Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Columbia Acorn Trust

|

|

| Entity Central Index Key |

0000002110

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| Columbia Acorn® Fund - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn® Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

LACAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn ® Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 51 | 1.05 % (a) |

|

|

| Expenses Paid, Amount |

$ 51

|

|

| Expense Ratio, Percent |

1.05%

|

[1] |

| Net Assets |

$ 2,461,733,489

|

|

| Holdings Count | Holding |

100

|

|

| Investment Company, Portfolio Turnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,461,733,489 | Total number of portfolio holdings | 100 | Portfolio turnover for the reporting period | 43% |

|

|

| Holdings [Text Block] |

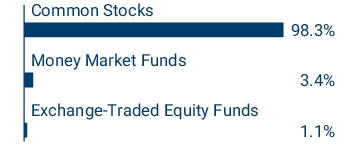

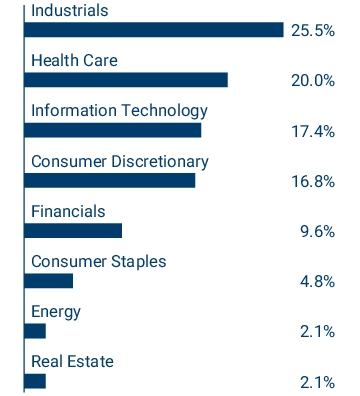

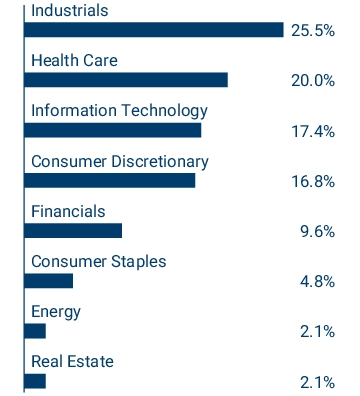

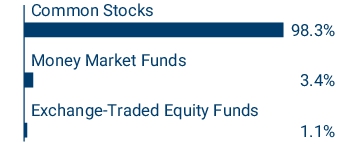

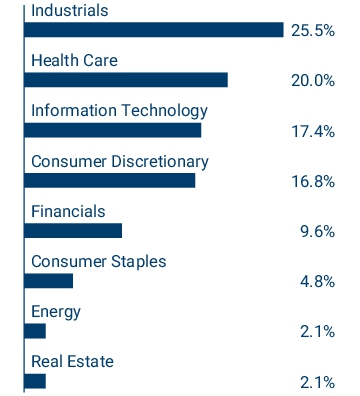

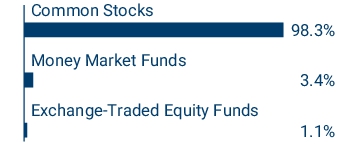

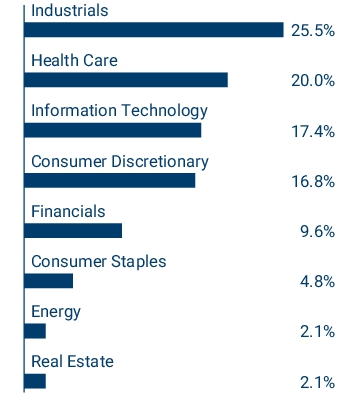

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets . Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Largest Holdings [Text Block] |

| SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Columbia Acorn® Fund - Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn® Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

LIACX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn ® Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 87 | 1.80 % (a) |

|

|

| Expenses Paid, Amount |

$ 87

|

|

| Expense Ratio, Percent |

1.80%

|

[1] |

| Net Assets |

$ 2,461,733,489

|

|

| Holdings Count | Holding |

100

|

|

| Investment Company, Portfolio Turnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,461,733,489 | Total number of portfolio holdings | 100 | Portfolio turnover for the reporting period | 43% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets . Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Largest Holdings [Text Block] |

| SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Columbia Acorn® Fund - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn® Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

ACRNX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn ® Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 39 | 0.80 % (a) |

|

|

| Expenses Paid, Amount |

$ 39

|

|

| Expense Ratio, Percent |

0.80%

|

[1] |

| Net Assets |

$ 2,461,733,489

|

|

| Holdings Count | Holding |

100

|

|

| Investment Company, Portfolio Turnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,461,733,489 | Total number of portfolio holdings | 100 | Portfolio turnover for the reporting period | 43% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets . Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Largest Holdings [Text Block] |

| SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Columbia Acorn® Fund - Institutional 2 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn® Fund

