Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Columbia Funds Variable Insurance Trust

|

|

| Entity Central Index Key |

0000815425

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| Columbia Variable Portfolio – Long Government/Credit Bond Fund - Class 1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Variable Portfolio – Long Government/Credit Bond Fund

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Variable Portfolio – Long Government/Credit Bond Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class 1 | $ 24 | 0.48 % (a) |

|

|

| Expenses Paid, Amount |

$ 24

|

|

| Expense Ratio, Percent |

0.48%

|

[1] |

| Net Assets |

$ 1,112,774,943

|

|

| Holdings Count | Holding |

185

|

|

| Investment Company, Portfolio Turnover |

27.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,112,774,943 | Total number of portfolio holdings | 185 | Portfolio turnover for the reporting period | 27% |

|

|

| Holdings [Text Block] |

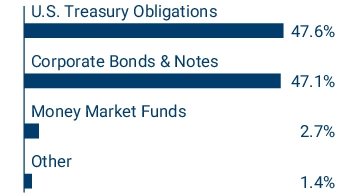

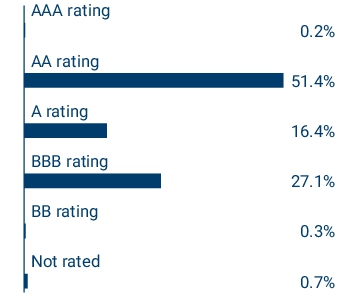

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. U.S. Treasury

08/15/2043 4.375% | 6.0 % | U.S. Treasury

05/15/2047 3.000% | 5.5 % | U.S. Treasury

02/15/2048 3.000% | 4.5 % | U.S. Treasury

05/15/2052 2.875% | 4.3 % | U.S. Treasury

02/15/2036 4.500% | 3.5 % | U.S. Treasury

05/15/2038 4.500% | 2.7 % | U.S. Treasury

02/15/2039 3.500% | 2.7 % | U.S. Treasury

05/15/2041 4.375% | 2.2 % | U.S. Treasury

05/15/2045 5.000% | 2.0 % | JPMorgan Chase & Co.

04/22/2036 5.572% | 1.9 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

U.S. Treasury

08/15/2043 4.375% | 6.0 % | U.S. Treasury

05/15/2047 3.000% | 5.5 % | U.S. Treasury

02/15/2048 3.000% | 4.5 % | U.S. Treasury

05/15/2052 2.875% | 4.3 % | U.S. Treasury

02/15/2036 4.500% | 3.5 % | U.S. Treasury

05/15/2038 4.500% | 2.7 % | U.S. Treasury

02/15/2039 3.500% | 2.7 % | U.S. Treasury

05/15/2041 4.375% | 2.2 % | U.S. Treasury

05/15/2045 5.000% | 2.0 % | JPMorgan Chase & Co.

04/22/2036 5.572% | 1.9 % |

|

|

| Columbia Variable Portfolio – Long Government/Credit Bond Fund - Class 2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Variable Portfolio – Long Government/Credit Bond Fund

|

|

| Class Name |

Class 2

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Variable Portfolio – Long Government/Credit Bond Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class 2 | $ 37 | 0.73 % (a) |

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.73%

|

[1] |

| Net Assets |

$ 1,112,774,943

|

|

| Holdings Count | Holding |

185

|

|

| Investment Company, Portfolio Turnover |

27.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,112,774,943 | Total number of portfolio holdings | 185 | Portfolio turnover for the reporting period | 27% |

|

|

| Holdings [Text Block] |

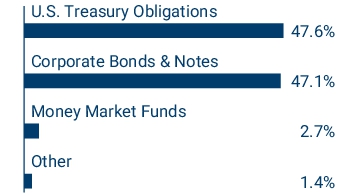

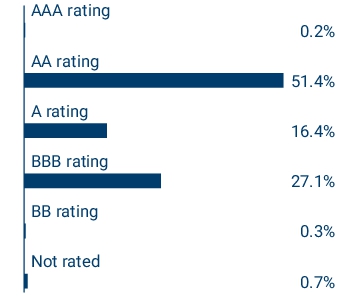

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. U.S. Treasury

08/15/2043 4.375% | 6.0 % | U.S. Treasury

05/15/2047 3.000% | 5.5 % | U.S. Treasury

02/15/2048 3.000% | 4.5 % | U.S. Treasury

05/15/2052 2.875% | 4.3 % | U.S. Treasury

02/15/2036 4.500% | 3.5 % | U.S. Treasury

05/15/2038 4.500% | 2.7 % | U.S. Treasury

02/15/2039 3.500% | 2.7 % | U.S. Treasury

05/15/2041 4.375% | 2.2 % | U.S. Treasury

05/15/2045 5.000% | 2.0 % | JPMorgan Chase & Co.

04/22/2036 5.572% | 1.9 % |

|

|

| Credit Quality Explanation [Text Block] |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P or Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

|

|

| Largest Holdings [Text Block] |

U.S. Treasury

08/15/2043 4.375% | 6.0 % | U.S. Treasury

05/15/2047 3.000% | 5.5 % | U.S. Treasury

02/15/2048 3.000% | 4.5 % | U.S. Treasury

05/15/2052 2.875% | 4.3 % | U.S. Treasury

02/15/2036 4.500% | 3.5 % | U.S. Treasury

05/15/2038 4.500% | 2.7 % | U.S. Treasury

02/15/2039 3.500% | 2.7 % | U.S. Treasury

05/15/2041 4.375% | 2.2 % | U.S. Treasury

05/15/2045 5.000% | 2.0 % | JPMorgan Chase & Co.

04/22/2036 5.572% | 1.9 % |

|

|

|

|