Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

JPMorgan Trust II

|

| Entity Central Index Key |

0000763852

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000010158 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class A Shares

|

| Trading Symbol |

OSGIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class A Shares) |

$119 |

1.10% |

|

| Expenses Paid, Amount |

$ 119

|

| Expense Ratio, Percent |

1.10%

|

| Factors Affecting Performance [Text Block] |

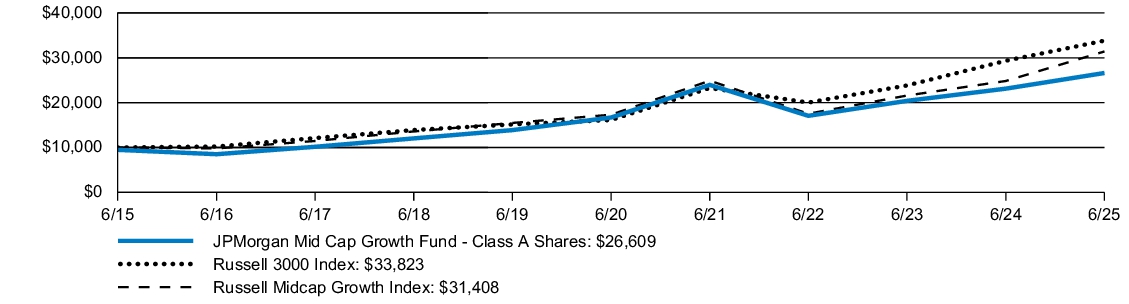

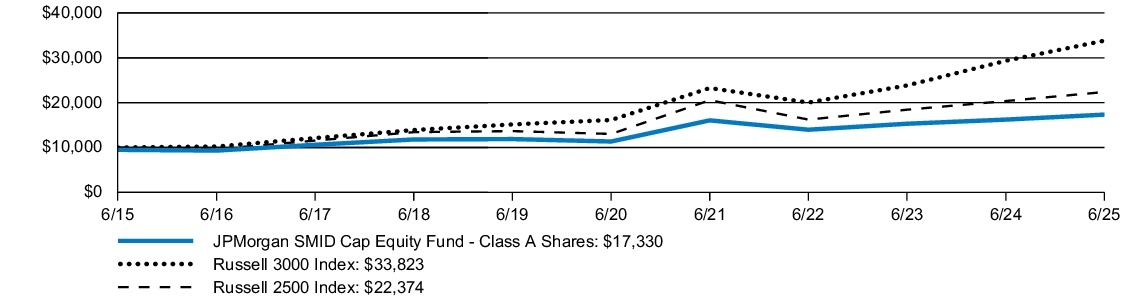

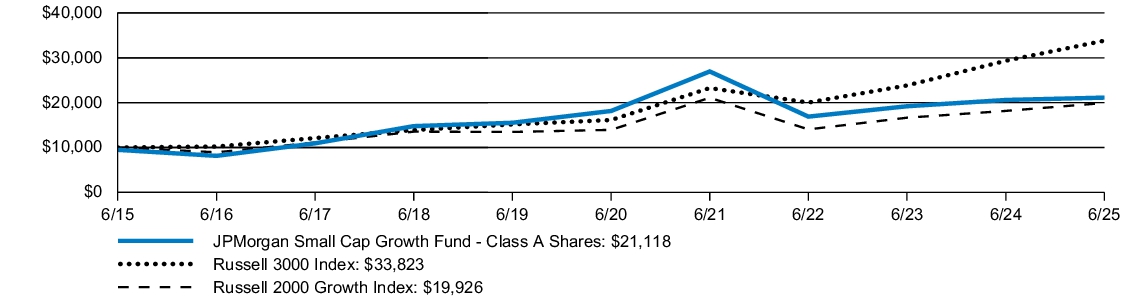

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class A Shares, without a sales charge, returned 15.09% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

| Line Graph [Table Text Block] |

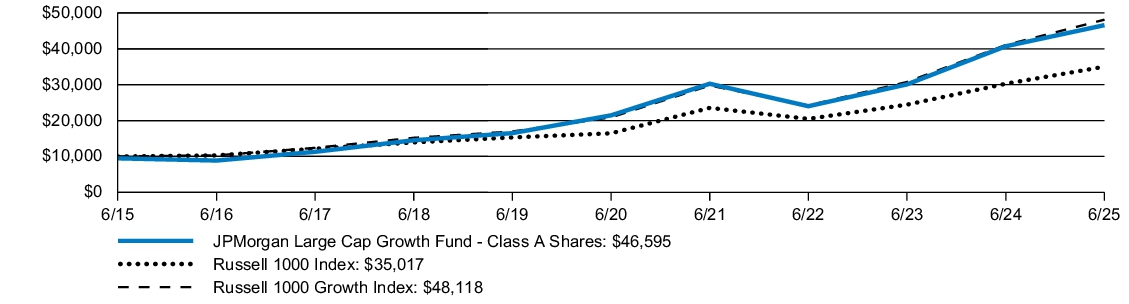

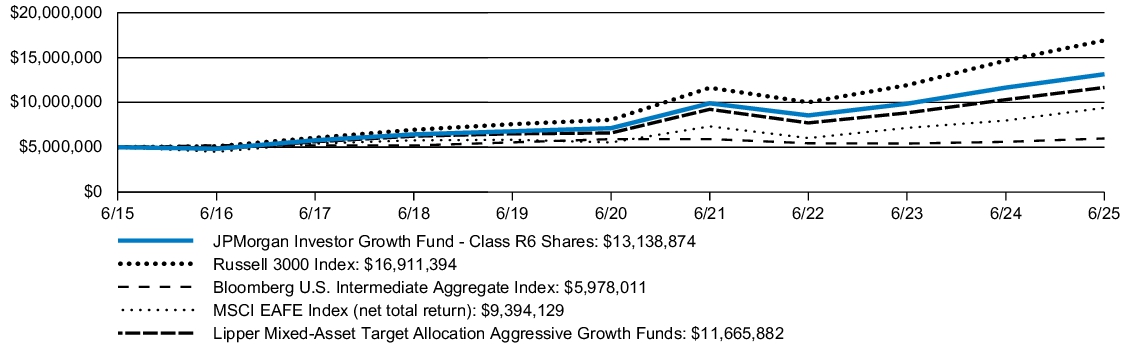

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class A Shares) |

February 18, 1992 |

9.05 |

% |

8.60 |

% |

10.28 |

% |

| JPMorgan Mid Cap Growth Fund (Class A Shares) - excluding sales charge |

|

15.09 |

|

9.78 |

|

10.88 |

|

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Feb. 18, 1992

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

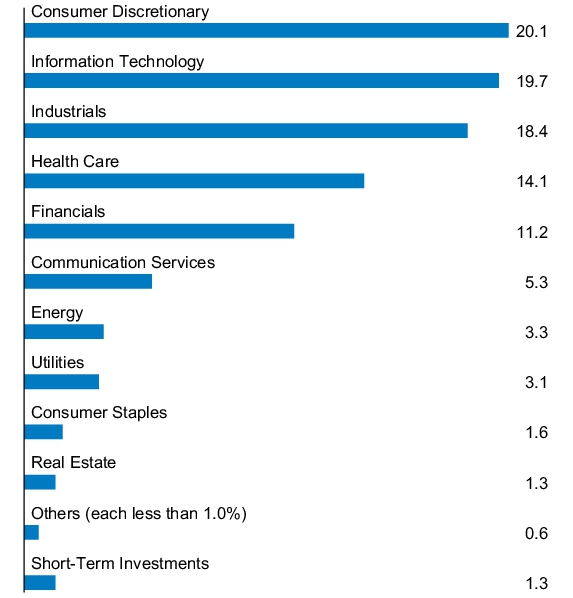

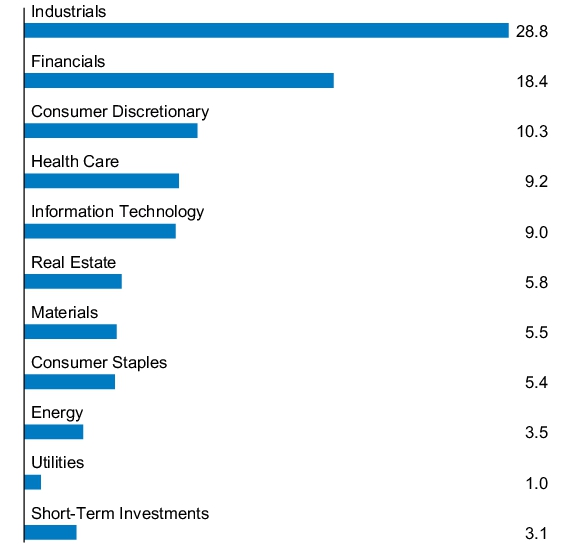

| Holdings [Text Block] |

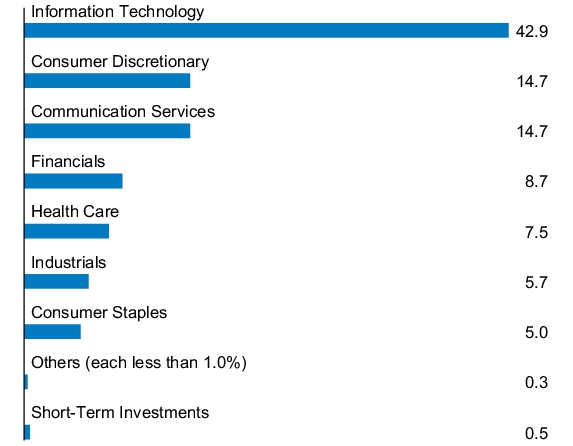

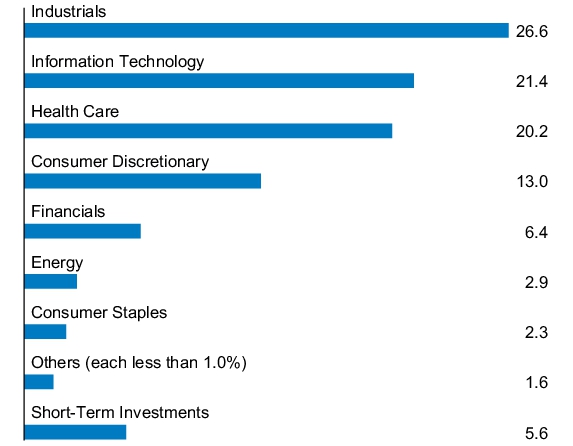

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.14% of the Fund's Class A Shares average daily net assets to 1.09% of the Fund's Class A Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.14% of the Fund's Class A Shares average daily net assets to 1.09% of the Fund's Class A Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000010160 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class C Shares

|

| Trading Symbol |

OMGCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class C Shares) |

$172 |

1.60% |

|

| Expenses Paid, Amount |

$ 172

|

| Expense Ratio, Percent |

1.60%

|

| Factors Affecting Performance [Text Block] |

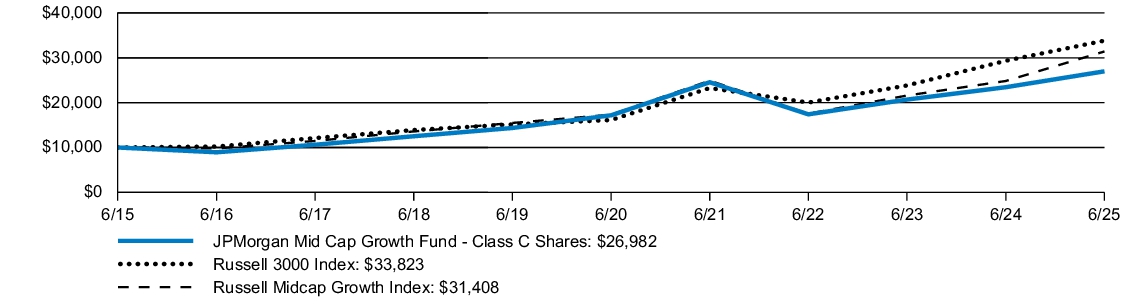

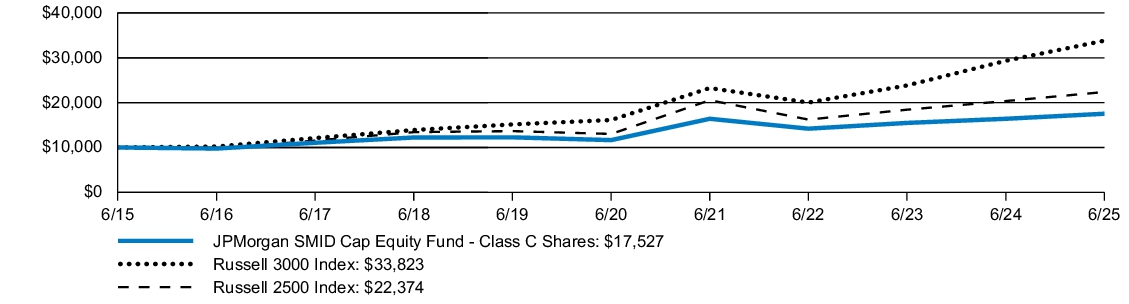

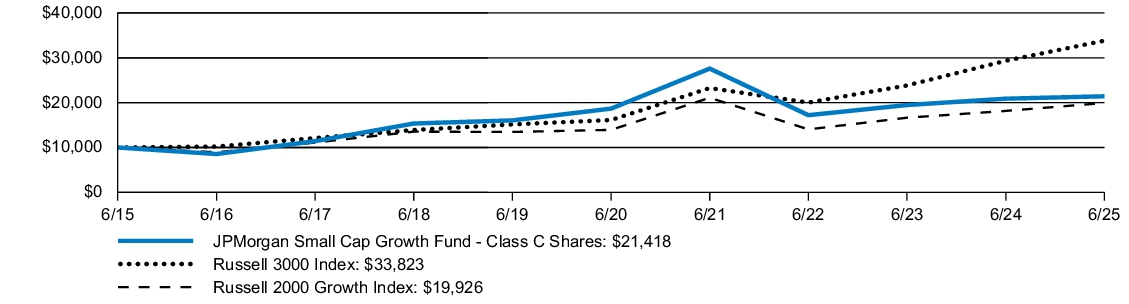

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class C Shares, without a sales charge, returned 14.52% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

