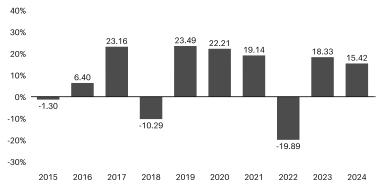

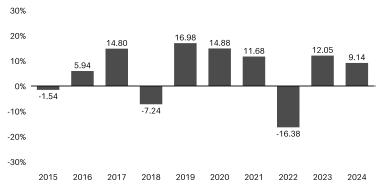

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The Fund’s average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund’s website at www.allspringglobal.com.

|

Calendar

Year Total Returns for Class C as of 12/31 each year2

| ||

|

|

Highest

Quarter: |

+17.51% |

|

Lowest

Quarter: |

-13.94% | |

|

Year-to-date total return as of June 30, 2025 is +9.28% |

| |

| Highest Quarter: | +17.51% |

| Lowest Quarter: | -13.94% |

| Year-to-date total return as of June 30, 2025 is +9.28% |

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)1,2,3,4 | ||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year | |

|

Class A (before taxes) |

2/10/2017 |

9.61% |

9.27% |

8.60% |

|

Class C (before taxes) |

10/1/1997 |

14.42% |

9.76% |

8.77% |

|

Class C (after taxes on distributions) |

10/1/1997 |

13.56% |

7.76% |

6.91% |

|

Class C (after taxes on distributions and the sale of Fund Shares) |

10/1/1997 |

10.44% |

7.34% |

6.65% |

|

Administrator Class (before taxes) |

2/4/2022 |

16.37% |

10.66% |

9.32% |

|

Institutional Class (before taxes) |

7/31/2018 |

16.65% |

10.94% |

9.47% |

|

Spectrum Aggressive Growth Blended Index (reflects no deduction for fees, expenses, or taxes)5 |

18.15% |

10.94% |

10.24% | |

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

23.81% |

13.86% |

12.55% | |

| 1. | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| 2. | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| 3. | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Institutional Class shares, adjusted to reflect the higher expenses applicable to the Administrator Class shares. |

| 4. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 5. | Source: Allspring Funds Management, LLC. The Spectrum Aggressive Growth Blended Index is composed of 70% of the Russell 3000® Index and 30% of the MSCI ACWI ex USA Index (Net). Effective November 2, 2020, the WealthBuilder Equity Blended Index was renamed the Spectrum Aggressive Growth Blended Index. You cannot invest directly in an index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown for only one class of shares. After-tax returns for any other class will vary.

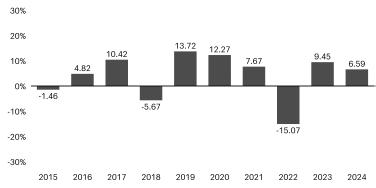

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The Fund’s average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund’s website at www.allspringglobal.com.

|

Calendar

Year Total Returns for Class C as of 12/31 each year2

| ||

|

|

Highest

Quarter: |

+9.92% |

|

Lowest

Quarter: |

-8.21% | |

|

Year-to-date total return as of June 30, 2025 is +4.80% |

| |

| Highest Quarter: | +9.92% |

| Lowest Quarter: | -8.21% |

| Year-to-date total return as of June 30, 2025 is +4.80% |

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)1,2,3 | ||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year | |

|

Class A (before taxes) |

2/10/2017 |

1.15% |

3.22% |

3.89% |

|

Class C (before taxes) |

9/30/2004 |

5.59% |

3.68% |

4.05% |

|

Class C (after taxes on distributions) |

9/30/2004 |

5.78% |

1.98% |

2.36% |

|

Class C (after taxes on distributions and the sale of Fund Shares) |

9/30/2004 |

3.94% |

2.35% |

2.69% |

|

Institutional Class (before taxes) |

7/31/2018 |

7.81% |

4.78% |

4.73% |

|

Spectrum Conservative Growth Blended Index (reflects no deduction for fees, expenses, or taxes)4 |

