Performance Management - Princeton Alternative Premium Fund

|

Aug. 25, 2025 |

| Prospectus [Line Items] |

|

| Bar Chart and Performance Table [Heading] |

Performance:

|

| Performance Narrative [Text Block] |

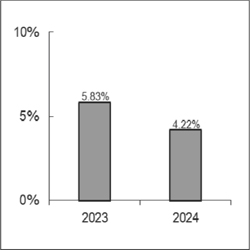

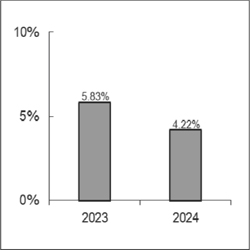

The bar chart and performance table below show the variability of the Fund’s returns, which is some indication of the risks

of investing in the Fund. The bar chart shows performance of the Class I shares of the Fund for each full calendar year since the Fund’s

inception. Although returns for Class A shares are similar to the returns of Class I shares because the classes are invested in the same

portfolio of securities and underlying funds, returns for Class A shares are different from Class I shares due to differences in fees,

which are not presented in the bar chart. The performance table compares the performance of the shares of the Fund over time to the performance

of a broad-based securities market index. You should be aware that the Fund’s past performance (before and after taxes) may not

be an indication of how the Fund will perform in the future. Updated performance information will be available at no cost by visiting

www.princetonadaptivepremiumfund.com or by calling 1-888-868-9501.

|

| Performance Past Does Not Indicate Future [Text] |

You should be aware that the Fund’s past performance (before and after taxes) may not

be an indication of how the Fund will perform in the future.

|

| Performance Information Illustrates Variability of Returns [Text] |

The bar chart and performance table below show the variability of the Fund’s returns, which is some indication of the risks

of investing in the Fund. The bar chart shows performance of the Class I shares of the Fund for each full calendar year since the Fund’s

inception.

|

| Bar Chart [Heading] |

Class

I Annual Total Return for Calendar Years Ended December 31

|

| Bar Chart [Table] |

|

| Bar Chart Closing [Text Block] |

| Best

Quarter: |

4th

Quarter 2023 |

1.61% |

| Worst

Quarter: |

3rd

Quarter 2024 |

0.31% |

The

Fund’s Class I year-to-date return as of June 30, 2025 was 3.41%.

|

| Year to Date Return, Label [Optional Text] |

The

Fund’s Class I year-to-date return

|

| Bar Chart, Year to Date Return |

3.41%

|

| Bar Chart, Year to Date Return, Date |

Jun. 30, 2025

|

| Highest Quarterly Return, Label [Optional Text] |

Best

Quarter:

|

| Highest Quarterly Return |

1.61%

|

| Highest Quarterly Return, Date |

Dec. 31, 2023

|

| Lowest Quarterly Return, Label [Optional Text] |

Worst

Quarter:

|

| Lowest Quarterly Return |

0.31%

|

| Lowest Quarterly Return, Date |

Sep. 30, 2024

|

| Performance Table Heading |

Performance

Table

Average Annual Total Returns

(For periods ended December 31, 2024)

|

| Performance Table Uses Highest Federal Rate |

After-tax

returns were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state

and local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax

returns shown are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or Individual

Retirement Accounts (IRAs).

|

| Performance [Table] |

| |

One

Year |

Since

Inception

(9/23/2022) |

| Class

I shares |

|

|

| Return before taxes |

4.22% |

4.92% |

| Return after taxes on distributions |

2.55% |

3.26% |

| Return after taxes on distributions and sale of Fund shares |

2.64% |

3.18% |

| Class

A shares |

|

|

| Return before taxes with sales charge(1) |

(2.97)% |

1.16%

|

| Return before taxes without sales charge |

2.96% |

3.83% |

| S&P

500 Total Return Index* |

25.02% |

24.64% |

| (1) | Returns

for Class A shares include the maximum sales charge of 5.75%. |

| * | The

S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account

charges, fees, taxes and other expenses. Investors may not invest in the index directly. |

|

| Performance Table One Class of after Tax Shown [Text] |

After-tax returns for Class A shares are not shown and would differ from those of Class I shares.

|

| Index No Deduction for Fees, Expenses, or Taxes [Text] |

The

S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account

charges, fees, taxes and other expenses.

|

| Performance Table Closing [Text Block] |

After-tax

returns were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state

and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax

returns shown are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or Individual

Retirement Accounts (IRAs). After-tax returns for Class A shares are not shown and would differ from those of Class I shares. Returns

for Class A shares include the maximum sales charge of 5.75%.

|

| Performance Availability Website Address [Text] |

www.princetonadaptivepremiumfund.com

|

| Performance Availability Phone [Text] |

1-888-868-9501

|