Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

DUPREE MUTUAL FUNDS

|

| Entity Central Index Key |

0000311101

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000032726 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Alabama Tax‑Free Income Series

|

| Class Name |

Alabama Tax‑Free Income Series

|

| Trading Symbol |

DUALX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Alabama Tax‑Free Income Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree‑funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree‑funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| Alabama Tax‑Free Income Series |

|

$ |

70 |

|

|

|

0.70% |

|

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

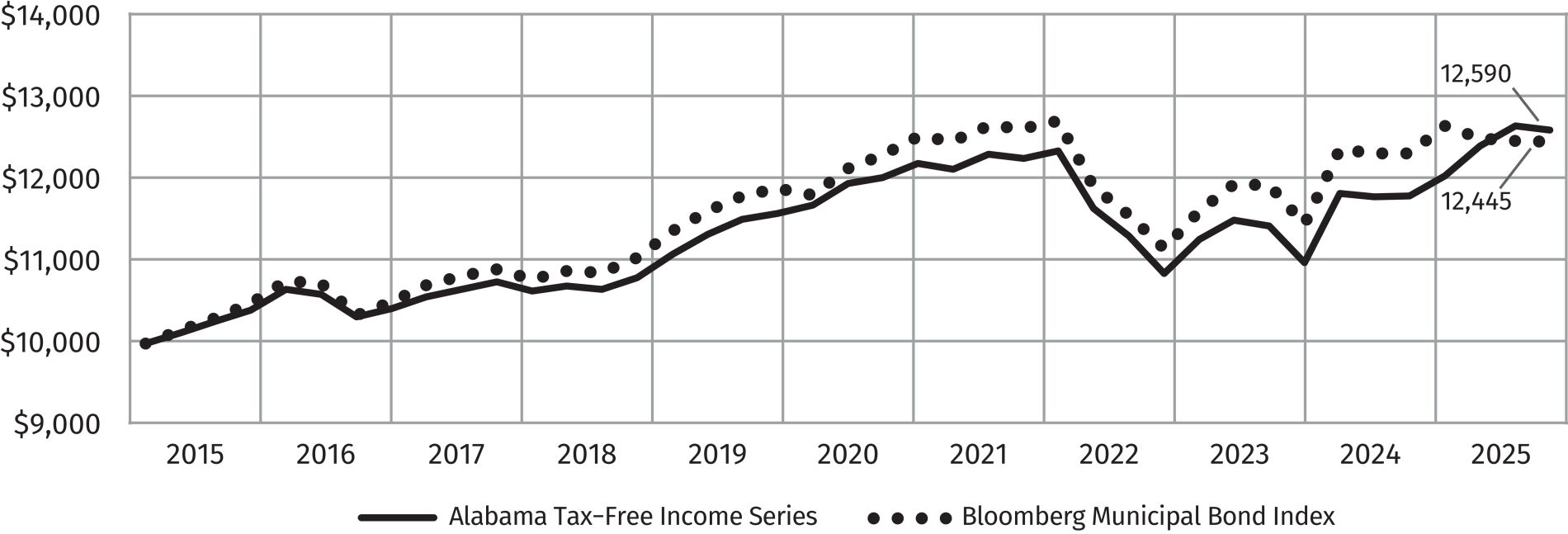

How did the Fund perform last year? Longer-dated municipal bonds generally underperformed shorter-dated municipal bonds during the 12‑month period ended June 30, 2025 (the “Review Period”). Shorter-dated bonds benefited from cuts to the fed funds rate, while yields on the long end of the yield curve climbed (lower prices) in response to an unexpected rebound in consumer-price inflation. The Fund provided a total return of ‑1.13% during the Review Period which was lower than the Bloomberg Municipal Bond Index (the “Muni Index”) which provided a total return of 1.11%. The Fund’s underperformance was primarily due to the fact that it had an average nominal maturity of 15.91 years versus 13.30 years for the Muni Index. Additionally, unlike the Fund, the Muni Index does not reflect any expenses and/or transaction costs. During the Review Period, the Fund’s use of its current investment strategies did not cause the Fund’s performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| Alabama Tax‑Free Income Series |

