Exhibit 99.1

|

PRESS

RELEASE | NASDAQ: IPX | ASX: IPX

|

|

September 2, 2025

|

IPERIONX ACCELERATES U.S. TITANIUM BUILDOUT TO DELIVER LARGEST SCALE AND LOWEST UNIT-COST PRODUCTION

Commercial scalability validated by higher titanium production capacity and lower unit costs

| ◾ |

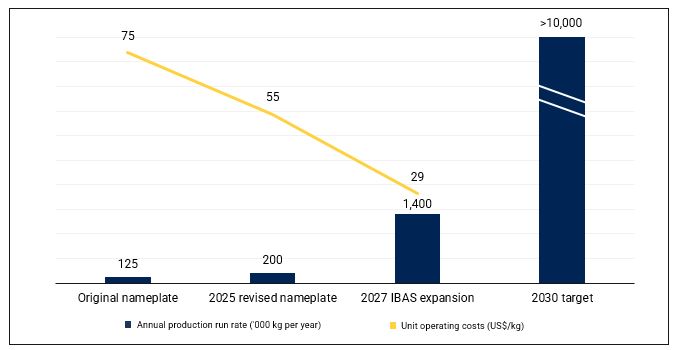

Nameplate titanium powder capacity increased by 60% to 200 metric tons per year (tpa), driven by operational and technology process improvements with no additional capex

|

| ◾ |

Projected titanium powder unit costs fall to ~US$55/kg at full utilization (from prior estimate of US$75/kg)

|

| ◾ |

Structured process innovation and improvement program in execution, targeting additional titanium capacity in 2026

|

| ◾ |

Titanium manufacturing sales expected to scale progressively, with a positive EBITDA inflection point by year- end 2026

|

| ◾ |

The successful commissioning and increased capacity confirm the scalability of the HAMRTM and HSPTTM technologies to industrial scale, providing a platform to revolutionize the

titanium industry

|

U.S. DoD backed expansion by mid-2027 has commenced, to become the largest volume & lowest cost U.S. producer

| ◾ |

Accelerated 7x expansion in titanium production capacity to 1,400 tpa, positioning IperionX to be the largest volume and lowest-cost American titanium powder producer, targeting titanium powder unit cost

of ~US$29/kg at full utilization

|

| ◾ |

Low-capital intensity, with expansion capital of ~US$75m, including contingency, funded by U.S. DoD award of US$47.1m, existing cash of $101mi, and prospective DoD SBIR Phase III task orders of

$99m

|

| ◾ |

Parallel rapid scaling of advanced titanium manufacturing capacity - powder metallurgy, forging, and additive systems to deliver integrated titanium supply chain capabilities

|

Accelerated growth targets global market and cost leadership in high-performance titanium components

| ◾ |

Roadmap to scale titanium capacity in high-performance titanium components, targeting cost competitiveness with stainless steel and aluminum

|

| ◾ |

IperionX aims for global leadership in advanced manufacturing of high-performance titanium components of +10,000 tpa by 2030

|

| ◾ |

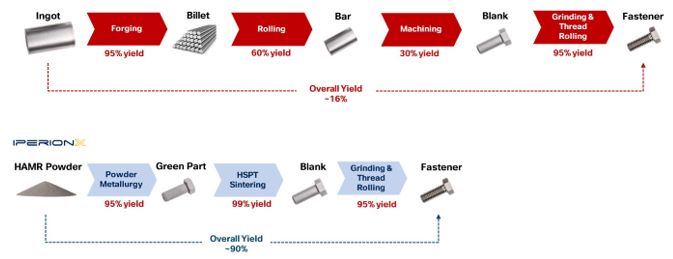

Technology-driven cost advantage – the patented titanium HAMR and HSPT technologies significantly increase manufacturing yields, while cutting process steps, energy and capex intensity, for long-term cost

advantage

|

| ◾ |

Scale resets the titanium cost curve – the modular process technologies scale efficiently to deliver unit-cost leadership and push the titanium cost curve structurally lower

|

Anastasios (Taso) Arima, IperionX CEO said:

“Our technology and process improvements at our Virginia Titanium Manufacturing Campus have lifted nameplate titanium powder capacity to 200 tpa - and laid the groundwork for a seven-fold

scale-up in titanium production to 1,400 tpa in 2027. In parallel, we’re rapidly scaling our powder metallurgy, HSPT forging and additive systems to manufacture high-performance American-made titanium components.

