Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

shares

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

DIAMOND HILL FUNDS

|

| Entity Central Index Key |

0001032423

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| Diamond Hill Small Cap Fund | Investor Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Small Cap Fund

|

| Class Name |

Investor

|

| Trading Symbol |

DHSCX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Small Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 63

|

| Expense Ratio, Percent |

1.27%

|

| Factors Affecting Performance [Text Block] |

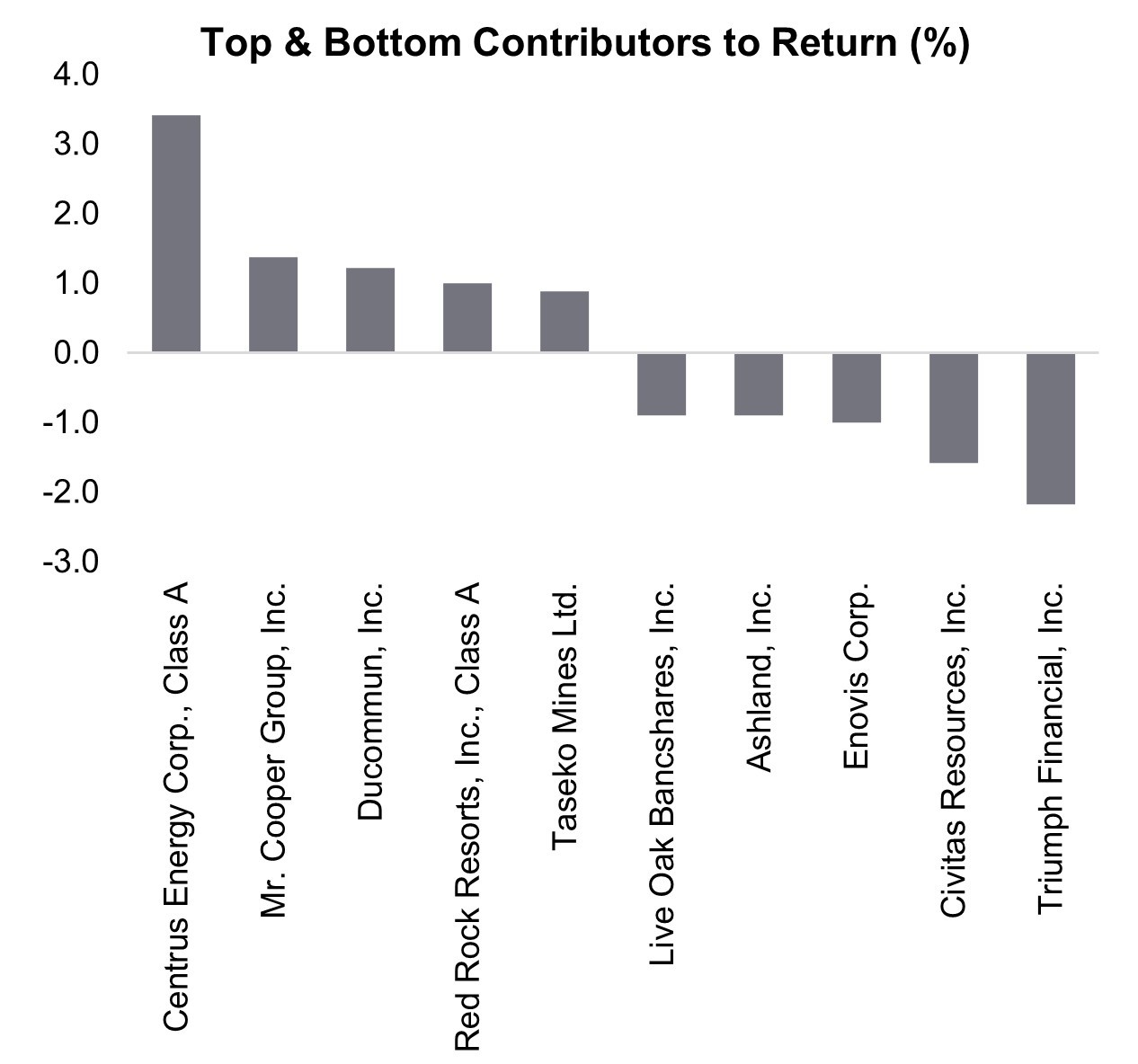

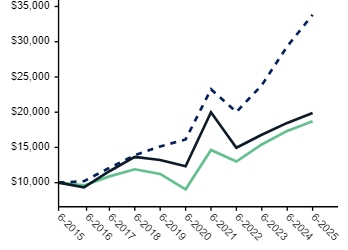

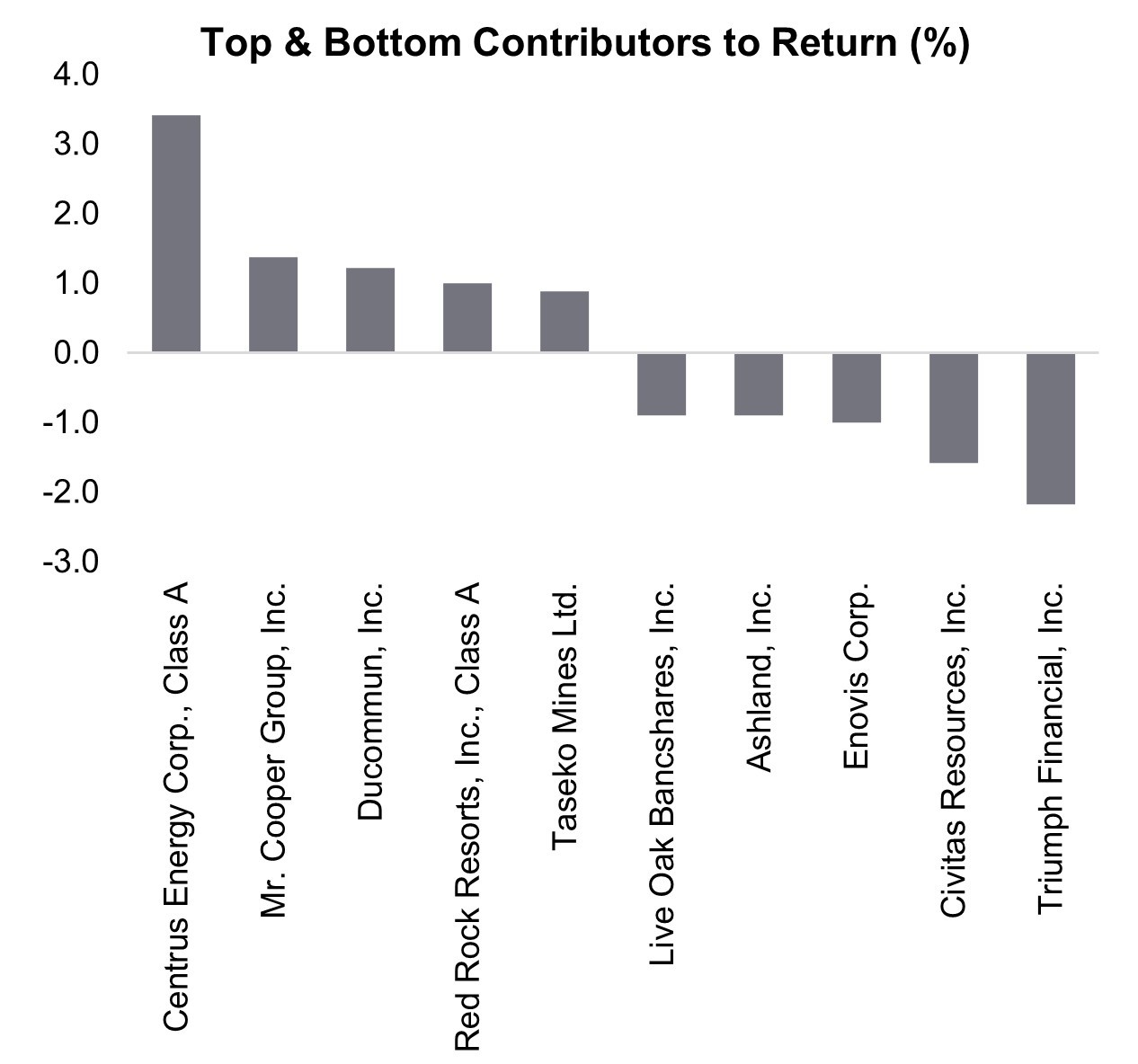

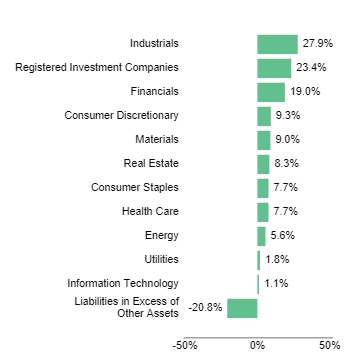

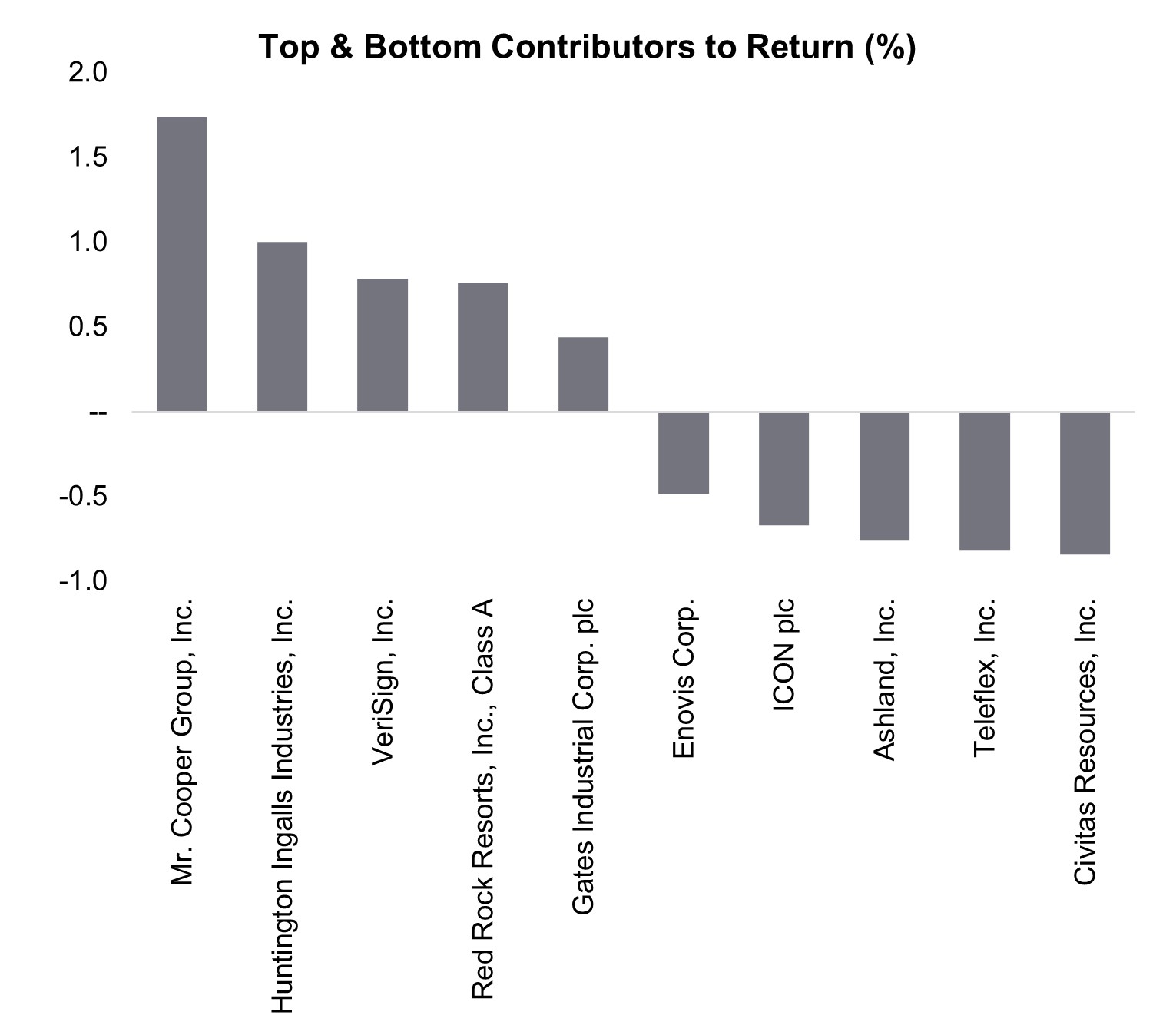

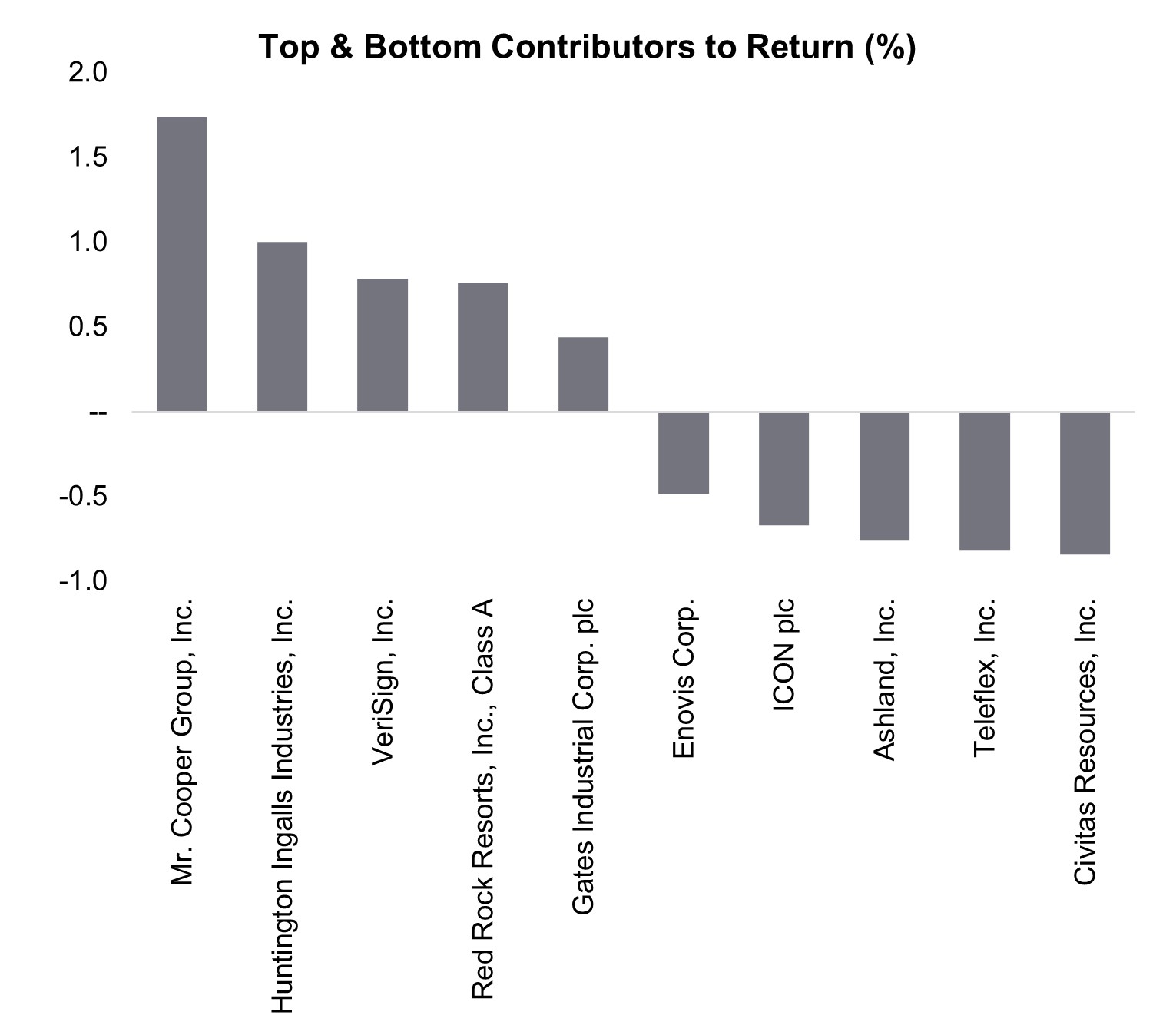

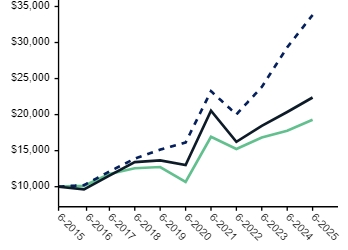

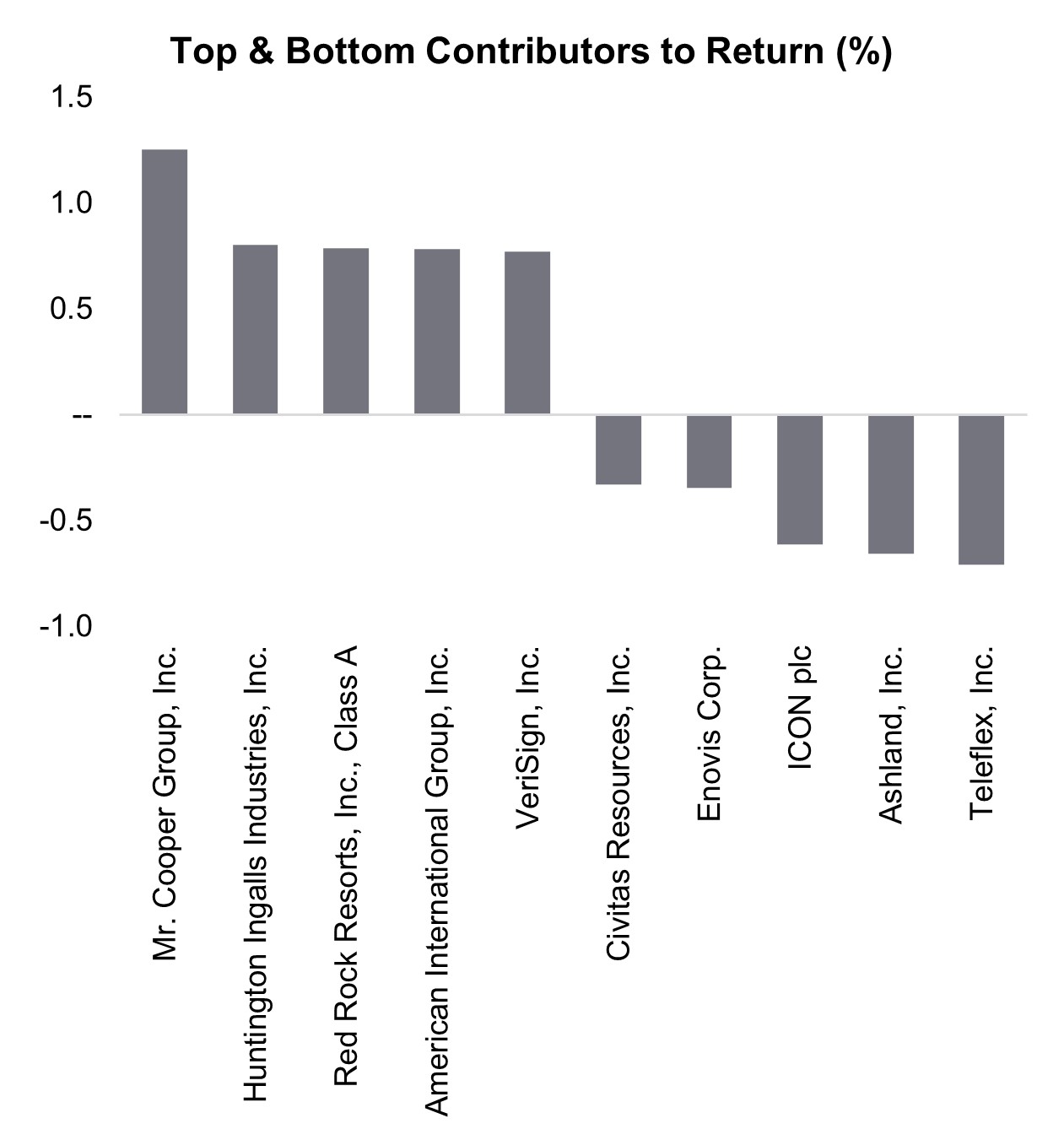

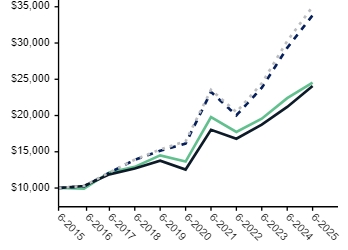

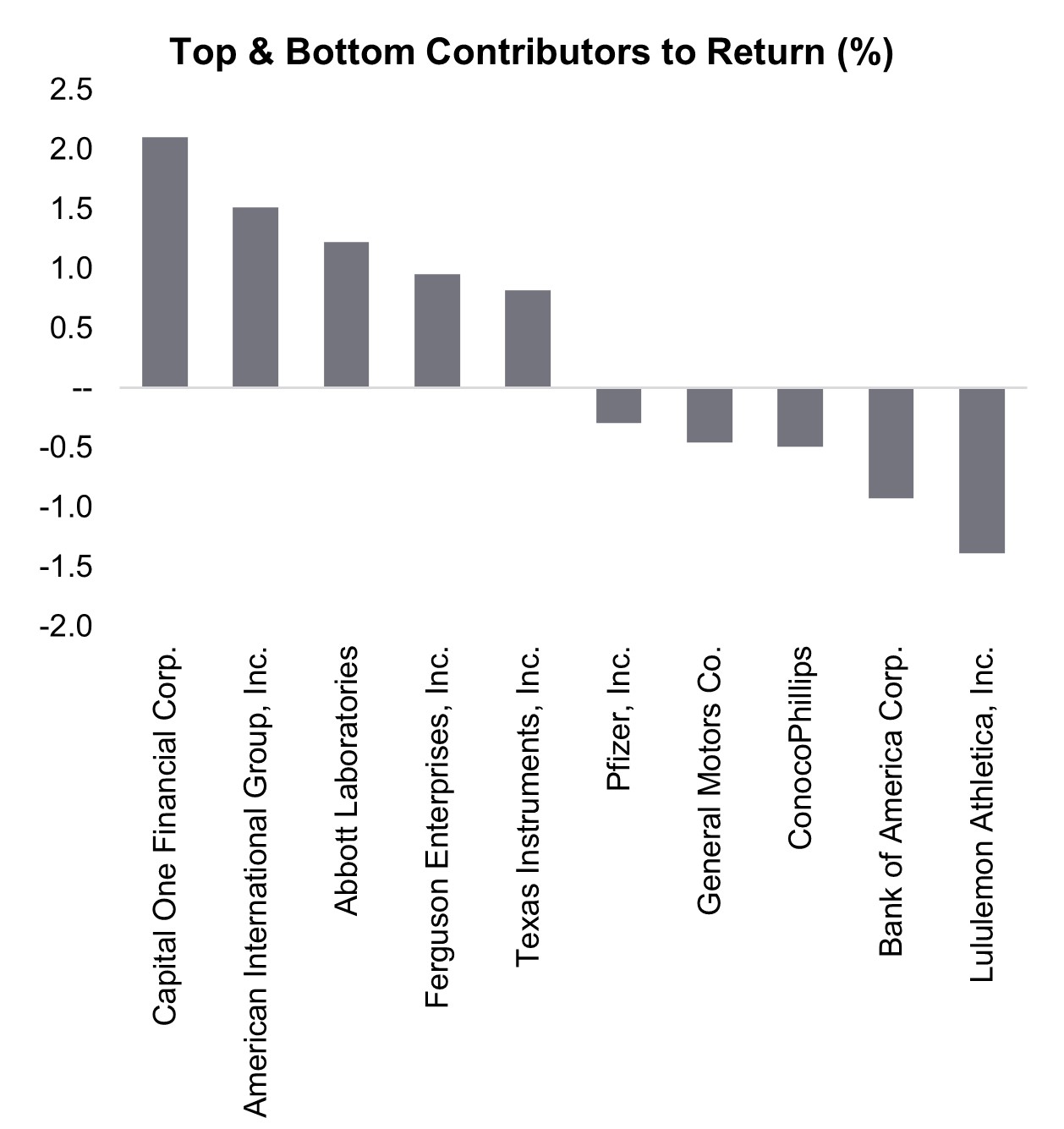

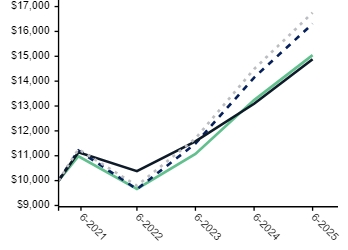

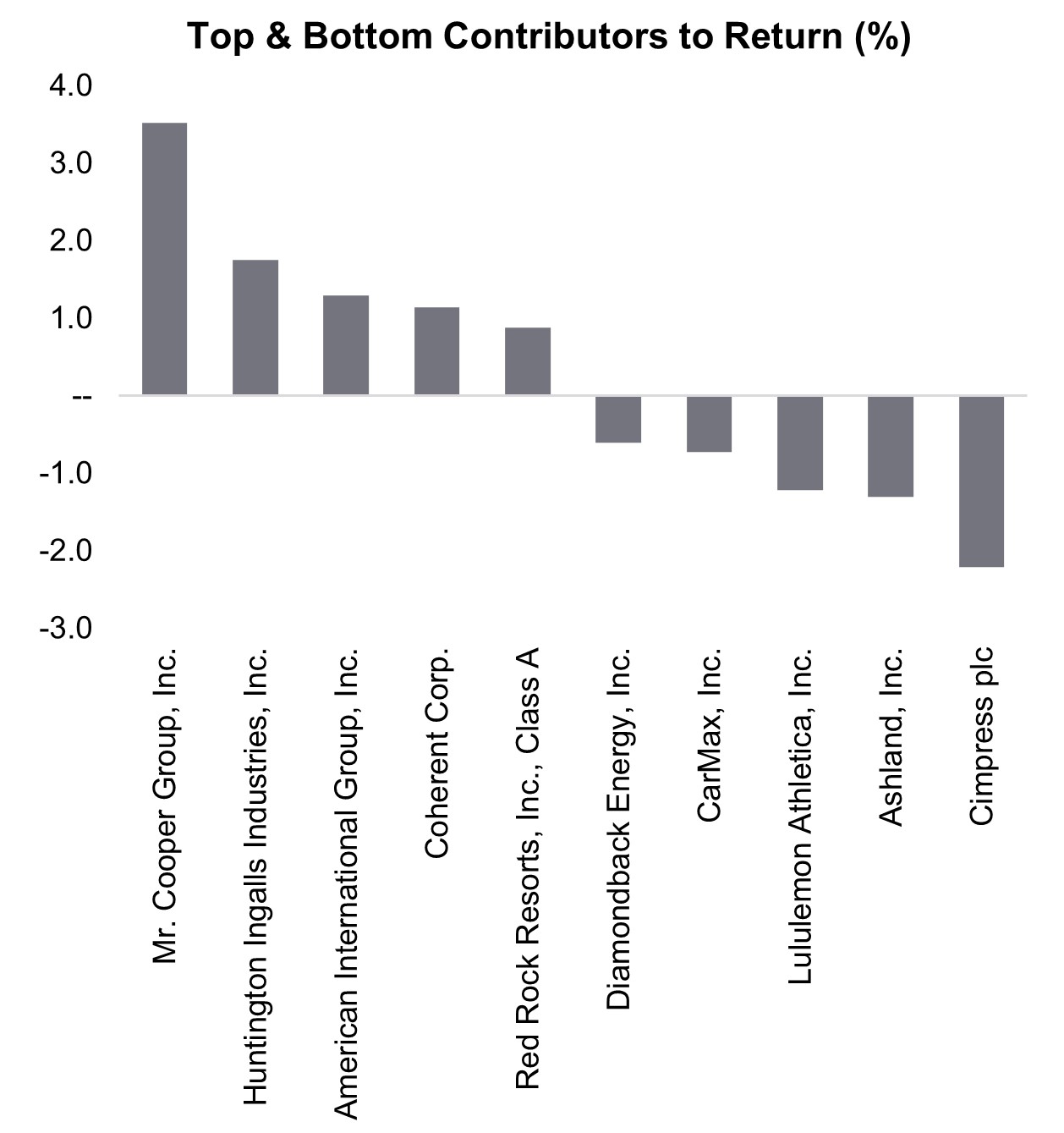

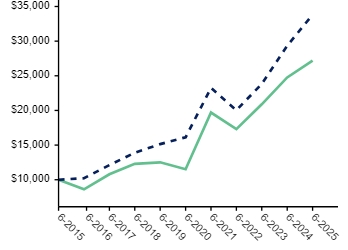

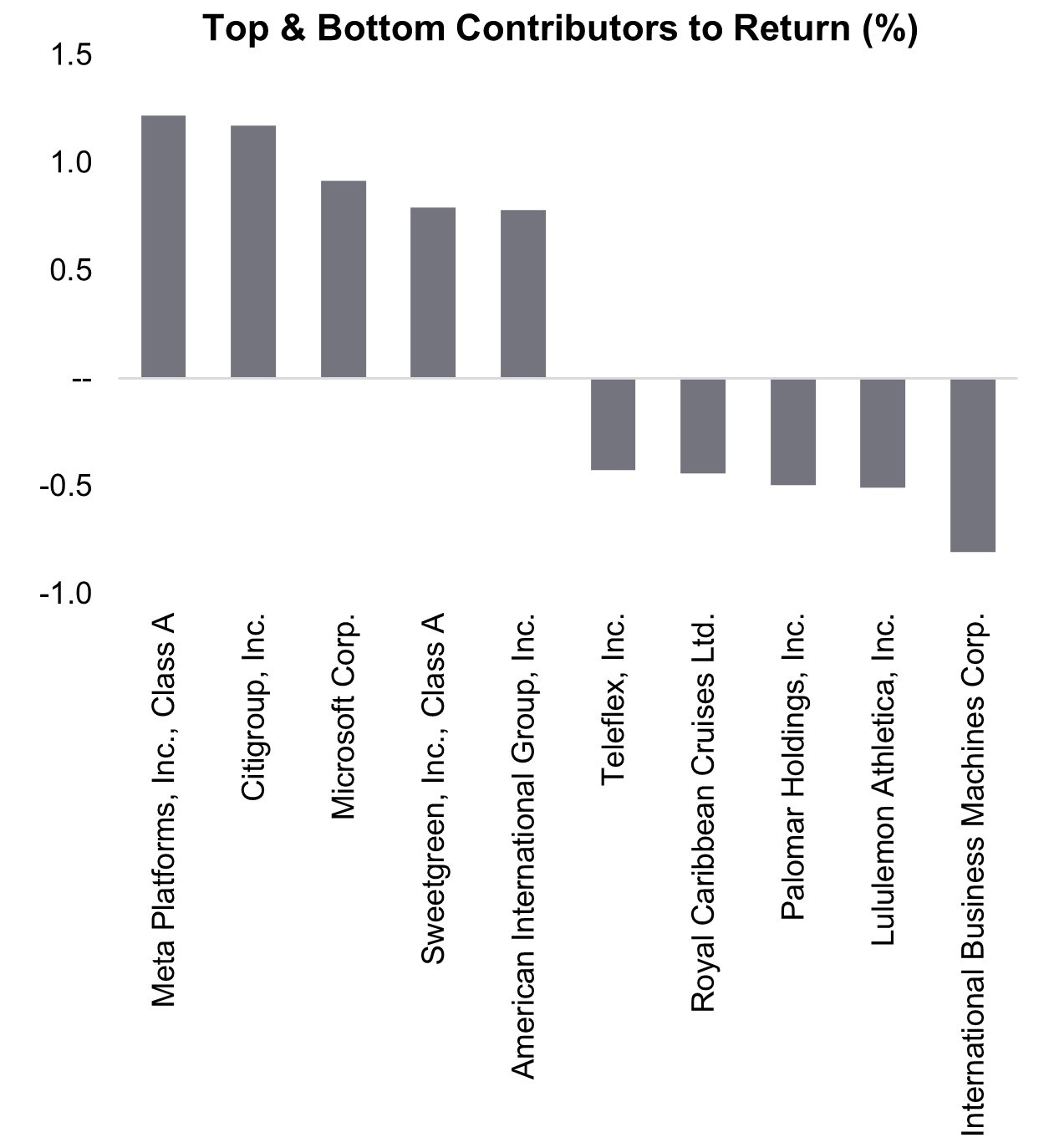

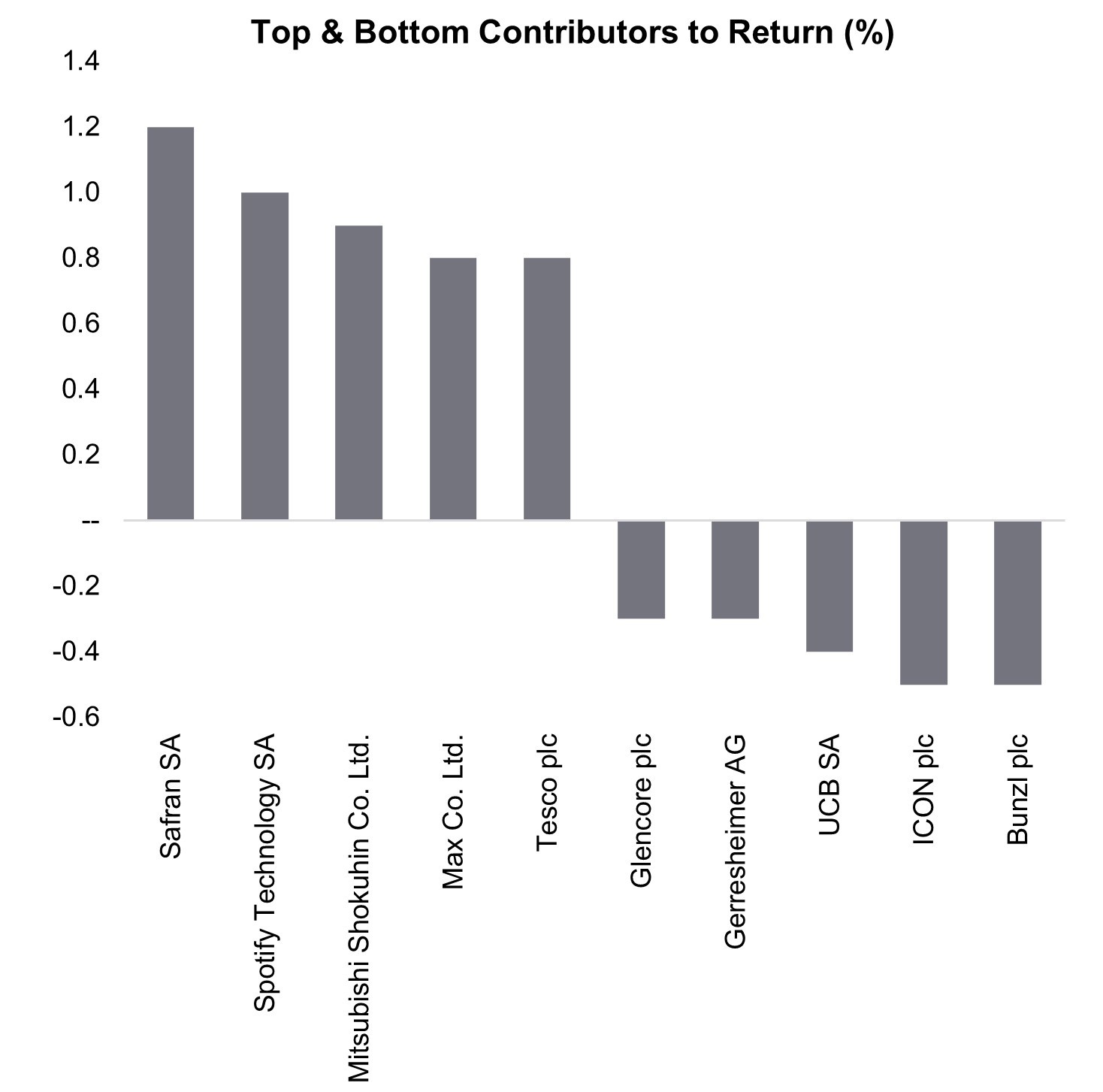

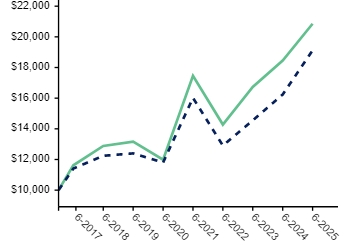

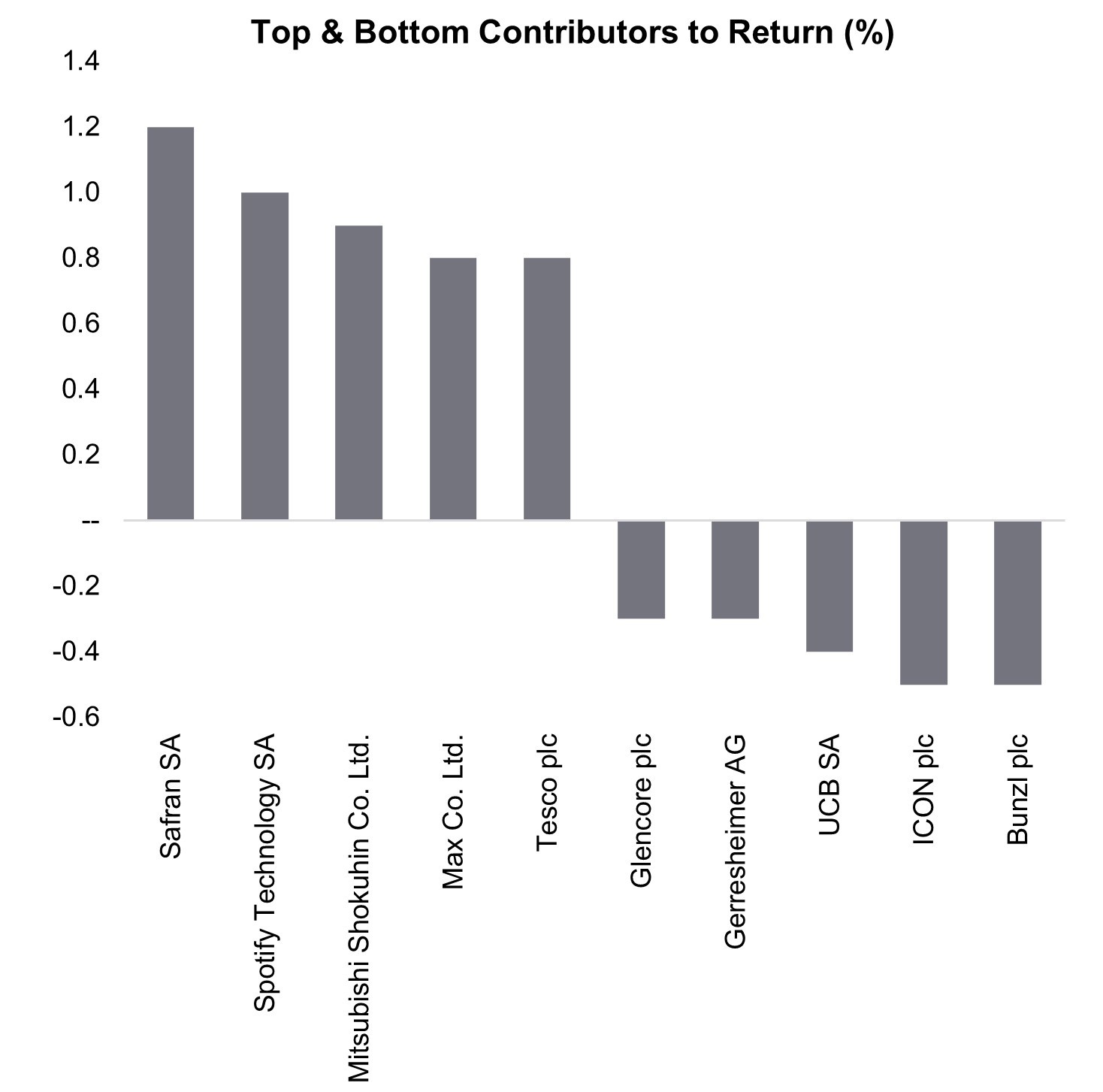

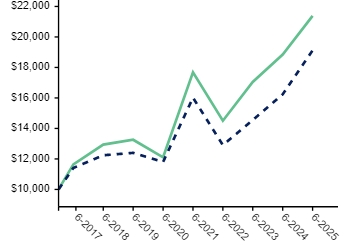

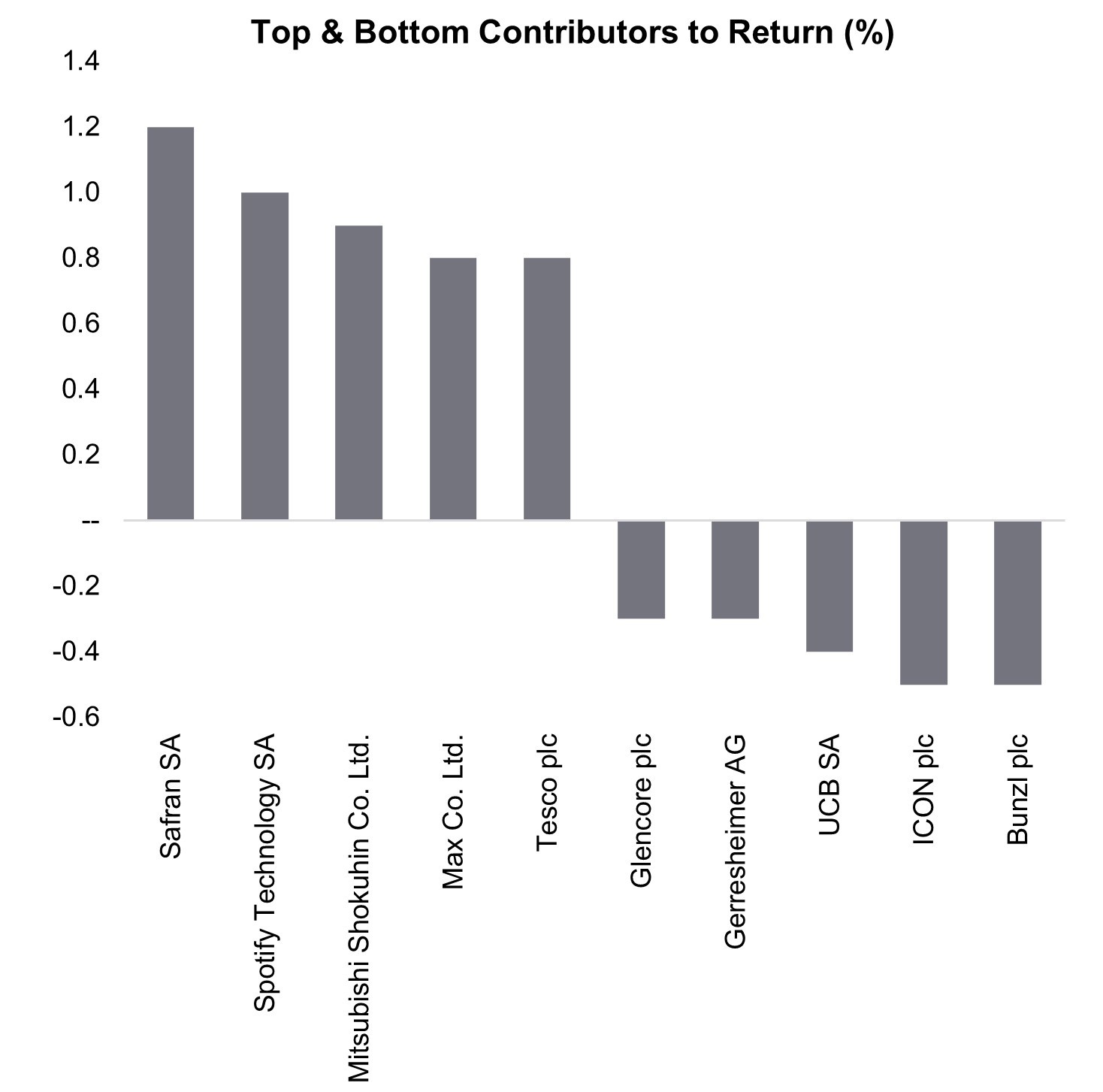

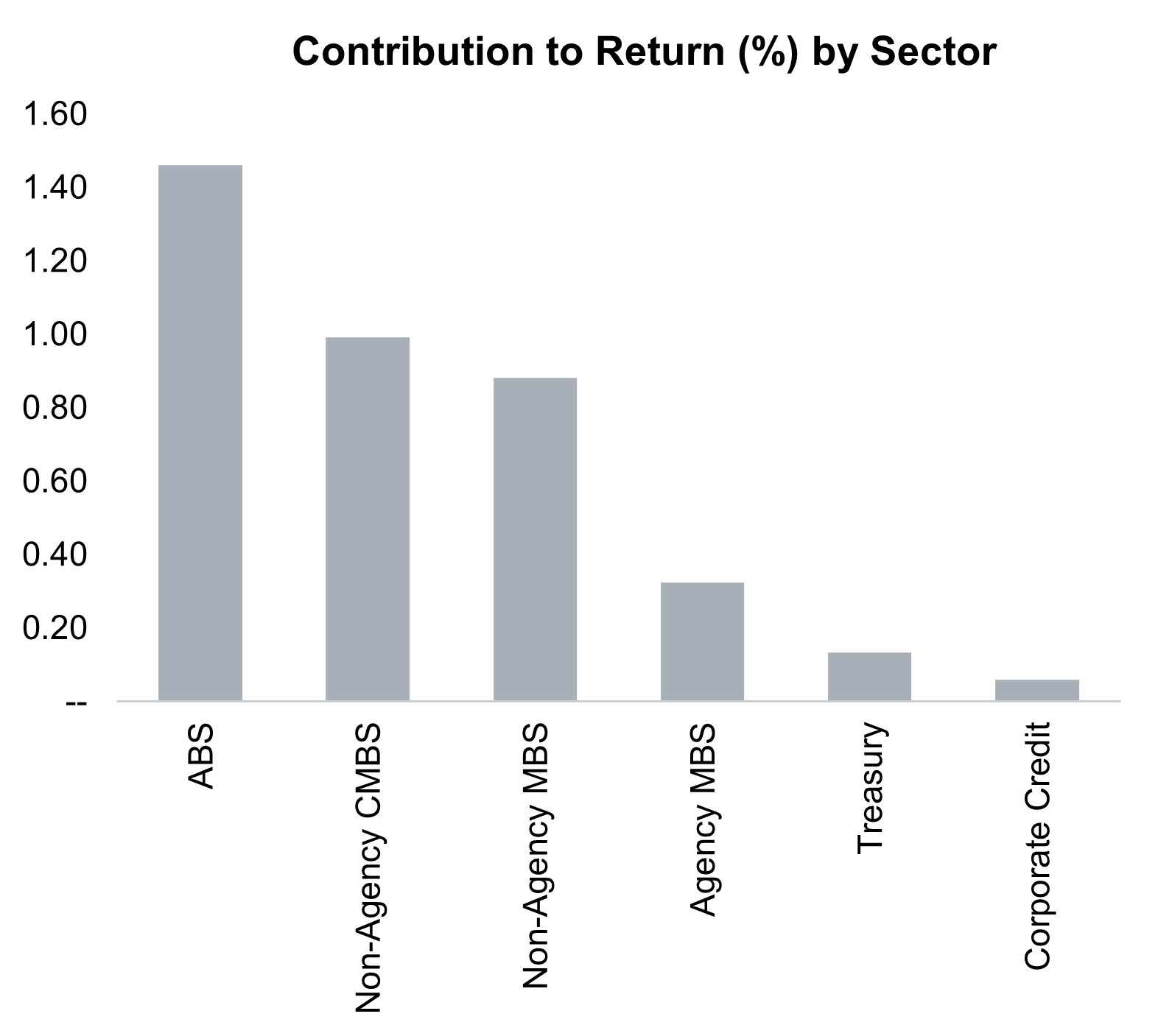

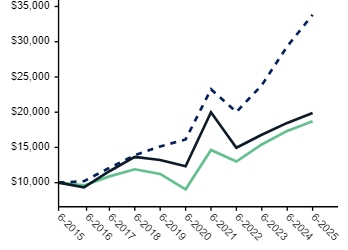

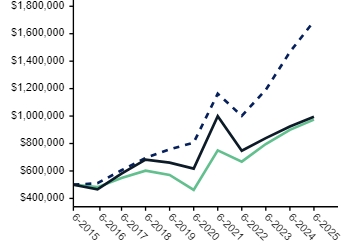

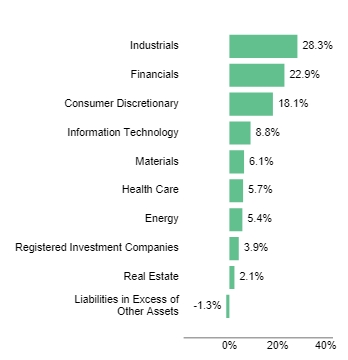

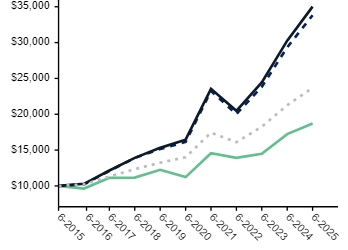

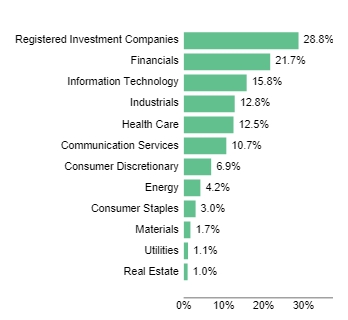

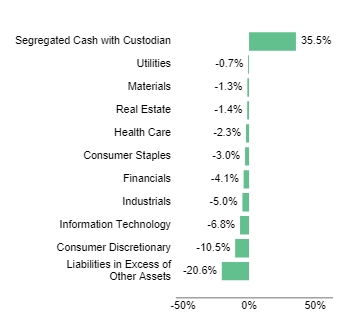

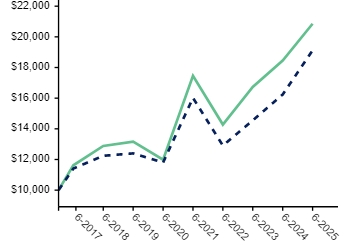

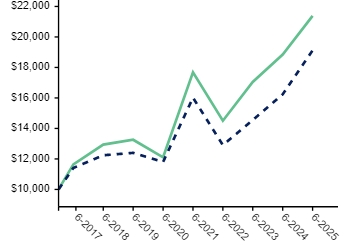

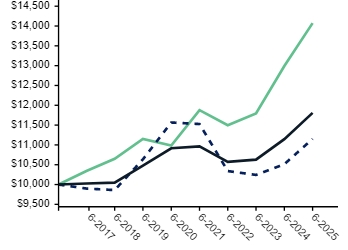

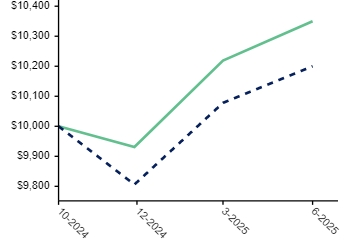

The Fund (Ticker: DHSCX) returned -1.35% for the 6-month period ended June 30, 2025. Over that same period, the Russell 2000 Index returned -1.79%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

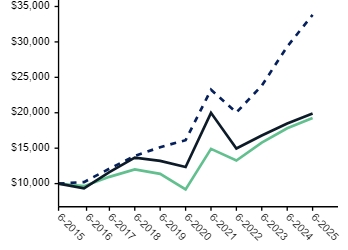

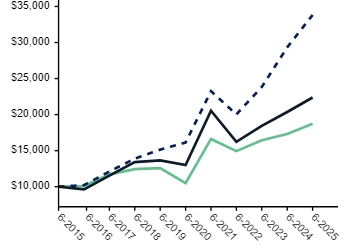

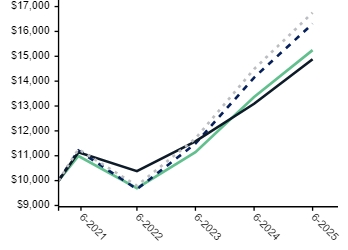

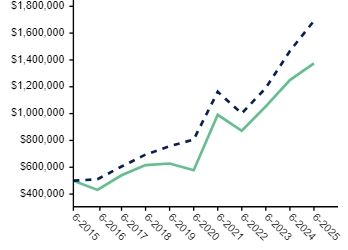

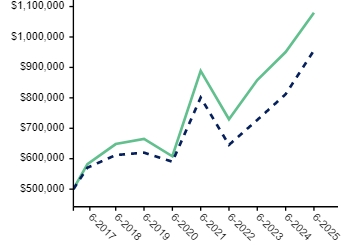

