|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$147

|

1.42%

|

|

|

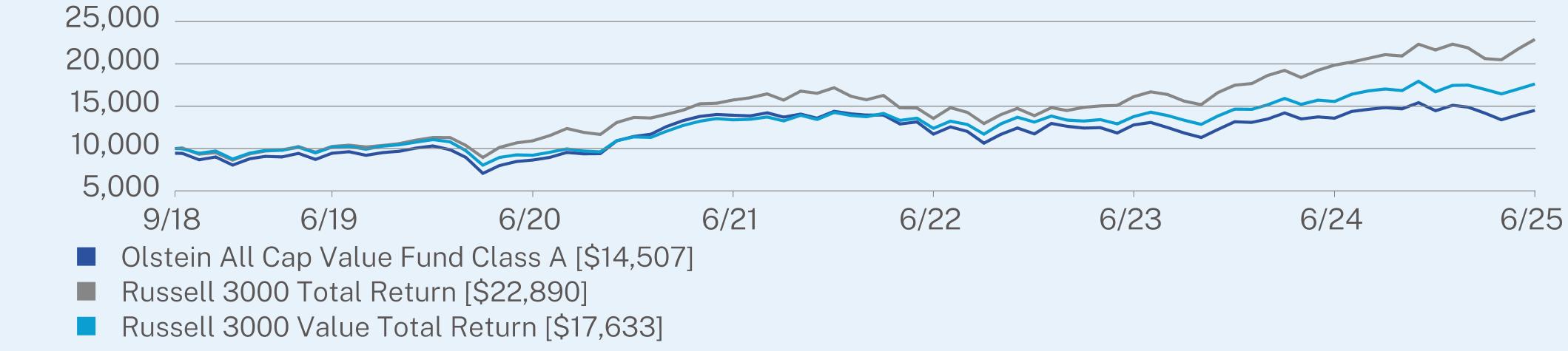

1 Year

|

5 Year

|

Since Inception

(09/17/2018) |

|

Class A (without sales charge)

|

6.75

|

10.91

|

6.52

|

|

Class A (with sales charge)

