Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

MFS SERIES TRUST XVII

|

|

| Entity Central Index Key |

0000867969

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000006994 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® International Equity Fund

|

|

| Class Name |

Class R6

|

|

| Trading Symbol |

MIEIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS International Equity Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes certain changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R6 |

$69 |

0.64% |

|

|

| Expenses Paid, Amount |

$ 69

|

|

| Expense Ratio, Percent |

0.64%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended June 30, 2025, Class R6 shares of the MFS International Equity Fund (fund) provided a total return of 16.69%, at net asset value. This compares with a return of 17.73% for the fund’s benchmark, the MSCI EAFE (Europe, Australasia, Far East) Index (net div).

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of tariffs on most US trading partners. Sector level tariffs remained in place. A temporary truce was reached separately with China, although tensions remained high as negotiations continued.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

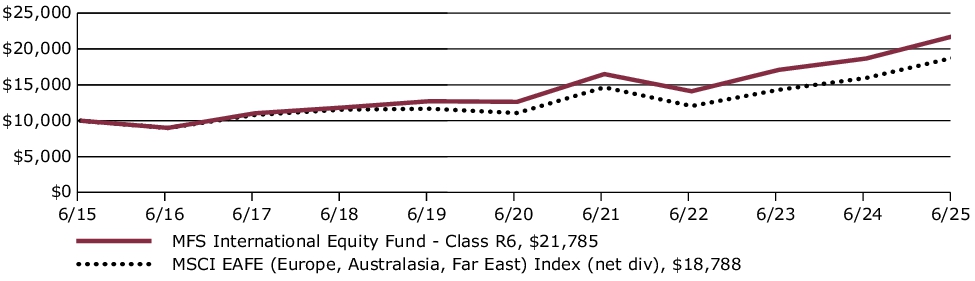

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment This graph shows the performance of a hypothetical $10,000 investment in Class R6 over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 6/30/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R6 without sales charge |

16.69% |

11.53% |

8.10% |

| Comparative Benchmark(s) |

|

|

|

| MSCI EAFE (Europe, Australasia, Far East) Index (net div) ∆ |

17.73% |

11.16% |

6.51% |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r6 for more recent performance information.

|

|

| Net Assets |

$ 28,905,082,239

|

|

| Holdings Count | Holding |

80

|

|

| Advisory Fees Paid, Amount |

$ 146,964,144

|

[1] |

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 6/30/25

| Net Assets ($): |

28,905,082,239 |

|

Total Management Fee ($)#: |

146,964,144 |

| Total Number of Holdings: |

80 |

|

Portfolio Turnover Rate (%): |

13 | # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 6/30/25) Portfolio structure

| Equities |

98.6% |

| Money Market Funds |

1.4% | Top ten holdings

| Hitachi Ltd. |

3.0% |

| SAP SE |

2.9% |

| Air Liquide S.A. |

2.9% |

| Schneider Electric SE |

2.7% |

| Rolls-Royce Holdings PLC |

2.4% |

| Roche Holding AG |

2.3% |

| Compass Group PLC |

2.3% |

| Compagnie Financiere Richemont S.A. |

2.2% |

| Deutsche Boerse AG |

2.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2.1% | Issuer country weightings

| Japan |

19.2% |

| France |

18.5% |

| United Kingdom |

13.8% |

| Switzerland |

12.6% |

| Germany |

9.6% |

| Canada |

3.3% |

| Ireland |

2.8% |

| Denmark |

2.5% |

| Italy |

2.5% |

| Other Countries |

15.2% |

|

|

| Largest Holdings [Text Block] |

Top ten holdings

| Hitachi Ltd. |

3.0% |

| SAP SE |

2.9% |

| Air Liquide S.A. |

2.9% |

| Schneider Electric SE |

2.7% |

| Rolls-Royce Holdings PLC |

2.4% |

| Roche Holding AG |

2.3% |

| Compass Group PLC |

2.3% |

| Compagnie Financiere Richemont S.A. |

2.2% |

| Deutsche Boerse AG |

2.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2.1% |

|

|

| Material Fund Change [Text Block] |

MATERIAL FUND CHANGES This is a summary of certain changes to the fund from July 1, 2024 through June 30, 2025. For more complete information, you may review the fund's prospectus as amended, which is available at funds.mfs.com or upon request at 1‑800‑225‑2606. Effective August 1, 2024, the management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets: 0.75% up to $1 billion; 0.70% in excess of $1 billion and up to $2.5 billion; 0.65% in excess of $2.5 billion and up to $10 billion; 0.60% in excess of $10 billion and up to $20 billion; 0.55% in excess of $20 billion and up to $25 billion; 0.525% in excess of $25 billion.

