| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $93 | 1.80%2 |

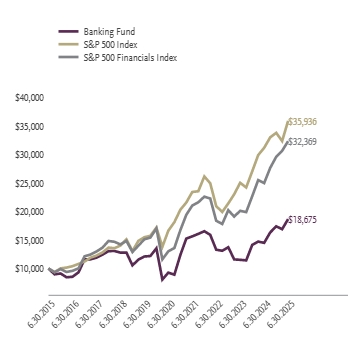

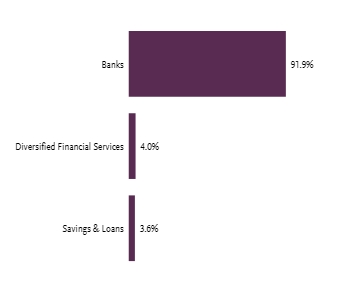

For the period of January 1, 2025 to June 30, 2025, the fund returned 7.30%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Financials Index, which returned 9.23% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were diversified banks, asset management & custody banks, and consumer finance. No industry detracted from performance. The holdings that contributed the most to performance were Nu Holdings Limited/Cayman Islands—Class A, JP Morgan Chase & Co, and Citigroup, Inc. Those that detracted the most were First Citizens BancShares, Inc.—Class A, Grupo Financiero Galicia SA Sponsored ADR—Class B, and U.S. Bancorp.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Banking Fund | 7.30% | 28.79% | 15.04% | 6.44% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Financials Index | 9.23% | 29.45% | 19.99% | 12.46% |

| Net Assets | $6,452,224 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 36% |

| Top 10 | % of Net Assets |

|---|---|

| Citigroup, Inc. | |

| Wells Fargo & Co. | |

| JPMorgan Chase & Co. | |

| Capital One Financial Corp. | |

| Bank of America Corp. | |

| PNC Financial Services Group, Inc. | |

| U.S. Bancorp | |

| NU Holdings Limited/Cayman Islands — Class A | |

| Bank of New York Mellon Corp. | |

| Truist Financial Corp. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Citigroup, Inc. | |

| Wells Fargo & Co. | |

| JPMorgan Chase & Co. | |

| Capital One Financial Corp. | |

| Bank of America Corp. | |

| PNC Financial Services Group, Inc. | |

| U.S. Bancorp | |

| NU Holdings Limited/Cayman Islands — Class A | |

| Bank of New York Mellon Corp. | |

| Truist Financial Corp. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.80%2 |

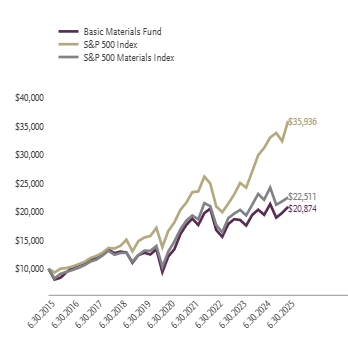

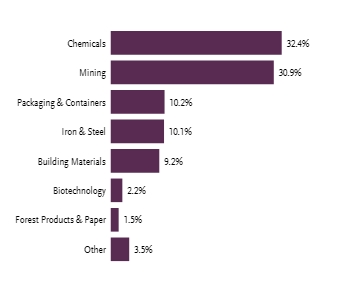

For the period of January 1, 2025 to June 30, 2025, the fund returned 10.01%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Materials Index, which returned 6.03% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were gold, steel, and fertilizers & agricultural chemicals. Those that detracted the most were specialty chemicals, commodity chemicals, and paper & plastic packaging products & materials. The holdings that contributed the most to performance were Newmont Corp., Linde plc, and Anglogold Ashanti plc. Those that detracted the most were Dow, Inc., LyondellBasell Industries N.V. - Class A, and Albemarle Corp.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Basic Materials Fund | 10.01% | 7.25% | 11.38% | 7.64% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Materials Index | 6.03% | 1.86% | 11.56% | 8.45% |

| Net Assets | $5,513,640 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 40% |

| Top 10 | % of Net Assets |

|---|---|

| Linde plc | |

| Sherwin-Williams Co. | |

| Ecolab, Inc. | |

| Newmont Corp. | |

| Freeport-McMoRan, Inc. | |

| Air Products and Chemicals, Inc. | |

| CRH plc | |

| Corteva, Inc. | |

| Vulcan Materials Co. | |

| Martin Marietta Materials, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Linde plc | |

| Sherwin-Williams Co. | |

| Ecolab, Inc. | |

| Newmont Corp. | |

| Freeport-McMoRan, Inc. | |

| Air Products and Chemicals, Inc. | |

| CRH plc | |

| Corteva, Inc. | |

| Vulcan Materials Co. | |

| Martin Marietta Materials, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $88 | 1.80%2 |

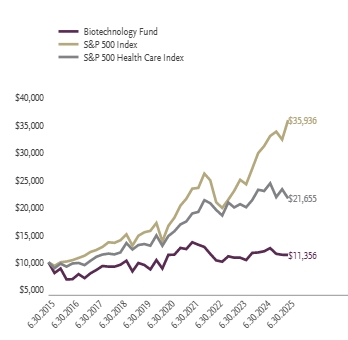

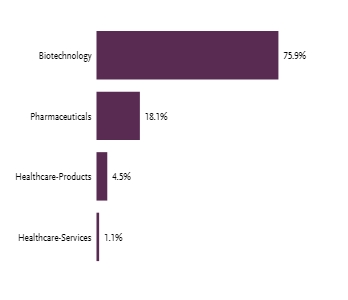

For the period of January 1, 2025 to June 30, 2025, the fund returned -1.71%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Health Care Index, which returned -1.11% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were pharmaceuticals, fertilizers & agricultural chemicals, and health care services. Those that detracted the most were biotechnology and life sciences tools & services. The holdings that contributed the most to performance were Corteva, Inc., Gilead Sciences, Inc., and Alnylam Pharmaceuticals, Inc. Those that detracted the most were Sarepta Therapeutics, Inc., Regeneron Pharmaceuticals, Inc., and Vaxcyte, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Biotechnology Fund | -1.71% | -5.52% | -0.01% | 1.28% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Health Care Index | -1.11% | -5.90% | 7.93% | 8.03% |

| Net Assets | $8,996,675 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 528% |

| Top 10 | % of Net Assets |

|---|---|

| AbbVie, Inc. | |

| Amgen, Inc. | |

| Gilead Sciences, Inc. | |

| Vertex Pharmaceuticals, Inc. | |

| Regeneron Pharmaceuticals, Inc. | |

| Corteva, Inc. | |

| Alnylam Pharmaceuticals, Inc. | |

| Natera, Inc. | |

| AstraZeneca plc ADR | |

| Insmed, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| AbbVie, Inc. | |

| Amgen, Inc. | |

| Gilead Sciences, Inc. | |

| Vertex Pharmaceuticals, Inc. | |

| Regeneron Pharmaceuticals, Inc. | |

| Corteva, Inc. | |

| Alnylam Pharmaceuticals, Inc. | |

| Natera, Inc. | |

| AstraZeneca plc ADR | |

| Insmed, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $90 | 1.80%2 |

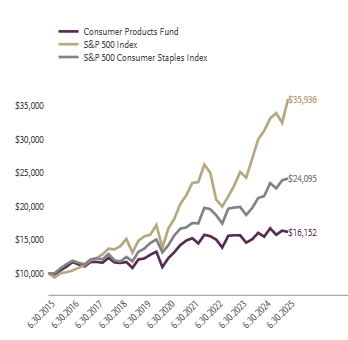

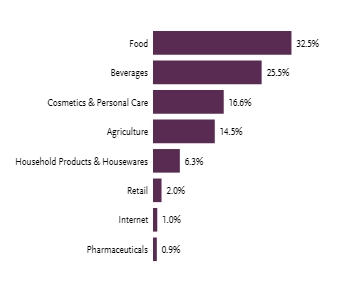

For the period of January 1, 2025 to June 30, 2025, the fund returned 2.72%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Consumer Staples Index, which returned 6.40% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were tobacco, soft drinks & non-alcoholic beverages, and food retail. Those that detracted the most were packaged foods & meats, distillers & vintners, and household products. The holdings that contributed the most to performance were Phillip Morris International, Inc., Coca-Cola Co., and Celsius Holdings, Inc. Those that detracted the most were PepsiCo, Inc., Freshpet, Inc., and Constellation Brands, Inc.—Class A.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Consumer Products Fund | 2.72% | 4.62% | 5.72% | 4.91% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Consumer Staples Index | 6.40% | 12.16% | 11.20% | 9.19% |