|

|

(1.13) |

% |

|

|

(0.50) |

% |

|

|

1.52 |

% |

| |

|

|

|

| Bloomberg Municipal Bond Index |

|

|

1.11 |

% |

|

|

0.51 |

% |

|

|

2.20 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 19,692,379

|

| Holdings Count | Holding |

70

|

| Advisory Fees Paid, Amount |

$ 69,740

|

| Investment Company Portfolio Turnover |

20.09%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

19,692,379 |

|

| |

|

| Total number of portfolio holdings |

|

|

70 |

|

| |

|

| Total advisory fees paid |

|

$ |

69,740 |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

20.09% |

|

|

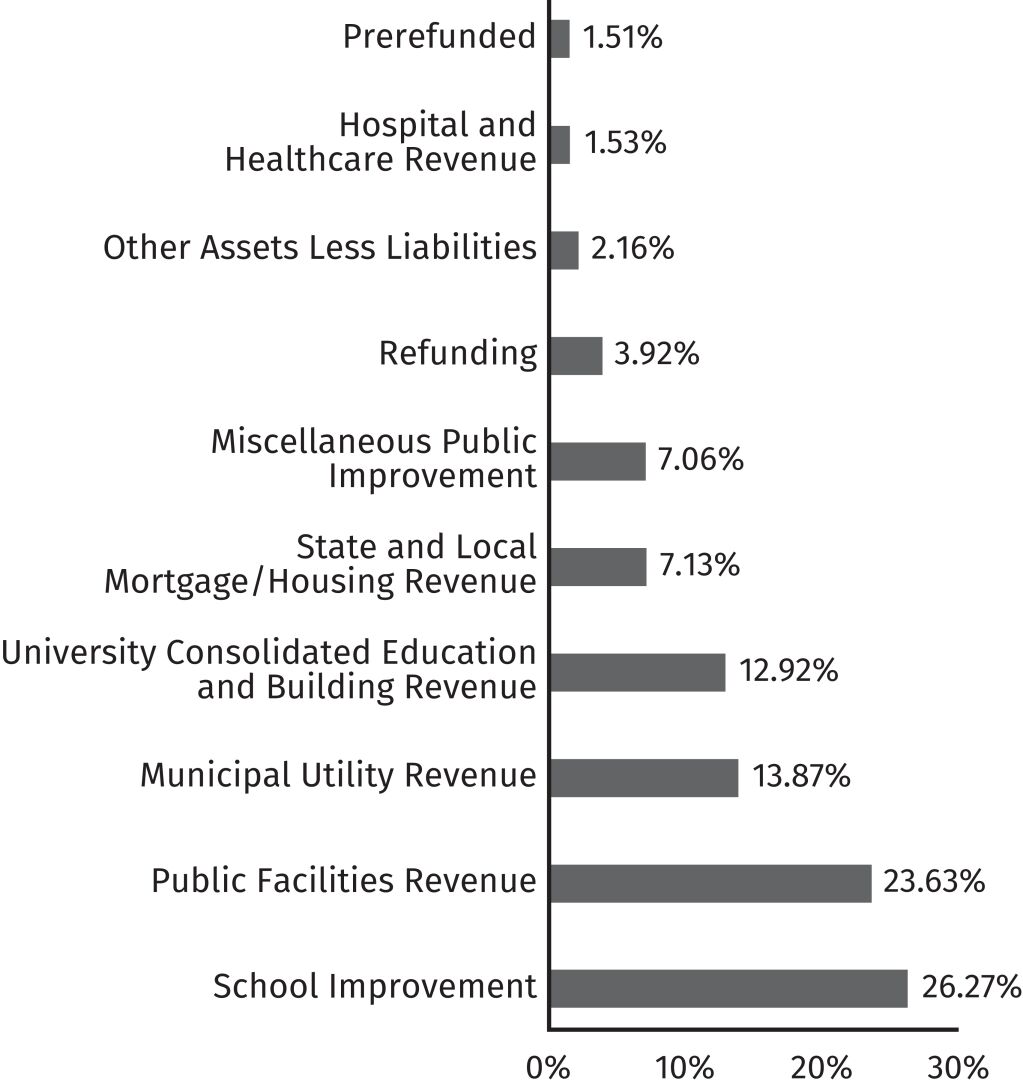

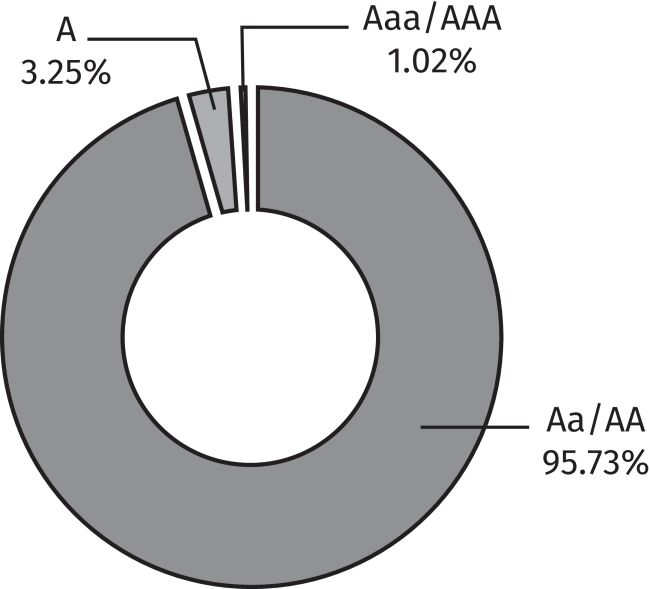

| Holdings [Text Block] |

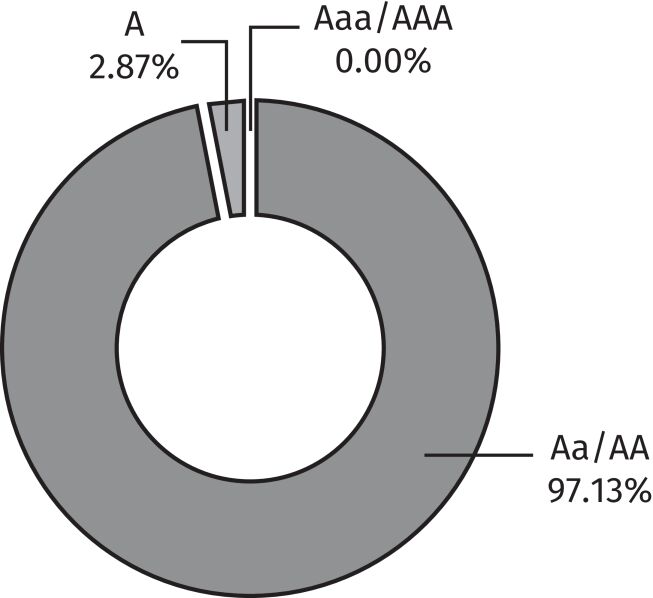

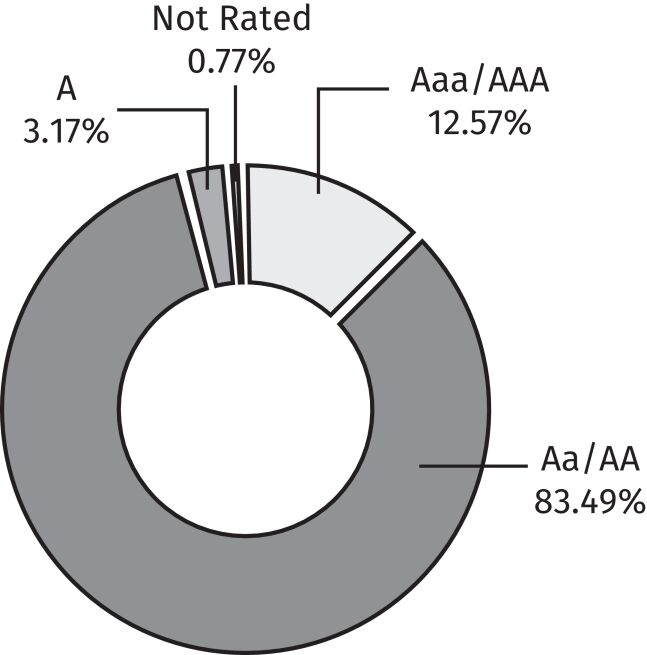

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments and/or total net assets of the Fund. Composition Credit Quality* Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|

| C000032727 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Kentucky Tax‑Free Income Series

|

| Class Name |

Kentucky Tax‑Free Income Series

|

| Trading Symbol |

KYTFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Kentucky Tax‑Free Income Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree-funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree-funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| Kentucky Tax‑Free Income Series |

|

$ |

61 |

|

|

|

0.61% |

|

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

0.61%

|

| Factors Affecting Performance [Text Block] |

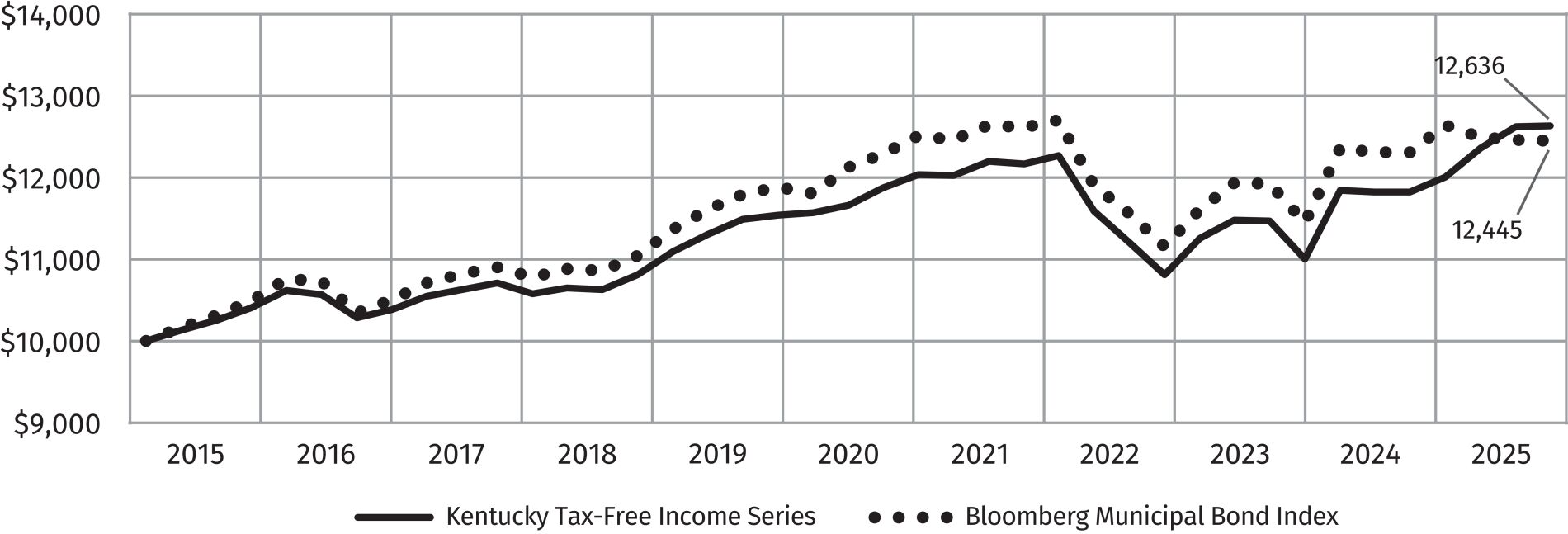

How did the Fund perform last year? Longer-dated municipal bonds generally underperformed shorter-dated bonds during the 12‑month period ended June 30, 2025 (the “Review Period”). Shorter-dated bonds benefited from cuts to the fed funds rate, while yields on the long end of the yield curve climbed (lower prices) in response to an unexpected rebound in consumer-price inflation. The Fund provided a total return of ‑0.18% during the Review Period which was lower than the Bloomberg Municipal Bond Index (“Muni Index”) which provided a total return of 1.11%. The Fund’s underperformance was primarily due to the fact that it had an average nominal maturity of 13.97 years versus 13.30 years for the Muni Index. Additionally, unlike the Fund, the Muni Index does not reflect any expenses and/or transaction costs. During the Review Period, the Fund’s use of its current investment strategies did not cause the Fund’s performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| Kentucky Tax‑Free Income Series |

