|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$112

|

1.06%

|

stock selection in communication services, industrials, and materials. An overweight in health care also

detracted from performance.

contributed to relative performance.

|

|

1 Year

|

5 Year

|

10 Year

|

|

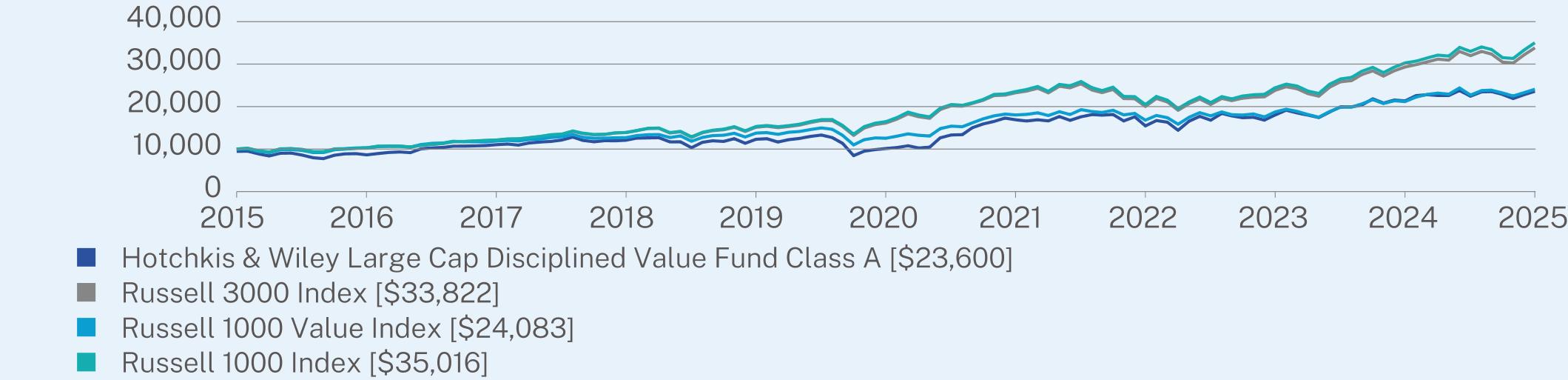

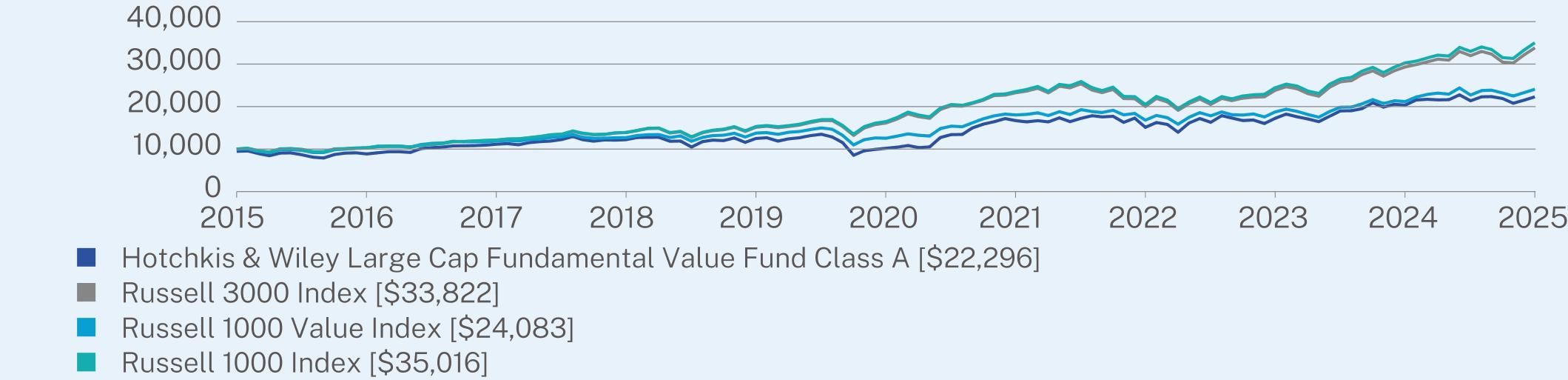

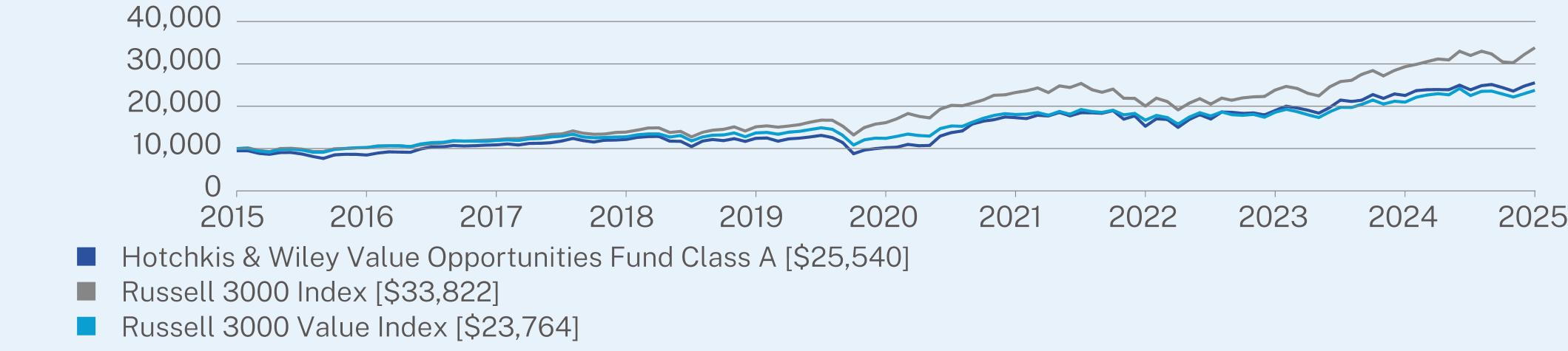

Class A (without sales charge)

|

10.55

|

18.43

|

9.55

|

|

Class A (with sales charge)

|

4.75

|

17.16

|

8.97

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index

|

15.66

|

16.30

|

13.35

|

|

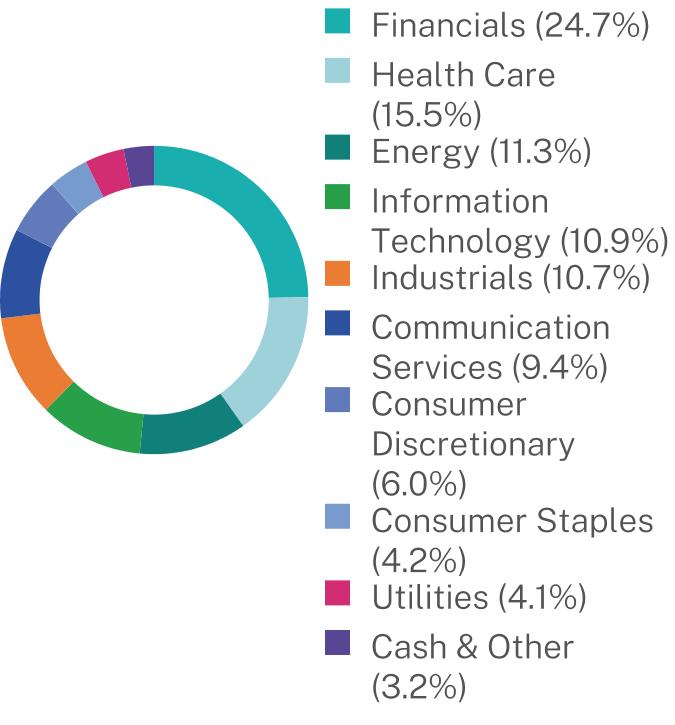

Net Assets

|

$80,713,765

|

|

Number of Holdings

|

79

|

|

Net Advisory Fee

|

$466,864

|

|

Portfolio Turnover

|

34%

|

|

Top 10 Issuers

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Workday, Inc.

|

4.5%

|

|

Citigroup, Inc.

|

3.6%

|

|

Telefonaktiebolaget LM Ericsson

|

2.9%

|

|

Comcast Corp.

|

2.8%

|

|

Wells Fargo & Co.

|

2.8%

|

|

American International Group, Inc.

|

2.7%

|

|

APA Corp.

|

2.4%

|

|

General Motors Co.

|

2.3%

|

|

Dominion Energy, Inc.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

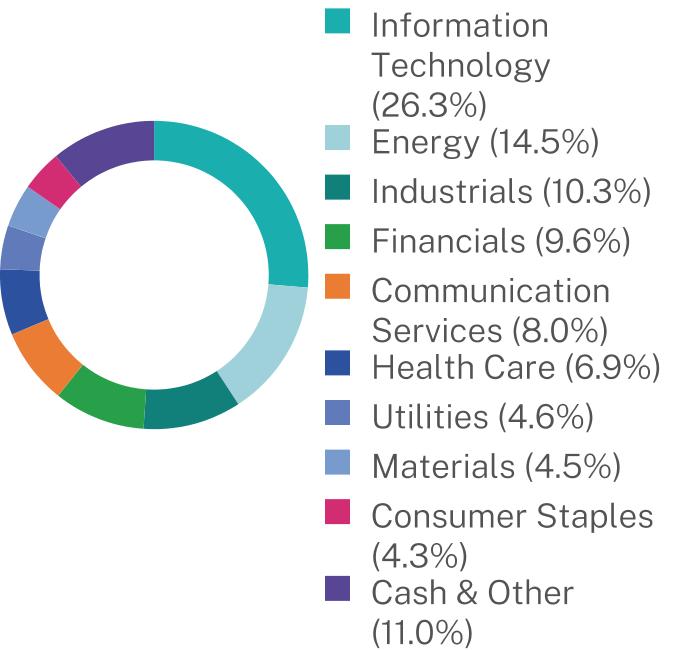

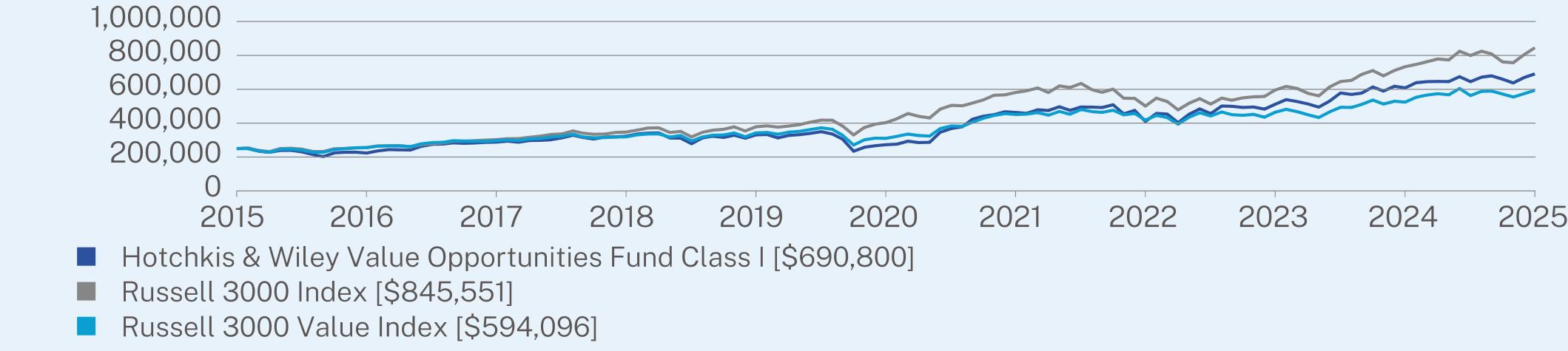

Class I

|

$84

|

0.80%

|

stock selection in communication services, industrials, and materials. An overweight in health care also

detracted from performance.

contributed to relative performance.