| Net Assets | $5,687,063 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 24% |

| Top 10 | % of Net Assets |

|---|---|

| Procter & Gamble Co. | |

| Philip Morris International, Inc. | |

| Coca-Cola Co. | |

| PepsiCo, Inc. | |

| Altria Group, Inc. | |

| Mondelez International, Inc. — Class A | |

| Colgate-Palmolive Co. | |

| Kroger Co. | |

| Keurig Dr Pepper, Inc. | |

| Monster Beverage Corp. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Procter & Gamble Co. | |

| Philip Morris International, Inc. | |

| Coca-Cola Co. | |

| PepsiCo, Inc. | |

| Altria Group, Inc. | |

| Mondelez International, Inc. — Class A | |

| Colgate-Palmolive Co. | |

| Kroger Co. | |

| Keurig Dr Pepper, Inc. | |

| Monster Beverage Corp. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $93 | 1.79%2 |

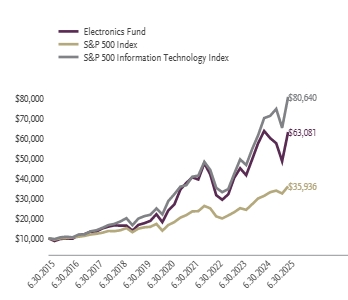

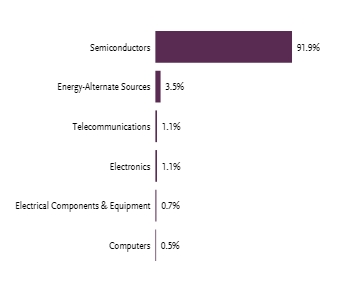

For the period of January 1, 2025 to June 30, 2025, the fund returned 9.74%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Information Technology Index, which returned 8.05% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were semiconductors and semiconductor materials & equipment. No industries detracted from performance. The holdings that contributed the most to performance were NVIDIA Corp., Broadcom, Inc. and KLA Corp. Those that detracted the most were Marvell Technology, Inc., Enphase Energy, Inc. and Teradyne, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Electronics Fund | 9.74% | -0.82% | 21.40% | 20.22% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Information Technology Index | 8.05% | 15.10% | 23.02% | 23.21% |

| Net Assets | $12,776,636 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 17% |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Broadcom, Inc. | |

| Advanced Micro Devices, Inc. | |

| Texas Instruments, Inc. | |

| QUALCOMM, Inc. | |

| Applied Materials, Inc. | |

| Micron Technology, Inc. | |

| Lam Research Corp. | |

| KLA Corp. | |

| Analog Devices, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Broadcom, Inc. | |

| Advanced Micro Devices, Inc. | |

| Texas Instruments, Inc. | |

| QUALCOMM, Inc. | |

| Applied Materials, Inc. | |

| Micron Technology, Inc. | |

| Lam Research Corp. | |

| KLA Corp. | |

| Analog Devices, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $89 | 1.80%2 |

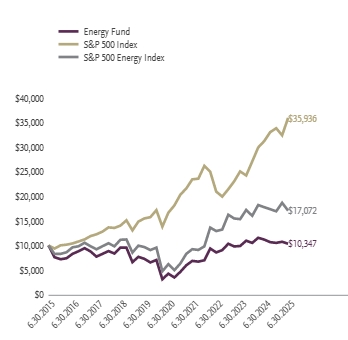

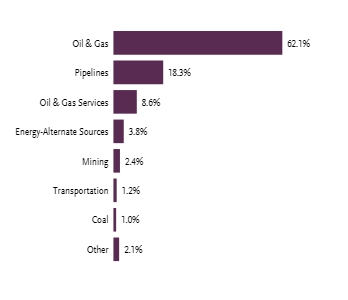

For the period of January 1, 2025 to June 30, 2025, the fund returned -1.60%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Energy Index, which returned 0.77% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were oil & gas refining and marketing, coal & consumable fuels, and oil & gas storage and transportation. Those that detracted the most were oil & gas equipment & services, oil & gas drilling, and oil & gas exploration & production. The holdings that contributed the most to performance were EQT Corp., Cameco Corp., and SolarEdge Technologies, Inc. Those that detracted the most were Enphase Energy, Inc., ONEOK, Inc., and New Fortress Energy Inc.—Class A.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Energy Fund | -1.60% | -7.56% | 19.47% | 0.34% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Energy Index | 0.77% | -3.96% | 22.54% | 5.49% |

| Net Assets | $10,239,991 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 415% |

| Top 10 | % of Net Assets |

|---|---|

| Exxon Mobil Corp. | |

| Chevron Corp. | |

| ConocoPhillips | |

| Williams Companies, Inc. | |

| EOG Resources, Inc. | |

| Kinder Morgan, Inc. | |

| Cheniere Energy, Inc. | |

| Marathon Petroleum Corp. | |

| ONEOK, Inc. | |

| Phillips 66 | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Exxon Mobil Corp. | |

| Chevron Corp. | |

| ConocoPhillips | |

| Williams Companies, Inc. | |

| EOG Resources, Inc. | |

| Kinder Morgan, Inc. | |

| Cheniere Energy, Inc. | |

| Marathon Petroleum Corp. | |

| ONEOK, Inc. | |

| Phillips 66 | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $81 | 1.80%2 |

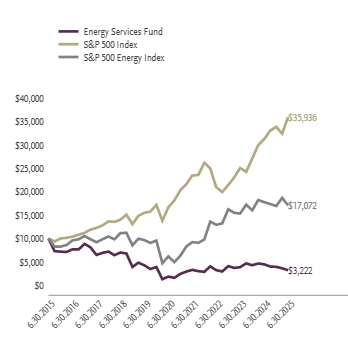

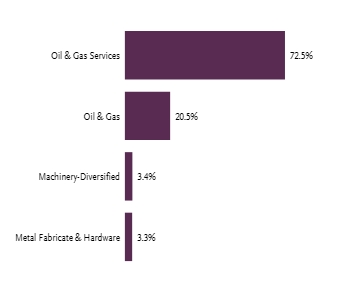

For the period of January 1, 2025 to June 30, 2025, the fund returned -18.50%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Energy Index, which returned 0.77% for the same period.

What factors materially affected the fund's performance over the last six months?