With a leading patented technology portfolio, we’re engineering a step‑change reduction in the cost of manufacturing titanium components and building a fully integrated U.S. titanium supply

chain that can serve our defense, aerospace, automotive and consumer electronics customers.”

|

North Carolina

|

Tennessee

|

Virginia

|

Utah

|

|

129 W Trade Street, Suite 1405

|

279 West Main Street

|

1092 Confroy Drive

|

1782 W 2300 S

|

| Charlotte, NC 28202 | Camden, TN 38320 | South Boston, VA 24592 | West Valley City, UT 84119 |

Figure 1: Projected titanium production and unit operating costs

|

1.

|

2025 OPERATIONS: COMMERCIAL SCALABILITY VALIDATED BY HIGHER TITANIUM PRODUCTION CAPACITY AND LOWER UNIT COSTS

|

IperionX has fully commissioned all critical systems at its titanium production facility in Virginia,

demonstrating steady-state production of high-quality, low-cost titanium metal products directly from recycled titanium scrap, using IperionX’s proprietary HAMR and HSPT technologies.

This milestone proves that our proprietary technologies can deliver a low-cost, fully integrated, circular titanium supply chain in the United States.

Structured process improvements and optimization has lifted nameplate titanium powder production capacity by 60% - from 125 tpa to 200 tpa - without additional capital spend. Higher throughput, lower reagent

intensity and reduced production cycle times are expected to cut operating costs down to ~$55/kg. This step-change reduction is driven by:

| ◾ |

Economies of scale that reduce unit labor costs;

|

| ◾ |

Lower reagent intensity; and

|

| ◾ |

Superior energy efficiency, which delivers more than 50% energy savings compared to the traditional Kroll & ingot melting process.

|

Our process-innovation and improvement program is expected to further increase nameplate titanium production capacity in 2026.

Titanium manufacturing sales are expected to progressively scale through 2026, with a positive EBITDA inflection point projected by year-end 2026.

IperionX now has capacity to manufacture a wide range of high-value titanium products for its customers, including:

| ◾ |

Defense: Multiple active U.S. Department of Defense projects focused on lightweight, corrosion-resistant components

|

| ◾ |

Consumer electronics: First production runs on post-consumer titanium scrap underway to fulfill the announced collaboration with ELG Utica on July 3, 2024

|

| ◾ |

Automotive & industrial: Prototype parts and new contract engagements accelerating

|

2

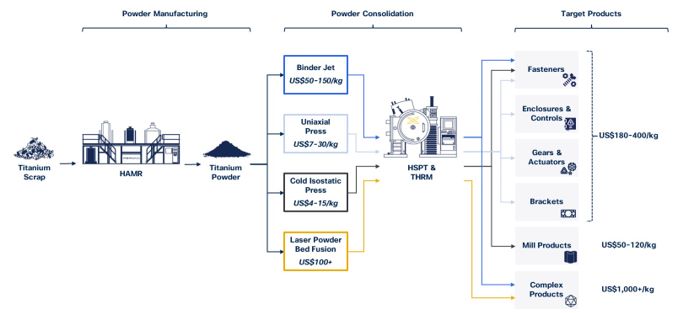

Figure 2: IperionX titanium near-net-shape and manufactured components

|

2.

|

U.S. DOD BACKED EXPANSION BY MID-2027 HAS COMMENCED, TO BECOME THE LARGEST & LOWEST COST U.S. PRODUCER

|

IperionX is scaling titanium capacity to 1,400 tpa at its Virginia Titanium Manufacturing Campus, with commissioning slated for mid-2027, positioning IperionX to be America’s largest and

lowest-cost titanium powder producer.

The total expansion capital is ~US$75 million, including ~US$17 million in contingency, and is majority funded through the U.S. Department of Defense (DoD) Industrial Base

Analysis and Sustainment (IBAS) award of US$47.1 million, along with IperionX's balance sheet cash. Additional contract awards under the US$99m SBIR Phase III program and access to Private Activity Bonds enhance financial flexibility.

