|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$123

|

2.49%

|

|

Net Assets

|

$41,129,878

|

|

Number of Holdings

|

54

|

|

Net Advisory Fee

|

$277,616

|

|

Portfolio Turnover

|

857%

|

|

Top 10 Issuers

|

(%)

|

|

Wynn Resorts Ltd.

|

4.0%

|

|

Penn National Gaming, Inc.

|

3.9%

|

|

Abercrombie & Fitch Co.

|

3.9%

|

|

Jefferies Financial Group, Inc.

|

3.7%

|

|

Healthcare Realty Trust, Inc.

|

3.2%

|

|

Rocket Cos., Inc.

|

3.1%

|

|

Williams-Sonoma, Inc.

|

3.1%

|

|

Builders FirstSource, Inc.

|

3.0%

|

|

International Flavors & Fragrances, Inc.

|

3.0%

|

|

Evercore Partners, Inc.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$159

|

3.24%

|

|

Net Assets

|

$41,129,878

|

|

Number of Holdings

|

54

|

|

Net Advisory Fee

|

$277,616

|

|

Portfolio Turnover

|

857%

|

|

Top 10 Issuers

|

(%)

|

|

Wynn Resorts Ltd.

|

4.0%

|

|

Penn National Gaming, Inc.

|

3.9%

|

|

Abercrombie & Fitch Co.

|

3.9%

|

|

Jefferies Financial Group, Inc.

|

3.7%

|

|

Healthcare Realty Trust, Inc.

|

3.2%

|

|

Rocket Cos., Inc.

|

3.1%

|

|

Williams-Sonoma, Inc.

|

3.1%

|

|

Builders FirstSource, Inc.

|

3.0%

|

|

International Flavors & Fragrances, Inc.

|

3.0%

|

|

Evercore Partners, Inc.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$110

|

2.24%

|

|

Net Assets

|

$41,129,878

|

|

Number of Holdings

|

54

|

|

Net Advisory Fee

|

$277,616

|

|

Portfolio Turnover

|

857%

|

|

Top 10 Issuers

|

(%)

|

|

Wynn Resorts Ltd.

|

4.0%

|

|

Penn National Gaming, Inc.

|

3.9%

|

|

Abercrombie & Fitch Co.

|

3.9%

|

|

Jefferies Financial Group, Inc.

|

3.7%

|

|

Healthcare Realty Trust, Inc.

|

3.2%

|

|

Rocket Cos., Inc.

|

3.1%

|

|

Williams-Sonoma, Inc.

|

3.1%

|

|

Builders FirstSource, Inc.

|

3.0%

|

|

International Flavors & Fragrances, Inc.

|

3.0%

|

|

Evercore Partners, Inc.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$104

|

2.08%

|

|

Net Assets

|

$235,787,341

|

|

Number of Holdings

|

420

|

|

Net Advisory Fee

|

$1,485,569

|

|

Portfolio Turnover

|

53%

|

|

Top 10 Issuers

|

(%)