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

CRBRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn ® Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 37 | 0.77 % (a) |

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.77%

|

[1] |

| Net Assets |

$ 2,461,733,489

|

|

| Holdings Count | Holding |

100

|

|

| Investment Company, Portfolio Turnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,461,733,489 | Total number of portfolio holdings | 100 | Portfolio turnover for the reporting period | 43% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets . Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Largest Holdings [Text Block] |

| SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Columbia Acorn® Fund - Institutional 3 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn® Fund

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CRBYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn ® Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 35 | 0.72 % (a) |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.72%

|

[1] |

| Net Assets |

$ 2,461,733,489

|

|

| Holdings Count | Holding |

100

|

|

| Investment Company, Portfolio Turnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,461,733,489 | Total number of portfolio holdings | 100 | Portfolio turnover for the reporting period | 43% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets . Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Largest Holdings [Text Block] |

| SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Columbia Acorn® Fund - Class S |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn® Fund

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

ACRSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn ® Fund (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 39 | 0.80 % (a) |

|

|

| Expenses Paid, Amount |

$ 39

|

|

| Expense Ratio, Percent |

0.80%

|

[1] |

| Net Assets |

$ 2,461,733,489

|

|

| Holdings Count | Holding |

100

|

|

| Investment Company, Portfolio Turnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 2,461,733,489 | Total number of portfolio holdings | 100 | Portfolio turnover for the reporting period | 43% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted . The Fund's portfolio composition is subject to change. | SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Largest Holdings [Text Block] |

| SPX Technologies, Inc. | 2.6 % | | Churchill Downs, Inc. | 2.4 % | | GCM Grosvenor, Inc., Class A | 2.4 % | | Parsons Corp. | 2.4 % | | Curtiss-Wright Corp. | 2.3 % | | Wingstop, Inc. | 2.2 % | | Five Below, Inc. | 2.2 % | | Carlyle Group, Inc. (The) | 2.1 % | | HealthEquity, Inc. | 2.1 % | | Colliers International Group, Inc. | 2.1 % |

|

|

| Columbia Acorn International® - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International®

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

LAIAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International ® (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 66 | 1.22 % (a) |

|

|

| Expenses Paid, Amount |

$ 66

|

|

| Expense Ratio, Percent |

1.22%

|

[1] |

| Net Assets |

$ 925,680,060

|

|

| Holdings Count | Holding |

67

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 925,680,060 | Total number of portfolio holdings | 67 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