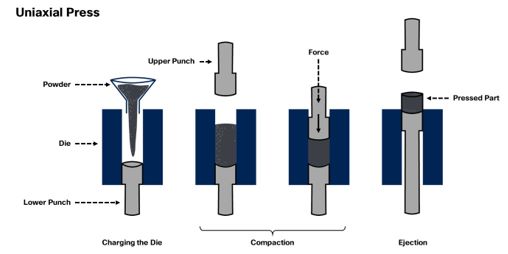

The 1,400 tpa expansion accelerates a more resilient and sustainable U.S. titanium supply chain, cutting reliance on foreign imports and supporting national security for aerospace, defense,

and electric vehicles. This integrated expansion program will deliver end-to-end titanium scrap-to-part capacity with downstream manufacturing equipment - powder-metallurgy presses (Appendix A), forging, and additive manufacturing - to process 100%

recycled scrap or domestic feedstocks into high-quality titanium powders and high-performance titanium components.

Targeted titanium products

The seven-fold increase in titanium production capacity will target high-value, high ‘buy-to-fly’ ratio titanium components, in the form of near-net-shape and manufactured products, with a target market pricing range

of $180/kg to $400/kg.

By leveraging cost advantages from proprietary HAMR and HSPT technologies, IperionX expects a material cost reduction across a range of titanium product categories, including:

| ◾ |

Fasteners: Titanium bolts, nuts, washers

|

| ◾ |

Enclosures & controls: Consumer electronics, smartphone and smartwatch cases, buttons

|

| ◾ |

Gears & actuator housings: Humanoid robotics

|

| ◾ |

Titanium brackets: High-performance applications across aerospace, automotive, marine, construction, and industrial sectors

|

3

Other titanium product categories include:

| ◾ |

Mill replacement products: Titanium plate, sheet, and bar

|

| ◾ |

High-value additive manufactured parts: Utilizing laser powder bed fusion (LPBF) and electron beam powder bed fusion (EB-PBF) technologies

|

Figure 3: IperionX titanium metal product map and current market price range estimates

Titanium fasteners

Fasteners — bolts, screws, nuts, washers, rivets — are ubiquitous across major U.S. markets in automotive, construction, aerospace, marine, and industrial machinery. Titanium fasteners

represent a large addressable market for IperionX. Leveraging our integrated patented technologies and near-net-shape manufacturing, IperionX modeling indicates scope for product cost reductions of over 80%, and in some cases more than 90%, versus

current market levels.

Figure 4: Productivity benefits of manufacturing titanium fasteners with IperionX’s patented technologies

4

The global titanium fastener market is ~US$4.3 billion1 annually, with the global stainless steel fastener market ~US$15.2 billion2 annually. Lower-cost titanium

fasteners, priced competitively with stainless steel, could unlock accelerated substitution, volume growth and a larger addressable market.

Enclosures & controls (consumer electronics)

The premium consumer electronics market is adopting titanium at scale, with leading global brands adding titanium to flagship devices. Over 1.2 billion3 mobile phones and 180

million3 smartwatches are sold every year.

IperionX offers a fully circular titanium supply chain that can convert consumer-electronics titanium scrap into high-quality titanium powder and titanium near-net-shape components, at lower

energy, cost and environmental footprint. Our first commercial project is already in progress to deliver into this market.

Gears & actuators (humanoid robotics)

The humanoid robotics market is forecast to expand from under US$3 billion today to more than US$38 billion4 by 2035. Core to these systems are lightweight, strong, corrosion-resistant gears and actuators

— ideal for titanium and perfectly suited to our uniaxial press-and-sinter manufacturing route, which mirrors traditional steel powder metallurgy gear production.

Titanium brackets

Titanium brackets are the natural complement to titanium fasteners across aerospace, marine, and construction—combining high strength, low weight, and exceptional corrosion resistance.

Mill products

Although not central to our market product plan, IperionX’s powder metallurgy process can produce near-final-gauge titanium plate, sheet, and bar after sintering - bypassing large portions of the titanium

melt–forge–roll chain. Multiple industry partners are collaborating to quantify the cost and efficiency gains.