|

|

(0.18) |

% |

|

|

0.23 |

% |

|

|

1.64 |

% |

| |

|

|

|

| Bloomberg Municipal Bond Index |

|

|

1.11 |

% |

|

|

0.51 |

% |

|

|

2.20 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 706,643,076

|

| Holdings Count | Holding |

411

|

| Advisory Fees Paid, Amount |

$ 2,907,238

|

| Investment Company Portfolio Turnover |

18.92%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

706,643,076 |

|

| |

|

| Total number of portfolio holdings |

|

|

411 |

|

| |

|

| Total advisory fees paid |

|

$ |

2,907,238 |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

18.92% |

|

|

| Holdings [Text Block] |

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments and/or total net assets of the Fund. Composition Credit Quality* Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective as of the close of business of May 16, 2025, the Kentucky Tax‑Free Short‑to‑Medium Series transferred all of its assets and liabilities to the Fund in exchange for shares of the Fund. Each shareholder in the Kentucky Tax‑Free Short‑to‑Medium Series received shares of the Fund equal to the value of the shares they owned in the Kentucky Tax‑Free Short‑to‑Medum Series.

|

| C000032729 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Mississippi Tax‑Free Income Series

|

| Class Name |

Mississippi Tax‑Free Income Series

|

| Trading Symbol |

DUMSX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Mississippi Tax‑Free Income Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree-funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree-funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| Mississippi Tax‑Free Income Series |

|

$ |

70 |

|

|

|

0.70% |

|

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? Longer-dated municipal bonds generally underperformed shorter-dated bonds during the 12‑month period ended June 30, 2025 (the “Review Period”). Shorter-dated bonds benefited from cuts to the fed funds rate, while yield on the long end of the yield curve climbed (lower prices) in response to an unexpected rebound in consumer-price inflation. The Fund provided a total return of 0.08% during the Review Period which was lower than the Bloomberg Municipal Bond Index (the “Muni Index”) which provided a total return of 1.11%.The underperformance of the Fund was due primarily to the fact that the Fund held had an average nominal maturity of 14.88 years versus 13.30 years for the Muni Index. Additionally, unlike the Fund, the Muni Index does not reflect any expenses and/or transaction costs. During the Review Period, the Fund’s use of its current investment strategy did not cause the Fund’s performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

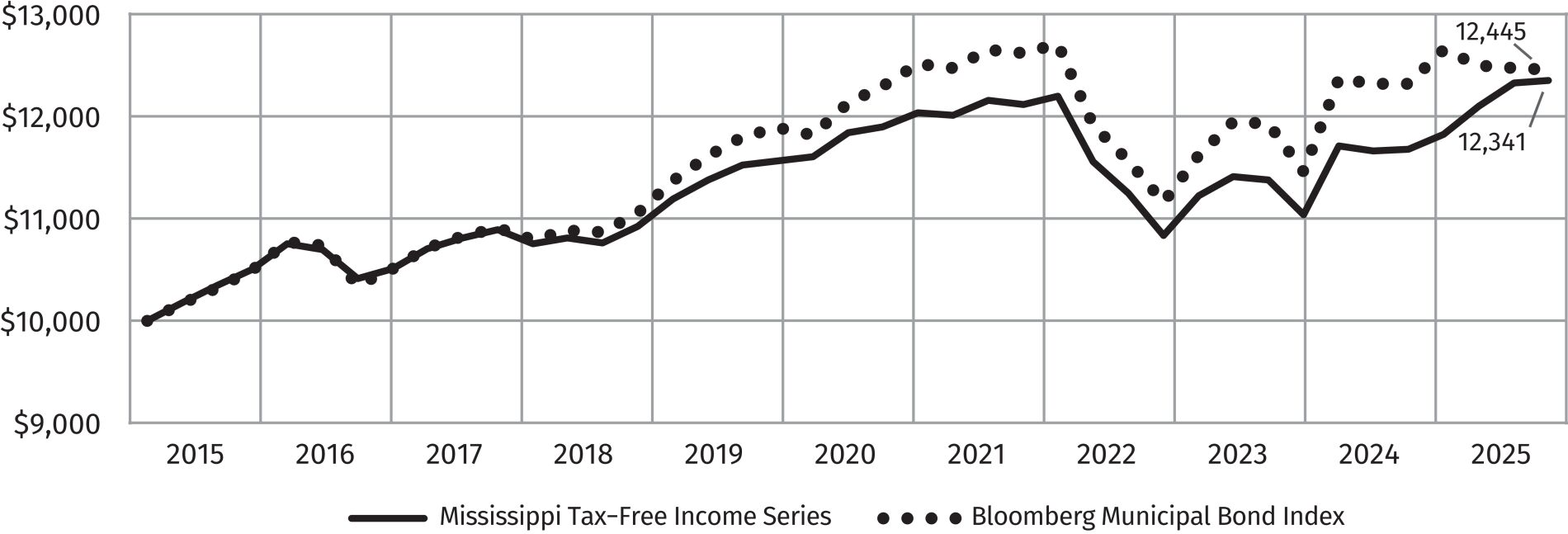

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| Mississippi Tax‑Free Income Series |