|

0.86

|

9.65

|

5.64

|

|

Russell 3000 Total Return

|

15.30

|

15.96

|

12.98

|

|

Russell 3000 Value Total Return

|

13.30

|

13.87

|

8.72

|

|

Net Assets

|

$499,627,715

|

|

Number of Equity Holdings

|

80

|

|

Net Advisory Fee

|

$5,309,140

|

|

Portfolio Turnover

|

38%

|

|

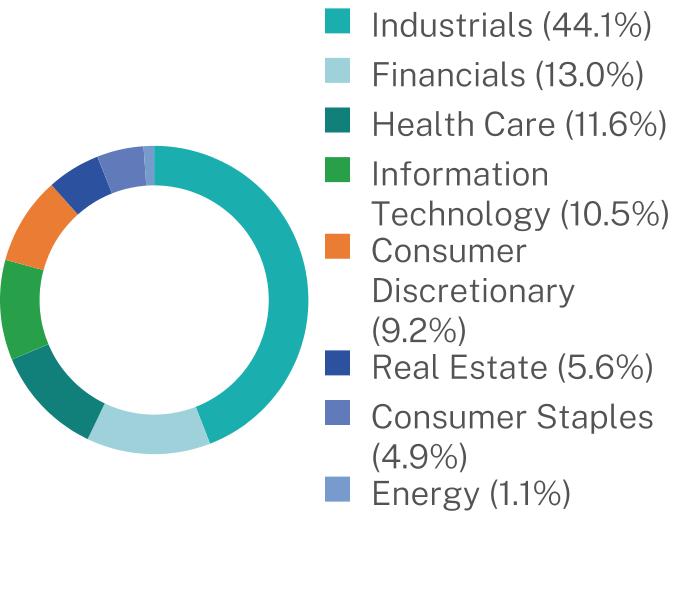

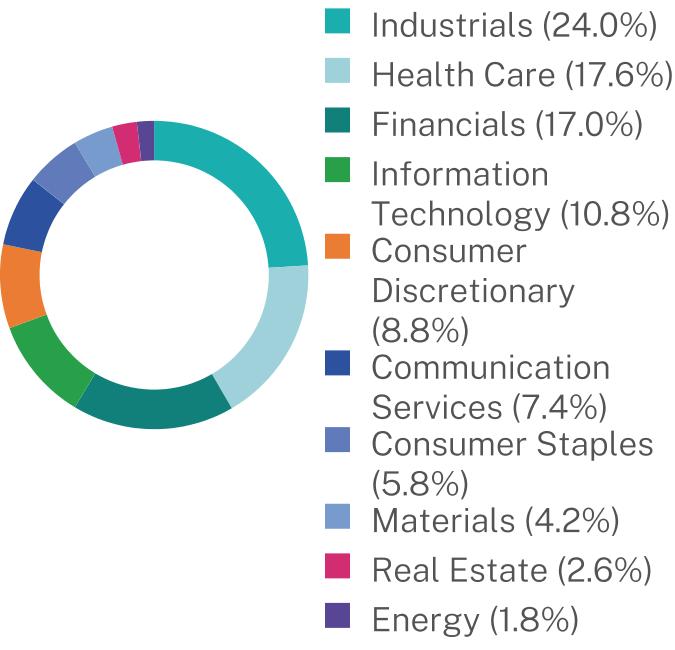

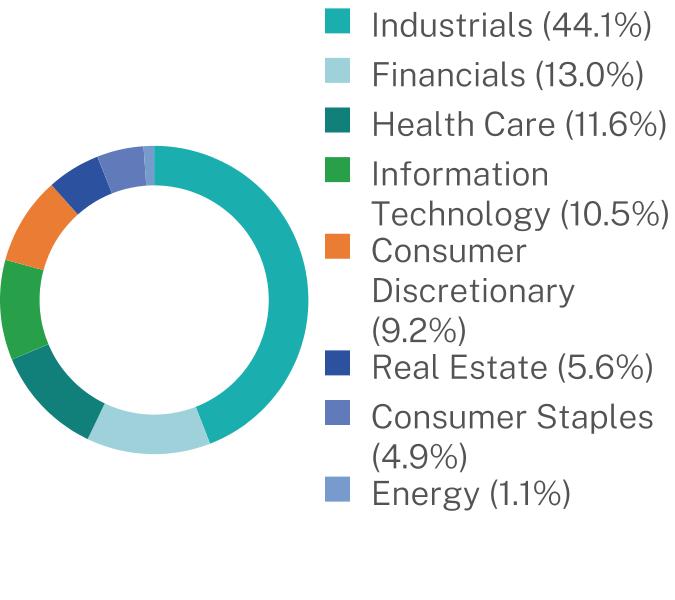

Security Type (% of Net Assets)

|

|

|

Common Stocks

|

96.6%

|

|

Cash & Other

|

3.4%

|

|

Top 10 Equity Issuers (% of Net Assets)

|

|

|

Walt Disney Company

|

2.8%

|

|

Johnson & Johnson

|

1.9%

|

|

General Dynamics Corporation

|

1.8%

|

|

Aptiv PLC

|

1.8%

|

|

Becton, Dickinson & Company

|

1.8%

|

|

Vontier Corporation

|

1.8%

|

|

Sensata Technologies Holdings PLC

|

1.7%

|

|

Schlumberger Ltd.

|

1.7%

|

|

ABM Industries, Inc.

|

1.6%

|

|

Baxter International, Inc.