No industry contributed to positive performance. The industries that detracted from performance were oil & gas drilling, and oil & gas equipment and services. The holdings that contributed the most to performance were TechnipFMC plc, Solaris Energy Infrastructure, Inc.—Class A, and Valaris Ltd. Those that detracted the most were Helmerich & Payne, Inc., SLB (formerly Schlumberger, Ltd.), and Halliburton Co.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Energy Services Fund | -18.50% | -28.25% | 11.49% | -10.71% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Energy Index | 0.77% | -3.96% | 22.54% | 5.49% |

| Net Assets | $2,989,824 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 1,273% |

| Top 10 | % of Net Assets |

|---|---|

| Schlumberger N.V. | |

| Baker Hughes Co. | |

| Halliburton Co. | |

| TechnipFMC plc | |

| ChampionX Corp. | |

| Archrock, Inc. | |

| NOV, Inc. | |

| Weatherford International plc | |

| Cactus, Inc. — Class A | |

| Noble Corporation plc | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Schlumberger N.V. | |

| Baker Hughes Co. | |

| Halliburton Co. | |

| TechnipFMC plc | |

| ChampionX Corp. | |

| Archrock, Inc. | |

| NOV, Inc. | |

| Weatherford International plc | |

| Cactus, Inc. — Class A | |

| Noble Corporation plc | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $93 | 1.80%2 |

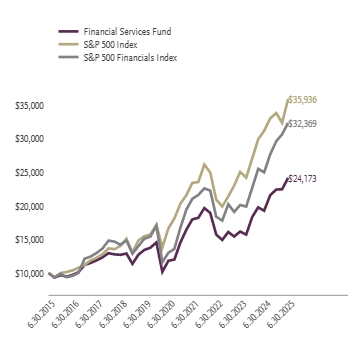

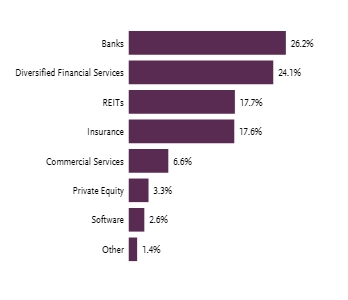

For the period of January 1, 2025 to June 30, 2025, the fund returned 7.72%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Financials Index, which returned 9.23% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were investment banking & brokerage, diversified banks, and financial exchanges & data. Those that detracted the most were data center REITs, multi-family residential REITs, and industrial REITs. The holdings that contributed the most to performance were Robinhood Markets, Inc.— Class A, JPMorgan Chase & Co., StoneCo, Ltd.—Class A. Those that detracted the most were Fiserv, Inc., Global Payments, Inc., and Blackstone, Inc.— Class A.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Financial Services Fund | 7.72% | 25.35% | 15.38% | 9.23% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Financials Index | 9.23% | 29.45% | 19.99% | 12.46% |

| Net Assets | $11,339,481 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 50% |

| Top 10 | % of Net Assets |

|---|---|

| Berkshire Hathaway, Inc. — Class B | |

| JPMorgan Chase & Co. | |

| Visa, Inc. — Class A | |

| Mastercard, Inc. — Class A | |

| Bank of America Corp. | |

| Wells Fargo & Co. | |

| Goldman Sachs Group, Inc. | |

| Blackstone, Inc. — Class A | |

| Morgan Stanley | |

| S&P Global, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Berkshire Hathaway, Inc. — Class B | |

| JPMorgan Chase & Co. | |

| Visa, Inc. — Class A | |

| Mastercard, Inc. — Class A | |

| Bank of America Corp. | |

| Wells Fargo & Co. | |

| Goldman Sachs Group, Inc. | |

| Blackstone, Inc. — Class A | |

| Morgan Stanley | |

| S&P Global, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $89 | 1.80%2 |

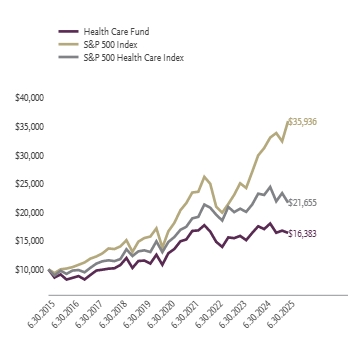

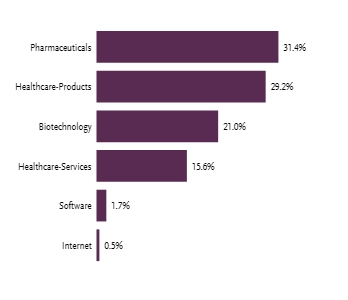

For the period of January 1, 2025 to June 30, 2025, the fund returned -0.11%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Health Care Index, which returned -1.11% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were health care equipment, health care services, and health care distributors. Those that detracted the most were life sciences tools & services, managed health care, and biotechnology. The holdings that contributed the most to performance were CVS Health Corp., Abbott Laboratories, and Boston Scientific Corp. Those that detracted the most were UnitedHealth Group, Inc., Sarepta Therapeutics, Inc. and Thermo Fisher Scientific, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Health Care Fund | -0.11% | -3.93% | 5.03% | 5.06% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Health Care Index | -1.11% | -5.90% | 7.93% | 8.03% |

| Net Assets | $9,027,393 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 43% |

| Top 10 | % of Net Assets |

|---|---|

| Eli Lilly & Co. | |

| Johnson & Johnson | |

| AbbVie, Inc. | |

| UnitedHealth Group, Inc. | |

| Abbott Laboratories | |

| Intuitive Surgical, Inc. | |

| Merck & Company, Inc. | |

| Boston Scientific Corp. | |

| Thermo Fisher Scientific, Inc. | |

| Stryker Corp. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Eli Lilly & Co. | |

| Johnson & Johnson | |

| AbbVie, Inc. | |

| UnitedHealth Group, Inc. | |

| Abbott Laboratories | |

| Intuitive Surgical, Inc. | |

| Merck & Company, Inc. | |

| Boston Scientific Corp. | |

| Thermo Fisher Scientific, Inc. | |

| Stryker Corp. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.80%2 |

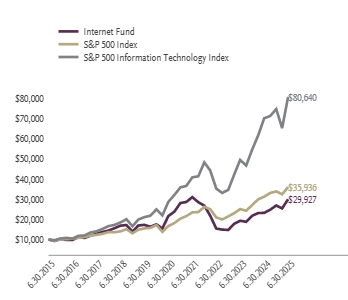

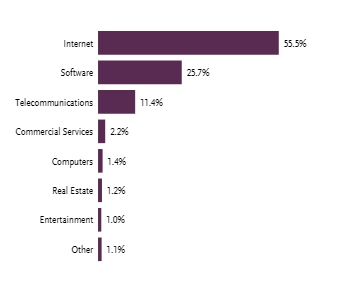

For the period of January 1, 2025 to June 30, 2025, the fund returned 11.54%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Information Technology Index, which returned 8.05% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were movies & entertainment, interactive home entertainment and internet services & infrastructure. Those that detracted the most were application software, transaction & payment processing, and human resources & employment services. The holdings that contributed the most to performance were Netflix, Inc., Uber Technologies, Inc., and Meta Platforms, Inc.—Class A. Those that detracted the most were Salesforce, Inc., Alphabet, Inc.—Class A, and Adobe, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Internet Fund | 11.54% | 29.18% | 6.75% | 11.59% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Information Technology Index | 8.05% | 15.10% | 23.02% | 23.21% |

| Net Assets | $5,640,733 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 50% |

| Top 10 | % of Net Assets |

|---|---|

| Meta Platforms, Inc. — Class A | |

| Amazon.com, Inc. | |

| Alphabet, Inc. — Class A | |

| Netflix, Inc. | |

| Cisco Systems, Inc. | |

| Salesforce, Inc. | |

| Uber Technologies, Inc. | |

| Adobe, Inc. | |

| DoorDash, Inc. — Class A | |

| Arista Networks, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Meta Platforms, Inc. — Class A | |