|

|

0.08 |

% |

|

|

(0.27) |

% |

|

|

1.54 |

% |

| |

|

|

|

| Bloomberg Municipal Bond Index |

|

|

1.11 |

% |

|

|

0.51 |

% |

|

|

2.20 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 4,510,744

|

| Holdings Count | Holding |

28

|

| Advisory Fees Paid, Amount |

$ 3,436

|

| Investment Company Portfolio Turnover |

10.08%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

4,510,744 |

|

| |

|

| Total number of portfolio holdings |

|

|

28 |

|

| |

|

| Total advisory fees paid |

|

$ |

3,436 |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

10.08% |

|

|

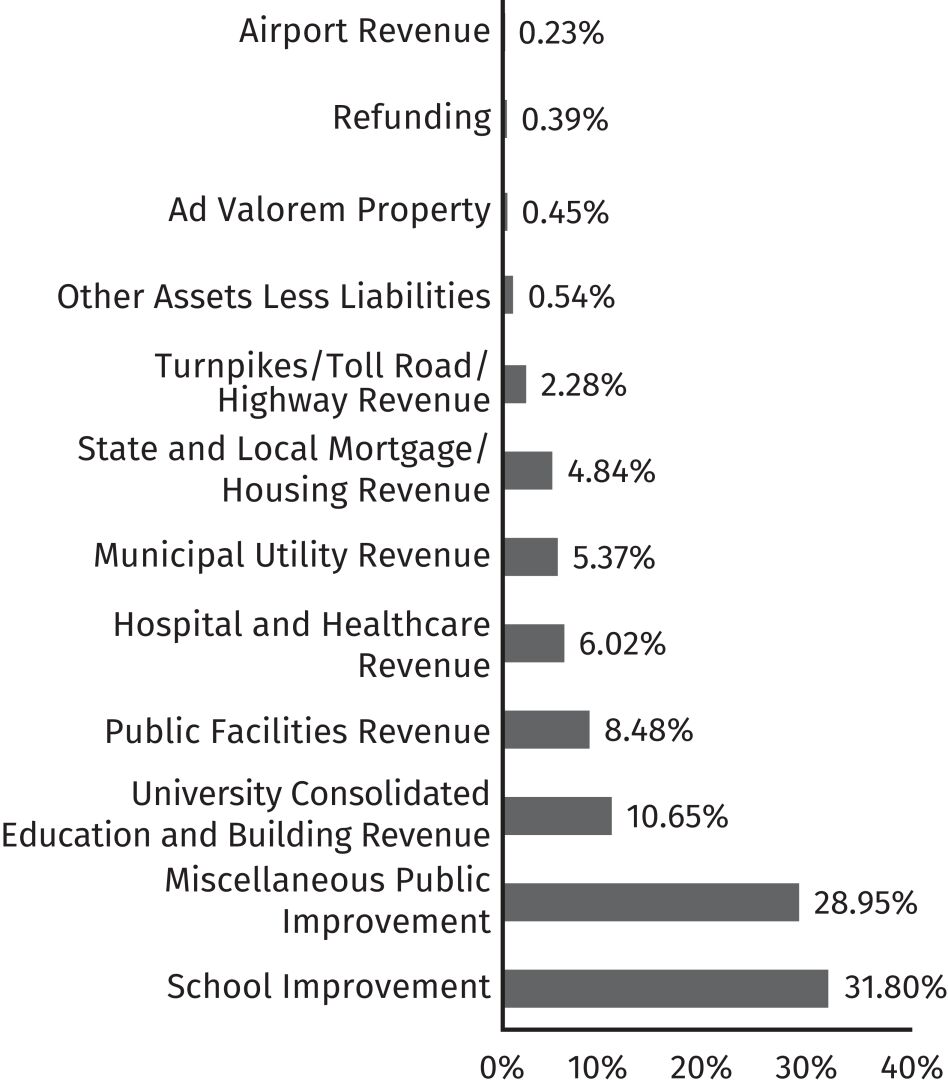

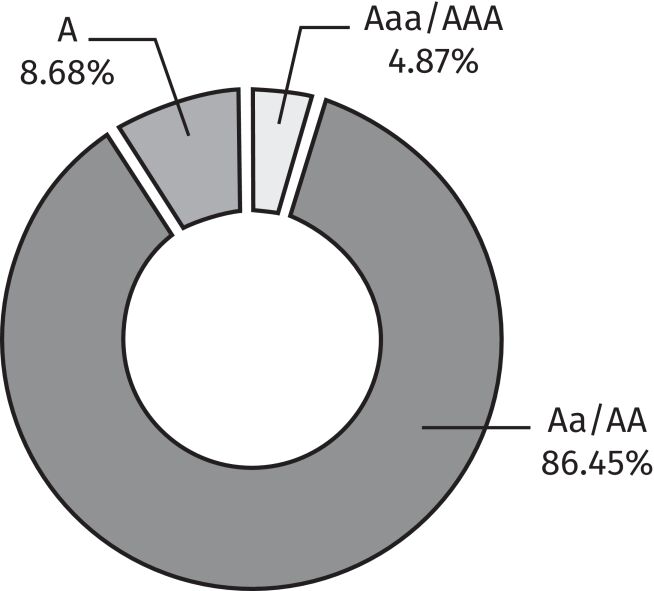

| Holdings [Text Block] |

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments and/or total net assets of the Fund. Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|

| C000032730 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

North Carolina Tax‑Free Income Series

|

| Class Name |

North Carolina Tax‑Free Income Series

|

| Trading Symbol |

NTFIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the North Carolina Tax‑Free Income Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree-funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree-funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund (Class) |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| North Carolina Tax‑Free Income Series |

|

$ |

70 |

|

|

|

0.70% |

|

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? Longer-dated municipal bonds generally underperformed shorter-dated bonds during the 12‑month period ended June 30, 2025 (the “Review Period”). Shorter-dated bonds benefited from cuts to the fed funds rate, while yields on the long end of the yield curve climbed (prices down) in response to an unexpected rebound in consumer-price inflation. The Fund provided a total return of 0.05% during the Review Period which was lower than the Bloomberg Municipal Bond Index (the “Muni Index”) which provided a total return of 1.11%. The underperformance of the Fund was due primarily to the fact that it had an average nominal maturity of 14.04 years versus 13.30 years for the Muni Index. Additionally, unlike the Fund, the Muni Index does not reflect any expenses and/or transaction costs. During the Review Period, the Fund’s use of its current investment strategy did not cause the Fund’s performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

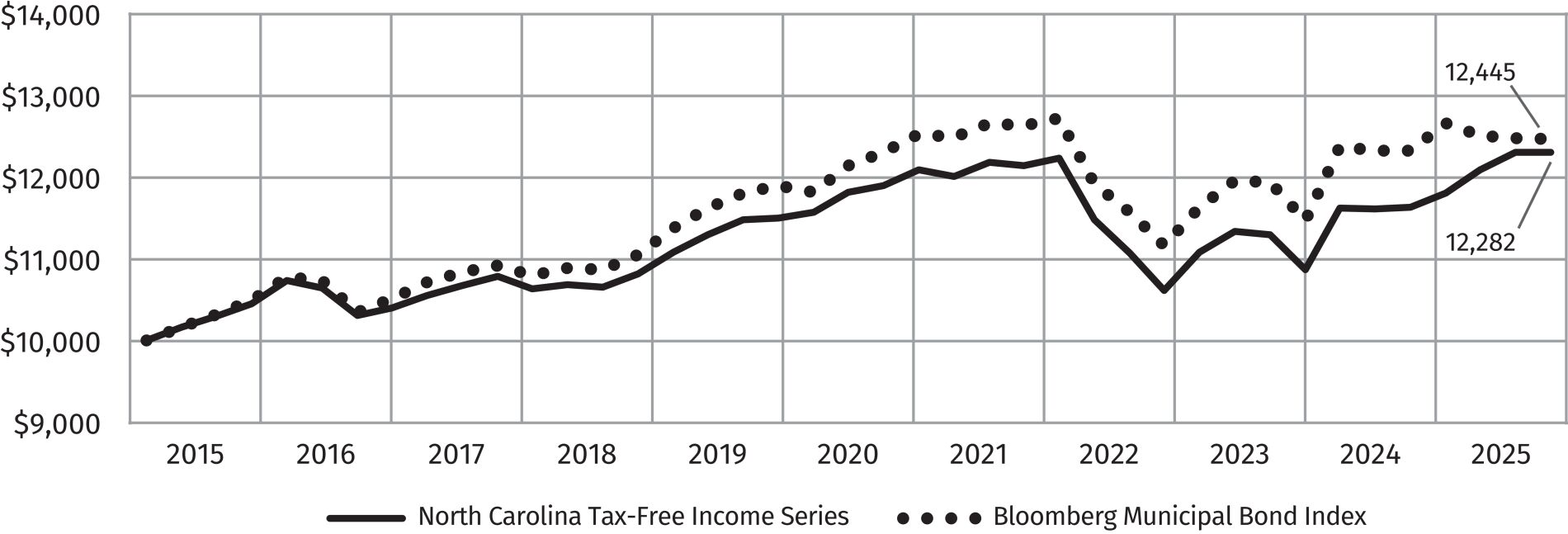

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| North Carolina Tax‑Free Income Series |

