Shareholder Report

|

|

6 Months Ended |

Jan. 01, 2025 |

Jun. 30, 2025

USD ($)

Holding

|

| Shareholder Report [Line Items] |

|

|

|

| Document Type |

|

|

N-CSRS

|

| Amendment Flag |

|

|

false

|

| Registrant Name |

|

|

Guardian Variable Products Trust

|

| Entity Central Index Key |

|

|

0001668512

|

| Entity Investment Company Type |

|

|

N-1A

|

| Document Period End Date |

|

|

Jun. 30, 2025

|

| C000223917 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Core Fixed Income VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Core Fixed Income VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Material Fund Change Notice [Text Block] |

|

|

This report describes Fund changes that occurred during the reporting period.

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Core Fixed Income VIP Fund |

$27 |

0.53%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 27

|

| Expense Ratio, Percent |

[1] |

|

0.53%

|

| Material Change Date |

|

Jan. 01, 2025

|

|

| AssetsNet |

|

|

$ 342,414,581

|

| Holdings Count | Holding |

|

|

221

|

| InvestmentCompanyPortfolioTurnover |

|

|

98.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$342,414,581 |

Total # of Portfolio Holdings |

221 |

Portfolio Turnover Rate |

98% | |

| Holdings [Text Block] |

|

|

Bond Sector Allocation(% of Total Net Assets)

U.S. Government Securities |

45.1 |

Corporate Bonds & Notes |

24.2 |

Agency Mortgage-Backed Securities |

19.8 |

Asset-Backed Securities |

8.9 |

Non-Agency Mortgage-Backed Securities |

3.7 |

Cash/Other Assets and Liabilities |

(1.7) |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

U.S. Treasury Notes, 4.125%, due 2/29/2032 |

14.0 |

U.S. Treasury Notes, 4.000%, due 2/28/2030 |

9.7 |

U.S. Treasury Bonds, 4.625%, due 11/15/2044 |

8.6 |

U.S. Treasury Notes, 4.625%, due 2/15/2035 |

5.0 |

U.S. Treasury Notes, 4.250%, due 2/15/2028 |

2.7 |

U.S. Treasury Bonds, 4.750%, due 2/15/2045 |

2.2 |

Uniform Mortgage-Backed Security, 2.000%, due 7/1/2054 |

1.9 |

U.S. Treasury Bonds, 4.625%, due 2/15/2055 |

1.6 |

Uniform Mortgage-Backed Security, 2.500%, due 7/1/2055 |

1.5 |

U.S. Treasury Bonds, 4.500%, due 11/15/2054 |

1.4 |

Total |

48.6 | |

| Material Fund Change [Text Block] |

|

|

What changes have occurred since the beginning of the reporting period? This is a summary of certain changes of the Fund since January 1, 2025. At a meeting of the Board of Trustees (the “Board”) of Guardian Variable Products Trust held on February 27, 2025, the Board considered and approved the appointment of FIAM LLC as the sub-adviser to the Fund, effective March 3, 2025. There were also related changes to the Fund’s principal investment strategies, principal risks, and portfolio managers. For more complete information, you may review the Fund’s Prospectus dated May 1, 2025. The Prospectus is available on the Trust’s website: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses/. Contract owners of variable life insurance policies may obtain a copy of the Prospectus by calling 1-888-GUARDIAN (1-888-482-7342). Contract owners of variable annuity contracts may obtain a copy of the Prospectus by calling 1-800-830-4147. |

| Material Fund Change Adviser [Text Block] |

|

|

At a meeting of the Board of Trustees (the “Board”) of Guardian Variable Products Trust held on February 27, 2025, the Board considered and approved the appointment of FIAM LLC as the sub-adviser to the Fund, effective March 3, 2025.

|

| Summary of Change Legend [Text Block] |

|

|

This is a summary of certain changes of the Fund since January 1, 2025.

|

| C000169892 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Core Plus Fixed Income VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Core Plus Fixed Income VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Core Plus Fixed Income VIP Fund |

