Shareholder Report

|

12 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Federated Hermes Short-Intermediate Duration Municipal Trust

|

| Entity Central Index Key |

0000353101

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000037571 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Federated Hermes Short-Intermediate Municipal Fund

|

| Class Name |

Class A Shares

|

| Trading Symbol |

FMTAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Federated Hermes Short-Intermediate Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1‑800‑341‑7400, Option 4, or your financial advisor.

|

| Material Fund Change Notice [Text Block] |

This report describes changes made to the Fund during the reporting period.

|

| Additional Information Phone Number |

1‑800‑341‑7400

|

| Additional Information Website |

FederatedHermes.com/us/FundInformation

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class A Shares |

$68 |

0.67% |

|

| Expenses Paid, Amount |

$ 68

|

| Expense Ratio, Percent |

0.67%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the S&P Municipal Bond Short Index (the “Index”) to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the S&P Municipal Bond Index, which represents the overall U.S. municipal fixed-income market. The Fund seeks to provide dividend income which is exempt from federal regular income tax by investing its assets so that normally distributions of annual interest income are exempt from federal regular income tax. A majority of the Fund’s assets are invested in securities rated investment-grade.

Top Contributors to Performance

-

Security selection contributed positively to relative Fund performance as the Fund outperformed the Index after accounting for duration, yield curve positioning, sector allocation and credit contributions. Noteworthy positive contributors included low-coupon discount bonds with maturities under five years. Additionally, a significant allocation to floating-rate notes, excluded from the Index, proved beneficial in a volatile interest rate environment with a steepening yield curve.

-

Sector allocation contributed positively with a significant overweight allocation to Housing bonds. An underweight allocation to pre-refunded bonds also contributed positively.

-

Credit allocation contributed positively with significant overweight positions relative to the Index in BBB-rated securities which outperformed the Index. An underweight allocation to underperforming AAA-rated securities also had a positive contribution.

Top Detractors from Performance

-

Duration management detracted from relative performance as yield curve allocations contributed negatively, namely a tactical 6% allocation to high-grade callable bonds with maturities beyond 10 years. The Fund held a long duration position relative to the index but reduced the long position at various points over the period during a volatile year for interest rates. The 5-year AAA-rated Bloomberg Evaluation Service municipal yield fluctuated over a wide range from 2.31% to 3.47% and ended the period lower by 24 basis points at 2.70%.

|

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

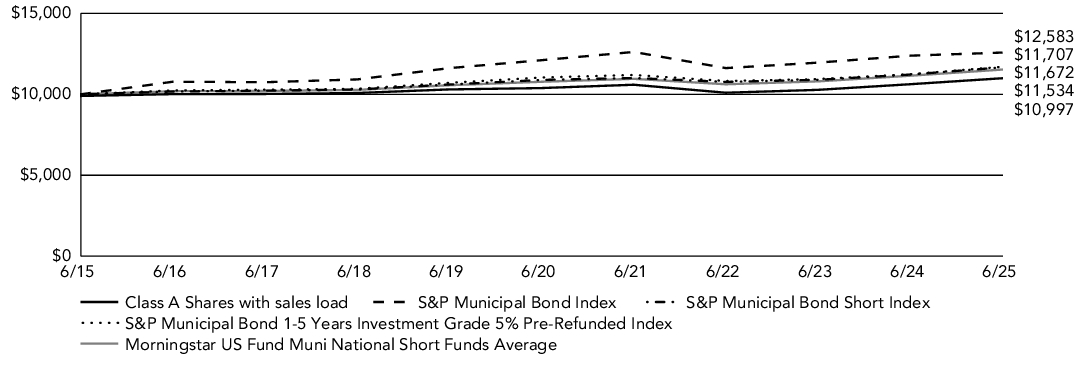

| Line Graph [Table Text Block] |

Fund Performance Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Cumulative Performance: June 30, 2015 through June 30, 2025 Initial Investment of $10,000

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Class A Shares with sales load |

2.44% |

0.95% |

0.95% |

| Class A Shares without sales load |

3.48% |

1.14% |

1.05% |

| S&P Municipal Bond Index |

1.55% |

0.77% |

2.32% |

| S&P Municipal Bond Short Index |

3.99% |

1.39% |

1.56% |

| S&P Municipal Bond 1-5 Years Investment Grade 5% Pre-Refunded Index |

4.11% |

1.18% |

1.59% |

| Morningstar US Fund Muni National Short Funds Average |

3.42% |

1.38% |

1.45% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

|

| Net Assets |

$ 367,819,667

|

| Holdings Count | Holding |

174

|

| Advisory Fees Paid, Amount |

$ 775,264

|

| Investment Company Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Net Assets |