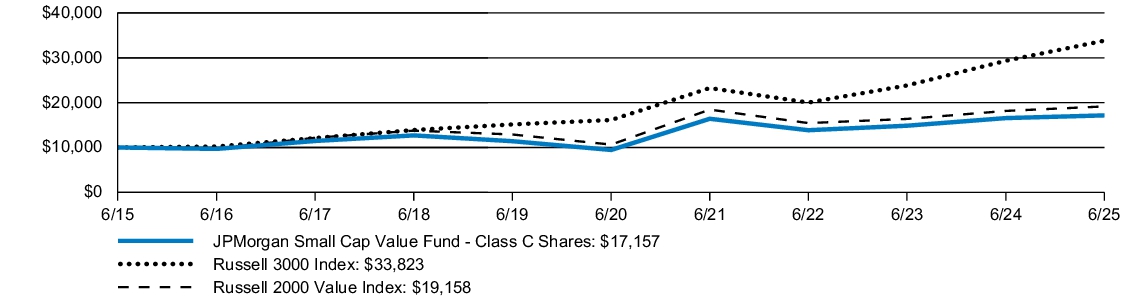

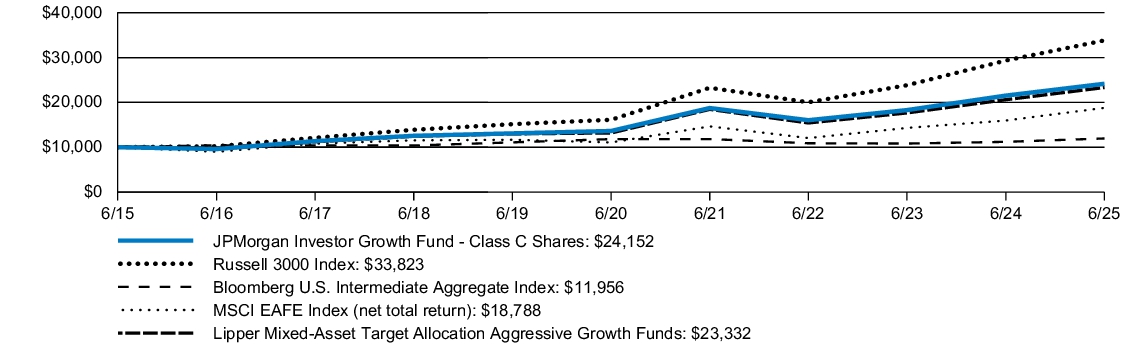

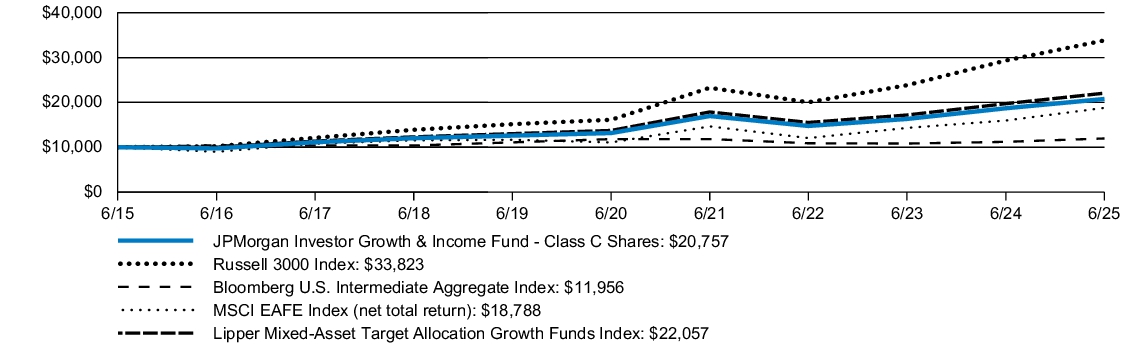

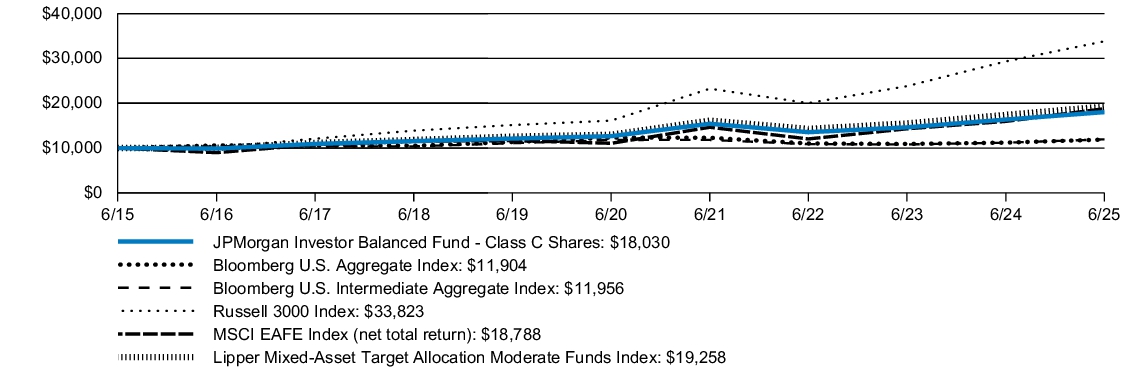

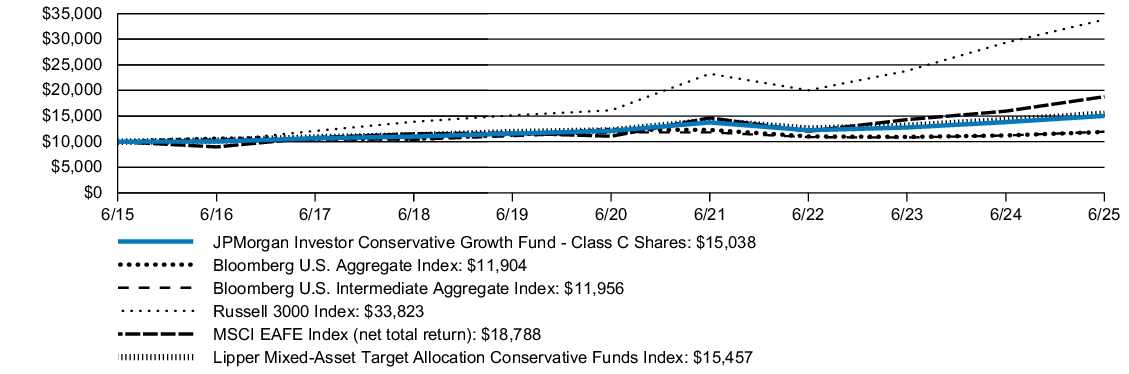

| Line Graph [Table Text Block] |

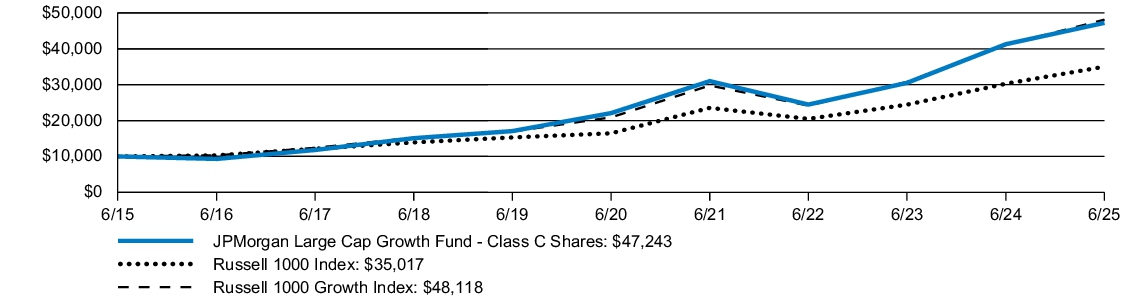

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class C Shares) |

November 4, 1997 |

13.52 |

% |

9.23 |

% |

10.43 |

% |

| JPMorgan Mid Cap Growth Fund (Class C Shares) - excluding sales charge |

|

14.52 |

|

9.23 |

|

10.43 |

|

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Nov. 04, 1997

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

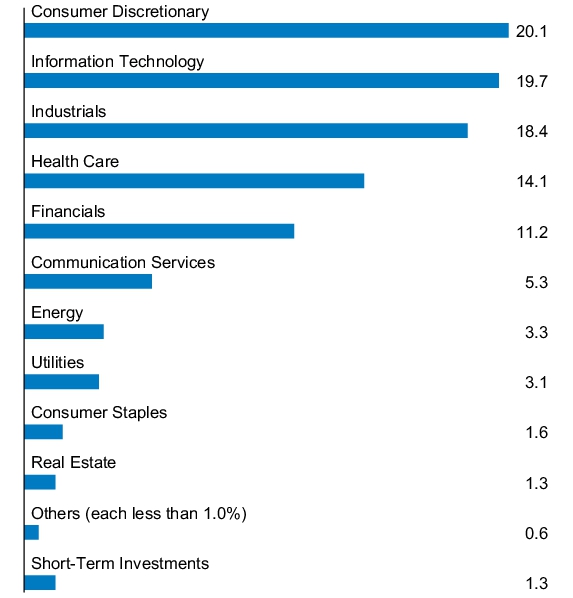

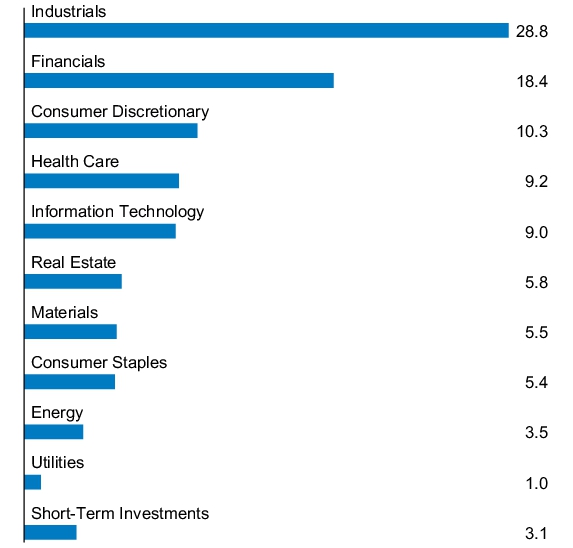

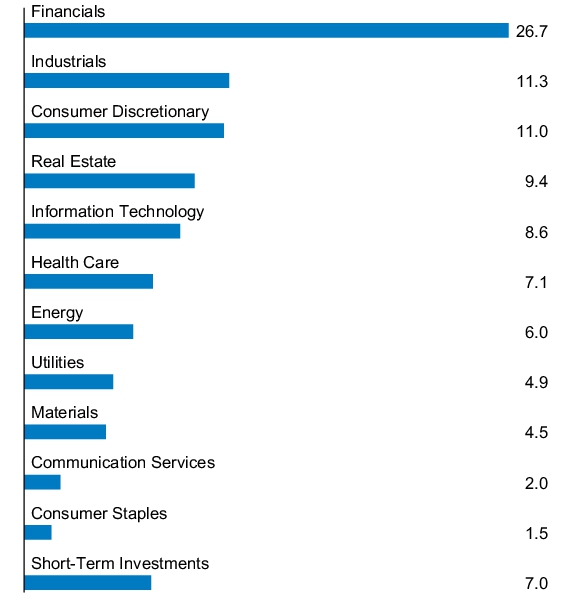

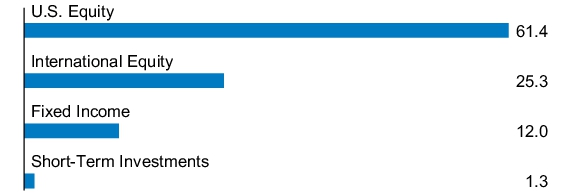

| Holdings [Text Block] |

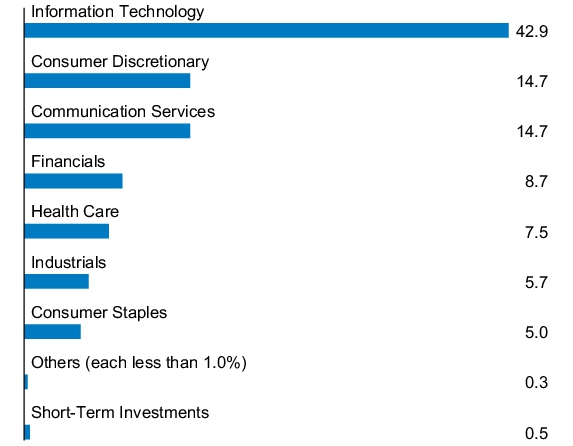

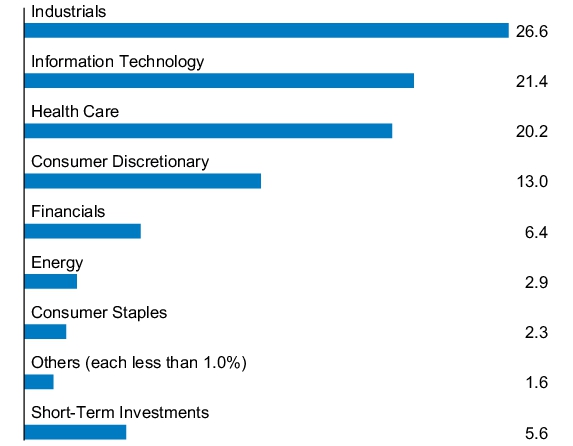

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.64% of the Fund's Class C Shares average daily net assets to 1.59% of the Fund's Class C Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.64% of the Fund's Class C Shares average daily net assets to 1.59% of the Fund's Class C Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000010157 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class I Shares

|

| Trading Symbol |

HLGEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class I Shares) |

$92 |

0.85% |

|

| Expenses Paid, Amount |

$ 92

|

| Expense Ratio, Percent |

0.85%

|

| Factors Affecting Performance [Text Block] |

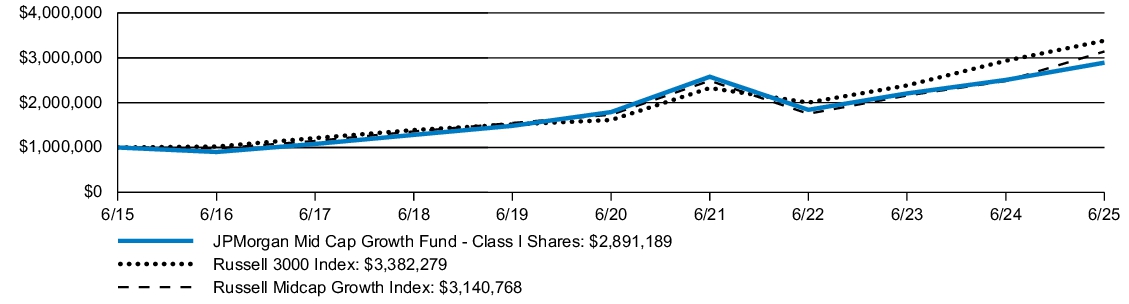

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class I Shares returned 15.37% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

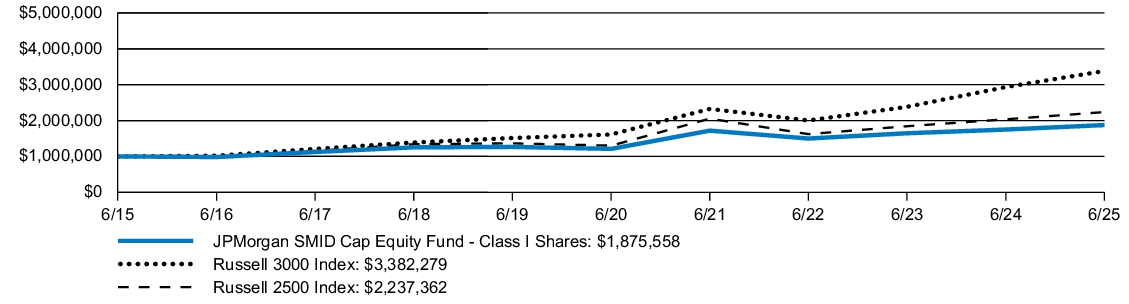

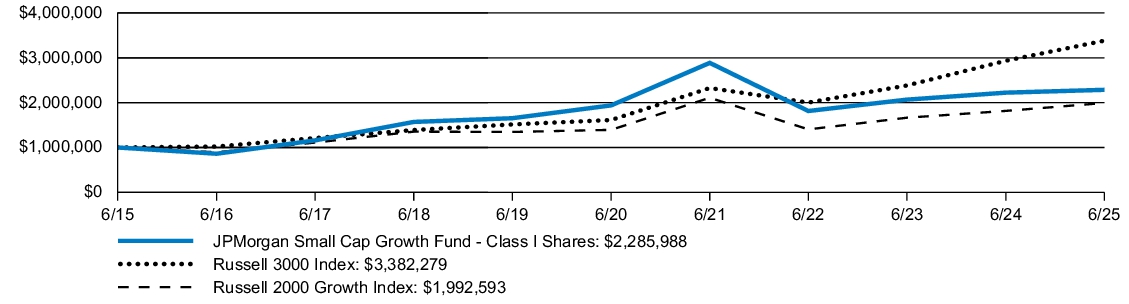

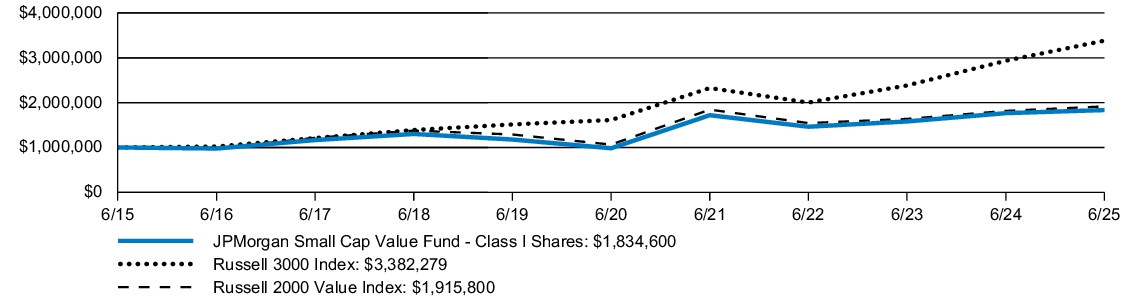

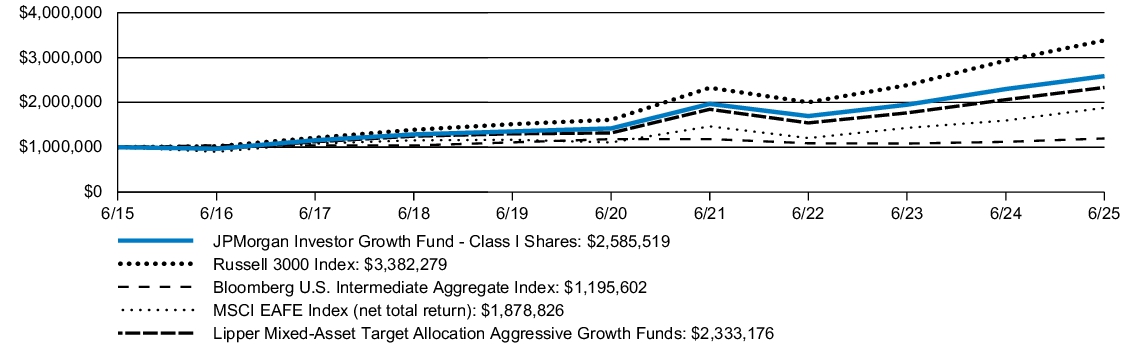

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class I Shares) |

March 2, 1989 |

15.37 |

% |

10.07 |

% |

11.20 |

% |

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Mar. 02, 1989

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

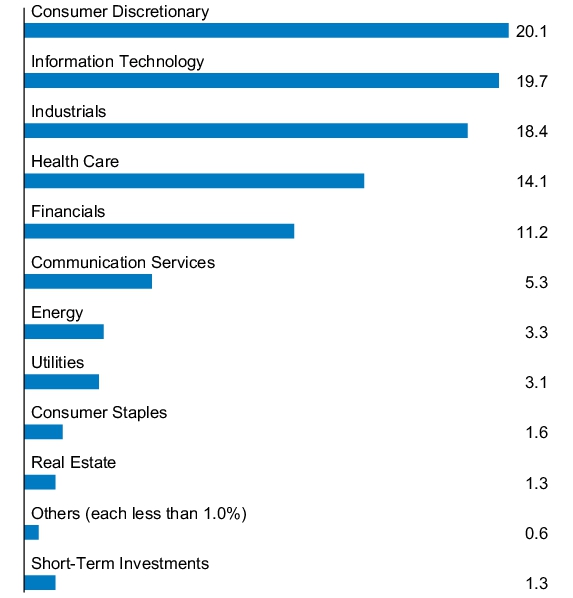

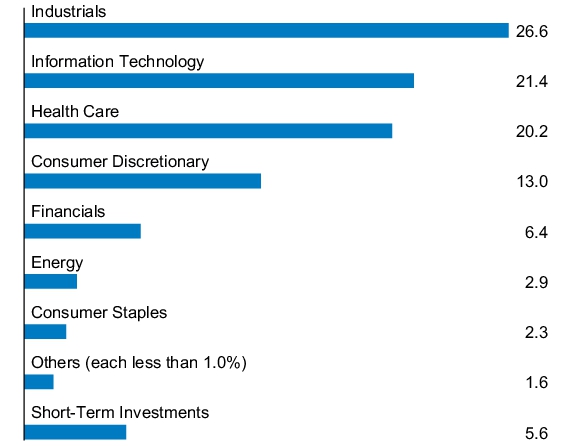

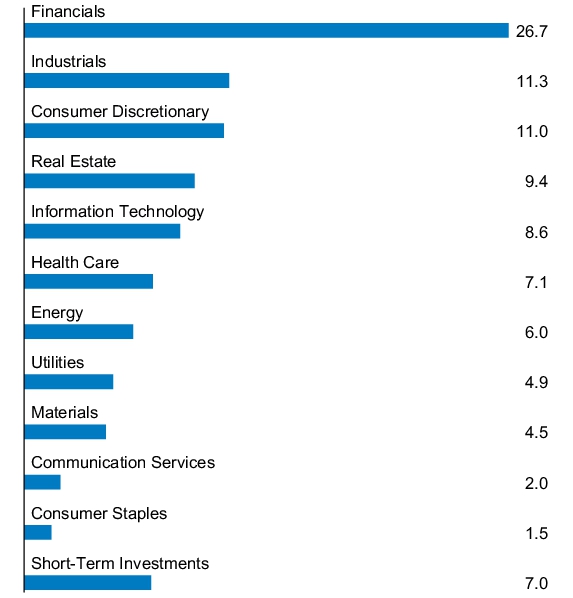

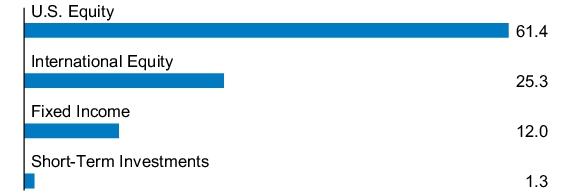

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.89% of the Fund's Class I Shares average daily net assets to 0.84% of the Fund's Class I Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.89% of the Fund's Class I Shares average daily net assets to 0.84% of the Fund's Class I Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000077259 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class R2 Shares

