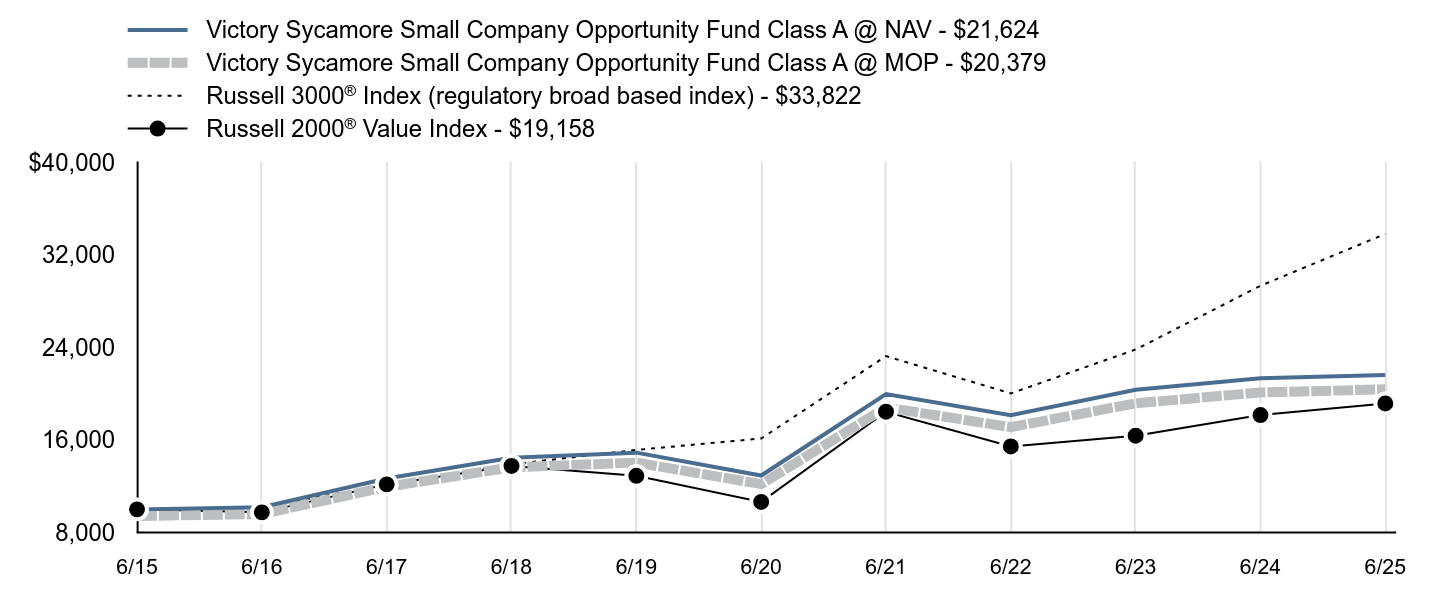

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell 2000® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, small value stocks underperformed small growth stocks. Top contributors to performance: From a benchmark perspective, communication services, information technology, and financials were the top performing sectors. The health care and utilities sectors were the largest positive contributors to the Fund’s performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocations to the utilities and information technology sectors.

Top detractors from performance: The energy and health care sectors were the largest detractors from relative performance. Security selection in the industrials, materials, and consumer discretionary sectors were the largest detractors from the Fund’s performance. From a style perspective, the Fund’s holdings on average, had lower beta and higher volume relative to the Index and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

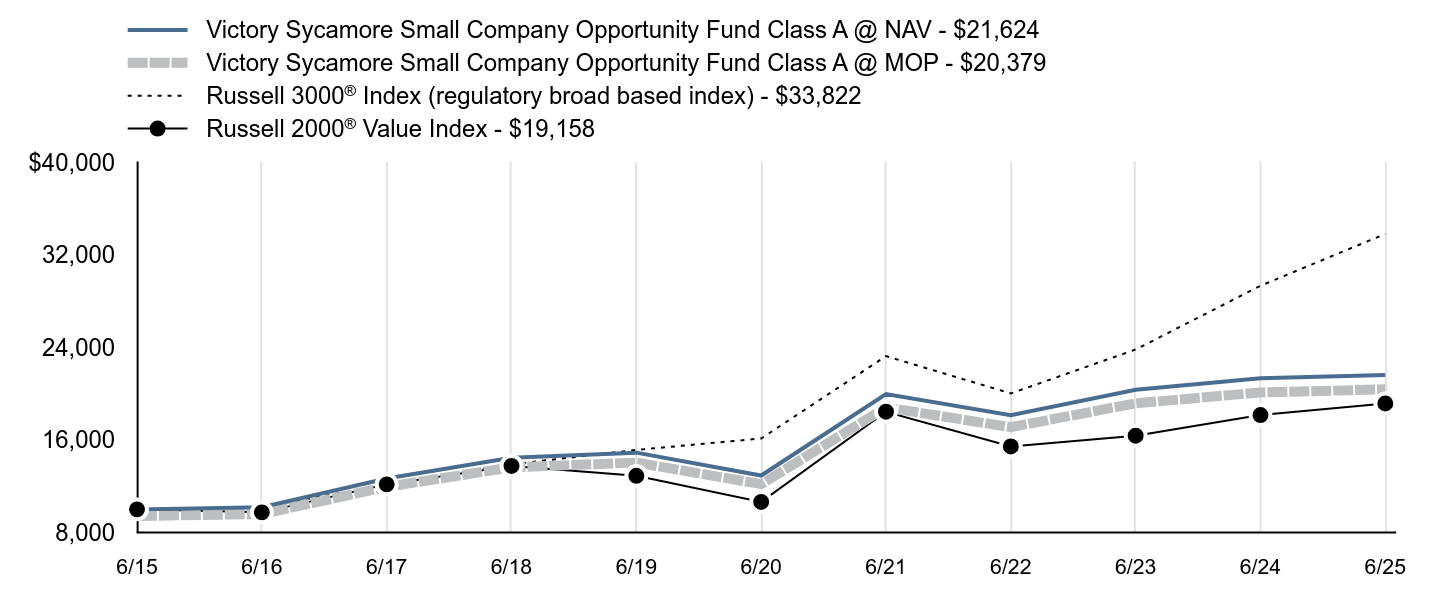

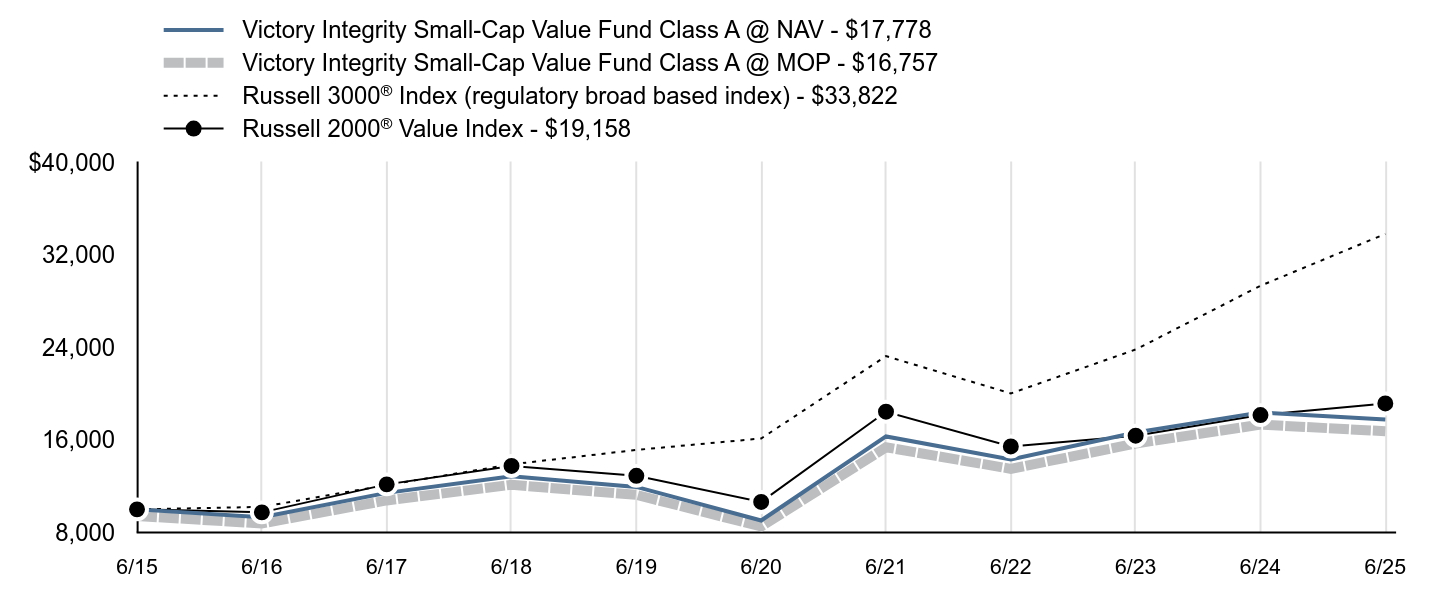

| Line Graph [Table Text Block] |

| Victory Integrity Small-Cap Value Fund Class A @ NAV - $17,778 | Victory Integrity Small-Cap Value Fund Class A @ MOP - $16,757 | Russell 3000® Index (regulatory broad based index) - $33,822 | Russell 2000® Value Index - $19,158 |

|---|

6/15 | $10,000 | $9,426 | $10,000 | $10,000 |

|---|

6/16 | $9,313 | $8,778 | $10,214 | $9,742 |

|---|

6/17 | $11,429 | $10,773 | $12,104 | $12,163 |

|---|

6/18 | $12,864 | $12,125 | $13,893 | $13,757 |

|---|

6/19 | $11,943 | $11,257 | $15,141 | $12,899 |

|---|

6/20 | $9,038 | $8,519 | $16,130 | $10,645 |

|---|

6/21 | $16,305 | $15,368 | $23,253 | $18,445 |

|---|

6/22 | $14,326 | $13,504 | $20,029 | $15,442 |

|---|

6/23 | $16,652 | $15,695 | $23,825 | $16,370 |

|---|

6/24 | $18,387 | $17,331 | $29,335 | $18,153 |

|---|

6/25 | $17,778 | $16,757 | $33,822 | $19,158 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class A @ NAV | -3.31% | 14.49% | 5.92% |

|---|

Class A @ MOP | -8.88% | 13.14% | 5.30% |

|---|

Russell 3000® Index | 15.30% | 15.96% | 12.96% |

|---|

Russell 2000® Value Index | 5.54% | 12.47% | 6.72% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| Previous Investment Adviser [Text Block] |

The maximum offering price (“MOP”) figures reflect a maximum sales charge of 5.75% for Class A. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

| AssetsNet |

$ 1,010,876,000

|

| Holdings Count | Holding |

127

|

| Advisory Fees Paid, Amount |

$ 9,956,000

|

| InvestmentCompanyPortfolioTurnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $1,010,876 |

|---|

Number of Holdings | 127 |

|---|

Investment Advisory Fees | $9,956 |

|---|

Portfolio Turnover | 44% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 2.1% | Materials | 4.1% | Utilities | 4.4% | Health Care | 6.1% | Energy | 6.3% | Information Technology | 7.7% | Consumer Discretionary | 10.8% | Real Estate | 11.4% | Industrials | 14.4% | FinancialsFootnote Reference** | 29.2% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Glacier Bancorp, Inc. | 1.3% |

|---|

Essent Group Ltd. | 1.3% |

|---|

Ameris Bancorp | 1.3% |

|---|

Hancock Whitney Corp. | 1.3% |

|---|

Valley National Bancorp | 1.2% |

|---|

Bank of Hawaii Corp. | 1.2% |

|---|

Taylor Morrison Home Corp. | 1.2% |

|---|

SouthState Corp. | 1.2% |

|---|

Flagstar Financial, Inc. | 1.2% |

|---|

The Chefs' Warehouse, Inc. | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000144978 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Small-Cap Value Fund

|

| Class Name |

Class C

|

| Trading Symbol |

MCVSX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class C | $230 | 2.35% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 230