|

|

1 Year

|

5 Year

|

10 Year

|

|

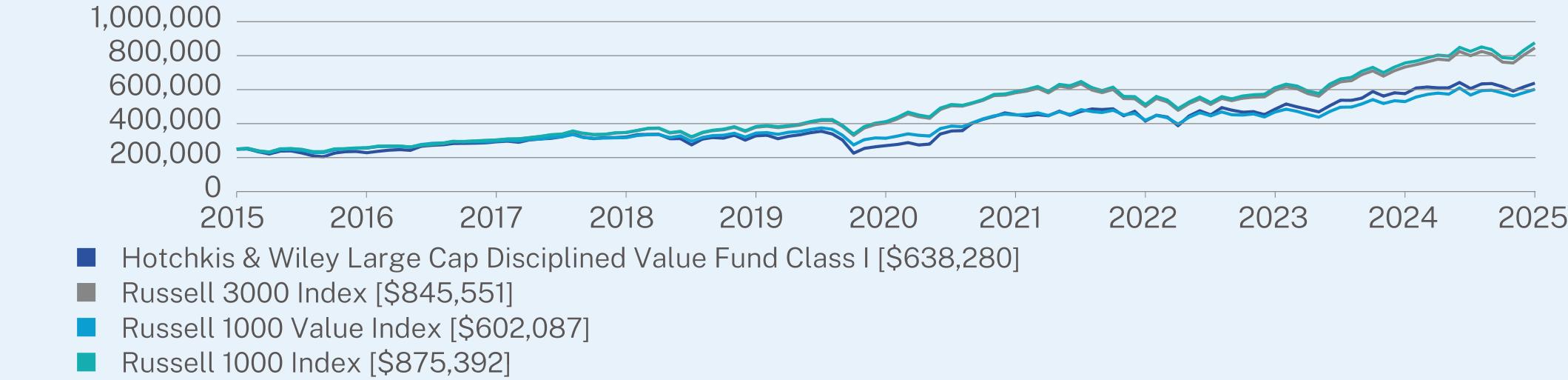

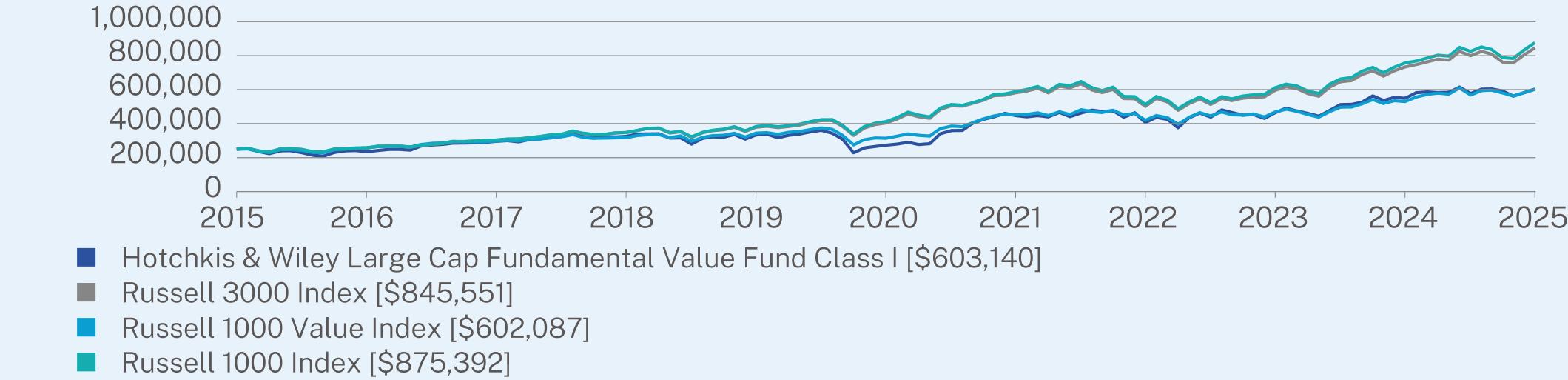

Class I

|

10.81

|

18.73

|

9.83

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index

|

15.66

|

16.30

|

13.35

|

|

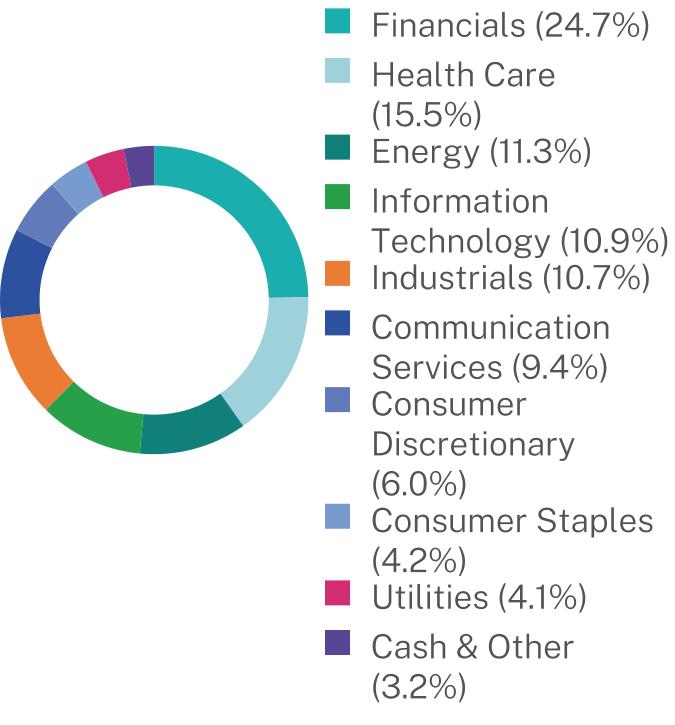

Net Assets

|

$80,713,765

|

|

Number of Holdings

|

79

|

|

Net Advisory Fee

|

$466,864

|

|

Portfolio Turnover

|

34%

|

|

Top 10 Issuers

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Workday, Inc.

|

4.5%

|

|

Citigroup, Inc.

|

3.6%

|

|

Telefonaktiebolaget LM Ericsson

|

2.9%

|

|

Comcast Corp.

|

2.8%

|

|

Wells Fargo & Co.

|

2.8%

|

|

American International Group, Inc.

|

2.7%

|

|

APA Corp.

|

2.4%

|

|

General Motors Co.

|

2.3%

|

|

Dominion Energy, Inc.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$124

|

1.18%

|

stock selection in communication services, industrials, and materials. An overweight in health care also detracted from performance.

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

9.62

|

16.95

|

8.94

|

|

Class A (with sales charge)

|

3.87

|

15.69

|

8.35

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index

|

15.66

|

16.30

|

13.35

|

|

Net Assets

|

$369,481,018

|

|

Number of Holdings

|

67

|

|

Net Advisory Fee

|

$2,592,818

|

|

Portfolio Turnover

|

40%

|

|

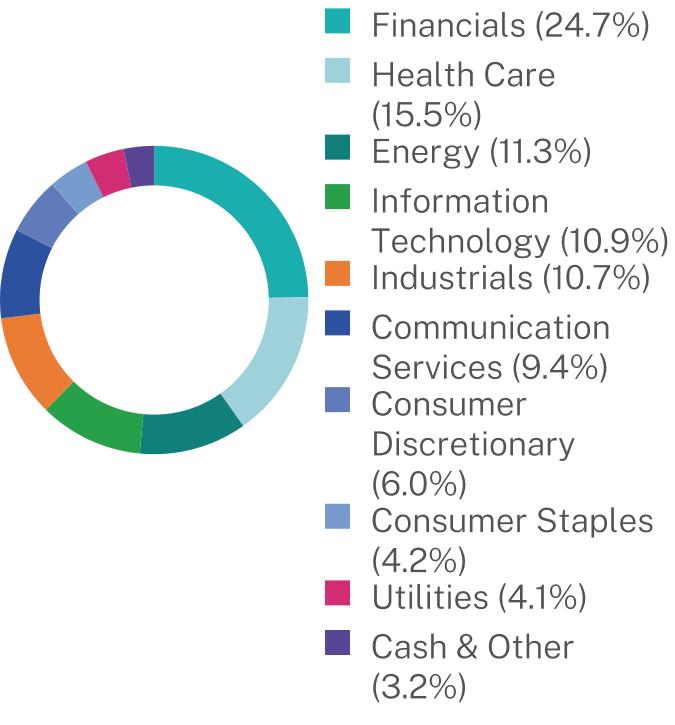

Top Holdings

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Citigroup, Inc.

|

3.8%

|

|

Wells Fargo & Co.

|

3.1%

|

|

Telefonaktiebolaget LM Ericsson

|

3.0%

|

|

Comcast Corp. - Class A

|

3.0%

|

|

American International Group, Inc.

|

2.9%

|

|

General Motors Co.

|

2.8%

|

|

Dominion Energy, Inc.

|

2.5%

|

|

Elevance Health, Inc.

|

2.3%

|

|

APA Corp.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$100

|

0.95%

|

stock selection in communication services, industrials, and materials. An overweight in health care also detracted from performance.

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

9.89

|

17.23

|

9.21

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index

|

15.66

|

16.30

|

13.35

|

|

Net Assets

|

$369,481,018

|

|

Number of Holdings

|

67

|

|

Net Advisory Fee

|

$2,592,818

|

|

Portfolio Turnover

|

40%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Citigroup, Inc.

|

3.8%

|

|

Wells Fargo & Co.

|

3.1%

|

|

Telefonaktiebolaget LM Ericsson

|

3.0%

|

|

Comcast Corp. - Class A

|

3.0%

|

|

American International Group, Inc.

|

2.9%

|

|

General Motors Co.

|

2.8%

|

|

Dominion Energy, Inc.

|

2.5%

|

|

Elevance Health, Inc.

|

2.3%

|

|

APA Corp.

|

2.3%

|

|

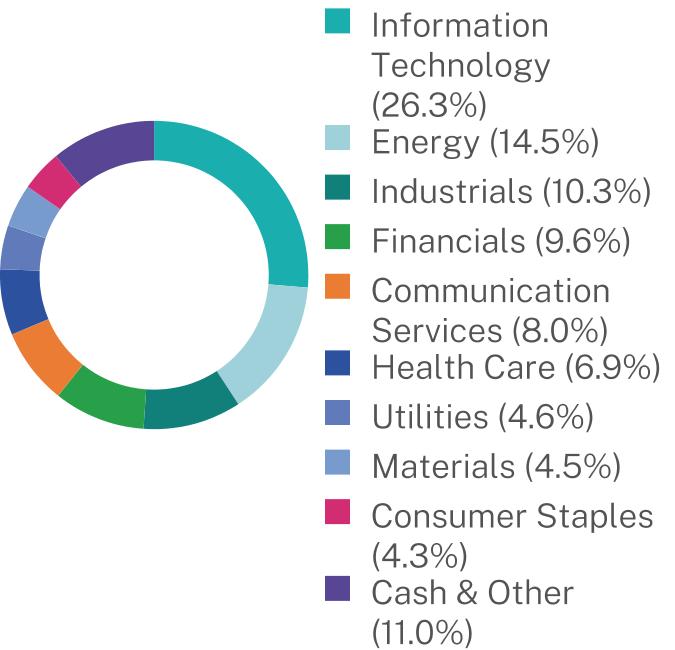

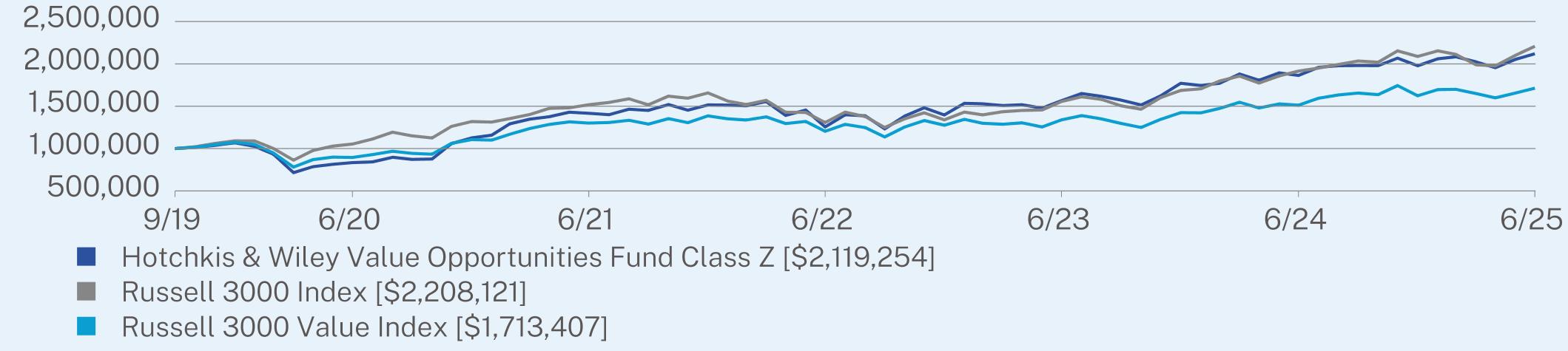

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Z

|

$89

|

0.85%

|

stock selection in communication services, industrials, and materials. An overweight in health care also detracted from performance.