7.06% |

4.05% |

4.92% | |

|

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

1.25% |

-0.33% |

1.35% | |

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

23.81% |

13.86% |

12.55% | |

| 1. | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| 2. | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 4. | Source: Allspring Funds Management, LLC. Effective September 1, 2025, the Spectrum Conservative Growth Blended Index is composed of 36% Bloomberg U.S. Aggregate Bond Index, 26% Russell 3000® Index, 15% Bloomberg U.S. TIPS Index, 13% MSCI ACWI ex USA Index (Net) and 10% ICE BofA U.S. High Yield Constrained Index. Prior to September 1, 2025, the weightings of the Spectrum Conservative Growth Blended Index were: 41% Bloomberg U.S. Aggregate Bond Index, 20% Russell 3000® Index, 15% Bloomberg U.S. TIPS Index, 15% ICE BofA U.S. High Yield Constrained Index and 9% MSCI ACWI ex USA Index (Net). Effective November 2, 2020, the WealthBuilder Moderate Balanced Blended Index, which was composed of 60% Bloomberg U.S. Aggregate Bond Index, 28% Russell 3000® Index and 12% MSCI ACWI ex USA Index (Net), was renamed the Spectrum Conservative Growth Blended Index. You cannot invest directly in an index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown for only one class of shares. After-tax returns for any other class will vary.

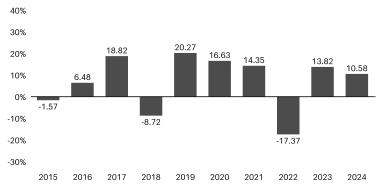

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The Fund’s average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund’s website at www.allspringglobal.com.

|

Calendar

Year Total Returns for Class C as of 12/31 each year2

| ||

|

|

Highest

Quarter: |

+15.27% |

|

Lowest

Quarter: |

-11.98% | |

|

Year-to-date total return as of June 30, 2025 is +6.59% |

| |

| Highest Quarter: | +15.27% |

| Lowest Quarter: | -11.98% |

| Year-to-date total return as of June 30, 2025 is +6.59% |

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)1,2,3 | ||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year | |

|

Class A (before taxes) |

2/10/2017 |

5.03% |

6.30% |

6.59% |

|

Class C (before taxes) |

9/30/2004 |

9.58% |

6.76% |

6.77% |

|

Class C (after taxes on distributions) |

9/30/2004 |

8.60% |

4.59% |

4.63% |

|

Class C (after taxes on distributions and the sale of Fund Shares) |

9/30/2004 |

6.94% |

4.77% |

4.84% |

|

Institutional Class (before taxes) |

7/31/2018 |

11.78% |

7.91% |

7.43% |

|

Spectrum Growth Blended Index (reflects no deduction for fees, expenses, or taxes)4 |

11.79% |

6.97% |

7.66% | |

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

23.81% |

13.86% |

12.55% | |

|

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

1.25% |

-0.33% |

1.35% | |

| 1. | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| 2. | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 4. | Source: Allspring Funds Management, LLC. Effective September 1, 2025, the Spectrum Growth Blended Index is composed of 45% Russell 3000® Index, 20% Bloomberg U.S. Aggregate Bond Index,19% MSCI ACWI ex USA Index (Net), 10% Bloomberg U.S. TIPS Index and 6% ICE BofA U.S. High Yield Constrained Index. Prior to September 1, 2025, the weightings of the Spectrum Growth Blended Index were: 40% Russell 3000® Index, 17% MSCI ACWI ex USA Index (Net), 15% Bloomberg U.S. Aggregate Bond Index, 14% Bloomberg U.S. TIPS Index and 14% ICE BofA U.S. High Yield Constrained Index. Effective November 2, 2020, the WealthBuilder Growth Allocation Blended Index, which was composed of 56% Russell 3000® Index, 24% MSCI ACWI ex USA Index (Net) and 20% Bloomberg U.S. Aggregate Bond Index, was renamed the Spectrum Growth Blended Index. You cannot invest directly in an index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown for only one class of shares. After-tax returns for any other class will vary.

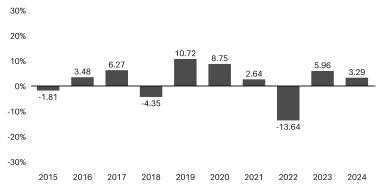

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The Fund’s average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund’s website at www.allspringglobal.com.

|

Calendar

Year Total Returns for Class C as of 12/31 each year2

| ||

|

|

Highest

Quarter: |

+7.37% |

|

Lowest

Quarter: |

-6.10% | |

|

Year-to-date total return as of June 30, 2025 is +3.18% |

| |

| Highest Quarter: | +7.37% |

| Lowest Quarter: | -6.10% |

| Year-to-date total return as of June 30, 2025 is +3.18% |

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)1,2,3 | ||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year | |

|

Class A (before taxes) |

2/10/2017 |

-1.96% |

0.64% |

1.91% |

|

Class C (before taxes) |

9/30/2004 |

2.29% |

1.08% |

2.04% |

|

Class C (after taxes on distributions) |

9/30/2004 |

2.24% |

-0.36% |

0.71% |

|

Class C (after taxes on distributions and the sale of Fund Shares) |

9/30/2004 |

1.96% |

0.36% |

1.17% |

|

Institutional Class (before taxes) |

7/31/2018 |

4.34% |

2.17% |

2.72% |

|

Spectrum Income Allocation Blended Index (reflects no deduction for fees, expenses, or taxes)4 |