|

|

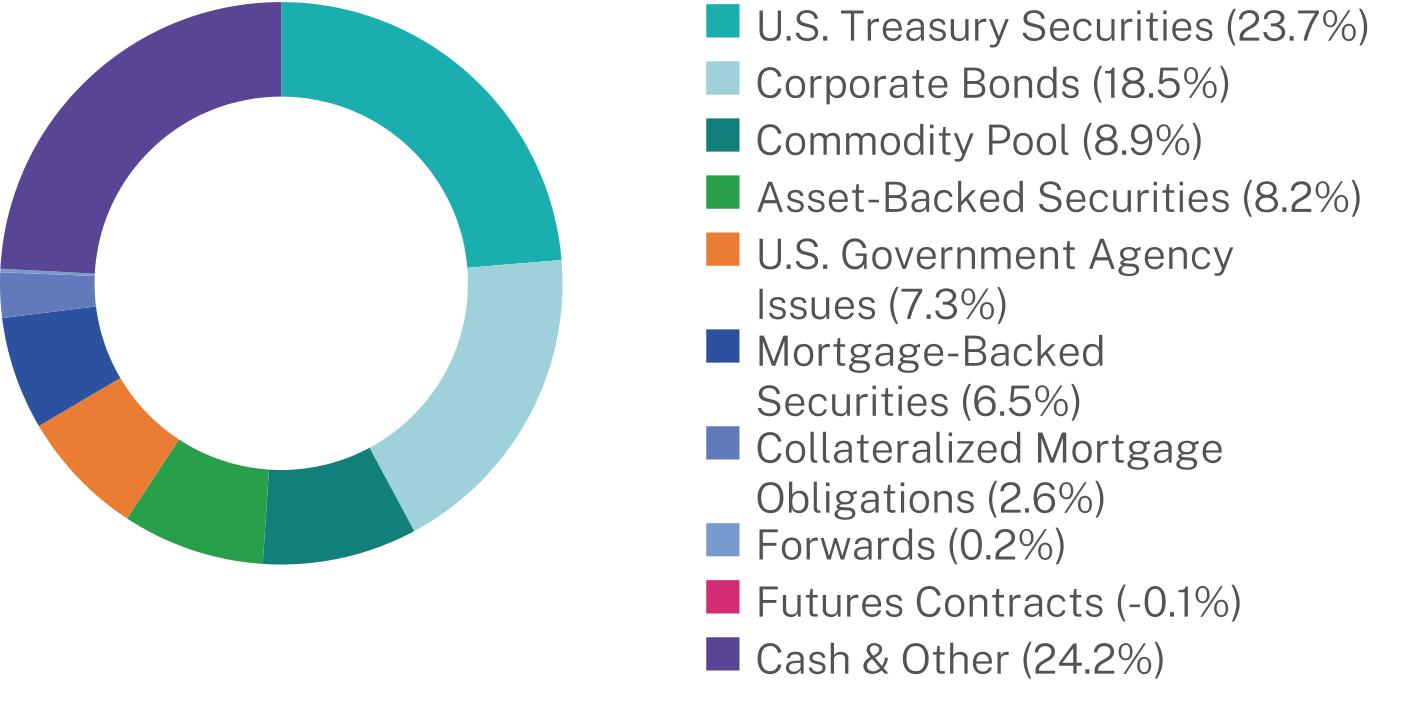

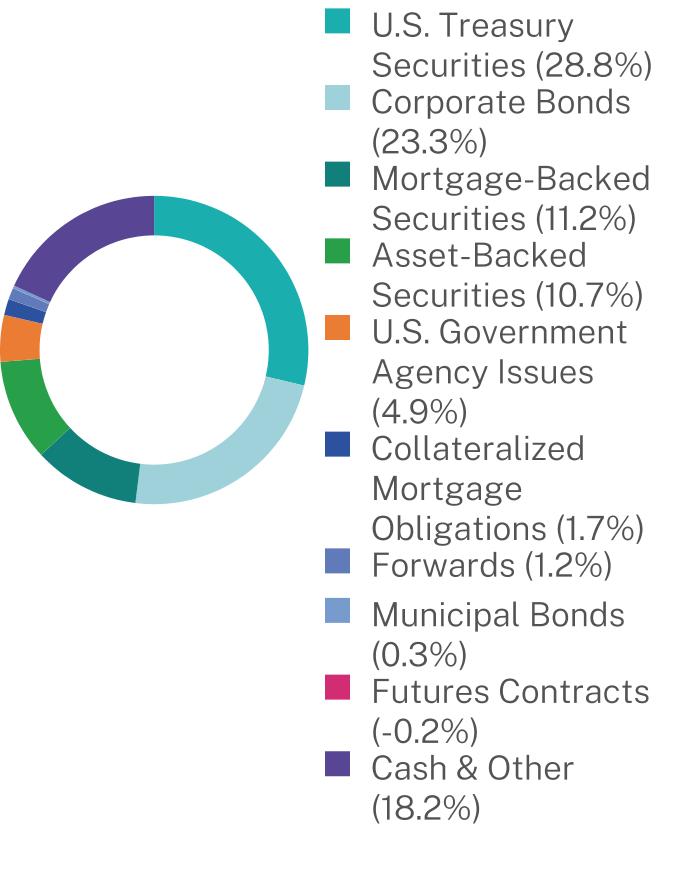

United States Treasury Note

|

23.7%

|

|

Galaxy Commodity-Polaris II Fund LLC

|

8.9%

|

|

Federal Home Loan Banks

|

3.7%

|

|

Federal Farm Credit Banks Funding Corp

|

3.5%

|

|

Fannie Mae Connecticut Avenue Securities

|

2.4%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.6%

|

|

Mars, Inc.

|

1.5%

|

|

Bank of America Corp.

|

1.0%

|

|

SREIT Trust

|

0.7%

|

|

Verizon Master Trust

|

0.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$91

|

1.83%

|

|

Net Assets

|

$235,787,341

|

|

Number of Holdings

|

420

|

|

Net Advisory Fee

|

$1,485,569

|

|

Portfolio Turnover

|

53%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

23.7%

|

|

Galaxy Commodity-Polaris II Fund LLC

|

8.9%

|

|

Federal Home Loan Banks

|

3.7%

|

|

Federal Farm Credit Banks Funding Corp

|

3.5%

|

|

Fannie Mae Connecticut Avenue Securities

|

2.4%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.6%

|

|

Mars, Inc.

|

1.5%

|

|

Bank of America Corp.