| Amazon.com, Inc. | |

| Alphabet, Inc. — Class A | |

| Netflix, Inc. | |

| Cisco Systems, Inc. | |

| Salesforce, Inc. | |

| Uber Technologies, Inc. | |

| Adobe, Inc. | |

| DoorDash, Inc. — Class A | |

| Arista Networks, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.80%2 |

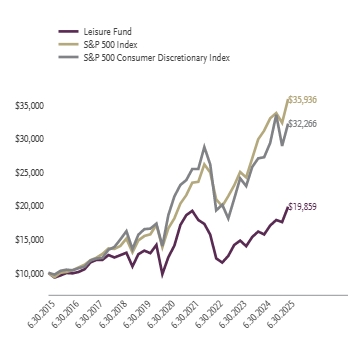

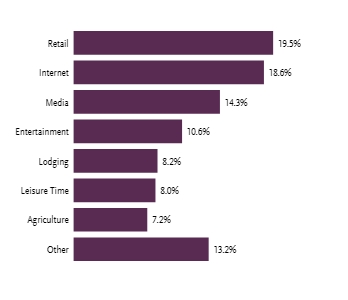

For the period of January 1, 2025 to June 30, 2025, the fund returned 11.07%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Consumer Discretionary Index, which returned -3.87% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were movies & entertainment, tobacco, and interactive home entertainment. Those that detracted the most were hotels resorts & cruise lines, distillers & vintners, and casinos & gaming. The holdings that contributed the most to performance were Netflix, Inc, Philip Morris International, Inc., Roblox Corp—Class A. Those that detracted the most were Constellation Brands, Inc.—Class A, Trip.com Group Ltd. ADR, and Starbucks Corp.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Leisure Fund | 11.07% | 26.27% | 10.00% | 7.10% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Consumer Discretionary Index | -3.87% | 18.40% | 11.65% | 12.43% |

| Net Assets | $6,517,889 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 154% |

| Top 10 | % of Net Assets |

|---|---|

| Netflix, Inc. | |

| Philip Morris International, Inc. | |

| Walt Disney Co. | |

| McDonald's Corp. | |

| Comcast Corp. — Class A | |

| DoorDash, Inc. — Class A | |

| Starbucks Corp. | |

| Altria Group, Inc. | |

| Royal Caribbean Cruises Ltd. | |

| Chipotle Mexican Grill, Inc. — Class A | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Netflix, Inc. | |

| Philip Morris International, Inc. | |

| Walt Disney Co. | |

| McDonald's Corp. | |

| Comcast Corp. — Class A | |

| DoorDash, Inc. — Class A | |

| Starbucks Corp. | |

| Altria Group, Inc. | |

| Royal Caribbean Cruises Ltd. | |

| Chipotle Mexican Grill, Inc. — Class A | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $105 | 1.70%2 |

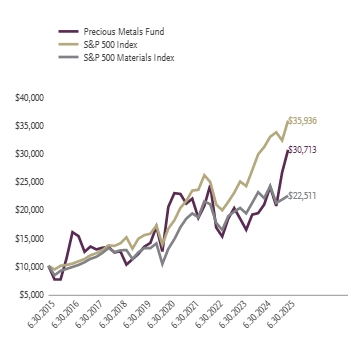

For the period of January 1, 2025 to June 30, 2025, the fund returned 48.39%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Materials Index, which returned 6.03% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were gold, silver, and precious metals. No industries detracted from performance. The holdings that contributed the most to performance were Newmont Corp., Agnicio Eagle Mines Ltd., and Anglogold Ashanti plc. No holdings detracted from performance.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Precious Metals Fund | 48.39% | 46.75% | 8.40% | 11.87% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Materials Index | 6.03% | 1.86% | 11.56% | 8.45% |

| Net Assets | $25,956,305 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 117% |

| Top 10 | % of Net Assets |

|---|---|

| Newmont Corp. | |

| Freeport-McMoRan, Inc. | |

| Agnico Eagle Mines Ltd. | |

| Wheaton Precious Metals Corp. | |

| Barrick Mining Corp. | |

| Kinross Gold Corp. | |

| Franco-Nevada Corp. | |

| Gold Fields Ltd. ADR | |

| Anglogold Ashanti plc | |

| Alamos Gold, Inc. — Class A | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Newmont Corp. | |

| Freeport-McMoRan, Inc. | |

| Agnico Eagle Mines Ltd. | |

| Wheaton Precious Metals Corp. | |

| Barrick Mining Corp. | |

| Kinross Gold Corp. | |

| Franco-Nevada Corp. | |

| Gold Fields Ltd. ADR | |

| Anglogold Ashanti plc | |

| Alamos Gold, Inc. — Class A | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $89 | 1.80%2 |

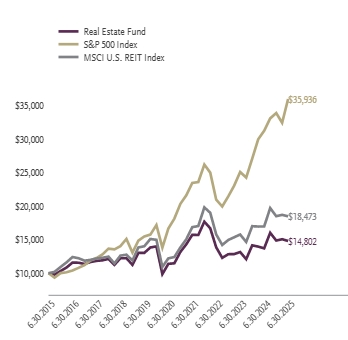

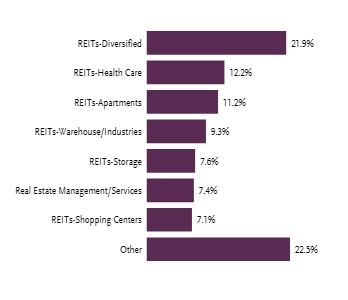

For the period of January 1, 2025 to June 30, 2025, the fund returned -0.45%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the MSCI U.S. REIT Index, which returned -0.09% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were telecom tower REITs, health care REITs, and other specialized REITs. Those that detracted the most were hotel & resort REITs, retail REITS, and office REITs. The holdings that contributed the most to performance were Welltower, Inc., American Tower Corp.— Class A, and Crown Castle, Inc. Those that detracted the most were Equinix, Inc., Alexandria Real Estate Equities, Inc., and Americold Realty Trust, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Real Estate Fund | -0.45% | 8.00% | 5.38% | 4.00% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| MSCI U.S. REIT Index | -0.09% | 8.92% | 8.63% | 6.33% |

| Net Assets | $3,654,812 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 144% |

| Top 10 | % of Net Assets |

|---|---|

| American Tower Corp. — Class A | |

| Welltower, Inc. | |

| Prologis, Inc. | |

| Digital Realty Trust, Inc. | |

| Realty Income Corp. | |

| Simon Property Group, Inc. | |

| Equinix, Inc. | |

| Public Storage | |

| Crown Castle, Inc. | |

| CBRE Group, Inc. — Class A | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| American Tower Corp. — Class A | |

| Welltower, Inc. | |

| Prologis, Inc. | |

| Digital Realty Trust, Inc. | |

| Realty Income Corp. | |

| Simon Property Group, Inc. | |

| Equinix, Inc. | |

| Public Storage | |

| Crown Castle, Inc. | |

| CBRE Group, Inc. — Class A | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $91 | 1.80%2 |

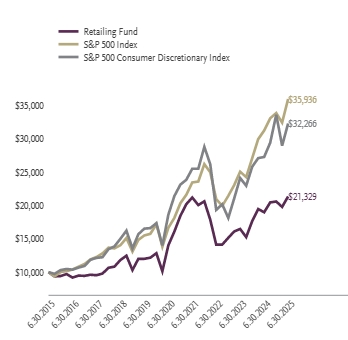

For the period of January 1, 2025 to June 30, 2025, the fund returned 3.65%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Consumer Discretionary Index, which returned -3.87% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were automotive retail, broadline retail, and consumer staples merchandise retail. Those that detracted the most were apparel retail, home improvement retail, and computer & electronics retail. The holdings that contributed the most to performance were Carvana Co., MercadoLibre, Inc., and Alibaba Group Holding Ltd. ADR. Those that detracted the most were Target Corp., Global-e Online Ltd., and Abercrombie & Fitch Co.—Class A.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Retailing Fund | 3.65% | 12.44% | 8.76% | 7.87% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Consumer Discretionary Index | -3.87% | 18.40% | 11.65% | 12.43% |

| Net Assets | $2,242,079 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 142% |

| Top 10 | % of Net Assets |

|---|---|

| Amazon.com, Inc. | |

| Walmart, Inc. | |

| Costco Wholesale Corp. | |

| TJX Companies, Inc. | |

| Home Depot, Inc. | |

| Lowe's Companies, Inc. | |

| O'Reilly Automotive, Inc. | |

| Carvana Co. | |

| Coupang, Inc. | |

| PDD Holdings, Inc.ADR | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Amazon.com, Inc. | |

| Walmart, Inc. | |

| Costco Wholesale Corp. | |

| TJX Companies, Inc. | |

| Home Depot, Inc. | |

| Lowe's Companies, Inc. | |

| O'Reilly Automotive, Inc. | |

| Carvana Co. | |

| Coupang, Inc. | |

| PDD Holdings, Inc.ADR | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.80%2 |