$41 |

0.81%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 41

|

| Expense Ratio, Percent |

[2] |

|

0.81%

|

| AssetsNet |

|

|

$ 150,359,381

|

| Holdings Count | Holding |

|

|

444

|

| InvestmentCompanyPortfolioTurnover |

|

|

67.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$150,359,381 |

Total # of Portfolio Holdings |

444 |

Portfolio Turnover Rate |

67% | |

| Holdings [Text Block] |

|

|

Bond Sector Allocation(% of Total Net Assets)

Corporate Bonds & Notes |

43.7 |

Agency Mortgage-Backed Securities |

31.1 |

Asset-Backed Securities |

15.9 |

U.S. Government Securities |

15.3 |

Non-Agency Mortgage-Backed Securities |

10.1 |

Senior Secured Loans |

2.2 |

Foreign Government |

0.3 |

Cash/Other Assets and Liabilities |

(18.6) |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

U.S. Treasury Bonds, 4.500%, due 11/15/2054 |

4.0 |

U.S. Treasury Bonds, 4.625%, due 11/15/2044 |

2.8 |

U.S. Treasury Notes, 3.750%, due 4/30/2027 |

2.4 |

U.S. Treasury Bonds, 4.750%, due 2/15/2045 |

2.0 |

U.S. Treasury Notes, 4.000%, due 3/31/2030 |

2.0 |

Uniform Mortgage-Backed Security, 5.500%, due 8/1/2039 |

2.0 |

Government National Mortgage Association, 5.500%, due 7/20/2054 |

1.9 |

Government National Mortgage Association, 6.000%, due 7/20/2054 |

1.6 |

U.S. Treasury Bonds, 3.375%, due 8/15/2042 |

1.4 |

Uniform Mortgage-Backed Security, 2.500%, due 8/1/2054 |

1.3 |

Total |

21.4 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169895 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Diversified Research VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Diversified Research VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Diversified Research VIP Fund |

$49 |

0.96%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 49

|

| Expense Ratio, Percent |

[3] |

|

0.96%

|

| AssetsNet |

|

|

$ 108,388,055

|

| Holdings Count | Holding |

|

|

132

|

| InvestmentCompanyPortfolioTurnover |

|

|

49.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$108,388,055 |

Total # of Portfolio Holdings |

132 |

Portfolio Turnover Rate |

49% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Information Technology |

32.0 |

Financials |

13.9 |

Communication Services |

10.5 |

Health Care |

9.4 |

Consumer Discretionary |

9.3 |

Industrials |

7.4 |

Consumer Staples |

5.5 |

Energy |

3.3 |

Materials |

3.0 |

Utilities |

2.7 |

Real Estate |

2.1 |

Cash/Other Assets and Liabilities |

0.9 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Microsoft Corp. |

7.8 |

NVIDIA Corp. |

7.3 |

Amazon.com, Inc. |

4.9 |

Apple, Inc. |

4.3 |

Meta Platforms, Inc., Class A |

3.7 |

Alphabet, Inc., Class A |

3.2 |

Broadcom, Inc. |

3.2 |

Cisco Systems, Inc. |

1.9 |

Tesla, Inc. |

1.9 |

Mastercard, Inc., Class A |

1.8 |

Total |

40.0 | |

| Material Fund Change [Text Block] |

|

|

|

| C000200218 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Global Utilities VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Global Utilities VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Global Utilities VIP Fund |

$57 |

1.07%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 57

|

| Expense Ratio, Percent |

[4] |

|

1.07%

|

| AssetsNet |

|

|

$ 45,509,507

|

| Holdings Count | Holding |

|

|

27

|

| InvestmentCompanyPortfolioTurnover |

|

|

19.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$45,509,507 |

Total # of Portfolio Holdings |

27 |

Portfolio Turnover Rate |

19% | |

| Holdings [Text Block] |

|

|

Geographic Region/Country Allocation (% of Total Net Assets)