|

|

| Material Fund Change Expenses [Text Block] |

Effective August 1, 2024, the management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets: 0.75% up to $1 billion; 0.70% in excess of $1 billion and up to $2.5 billion; 0.65% in excess of $2.5 billion and up to $10 billion; 0.60% in excess of $10 billion and up to $20 billion; 0.55% in excess of $20 billion and up to $25 billion; 0.525% in excess of $25 billion.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund from July 1, 2024 through June 30, 2025. For more complete information, you may review the fund's prospectus as amended, which is available at funds.mfs.com or upon request at 1‑800‑225‑2606.

|

|

| Updated Prospectus Phone Number |

1‑800‑225‑2606

|

|

| Updated Prospectus Web Address |

funds.mfs.com

|

|

| C000238582 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® International Equity Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

MIEKX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS International Equity Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes certain changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| I |

$78 |

0.72% |

|

|

| Expenses Paid, Amount |

$ 78

|

|

| Expense Ratio, Percent |

0.72%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended June 30, 2025, Class I shares of the MFS International Equity Fund (fund) provided a total return of 16.58%, at net asset value. This compares with a return of 17.73% for the fund’s benchmark, the MSCI EAFE (Europe, Australasia, Far East) Index (net div).

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of tariffs on most US trading partners. Sector level tariffs remained in place. A temporary truce was reached separately with China, although tensions remained high as negotiations continued.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

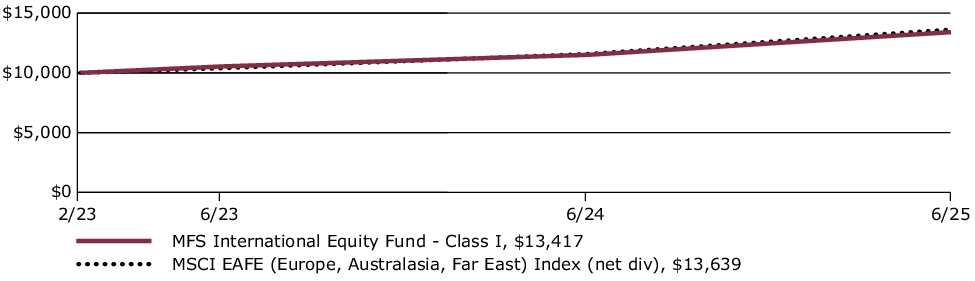

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment* This graph shows the performance of a hypothetical $10,000 investment in Class I over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance. *For the period from the commencement of the class's investment operations, February 8, 2023 through June 30, 2025.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 6/30/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

Life* |

| I without sales charge |

16.58% |

13.05% |

| Comparative Benchmark(s) |

|

|

| MSCI EAFE (Europe, Australasia, Far East) Index (net div) ∆ |

17.73% |

13.84% |

|

* |

For the period from the commencement of the class's investment operations, February 8, 2023 through June 30, 2025. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| Performance Inception Date |

Feb. 08, 2023

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/i for more recent performance information.

|

|

| Net Assets |

$ 28,905,082,239

|

|

| Holdings Count | Holding |

80

|

|

| Advisory Fees Paid, Amount |

$ 146,964,144

|

[2] |

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 6/30/25

| Net Assets ($): |

28,905,082,239 |

|

Total Management Fee ($)#: |

146,964,144 |

| Total Number of Holdings: |

80 |

|

Portfolio Turnover Rate (%): |

13 | # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 6/30/25) Portfolio structure

| Equities |

98.6% |

| Money Market Funds |

1.4% | Top ten holdings

| Hitachi Ltd. |

3.0% |

| SAP SE |

2.9% |

| Air Liquide S.A. |

2.9% |

| Schneider Electric SE |

2.7% |

| Rolls-Royce Holdings PLC |

2.4% |

| Roche Holding AG |

2.3% |

| Compass Group PLC |

2.3% |

| Compagnie Financiere Richemont S.A. |

2.2% |

| Deutsche Boerse AG |

2.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2.1% | Issuer country weightings