|

|

0.05 |

% |

|

|

(0.31) |

% |

|

|

1.49 |

% |

| |

|

|

|

| Bloomberg Municipal Bond Index |

|

|

1.11 |

% |

|

|

0.51 |

% |

|

|

2.20 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 110,020,439

|

| Holdings Count | Holding |

182

|

| Advisory Fees Paid, Amount |

$ 504,980

|

| Investment Company Portfolio Turnover |

23.38%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

110,020,439 |

|

| |

|

| Total number of portfolio holdings |

|

|

182 |

|

| |

|

| Total advisory fees paid |

|

$ |

504,980 |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

23.38% |

|

|

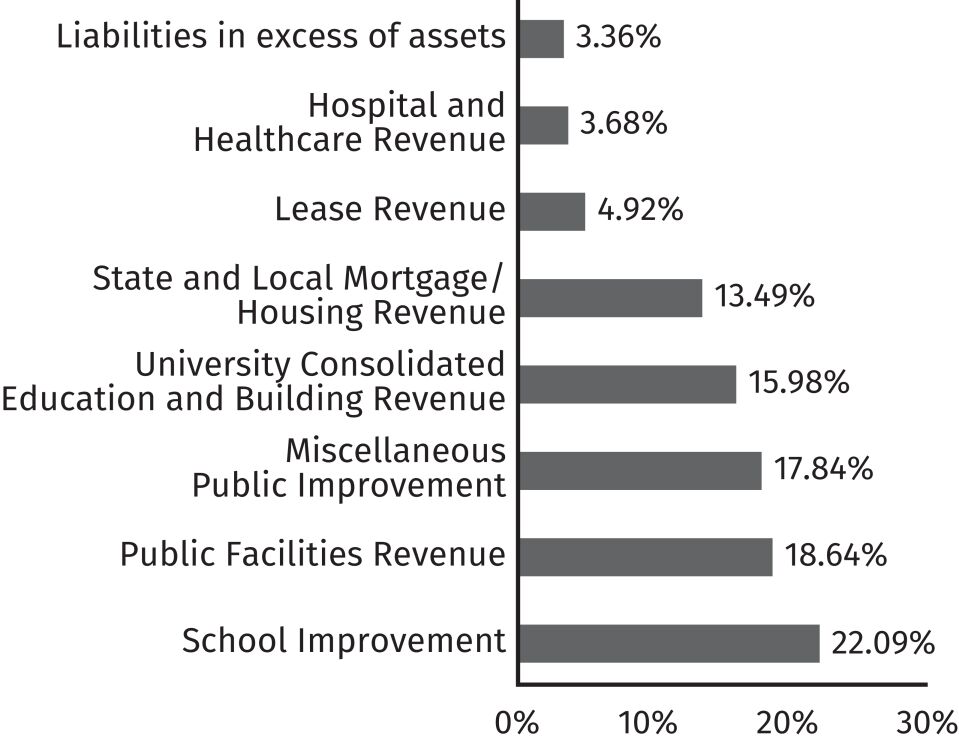

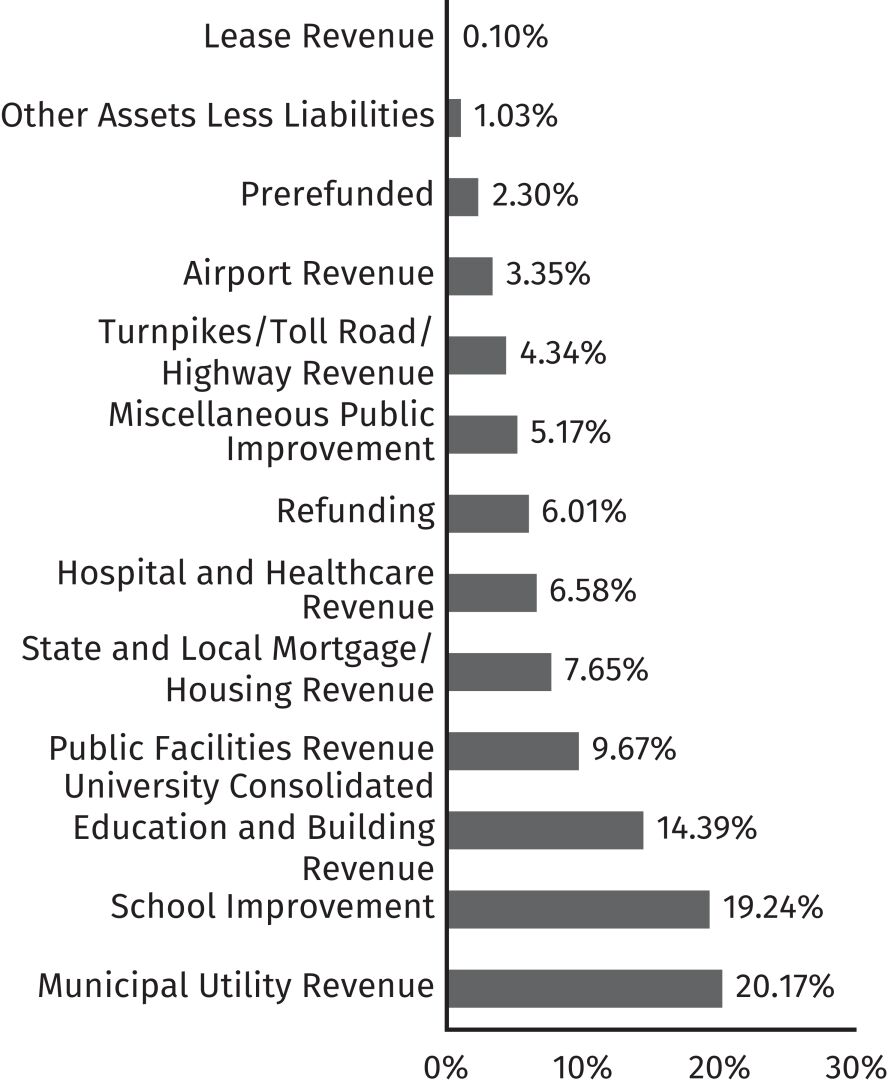

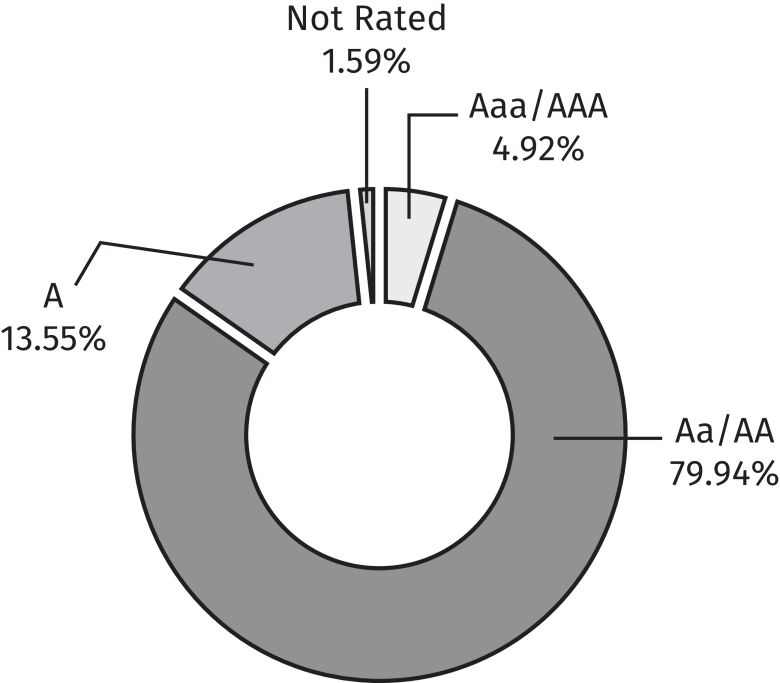

| Holdings [Text Block] |

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments and/or total net assets of the Fund. Composition Credit Quality* Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective as of the close of business of May 16, 2025, the North Carolina Tax‑Free Short‑to‑Medium Series transferred all of its assets and liabilities to the Fund in exchange for shares of the Fund. Each shareholder in the North Carolina Tax‑Free Short‑to‑Medium Series received shares of the Fund equal to the value of the shares they owned in the North Carolina Tax‑Free Short‑to‑Medum Series.

|

| C000032732 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Tennessee Tax‑Free Income Series

|

| Class Name |

Tennessee Tax‑Free Income Series

|

| Trading Symbol |

TNTIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Tennessee Tax‑Free Income Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree‑funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree‑funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| Tennessee Tax‑Free Income Series |

|

$ |

70 |

|

|

|

0.70% |

|

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? Longer-dated municipal bonds generally underperformed shorter-dated bonds during the 12‑month period ended June 30, 2025 (the “Review Period”). Shorter-dated bonds benefited from cuts to the fed funds rate, while yields on the long end of the yield curve climbed (lower prices) in response to an unexpected rebound in consumer-price inflation. The Fund provided a total return of ‑0.97% during the Review Period which was lower than the Bloomberg Municipal Bond Index (the “Muni Index”) which provided a total return of 1.11%. The underperformance of the Fund was primarily due to the fact that the Fund had an average nominal maturity of 14.93 years versus 13.30 years for the Muni Index. Additionally, unlike the Fund, the Muni Index does not reflect any expenses and/or transaction costs During the Review Period, the Fund’s use of its current investment strategy did not cause the Fund’s performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