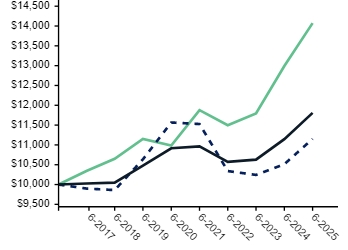

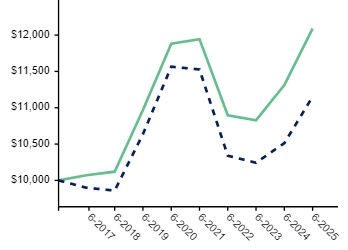

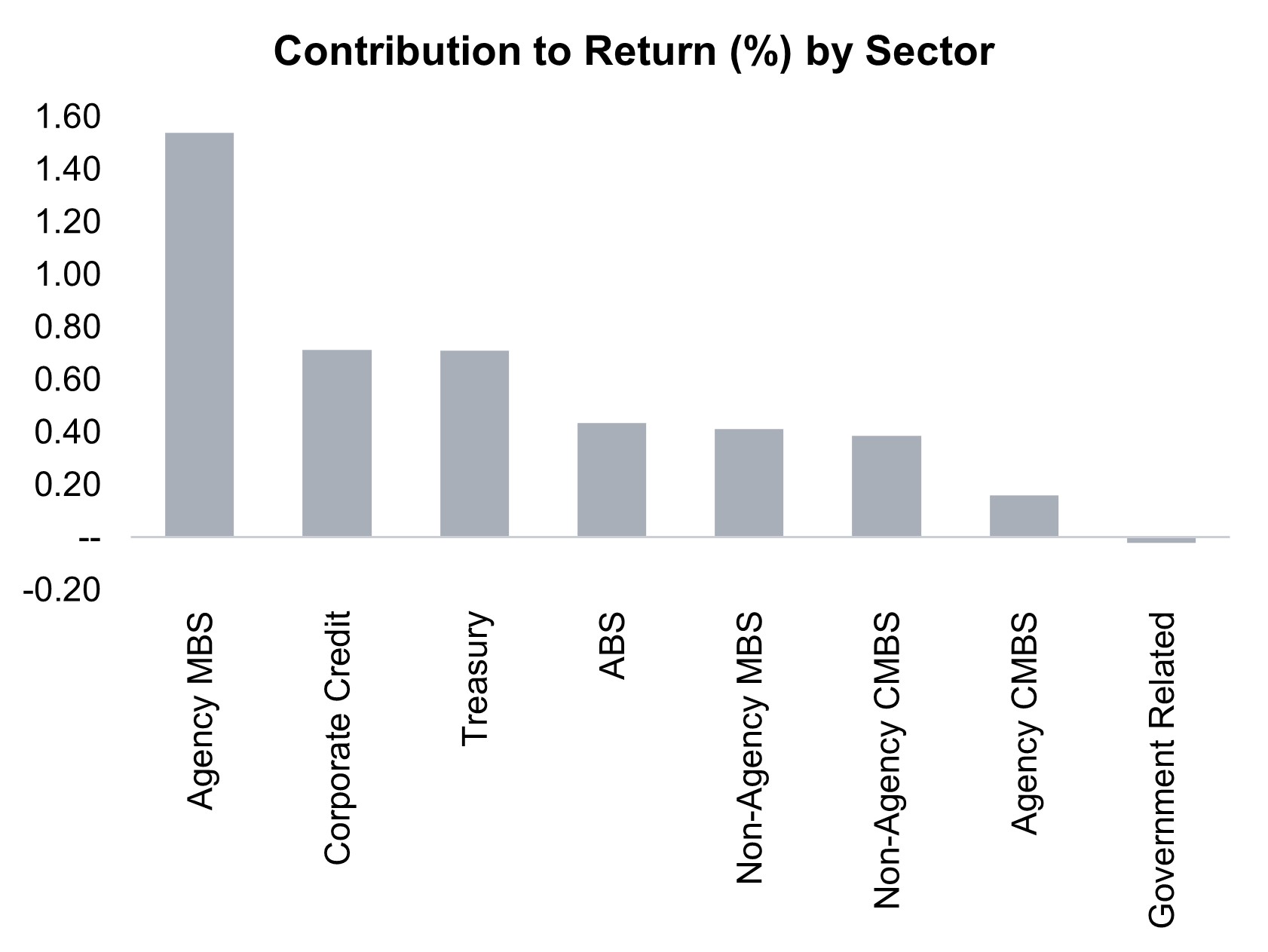

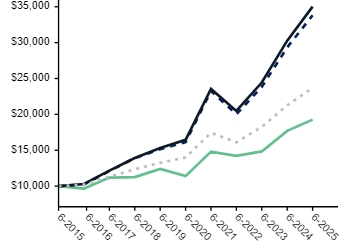

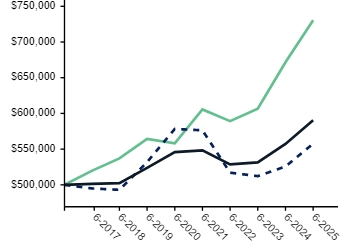

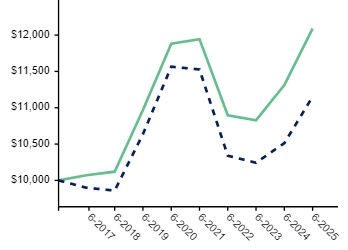

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Investor |

-1.35%

|

7.83%

|

15.61%

|

6.46%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Index |

-1.79

|

7.68

|

10.04

|

7.12

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 205,151,858

|

| Holdings Count | shares |

60

|

| Advisory Fees Paid, Amount |

$ 849,449

|

| Investment Company, Portfolio Turnover |

36.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$205,151,858 |

| Number of Portfolio Holdings |

60 |

| Portfolio Turnover Rate |

36% |

| Total Advisory Fees Paid |

$849,449 |

|

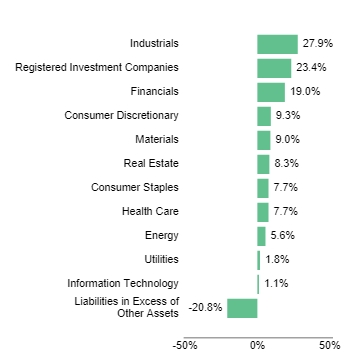

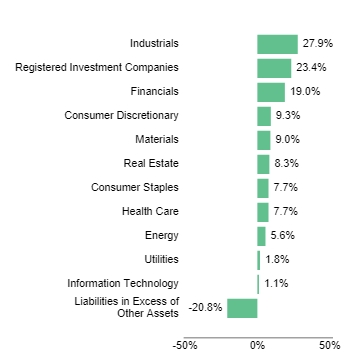

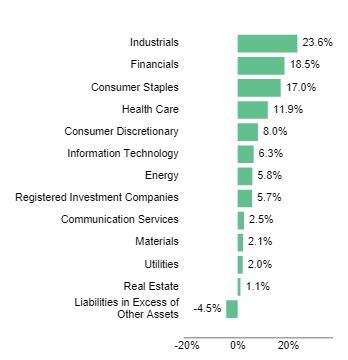

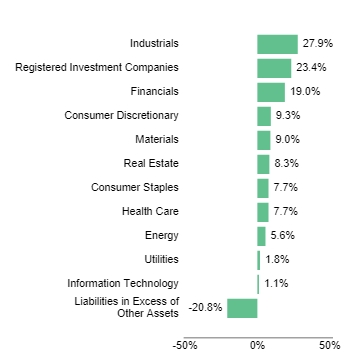

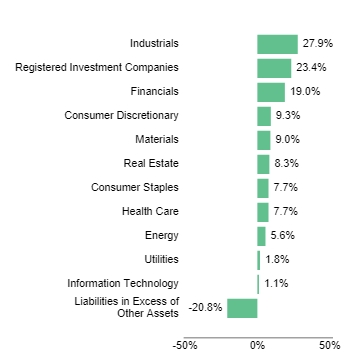

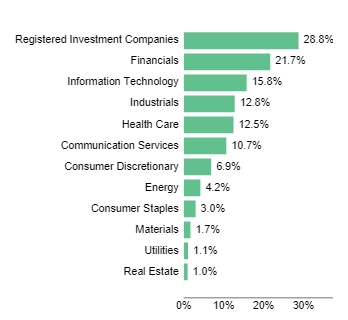

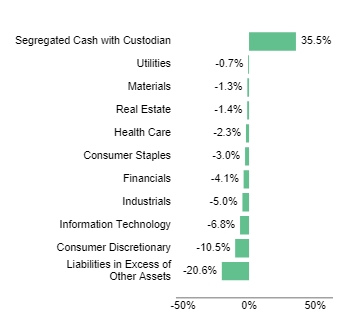

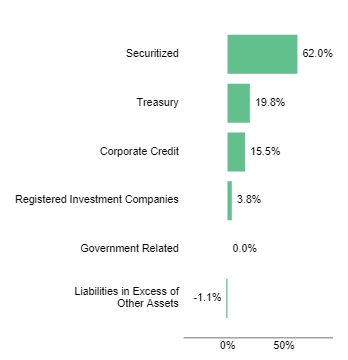

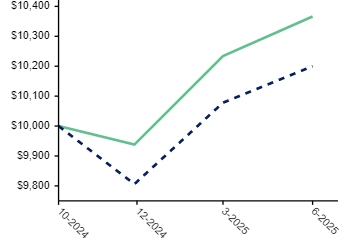

| Holdings [Text Block] |

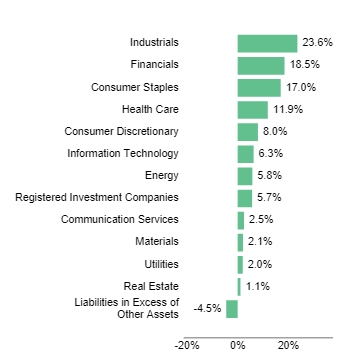

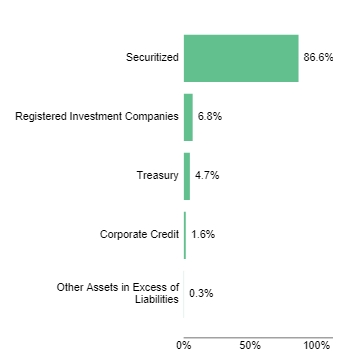

|

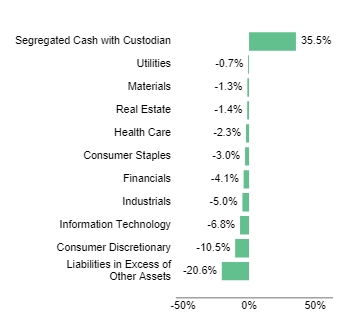

Industrials

|

27.9% |

|

Registered Investment Companies

|

23.4% |

|

Financials

|

19.0% |

|

Consumer Discretionary

|

9.3% |

|

Materials

|

9.0% |

|

Real Estate

|

8.3% |

|

Consumer Staples

|

7.7% |

|

Health Care

|

7.7% |

|

Energy

|

5.6% |

|

Utilities

|

1.8% |

|

Information Technology

|

1.1% |

|

Liabilities in Excess of Other Assets

|

-20.8% |

|

Red Rock Resorts, Inc. Class A

|

6.2 |

|

Ryman Hospitality Properties, Inc.

|

4.5 |

|

Ducommun, Inc.

|

4.3 |

|

Bank OZK

|

4.0 |

|

Triumph Financial, Inc.

|

3.7 |

|

Mr. Cooper Group, Inc.

|

3.4 |

|

Astrana Health, Inc.

|

2.9 |

|

Live Oak Bancshares, Inc.

|

2.9 |

|

Graham Corp.

|

2.8 |

|

United States Lime & Minerals, Inc.

|

2.8 |

|

| Largest Holdings [Text Block] |

|

Red Rock Resorts, Inc. Class A

|

6.2 |

|

Ryman Hospitality Properties, Inc.

|

4.5 |