|

| Expense Ratio, Percent |

2.35%

|

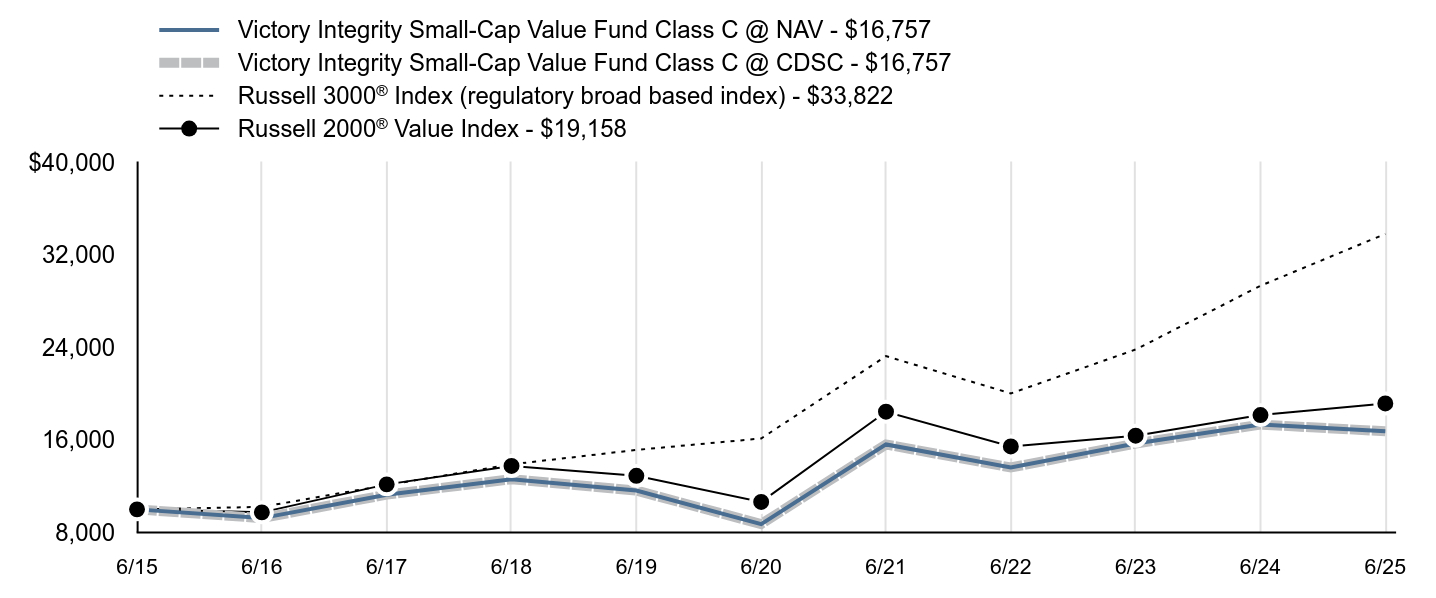

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell 2000® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, small value stocks underperformed small growth stocks. Top contributors to performance: From a benchmark perspective, communication services, information technology, and financials were the top performing sectors. The health care and utilities sectors were the largest positive contributors to the Fund’s performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocations to the utilities and information technology sectors.

Top detractors from performance: The energy and health care sectors were the largest detractors from relative performance. Security selection in the industrials, materials, and consumer discretionary sectors were the largest detractors from the Fund’s performance. From a style perspective, the Fund’s holdings on average, had lower beta and higher volume relative to the Index and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

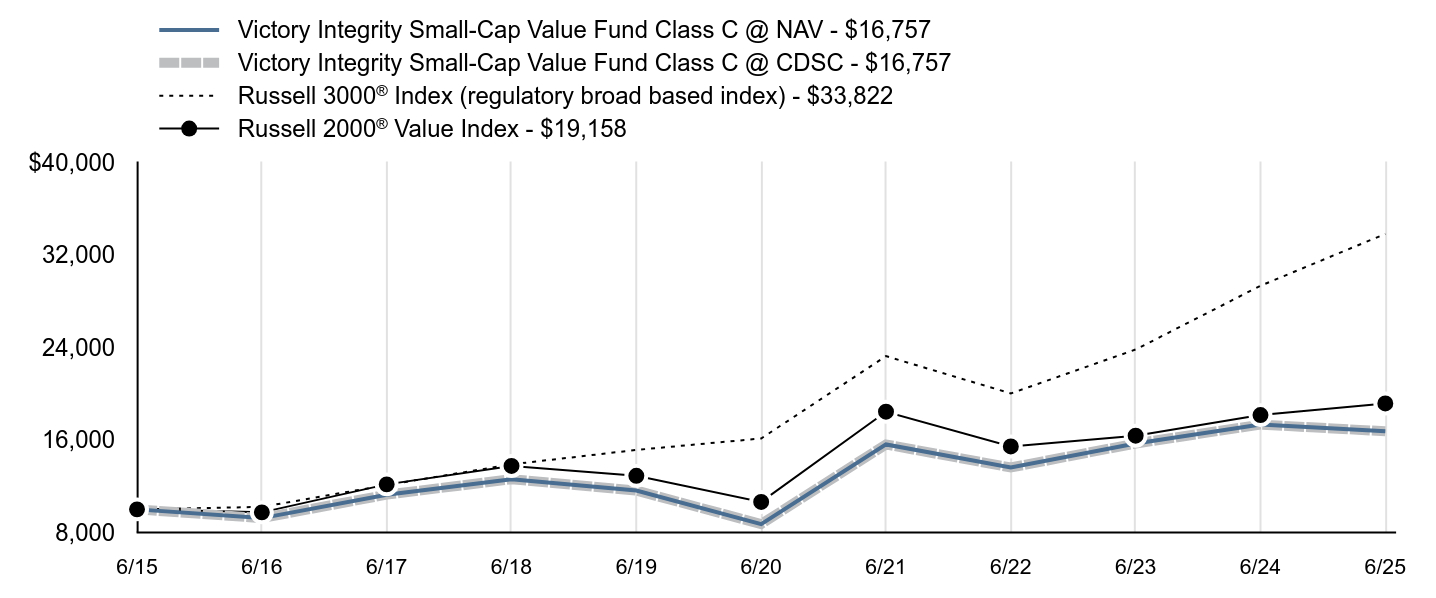

| Line Graph [Table Text Block] |

| Victory Integrity Small-Cap Value Fund Class C @ NAV - $16,757 | Victory Integrity Small-Cap Value Fund Class C @ CDSC - $16,757 | Russell 3000® Index (regulatory broad based index) - $33,822 | Russell 2000® Value Index - $19,158 |

|---|

6/15 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $9,244 | $9,244 | $10,214 | $9,742 |

|---|

6/17 | $11,271 | $11,271 | $12,104 | $12,163 |

|---|

6/18 | $12,608 | $12,608 | $13,893 | $13,757 |

|---|

6/19 | $11,627 | $11,627 | $15,141 | $12,899 |

|---|

6/20 | $8,730 | $8,730 | $16,130 | $10,645 |

|---|

6/21 | $15,615 | $15,615 | $23,253 | $18,445 |

|---|

6/22 | $13,621 | $13,621 | $20,029 | $15,442 |

|---|

6/23 | $15,696 | $15,696 | $23,825 | $16,370 |

|---|

6/24 | $17,331 | $17,331 | $29,335 | $18,153 |

|---|

6/25 | $16,757 | $16,757 | $33,822 | $19,158 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class C @ NAV | -4.24% | 13.50% | 5.30% |

|---|

Class C @ CDSC | -5.01% | 13.50% | 5.30% |

|---|

Russell 3000® Index | 15.30% | 15.96% | 12.96% |

|---|

Russell 2000® Value Index | 5.54% | 12.47% | 6.72% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| Previous Investment Adviser [Text Block] |

Class C is not subject to an initial sales charge, but is subject to Contingent Deferred Sales Charge (“CDSC”) of 1.00% on shares redeemed within one year of purchase. The Net Asset Value ("NAV") figures do not reflect sales charges.

|

| AssetsNet |

$ 1,010,876,000

|

| Holdings Count | Holding |

127

|

| Advisory Fees Paid, Amount |

$ 9,956,000

|

| InvestmentCompanyPortfolioTurnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $1,010,876 |

|---|

Number of Holdings | 127 |

|---|

Investment Advisory Fees | $9,956 |

|---|

Portfolio Turnover | 44% |

|---|

|

| Holdings [Text Block] |

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Value | Value |

|---|

Consumer Staples | 2.1% | Materials | 4.1% | Utilities | 4.4% | Health Care | 6.1% | Energy | 6.3% | Information Technology | 7.7% | Consumer Discretionary | 10.8% | Real Estate | 11.4% | Industrials | 14.4% | FinancialsFootnote Reference** | 29.2% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference(as of June 30, 2025)Glacier Bancorp, Inc. | 1.3% |

|---|

Essent Group Ltd. | 1.3% |

|---|

Ameris Bancorp | 1.3% |

|---|

Hancock Whitney Corp. | 1.3% |

|---|

Valley National Bancorp | 1.2% |

|---|

Bank of Hawaii Corp. | 1.2% |

|---|

Taylor Morrison Home Corp. | 1.2% |

|---|

SouthState Corp. | 1.2% |

|---|

Flagstar Financial, Inc. | 1.2% |

|---|

The Chefs' Warehouse, Inc. | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

|

| C000144979 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Victory Integrity Small-Cap Value Fund

|

| Class Name |

Class R

|

| Trading Symbol |

MRVSX

|

| Annual or Semi-Annual Statement [Text Block] |

Annual Shareholder Report

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-539-3863 or visiting vcm.com/contact-us.

|

| Additional Information Phone Number |

800-539-3863

|

| Additional Information Website |

vcm.com

|

| Expenses [Text Block] |

What were the Fund's costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 Investment | Costs paid as a percentage of a $10,000 Investment |