|

| Trading Symbol |

JMGZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class R2 Shares) |

$152 |

1.41% |

|

| Expenses Paid, Amount |

$ 152

|

| Expense Ratio, Percent |

1.41%

|

| Factors Affecting Performance [Text Block] |

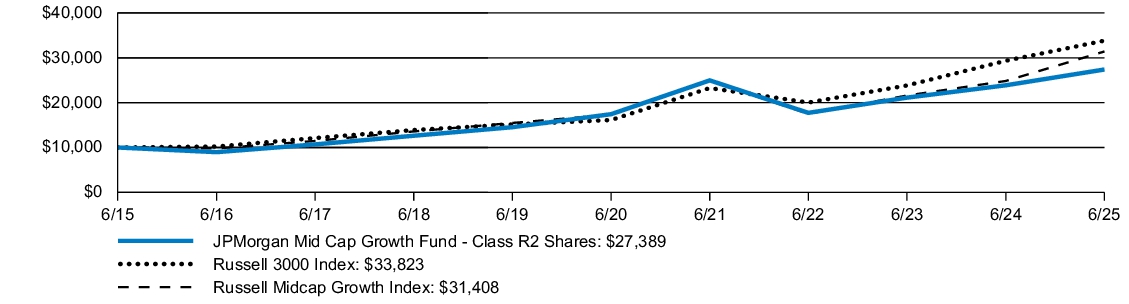

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class R2 Shares returned 14.75% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

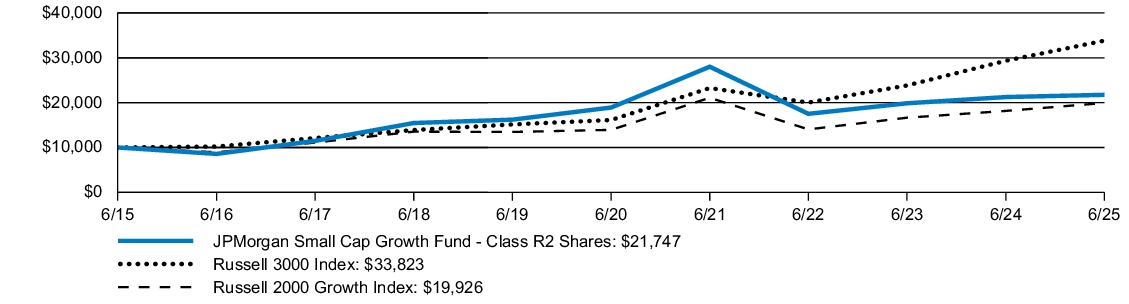

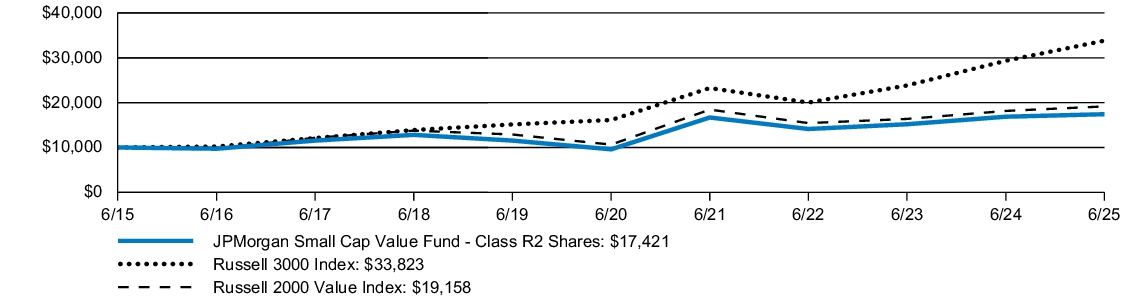

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class R2 Shares) |

June 19, 2009 |

14.75 |

% |

9.46 |

% |

10.60 |

% |

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Jun. 19, 2009

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

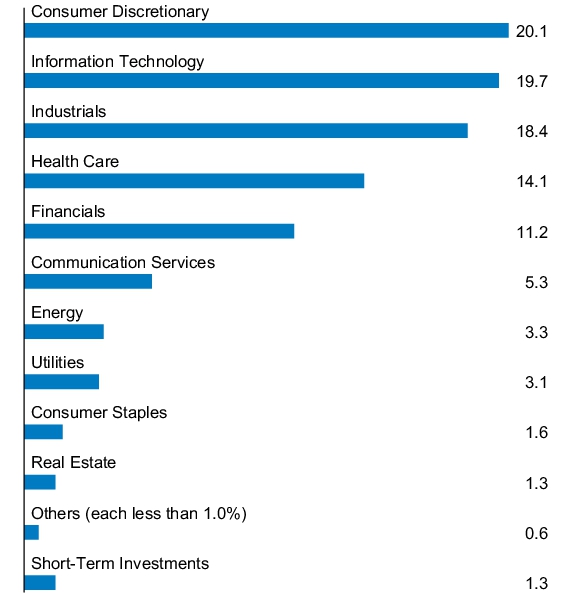

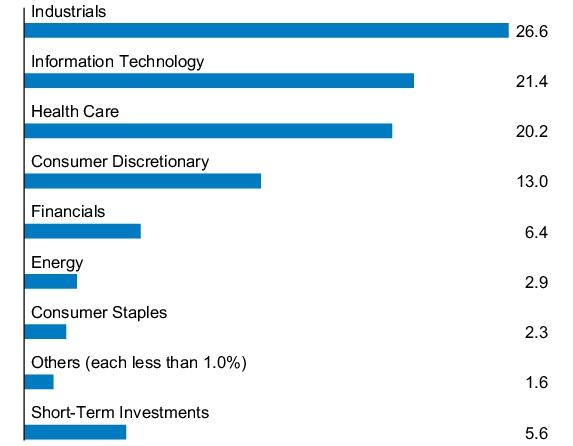

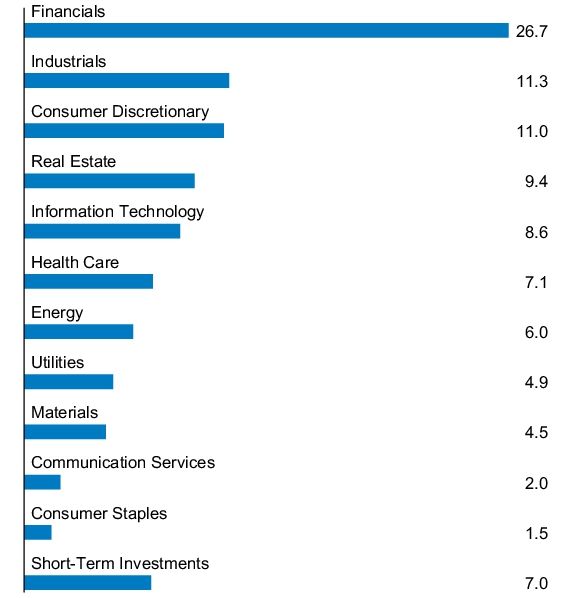

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.45% of the Fund's Class R2 Shares average daily net assets to 1.40% of the Fund's Class R2 Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.45% of the Fund's Class R2 Shares average daily net assets to 1.40% of the Fund's Class R2 Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000173559 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class R3 Shares

|

| Trading Symbol |

JMGPX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class R3 Shares) |

$125 |

1.16% |

|

| Expenses Paid, Amount |

$ 125

|

| Expense Ratio, Percent |

1.16%

|

| Factors Affecting Performance [Text Block] |

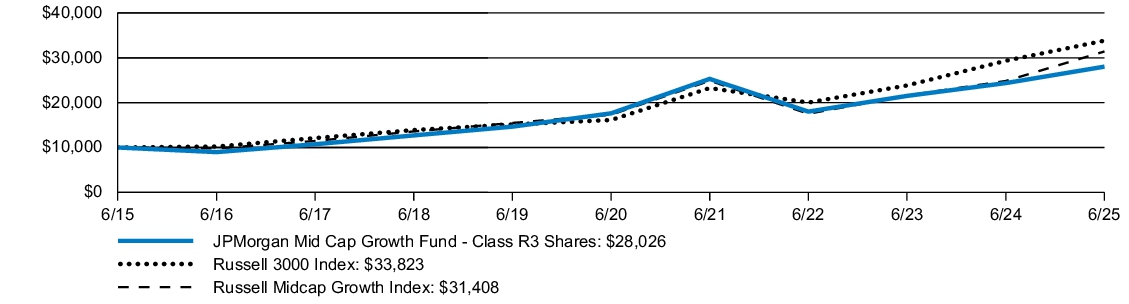

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class R3 Shares returned 15.02% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

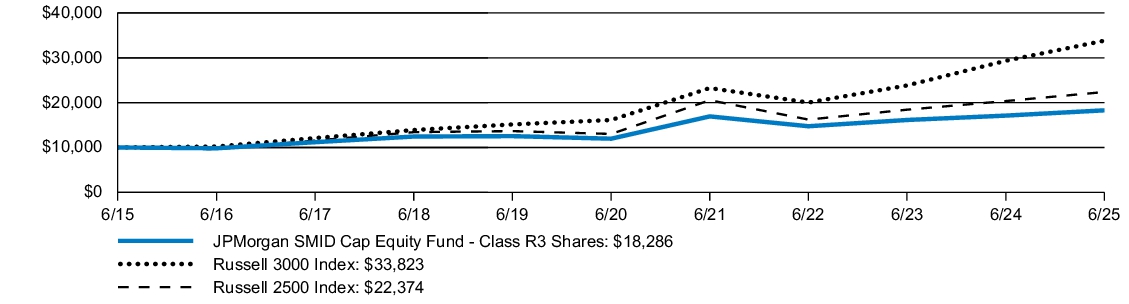

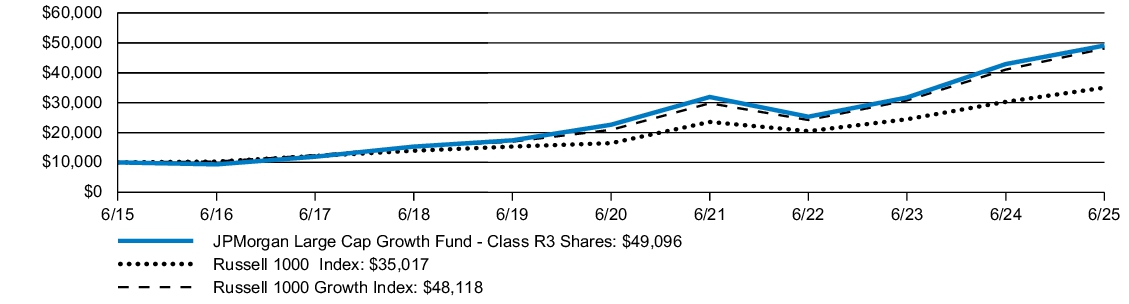

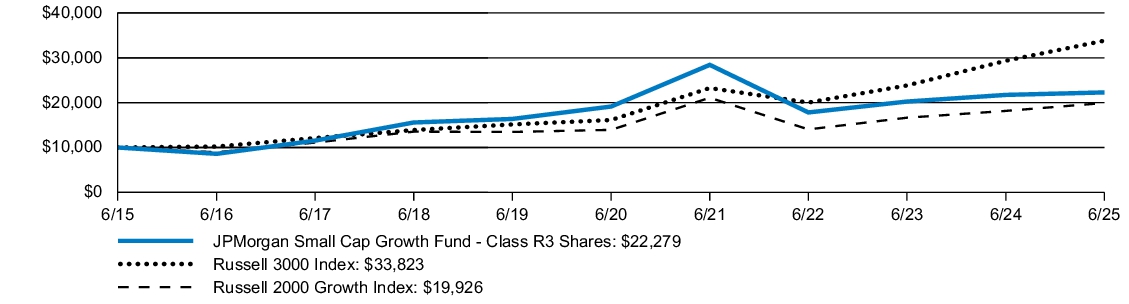

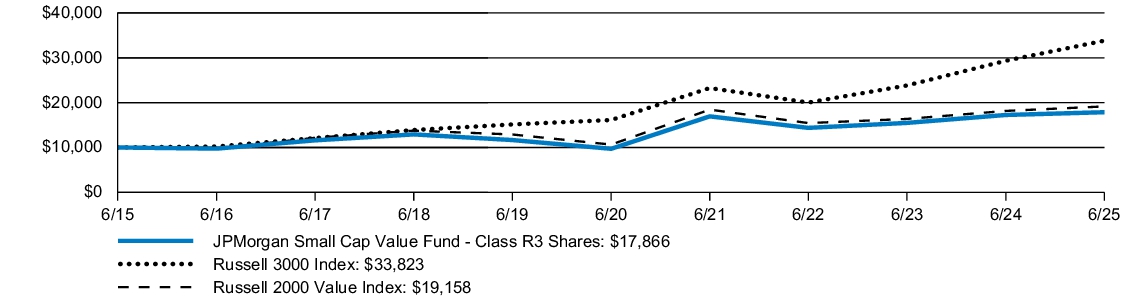

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class R3 Shares) |

September 9, 2016 |

15.02 |

% |

9.73 |

% |

10.86 |

% |

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Sep. 09, 2016

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

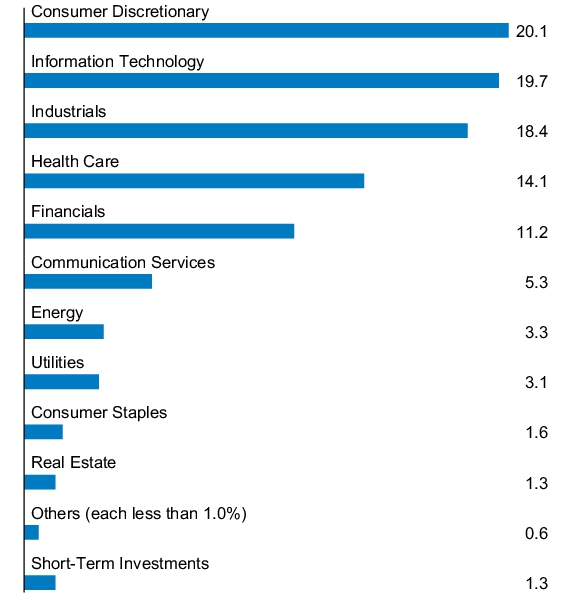

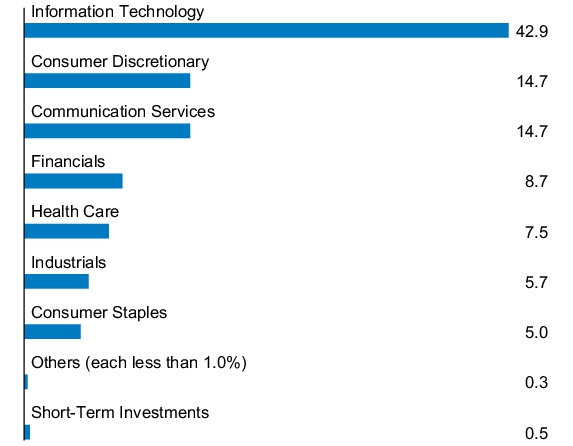

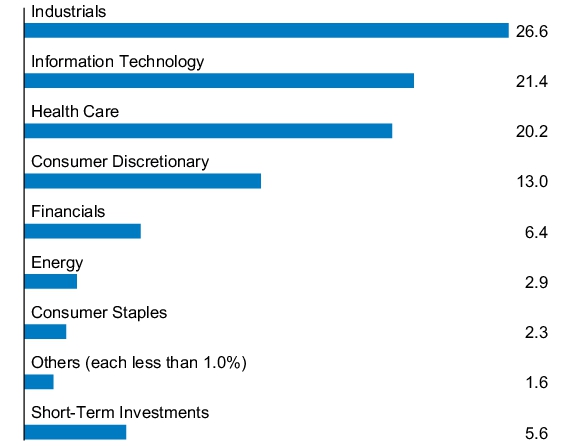

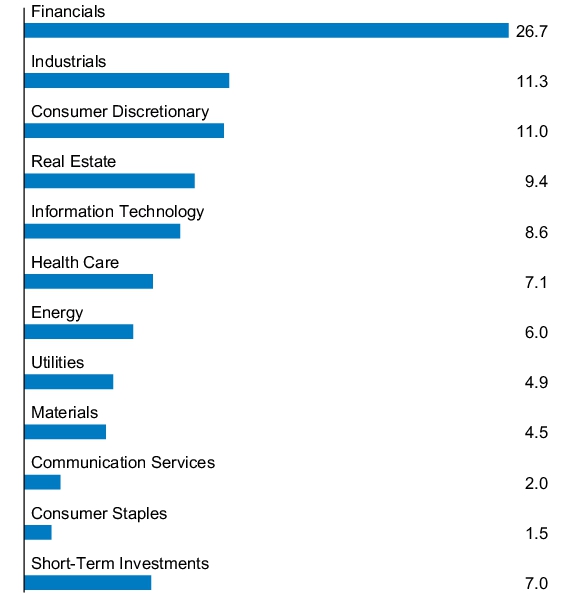

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.20% of the Fund's Class R3 Shares average daily net assets to 1.15% of the Fund's Class R3 Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 1.20% of the Fund's Class R3 Shares average daily net assets to 1.15% of the Fund's Class R3 Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000173560 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class R4 Shares