|

1.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$223

|

2.17%

|

|

|

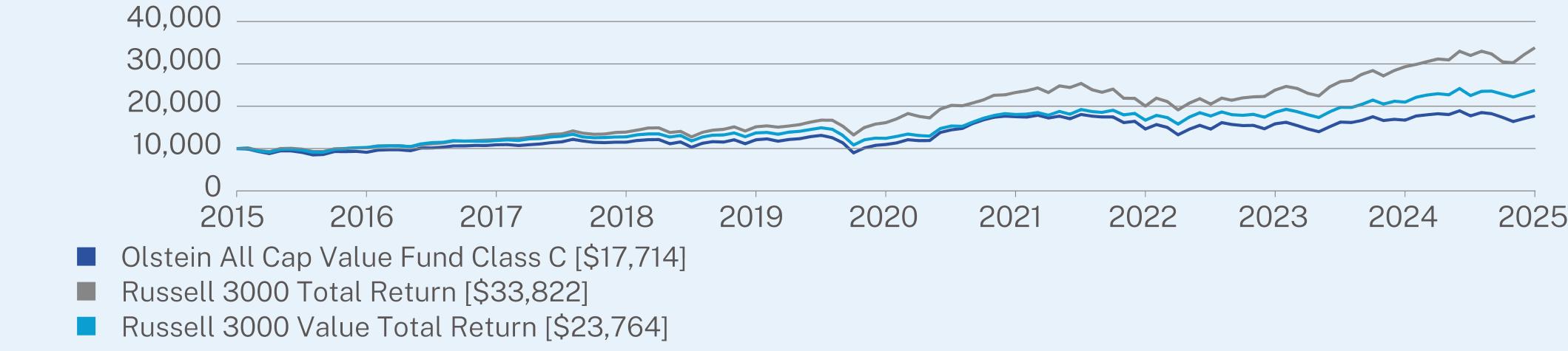

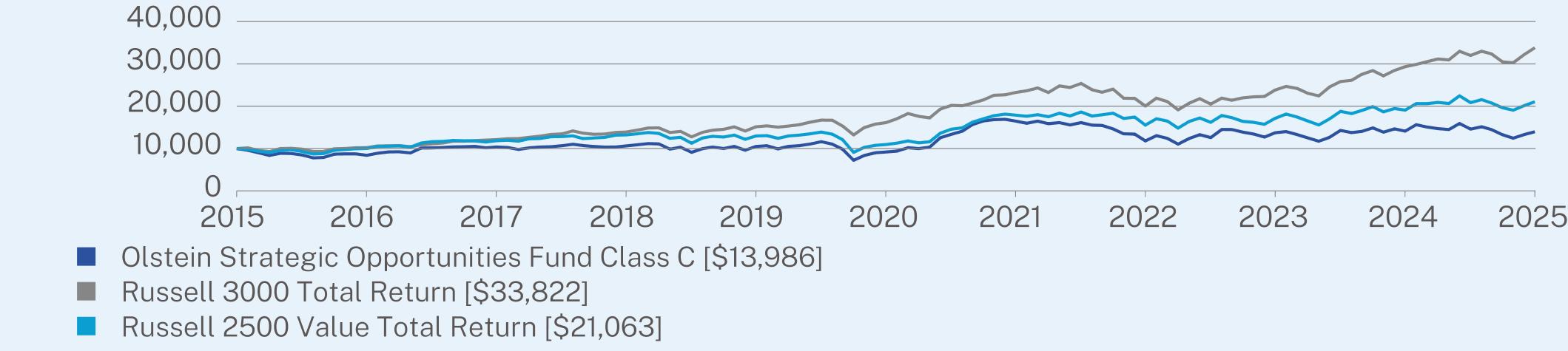

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

5.98

|

10.07

|

5.88

|

|

Class C (with sales charge)