|---|

Class R | $172 | 1.75% |

|---|

| | |

|---|

|

| Expenses Paid, Amount |

$ 172

|

| Expense Ratio, Percent |

1.75%

|

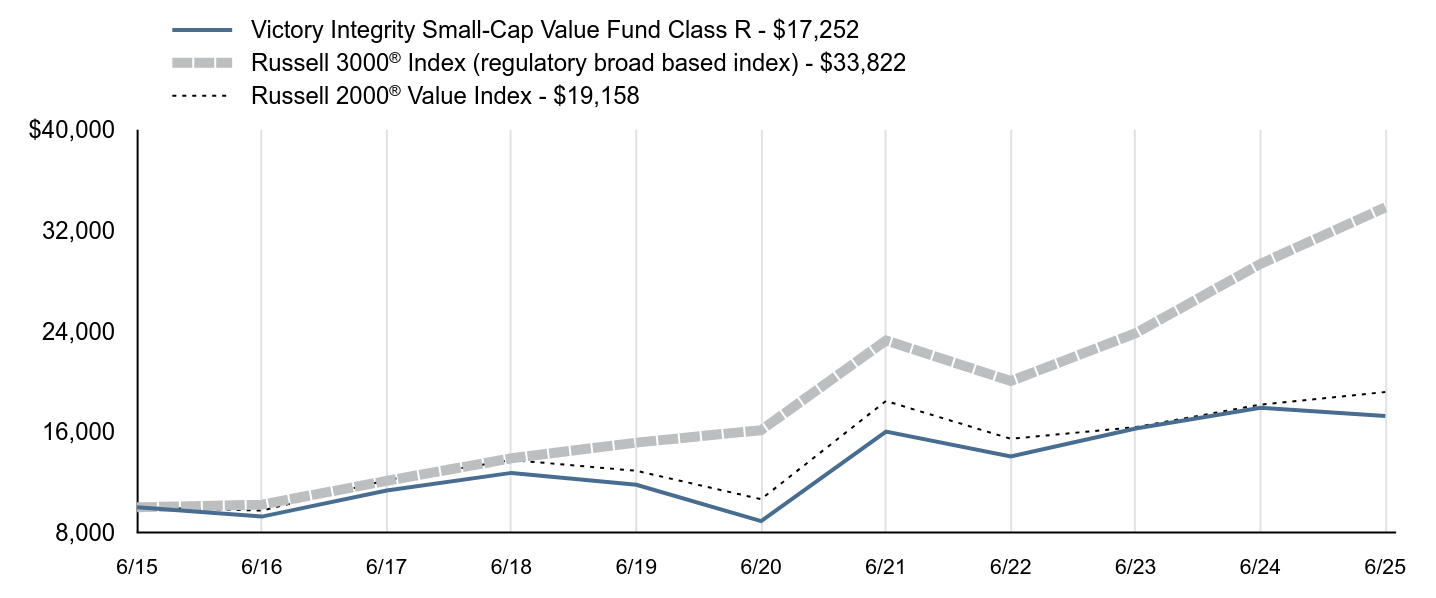

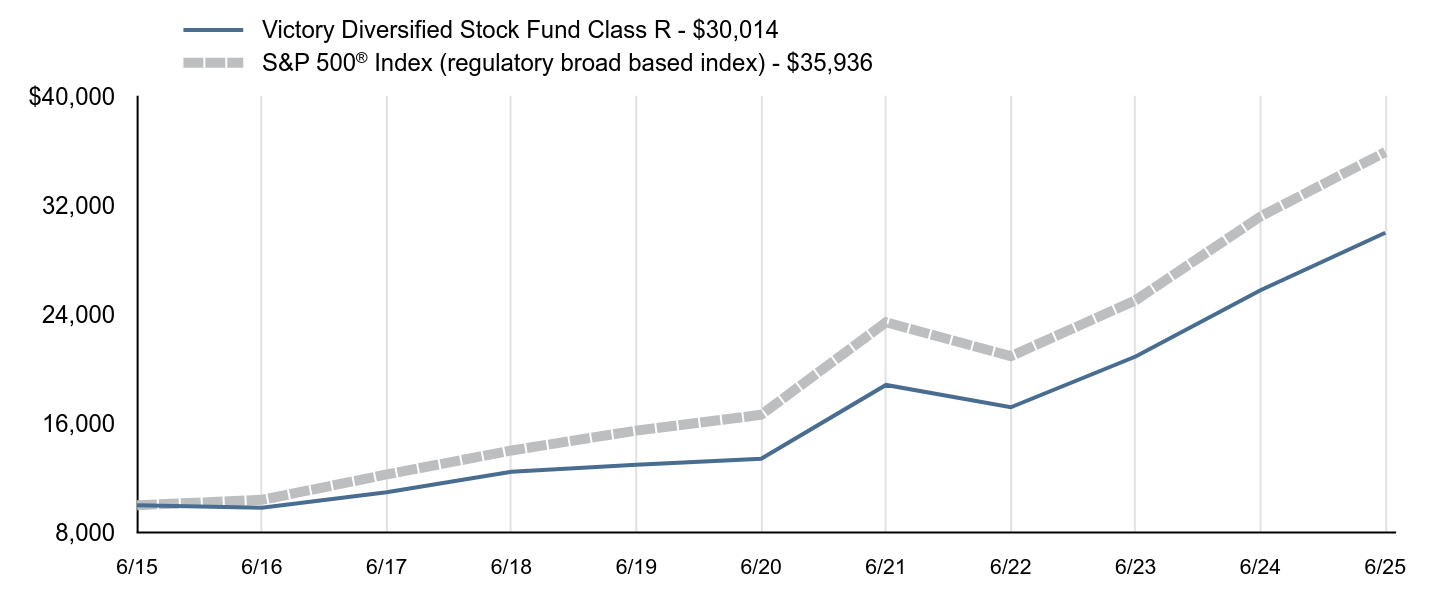

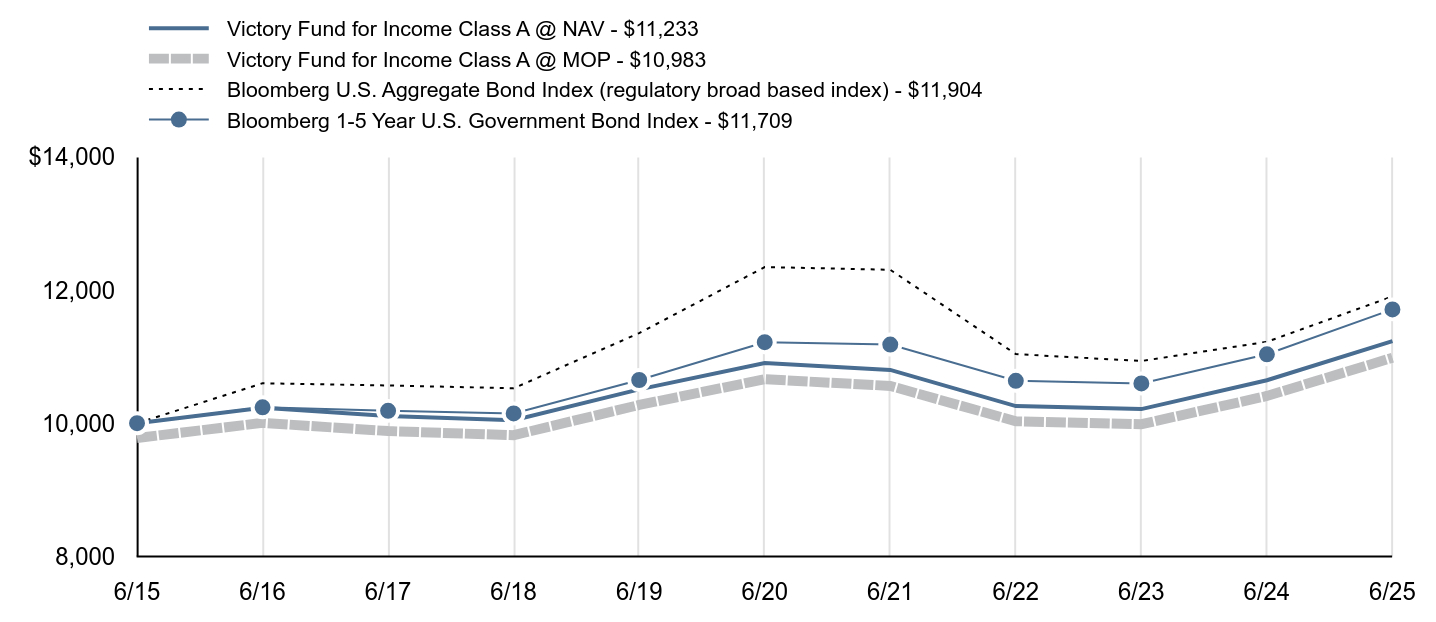

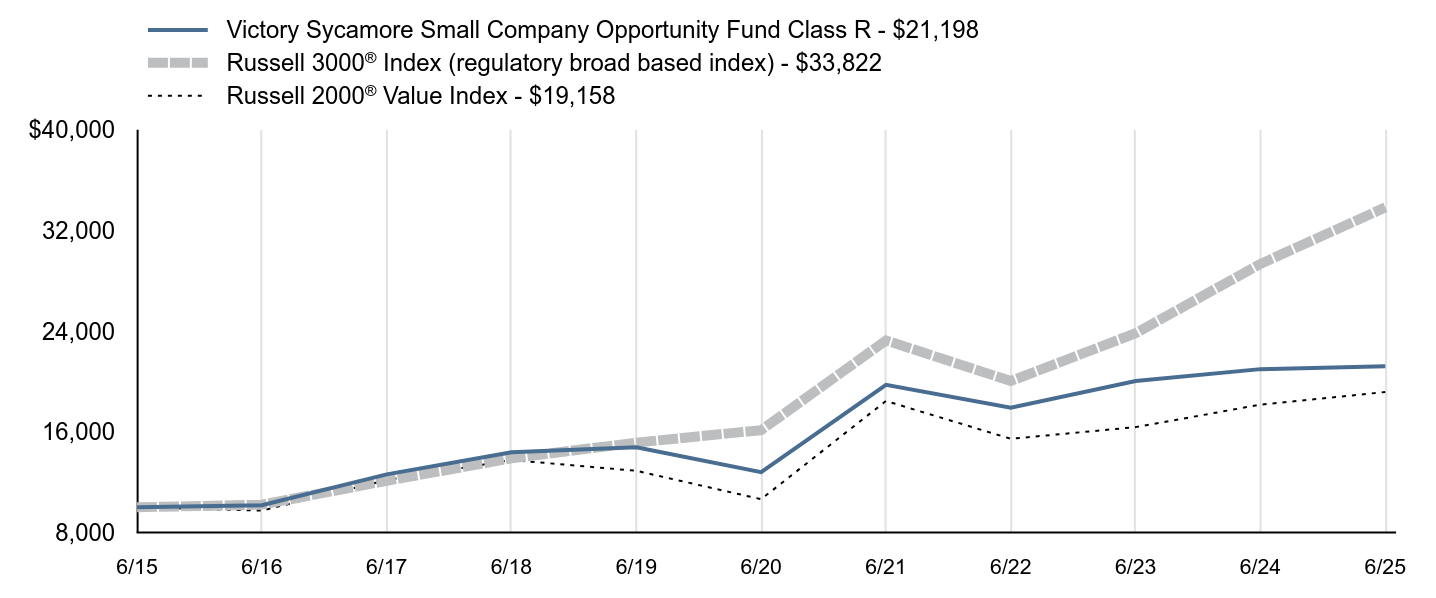

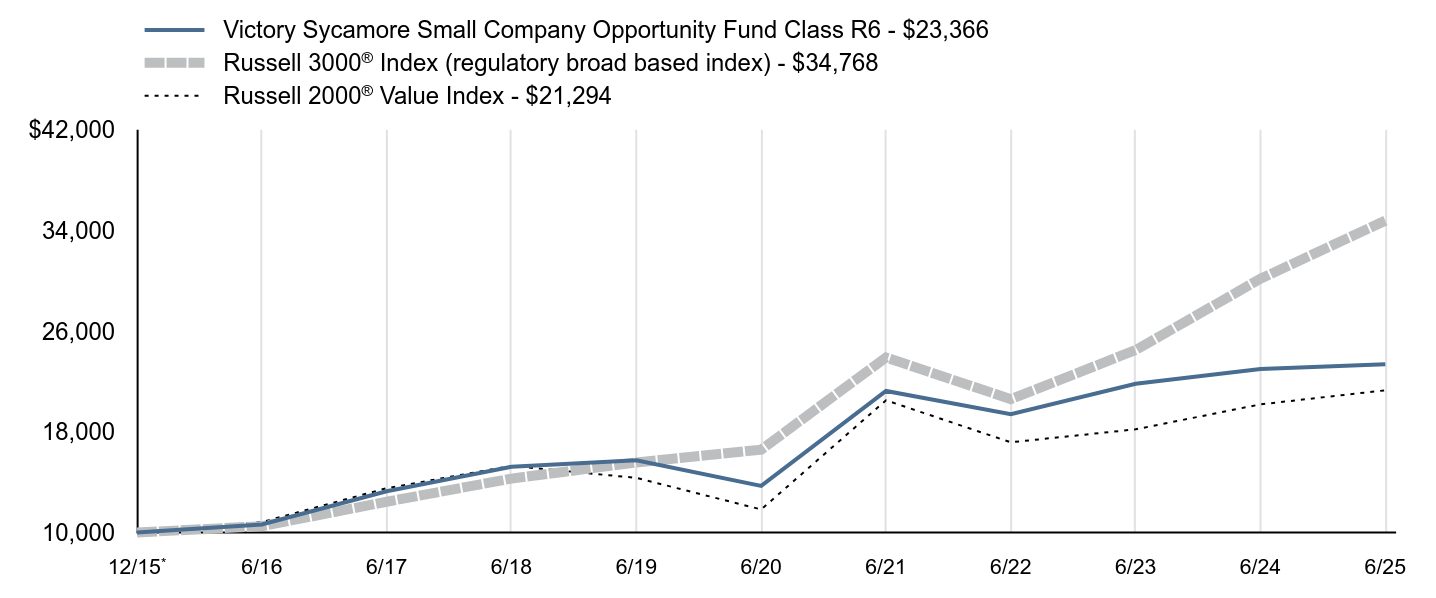

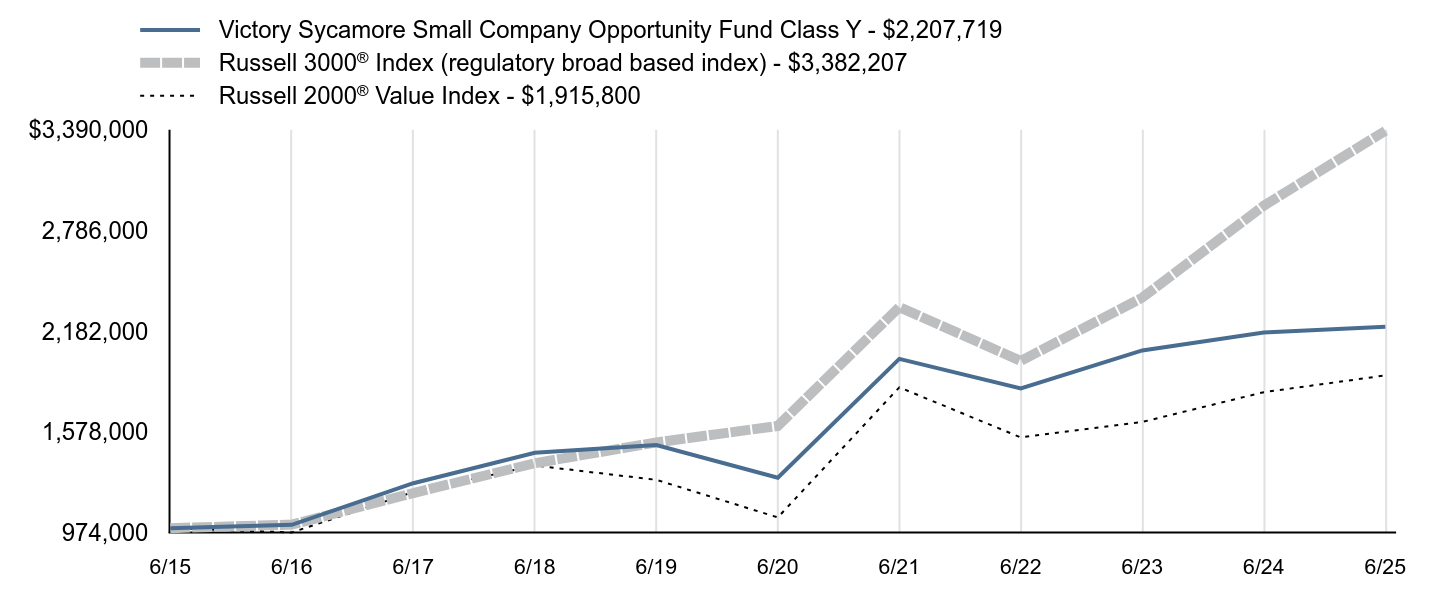

| Factors Affecting Performance [Text Block] |

What affected the Fund’s performance during the last year?For the fiscal year ended June 30, 2025, the Fund underperformed its benchmark, the Russell 2000® Value Index (the “Index”). Over the last 12 months, U.S. equity market reactions to the Federal Reserve’s interest rate policy and President Trump’s tariff plans dominated headlines. Even though equities reached all-time highs in the fourth quarter of 2024, investor expectations for further rate cuts in 2025 began to cool. As the calendar turned to 2025, we believe market volatility increased due to concern and uncertainty regarding President Trump’s tariff agenda. As the fourth quarter of the Fund’s fiscal year end concluded, U.S. markets rallied once again to record highs. We believe that investor sentiment was boosted by hopes that the U.S. will reach trade agreements that could result in lower tariffs and optimism that the Federal Reserve could cut rates. For the one-year period ending June 30, 2025, small value stocks underperformed small growth stocks. Top contributors to performance: From a benchmark perspective, communication services, information technology, and financials were the top performing sectors. The health care and utilities sectors were the largest positive contributors to the Fund’s performance. Sector weights contributed positively to the Fund’s performance relative to the Index largely due to the Fund’s underweight allocation to the health care sector and the Fund’s overweight allocations to the utilities and information technology sectors.

Top detractors from performance: The energy and health care sectors were the largest detractors from relative performance. Security selection in the industrials, materials, and consumer discretionary sectors were the largest detractors from the Fund’s performance. From a style perspective, the Fund’s holdings on average, had lower beta and higher volume relative to the Index and both were headwinds.

|

| Performance Past Does Not Indicate Future [Text] |

The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Past performance is not a good predictor of the Fund's future performance.