|

| Trading Symbol |

JMGQX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class R4 Shares) |

$98 |

0.91% |

|

| Expenses Paid, Amount |

$ 98

|

| Expense Ratio, Percent |

0.91%

|

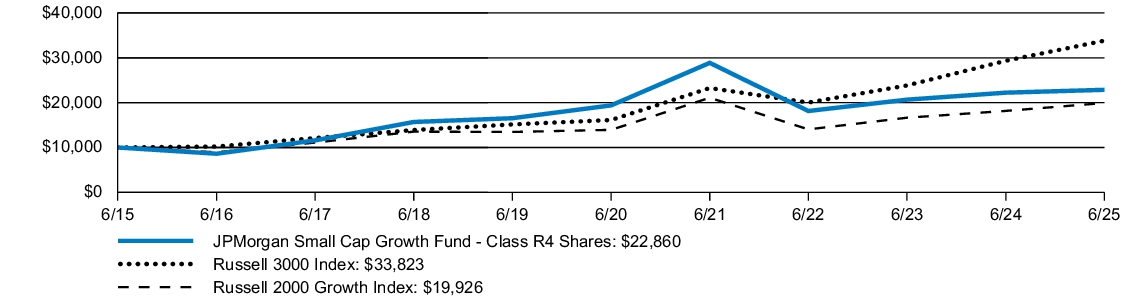

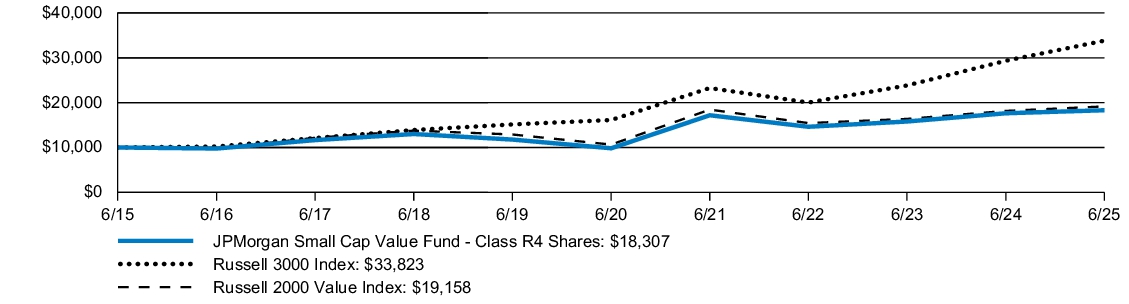

| Factors Affecting Performance [Text Block] |

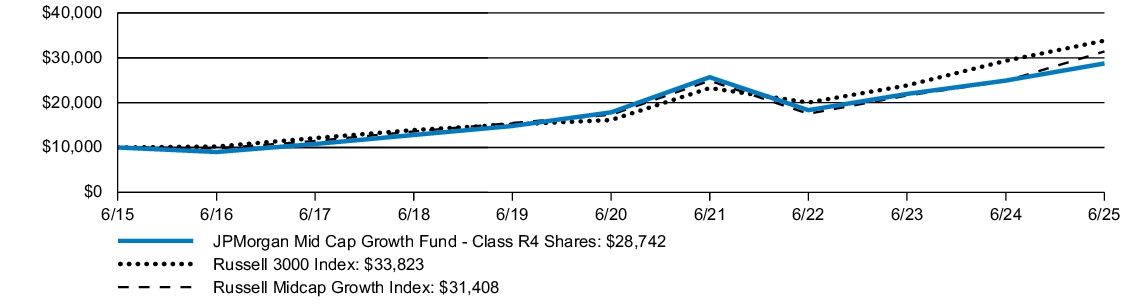

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class R4 Shares returned 15.33% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

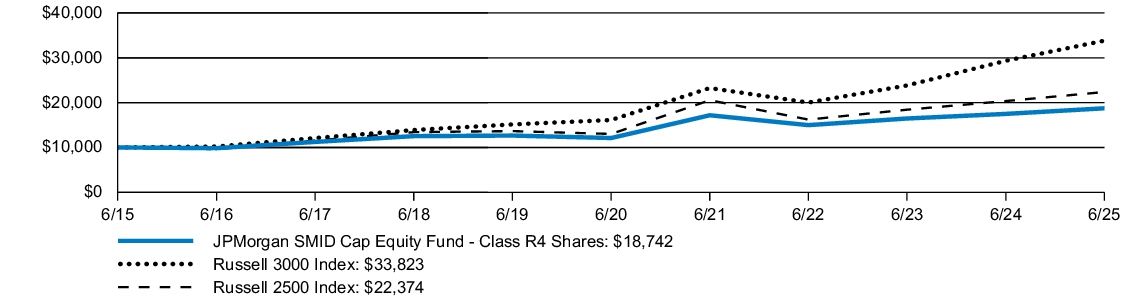

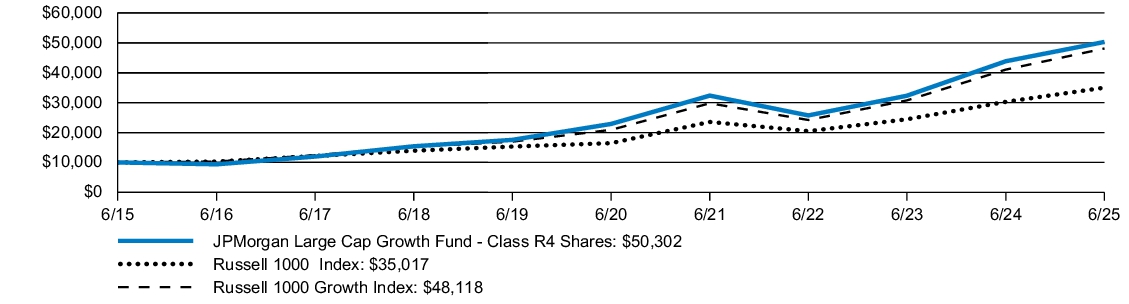

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class R4 Shares) |

September 9, 2016 |

15.33 |

% |

10.00 |

% |

11.14 |

% |

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Sep. 09, 2016

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

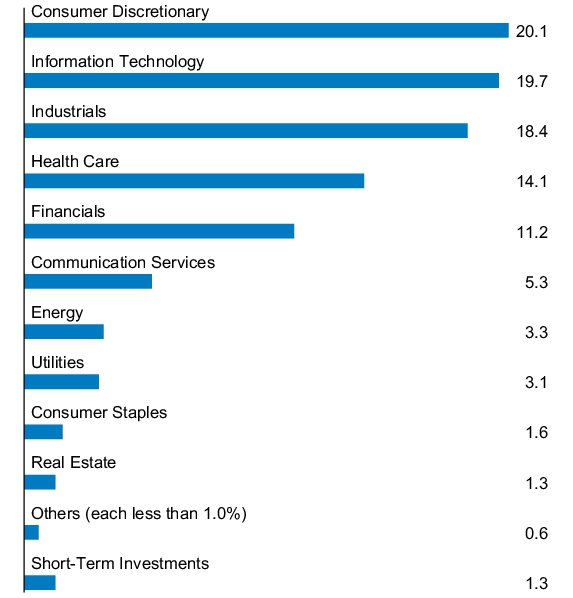

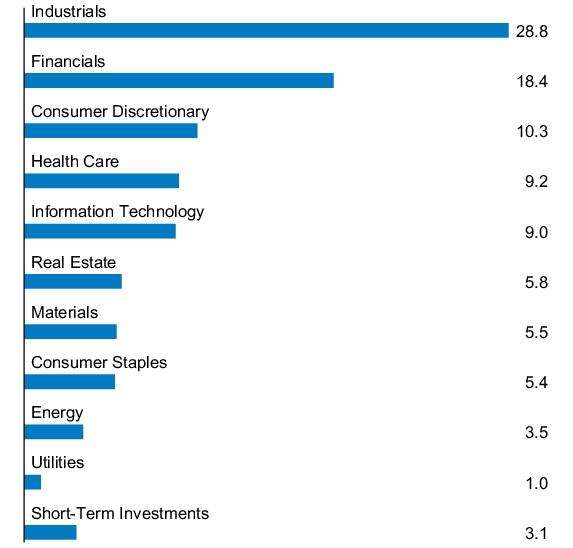

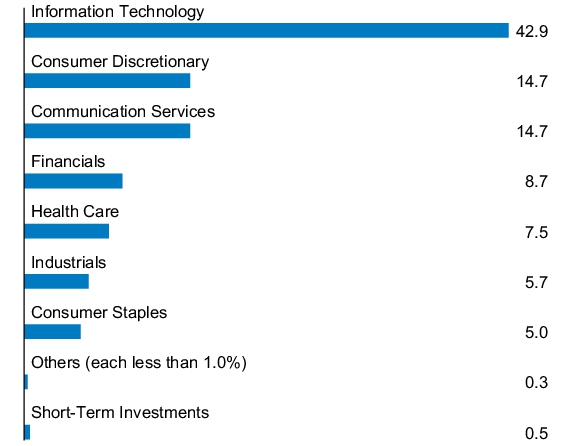

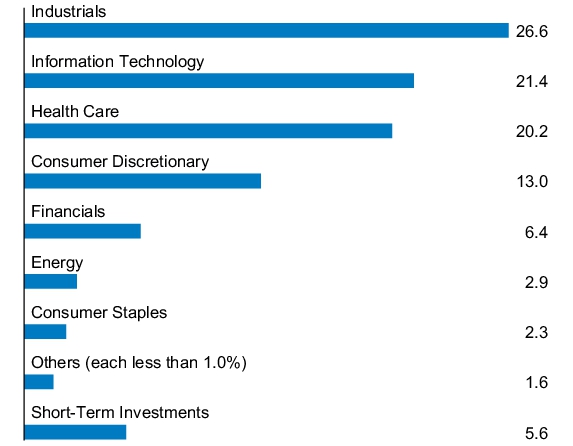

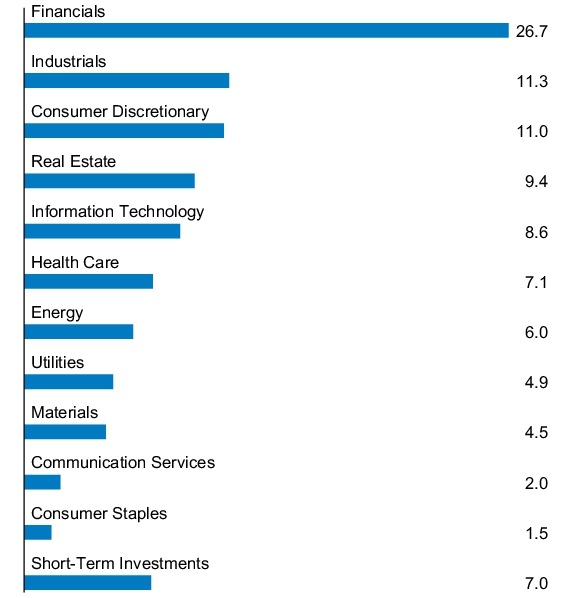

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.95% of the Fund's Class R4 Shares average daily net assets to 0.90% of the Fund's Class R4 Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.95% of the Fund's Class R4 Shares average daily net assets to 0.90% of the Fund's Class R4 Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000106055 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class R5 Shares

|

| Trading Symbol |

JMGFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class R5 Shares) |

$81 |

0.75% |

|

| Expenses Paid, Amount |

$ 81

|

| Expense Ratio, Percent |

0.75%

|

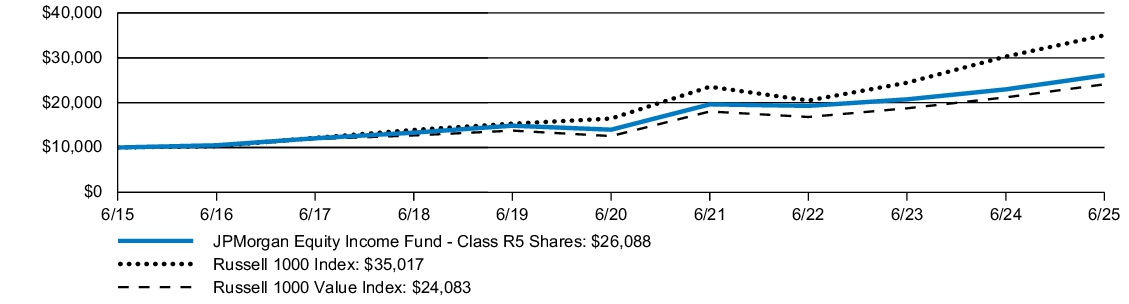

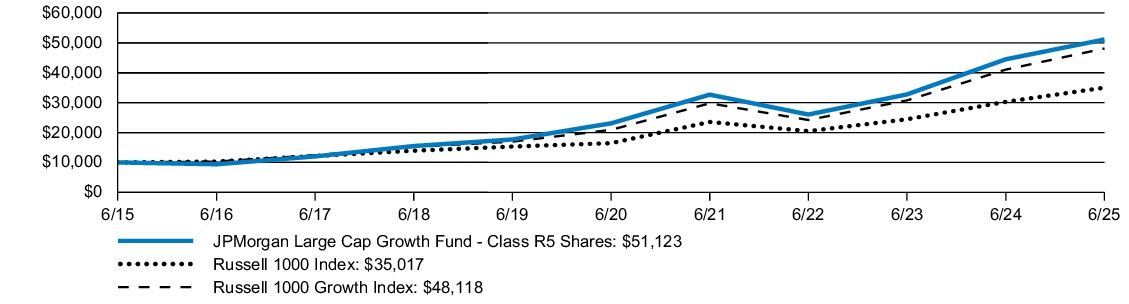

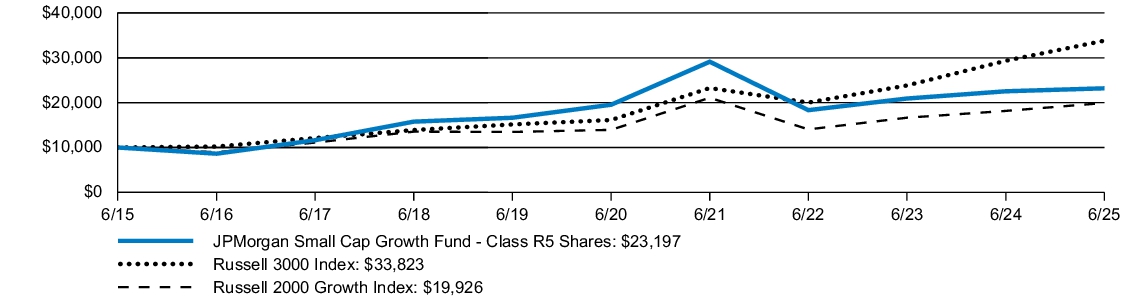

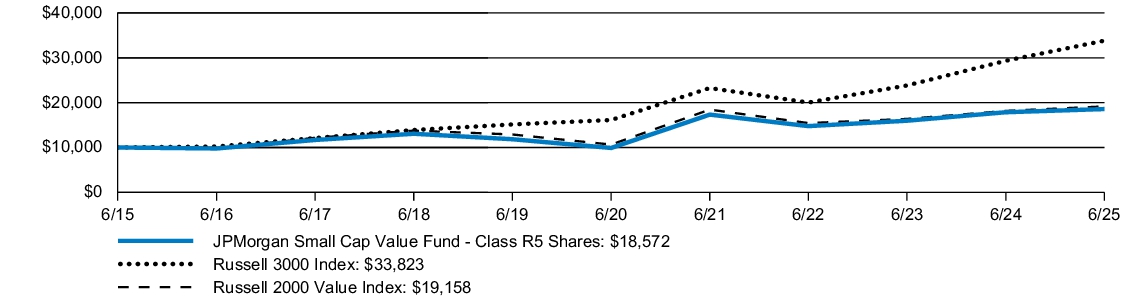

| Factors Affecting Performance [Text Block] |

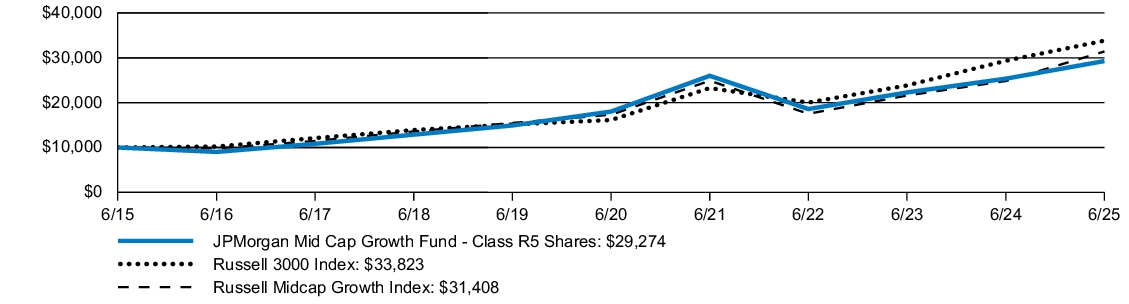

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class R5 Shares returned 15.49% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

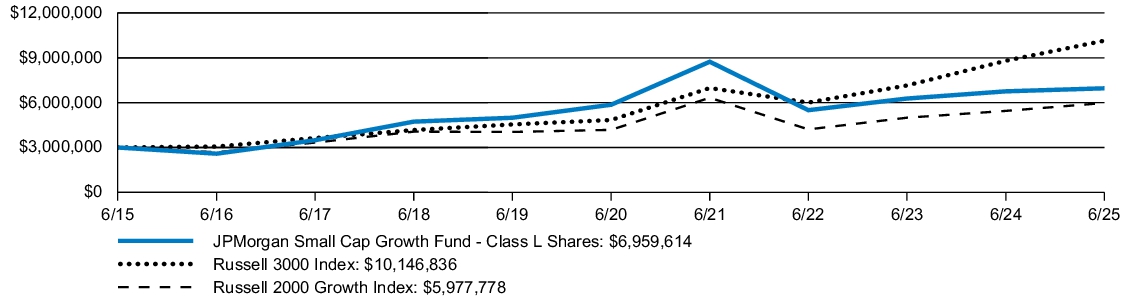

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class R5 Shares) |

November 1, 2011 |

15.49 |

% |

10.19 |

% |

11.34 |

% |

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Nov. 01, 2011

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

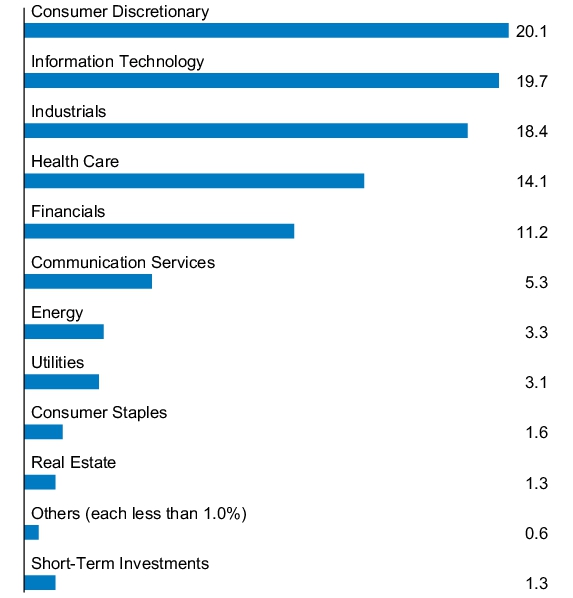

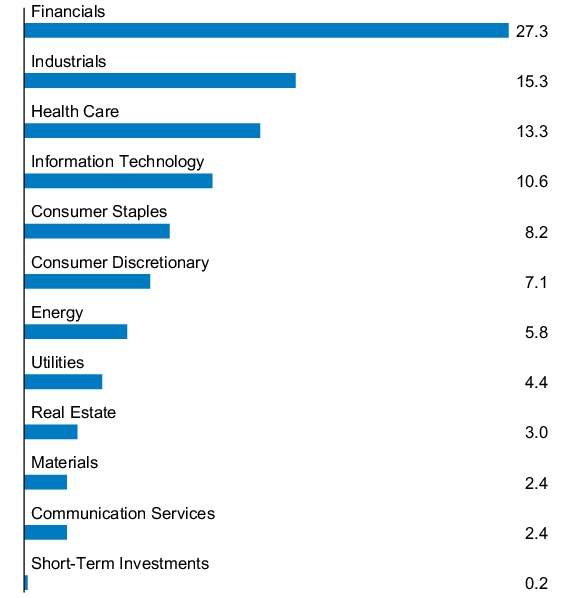

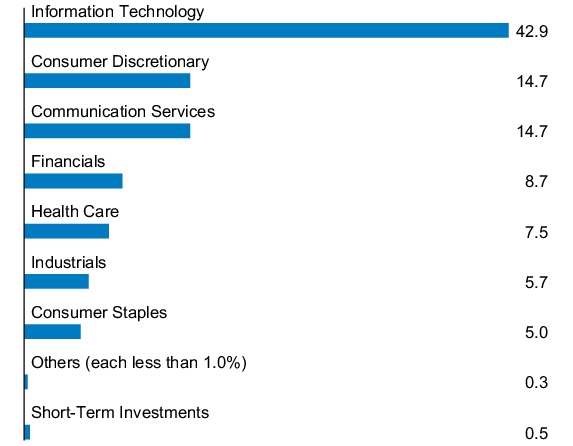

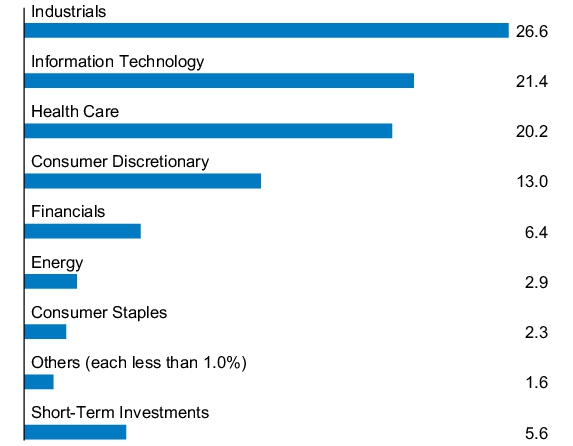

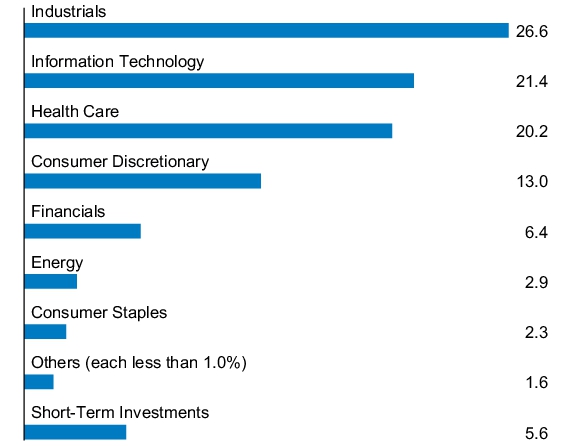

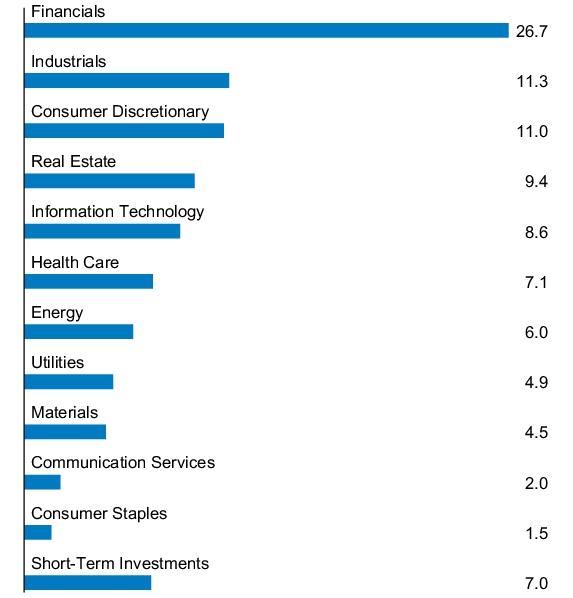

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.79% of the Fund's Class R5 Shares average daily net assets to 0.74% of the Fund's Class R5 Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.79% of the Fund's Class R5 Shares average daily net assets to 0.74% of the Fund's Class R5 Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000106056 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Mid Cap Growth Fund

|

| Class Name |

Class R6 Shares

|

| Trading Symbol |

JMGMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Material Fund Change Notice [Text Block] |

This report describes material changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Mid Cap Growth Fund

(Class R6 Shares) |

$71 |

0.66% |

|

| Expenses Paid, Amount |

$ 71

|

| Expense Ratio, Percent |

0.66%

|

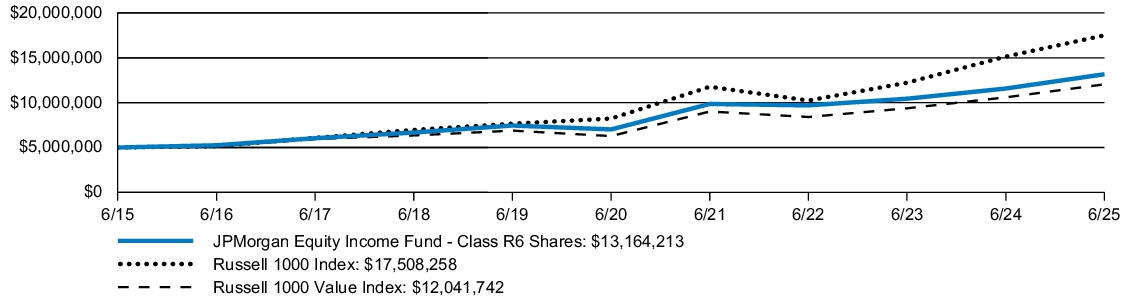

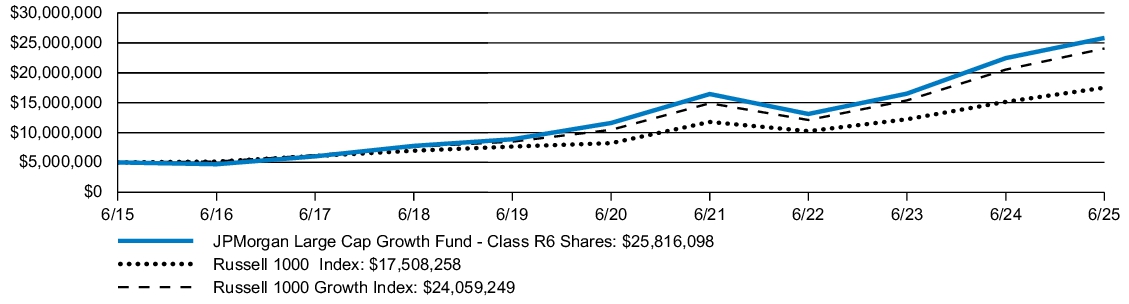

| Factors Affecting Performance [Text Block] |

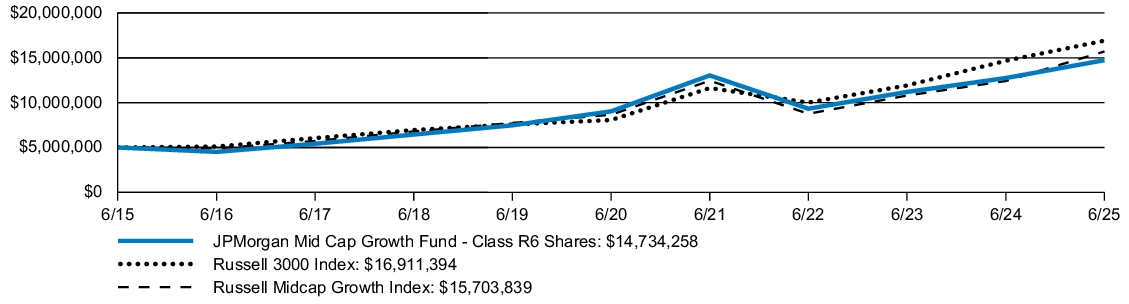

How did the Fund Perform? The JPMorgan Mid Cap Growth Fund's Class R6 Shares returned 15.61% for the twelve months ended June 30, 2025. The Russell 3000 Index returned 15.30% and the Russell Midcap Growth Index (the "Index") returned 26.49% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the information technology and consumer discretionary sectors overweight detracted from performance. -

The Fund’s underweight allocation to Palantir Technologies Inc. and overweight allocation to e.l.f. Beauty, Inc. detracted from performance. -

The Fund’s security selection in the financials and energy sectors contributed to performance. -

The Fund’s overweight allocation to Robinhood Markets, Inc. and DoorDash, Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

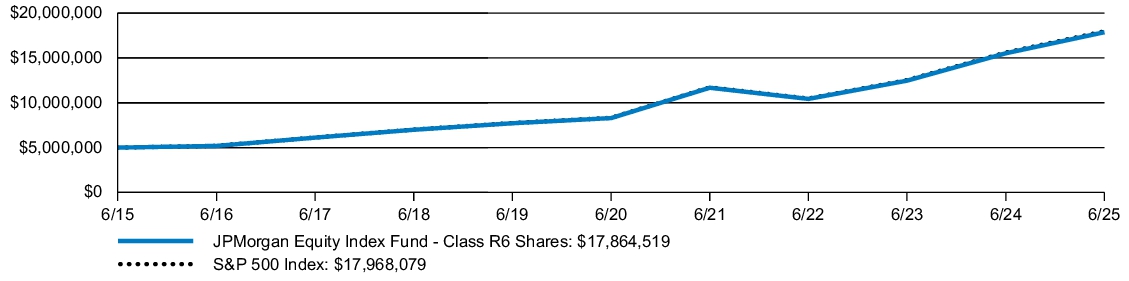

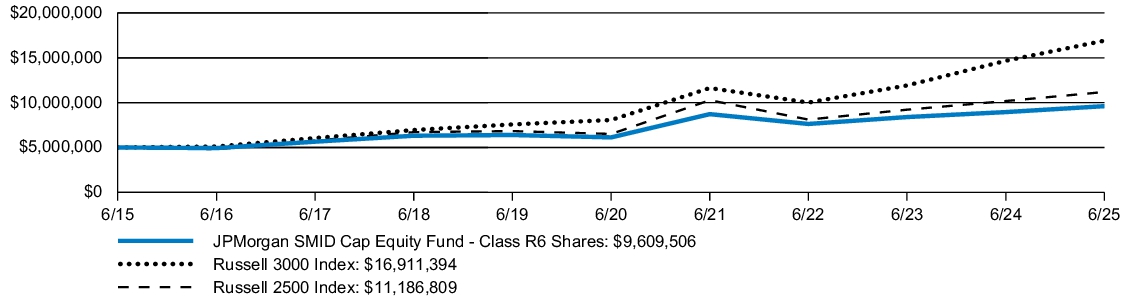

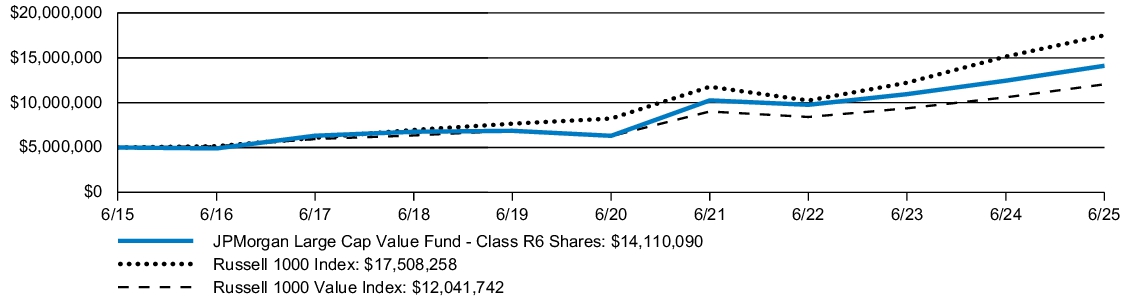

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Mid Cap Growth Fund (Class R6 Shares) |

November 1, 2011 |

15.61 |

% |

10.28 |

% |

11.41 |

% |

| Russell 3000 Index |

|

15.30 |

|

15.96 |

|

12.96 |

|

| Russell Midcap Growth Index |

|

26.49 |

|

12.65 |

|

12.13 |

|

|

| Performance Inception Date |

Nov. 01, 2011

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Material Change Date |

Nov. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 12,591,027,000

|

| Holdings Count | Holding |

111

|

| Advisory Fees Paid, Amount |

$ 67,189,000

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$12,591,027 |

|

| Total number of portfolio holdings |

111 |

|

| Portfolio turnover rate |

67 |

% |

| Total advisory fees paid (000's) |

$67,189 |

|

|

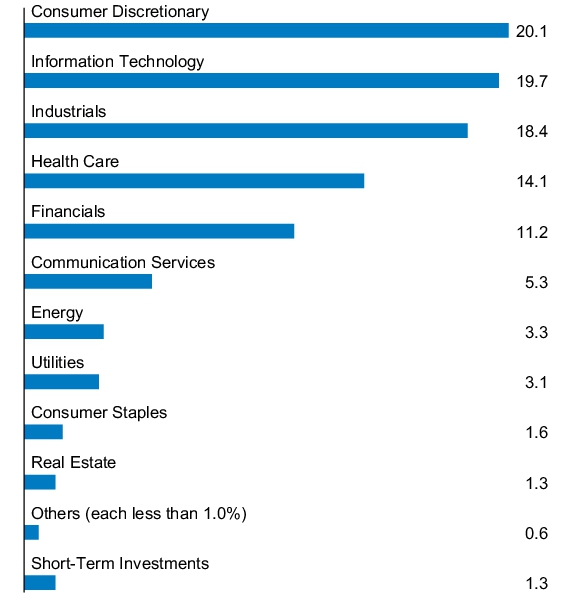

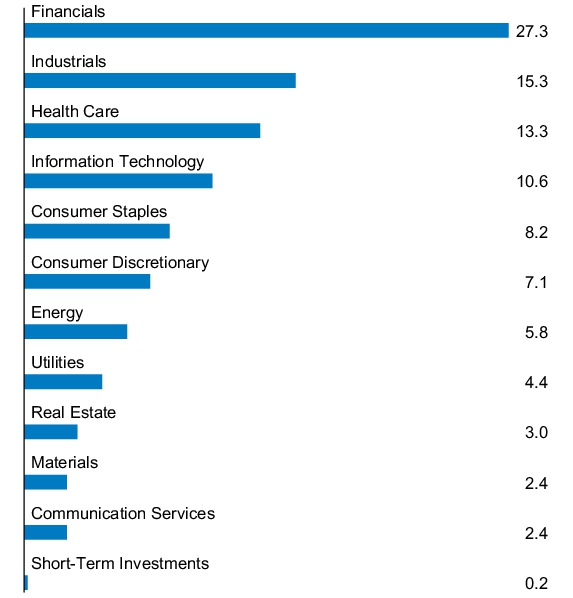

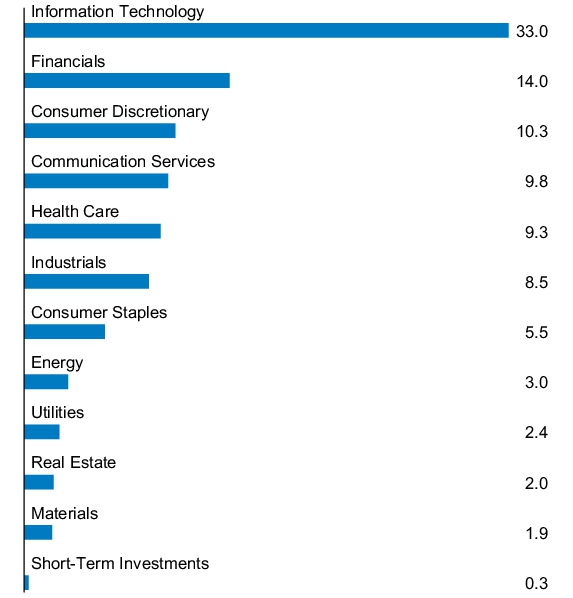

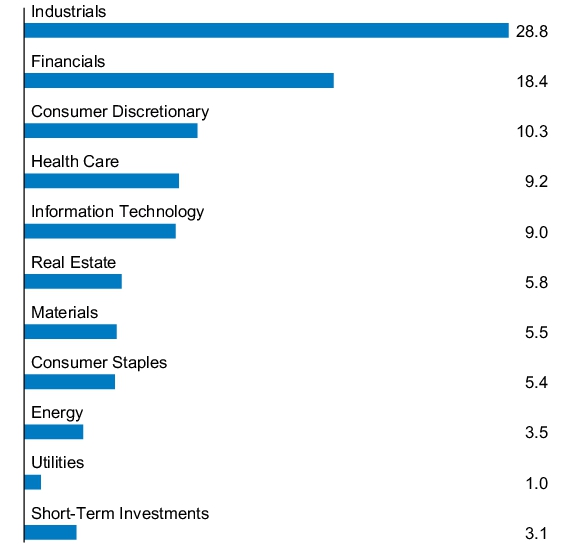

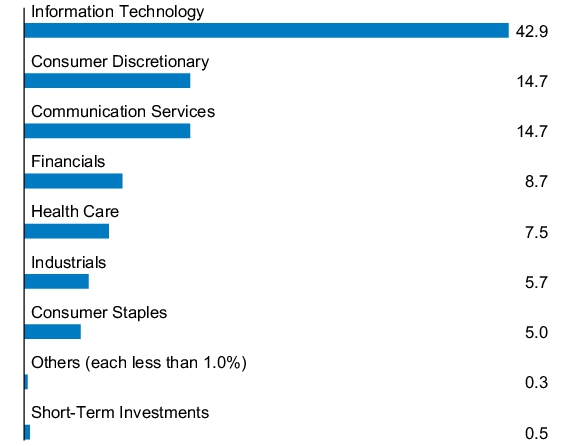

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| Material Fund Change [Text Block] |

Material changes to the Fund during the period Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.70% of the Fund's Class R6 Shares average daily net assets to 0.65% of the Fund's Class R6 Shares average daily net assets. . This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Material Fund Change Expenses [Text Block] |

Effective November 1, 2024, the Fund’s reduced its advisory fee from 0.65% of the Fund’s average daily net assets to 0.60% of the Fund’s average daily net assets. Effective November 1, 2024, the Fund’s Adviser, Administrator and/or Principal Underwriter reduced the amount they have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed 0.70% of the Fund's Class R6 Shares average daily net assets to 0.65% of the Fund's Class R6 Shares average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund’s prospectus at www.jpmorganfunds.com/funddocuments or upon request at 1-800-480-4111.

|

| Updated Prospectus Phone Number |

1-800-480-4111

|

| Updated Prospectus Web Address |

www.jpmorganfunds.com/funddocuments

|

| C000010744 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Equity Income Fund

|

| Class Name |

Class A Shares

|

| Trading Symbol |

OIEIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Income Fund

(Class A Shares) |

$101 |

0.95% |

|

| Expenses Paid, Amount |

$ 101

|

| Expense Ratio, Percent |

0.95%

|

| Factors Affecting Performance [Text Block] |

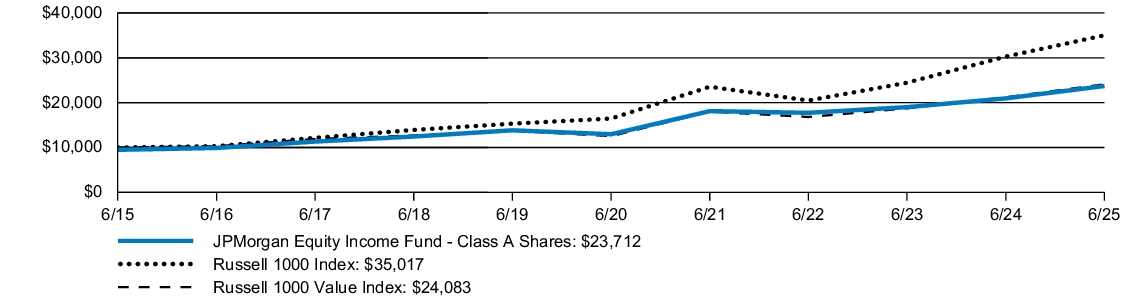

How did the Fund Perform? The JPMorgan Equity Income Fund's Class A Shares, without a sales charge, returned 13.17% for the twelve months ended June 30, 2025. The Russell 1000 Index returned 15.66% and the Russell 1000 Value Index (the "Index") returned 13.70% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the industrials and communication services detracted from performance. -

The Fund’s underweight allocation to JPMorgan Chase & Co. and Berkshire Hathaway detracted from performance. -

The Fund’s security selection in the financials and consumer staples sectors contributed to performance. -

The Fund’s overweight allocation to Wells Fargo & Company and Philip Morris International Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

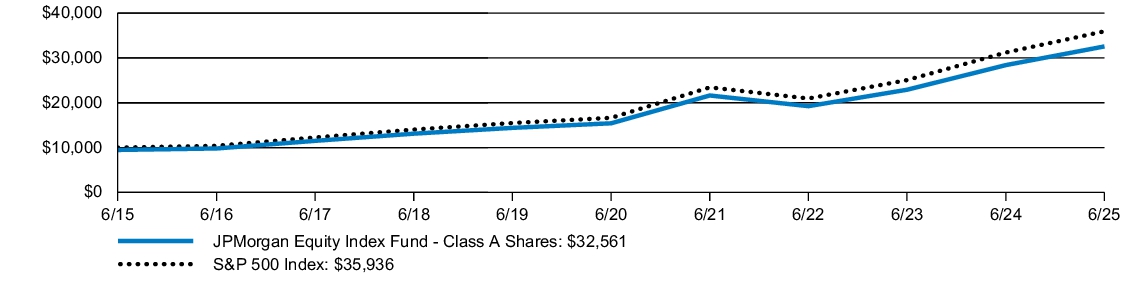

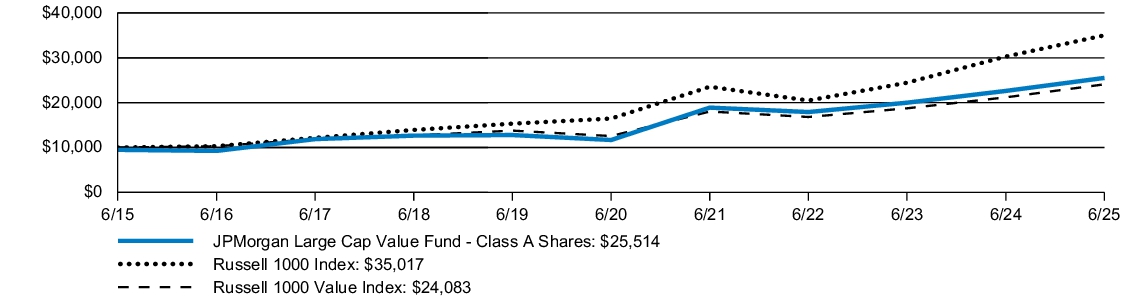

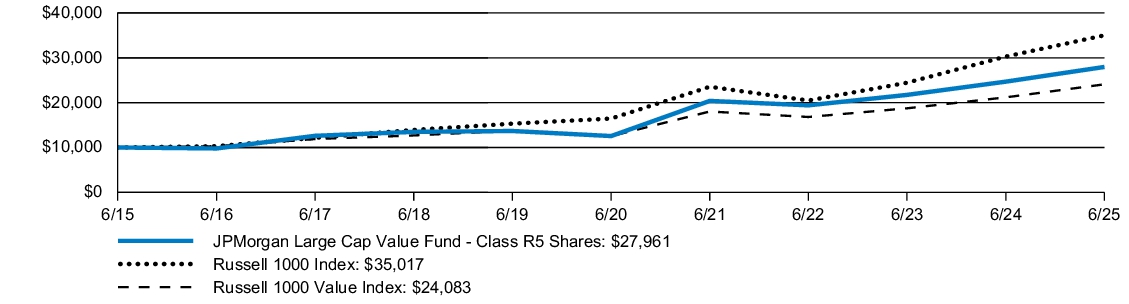

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Equity Income Fund (Class A Shares) |

February 18, 1992 |

7.23 |

% |

11.64 |

% |

9.02 |

% |

| JPMorgan Equity Income Fund (Class A Shares) - excluding sales charge |

|

13.17 |

|

12.85 |

|

9.61 |

|

| Russell 1000 Index |

|

15.66 |

|

16.30 |

|

13.35 |

|

| Russell 1000 Value Index |

|

13.70 |

|

13.93 |

|

9.19 |

|

|

| Performance Inception Date |

Feb. 18, 1992

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 43,836,022,000

|

| Holdings Count | Holding |

85

|

| Advisory Fees Paid, Amount |

$ 178,869,000

|

| Investment Company Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$43,836,022 |

|

| Total number of portfolio holdings |

85 |

|

| Portfolio turnover rate |

20 |

% |

| Total advisory fees paid (000's) |

$178,869 |

|

|

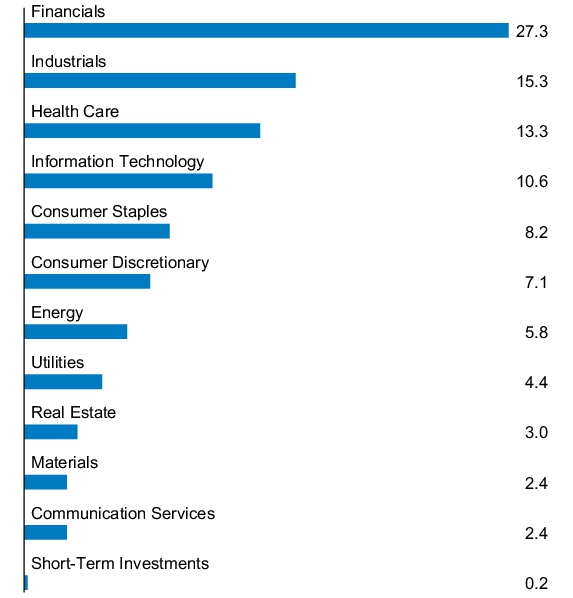

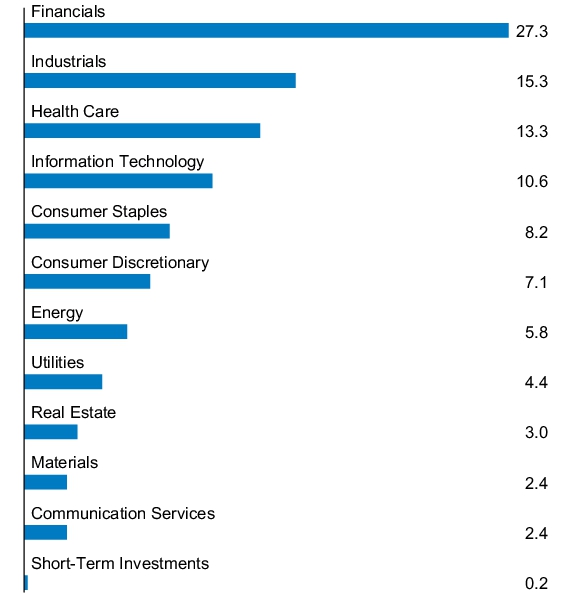

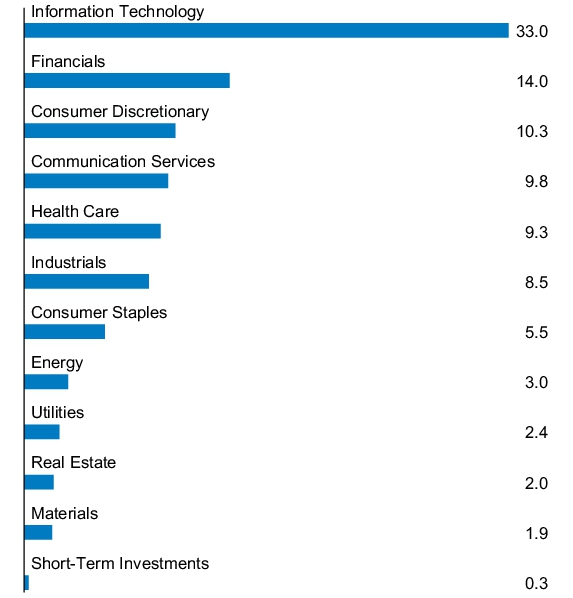

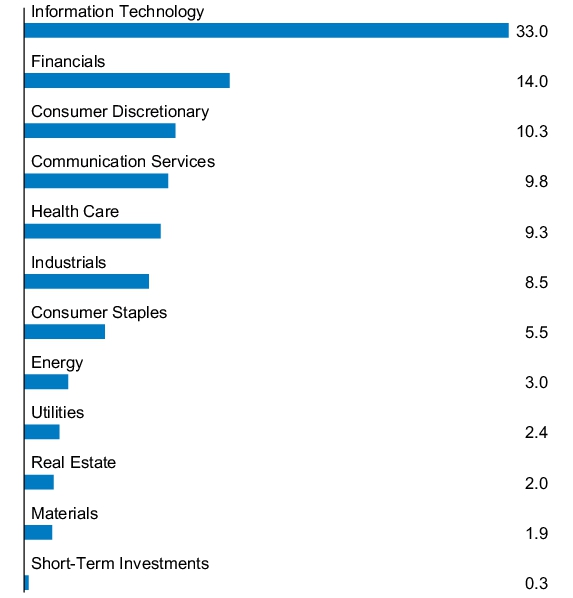

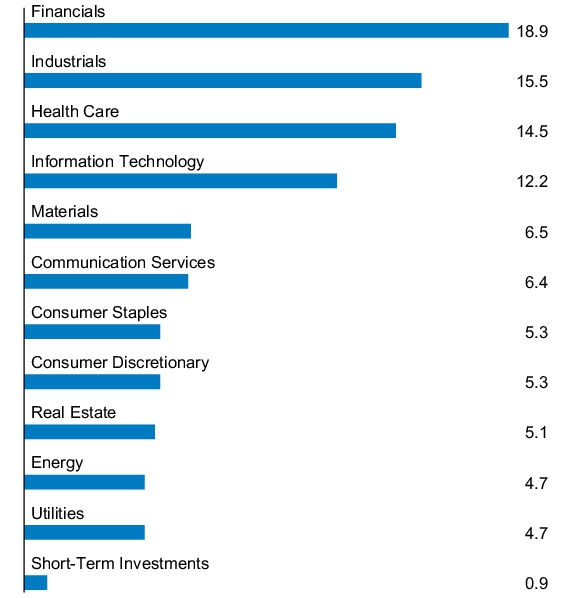

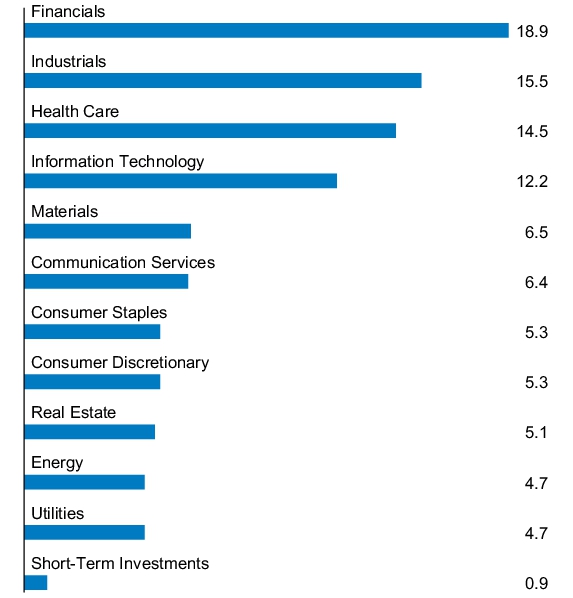

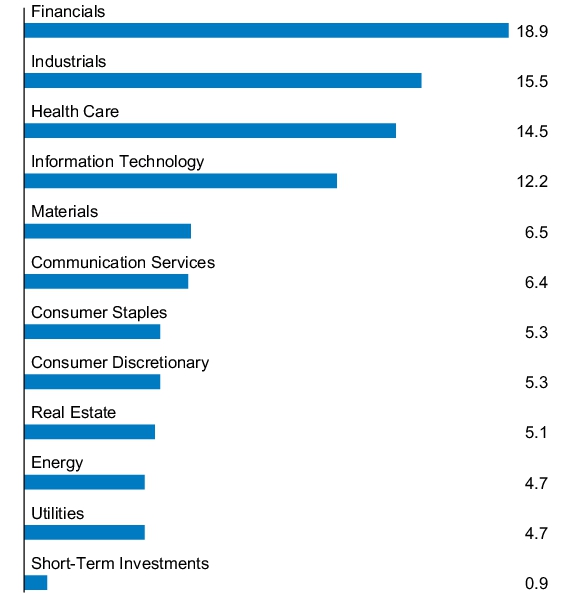

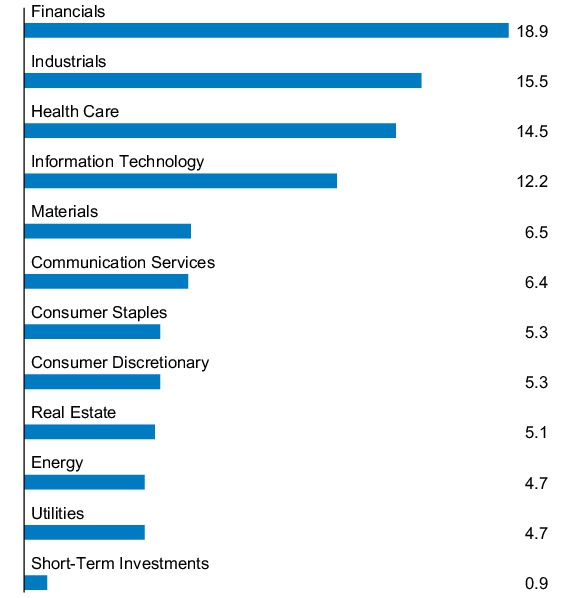

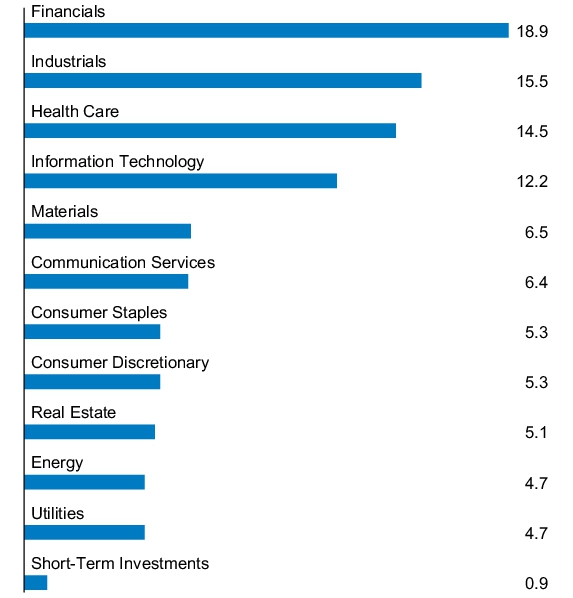

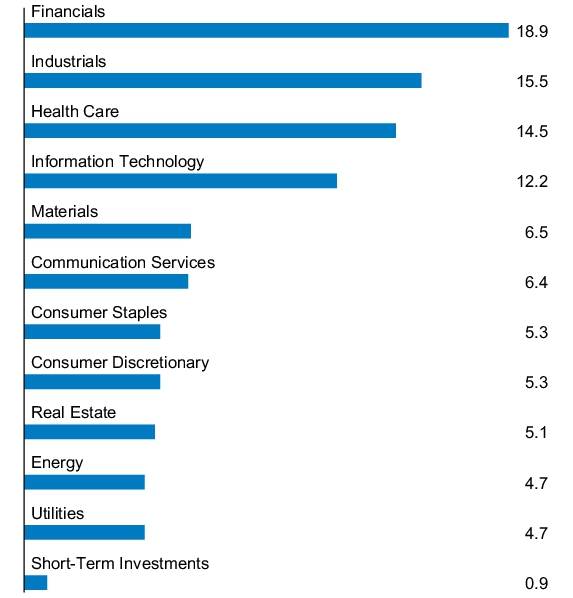

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| C000010746 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Equity Income Fund

|

| Class Name |

Class C Shares

|

| Trading Symbol |

OINCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Income Fund

(Class C Shares) |

$154 |

1.45% |

|

| Expenses Paid, Amount |

$ 154

|

| Expense Ratio, Percent |

1.45%

|

| Factors Affecting Performance [Text Block] |

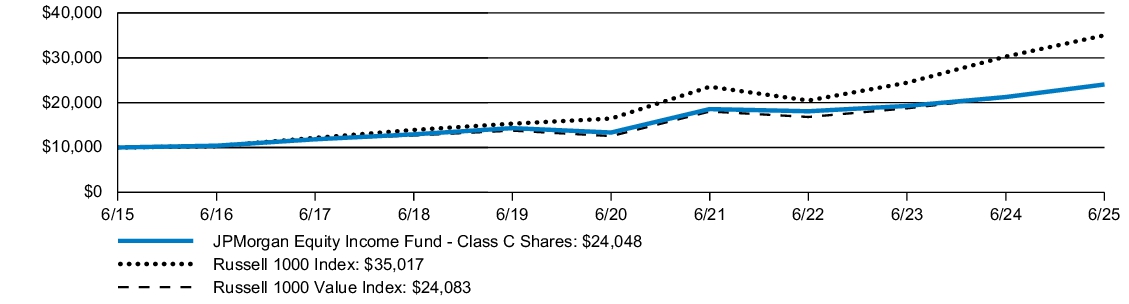

How did the Fund Perform? The JPMorgan Equity Income Fund's Class C Shares, without a sales charge, returned 12.63% for the twelve months ended June 30, 2025. The Russell 1000 Index returned 15.66% and the Russell 1000 Value Index (the "Index") returned 13.70% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the industrials and communication services detracted from performance. -

The Fund’s underweight allocation to JPMorgan Chase & Co. and Berkshire Hathaway detracted from performance. -

The Fund’s security selection in the financials and consumer staples sectors contributed to performance. -

The Fund’s overweight allocation to Wells Fargo & Company and Philip Morris International Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

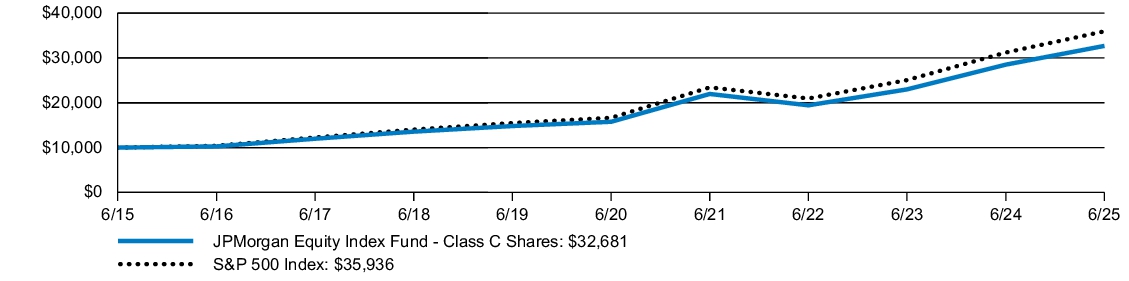

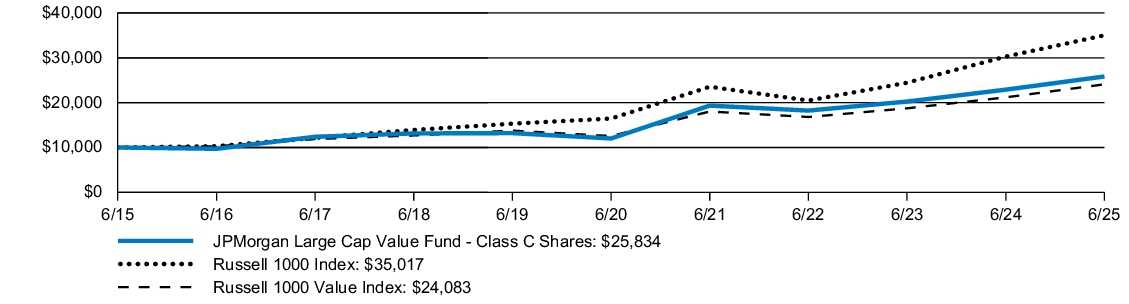

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Equity Income Fund (Class C Shares) |

November 4, 1997 |

11.63 |

% |

12.29 |

% |

9.17 |

% |

| JPMorgan Equity Income Fund (Class C Shares) - excluding sales charge |

|

12.63 |

|

12.29 |

|

9.17 |

|

| Russell 1000 Index |

|

15.66 |

|

16.30 |

|

13.35 |

|

| Russell 1000 Value Index |

|

13.70 |

|

13.93 |

|

9.19 |

|

|

| Performance Inception Date |

Nov. 04, 1997

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 43,836,022,000

|

| Holdings Count | Holding |

85

|

| Advisory Fees Paid, Amount |

$ 178,869,000

|

| Investment Company Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$43,836,022 |

|

| Total number of portfolio holdings |

85 |

|

| Portfolio turnover rate |

20 |

% |

| Total advisory fees paid (000's) |

$178,869 |

|

|

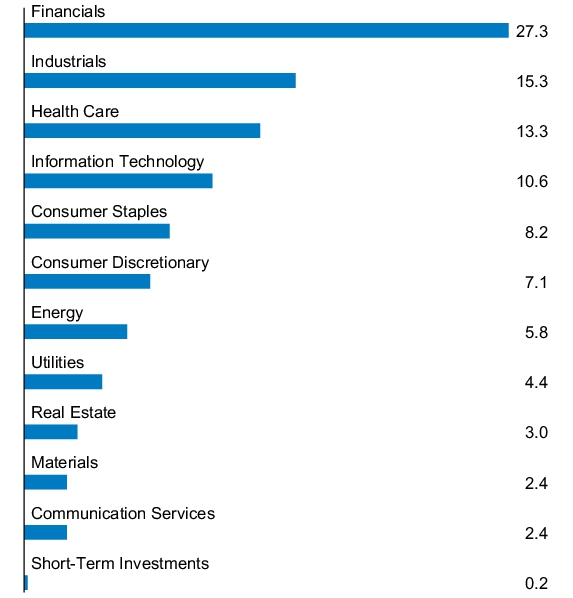

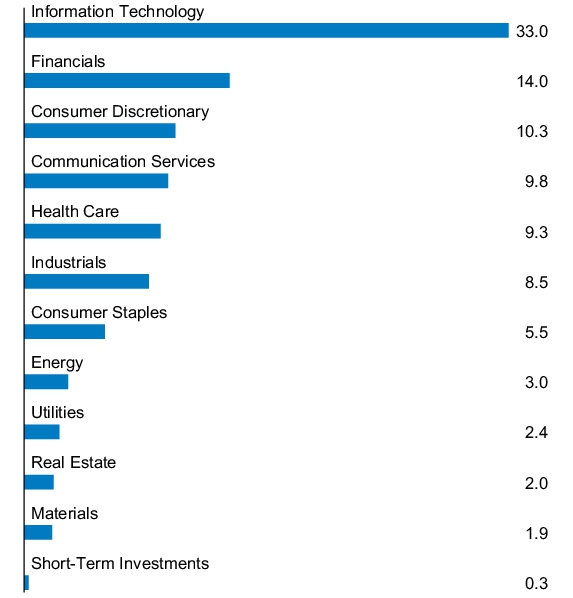

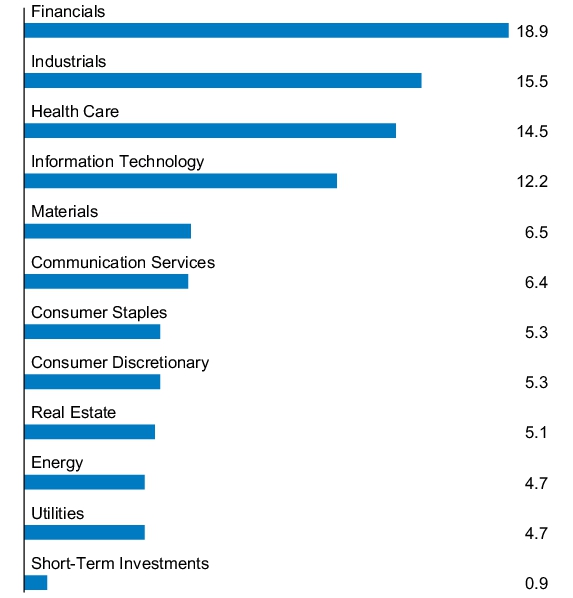

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| C000010743 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Equity Income Fund

|

| Class Name |

Class I Shares

|

| Trading Symbol |

HLIEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Income Fund

(Class I Shares) |

$74 |

0.70% |

|

| Expenses Paid, Amount |

$ 74

|

| Expense Ratio, Percent |

0.70%

|

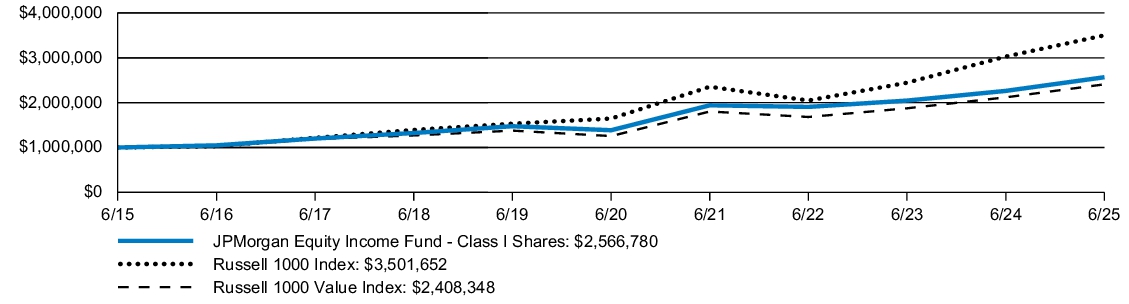

| Factors Affecting Performance [Text Block] |

How did the Fund Perform? The JPMorgan Equity Income Fund's Class I Shares returned 13.46% for the twelve months ended June 30, 2025. The Russell 1000 Index returned 15.66% and the Russell 1000 Value Index (the "Index") returned 13.70% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the industrials and communication services detracted from performance. -

The Fund’s underweight allocation to JPMorgan Chase & Co. and Berkshire Hathaway detracted from performance. -

The Fund’s security selection in the financials and consumer staples sectors contributed to performance. -

The Fund’s overweight allocation to Wells Fargo & Company and Philip Morris International Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

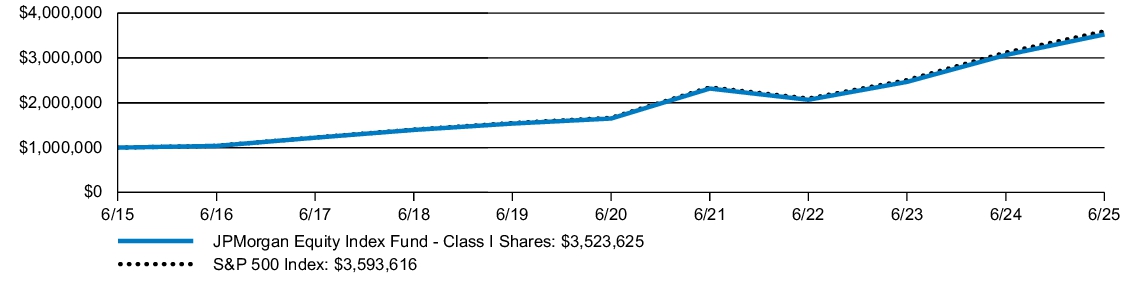

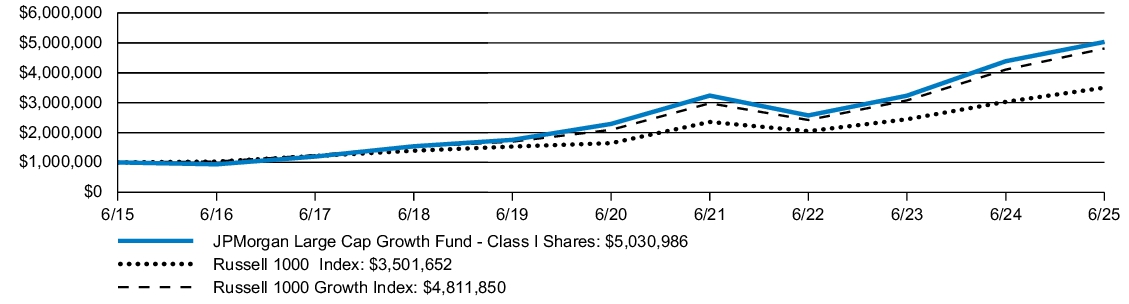

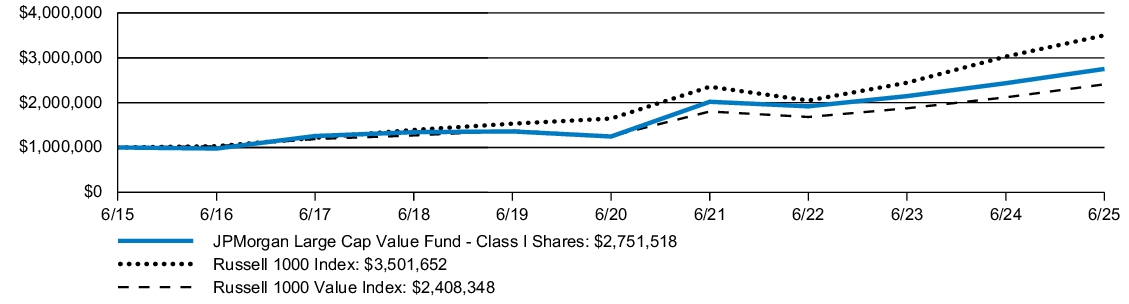

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Equity Income Fund (Class I Shares) |