|

|

1 Year

|

5 Year

|

Since Inception

(09/30/2019) |

|

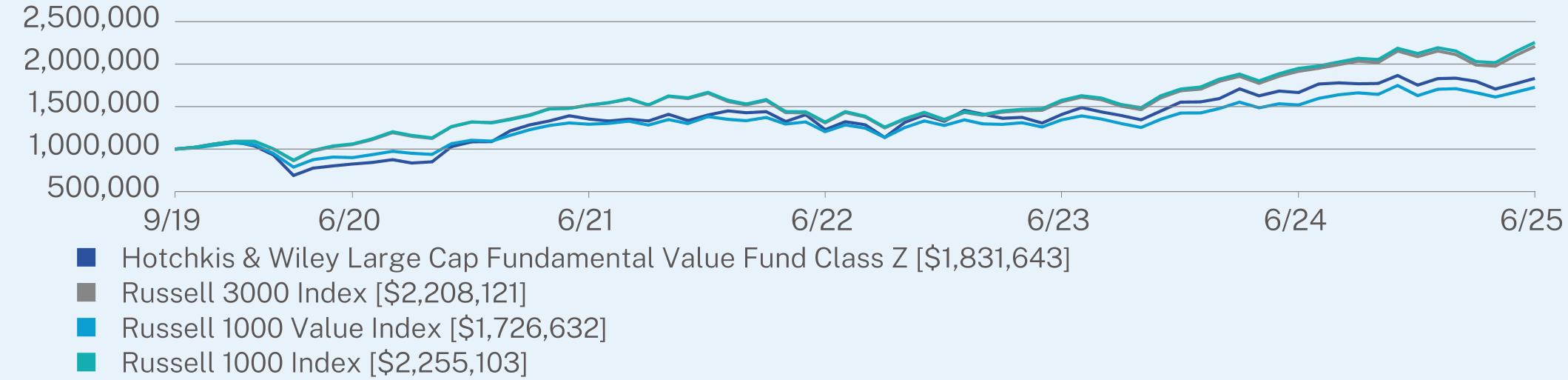

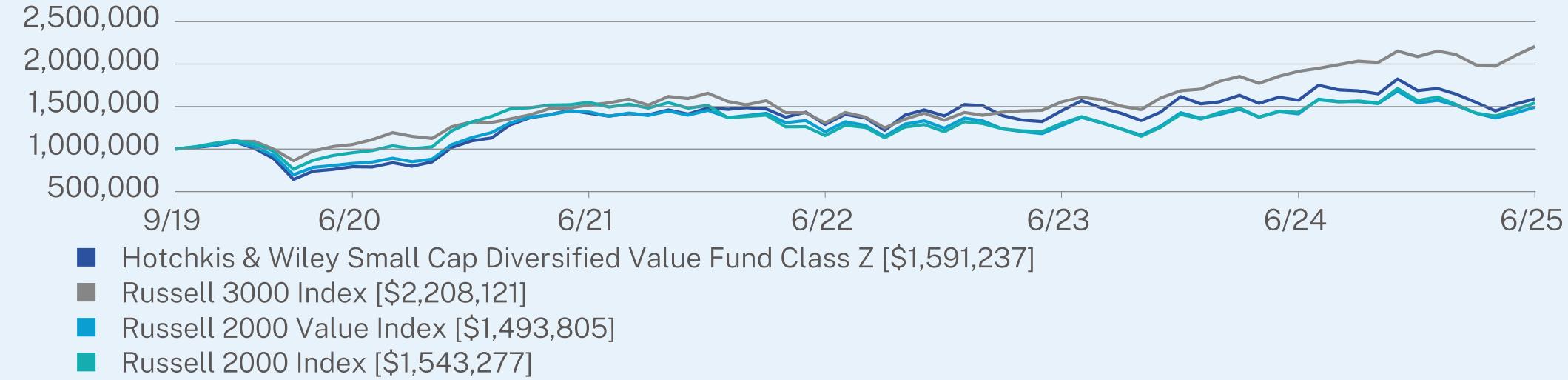

Class Z

|

9.98

|

17.34

|

11.10

|

|

Russell 3000 Index

|

15.30

|

15.96

|

14.77

|

|

Russell 1000 Value Index

|

13.70

|

13.93

|

9.96

|

|

Russell 1000 Index

|

15.66

|

16.30

|

15.19

|

|

Net Assets

|

$369,481,018

|

|

Number of Holdings

|

67

|

|

Net Advisory Fee

|

$2,592,818

|

|

Portfolio Turnover

|

40%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Citigroup, Inc.

|

3.8%

|

|

Wells Fargo & Co.

|

3.1%

|

|

Telefonaktiebolaget LM Ericsson

|

3.0%

|

|

Comcast Corp. - Class A

|

3.0%

|

|

American International Group, Inc.

|

2.9%

|

|

General Motors Co.

|

2.8%

|

|

Dominion Energy, Inc.

|

2.5%

|

|

Elevance Health, Inc.

|

2.3%

|

|

APA Corp.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

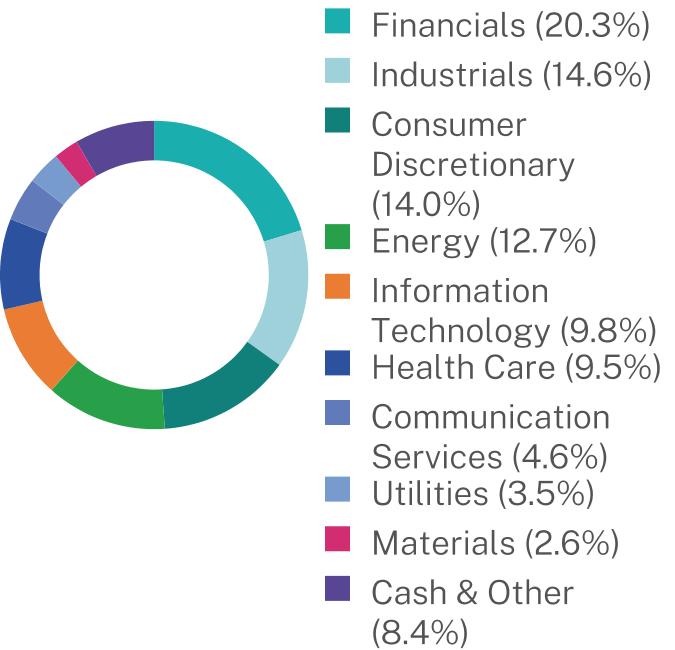

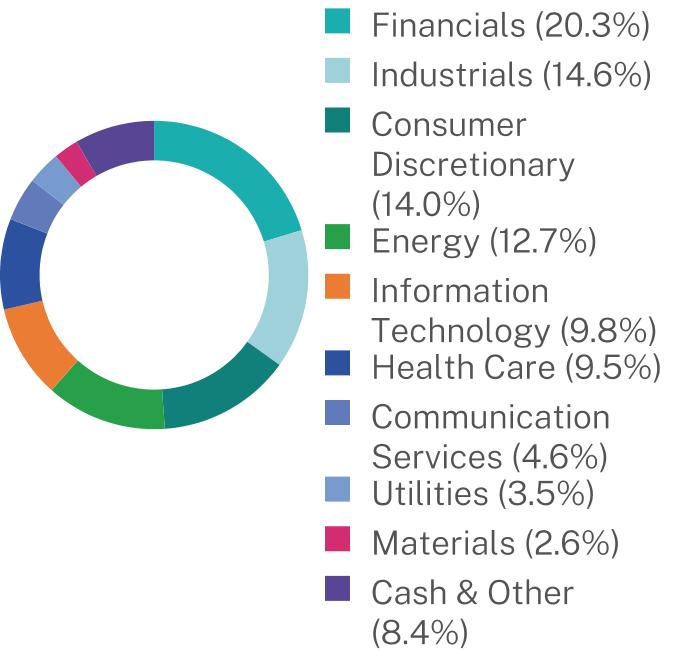

Class A

|

$122

|

1.21%

|

|

|

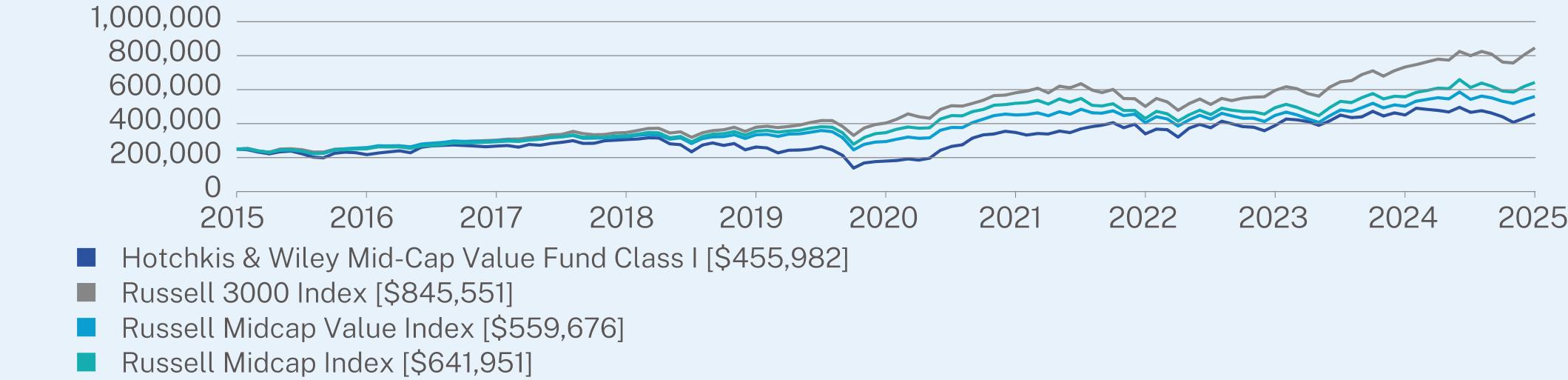

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

1.01

|

20.29

|

5.96

|

|

Class A (with sales charge)

|

-4.30

|

18.99

|

5.39

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell Midcap Value Index

|

11.53

|

13.71

|

8.39

|

|

Russell Midcap Index

|

15.21

|

13.11

|

9.89

|

|

Net Assets

|

$379,156,892

|

|

Number of Holdings

|

71

|

|

Net Advisory Fee

|

$3,090,577

|

|

Portfolio Turnover

|

31%

|

|

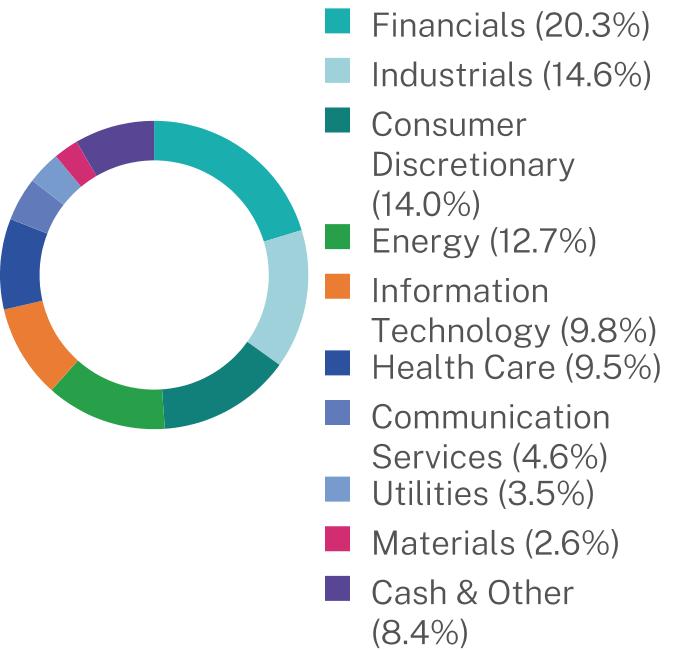

Top Holdings

|

(%)

|

|

F5, Inc.