$367,819,667 |

| Number of Investments |

174 |

| Portfolio Turnover Rate |

17% |

| Total Advisory Fees Paid |

$775,264 |

|

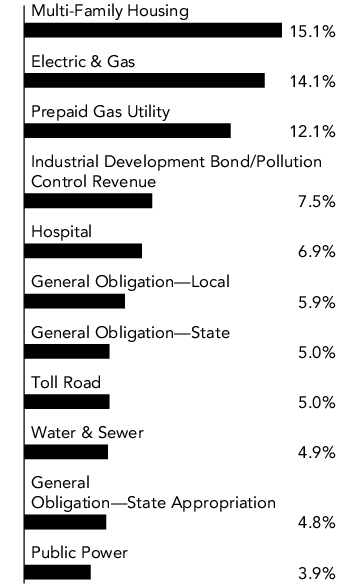

| Holdings [Text Block] |

Fund Holdings Top Sectors

(% of Net Assets)

|

| Material Fund Change [Text Block] |

Material Fund Changes The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor. Effective May 1, 2025, Jeff Kozemchak no longer serves as a portfolio manager of the Fund. Effective February 10, 2025, Ann Ferentino joined Mary Jo Ochson, CFA, and Kyle Stewart, CFA, as a portfolio manager of the Fund.

|

| Summary of Change Legend [Text Block] |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

|

| Updated Prospectus Phone Number |

1-800-341-7400

|

| Updated Prospectus Web Address |

FederatedHermes.com/us/FundInformation

|

| C000024677 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Federated Hermes Short-Intermediate Municipal Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

FSHIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Federated Hermes Short-Intermediate Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1‑800‑341‑7400, Option 4, or your financial advisor.

|

| Material Fund Change Notice [Text Block] |

This report describes changes made to the Fund during the reporting period.

|

| Additional Information Phone Number |

1‑800‑341‑7400

|

| Additional Information Website |

FederatedHermes.com/us/FundInformation

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Institutional Shares |

$43 |

0.42% |

|

| Expenses Paid, Amount |

$ 43

|

| Expense Ratio, Percent |

0.42%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the S&P Municipal Bond Short Index (the “Index”) to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the S&P Municipal Bond Index, which represents the overall U.S. municipal fixed-income market. The Fund seeks to provide dividend income which is exempt from federal regular income tax by investing its assets so that normally distributions of annual interest income are exempt from federal regular income tax. A majority of the Fund’s assets are invested in securities rated investment-grade.

Top Contributors to Performance

-

Security selection contributed positively to relative Fund performance as the Fund outperformed the Index after accounting for duration, yield curve positioning, sector allocation and credit contributions. Noteworthy positive contributors included low-coupon discount bonds with maturities under five years. Additionally, a significant allocation to floating-rate notes, excluded from the Index, proved beneficial in a volatile interest rate environment with a steepening yield curve.

-

Sector allocation contributed positively with a significant overweight allocation to Housing bonds. An underweight allocation to pre-refunded bonds also contributed positively.

-

Credit allocation contributed positively with significant overweight positions relative to the Index in BBB-rated securities which outperformed the Index. An underweight allocation to underperforming AAA-rated securities also had a positive contribution.

Top Detractors from Performance

-

Duration management detracted from relative performance as yield curve allocations contributed negatively, namely a tactical 6% allocation to high-grade callable bonds with maturities beyond 10 years. The Fund held a long duration position relative to the index but reduced the long position at various points over the period during a volatile year for interest rates. The 5-year AAA-rated Bloomberg Evaluation Service municipal yield fluctuated over a wide range from 2.31% to 3.47% and ended the period lower by 24 basis points at 2.70%.

|

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

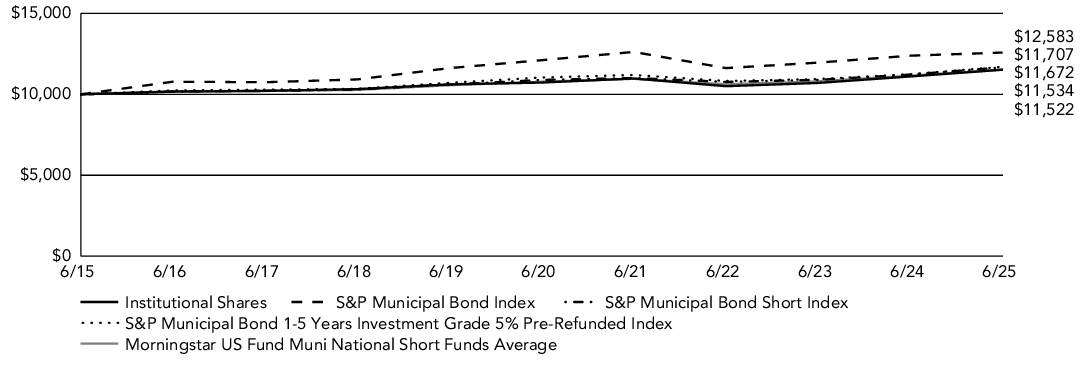

| Line Graph [Table Text Block] |

Fund Performance Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Cumulative Performance: June 30, 2015 through June 30, 2025 Initial Investment of $10,000

