Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Columbia Funds Variable Insurance Trust

|

|

| Entity Central Index Key |

0000815425

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| Variable Portfolio – Managed Volatility Growth Fund - Class 1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Variable Portfolio – Managed Volatility Growth Fund

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Variable Portfolio – Managed Volatility Growth Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Class 1 |

$ 12 |

0.24 % (a) |

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.24%

|

[1] |

| Net Assets |

$ 11,138,471,654

|

|

| Holdings Count | Holding |

83

|

|

| Investment Company, Portfolio Turnover |

106.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

Fund net assets |

$ 11,138,471,654 |

Total number of portfolio holdings |

83 |

Portfolio turnover for the reporting peri od |

106% |

|

|

| Holdings [Text Block] |

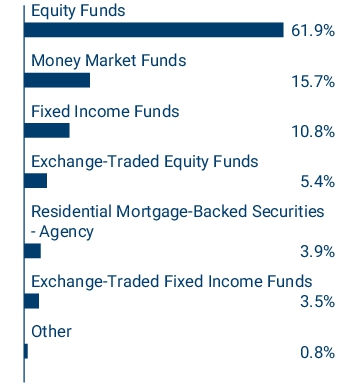

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

|

Long |

| Equity Risk |

18.2 % |

| Foreign Exchange Risk |

6.8 % |

| Interest Rate Risk |

4.2 % |

|

Short |

| Equity Risk |

39.5 % |

| Foreign Exchange Risk |

1.6 % |

|

|

| Variable Portfolio – Managed Volatility Growth Fund - Class 2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Variable Portfolio – Managed Volatility Growth Fund

|

|

| Class Name |

Class 2

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Variable Portfolio – Managed Volatility Growth Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Class 2 |

$ 25 |

0.49 % (a) |

|

|

| Expenses Paid, Amount |

$ 25

|

|

| Expense Ratio, Percent |

0.49%

|

[1] |

| Net Assets |

$ 11,138,471,654

|

|

| Holdings Count | Holding |

83

|

|

| Investment Company, Portfolio Turnover |

106.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

Fund net assets |

$ 11,138,471,654 |

Total number of portfolio holdings |

83 |

Portfolio turnover for the reporting period |

106% |

|

|

| Holdings [Text Block] |

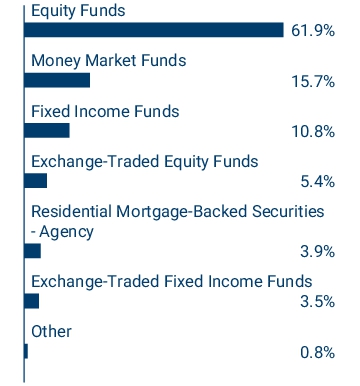

Graphical Representation of F u nd Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

|

Long |

| Equity Risk |

18.2 % |

| Foreign Exchange Risk |

6.8 % |

| Interest Rate Risk |

4.2 % |

|

Short |

| Equity Risk |

39.5 % |

| Foreign Exchange Risk |

1.6 % |

|

|

|

|