|

4.0%

|

|

Popular, Inc.

|

4.0%

|

|

Telefonaktiebolaget LM Ericsson

|

3.9%

|

|

APA Corp.

|

3.7%

|

|

Citizens Financial Group, Inc.

|

3.5%

|

|

Fluor Corp.

|

3.5%

|

|

Adient PLC

|

2.8%

|

|

State Street Corp.

|

2.7%

|

|

American International Group, Inc.

|

2.7%

|

|

Magna International, Inc.

|

2.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$101

|

1.00%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

1.21

|

20.52

|

6.19

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell Midcap Value Index

|

11.53

|

13.71

|

8.39

|

|

Russell Midcap Index

|

15.21

|

13.11

|

9.89

|

|

Net Assets

|

$379,156,892

|

|

Number of Holdings

|

71

|

|

Net Advisory Fee

|

$3,090,577

|

|

Portfolio Turnover

|

31%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

4.0%

|

|

Popular, Inc.

|

4.0%

|

|

Telefonaktiebolaget LM Ericsson

|

3.9%

|

|

APA Corp.

|

3.7%

|

|

Citizens Financial Group, Inc.

|

3.5%

|

|

Fluor Corp.

|

3.5%

|

|

Adient PLC

|

2.8%

|

|

State Street Corp.

|

2.7%

|

|

American International Group, Inc.

|

2.7%

|

|

Magna International, Inc.

|

2.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

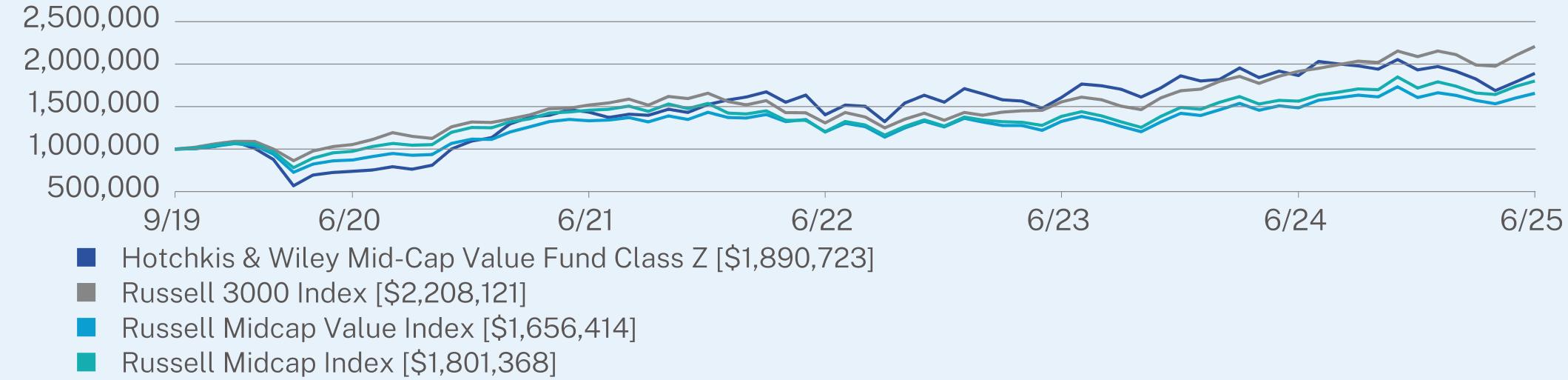

Class Z

|

$89

|

0.88%

|

|

|

1 Year

|

5 Year

|

Since Inception

(09/30/2019) |

|

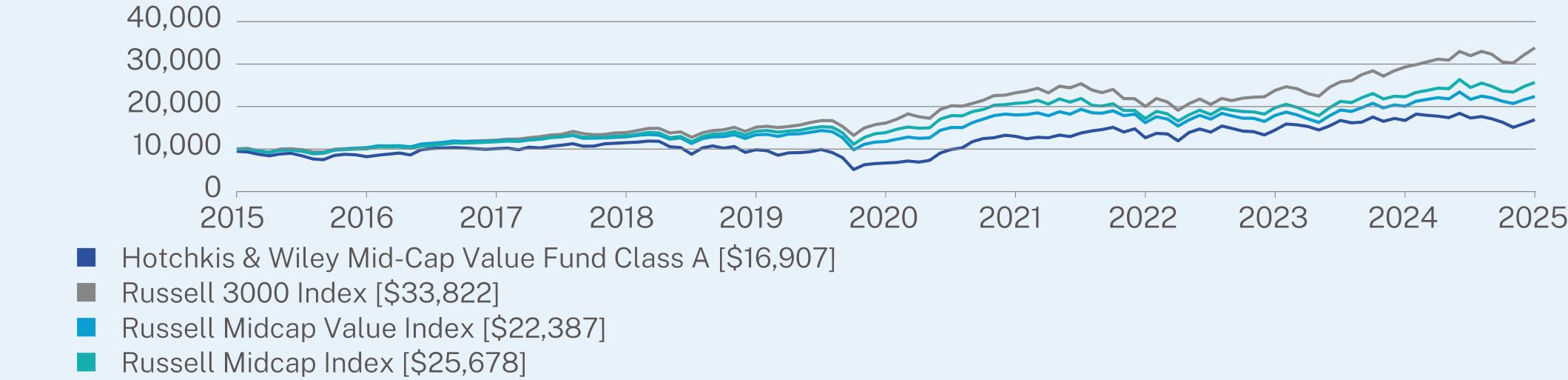

Class Z

|

1.33

|

20.69

|

11.71

|

|

Russell 3000 Index

|

15.30

|

15.96

|

14.77

|

|

Russell Midcap Value Index

|

11.53

|

13.71

|

9.17

|

|

Russell Midcap Index

|

15.21

|

13.11

|

10.78

|

|

Net Assets

|

$379,156,892

|

|

Number of Holdings

|

71

|

|

Net Advisory Fee

|

$3,090,577

|

|

Portfolio Turnover

|

31%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

4.0%

|

|

Popular, Inc.

|

4.0%

|

|

Telefonaktiebolaget LM Ericsson

|

3.9%

|

|

APA Corp.

|

3.7%

|

|

Citizens Financial Group, Inc.

|

3.5%

|

|

Fluor Corp.

|

3.5%

|

|

Adient PLC

|

2.8%

|

|

State Street Corp.

|

2.7%

|

|

American International Group, Inc.

|

2.7%

|

|

Magna International, Inc.

|

2.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

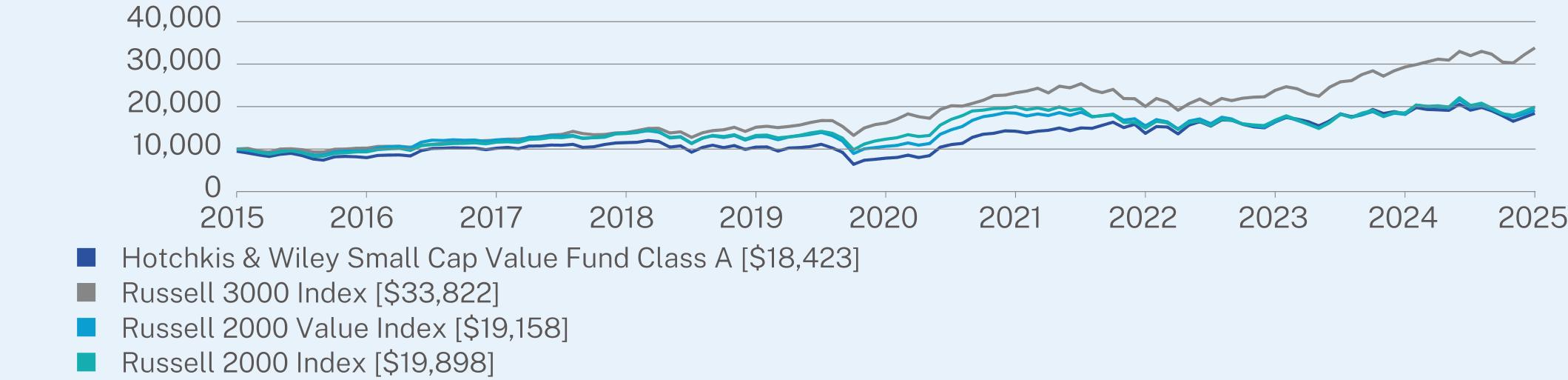

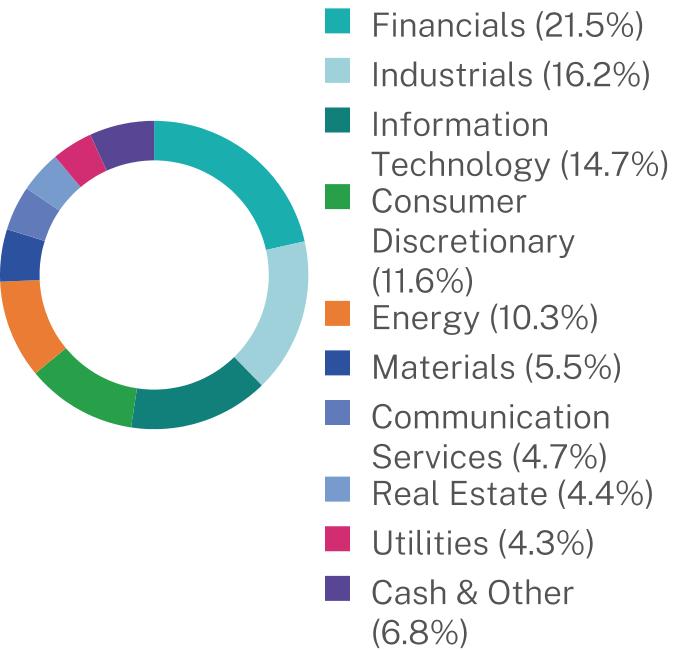

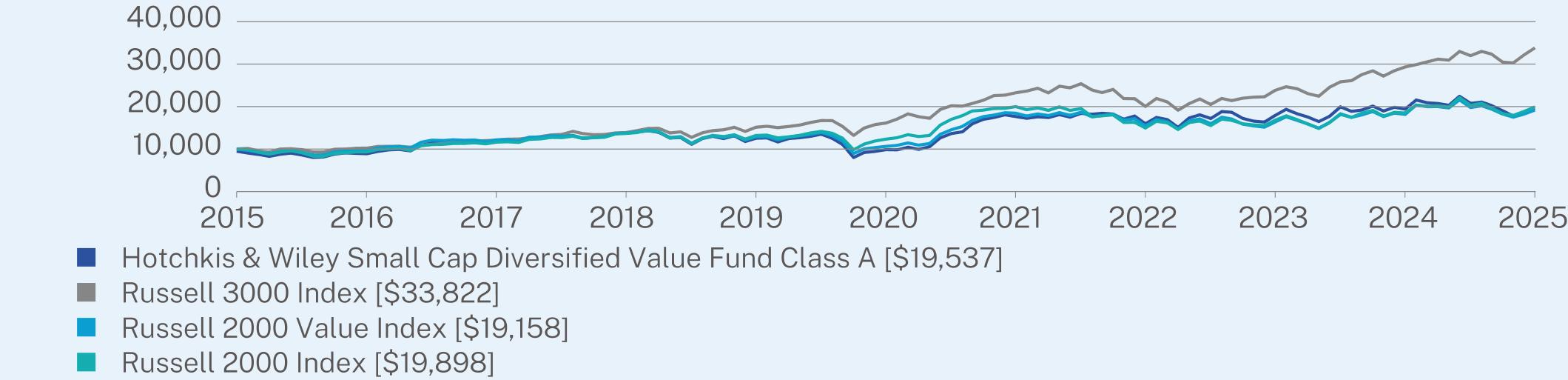

Class A

|

$121

|

1.20%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

1.04

|

18.56

|

6.87

|

|

Class A (with sales charge)