|

1.0%

|

|

SREIT Trust

|

0.7%

|

|

Verizon Master Trust

|

0.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$105

|

2.09%

|

|

Net Assets

|

$467,548,013

|

|

Number of Holdings

|

167

|

|

Net Advisory Fee

|

$3,722,109

|

|

Portfolio Turnover

|

25%

|

|

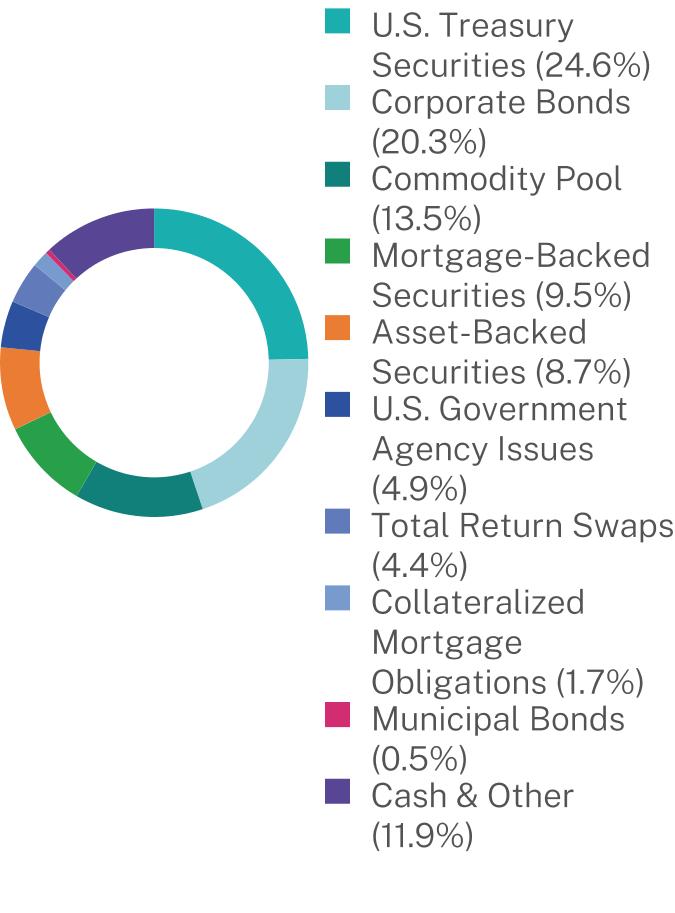

Top 10 Issuers

|

(%)