| Japan |

19.2% |

| France |

18.5% |

| United Kingdom |

13.8% |

| Switzerland |

12.6% |

| Germany |

9.6% |

| Canada |

3.3% |

| Ireland |

2.8% |

| Denmark |

2.5% |

| Italy |

2.5% |

| Other Countries |

15.2% |

|

|

| Largest Holdings [Text Block] |

Top ten holdings

| Hitachi Ltd. |

3.0% |

| SAP SE |

2.9% |

| Air Liquide S.A. |

2.9% |

| Schneider Electric SE |

2.7% |

| Rolls-Royce Holdings PLC |

2.4% |

| Roche Holding AG |

2.3% |

| Compass Group PLC |

2.3% |

| Compagnie Financiere Richemont S.A. |

2.2% |

| Deutsche Boerse AG |

2.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2.1% |

|

|

| Material Fund Change [Text Block] |

MATERIAL FUND CHANGES This is a summary of certain changes to the fund from July 1, 2024 through June 30, 2025. For more complete information, you may review the fund's prospectus as amended, which is available at funds.mfs.com or upon request at 1‑800‑225‑2606. Effective August 1, 2024, the management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets: 0.75% up to $1 billion; 0.70% in excess of $1 billion and up to $2.5 billion; 0.65% in excess of $2.5 billion and up to $10 billion; 0.60% in excess of $10 billion and up to $20 billion; 0.55% in excess of $20 billion and up to $25 billion; 0.525% in excess of $25 billion.

|

|

| Material Fund Change Expenses [Text Block] |

Effective August 1, 2024, the management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets: 0.75% up to $1 billion; 0.70% in excess of $1 billion and up to $2.5 billion; 0.65% in excess of $2.5 billion and up to $10 billion; 0.60% in excess of $10 billion and up to $20 billion; 0.55% in excess of $20 billion and up to $25 billion; 0.525% in excess of $25 billion.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund from July 1, 2024 through June 30, 2025. For more complete information, you may review the fund's prospectus as amended, which is available at funds.mfs.com or upon request at 1‑800‑225‑2606.

|

|

| Updated Prospectus Phone Number |

1‑800‑225‑2606

|

|

| Updated Prospectus Web Address |

funds.mfs.com

|

|

| C000238581 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® International Equity Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MIEJX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS International Equity Fund for the period of July 1, 2024 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes certain changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| A |

$105 |

0.97% |

|

|

| Expenses Paid, Amount |

$ 105

|

|

| Expense Ratio, Percent |

0.97%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended June 30, 2025, Class A shares of the MFS International Equity Fund (fund) provided a total return of 16.26%, at net asset value. This compares with a return of 17.73% for the fund’s benchmark, the MSCI EAFE (Europe, Australasia, Far East) Index (net div).

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period as the Trump administration imposed, then suspended for 90-days, an array of tariffs on most US trading partners. Sector level tariffs remained in place. A temporary truce was reached separately with China, although tensions remained high as negotiations continued.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

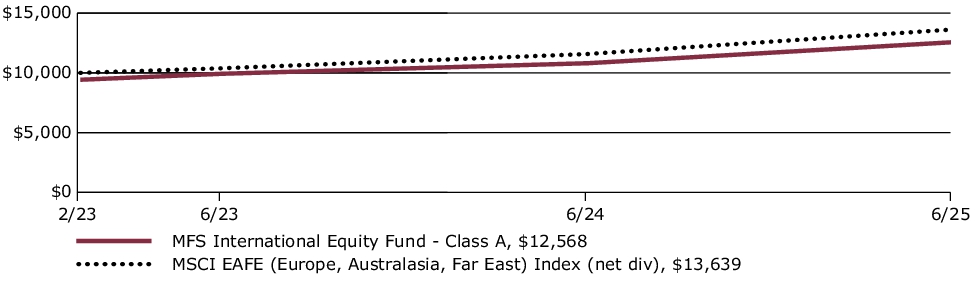

FUND PERFORMANCE The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions. Growth of a Hypothetical $10,000 Investment* This graph shows the performance of a hypothetical $10,000 investment in Class A over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance. This graph includes the deduction of the maximum applicable sales charge. *For the period from the commencement of the class's investment operations, February 8, 2023 through June 30, 2025.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 6/30/25 This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