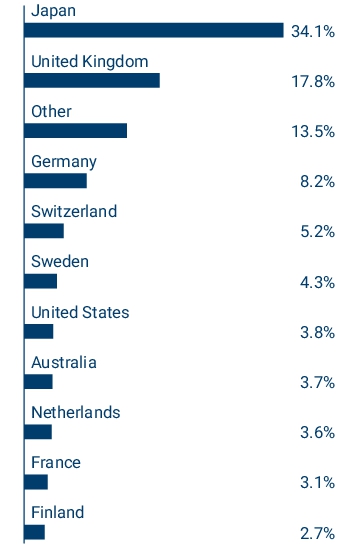

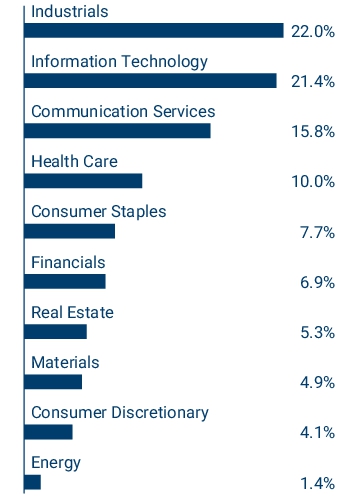

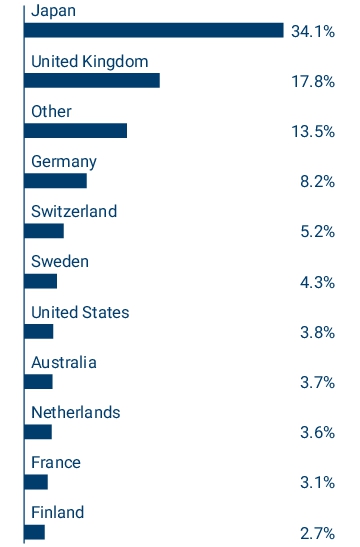

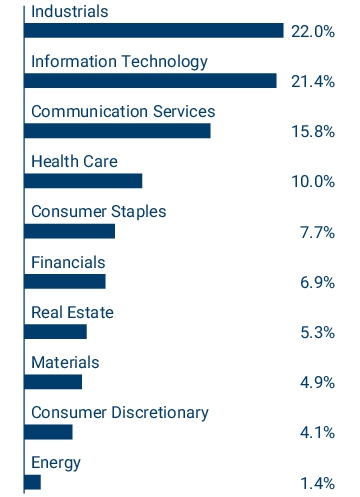

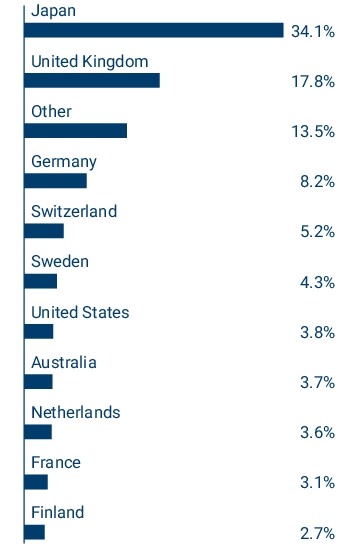

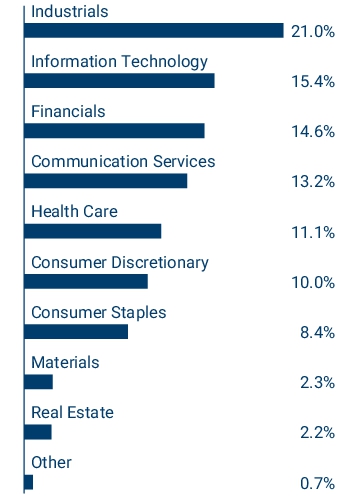

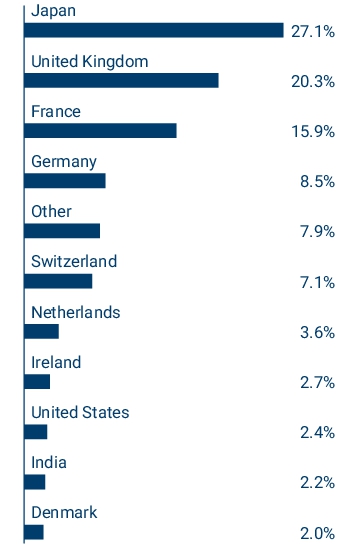

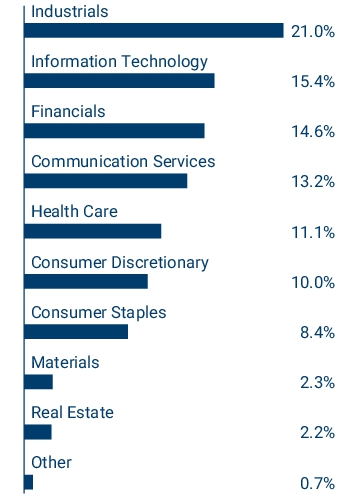

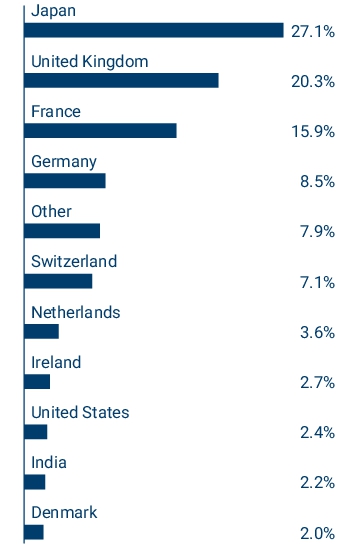

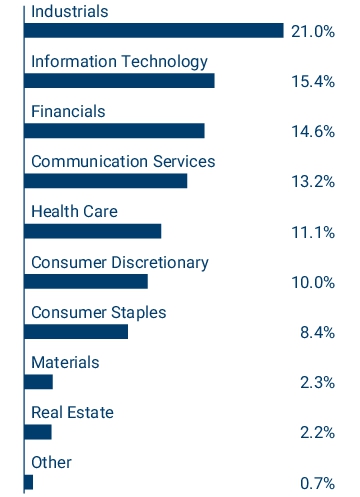

Graphical Representation of Fund Holdings The tables below show the inv es tment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Columbia Acorn International® - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International®