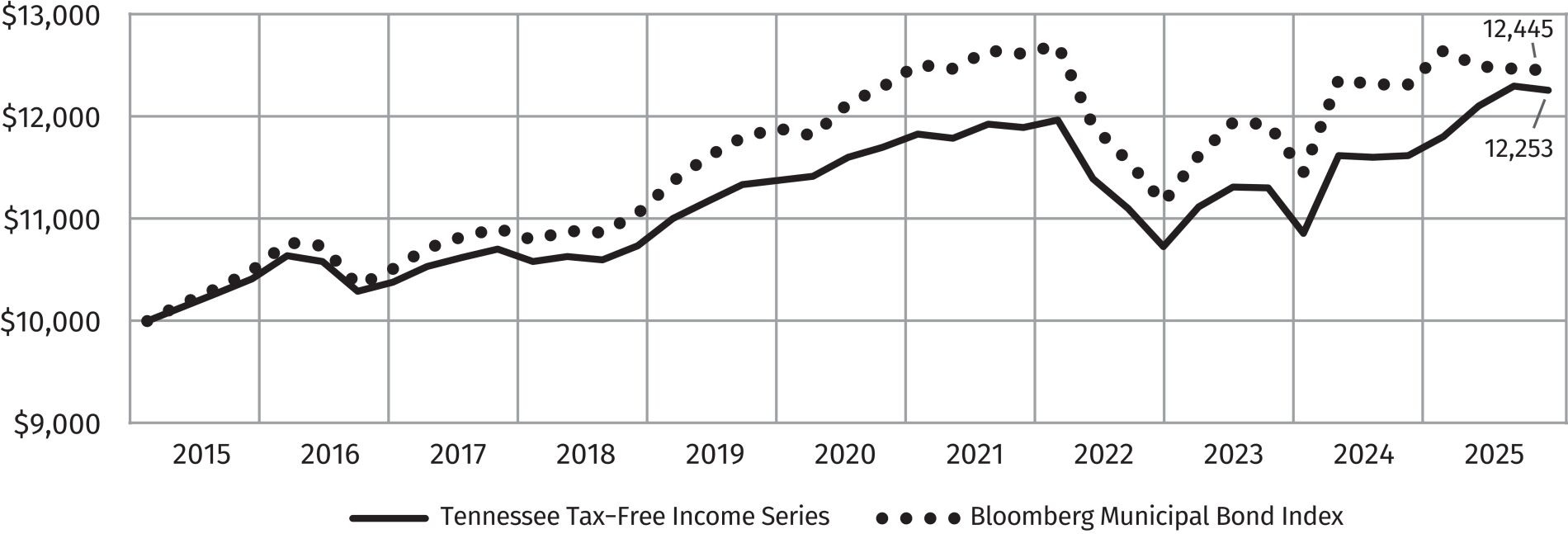

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| Tennessee Tax‑Free Income Series |

|

|

(0.97) |

% |

|

|

(0.17) |

% |

|

|

1.38 |

% |

| |

|

|

|

| Bloomberg Municipal Bond Index |

|

|

1.11 |

% |

|

|

0.51 |

% |

|

|

2.20 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 50,198,014

|

| Holdings Count | Holding |

78

|

| Advisory Fees Paid, Amount |

$ 220,385

|

| Investment Company Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

50,198,014 |

|

| |

|

| Total number of portfolio holdings |

|

|

78 |

|

| |

|

| Total advisory fees paid |

|

$ |

220,385 |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

24.00% |

|

|

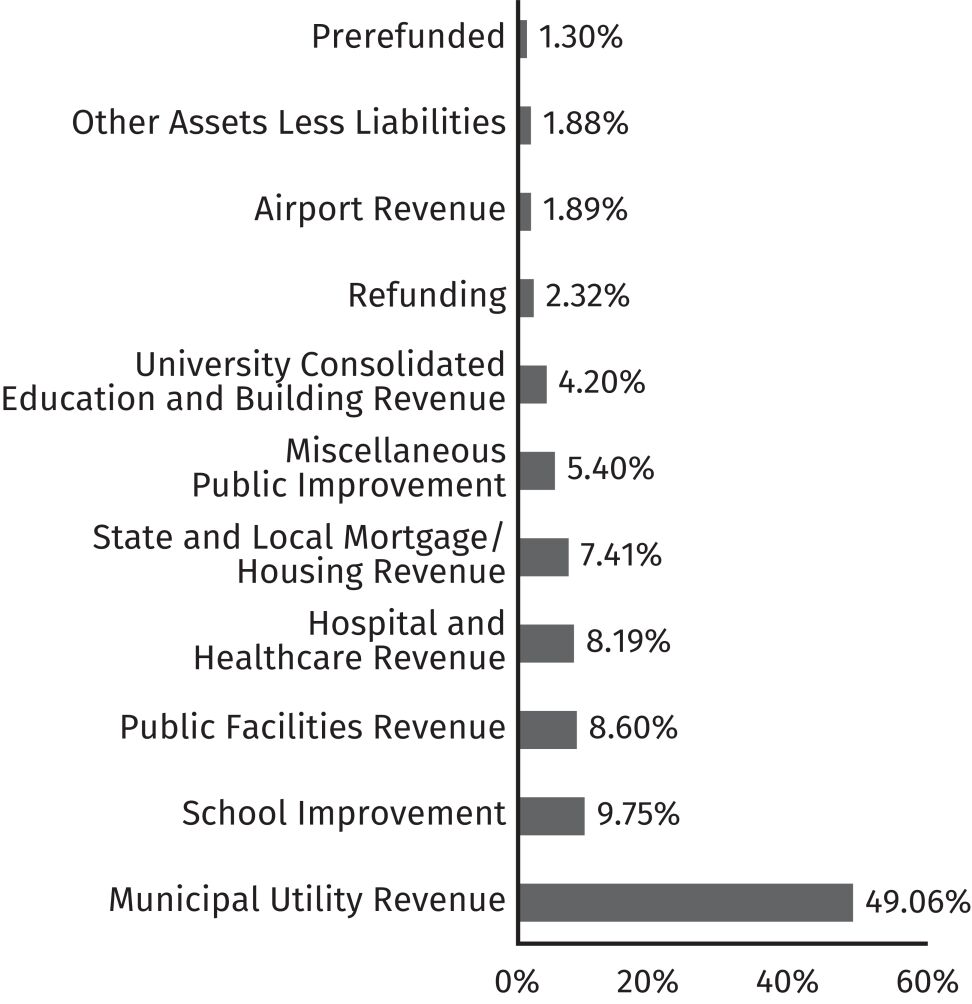

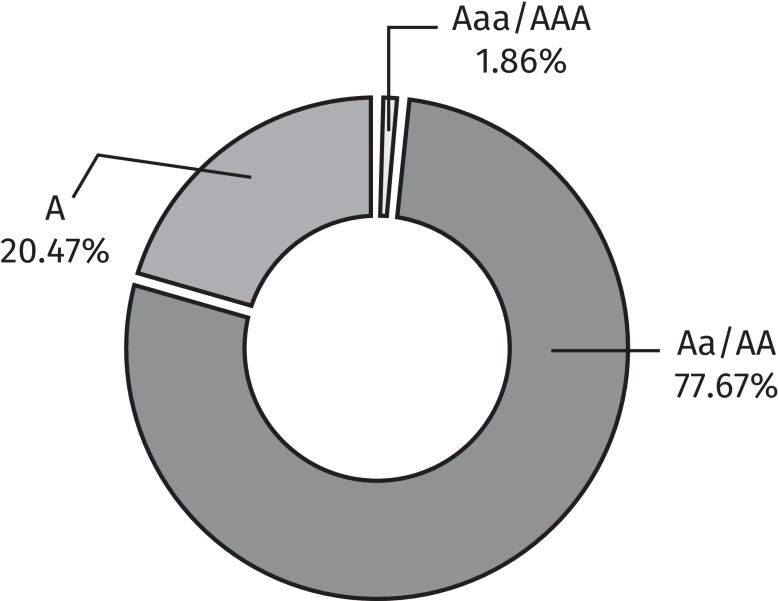

| Holdings [Text Block] |

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments and/or total net assets of the Fund. Composition Credit Quality* Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective as of the close of business of May 16, 2025, the Tennessee Tax‑Free Short‑to‑Medium Series transferred all of its assets and liabilities to the Fund in exchange for shares of the Fund. Each shareholder in the Tennessee Tax‑Free Short‑to‑Medium Series received shares of the Fund equal to the value of the shares they owned in the Tennessee Tax‑Free Short‑to‑Medum Series.