North America |

60.1 |

Europe |

23.9 |

Asia-Pacific |

6.4 |

United Kingdom |

4.6 |

South America |

3.7 |

Cash/Other Assets and Liabilities |

1.3 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

NextEra Energy, Inc. |

6.4 |

American Electric Power Co., Inc. |

6.4 |

E.ON SE |

6.2 |

Engie SA |

5.8 |

Sempra |

5.7 |

Iberdrola SA |

5.5 |

Enel SpA |

5.1 |

National Grid PLC |

4.6 |

Dominion Energy, Inc. |

4.6 |

Atmos Energy Corp. |

4.4 |

Total |

54.7 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169897 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Growth & Income VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Growth & Income VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Growth & Income VIP Fund |

$49 |

0.97%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 49

|

| Expense Ratio, Percent |

[5] |

|

0.97%

|

| AssetsNet |

|

|

$ 101,416,112

|

| Holdings Count | Holding |

|

|

74

|

| InvestmentCompanyPortfolioTurnover |

|

|

26.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$101,416,112 |

Total # of Portfolio Holdings |

74 |

Portfolio Turnover Rate |

26% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Financials |

23.1 |

Health Care |

18.0 |

Industrials |

17.1 |

Consumer Staples |

9.0 |

Information Technology |

8.7 |

Consumer Discretionary |

6.6 |

Energy |

6.2 |

Communication Services |

5.9 |

Materials |

2.8 |

Real Estate |

1.0 |

Cash/Other Assets and Liabilities |

1.6 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

JPMorgan Chase & Co. |

4.3 |

Berkshire Hathaway, Inc., Class B |

3.9 |

Philip Morris International, Inc. |

3.8 |

Johnson & Johnson |

3.7 |

Walmart, Inc. |

3.3 |

RTX Corp. |

3.2 |

Texas Instruments, Inc. |

2.6 |

S&P Global, Inc. |

2.5 |

EOG Resources, Inc. |

2.5 |

Fiserv, Inc. |

2.2 |

Total |

32.0 | |

| Material Fund Change [Text Block] |

|

|

|

| C000219765 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian All Cap Core VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian All Cap Core VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian All Cap Core VIP Fund |

$43 |

0.84%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 43

|

| Expense Ratio, Percent |

[6] |

|

0.84%

|

| AssetsNet |

|

|

$ 239,447,224

|

| Holdings Count | Holding |

|

|

179

|

| InvestmentCompanyPortfolioTurnover |

|

|

28.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$239,447,224 |

Total # of Portfolio Holdings |

179 |

Portfolio Turnover Rate |

28% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Information Technology |

28.5 |

Financials |

14.0 |

Industrials |

12.5 |

Consumer Discretionary |

11.0 |

Health Care |

10.3 |

Communication Services |

9.1 |

Consumer Staples |

4.6 |

Energy |

3.1 |

Real Estate |

2.2 |

Utilities |

2.2 |

Materials |

2.1 |

Cash/Other Assets and Liabilities |

0.4 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Microsoft Corp. |

7.2 |

Amazon.com, Inc. |

4.7 |

NVIDIA Corp. |

4.0 |

Meta Platforms, Inc., Class A |

3.2 |

Apple, Inc. |

3.1 |

Alphabet, Inc., Class A |

2.9 |

Broadcom, Inc. |

2.8 |

JPMorgan Chase & Co. |

2.1 |

Mastercard, Inc., Class A |

1.7 |

TransUnion |

1.5 |

Total |

33.2 | |

| Material Fund Change [Text Block] |

|

|

|

| C000219766 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Balanced Allocation VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Balanced Allocation VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Balanced Allocation VIP Fund |