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

ACINX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International ® (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 52 | 0.96 % (a) |

|

|

| Expenses Paid, Amount |

$ 52

|

|

| Expense Ratio, Percent |

0.96%

|

[1] |

| Net Assets |

$ 925,680,060

|

|

| Holdings Count | Holding |

67

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 925,680,060 | Total number of portfolio holdings | 67 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Columbia Acorn International® - Institutional 2 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International®

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

CAIRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International ® (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 48 | 0.90 % (a) |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.90%

|

[1] |

| Net Assets |

$ 925,680,060

|

|

| Holdings Count | Holding |

67

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 925,680,060 | Total number of portfolio holdings | 67 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdin gs The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Columbia Acorn International® - Institutional 3 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International®

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CCYIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International ® (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 46 | 0.85 % (a) |

|

|

| Expenses Paid, Amount |

$ 46

|

|

| Expense Ratio, Percent |

0.85%

|

[1] |

| Net Assets |

$ 925,680,060

|

|

| Holdings Count | Holding |

67

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 925,680,060 | Total number of portfolio holdings | 67 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Columbia Acorn International® - Class S |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International®

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

CCIDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International ® (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 52 | 0.97 % (a) |

|

|

| Expenses Paid, Amount |

$ 52

|

|

| Expense Ratio, Percent |

0.97%

|

[1] |

| Net Assets |

$ 925,680,060

|

|

| Holdings Count | Holding |

67

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 925,680,060 | Total number of portfolio holdings | 67 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Capcom Co., Ltd. | 3.2 % | | Halma PLC | 2.8 % | | Rightmove PLC | 2.7 % | | Fisher & Paykel Healthcare Corp., Ltd. | 2.6 % | | CTS Eventim AG & Co. KGaA | 2.6 % | | Auto Trader Group PLC | 2.5 % | Niterra Co., Ltd.

| 2.4 % | | Nemetschek SE | 2.3 % | | Belimo Holding AG, Registered Shares | 2.3 % | | CAR Group Ltd. | 2.3 % |

|

|

| Columbia Acorn International SelectSM - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International SelectSM

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

LAFAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International Select SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 62 | 1.16 % (a) |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.16%

|

[1] |

| Net Assets |

$ 203,521,015

|

|

| Holdings Count | Holding |

59

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 203,521,015 | Total number of portfolio holdings | 59 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