|

-4.26

|

17.29

|

6.30

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

6.72

|

|

Russell 2000 Index

|

7.68

|

10.04

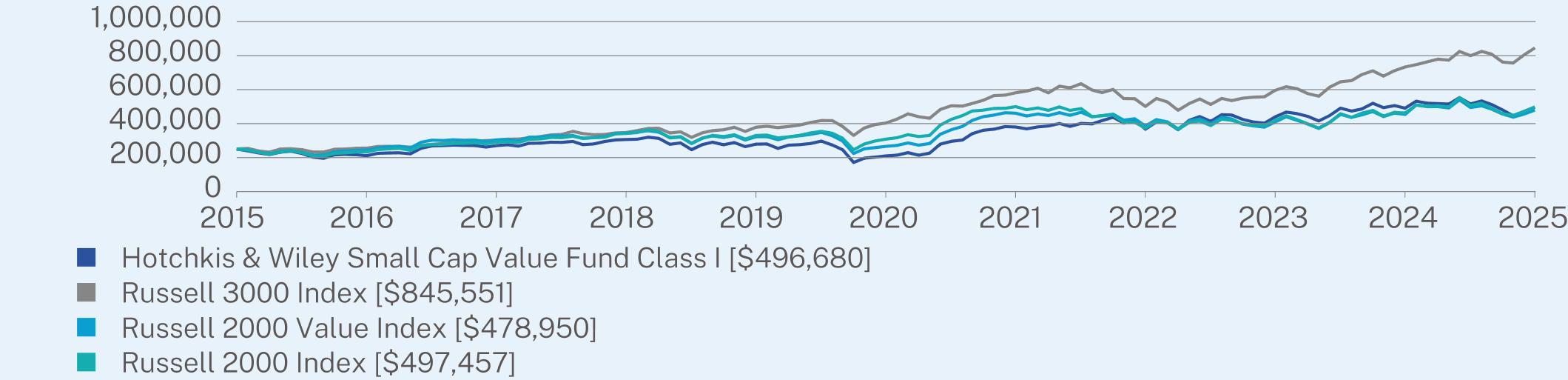

|

7.12

|

|

Net Assets

|

$743,590,211

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$5,490,376

|

|

Portfolio Turnover

|

41%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

9.2%

|

|

NOV, Inc.

|

4.2%

|

|

Avnet, Inc.

|

4.0%

|

|

Jones Lang LaSalle, Inc.

|

3.8%

|

|

Stagwell, Inc.

|

3.8%

|

|

U-Haul Holding Co.

|

3.3%

|

|

First Hawaiian, Inc.

|

3.3%

|

|

Popular, Inc.

|

3.3%

|

|

Fluor Corp.

|

3.1%

|

|

Ecovyst, Inc.

|

3.1%

|

|

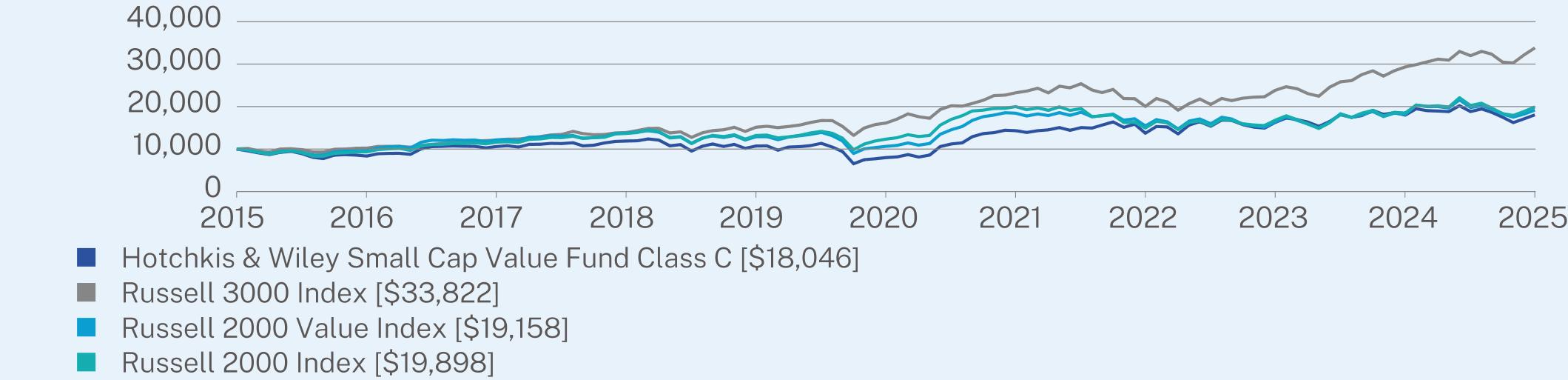

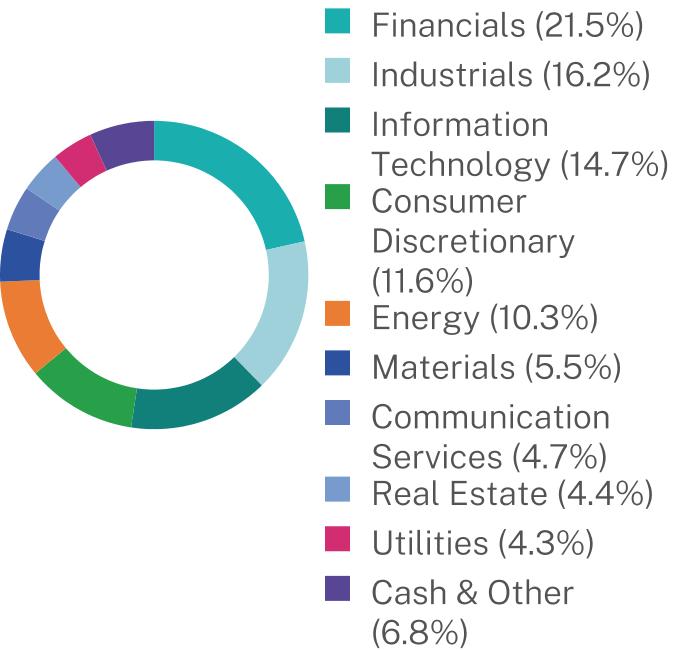

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$196

|

1.96%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

0.28

|

17.68

|

6.08

|

|

Class C (with sales charge)

|

-0.63

|

17.68

|

6.08

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

6.72

|

|

Russell 2000 Index

|

7.68

|

10.04

|

7.12

|

|

Net Assets

|

$743,590,211

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$5,490,376

|

|

Portfolio Turnover

|

41%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

9.2%

|

|

NOV, Inc.

|

4.2%

|

|

Avnet, Inc.

|

4.0%

|

|

Jones Lang LaSalle, Inc.

|

3.8%

|

|

Stagwell, Inc.

|

3.8%

|

|

U-Haul Holding Co.

|

3.3%

|

|

First Hawaiian, Inc.

|

3.3%

|

|

Popular, Inc.

|

3.3%

|

|

Fluor Corp.

|

3.1%

|

|

Ecovyst, Inc.

|

3.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$100

|

0.99%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

1.25

|

18.79

|

7.11

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

6.72

|

|

Russell 2000 Index

|

7.68

|

10.04

|

7.12

|

|

Net Assets

|

$743,590,211

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$5,490,376

|

|

Portfolio Turnover

|

41%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

9.2%

|

|

NOV, Inc.

|

4.2%

|

|

Avnet, Inc.

|

4.0%

|

|

Jones Lang LaSalle, Inc.

|

3.8%

|

|

Stagwell, Inc.

|

3.8%

|

|

U-Haul Holding Co.

|

3.3%

|

|

First Hawaiian, Inc.

|

3.3%

|

|

Popular, Inc.

|

3.3%

|

|

Fluor Corp.

|

3.1%

|

|

Ecovyst, Inc.

|

3.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Z

|

$90

|

0.89%

|

|

|

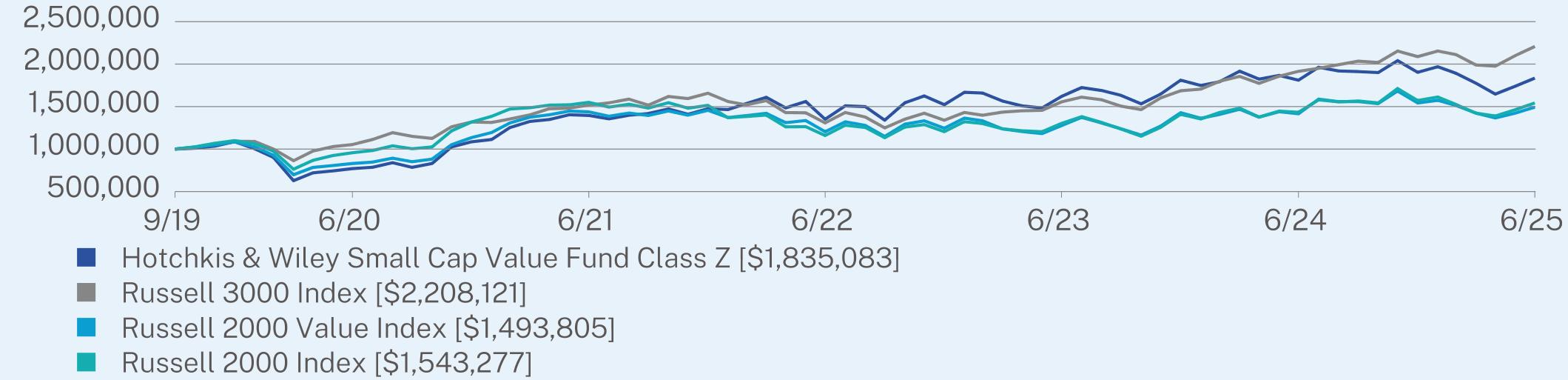

1 Year

|

5 Year

|

Since Inception

(09/30/2019) |

|

Class Z

|

1.35

|

18.97

|

11.13

|

|

Russell 3000 Index

|

15.30

|

15.96

|

14.77

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

7.23

|

|

Russell 2000 Index

|

7.68

|

10.04

|

7.84

|

|

Net Assets

|

$743,590,211

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$5,490,376

|

|

Portfolio Turnover

|

41%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

9.2%

|

|

NOV, Inc.

|

4.2%

|

|

Avnet, Inc.

|

4.0%

|

|

Jones Lang LaSalle, Inc.

|

3.8%

|

|

Stagwell, Inc.

|

3.8%

|

|

U-Haul Holding Co.

|

3.3%

|

|

First Hawaiian, Inc.

|

3.3%

|

|

Popular, Inc.

|

3.3%

|

|

Fluor Corp.

|

3.1%

|

|

Ecovyst, Inc.

|

3.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$106

|

1.06%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

0.75

|

14.66

|

7.50

|

|

Class A (with sales charge)

|

-4.55

|

13.44

|

6.93

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

6.72

|

|

Russell 2000 Index

|

7.68

|

10.04

|

7.12

|

|

Net Assets

|

$730,982,432

|

|

Number of Holdings

|

353

|

|

Net Advisory Fee

|

$4,934,657

|

|

Portfolio Turnover

|

60%

|

|

Top Holdings

|

(%)

|

|

Par Pacific Holdings, Inc.

|

0.6%

|

|

Fluor Corp.

|

0.6%

|

|

Ecovyst, Inc.

|

0.5%

|

|

ScanSource, Inc.

|

0.5%

|

|

Cushman & Wakefield PLC

|

0.5%

|

|

Sonic Automotive, Inc. - Class A

|

0.5%

|

|

NEXTracker, Inc. - Class A

|

0.5%

|

|

Hilton Grand Vacations, Inc.

|

0.5%

|

|

WEX, Inc.