$46 |

0.91%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 46

|

| Expense Ratio, Percent |

[7] |

|

0.91%

|

| AssetsNet |

|

|

$ 212,889,597

|

| Holdings Count | Holding |

|

|

383

|

| InvestmentCompanyPortfolioTurnover |

|

|

87.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$212,889,597 |

Total # of Portfolio Holdings |

383 |

Portfolio Turnover Rate |

87% | |

| Holdings [Text Block] |

|

|

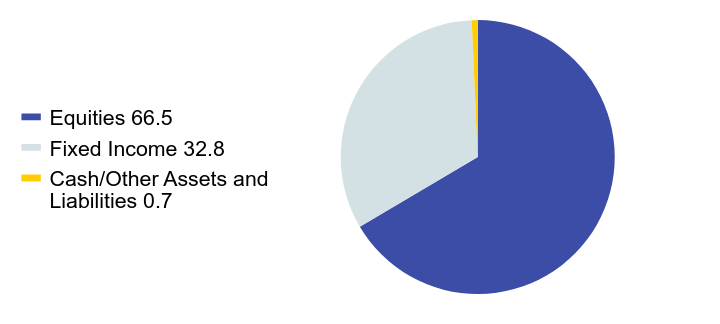

Portfolio Composition (% of Total Net Assets)

Value |

Value |

Equities |

66.5 |

Fixed Income |

32.8 |

Cash/Other Assets and Liabilities |

0.7 | Top Ten Holdings(% of Total Net Assets)

NVIDIA Corp. |

5.8 |

Microsoft Corp. |

4.9 |

Amazon.com, Inc. |

3.8 |

Meta Platforms, Inc., Class A |

2.7 |

Wells Fargo & Co. |

2.7 |

Broadcom, Inc. |

2.4 |

Alphabet, Inc., Class A |

2.4 |

Philip Morris International, Inc. |

2.1 |

Sempra |

1.9 |

Apple, Inc. |

1.8 |

Total |

30.5 | Bond Sector Allocation(% of Total Net Assets)

U.S. Government Securities |

15.6 |

Agency Mortgage-Backed Securities |

8.5 |

Corporate Bonds & Notes |

7.0 |

Asset-Backed Securities |

1.2 |

Non-Agency Mortgage-Backed Securities |

0.8 |

Exchange-Traded Funds |

0.5 |

Municipals |

0.3 |

Foreign Government |

0.3 |

Agency Mortgage-Backed Securities TBA Sale Commitments |

(1.4) |

Cash/Other Assets and Liabilities |

0.7 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Equity Sector Allocation (% of Total Net Assets)

Information Technology |

21.2 |

Financials |

9.2 |

Communication Services |

8.2 |

Consumer Discretionary |

7.9 |

Health Care |

6.5 |

Industrials |

3.9 |

Consumer Staples |

3.0 |

Energy |

2.3 |

Utilities |

1.9 |

Materials |

1.6 |

Real Estate |

0.8 | |

| Material Fund Change [Text Block] |

|

|

|

| C000223918 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Equity Income VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Equity Income VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Equity Income VIP Fund |

$30 |

0.58%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 30

|

| Expense Ratio, Percent |

[8] |

|

0.58%

|

| AssetsNet |

|

|

$ 926,918,284

|

| Holdings Count | Holding |

|

|

71

|

| InvestmentCompanyPortfolioTurnover |

|

|

158.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$926,918,284 |

Total # of Portfolio Holdings |

71 |

Portfolio Turnover Rate |

158% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Financials |

19.2 |

Health Care |

14.5 |

Industrials |

13.2 |

Consumer Staples |

9.5 |

Information Technology |

9.1 |

Energy |

8.8 |

Utilities |

8.6 |

Real Estate |

6.0 |

Materials |

5.0 |

Consumer Discretionary |

4.0 |

Communication Services |

0.9 |

Cash/Other Assets and Liabilities |

1.2 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Bank of America Corp. |

3.1 |

Johnson & Johnson |

2.7 |

JPMorgan Chase & Co. |

2.6 |

UnitedHealth Group, Inc. |

2.5 |

ConocoPhillips |

2.3 |

Merck & Co., Inc. |

2.2 |

PACCAR, Inc. |

2.0 |

American International Group, Inc. |

2.0 |

Gilead Sciences, Inc. |

1.9 |

Unilever PLC, ADR |

1.8 |

Total |

23.1 | |

| Material Fund Change [Text Block] |

|

|

|

| C000219767 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Select Mid Cap Core VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Select Mid Cap Core VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Select Mid Cap Core VIP Fund |