|

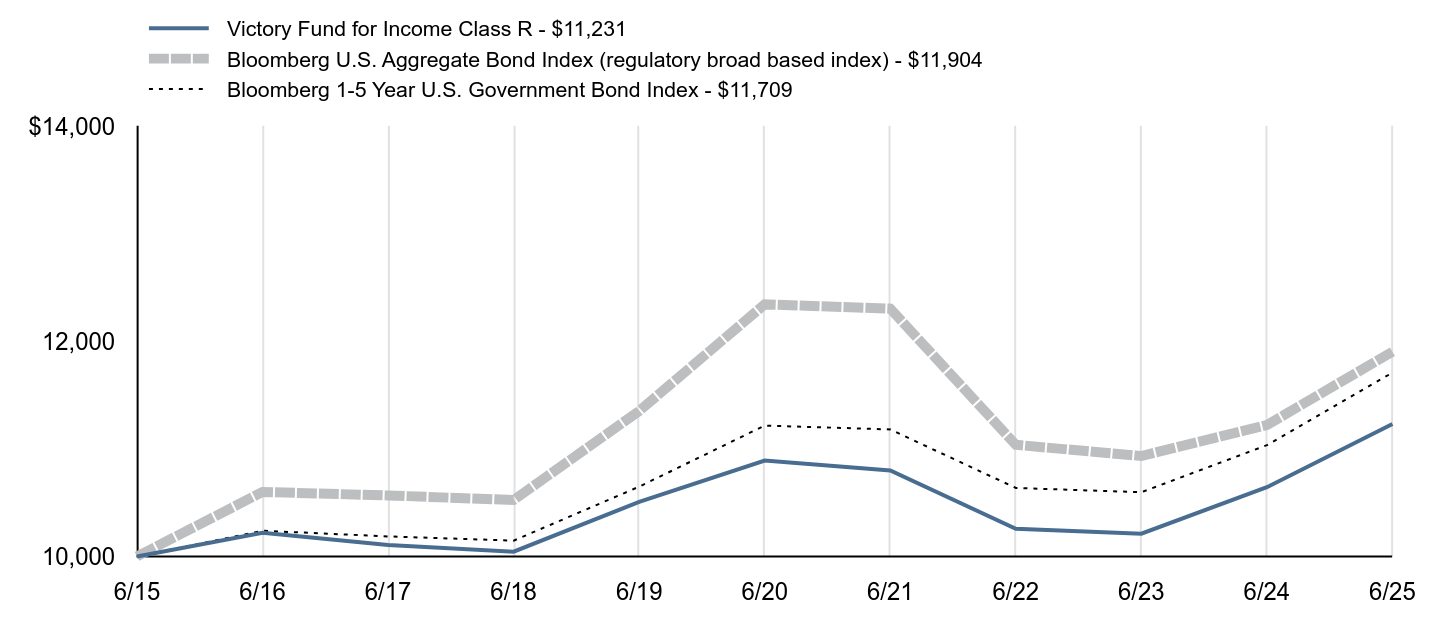

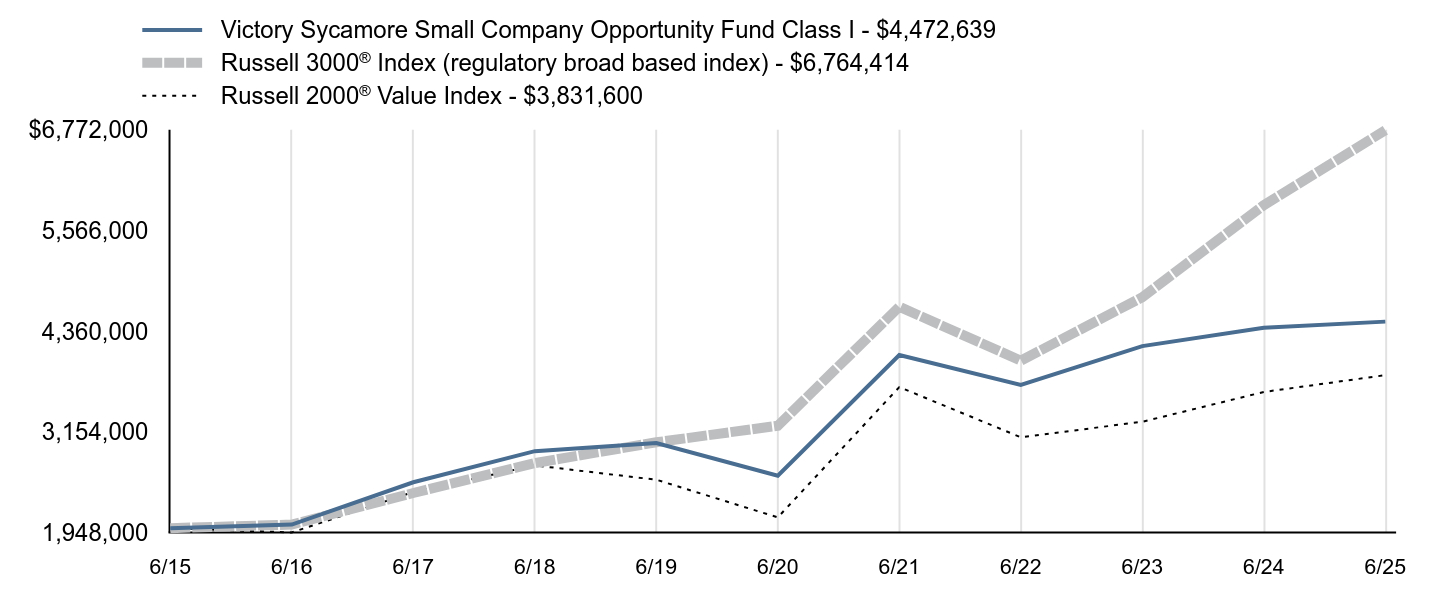

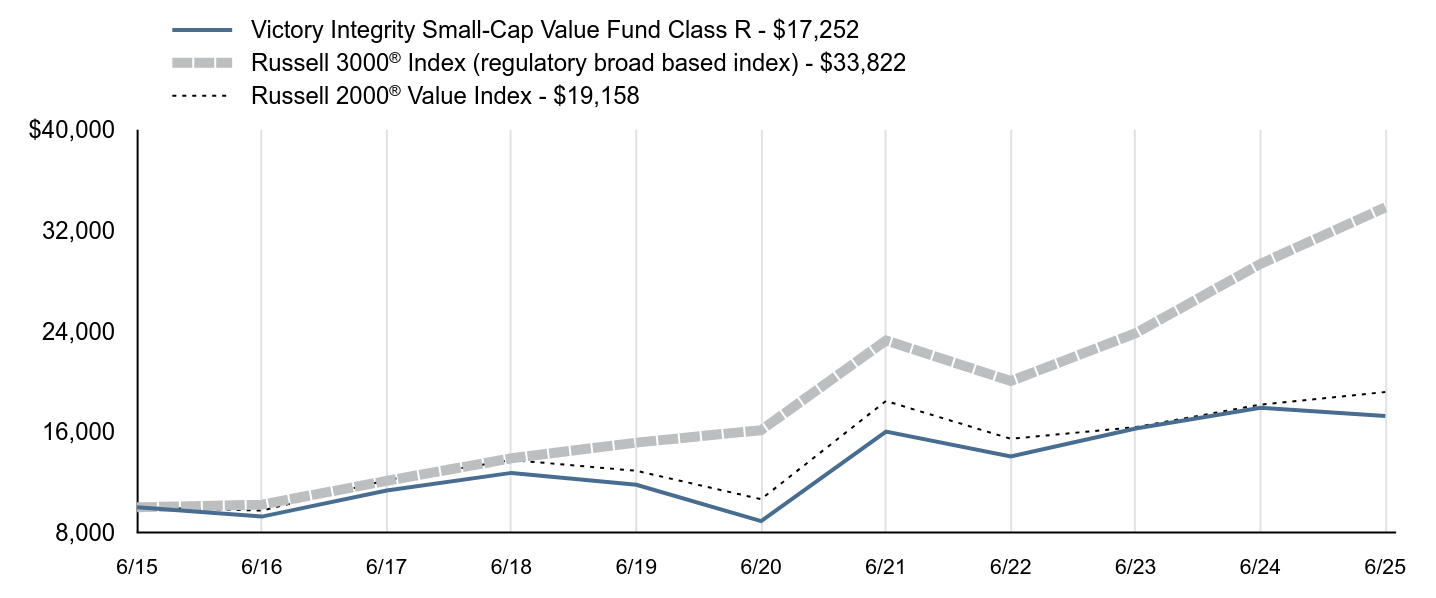

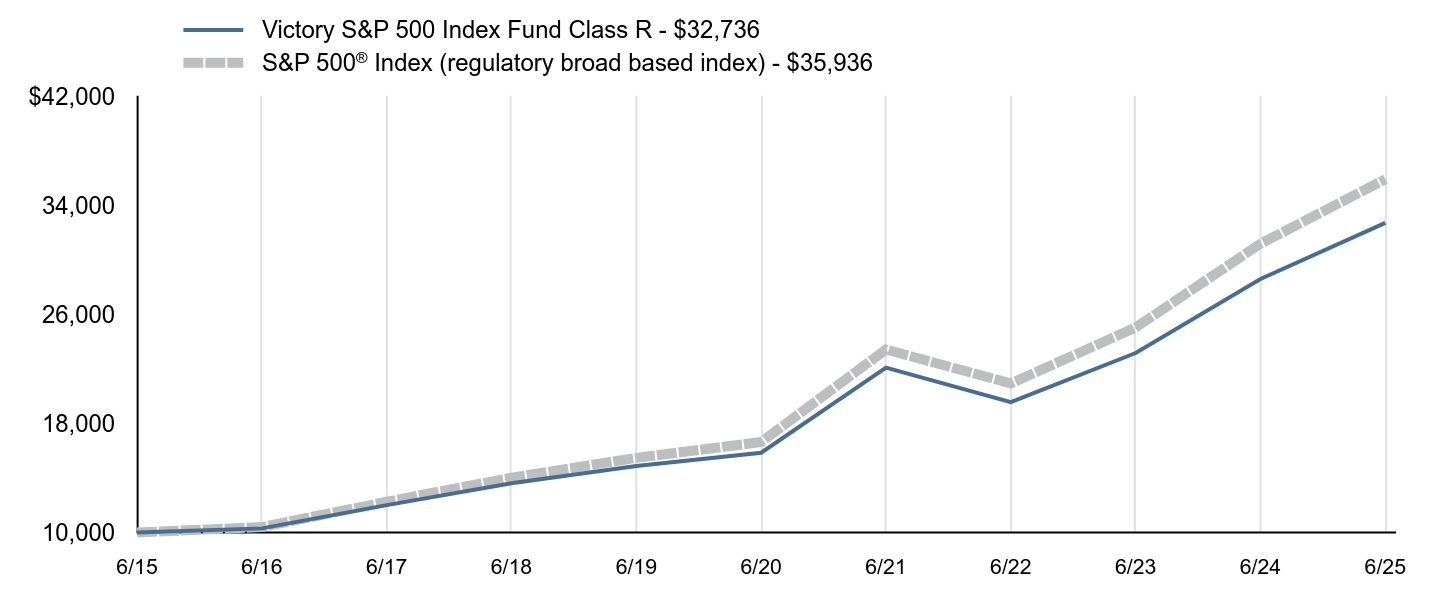

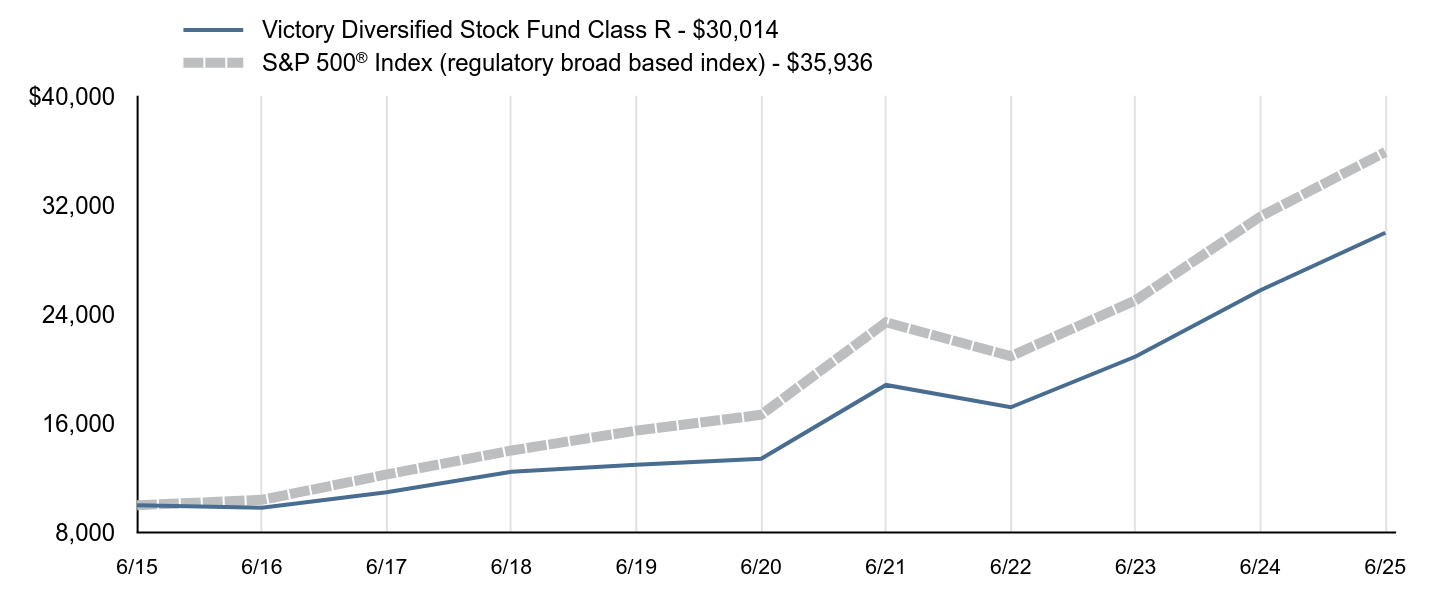

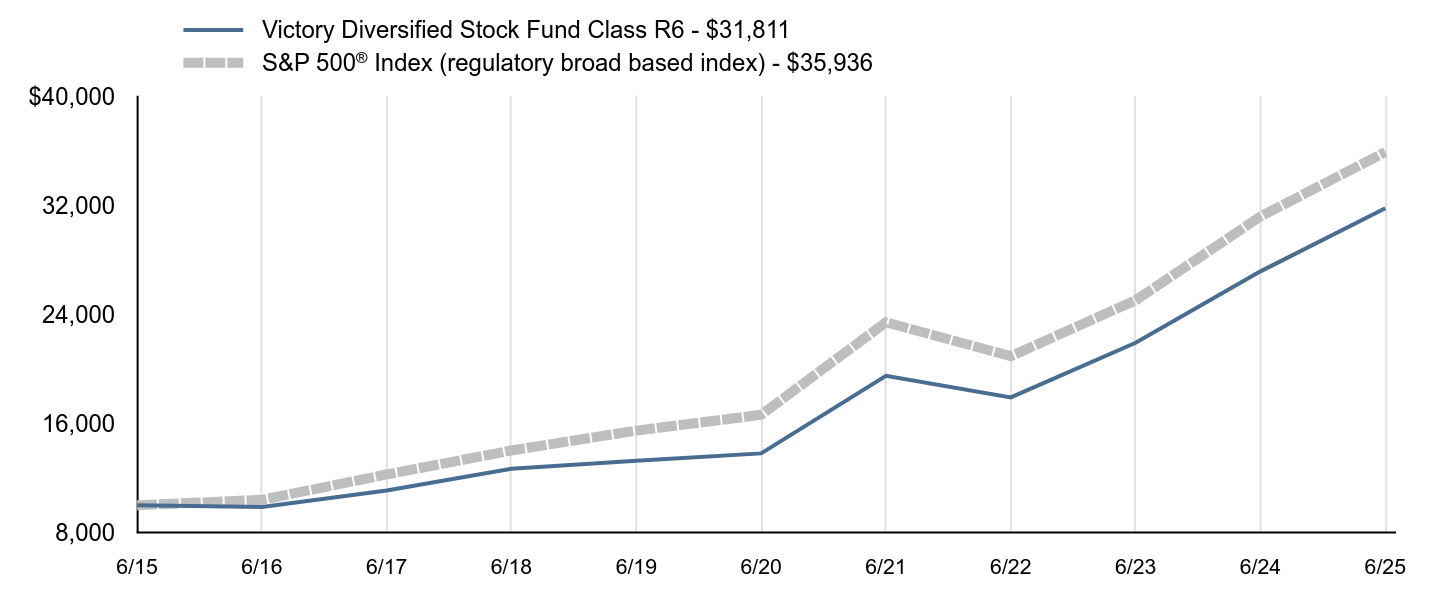