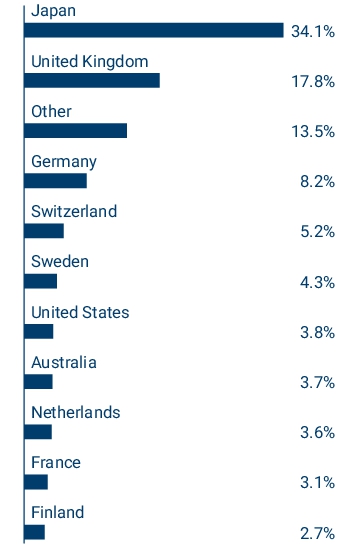

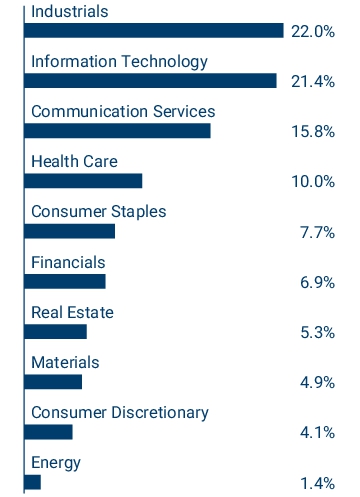

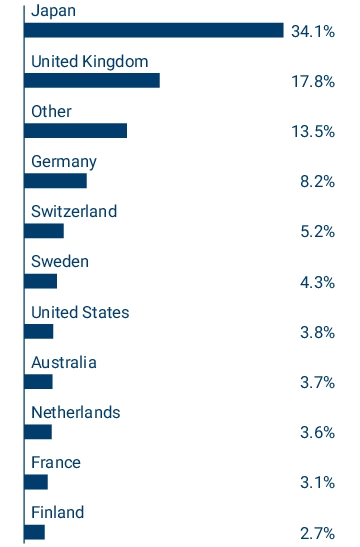

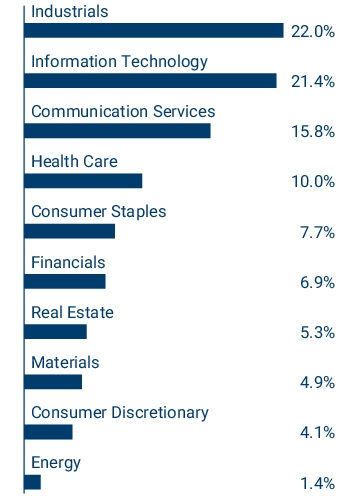

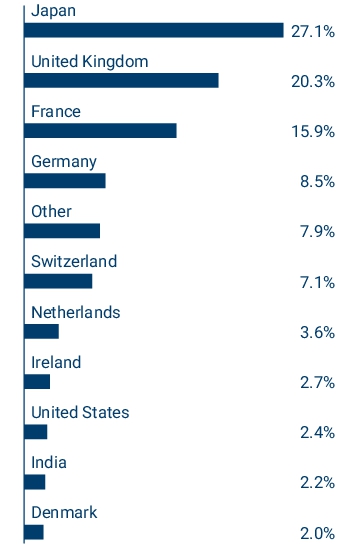

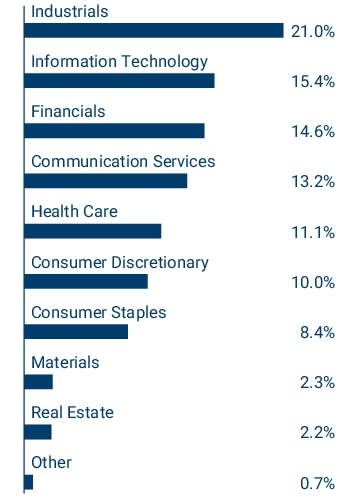

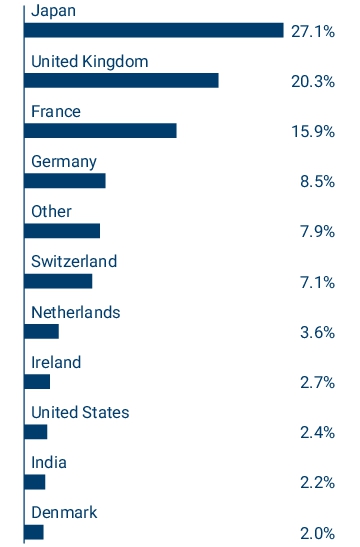

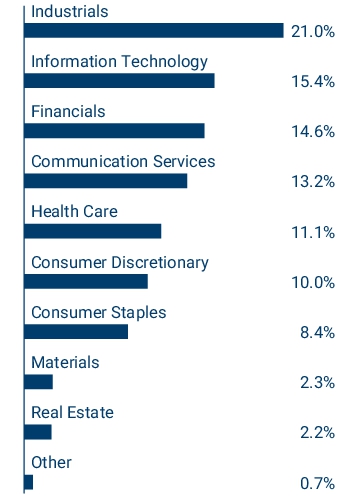

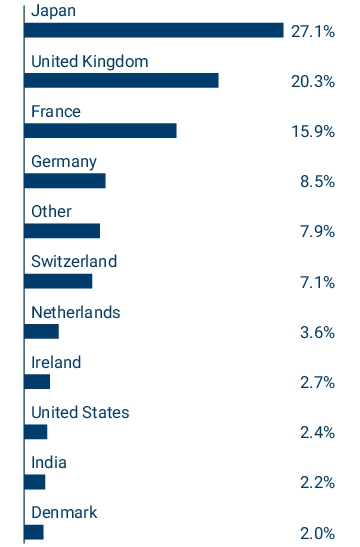

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Columbia Acorn International SelectSM - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International SelectSM

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

ACFFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International Select SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 48 | 0.91 % (a) |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.91%

|

[1] |

| Net Assets |

$ 203,521,015

|

|

| Holdings Count | Holding |

59

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 203,521,015 | Total number of portfolio holdings | 59 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Columbia Acorn International SelectSM - Institutional 2 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International SelectSM

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

CRIRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International Select SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 41 | 0.77 % (a) |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.77%

|

[1] |

| Net Assets |

$ 203,521,015

|

|

| Holdings Count | Holding |

59

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 203,521,015 | Total number of portfolio holdings | 59 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Columbia Acorn International SelectSM - Institutional 3 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International SelectSM

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CSIRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International Select SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 38 | 0.71 % (a) |

|

|

| Expenses Paid, Amount |

$ 38

|

|

| Expense Ratio, Percent |

0.71%

|

[1] |

| Net Assets |

$ 203,521,015

|

|

| Holdings Count | Holding |

59

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 203,521,015 | Total number of portfolio holdings | 59 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Columbia Acorn International SelectSM - Class S |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn International SelectSM