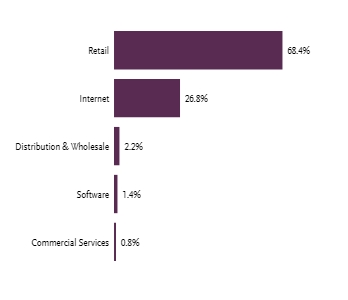

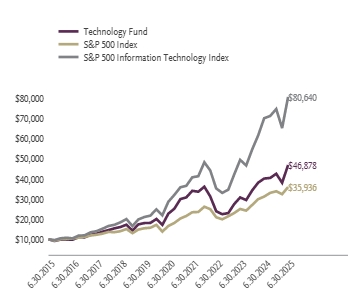

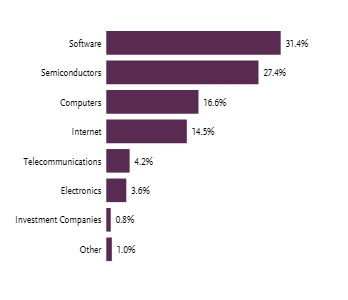

For the period of January 1, 2025 to June 30, 2025, the fund returned 10.26%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Information Technology Index, which returned 8.05% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were systems software, semiconductors, and application software. Those that detracted the most were technology hardware storage & peripherals, and electronic equipment & instruments. The holdings that contributed the most to performance were Palantir Technologies, Inc.—Class A, Microsoft Corp., and NVIDIA Corp. Those that detracted the most were Apple, Inc., Alphabet, Inc.—Class A, and Marvell Technology, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Technology Fund | 10.26% | 16.76% | 15.58% | 16.71% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Information Technology Index | 8.05% | 15.10% | 23.02% | 23.21% |

| Net Assets | $29,999,078 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 140% |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Microsoft Corp. | |

| Apple, Inc. | |

| Alphabet, Inc. — Class A | |

| Meta Platforms, Inc. — Class A | |

| Broadcom, Inc. | |

| Oracle Corp. | |

| International Business Machines Corp. | |

| Advanced Micro Devices, Inc. | |

| Cisco Systems, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Microsoft Corp. | |

| Apple, Inc. | |

| Alphabet, Inc. — Class A | |

| Meta Platforms, Inc. — Class A | |

| Broadcom, Inc. | |

| Oracle Corp. | |

| International Business Machines Corp. | |

| Advanced Micro Devices, Inc. | |

| Cisco Systems, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.80%2 |

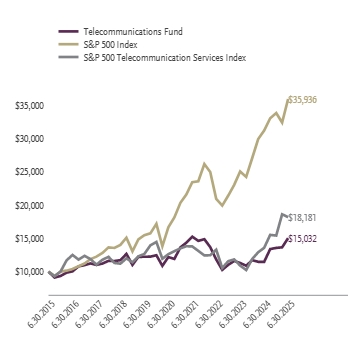

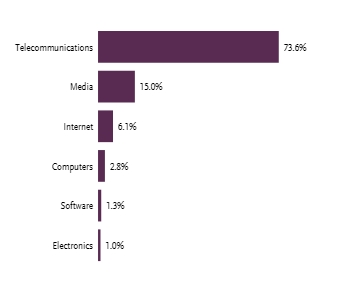

For the period of January 1, 2025 to June 30, 2025, the fund returned 10.77%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Telecommunication Services Index, which returned 17.87% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were communications equipment, integrated telecommunication services, and wireless telecommunication services. No industries detracted from performance. The holdings that contributed the most to performance were AT&T, Inc., Liberty Broadband Corp.—Class C, and AST SpaceMobile, Inc. Those that detracted the most were Liberty Global Ltd.—Class A, Lumen Technologies, Inc., and Motorola Solutions, Inc.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Telecommunications Fund | 10.77% | 31.02% | 4.28% | 4.16% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Telecommunication Services Index | 17.87% | 33.88% | 7.58% | 6.16% |

| Net Assets | $5,434,626 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 489% |

| Top 10 | % of Net Assets |

|---|---|

| Cisco Systems, Inc. | |

| AT&T, Inc. | |

| Verizon Communications, Inc. | |

| Comcast Corp. — Class A | |

| T-Mobile US, Inc. | |

| Arista Networks, Inc. | |

| Charter Communications, Inc. — Class A | |

| Motorola Solutions, Inc. | |

| Roku, Inc. | |

| Juniper Networks, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Cisco Systems, Inc. | |

| AT&T, Inc. | |

| Verizon Communications, Inc. | |

| Comcast Corp. — Class A | |

| T-Mobile US, Inc. | |

| Arista Networks, Inc. | |

| Charter Communications, Inc. — Class A | |

| Motorola Solutions, Inc. | |

| Roku, Inc. | |

| Juniper Networks, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $88 | 1.80%2 |

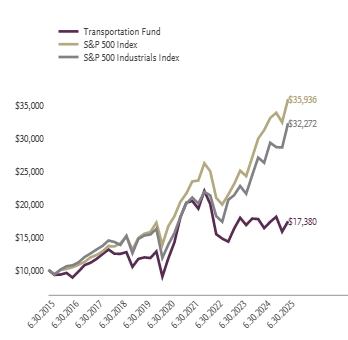

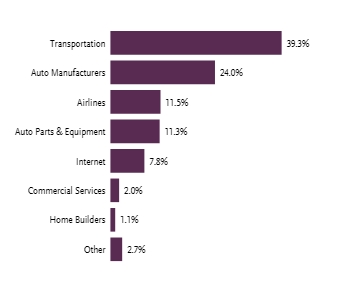

For the period of January 1, 2025 to June 30, 2025, the fund returned -3.77%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P 500 Industrials Index, which returned 12.72% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were passenger ground transportation, rail transportation, and automotive parts & equipment. Those that detracted the most were automobile manufacturers, air freight & logistics, and cargo transportation. The holdings that contributed the most to performance were Uber Technologies, Inc., Avis Budget Group, Inc, and Ryanair Holdings plc ADR. Those that detracted the most were Tesla, Inc, United Parcel Service, Inc. — Class B, and FedEx Corp.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Transportation Fund | -3.77% | 6.29% | 8.14% | 5.68% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Industrials Index | 12.72% | 22.89% | 18.43% | 12.43% |

| Net Assets | $3,357,350 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 23% |

| Top 10 | % of Net Assets |

|---|---|

| Tesla, Inc. | |

| Uber Technologies, Inc. | |

| Union Pacific Corp. | |

| United Parcel Service, Inc. — Class B | |

| CSX Corp. | |

| Norfolk Southern Corp. | |

| FedEx Corp. | |

| General Motors Co. | |

| Ford Motor Co. | |

| Delta Air Lines, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| Tesla, Inc. | |

| Uber Technologies, Inc. | |

| Union Pacific Corp. | |

| United Parcel Service, Inc. — Class B | |

| CSX Corp. | |

| Norfolk Southern Corp. | |

| FedEx Corp. | |

| General Motors Co. | |

| Ford Motor Co. | |

| Delta Air Lines, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.80%2 |

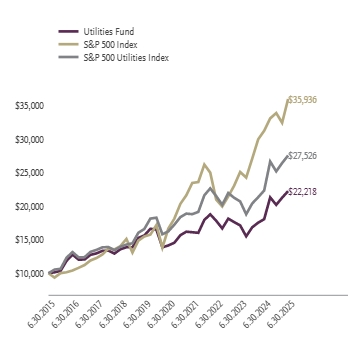

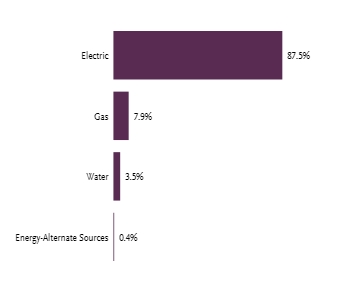

For the period of January 1, 2025 to June 30, 2025, the fund returned 10.09%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the S&P 500 Utilities Index, which returned 9.41% for the same period.

What factors materially affected the fund's performance over the last six months?

The industries that contributed the most to performance were electric utilities, multi utilities, and independent power producers & energy traders. No industries detracted from performance. The holdings that contributed the most to performance were Constellation Energy Corp., NRG Energy, Inc., and Vistra Corp. Those that detracted the most were PG&E Corp., Edison International, and Sempra.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Utilities Fund | 10.09% | 23.16% | 9.46% | 8.31% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P 500 Utilities Index | 9.41% | 23.40% | 11.14% | 10.66% |

| Net Assets | $11,199,910 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 192% |

| Top 10 | % of Net Assets |

|---|---|

| NextEra Energy, Inc. | |

| Constellation Energy Corp. | |

| Southern Co. | |

| Duke Energy Corp. | |

| Vistra Corp. | |

| American Electric Power Company, Inc. | |

| Sempra | |

| Dominion Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| Exelon Corp. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Top 10 | % of Net Assets |

|---|---|

| NextEra Energy, Inc. | |

| Constellation Energy Corp. | |

| Southern Co. | |

| Duke Energy Corp. | |

| Vistra Corp. | |

| American Electric Power Company, Inc. | |

| Sempra | |

| Dominion Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| Exelon Corp. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $94 | 1.87%2 |

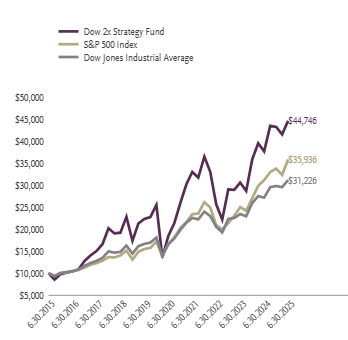

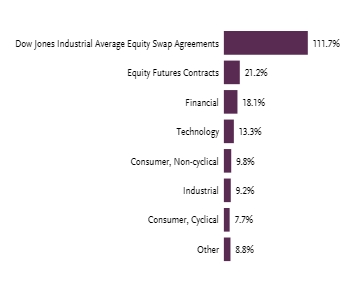

For the period of January 1, 2025 to June 30, 2025, the fund returned 3.18%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the Dow Jones Industrial Average, which returned 4.55% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were financials, industrials, and information technology. Those that detracted the most were health care, consumer discretionary, and energy. The holdings that contributed the most to return of the underlying index were Goldman Sachs Group, Inc., Microsoft Corp., and International Business Machines Corp. Those that detracted the most were UnitedHealth Group., Inc., Salesforce, Inc., and Apple, Inc. The fund maintained a daily correlation of over 99% to its benchmark of 200% of the daily price movement of the Dow Jones Industrial Average.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Dow 2x Strategy Fund | 3.18% | 18.43% | 19.35% | 16.16% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| Dow Jones Industrial Average | 4.55% | 14.72% | 13.52% | 12.06% |

| Net Assets | $8,356,478 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 600% |

| Top 10 | % of Net Assets |

|---|---|

| Goldman Sachs Group, Inc. | |

| Microsoft Corp. | |

| Caterpillar, Inc. | |

| Home Depot, Inc. | |

| Visa, Inc. — Class A | |

| Sherwin-Williams Co. | |

| American Express Co. | |

| UnitedHealth Group, Inc. | |

| International Business Machines Corp. | |

| McDonald's Corp. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Goldman Sachs Group, Inc. | |

| Microsoft Corp. | |

| Caterpillar, Inc. | |

| Home Depot, Inc. | |

| Visa, Inc. — Class A | |

| Sherwin-Williams Co. | |

| American Express Co. | |

| UnitedHealth Group, Inc. | |

| International Business Machines Corp. | |

| McDonald's Corp. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $88 | 1.84%2 |

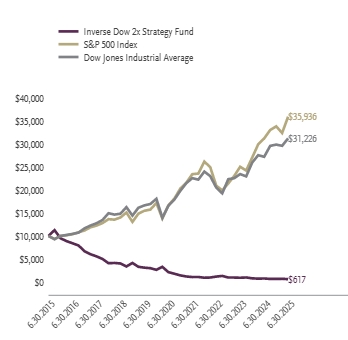

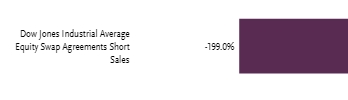

For the period of January 1, 2025 to June 30, 2025, the fund returned -7.98%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the Dow Jones Industrial Average, which returned 4.55% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were financials, industrials, and information technology. Those that detracted the most were health care, consumer discretionary, and energy. The holdings that contributed the most to return of the underlying index were Goldman Sachs Group, Inc., Microsoft Corp., and International Business Machines Corp. Those that detracted the most were UnitedHealth Group, Inc., Salesforce, Inc., and Apple, Inc. The fund maintained a daily correlation of over 99% to its benchmark of -200% of the daily price movement of the Dow Jones Industrial Average.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Inverse Dow 2x Strategy Fund | -7.98% | -19.73% | -22.11% | -24.32% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| Dow Jones Industrial Average | 4.55% | 14.72% | 13.52% | 12.06% |

| Net Assets | $780,387 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 0% |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $87 | 1.79%2 |

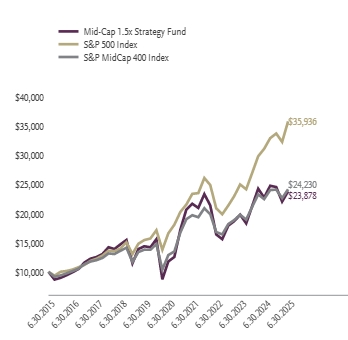

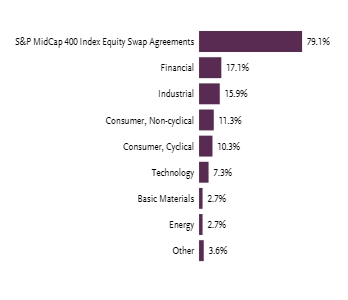

For the period of January 1, 2025 to June 30, 2025, the fund returned -2.99%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P MidCap 400 Index, which returned 0.20% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were industrials, consumer staples, and financials. The sectors that detracted the most were health care, consumer discretionary, and information technology. The holdings that contributed the most to the return of the underlying index were Curtiss-Wright Corp, Carpenter Technology Corp, and ATI, Inc. Those that detracted the most were Sarepta Therapeutics, Inc., Illumina, Inc., and Avantor, Inc. The fund maintained a correlation of over 99% to its benchmark of 150% of the daily price movement of the S&P MidCap 400 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Mid-Cap 1.5x Strategy Fund | -2.99% | 4.83% | 15.15% | 9.09% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P MidCap 400 Index | 0.20% | 7.53% | 13.44% | 9.25% |

| Net Assets | $3,403,459 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 12% |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Interactive Brokers Group, Inc. — Class A | |

| EMCOR Group, Inc. | |

| Guidewire Software, Inc. | |

| RB Global, Inc. | |

| Flex Ltd. | |

| Casey's General Stores, Inc. | |

| Comfort Systems USA, Inc. | |

| Curtiss-Wright Corp. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Interactive Brokers Group, Inc. — Class A | |

| EMCOR Group, Inc. | |

| Guidewire Software, Inc. | |

| RB Global, Inc. | |

| Flex Ltd. | |

| Casey's General Stores, Inc. | |

| Comfort Systems USA, Inc. | |

| Curtiss-Wright Corp. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $91 | 1.84%2 |