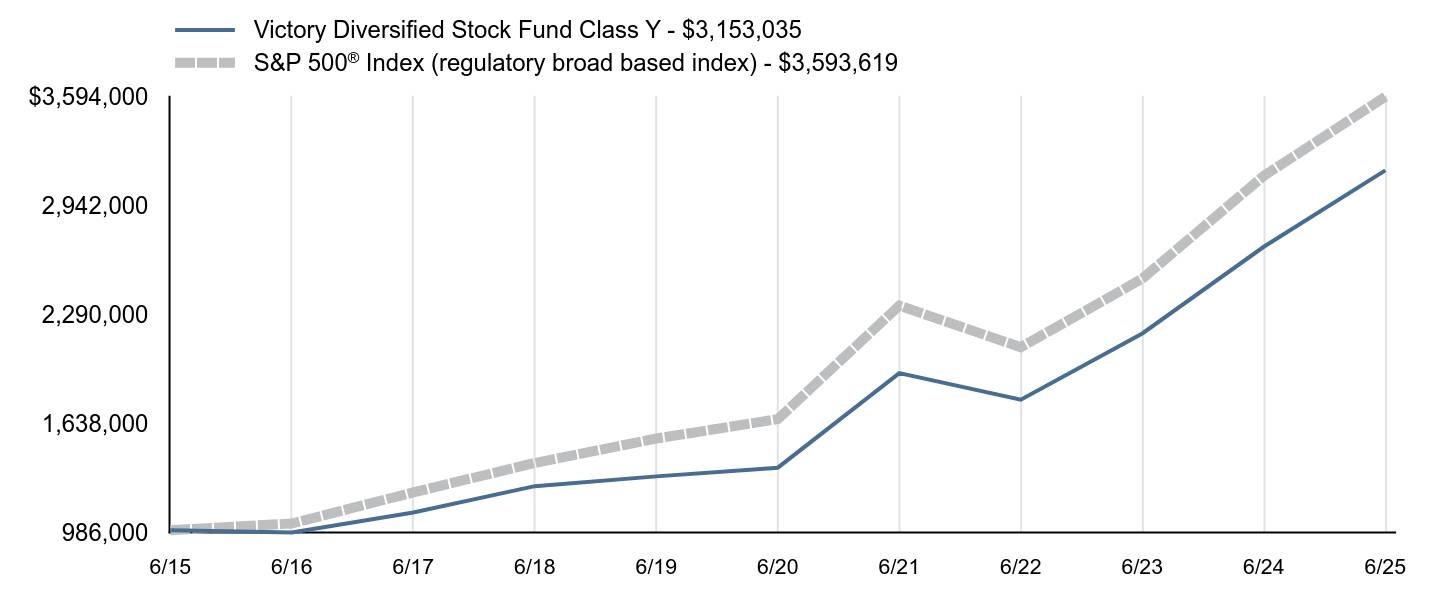

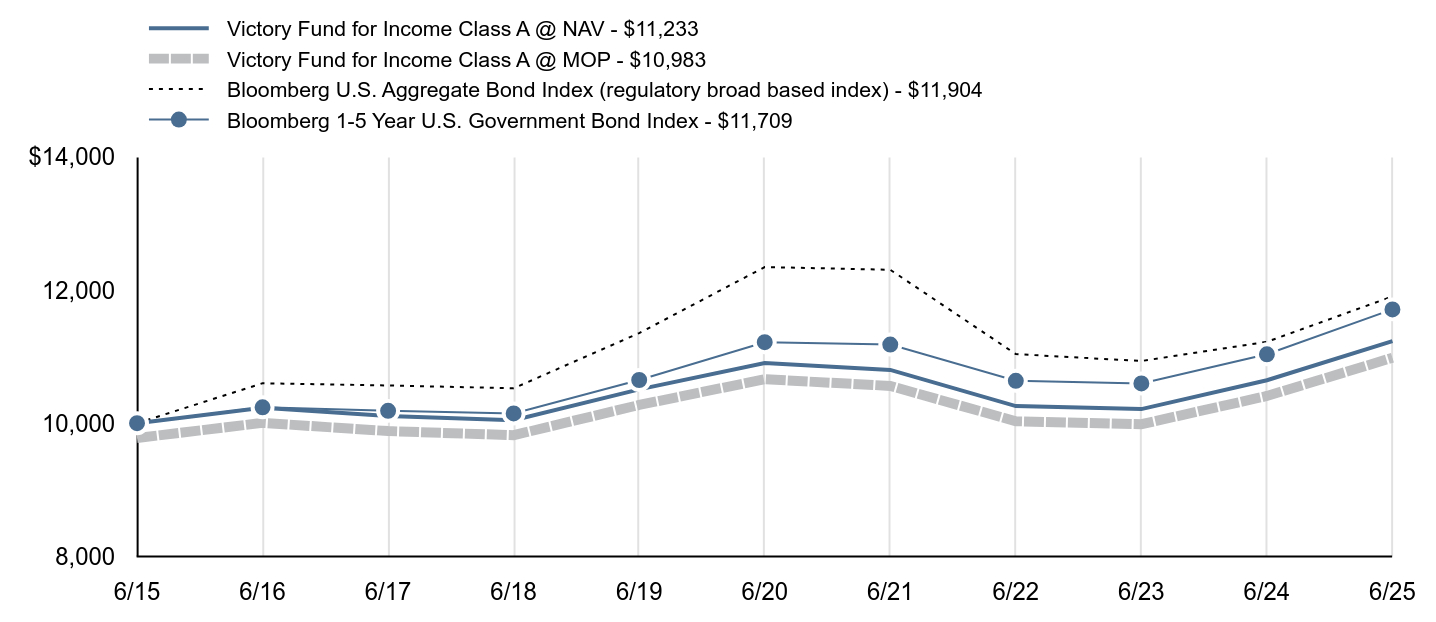

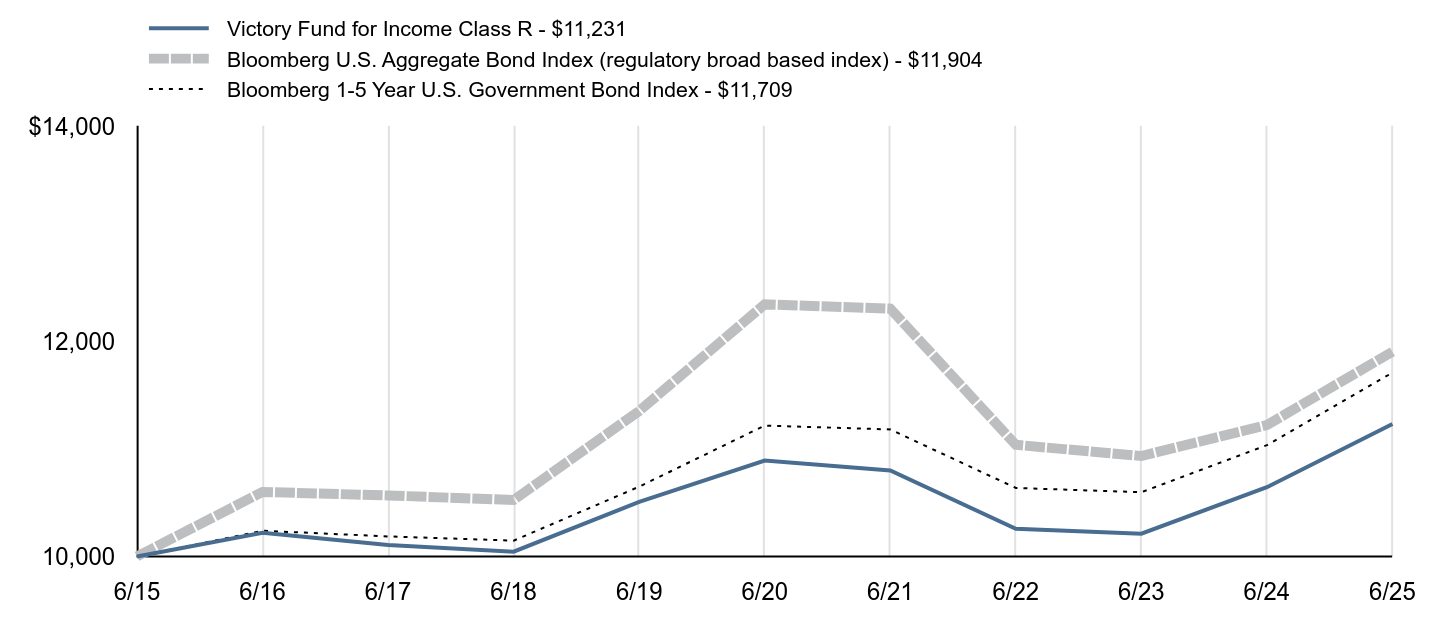

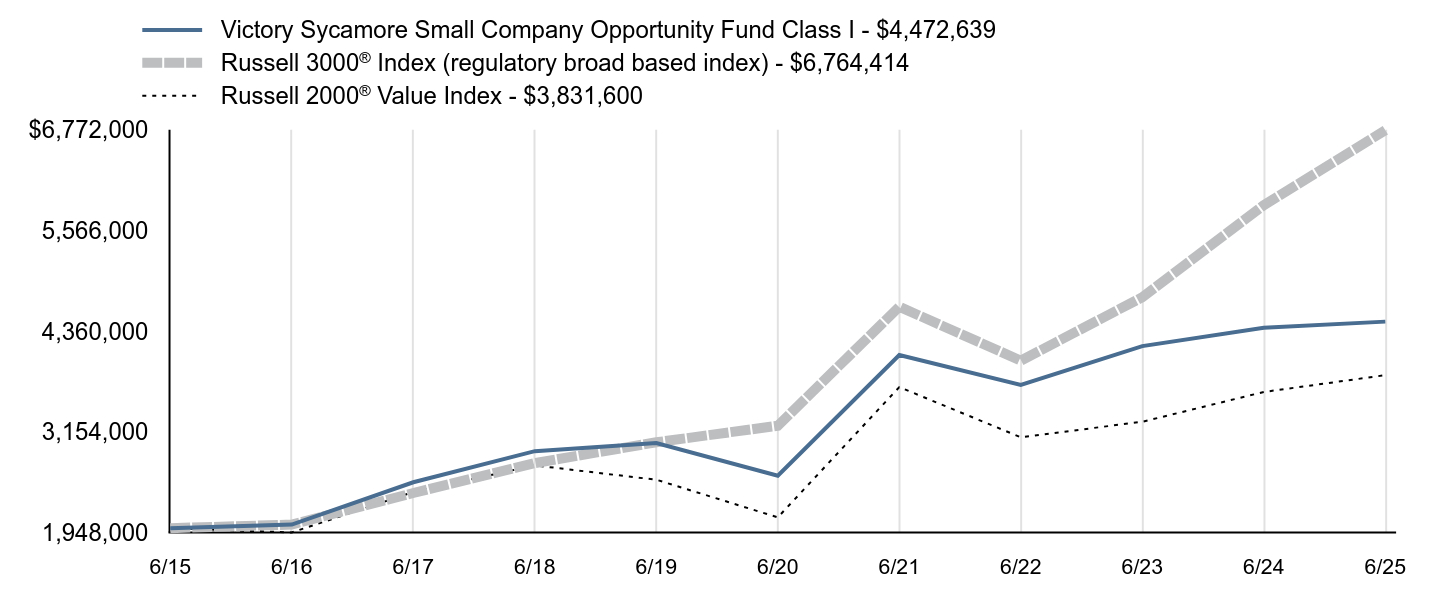

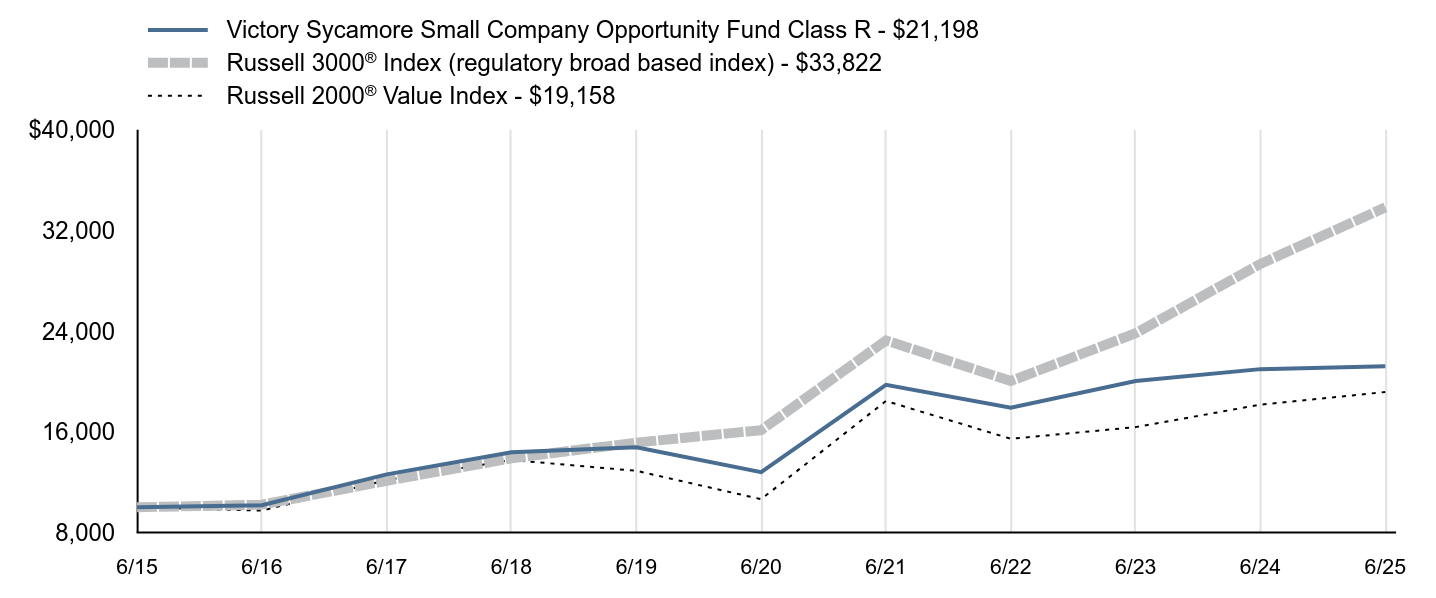

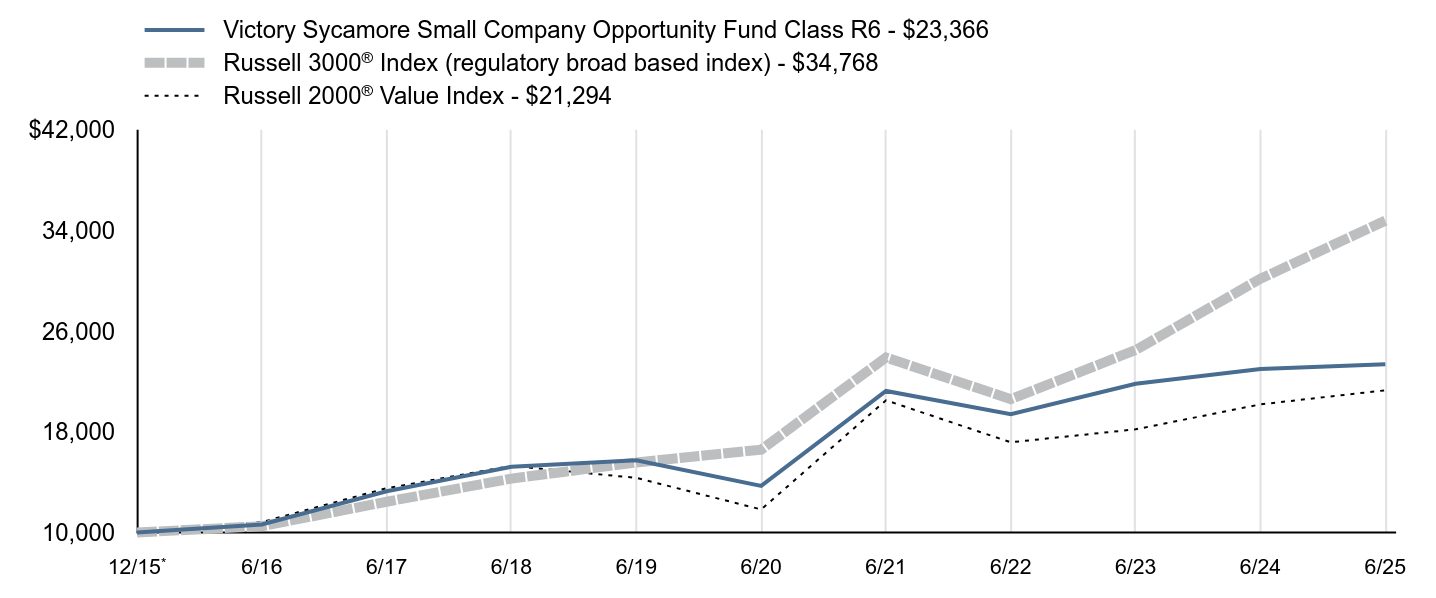