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

ACFEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn International Select SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 48 | 0.91 % (a) |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.91%

|

[1] |

| Net Assets |

$ 203,521,015

|

|

| Holdings Count | Holding |

59

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 203,521,015 | Total number of portfolio holdings | 59 | Portfolio turnover for the reporting period | 9% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Largest Holdings [Text Block] |

| Schneider Electric SE | 3.9 % | | Capcom Co., Ltd. | 3.9 % | | 3i Group PLC | 3.2 % | | Airbus Group SE | 2.7 % | | Bank of Ireland Group PLC | 2.7 % | | ASML Holding NV | 2.6 % | | Adidas AG | 2.6 % | | Publicis Groupe SA | 2.5 % | | BT Group PLC | 2.4 % | | Nestlé SA, Registered Shares | 2.3 % |

|

|

| Columbia Thermostat FundSM - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Thermostat FundSM

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

CTFAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Thermostat Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 25 | 0.49 % (a) |

|

|

| Expenses Paid, Amount |

$ 25

|

|

| Expense Ratio, Percent |

0.49%

|

[1] |

| Net Assets |

$ 1,248,605,013

|

|

| Holdings Count | Holding |

12

|

|

| Investment Company, Portfolio Turnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,248,605,013 | Total number of portfolio holdings | 12 | Portfolio turnover for the reporting period | 60% |

|

|

| Holdings [Text Block] |

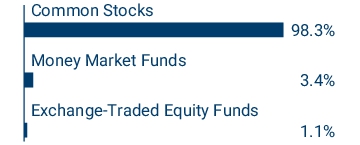

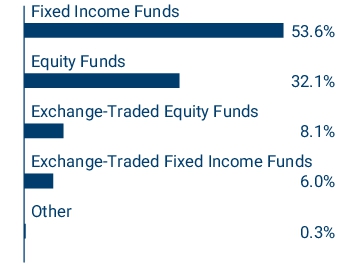

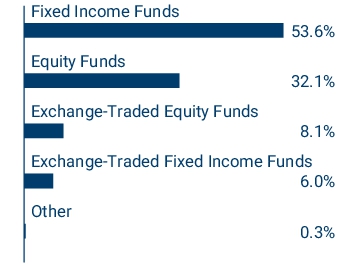

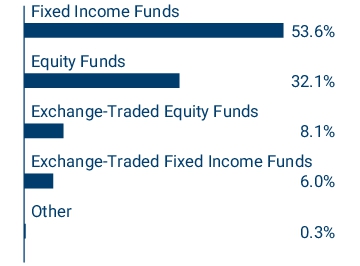

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Largest Holdings [Text Block] |

| Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Columbia Thermostat FundSM - Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Thermostat FundSM

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

CTFDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Thermostat Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 64 | 1.24 % (a) |

|

|

| Expenses Paid, Amount |

$ 64

|

|

| Expense Ratio, Percent |

1.24%

|

[1] |

| Net Assets |

$ 1,248,605,013

|

|

| Holdings Count | Holding |

12

|

|

| Investment Company, Portfolio Turnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 1,248,605,013 | Total number of portfolio holdings | 12 | Portfolio turnover for the reporting period | 60% |

|

|

| Holdings [Text Block] |

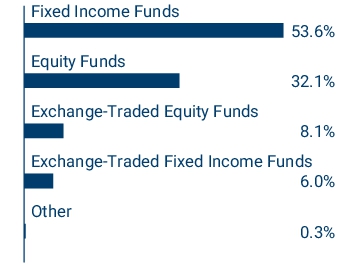

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund repre se nted as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Largest Holdings [Text Block] |

| Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Columbia Thermostat FundSM - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Thermostat FundSM

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

COTZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Thermostat Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 12 | 0.24 % (a) |

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.24%

|

[1] |

| Net Assets |

$ 1,248,605,013

|

|

| Holdings Count | Holding |

12

|

|

| Investment Company, Portfolio Turnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,248,605,013 | Total number of portfolio holdings | 12 | Portfolio turnover for the reporting period | 60% |

|

|

| Holdings [Text Block] |

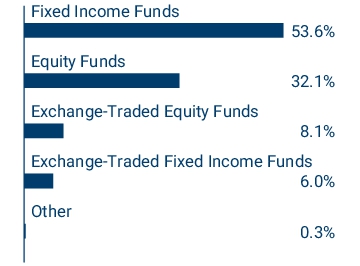

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund repre se nted as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Largest Holdings [Text Block] |

| Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Columbia Thermostat FundSM - Institutional 2 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Thermostat FundSM