$48 |

0.96%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 48

|

| Expense Ratio, Percent |

[9] |

|

0.96%

|

| AssetsNet |

|

|

$ 179,730,111

|

| Holdings Count | Holding |

|

|

203

|

| InvestmentCompanyPortfolioTurnover |

|

|

32.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$179,730,111 |

Total # of Portfolio Holdings |

203 |

Portfolio Turnover Rate |

32% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Industrials |

22.3 |

Financials |

17.8 |

Consumer Discretionary |

12.9 |

Information Technology |

11.6 |

Health Care |

8.4 |

Real Estate |

6.8 |

Materials |

5.8 |

Consumer Staples |

5.2 |

Energy |

3.7 |

Utilities |

2.8 |

Communication Services |

1.2 |

Government |

0.2 |

Cash/Other Assets and Liabilities |

1.3 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Howmet Aerospace, Inc. |

1.7 |

Bancorp, Inc. |

1.6 |

HEICO Corp., Class A |

1.5 |

Popular, Inc. |

1.5 |

XPO, Inc. |

1.4 |

American Financial Group, Inc. |

1.3 |

Carlisle Cos., Inc. |

1.3 |

ITT, Inc. |

1.1 |

Esab Corp. |

1.1 |

Masimo Corp. |

1.1 |

Total |

13.6 | |

| Material Fund Change [Text Block] |

|

|

|

| C000219768 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Small-Mid Cap Core VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Small-Mid Cap Core VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Small-Mid Cap Core VIP Fund |

$51 |

1.04%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 51

|

| Expense Ratio, Percent |

[10] |

|

1.04%

|

| AssetsNet |

|

|

$ 230,413,289

|

| Holdings Count | Holding |

|

|

74

|

| InvestmentCompanyPortfolioTurnover |

|

|

42.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$230,413,289 |

Total # of Portfolio Holdings |

74 |

Portfolio Turnover Rate |

42% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Industrials |

24.4 |

Financials |

19.7 |

Information Technology |

16.6 |

Consumer Discretionary |

12.1 |

Health Care |

9.7 |

Materials |

7.3 |

Real Estate |

6.0 |

Energy |

2.6 |

Consumer Staples |

1.3 |

Cash/Other Assets and Liabilities |

0.3 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Marvell Technology, Inc. |

2.6 |

Air Lease Corp. |

2.5 |

Carlisle Cos., Inc. |

2.2 |

National Vision Holdings, Inc. |

2.2 |

QXO, Inc. |

2.0 |

API Group Corp. |

1.9 |

Dynatrace, Inc. |

1.9 |

WNS Holdings Ltd. |

1.9 |

HealthEquity, Inc. |

1.9 |

Planet Fitness, Inc., Class A |

1.8 |

Total |

20.9 | |

| Material Fund Change [Text Block] |

|

|

|

| C000219769 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Strategic Large Cap Core VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Strategic Large Cap Core VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Strategic Large Cap Core VIP Fund |

$47 |

0.92%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 47

|

| Expense Ratio, Percent |

[11] |

|

0.92%

|

| AssetsNet |

|

|

$ 197,459,109

|

| Holdings Count | Holding |

|

|

84

|

| InvestmentCompanyPortfolioTurnover |

|

|

22.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$197,459,109 |

Total # of Portfolio Holdings |

84 |

Portfolio Turnover Rate |

22% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Information Technology |

33.2 |

Financials |

16.8 |

Industrials |

11.0 |

Health Care |

10.1 |

Consumer Discretionary |

9.2 |

Communication Services |

8.1 |

Consumer Staples |

5.3 |

Utilities |

2.6 |

Energy |

1.9 |

Real Estate |

0.9 |

Cash/Other Assets and Liabilities |

0.9 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Microsoft Corp. |

8.6 |

Apple, Inc. |

4.3 |

Broadcom, Inc. |

3.4 |

NVIDIA Corp. |

3.2 |

Alphabet, Inc., Class C |

2.8 |

Amazon.com, Inc. |

2.7 |

Meta Platforms, Inc., Class A |

2.4 |

Visa, Inc., Class A |

2.2 |

Intuit, Inc. |

2.0 |

McKesson Corp. |

1.9 |

Total |

33.5 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169894 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Integrated Research VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Integrated Research VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Integrated Research VIP Fund |