|

0.5%

|

|

NMI Holdings, Inc. - Class A

|

0.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

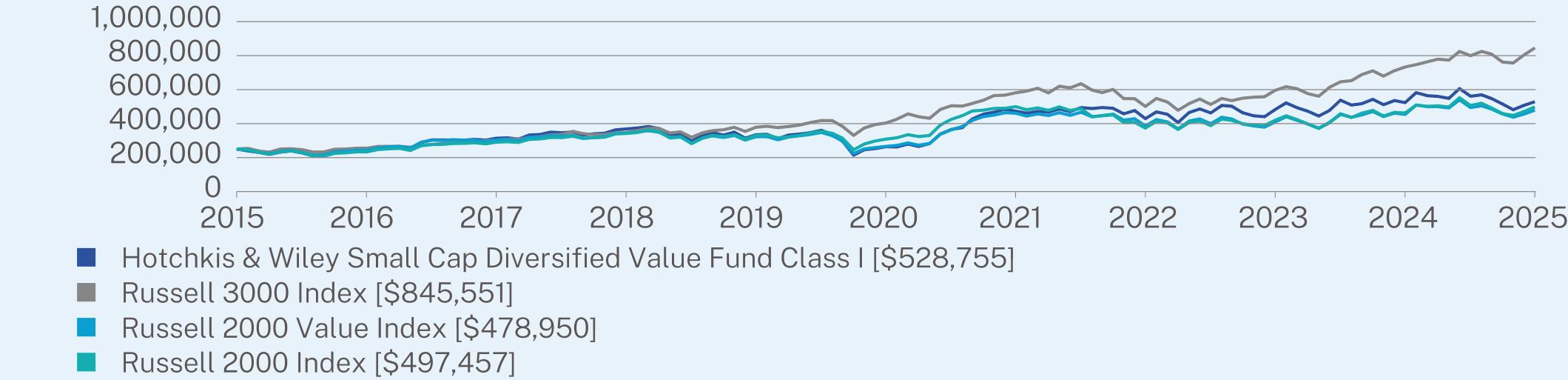

Class I

|

$81

|

0.81%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

1.01

|

14.91

|

7.78

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

6.72

|

|

Russell 2000 Index

|

7.68

|

10.04

|

7.12

|

|

Net Assets

|

$730,982,432

|

|

Number of Holdings

|

353

|

|

Net Advisory Fee

|

$4,934,657

|

|

Portfolio Turnover

|

60%

|

|

Top Holdings

|

(%)

|

|

Par Pacific Holdings, Inc.

|

0.6%

|

|

Fluor Corp.

|

0.6%

|

|

Ecovyst, Inc.

|

0.5%

|

|

ScanSource, Inc.

|

0.5%

|

|

Cushman & Wakefield PLC

|

0.5%

|

|

Sonic Automotive, Inc. - Class A

|

0.5%

|

|

NEXTracker, Inc. - Class A

|

0.5%

|

|

Hilton Grand Vacations, Inc.

|

0.5%

|

|

WEX, Inc.

|

0.5%

|

|

NMI Holdings, Inc. - Class A

|

0.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Z

|

$78

|

0.78%

|

|

|

1 Year

|

5 Year

|

Since Inception

(09/30/2019) |

|

Class Z

|

1.06

|

14.96

|

8.41

|

|

Russell 3000 Index

|

15.30

|

15.96

|

14.77

|

|

Russell 2000 Value Index

|

5.54

|

12.47

|

7.23

|

|

Russell 2000 Index

|

7.68

|

10.04

|

7.84

|

|

Net Assets

|

$730,982,432

|

|

Number of Holdings

|

353

|

|

Net Advisory Fee

|

$4,934,657

|

|

Portfolio Turnover

|

60%

|

|

Top Holdings

|

(%)

|

|

Par Pacific Holdings, Inc.

|

0.6%

|

|

Fluor Corp.

|

0.6%

|

|

Ecovyst, Inc.

|

0.5%

|

|

ScanSource, Inc.

|

0.5%

|

|

Cushman & Wakefield PLC

|

0.5%

|

|

Sonic Automotive, Inc. - Class A

|

0.5%

|

|

NEXTracker, Inc. - Class A

|

0.5%

|

|

Hilton Grand Vacations, Inc.

|

0.5%

|

|

WEX, Inc.

|

0.5%

|

|

NMI Holdings, Inc. - Class A

|

0.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$129

|

1.20%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

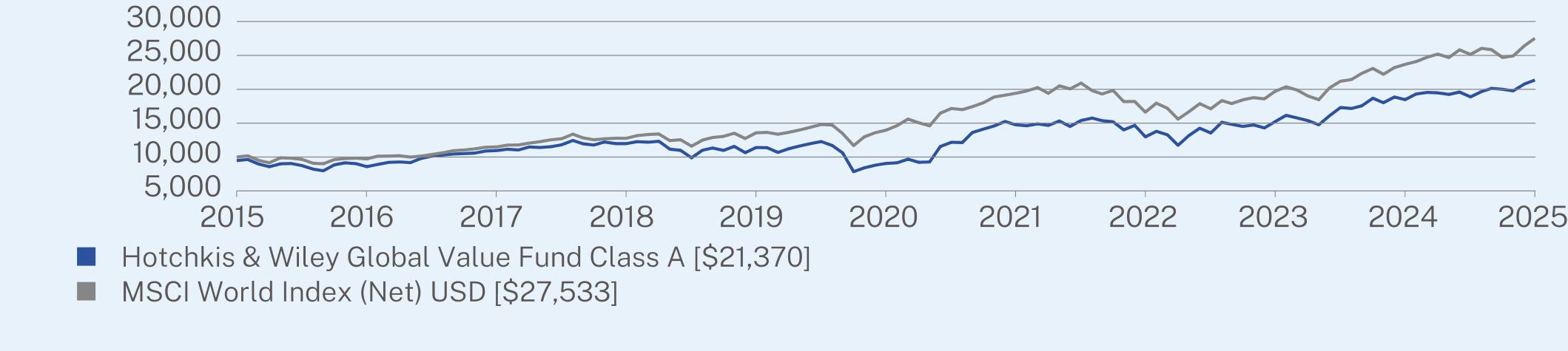

Class A (without sales charge)

|

15.70

|

18.74

|

8.47

|

|

Class A (with sales charge)

|

9.66

|

17.46

|

7.89

|

|

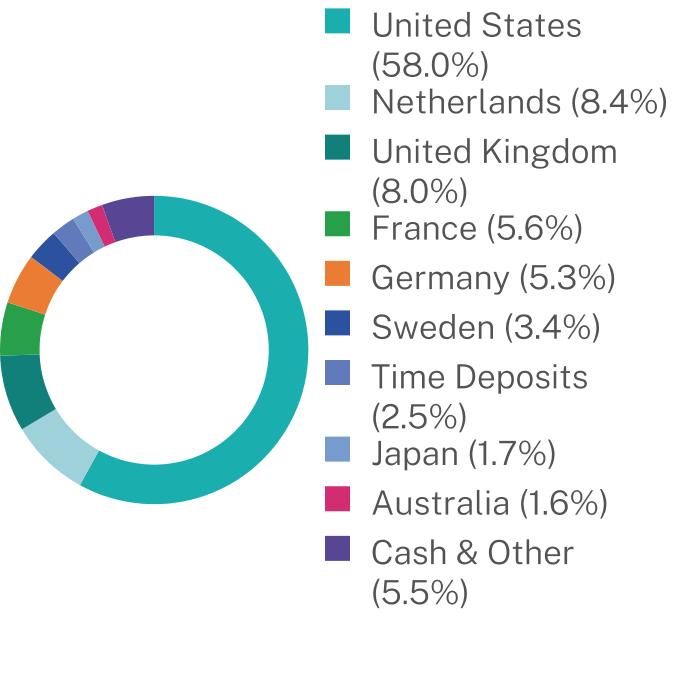

MSCI World Index (Net) USD

|

16.26

|

14.55

|

10.66

|

|

Net Assets

|

$39,828,890

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$165,187

|

|

Portfolio Turnover

|

51%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Workday, Inc. - Class A

|

4.4%

|

|

Telefonaktiebolaget LM Ericsson

|

3.4%

|

|

Dominion Energy, Inc.

|

2.6%

|

|

Comcast Corp. - Class A

|

2.5%

|

|

GE HealthCare Technologies, Inc.

|

2.5%

|

|

Elevance Health, Inc.

|

2.4%

|

|

General Motors Co.

|

2.4%

|

|

American International Group, Inc.

|

2.3%

|

|

Heineken Holding NV

|

2.3%

|

|

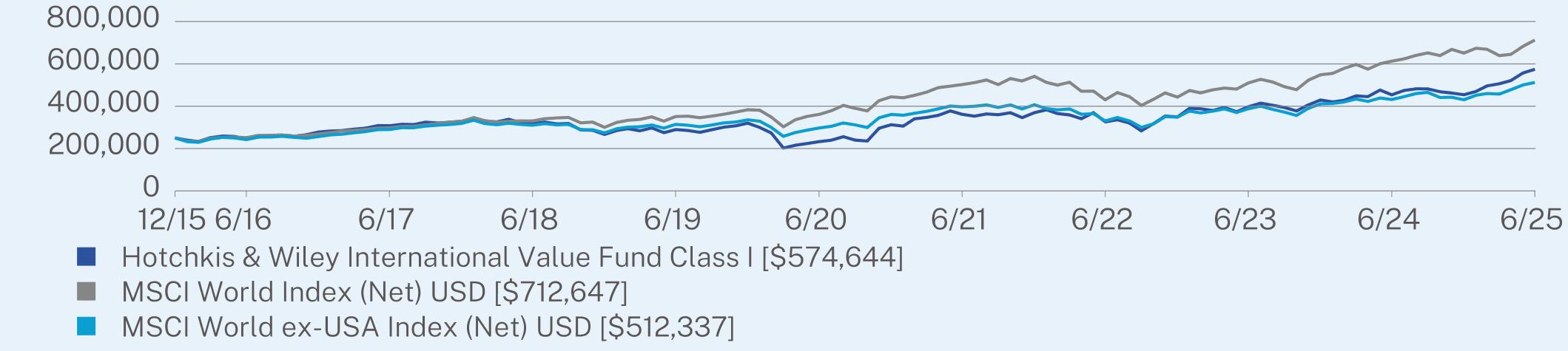

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$103

|

0.95%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

16.00

|

19.05

|

8.74

|

|

MSCI World Index (Net) USD

|

16.26

|

14.55

|

10.66

|

|

Net Assets

|

$39,828,890

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$165,187

|

|

Portfolio Turnover

|

51%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

5.0%

|

|

Workday, Inc. - Class A

|

4.4%

|

|

Telefonaktiebolaget LM Ericsson

|

3.4%

|

|

Dominion Energy, Inc.

|

2.6%

|

|

Comcast Corp. - Class A

|

2.5%

|

|

GE HealthCare Technologies, Inc.

|

2.5%

|

|

Elevance Health, Inc.

|

2.4%

|

|

General Motors Co.

|

2.4%

|

|

American International Group, Inc.