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

CQTRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Thermostat Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 10 | 0.19 % (a) |

|

|

| Expenses Paid, Amount |

$ 10

|

|

| Expense Ratio, Percent |

0.19%

|

[1] |

| Net Assets |

$ 1,248,605,013

|

|

| Holdings Count | Holding |

12

|

|

| Investment Company, Portfolio Turnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,248,605,013 | Total number of portfolio holdings | 12 | Portfolio turnover for the reporting period | 60% |

|

|

| Holdings [Text Block] |

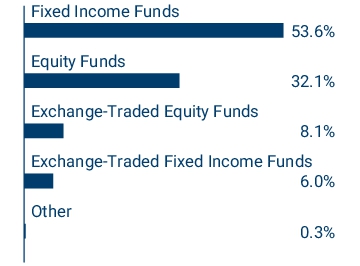

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Largest Holdings [Text Block] |

| Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Columbia Thermostat FundSM - Institutional 3 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Thermostat FundSM

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CYYYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Thermostat Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 7 | 0.14 % (a) |

|

|

| Expenses Paid, Amount |

$ 7

|

|

| Expense Ratio, Percent |

0.14%

|

[1] |

| Net Assets |

$ 1,248,605,013

|

|

| Holdings Count | Holding |

12

|

|

| Investment Company, Portfolio Turnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,248,605,013 | Total number of portfolio holdings | 12 | Portfolio turnover for the reporting period | 60% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Largest Holdings [Text Block] |

| Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Columbia Thermostat FundSM - Class S |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Thermostat FundSM

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

COTDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Thermostat Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 12 | 0.24 % (a) |

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.24%

|

[1] |

| Net Assets |

$ 1,248,605,013

|

|

| Holdings Count | Holding |

12

|

|

| Investment Company, Portfolio Turnover |

60.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 1,248,605,013 | Total number of portfolio holdings | 12 | Portfolio turnover for the reporting period | 60% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Largest Holdings [Text Block] |

| Columbia Total Return Bond Fund, Institutional 3 Class | 14.9 % | | Columbia Corporate Income Fund, Institutional 3 Class | 11.9 % | | Columbia U.S. Treasury Index Fund, Institutional 3 Class | 11.9 % | | Columbia Contrarian Core Fund, Institutional 3 Class | 10.1 % | | Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10.0 % | | Columbia Quality Income Fund, Institutional 3 Class | 9.0 % | | Columbia Research Enhanced Core ETF | 8.1 % | | Columbia Large Cap Index Fund, Institutional 3 Class | 8.0 % | | Columbia High Yield Bond Fund, Institutional 3 Class | 5.9 % | | Columbia Diversified Fixed Income Allocation ETF | 6.0 % |

|

|

| Columbia Acorn European FundSM - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn European FundSM

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

CAEAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn European Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 75 | 1.37 % (a) |

|

|

| Expenses Paid, Amount |

$ 75

|

|

| Expense Ratio, Percent |

1.37%

|

[1] |

| Net Assets |

$ 41,167,250

|

|

| Holdings Count | Holding |

91

|

|

| Investment Company, Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 41,167,250 | Total number of portfolio holdings | 91 | Portfolio turnover for the reporting period | 53% |