Life* |

| A without sales charge |

16.26% |

12.76% |

| A with initial sales charge (5.75%) |

9.58% |

10.01% |

| Comparative Benchmark(s) |

|

|

| MSCI EAFE (Europe, Australasia, Far East) Index (net div) ∆ |

17.73% |

13.84% |

|

* |

For the period from the commencement of the class's investment operations, February 8, 2023 through June 30, 2025. |

|

∆ |

Source: FactSet Research Systems Inc. |

|

|

| Performance Inception Date |

Feb. 08, 2023

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/a for more recent performance information.

|

|

| Net Assets |

$ 28,905,082,239

|

|

| Holdings Count | Holding |

80

|

|

| Advisory Fees Paid, Amount |

$ 146,964,144

|

[3] |

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 6/30/25

| Net Assets ($): |

28,905,082,239 |

|

Total Management Fee ($)#: |

146,964,144 |

| Total Number of Holdings: |

80 |

|

Portfolio Turnover Rate (%): |

13 | # Includes the effect of any management fee waivers, if applicable. Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 6/30/25) Portfolio structure

| Equities |

98.6% |

| Money Market Funds |

1.4% | Top ten holdings

| Hitachi Ltd. |

3.0% |

| SAP SE |

2.9% |

| Air Liquide S.A. |

2.9% |

| Schneider Electric SE |

2.7% |

| Rolls-Royce Holdings PLC |

2.4% |

| Roche Holding AG |

2.3% |

| Compass Group PLC |

2.3% |

| Compagnie Financiere Richemont S.A. |

2.2% |

| Deutsche Boerse AG |

2.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2.1% | Issuer country weightings

| Japan |

19.2% |

| France |

18.5% |

| United Kingdom |

13.8% |

| Switzerland |

12.6% |

| Germany |

9.6% |

| Canada |

3.3% |

| Ireland |

2.8% |

| Denmark |

2.5% |

| Italy |

2.5% |

| Other Countries |

15.2% |

|

|

| Largest Holdings [Text Block] |

Top ten holdings

| Hitachi Ltd. |

3.0% |

| SAP SE |

2.9% |

| Air Liquide S.A. |

2.9% |

| Schneider Electric SE |

2.7% |

| Rolls-Royce Holdings PLC |

2.4% |

| Roche Holding AG |

2.3% |

| Compass Group PLC |

2.3% |

| Compagnie Financiere Richemont S.A. |

2.2% |

| Deutsche Boerse AG |

2.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2.1% |

|

|

| Material Fund Change [Text Block] |

MATERIAL FUND CHANGES This is a summary of certain changes to the fund from July 1, 2024 through June 30, 2025. For more complete information, you may review the fund's prospectus as amended, which is available at funds.mfs.com or upon request at 1‑800‑225‑2606. Effective August 1, 2024, the management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets: 0.75% up to $1 billion; 0.70% in excess of $1 billion and up to $2.5 billion; 0.65% in excess of $2.5 billion and up to $10 billion; 0.60% in excess of $10 billion and up to $20 billion; 0.55% in excess of $20 billion and up to $25 billion; 0.525% in excess of $25 billion.

|

|

| Material Fund Change Expenses [Text Block] |

Effective August 1, 2024, the management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets: 0.75% up to $1 billion; 0.70% in excess of $1 billion and up to $2.5 billion; 0.65% in excess of $2.5 billion and up to $10 billion; 0.60% in excess of $10 billion and up to $20 billion; 0.55% in excess of $20 billion and up to $25 billion; 0.525% in excess of $25 billion.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund from July 1, 2024 through June 30, 2025. For more complete information, you may review the fund's prospectus as amended, which is available at funds.mfs.com or upon request at 1‑800‑225‑2606.

|

|

| Updated Prospectus Phone Number |

1‑800‑225‑2606

|

|

| Updated Prospectus Web Address |

funds.mfs.com

|

|

|

|