The Fund seeks long-term capital appreciation with no emphasis on income.

These tables are intended to help you understand the various costs and expenses you will pay if you buy, hold and sell shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Allspring Funds. More information about these and other discounts is available from your financial professional and in “Share Class Features” and “Reductions and Waivers of Sales Charges” on pages 49 and 50 of the Prospectus and “Additional Purchase and Redemption Information” on page 86 of the Statement of Additional Information. Investors who purchase through certain intermediaries may be subject to different sales charge discounts than those outlined shares in these sections. Please see Appendix A on page 77 for further information.

|

Shareholder Fees (fees paid directly from your investment) | ||||

|

A |

C |

Administrator |

Institutional | |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

5.75% |

None |

None |

None |

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None1 |

1.00% |

None |

None |

| 1. | Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred sales charge of 1.00% if redeemed within 18 months from the date of purchase. |

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)1 | ||||

|

A |

C |

Administrator |

Institutional | |

|

Management Fees |

0.25% |

0.25% |

0.25% |

0.25% |

|

Distribution (12b-1) Fees |

0.00% |

0.75% |

0.00% |

0.00% |

|

Other Expenses |

0.50% |

0.50% |

0.43% |

0.18% |

|

Acquired Fund Fees and Expenses |

0.27% |

0.27% |

0.27% |

0.27% |

|

Total Annual Fund Operating Expenses2 |

1.02% |

1.77% |

0.95% |

0.70% |

|

Fee Waivers |

(0.03)% |

(0.03)% |

(0.03)% |

(0.03)% |

|

Total Annual Fund Operating Expenses After Fee Waivers2,3 |

0.99% |

1.74% |

0.92% |

0.67% |

| 1. | Expenses have been adjusted as necessary from amounts incurred during the Fund’s most recent fiscal year to reflect current fees and expenses. |

| 2. | The expense ratio shown does not correlate to the corresponding expense ratio shown in the Financial Highlights, which reflects only the operating expenses of the Fund and does not include any acquired fund fees and expenses. |

| 3. | The Manager has contractually committed through August 31, 2026, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.72% for Class A, 1.47% for Class C, 0.65% for Administrator Class and 0.40% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other funds. The example assumes a $10,000 initial investment, 5% annual total return, and that fees and expenses remain the same as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the example assumes that such waiver or reimbursement will only be in place through the date noted above. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

Assuming you sold your shares, you would pay: |

After 1 Year |

After 3 Years |

After 5 Years |

After 10 Years |

|

Class A |

$670 |

$878 |

$1,103 |

$1,749 |

|

Class C |

$277 |

$554 |

$957 |

$2,081 |

|

Administrator Class |

$94 |

$300 |

$523 |

$1,164 |

|

Institutional Class |

$68 |

$221 |

$387 |

$868 |

|

Assuming you held your shares, you would pay: |

After 1 Year |

After 3 Years |

After 5 Years |

After 10 Years |

|

Class C |

$177 |

$554 |

$957 |

$2,081 |

|

Assuming you sold your shares, you would pay: |

After 1 Year |

After 3 Years |

After 5 Years |

After 10 Years |

|

Class A |

$670 |

$878 |

$1,103 |

$1,749 |

|

Class C |

$277 |

$554 |

$957 |

$2,081 |

|

Administrator Class |

$94 |

$300 |

$523 |

$1,164 |

|

Institutional Class |

$68 |

$221 |

$387 |

$868 |

|

Assuming you held your shares, you would pay: |

After 1 Year |

After 3 Years |

After 5 Years |

After 10 Years |

|

Class C |

$177 |

$554 |

$957 |

$2,081 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 29% of the average value of its portfolio.

The Fund is a fund-of-funds that invests in various affiliated and unaffiliated mutual funds and exchange-traded funds (“Underlying Funds”) to pursue its investment objective. We seek to achieve the Fund’s investment objective by investing at least 80% of the Fund’s net assets in equity securities (through investment in Underlying Funds). The Fund is a diversified equity investment that consists of Underlying Funds that employ different and complementary investment styles to provide potential for growth. These equity styles include large company, small company, and international. The Fund will invest at least 50% and up to 70% of its assets in U.S. large company stock funds, at least 20% and up to 40% of its assets in international stock funds and up to 20% of its assets in U.S. small company stock funds. Additionally, we may invest up to 20% of the Fund’s net assets in bond or alternative-style asset classes (through investment in Underlying Funds).