$44 |

0.86%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 44

|

| Expense Ratio, Percent |

[12] |

|

0.86%

|

| AssetsNet |

|

|

$ 267,675,003

|

| Holdings Count | Holding |

|

|

66

|

| InvestmentCompanyPortfolioTurnover |

|

|

16.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$267,675,003 |

Total # of Portfolio Holdings |

66 |

Portfolio Turnover Rate |

16% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Information Technology |

32.5 |

Financials |

14.1 |

Communication Services |

11.2 |

Consumer Discretionary |

10.3 |

Industrials |

10.1 |

Health Care |

8.3 |

Consumer Staples |

4.9 |

Energy |

2.9 |

Materials |

2.0 |

Utilities |

1.9 |

Real Estate |

1.2 |

Cash/Other Assets and Liabilities |

0.6 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

NVIDIA Corp. |

8.3 |

Microsoft Corp. |

7.9 |

Apple, Inc. |

6.5 |

Amazon.com, Inc. |

5.1 |

Alphabet, Inc., Class A |

4.1 |

Broadcom, Inc. |

3.6 |

Meta Platforms, Inc., Class A |

3.4 |

JPMorgan Chase & Co. |

2.5 |

Mastercard, Inc., Class A |

2.2 |

Eli Lilly & Co. |

2.1 |

Total |

45.7 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169891 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian International Equity VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian International Equity VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian International Equity VIP Fund |

$62 |

1.14%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 62

|

| Expense Ratio, Percent |

[13] |

|

1.14%

|

| AssetsNet |

|

|

$ 215,417,141

|

| Holdings Count | Holding |

|

|

100

|

| InvestmentCompanyPortfolioTurnover |

|

|

14.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$215,417,141 |

Total # of Portfolio Holdings |

100 |

Portfolio Turnover Rate |

14% | |

| Holdings [Text Block] |

|

|

Sector Allocation (% of Total Net Assets)

Financials |

20.5 |

Industrials |

16.5 |

Health Care |

15.4 |

Consumer Discretionary |

12.5 |

Information Technology |

12.3 |

Consumer Staples |

8.3 |

Communication Services |

6.1 |

Materials |

2.6 |

Utilities |

2.3 |

Energy |

2.3 |

Real Estate |

0.6 |

Cash/Other Assets and Liabilities |

0.6 |

Total |

100.0 | Geographic Region/Country Allocation (% of Total Net Assets)

Europe |

47.2 |

Asia-Pacific |

28.1 |

United Kingdom |

19.2 |

North America |

4.9 |

Cash/Other Assets and Liabilities |

0.6 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

SAP SE (Germany) |

3.2 |

Mitsubishi UFJ Financial Group, Inc. (Japan) |

2.5 |

Shell PLC (United Kingdom) |

2.3 |

Roche Holding AG (Switzerland) |

2.2 |

ASML Holding NV (Netherlands) |

2.0 |

AstraZeneca PLC (United Kingdom) |

2.0 |

Sony Group Corp. (Japan) |

2.0 |

Allianz SE (Germany) |

1.9 |

Banco Bilbao Vizcaya Argentaria SA (Spain) |

1.8 |

Unilever PLC (United Kingdom) |

1.7 |

Total |

21.6 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169900 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian International Growth VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian International Growth VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian International Growth VIP Fund |

$62 |

1.16%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 62

|

| Expense Ratio, Percent |

[14] |

|

1.16%

|

| AssetsNet |

|

|

$ 75,743,256

|

| Holdings Count | Holding |

|

|

68

|

| InvestmentCompanyPortfolioTurnover |

|

|

25.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$75,743,256 |

Total # of Portfolio Holdings |

68 |

Portfolio Turnover Rate |

25% | |

| Holdings [Text Block] |

|

|

Sector Allocation (% of Total Net Assets)