|

2.3%

|

|

Heineken Holding NV

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$108

|

0.95%

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2015) |

|

Class I

|

26.60

|

19.81

|

9.16

|

|

MSCI World Index (Net) USD

|

16.26

|

14.55

|

11.66

|

|

MSCI World ex-USA Index (Net) USD

|

18.70

|

11.51

|

7.85

|

|

Net Assets

|

$4,795,621

|

|

Number of Holdings

|

56

|

|

Net Advisory Fee

|

$0

|

|

Portfolio Turnover

|

35%

|

|

Top Holdings

|

(%)

|

|

Siemens AG

|

4.6%

|

|

Telefonaktiebolaget LM Ericsson - Class B

|

4.1%

|

|

Henkel AG & Co. KGaA

|

3.9%

|

|

Heineken Holding NV

|

3.5%

|

|

Akzo Nobel NV

|

3.4%

|

|

Shell PLC

|

3.2%

|

|

Lloyds Banking Group PLC

|

2.9%

|

|

TotalEnergies SE

|

2.8%

|

|

BNP Paribas SA

|

2.8%

|

|

Societe Generale SA

|

2.7%

|

|

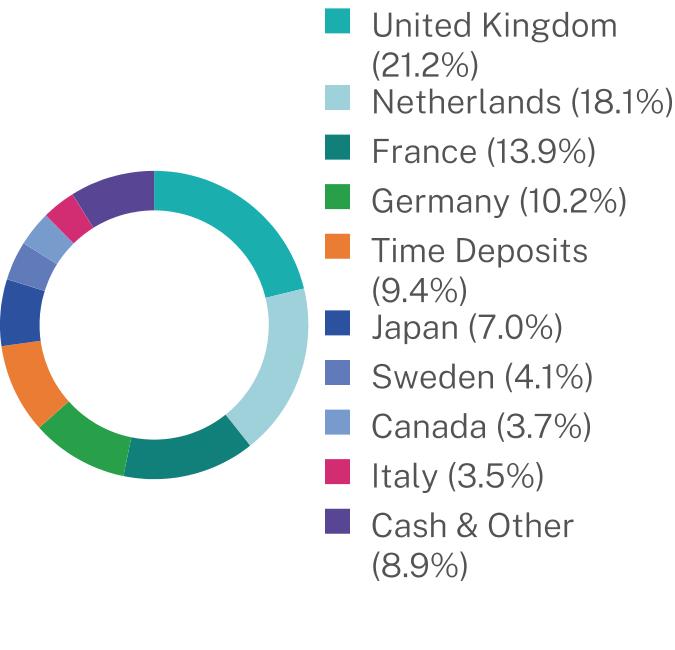

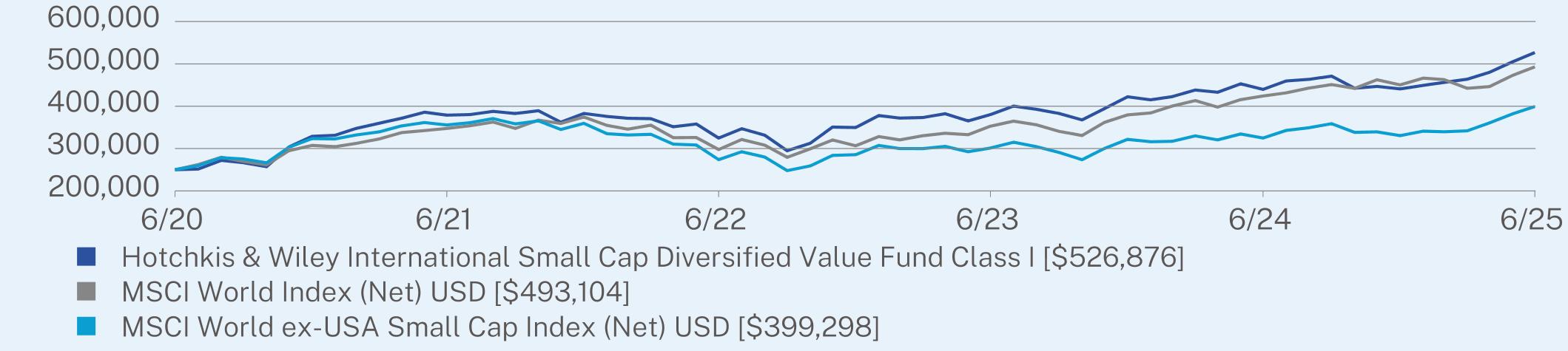

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$110

|

1.00%

|

communication services were the main detractors to relative performance. An overweight in energy also negatively impacted returns.

|

|

1 Year

|

5 Year

|

Since Inception

(06/30/2020) |

|

Class I

|

19.82

|

16.08

|

16.08

|

|

MSCI World Index (Net) USD

|

16.26

|

14.55

|

14.55

|

|

MSCI World ex-USA Small Cap Index (Net) USD

|

22.92

|

9.82

|

9.82

|

|

Net Assets

|

$4,665,436

|

|

Number of Holdings

|

299

|

|

Net Advisory Fee

|

$0

|

|

Portfolio Turnover

|

63%

|

|

Top Holdings

|

(%)

|

|

Shibaura Mechatronics Corp.

|

0.6%

|

|

Sesa SpA

|

0.6%

|

|

SUSS MicroTec SE

|

0.6%

|

|

Fuso Chemical Co. Ltd.

|

0.6%

|

|

Riken Vitamin Co. Ltd.

|

0.6%

|

|

GRENKE AG

|

0.6%

|

|

RS Technologies Co. Ltd.

|

0.6%

|

|

Tocalo Co. Ltd.

|

0.6%

|

|

Tazmo Co. Ltd.

|

0.6%

|

|

Hyakujushi Bank Ltd.

|

0.6%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$128

|

1.20%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

13.31

|

20.10

|

10.42

|

|

Class A (with sales charge)

|

7.35

|

18.81

|

9.83

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 3000 Value Index

|

13.30

|

13.87

|

9.04

|

|

Net Assets

|

$725,124,671

|

|

Number of Holdings

|

70

|

|

Net Advisory Fee

|

$5,074,719

|

|

Portfolio Turnover

|

78%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

8.5%

|

|

Workday, Inc. - Class A

|

7.6%

|

|

Telefonaktiebolaget LM Ericsson

|

5.5%

|

|

Dominion Energy, Inc.

|

4.6%

|

|

Schlumberger NV

|

3.6%

|

|

Microsoft Corp.

|

3.4%

|

|

U-Haul Holding Co.

|

2.9%

|

|

Jones Lang LaSalle, Inc.

|

2.5%

|

|

Havas NV

|

2.5%

|

|

Siemens AG

|

2.4%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

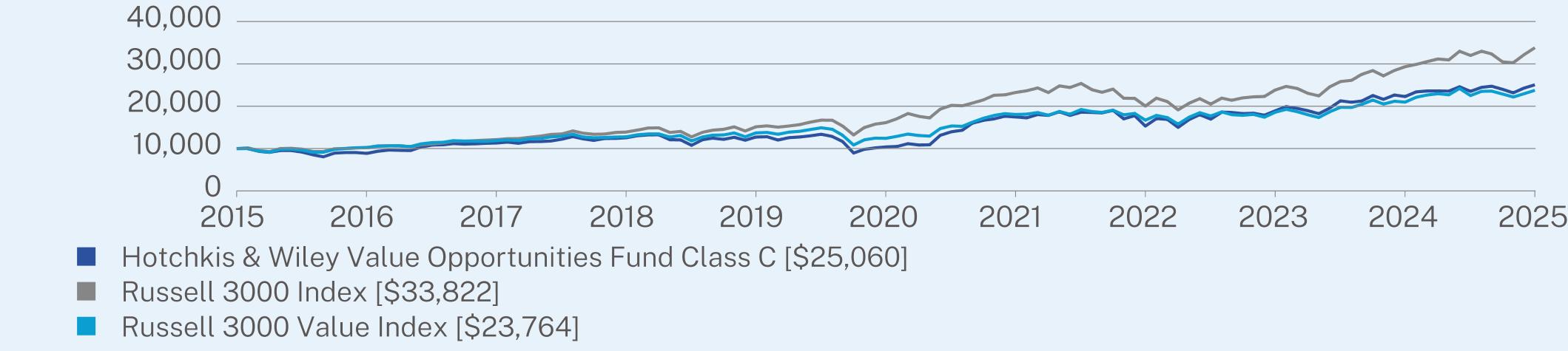

Class C

|

$205

|

1.93%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

12.50

|

19.24

|

9.62

|

|

Class C (with sales charge)

|

11.50

|

19.24

|

9.62

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 3000 Value Index

|

13.30

|

13.87

|

9.04

|

|

Net Assets

|

$725,124,671

|

|

Number of Holdings

|

70

|

|

Net Advisory Fee

|

$5,074,719

|

|

Portfolio Turnover

|

78%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

8.5%

|

|

Workday, Inc. - Class A

|

7.6%

|

|

Telefonaktiebolaget LM Ericsson

|

5.5%

|

|

Dominion Energy, Inc.

|

4.6%

|

|

Schlumberger NV

|

3.6%

|

|

Microsoft Corp.

|

3.4%

|

|

U-Haul Holding Co.

|

2.9%

|

|

Jones Lang LaSalle, Inc.

|

2.5%

|

|

Havas NV

|

2.5%

|

|

Siemens AG

|

2.4%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$104

|

0.97%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

13.58

|

20.41

|

10.70

|

|

Russell 3000 Index

|

15.30

|

15.96

|

12.96

|

|

Russell 3000 Value Index

|

13.30

|

13.87

|

9.04

|

|

Net Assets

|

$725,124,671

|

|

Number of Holdings

|

70

|

|

Net Advisory Fee

|

$5,074,719

|

|

Portfolio Turnover

|

78%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

8.5%

|

|

Workday, Inc. - Class A

|

7.6%

|

|

Telefonaktiebolaget LM Ericsson

|

5.5%

|

|

Dominion Energy, Inc.

|

4.6%

|

|

Schlumberger NV

|

3.6%

|

|

Microsoft Corp.

|

3.4%

|

|

U-Haul Holding Co.

|

2.9%

|

|

Jones Lang LaSalle, Inc.

|

2.5%

|

|

Havas NV

|

2.5%

|

|

Siemens AG

|

2.4%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Z

|

$94

|

0.88%

|

|

|

1 Year

|

5 Year

|

Since Inception

(09/30/2019) |

|

Class Z

|

13.70

|

20.51

|

13.95

|

|

Russell 3000 Index

|

15.30

|

15.96

|

14.77

|

|

Russell 3000 Value Index

|

13.30

|

13.87

|

9.82

|

|

Net Assets

|

$725,124,671

|

|

Number of Holdings

|

70

|

|

Net Advisory Fee

|

$5,074,719

|

|

Portfolio Turnover

|

78%

|

|

Top Holdings

|

(%)

|

|

F5, Inc.

|

8.5%

|

|

Workday, Inc. - Class A

|

7.6%

|

|

Telefonaktiebolaget LM Ericsson

|

5.5%

|

|

Dominion Energy, Inc.

|

4.6%

|

|

Schlumberger NV

|

3.6%

|

|

Microsoft Corp.

|

3.4%

|

|

U-Haul Holding Co.

|

2.9%

|

|

Jones Lang LaSalle, Inc.

|

2.5%

|

|

Havas NV

|

2.5%

|

|

Siemens AG

|

2.4%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$95

|

0.91%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

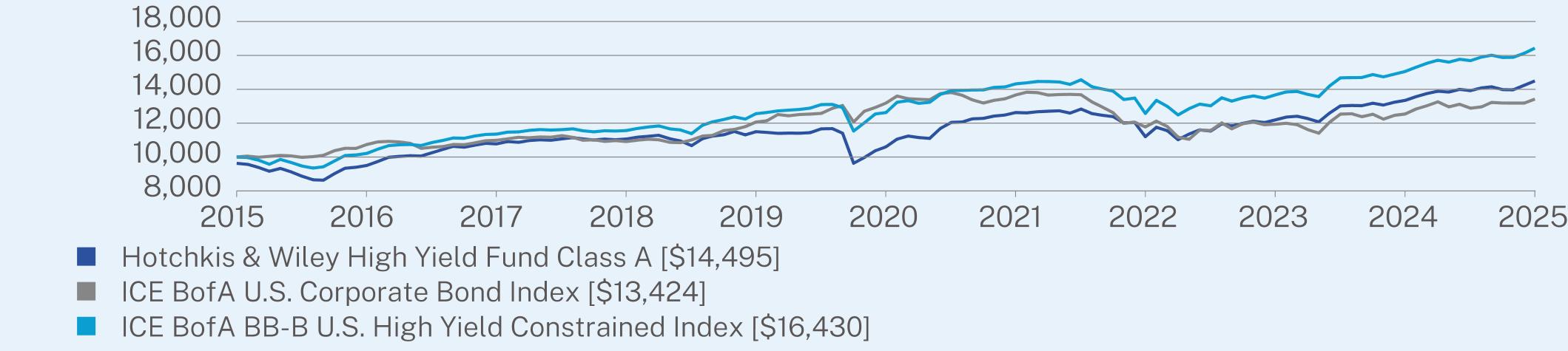

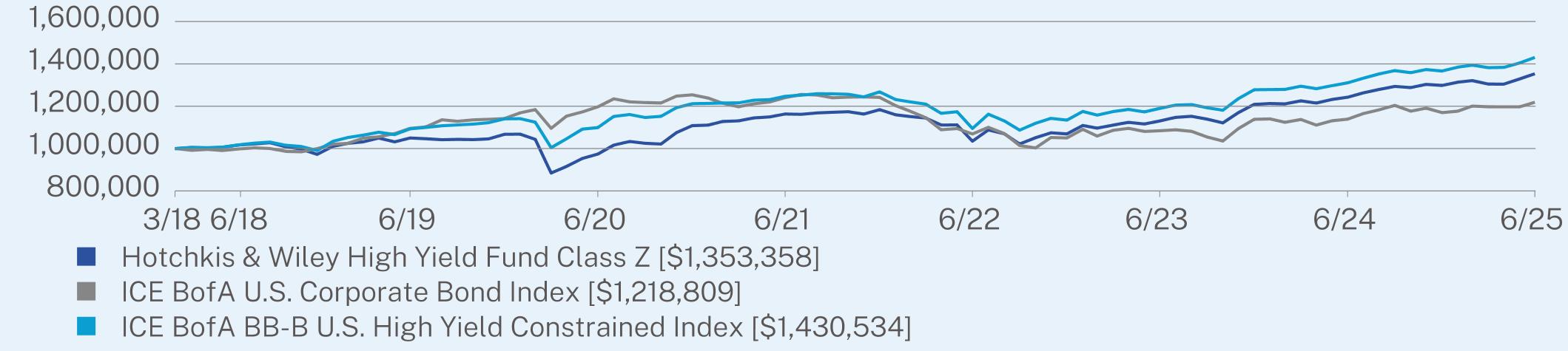

Class A (without sales charge)

|

8.63

|

6.45

|

4.18

|

|

Class A (with sales charge)

|

4.58

|

5.65

|

3.78

|

|

ICE BofA U.S. Corporate Bond Index

|

7.03

|

0.36

|

2.99

|

|

ICE BofA BB-B U.S. High Yield Constrained Index

|

9.15

|

5.41

|

5.09

|

|

Net Assets

|

$775,924,165

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$4,189,946

|

|

Portfolio Turnover

|

41%

|

|

Top 10 Issuers

|

(%)

