Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

The Charles Schwab Family of Funds

|

|

| Entity Central Index Key |

0000857156

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| Schwab Prime Advantage Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Prime Advantage Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SWVXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Prime Advantage Money Fund, Investor Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 371,120,000,000

|

|

| Holdings Count | Holding |

762

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

|

|

| Holdings [Text Block] |

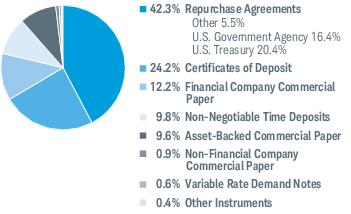

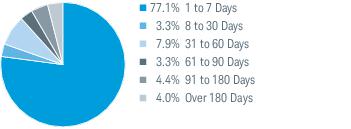

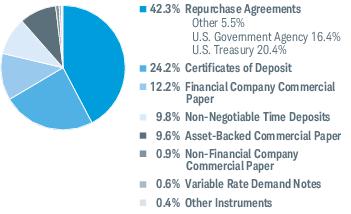

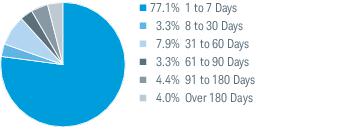

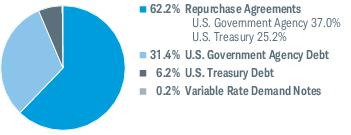

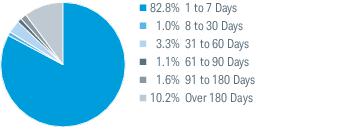

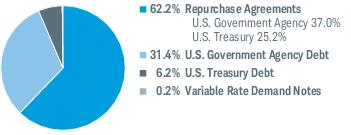

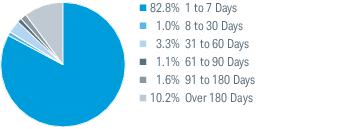

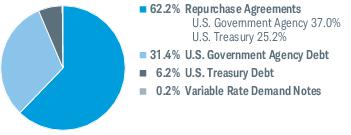

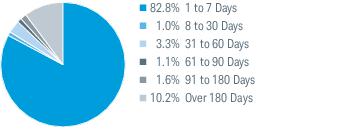

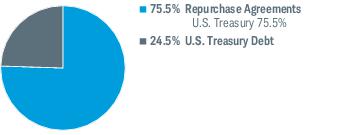

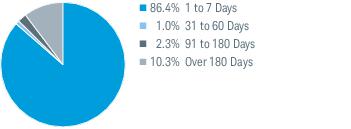

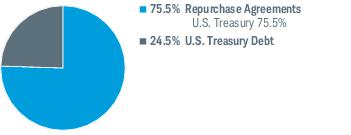

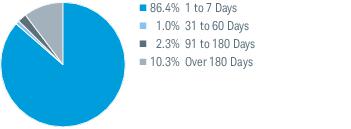

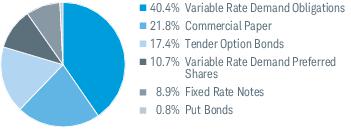

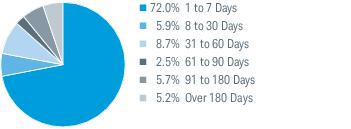

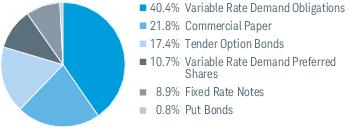

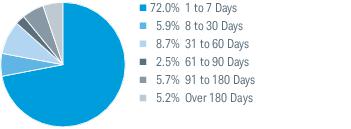

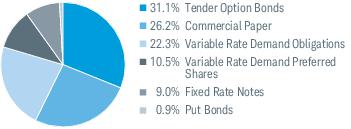

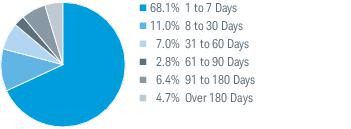

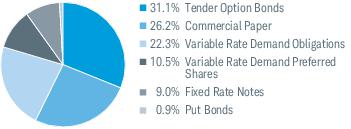

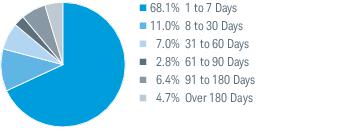

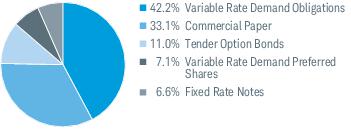

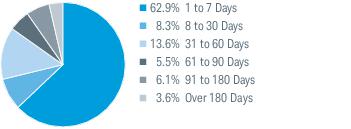

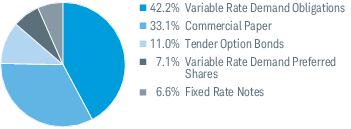

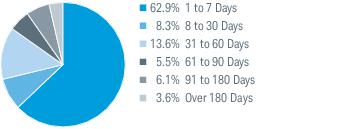

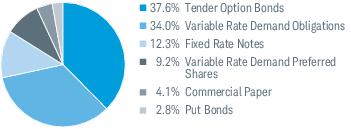

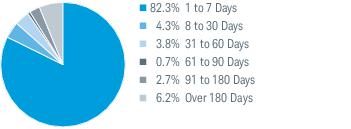

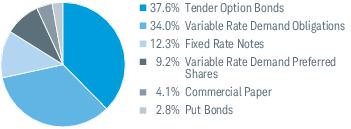

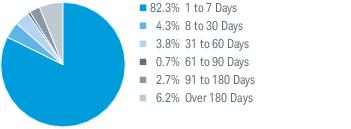

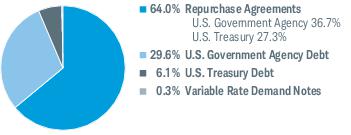

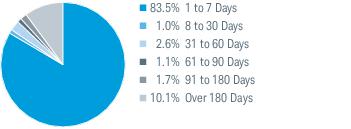

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Prime Advantage Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Prime Advantage Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SNAXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com . |

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Prime Advantage Money Fund, Ultra Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 10

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 371,120,000,000

|

|

| Holdings Count | Holding |

762

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Government Money Fund - Sweep Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Government Money Fund

|

|

| Class Name |

Sweep Shares

|

|

| Trading Symbol |

SWGXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Government Money Fund, Sweep Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 22

|

[1] |

| Expense Ratio, Percent |

0.44%

|

[1],[2] |

| Net Assets |

$ 81,085,000,000

|

|

| Holdings Count | Holding |

297

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