|

|

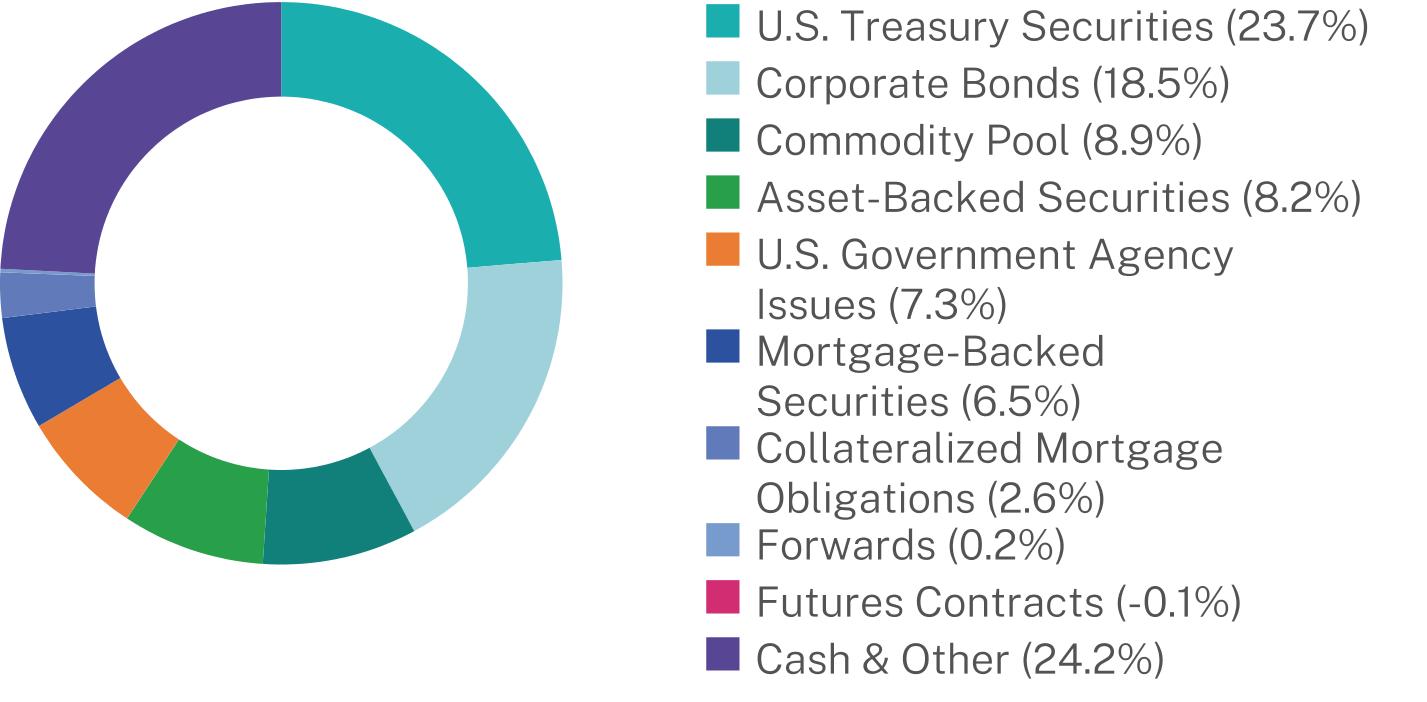

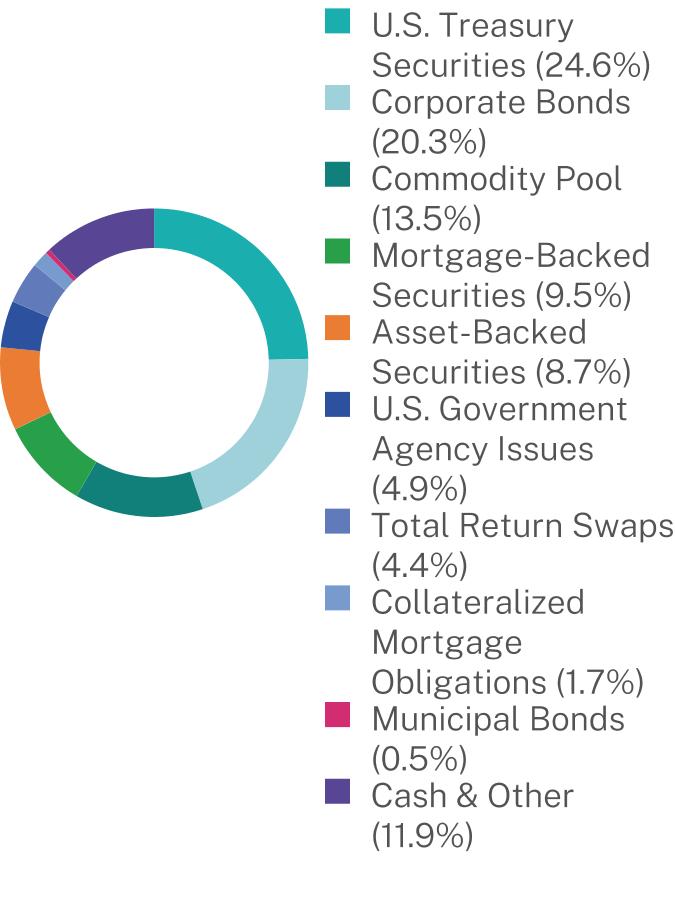

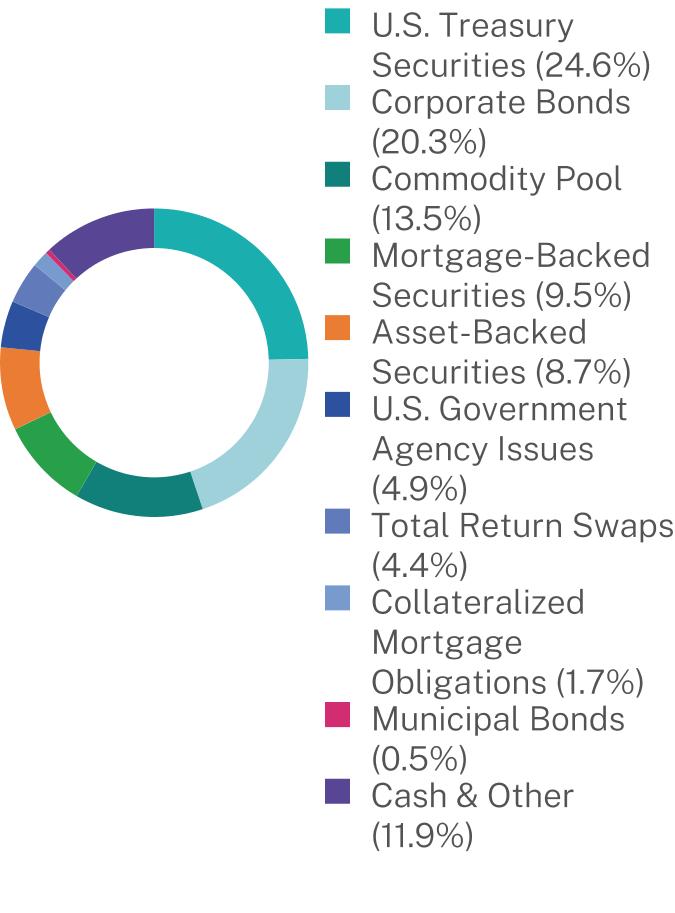

United States Treasury Note

|

24.6%

|

|

Galaxy Commodity - Polaris Fund LLC

|

13.5%

|

|

LoCorr Commodities Index

|

4.4%

|

|

Fannie Mae Connecticut Avenue Securities

|

3.5%

|

|

Federal National Mortgage Association

|

2.9%

|

|

Federal Home Loan Banks

|

1.9%

|

|

Mars, Inc.

|

1.7%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.6%

|

|

Toyota Auto Receivables Owner Trust

|

1.2%

|

|

Bank of America Corp.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$142

|

2.84%

|

|

Net Assets

|

$467,548,013

|

|

Number of Holdings

|

167

|

|

Net Advisory Fee

|

$3,722,109

|

|

Portfolio Turnover

|

25%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

24.6%

|

|

Galaxy Commodity - Polaris Fund LLC

|

13.5%

|

|

LoCorr Commodities Index

|

4.4%

|

|

Fannie Mae Connecticut Avenue Securities

|

3.5%

|

|

Federal National Mortgage Association

|

2.9%

|

|

Federal Home Loan Banks

|

1.9%

|

|

Mars, Inc.

|

1.7%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.6%

|

|

Toyota Auto Receivables Owner Trust

|

1.2%

|

|

Bank of America Corp.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$92

|

1.84%

|

|

Net Assets

|

$467,548,013

|

|

Number of Holdings

|

167

|

|

Net Advisory Fee

|

$3,722,109

|

|

Portfolio Turnover

|

25%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

24.6%

|

|

Galaxy Commodity - Polaris Fund LLC

|

13.5%

|

|

LoCorr Commodities Index

|

4.4%

|

|

Fannie Mae Connecticut Avenue Securities

|

3.5%

|

|

Federal National Mortgage Association

|

2.9%

|

|

Federal Home Loan Banks

|

1.9%

|

|

Mars, Inc.