3.95% |

1.79% |

3.11% | |

|

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

1.25% |

-0.33% |

1.35% | |

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

23.81% |

13.86% |

12.55% | |

| 1. | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| 2. | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 4. | Source: Allspring Funds Management, LLC. Effective September 1, 2025, the Spectrum Income Allocation Blended Index is composed of 54% Bloomberg U.S. Aggregate Bond Index, 15% Bloomberg U.S. TIPS Index, 12% ICE BofA U.S. High Yield Constrained Index, 12% Russell 3000® Index and 7% of the MSCI ACWI ex USA Index (Net). Prior to September 1, 2025, the weightings of the Spectrum Income Allocation Blended Index were: 65% Bloomberg U.S. Aggregate Bond Index, 15% ICE BofA U.S. High Yield Constrained Index, 10% Bloomberg U.S. TIPS Index, 7% Russell 3000® Index and 3% MSCI ACWI ex USA Index (Net). Effective November 2, 2020, the WealthBuilder Conservative Allocation Blended Index, which was composed of 80% Bloomberg U.S. Aggregate Bond Index, 14% Russell 3000® Index and 6% MSCI ACWI ex USA Index (Net), was renamed the Spectrum Income Allocation Blended Index. You cannot invest directly in an Index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown for only one class of shares. After-tax returns for any other class will vary.

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The Fund’s average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund’s website at www.allspringglobal.com.

|

Calendar

Year Total Returns for Class C as of 12/31 each year2

| ||

|

|

Highest

Quarter: |

+12.64% |

|

Lowest

Quarter: |

-10.06% | |

|

Year-to-date total return as of June 30, 2025 is +5.95% |

| |

| Highest Quarter: | +12.64% |

| Lowest Quarter: | -10.06% |

| Year-to-date total return as of June 30, 2025 is +5.95% |

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)1,2,3 | ||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year | |

|

Class A (before taxes) |

2/10/2017 |

3.63% |

5.12% |

5.48% |

|

Class C (before taxes) |

10/1/1997 |

8.14% |

5.58% |

5.64% |

|

Class C (after taxes on distributions) |

10/1/1997 |

8.03% |

3.72% |

3.76% |

|

Class C (after taxes on distributions and the sale of Fund Shares) |

10/1/1997 |

5.52% |

3.86% |

3.95% |

|

Institutional Class (before taxes) |

7/31/2018 |

10.30% |

6.72% |

6.32% |

|

Spectrum Moderate Growth Blended Index (reflects no deduction for fees, expenses, or taxes)4 |

9.86% |

5.87% |

6.49% | |

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

23.81% |

13.86% |

12.55% | |

|

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

1.25% |

-0.33% |

1.35% | |

| 1. | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| 2. | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 4. | Source: Allspring Funds Management, LLC. Effective September 1, 2025, the Spectrum Moderate Growth Blended Index is composed of 37% Russell 3000® Index, 29% Bloomberg U.S. Aggregate Bond Index, 16% MSCI ACWI ex USA Index (Net), 10% Bloomberg U.S. TIPS Index and 8% ICE BofA U.S. High Yield Constrained Index. Prior to September 1, 2025, the weightings of the Spectrum Moderate Growth Blended Index were: 32% Russell 3000® Index, 26% Bloomberg U.S. Aggregate Bond Index, 14% Bloomberg U.S. TIPS Index, 14% ICE BofA U.S. High Yield Constrained Index and 14% MSCI ACWI ex USA Index (Net). Effective November 2, 2020, the WealthBuilder Growth Balanced Blended Index, which was composed of 42% Russell 3000® Index, 40% Bloomberg U.S. Aggregate Bond Index and 18% MSCI ACWI ex USA Index (Net), was renamed the Spectrum Moderate Growth Blended Index. You cannot invest directly in an index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown for only one class of shares. After-tax returns for any other class will vary.

| [1] | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| [2] | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Institutional Class shares, adjusted to reflect the higher expenses applicable to the Administrator Class shares. |

| [3] | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| [4] | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| [5] | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| [6] | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| [7] | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| [8] | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| [9] | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| [10] | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| [11] | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| [12] | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| [13] | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| [14] | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| [15] | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that the Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| [16] | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |