What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Class K Shares | $97 | 0.89% |

How did the Fund perform last year?

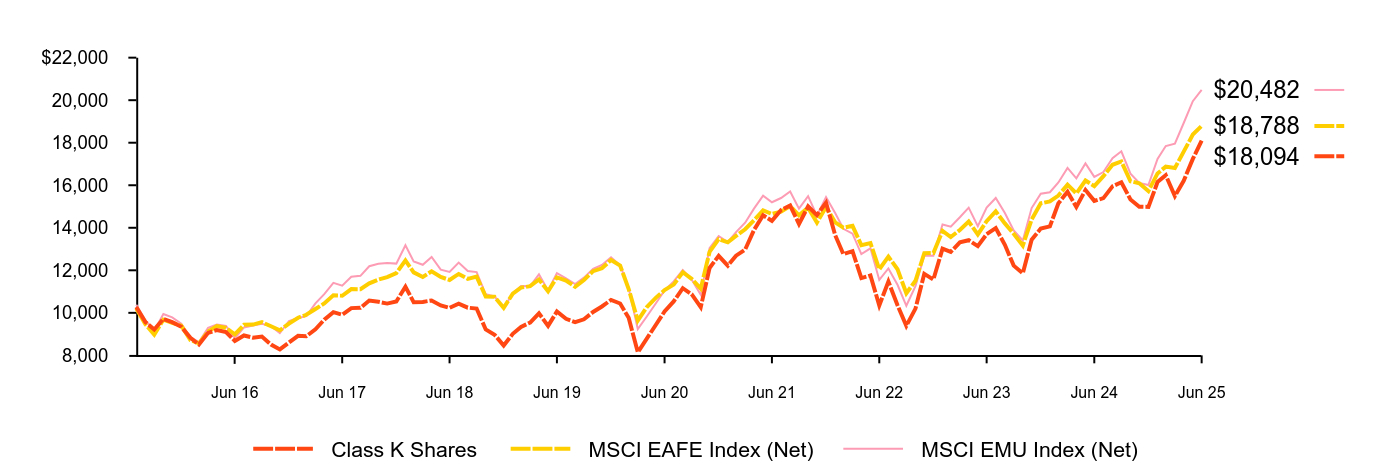

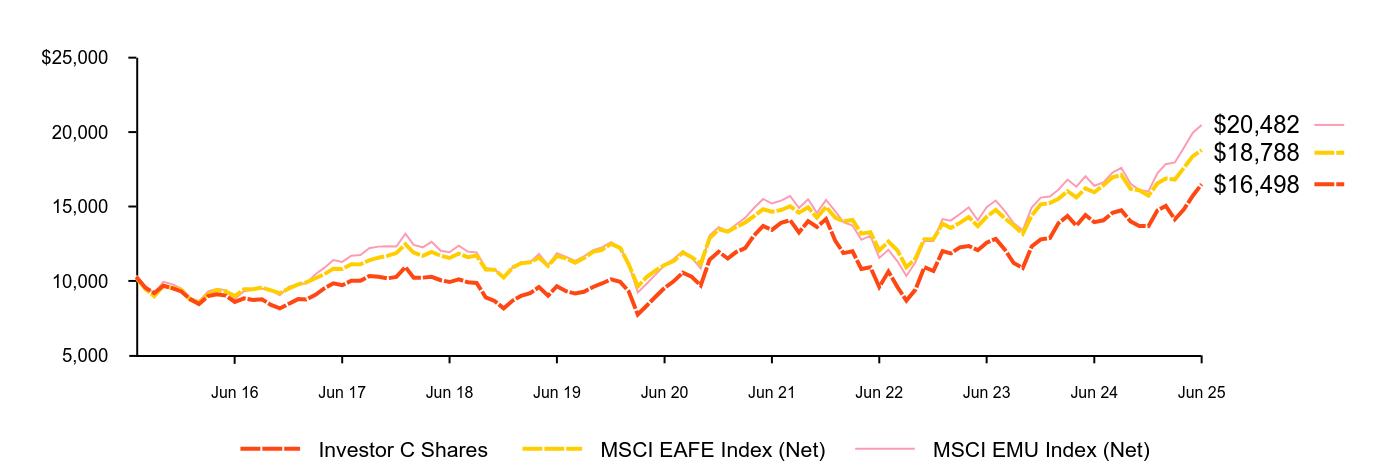

For the reporting period ended June 30, 2025, the Fund's Class K Shares returned 18.54%.

For the same period, the Fund’s current benchmark, the MSCI EAFE Index (Net), returned 17.73%, while its previous benchmark, the MSCI EMU Index (Net), returned 24.93%.

What contributed to performance?

German enterprise software company SAP SE was the largest absolute contributor over the period. The company released strong financial results, driven by robust cloud enterprise resource planning bookings and positive market reception to its AI-focused restructuring plans. SAP benefitted from the digitalization trend and growth of its cloud business revenue was expected to accelerate from 2025-2027, with the majority of revenue recurring.

Italian multinational bank UniCredit Group AG contributed positively as European banks have been a significant driver of the European equity market rally in 2025. Company reporting continues to show positive trends related to deposits, loan growth and balance sheet. Positions in holdings in Spanish bank CaixaBank S.A. and Allied Irish Banks, p.l.c. were also among the top contributors over the period.

What detracted from performance?

Dutch semiconductor equipment company ASML Holding NV was the largest absolute detractor over the period. The stock fell in October as the company reduced its 2025 revenue guidance meaningfully, driven by lowered projections for the shipment of the extreme ultraviolet lithography systems critical to manufacturing advanced chips, along with a significant trimming of expected sales into China. Within the semiconductor sector, volatility rose following the DeepSeek large language model launch in January 2025 on concerns that growth in spending on AI-related technologies may significantly slow beyond 2025.

Danish pharmaceutical company Novo Nordisk A/S detracted as perceptions of the obesity market’s growth potential changed. The stock fell sharply after investors were disappointed with efficacy results during trials. The company’s results have also been challenged by a longer-than-expected overhang from compounders (companies which produce non-FDA approved medication) which have taken some near-term market share.

Class K Shares | MSCI EAFE Index (Net) | MSCI EMU Index (Net) | |

|---|---|---|---|

Jul 15 | $10,271 | $10,208 | $10,381 |

Aug 15 | $9,562 | $9,457 | $9,641 |

Sep 15 | $9,213 | $8,977 | $9,160 |

Oct 15 | $9,716 | $9,678 | $9,943 |

Nov 15 | $9,562 | $9,528 | $9,787 |

Dec 15 | $9,347 | $9,399 | $9,489 |

Jan 16 | $8,822 | $8,720 | $8,854 |

Feb 16 | $8,508 | $8,560 | $8,621 |

Mar 16 | $9,058 | $9,117 | $9,291 |

Apr 16 | $9,189 | $9,381 | $9,450 |

May 16 | $9,098 | $9,296 | $9,383 |

Jun 16 | $8,678 | $8,984 | $8,800 |

Jul 16 | $8,934 | $9,439 | $9,311 |

Aug 16 | $8,829 | $9,446 | $9,399 |

Sep 16 | $8,888 | $9,562 | $9,485 |

Oct 16 | $8,508 | $9,366 | $9,375 |

Nov 16 | $8,278 | $9,179 | $9,044 |

Dec 16 | $8,604 | $9,493 | $9,617 |

Jan 17 | $8,920 | $9,769 | $9,755 |

Feb 17 | $8,900 | $9,908 | $9,845 |

Mar 17 | $9,228 | $10,181 | $10,445 |

Apr 17 | $9,678 | $10,440 | $10,877 |

May 17 | $10,033 | $10,823 | $11,408 |

Jun 17 | $9,912 | $10,804 | $11,278 |

Jul 17 | $10,221 | $11,116 | $11,696 |

Aug 17 | $10,234 | $11,112 | $11,740 |

Sep 17 | $10,576 | $11,388 | $12,192 |

Oct 17 | $10,523 | $11,561 | $12,305 |

Nov 17 | $10,435 | $11,682 | $12,338 |

Dec 17 | $10,534 | $11,870 | $12,315 |

Jan 18 | $11,226 | $12,465 | $13,181 |

Feb 18 | $10,500 | $11,903 | $12,419 |

Mar 18 | $10,513 | $11,688 | $12,259 |

Apr 18 | $10,581 | $11,955 | $12,630 |

May 18 | $10,350 | $11,686 | $12,029 |

Jun 18 | $10,235 | $11,544 | $11,926 |

Jul 18 | $10,432 | $11,828 | $12,365 |

Aug 18 | $10,242 | $11,599 | $11,969 |

Sep 18 | $10,201 | $11,700 | $11,915 |

Oct 18 | $9,217 | $10,769 | $10,873 |

Nov 18 | $8,973 | $10,755 | $10,773 |

Dec 18 | $8,461 | $10,233 | $10,234 |

Jan 19 | $9,015 | $10,906 | $10,919 |

Feb 19 | $9,338 | $11,184 | $11,262 |

Mar 19 | $9,542 | $11,254 | $11,252 |

Apr 19 | $9,977 | $11,570 | $11,808 |

May 19 | $9,387 | $11,015 | $11,050 |

Jun 19 | $10,061 | $11,668 | $11,869 |

Jul 19 | $9,717 | $11,520 | $11,621 |

Aug 19 | $9,563 | $11,222 | $11,353 |

Sep 19 | $9,696 | $11,543 | $11,657 |

Oct 19 | $10,040 | $11,958 | $12,072 |

Nov 19 | $10,299 | $12,093 | $12,248 |

Dec 19 | $10,607 | $12,486 | $12,609 |

Jan 20 | $10,438 | $12,225 | $12,234 |

Feb 20 | $9,767 | $11,120 | $11,165 |

Mar 20 | $8,144 | $9,636 | $9,234 |

Apr 20 | $8,772 | $10,258 | $9,815 |

May 20 | $9,429 | $10,705 | $10,440 |

Jun 20 | $10,064 | $11,069 | $11,056 |

Jul 20 | $10,537 | $11,327 | $11,476 |

Aug 20 | $11,158 | $11,910 | $12,015 |

Sep 20 | $10,875 | $11,600 | $11,566 |

Oct 20 | $10,268 | $11,137 | $10,847 |

Nov 20 | $12,110 | $12,864 | $13,044 |

Dec 20 | $12,682 | $13,462 | $13,605 |

Jan 21 | $12,216 | $13,318 | $13,329 |

Feb 21 | $12,689 | $13,617 | $13,796 |

Mar 21 | $12,978 | $13,930 | $14,239 |

Apr 21 | $13,896 | $14,349 | $14,899 |

May 21 | $14,588 | $14,817 | $15,508 |

Jun 21 | $14,326 | $14,650 | $15,200 |

Jul 21 | $14,835 | $14,761 | $15,399 |

Aug 21 | $15,046 | $15,021 | $15,706 |

Sep 21 | $14,178 | $14,585 | $14,900 |

Oct 21 | $15,004 | $14,944 | $15,489 |

Nov 21 | $14,595 | $14,248 | $14,570 |

Dec 21 | $15,180 | $14,978 | $15,446 |

Jan 22 | $13,656 | $14,254 | $14,696 |

Feb 22 | $12,760 | $14,002 | $13,954 |

Mar 22 | $12,901 | $14,092 | $13,726 |

Apr 22 | $11,631 | $13,180 | $12,763 |

May 22 | $11,758 | $13,279 | $13,033 |

Jun 22 | $10,346 | $12,047 | $11,549 |

Jul 22 | $11,475 | $12,647 | $12,087 |

Aug 22 | $10,353 | $12,047 | $11,320 |

Sep 22 | $9,386 | $10,920 | $10,332 |

Oct 22 | $10,198 | $11,507 | $11,250 |

Nov 22 | $11,835 | $12,803 | $12,698 |

Dec 22 | $11,564 | $12,813 | $12,688 |

Jan 23 | $13,017 | $13,851 | $14,154 |

Feb 23 | $12,867 | $13,562 | $14,049 |

Mar 23 | $13,316 | $13,898 | $14,494 |

Apr 23 | $13,416 | $14,290 | $14,945 |

May 23 | $13,138 | $13,686 | $14,077 |

Jun 23 | $13,701 | $14,308 | $14,954 |

Jul 23 | $13,985 | $14,771 | $15,402 |

Aug 23 | $13,202 | $14,205 | $14,695 |

Sep 23 | $12,219 | $13,720 | $13,875 |

Oct 23 | $11,856 | $13,164 | $13,400 |

Nov 23 | $13,437 | $14,386 | $14,928 |

Dec 23 | $13,966 | $15,150 | $15,599 |

Jan 24 | $14,067 | $15,237 | $15,672 |

Feb 24 | $15,149 | $15,516 | $16,131 |

Mar 24 | $15,690 | $16,027 | $16,814 |

Apr 24 | $14,976 | $15,616 | $16,328 |

May 24 | $15,777 | $16,221 | $17,029 |

Jun 24 | $15,265 | $15,959 | $16,395 |

Jul 24 | $15,395 | $16,427 | $16,622 |

Aug 24 | $15,950 | $16,962 | $17,277 |

Sep 24 | $16,138 | $17,118 | $17,597 |

Oct 24 | $15,330 | $16,187 | $16,548 |

Nov 24 | $14,991 | $16,095 | $16,108 |

Dec 24 | $14,981 | $15,729 | $16,010 |

Jan 25 | $16,150 | $16,556 | $17,241 |

Feb 25 | $16,472 | $16,877 | $17,843 |

Mar 25 | $15,493 | $16,809 | $17,959 |

Apr 25 | $16,209 | $17,579 | $18,928 |

May 25 | $17,239 | $18,383 | $19,955 |

Jun 25 | $18,094 | $18,788 | $20,482 |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Class K Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 18.54% | 12.45% | 6.11% |

MSCI EAFE Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.73 | 11.16 | 6.51 |

MSCI EMU Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 24.93 | 13.12 | 7.43 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $119,510,046 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 44 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $487,995 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 89% |

Geographic allocation

Ten largest holdings

Country/Geographic Region | Percent of

Net Assets |

|---|---|

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.8% |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.7 |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.9 |

Netherlands........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.8 |

Switzerland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.3 |

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.3 |

Japan........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.3 |

Denmark........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.1 |

Italy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.9 |

Australia........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.1 |

OtherFootnote Reference(a)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.5 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

Other Assets Less Liabilities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.0 |

SecurityFootnote Reference(b) | Percent of

Net Assets |

|---|---|

SAP SE........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.1% |

Mastercard, Inc., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.4 |

UniCredit SpA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.4 |

RELX plc........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.0 |

Safran SA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.8 |

Cie de Saint-Gobain SA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.3 |

MTU Aero Engines AG........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |

Taiwan Semiconductor Manufacturing Co. Ltd......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 3.2 |

Advantest Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 3.1 |

Adyen NV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

| Footnote | Description |

Footnote(a) | Ten largest countries/geographic regions are presented. Additional countries/geographic regions are found in Other. |

Footnote(b) | Excludes short-term securities. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Class R Shares | $158 | 1.45% |

How did the Fund perform last year?

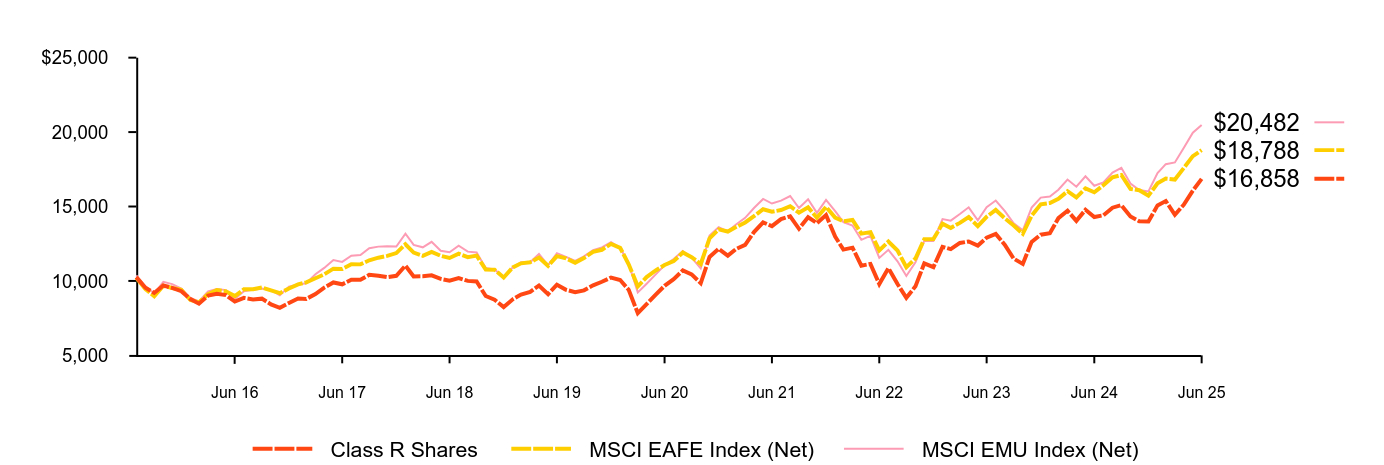

For the reporting period ended June 30, 2025, the Fund's Class R Shares returned 17.96%.

For the same period, the Fund’s current benchmark, the MSCI EAFE Index (Net), returned 17.73%, while its previous benchmark, the MSCI EMU Index (Net), returned 24.93%.

What contributed to performance?

German enterprise software company SAP SE was the largest absolute contributor over the period. The company released strong financial results, driven by robust cloud enterprise resource planning bookings and positive market reception to its AI-focused restructuring plans. SAP benefitted from the digitalization trend and growth of its cloud business revenue was expected to accelerate from 2025-2027, with the majority of revenue recurring.

Italian multinational bank UniCredit Group AG contributed positively as European banks have been a significant driver of the European equity market rally in 2025. Company reporting continues to show positive trends related to deposits, loan growth and balance sheet. Positions in holdings in Spanish bank CaixaBank S.A. and Allied Irish Banks, p.l.c. were also among the top contributors over the period.

What detracted from performance?

Dutch semiconductor equipment company ASML Holding NV was the largest absolute detractor over the period. The stock fell in October as the company reduced its 2025 revenue guidance meaningfully, driven by lowered projections for the shipment of the extreme ultraviolet lithography systems critical to manufacturing advanced chips, along with a significant trimming of expected sales into China. Within the semiconductor sector, volatility rose following the DeepSeek large language model launch in January 2025 on concerns that growth in spending on AI-related technologies may significantly slow beyond 2025.

Danish pharmaceutical company Novo Nordisk A/S detracted as perceptions of the obesity market’s growth potential changed. The stock fell sharply after investors were disappointed with efficacy results during trials. The company’s results have also been challenged by a longer-than-expected overhang from compounders (companies which produce non-FDA approved medication) which have taken some near-term market share.