|

Ducommun, Inc.

|

4.3 |

|

Bank OZK

|

4.0 |

|

Triumph Financial, Inc.

|

3.7 |

|

Mr. Cooper Group, Inc.

|

3.4 |

|

Astrana Health, Inc.

|

2.9 |

|

Live Oak Bancshares, Inc.

|

2.9 |

|

Graham Corp.

|

2.8 |

|

United States Lime & Minerals, Inc.

|

2.8 |

|

| Diamond Hill Small Cap Fund | Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Small Cap Fund

|

| Class Name |

Class I

|

| Trading Symbol |

DHSIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Small Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 48

|

| Expense Ratio, Percent |

0.98%

|

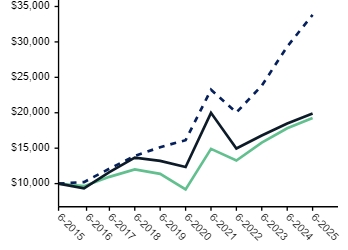

| Factors Affecting Performance [Text Block] |

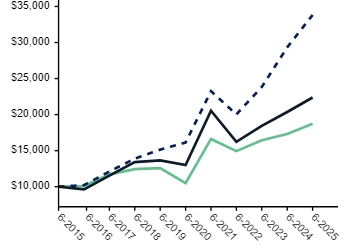

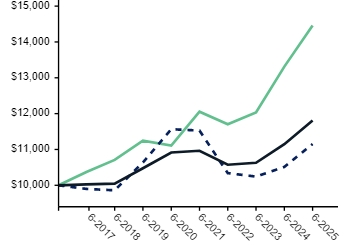

The Fund (Ticker: DHSIX) returned -1.17% for the 6-month period ended June 30, 2025. Over that same period, the Russell 2000 Index returned -1.79%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

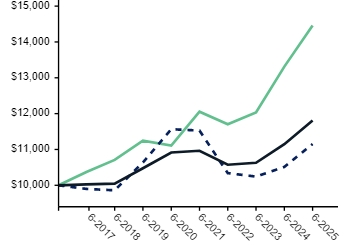

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class I |

-1.17%

|

8.16%

|

15.94%

|

6.77%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Index |

-1.79

|

7.68

|

10.04

|

7.12

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 205,151,858

|

| Holdings Count | shares |

60

|

| Advisory Fees Paid, Amount |

$ 849,449

|

| Investment Company, Portfolio Turnover |

36.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$205,151,858 |

| Number of Portfolio Holdings |

60 |

| Portfolio Turnover Rate |

36% |

| Total Advisory Fees Paid |

$849,449 |

|

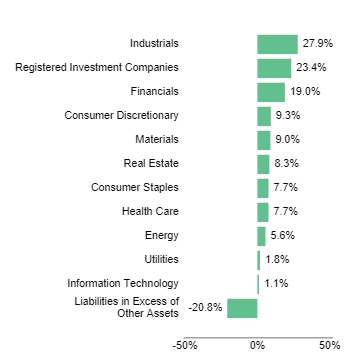

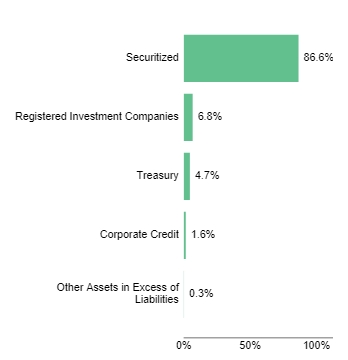

| Holdings [Text Block] |

|

Industrials

|

27.9% |

|

Registered Investment Companies

|

23.4% |

|

Financials

|

19.0% |

|

Consumer Discretionary

|

9.3% |

|

Materials

|

9.0% |

|

Real Estate

|

8.3% |

|

Consumer Staples

|

7.7% |

|

Health Care

|

7.7% |

|

Energy

|

5.6% |

|

Utilities

|

1.8% |

|

Information Technology

|

1.1% |

|

Liabilities in Excess of Other Assets

|

-20.8% |

|

Red Rock Resorts, Inc. Class A

|

6.2 |

|

Ryman Hospitality Properties, Inc.

|

4.5 |

|

Ducommun, Inc.

|

4.3 |

|

Bank OZK

|

4.0 |

|

Triumph Financial, Inc.

|

3.7 |

|

Mr. Cooper Group, Inc.

|

3.4 |

|

Astrana Health, Inc.

|

2.9 |

|

Live Oak Bancshares, Inc.

|

2.9 |

|

Graham Corp.

|

2.8 |

|

United States Lime & Minerals, Inc.

|

2.8 |

|

| Largest Holdings [Text Block] |

|

Red Rock Resorts, Inc. Class A

|

6.2 |

|

Ryman Hospitality Properties, Inc.

|

4.5 |

|

Ducommun, Inc.

|

4.3 |

|

Bank OZK

|

4.0 |

|

Triumph Financial, Inc.

|

3.7 |

|

Mr. Cooper Group, Inc.

|

3.4 |

|

Astrana Health, Inc.

|

2.9 |

|

Live Oak Bancshares, Inc.

|

2.9 |

|

Graham Corp.

|

2.8 |

|

United States Lime & Minerals, Inc.

|

2.8 |

|

| Diamond Hill Small Cap Fund | Class Y |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Small Cap Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

DHSYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Small Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 42

|

| Expense Ratio, Percent |

0.86%

|

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHSYX) returned -1.13% for the 6-month period ended June 30, 2025. Over that same period, the Russell 2000 Index returned -1.79%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class Y |

-1.13%

|

8.30%

|

16.09%

|

6.90%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 2000 Index |

-1.79

|

7.68

|

10.04

|

7.12

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 205,151,858

|

| Holdings Count | shares |

60

|

| Advisory Fees Paid, Amount |

$ 849,449

|

| Investment Company, Portfolio Turnover |

36.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$205,151,858 |

| Number of Portfolio Holdings |

60 |

| Portfolio Turnover Rate |

36% |

| Total Advisory Fees Paid |

$849,449 |

|

| Holdings [Text Block] |

|

Industrials

|

27.9% |

|

Registered Investment Companies

|

23.4% |

|

Financials

|

19.0% |

|

Consumer Discretionary

|

9.3% |

|

Materials

|

9.0% |

|

Real Estate

|

8.3% |

|

Consumer Staples

|

7.7% |

|

Health Care

|

7.7% |

|

Energy

|

5.6% |

|

Utilities

|

1.8% |

|

Information Technology

|

1.1% |

|

Liabilities in Excess of Other Assets

|

-20.8% |

|

Red Rock Resorts, Inc. Class A

|

6.2 |

|

Ryman Hospitality Properties, Inc.

|

4.5 |

|

Ducommun, Inc.

|

4.3 |

|

Bank OZK

|

4.0 |

|

Triumph Financial, Inc.

|

3.7 |

|

Mr. Cooper Group, Inc.

|

3.4 |

|

Astrana Health, Inc.

|

2.9 |

|

Live Oak Bancshares, Inc.

|

2.9 |

|

Graham Corp.

|

2.8 |

|

United States Lime & Minerals, Inc.

|

2.8 |

|

| Largest Holdings [Text Block] |

|

Red Rock Resorts, Inc. Class A

|

6.2 |

|

Ryman Hospitality Properties, Inc.

|

4.5 |

|

Ducommun, Inc.

|

4.3 |

|

Bank OZK

|

4.0 |

|

Triumph Financial, Inc.

|

3.7 |

|

Mr. Cooper Group, Inc.

|

3.4 |

|

Astrana Health, Inc.

|

2.9 |

|

Live Oak Bancshares, Inc.

|

2.9 |

|

Graham Corp.

|

2.8 |

|

United States Lime & Minerals, Inc.

|

2.8 |

|

| Diamond Hill Small-Mid Cap Fund | Investor Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Small-Mid Cap Fund

|

| Class Name |

Investor

|

| Trading Symbol |

DHMAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Small-Mid Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 60

|

| Expense Ratio, Percent |

1.21%

|

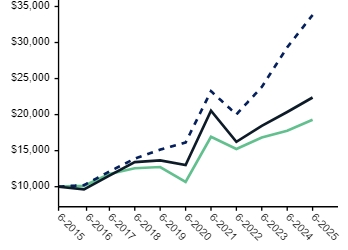

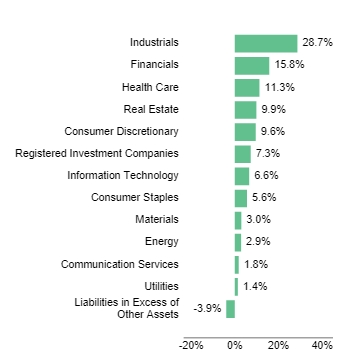

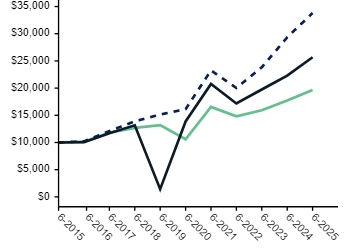

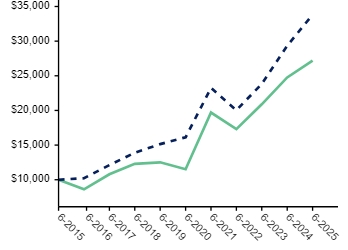

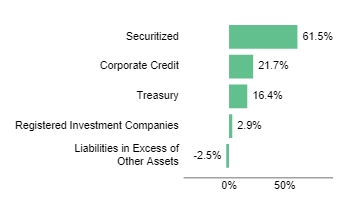

| Factors Affecting Performance [Text Block] |

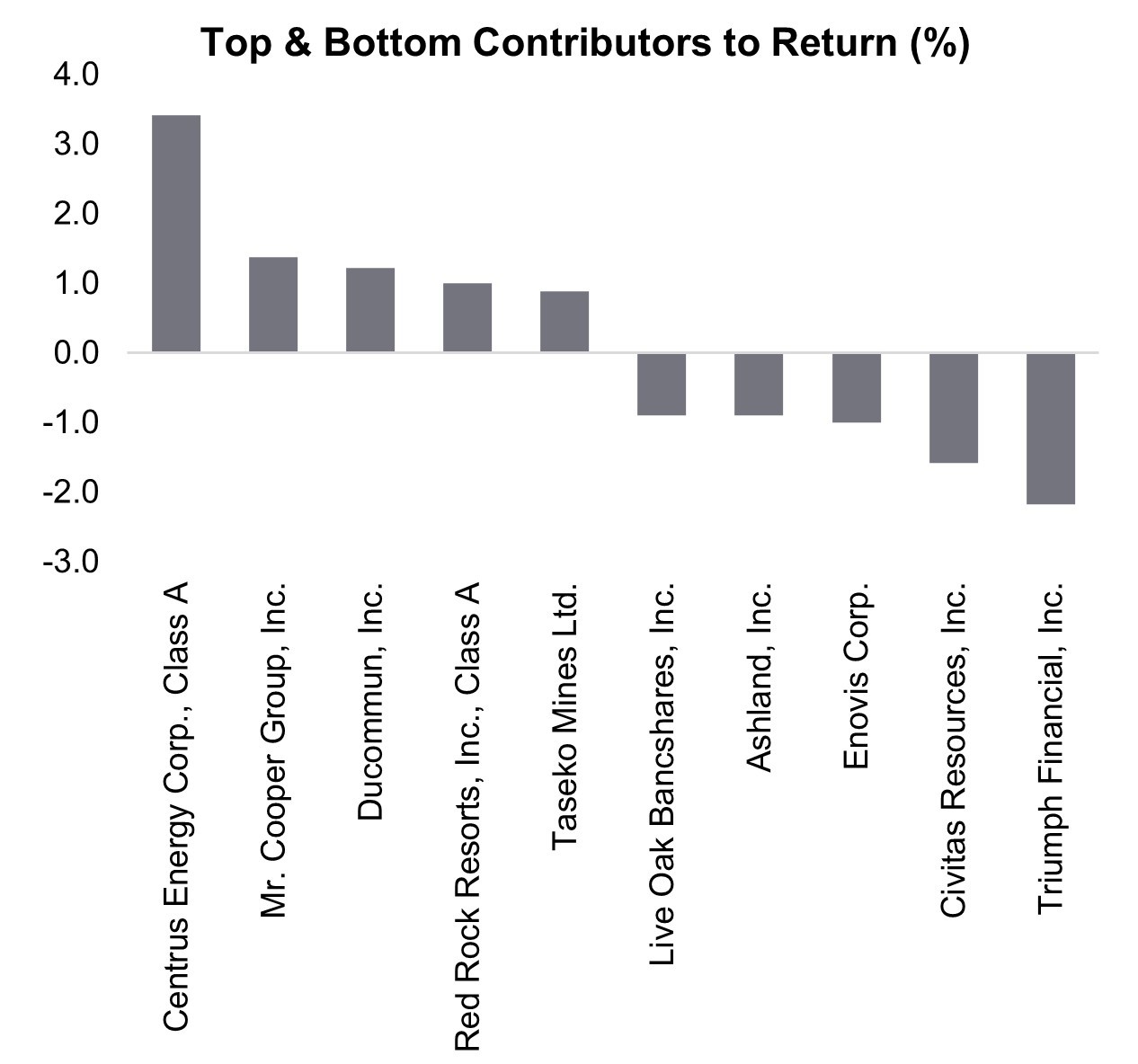

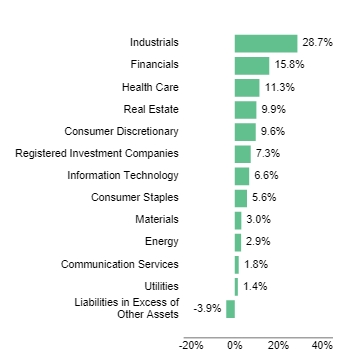

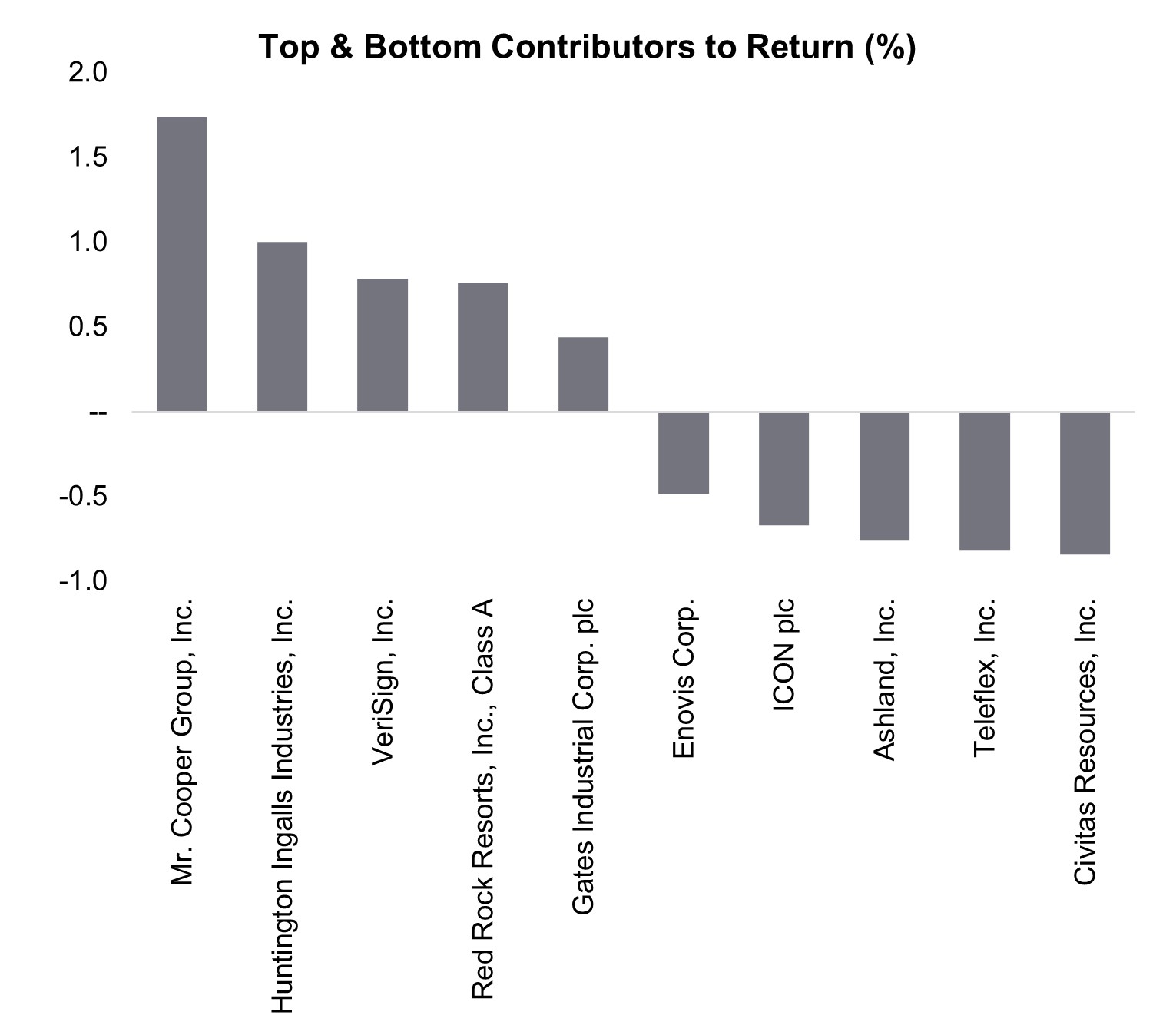

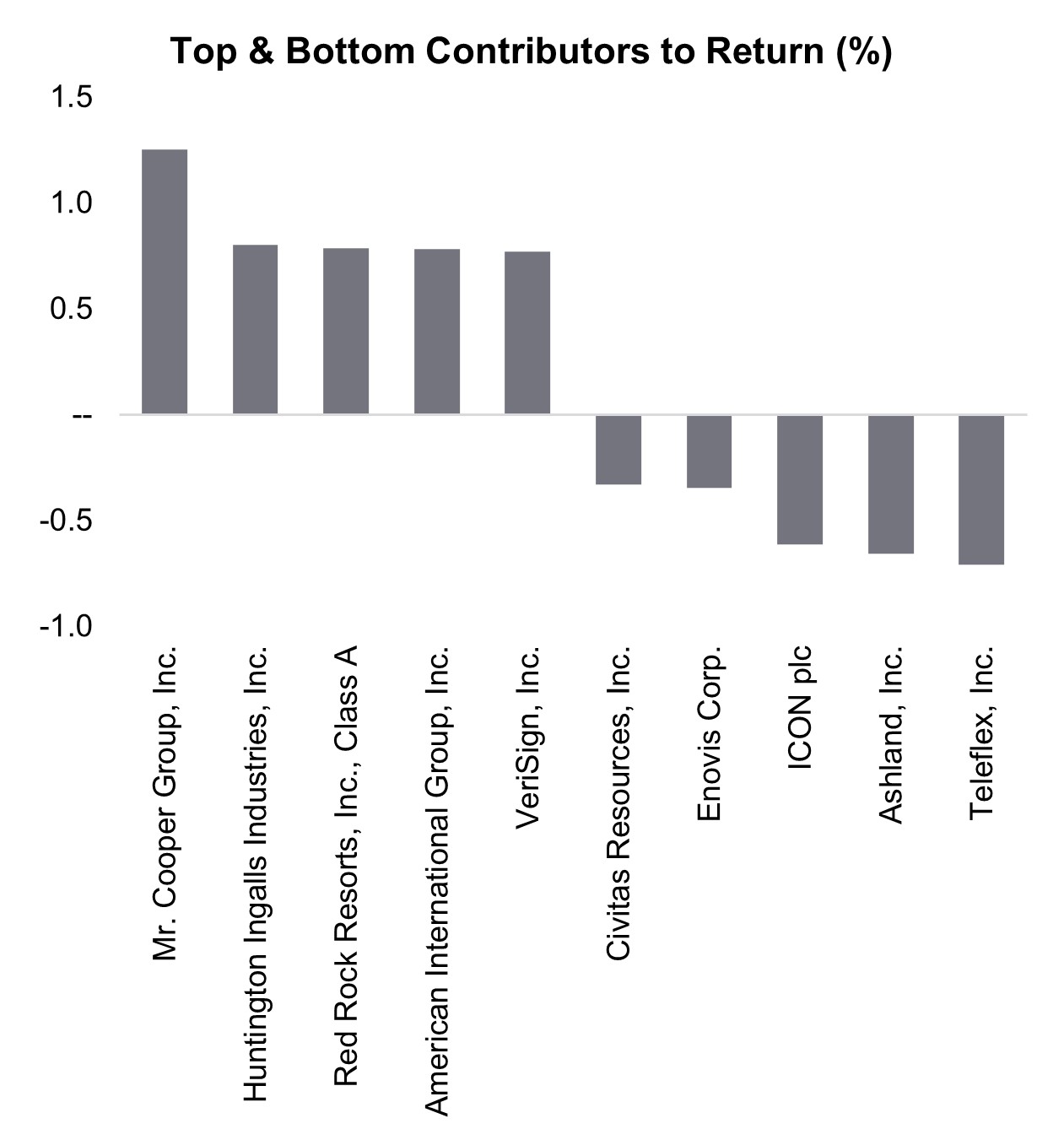

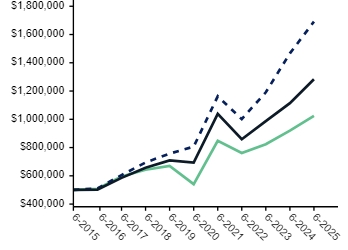

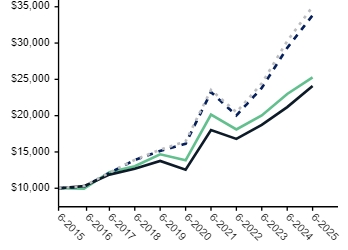

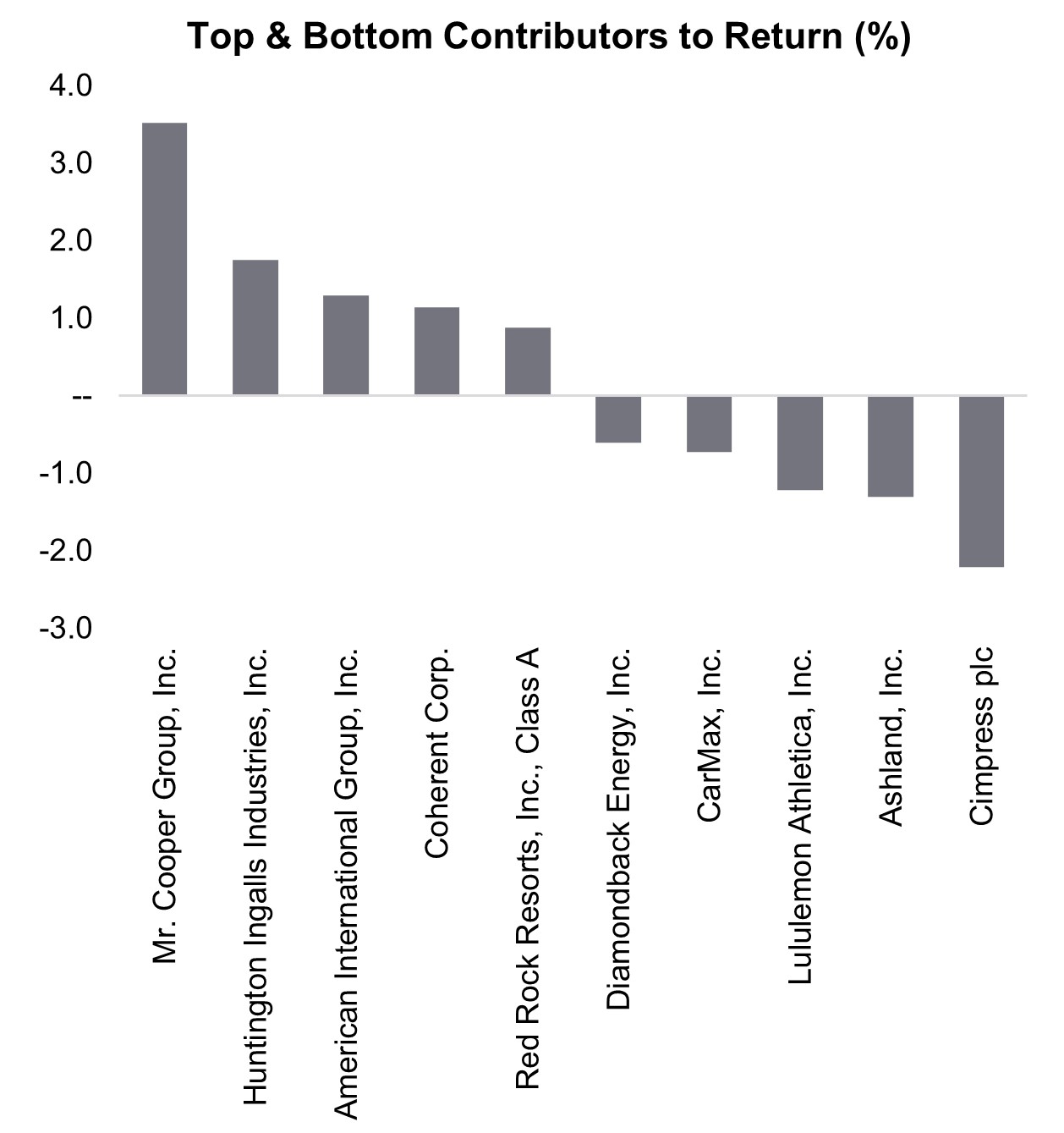

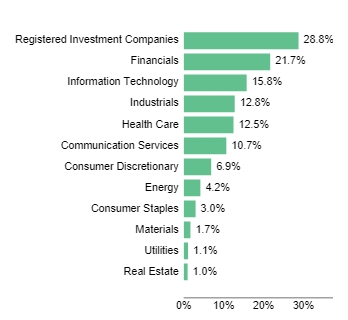

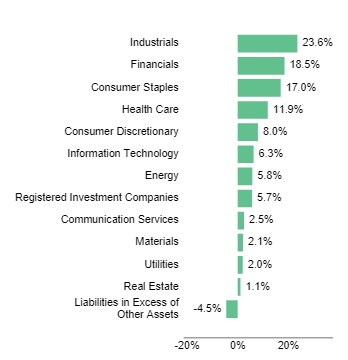

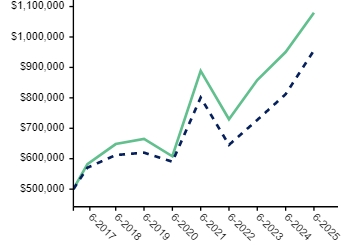

The Fund (Ticker: DHMAX) returned 0.94% for the 6-month period ended June 30, 2025. Over that same period, the Russell 2500 Index returned 0.44%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

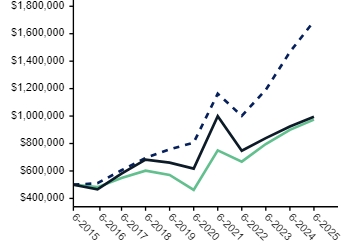

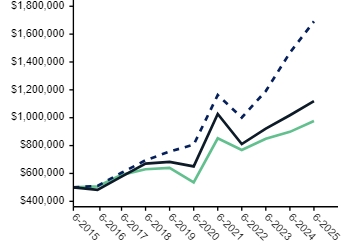

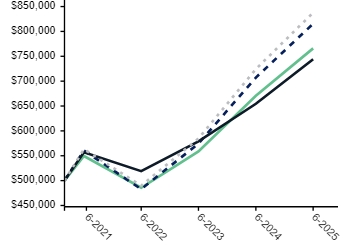

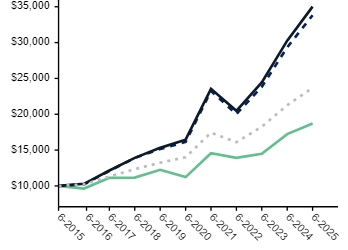

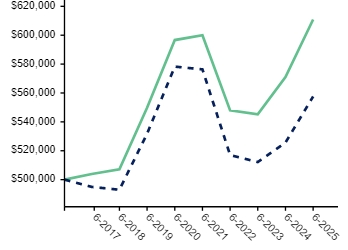

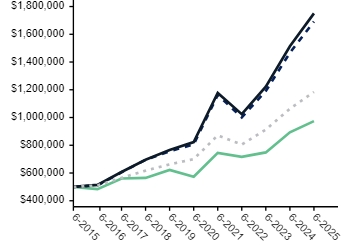

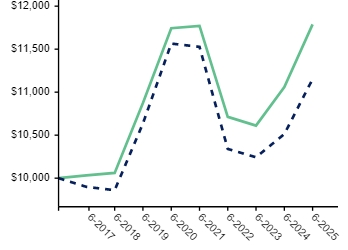

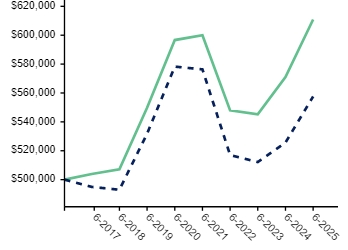

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Investor |

0.94%

|

8.20%

|

12.26%

|

6.48%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 2500 Index |

0.44

|

9.91

|

11.44

|

8.39

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 899,489,126

|

| Holdings Count | shares |

64

|

| Advisory Fees Paid, Amount |

$ 3,583,563

|

| Investment Company, Portfolio Turnover |

11.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$899,489,126 |

| Number of Portfolio Holdings |

64 |

| Portfolio Turnover Rate |

11% |

| Total Advisory Fees Paid |

$3,583,563 |

|

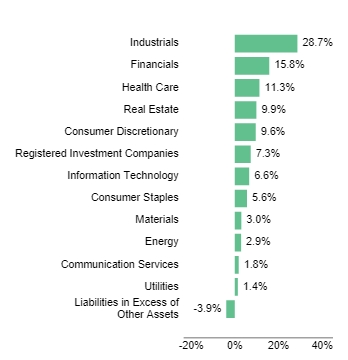

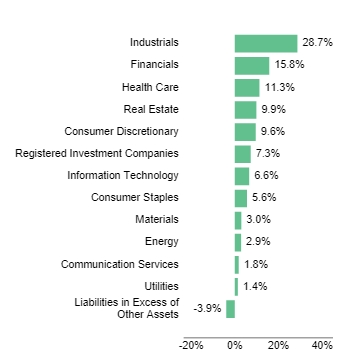

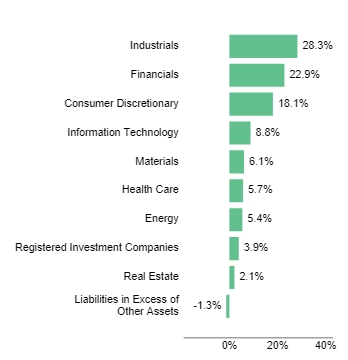

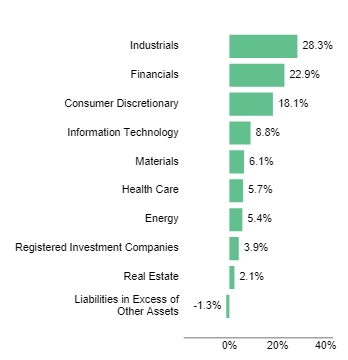

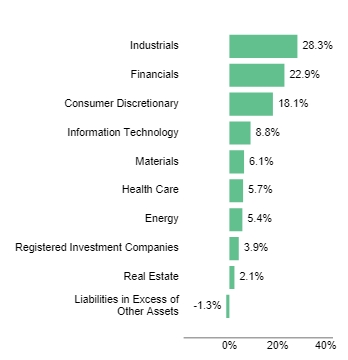

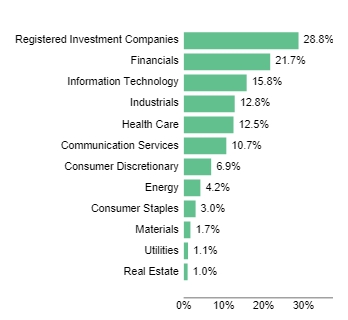

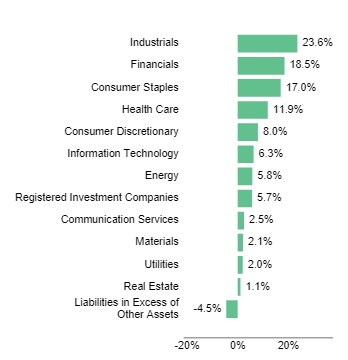

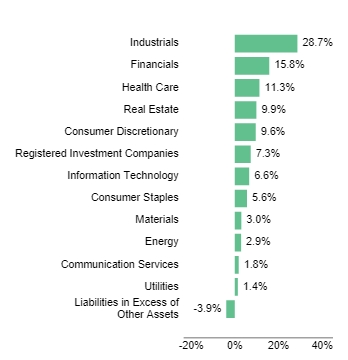

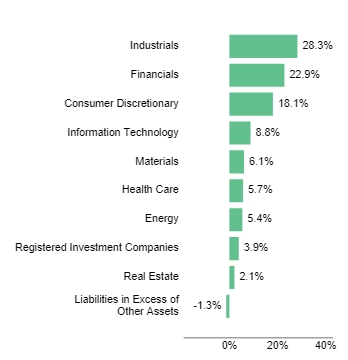

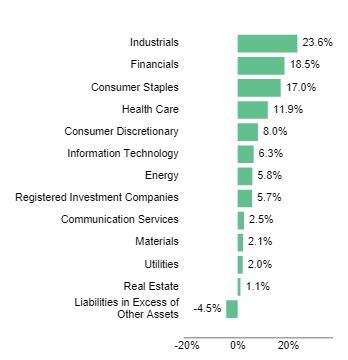

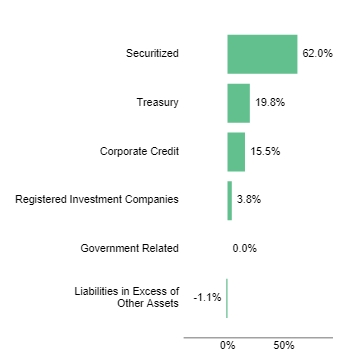

| Holdings [Text Block] |

|

Industrials

|

28.7% |

|

Financials

|

15.8% |

|

Health Care

|

11.3% |

|

Real Estate

|

9.9% |

|

Consumer Discretionary

|

9.6% |

|

Registered Investment Companies

|

7.3% |

|

Information Technology

|

6.6% |

|

Consumer Staples

|

5.6% |

|

Materials

|

3.0% |

|

Energy

|

2.9% |

|

Communication Services

|

1.8% |

|

Utilities

|

1.4% |

|

Liabilities in Excess of Other Assets

|

-3.9% |

|

WESCO International, Inc.

|

5.0 |

|

Red Rock Resorts, Inc. Class A

|

5.0 |

|

Mr. Cooper Group, Inc.

|

4.4 |

|

Post Holdings, Inc.

|

4.0 |

|

Regal Rexnord Corp.

|

3.7 |

|

Gates Industrial Corp. plc

|

3.6 |

|

Huntington Ingalls Industries, Inc.

|

3.3 |

|

CubeSmart

|

3.1 |

|

SS&C Technologies Holdings, Inc.

|

2.6 |

|

Webster Financial Corp.

|

2.5 |

|

| Largest Holdings [Text Block] |

|

WESCO International, Inc.

|

5.0 |

|

Red Rock Resorts, Inc. Class A

|

5.0 |

|

Mr. Cooper Group, Inc.

|

4.4 |

|

Post Holdings, Inc.

|

4.0 |

|

Regal Rexnord Corp.

|

3.7 |

|

Gates Industrial Corp. plc

|

3.6 |

|

Huntington Ingalls Industries, Inc.

|

3.3 |

|

CubeSmart

|

3.1 |

|

SS&C Technologies Holdings, Inc.

|

2.6 |

|

Webster Financial Corp.

|

2.5 |

|

| Diamond Hill Small-Mid Cap Fund | Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Small-Mid Cap Fund

|

| Class Name |

Class I

|

| Trading Symbol |

DHMIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Small-Mid Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.92%

|

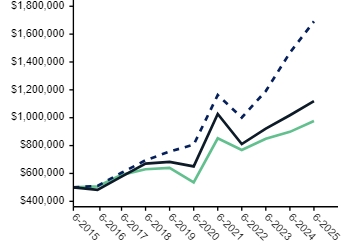

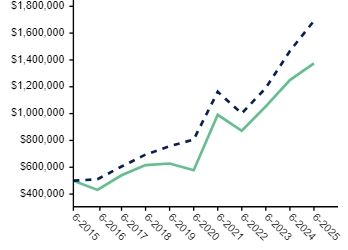

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHMIX) returned 1.09% for the 6-month period ended June 30, 2025. Over that same period, the Russell 2500 Index returned 0.44%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class I |

1.09%

|

8.53%

|

12.58%

|

6.79%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 2500 Index |

0.44

|

9.91

|

11.44

|

8.39

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 899,489,126

|

| Holdings Count | shares |

64

|

| Advisory Fees Paid, Amount |

$ 3,583,563

|

| Investment Company, Portfolio Turnover |

11.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$899,489,126 |

| Number of Portfolio Holdings |

64 |

| Portfolio Turnover Rate |

11% |

| Total Advisory Fees Paid |

$3,583,563 |

|

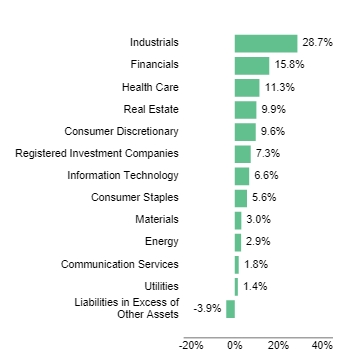

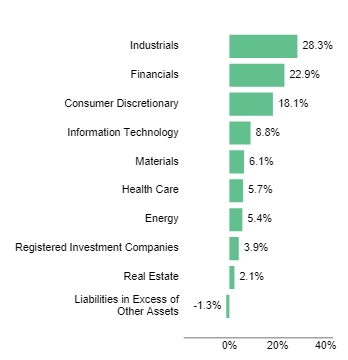

| Holdings [Text Block] |

|

Industrials

|

28.7% |

|

Financials

|

15.8% |

|

Health Care

|

11.3% |

|

Real Estate

|

9.9% |

|

Consumer Discretionary

|

9.6% |

|

Registered Investment Companies

|

7.3% |

|

Information Technology

|

6.6% |

|

Consumer Staples

|

5.6% |

|

Materials

|

3.0% |

|

Energy

|

2.9% |

|

Communication Services

|

1.8% |

|

Utilities

|

1.4% |

|

Liabilities in Excess of Other Assets

|

-3.9% |

|

WESCO International, Inc.

|

5.0 |

|

Red Rock Resorts, Inc. Class A

|

5.0 |

|

Mr. Cooper Group, Inc.

|

4.4 |

|

Post Holdings, Inc.

|

4.0 |

|

Regal Rexnord Corp.

|

3.7 |

|

Gates Industrial Corp. plc

|

3.6 |

|

Huntington Ingalls Industries, Inc.

|

3.3 |

|

CubeSmart

|

3.1 |

|

SS&C Technologies Holdings, Inc.

|

2.6 |

|

Webster Financial Corp.

|

2.5 |

|

| Largest Holdings [Text Block] |

|

WESCO International, Inc.

|

5.0 |

|

Red Rock Resorts, Inc. Class A

|

5.0 |

|

Mr. Cooper Group, Inc.

|

4.4 |

|

Post Holdings, Inc.

|

4.0 |

|

Regal Rexnord Corp.

|

3.7 |

|

Gates Industrial Corp. plc

|

3.6 |

|

Huntington Ingalls Industries, Inc.

|

3.3 |

|

CubeSmart

|

3.1 |

|

SS&C Technologies Holdings, Inc.

|

2.6 |

|

Webster Financial Corp.

|

2.5 |

|

| Diamond Hill Small-Mid Cap Fund | Class Y |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Small-Mid Cap Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

DHMYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Small-Mid Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 40

|

| Expense Ratio, Percent |

0.80%

|

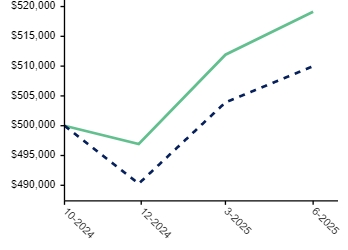

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHMYX) returned 1.17% for the 6-month period ended June 30, 2025. Over that same period, the Russell 2500 Index returned 0.44%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class Y |

1.17%

|

8.65%

|

12.72%

|

6.92%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 2500 Index |

0.44

|

9.91

|

11.44

|

8.39

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 899,489,126

|

| Holdings Count | shares |

64

|

| Advisory Fees Paid, Amount |

$ 3,583,563

|

| Investment Company, Portfolio Turnover |

11.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$899,489,126 |

| Number of Portfolio Holdings |

64 |

| Portfolio Turnover Rate |

11% |

| Total Advisory Fees Paid |

$3,583,563 |

|

| Holdings [Text Block] |

|

Industrials

|

28.7% |

|

Financials

|

15.8% |

|

Health Care

|

11.3% |

|

Real Estate

|

9.9% |

|

Consumer Discretionary

|

9.6% |

|

Registered Investment Companies

|

7.3% |

|

Information Technology

|

6.6% |

|

Consumer Staples

|

5.6% |

|

Materials

|

3.0% |

|

Energy

|

2.9% |

|

Communication Services

|

1.8% |

|

Utilities

|

1.4% |

|

Liabilities in Excess of Other Assets

|

-3.9% |

|

WESCO International, Inc.

|

5.0 |

|

Red Rock Resorts, Inc. Class A

|

5.0 |

|

Mr. Cooper Group, Inc.

|

4.4 |

|

Post Holdings, Inc.

|

4.0 |

|

Regal Rexnord Corp.

|

3.7 |

|

Gates Industrial Corp. plc

|

3.6 |

|

Huntington Ingalls Industries, Inc.

|

3.3 |

|

CubeSmart

|

3.1 |

|

SS&C Technologies Holdings, Inc.

|

2.6 |

|

Webster Financial Corp.

|

2.5 |

|

| Largest Holdings [Text Block] |

|

WESCO International, Inc.

|

5.0 |

|

Red Rock Resorts, Inc. Class A

|

5.0 |

|

Mr. Cooper Group, Inc.

|

4.4 |

|

Post Holdings, Inc.

|

4.0 |

|

Regal Rexnord Corp.

|

3.7 |

|

Gates Industrial Corp. plc

|

3.6 |

|

Huntington Ingalls Industries, Inc.

|

3.3 |

|

CubeSmart

|

3.1 |

|

SS&C Technologies Holdings, Inc.

|

2.6 |

|

Webster Financial Corp.

|

2.5 |

|

| Diamond Hill Mid Cap Fund | Investor Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Mid Cap Fund

|

| Class Name |

Investor

|

| Trading Symbol |

DHPAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Mid Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 54

|

| Expense Ratio, Percent |

1.07%

|

| Factors Affecting Performance [Text Block] |

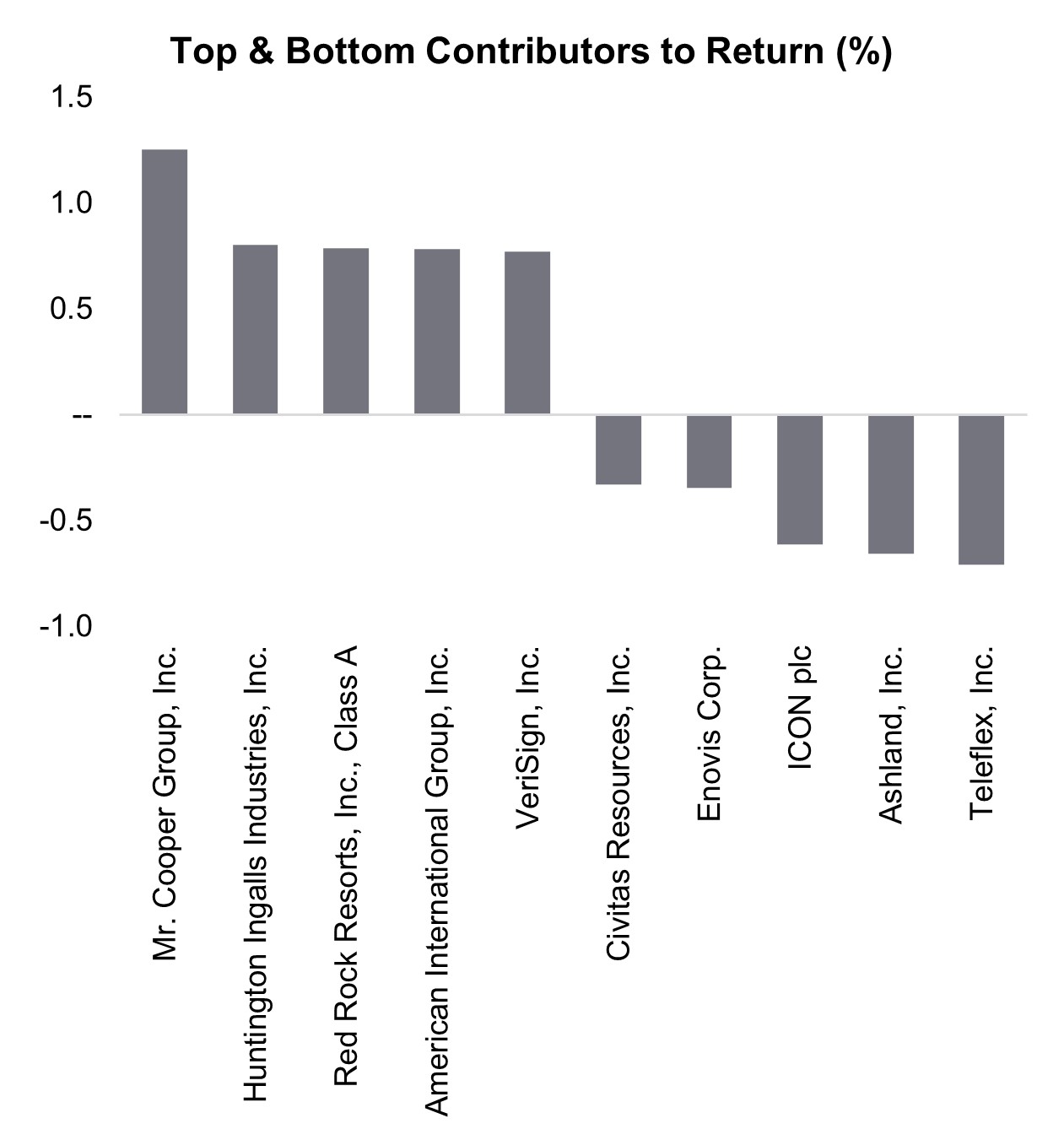

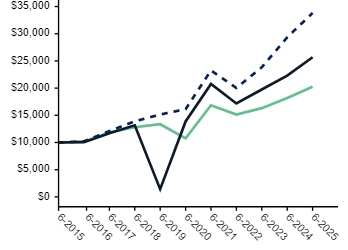

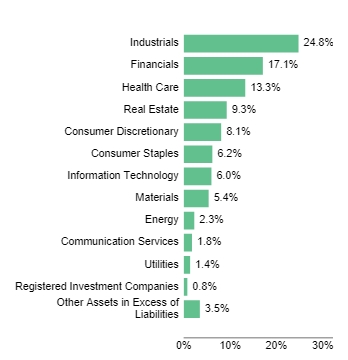

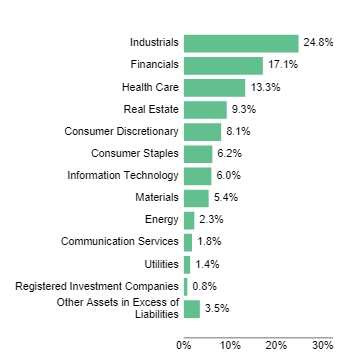

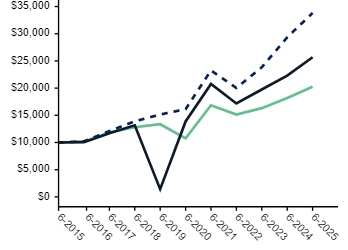

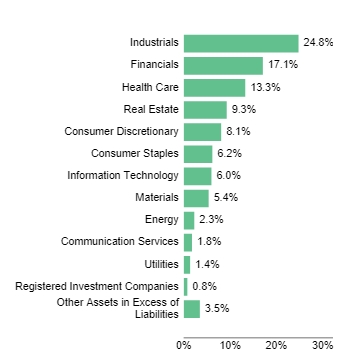

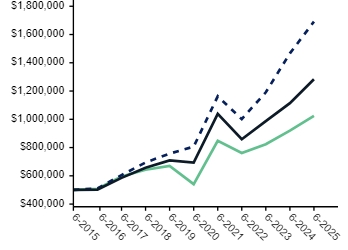

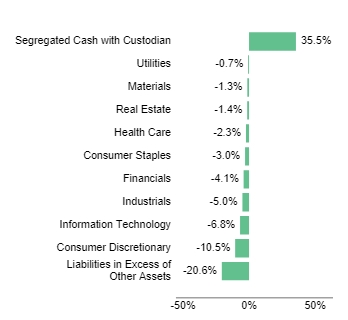

The Fund (Ticker: DHPAX) returned 4.86% for the 6-month period ended June 30, 2025. Over that same period, the Russell Midcap Index returned 4.84%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