|

5.03

|

10.07

|

5.88

|

|

Russell 3000 Total Return

|

15.30

|

15.96

|

12.96

|

|

Russell 3000 Value Total Return

|

13.30

|

13.87

|

9.04

|

|

Net Assets

|

$499,627,715

|

|

Number of Equity Holdings

|

80

|

|

Net Advisory Fee

|

$5,309,140

|

|

Portfolio Turnover

|

38%

|

|

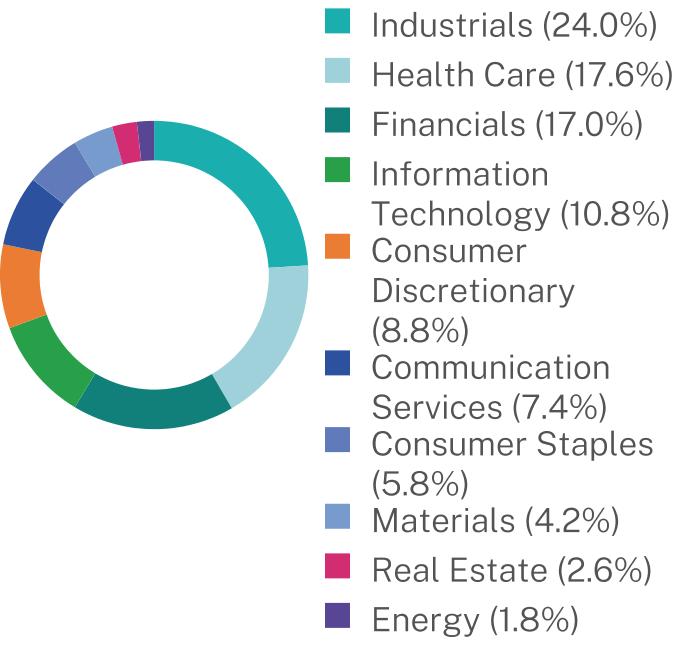

Security Type (% of Net Assets)

|

|

|

Common Stocks

|

96.6%

|

|

Cash & Other

|

3.4%

|

|

Top 10 Equity Issuers (% of Net Assets)

|

|

|

Walt Disney Company

|

2.8%

|

|

Johnson & Johnson

|

1.9%

|

|

General Dynamics Corporation

|

1.8%

|

|

Aptiv PLC

|

1.8%

|

|

Becton, Dickinson & Company

|

1.8%

|

|

Vontier Corporation

|

1.8%

|

|

Sensata Technologies Holdings PLC

|

1.7%

|

|

Schlumberger Ltd.

|

1.7%

|

|

ABM Industries, Inc.

|

1.6%

|

|

Baxter International, Inc.

|

1.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Adviser Class

|

$121

|

1.17%

|

|

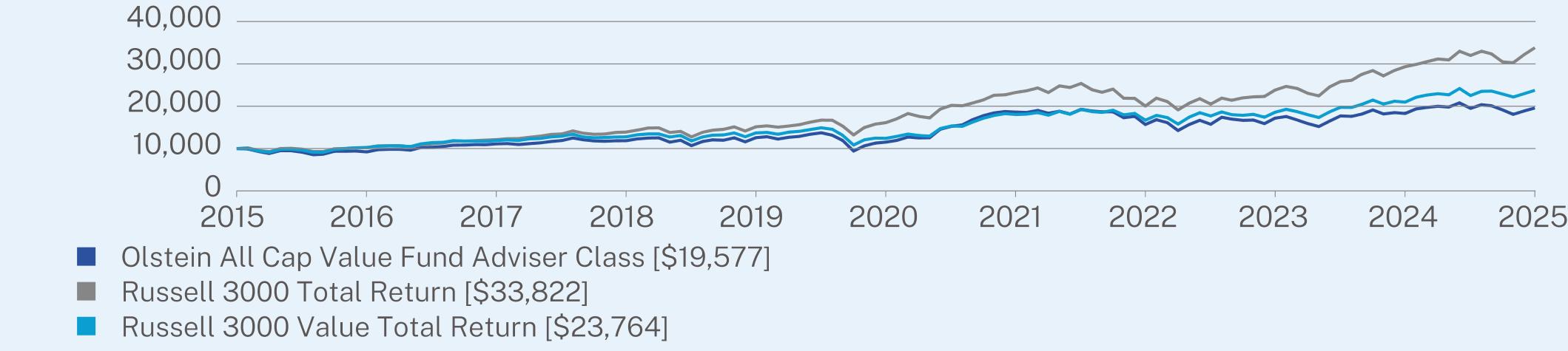

|

1 Year

|

5 Year

|

10 Year

|

|

Adviser Class (without sales charge)