|

1.7%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.6%

|

|

Toyota Auto Receivables Owner Trust

|

1.2%

|

|

Bank of America Corp.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$105

|

2.13%

|

|

Net Assets

|

$1,537,620,282

|

|

Number of Holdings

|

500

|

|

Net Advisory Fee

|

$12,940,941

|

|

Portfolio Turnover

|

36%

|

|

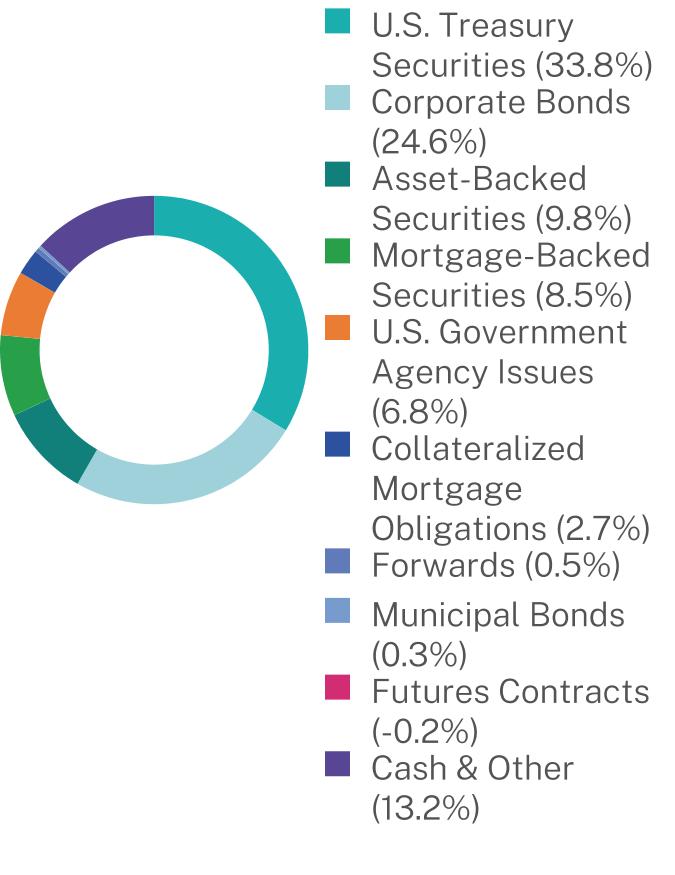

Top 10 Issuers

|

(%)

|

|

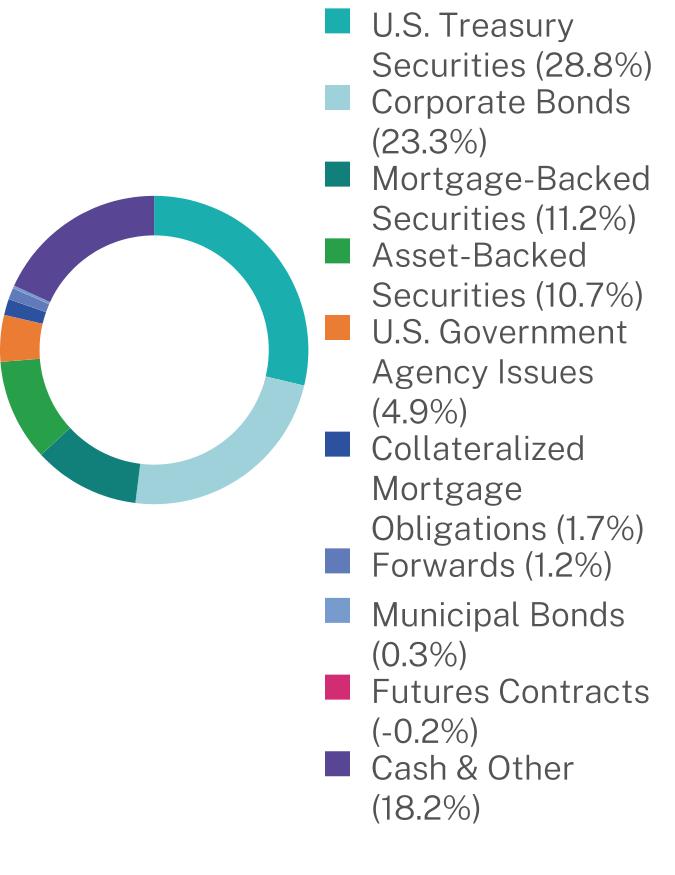

United States Treasury Note

|

33.8%

|

|

Federal National Mortgage Association

|

3.8%

|

|

Fannie Mae Connecticut Avenue Securities

|

2.8%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

2.2%

|

|

Mars, Inc.

|

2.0%

|

|

Federal Farm Credit Banks Funding Corp.

|

1.9%

|

|

Bank of America Corp.

|

1.4%

|

|

Federal Home Loan Banks

|

1.1%

|

|

Ford Credit Auto Owner Trust

|

1.0%

|

|

JPMorgan Chase & Co.

|

0.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$142

|

2.88%

|

|

Net Assets

|

$1,537,620,282

|

|

Number of Holdings

|

500

|

|

Net Advisory Fee

|

$12,940,941

|

|

Portfolio Turnover

|

36%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

33.8%

|

|

Federal National Mortgage Association

|

3.8%

|

|

Fannie Mae Connecticut Avenue Securities

|

2.8%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

2.2%

|

|

Mars, Inc.

|

2.0%

|

|

Federal Farm Credit Banks Funding Corp.

|

1.9%

|

|

Bank of America Corp.