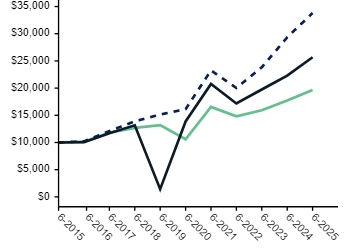

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Investor |

4.86%

|

10.99%

|

13.15%

|

6.99%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell Midcap Index |

4.84

|

15.21

|

13.11

|

9.89

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 82,017,666

|

| Holdings Count | shares |

57

|

| Advisory Fees Paid, Amount |

$ 396,629

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$82,017,666 |

| Number of Portfolio Holdings |

57 |

| Portfolio Turnover Rate |

13% |

| Total Advisory Fees Paid |

$396,629 |

|

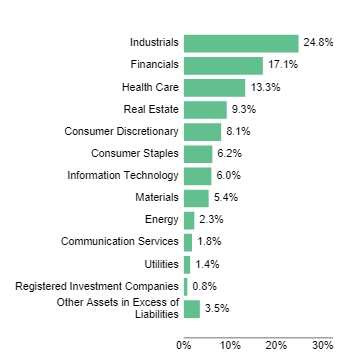

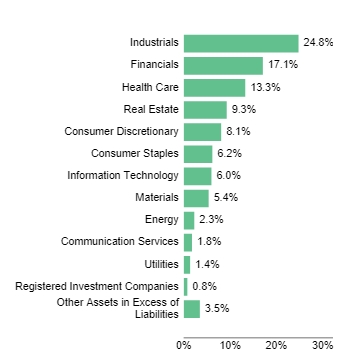

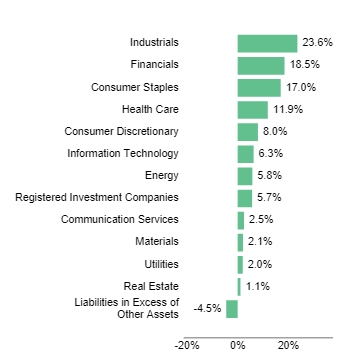

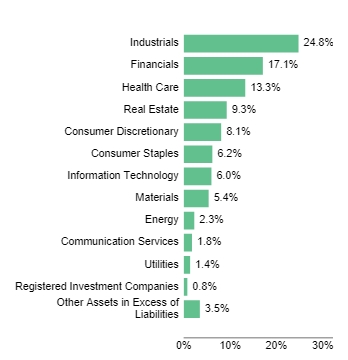

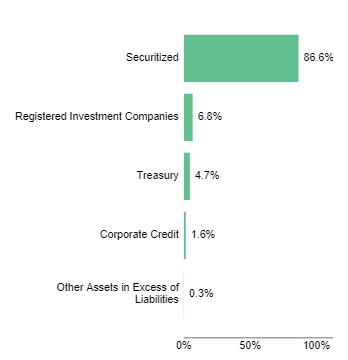

| Holdings [Text Block] |

|

Industrials

|

24.8% |

|

Financials

|

17.1% |

|

Health Care

|

13.3% |

|

Real Estate

|

9.3% |

|

Consumer Discretionary

|

8.1% |

|

Consumer Staples

|

6.2% |

|

Information Technology

|

6.0% |

|

Materials

|

5.4% |

|

Energy

|

2.3% |

|

Communication Services

|

1.8% |

|

Utilities

|

1.4% |

|

Registered Investment Companies

|

0.8% |

|

Other Assets in Excess of Liabilities

|

3.5% |

|

WESCO International, Inc.

|

4.9 |

|

Red Rock Resorts, Inc. Class A

|

4.7 |

|

American International Group, Inc.

|

4.6 |

|

Mr. Cooper Group, Inc.

|

4.5 |

|

Post Holdings, Inc.

|

3.7 |

|

Boston Scientific Corp.

|

3.6 |

|

Regal Rexnord Corp.

|

3.6 |

|

Parker-Hannifin Corp.

|

3.3 |

|

Huntington Ingalls Industries, Inc.

|

2.6 |

|

Freeport-McMoRan, Inc.

|

2.5 |

|

| Largest Holdings [Text Block] |

|

WESCO International, Inc.

|

4.9 |

|

Red Rock Resorts, Inc. Class A

|

4.7 |

|

American International Group, Inc.

|

4.6 |

|

Mr. Cooper Group, Inc.

|

4.5 |

|

Post Holdings, Inc.

|

3.7 |

|

Boston Scientific Corp.

|

3.6 |

|

Regal Rexnord Corp.

|

3.6 |

|

Parker-Hannifin Corp.

|

3.3 |

|

Huntington Ingalls Industries, Inc.

|

2.6 |

|

Freeport-McMoRan, Inc.

|

2.5 |

|

| Diamond Hill Mid Cap Fund | Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Mid Cap Fund

|

| Class Name |

Class I

|

| Trading Symbol |

DHPIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Mid Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 40

|

| Expense Ratio, Percent |

0.78%

|

| Factors Affecting Performance [Text Block] |

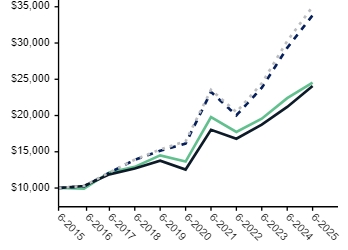

The Fund (Ticker: DHPIX) returned 4.99% for the 6-month period ended June 30, 2025. Over that same period, the Russell Midcap Index returned 4.84%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class I |

4.99%

|

11.32%

|

13.49%

|

7.31%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell Midcap Index |

4.84

|

15.21

|

13.11

|

9.89

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 82,017,666

|

| Holdings Count | shares |

57

|

| Advisory Fees Paid, Amount |

$ 396,629

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$82,017,666 |

| Number of Portfolio Holdings |

57 |

| Portfolio Turnover Rate |

13% |

| Total Advisory Fees Paid |

$396,629 |

|

| Holdings [Text Block] |

|

Industrials

|

24.8% |

|

Financials

|

17.1% |

|

Health Care

|

13.3% |

|

Real Estate

|

9.3% |

|

Consumer Discretionary

|

8.1% |

|

Consumer Staples

|

6.2% |

|

Information Technology

|

6.0% |

|

Materials

|

5.4% |

|

Energy

|

2.3% |

|

Communication Services

|

1.8% |

|

Utilities

|

1.4% |

|

Registered Investment Companies

|

0.8% |

|

Other Assets in Excess of Liabilities

|

3.5% |

|

WESCO International, Inc.

|

4.9 |

|

Red Rock Resorts, Inc. Class A

|

4.7 |

|

American International Group, Inc.

|

4.6 |

|

Mr. Cooper Group, Inc.

|

4.5 |

|

Post Holdings, Inc.

|

3.7 |

|

Boston Scientific Corp.

|

3.6 |

|

Regal Rexnord Corp.

|

3.6 |

|

Parker-Hannifin Corp.

|

3.3 |

|

Huntington Ingalls Industries, Inc.

|

2.6 |

|

Freeport-McMoRan, Inc.

|

2.5 |

|

| Largest Holdings [Text Block] |

|

WESCO International, Inc.

|

4.9 |

|

Red Rock Resorts, Inc. Class A

|

4.7 |

|

American International Group, Inc.

|

4.6 |

|

Mr. Cooper Group, Inc.

|

4.5 |

|

Post Holdings, Inc.

|

3.7 |

|

Boston Scientific Corp.

|

3.6 |

|

Regal Rexnord Corp.

|

3.6 |

|

Parker-Hannifin Corp.

|

3.3 |

|

Huntington Ingalls Industries, Inc.

|

2.6 |

|

Freeport-McMoRan, Inc.

|

2.5 |

|

| Diamond Hill Mid Cap Fund | Class Y |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Mid Cap Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

DHPYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Mid Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 34

|

| Expense Ratio, Percent |

0.66%

|

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHPYX) returned 5.15% for the 6-month period ended June 30, 2025. Over that same period, the Russell Midcap Index returned 4.84%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class Y |

5.15%

|

11.48%

|

13.63%

|

7.44%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell Midcap Index |

4.84

|

15.21

|

13.11

|

9.89

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 82,017,666

|

| Holdings Count | shares |

57

|

| Advisory Fees Paid, Amount |

$ 396,629

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$82,017,666 |

| Number of Portfolio Holdings |

57 |

| Portfolio Turnover Rate |

13% |

| Total Advisory Fees Paid |

$396,629 |

|

| Holdings [Text Block] |

|

Industrials

|

24.8% |

|

Financials

|

17.1% |

|

Health Care

|

13.3% |

|

Real Estate

|

9.3% |

|

Consumer Discretionary

|

8.1% |

|

Consumer Staples

|

6.2% |

|

Information Technology

|

6.0% |

|

Materials

|

5.4% |

|

Energy

|

2.3% |

|

Communication Services

|

1.8% |

|

Utilities

|

1.4% |

|

Registered Investment Companies

|

0.8% |

|

Other Assets in Excess of Liabilities

|

3.5% |

|

WESCO International, Inc.

|

4.9 |

|

Red Rock Resorts, Inc. Class A

|

4.7 |

|

American International Group, Inc.

|

4.6 |

|

Mr. Cooper Group, Inc.

|

4.5 |

|

Post Holdings, Inc.

|

3.7 |

|

Boston Scientific Corp.

|

3.6 |

|

Regal Rexnord Corp.

|

3.6 |

|

Parker-Hannifin Corp.

|

3.3 |

|

Huntington Ingalls Industries, Inc.

|

2.6 |

|

Freeport-McMoRan, Inc.

|

2.5 |

|

| Largest Holdings [Text Block] |

|

WESCO International, Inc.

|

4.9 |

|

Red Rock Resorts, Inc. Class A

|

4.7 |

|

American International Group, Inc.

|

4.6 |

|

Mr. Cooper Group, Inc.

|

4.5 |

|

Post Holdings, Inc.

|

3.7 |

|

Boston Scientific Corp.

|

3.6 |

|

Regal Rexnord Corp.

|

3.6 |

|

Parker-Hannifin Corp.

|

3.3 |

|

Huntington Ingalls Industries, Inc.

|

2.6 |

|

Freeport-McMoRan, Inc.

|

2.5 |

|

| Diamond Hill Large Cap Fund | Investor Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Large Cap Fund

|

| Class Name |

Investor

|

| Trading Symbol |

DHLAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Large Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.96%

