| Fund | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Bretton Fund | $68 | 1.35%1 |

For the first half of the year, the biggest detractor from the Fund's performance was UnitedHealth Group, which took off 1.8% as it struggled with rising medical costs of its enrollees. Eagle Materials dragged down performance by 0.8% due to weak earnings driven by poor weather and weak demand. Ross Stores hurt performance amid investor concerns over tariffs.

On the positive side, JPMorgan Chase added 1.1% after reporting stronger than expected earnings. Progressive added 1.0%, and AutoZone added 0.9%.

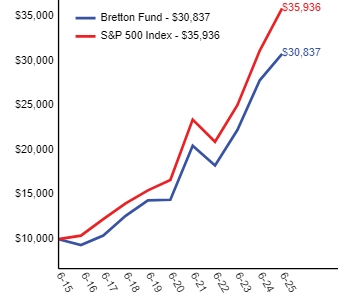

| 1 Year | 5 Years | 10 Years | |

|---|---|---|---|

| Bretton Fund | 10.71% | 16.40% | 11.92% |

| S&P 500 Index | 15.16% | 16.64% | 13.65% |

| Net Assets ($) | $111,149,114 |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) | 0% |

* | Net Assets represents cash equivalents and liabilities in excess of other assets. |

| Alphabet Inc. - Class C | |

| The Progressive Corporation | |

| AutoZone, Inc. | |

| American Express Company | |

| JPMorgan Chase & Co. | |

| Microsoft Corporation | |

| Visa Inc. - Class A | |

| Bank of America Corporation | |

| The TJX Companies, Inc. | |

| MasterCard Incorporated - Class A |

| Alphabet Inc. - Class C | |

| The Progressive Corporation | |

| AutoZone, Inc. | |

| American Express Company | |

| JPMorgan Chase & Co. | |

| Microsoft Corporation | |

| Visa Inc. - Class A | |

| Bank of America Corporation | |

| The TJX Companies, Inc. | |

| MasterCard Incorporated - Class A |