|

1.4%

|

|

Federal Home Loan Banks

|

1.1%

|

|

Ford Credit Auto Owner Trust

|

1.0%

|

|

JPMorgan Chase & Co.

|

0.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$93

|

1.88%

|

|

Net Assets

|

$1,537,620,282

|

|

Number of Holdings

|

500

|

|

Net Advisory Fee

|

$12,940,941

|

|

Portfolio Turnover

|

36%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

33.8%

|

|

Federal National Mortgage Association

|

3.8%

|

|

Fannie Mae Connecticut Avenue Securities

|

2.8%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

2.2%

|

|

Mars, Inc.

|

2.0%

|

|

Federal Farm Credit Banks Funding Corp.

|

1.9%

|

|

Bank of America Corp.

|

1.4%

|

|

Federal Home Loan Banks

|

1.1%

|

|

Ford Credit Auto Owner Trust

|

1.0%

|

|

JPMorgan Chase & Co.

|

0.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$98

|

2.05%

|

|

Net Assets

|

$273,204,823

|

|

Number of Holdings

|

257

|

|

Net Advisory Fee

|

$2,477,873

|

|

Portfolio Turnover

|

49%

|

|

Top 10 Issuers

|

(%)

|

|

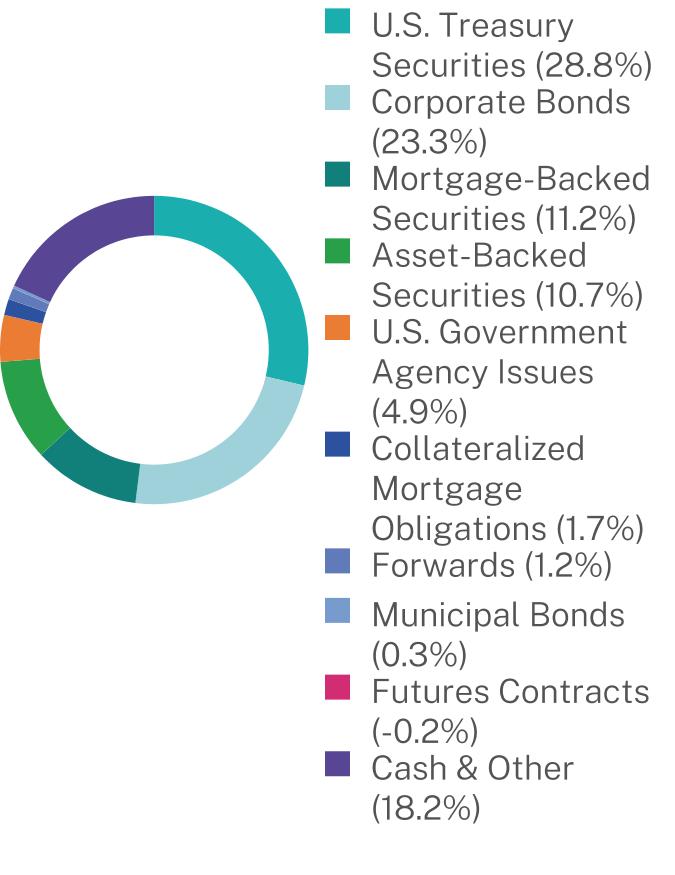

United States Treasury Note

|

28.8%

|

|

Fannie Mae Connecticut Avenue Securities

|

4.8%

|

|

Federal Home Loan Banks

|

3.5%

|

|

Mars, Inc.

|

1.9%

|

|

Ford Credit Auto Owner Trust

|

1.6%

|

|

Bank of America Corp.

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.2%

|

|

Toyota Auto Receivables Owner Trust

|

1.1%

|

|

MVW Owner Trust

|

1.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$134

|

2.80%

|

|

Net Assets

|

$273,204,823

|

|

Number of Holdings

|

257

|

|

Net Advisory Fee

|

$2,477,873

|

|

Portfolio Turnover

|

49%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

28.8%

|

|

Fannie Mae Connecticut Avenue Securities

|

4.8%

|

|

Federal Home Loan Banks

|

3.5%

|

|

Mars, Inc.

|

1.9%

|

|

Ford Credit Auto Owner Trust

|

1.6%

|

|

Bank of America Corp.

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.2%

|

|

Toyota Auto Receivables Owner Trust

|

1.1%

|

|

MVW Owner Trust

|

1.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$86

|

1.80%

|

|

Net Assets

|

$273,204,823

|

|

Number of Holdings

|

257

|

|

Net Advisory Fee

|

$2,477,873

|

|

Portfolio Turnover

|

49%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

28.8%

|

|

Fannie Mae Connecticut Avenue Securities

|

4.8%

|

|

Federal Home Loan Banks

|

3.5%

|

|

Mars, Inc.

|

1.9%

|

|

Ford Credit Auto Owner Trust

|

1.6%

|

|

Bank of America Corp.