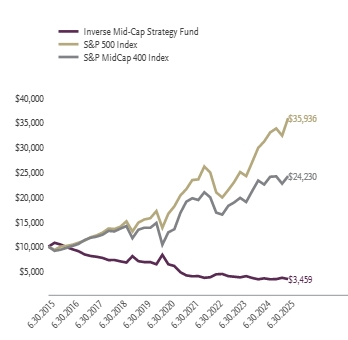

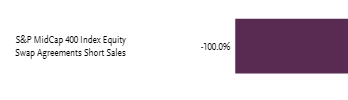

For the period of January 1, 2025 to June 30, 2025, the fund returned 0.17%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the S&P MidCap 400 Index, which returned 0.20% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were industrials, consumer staples, and financials. The sectors that detracted the most were health care, consumer discretionary, and information technology. The holdings that contributed the most to the return of the underlying index were Curtiss-Wright Corp, Carpenter Technology Corp, and ATI, Inc. Those that detracted the most were Sarepta Therapeutics, Inc., Illumina, Inc., and Avantor, Inc. The fund maintained a daily correlation of 99% to its benchmark of -100% of the daily price movement of the S&P MidCap 400 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Inverse Mid-Cap Strategy Fund | 0.17% | -4.09% | -11.69% | -10.07% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| S&P MidCap 400 Index | 0.20% | 7.53% | 13.44% | 9.25% |

| Net Assets | $135,660 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 0% |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Total |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $88 | 1.72%2 |

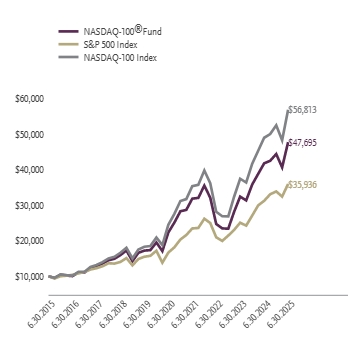

For the period of January 1, 2025 to June 30, 2025, the fund returned 7.51%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the NASDAQ-100 Index, which returned 8.35% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were information technology, communication services, and utilities. Those that detracted the most were consumer discretionary, energy, and financials. The holdings that contributed the most to the return of the underlying index were Microsoft Corp., NVIDIA Corp., and Netflix, Inc. Those that detracted the most were Apple, Inc., Tesla, Inc. and PepsiCo, Inc. The fund maintained a daily correlation of over 99% to its benchmark of 100% of the daily price movement of the NASDAQ-100 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| NASDAQ-100® Fund | 7.51% | 14.27% | 16.42% | 16.91% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| NASDAQ-100 Index | 8.35% | 16.10% | 18.36% | 18.97% |

| Net Assets | $129,330,613 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 73% |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Microsoft Corp. | |

| Guggenheim Strategy Fund II | |

| Apple, Inc. | |

| Amazon.com, Inc. | |

| Broadcom, Inc. | |

| Meta Platforms, Inc. — Class A | |

| Netflix, Inc. | |

| Tesla, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Microsoft Corp. | |

| Guggenheim Strategy Fund II | |

| Apple, Inc. | |

| Amazon.com, Inc. | |

| Broadcom, Inc. | |

| Meta Platforms, Inc. — Class A | |

| Netflix, Inc. | |

| Tesla, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $98 | 1.90%2 |

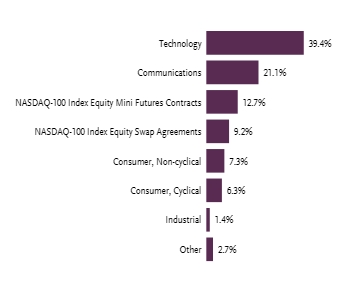

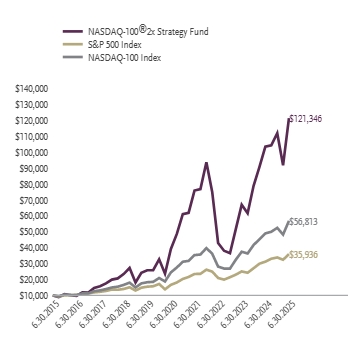

For the period of January 1, 2025 to June 30, 2025, the fund returned 8.50%, outperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the NASDAQ-100 Index, which returned 8.35% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were information technology, communication services, and utilities. Those that detracted the most were consumer discretionary, energy, and financials. The holdings that contributed the most to the return of the underlying index were Microsoft Corp., NVIDIA Corp., and Netflix, Inc. Those that detracted the most were Apple, Inc., Tesla, Inc. and PepsiCo, Inc. The fund maintained a daily correlation of over 99% to its benchmark of 200% of the daily price movement of the NASDAQ-100 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| NASDAQ-100® 2x Strategy Fund | 8.50% | 17.31% | 25.38% | 28.35% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| NASDAQ-100 Index | 8.35% | 16.10% | 18.36% | 18.97% |

| Net Assets | $142,037,041 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 370% |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Microsoft Corp. | |

| Apple, Inc. | |

| Amazon.com, Inc. | |

| Broadcom, Inc. | |

| Meta Platforms, Inc. — Class A | |

| Netflix, Inc. | |

| Tesla, Inc. | |

| Costco Wholesale Corp. | |

| Alphabet, Inc. — Class A | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or in investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| NVIDIA Corp. | |

| Microsoft Corp. | |

| Apple, Inc. | |

| Amazon.com, Inc. | |

| Broadcom, Inc. | |

| Meta Platforms, Inc. — Class A | |

| Netflix, Inc. | |

| Tesla, Inc. | |

| Costco Wholesale Corp. | |

| Alphabet, Inc. — Class A | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $86 | 1.82%2 |

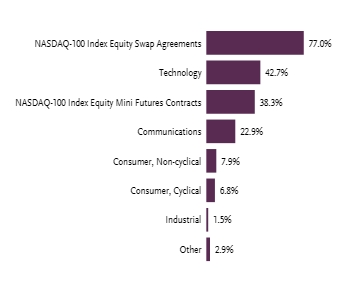

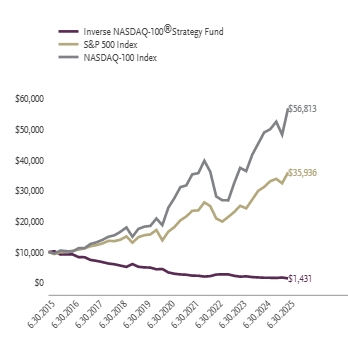

For the period of January 1, 2025 to June 30, 2025, the fund returned -8.85%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the NASDAQ-100 Index, which returned 8.35% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were information technology, communication services, and utilities. Those that detracted the most were consumer discretionary, energy, and financials. The holdings that contributed the most to the return of the underlying index were Microsoft Corp., NVIDIA Corp., and Netflix, Inc. Those that detracted the most were Apple, Inc., Tesla, Inc. and PepsiCo, Inc. The fund maintained a daily correlation of over 99% to its benchmark of -100% of the daily price movement of the NASDAQ-100 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Inverse NASDAQ-100® Strategy Fund | -8.85% | -12.95% | -15.81% | -17.67% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| NASDAQ-100 Index | 8.35% | 16.10% | 18.36% | 18.97% |

| Net Assets | $1,061,736 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 0% |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Total |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $87 | 1.81%2 |