High-value additive manufactured (AM) parts

For strategic programs and customers, we will manufacture high-value complex titanium parts via LPBF and EB-PBF, smaller in output but with high-value margins. As the expected lowest cost U.S. titanium-powder

producer, IperionX will strengthen the additive manufacturing supply chain and deliver lower-cost AM titanium parts.

Capital and operating cost estimates

Operating cost estimate

Operating costs for titanium powder are projected at US$29 per kg, at full utilization of 1,400 tpa capacity. Direct conversion of titanium scrap to powder using proprietary technologies,

followed by near-net-shape consolidation and forging, sharply reduces waste and supports value-in-use pricing that approaches competitiveness with stainless steel and aluminum while maintaining titanium’s strength-to-weight, corrosion, and

biocompatibility advantages.

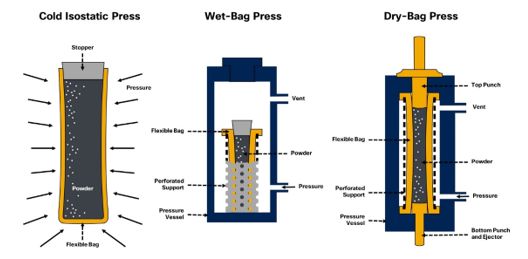

Titanium powder-to-part consolidation and forging costs (incremental, ex-powder) are projected to range by manufacturing modality for standard products such as fasteners: uniaxial pressing

US$7–30/kg; cold isostatic pressing US$4–15/kg; binder jet printing US$50–150/kg; LPBF / EB-PBF US$100-375/kg (per kg of near-net-shape part).

1 Verified Market Research - Titanium Alloy Fasteners Market report

2 Verified Market Research - Stainless Steel Fasteners Market report

3 Statista - Global smartphone / smartwatch sales to end users 2007-2023

4 Goldman Sachs - The global market for humanoid robots could reach $38 billion by 2035

5

Capital cost estimate

The expansion to 1,400 tpa is expected to cost US$75.1 million, delivering best-in-class capital intensity for production of finished titanium parts, representing an order of magnitude

improvement compared to the current Kroll-based supply chain, which is characterized by high energy consumption, complex multi-stage processing, the generation of up to 90% waste, and as such, exceptionally high capital intensity. IperionX's

modular, scalable approach leverages off-the-shelf furnace technology and patented processes to achieve superior efficiencies, shorter cycle times, and higher yields, while eliminating toxic chemicals and reducing environmental impacts.

|

TOTAL OPEX – 1,400 TPA

|

$/kg-Ti

|

% Total

|

|

|

Materials and reagents

|

14.7

|

51%

|

|

|

Labor

|

6.6

|

23%

|

|

|

Power & utilities

|

3.0

|

10%

|

|

|

Repairs & maintenance

|

1.4

|

5%

|

|

|

G&A

|

1.9

|

7%

|

|

|

Total OPEX before contingency

|

27.6

|

95%

|

|

|

~5% contingency

|

1.4

|

5%

|

|

|

Total OPEX

|

29.0

|

100%

|

|

TOTAL CAPEX – 1,400 TPA

|

$m

|

% Total

|

|

|

Equipment & facilities

|

48.0

|

64%

|

|

|

Owner's cost

|

4.7

|

6%

|

|

|

Other

|

4.1

|

5%

|

|

|

EPCM

|

1.4

|

2%

|

|

|

Total CAPEX before contingency

|

58.2

|

77%

|

|

|

~30% contingency

|

16.9

|

23%

|

|

|

Total CAPEX

|

75.1

|

100%

|

|

3.

|

ACCELERATED GROWTH ROADMAP TARGETS MARKET AND COST LEADERSHIP IN HIGH-PERFORMANCE TITANIUM COMPONENTS

|

IperionX is aiming for global leadership in advanced manufacturing of high-performance titanium components of +10,000 tpa by 2030, and has developed a plan to scale titanium capacity in

high-performance titanium components, targeting cost competitiveness with stainless steel and aluminum.