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

Freddie Mac Structured Agency Credit Risk Debt Notes

|

1.2%

|

|

Toyota Auto Receivables Owner Trust

|

1.1%

|

|

MVW Owner Trust

|

1.0%

|

|

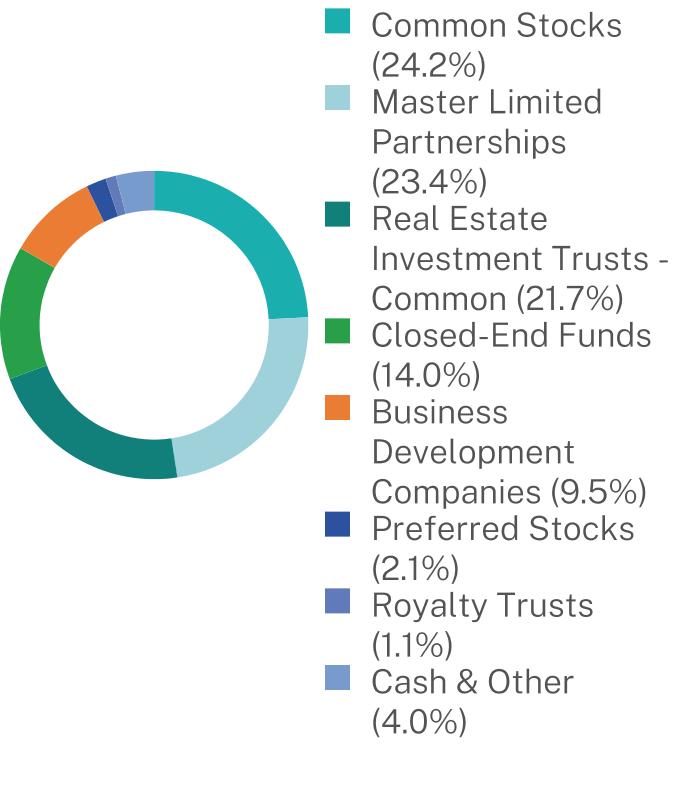

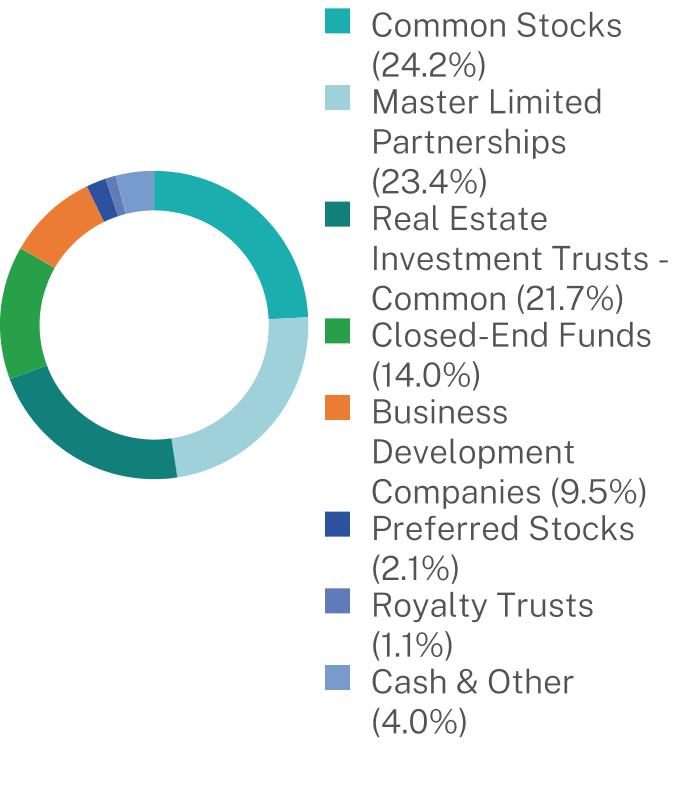

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$104

|

2.05%

|

|

Net Assets

|

$72,144,052

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$459,450

|

|

Portfolio Turnover

|

20%

|

|

Top 10 Issuers

|

(%)

|

|

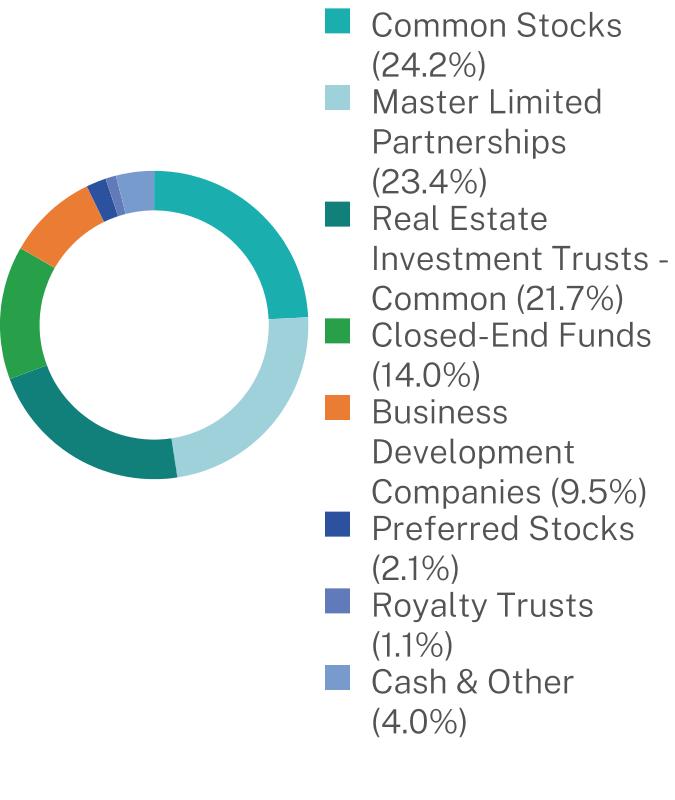

AGNC Investment Corp.