|

7.05

|

11.18

|

6.95

|

|

Russell 3000 Total Return

|

15.30

|

15.96

|

12.96

|

|

Russell 3000 Value Total Return

|

13.30

|

13.87

|

9.04

|

|

Net Assets

|

$499,627,715

|

|

Number of Equity Holdings

|

80

|

|

Net Advisory Fee

|

$5,309,140

|

|

Portfolio Turnover

|

38%

|

|

Security Type (% of Net Assets)

|

|

|

Common Stocks

|

96.6%

|

|

Cash & Other

|

3.4%

|

|

Top 10 Equity Issuers (% of Net Assets)

|

|

|

Walt Disney Company

|

2.8%

|

|

Johnson & Johnson

|

1.9%

|

|

General Dynamics Corporation

|

1.8%

|

|

Aptiv PLC

|

1.8%

|

|

Becton, Dickinson & Company

|

1.8%

|

|

Vontier Corporation

|

1.8%

|

|

Sensata Technologies Holdings PLC

|

1.7%

|

|

Schlumberger Ltd.

|

1.7%

|

|

ABM Industries, Inc.

|

1.6%

|

|

Baxter International, Inc.

|

1.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$160

|

1.60%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

-0.13

|

9.59

|

4.19

|

|

Class A (with sales charge)