|

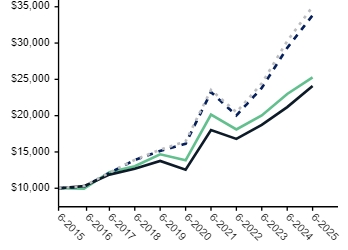

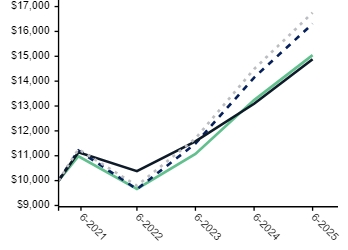

| Factors Affecting Performance [Text Block] |

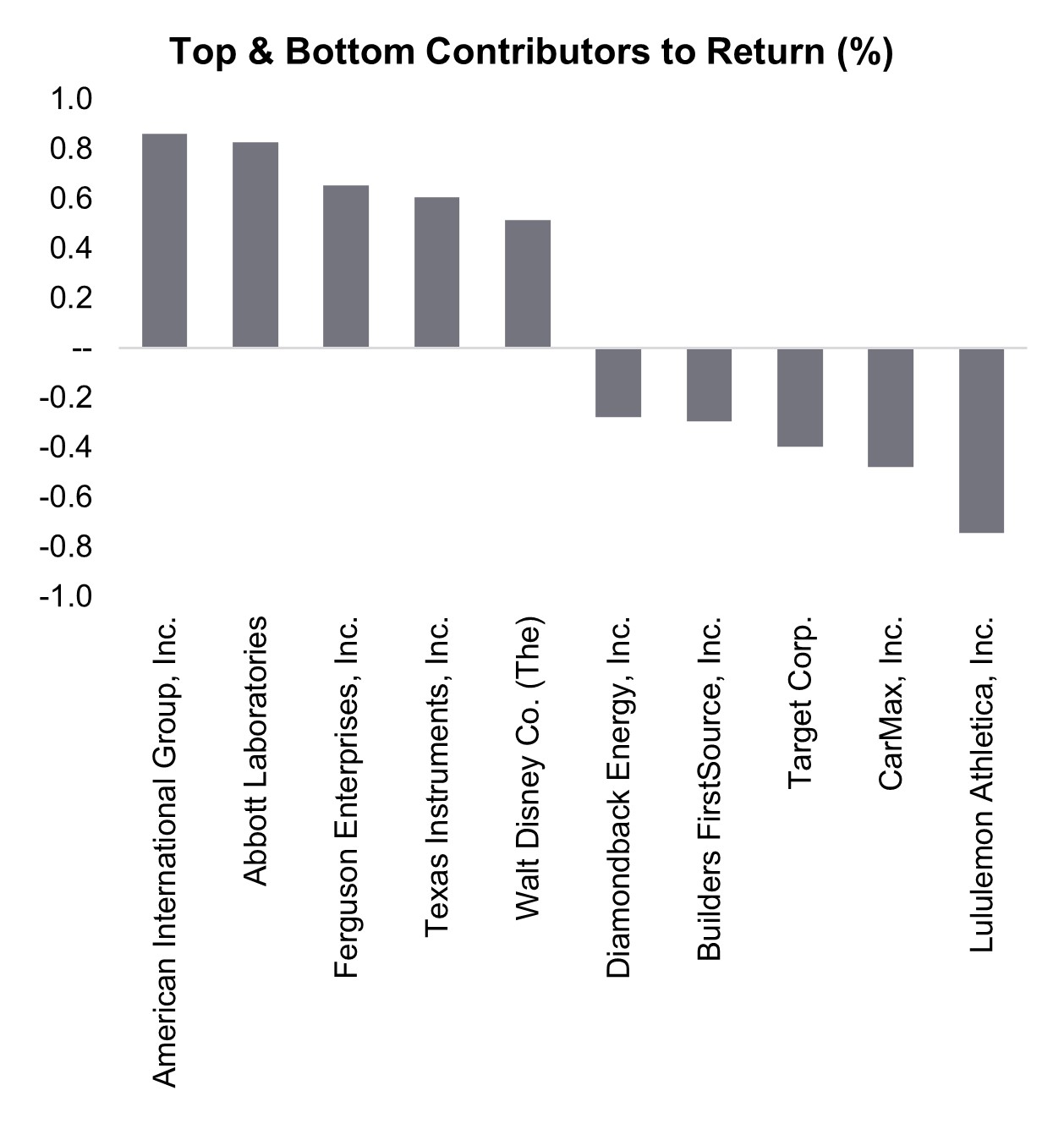

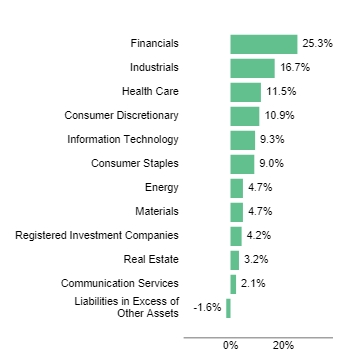

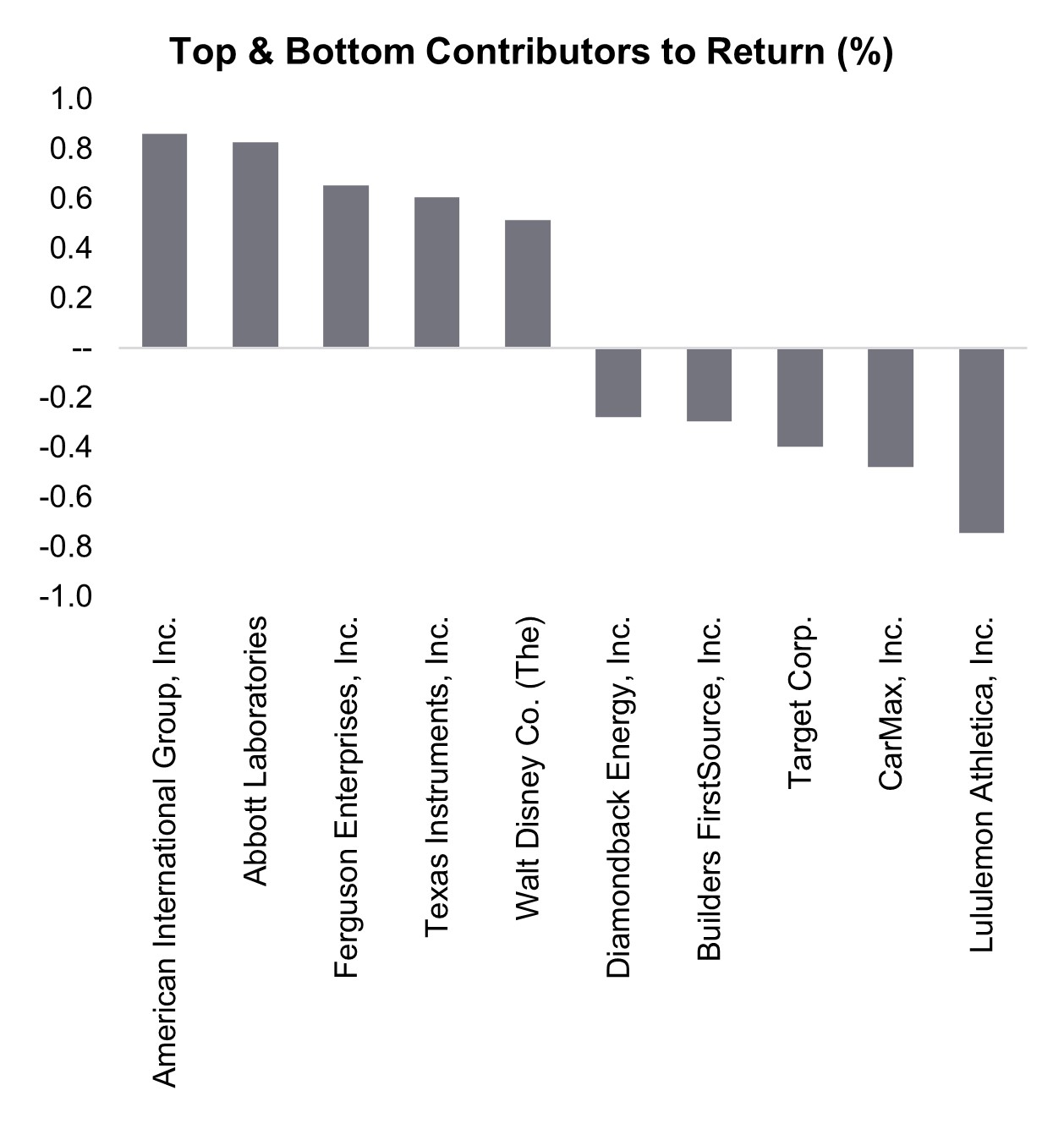

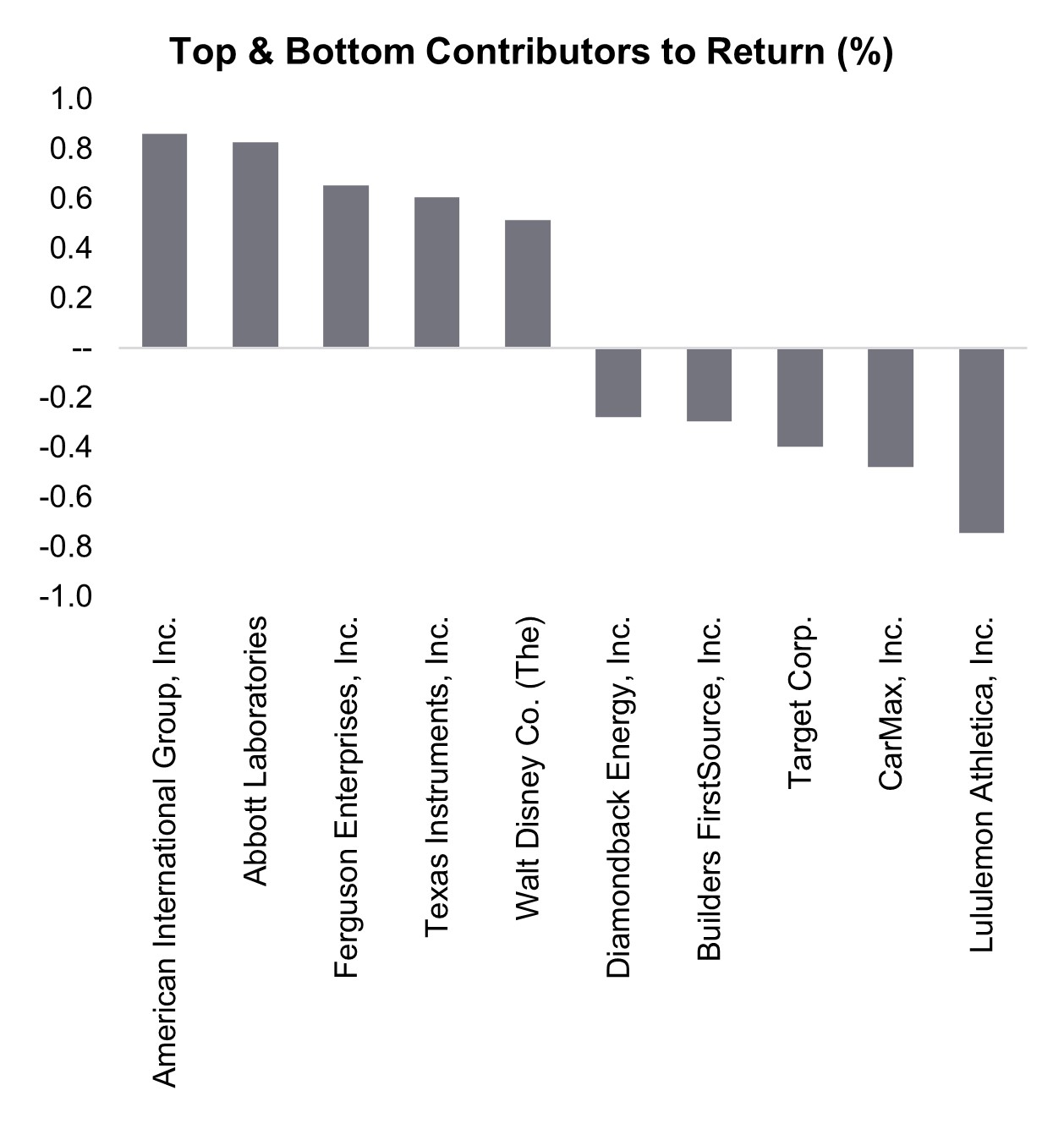

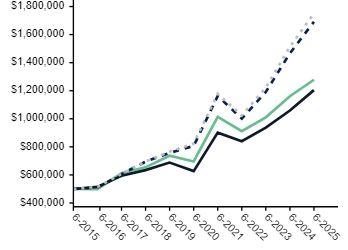

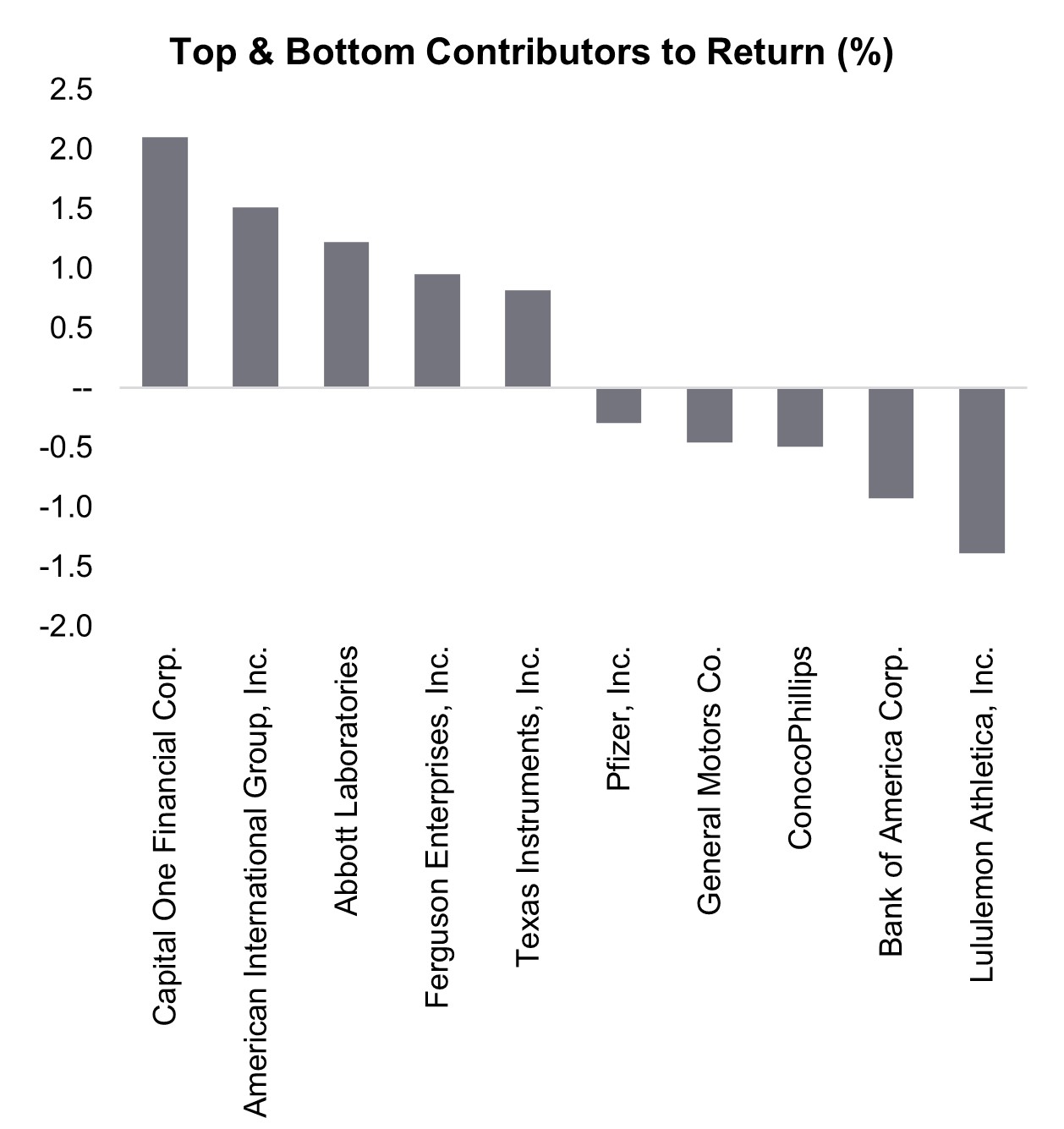

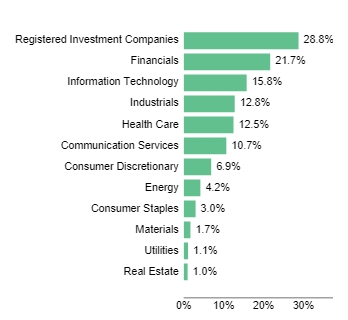

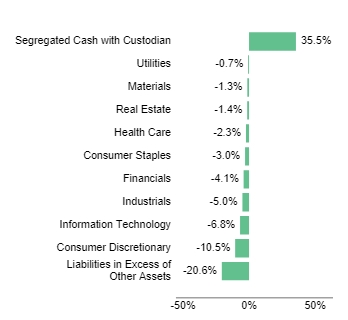

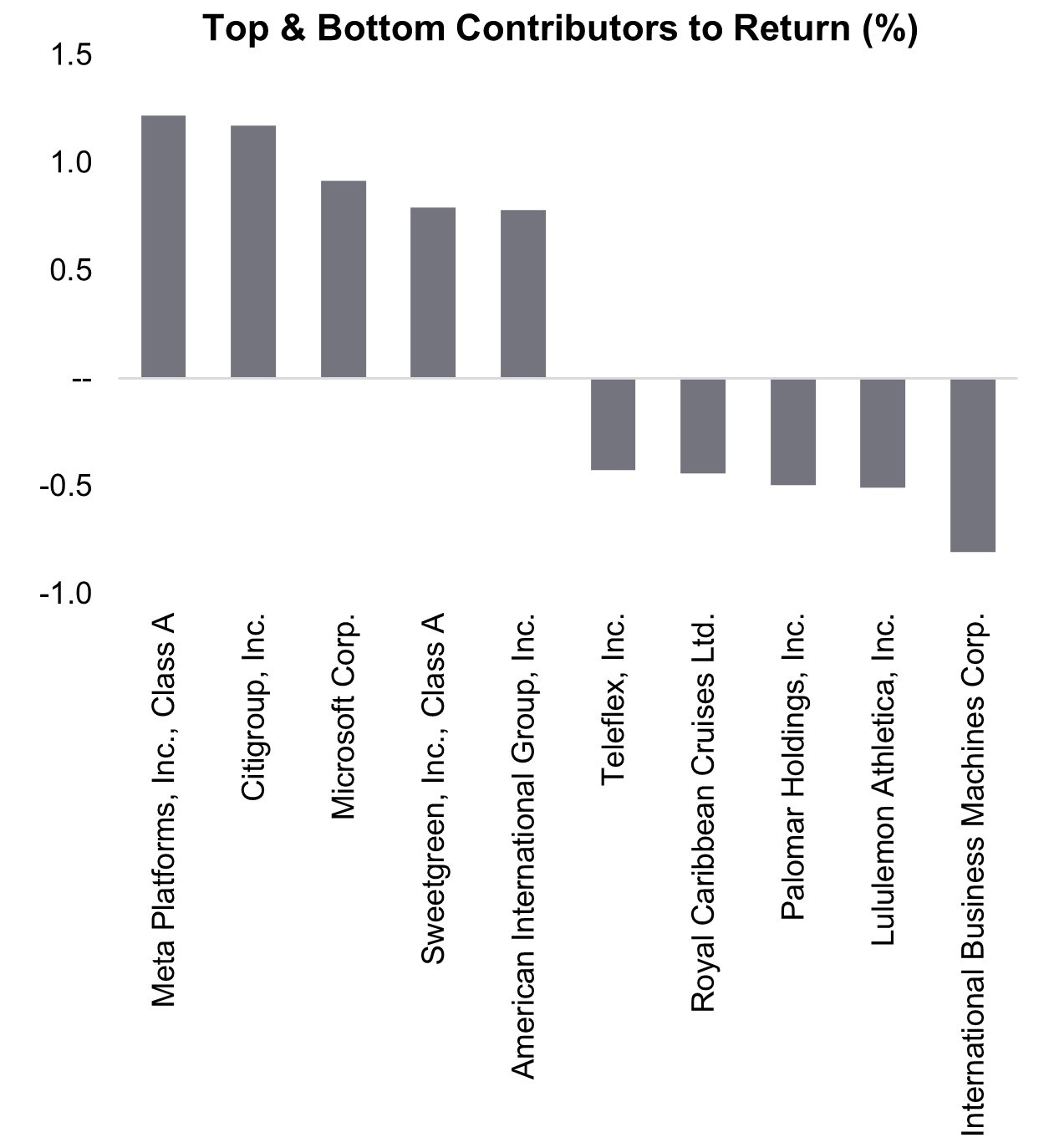

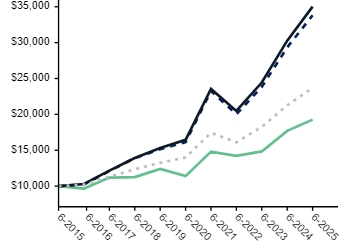

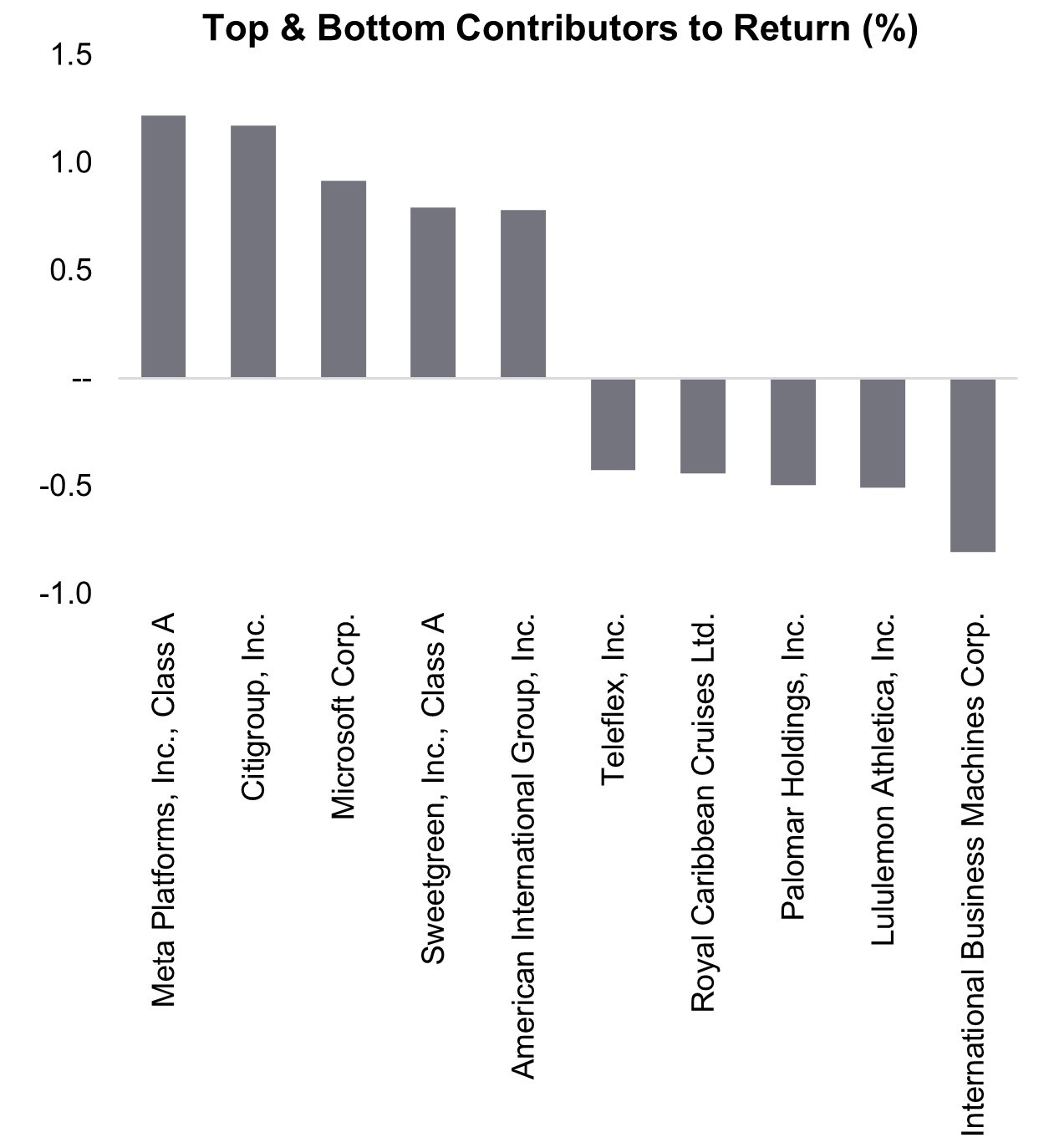

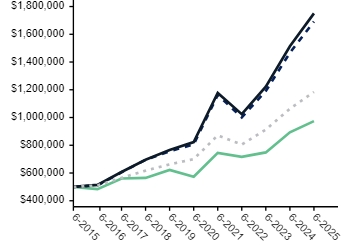

The Fund (Ticker: DHLAX) returned 4.10% for the 6-month period ended June 30, 2025. Over that same period, the Russell 1000 Value Index returned 6.00%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Investor |

4.10%

|

9.67%

|

12.46%

|

9.40%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index |

6.00

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index |

6.12

|

15.66

|

16.30

|

13.35

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 8,414,727,808

|

| Holdings Count | shares |

48

|

| Advisory Fees Paid, Amount |

$ 20,831,323

|

| Investment Company, Portfolio Turnover |

26.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$8,414,727,808 |

| Number of Portfolio Holdings |

48 |

| Portfolio Turnover Rate |

26% |

| Total Advisory Fees Paid |

$20,831,323 |

|

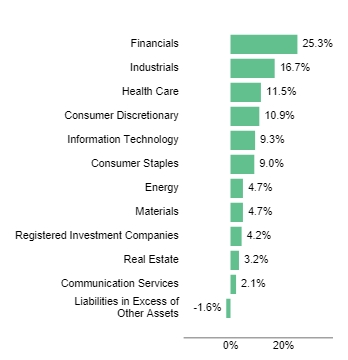

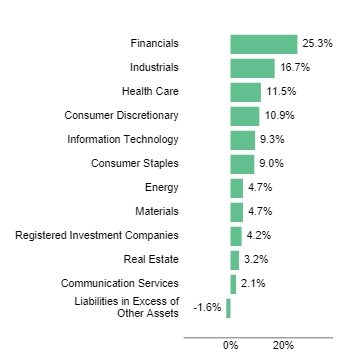

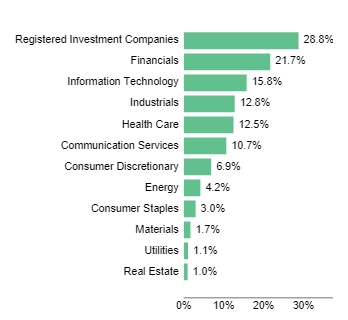

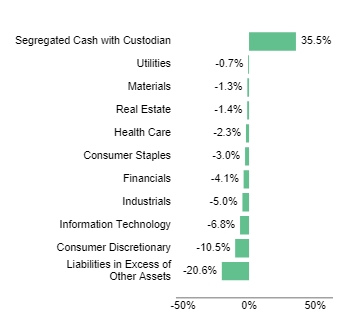

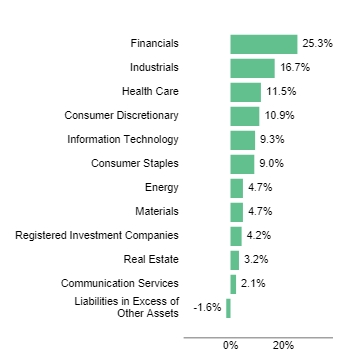

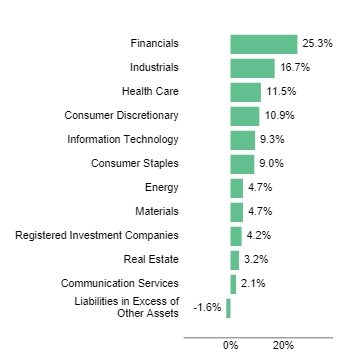

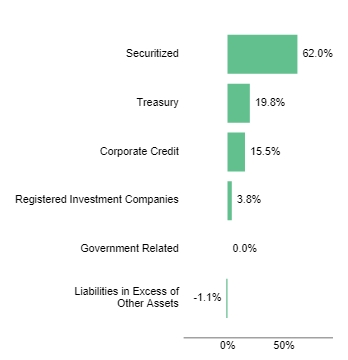

| Holdings [Text Block] |

|

Financials

|

25.3% |

|

Industrials

|

16.7% |

|

Health Care

|

11.5% |

|

Consumer Discretionary

|

10.9% |

|

Information Technology

|

9.3% |

|

Consumer Staples

|

9.0% |

|

Energy

|

4.7% |

|

Materials

|

4.7% |

|

Registered Investment Companies

|

4.2% |

|

Real Estate

|

3.2% |

|

Communication Services

|

2.1% |

|

Liabilities in Excess of Other Assets

|

-1.6% |

|

American International Group, Inc.

|

4.8 |

|

Berkshire Hathaway, Inc., Class B

|

4.3 |

|

Abbott Laboratories

|

4.2 |

|

Texas Instruments, Inc.

|

3.9 |

|

Aon plc, Class A

|

3.2 |

|

Capital One Financial Corp.

|

3.2 |

|

Colgate-Palmolive Co.

|

3.1 |

|

ConocoPhillips

|

2.9 |

|

Sysco Corp.

|

2.8 |

|

Bank of America Corp.

|

2.6 |

|

| Largest Holdings [Text Block] |

|

American International Group, Inc.

|

4.8 |

|

Berkshire Hathaway, Inc., Class B

|

4.3 |

|

Abbott Laboratories

|

4.2 |

|

Texas Instruments, Inc.

|

3.9 |

|

Aon plc, Class A

|

3.2 |

|

Capital One Financial Corp.

|

3.2 |

|

Colgate-Palmolive Co.

|

3.1 |

|

ConocoPhillips

|

2.9 |

|

Sysco Corp.

|

2.8 |

|

Bank of America Corp.

|

2.6 |

|

| Diamond Hill Large Cap Fund | Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Large Cap Fund

|

| Class Name |

Class I

|

| Trading Symbol |

DHLRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Large Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 34

|

| Expense Ratio, Percent |

0.67%

|

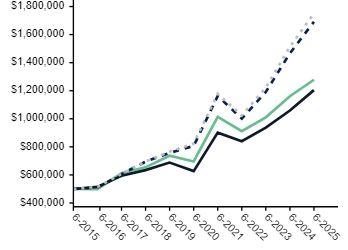

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHLRX) returned 4.27% for the 6-month period ended June 30, 2025. Over that same period, the Russell 1000 Value Index returned 6.00%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class I |

4.27%

|

9.99%

|

12.79%

|

9.72%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index |

6.00

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index |

6.12

|

15.66

|

16.30

|

13.35

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 8,414,727,808

|

| Holdings Count | shares |

48

|

| Advisory Fees Paid, Amount |

$ 20,831,323

|

| Investment Company, Portfolio Turnover |

26.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$8,414,727,808 |

| Number of Portfolio Holdings |

48 |

| Portfolio Turnover Rate |

26% |

| Total Advisory Fees Paid |

$20,831,323 |

|

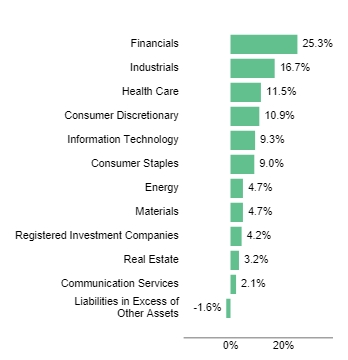

| Holdings [Text Block] |

|

Financials

|

25.3% |

|

Industrials

|

16.7% |

|

Health Care

|

11.5% |

|

Consumer Discretionary

|

10.9% |

|

Information Technology

|

9.3% |

|

Consumer Staples

|

9.0% |

|

Energy

|

4.7% |

|

Materials

|

4.7% |

|

Registered Investment Companies

|

4.2% |

|

Real Estate

|

3.2% |

|

Communication Services

|

2.1% |

|

Liabilities in Excess of Other Assets

|

-1.6% |

|

American International Group, Inc.

|

4.8 |

|

Berkshire Hathaway, Inc., Class B

|

4.3 |

|

Abbott Laboratories

|

4.2 |

|

Texas Instruments, Inc.

|

3.9 |

|

Aon plc, Class A

|

3.2 |

|

Capital One Financial Corp.

|

3.2 |

|

Colgate-Palmolive Co.

|

3.1 |

|

ConocoPhillips

|

2.9 |

|

Sysco Corp.

|

2.8 |

|

Bank of America Corp.

|

2.6 |

|

| Largest Holdings [Text Block] |

|

American International Group, Inc.

|

4.8 |

|

Berkshire Hathaway, Inc., Class B

|

4.3 |

|

Abbott Laboratories

|

4.2 |

|

Texas Instruments, Inc.

|

3.9 |

|

Aon plc, Class A

|

3.2 |

|

Capital One Financial Corp.

|

3.2 |

|

Colgate-Palmolive Co.

|

3.1 |

|

ConocoPhillips

|

2.9 |

|

Sysco Corp.

|

2.8 |

|

Bank of America Corp.

|

2.6 |

|

| Diamond Hill Large Cap Fund | Class Y |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Large Cap Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

DHLYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Large Cap Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 28

|

| Expense Ratio, Percent |

0.55%

|

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHLYX) returned 4.33% for the 6-month period ended June 30, 2025. Over that same period, the Russell 1000 Value Index returned 6.00%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class Y |

4.33%

|

10.13%

|

12.93%

|

9.84%

|

|

Russell 3000 Index |

5.75

|

15.30

|

15.96

|

12.96

|

|

Russell 1000 Value Index |

6.00

|

13.70

|

13.93

|

9.19

|

|

Russell 1000 Index |

6.12

|

15.66

|

16.30

|

13.35

|

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Net Assets |

$ 8,414,727,808

|

| Holdings Count | shares |

48

|

| Advisory Fees Paid, Amount |

$ 20,831,323

|

| Investment Company, Portfolio Turnover |

26.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$8,414,727,808 |

| Number of Portfolio Holdings |

48 |

| Portfolio Turnover Rate |

26% |

| Total Advisory Fees Paid |

$20,831,323 |

|

| Holdings [Text Block] |

|

Financials

|

25.3% |

|

Industrials

|

16.7% |

|

Health Care

|

11.5% |

|

Consumer Discretionary

|

10.9% |

|

Information Technology

|

9.3% |

|

Consumer Staples

|

9.0% |

|

Energy

|

4.7% |

|

Materials

|

4.7% |

|

Registered Investment Companies

|

4.2% |

|

Real Estate

|

3.2% |

|

Communication Services

|

2.1% |

|

Liabilities in Excess of Other Assets

|

-1.6% |

|

American International Group, Inc.

|

4.8 |

|

Berkshire Hathaway, Inc., Class B

|

4.3 |

|

Abbott Laboratories

|

4.2 |

|

Texas Instruments, Inc.

|

3.9 |

|

Aon plc, Class A

|

3.2 |

|

Capital One Financial Corp.

|

3.2 |

|

Colgate-Palmolive Co.

|

3.1 |

|

ConocoPhillips

|

2.9 |

|

Sysco Corp.

|

2.8 |

|

Bank of America Corp.

|

2.6 |

|

| Largest Holdings [Text Block] |

|

American International Group, Inc.

|

4.8 |

|

Berkshire Hathaway, Inc., Class B

|

4.3 |

|

Abbott Laboratories

|

4.2 |

|

Texas Instruments, Inc.

|

3.9 |

|

Aon plc, Class A

|

3.2 |

|

Capital One Financial Corp.

|

3.2 |

|

Colgate-Palmolive Co.