Our patented HAMR and HSPT technologies increase manufacturing yields, remove high-cost process steps, and materially cut energy and capital intensity – creating a structural cost advantage

that strengthens with increased scale. Modular process technologies underpin efficient lower-cost scale-up, pushing the titanium cost curve lower. New process technology innovations are expected to position titanium manufacturing costs for

value-in-use competitiveness in applications that today default to stainless steel and aluminum.

This announcement has been authorized for release by the CEO and Managing Director.

For further information and enquiries please contact:

info@iperionx.com

+1 980 237 8900

6

Appendix A: Powder Metallurgy Presses

7

Appendix B: Material Assumptions and Cautionary Statements

1,400 tpa – “Phase 2”

Engineering and design work relating to the production capacities referred to in this announcement has been undertaken to determine the potential viability of the Company’s proposed Phase 2 facility to produce

titanium metal products. The results should not be considered a profit forecast or a production forecast.

The Phase 2 capacity estimates are based on the material assumptions outlined below and elsewhere in this announcement. These include assumptions about the availability of funding. While the Company considers all of

the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Phase 2 projections will be achieved.

Estimates for capital and operating costs are subject to a variety of potential variances including, but not limited to, price of labor, price of consumables, foreign exchange impacts, and raw material prices.

To achieve the Phase 2 capacity estimates, funding in the order of $73 million will likely be required, which may be sourced from

existing cash balance and government grants, including the Department of Defense IBAS and SBIR Phase III programs.

The Phase 2 capacity estimates are based on the material assumptions outlined below and elsewhere in this announcement. These include assumptions about the availability of funding. While the Company considers all of

the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Phase 2 projections will be achieved.

|

Item

|

1,400 tpa

|

|

|

Annual capacity (cumulative)

|

1,400 tpa total

|

|

|

Procurement start date

|

Q3 2025

|

|

|

Operational commissioning

|

Q2 2027

|

|

|

Full capacity utilization

|

Q1-Q2 2028

|

|

|

Pricing range (low, excl. complex products)

|

$130 / kg

|

|

|

Pricing range (high, excl. complex products)

|

$400 / kg

|

|

|

Proportion of titanium powder sold as near net shape / finished products

|

Up to 95%

|

8

About IperionX

IperionX is a leading American titanium metal and critical materials company – using patented metal technologies to produce high performance titanium alloys, from titanium minerals or scrap

titanium, at lower energy, cost and carbon emissions.

Our Titan critical minerals project is the largest JORC-compliant mineral resource of titanium, rare earth and zircon minerals sands in the United States.

IperionX’s titanium metal and critical minerals are essential for advanced U.S. industries including space, aerospace, defense, consumer electronics, hydrogen, automotive and additive

manufacturing.

|

Forward Looking Statements

Information included in this release constitutes forward-looking statements. Often, but not always, forward looking statements can

generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation, statements

regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual

results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and

general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or

grades of reserves, the Company’s ability to comply with the relevant contractual terms to access the technologies, commercially scale its closed-loop titanium production processes, or protect its intellectual property rights, political

and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial

relations issues and litigation.

Forward looking statements are based on the Company and its management’s good faith assumptions relating to the financial,

market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are

based will prove to be correct, or that the Company’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company’s

control.

Although the Company attempts and has attempted to identify factors that would cause actual actions, events or results to differ materially

from those disclosed in forward looking statements, there may be other factors that could cause actual results, performance, achievements, or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable

control of the Company. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Subject to any continuing obligations under

applicable law or any relevant stock exchange listing rules, in providing this information the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in

events, conditions or circumstances on which any such statement is based.

Competent Persons Statement

The information in this announcement that relates to Exploration Results and Mineral Resources is extracted from IperionX’s ASX Announcement

dated October 6, 2021 (“Original ASX Announcement”) which is available to view at IperionX’s website at www.iperionx.com. The Company confirms that a) it is not aware of any new information or data that materially affects the information

included in the Original ASX Announcement; b) all material assumptions and technical parameters underpinning the Mineral Resource Estimate included in the Original ASX Announcement continue to apply and have not materially changed; and c)

the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially changed from the Original ASX Announcement.

|

i Pro-forma June 30, 2025 cash balance + July 22, 2025 capital raise