Class R Shares | MSCI EAFE Index (Net) | MSCI EMU Index (Net) | |

|---|---|---|---|

Jul 15 | $10,257 | $10,208 | $10,381 |

Aug 15 | $9,545 | $9,457 | $9,641 |

Sep 15 | $9,194 | $8,977 | $9,160 |

Oct 15 | $9,691 | $9,678 | $9,943 |

Nov 15 | $9,537 | $9,528 | $9,787 |

Dec 15 | $9,315 | $9,399 | $9,489 |

Jan 16 | $8,783 | $8,720 | $8,854 |

Feb 16 | $8,470 | $8,560 | $8,621 |

Mar 16 | $9,010 | $9,117 | $9,291 |

Apr 16 | $9,132 | $9,381 | $9,450 |

May 16 | $9,045 | $9,296 | $9,383 |

Jun 16 | $8,618 | $8,984 | $8,800 |

Jul 16 | $8,862 | $9,439 | $9,311 |

Aug 16 | $8,757 | $9,446 | $9,399 |

Sep 16 | $8,809 | $9,562 | $9,485 |

Oct 16 | $8,426 | $9,366 | $9,375 |

Nov 16 | $8,199 | $9,179 | $9,044 |

Dec 16 | $8,517 | $9,493 | $9,617 |

Jan 17 | $8,820 | $9,769 | $9,755 |

Feb 17 | $8,793 | $9,908 | $9,845 |

Mar 17 | $9,114 | $10,181 | $10,445 |

Apr 17 | $9,551 | $10,440 | $10,877 |

May 17 | $9,899 | $10,823 | $11,408 |

Jun 17 | $9,774 | $10,804 | $11,278 |

Jul 17 | $10,077 | $11,116 | $11,696 |

Aug 17 | $10,077 | $11,112 | $11,740 |

Sep 17 | $10,407 | $11,388 | $12,192 |

Oct 17 | $10,354 | $11,561 | $12,305 |

Nov 17 | $10,256 | $11,682 | $12,338 |

Dec 17 | $10,347 | $11,870 | $12,315 |

Jan 18 | $11,030 | $12,465 | $13,181 |

Feb 18 | $10,302 | $11,903 | $12,419 |

Mar 18 | $10,311 | $11,688 | $12,259 |

Apr 18 | $10,374 | $11,955 | $12,630 |

May 18 | $10,140 | $11,686 | $12,029 |

Jun 18 | $10,014 | $11,544 | $11,926 |

Jul 18 | $10,194 | $11,828 | $12,365 |

Aug 18 | $10,005 | $11,599 | $11,969 |

Sep 18 | $9,960 | $11,700 | $11,915 |

Oct 18 | $8,989 | $10,769 | $10,873 |

Nov 18 | $8,738 | $10,755 | $10,773 |

Dec 18 | $8,241 | $10,233 | $10,234 |

Jan 19 | $8,768 | $10,906 | $10,919 |

Feb 19 | $9,082 | $11,184 | $11,262 |

Mar 19 | $9,267 | $11,254 | $11,252 |

Apr 19 | $9,683 | $11,570 | $11,808 |

May 19 | $9,110 | $11,015 | $11,050 |

Jun 19 | $9,748 | $11,668 | $11,869 |

Jul 19 | $9,406 | $11,520 | $11,621 |

Aug 19 | $9,249 | $11,222 | $11,353 |

Sep 19 | $9,369 | $11,543 | $11,657 |

Oct 19 | $9,702 | $11,958 | $12,072 |

Nov 19 | $9,942 | $12,093 | $12,248 |

Dec 19 | $10,229 | $12,486 | $12,609 |

Jan 20 | $10,063 | $12,225 | $12,234 |

Feb 20 | $9,406 | $11,120 | $11,165 |

Mar 20 | $7,834 | $9,636 | $9,234 |

Apr 20 | $8,444 | $10,258 | $9,815 |

May 20 | $9,073 | $10,705 | $10,440 |

Jun 20 | $9,674 | $11,069 | $11,056 |

Jul 20 | $10,118 | $11,327 | $11,476 |

Aug 20 | $10,710 | $11,910 | $12,015 |

Sep 20 | $10,442 | $11,600 | $11,566 |

Oct 20 | $9,850 | $11,137 | $10,847 |

Nov 20 | $11,616 | $12,864 | $13,044 |

Dec 20 | $12,153 | $13,462 | $13,605 |

Jan 21 | $11,700 | $13,318 | $13,329 |

Feb 21 | $12,144 | $13,617 | $13,796 |

Mar 21 | $12,421 | $13,930 | $14,239 |

Apr 21 | $13,281 | $14,349 | $14,899 |

May 21 | $13,938 | $14,817 | $15,508 |

Jun 21 | $13,679 | $14,650 | $15,200 |

Jul 21 | $14,150 | $14,761 | $15,399 |

Aug 21 | $14,345 | $15,021 | $15,706 |

Sep 21 | $13,503 | $14,585 | $14,900 |

Oct 21 | $14,280 | $14,944 | $15,489 |

Nov 21 | $13,882 | $14,248 | $14,570 |

Dec 21 | $14,428 | $14,978 | $15,446 |

Jan 22 | $12,976 | $14,254 | $14,696 |

Feb 22 | $12,107 | $14,002 | $13,954 |

Mar 22 | $12,236 | $14,092 | $13,726 |

Apr 22 | $11,024 | $13,180 | $12,763 |

May 22 | $11,145 | $13,279 | $13,033 |

Jun 22 | $9,794 | $12,047 | $11,549 |

Jul 22 | $10,858 | $12,647 | $12,087 |

Aug 22 | $9,794 | $12,047 | $11,320 |

Sep 22 | $8,869 | $10,920 | $10,332 |

Oct 22 | $9,637 | $11,507 | $11,250 |

Nov 22 | $11,182 | $12,803 | $12,698 |

Dec 22 | $10,923 | $12,813 | $12,688 |

Jan 23 | $12,291 | $13,851 | $14,154 |

Feb 23 | $12,134 | $13,562 | $14,049 |

Mar 23 | $12,550 | $13,898 | $14,494 |

Apr 23 | $12,652 | $14,290 | $14,945 |

May 23 | $12,375 | $13,686 | $14,077 |

Jun 23 | $12,902 | $14,308 | $14,954 |

Jul 23 | $13,161 | $14,771 | $15,402 |

Aug 23 | $12,421 | $14,205 | $14,695 |

Sep 23 | $11,496 | $13,720 | $13,875 |

Oct 23 | $11,145 | $13,164 | $13,400 |

Nov 23 | $12,624 | $14,386 | $14,928 |

Dec 23 | $13,108 | $15,150 | $15,599 |

Jan 24 | $13,202 | $15,237 | $15,672 |

Feb 24 | $14,216 | $15,516 | $16,131 |

Mar 24 | $14,714 | $16,027 | $16,814 |

Apr 24 | $14,038 | $15,616 | $16,328 |

May 24 | $14,780 | $16,221 | $17,029 |

Jun 24 | $14,291 | $15,959 | $16,395 |

Jul 24 | $14,414 | $16,427 | $16,622 |

Aug 24 | $14,921 | $16,962 | $17,277 |

Sep 24 | $15,090 | $17,118 | $17,597 |

Oct 24 | $14,329 | $16,187 | $16,548 |

Nov 24 | $14,010 | $16,095 | $16,108 |

Dec 24 | $13,988 | $15,729 | $16,010 |

Jan 25 | $15,075 | $16,556 | $17,241 |

Feb 25 | $15,371 | $16,877 | $17,843 |

Mar 25 | $14,446 | $16,809 | $17,959 |

Apr 25 | $15,113 | $17,579 | $18,928 |

May 25 | $16,067 | $18,383 | $19,955 |

Jun 25 | $16,858 | $18,788 | $20,482 |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Class R Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.96% | 11.75% | 5.36% |

MSCI EAFE Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.73 | 11.16 | 6.51 |

MSCI EMU Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 24.93 | 13.12 | 7.43 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $119,510,046 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 44 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $487,995 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 89% |

Geographic allocation

Ten largest holdings

Country/Geographic Region | Percent of

Net Assets |

|---|---|

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.8% |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.7 |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.9 |

Netherlands........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.8 |

Switzerland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.3 |

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.3 |

Japan........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.3 |

Denmark........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.1 |

Italy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.9 |

Australia........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.1 |

OtherFootnote Reference(a)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.5 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

Other Assets Less Liabilities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.0 |

SecurityFootnote Reference(b) | Percent of

Net Assets |

|---|---|

SAP SE........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.1% |

Mastercard, Inc., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.4 |

UniCredit SpA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.4 |

RELX plc........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.0 |

Safran SA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.8 |

Cie de Saint-Gobain SA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.3 |

MTU Aero Engines AG........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |

Taiwan Semiconductor Manufacturing Co. Ltd......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 3.2 |

Advantest Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 3.1 |

Adyen NV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

| Footnote | Description |

Footnote(a) | Ten largest countries/geographic regions are presented. Additional countries/geographic regions are found in Other. |

Footnote(b) | Excludes short-term securities. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Institutional Shares | $103 | 0.95% |