|

3.1 |

|

ConocoPhillips

|

2.9 |

|

Sysco Corp.

|

2.8 |

|

Bank of America Corp.

|

2.6 |

|

| Diamond Hill Large Cap Concentrated Fund | Investor Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Large Cap Concentrated Fund

|

| Class Name |

Investor

|

| Trading Symbol |

DHFAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Large Cap Concentrated Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.96%

|

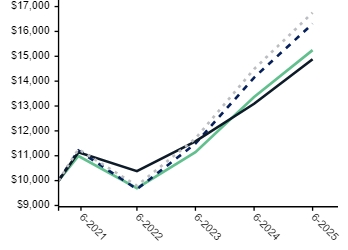

| Factors Affecting Performance [Text Block] |

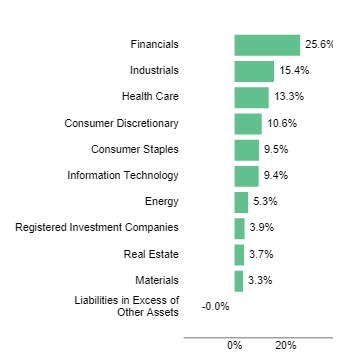

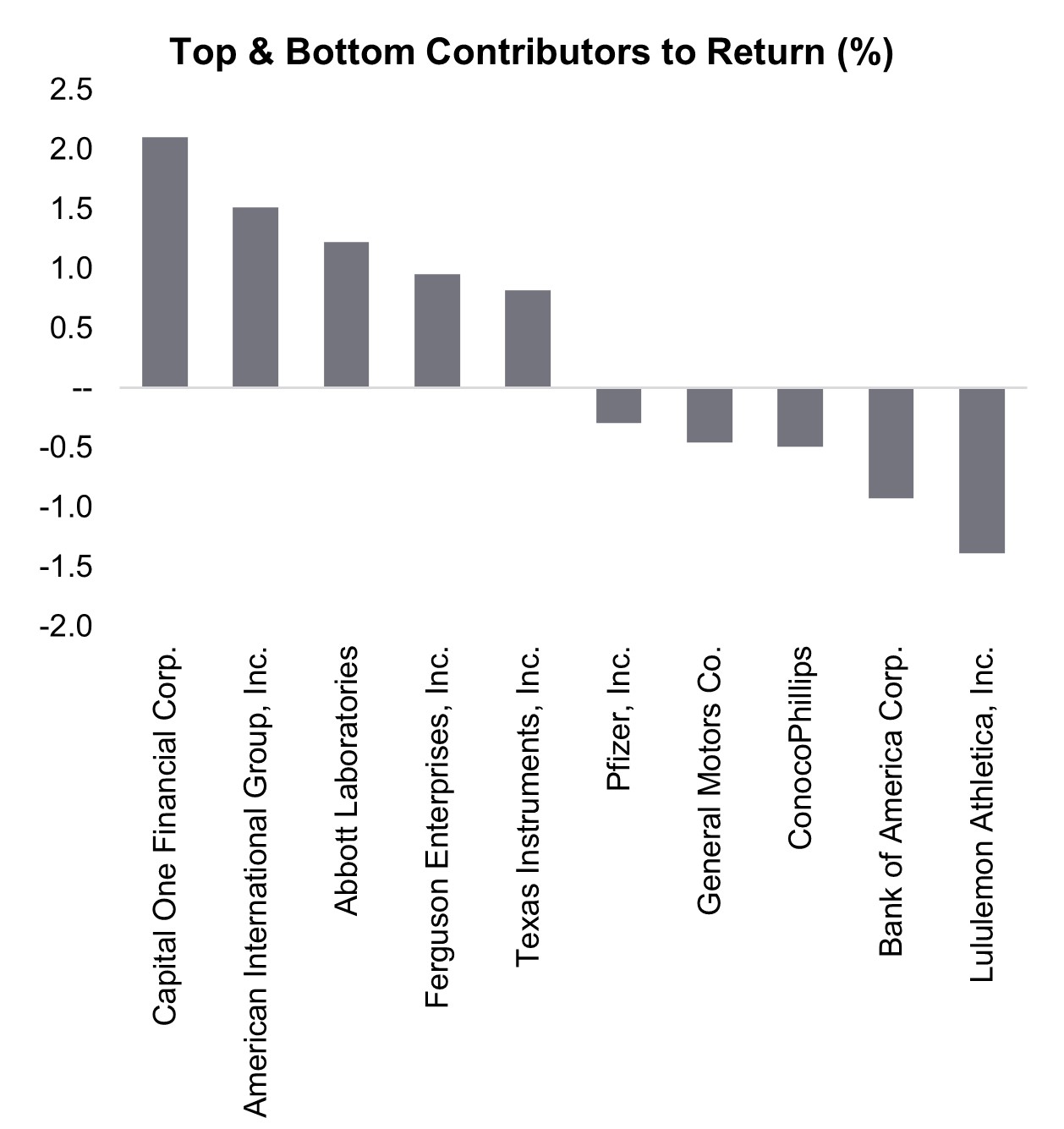

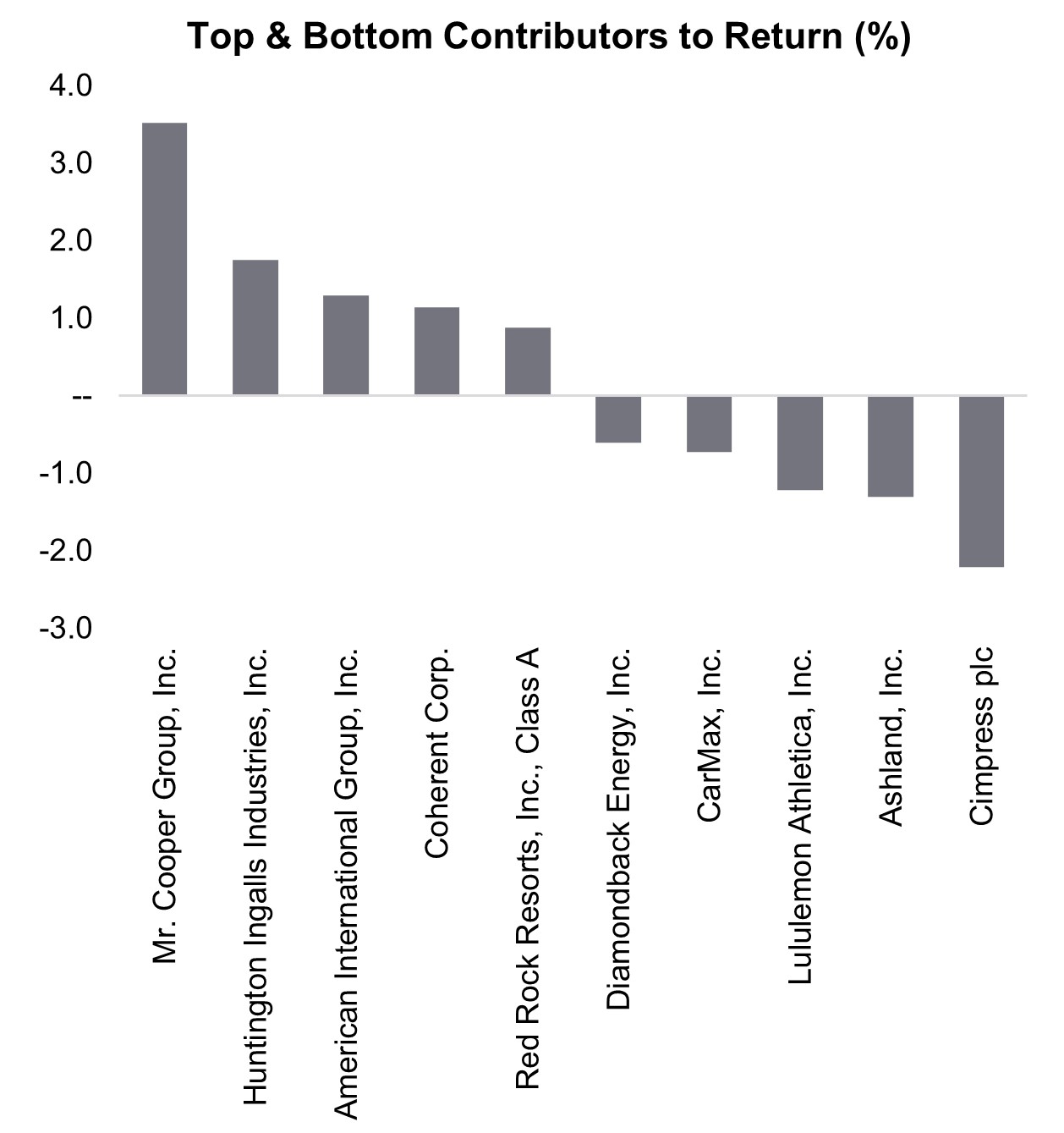

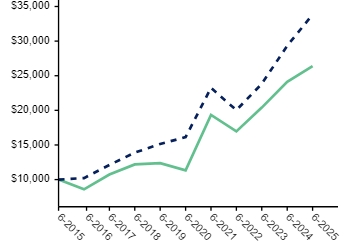

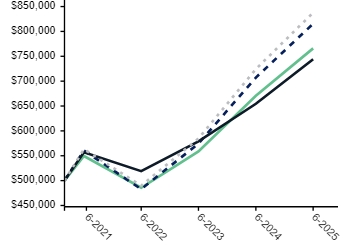

The Fund (Ticker: DHFAX) returned 7.75% for the 6-month period ended June 30, 2025. Over that same period, the Russell 1000 Value Index returned 6.00%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Investor |

7.75%

|

13.66%

|

9.87%

|

|

Russell 3000 Index |

5.75

|

15.30

|

11.95

|

|

Russell 1000 Value Index |

6.00

|

13.70

|

9.61

|

|

Russell 1000 Index |

6.12

|

15.66

|

12.65

|

|

| Performance Inception Date |

Feb. 26, 2021

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Material Change Date |

Jan. 01, 2025

|

| Net Assets |

$ 41,786,984

|

| Holdings Count | shares |

22

|

| Advisory Fees Paid, Amount |

$ 95,472

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$41,786,984 |

| Number of Portfolio Holdings |

22 |

| Portfolio Turnover Rate |

35% |

| Total Advisory Fees Paid |

$95,472 |

|

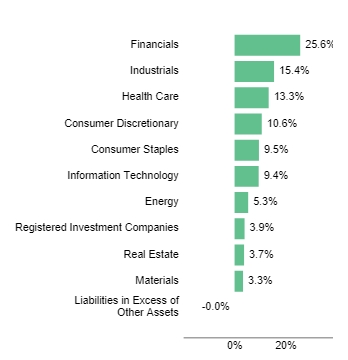

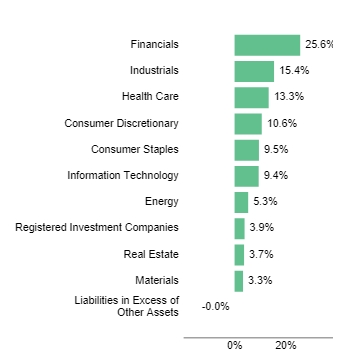

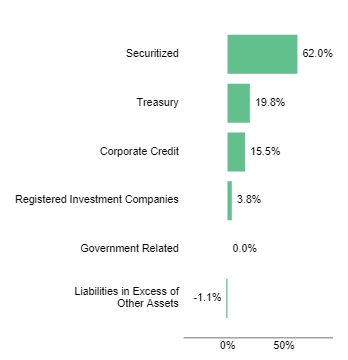

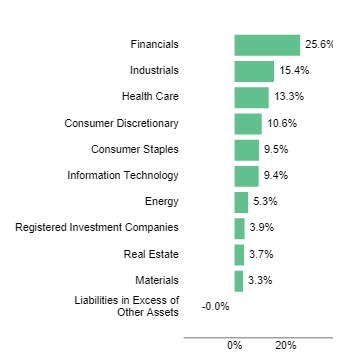

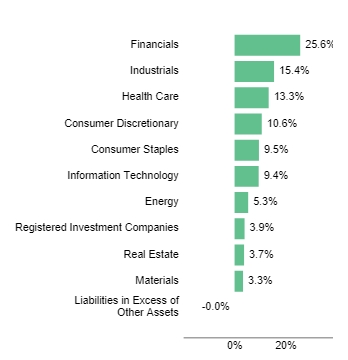

| Holdings [Text Block] |

|

Financials

|

25.6% |

|

Industrials

|

15.4% |

|

Health Care

|

13.3% |

|

Consumer Discretionary

|

10.6% |

|

Consumer Staples

|

9.5% |

|

Information Technology

|

9.4% |

|

Energy

|

5.3% |

|

Registered Investment Companies

|

3.9% |

|

Real Estate

|

3.7% |

|

Materials

|

3.3% |

|

Liabilities in Excess of Other Assets

|

0.0% |

|

American International Group, Inc.

|

8.4 |

|

Texas Instruments, Inc.

|

6.4 |

|

Berkshire Hathaway, Inc., Class B

|

6.3 |

|

Capital One Financial Corp.

|

6.2 |

|

Abbott Laboratories

|

5.7 |

|

ConocoPhillips

|

5.3 |

|

Colgate-Palmolive Co.

|

4.9 |

|

Aon plc, Class A

|

4.7 |

|

Ferguson Enterprises, Inc.

|

4.7 |

|

Sysco Corp.

|

4.6 |

|

| Largest Holdings [Text Block] |

|

American International Group, Inc.

|

8.4 |

|

Texas Instruments, Inc.

|

6.4 |

|

Berkshire Hathaway, Inc., Class B

|

6.3 |

|

Capital One Financial Corp.

|

6.2 |

|

Abbott Laboratories

|

5.7 |

|

ConocoPhillips

|

5.3 |

|

Colgate-Palmolive Co.

|

4.9 |

|

Aon plc, Class A

|

4.7 |

|

Ferguson Enterprises, Inc.

|

4.7 |

|

Sysco Corp.

|

4.6 |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's next prospectus, which we expect to be available by September 26, 2025 at https://diamond-hill.com/documents or upon request at 888-226-5595. The Board of Trustees after careful consideration and upon the recommendation of the Adviser, approved the conversion (the "Reorganization") of the Large Cap Concentrated Fund (the "Target Fund") into an exchange-traded fund ("ETF") by reorganizing the Target Fund into the newly created series of the Trust, the Diamond Hill Large Cap Concentrated ETF (the "Survivor Fund"). The Reorganization is expected to occur on or about September 26, 2025 (the "Closing Date"). The Survivor Fund will not commence operations before completion of the Reorganization and does not have existing shareholders. Shareholders are not required to approve the Reorganization, and shareholders will not be asked to vote. However, shareholders received a Combined Prospectus/Information Statement that contains information about the Survivor Fund and provides details about the terms and conditions of the Reorganization. |

| Material Fund Change Strategies [Text Block] |

The Board of Trustees after careful consideration and upon the recommendation of the Adviser, approved the conversion (the "Reorganization") of the Large Cap Concentrated Fund (the "Target Fund") into an exchange-traded fund ("ETF") by reorganizing the Target Fund into the newly created series of the Trust, the Diamond Hill Large Cap Concentrated ETF (the "Survivor Fund"). The Reorganization is expected to occur on or about September 26, 2025 (the "Closing Date"). The Survivor Fund will not commence operations before completion of the Reorganization and does not have existing shareholders. Shareholders are not required to approve the Reorganization, and shareholders will not be asked to vote. However, shareholders received a Combined Prospectus/Information Statement that contains information about the Survivor Fund and provides details about the terms and conditions of the Reorganization.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's next prospectus, which we expect to be available by September 26, 2025 at https://diamond-hill.com/documents or upon request at 888-226-5595.

|

| Updated Prospectus Phone Number |

888-226-5595

|

| Updated Prospectus Web Address |

https://diamond-hill.com/documents

|

| Diamond Hill Large Cap Concentrated Fund | Class I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Large Cap Concentrated Fund

|

| Class Name |

Class I

|

| Trading Symbol |

DHFIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Large Cap Concentrated Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 35

|

| Expense Ratio, Percent |

0.67%

|

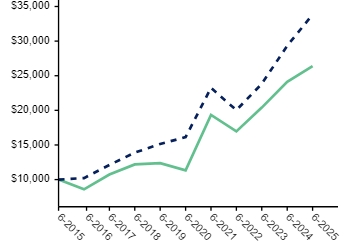

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHFIX) returned 7.94% for the 6-month period ended June 30, 2025. Over that same period, the Russell 1000 Value Index returned 6.00%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class I |

7.94%

|

14.10%

|

10.21%

|

|

Russell 3000 Index |

5.75

|

15.30

|

11.95

|

|

Russell 1000 Value Index |

6.00

|

13.70

|

9.61

|

|

Russell 1000 Index |

6.12

|

15.66

|

12.65

|

|

| Performance Inception Date |

Feb. 26, 2021

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Material Change Date |

Jan. 01, 2025

|

| Net Assets |

$ 41,786,984

|

| Holdings Count | shares |

22

|

| Advisory Fees Paid, Amount |

$ 95,472

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$41,786,984 |

| Number of Portfolio Holdings |

22 |

| Portfolio Turnover Rate |

35% |

| Total Advisory Fees Paid |

$95,472 |

|

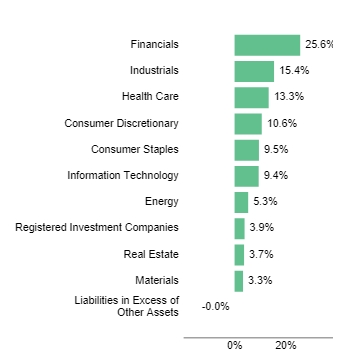

| Holdings [Text Block] |

|

Financials

|

25.6% |

|

Industrials

|

15.4% |

|

Health Care

|

13.3% |

|

Consumer Discretionary

|

10.6% |

|

Consumer Staples

|

9.5% |

|

Information Technology

|

9.4% |

|

Energy

|

5.3% |

|

Registered Investment Companies

|

3.9% |

|

Real Estate

|

3.7% |

|

Materials

|

3.3% |

|

Liabilities in Excess of Other Assets

|

0.0% |

|

American International Group, Inc.

|

8.4 |

|

Texas Instruments, Inc.

|

6.4 |

|

Berkshire Hathaway, Inc., Class B

|

6.3 |

|

Capital One Financial Corp.

|

6.2 |

|

Abbott Laboratories

|

5.7 |

|

ConocoPhillips

|

5.3 |

|

Colgate-Palmolive Co.

|

4.9 |

|

Aon plc, Class A

|

4.7 |

|

Ferguson Enterprises, Inc.

|

4.7 |

|

Sysco Corp.

|

4.6 |

|

| Largest Holdings [Text Block] |

|

American International Group, Inc.

|

8.4 |

|

Texas Instruments, Inc.

|

6.4 |

|

Berkshire Hathaway, Inc., Class B

|

6.3 |

|

Capital One Financial Corp.

|

6.2 |

|

Abbott Laboratories

|

5.7 |

|

ConocoPhillips

|

5.3 |

|

Colgate-Palmolive Co.

|

4.9 |

|

Aon plc, Class A

|

4.7 |

|

Ferguson Enterprises, Inc.

|

4.7 |

|

Sysco Corp.

|

4.6 |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's next prospectus, which we expect to be available by September 26, 2025 at https://diamond-hill.com/documents or upon request at 888-226-5595. The Board of Trustees after careful consideration and upon the recommendation of the Adviser, approved the conversion (the "Reorganization") of the Large Cap Concentrated Fund (the "Target Fund") into an exchange-traded fund ("ETF") by reorganizing the Target Fund into the newly created series of the Trust, the Diamond Hill Large Cap Concentrated ETF (the "Survivor Fund"). The Reorganization is expected to occur on or about September 26, 2025 (the "Closing Date"). The Survivor Fund will not commence operations before completion of the Reorganization and does not have existing shareholders. Shareholders are not required to approve the Reorganization, and shareholders will not be asked to vote. However, shareholders received a Combined Prospectus/Information Statement that contains information about the Survivor Fund and provides details about the terms and conditions of the Reorganization. |

| Material Fund Change Strategies [Text Block] |

The Board of Trustees after careful consideration and upon the recommendation of the Adviser, approved the conversion (the "Reorganization") of the Large Cap Concentrated Fund (the "Target Fund") into an exchange-traded fund ("ETF") by reorganizing the Target Fund into the newly created series of the Trust, the Diamond Hill Large Cap Concentrated ETF (the "Survivor Fund"). The Reorganization is expected to occur on or about September 26, 2025 (the "Closing Date"). The Survivor Fund will not commence operations before completion of the Reorganization and does not have existing shareholders. Shareholders are not required to approve the Reorganization, and shareholders will not be asked to vote. However, shareholders received a Combined Prospectus/Information Statement that contains information about the Survivor Fund and provides details about the terms and conditions of the Reorganization.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's next prospectus, which we expect to be available by September 26, 2025 at https://diamond-hill.com/documents or upon request at 888-226-5595.

|

| Updated Prospectus Phone Number |

888-226-5595

|

| Updated Prospectus Web Address |

https://diamond-hill.com/documents

|

| Diamond Hill Large Cap Concentrated Fund | Class Y |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Diamond Hill Large Cap Concentrated Fund

|

| Class Name |

Class Y

|

| Trading Symbol |

DHFYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Diamond Hill Large Cap Concentrated Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://diamond-hill.com/documents. You can also request this information by contacting us at 888-226-5595 or info@diamond-hill.com or by contacting your financial advisor.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

888-226-5595

|

| Additional Information Email |

info@diamond-hill.com

|

| Additional Information Website |

https://diamond-hill.com/documents

|

| Expenses [Text Block] |

|

| Expenses Paid, Amount |

$ 28

|

| Expense Ratio, Percent |

0.55%

|

| Factors Affecting Performance [Text Block] |

The Fund (Ticker: DHFYX) returned 8.01% for the 6-month period ended June 30, 2025. Over that same period, the Russell 1000 Value Index returned 6.00%. Security selection is the primary driver of the Fund's performance during any given period — the top and bottom contributors to return are illustrated in the chart. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future results.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

|

Class Y |

8.01%

|

14.19%

|

10.32%

|

|

Russell 3000 Index |

5.75

|

15.30

|

11.95

|

|

Russell 1000 Value Index |

6.00

|

13.70

|

9.61

|

|

Russell 1000 Index |

6.12

|

15.66

|

12.65

|

|

| Performance Inception Date |

Feb. 26, 2021

|

| No Deduction of Taxes [Text Block] |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Material Change Date |

Jan. 01, 2025

|

| Net Assets |

$ 41,786,984

|

| Holdings Count | shares |

22

|

| Advisory Fees Paid, Amount |

$ 95,472

|

| Investment Company, Portfolio Turnover |

35.00%

|

| Additional Fund Statistics [Text Block] |

| Net Assets |

$41,786,984 |

| Number of Portfolio Holdings |

22 |

| Portfolio Turnover Rate |

35% |

| Total Advisory Fees Paid |

$95,472 |

|

| Holdings [Text Block] |

|

Financials

|

25.6% |

|