|

-5.64

|

8.36

|

3.60

|

|

Russell 3000 Total Return

|

15.30

|

15.96

|

12.96

|

|

Russell 2500 Value Total Return

|

10.47

|

13.96

|

7.73

|

|

Net Assets

|

$51,475,990

|

|

Number of Equity Holdings

|

37

|

|

Net Advisory Fee

|

$498,290

|

|

Portfolio Turnover

|

24%

|

|

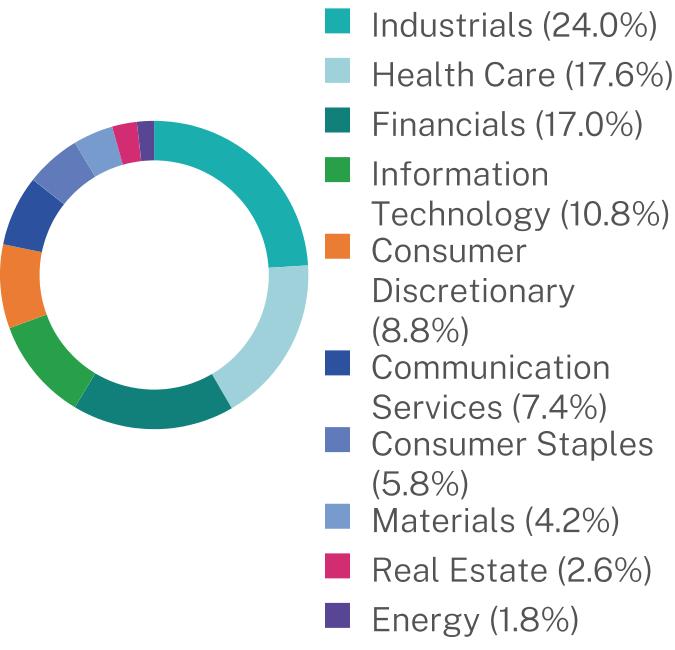

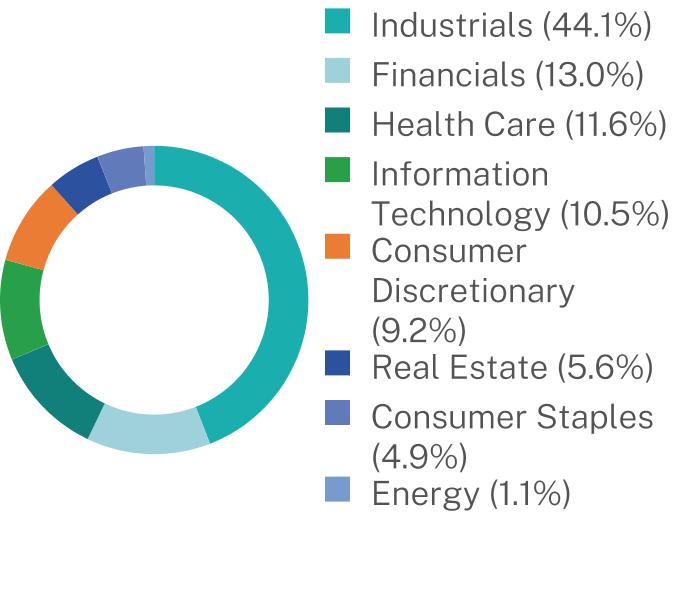

Security Type (% of Net Assets)

|

|

|

Common Stocks

|

98.5%

|

|

Cash & Other

|

1.5%

|

|

Top 10 Equity Issuers (% of Net Assets)

|

|

|

Sensata Technologies Holding PLC

|

4.8%

|

|

Shyft Group, Inc.

|

4.7%

|

|

Blue Bird Corporation

|

4.3%

|

|

Gates Industrial Corporation PLC

|

4.3%

|

|

Vontier Corporation

|

4.1%

|

|

Dine Brands Global, Inc.

|

3.7%

|

|

Invesco Ltd.

|

3.6%

|

|

Vishay Intertechnology, Inc.

|

3.5%

|

|

ABM Industries, Inc.

|

3.4%

|

|

Central Garden & Pet Company - Class A

|

3.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$234

|

2.35%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

-0.89

|

8.76

|

3.41

|

|

Class C (with sales charge)

|

-1.81

|

8.76

|

3.41

|

|

Russell 3000 Total Return

|

15.30

|

15.96

|

12.96

|

|

Russell 2500 Value Total Return

|

10.47

|

13.96

|

7.73

|

|

Net Assets

|

$51,475,990

|

|

Number of Equity Holdings

|

37

|

|

Net Advisory Fee

|

$498,290

|

|

Portfolio Turnover

|

24%

|

|

Security Type (% of Net Assets)

|

|

|

Common Stocks

|

98.5%

|

|

Cash & Other

|

1.5%

|

|

Top 10 Equity Issuers (% of Net Assets)

|

|

|

Sensata Technologies Holding PLC

|

4.8%

|

|

Shyft Group, Inc.

|

4.7%

|

|

Blue Bird Corporation

|

4.3%

|

|

Gates Industrial Corporation PLC

|

4.3%

|

|

Vontier Corporation

|

4.1%

|

|

Dine Brands Global, Inc.

|

3.7%

|

|

Invesco Ltd.

|

3.6%

|

|

Vishay Intertechnology, Inc.

|

3.5%

|

|

ABM Industries, Inc.