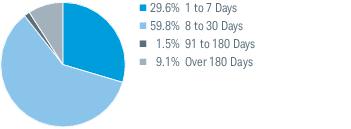

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Government Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Government Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SNVXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Government Money Fund, Investor Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 81,085,000,000

|

|

| Holdings Count | Holding |

297

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Government Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Government Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SGUXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Government Money Fund, Ultra Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 10

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 81,085,000,000

|

|

| Holdings Count | Holding |

297

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

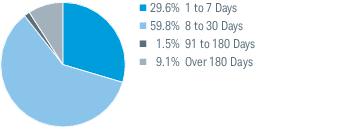

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab U.S. Treasury Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab U.S. Treasury Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SNSXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab U.S. Treasury Money Fund, Investor Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 92,451,000,000

|

|

| Holdings Count | Holding |

44

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab U.S. Treasury Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab U.S. Treasury Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SUTXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab U.S. Treasury Money Fund, Ultra Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 10

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 92,451,000,000

|

|

| Holdings Count | Holding |

44

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Treasury Obligations Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Treasury Obligations Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SNOXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Treasury Obligations Money Fund, Investor Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 74,269,000,000

|

|

| Holdings Count | Holding |

78

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Treasury Obligations Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Treasury Obligations Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SCOXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Treasury Obligations Money Fund, Ultra Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 10

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 74,269,000,000

|

|

| Holdings Count | Holding |

78

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Municipal Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Municipal Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SWTXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Municipal Money Fund, Investor Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 17,057,000,000