Industrials |

26.4 |

Financials |

17.4 |

Consumer Discretionary |

13.4 |

Information Technology |

13.3 |

Health Care |

10.0 |

Materials |

5.8 |

Consumer Staples |

5.5 |

Communication Services |

4.8 |

Utilities |

1.6 |

Real Estate |

0.8 |

Cash/Other Assets and Liabilities |

1.0 |

Total |

100.0 | Geographic Region/Country Allocation (% of Total Net Assets)

Europe |

46.3 |

Asia-Pacific |

31.0 |

United Kingdom |

20.8 |

North America |

0.9 |

Cash/Other Assets and Liabilities |

1.0 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

Safran SA (France) |

4.5 |

Sony Group Corp. (Japan) |

4.2 |

Air Liquide SA (France) |

4.0 |

SAP SE (Germany) |

3.0 |

Hitachi Ltd. (Japan) |

2.7 |

RELX PLC (United Kingdom) |

2.5 |

Cie Financiere Richemont SA, Class A (Switzerland) |

2.5 |

Schneider Electric SE (France) |

2.4 |

London Stock Exchange Group PLC (United Kingdom) |

2.4 |

Rolls-Royce Holdings PLC (United Kingdom) |

2.4 |

Total |

30.6 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169893 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Large Cap Disciplined Growth VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Large Cap Disciplined Growth VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Material Fund Change Notice [Text Block] |

|

|

This report describes Fund changes that occurred during the reporting period.

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Large Cap Disciplined Growth VIP Fund |

$44 |

0.87%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 44

|

| Expense Ratio, Percent |

[15] |

|

0.87%

|

| Material Change Date |

|

Jan. 01, 2025

|

|

| AssetsNet |

|

|

$ 371,835,080

|

| Holdings Count | Holding |

|

|

53

|

| InvestmentCompanyPortfolioTurnover |

|

|

30.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$371,835,080 |

Total # of Portfolio Holdings |

53 |

Portfolio Turnover Rate |

30% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Information Technology |

51.2 |

Communication Services |

15.4 |

Consumer Discretionary |

11.5 |

Financials |

7.1 |

Health Care |

6.0 |

Industrials |

4.4 |

Consumer Staples |

2.2 |

Materials |

1.0 |

Real Estate |

0.8 |

Cash/Other Assets and Liabilities |

0.4 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

NVIDIA Corp. |

13.4 |

Microsoft Corp. |

10.8 |

Apple, Inc. |

10.8 |

Amazon.com, Inc. |

6.4 |

Broadcom, Inc. |

5.0 |

Alphabet, Inc., Class A |

5.0 |

Meta Platforms, Inc., Class A |

5.0 |

Eli Lilly & Co. |

2.7 |

Mastercard, Inc., Class A |

2.7 |

Netflix, Inc. |

2.7 |

Total |

64.5 | |

| Material Fund Change [Text Block] |

|

|

What changes have occurred since the beginning of the reporting period? This is a summary of certain changes of the Fund since January 1, 2025. Effective May 1, 2025, the Fund’s sub-classification under the Investment Company Act of 1940 was changed from “diversified” to “non-diversified, which permits the Fund to invest a greater percentage of its assets in the obligations or securities of a smaller number of issuers or any one issuer as compared to a diversified fund, as further described in the Fund’s Prospectus. For more complete information, you may review the Fund’s Prospectus dated May 1, 2025. The Prospectus is available on the Trust’s website: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses/. Contract owners of variable life insurance policies may obtain a copy of the Prospectus by calling 1-888-GUARDIAN (1-888-482-7342). Contract owners of variable annuity contracts may obtain a copy of the Prospectus by calling 1-800-830-4147. |

| Material Fund Change Strategies [Text Block] |

|

|

Effective May 1, 2025, the Fund’s sub-classification under the Investment Company Act of 1940 was changed from “diversified” to “non-diversified, which permits the Fund to invest a greater percentage of its assets in the obligations or securities of a smaller number of issuers or any one issuer as compared to a diversified fund, as further described in the Fund’s Prospectus.

|

| Summary of Change Legend [Text Block] |

|

|

This is a summary of certain changes of the Fund since January 1, 2025.