|

|

| Holdings [Text Block] |

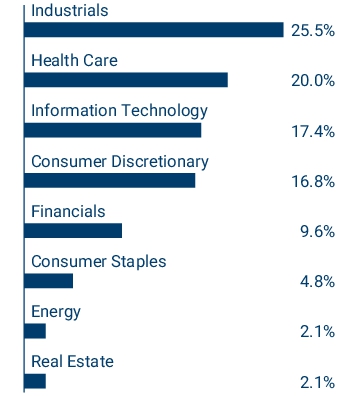

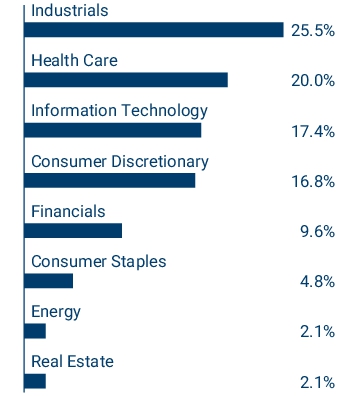

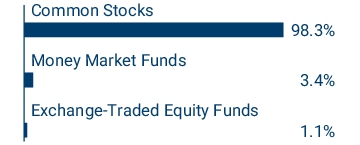

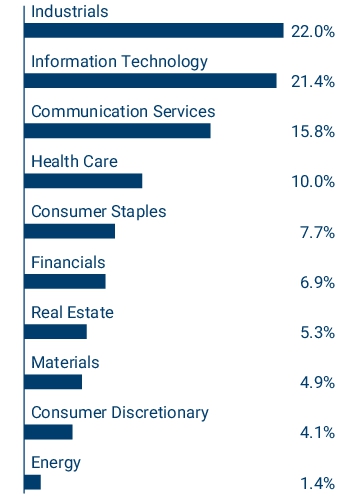

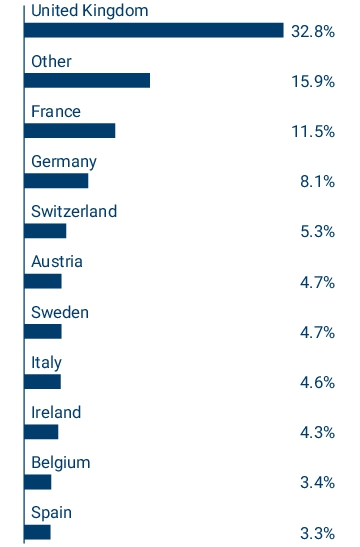

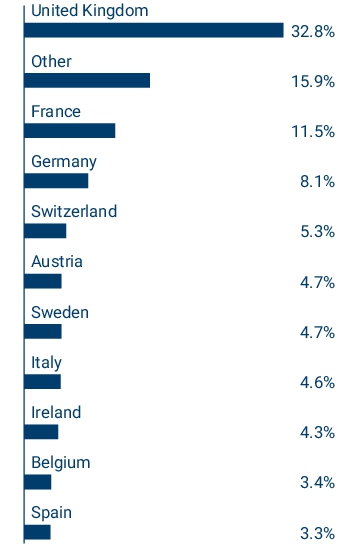

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the ta ble s unless otherwise noted. The Fund's portfolio composition is subject to change. | Elis SA | 2.9 % | | CTS Eventim AG & Co. KGaA | 2.3 % | | Storebrand ASA | 2.3 % | | Nexans SA | 2.2 % | | Safestore Holdings PLC | 2.2 % | | Quilter PLC | 2.1 % | | LondonMetric Property PLC | 2.0 % | | Buzzi SpA | 1.8 % | | Banco Comercial Portugues SA | 1.8 % | | Chemring Group PLC | 1.7 % |

|

|

| Largest Holdings [Text Block] |

| Elis SA | 2.9 % | | CTS Eventim AG & Co. KGaA | 2.3 % | | Storebrand ASA | 2.3 % | | Nexans SA | 2.2 % | | Safestore Holdings PLC | 2.2 % | | Quilter PLC | 2.1 % | | LondonMetric Property PLC | 2.0 % | | Buzzi SpA | 1.8 % | | Banco Comercial Portugues SA | 1.8 % | | Chemring Group PLC | 1.7 % |

|

|

| Columbia Acorn European FundSM - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Acorn European FundSM

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

CAEZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Acorn European Fund SM (the Fund) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 62 | 1.13 % (a) |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.13%

|

[1] |

| Net Assets |

$ 41,167,250

|

|

| Holdings Count | Holding |

91

|

|

| Investment Company, Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 41,167,250 | Total number of portfolio holdings | 91 | Portfolio turnover for the reporting period | 53% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Elis SA | 2.9 % | | CTS Eventim AG & Co. KGaA | 2.3 % | | Storebrand ASA | 2.3 % | | Nexans SA | 2.2 % | | Safestore Holdings PLC | 2.2 % | | Quilter PLC | 2.1 % | | LondonMetric Property PLC | 2.0 % | | Buzzi SpA | 1.8 % | | Banco Comercial Portugues SA | 1.8 % | | Chemring Group PLC | 1.7 % |

|

|

| Largest Holdings [Text Block] |

| Elis SA | 2.9 % | | CTS Eventim AG & Co. KGaA | 2.3 % | | Storebrand ASA | 2.3 % | | Nexans SA | 2.2 % | | Safestore Holdings PLC | 2.2 % | | Quilter PLC | 2.1 % | | LondonMetric Property PLC | 2.0 % | | Buzzi SpA | 1.8 % | | Banco Comercial Portugues SA | 1.8 % | | Chemring Group PLC | 1.7 % |

|

|

|

|