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Institutional Shares |

3.73% |

1.44% |

1.43% |

| S&P Municipal Bond Index |

1.55% |

0.77% |

2.32% |

| S&P Municipal Bond Short Index |

3.99% |

1.39% |

1.56% |

| S&P Municipal Bond 1-5 Years Investment Grade 5% Pre-Refunded Index |

4.11% |

1.18% |

1.59% |

| Morningstar US Fund Muni National Short Funds Average |

3.42% |

1.38% |

1.45% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

|

| Net Assets |

$ 367,819,667

|

| Holdings Count | Holding |

174

|

| Advisory Fees Paid, Amount |

$ 775,264

|

| Investment Company Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Net Assets |

$367,819,667 |

| Number of Investments |

174 |

| Portfolio Turnover Rate |

17% |

| Total Advisory Fees Paid |

$775,264 |

|

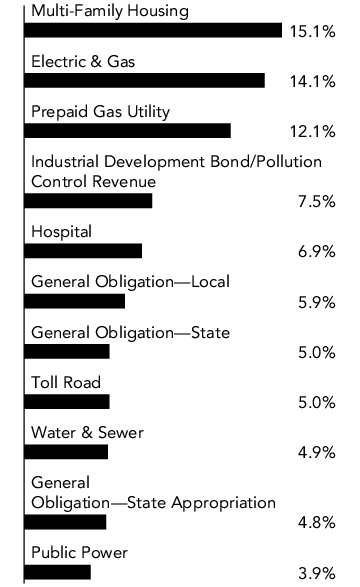

| Holdings [Text Block] |

Fund Holdings Top Sectors

(% of Net Assets)

|

| Material Fund Change [Text Block] |

Material Fund Changes The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor. Effective May 1, 2025, Jeff Kozemchak no longer serves as a portfolio manager of the Fund. Effective February 10, 2025, Ann Ferentino joined Mary Jo Ochson, CFA, and Kyle Stewart, CFA, as a portfolio manager of the Fund.

|

| Summary of Change Legend [Text Block] |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

|

| Updated Prospectus Phone Number |

1-800-341-7400

|

| Updated Prospectus Web Address |

FederatedHermes.com/us/FundInformation

|

| C000024678 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Federated Hermes Short-Intermediate Municipal Fund

|

| Class Name |

Service Shares

|

| Trading Symbol |

FSHSX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Federated Hermes Short-Intermediate Municipal Fund (the “Fund”) for the period of July 1, 2024 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1‑800‑341‑7400, Option 4, or your financial advisor.

|

| Material Fund Change Notice [Text Block] |

This report describes changes made to the Fund during the reporting period.

|

| Additional Information Phone Number |

1‑800‑341‑7400

|

| Additional Information Website |

FederatedHermes.com/us/FundInformation

|

| Expenses [Text Block] |

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Service Shares |

$67 |

0.66% |

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

0.66%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance

The following discussion compares the performance of the Fund to the S&P Municipal Bond Short Index (the “Index”) to show how the Fund’s performance compares to the returns of similar investments for the reporting period. See the Average Annual Total Returns table below for the returns of the Fund and related indexes, including the S&P Municipal Bond Index, which represents the overall U.S. municipal fixed-income market. The Fund seeks to provide dividend income which is exempt from federal regular income tax by investing its assets so that normally distributions of annual interest income are exempt from federal regular income tax. A majority of the Fund’s assets are invested in securities rated investment-grade.

Top Contributors to Performance

-

Security selection contributed positively to relative Fund performance as the Fund outperformed the Index after accounting for duration, yield curve positioning, sector allocation and credit contributions. Noteworthy positive contributors included low-coupon discount bonds with maturities under five years. Additionally, a significant allocation to floating-rate notes, excluded from the Index, proved beneficial in a volatile interest rate environment with a steepening yield curve.

-

Sector allocation contributed positively with a significant overweight allocation to Housing bonds. An underweight allocation to pre-refunded bonds also contributed positively.

-

Credit allocation contributed positively with significant overweight positions relative to the Index in BBB-rated securities which outperformed the Index. An underweight allocation to underperforming AAA-rated securities also had a positive contribution.