|

|

| Holdings Count | Holding |

1,175

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

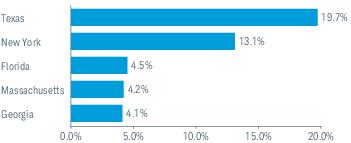

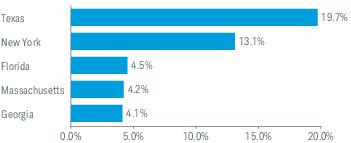

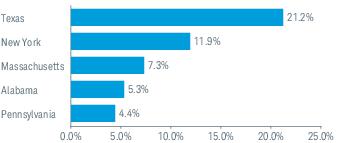

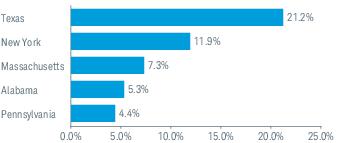

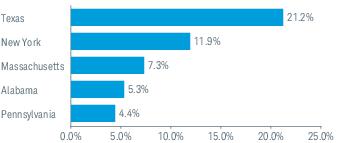

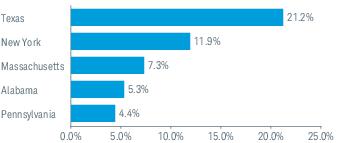

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Largest Holdings by State % of Investments Portfolio holdings may have changed since the report date. |

|

| Largest Holdings [Text Block] |

Largest Holdings by State % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab Municipal Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Municipal Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SWOXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Municipal Money Fund, Ultra Shares* |

|

| Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund.

|

|

| Expenses Paid, Amount |

$ 9

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 17,057,000,000

|

|

| Holdings Count | Holding |

1,175

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Largest Holdings by State % of Investments Portfolio holdings may have changed si nce th e report date.

|

|

| Largest Holdings [Text Block] |

Largest Holdings by State % of Investments Portfolio holdings may have changed si nce th e report date. |

|

| Schwab AMT Tax-Free Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab AMT Tax-Free Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SWWXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab AMT Tax-Free Money Fund, Investor Shares* |

|

| Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 3,543,000,000

|

|

| Holdings Count | Holding |

560

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Largest Holdings by State % of Investments Portfolio holdings may have changed since the report date. |

|

| Largest Holdings [Text Block] |

Largest Holdings by State % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab AMT Tax-Free Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab AMT Tax-Free Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SCTXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab AMT Tax-Free Money Fund, Ultra Shares* |

|

| Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund.

|

|

| Expenses Paid, Amount |

$ 9

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 3,543,000,000

|

|

| Holdings Count | Holding |

560

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Largest Holdings by State % of Investments Portfolio holdings may have changed since the report date. |

|

| Largest Holdings [Text Block] |

Largest Holdings by State % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab California Municipal Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab California Municipal Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SWKXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab California Municipal Money Fund, Investor Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 9,079,000,000

|

|

| Holdings Count | Holding |

467

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab California Municipal Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab California Municipal Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SCAXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab California Municipal Money Fund, Ultra Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 9

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 9,079,000,000

|

|

| Holdings Count | Holding |

467

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab New York Municipal Money Fund - Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab New York Municipal Money Fund

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

SWYXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab New York Municipal Money Fund, Investor Shares* |

|

| Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund.

|

|

| Expenses Paid, Amount |

$ 17

|

[1] |

| Expense Ratio, Percent |

0.34%

|

[1],[2] |

| Net Assets |

$ 2,897,000,000

|

|

| Holdings Count | Holding |

363

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date. |

|

| Schwab New York Municipal Money Fund - Ultra Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab New York Municipal Money Fund

|

|

| Class Name |

Ultra Shares

|

|

| Trading Symbol |

SNYXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab New York Municipal Money Fund, Ultra Shares* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 9

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 2,897,000,000

|

|

| Holdings Count | Holding |

363

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date.

|

|

| Schwab Retirement Government Money Fund |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Retirement Government Money Fund

|

|

| Class Name |

Schwab Retirement Government Money Fund

|

|

| Trading Symbol |

SNRXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of January 1, 2025, to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED June 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| |

|

|

Schwab Retirement Government Money Fund* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long a s the in vestment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 10

|

[1] |

| Expense Ratio, Percent |

0.19%

|

[1],[2] |

| Net Assets |

$ 2,480,000,000

|

|

| Holdings Count | Holding |

273

|

|

| Additional Fund Statistics [Text Block] |

| |

|

| |

|

Weighted Average Maturity |

|

Seven-Day Yield (with waivers) |

|

Seven-Day Yield (without waivers) |

|

Seven-Day Effective Yield (with waivers) |

|

|

|

| Holdings [Text Block] |

Portfolio Composition by Security Type % of Investments Portfolio Composition By Effective Maturity % of Investments Portfolio holdings may have changed since the report date.

|

|

|

|