Depending on market conditions, some equity asset classes will perform better than others. The Fund’s broad diversification across equity styles and the use of tactical allocation between equity styles may help to reduce the overall impact of poor performance in any one equity asset class.

We employ both quantitative analysis and qualitative judgments in making tactical allocations among various Underlying Funds. Quantitative analysis involves the use of proprietary asset allocation models, which employ various valuation techniques. Qualitative judgments are made based on assessments of a number of factors, including economic conditions, corporate earnings, monetary policy, market valuations, investor sentiment, and market technicals. Changes to effective allocations in the Fund may be implemented with index futures contracts or by buying and selling Underlying Funds, or both.

The Fund incorporates a derivatives overlay strategy that contains three specific risk management components: 1.) Tactical Asset Allocation (TAA) Overlay, 2.) Volatility Management Overlay (VMO), and 3.) Tail Risk Management (TRM). Together these strategies will allow the Fund to attempt to manage short-term volatility, mitigate risk and/or improve returns under certain market conditions. To execute this overlay strategy, the Fund invests in long and/or short positions in exchange-traded futures contracts across a variety of asset classes, which include, but are not limited to, stocks, bonds, and currencies.

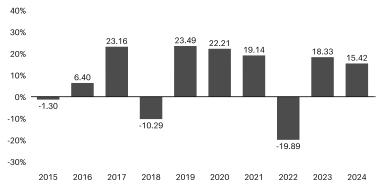

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The Fund’s average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund’s website at www.allspringglobal.com.

|

Calendar

Year Total Returns for Class C as of 12/31 each year2

| ||

|

|

Highest

Quarter: |

+17.51% |

|

Lowest

Quarter: |

-13.94% | |

|

Year-to-date total return as of June 30, 2025 is +9.28% |

| |

| Highest Quarter: | +17.51% |

| Lowest Quarter: | -13.94% |

| Year-to-date total return as of June 30, 2025 is +9.28% |

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)1,2,3,4 | ||||

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year | |

|

Class A (before taxes) |

2/10/2017 |

9.61% |

9.27% |

8.60% |

|

Class C (before taxes) |

10/1/1997 |

14.42% |

9.76% |

8.77% |

|

Class C (after taxes on distributions) |

10/1/1997 |

13.56% |

7.76% |

6.91% |

|

Class C (after taxes on distributions and the sale of Fund Shares) |

10/1/1997 |

10.44% |

7.34% |

6.65% |

|

Administrator Class (before taxes) |

2/4/2022 |

16.37% |

10.66% |

9.32% |

|

Institutional Class (before taxes) |

7/31/2018 |

16.65% |

10.94% |

9.47% |

|

Spectrum Aggressive Growth Blended Index (reflects no deduction for fees, expenses, or taxes)5 |

18.15% |

10.94% |

10.24% | |

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

23.81% |

13.86% |

12.55% | |

| 1. | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| 2. | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |

| 3. | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Institutional Class shares, adjusted to reflect the higher expenses applicable to the Administrator Class shares. |

| 4. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 5. | Source: Allspring Funds Management, LLC. The Spectrum Aggressive Growth Blended Index is composed of 70% of the Russell 3000® Index and 30% of the MSCI ACWI ex USA Index (Net). Effective November 2, 2020, the WealthBuilder Equity Blended Index was renamed the Spectrum Aggressive Growth Blended Index. You cannot invest directly in an index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown for only one class of shares. After-tax returns for any other class will vary.

| [1] | Historical performance for the Class A shares prior to their inception reflects the performance of the Class C shares and includes the higher expenses applicable to the Class C shares. If these expenses had not been included, returns for the Class A shares would be higher. |

| [2] | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Institutional Class shares, adjusted to reflect the higher expenses applicable to the Administrator Class shares. |

| [3] | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Class A shares adjusted to reflect that Institutional Class shares do not have a sales load but not adjusted to reflect the Institutional Class expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| [4] | Prior to February 13, 2017, historical performance shown for the Class C shares reflects the performance of the Fund’s predecessor WealthBuilder Portfolio share class and does not reflect the front-end sales load previously attributable to the predecessor class. The expenses for Class C shares and the predecessor share class are similar. |