|

| C000169896 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Large Cap Disciplined Value VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Large Cap Disciplined Value VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Large Cap Disciplined Value VIP Fund |

$50 |

0.97%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 50

|

| Expense Ratio, Percent |

[16] |

|

0.97%

|

| AssetsNet |

|

|

$ 84,929,008

|

| Holdings Count | Holding |

|

|

87

|

| InvestmentCompanyPortfolioTurnover |

|

|

27.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$84,929,008 |

Total # of Portfolio Holdings |

87 |

Portfolio Turnover Rate |

27% | |

| Holdings [Text Block] |

|

|

Sector Allocation(% of Total Net Assets)

Financials |

23.4 |

Industrials |

15.8 |

Information Technology |

12.1 |

Health Care |

10.6 |

Consumer Staples |

9.3 |

Consumer Discretionary |

6.9 |

Energy |

6.7 |

Materials |

5.6 |

Communication Services |

4.6 |

Utilities |

4.5 |

Cash/Other Assets and Liabilities |

0.5 |

Total |

100.0 | |

| Largest Holdings [Text Block] |

|

|

Top Ten Holdings(% of Total Net Assets)

JPMorgan Chase & Co. |

4.5 |

Philip Morris International, Inc. |

3.0 |

Amazon.com, Inc. |

2.2 |

Uber Technologies, Inc. |

2.0 |

U.S. Foods Holding Corp. |

2.0 |

Honeywell International, Inc. |

1.9 |

Oracle Corp. |

1.9 |

Cencora, Inc. |

1.9 |

Walt Disney Co. |

1.9 |

CRH PLC |

1.8 |

Total |

23.1 | |

| Material Fund Change [Text Block] |

|

|

|

| C000169890 |

|

|

|

| Shareholder Report [Line Items] |

|

|

|

| Fund Name |

|

|

Guardian Large Cap Fundamental Growth VIP Fund

|

| No Trading Symbol [Flag] |

|

|

true

|

| Annual or Semi-Annual Statement [Text Block] |

|

|

This semi-annual shareholder report contains important information about Guardian Large Cap Fundamental Growth VIP Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

|

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

|

|

You can find additional information about the Fund at: https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses. You can also request this information by sending an email request to GIAC_CRU@glic.com, or by calling us toll-free at 1-888-GUARDIAN (1-888-482-7342) (variable life policy owners) or 1-800-830-4147 (variable annuity contract owners).

|

| Material Fund Change Notice [Text Block] |

|

|

This report describes Fund changes that occurred during the reporting period.

|

| Additional Information Phone Number |

|

|

1-888-GUARDIAN (1-888-482-7342)

|

| Additional Information Email |

|

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 14.4px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;">GIAC_CRU@glic.com</span>

|

| Additional Information Website |

|

|

https://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses

|

| Expenses [Text Block] |

|

|

What were the Fund costs for the last six months?(Based on a hypothetical $10,000 investment)

Fund |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Guardian Large Cap Fundamental Growth VIP Fund |

$51 |

1.00%Footnote Reference* | The table above does not reflect charges, fees or expenses that are, or may be, imposed under your variable annuity contract or variable life insurance policy through which Fund shares are offered as an investment option. If those charges, fees or expenses were reflected, the costs shown in the table above would be higher.

| Footnote |

Description |

Footnote* |

Annualized. Reflects fee waivers and/or expense reimbursements, without which expenses would be higher. | |

| Expenses Paid, Amount |

|

|

$ 51

|

| Expense Ratio, Percent |

[17] |

|

1.00%

|

| Material Change Date |

|

Jan. 01, 2025

|

|

| AssetsNet |

|

|

$ 188,991,229

|

| Holdings Count | Holding |

|

|

120

|

| InvestmentCompanyPortfolioTurnover |

|

|

23.00%

|

| Additional Fund Statistics [Text Block] |

|

|

Fund Statistics(as of June 30, 2025)

FUND STATISTICS |

fund |

Total Net Assets |

$188,991,229 |

Total # of Portfolio Holdings |

120 |

Portfolio Turnover Rate |

23% | |

| Holdings [Text Block] |

|

|