|

3.4%

|

|

Central Garden & Pet Company - Class A

|

3.3%

|

|

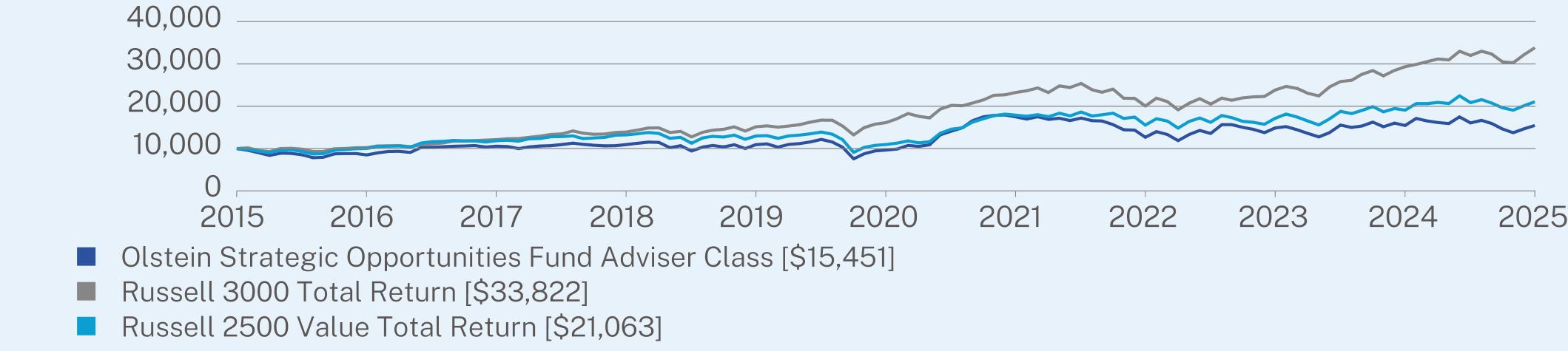

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Adviser Class

|

$135

|

1.35%

|

|

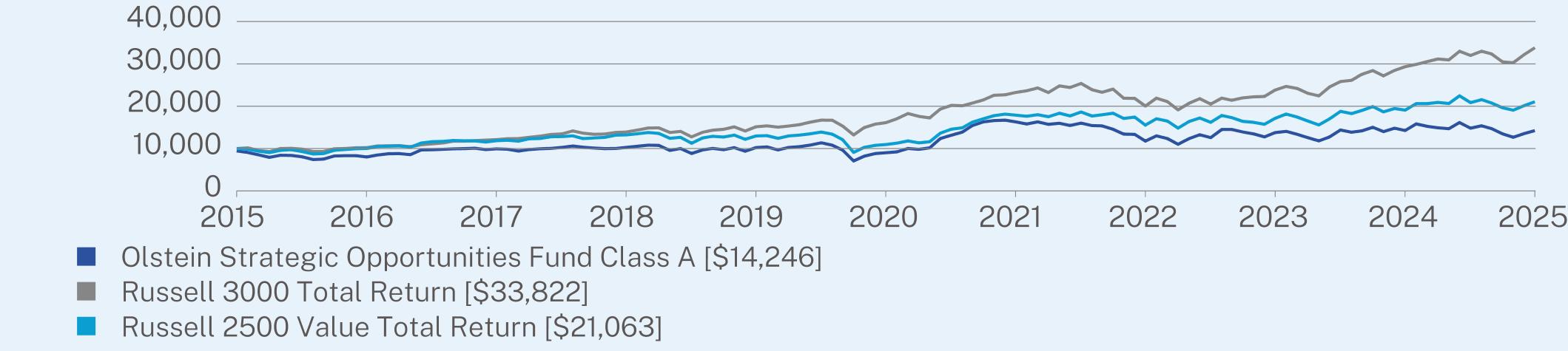

|

1 Year

|

5 Year

|

10 Year

|

|

Adviser Class (without sales charge)

|

0.10

|

9.86

|

4.45

|

|

Russell 3000 Total Return

|

15.30

|

15.96

|

12.96

|

|

Russell 2500 Value Total Return

|

10.47

|

13.96

|

7.73

|

|

Net Assets

|

$51,475,990

|

|

Number of Equity Holdings

|

37

|

|

Net Advisory Fee

|

$498,290

|

|

Portfolio Turnover

|

24%

|

|

Security Type (% of Net Assets)

|

|

|

Common Stocks

|

98.5%

|

|

Cash & Other

|

1.5%

|

|

Top 10 Equity Issuers (% of Net Assets)

|

|

|

Sensata Technologies Holding PLC

|

4.8%

|

|

Shyft Group, Inc.

|

4.7%

|

|

Blue Bird Corporation

|

4.3%

|

|

Gates Industrial Corporation PLC

|

4.3%

|

|

Vontier Corporation

|

4.1%

|

|

Dine Brands Global, Inc.

|

3.7%

|

|

Invesco Ltd.

|

3.6%

|

|

Vishay Intertechnology, Inc.

|

3.5%

|

|

ABM Industries, Inc.

|

3.4%

|

|

Central Garden & Pet Company - Class A

|

3.3%

|