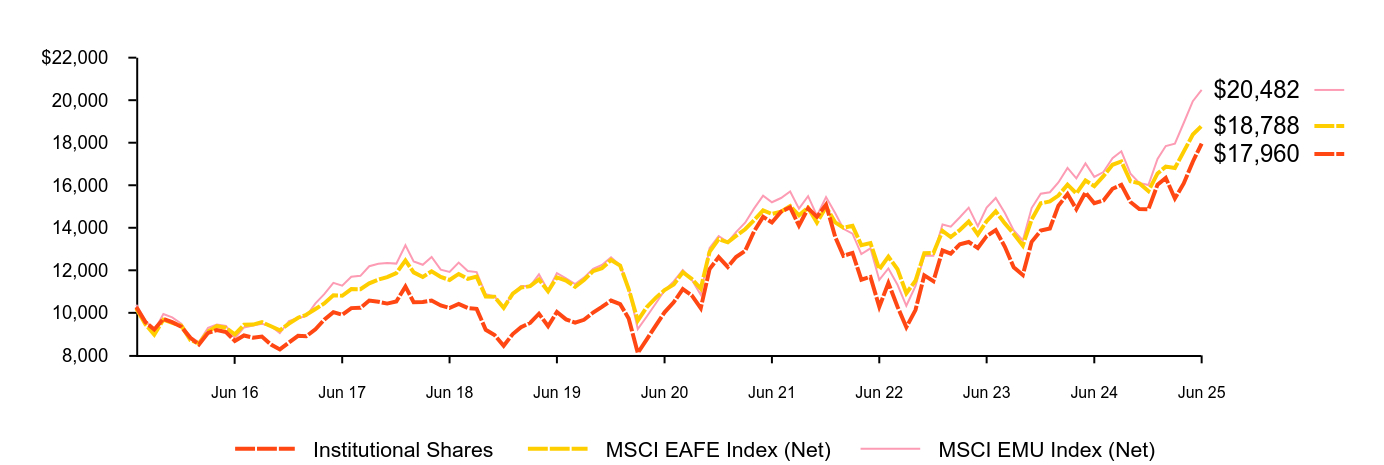

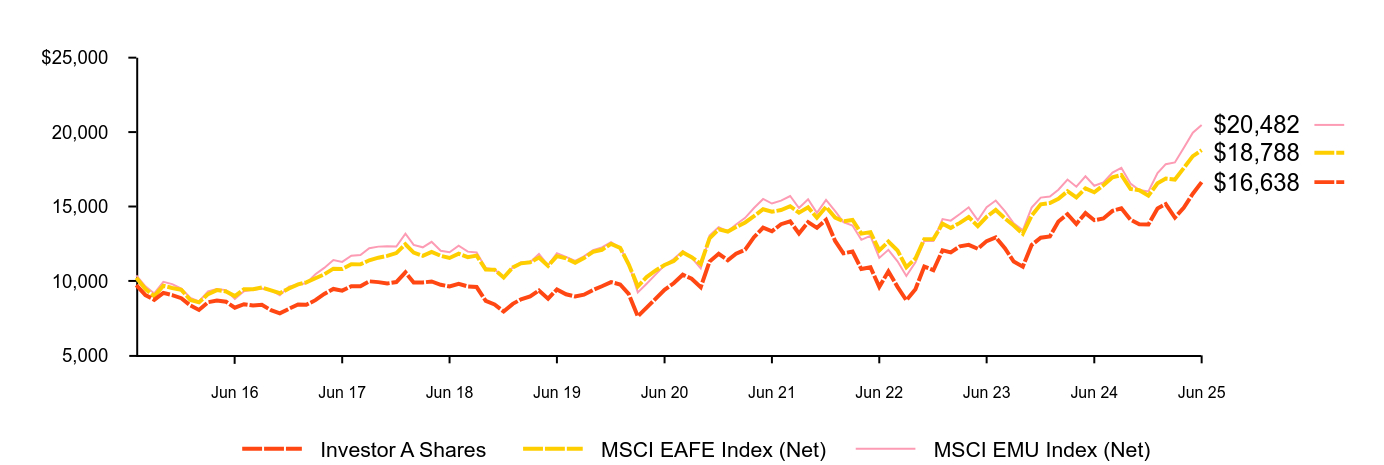

How did the Fund perform last year?

For the reporting period ended June 30, 2025, the Fund's Institutional Shares returned 18.52%.

For the same period, the Fund’s current benchmark, the MSCI EAFE Index (Net), returned 17.73%, while its previous benchmark, the MSCI EMU Index (Net), returned 24.93%.

What contributed to performance?