|

| C000032734 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Intermediate Government Bond Series

|

| Class Name |

Intermediate Government Bond Series

|

| Trading Symbol |

DPIGX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Intermediate Government Bond Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree-funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree-funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| Intermediate Government Bond Series |

|

$ |

70 |

|

|

|

0.70% |

|

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? The Federal Reserve cut the fed funds rate on three separate occasions during the 12‑month period ended June 30, 2025 (the “Review Period”) causing Treasury yields to decline (prices higher) on the short and intermediate portions of the yield curve. The Fund provided a total return of 4.86% during the Review Period which was lower than the Bloomberg Intermediate U.S. Government Bond Index (“Gov. Bond Index”) which provided a total return of 6.23%. The Fund’s underperformance was due primarily to the fact that it had a shorter duration of 2.28 years than the Gov Bond Index which had a duration of 3.54 years. Shorter-dated bonds which were anchored to par experienced less price appreciation than bonds with slightly longer durations. During the Review Period, the Fund’s use of its current management strategy did not cause the performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

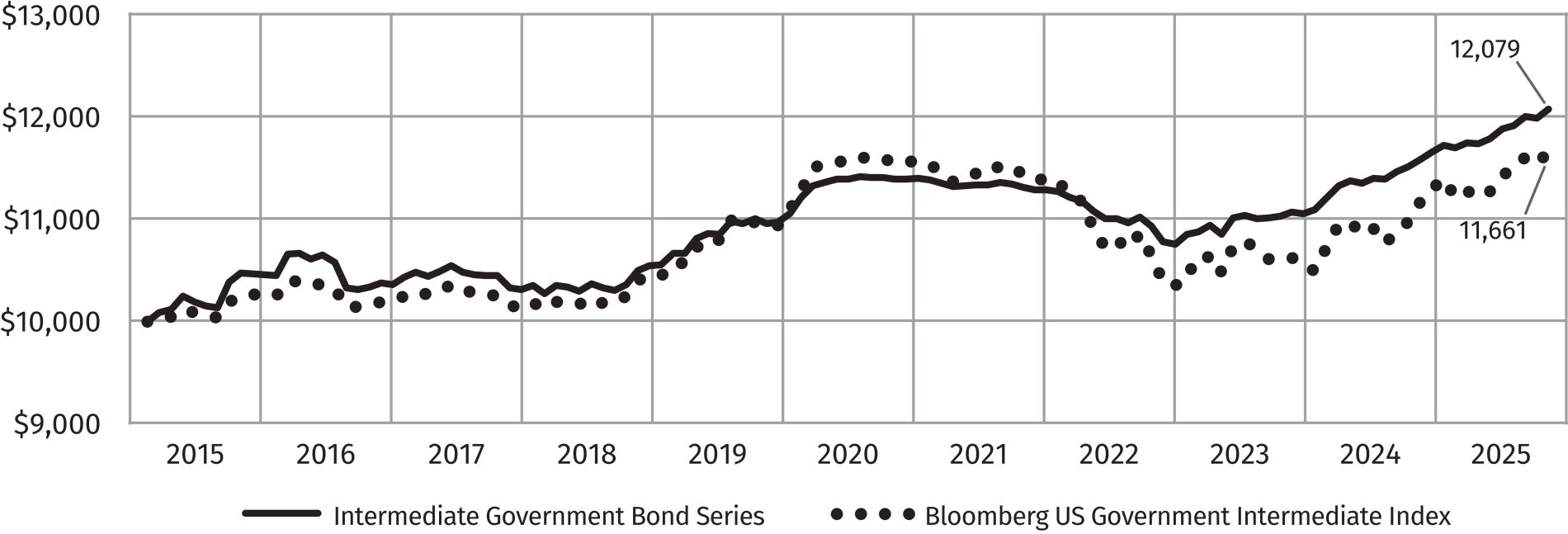

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| Intermediate Government Bond Series |

|

|

4.86 |

% |

|

|

1.16 |

% |

|

|

1.88 |

% |

| |

|

|

|

| Bloomberg Intermediate U.S. Government Bond Index |

|

|

6.23 |

% |

|

|

0.15 |

% |

|

|

1.55 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 8,482,244

|

| Holdings Count | Holding |

21

|

| Advisory Fees Paid, Amount |

$ 5,773

|

| Investment Company Portfolio Turnover |

80.78%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

8,482,244 |

|

| |

|

| Total number of portfolio holdings |

|

|

21 |

|

| |

|

| Total advisory fees paid |

|

$ |

5,773 |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

80.78% |

|

|

| Holdings [Text Block] |

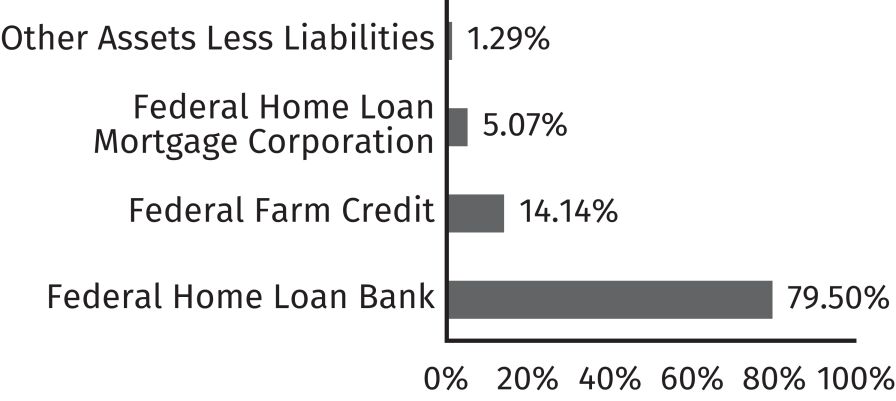

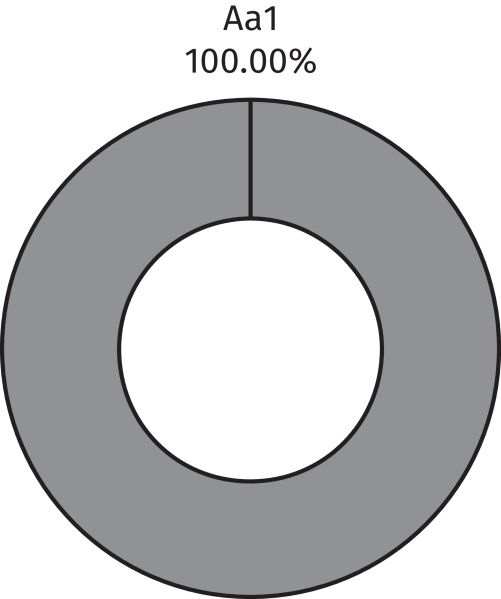

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Composition Credit Quality* Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|

| C000093320 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Taxable Municipal Bond Series

|

| Class Name |

Taxable Municipal Bond Series

|

| Trading Symbol |

DUTMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Taxable Municipal Bond Series (the “Fund”) for the period from July 1, 2024, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.dupree‑funds.com/documents. You can also request this information by contacting us at (800) 866‑0614 or info@dupree-funds.com.

|

| Additional Information Phone Number |

(800) 866‑0614

|

| Additional Information Email |

info@dupree-funds.com

|

| Additional Information Website |

www.dupree‑funds.com/documents

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment) The table below explains the costs that you would have paid within the reporting period.

|

|

|

|

|

|

|

|

|

| |

|

|

| Fund |

|

Costs of a $10,000 investment |

|

|

Costs paid as a percentage of a

$10,000 investment |

|

| |

|

|

| Taxable Municipal Bond Series |

|

$ |

70 |

|

|

|

0.70% |

|

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

0.70%

|

| Factors Affecting Performance [Text Block] |

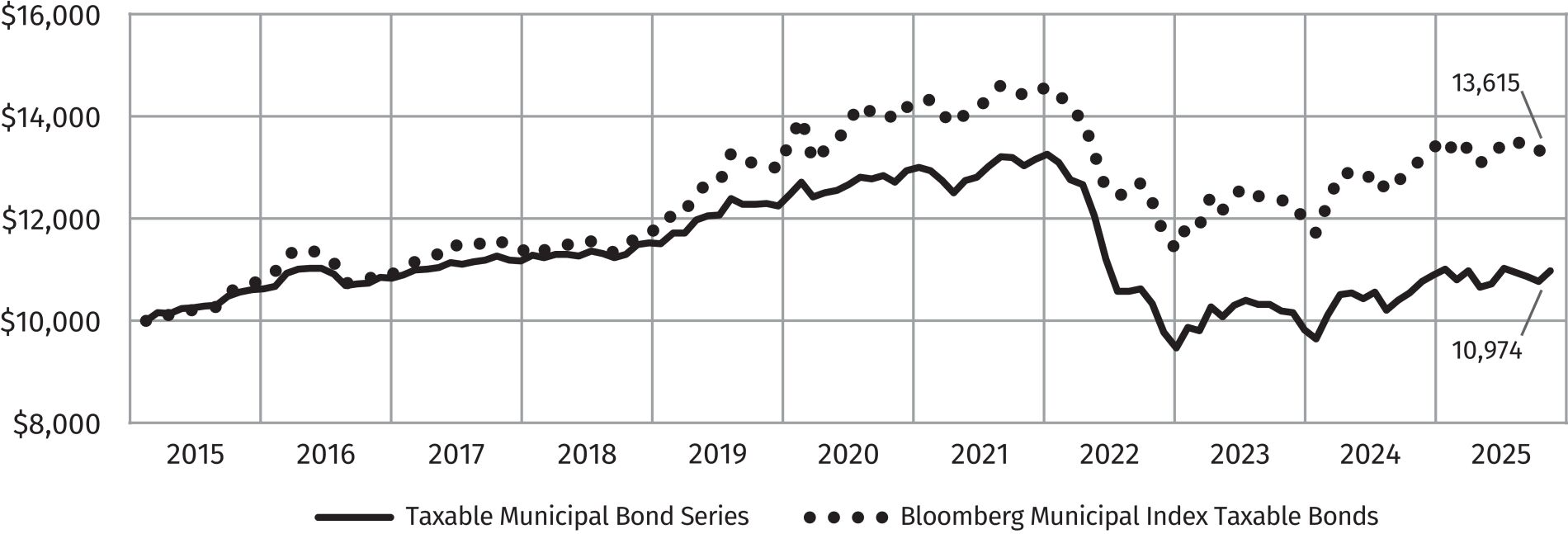

How did the Fund perform last year? Longer-dated taxable municipal bonds generally underperformed shorter-dated taxable municipal bonds during the 12‑month period ended June 30, 2025 (the “Review Period”). Shorter-dated bonds benefited from cuts to the fed funds rate, while yields on the long end of the yield curve climbed (lower prices) in response to an unexpected rebound in consumer-price inflation. The Fund provided a total return of 4.00% during the Review Period which was lower than the Bloomberg Taxable Municipal Bond Index (“Taxable Muni Index”) which provided a total return of 5.54%. The Fund’s underperformance was due primarily to the fact that it had an average nominal maturity of 18.27 years versus 14.12 years for the Taxable Muni Index. During the Review Period, the Fund’s use of its current investment strategy did not cause the performance to deviate materially from the manager’s expectations. We do not plan to change the investment strategy of the Fund substantially in the upcoming year.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

How has the Fund historically performed? The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate broad-based securities market index for the same period.

|

| Average Annual Return [Table Text Block] |

Average annual total return values (as of June 30, 2025):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| |

|

|

|

| Taxable Municipal Bond Series |

|

|

4.00 |

% |

|

|

(2.81) |

% |

|

|

0.91 |

% |

| |

|

|

|

| Bloomberg Taxable Municipal Bond Index |

|

|

5.51 |

% |

|

|

(0.43) |

% |

|

|

3.13 |

% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 3,385,865

|

| Holdings Count | Holding |

20

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

12.60%

|

| Additional Fund Statistics [Text Block] |

What are the Key Fund statistics you should know? The following table outlines key Fund statistics that you should pay attention to:

|

|

|

|

|

| |

|

| Fund’s net assets |

|

$ |

3,385,865 |

|

| |

|

| Total number of portfolio holdings |

|

|

20 |

|

| |

|

| Total advisory fees paid |

|

$ |

‑0‑ |

|

| |

|

| Portfolio turnover rate as of the end of year |

|

|

12.60% |

|

|

| Holdings [Text Block] |

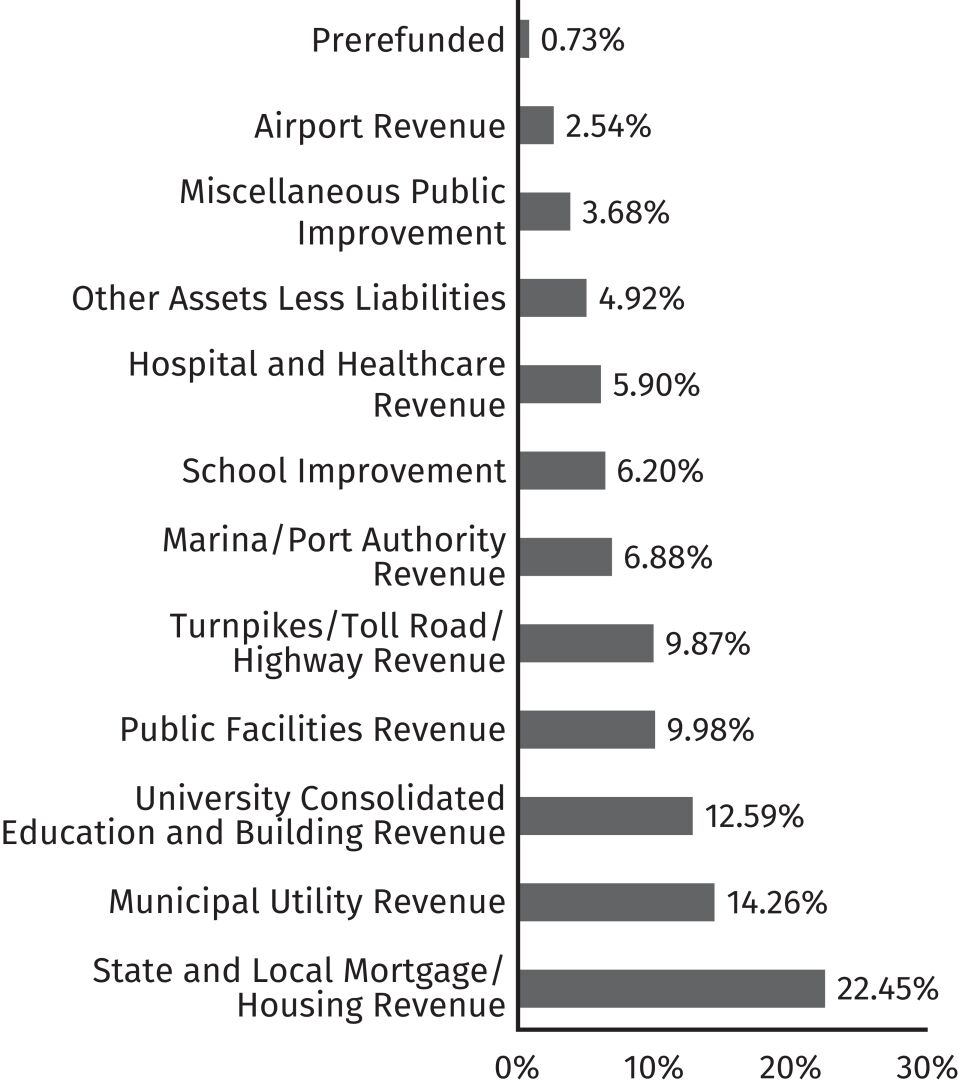

What is the Fund invested in? The tables and charts below show the investment makeup of the Fund, representing the percentage of total investments and/or total net assets of the Fund. Ratings have been assigned by a Nationally Recognized Statistical Rating Organization (“NRSRO”). See Schedules of Portfolio Investments for individual bond ratings. Visit our website at www.dupree-funds.com/documents.

|