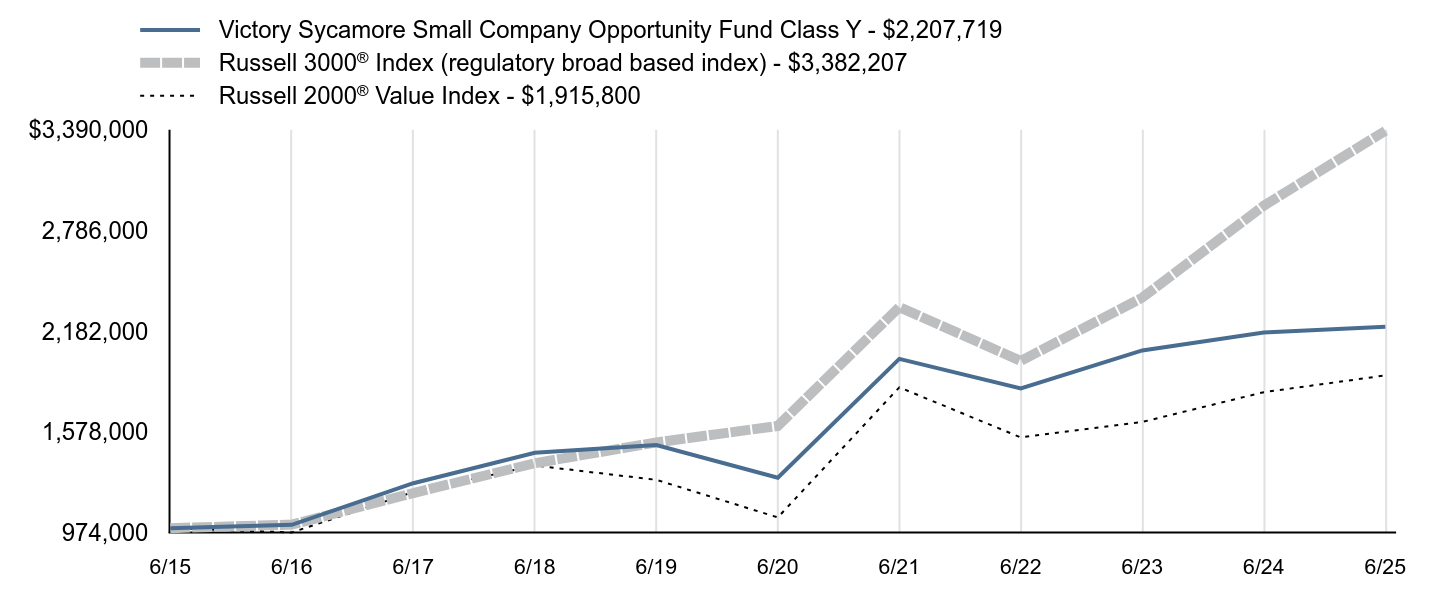

| Line Graph [Table Text Block] |

| Victory Integrity Small-Cap Value Fund Class R - $17,252 | Russell 3000® Index (regulatory broad based index) - $33,822 | Russell 2000® Value Index - $19,158 |