|

2.7%

|

|

Barrick Mining Corp.

|

2.6%

|

|

Hess Midstream LP

|

2.5%

|

|

Williams Cos., Inc.

|

2.2%

|

|

Iron Mountain, Inc.

|

2.2%

|

|

Cheniere Energy Partners LP

|

2.2%

|

|

Energy Transfer LP

|

2.2%

|

|

Digital Realty Trust, Inc.

|

2.1%

|

|

Blackstone Secured Lending Fund

|

2.1%

|

|

MPLX LP

|

2.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$142

|

2.80%

|

|

Net Assets

|

$72,144,052

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$459,450

|

|

Portfolio Turnover

|

20%

|

|

Top 10 Issuers

|

(%)

|

|

AGNC Investment Corp.

|

2.7%

|

|

Barrick Mining Corp.

|

2.6%

|

|

Hess Midstream LP

|

2.5%

|

|

Williams Cos., Inc.

|

2.2%

|

|

Iron Mountain, Inc.

|

2.2%

|

|

Cheniere Energy Partners LP

|

2.2%

|

|

Energy Transfer LP

|

2.2%

|

|

Digital Realty Trust, Inc.

|

2.1%

|

|

Blackstone Secured Lending Fund

|

2.1%

|

|

MPLX LP

|

2.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$91

|

1.80%

|

|

Net Assets

|

$72,144,052

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$459,450

|

|

Portfolio Turnover

|

20%

|

|

Top 10 Issuers

|

(%)

|

|

AGNC Investment Corp.

|

2.7%

|

|

Barrick Mining Corp.

|

2.6%

|

|

Hess Midstream LP

|

2.5%

|

|

Williams Cos., Inc.

|

2.2%

|

|

Iron Mountain, Inc.

|

2.2%

|

|

Cheniere Energy Partners LP

|

2.2%

|

|

Energy Transfer LP

|

2.2%

|

|

Digital Realty Trust, Inc.

|

2.1%

|

|

Blackstone Secured Lending Fund

|

2.1%

|

|

MPLX LP

|

2.0%

|

|

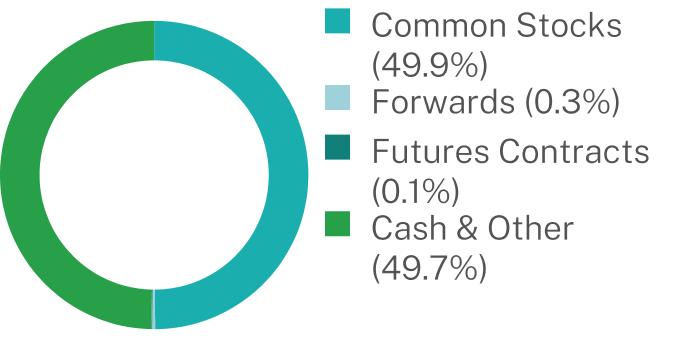

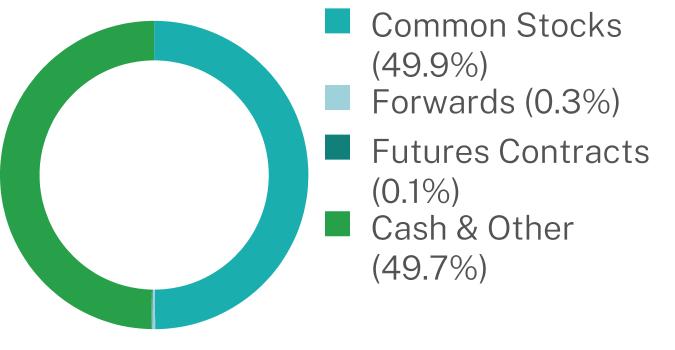

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$84

|

1.84%

|

|

Net Assets

|

$37,996,473

|

|

Number of Holdings

|

647

|

|

Net Advisory Fee

|

-$124,124

|

|

Portfolio Turnover

|

39%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

3.6%

|

|

Microsoft Corp.

|

3.5%

|

|

Apple, Inc.

|

2.8%

|

|

Amazon.com, Inc.

|

2.0%

|

|

Alphabet, Inc.

|

1.7%

|

|

Meta Platforms, Inc.

|

1.5%

|

|

Broadcom, Inc.

|

1.2%

|

|

Berkshire Hathaway, Inc.

|

0.9%

|

|

Tesla Motors, Inc.

|

0.8%

|

|

JPMorgan Chase & Co.

|

0.8%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$74

|

1.59%

|

|

Net Assets

|

$37,996,473

|

|

Number of Holdings

|

647

|

|

Net Advisory Fee

|

-$124,124

|

|

Portfolio Turnover

|

39%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

3.6%

|

|

Microsoft Corp.

|

3.5%

|

|

Apple, Inc.

|

2.8%

|

|

Amazon.com, Inc.

|

2.0%

|

|

Alphabet, Inc.

|

1.7%

|

|

Meta Platforms, Inc.

|

1.5%

|

|

Broadcom, Inc.

|

1.2%

|

|

Berkshire Hathaway, Inc.

|

0.9%

|

|

Tesla Motors, Inc.

|

0.8%

|

|

JPMorgan Chase & Co.

|

0.8%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|

||

| [16] |

|

||

| [17] |

|

||

| [18] |

|

||

| [19] |

|