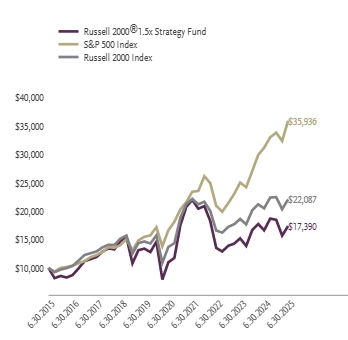

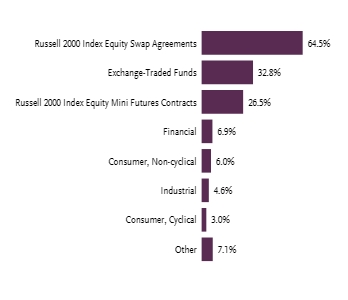

For the period of January 1, 2025 to June 30, 2025, the fund returned -5.94%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the Russell 2000 Index, which returned -1.79% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were industrials, financials, and materials. The sectors that detracted the most were health care, energy, and consumer discretionary. The holdings that contributed the most to the return of the underlying index were Carpenter Technology Corp., Insmed, Inc., and Hims & Hers Health, Inc. Those that detracted the most were Vaxcyte, Inc., Abercrombie & Fitch Co.—Class A, and FTAI Aviation, Ltd. The fund maintained a daily correlation of over 99% to its benchmark of 150% of the daily price movement of the Russell 2000 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Russell 2000® 1.5x Strategy Fund | -5.94% | 4.51% | 9.61% | 5.69% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| Russell 2000 Index | -1.79% | 7.68% | 10.04% | 8.25% |

| Net Assets | $2,484,166 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 4% |

| Top 10 | % of Net Assets |

|---|---|

| Vanguard Russell 2000 ETF | |

| iShares Russell 2000 Index ETF | |

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Credo Technology Group Holding Ltd. | |

| Fabrinet | |

| IonQ, Inc. | |

| Hims & Hers Health, Inc. | |

| HealthEquity, Inc. | |

| Ensign Group, Inc. | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Vanguard Russell 2000 ETF | |

| iShares Russell 2000 Index ETF | |

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Credo Technology Group Holding Ltd. | |

| Fabrinet | |

| IonQ, Inc. | |

| Hims & Hers Health, Inc. | |

| HealthEquity, Inc. | |

| Ensign Group, Inc. | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $87 | 1.85%2 |

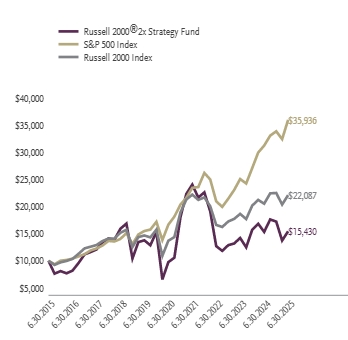

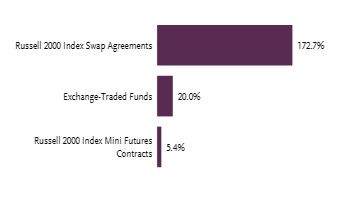

For the period of January 1, 2025 to June 30, 2025, the fund returned -10.37%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and underperforming the fund's secondary index, the Russell 2000 Index, which returned -1.79% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were industrials, financials, and materials. The sectors that detracted the most were health care, energy, and consumer discretionary. The holdings that contributed the most to the return of the underlying index were Carpenter Technology Corp., Insmed, Inc., and Hims & Hers Health, Inc. Those that detracted the most were Vaxcyte, Inc., Abercrombie & Fitch Co.—Class A, and FTAI Aviation, Ltd. The fund maintained a daily correlation of over 99% to its benchmark of 200% of the daily price movement of the Russell 2000 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Russell 2000® 2x Strategy Fund | -10.37% | 0.71% | 9.62% | 4.43% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| Russell 2000 Index | -1.79% | 7.68% | 10.04% | 8.25% |

| Net Assets | $2,015,002 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 0% |

| Top 10 | % of Net Assets |

|---|---|

| Vanguard Russell 2000 ETF | |

| iShares Russell 2000 Index ETF | |

| Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Vanguard Russell 2000 ETF | |

| iShares Russell 2000 Index ETF | |

| Total |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $92 | 1.83%2 |

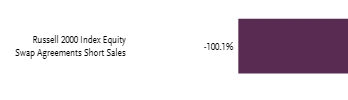

For the period of January 1, 2025 to June 30, 2025, the fund returned 2.34%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period and outperforming the fund's secondary index, the Russell 2000 Index, which returned -1.79% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were industrials, financials, and materials. The sectors that detracted the most were health care, energy, and consumer discretionary. The holdings that contributed the most to the return of the underlying index were Carpenter Technology Corp., Insmed, Inc. and Hims & Hers Health, Inc. Those that detracted the most were Vaxcyte, Inc., Abercrombie & Fitch Co.—Class A, and FTAI Aviation, Ltd. The fund maintained a daily correlation of over 99% to its benchmark of -100% of the daily price movement of the Russell 2000 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Inverse Russell 2000® Strategy Fund | 2.34% | -4.66% | -10.40% | -9.50% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| Russell 2000 Index | -1.79% | 7.68% | 10.04% | 8.25% |

| Net Assets | $881,224 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 0% |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Top 10 | % of Net Assets |

|---|---|

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| Total |

2 | "Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $87 | 1.70%2 |

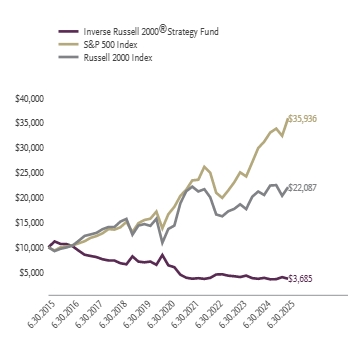

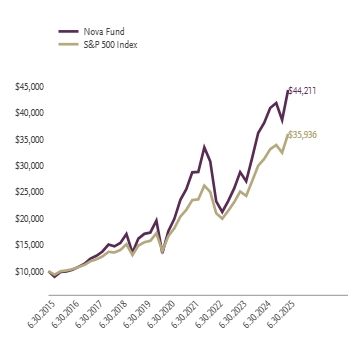

For the period of January 1, 2025 to June 30, 2025, the fund returned 5.89%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period.

What factors materially affected the fund's performance over the last six months?

The sectors that contributed the most to the return of the underlying index were information technology, financials, and industrials. Those that detracted the most were consumer discretionary, health care, and energy. The holdings that contributed the most to the return of the underlying index were Microsoft Corp., NVIDIA Corp., and Meta Platforms, Inc., Class A. Those that detracted the most were Apple, Inc, Tesla, Inc. and UnitedHealth Group, Inc. The fund maintained a daily correlation of over 99% to its benchmark of 150% of the daily price movement of the S&P 500 Index.

| 6 Month‡ | One Year | Five Years | Ten Years | |

|---|---|---|---|---|

| Nova Fund | 5.89% | 16.40% | 20.25% | 16.03% |

| S&P 500 Index | 6.20% | 15.16% | 16.64% | 13.65% |

| Net Assets | $37,060,913 |

| Total Number of Portfolio Holdings | |

| Portfolio Turnover Rate | 80% |

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| NVIDIA Corp. | |

| Microsoft Corp. | |

| Apple, Inc. | |

| Amazon.com, Inc. | |

| Meta Platforms, Inc. — Class A | |

| Broadcom, Inc. | |

| Alphabet, Inc. — Class A | |

| Berkshire Hathaway, Inc. — Class B | |

| Top 10 Total |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

| Guggenheim Ultra Short Duration Fund — Institutional Class | |

| Guggenheim Strategy Fund II | |

| NVIDIA Corp. | |

| Microsoft Corp. | |

| Apple, Inc. | |

| Amazon.com, Inc. | |

| Meta Platforms, Inc. — Class A | |

| Broadcom, Inc. | |

| Alphabet, Inc. — Class A | |

| Berkshire Hathaway, Inc. — Class B | |

| Top 10 Total |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| Class | Costs of a $10,000 Investment | Costs Paid as a % of a $10,000 Investment |

|---|---|---|

| Variable Annuity | $99 | 1.93%2 |

For the period of January 1, 2025 to June 30, 2025, the fund returned 5.93%, underperforming the fund's broad-based securities market index, the S&P 500 Index, which returned 6.20% for the same period.

What factors materially affected the fund's performance over the last six months?