|---|

6/15 | $10,000 | $10,000 | $10,000 |

|---|

6/16 | $9,264 | $10,214 | $9,742 |

|---|

6/17 | $11,340 | $12,104 | $12,163 |

|---|

6/18 | $12,734 | $13,893 | $13,757 |

|---|

6/19 | $11,793 | $15,141 | $12,899 |

|---|

6/20 | $8,899 | $16,130 | $10,645 |

|---|

6/21 | $16,010 | $23,253 | $18,445 |

|---|

6/22 | $14,038 | $20,029 | $15,442 |

|---|

6/23 | $16,265 | $23,825 | $16,370 |

|---|

6/24 | $17,901 | $29,335 | $18,153 |

|---|

6/25 | $17,252 | $33,822 | $19,158 |

|---|

|

| Average Annual Return [Table Text Block] |

| 1 Year | 5 Year | 10 Year |

|---|

Class R | -3.63% | 14.16% | 5.60% |

|---|

Russell 3000® Index | 15.30% | 15.96% | 12.96% |

|---|

Russell 2000® Value Index | 5.54% | 12.47% | 6.72% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

|

| AssetsNet |

$ 1,010,876,000

|

| Holdings Count | Holding |

127

|

| Advisory Fees Paid, Amount |

$ 9,956,000

|

| InvestmentCompanyPortfolioTurnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS($ amounts in 000s)(as of June 30, 2025)Net Assets | $1,010,876 |