Top Detractors from Performance

-

Duration management detracted from relative performance as yield curve allocations contributed negatively, namely a tactical 6% allocation to high-grade callable bonds with maturities beyond 10 years. The Fund held a long duration position relative to the index but reduced the long position at various points over the period during a volatile year for interest rates. The 5-year AAA-rated Bloomberg Evaluation Service municipal yield fluctuated over a wide range from 2.31% to 3.47% and ended the period lower by 24 basis points at 2.70%.

|

| Performance Past Does Not Indicate Future [Text] |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

|

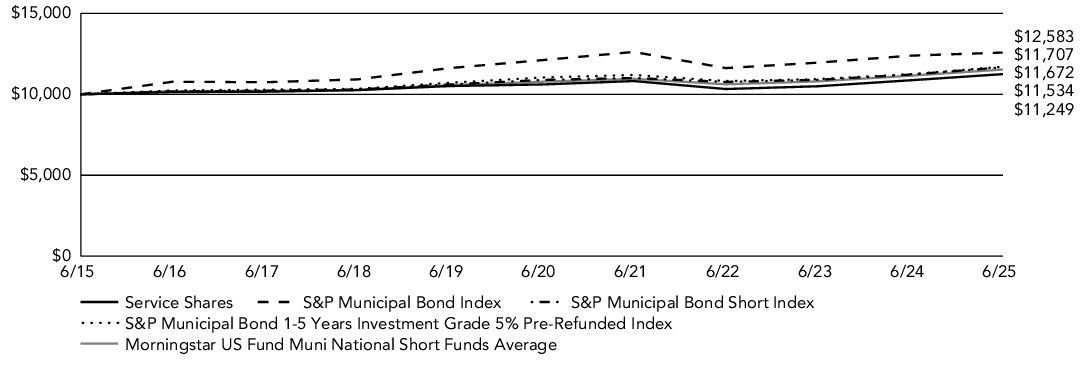

| Line Graph [Table Text Block] |

Fund Performance

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Cumulative Performance: June 30, 2015 through June 30, 2025

Initial Investment of $10,000

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Service Shares |

3.49% |

1.18% |

1.18% |

| S&P Municipal Bond Index |

1.55% |

0.77% |

2.32% |

| S&P Municipal Bond Short Index |

3.99% |

1.39% |

1.56% |

| S&P Municipal Bond 1-5 Years Investment Grade 5% Pre-Refunded Index |

4.11% |

1.18% |

1.59% |

| Morningstar US Fund Muni National Short Funds Average |

3.42% |

1.38% |

1.45% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit FederatedHermes.com/us/FundInformation and click on the link to your fund and share class for more recent performance information.

|

| Net Assets |

$ 367,819,667

|

| Holdings Count | Holding |

174

|

| Advisory Fees Paid, Amount |

$ 775,264

|

| Investment Company Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Net Assets |

$367,819,667 |

| Number of Investments |

174 |

| Portfolio Turnover Rate |

17% |

| Total Advisory Fees Paid |

$775,264 |

|

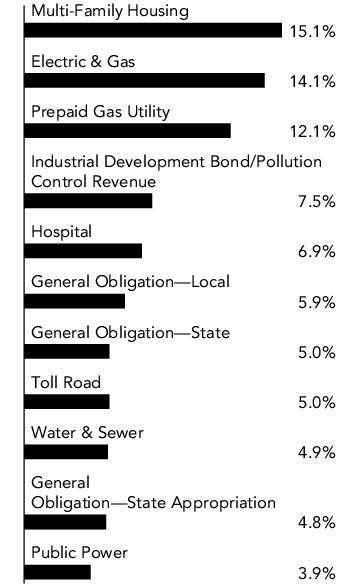

| Holdings [Text Block] |

Fund Holdings

Top Sectors

(% of Net Assets)

|

| Material Fund Change [Text Block] |

Material Fund Changes

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

Effective May 1, 2025, Jeff Kozemchak no longer serves as a portfolio manager of the Fund.

Effective February 10, 2025, Ann Ferentino joined Mary Jo Ochson, CFA, and Kyle Stewart, CFA, as a portfolio manager of the Fund.

|

| Summary of Change Legend [Text Block] |

The following is a summary of material changes made to the Fund during the reporting period. For more complete and current information, you may review the Fund’s disclosure documents on its webpage at FederatedHermes.com/us/FundInformation or upon request at 1-800-341-7400, Option 4, or by contacting your financial advisor.

|

| Updated Prospectus Phone Number |

1-800-341-7400

|

| Updated Prospectus Web Address |

FederatedHermes.com/us/FundInformation

|