July 2, 1987 |

13.46 |

% |

13.14 |

% |

9.89 |

% |

| Russell 1000 Index |

|

15.66 |

|

16.30 |

|

13.35 |

|

| Russell 1000 Value Index |

|

13.70 |

|

13.93 |

|

9.19 |

|

|

| Performance Inception Date |

Jul. 02, 1987

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 43,836,022,000

|

| Holdings Count | Holding |

85

|

| Advisory Fees Paid, Amount |

$ 178,869,000

|

| Investment Company Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$43,836,022 |

|

| Total number of portfolio holdings |

85 |

|

| Portfolio turnover rate |

20 |

% |

| Total advisory fees paid (000's) |

$178,869 |

|

|

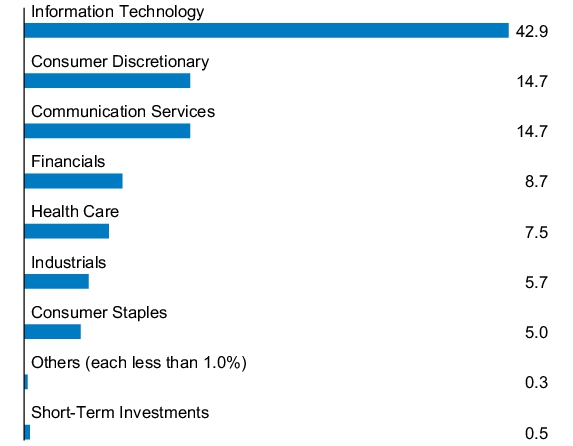

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| C000098140 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Equity Income Fund

|

| Class Name |

Class R2 Shares

|

| Trading Symbol |

OIEFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Income Fund

(Class R2 Shares) |

$128 |

1.20% |

|

| Expenses Paid, Amount |

$ 128

|

| Expense Ratio, Percent |

1.20%

|

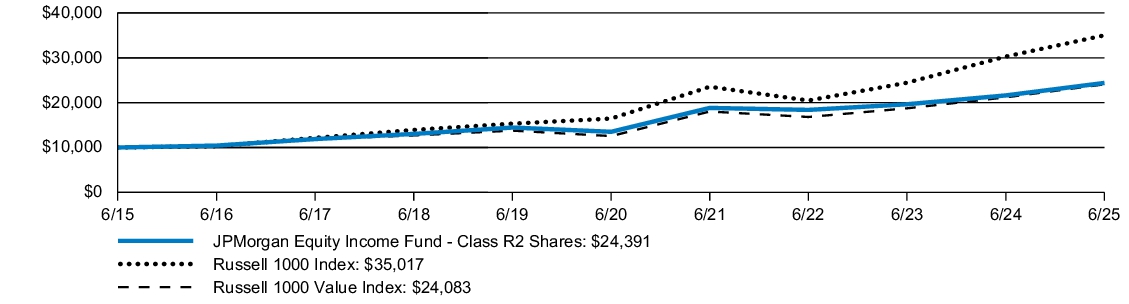

| Factors Affecting Performance [Text Block] |

How did the Fund Perform? The JPMorgan Equity Income Fund's Class R2 Shares returned 12.87% for the twelve months ended June 30, 2025. The Russell 1000 Index returned 15.66% and the Russell 1000 Value Index (the "Index") returned 13.70% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the industrials and communication services detracted from performance. -

The Fund’s underweight allocation to JPMorgan Chase & Co. and Berkshire Hathaway detracted from performance. -

The Fund’s security selection in the financials and consumer staples sectors contributed to performance. -

The Fund’s overweight allocation to Wells Fargo & Company and Philip Morris International Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

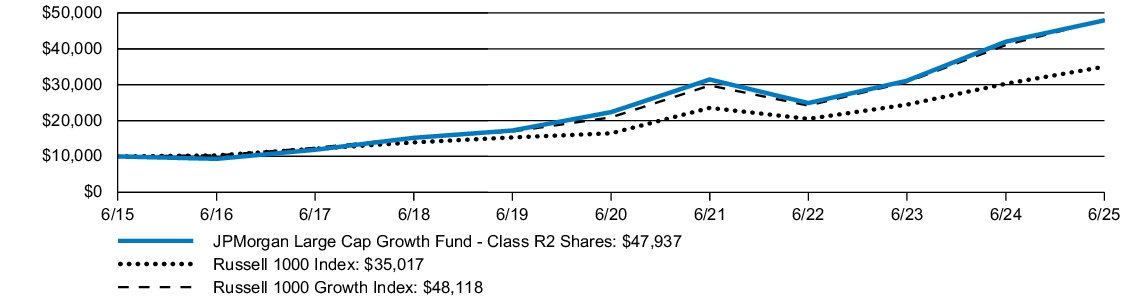

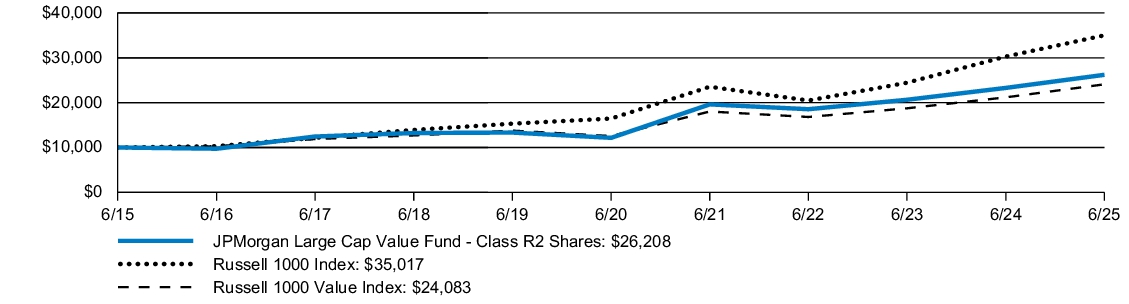

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Equity Income Fund (Class R2 Shares) |

February 28, 2011 |

12.87 |

% |

12.56 |

% |

9.33 |

% |

| Russell 1000 Index |

|

15.66 |

|

16.30 |

|

13.35 |

|

| Russell 1000 Value Index |

|

13.70 |

|

13.93 |

|

9.19 |

|

|

| Performance Inception Date |

Feb. 28, 2011

|

| No Deduction of Taxes [Text Block] |

Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

|

| Net Assets |

$ 43,836,022,000

|

| Holdings Count | Holding |

85

|

| Advisory Fees Paid, Amount |

$ 178,869,000

|

| Investment Company Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

| Fund net assets (000's) |

$43,836,022 |

|

| Total number of portfolio holdings |

85 |

|

| Portfolio turnover rate |

20 |

% |

| Total advisory fees paid (000's) |

$178,869 |

|

|

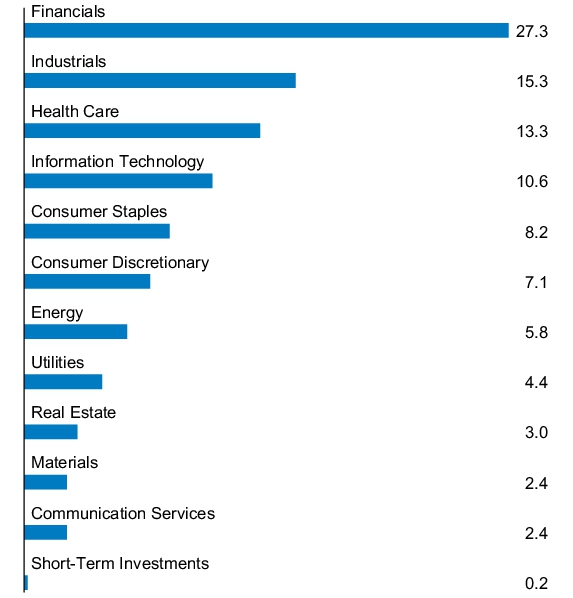

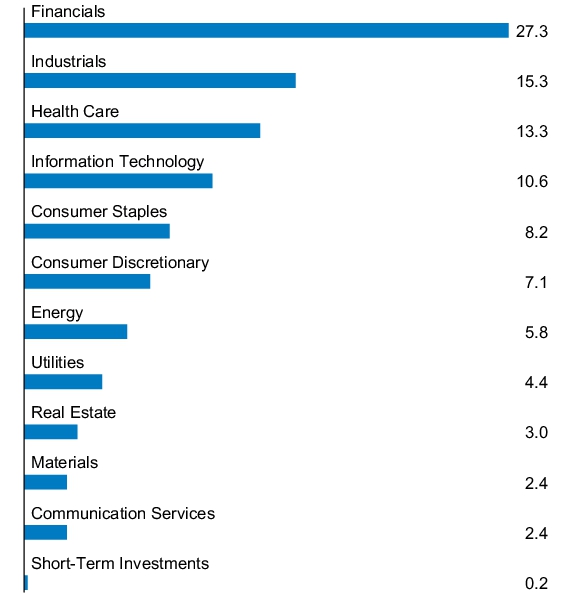

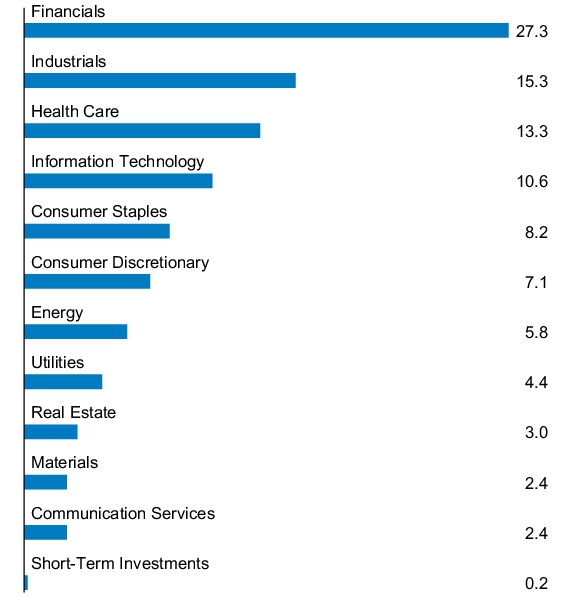

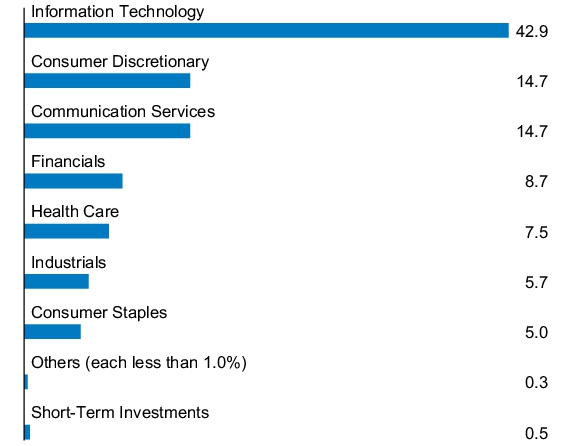

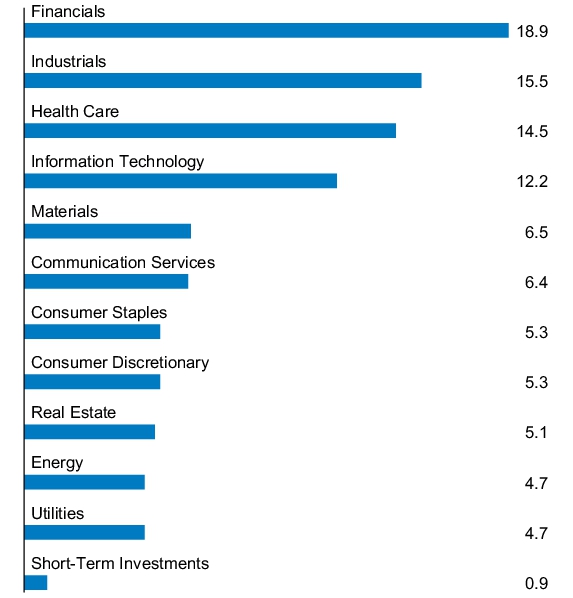

| Holdings [Text Block] |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

|

| C000173561 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

JPMorgan Equity Income Fund

|

| Class Name |

Class R3 Shares

|

| Trading Symbol |

OIEPX

|

| Annual or Semi-Annual Statement [Text Block] |

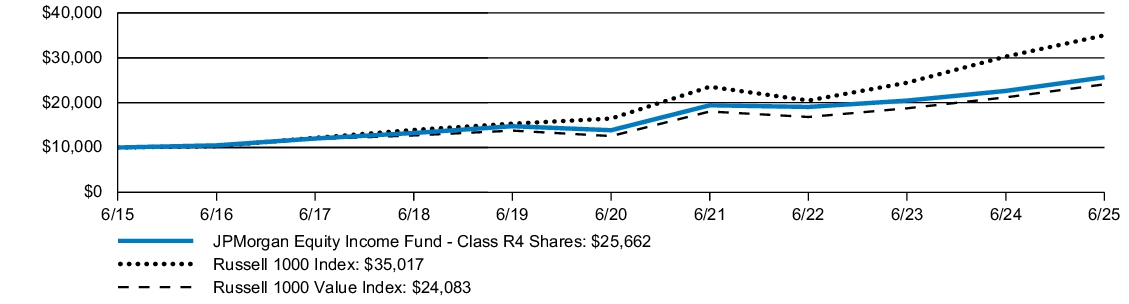

This annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

|

| Additional Information Phone Number |

1-800-480-4111

|

| Additional Information Email |

Funds.Website.Support@jpmorganfunds.com

|

| Additional Information Website |

www.jpmorganfunds.com/funddocuments

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a

$10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Income Fund

(Class R3 Shares) |

$101 |

0.95% |

|

| Expenses Paid, Amount |

$ 101

|

| Expense Ratio, Percent |

0.95%

|

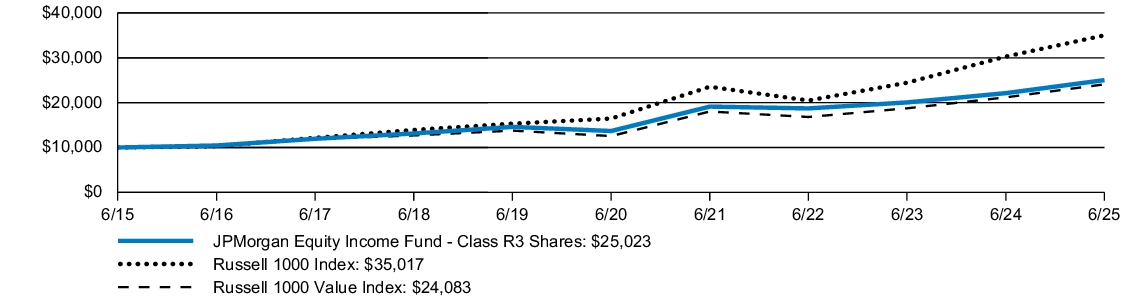

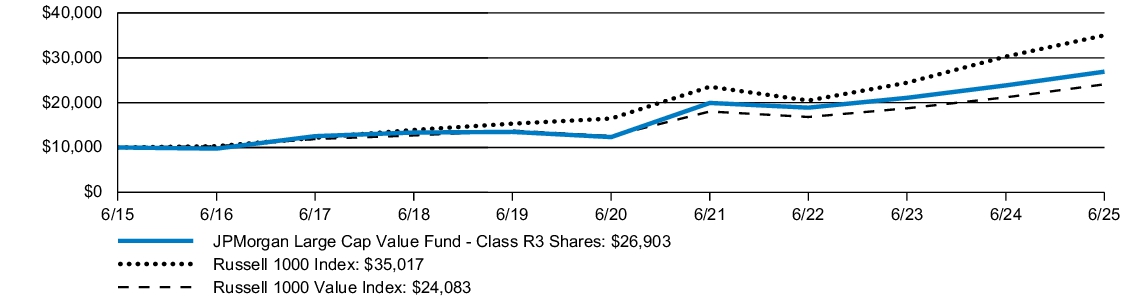

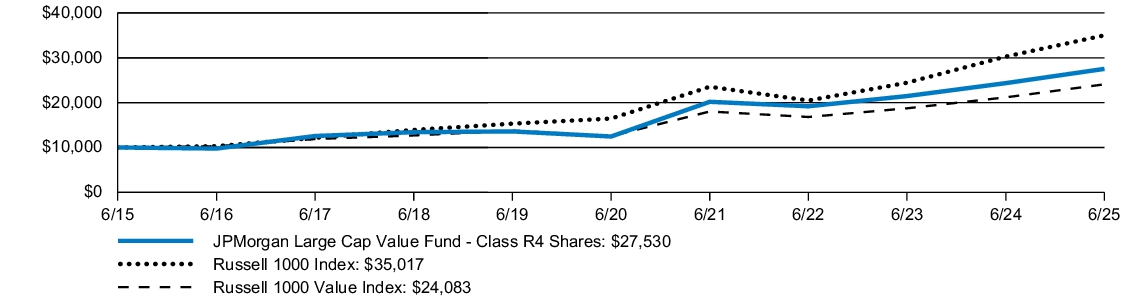

| Factors Affecting Performance [Text Block] |

How did the Fund Perform? The JPMorgan Equity Income Fund's Class R3 Shares returned 13.13% for the twelve months ended June 30, 2025. The Russell 1000 Index returned 15.66% and the Russell 1000 Value Index (the "Index") returned 13.70% for the twelve months ended June 30, 2025. -

The Fund’s security selection in the industrials and communication services detracted from performance. -

The Fund’s underweight allocation to JPMorgan Chase & Co. and Berkshire Hathaway detracted from performance. -

The Fund’s security selection in the financials and consumer staples sectors contributed to performance. -

The Fund’s overweight allocation to Wells Fargo & Company and Philip Morris International Inc. contributed to performance.

|

| Performance Past Does Not Indicate Future [Text] |

The performance quoted is past performance and is not a guarantee of future results.

|

| Line Graph [Table Text Block] |

Fund Performance

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURNS |

INCEPTION

DATE |

1 YEAR |

|

5 YEAR |

|

10 YEAR |

|

| JPMorgan Equity Income Fund (Class R3 Shares) |

September 9, 2016 |

13.13 |

% |

12.84 |

% |

9.61 |

% |

| Russell 1000 Index |