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

2.3%

|

|

Carnival Corp.

|

1.5%

|

|

Authentic Brands Group LLC

|

1.3%

|

|

CSC Holdings LLC

|

1.0%

|

|

WR Grace Holdings LLC

|

0.9%

|

|

Fortis 333, Inc.

|

0.9%

|

|

Gray Media, Inc.

|

0.9%

|

|

Venture Global Plaquemines LNG LLC

|

0.8%

|

|

Herc Holdings, Inc.

|

0.8%

|

|

TransDigm, Inc.

|

0.8%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$73

|

0.70%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

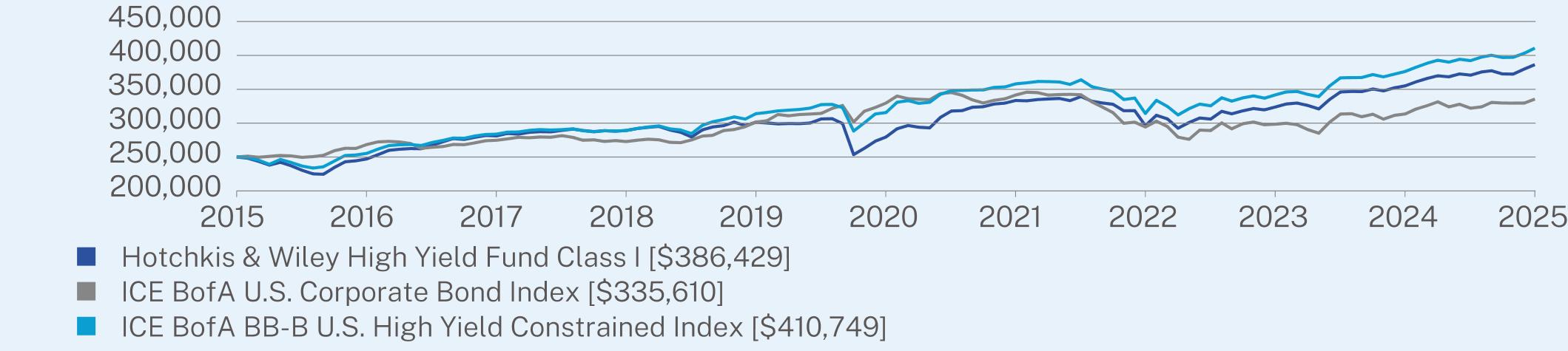

Class I

|

8.82

|

6.69

|

4.45

|

|

ICE BofA U.S. Corporate Bond Index

|

7.03

|

0.36

|

2.99

|

|

ICE BofA BB-B U.S. High Yield Constrained Index

|

9.15

|

5.41

|

5.09

|

|

Net Assets

|

$775,924,165

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$4,189,946

|

|

Portfolio Turnover

|

41%

|

|

Top 10 Issuers

|

(%)

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

2.3%

|

|

Carnival Corp.

|

1.5%

|

|

Authentic Brands Group LLC

|

1.3%

|

|

CSC Holdings LLC

|

1.0%

|

|

WR Grace Holdings LLC

|

0.9%

|

|

Fortis 333, Inc.

|

0.9%

|

|

Gray Media, Inc.

|

0.9%

|

|

Venture Global Plaquemines LNG LLC

|

0.8%

|

|

Herc Holdings, Inc.

|

0.8%

|

|

TransDigm, Inc.

|

0.8%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Z

|

$63

|

0.60%

|

|

|

1 Year

|

5 Year

|

Since Inception

(03/29/2018) |

|

Class Z

|

8.94

|

6.80

|

4.26

|

|

ICE BofA U.S. Corporate Bond Index

|

7.03

|

0.36

|

2.77

|

|

ICE BofA BB-B U.S. High Yield Constrained Index

|

9.15

|

5.41

|

5.06

|

|

Net Assets

|

$775,924,165

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$4,189,946

|

|

Portfolio Turnover

|

41%

|

|

Top 10 Issuers

|

(%)

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

2.3%

|

|

Carnival Corp.

|

1.5%

|

|

Authentic Brands Group LLC

|

1.3%

|

|

CSC Holdings LLC

|

1.0%

|

|

WR Grace Holdings LLC

|

0.9%

|

|

Fortis 333, Inc.

|

0.9%

|

|

Gray Media, Inc.

|

0.9%

|

|

Venture Global Plaquemines LNG LLC

|

0.8%

|

|

Herc Holdings, Inc.

|

0.8%

|

|

TransDigm, Inc.

|

0.8%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

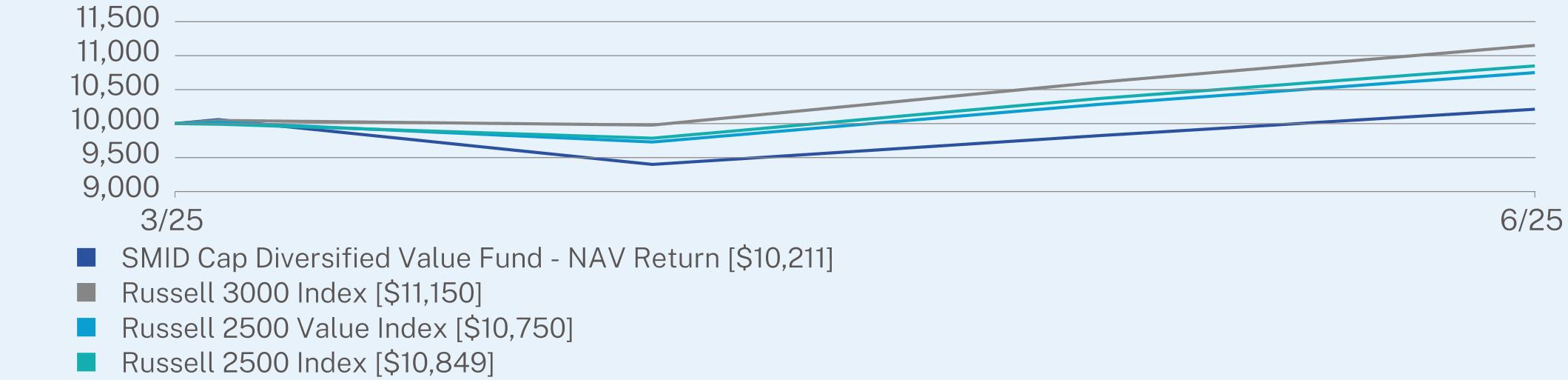

SMID Cap Diversified Value Fund

|

$14

|

0.55%

|

|

•

|

Stock selection in information technology, along with an overweight in energy and an underweight position in technology, were the primary detractors from performance. Stock selection in industrials, consumer staples, and communication services also detracted from returns.

|

|

•

|

Stock selection in real estate and an underweight in health care helped relative performance.

|

|

|

Since Inception

(03/28/2025) |

|

SMID Cap Diversified Value Fund - NAV Return

|

2.11

|

|

Russell 3000 Index

|

11.50

|

|

Russell 2500 Value Index

|

7.50

|

|

Russell 2500 Index

|

8.49

|

|

Net Assets

|

$2,002,254

|

|

Number of Holdings

|

156

|

|

Net Advisory Fee

|

$2,319

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(%)

|

|

Synchrony Financial

|

1.2%

|

|

Franklin Resources, Inc.

|

1.2%

|

|

Popular, Inc.

|

1.2%

|

|

BorgWarner, Inc.

|

1.2%

|

|

Huntington Ingalls Industries, Inc.

|

1.2%

|

|

State Street Corp.

|

1.1%

|

|

TE Connectivity PLC

|

1.1%

|

|

WESCO International, Inc.

|

1.1%

|

|

Corebridge Financial, Inc.

|

1.1%

|

|

Magna International, Inc.

|

1.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

HW Opportunities MP Fund

|

$0

|

0.00%

|

|

|

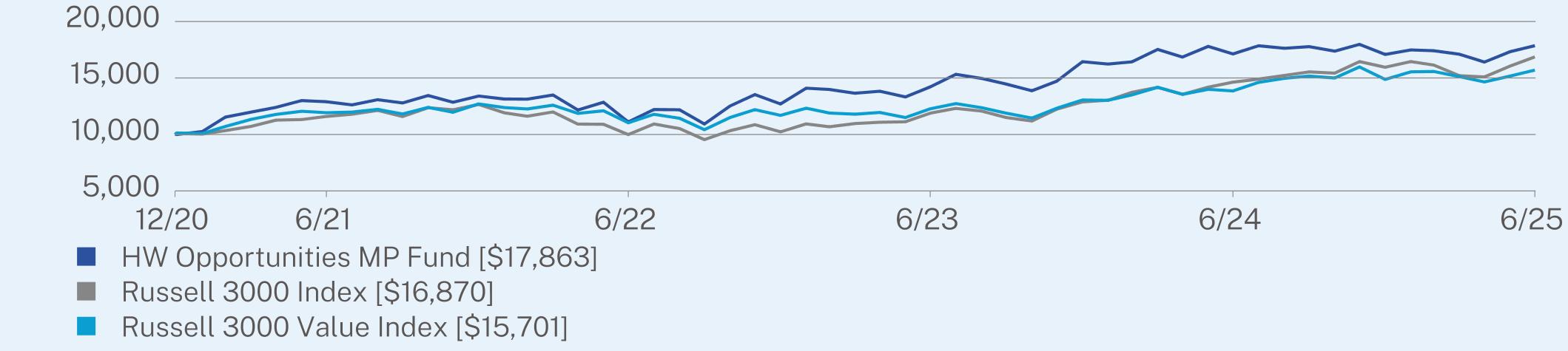

1 Year

|

Since Inception

(12/30/2020) |

|

Fund

|

4.26

|

13.76

|

|

Russell 3000 Index

|

15.30

|

12.32

|

|

Russell 3000 Value Index

|

13.30

|

10.54

|

|

Net Assets

|

$69,365,301

|

|

Number of Holdings

|

49

|

|

Net Advisory Fee

|

$0

|

|

Portfolio Turnover

|

107%

|

|

Top Holdings

|

(%)

|

|

U-Haul Holding Co.

|

8.0%

|

|

Havas NV

|

6.6%

|

|

Qantas Airways Ltd.

|

6.4%

|

|

Ecovyst, Inc.

|

5.9%

|

|

Fuso Chemical Co. Ltd.

|

5.5%

|

|

Henkel AG & Co. KGaA

|

4.5%

|

|

Stagwell, Inc.

|

4.4%

|

|

Jones Lang LaSalle, Inc.

|

4.3%

|

|

Vanguard Long-Term Treasury ETF

|

4.1%

|

|

Siemens AG

|

3.9%

|

| [1] |

|