|---|

Number of Holdings | 127 |

|---|

Investment Advisory Fees | $9,956 |

|---|

Portfolio Turnover | 44% |

|---|

|

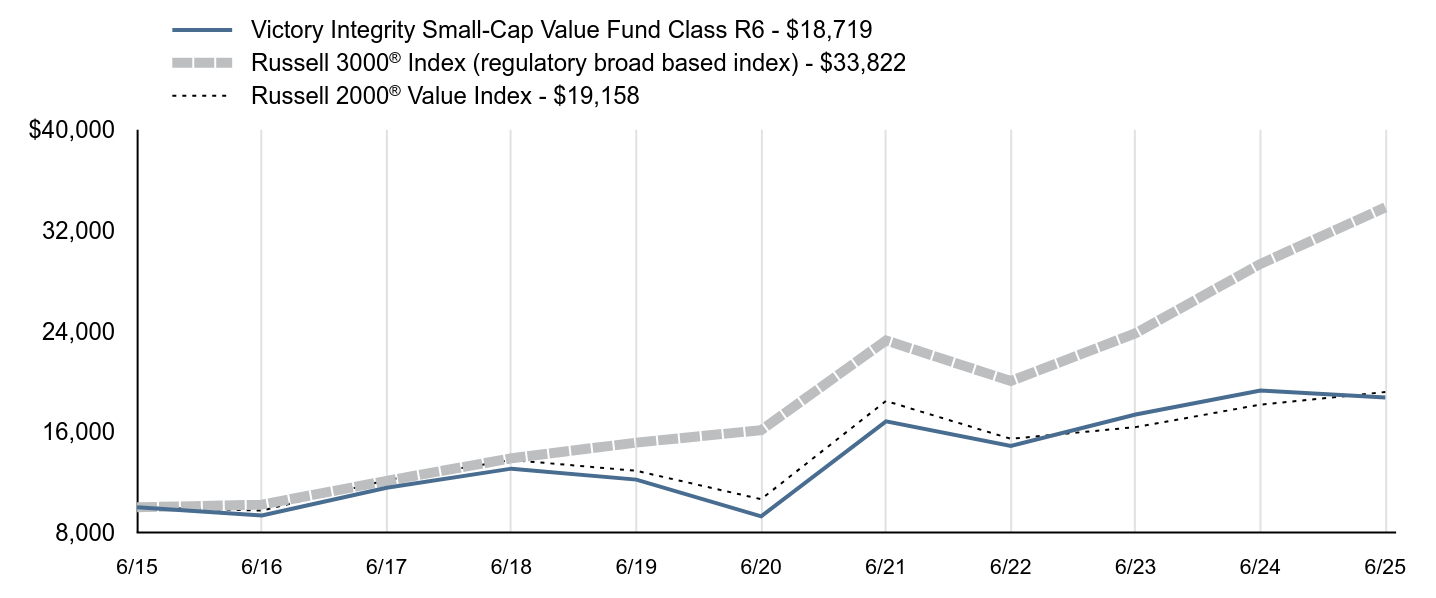

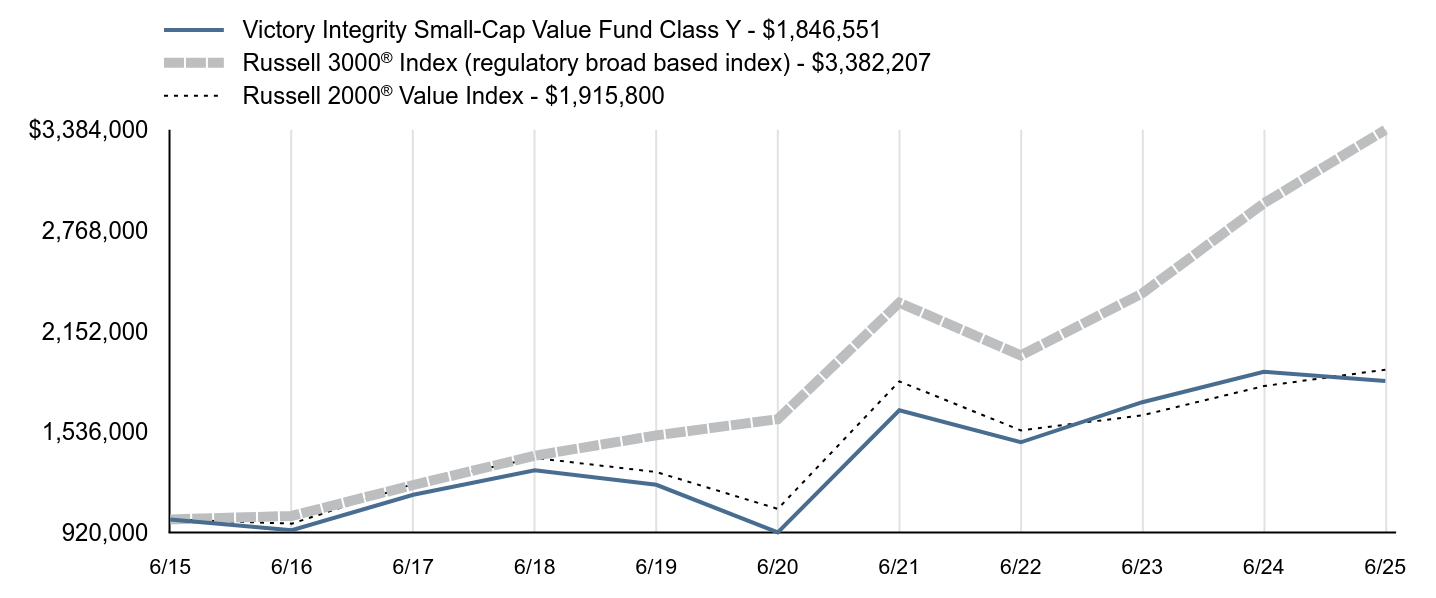

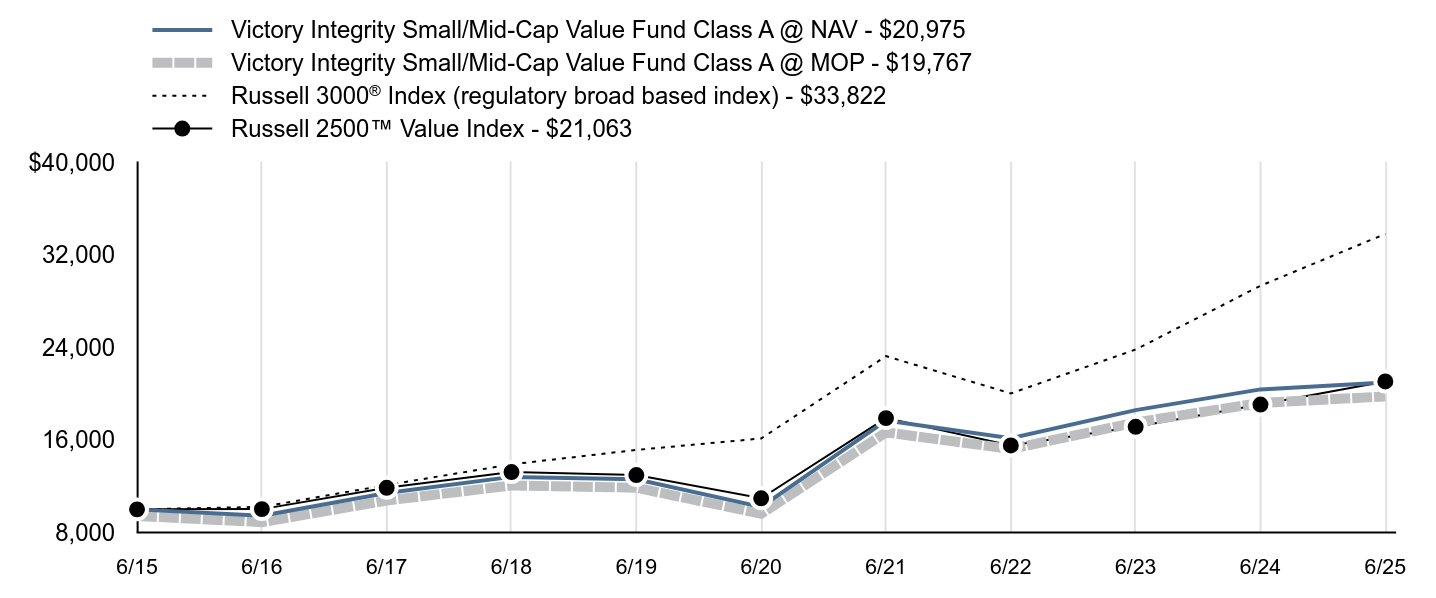

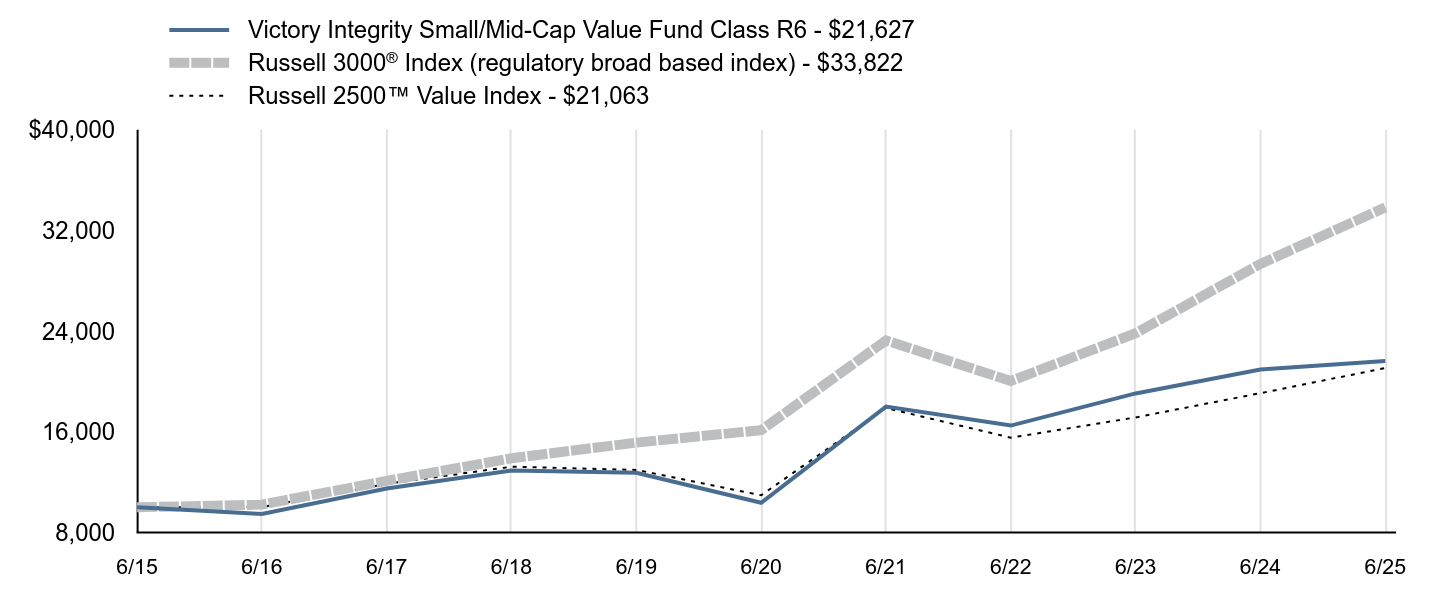

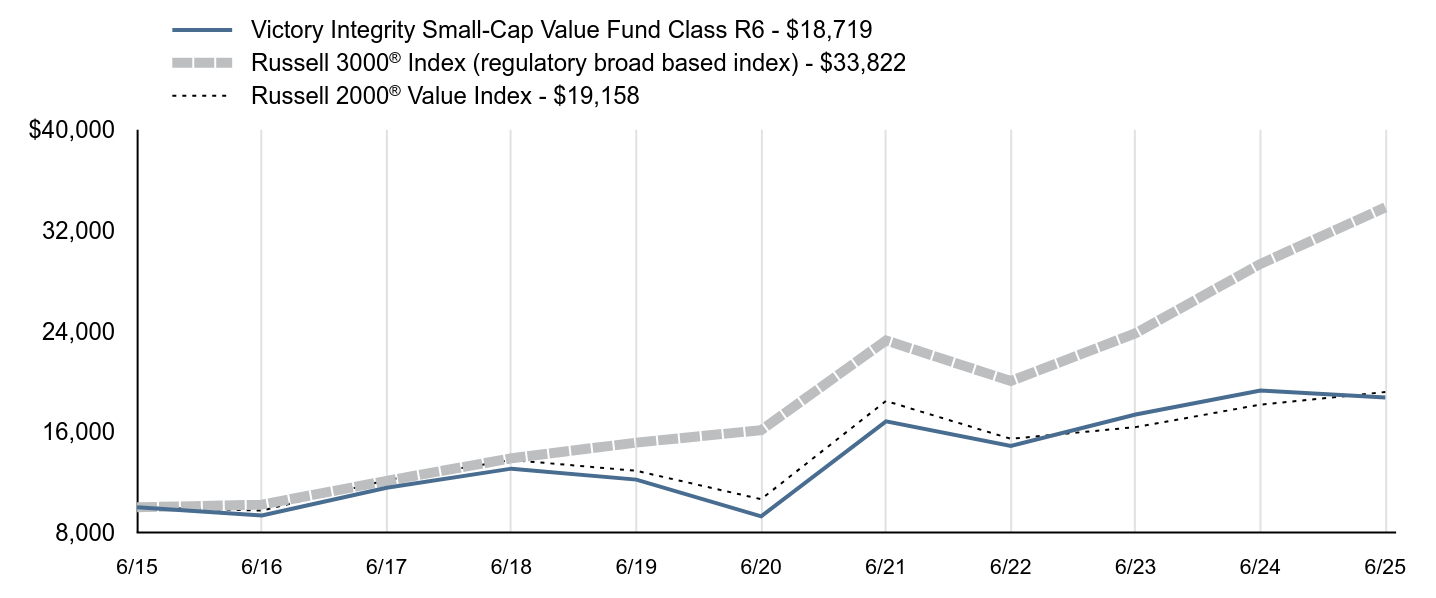

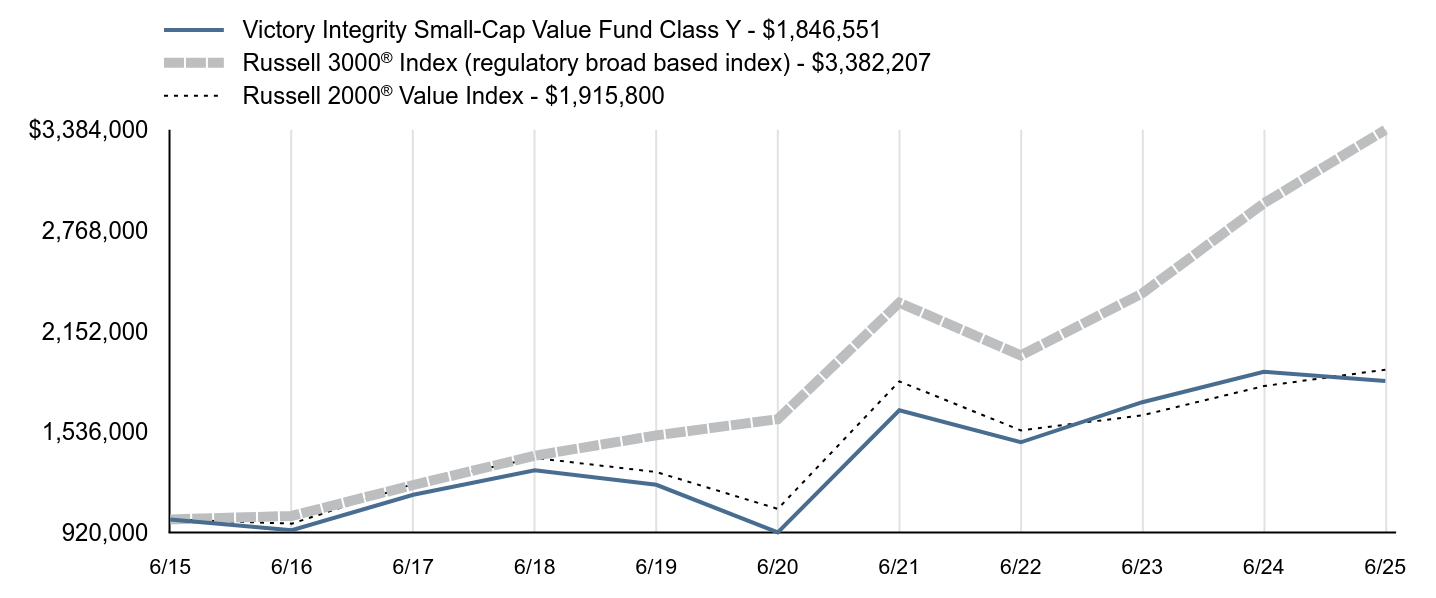

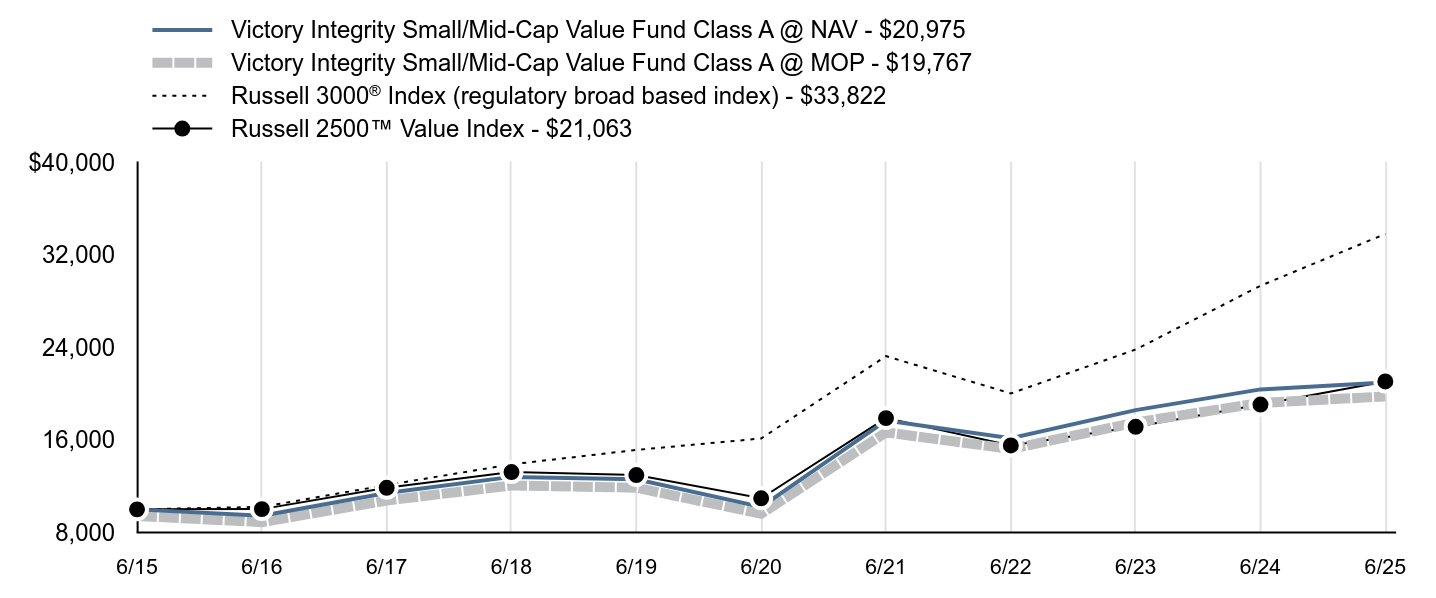

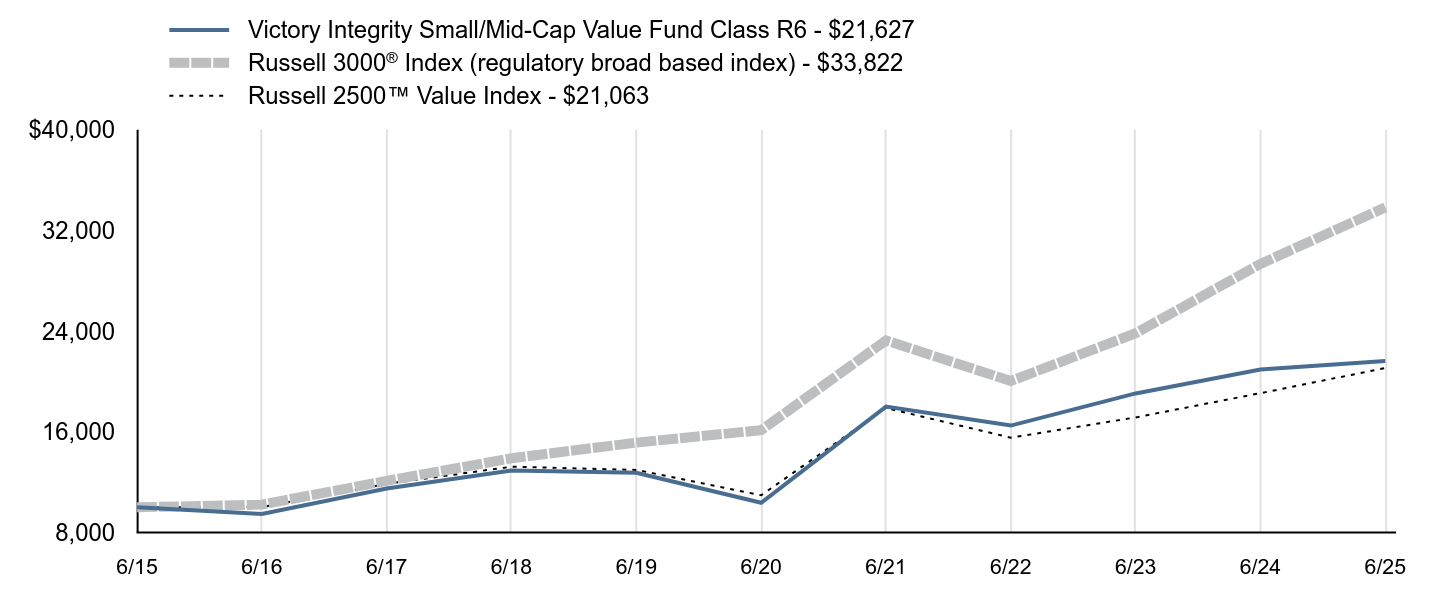

| Holdings [Text Block] |